Forex analysis review |

- Forecast for EUR/USD on November 6, 2020

- Forecast for GBP/USD on November 6, 2020

- AUD/USD Forecast for November 6, 2020

- Forecast for USD/JPY on November 6, 2020

- Hot forecast and trading signals for GBP/USD on November 6. COT report. Will traders pay attention to US statistics?

- Hot forecast and trading signals for EUR/USD on November 6. COT report. Adoption of stimulus package can be delayed indefinitely

- Overview of the GBP/USD pair. November 6. The Bank of England is expanding its QE program and preparing for negative rates

- Overview of the EUR/USD pair. November 6. Donald Trump starts attacking the states where he lost the election. The vote count

- The Dollar trap: the Fed won't help

- Bank of England meeting results: QE +150 billion, dovish remarks and status quo at the rate

- Gold bulls try to end the week with a bullish note for the weeks to come

- EURUSD challenging major resistance

- USDCHF vulnerable to a move lower towards 0.8870

- EUR/USD outlook for November 5

- EUR/JPY Trading Plan for November 5

- Market remains under speculators' control. Outlook for GBP/USD on November 5

- GBPUSD and EURUSD: The Bank of England follows a gradual policy of stimulating the economy. The euro is returning to the

- EUR/USD. The euro depends on the outcome of the US election

- Evening outlook for EUR/USD on November 5. Euro shows significant rise

- November 5, 2020 : EUR/USD daily technical review and trade recommendations.

- US dollar crashes

- BTC analysis for November 05,.2020 - Median Pitchfork line will be important resistance for BTC

- Extremely volatile EURUSD

- Analysis of Gold for November 05,.2020 - Watch for the breakout of the weekly coil to confirm further direction. Key resistance

- November 5, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

| Forecast for EUR/USD on November 6, 2020 Posted: 05 Nov 2020 07:20 PM PST EUR/USD The final results of the US presidential election have not yet been determined. But Joe Biden needs to confirm his advantage in two states in order to win, while Donald Trump needs to confirm an advantage in four. Artificial difficulties that Trump created in regards to the counting of votes, the demand for US government bonds and the lack of only one place for the Republicans in the Senate to obtain a majority made it possible for the euro to rise by 100 points. The Federal Reserve meeting was a passing one yesterday, it had no effect on the market. The price has powerfully reached the target level of 1.1830 and has settled below it on the daily chart. The signal line of the Marlin oscillator began to show a reversal, there is a chance that the price will fall below the target level of 1.1770, settle below it, and this will then confirm the reversal. In this case, the 1.1620 level will be the target, that is, the initial position before the market starts working out the American elections. The level is very strong and ideologically significant, so the price moving below it will be a sign of starting a medium-term downward trend. But this is still far away (two figures), and in the current situation, the 1.1770-1.1830 range is an area of uncertainty. Getting the price to settle above it will mean it could also rise to 1.1880 or even higher, to the MACD line (1.1920). The four-hour chart shows that there is support for the MAD line (1.1728 area) below the 1.1770 level, therefore, in order to confirm the downward movement, it is not enough for the price to just settle below the 1.1770 level, it should go beyond this support. As a result, the probability of price reversal from the current levels is 55-60%. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for GBP/USD on November 6, 2020 Posted: 05 Nov 2020 07:18 PM PST GBP/USD The pound fell slightly short of the MACD line (1.3180) on the daily chart. It is possible to reach the level, and then a reversal divergence will form according to the Marlin oscillator. A reversal from the current levels will be confirmed when the price settles below the 1.3050 level. In this case, the price will return to 1.2930. There is no strong reversal signal on the 4-hour chart. When forming, say, a divergence, the price will need to go even lower and reach 1.3180. US employment data for October will be released today, so speculative action is likely to a high degree. The unemployment rate is forecast to decline from 7.9% to 7.7%. We are waiting for the development of events. |

| AUD/USD Forecast for November 6, 2020 Posted: 05 Nov 2020 07:06 PM PST AUD/USD Yesterday, the Australian dollar showed a rare side of high dynamics as its growth was just over a hundred points ahead of the Euro. The growth stopped at the daily Kruzenshtern line and this morning the price started to reverse. Leaving the price with a consolidation under 0.7222 will mean a reversal of this dynamics in the opposite direction, the first goal will be 0.7120, then 0.7058. Growth is possible with a 35% probability. To do this, the price needs to overcome yesterday's high and the target will be the upper limit of the price channel at 0.7335. Based on the four-hour scale chart, the reversal is not yet pronounced, the indicators only show its possible beginning, albeit with a high probability. To confirm it, you need to wait for the price to fall below the nearest level of 0.7222. |

| Forecast for USD/JPY on November 6, 2020 Posted: 05 Nov 2020 07:06 PM PST USD/JPY Upon the general fall of the dollar, the yen strengthened yesterday by 100 points. The yen strengthened its correlation with the stock market, which rose by almost 2% on Thursday. It seems that the pair will continue to decline regardless of external circumstances, and this decline does not happen without the participation of the Bank of Japan. The strategic goals of this are still vague, but the nearest goal is clearly visible - 102.75, which is followed by 101.95.

On the four-hour chart (H4), the price has consolidated below the target level of 103.75 and is consolidating below it. The Marlin oscillator shows a reversal, however, not confidently. It is possible that the price will resume to consolidate, after which it will continue to decline.

|

| Posted: 05 Nov 2020 05:11 PM PST GBP/USD 1H The GBP/USD pair also traded up all day on Thursday, November 5, repeating the dynamics of the EUR/USD pair. Buyers managed to bring quotes to the previous local high, but failed to go beyond it. Therefore, since the fundamental background is not on the side of the British pound, quotes may sharply fall to a new ascending trend line today, which so far supports those trading upward, but at the same time it is not strong. The problem is that the recent upward trend is purely fundamental. This means that when the current fundamental background weakens, the mood of market participants may completely change, and the current trend will be broken in a matter of hours. Moreover, the British currency has no market support, since the UK has not provided any positive news. This indicates that this currency continues to balance on the brink of an abyss, and only the political crisis in the United States keeps it from falling again. GBP/USD 15M The linear regression channels are directed to the upside on the 15-minute timeframe, which fully corresponds to the nature of the pair's movement on the hourly chart. At the same time, we expect the quotes to fall during the day. COT report The latest Commitments of Traders (COT) report on the British pound showed that non-commercial traders were quite active in the period from October 20-26. However, their sentiment changed again, as can be seen from the green line of the first indicator in the chart. The mood of the "non-commercial" group of traders became more bullish for three consecutive weeks, but the net position decreased by 5,000 contracts over the last reporting week, so we can conclude that professional traders are again inclined to sell off the pound. However, if you look at the COT reports over the past few weeks or look at the first indicator, it becomes clear that commercial and non-commercial traders do not have a clear trading strategy right now. Perhaps this is due to an extremely unstable and complex fundamental background. The fact remains. The pound lost 90 points in recent trading days, and we believe that it will continue to fall. However, in the near future, we might receive important information about the progress of negotiations on the UK-EU trade deal, and the results of the vote for the US president will also become known. This information can change the mindset of professional traders. You need to be prepared for this. The fundamental background was very weak for the British currency on Thursday. This point here is the failure of the next round of talks on the EU-UK trade deal, as well as the dovish position of the Bank of England, which was summed up at the results of the latest meeting. However, this information did pull down the pound because the US elections are of much greater concern to traders. Therefore, the pound grew and even the summing up of the results of the Fed meeting did not really change the situation. Now traders can count on a downward correction. In general, we believe that the pound is simply obliged to start falling on Friday, as it is impossible for one fundamental background to be ignored and the other to be worked out. US macroeconomic reports will be released on Friday. NonFarm Payrolls, unemployment rate, average hourly wages. Naturally, the main focus of traders will be on the indicator of the number of new jobs created outside the agricultural sector. Forecast at +600,000. Any value below can exert more pressure on the dollar. The unemployment rate is expected to drop to 7.7%, but there is a suspicion that the market will not take these statistics into account due to the US presidential elections. We have two trading ideas for November 6: 1) Buyers of the pound/dollar pair tried to get ahead again, but gave up before the 1.3130 level, but they still managed to form an upward trend. And so traders are advised to stick with buy positions while aiming for the resistance level of 1.3166, but be careful, as a downward reversal around the 1.3130 level is possible. Take Profit in this case will be up to 50 points. 2) Sellers do not currently own the initiative in the market. And so you are advised to open new sell orders while aiming for the 1.2855-1.2874 area in case the price settles below the Kijun-sen line (1.2996) and the trend line, but also in small lots and with extreme caution. Take Profit in this case can be up to 80 points. Take note there may be highly volatile trades and sharp price reversals today. Hot forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Nov 2020 05:09 PM PST EUR/USD 1H The EUR/USD pair was trading quite volatile again on the hourly timeframe on Thursday, November 5. The US dollar continued to depreciate. Buyers brought quotes above the resistance level of 1.1791, breaking the Kijun-sen and Senkou Span B lines along the way. Therefore, there are prospects for further growth for the EUR/USD pair, towards the resistance area of 1.1886-1.1912. However, take note that current market conditions are not entirely normal. High volatility is associated with the strongest fundamental background. This fundamental background can change, it can intensify, and the reaction of traders to it is unpredictable. Thus, you are advised to trade with extreme caution. EUR/USD 15M The linear regression channels are directed to the upside on the 15-minute timeframe, which reflects the nature of the movement on the hourly chart during the past day. However, a downward reversal may follow and quotes could fall in the near future. COT report The EUR/USD pair rose quite a bit during the last reporting week (October 20-26). Therefore, we can conclude that professional market participants did not make any extremely large purchases and sales of the European currency. However, the new Commitment of Traders (COT) report showed that non-commercial traders were actively closing Buy-contracts (longs) during the reporting week. In total, 12,000 of them were closed. But professional traders were in no hurry to get rid of Sell-contracts (shorts), having closed only 1,000. Thus, the net position of this group of traders decreased by 11,000 contracts at once. It is possible that the main closing of the Buy-contracts took place at the end of the reporting week, because in the following days a more tangible drop in euro's quotes began. Within its framework, the euro/dollar pair lost about 160 points. We remind you that if the net position decreases, it means that the traders' sentiment becomes more bearish. Thus, so far, our forecast is coming true. In the analysis of previous COT reports, we said that the high around the 1.2000 level could remain as the peak for the entire upward trend. The first indicator and its green line clearly show that non-commercial traders have been cutting back on long deals on the euro for two months now. And non-commercial traders are the most important group of large traders in the foreign exchange market. It is believed that it is the one responsible for driving the market. The European Union released its September retail sales figure on Thursday. It turned out to be worse than the forecast values, however, the euro continued to rise during the day, regardless of European data. Meanwhile, a report on applications for unemployment benefits was released in the United States, which turned out to be slightly worse than forecasts, but was also ignored by market participants. There has been no global news in the European Union in recent days, and the coronavirus epidemic, as we see, does not hinder the euro's growth too much. The US elections is still the key topic in the foreign exchange. And it seems that it is pulling down the dollar (against the pound too). General uncertainty remains, and both Trump and Biden have a chance of winning. But this is not what makes traders get rid of the US dollar. The fact that a litigation between Democrats and Republicans will begin immediately after the final results are announced, makes us talk about a constitutional crisis. And a new potential confrontation between Trump and Biden significantly lowers the chances of reaching an agreement on a new stimulus package for the US economy in the near future. We have two trading ideas for November 6: 1) The EUR/USD pair managed to maintain an upward trend yesterday. And so, buyers are advised to trade upward while aiming for the resistance area of 1.1886-1.1912, if the price manages to stay above the 1.1791 level. Take Profit in this case can be up to 80 points. Take note that sharp price reversals and high volatility are still possible today. 2) Bears still do not have the initiative in the market. Thus, sellers are advised to return to trading down while aiming for the 1.1692-1.1699 and 1.1612-1.1624 area, if the price settles below the Kijun-sen line (1.1730). Take Profit in this case can range from 20 to 90 points. The fundamental background is not on the side of the US dollar righ now. Hot forecast and trading signals for GBP/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Nov 2020 04:20 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - sideways Moving average (20; smoothed) - upward. CCI: 179.5236 The British pound sterling paired with the US dollar also started a new round of upward movement, which was caused by the level of uncertainty that the US and the US economy are currently facing. However, as we have said many times before, the pound itself may now be under market pressure, as the fundamental background from the UK is also extremely unpleasant. Thus, the strengthening of the British currency may not be very long-term. Last time, the price bounced from the Murray level of "7/8" - 1.3123, now it has come close to it. A price rebound from this level may trigger a new round of downward movement. In principle, this is exactly the movement that has been going on for the pound for several weeks: frequent changes in the direction of movement, the frequent overcoming of the moving average. Thus, the technical picture of the GBP/USD pair remains extremely ambiguous. The most important news of recent days for the British pound still concerns the negotiations on a trade deal between the EU and the UK. The next round of negotiations has finally ended, and the heads of the negotiating groups said again that the current progress is not enough to conclude a trade agreement. Michel Barnier said that there are still strong differences between the parties on several key issues. David Frost also confirmed his rhetoric, adding that there is still some progress. However, Britain, the British economy, and the pound do not need "some progress", they need a deal that will somehow mitigate the negative effect of the "divorce" from the European Union. And the "deal" at the moment still does not even "smell". In other words, the parties continue negotiations, which are classified, because market participants do not know in which areas progress has been made, which issues remain unresolved. Further, it is unclear how much longer they will continue. Boris Johnson said earlier that the new deadline for negotiations is November 15. However, before that, he said that the deadline is October 15. Thus, the negotiations may continue after November 15. We have repeatedly noted that London and Brussels have nothing to lose. They have a "great" prospect of trading with each other under the WTO rules, which are much less favorable than the rules of the free trade zone. Thus, from January 1, they will start trading according to the WTO rules, however, this does not mean that they will not be able to agree, for example, in February and April to start trading according to the agreement reached. It is better to trade without a deal for three months than for several decades. Well, the Bank of England at this time began to ease monetary policy. More precisely, continued softening. This morning, the results of the next meeting of the Bank of England were summed up, at which it was decided to expand the quantitative easing program by 150 billion pounds. It should be noted that traders were waiting for an increase in the QE program by 100 billion. Thus, the Bank of England's actions were more "dovish" than expected. The discount rate remained unchanged at 0.1%. BA also updated its GDP forecasts for the coming years. The regulator now expects the British economy to fall by 11% this year and recover by 7.25% next year. The Bank of England fears a new negative impact on the economy of a repeated "lockdown", as well as a break with the EU without an agreement. As for inflation, the Bank of England said that monetary policy will not be tightened before reaching a stable level of 2.0% y/y, and this level may be reached within two years. A very optimistic forecast, from our point of view. The monetary committee also noted in a press release that it is still ready to use any available monetary policy tools to stimulate the economy and inflation. Earlier, the BA and its chief executive, Andrew Bailey, repeatedly hinted at the possible use of negative interest rates. And market participants are waiting for the introduction of these in the coming months. Well, as for the Fed meeting, there was nothing overly important and overly interesting this time. It took place late in the evening when the European and American markets were either closed or were preparing to close. Moreover, in the first place in terms of importance for traders now are the elections, vote counting, and the political crisis in the United States, and not the next "passing" meeting of the Fed. And with the elections, the situation is extremely interesting. We have already said in the article on the euro/dollar that both Biden and Trump maintain the same chances of winning even though the Democrat is far ahead and only six votes short of winning. However, it should be recalled that in addition to the presidential elections in America, at the same time, there were also elections to the Senate and Congress. And at the moment, the Democrats and Republicans have received 48 seats in the Senate (for a majority, you need 50), and in the House of Representatives, the Democrats are still gaining 204 seats, and the Republicans - 190. However, to get a majority, you need to gain 218 seats. Thus, neither of them has a clear advantage and a clear victory yet. As for the pound/dollar pair, it cheerfully ignored the results of the Bank of England meeting, because these results should have led to a fall in the pound. However, since it is the US dollar that is falling now, and both currencies cannot fall at the same time in this pair, today the British currency had the advantage. Market participants are still waiting for the final results of the vote in America, and are already preparing for any further events that may drive the States into a constitutional crisis. In any case, there are still a lot of extremely interesting events waiting for us before the end of the year. In addition to the American events, the issue of a trade deal between the EU and the Kingdom is still unresolved, but the point in their negotiations is not set. So we are waiting for new information on this issue.

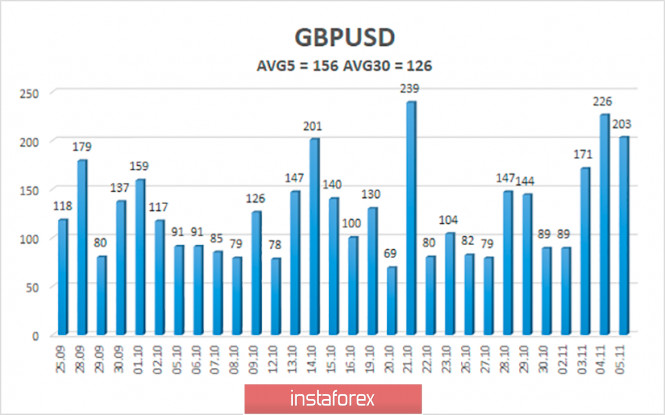

The average volatility of the GBP/USD pair is currently 156 points per day. For the pound/dollar pair, this value is "high". On Friday, November 6, thus, we expect movement inside the channel, limited by the levels of 1.2940 and 1.3252. A reversal of the Heiken Ashi indicator downwards signals a possible round of downward movement. Nearest support levels: S1 – 1.3062 S2 – 1.3000 S3 – 1.2939 Nearest resistance levels: R1 – 1.3123 R2 – 1.3184 R3 – 1.3245 Trading recommendations: The GBP/USD pair has started a new round of upward movement on the 4-hour timeframe. Thus, today it is recommended to keep open long positions with targets of 1.3184 and 1.3245 until the Heiken Ashi indicator turns down. It is recommended to trade the pair down with targets of 1.2940 and 1.2878 if the price is fixed below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Nov 2020 04:20 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 172.6574 During the fourth trading day of the week, the EUR/USD pair continued the upward movement that began the day before. From a technical point of view, it was hardly possible to predict a new round of growth of the European currency by more than 150 points. However, do not forget that in America, the counting of votes continues. And in the context of this event, the fall of the US currency now looks quite logical. The thing is that the elections will not end with elections, no matter how absurd it may sound. The counting of votes will end, but the elections themselves will continue. A few months before November 3, Donald Trump began to send non-ambiguous signals that there would be no simple and calm transfer of power in the event of his defeat. The current US President began to accuse the Democrats of election fraud long before the election itself. What does this mean? This suggests that Donald Trump understood from the very beginning that his chances of winning the election are small, to say the least. Thus, Trump immediately began to prepare Americans for the fact that the Biden team would allegedly try to cheat, especially with voting by mail. Trump declared his victory in the election without even waiting for the full vote count. And just when he was losing to Joe Biden. And he lost to Biden at any point in the vote count. Thus, market participants are now just preparing for the fact that multi-week trials, recounts of votes, a new confrontation between Democrats and Republicans with tons of mutual accusations of each other will begin. Naturally, such a political situation cannot contribute to the strengthening of the US dollar. We have previously said that the United States is experiencing a full-scale political crisis, and also warned that the country is on the edge of a constitutional crisis. Recall that under US law, Trump is not required to leave the White House on January 20, even if he is defeated. That is, Trump can stay in the White House, and Biden and his team will have to "smoke" him out of the presidential administration by any means or through the same courts. Also, Trump can challenge the results of the voting in almost any state. And any trial is time. We already wrote about the most interesting difference between the US electoral system and others yesterday. Whatever the outcome of the American vote, the electoral college has every right to vote for whomever it pleases. That is, it is now the election results are based on the "electoral votes" that each state must give to a particular candidate. The electors will vote on December 14 for a particular candidate. And until they vote, it is impossible to say that one or another candidate won. There were cases when up to 10 electors tried to cast their votes to the "wrong" candidate for whom the state voted. The Trump team has already started working towards legal proceedings. The Trump campaign appealed to the courts of Georgia, Michigan, and Pennsylvania to stop the counting of votes. Trump's staff also said they would call for a recount in both Wisconsin and Philadelphia. Also, Trump's representatives named several other states where Trump has already lost by a narrow margin. In these states, Republicans will also demand a recount. Nothing is surprising about this. This is what we have repeatedly written about over the past months. And now attention – yesterday and today, we just saw the reaction of traders to the elections. The dollar started to fall due to complete confusion and may continue to be under pressure in the next few days. And further counting of votes may just last another 1 or 2 days. In Alaska, it is reported that the vote shall take another week. In Pennsylvania, you can assume the vote until Saturday. In Nevada – the vote count stopped, saying it will resume work in a day. In general, the situation is absurd, as well as everything that concerns the US elections, as well as the election campaigns and the confrontation between Trump and Biden, which began long before the elections themselves. But the OSCE representatives believe that there were no special violations during the elections and counting of votes. Moreover, the OSCE says that Trump regularly made baseless statements about possible fraud on the part of the Democrats. "Baseless allegations of systematic violations, in particular by the incumbent President, including on election night, undermine public confidence in democratic institutions," said OSCE representative Michael Georg Link. Well, the situation is even more interesting with the remaining states, for which it is still unknown exactly who will win them. That is, it is still quite possible that Trump will win the remaining states and get ahead of his opponent. In this case, the Republicans will get 271 votes with the necessary 270. Thus, despite the seemingly huge gap between Biden and Trump (both before the election and after), nothing has been decided yet. It is also possible that the margin of one candidate from another will be no more than 10 or 20 votes. In other words, changing the results in just one state can make a winner a loser and vice versa. Trump has already begun preparing for legal proceedings. There is no doubt that Biden's staff is also preparing for them. Well, the euro/dollar pair may continue to remain in the "storm" over the next few days. We have already said that traders and investors do not like uncertainty very much. It is this uncertainty that has prevented the US currency from rising in price over the past few months, even as part of a correction. Now the situation in the United States has not changed. Even if all the votes are counted in the coming days, Trump will immediately announce that he will be sued and that he will not admit defeat. Therefore, the election results will not be considered final. Thus, the US currency may continue to be in limbo for another month or even more. Everything will depend on how far Donald Trump and his staff will go in the confrontation with Biden.

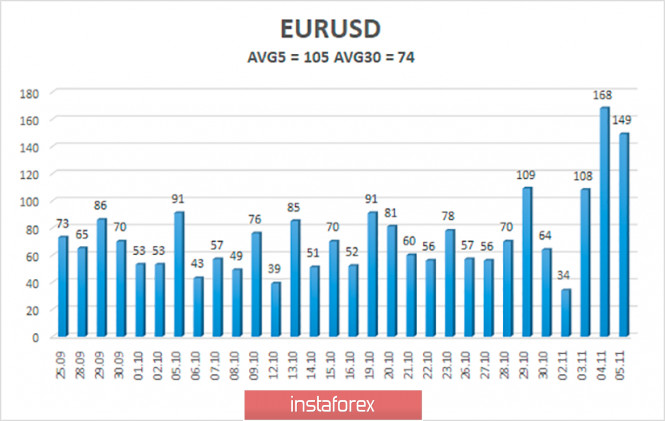

The volatility of the euro/dollar currency pair as of November 6 is 105 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1698 and 1.1908. A reversal of the Heiken Ashi indicator down may signal a new round of downward movement. Nearest support levels: S1 – 1.1780 S2 – 1.1719 S3 – 1.1658 Nearest resistance levels: R1 – 1.1841 R2 – 1.1902 R3 – 1.1963 Trading recommendations: The EUR/USD pair continues to move up. Thus, today it is recommended to keep open buy orders with targets of 1.1841 and 1.1902 as long as the Heiken Ashi indicator is directed upwards. It is recommended to consider sell orders if the pair is fixed below the moving average with the first targets of 1.1658 and 1.1597. The material has been provided by InstaForex Company - www.instaforex.com |

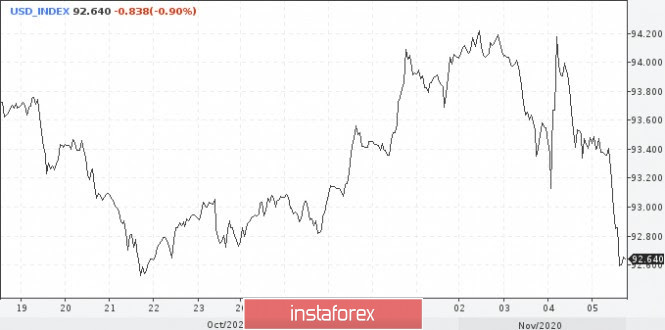

| The Dollar trap: the Fed won't help Posted: 05 Nov 2020 03:58 PM PST The Dollar extended its decline on Thursday, showing the biggest three-day decline. Demand for it has fallen as markets anticipate the victory of Joe Biden. In recent days-- even weeks-- investors have been in a state of uncertainty as Donald Trump has launched a multi-pronged attack; filing lawsuits to recount votes in several States. This is also seen as a negative factor for the greenback. The Federal Reserve, which will announce its decision on the rate of monetary policy today, may worsen the already shaky position of the US Dollar. The regulator, as market players expect, hints at a possible adjustment to the asset purchase program either in an accompanying statement or during a press conference by Jerome Powell. "The meeting of the Federal Reserve is a secondary issue but there is a chance that it may strengthen hints about a possible expansion of quantitative easing, and this will be an additional negative factor for the Dollar," experts write. However, most market strategists still believe that now is not the time for any statements and hints. The Central Bank will wait until December. Since the winner of the election has not yet been announced, Fed members will strictly adhere to their latest statement. They will once again promise to do everything possible to help the economy overcome the downturn caused by the pandemic. The dollar index sank 0.9% today to 92.64. Its lowest level in more than a week. Its weakness is also compounded by the widespread decline in Treasury yields. The spread between benchmark 10-year and 2-year debt narrowed to a 3-week low. Meanwhile, the European regulator published a new batch of statistics on changes in assets on its balance sheet. There was a decrease of 6.06 billion Euros against an increase of 38.3 billion Euros in the previous week. Financiers reduced the repurchase of securities by 17.49 billion Euros, which was the main reason for the decline in assets on the balance sheet. This is a positive signal for the Euro. As for the Pound, it was able to rise to the area of 1.30 in a pair with the Dollar today. The Pound certainly took advantage of the weakness of the US currency. Buyers also became more active after the results of the Bank of England meeting were summed up. The Central Bank kept the rate at the same level and announced an increase in the program for buying state bonds by $195 billion. The accompanying statement noted that the British economy will contract in the current quarter. Starting today, the country has declared a four-week quarantine. A little earlier, lockdown was introduced in Scotland, Wales, and Northern Ireland. Despite attempts to recover, the overall negative background will restrain the growth of the British Pound in the future. The composite PMI in October fell short of the forecast 52.3, amounting to 52.1 points. The index of business activity in the service sector fell to 51.4 points. If you add national quarantine and Brexit, it turns out that the Pound has no chance of growth. The only consolation for him now is a weak Dollar. The material has been provided by InstaForex Company - www.instaforex.com |

| Bank of England meeting results: QE +150 billion, dovish remarks and status quo at the rate Posted: 05 Nov 2020 01:24 PM PST The results of the November meeting of the Bank of England supported the British currency, strengthening the bullish sentiment for the GBP/USD pair. And although the central bank increased the volume of the asset purchase program, investors were not upset - on the contrary, the pound perked up and settled within the 30th figure. Of course, the pair's growth momentum is primarily due to the weakening of the dollar, but nevertheless, the British central bank also provided support. There are two main messages that were announced at today's central bank meeting. Firstly, the BoE intends to support the British economy (including by expanding QE), and secondly, not by reducing the rate to the negative area. At least this scenario is not yet considered in the context of practical implementation. This alignment was to the liking of investors, despite the dovish remarks expressed by BoE Governor Andrew Bailey at the final press conference. In particular, he said that the prospects for economic recovery remain "unusually uncertain." There are signs of weakening consumer spending, and the amount of idle capacity in the economy remains "very significant". Bailey also mentioned the second wave of coronavirus that swept the UK. He quite reasonably suggested that the tough quarantine, which was approved by the British Parliament just yesterday, would again hit inflation and the main indicators of the labor market. Let me remind you that the new semi-lockdown began to operate from today and will last at least until December 2. During this period, restaurants and pubs will have to shut down, as will gyms and shops that do not sell essential goods. Commenting on this decision of the British Parliament, Bailey noted that the COVID-19 epidemic will have "an indirect sustained impact on the economy." But here, too, he added that an additional 150 billion pounds under the QE program will help bring inflation back to target levels over the next two years. Take note that the Committee members voted unanimously to increase the size of the QE program - as well as to keep the interest rate at the current level of 0.1%. In the pre-crisis times, such a result would have exerted significant pressure on the pound, but in the current environment, amid the coronavirus crisis, traders are content with maintaining the status quo on the rate and are optimistic about the unexpected news of the expansion of the stimulus program. With regard to the negative rate, the BoE signalled that its work examining the effects on negative rates had not yet been completed, therefore it is inappropriate to talk about it on a practical plane. It is worth recalling here that they have been studying this issue for the third consecutive month - central bank economists interact with the country's financial institutions, simulating and analyzing the consequences of this step. Financial institutions must send their responses to the relevant requests by November 12. That is, by the December meeting, the results of this kind of poll will probably be known. According to preliminary data, the dovish initiative of the central bank caused an extremely negative reaction not only from large banks, but also from depositors. And among the members of the Committee there is no consensus on this matter. In their public speeches, many of them (in particular, David Ramsden, Gertjan Vlieghe, Andy Haldane) opposed such an extraordinary and controversial step. And judging by the fact that the central bank refrained from substantive discussion of negative rates at the November meeting, this issue is unlikely to receive support from the Committee in the near future - at least this year. These conclusions made it possible for buyers of GBP/USD to strengthen their positions, especially against the backdrop of a weakening dollar. The dollar is gradually falling in response to a sharp decline in anti-risk sentiment in the market. Joe Biden secured the support of 264 electors against the 270 needed. The vote count is still ongoing in Alaska, Arizona, Georgia, Nevada, North Carolina and Pennsylvania. The Democratic leader needs to maintain victory in those states where he is already in the lead and win in at least one of the key states (now the focus is Nevada). Trump's task is much more difficult - in addition to retaining victory in his states, he must conquer several key regions. But the market, by all appearances, has already drawn its conclusions by appointing the Democrat as the 46th US president, welcoming the approaching end of the phase of uncertainty regarding the outcome of the elections. In my opinion, such conclusions are fully justified, since the majority of the uncounted votes are mail votes. And according to numerous studies, supporters of the Democratic Party prefer to vote by mail. Therefore, we can assume that Biden is already one foot in the White House. In turn, Trump prepares and files lawsuits. However, according to many American political scientists, lawyers, as well as observers from the OSCE, these claims, as a rule, will not have a judicial perspective. All this suggests that the GBP/USD pair retains the potential for further growth until the Brexit issue is back on the agenda. At the moment, the price is testing the resistance level 1.3070 (the upper border of the Kumo cloud on the daily chart). The first (and, so far, the main) target of the growth movement is the 1.3150 level - this is the upper line of the Bollinger Bands on the same timeframe. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold bulls try to end the week with a bullish note for the weeks to come Posted: 05 Nov 2020 08:34 AM PST Yesterday's price action with the early decline and the strong finish was the first sign of Bull's strength. Today bulls confirmed this strength by breaking above key short-term resistance levels increasing their hopes for a move towards $2,000 again.

Gold price has broken above the trend line resistance. Price has also move above recent high at $1,931 starting a new sequence of higher highs and higher lows, since yesterday's $1,882 pull back did not violate the September low at $1,848. Now the $1,882 level rises in importance and bulls do not want to see price below it. On the other hand bears have a lot of work to do.

As we said in previous posts, it is important to focus on the weekly chart this week and not in the short-term ups and downs as volatility due to the elections has pushed price to extremes. Tomorrow is last trading session for the week and a good solid close above $1,950 would be a big win for bulls that could promise bullish weeks to come until the end of the month. The material has been provided by InstaForex Company - www.instaforex.com |

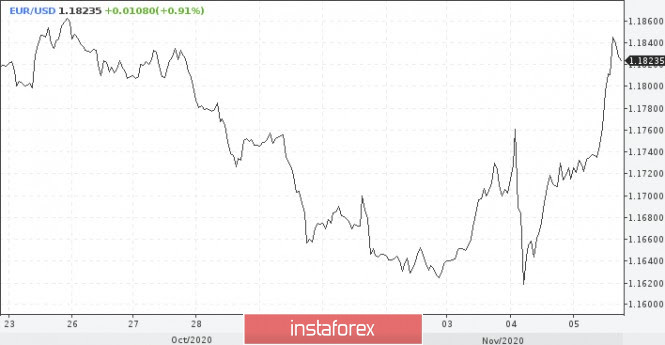

| EURUSD challenging major resistance Posted: 05 Nov 2020 08:25 AM PST EURUSD is challenging the major resistance at 1.1830-1.1850 after bouncing off key support at 1.16 yesterday. Yesterday's long lower tailed candle confirmed the importance of the 1.16 support area that we have identified for some time.

Green rectangle - support Price so far has touched the resistance trend line but has not yet broken above it. The momentum favors bulls. However price remains trapped inside a tightening trading range that looks like a triangle pattern with lower highs and same lows. Traders should keep a close eye on the 1.16 level in case it is broken and at the 1.1850 level as it is key resistance. If bulls manage to recapture 1.1850-1.1870 then we can see new highs over the next couple of weeks. A rejection here could bring price back to 1.16. All scenarios are still open. That is what the US election volatility brought and that is why we said that it was time traders stayed calm and patient for the dust to settle. We continue to focus on the weekly closing level to get more information for the coming weeks. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCHF vulnerable to a move lower towards 0.8870 Posted: 05 Nov 2020 08:20 AM PST USDCHF got rejected this week at the trend line resistance at 0.9185 and is now turning lower towards the support area at 0.9030. This support area has been confirmed several times before and breaking below it will be an important bearish signal.

Green rectangle -support area Red lines - expected downward move size if support fails to hold USDCHF is vulnerable to a move lower. The inability to break and stay above the blue downward sloping trend line resistance increases the chances of a move lower towards 0.89. If support at the green rectangle area at 0.9030 fails to hold, our first target will be 0.8870 and our second target would be 0.8770. We remain slightly bearish as long as price is below recent highs at 0.9210 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD outlook for November 5 Posted: 05 Nov 2020 07:30 AM PST Speculative interest keeps selling the greenback ahead of the final result of the US presidential election, with the EUR/USD trading well above the 1.1800 level.

The EUR/USD on the daily chart reversed strongly to the upside from a failed breakout below the key support (1.1620) of the 4-month trading range. The bulls see this as a double bottom in a bull flag pattern. The 2-days rally has been very strong. It should attract profit-taking soon that could lead to a 50 to 100-pip pullback. The bulls want a strong breakout above the October swing high (1.1860) and will carve a path to the September high at 1.1935 of the 4-month range. The risk is skewed to the upside, although the election's noise may well trigger a U-turn in the current risk-on stance. The focus remains on the US presidential election, as a winner has not been announced yet. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/JPY Trading Plan for November 5 Posted: 05 Nov 2020 07:05 AM PST The single European currency declined by 80 points or 0.65% against the Japanese yen on Wednesday. EUR/JPY is currently holding at 122.70 back in the range. If we see a breakthrough above the significant key level of 122.50, we can expect a continuation of the movement to the target at 124.00 phycological area.

In the early session, EUR/JPY formed an inverted Head and Shoulders (HNS) reversal pattern. This reversal pattern confirms the bearish move from 20-30th October that may turn into a near-term bull market coupled with a bullish impulse breakthrough to test. Currently, the price is about to retest the neckline breakout boundary of the pattern. If the breakout occurs above 123.00, a surge towards the 124.0 level could be expected to a retest the ascending trend line. However, if the channel pattern fails to hold, bears might drive the price back to October low in the following trading days. The material has been provided by InstaForex Company - www.instaforex.com |

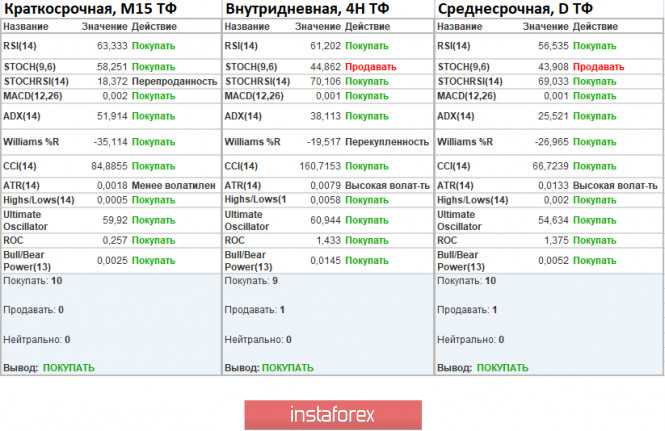

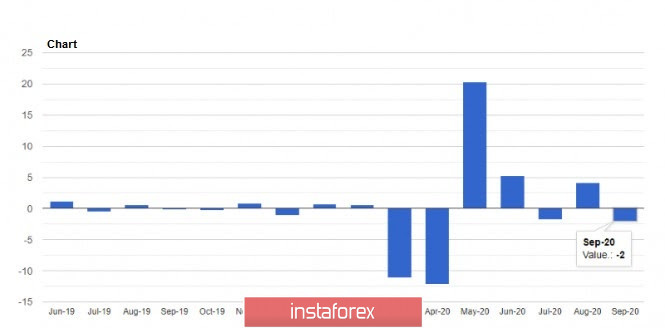

| Market remains under speculators' control. Outlook for GBP/USD on November 5 Posted: 05 Nov 2020 06:37 AM PST Yesterday, market participants became shocked as during the Asian session, the market tumbled and the US dollar jumped by over 200 pinps in just a few hours. Local jumps is a usual phenomenon amid important events such as the counting of votes in the US. Market forgot about the coronavirus, Brexit, and other problems and focused only on one topic that is the US Presidential election Speculators are trying to make the most of the uncertainties in the results of voting. Once a report is published on a particular polling station, there are swings in the market. The system is the following: If Joe Biden is ahead, the dollar loses in value. If Donald Trump is ahead, the dollar strengthens. Speculators analyze the information flow and perform local operations, while investors wait for the results of the race and only then will make a strategic decision. In terms of a technical analysis, there are many failures, and this is normal amid such high volatility. Fresh news is the trigger for actions, but there is still something to pay attention to. After the collapse in the pound sterling exchange rate during the Asian session, the market switched to a slowdown mode, where the levels of 1.2930/1.3050 became variable boundaries. In fact, there was a kind of accumulation, which ended the following day. As for the details of volatility, there is a consistent acceleration process and the quote jumped by 167 pips on November 3. Later, it increased by another 223 pips, which is 81% higher than the average level. In turn, the coefficient of speculative operations is at the highest level. Looking at the trading chart (daily period), you can see that the quote has been in the correction stage for at least six weeks from the local minimum of 1.2674. There a variable pivot point in the form of the area of 1.2840/1.2860/1.2885 has been found in recent weeks. Today, according to the macroeconomic calendar, there was a meeting of the Bank of England. The regulator decided to leave the interest rate at 0.1%, which was not surprising. The British currency was supported by the regulator's decision to increase the bond repurchase program by 130 billion pounds, bringing it to 875 billion pounds, which exceeded the forecast. Also, today, we expect a meeting of the US Federal Reserve System. Economists do not expect any changes. The fact is that the regulator will hardly act until the end of the vote counting process. The main reason for the speculative hikes is the presidential race. Analyzing the current trading chart, you can see that during the European session, there was an upward movement of the price, which led to a break of the 1.3050 limit. As a result, we can see an inertial move. A number of factors serve as a signal to open buy deals: - Joe Biden's lead in the presidential race. - The Bank of England's decision to buy back bonds. - A break of the limit of 1.3050. The weakening of the US dollar is another manipulation of speculators. It is possible that chaotic jumps will continue in the market. Areas of trade forces interaction: 1.3100/1.3140; 1.3175 (in case of the uptrend) 1.3000; 1.2930; 1.2840/1.2885 (in case of the downtrend) Based on the data obtained, we can make the following predictions: It is recommended to buy the currency pair higher than 1.3140 with the target at 1.3175. It is recommended to sell the currency pair below 1.3050 with the target at 1.3000-1.2930. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments are unanimously signaling a purchase, due to the inertial upward movement during the European session, as well as the price consolidation above 1.3100. It is worth noting that high market activity may negatively affect the reliability of indicators. The volatility for a week / Measurement of volatility: month/quarter/year. The measurement of volatility reflects the average daily fluctuation, calculated for a month/quarter/year. At the moment, volatility is 177 pips, which is 44% higher than the average level. It can be assumed that speculators will continue to work amid the new flow, which will lead to subsequent jumps in the market. Key levels: Resistance levels: 1.3200; 1.3300**; 1.3600; 1.3850; 1.4000***; 1.4350**. Support levels: 1.3000***; 1.2840/1.2860/1.2885; 1.2770**; 1.2620; 1.2500; 1.2350**; 1.2250; 1.2150**; 1.2000*** (1.1957);1.1850; 1.1660; 1.1450 (1.1411). * Periodic level * * Range level ***Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

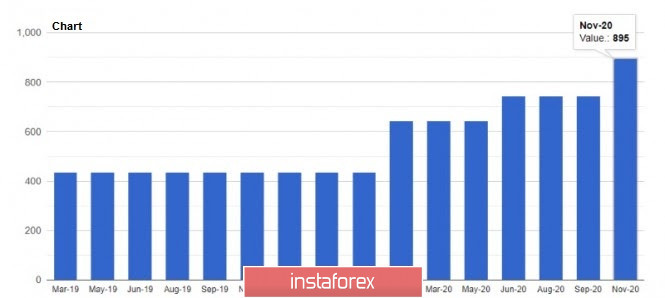

| Posted: 05 Nov 2020 06:26 AM PST The British pound is expected to rise against the US dollar on the background of another expansion of the program of assistance to the economy, which everyone has been waiting for a long time. However, the increase was more due to the fact that the regulator did not touch on the issue of introducing negative interest rates, which everyone fears at the beginning of next year. This gives traders hope that this method of stimulating the economy will not have to be resorted to at all. As I noted above, the monetary policy committee of the Bank of England announced an increase in the government bond purchase program by 150 billion pounds. Now the total volume of purchases will be 895 billion pounds. The key interest rate remained unchanged at 0.1%. It is also worth noting that all members of the monetary policy committee supported an increase in bond purchases. The Bank of England also noted that they will not tighten policy until they see clear signs of a reduction in spare capacity. If necessary, the regulator is ready to do whatever is required of it. Particular emphasis was placed on the worsening outlook for inflation. According to forecasts and taking into account the introduction of quarantine measures for November this year in the UK, GDP is likely to decline in the 4th quarter of this year. Bank of England Governor Andrew Bailey was brief in his speech. In his opinion, there is now a steady indirect impact of the coronavirus on the economy, and most likely, UK GDP will return to the level of 2019 no earlier than the 1st quarter of 2022. The pound "swallowed" all of this, along with expectations of the results of the US election, which will have a larger short-term impact than even today's decision on interest rates. As for the technical picture of the GBPUSD pair, buyers are targeting the highs of this week, the breakout of which will open a direct road to the levels of 1.3230 and 1.3320, which will indicate the formation of a new upward trend. The European currency also did not miss its moment and added against the US dollar, as faith in the victory of Joe Biden in the US presidential election continues to push fans of risky assets to rash actions. Today's forecast from the European Commission convinced investors that everything is not as bad as it might seem. The report indicates that the Eurozone's GDP will shrink by 7.8% in 2020, rather than by 8.7%, as predicted earlier this summer. But as for 2021, the forecast for Eurozone GDP growth in 2021 was revised to 4.2% from 6.1%. Growth of about 3.0% is expected for 2022. The beautiful figures on inflation that were drawn by the European Commission are unlikely to come true, but why not dream about it. And if the option of growth in 2021 and 2022 by 1.1% and 1.3% still corresponds to reality, then the November quarantine measures in the Eurozone due to the coronavirus will seriously hit consumer activity, which may push inflation in the EU at the end of the year to zero. The EC forecasts its growth by 0.3%. As for unemployment, the European Commission also has special views on it. Considering the programs of assistance to the population in Germany, France and a number of other developed countries, the more optimistic expectations of 8.3% against the background of the new wave of coronavirus clearly seem inappropriate in the current situation. But in 2021, it is expected to rise to the level of 9.4%, and here we can not disagree because of the curtailment of the above programs. To sum up the report, the European Commission believes that the future is surrounded by extremely high uncertainty, and the balance of risks for forecasts for economic growth is shifted to the negative side. . Another report that shows what problems await the Eurozone in the future concerns retail sales. According to the data, retail sales in the Eurozone in September this year fell by 2.0% compared to August. On an annualized basis, sales jumped 2.2%. The slowdown in the economic recovery and the increase in coronavirus infections are unlikely to have a positive impact on this indicator in the fall. As for the technical picture of the EURUSD pair, the growth continues as the expectation of Biden's victory in the elections increases. At the moment, the bulls are focused on the resistance of 1.1865, a break of which will open a direct road to the 19th figure, and then not far from the test of the maximum of 1.1970. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. The euro depends on the outcome of the US election Posted: 05 Nov 2020 06:15 AM PST

The US stock market rose significantly following the results of trading on Wednesday. In particular, the S&P 500 index showed the highest rise in its history for the day after the US presidential election. Investors reacted positively to the prospect of Democrat Joe Biden entering the White House, welcoming the imminent end of uncertainty about the outcome of the November 3 vote. Against this background, the greenback reached two-week lows, sinking below the mark of 93 points. Joe Biden is just a few steps away from winning. He has already won 264 electoral votes to Donald Trump's 214. Meanwhile, the experts' hopes that the so-called "blue wave" will become the result of the November elections in the United States does not seem to have come true. The result is that the Senate will remain Republican, and the Democrats' advantage in the House of Representatives will be reduced. Thus, investors should be prepared to assume that the progress of the aid package for the US economy will still depend on the ability of the two opposing parties to agree, which will seriously delay the process. Also, D. Trump does not intend to give up without a fight. He has already criticized the vote count in several states and even filed lawsuits demanding a recount. This means that market participants should prepare for several days or even weeks of uncertainty.

According to some estimates, if Joe Biden wins, the greenback may fall by about 5%, which will send the euro to the $ 1.25 area. Biden is expected to pursue a more peaceful trade policy, which is likely to put pressure on the dollar and provoke increased demand for risky assets. The weakening of the US currency will be limited if the Federal Reserve reduces its activity due to increased fiscal stimulus, which will spur growth in the US economy and increase the risks of interest rate hikes. The USD depreciation will be deeper if the global epidemiological situation improves or if a reliable COVID-19 vaccine becomes available. Donald Trump's re-election will mean the continued tension in trade relations between Washington and Brussels. The growing incidence of COVID-19 in the EU may weaken the region's economic recovery, which also needs to be taken into account. The European Commission estimates that the Eurozone economy will contract by 0.1% in the fourth quarter compared to the previous one due to new restrictions caused by the second wave of coronavirus. This year, the currency bloc expects the sharpest decline in history – by 7.8%. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening outlook for EUR/USD on November 5. Euro shows significant rise Posted: 05 Nov 2020 06:08 AM PST The euro/dollar has already approached the highest level of the range. Today, the main news is devoted to the US Presidential election. Joe Biden is confidently moving towards the victory. However, Donald Trump still has chances to keep his post. News from the US: the number of unemployed people declined to 7.3 million from 7.8 million. The euro is likely to hold its upward momentum. Buy deals could be still initiated from 1.1750. The material has been provided by InstaForex Company - www.instaforex.com |

| November 5, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 05 Nov 2020 05:28 AM PST

Three weeks ago, temporary breakout above 1.1750 was demonstrated within the depicted ascending channel. This indicated high probability of bullish continuation towards 1.1880. However, downside pressure pushed the EUR/USD pair towards 1.1700 where significant BUYING Pressure Existed. This was followed by another quick upside movement towards 1.1880-1.1900. The price zone around 1.1880-1.1900 constituted a KEY Price-Zone as it corresponded to the backside of the depicted broken ascending channel where significant bearish pressure and a reversal Head & Shoulders pattern were demonstrated. Recently, Two opportunities for SELL Entries were offered upon the recent upside movement towards 1.1880-1.1900. All target levels were achieved. EXIT LEVEL was reached around 1.1720. Early signs of bullish reversal were demonstrated around the current price levels of 1.1600. The EUR/USD pair is currently demonstrating a strong BUYING Pattern especially after the current upside breakout above the depicted price zone (1.1750-1.1780) was achieved.The pair is probably targeting the price levels around 1.1920 provided that the breakout above 1.1780 is maintained on the chart.Trade Recommendations :- Currently, the price zone of 1.175-1.1780 stands as a significant SUPPORT-Zone to be watched upon any upcoming downside pullback for a valid BUY Position. Exit level should be placed below 1.1740. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Nov 2020 05:06 AM PST

On Thursday, the US dollar showed negative dynamics in day trading. EUR/USD rose by 0.2% to hit 1.1740, while USD/JPY fell by 0.1% to settle at 104.38. AUD/USD increased by 0.2% to trade at 0.7187. USD/CNY fell by 0.1% to hit 6.6429, while USD/MXN gained 0.1% reaching 20.922. The US dollar index, which measures it against a basket of six other currencies, lost 0.1% to trade at 93.312. It is still unclear who will become the President of the United States. However, Joe Biden leads in the key US states of the Midwest, Wisconsin and Michigan. This suggests that he can take the presidency. Many experts say that Biden's policy will make the US dollar more vulnerable against the currencies of countries that have often faced the threat of sanctions during Trump's administration. Donald Trump has previously stated that he intends to refute the election results in case of defeat. And now Donald Trump is filing lawsuits because he does not agree with the preliminary count of votes. This suggests that uncertainty in the markets will remain for several weeks. The US Federal Reserve will announce its latest monetary policy decision later on Thursday. Many are confident that the decision will be suspended due to the uncertain political situation. GBP/USD surged 0.2% to 1.3010 amid the news that the Bank of England will increase its bond-buying program by £150 billion to £875 billion which is expected to support the country's weakening economy. However, the regulator continues to keep the key interest rate at 0.1%. This decision was made due to a sharp slowdown in UK economic growth and the rapid spread of COVID-19. The growing infection rate forced the government to reintroduce lockdown restrictions. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for November 05,.2020 - Median Pitchfork line will be important resistance for BTC Posted: 05 Nov 2020 05:04 AM PST Further Development

Analyzing the current trading chart of BTC, I found that the buyers are in control today and that there is no sign fo any reversal yet. Anyway, based on the weekly time-frame, I found that BTC is approaching the important pivot resistance level at $15,300 and that you should watch carefully for the price action around it cause that is Median Pitchfork line. Another resistance is set at $16,660 Key Levels: Resistance: $15,300 and 16,660 Support levels: $13,850 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Nov 2020 04:53 AM PST For the last 44 hours, price fluctuations were so strong that it might seem for a moment that there was a certain inertia. The information background along with intense speculation played a dirty trick to the market. As a result, a V-shaped pattern ( 1.1767 - 1.1602 - 1.1767) was formed. From the point of view of technical analysis, it is impossible to explain the reason for such a drastic change, since fundamental analysis, in particular noisy data, serves as a lever for manipulations. Thus, speculators are supported by the drama of the presidential election in the United States. Consequently, any incoming information about the vote count is perceived by market participants as a call to action. In the previous review, I said a few words about the candidates and the greenback's reaction to both them. I would like to remind you about the essence of my previous review. Biden's victory could lead to the weakening of the US dollar due to uncertainty surrounding the future of the American economy. Investors are getting used to stability and have an idea about Donald Trump's actions in case of victory. Therefore, the win of the current president may lead to a rise in the US dollar. The outcome of the presidential election is hampered by the counting of votes, since almost half of the voters chose to vote by mail instead of visiting polling stations. It is extremely difficult to draw any conclusions. The gap between the candidates is small and everything can change at any moment. Investors are monitoring the incoming information and are in no hurry to take action unlike speculators who use the thin market and noise to their advantage. Given such intense activity, there is no point in using the entire volume of capital, as it can lead to substantial losses in case of lack of the speculative tact. In order to identify noisy data as early as possible, I advise you to use sources such as Bloomberg, Wall Street Journal, Reuters when you are analyzing the burning topic of elections. As for the market dynamics, the crucial moment was when the market stopped on November 2. That day, volatility was only 33 pips, which was considered an extremely low value. In fact, it was a sign that speculators were preparing for the upcoming vote. November 3 was a voting day. The market activity was 107 pips, which was 40 pips above the average level. On November 4, the first results were announced. Volatility amounted to 165 pips for the first time in 109 days, which was 116% higher than the average level. Analyzing the trading chart in general terms (daily period), it is worth mentioning that the medium-term trend remains sideways, while the level of 1.1612 serves as a variable support.

As for the economic calendar, there is a Federal Open Market Committee meeting. The regulator is unlikely to make any crucial decisions until the counting of votes is finished. The topic of the election is considered to be the main one. Therefore, the meeting and macroeconomic statistics are of secondary importance. Analyzing the current trading chart, you can notice that with the start of the European session, the price resumed its upward movement. That led to a breakout at the local high of 1.1767. Apart from that, the formation of a V-shaped pattern (1.1767 - 1.1602 - 1.1767) ended after a breakout of its upper border. Notably, a wave of speculation took place when it was announced that Joe Biden was leading. As a result, the US dollar started to weaken. Most likely, price fluctuations will last until the winner of the presidential race is determined. Levels of interaction between the price and market participants: 1.1810 and 1.1880 - reduction in the volume of long positions 1.1750, 1.1700, and 1.1650 - reduction in the volume of short positions That is, we are talking about the points of partial and complete closure of speculators' positions. This can help us place new orders. Buy/sell recommendations: Consider opening Long positions above the level of 1.1825 with the view of reaching the area of 1.1850-1.1880. Consider opening Short positions below the level of 1.1790 with the view of reaching the area of 1.1750 - 1.1700.

Indicator analysis Analyzing different sectors of time frames (TF), it becomes clear that the technical tools are giving a buy signal. However, due to high volatility, false market direction signals are not excluded, which is common to tools when the level of speculation is increasing. Weekly volatility/Measure of Volatility: Month; Quarter; Year Measure of Volatility reflects the average daily price fluctuation per Month / Quarter / Year. The current dynamics is 103 pips, which is 34% higher than the average level. Volatility may continue rising along with the flow of speculations in the market. Key levels Resistance zones: 1.1880; 1.1910; 1.2000***; 1.2100*; 1.2450**; 1.2550; 1.2825. Support Zones: 1,1700; 1.1612*; 1.1500; 1.1350; 1.1250*; 1.1180**; 1.1080; 1.1000***. * Periodic level ** Range level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Nov 2020 04:49 AM PST US October Challenger layoffs 81k vs 119k prior Prior 119k US-based employers announced another 80,666 job cuts in October with the majority of cuts continuing to come from the entertainment/leisure sector i.e. 14,876 reductions. The total job cuts for the year-to-date stands at 2,162,928, being a record annual total for any given year, although that was already set when the August report came about.

Further Development

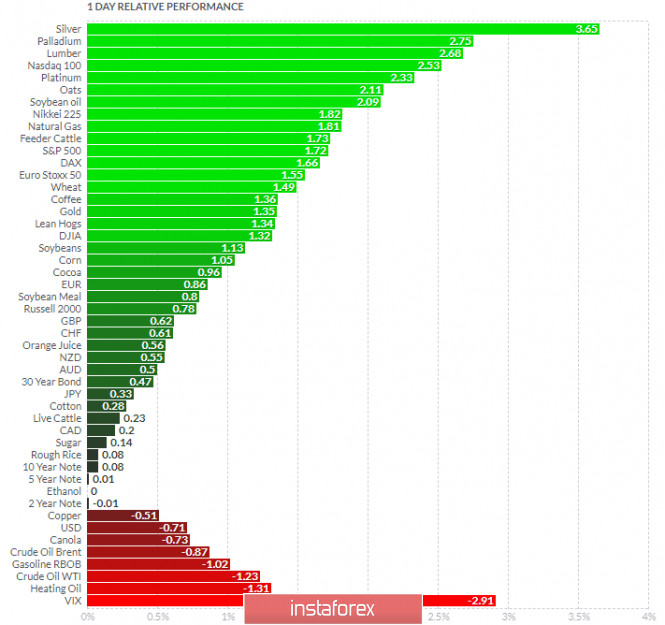

Analyzing the current trading chart of Gold, I found that the buyers are in control today and that there is no sign fo any reversal yet. Anyway, based on the weekly time-frame, I found that t Gold is approaching the important pivot resistance level at $1,933 and that you should watch carefully for the price action around it. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Silver and Platinum today and on the bottom VIX and heating oil. Gold is positive on the relative strength list... Key Levels: Resistance: $1,933 Support levels: $1,848 The material has been provided by InstaForex Company - www.instaforex.com |

| November 5, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 05 Nov 2020 04:48 AM PST

Short-term bearish outlook was expected especially after bearish persistence was achieved below the lower limit of the newly-established ascending-channel around 1.3100. A quick bearish decline took place towards 1.2780 and 1.2700 where considerable bullish rejection brought the pair back towards 1.3000 and 1.3100 during the past few weeks. The price zone of 1.3100-1.3150 (the depicted channel upper limit) constituted an Intraday Key-Zone to offering considerable bearish pressure on the GBPUSD Pair. Bullish Persistence above the mentioned price zone of 1.3100-1.3150 was supposed to allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested bullish pattern. However, the GBP/USD pair failed to do so, Instead, another bearish movement was targeting the price level of 1.2840 where bullish SUPPORT existed allowing another bullish movement initially towards 1.3000. On the other hand, please note that the current bullish breakout above 1.3000 will probably enable further bullish advancement towards 1.3150-1.3170 to gather sufficient bearish pressure. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment