Forex analysis review |

- Forecast for EUR/USD on October 6, 2020

- Forecast for AUD/USD on October 6, 2020

- Forecast for USD/JPY on October 6, 2020

- Hot forecast and trading signals for the GBP/USD on October 6. COT report. Pound is struggling to grow due to Trump's illness

- Hot forecast and trading signals for the EUR/USD on October 6. COT report. Buyers lead the pair to new heights again

- Overview of the GBP/USD pair. October 6. The European Union was saved from the onslaught and pressure of Boris Johnson. The

- Overview of the EUR/USD pair. October 6. Donald Trump's illness further lowers his chances of re-election.

- Analytics and trading signals for beginners. How to trade EUR/USD on October 6? Getting ready for Tuesday session

- EUR/USD. Green zone PMIs, Congressional battles and Trump's caps lock

- October 5, 2020 : EUR/USD daily technical review and trade recommendations.

- October 5, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- October 5, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- US stimulus package an indicator for gold's growth

- Daily Video Analysis: XAUUSD High Probability Setup

- AUDUSD trendline re-test followed by a drop!

- AUDJPY reversing from 1st resistance, further drop expected !

- USDJPY is testing resistance, potential reversal!

- Trump's COVID-19 test results affect global stocks dynamics

- Evening review of EUR/USD on 05.10.2020

- EURUSD and GBPUSD. EU recovery fund distribution can complicate the life of the euro. The pound is ready to go to new highs

- Ichimoku cloud indicator Daily analysis of EURUSD

- Ichimoku cloud indicator Daily analysis of Gold

- USDCAD at major short-term support area

- Trump's coronavirus to affect presidential race

- Major stock indexes in US and Asia slightly went up

| Forecast for EUR/USD on October 6, 2020 Posted: 05 Oct 2020 08:02 PM PDT EUR/USD The euro started the new week with a steady growth, yesterday's rise was 68 points, the price overcame the signal level of 1.1754 and there is a possibility of the MACD line reaching the 1.1895 area on the daily chart. The signal line of the Marlin oscillator has entered the growth trend zone. Overcoming this resistance will lead to growth to the upper border of the price channel at 1.1975, but so far there are no prerequisites for this, we still consider the ongoing growth from the decline from September 1 as corrective. We do not even exclude a variant with a false breakout of the signal level (1.1754), due to the only insignificant exit of Marlin into the growth zone and there might be a reversal from the border of the neutral line. Therefore, we recommend that you be extremely careful with your longs. Selling is possible after the price settles below the signal level. Target levels are indicated on the chart: 1.1650, 1.1550. Forming a price divergence with the oscillator is starting to take place on the four-hour chart. Since investors are strongly interested in buy positions, we might not complete the divergence and Marlin will continue to grow, but weak buying tendencies may strengthen the formation and a price reversal in the next day. We are waiting for the development of events. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on October 6, 2020 Posted: 05 Oct 2020 08:02 PM PDT AUD/USD The Australian dollar grew yesterday due to general market interest in risk, and it gained 18 points. It stopped growing due to the resistance of the extremes on September 9, August 13 and other days in the past. The aussie is trying to overcome this level again this morning. Pushing the price above the high on October 1 (0.7210), may bring the aussie to the target level of 0.7270. A price slowdown with a breakout of the signal level will cause the Marlin oscillator to reach the border of the growth area and a reverse from it, then the probability of a price reversal will increase. The price is in the range between the target level of 0.7190 and the signal level of 0.7210 on the four-hour chart, while Marlin is trying to go into the negative zone, after which the pressure on the price will increase. This is the first sign that prices will not rise to 0.7270, but this is only the first and weakest sign. To strengthen the reversal, the price needs to settle below the lower signal level of 0.7132, and then go below the MACD line. The price has a lot to do, so we just have to wait for the development of events. |

| Forecast for USD/JPY on October 6, 2020 Posted: 05 Oct 2020 08:02 PM PDT USD/JPY Yesterday's rapid growth in stock indices caused the USD/JPY pair to grow by 43 points. There is not much left for the price to reach the first target level of 105.95, set by the MACD line on the daily chart. The Marlin oscillator has only slightly deepened into the growth zone, so we expect the price to successfully overcome the first target level and expect succeeding growth to the embedded line of the price channel in the 106.35 area. Leaving the area which is above the second target opens the third at 106.96, the high on August 28. The price is above the balance (red) and MACD (blue) indicator lines on the four-hour chart. Marlin is in the positive zone. The short-term trend is correspondingly increasing. |

| Posted: 05 Oct 2020 06:15 PM PDT GBP/USD 1H The GBP/USD pair continued to trade within the ascending channel on October 5, which was slightly rebuilt by us. Now it has a smaller slope, but the British pound sterling is still very reluctant to rise in price. Thus, the upward movement continues, but it is difficult to say how long it will last. The problem is the fundamental background, which is equally bad in the US and in the UK. Traders could change their mood to the opposite at any moment, and the pair was generally "stormy" at the end of last week. Therefore, while the initiative remains in the hands of buyers, you can consolidate the price below the ascending channel, which may provoke a renewed downward movement. GBP/USD 15M The linear regression channels are directed upward on the 15-minute timeframe, which fully supports the trend of the hourly timeframe and indicates that there are no signs of starting a correction. The latest Commitments of Traders (COT) report for the British pound showed that non-commercial traders started to open high-volume sell contracts. In total, 12,000 Sell-contracts (shorts) were opened from September 23-29. At the same time, the "non-commercial" group of traders also closed around 4,000 Buy-contracts (longs). That is, the net position for this category of traders suddenly decreased by 16,000, which is a lot for the pound, given that there are about 100,000 contracts open at this time. The sentiment of non-commercial traders has become much more bearish. However, the pound only rose in price from September 23-29. It did not grow much, only 140 points, and continues to move up, very uncertainly if I may add. We tend to think that the pound will resume falling in the near future (based on the latest COT reports). The UK Services PMI was released on Monday, October 5. However, this report is not important, and besides that, it did not particularly impress traders. Business activity rose to 56.1 points. There were no other important economic events in Great Britain yesterday. Federal Reserve Chairman Jerome Powell will deliver a speech today, we recommend not to miss this event, and we also have European Central Bank President Christine Lagarde's speech in the EU. These are potentially significant events, but everything will depend on what the heads of the central bank will say. We would say that the markets currently attach much more importance to US President Donald Trump's illness than to various economic news and reports. As for the UK, Brexit and the one-month-long negotiations on a trade deal remain in first place. Thus, we advise traders to pay more attention to the general fundamental background at this time, and not to single macroeconomic reports. We have two trading ideas for October 6: 1) Buyers continue to push the pair upward and remain inside the ascending channel. Thus, it is recommended to stay in long positions while aiming for the resistance area of 1.3004-1.3024 and the 1.3114 level as long as the pair remains above the Kijun-sen line (1.2899) and within the channel. Take Profit in this case will be from 30 to 130 points. The fundamental background is simultaneously bad for both the pound and the dollar. 2) Sellers failed to seize the initiative in the market several times, although the attempts were solid. Now they need to wait until the price settles below the Kijun-sen line (1.2831) and under the ascending channel and only after that should you resume trading downward while aiming for the Senkou Span B line (1.2836), support level 1.2794 and support area of 1.2636-1.2660. Take Profit in this case can range from 40 to 200 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Oct 2020 06:14 PM PDT EUR/USD 1H The euro/dollar pair, quite unexpectedly for many, resumed its upward movement on the hourly timeframe on October 5, after trading flat just a few days before. Nevertheless, the bulls found the strength to start buying the pair again, which caused the euro to grow. The first resistance level for this week has been reached, the ascending trend line, below which there was a consolidation prior, has been rebuilt and now provides support to the bull traders. Thus, the price broke out of the 1.1683-1.1756 area, in which there was a rare accumulation of various lines and resistances, which significantly increases the likelihood of forming an upward trend. Which, by the way, is much more likely from a fundamental point of view. EUR/USD 15M Both linear regression channels turned to the upside on the 15-minute timeframe, which clearly reflects the resumption of the upward trend on the higher timeframe. The euro/dollar rose in price by around 30 or 40 points during the last reporting week (September 23-29). We cannot even call it growth, just a normal market noise. The previous Commitment of Traders (COT) report showed that non-commercial traders opened 15,500 new Buy-contracts (longs) and almost 6,000 Sell-contracts (shorts). Thus, the net position for this group of traders increased by around 9,000. The new report clearly reflects what is currently happening in the foreign exchange market. Professional traders closed 4,500 contracts for buy positions on the euro and 3,300 contracts for sell positions during the reporting week. That is, the net position for the "non-commercial" group has decreased by around a thousand contracts, which means that the mood of large traders has become a little more bearish. However, these are not changes that can be acknowledged as global. Therefore, we conclude that the situation has not changed dramatically. The EUR/USD pair generally stood in one place for the next three trading days (after September 29). Therefore, the next COT report may also show minimal changes in the mood of professional traders. The European Union published an index of business activity in the services sector for September. Despite the fact that its value remained below 50.0, the European currency was still rising in price against the dollar during the day. This means that this report was also ignored following much more important reports on inflation in the EU and NonFarm Payrolls in the US on Friday. Retail sales in the EU in August grew by 3.7% in annual terms and 4.4% in monthly terms. And take note that this report could have provoked the euro's growth, since it began approximately at the time of its release. As for the important ISM index of business activity in the US services sector, it rose even more in September and reached 57.8 points. However, the dollar did not strengthen in the afternoon. Thus, it turns out that traders have worked out the report on retail sales in the EU, but ignored the reports on business activity in the EU and the US. It is rather difficult to believe in such selectivity, so we conclude that all macroeconomic data were ignored on Monday. We have two trading ideas for October 6: 1) Buyers have the initiative in the market once again and managed to get the pair out of the 1.1683-1.1756 horizontal channel. Thus, traders are encouraged to continue to trade upward with targets at the resistance levels of 1.1786 and 1.1855. A downward correction may begin now, since the first target was not overcome. But the upward trend persists above the trend line. Take Profit in this case will be up to 70 points. 2) Bears have finally released the market from their hands, but may return the downward trend if they manage to get the pair to settle below the upward trend line. In this case, we recommend opening new short positions with the target at 1.1631. In this case, the potential Take Profit is up to 80 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Oct 2020 05:06 PM PDT 4-hour timeframe

Technical data: Senior channel of linear regression: direction – up. Junior channel of linear regression: downward direction. Moving average (20; smoothed) - upward. CCI: 151.2681 On Monday, October 5, the British pound continued to trade with minimal upward bias. Formally, the upward trend for the pound/dollar pair remains, since the price is still consistently above the moving average line. However, we still consider the pound sterling to be the weakest currency on the market at this time. And its strengthening in recent days raises many questions. Yes, no currency can rise or fall forever. And since the beginning of September, the pound has fallen by 8 cents. Thus, it is possible that now we are just seeing a correction, after which the downward movement will resume. Moreover, we have repeatedly talked about the level of 1.3000, which is a psychologically important level and which may not let the pair go further up. Therefore, despite the fact that the upward trend is still maintained, we still believe that there is more chance of a new fall in the pound. The European Union has gone back on its word. This is how you can describe what is happening now between London and Brussels. Recall that the European Union has taken a tough position on the "Johnson bill", which violates the principles of international law and the existing agreement with the EU on Brexit. The European Union behaved as it should in a situation where agreements are changed unilaterally – it threatened legal proceedings. London did not meet them halfway and the Parliament approved the "Johnson bill". In addition, the eighth and ninth rounds of negotiations on a trade deal also did not bring any success. Thus, this weekend was scheduled for a conversation between the head of the European Commission Ursula von der Leyen and British Prime Minister Boris Johnson. Two high-ranking officials were supposed to discuss the situation and try to find a way out of it. Earlier, Boris Johnson repeatedly stated that the deadline for negotiations with the EU is October 15. However, just as last year, when Boris Johnson punched himself in the chest and declared that "I'd rather die in a ditch than postpone Brexit to a later date" when it was necessary, the Prime Minister easily forgot about all his previous statements and moved the deadline a month ahead. What exactly the head of the European Commission and the British Prime Minister said is unknown. The parties agreed to continue negotiations, but immediately everyone had one question: what is the point? London and Brussels could not agree on a deal in 6 months. At the same time, neither London nor Brussels clearly showed excessive zeal in the negotiations. No one wanted to give in on key issues and, in fact, these issues remain unresolved to this day. Thus, it seems that we are waiting for an additional month of unsuccessful negotiations, which both sides will spend simply on throwing the ball to the other half of the field. And it is not at all clear what will happen now with the trial, which the European Union seems to have already initiated. Will it be paused? How is Brussels going to continue to negotiate with London, if the British Parliament has already approved the "Johnson bill"? So Brussels suddenly stopped abruptly condemning Britain for its "internal market" bill? And if the parties fail to reach an agreement on a trade agreement, will the legal proceedings resume? In general, to be honest, the whole situation with Brexit before was very similar to the TV series "Santa Barbara". Well, who really wants to listen to in this situation is the most honest, direct, and frank Michel Barnier, who clearly sums up the results after each round of negotiations, without any fantasies and dreams. At the end of the ninth round of negotiations, Barnier noted minimal progress towards an agreement, noted "positive evolution", but also said that serious differences on all key issues remain in force. Michel Barnier believes that the future partnership between the UK and the EU should be based on absolutely clear and transparent rules. This concerns compliance with various standards, fair and healthy competition, a fair judicial system, and other issues. Barnier also noted that the EU still believes that European fishermen should have access to British waters. Also, the chief negotiator from the Kingdom believes that the protocol on the Northern Irish border should be implemented by London, otherwise it will be extremely difficult to conclude a deal. Such is the case in the British Kingdom. Well, for the pound, all this news does not mean anything good. At this time, the British currency continues to grow moderately, but at any time it can resume falling. Yes, the recent events described above give hope that the parties will still be able to agree on a deal. Or at least they give extra time for a miracle to happen. Thus, in the coming month, the pound may even show moderate growth, especially against the background of everything that is happening now in the United States. However, in general, we believe that it is the UK currency that remains the weakest and with the worst prospects. Moreover, the second "wave" of the "coronavirus" has begun in the UK. On October 4, 23 thousand new cases of the disease were registered. For a second, at the peak of the first "wave", no more than 5.5 thousand cases were registered daily. Thus, the second "wave" of the pandemic may not even be twice as strong as the first, but several times stronger. And its negative impact on the British economy may be much larger than in the second quarter.

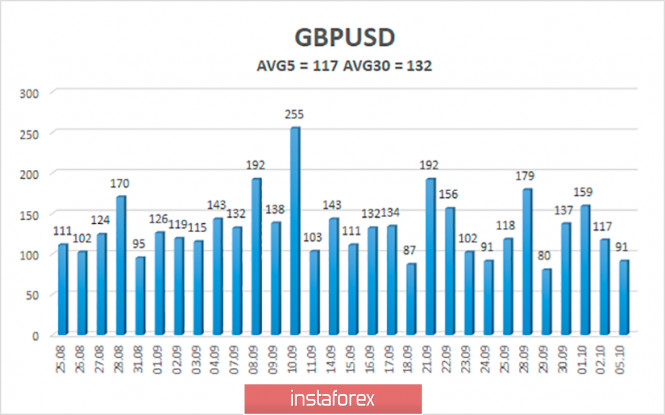

The average volatility of the GBP/USD pair is currently 117 points per day. For the pound/dollar pair, this value is "high". On Tuesday, October 6, therefore, we expect movement inside the channel, limited by the levels of 1.2859 and 1.3093. A new reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement. Nearest support levels: S1 – 1.2970 S2 – 1.2939 S3 – 1.2909 Nearest resistance levels: R1 – 1.3000 Trading recommendations: The GBP/USD pair on the 4-hour timeframe hardly continues its upward movement, bouncing off the moving average line once again. Thus, today it is recommended to stay in the longs with the goals of 1.3000 and 1.3093 as long as the Heiken Ashi indicator is directed upwards. It is recommended to trade the pair down with targets of 1.2817 and 1.2756 if the price returns to the area below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Oct 2020 05:06 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 185.8802 On Monday, October 5, the European currency resumed its upward movement, bouncing off from the moving average line. Thus, the position of the US currency at this time remains extremely weak. It should only be noted that after the growth of 1300 points, traders did not manage to correct the pair properly. At the moment, the correction is no more than 400 points. On the one hand, of course, this is quite a lot, on the other hand, the correction shows that the upward movement should resume, so traders can expect quotes to leave above the previous local maximum of $ 1.20. At the same time, it should be noted that in the last three months, the pair is in the closest possible movement to the definition of "flat". This point should be taken into account in long-term trading. Meanwhile, in the US, all attention is focused on Donald Trump, who at the end of last week announced that he and his wife Melania had contracted the "coronavirus". Donald Trump even needed to be hospitalized, although his condition was not considered serious. This was followed by information that Trump is being treated with fairly strong drug dexamethasone, which is prescribed only to patients with a very severe form of the disease. However, despite the fact that Trump is in the hospital for only a couple of days, today or tomorrow, according to some journalists, the US President may return to the White House. Trump's attending physician, Sean Conley, said Trump's condition is improving. At the same time, Donald did not miss the opportunity to drive around the hospital in a car, accompanied by a whole retinue, to greet his supporters. What is the true state of Trump, if his doctor calmly lets the patient go outside, is unknown. Maybe Trump is not really sick? Moreover, how can they return to their duties in the next few days if they must be isolated for at least 14 days? Or will the entire White House be evacuated? Or will the entire White House wear chemical protection suits and gas masks? In general, it is absolutely unclear where the truth is and where the lie is. Meanwhile, in the States, polls continue to be conducted almost every day. As we have repeatedly stated, the largest and most reliable polls of Americans continue to show that Donald Trump lags behind Joe Biden by about 8-10%. This time, the poll was conducted by the respected Reuters news agency and its results showed that 51% of respondents are ready to vote for Biden right now, and 41% for Trump. Also, 55% of respondents said they don't believe Trump when he talks about "coronavirus". Therefore, as we said earlier, the President's ratings simply had nothing to grow on in recent months. Trump did not fight the "coronavirus" from the very beginning, did not take any additional measures when the epidemic was in full swing, and his sacramental statement that "the consequences of the fall of the economy can be even more devastating than the consequences of COVID-2019" shows that Trump is more concerned about the economy, and not the lives and health of his nation. In the end, Trump himself was infected with the "coronavirus" and now it is unknown when he will return to his duties. Meanwhile, the election is less than a month away. For sure, Trump was going to spend this month trying to narrow the gap as much as possible from his opponent from the Democratic party. For example, by holding rallies and speeches in the most controversial states and cities in the United States. However, it is now completely unclear how Donald's election campaign will proceed. Other news on Monday was not available to traders, except for a few macroeconomic publications, which are still not taken into account at this time by market participants. The euro is getting more expensive again because there are a number of reasons for this. We still believe that the country is facing a serious political crisis, which has now eclipsed even the economic and epidemiological crises. The level of uncertainty about the future of the country and its economy is off the scale. Thus, market participants simply do not risk buying the US dollar, especially in the long term. The topic of elections deserves a separate article every day. TV debates that took place recently showed that the level of civility of both presidential candidates tends to zero. Donald Trump showed himself entirely familiar with the parties. Constantly interrupted the opponent and the host. And this is not a debate in a third-world country. For a moment, we are talking about a country with the world's largest economy. However, this is the American reality in 2020. Another important issue that needs to be resolved in the near future is the appointment of a judge to the Supreme Court in place of the untimely deceased Ruth Ginsburg. Recall that Trump was very much in a hurry to nominate his candidate for this position, and he had every reason to expect that the Senate would approve him. And then, Trump would get the necessary advantage in the US Supreme Court. And he needs this advantage because the elections can smoothly move from the polling stations to the court. And then it will depend on the judges whether a recount of votes in a particular state will be allowed, whether the elections will be recognized as legitimate, no matter who wins them. In general, the situation is absolutely non-standard and sometimes even absurd. In such conditions, there is no reason for the US currency to become more expensive. From a technical point of view, a new upward trend has been formed, which is not yet strong. Thus, the rise in the price of the euro currency in principle looks very logical in recent months.

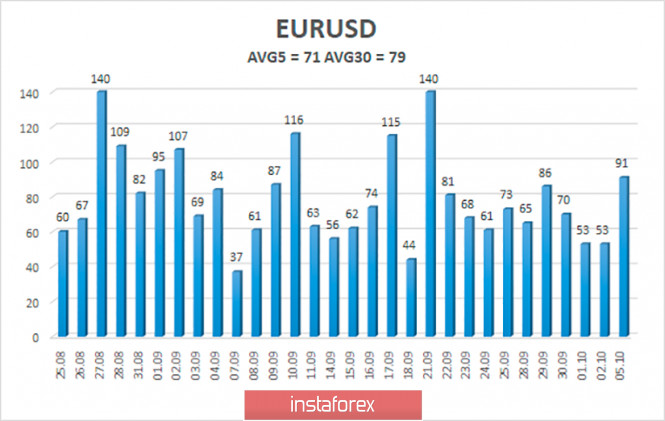

The volatility of the euro/dollar currency pair as of October 6 is 71 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1707 and 1.1849. A reversal of the Heiken Ashi indicator back down may signal a new round of corrective movement. Nearest support levels: S1 – 1.1719 S2 – 1.1658 S3 – 1.1597 Nearest resistance levels: R1 – 1.1780 R2 – 1.1841 R3 – 1.1902 Trading recommendations: The EUR/USD pair continues to be located above the moving average line. Thus, today it is recommended to continue to stay in long positions with a target of 1.1841 until the Heiken Ashi indicator turns down. It is recommended to consider sell orders again if the pair is fixed back below the moving average with the first target of 1.1658. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Oct 2020 02:36 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair moved up on Monday, October 5. The pair grew from the very morning and continued to do so throughout the day. In the morning we talked about the fact that the upward trend line was rebuilt and therefore we recommend trading up while aiming for 1.1745 and 1.1773. However, the euro/dollar pair exceeded the morning plan and reached the third resistance level of 1.1798 during the day. Novice traders who opened trades according to our recommendations in the morning could earn about 40 points if they closed buy trades near the 1.1773 level, and around 60 points if they are still in the longs (buy orders). You can close long positions by turning the MACD indicator down or even right now, without waiting for it. The fact is that the upward trend is still maintained, so the price needs to correct in order to possibly resume the upward movement later. The same goes for the MACD indicator. It needs to ease as close to the zero level as possible in order to form a new buy signal in time. Several macroeconomic reports were published in the European Union and in the United States during the first trading day of the new week. However, we tend to believe that the markets completely ignored them. But do take note that the ISM index of business activity in the US services sector was at a high level (and did not provoke a rise in the US dollar), and the index of business activity in the EU services sector was at 50.0 (and did not put pressure on the European currency). The only exception was the report on retail sales in the European Union, which grew by 4.4% m/m in August, but it is unlikely that this one report provoked the euro's growth, while traders ignored other reports. Market participants showed much more interest in Donald Trump's condition, who is in the hospital right now after being infected with the coronavirus. All of the media covered this topic. However, the very fact that the US president was seriously ill a month before the election (Trump is at high risk, since he is 74 years old and overweight), it put pressure on the US currency. European Central Bank President Christine Lagarde is scheduled to speak in the European Union on Tuesday, October 6, and Federal Reserve ChairmanJerome Powell is set to speak in the United States. Therefore, we have two speeches by high-ranking officials that are directly related to the EU and US economies. However, the recent speeches of Powell and Lagarde did not give the markets any fundamentally new information. However, no one knows in advance what the heads of the central banks of America and the European Union will be talking about this time. Possible scenarios for September 29: 1) Buy positions on the EUR/USD pair remain relevant at the moment, since the ascending trend line has been rebuilt, and the price has not managed to gain a foothold below the 1.1696 level. Thus, we recommend novice traders to stay in long positions until the MACD indicator turns down. You are advised to open new buy orders after the price corrects downward and a new buy signal from MACD appears. In other words, tomorrow morning you will be able to see at what stage of implementation of this plan the pair is. 2) Sell positions may become relevant again if the pair settles below the trend line. This is the first prerequisite. However, it may be necessary to wait for the price to settle below the 1.1696 level and only after that consider the possibility of opening sell orders. Take note that the dollar seems reluctant to rise in price, and the fundamental background is not in its favor. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Green zone PMIs, Congressional battles and Trump's caps lock Posted: 05 Oct 2020 02:36 PM PDT The decline in anti-risk sentiment, rumors about the health of US President Donald Trump and uncertainty about the prospects for additional assistance to the US economy - all these fundamental factors put pressure on the dollar. Even the ISM index in the non-manufacturing sector, which was in the green zone, did not help the greenback: today, the dollar index retreated from the local low of 93.90 to the current value of 93.40. In turn, the European currency received support today from the September PMI indices, which were revised up. This combination of fundamental factors made it possible for EUR/USD buyers to take control of the situation, directing the price towards the upper limit of the flat range of 1.1630-1.1820 (the lower line of the Bollinger Bands is the upper limit of the Kumo cloud on the daily chart). But the bulls need an informational impulse to break the upper limit of this range. While we only see an "accumulation of negative potential" against the US currency at the moment. By and large, the pair is growing only due to the weakening of the greenback, while European fundamentals play a secondary role. Still, today's releases should not be ignored. The German index of business activity in the service sector was unexpectedly revised up. If the initial estimate was at 49.1 points, the final one is at 50.6 points. As you know, all values above the 50-point mark reflect an improvement in the situation, and vice versa. Therefore, in this case, the revision of the indicator was not a mere formality. PMI business activity indices in the service sector also came out in the green zone in other key European countries (except Spain). We were also pleased with the pan-European composite purchasing managers' index, which similarly turned out to be higher than the forecast level. One more release today is worth mentioning separately. This is an indicator of retail trade in the eurozone countries. This indicator of consumer activity fell into negative territory in July, reflecting a slowdown in inflation processes. However, the August data showed significant growth, both in annual and monthly terms. According to forecasts, this indicator was expected to grow to 2.4% m/m and 2.2% y/y. However, in reality, the indicators rose by 4.4% and 3.7%, respectively. It is worth recalling that we received failed data on the growth of European inflation last Friday. Commenting on this release, the European Central Bank vice president complained about low consumer demand. Today's data partially offset pessimism about the prospects for the pan-European CPI. However, all the above-mentioned successes of European data only provided background support for the euro. The dollar was the main driver of EUR/USD growth, which is showing weakness again today. And if the dollar index slowly slid down during the European session, then the downward dynamics intensified during the US session. In general, the greenback is trading in conditions of increased uncertainty. Speculation about the health of Trump, as well as conflicting news on the topic of fiscal stimulus for the US economy, do not allow dollar bulls to show character. Traders can't find a firm foothold that would allow the greenback to claim an advantage. Even Nonfarm, which was published last Friday, left a mixed impression. On the one hand, the unemployment rate fell below the 8% mark, and the number of people employed in the manufacturing sector increased by 66,000 (with a forecast of 32,000). On the other hand, we were disappointed with wages, which are particularly important for the dollar in the context of the Federal Reserve's updated strategy. In addition, the number of people employed in the non-agricultural sector increased by only 660,000, while most analysts expected to see this indicator much higher (985,000). In other words, the Nonfarm report did not become a catalyst for the greenback's growth. Dollar bulls were also puzzled by Trump, who contracted the coronavirus last week. He held a kind of performance during the weekend: in his motorcade, he toured the hospital area, greeting his supporters. At the same time, the press reported that Trump may be discharged on Monday. But today it became known that Trump was not only not discharged, but also began to be treated for COVID-19 with dexamethasone, a drug that is prescribed to seriously ill patients. This was reported by the Associated Press, citing its own sources. According to their information, doctors began using the steroid drug after the oxygen level in Trump's body dropped to 93%. According to some doctors who commented on this information, the use of dexamethasone implies "a higher degree of severity of the situation." By the way, while in the hospital, he wrote more than 20 tweets in just two hours today – and in all caps. In each of them, he called for voting for himself in the presidential election, and also told how bad it would be for Americans under the Democrats. This abnormal and somewhat unbalanced activity of Trump also alerted investors. In addition, the US dollar is under pressure amid ongoing negotiations between Democrats, Republicans and the White House. Today, White House Chief of Staff Mark Meadows said that "the deal has potential." But judging by the dollar's reaction, traders are already skeptical of such statements. Let me remind you that similar theses were voiced last week by the US Treasury Secretary, who even announced serious progress in this direction until the beginning of October. But, as you know, "things are still there." Therefore, the market ignored the signals from the White House. Thus, the EUR/USD pair has every reason for further upward movement – at least to the upper limit of the flat range, that is, to the 1.1820 level (the upper limit of the Kumo cloud on the daily chart). A break of this resistance level will open the way for buyers to the main resistance level of 1.1900 (the upper line of the Bollinger Bands on the same timeframe). The material has been provided by InstaForex Company - www.instaforex.com |

| October 5, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 05 Oct 2020 11:12 AM PDT

By the end of August, the EURUSD pair has achieved a temporary breakout above the previously mentioned resistance zone located around 1.1900. However, Significant SELLING pressure was applied around 1.2000 where the upper limit of the movement pattern came to meet the pair. That's why, the EUR/USD pair has demonstrated a quick bearish decline towards 1.1800 then 1.1770-1.1750 which failed to offer sufficient Support for the EUR/USD. Earlier Last week, a breakout to the downside was executed below the price level of 1.1750 (Lower limit of the depicted movement pattern). Hence intraday technical outlook has turned into bearish. Intraday traders should consider any pullback towards the recently-broken key-zone (1.1750-1.1770) for a valid SELL Entry. On the other hand, a breakout above 1.1820 (Exit Level) will probably enable further upside movement towards 1.1860-1.1900. The material has been provided by InstaForex Company - www.instaforex.com |

| October 5, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 05 Oct 2020 11:10 AM PDT

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the newly-established key-level of 1.3300. A quick bearish decline took place towards 1.2900 then 1.2780 where considerable bullish rejection has been expressed during the past few weeks. The price zone of 1.3130-1.3150 (the backside of the broken trend) remains an Intraday Key-Zone to offer bearish pressure if retested again. However, the GBPUSD pair has shown lack of sufficient bullish momentum to pursue above the price level of 1.3000 upon the past few bullish trials. Bullish Persistence above the depicted price zone of 1.2975 -1.3000 is currently needed to allow bullish pullback to pursue towards 1.3100. Otherwise, further bearish decline would be expected towards the price level of 1.2600. Trade recommendations : Conservative traders are advised to wait for the current bullish pullback to pursue towards 1.3130-1.3150 (the backside of the broken trend) for a valid SELL Entry. Initial T/p level is to be located around 1.3050 and 1.2900 if sufficient bearish pressure is maintained. The material has been provided by InstaForex Company - www.instaforex.com |

| October 5, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 05 Oct 2020 11:08 AM PDT

|

| US stimulus package an indicator for gold's growth Posted: 05 Oct 2020 08:45 AM PDT

If earlier missiles fired at the Middle East, or nuclear tests conducted by North Korea, could easily trigger a gold rally, now all this seems to have no meaning for the so-called "safe harbor". Even the news that US President Donald Trump had contracted the coronavirus did not cause the precious metal to rise rapidly. Nonetheless, against this news background, gold rose above $1900, however, this movement did not receive a strong continuation. The dollar, on the other hand, reacted quite positively and began to strengthen. The weakening of Trump's positions in the election race is a positive factor for the greenback, as it increases the alertness of stock market participants and increases the craving for defensive assets. Greenback has risen periodically since early August, despite a gaping U.S. budget deficit pit, record unemployment rates in the country, and other economic troubles associated with the COVID-19 pandemic. It is the counterintuitive rise in the USD that is one of the reasons why gold is unable to return to record highs in the $ 2,000 mark. At the same time, it is now becoming clear that new economic stimulus measures in the US are needed to resume the gold's upward trend. Without this, according to experts, sentiment on the precious metal market is increasingly shifting towards bearish. This year, gold has reached unprecedented heights amid unprecedented support measures for the US economy. The $3 trillion allocated for this purpose dried up by the second quarter, additional funds were needed to inject into the economy, and the gold bulls were already anticipating the ringing of coins. However, negotiations between Republicans and Democrats on the next package of support measures have stalled. Against this background, gold dipped in September to two-month lows around $1,855. After much verbal battles in Congress, progress was at last made last week, when US Treasury Secretary Steven Mnuchin announced that he had had a round of effective talks with House Speaker Nancy Pelosi on new measures to stimulate the national economy. This allowed gold to move away from two-month lows and return to $ 1900. The hopes that the US Congress will pass stimulus legislation seems to be what the market is holding onto right now. "We expect gold to continue to consolidate ahead of a possible move above $ 1993 to target $ 2075 again. A possible move above this level will resume the bullish trend with resistance at $ 2,175, then at $ 2,300. Meanwhile, a breakdown of the $ 1,837 mark could trigger a deeper fall to $ 1,765, potentially to $ 1,726. We are not looking for weak points here, which will appear below. However, if this happened, it would significantly increase the risk of the end of the bullish trend," said Credit Suisse. The material has been provided by InstaForex Company - www.instaforex.com |

| Daily Video Analysis: XAUUSD High Probability Setup Posted: 05 Oct 2020 08:17 AM PDT Today we take a look at XAUUSD. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD trendline re-test followed by a drop! Posted: 05 Oct 2020 08:16 AM PDT

AUDUSD broke out of ascending trendline support (now resistance) to the downside before coming back to retest the trendline and 61.8% Fibonacci retracement at 1st resistance 0.72093. A drop towards 1st support at 0.71311 is expected. Stochastics is testing resistance where price reacted in the past as well. Trading Recommendation Entry: 0.72093 Reason for Entry: 61.8% fib retracement, ascending trendline resistance Take Profit : 0.71311 Reason for Take Profit: 38.2% fib retracement, Recent swing low Stop Loss: 0.72651 Reason for Stop loss: -27.2% and 78.6% Fib retracement, 61.8% Fib extension The material has been provided by InstaForex Company - www.instaforex.com |

| AUDJPY reversing from 1st resistance, further drop expected ! Posted: 05 Oct 2020 08:15 AM PDT

AUDJPY is reversing from 1st resistance where the horizontal swing high ,78.6% fib retracement and 78.6% fib extension are. Stochastics also show that price is reaching resistance. Trading Recommendation Entry: 75.867 Reason for Entry: horizontal swing high ,78% fib retracement and 78.6% fib extension Take Profit: 75.296 Reason for Take Profit: 61.8% fib retracement Stop Loss: 76.416 Reason for Stop Loss: 127% fib retracement The material has been provided by InstaForex Company - www.instaforex.com |

| USDJPY is testing resistance, potential reversal! Posted: 05 Oct 2020 08:15 AM PDT

Price is testing our first resistance, in line with our descending trend line, 78.6% fibonacci retracement and 78.6% fibonacci extension where we could see a reversal below this level. Trading Recommendation Entry: 105.649 Reason for Entry: descending trend line, 78.6% fibonacci retracement and 78.6% fibonacci extension Take Profit: 104.955 Reason for Take Profit: 50% fibonacci retracement and Horizontal swing low support Stop Loss: 105.820 Reason for Stop Loss: 127% fibonacci Extension, horizontal swing high resistance The material has been provided by InstaForex Company - www.instaforex.com |

| Trump's COVID-19 test results affect global stocks dynamics Posted: 05 Oct 2020 07:31 AM PDT

Trading floors in Russia declined on Friday amid news that US President Donald Trump tested positive for COVID-19. In such a situation, the greenback can rejoice with might and main, because the markets of developing countries, including Russia, are suffering significant losses. And here's a good example: the Moscow Exchange index fell 1.29% on Friday, the dollar-denominated RTS index plunged 2.25%. Moreover, Sberbank, Aeroflot, GDR Rusagro, Lenta, Pharmacies 36 and 6, and Rosneft also suffered significant losses. Futures on the Dow Jones industrial index also went down by 0.48%. The same fate befell the S&P 500 broad market index, which sank 0.96%. The NASDAQ hi-tech index also fell 2.22% despite recent clear gains. Europe stocks, on the other hand, showed multidirectional movements. Stock indexes in the UK, France, Holland, and Switzerland slightly went up, while German stocks, on the contrary, suffered a loss. Meanwhile, positive news on Trump's improving health condition quickly reflected on the Asian stocks: the Japanese trade was in clear advantage. Nikkei 225 climbed 1.26%, KOSPI also rose 1.26%, and Hang Seng joined the trend with an increase of 1.31%. Trading in China was closed due to its celebration of a National Day. To date, many of the world's major economies are measured by the Services PMI. The US is expected to publish the non-manufacturing employment index (ISM) and the ISM non-manufacturing purchasing managers index. Likewise, the EU should provide information on the trend in retail sales in its countries. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review of EUR/USD on 05.10.2020 Posted: 05 Oct 2020 07:19 AM PDT Eventually, EUR has broken 1.1770 upwards with the next target at 1.1875. I would suggest holding long positions from 1.1685 with stop loss at 1.1640. Stop loss could be shifted to near 1.1680 with minor downward fine-tuning. The material has been provided by InstaForex Company - www.instaforex.com |

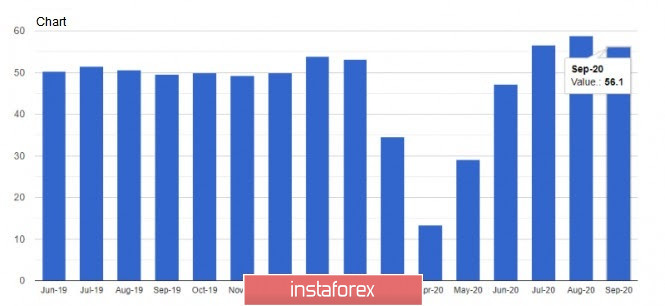

| Posted: 05 Oct 2020 07:19 AM PDT Today, the Eurogroup meeting will begin discussing the main issue related to the implementation of budget support measures and the distribution of funds from the Eurozone economic recovery fund, which was formed at the end of this summer and which amounts to 750 billion euros. As recently as last week, there was news that distributing money among European countries, while respecting the rule of law, will not be as easy as it seems, and that it will be necessary to compromise again. If there are problems with the distribution of this fund from the first meetings of the Eurogroup, this may negatively affect the exchange rate of the European currency, since closer to winter, when time is running out, it will again require the intervention of the most influential European politicians, as was the case with the decision on the formation of the above-mentioned fund. Even so, another weakening factor for the euro remains the rather high probability of monetary easing in the Eurozone at the end of this year. According to many analysts, there is a fairly high probability that the ECB's Governing Council will announce additional quantitative easing and the extension of the emergency PEPP asset purchase program until the end of 2021 at the December meeting. Today's reports on the services sector and the composite index helped risk assets to get close to the highs of last week, where the movement again slowed down. The final data was much better than the preliminary data, which led to the growth of the euro in the first half of the day. According to a report by IHS Markit, the purchasing managers' index (PMI) for the Eurozone services sector in September this year fell to 48.0. However, it is worth noting that the indicator values below 50 points indicate a reduction in activity, whereas at the end of this summer in August, the indicator was equal to 50.5 points. Economists had forecast that the final PMI for the Eurozone services sector in September would remain unchanged. The slowdown in the European economy in the early autumn of this year is directly related to the end of the V-shaped rebound after the lifting of quarantine measures, as well as due to the second wave of the coronavirus outbreak. As for individual countries, for example, in Germany, the final index for the service sector was 50.6 points against the August level of 52.5 points. In France, the services PMI fell to 47.5 points from 51.5 points a month earlier. The indicators coincided with the preliminary assessment and analysts' expectations. Another indicator that had a positive impact on the euro was the report on retail sales in the Eurozone. And although the data comes out with a one-month delay, a sharp increase in retail sales in August should smooth out the autumn slowdown in the European economy. According to a report by the statistical agency Eurostat, retail sales in August 2020 increased by 4.4% compared to July, while economists had expected it to grow by 2.4%. On an annual basis, retail sales in the Eurozone increased by 3.7%. As for the technical picture of the EURUSD pair, the bulls are following the planned path and have already broken above the level of 1.1755, once again resting on the highs of last week. Going beyond this range will lead to a more active recovery of the trading instrument in the area of 1.1800 and 1.1840. If growth slows down once again at the high of last week, the bears can take advantage of the moment and return risky assets to the support area of 1.1700, for which another drama will once again unfold. A break in this range will increase the pressure on the pair, which will lead to a downward movement to the area of lows 1.1655 and 1.1610. GBPUSD The British pound is moving on the path of its further strengthening, and the bulls are ready to break through the highs of last week. This requires a breakdown of the resistance of 1.2980, which will open a direct path to the levels of 1.3030 and 1.3090. If the pair declines, support will be provided by the same middle of the channel 1.2900, a break of which will push the pound to the more important support level of 1.2820, where a major struggle will once again unfold, determining the further direction of the pair. The pound received the main support today after the report on activity in the service sector, which is so important for the UK. The data was slightly better than the initial estimate. In the IHS Markit report, the purchasing managers' index (PMI) for the services sector for September was at 56.1 points, against the first estimate of 55.1 points and 58.8 points in August. A value above 50 indicates an increase in the activity. Although the optimism of companies for the year ahead has slightly decreased due to the second wave of the coronavirus pandemic, the balance of risks remains quite tolerable. The material has been provided by InstaForex Company - www.instaforex.com |

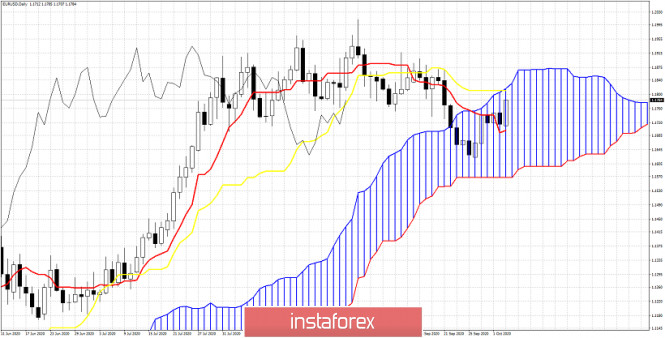

| Ichimoku cloud indicator Daily analysis of EURUSD Posted: 05 Oct 2020 07:07 AM PDT Today we use the Ichimoku cloud indicator in order to identify key support and resistance levels for EURUSD. Trend is neutral as price is inside the Kumo (cloud). As we said in previous post 1.18 is key resistance and this is verified by the Ichimoku cloud.

Support by the tenkan-sen (red line indicator) is at 1.17. Resistance by the kijun-sen and the upper cloud boundary is at 1.18-1.1815. Bulls need to recapture this level in order to hope for a move towards 1.19 and higher. A rejection at 1.18 will open the way for a pull back towards 1.17-1.16. The material has been provided by InstaForex Company - www.instaforex.com |

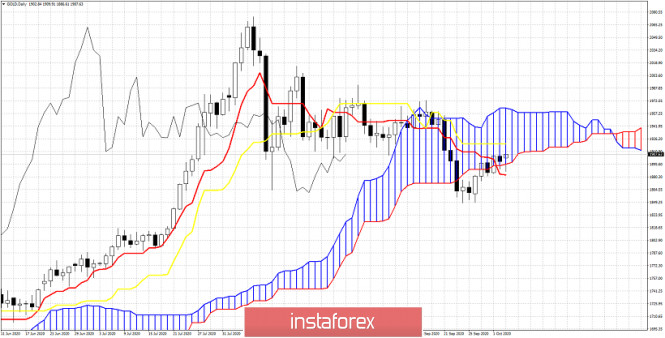

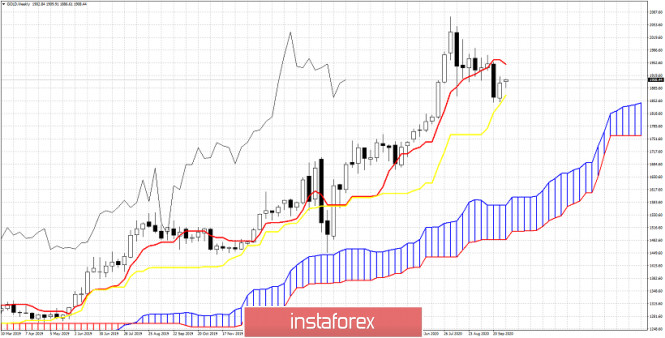

| Ichimoku cloud indicator Daily analysis of Gold Posted: 05 Oct 2020 07:02 AM PDT Gold price is trading around key resistance area of $1,900-$1,910. In Ichimoku cloud terms, short-term trend is neutral as price is inside the Kumo (cloud). The cloud boundaries are now used as key support and resistance levels.

|

| USDCAD at major short-term support area Posted: 05 Oct 2020 06:56 AM PDT USDCAD as we expected by our previous analysis has pulled back inside our target area of 1.3250-1.33. However price is now breaking below a key upward sloping trend line support and unless we see soon an upward reversal, then this break down could unfold into a bigger pull back.

Green rectangle - pull back target since 1.34 USDCAD is trading below the red support trend line. This is not a good sign for bulls. However price has one more support at 1.3230 that needs to hold in order for bulls to keep hoping for a move higher towards 1.35. If traders do not see price reverse to the upside in the next 24 hours, we should expect more downside to come and 1.3230 to be challenged. 1.3320 is short-term resistance and if bulls manage to recapture this level, then they will have more hopes for a continued move higher. The material has been provided by InstaForex Company - www.instaforex.com |

| Trump's coronavirus to affect presidential race Posted: 05 Oct 2020 06:47 AM PDT

Breaking news of the week: Trump's COVID-19 and Market Volatility 1. Trump's COVID-19 diagnosis brings ambiguity to the election race. On Friday, October 2, the whole world learned that US President Donald Trump, along with his wife, had contracted the coronavirus. Trump said on Saturday that they will face several difficult days in treatment for COVID-19.A month later, the US presidential elections will take place. Trump's illness has wreaked havoc on his presidential campaign and has shown in part how he is coping with the pandemic. According to opinion polls, he lags behind his Democratic rival Joe Biden.The President of the United States has repeatedly downplayed the threat of the coronavirus pandemic, even though it claimed the lives of more than 208,000 Americans and seriously damaged the country's economy.2. Pay more attention to talking about incentivesAt the moment, negotiations are underway in Washington on a new financial aid package. Trump's illness has also heightened the already intense scrutiny of the fact.US House Speaker Nancy Pelosi said on Friday that negotiations are in progress and recommended that airlines stop transferring employees to unpaid leave and layoffs. The House of Representatives could pass a separate law to allocate funds to help airlines.It is not known for certain whether Trump's illness or a weaker September jobs report last Friday will affect the adoption of the new stimulus package.Another sign that the US economy is declining is the slowdown in the recovery of the labor market.3. Market volatility is still highInvestors are confident that any deterioration in the president's health could weaken US stock indices. They showed the worst results in a month after the March sell-off.There are speculations that if the uncertainty in the indices persists, the tech and dynamic stocks, that have boosted the market this year, could become particularly vulnerable to a sell-off. The high-tech Nasdaq fell more than 2% on Friday, double the drop in the S&P 500.4. Powell's speechUS Federal Reserve Chairman Jerome Powell will deliver a speech to the National Association for Business Economics on Tuesday to reaffirm the need for additional fiscal stimulus to support the economy.In addition to Powell, several other Fed representatives will speak this week, including Chicago Fed Chairman Charles Evans, Atlanta Fed Governor Rafael Bostic, New York Fed Governor John Williams, Minneapolis Fed Governor Neil Kashkari, and Boston Fed Governor Eric Rosengren.The Fed is also expected to release minutes of the September meeting of the Federal Open Market Committee (FOMC) on Wednesday. This will highlight the message that the prospects for a rate hike in the next couple of years are slim.5. Failures in the euro zone bailout fundEurozone finance ministers are due to meet in Brussels on Monday to discuss the creation of a €750 billion coronavirus recovery fund.Germany insists that only the countries who respect the rule of law can benefit from the fund amid growing concerns in the EU about backsliding on the rule of law in Poland and Hungary. This proposal provoked the outrage of these two countries.Italy, Spain, and Greece, whose economies have been hardest hit by the pandemic, will lose out on any delay in funding the recovery. The material has been provided by InstaForex Company - www.instaforex.com |

| Major stock indexes in US and Asia slightly went up Posted: 05 Oct 2020 06:17 AM PDT

The coronavirus outbreak in European countries remains an important factor for investors. The re-introduction of quarantine measures can have the most negative impact on the state of an already suffering economy. According to official data, there are already more than 35 million cases of coronavirus infection in the world. The news that the US President Donald Trump and his wife both tested positive for coronavirus may negatively affect his rating in the election race and the market as a whole. Nonetheless, positive statements were given by Trump's attending physician, stating that he will be able to return to work starting Monday. Meanwhile, market players expect progress regarding the agreement on a new support package for the US economy. In the event of any favorable impulses in this process, the risk of investors may be fully justified. In addition, investors' attention is focused on the publication of data on the index of business activity in the services sector of European countries and the US, as well as the data on unemployment in the US, and the release of minutes of the meeting of the Federal Reserve. In general, Monday morning is filled with positive sentiment in the global markets. Leading Asian trading floors went up by 1.3% against the background of positive data on the index of business activity in the Japanese services sector. Friday's decline in futures for major stock indices in the US was replaced by a rise of 0.6% on Monday. A positive trend is also observed in the energy market: Brent crude futures showed growth, reaching $ 40 per barrel. The opening of Monday's trading session also promised to illustrate the buying advantage of Russian stocks. This phenomenon can help the Moscow Exchange index to win back part of Friday's losses, as well as maintain the level above 2850 points. Significant shifts in the course of trading today are possible based on the results of these indices of business activity in the services sector of the world's leading countries: the weaker the statistics, the more likely it is that sales will return to the Russian market. This phenomenon can compensate for the morning growth and demonstrate that the market leaves below 2850 points. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

T/P levels to be located around 1.1770, 1.1645 and 1.1600 while S/L to be placed above 1.1860 to minimize the associated risk.

T/P levels to be located around 1.1770, 1.1645 and 1.1600 while S/L to be placed above 1.1860 to minimize the associated risk.

No comments:

Post a Comment