Forex analysis review |

- Forecast for EUR/USD on November 2, 2020

- Forecast for AUD/USD on November 2, 2020

- Forecast for USD/JPY on November 2, 2020

- Forecast for USD/CAD on November 2, 2020

- Hot forecast and trading signals for GBP/USD on November 2. COT report. Traders await the outcome of trade deal talks

- Hot forecast and trading signals for EUR/USD on November 2. COT report. European economy recovered quickly enough. Until

- Overview of the GBP/USD pair. November 2. The UK is going into quarantine. Boris Johnson announced the introduction of a

- Overview of the EUR/USD pair. November 2. The media, experts, and markets have calmed down about the presidential election.

- Analytics and trading signals for beginners. How to trade EUR/USD on November 2. Analysis of Friday deals. Getting ready

| Forecast for EUR/USD on November 2, 2020 Posted: 01 Nov 2020 07:21 PM PST EUR/USD Last Friday the euro settled below the balance indicator line on the daily timeframe. The MACD indicator line turned down, while the Marlin oscillator settled in the downward trend zone. The situation is completely downward in the medium term. The closest target is the 1.1590 level, then 1.1495. A weak convergence formed according to Marlin on the four-hour chart, this gives a precondition for the price to settle before the presidential elections in the United States. The price will likely settle in a narrow range below the 1.1650 level. As for the price's behavior after Biden's victory, the dollar will most likely strengthen, since we see no reason for the opposite due to the victory of the Democrats. In the current economic cycle and with geopolitical events, a strong dollar is beneficial to the United States, regardless of the party that came to power. Moreover, the euro's growth back in July-August was speculative, since no financial institution in the United States, be it a bank or an investment company, gave an intelligible answer to this growth. The Commitment of Traders (COT) data shows the largest volume of accumulated long positions in the euro over the past nine months, it's time to send the bulls to the slaughterhouses. We expect the euro to start falling from 1.1165-1.1200 within 2-3 weeks. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on November 2, 2020 Posted: 01 Nov 2020 07:21 PM PST AUD/USD On Friday, the Australian dollar traded in Thursday's range below 0.7058, which strengthened it even more. Now we are waiting for the price to drop to the previously determined target levels of 0.6970 and 0.6938. All indicators on the daily chart indicate the AUD/USD pair's succeeding decline. No changes occurred during the day on the four-hour chart. We still have a falling trend, we wait for the price at the indicated levels. |

| Forecast for USD/JPY on November 2, 2020 Posted: 01 Nov 2020 07:21 PM PST USD/JPY The yen traded in the 60-point range last Friday, but the indicators did not change, since it closed the day near its opening. This morning, the signal line of the Marlin oscillator has left its own narrow range (gray area), but according to historical analogies, the most likely Marlin exit was expected to go down, so the growth may turn out to be false. The main reason for the fall, as we expect, will be a decline in the stock market after Biden's victory in the US presidential election. Or, which more accurately describes the situation, after Trump's defeat in the presidential elections. Obviously, before the first election results, the yen's behavior will be unpredictable. Getting the price to settle above the trend line at 104.83 will allow it to rise to the MACD line at 105.40 for a short period of time. A price retracement below 104.20 will extend the fall to 103.75 and below. The price is still hesitating to go under the MACD line on the four-hour chart, trying to reach the nearest resistance at 104.83. A price lag before reaching the level will move the Marlin oscillator into the negative zone and the potential for a decline will increase. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/CAD on November 2, 2020 Posted: 01 Nov 2020 07:21 PM PST USD/CAD The price settled above the balance indicator line and the Fibonacci level of 76.4% on the daily chart. The combination of the two supports is a good platform for further growth. The signal line of the Marlin oscillator is moving horizontally, which is also a sign of vigorous growth. The first target for growth is the Fibonacci level of 110.0%, which coincides with the July 30 high at 1.3460. It is possible for the price to grow to the Fibonacci level of 123.6% at 1.3525. The four-hour shows that the consolidation at the 76.4% Fibonacci level is visually complete. The Marlin oscillator has discharged from the overbought zone and is now ready to grow further. We are waiting for the price at the first target level of 1.3460. |

| Posted: 01 Nov 2020 05:35 PM PST The GBP/USD pair failed to overcome the support level of 1.2897 and, after rebounding from it, corrected to the critical Kijun-sen line on October 30. The descending channel has been rebuilt and is now supporting bearish traders again. The fact that the price failed to gain a foothold above the Kijun-sen line preserves excellent chances for the pair to resume the downward trend. Thus, the initiative remains in the hands of sellers, while buyers should continue to wait for the price to settle above the Senkou Span B line (and at the same time the descending channel). From a fundamental point of view and in our opinion, it is most preferable for the pound to fall. GBP/USD 15M The lower linear regression channel turned to the upside on the 15-minute timeframe, which indicates that a weak correction has begun on the hourly chart. However, it could have already ended near the critical line. COT report The latest Commitments of Traders (COT) report on the British pound showed that non-commercial traders were quite active in the period from October 20-26. However, their sentiment changed again, as can be seen from the green line of the first indicator in the chart. The mood of the "non-commercial" group of traders became more bullish for three consecutive weeks, but the net position decreased by 5,000 contracts over the last reporting week, so we can conclude that professional traders are again inclined to sell off the pound. However, if you look at the COT reports over the past few weeks or look at the first indicator, it becomes clear that commercial and non-commercial traders do not have a clear trading strategy right now. Perhaps this is due to an extremely unstable and complex fundamental background. The fact remains. The pound lost 90 points in recent trading days, and we believe that it will continue to fall. However, in the near future, we might receive important information about the progress of negotiations on the UK-EU trade deal, and the results of the vote for the US president will also become known. This information can change the mindset of professional traders. You need to be prepared for this. The fundamental background for GBP/USD did not change on Friday. Traders were waiting for information about the course of talks in London, but did not wait for it. And, in principle, Great Britain did not provide any particularly important macroeconomic information on Friday. Minor reports on changes in personal income and spending for September were published in America, as well as the University of Michigan consumer confidence index for October. However, this information had no effect on the course of the auction. Britain will publish an index of business activity in the manufacturing sector on Monday, which has a fairly neutral forecast of 53.3. Perhaps some information will finally come in about how the next round of negotiations with the European Union went. And this information can cause a surge in activity for the pound/dollar pair. Well, do not forget that there will be Presidential Election Day in America tomorrow, so you also need to be prepared for increased volatility. Not the fact that we might face increased volatility, but it is possible. In general, the fundamental background remains extremely complex and confusing for the pound (especially with the introduction of a lockdown in England), but we are inclined to expect that quotes would fall further. We have two trading ideas for November 2: 1) Buyers for the pound/dollar pair failed to settle above the Kijun-Sen line. Thus, the initiative remains in the hands of the bears, and long positions, accordingly, are irrelevant. You are advised to reconsider long deals in case the price settles above the Senkou Span B (1.3018) and Kijun-sen (1.2979) lines with the target of the resistance area of 1.3160 -1.3184. Take Profit in this case will be up to 110 points. 2) Sellers continue to pull down the pair and have reached the 1.2897 level, which they have not been able to overcome so far. Since a rebound followed from the Kijun-sen line, traders could already open new sell orders with targets at the 1.2897 level and the support area of 1.2854-1.2874. If these targets are overcome, then you are advised to trade down while aiming for the 1.2754 level. Take Profit in the first case will be 30-60 points, in the second - up to 80. Hot forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

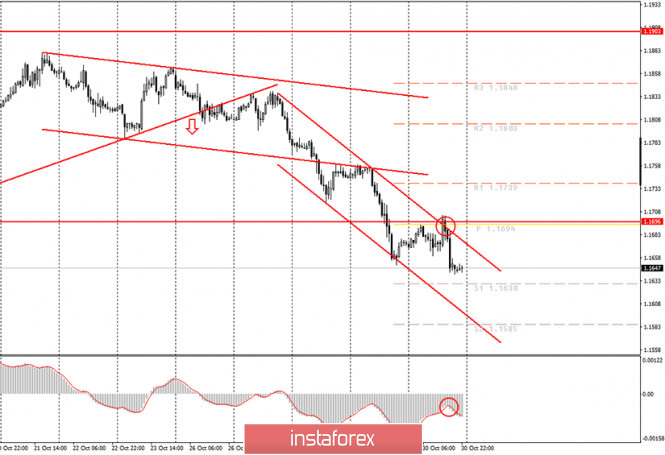

| Posted: 01 Nov 2020 05:34 PM PST EUR/USD 1H The EUR/USD pair tried to start a more or less tangible correction on the hourly timeframe on October 30, but failed to do so. Buyers failed to take the pair above the resistance area of 1.1691-1.1698. The pair rebounded off this area and the bears got down to business again. As a result, the pair dropped to the support level of 1.1637 by the end of the day. The price is far from the descending channel, so it can no longer be considered relevant. There are no new channels or trend lines at this time. Therefore, when making trading decisions, you can only rely on rebounds/overcoming from one or another resistance/support. By the way, the price failed to quickly return to the 1.1700-1.1900 area, so it is quite possible that a new downward trend will actually begin now. EUR/USD 15M Both linear regression channels are directed to the downside on the 15-minute timeframe, which eloquently indicates the current trend on the hourly chart and indicates that there are no signs of a noticeable upward correction. COT report The EUR/USD pair rose quite a bit during the last reporting week (October 20-26). Therefore, we can conclude that professional market participants did not make any extremely large purchases and sales of the European currency. However, the new Commitment of Traders (COT) report showed that non-commercial traders were actively closing Buy-contracts (longs) during the reporting week. In total, 12,000 of them were closed. But professional traders were in no hurry to get rid of Sell-contracts (shorts), having closed only 1,000. Thus, the net position of this group of traders decreased by 11,000 contracts at once. It is possible that the main closing of the Buy-contracts took place at the end of the reporting week, because in the following days a more tangible drop in euro's quotes began. Within its framework, the euro/dollar pair lost about 160 points. We remind you that if the net position decreases, it means that the traders' sentiment becomes more bearish. Thus, so far, our forecast is coming true. In the analysis of previous COT reports, we said that the high around the 1.2000 level could remain as the peak for the entire upward trend. The first indicator and its green line clearly show that non-commercial traders have been cutting back on long deals on the euro for two months now. And non-commercial traders are the most important group of large traders in the foreign exchange market. It is believed that it is the one responsible for driving the market. There were a lot of macroeconomic publications on Friday, October 30. It all started in Germany, where the GDP for the third quarter was published in the first estimate. It turned out that the growth of the indicator in quarterly terms was 8.2%. We think this is quite small. For example, the increase was 16.1% in Italy, and 16.7% in Spain. It is another matter that all these numbers are not of particular importance now, since the second wave of COVID-2019 continues to gain momentum in the European Union, and the German economy has already entered the second lockdown. Quarantine measures are tightening in all European countries, so at the end of the year, we can again expect a reduction in GDP. The European Union also published its GDP indicator, which increased by 12.7%, offsetting almost all losses of the second quarter. However, traders were more impressed by the words of European Central Bank President Christine Lagarde, who made a very pessimistic statement about the prospects for the European economy a day earlier, so they did not appreciate the recovery of the EU economies. After all these data, the inflation rate did not matter much for the markets. We have two trading ideas for November 2: 1) The EUR/USD pair resumed its downward movement. Thus, buyers are encouraged to wait for more favorable conditions to open a position. For example, when the price settles above the 1.1691-1.1698 area. In this case, you can open small longs while aiming for the Kijun-sen line (1.1739) and the Senkou Span B line (1.1784). Take Profit in this case can be up to 70 points. 2) Bears are active, but gradually, pull down the pair. Thus, sellers are advised to continue to trade down while aiming for the support level of 1.1570, if the price settles below the 1.1637 level. A price rebound from any target can trigger a round of corrective movement. Take Profit in this case can be up to 50 points, which is not so little, given the current volatility levels. Hot forecast and trading signals for GBP/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Nov 2020 04:51 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -78.7393 The British pound sterling paired with the US currency on Friday began a new round of upward correction. However, in general, it continues to trade quite calmly in recent days and with a clear downward bias. We have repeatedly said that we expect a resumption of the downward trend, as there are a lot of technical factors in favor of this. Starting from the price rebound from the 61.8% Fibonacci level after the fall on September 1, ending with another overcoming of the moving average line and overbought of the British pound in the current fundamental conditions. "Foundation" is generally a separate conversation that has a complex impact on the foreign exchange market and its participants. Perhaps it is for the pound/dollar pair that the "Foundation" is the most complex and confusing. In addition to all the American problems and the upcoming elections, which we have already written about many times, there are still extremely big British problems for the GBP/USD pair, extremely weak prospects for the British economy, and the problem of the lack of a trade deal with the European Union. Thus, for the pound sterling, the fundamental background is bad, and for the US currency, it is also "no sugar". The situation with the "coronavirus" in the UK is also no better than in the US. If in the States there is now an increase in cases of the disease to 100 thousand per day (with a population of 328 million), then in the UK there is an increase to 25 thousand per day (with a population of 66 million). That is, in relative comparison, the numbers are approximately the same. However, this weekend it became known that Boris Johnson decided to follow the example of his German and French colleagues and also introduced a second "lockdown" from November 5 to December 2. "From Thursday, the main message will be the same as during the spring lockdown - stay at home," Johnson said. However, "lockdown" this time will still not be as "tough" as in the spring. Firstly, schools, colleges, and universities will work. Britons will be allowed to go to the store, to work, to the doctor, and their loved ones. By and large, all restrictions apply only to services and entertainment. Shops (all but grocery stores), hairdressers, beauty salons, gyms, and various entertainment venues will be closed. All trips abroad, except for workers, are prohibited. Thus, the British were restricted access to services and entertainment, while Johnson tried to keep the economy itself open as much as possible. However, earlier the British Prime Minister stated that there will be no repeated "lockdown". And earlier that "he would rather die in a ditch than ask the European Union to extend the deadline for negotiations." Thus, it is not the first time that Johnson has "forgotten" about his previous statements. By the way, literally one of these days we will be able to find out what results of such a policy will be for Donald Trump, who also very often makes unfounded, unsubstantiated, misleading statements. Also, Johnson said that this year's Christmas celebration may be very different from the usual, and small and medium-sized businesses may suffer serious losses. However, we still approve of the actions of the British government in this matter, since we are still talking about the lives and health of British citizens. Meanwhile, there is still no information about the negotiations on the Brexit trade agreement. The next round of talks was supposed to end last Thursday, however, there were no speeches from Boris Johnson, Michel Barnier, David Frost, Ursula von der Leyen, or Charles Michel on this occasion. Thus, we conclude that negotiations are ongoing, but we can only guess at the presence or absence of progress. On the one hand, if the negotiations continue all this time, then there is some progress. None of the previous rounds lasted more than a week. Usually, the parties very quickly concluded that no one wants to give in to anything and parted until the next stage. This time, however, the groups of Michel Barnier and David Frost are taking a long time to discuss the future relationship between the UK and the European Union. Thus, it is possible to assume that the parties are still moving towards each other. The question here is different. Will this progress be enough for a trade agreement? After all, there are at least several important and controversial issues between the parties, in which it will be extremely difficult to reach a compromise. But Brussels and London want to conclude not just an agreement, but an agreement within the established time frame, so that from January 1, 2021, they do not have to trade with each other under WTO rules. Thus, they have a maximum of two weeks to reach a consensus, after which the negotiations can once again be curtailed. In principle, the situation here is the same as with the US elections. Traders have no choice but to wait for information. We do not recommend trying to guess how the negotiations will end, as this is a thankless task. Well, in the new week, there will be another important event for the British pound. This is a meeting of the Bank of England. Recall that the British regulator has been talking about expanding the quantitative easing program for a long time. Also, market participants have little doubt that the BA will go to the introduction of negative rates. However, if negative rates are expected by the markets in 2021, the Bank of England will most likely decide to expand the QE program this Thursday. In principle, this is an logical and expected decision of the Bank of England, since the British economy is not only experiencing problems now but is almost guaranteed to continue experiencing them in 2021. The recovery of British GDP in the third quarter, according to preliminary estimates, is not too high, about 15% q/q after losses of 19.8% q/q in the second quarter. Moreover, the repeated "lockdown" will affect the economy of the Foggy Albion, although, in our opinion, this quarantine will be less "tough" than the spring one. Thus, the British regulator simply has no other options but to continue to ease monetary policy.

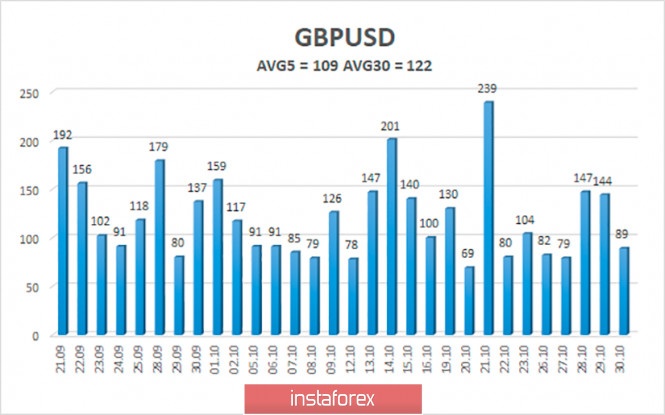

The average volatility of the GBP/USD pair is currently 109 points per day. For the pound/dollar pair, this value is "high". On Monday, November 2, thus, we expect movement inside the channel, limited by the levels of 1.2833 and 1.3051. The reversal of the Heiken Ashi indicator down may signal a possible resumption of the downward movement. Nearest support levels: S1 – 1.2939 S2 – 1.2878 S3 – 1.2817 Nearest resistance levels: R1 – 1.3000 R2 – 1.3062 R3 – 1.3123 Trading recommendations: The GBP/USD pair has started a new round of corrective movement on the 4-hour timeframe. Thus, today it is recommended to open new short positions with targets of 1.2878 and 1.2833 as soon as the Heiken Ashi indicator turns down. It is recommended to trade the pair for an increase with targets of 1.3062 and 1.3123 if the price is fixed back above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Nov 2020 04:51 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - sideways. Moving average (20; smoothed) - downward. CCI: -134.4027 During the last trading day of the past week, the EUR/USD pair continued its downward movement and fell to the level of 1.1650 by the end of the day. Thus, it seems that the bears are still seriously determined to end the three-month flat and start forming a new downward trend. Of course, there are still chances that the pair will simply take and return to the side channel of $ 1.17 - $ 1.19, as it was once before. Well, the most important thing is that the US presidential election will finally take place on Tuesday, which means that this week we will find out who won the popular vote. In the popular vote, but not in the elections, because we have repeatedly said that there is a very low probability that after the vote count is completed, one of the candidates will admit defeat and that will be the end of it. Most likely, there will be lengthy proceedings and mutual accusations of fraud. And no one knows how much time will pass before all the proceedings are completed. Thus, we would say that the most interesting and fun part of 2020 is coming for the markets. Oddly enough, almost no information has been received recently from the two US presidential candidates. If earlier Donald Trump spoke, gave comments 10 times a day, commenting on absolutely any topics and questions, now "news calm". Neither Trump nor Biden did not do loud statements. There is no new data from Steven Mnuchin or Nancy Pelosi. The media does not comment on the new anti-records for the disease "coronavirus" in the United States. There is no new information about the coronavirus vaccine. Jerome Powell remains silent and does not comment on the economy or monetary policy. Democrats and Republicans have not been able to agree on a new stimulus package. It seems that everything that was said, written, and shown in recent months has suddenly lost any meaning. Meanwhile, more than 90 million people have already voted in America one day before election day. This is a record. This is almost 43% of the voters registered in the country. At the same time, experts continue to analyze the current situation and try to predict the election results. In general, if it were not about Trump, but about any other president, then there would be nothing to talk about. With such a large margin of voter support, Joe Biden would have a nearly 100% chance of winning. However, all as one, experts and political scientists believe that if we are talking about Donald Trump, then surprises will be possible. Trump is the most unpopular US president in recent decades. The approval rate for his policies never reached 50%. Donald Trump has never been able to surpass Joe Biden in approval ratings. In most of the "disputed" states, Biden continues to lead. Also, we recall all those "victories" of Trump as President of the United States and understand that there is simply no reason to re-elect him. President Trump failed the fight against the "coronavirus", lost the trade war with China (at least America did not get any dividends for itself), left the WHO, quarreled with the Democrats and everyone who did not want to adhere to his opinion and generally turned most of America against him. His almost only trump card was the economy, which continued to grow, but it should be remembered that it began to grow in the time of Barack Obama. So it wasn't Donald Trump who lifted the economy "off its knees". Well, in 2020, this main trump card of the current President was leveled. And we still do not remember such events as impeachment, the scandal with Ukrainian President Vladimir Zelensky, "racial" scandals, and other delights. In general, if you look exclusively at facts and figures, it turns out that Trump has no chance of re-election. However, Trump did not lead in the preliminary polls in 2016. And, of course, a huge problem for the United States now remains the problem of COVID-2019. On October 30, almost 100,000 new cases were recorded in America, and the total number of cases reached 9.1 million. At the same time, Donald Trump, speaking at a rally in Waterford, Michigan, said that American doctors exaggerate the severity of the "coronavirus" because they earn money from it. "Our doctors are very smart people. They say: everyone dies from COVID. And this is about two thousand dollars of extra money, so they have more money," the US President said, which seems to have further lowered his chances of re-election. In general, everything has been said about the election more than a dozen times. Therefore, we believe that it is best to just wait for the votes to be counted and draw any conclusions about the further movement of the euro/dollar pair after. At this time, it is still impossible to say which of the candidates is the best for the US currency. Moreover, it is unlikely that the US dollar will become more expensive or cheaper based on the fact that Trump will become President again. These are long-term issues. Recall that in the four years of the Democrats, the US dollar usually becomes cheaper and it becomes more expensive under the Republicans. Of course, this may be a coincidence, however, there is a certain trend. We should also not forget about Europe. France and Germany have been quarantined, and other countries may soon join them. However, COVID-2019 is a worldwide problem and there are even more cases in the United States than in Europe. Therefore, most likely, the "coronavirus" itself or the fact of quarantine will not affect the European currency in any way. But the prospects of the European economy, which may again be quarantined, and most importantly the mood of traders, cause serious concerns. After all, in America, despite the record number of diseases, quarantine is not going to be introduced. But the EU economy may start shrinking again in the near future. These are the concerns expressed last Thursday by ECB chief Christine Lagarde. What do "new cuts" mean? They mean that the economy will need stimulus measures again, it will start to slow down again, and it will eventually take a very long time to recover.

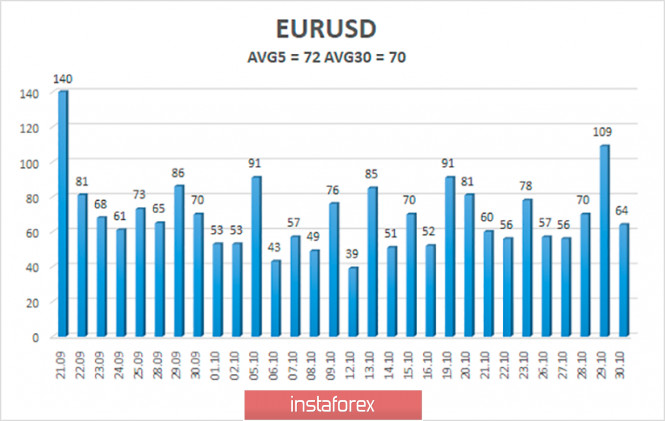

The volatility of the euro/dollar currency pair as of November 2 is 72 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1575 and 1.1719. A reversal of the Heiken Ashi indicator to the top may signal a new round of upward correction. Nearest support levels: S1 – 1.1597 Nearest resistance levels: R1 – 1.1658 R2 – 1.1719 R3 – 1.1780 Trading recommendations: The EUR/USD pair continues its downward movement. Thus, today it is recommended to maintain open sell orders with targets of 1.1597 and 1.1575 as long as the Heiken Ashi indicator is directed down. It is recommended to consider buy orders if the pair is fixed above the moving average line with the first targets of 1.1780 and 1.1841. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Nov 2020 10:53 AM PST EUR/USD hourly chart On Friday, October 30, EUR/USD resumed its downward movement after a slight correction and reached the level of 1.1650 by the end of the day. Thus, the pair continues to move within the downward channel, having failed to consolidate above it. In addition, the pair failed to settle above the level of 1.1696 that served as the lower border of the sideways channel for a long time. Therefore, the pair's trajectory has been predictable so far. As for trading signals, on Friday a signal of medium strength was generated (marked by a circle on the chart). By the time of its formation, the MACD indicator had not yet reached the zero level. So, at the moment when the sell signal was formed, the price had already moved down by 50 pips, which is quite a lot given the current volatility. So, those novice traders who opened the deals following this signal gained zero profit by the end of the session. We think that the downtrend will not continue immediately at the trade opening on Monday. Therefore, we recommend waiting for a new round of correction and new sell signals (if the downtrend continues). On Friday, a number of various macroeconomic reports were published in the EU. We will focus on the most important ones. Thus, inflation rate in the EU in October reached -0.3% year-on-year, which is extremely low, whereas the unemployment rate rose to 8.3%. The first two reports were negative for the European currency. According to preliminary estimates, the most important GDP indicator for the third quarter was -4.3% y/y and +12.7% q/q. The quarterly data was quite strong and significantly exceeded the forecasts of + 9.4%. This means that the rate of economic growth in Europe for the third quarter is quite high and is much higher than in the US and the UK. However, the European economy may face another round of contraction due to the second wave of coronavirus and new lockdowns imposed in the euro area. This makes traders more cautions when trading the euro. As a result, we can say that there was no particular reaction to these reports. What is more, the rise of the US currency in the second half of the day can hardly be linked to any macroeconomic events since there were no important publications in the US that day. On Monday, November 2, the EU will release the data on business activity in the manufacturing sector for October. According to forecasts, these indicators will not differ much from the previous month's data. Moreover, the industrial sector is expected to be in a more or less good state despite the pandemic. The service sector will suffer the most, as already mentioned by Christine Lagarde, head of the European Central Bank. The ISM and Markit PMI data will be published in the US on Monday. The indices are expected to be above 50.0, so the markets are unlikely to react to this data. Possible scenarios for November 2 1) Buying EUR/USD is not relevant at the moment, since the price is still holding within the descending channel. Thus, novice traders should at least wait for the price to settle above the descending channel and to start an uptrend. In this case, the first upward target will be found at the level of 1.1739. 2) At the moment, selling the pair looks more relevant, although the price has already fallen by 190 pips. As long as the price remains inside the descending channel, it is recommended to sell. The problem is that the channel is quite narrow and any correction may push the price out of it. The MACD indicator does not have enough time to form a strong sell signal. We believe that this trend will end in the coming days. On the chart Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trendlines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines). Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exit the market in order to avoid sharp price fluctuations. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment