Forex analysis review |

- Trump has reason to be nervous: Biden is still in the lead

- Analysis of GBP/USD on November 6. US elections are more important than the meetings of the Bank of England and Fed, as well

- Analysis of EUR/USD on November 6. Joe Biden is surging ahead in three of the four yet-to-be-finalized states.

- Gold to end week at the highest level

- EURUSD ends week with a bullish note

- USDCAD challenges August lows

- November 6, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- November 6, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- November 6, 2020 : EUR/USD daily technical review and trade recommendations.

- EURUSD: Biden's victory will not have such a strong impact on the dollar as expected, Germany maintains the growth rate of

- APX and Europe stock exchange traded in red zone

- EU economy to hardly recover soon

- BTC analysis for November 06,.2020 - Median Pitchfork line on the test and potential for the downside rotation

- Dollar: more pressure factors

- Analysis of Gold for November 06,.2020 - Bearish divergence on the Gold with potential for downside rotation towards $1.936

- EUR/USD analysis for November 06 2020 - Bearish divergence on the stochastic oscillator and potential for the downside rotation

- EUR/USD: the dollar is grasping at straws

- USD index rolled down as Biden builds advantage on the race

- Crude oil prices plummeted as market faces sets of problem

- USD/CAD Continuation Pattern Violated

- Elliott wave analysis of EURJPY for November 6, 2020

- Experts predict the future of oil prices

- Bitcoin's nearest target is $20,000

- Technical analysis of EUR/USD for November 06, 2020

- America right now: US elections, Fed meeting and data on employment

| Trump has reason to be nervous: Biden is still in the lead Posted: 06 Nov 2020 01:17 PM PST The United States continues to elect a president. No certainty on this matter yet. A couple of points added to Democrat Joe Biden, who, according to CNN's statement this morning, is significantly ahead of Donald Trump in terms of votes. Biden has 1,096 votes more than the current president in the state of Georgia. But in the previous two days, Trump held the lead there. By the way, no Democrat candidate has won in this state since 1992. However, this information can hardly add confidence in the outcome of the elections. The outcome of the race cannot be considered decided as long as the vote is still being counted in several important states. But we must admit that Trump is no longer as confident in his victory as before. He is clearly alarmed by the lag behind his rival and does not intend to put up with his possible defeat. The day before, the head of the White House rushed to file lawsuits against the Democrats over the incorrect counting of votes in Nevada, Pennsylvania, Georgia and Michigan, as well as demanding to suspend the counting of votes. Trump insists that the current election results are clearly unreliable. He is sure that the wrong votes are being counted. For example, in Michigan, representatives of the president's headquarters noted that observers were unable to monitor the count of ballots. Trump demanded the elimination of violations and a recount of the counted votes. However, the claim was rejected. A similar situation occurred in the state of Georgia. And here the court also did not support the president's demands for a recount of votes. In Philadelphia, a federal court also denied the presidential headquarters a request to stop the count. Although it is worth noting that before that the local court went to meet the supporters of the incumbent president and allowed observers to approach those who are counting the votes. At the same time, Trump's supporters noted that it was extremely difficult to follow the procedure, and they are not sure that everything was fair. In Nevada, the president's headquarters also announced violations in the form of counting "illegal" ballots and filed a lawsuit. However, it is worth recognizing that Trump's headquarters could not present any evidence, so it is not surprising that this kind of passage did not have any effect. On his Twitter, the president said he was going to file lawsuits against the authorities of all states, where Biden is now leading. It's hard to say whether the game is fair in the United States now. However, some facts make you wonder. So yesterday, Trump's address to US citizens was interrupted by several American TV channels (MSNBC, CNBC, CBS, ABC and NBC), explaining that the president was spreading conspiracy data and was simply lying. These incidents can be viewed on Twitter. The fastest in this matter was the cable network MSNBC, where, just 35 seconds after the start of the speech of the incumbent president, presenter Brian Williams said that he was forced to interrupt Trump's speech due to its incorrectness. Prior to that, the president tried to convey to the audience that his victory would take place if all the "legal" votes were counted. He also stated that the majority voted for him in Florida and Ohio. However, the audience did not listen to the president to the end, because after the break, the TV channel never returned to broadcasting Trump's speech. The same incident happened on NBC. Host Savannah Guthrie interrupted Trump's broadcast following his announcement of victory in Georgia, Pennsylvania and Michigan. Trump tried to convey to the audience information about the falsification of these elections. However, the viewers could not hear the continuation of the speech, as in the case of MSNBC. CNBC host Shepard Smith also stopped broadcasting Trump's speech. Obviously without consulting his colleague from NBC, he seemed to repeat her explanation, calling Trump's statements "absolutely untrue." The television channels CNN and Fox News distinguished themselves only by broadcasting the full speech of Donald Trump. However, this did not exclude open hostility. The caustic comments of the hosts are hard not to remember. The Fox News presenter noted the president's words as unsubstantiated, and the CNN presenter called the speech of the head of the White House "pathetic." One way or another, due to litigation and recounts in individual states, uncertainty about the election result may last for a very long time. Until the day of the inauguration on January 20, 2021, Trump will be the president of the United States anyway. If the outcome is not approved before the inauguration, then Trump will have to step down and give up the chair in the Oval Office to the acting president. And recounts in a number of wavering states such as Michigan and Wisconsin are more likely. Experts are still inclined to believe that Trump will hardly be able to win through courts and recounts. In the United States, the practice of recounts rarely influenced the outcome of the elections. Uncertainty about the outcome of the elections is not the only problem in the United States. The recovery of the country's economy after the pandemic is also important. And this uncertainty is growing along with the rise in the number of cases of COVID-19 infections. A share of optimism is added by the fact that unemployment in the United States fell better than expected in October, it decreased to 6.9%, and the number of jobs in non-agricultural sectors of the economy increased by 638,000. Yesterday, the US Federal Reserve kept its monetary policy unchanged. However, Fed Chairman Jerome Powell announced the need for additional fiscal and monetary support, without which the recovery of the US economy would be extremely difficult. The dollar index, which tracks its exchange rate against a basket of six other currencies, was down 0.16% to 92.362. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Nov 2020 09:08 AM PST

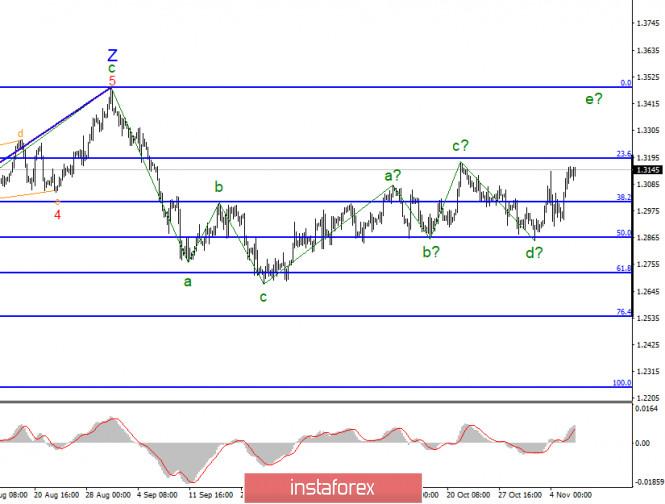

In the most global sense, the construction of an upward trend section may resume, however, the entire wave marking takes a more complex form. The section of the trend that starts on September 23 takes a five-wave form, however, it is not an impulse one. Thus, after the end of the next rising wave, the construction of a new three-wave section of the trend can begin. However, given that there is no classical wave marking now, the section of the trend from September 23 can be complicated as many times as necessary. The news background is now of great importance for the markets. Now the British dollar is rising, as markets are afraid of dollar purchases. In a week, the dollar may start to grow, as the markets will start to get rid of the British dollar.

The lower chart clearly shows two failed attempts to break the 50.0% Fibonacci level, which are currently interpreted as the lows of waves b and d. Thus, the wave marking takes on a rather non-standard appearance, and the construction of the next ascending wave can be completed already around the 23.6% Fibonacci level. At the same time, a successful attempt to break the 1.3189 mark will indicate that the markets are ready for further purchases of the British dollar within the expected wave e. Yesterday, the Bank of England and the Federal Reserve met, and Jerome Powell and Andrew Bailey delivered speeches. If the Fed meeting turned out to be quite boring, since no important decisions were made, then the Bank of England meeting turned out to be quite interesting. In particular, the Central Bank expanded the QE program by 150 billion pounds. Now markets are waiting for a reduction in key rates in the UK, as the economy continues to "limp", and at the end of 2020 may again shrink due to the coronavirus and a new "lockdown". There is also no trade agreement with the European Union, so during 2021, the British economy may "limp" on two legs. However, Jerome Powell also hinted at possible new economic stimulus actions. All this data did not interest the markets at all. Demand for the British pound persisted despite the dovish actions of the Bank of England. Today in America, an important Nonfarm Payrolls report was released, which showed that in October, 638,000 new jobs were created outside the agricultural sector. Markets were expecting only 600,000. The unemployment rate in October fell from 7.9% to 6.9%, although expectations equated to 7.7%. Thus, two very important reports showing a good recovery in the US economy did not provide any support to the dollar. Consequently, the markets remain fully focused on the vote count, as well as on the political chaos that may begin in the near future. Statistics (even important ones) are not important now, and even the topic of Brexit is fading into the background. Thus, we need to wait for the final results of the elections and further actions of both presidential candidates. General conclusions and recommendations: The pound/dollar instrument resumed building an upward trend section, but its last wave may end near the 23.6% Fibonacci level. Thus, in case of a successful attempt to break the 1.3189 mark, I recommend buying a tool with targets located near the 1.3484 mark, which corresponds to 0.0% Fibonacci. Otherwise, a new downward section of the trend may start building. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Nov 2020 09:08 AM PST The wave marking of the EUR/USD instrument in global terms suffered certain changes after the quotes fell below the minimum of wave b. And in the coming days, it may suffer new changes, since the trading of recent days has almost completely broken the current wave markup. At first, I assumed that a new triple down would be built. Now the entire wave marking can take an even more serious form and the construction of an upward trend section will resume. If this is true, then the increase in quotes will resume within wave 5, and wave 4 will take a very long form. A smaller-scale wave marking also indicates the possible end of the downward section of the trend that begins on October 21. With the final decrease, the instrument could form a wave from the next three, so after its completion, a new three can be built up, or the upward trend section within the global wave 5 can be resumed, as I mentioned when analyzing the 24-hour timeframe. If this is the case, then the construction of a correction wave 2 or b may soon begin. The American election is over, however, the vote count continues. If yesterday the chances of Joe Biden were in the balance, although he was ahead by 50 electoral votes, as wavering states preferred Donald Trump, now in three of the four still uncounted states, Joe Biden is already in the lead. Thus, the Democrat can breathe more calmly. Most likely, he will win the presidential election. Meanwhile, Donald Trump, according to several sources in the United States, will behave in the coming weeks as if he won the election. It is reported that the current President does not recognize the possible victory of Joe Biden and is going to sign several very serious documents in the near future, in particular, with China. This strategy will be aimed at convincing the country that it was he who won the election and to look as "presidential" as possible, according to American sources. Several layoffs could also follow, notably FBI Director Christopher Wray and Defense Secretary Mark Esper. At the same time, the Trump team is going to initiate legal proceedings in several states at once, where, in their opinion, there were violations in the counting of votes. Thus, the most interesting part of the election is still ahead. Yesterday, the Fed also held a meeting, at which no important decisions were made. Markets' attention was drawn to the speech of Fed Chairman Jerome Powell, who was very pessimistic due to the uncertainty associated with the coronavirus in the United States, as well as the lack of a new package of assistance to the American economy. However, the markets were not too interested in this information. The US dollar continues to decline amid political confusion and potential chaos. General conclusions and recommendations: The euro/dollar pair presumably completed the construction of a three-wave downward trend section. Thus, at this time, I recommend buying a tool with targets located near the 1.2010 mark, which corresponds to 0.0% Fibonacci, for each MACD signal "up", based on the construction of wave C. However, before the construction of this wave begins, quotes may depart from the reached highs within wave b. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold to end week at the highest level Posted: 06 Nov 2020 08:42 AM PST After a volatile week Gold price is breaking to the upside. Bulls are recapturing key resistance levels. Holding above $1,900 was important for bulls and focusing on the bigger picture, Gold bulls recapturing $1,950 is a big step towards starting a new upward wave.

Gold price is now ending this week at the highest level for the last 9 weeks. This is an important step towards a new upward wave that could bring Gold price to $2,000 and higher. Bullish trend is alive and remains valid as long as price is above $1,900. The material has been provided by InstaForex Company - www.instaforex.com |

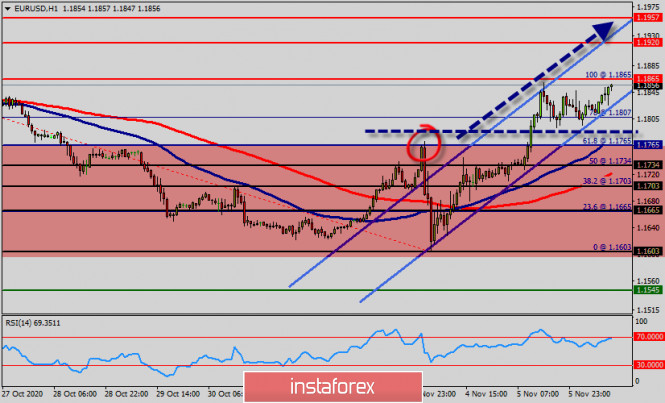

| EURUSD ends week with a bullish note Posted: 06 Nov 2020 08:39 AM PST EURUSD had a volatile week due to the swinging of the election results. EURUSD started the week around 1.18, turned lower to test key support at 1.16 and now price is breaking to new higher highs.

Green line resistance EURUSD is ending the week on a higher level than the previous 9 weeks. Price is breaking above the resistance and bulls seem to be in control of the 1.18 level and look strong enough to defend it. Trend is expected to continue to be bullish and as long as price holds above 1.1750 we believe 1.21 is more probable. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Nov 2020 08:34 AM PST USDCAD is trading just above 1.30 after having broken a triangle pattern to the downside. Price has reversed strongly this week after reaching as high as 1.33. Price is now just above 1.30 and as long as price continues to trade below 1.3150 I expect bears to remain in control.

Green line - lower triangle boundary USDCAD is now challenging the August lows. Breaking below 1.30 will open the way for a move lower towards 1.28. However bears should not get overconfident because the RSI provides us with some bullish warnings as the price of the RSI is not making new lower lows. This is not a bullish reversal signal but just a warning. As long as price continues to make lower lows and lower highs trend remains bearish. The key resistance level to watch is 1.3320. The material has been provided by InstaForex Company - www.instaforex.com |

| November 6, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 06 Nov 2020 07:30 AM PST

Short-term bearish outlook was expected especially after bearish persistence was achieved below the lower limit of the newly-established ascending-channel around 1.3100. A quick bearish decline took place towards 1.2780 and 1.2700 where considerable bullish rejection brought the pair back towards 1.3000 and 1.3100 during the past few weeks. The price zone of 1.3100-1.3150 (the depicted channel upper limit) constituted an Intraday Key-Zone to offering considerable bearish pressure on the GBPUSD Pair. Bullish Persistence above the mentioned price zone of 1.3100-1.3150 was supposed to allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested bullish pattern. However, the GBP/USD pair failed to do so, Instead, another bearish movement was targeting the price level of 1.2840 where bullish SUPPORT existed allowing another bullish movement initially towards 1.3000. Moreover, the current bullish breakout above 1.3000 will probably enable further bullish advancement towards 1.3150-1.3170 to gather sufficient bearish pressure. The material has been provided by InstaForex Company - www.instaforex.com |

| November 6, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 06 Nov 2020 07:28 AM PST

In July, the EURUSD pair has failed to maintain bearish momentum strong enough to move below 1.1200 (consolidation range lower zone). Instead, bullish breakout was achieved above 1.1380-1.1400.This has lead to a quick bullish spike directly towards 1.1750 which failed to offer sufficient bearish pressure as well. Bullish persistence above 1.1700 - 1.1760 favored further bullish advancement towards 1.1975 - 1.2000 ( the upper limit of the technical channel ) which constituted a Solid SUPPLY-Zone offering bearish pressure. Moreover, Intraday traders should have noticed the recent bearish closure below 1.1700. This indicates bearish domination on the short-term. However, the EURUSD pair has failed to maintain sufficient bearish momentum below 1.1625 (38% Fibonacci Level). Instead, another bullish breakout was being demonstrated towards 1.1870 which corresponds to 76% Fibonacci Level. As mentioned in previous articles, the price zone of 1.1870-1.1900 stood as a solid SUPPLY Zone corresponding to the backside of the broken channel. Moreover, the recent bearish H4 candlestick closure below 1.1770 was mentioned in previous articles to indicate a valid short-term SELL Signal with bearish targets already achieved at 1.1700 and 1.1630. The current bullish pullback towards the price zone of 1.1870-1.1900 should also be considered for signs of bearish rejection and another valid SELL Entry. S/L should be placed just above 1.1810. The material has been provided by InstaForex Company - www.instaforex.com |

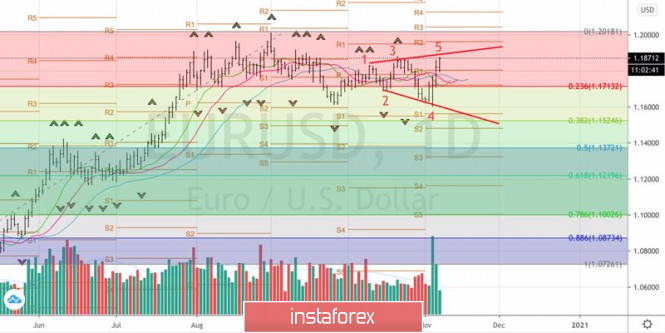

| November 6, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 06 Nov 2020 07:26 AM PST

Three weeks ago, temporary breakout above 1.1750 was demonstrated within the depicted ascending channel. This indicated high probability of bullish continuation towards 1.1880. However, downside pressure pushed the EUR/USD pair towards 1.1700 where significant BUYING Pressure Existed. This was followed by another quick upside movement towards 1.1880-1.1900. The price zone around 1.1880-1.1900 constituted a KEY Price-Zone as it corresponded to the backside of the depicted broken ascending channel where significant bearish pressure and a reversal Head & Shoulders pattern were demonstrated. Recently, Two opportunities for SELL Entries were offered upon the recent upside movement towards 1.1880-1.1900. All target levels were achieved. EXIT LEVEL was reached around 1.1720. Early signs of bullish reversal were demonstrated around the current price levels of 1.1600. The EUR/USD pair is currently demonstrating a strong BUYING Pattern especially after the current upside breakout above the depicted price zone (1.1750-1.1780) was achieved. The pair is probably targeting the price levels around 1.1920 provided that the breakout above 1.1780 is maintained on the chart. Trade Recommendations :- Currently, the price zone of 1.1800-1.1820 stands as a significant SUPPORT-Zone to be watched upon any upcoming downside pullback for a valid BUY Position. Exit level should be placed below 1.1740. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Nov 2020 06:15 AM PST While the European currency is steadily climbing up against the US dollar amid expectations that the new President of the United States will be Joe Biden, leading analytical agencies are already predicting a larger intervention by the Federal Reserve to save the US economy. The point is that even if Biden becomes President, he is unlikely to be able to push through the Senate everything that his Democratic party wants since the majority will remain with the Republicans. Therefore, it is not difficult to assume on whose shoulders the task of saving the American economy will again fall, since it is unlikely that the new package of support measures worth $ 2.2 trillion proposed by the Democrats will pass through the approval of the US Senate. The adoption of a more modest budget spending program than would be expected in the event of a complete victory of the Democrats in the elections, and we are talking about only 1.5 trillion dollars, may ease short-term pressure on the US dollar, which is rapidly losing its position against risky assets. On the other hand, if real Fed intervention is required and monetary policy easing continues, the dollar is likely to lose ground in the medium term. If the COVID-19 infection situation continues to grow, it will force the Fed to intervene before the White House administration does. As for today's figures, which were published for the Eurozone, the good growth of industrial production in Germany in September this year once again confirmed the recovery of the economy after the first wave of coronavirus. According to a report by the Federal Bureau of Statistics Destatis, industrial production in September increased by 1.6% compared to August, while economists had forecast an increase of 2.5%. Compared to the same period in 2019, industrial production decreased by 7.3%. As for another indicator that indicates the advanced state of the German economy, it has improved, but the data was collected before the new lockdown, so these figures are no longer of serious significance. According to Commerzbank, the leading indicator of the state of the German economy in October rose to 0.41 points from 0.31 points in September. The overall recovery of the world economy in the manufacturing sector has led to a good rise in the indicator over the past two years. However, the introduction of new restrictions and quarantine measures to contain the coronavirus pandemic may only have an indirect impact on the manufacturing sector, as the service sector will be most affected. The report on retail sales in Italy for September showed that this Euroregion will not be so easy to enter the second wave of coronavirus, although economists' forecasts almost coincided with real data. According to the Istat report, retail sales declined in September this year after a booming period of growth in the summer, indicating that the recovery in consumer spending is fading. The index fell by 0.8% in September and grew by only 1.3% compared to the same period last year. In Q3, compared to Q2, growth was 16.1%, but this is the result of a rebound after a disastrous failure in Q2 when the economy contracted heavily as a result of the pandemic. In conclusion, I would like to note the growth of industrial production in Spain, which according to the report, in September this year increased by 0.8%, but immediately decreased by 3.4% compared to last year. Most of all, there was an increase in the production of capital goods in September compared to August, where the increase was 1.9%. Production of consumer durables declined the most. As for the current technical picture of the EURUSD pair, now the bulls are focused on breaking through the resistance of 1.1880, which will open a direct road to the area of the new maximum of 1.1920, from which it is "close at hand" to 1.1970. Most likely, the final calculation of the results of the US presidential election will shift to the weekend, so we expect major gaps on Monday with the opening of the Asian session. In this regard, I do not recommend speculative traders to leave open positions for the next week, as it is not clear which way the market reaction will be after the results are announced. The material has been provided by InstaForex Company - www.instaforex.com |

| APX and Europe stock exchange traded in red zone Posted: 06 Nov 2020 05:36 AM PST

Asia-Pacific Stock Exchanges (APX) showed multidirectional dynamics on Friday morning. The major stock indexes continue to react differently to foreign policy news. Investors' attention was mainly directed towards the results of the US presidential elections, which remains partial up to this moment. The vote count is still ongoing, however, it is already causing a fundamental objection among Donald Trump's supporters. Initially, Trump took the lead in many American states, but closer to the end of the calculations, an unexpected shift took place. The situation raises many questions, especially how the votes were counted in the ballots that were sent by mail after the closing of polling stations in the country. The current president Donald Trump has already filed lawsuits over the illegal counting of those votes that came after the completion of the main voting stage. The situation remains uncertain, which puts quite serious pressure on the stock markets not only in America but also in other regions. According to the latest data, the number of votes cast in favor of Biden is 264 of the 270 needed to win, while Trump has 214. Despite the partial results, Trump is already making a statement that he is not going to leave the presidency without a fight and intends to challenge the results of the vote in court. This means that the struggle for leadership promises to be long and exhausting. Of course, this is one of the most unfavorable factors for the stock markets. Nevertheless, there is still hope that the scandal will be avoided. Meanwhile, the two-day meeting of the US Federal Reserve System ended on Thursday. The regulator decided not to change the planned course of monetary policy since the country's economic recovery continues, although not at a very rapid pace. The prospects for further economic growth are not completely clear, but the large negative impact has not yet been noted either. The Fed chairman proposes to closely monitor the course of events and not make premature decisions. Thus, the base interest rate on loans in the US remained in the range from 0 to 0.25% per annum. Japan's Nikkei 225 is up 1.07%, pushing it close to its twenty-nine-year high. China's Shanghai Composite Index, on the other hand, decreased by 0.68%. The Hong Kong Hang Seng Index split this trend and sank 0.26%. South Korea's KOSPI index dropped 0.14%. The Australian S & P / ASX 200 Index climbed 0.14%. However, the prospects for further development of the country's economy look rather vague. According to the statements of the country's main regulator - the Reserve Bank of Australia - the coronavirus pandemic has had a deeply negative impact, the consequences of which will be felt for a long time in the economic development of the state. The level of GDP has suffered so much that it will be possible to return to the reverse pre-crisis level not earlier than by the end of next year. In this regard, the regulator decided to reduce the base interest rate to a record level, as well as to reduce the target yield of government bonds with a repurchase period of three years. Perhaps the most important issue of the Reserve Bank of Australia was the ratification of the next quantitative easing program, which amounts to 100 billion Australian dollars or 70.57 billion USD. A depressed mood reigns on European stock exchanges on Friday. The major stock indexes are declining amid the growing wave of coronavirus infection, as well as the uncertainty of the results of the US presidential election. The general index of large enterprises in the European region STOXX Europe 600 in the morning fell 0.57%, which forced it to move to the level of 365.03 points. The UK FTSE 100 Index sank 0.41%. The German DAX index parted from 1.23% immediately, making it the leader of Friday's fall. France's CAC 40 index fell 1.06%. Italy's FTSE MIB Index declined 0.65%. Spain's IBEX 35 Index also fell 0.93%. Market participants continue to express extreme concern about the increase in the number of new coronavirus cases in the region and, in particular, the record number of deaths that have been recorded in individual countries - Italy and Spain. The material has been provided by InstaForex Company - www.instaforex.com |

| EU economy to hardly recover soon Posted: 06 Nov 2020 05:15 AM PST

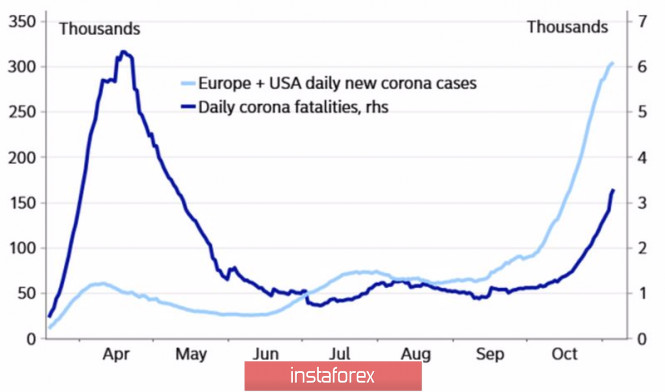

This spring, the eurozone faced the deepest recession ever caused by a global lockdown. According to the European Commission's quarterly report, the eurozone's GDP will decline by 7.8% in 2020. Next year, GDP will grow by 4.2%, and in 2022 - by 3.0%. Over the summer, the European economy managed to recover almost completely, showing record growth rates. However, the sharp growth in the number of infected people in autumn canceled out the success. The second wave of the coronavirus forced many countries to reintroduce restrictive measures. As a result, the economic recovery began to slow down. A decrease in GDP is expected in all EU countries, but the damage is uneven. Spain, France, and Italy have been hit hardest, according to the European Commission's estimates. The GDP's drop in these countries may exceed 9%. For comparison, in Germany, GDP fell by only 5.6%. Moreover, Spain and Italy have the highest daily COVID-19 incidence rates. In some regions, quarantine has been already reintroduced. Also, Italy joined countries such as France, Britain, and Germany in suspending vast sectors of their economies. Besides, in Germany, industrial production rose less than expected in September. In other words, the continent could be hit by a double recession. The scale of the virus spread and the severity of the measures taken to contain COVID-19 are different. In other words, each EU country will take a different amount of time to recover from the consequences. State support measures play an important role in this situation as well. By the way, Vice-President of the European Commission Valdis Dombrovskis informed of the new NextGenerationEU package of measures, which was created in order to provide significant support to those regions that have been most affected by the coronavirus. Meanwhile, amid a weakening economy and fear of the virus, European indices fell. Germany's DAX lost 0.5%, France's CAC 40 fell by 0.4%, and the UK's FTSE decreased by 0.2%. On Friday, oil prices fell under pressure from signs of the overproduction at OPEC and more drastic discounts from Saudi Arabia to consumers in Asia. WTI crude futures lost 1.2% to trade at $38.34 per barrel, Brent crude fell by 1.3% to $40.42 as well. Gold futures rose by 0.1% to hit $1,949.30 per ounce. EUR/USD increased by 0.2% to settle at 1.1848. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Nov 2020 04:47 AM PST Further Development

Analyzing the current trading chart of BTC, I found that the buyers got exhausted today and the upside target from yesterday at the price of $15,500 has been reached. Anyway, the price is at the median Pitchfork line and there is potential for the downside rotation towards the level at $13,795 Stochastic is showing overbought condition. Watch for selling opportunities with the target at $13,795Watch for selling opportunities with the downside targets at $1,936 and $1,917 Resistance is set at $15,500 and $16,500 Key Levels: Resistance: $15,500 and $16,500 Support levels: $13,795 The material has been provided by InstaForex Company - www.instaforex.com |

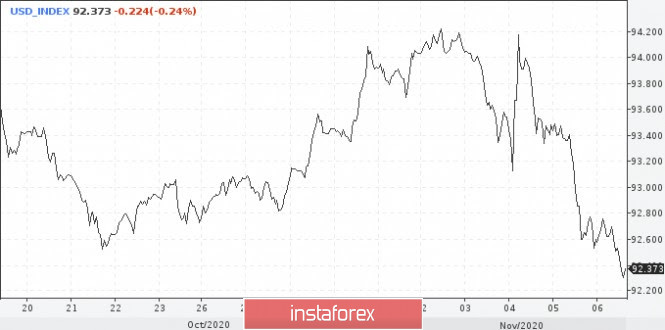

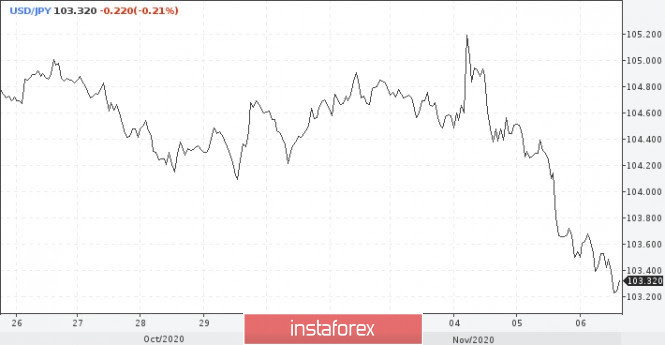

| Posted: 06 Nov 2020 04:41 AM PST The elections are developing according to the worst-case scenario. Both candidates are confident of their victory, while Donald Trump continues to threaten to challenge the results of the vote in court. The Asian session received an update on the vote today. Currencies reacted poorly to it because few people believe that the situation with the determination of the US President will be resolved quickly. There are weeks or even months of uncertainty ahead. Delaying this process should benefit the US Dollar but for now it has shown weakness. Yesterday's high was associated with the confidence of the markets in the victory of the Democrat and hopes for the allocation of money for the American economy. However, it is worth considering that the Republicans will retain control of the Senate. The adoption of a larger stimulus package will be difficult. In addition, if you reject the idea of legal proceedings over the vote and look at what is happening now, a different picture will emerge. Yes, Biden retains the advantage but the votes have not yet been counted which means that Trump's victory could still be possible. On Friday, the dollar index is trading near two-week lows-- around 92.60. During the week, the indicator lost 1.5% of its value, which is the largest drop in almost four months. Pressure on the Dollar was also triggered by the fall in the yield of long-term Treasury bonds. Yields declined due to expectations of budget cuts, as well as a rally in stocks and other riskier assets. So far, the currency will continue to remain under pressure. Today, investors are evaluating data on non-agricultural employment in the United States. The report should reflect a slight slowdown in job creation. Concerns about the economy are growing and this is a reason for the continuation of the downward trend in the Dollar. The rise in new Coronavirus cases to record levels in several states is likely to contain economic activity. Against the Yen, the Dollar was trading at 103.25 today, close to an eight-month low. The Prime Minister of Japan intends to work closely with foreign authorities to maintain the exchange rate of the national currency. The strongest Yen is seen as a threat to the Japanese economy. However, closing the USD / JPY pair below 104 will strengthen expectations of further depreciation and may open the way to the 101 mark. The reasons for this failure are that the difference in interest rates on the 10-year government debt has changed for the worse against the Dollar this week. The yield on American ten-year-notes has fallen by 11bps since last Friday while the corresponding yield on Japanese securities has sunk by just 2bps. This, of course, cannot fully explain the weakness of the USD/JPY pair. However, the fall in US yields has made a big contribution to the weakening of the Dollar this week. The Euro is helped by expectations of a Biden victory and progress in creating an EU recovery fund. The main pair was trading near 1.19 on Friday. A Democrat who doesn't control the Senate will be less aggressive on trade policy but will have to be more limited on fiscal stimulus. One of the main roles will be assigned to the Federal Reserve, which means low rates for a long time. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Nov 2020 04:40 AM PST UK October Halifax house prices +0.3% vs +0.5% m/m expected Latest data released by Halifax - 6 November 2020

Slight delay in the release by the source. The annual change marks the highest growth in house prices since June 2016, as the UK housing market continues to stay more resilient after the bounce back from lockdown measures in Q2. Halifax notes that: "This level of price inflation is underpinned by unusually high levels of demand, with latest industry figures showing home-buyer mortgage approvals at their highest level since 2007, as transaction levels continue to be supercharged by pent-up demand as a result of the spring/summer lockdown, as well as the Chancellor's waiver on stamp duty for properties up to £500,000. Further Development

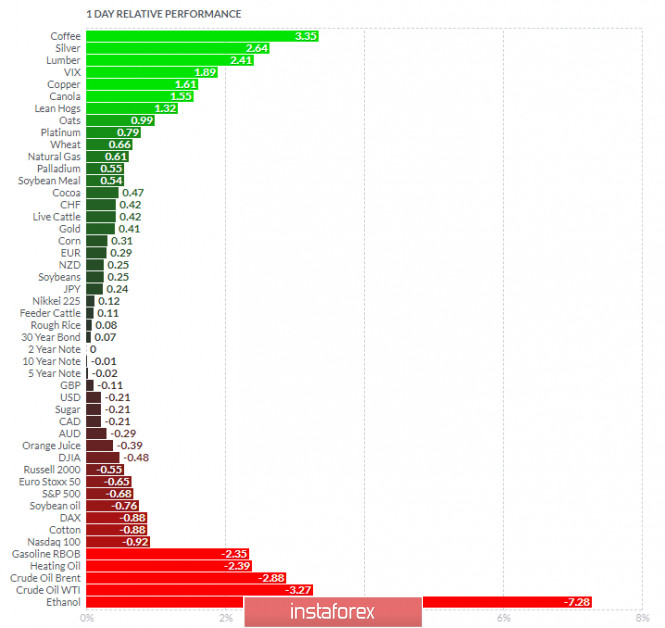

Analyzing the current trading chart of Gold, I found that the buyers got exhausted today and the downside rotation would be probably to correct strong upside movement from recent few days. Stochastic is showing bearish divergence on the 4H time-frame, which is another sign of weakness. Watch for selling opportunities with the downside targets at $1,936 and $1,917 Resistance is set at $1,953 1-Day relative strength performance Finviz Based on the graph above I found that on the top of the list we got Coffee and Silver today and on the bottom Ethanol and Crude Oil. Gold is slightly positive on the list but with decreasing in the upside momentum. Key Levels: Resistance: $1,953 Support levels: $1,936 and $1,917 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Nov 2020 04:28 AM PST Irish prime minister Martin says still sees potential for Brexit deal This has become the usual filler in between negotiationsAfter another round of Brexit negotiations last week, nothing has changed but at least both sides are continuing to talk although key outstanding issues remain unresolved. It seems like both the EU and UK are willing to let this run for a while longer, but that will run it close to the end of the transition period on 31 December. Not to mention the fact that any agreement struck also still needs to be approved and ratified in parliament, before taking effect. Further Development

Analyzing the current trading chart of EUR/USD, I found that the buyers got exhausted today and the downside rotation would be probably to correct strong upside movement from recent few days. Stochastic is showing bearish divergence on the 4H time-frame, which is another sign of weakness. Watch for selling opportunities with the downside targets at 1,1795 and 1,1773 Resistance is set at 1,1880 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Coffee and Silver today and on the bottom Ethanol and Crude Oil. Key Levels: Resistance: 1,1880 Support levels: 1,1795 and 1,1770 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: the dollar is grasping at straws Posted: 06 Nov 2020 04:28 AM PST

On Friday, the US currency rate somewhat stabilized after a sharp drop recorded a day earlier. The uncertainty surrounding the outcome of the US election keeps investors on their toes, allowing the greenback to stay afloat. Although the chances of Joe Biden winning are growing, the final result has not yet been announced. Vote counting continues in five key states: Pennsylvania, Georgia, Nevada, Arizona, and North Carolina. The current head of the White House, Donald Trump, is threatening to sue, trying in every possible way to get a victory in the election. There is a chance that Republicans will retain control of the Senate, which will make it harder for Democrats to pass the larger fiscal stimulus package they promoted earlier. Despite all this, US stock indexes continued to rise on Thursday, being one step away from showing the maximum weekly rise since April. Investors are banking on the fact that Biden will be able to overcome the legal obstacles from the side of Trump to become the next President of the United States. The jump in the stock market is also due to the fact that maintaining Republican control of the Senate guarantees that corporate tax increases will not be raised. Even if a divided Congress fails to provide stimulus, the Fed still has the resources to act. On Thursday, the regulator confirmed its "dovish" position and expressed its readiness to do more if necessary. Federal Reserve Chairman Jerome Powell said that FOMC members had thoroughly discussed options for quantitative easing, adding that they understand how to adjust its parameters if it turns out to be appropriate. The Fed's penchant for additional stimulus is bad news for the greenback. Over the week, the US currency fell by 1.5%, which is currently the largest drop in almost four months. The greenback moved to the lower end of its recent trading range of 92.00–94.00. According to experts, a fall below the level of 92.50 will create prerequisites for retesting the September low in the area of 91.70. Next, the focus will shift to the psychologically important 90.00 mark. On Thursday, the EUR/USD pair showed the highest daily growth in the last five months. "The euro may continue to grow. At the same time, the October peak of 1.1880 is a strong resistance. Although the main currency pair can break through this level, it is unlikely to be able to stay above it. The next resistance is at 1.1915. Support is located at 1.1785. Only a breakdown of 1.1760 will indicate a weakening of the current upward pressure," UOB strategists noted. The material has been provided by InstaForex Company - www.instaforex.com |

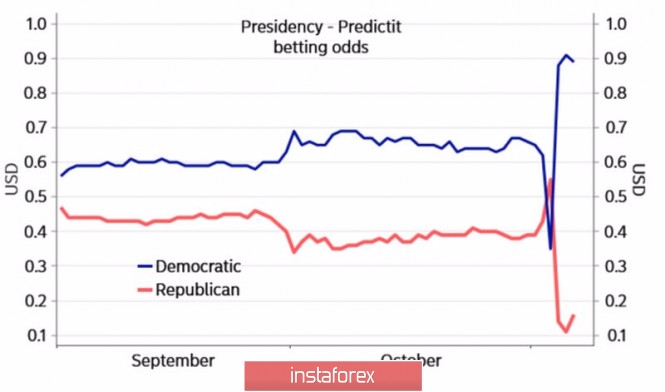

| USD index rolled down as Biden builds advantage on the race Posted: 06 Nov 2020 04:03 AM PST While America was summing up the voting results, EUR / USD bulls were thrown into heat and cold. And even if we managed to form euro longs from the very attractive level of $1.164, future dynamics is still uncertain. Donald Trump's chances of re-election came as a complete surprise to financial markets. In this situation, the US dollar began to strengthen naturally, fortunately, not for long. Joe Biden began to build up his advantage, and the USD index rolled down. The dynamics of chances for the presidency:

Currently, the most likely option is the Democratic takeover of the White House and the House of Representatives, and the Republicans - the Senate. In this situation, one should not expect a large-scale fiscal stimulus, it will most likely be rejected by the Upper House of Congress. The budget may amount to less than $2 trillion. On the other hand, the chances of tax hikes and stricter regulation of tech companies are also diminished. As well as the risks of a renewed trade war with China and the EU. All of this is clearly positive for the S&P 500 and negative for safe-haven assets, including the US dollar. At the same time, in the short term, Donald Trump, who is dissatisfied with the election results, is quite capable of making hell for his opponents, which, coupled with the worsening epidemiological situation in the United States and Europe, will limit the growth potential of risky assets and allow the USD index to regain some of its losses. Dynamics of infected and deaths from COVID-19:

It should be borne in mind that the dollar does not always go in the opposite direction to the movement of US stock indices. The rally in US stocks often supports bears on EUR / USD. Moreover, such factors as divergence in economic growth and in monetary policy play on their side. With the imposition of new social distancing restrictions by Germany, France, and other eurozone countries, the currency bloc is in danger of falling into a double recession. Goldman Sachs expects European GDP to sag by 2.3% in the fourth quarter, in line with the consensus estimate of the Financial Times experts. In such a situation, the ECB has no opportunity to sit idly by. The central bank must do something to support the economy. At the very least, expand the program of emergency asset purchases due to the pandemic by €500 billion. The Fed, on the contrary, does not see the need for additional monetary stimulus. At a press conference following the November meeting of the FOMC, Chair Jerome Powell stressed that the program for buying bonds worth $120 billion a month is too much and noted that if the regulator had to act, it would most likely change the structure of asset acquisition. Technically, the EUR / USD clearly worked out the 5-0 pattern on the daily chart allowing us to form longs from the level of 1.164. Currently, a Broadening Wedge pattern is being formed. If the bulls manage to take the resistance at 1.188 by storm and keep the quotes above it, there is no point in getting rid of long positions. The recommendation is "hold". If you fail to gain a foothold above 1.188, it makes sense to fix part of the profit and wait for new signals. EUR / USD daily chart:

|

| Crude oil prices plummeted as market faces sets of problem Posted: 06 Nov 2020 03:58 AM PST

Crude oil prices rapidly depreciate and already lost 2.5% on Friday morning. Two factors intensified the negative expectations of market participants: first, the second wave of the coronavirus pandemic is spreading too quickly, and second, there is already great uncertainty about the results of the presidential elections in the US. The price of futures contracts for Brent crude oil for delivery in January on the trading floor in London sank 2.54% at once, which sent it to $39.89 per barrel. The price of futures contracts for WTI crude oil for December delivery on the electronic trading platform in New York lost 2.76% in the morning. Its current level was $37.72 per barrel. Such a significant reduction in the value of black gold is justified by the rise that happened on Thursday and over the past several days. Raw materials were strengthening throughout the week, which allowed them to increase by about 5-6% to the value. Moreover, the growth intensified after the news that the level of oil reserves in the US over the past week was much lower than the preliminary data. In addition, the total volume of oil produced has also declined. All this further encouraged investors, who stepped up their activity in the markets, however, this led to the expected correction, which does not frighten market participants as much as the previous negative news. The main attention of traders is now gradually shifting to the worsening epidemiological situation in the country. The spread of coronavirus infection is progressing at a rapid pace: in the last 24 hours alone, the number of infected people increased by a record of 120,000 new cases. This again prompted an active discussion of the possible introduction of strict restrictive quarantine measures, which are not perceived by investors too positively. Nevertheless, the recent experience of the European region, where the second wave of COVID-19 turned out to be much more serious than the first, shows that quarantine measures are necessary. Which, in turn, poses a great threat to the stability of the oil market. The positive statistics that came out recently will only support the oil market well for a while, but then the issue of reducing the demand for raw materials will inevitably take the main attention of market participants. Demand in the context of the coronavirus pandemic is extremely limited and will decline even more with the adoption of new quarantine measures. This means that investors' fears will intensify. Another major current concern for oil is uncertainty over the outcome of the US presidential vote. There is still no data from individual states and there are demands on the quality of the calculations and the procedure for their implementation. It should be noted that analysts had previously warned of a similar situation, pointing out the possible deliberate escalation of the situation. So far, according to preliminary calculations, the candidate from the Democratic Party - Joe Biden is leading in the race. However, Donald Trump has already started accusing the Democrats of vote-rigging and dishonest political struggles, which only creates even more tension in anticipation of official results. Taking into account all of the above, oil raw materials are now under intense pressure. In this regard, market participants must prepare for sales, which will force the price of black gold to rapidly decline further. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD Continuation Pattern Violated Posted: 06 Nov 2020 03:35 AM PST USD/CAD managed to escape from the symmetrical triangle developed on the H4 chart. I have told you in a previous analysis that the price is likely to continue to drop if it breaks below the target level. The pair came back to retest the 1.3089 level. If you remember, a drop under 1.3089 signals further drop and brings a selling opportunity. Still, if you want to be sure that USD/CAD will continue to drop, maybe you should wait for a drop also below the 1.2990 static support, former low.

You can sell the breakdown from the triangle chart pattern using a Stop Loss above the triangle's upside line and a potential Take Profit at the 1.2800 psychological level. Also, you can sell from below 1.2990 after the rate will make another lower low. This scenario could signal a deeper drop. The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of EURJPY for November 6, 2020 Posted: 06 Nov 2020 03:29 AM PST

Contrary to the equity market, the forex market is bearish due to the uncertainty as the outcome of the presidential election is still unclear. Is it a risk-on or a risk-off environment? Because of that uncertainty EUR/JPY barely has not moved the last couple of days. As long as support at 121.59 is able to protect the downside, we will continue to look for more upside pressure through minor resistance at 123.18 and more importantly above resistance at 124.23 confirming a new impulsive rally in wave 3/ is in motion. A break below support at 121.59 will call for a dip to 120.58 before going up. R3: 125.00 R2: 124.23 R1: 123.18 Pivot: 122.78 S1: 122.26 S2: 121.59 S3: 120.58 The material has been provided by InstaForex Company - www.instaforex.com |

| Experts predict the future of oil prices Posted: 06 Nov 2020 03:14 AM PST The fall in oil prices, which is turning into a stable negative trend today, has a dual character-fundamental and speculative - according to industry experts.

In their opinion, one of the fundamental reasons for this phenomenon was the refusal of several countries (in particular Libya) to limit the production of black gold. At the same time, the world economy is currently under the heavy burden of the coronavirus pandemic, which forces states to impose strict quarantine. Serious restrictive measures, in turn, negatively affect the oil demand, and the global market creates a surplus. Analysts note that low prices for raw materials are especially dangerous for Russia since they directly affect the fullness of its budget and the national welfare Fund, from which it is necessary to borrow a lot of money to support the economy. Despite this, experts allow an increase in oil prices until the end of this year due to OPEC+ statements about the possibility of new restrictions on black gold production. Perhaps a final decision on this issue will be made in the next few weeks because the members of the organization need to take urgent measures to improve the situation in the market. Meanwhile, the energy Ministry to comment on that statement is not yet ready, although previously the head of Department Alexander Novak mentioned that the final decision will have to observe how the situation will develop in the oil market during November. The indecision of OPEC+ participants is explained very simply – jumps in barrel quotes can always be explained by early statements about extending the current conditions for reducing 7.7 million barrels per day for three months of 2021. However, today, in addition to the COVID-19 pandemic, the market is seriously destabilized by the uncertainty with the US presidential election, which will be lifted by the end of November. By this time, it will become more obvious to what extent production in Libya will increase, which is already about 800 thousand barrels per day. In fact, by the beginning of December, only the story of the coronavirus will remain unpredictable for the raw materials market, and then it will be possible to take some serious steps. Today, it is difficult to predict the scale and duration of the second wave of the pandemic, but the quarantine measures already taken in several leading economies of the world allow us to conclude that the expected decline in economic activity and a possible reduction in demand for oil and petroleum products. Undoubtedly, in response to this, OPEC+ participants will be forced to launch mechanisms to achieve an optimal balance of supply and demand, at least keeping quotas at the current level or increasing them. The simplest solution in this situation is not to reduce the volume of production cuts from January 2021. However, if the oil demand begins to fall even more confidently, it is possible to return to the maximum reduction level of 9.7 million barrels. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin's nearest target is $20,000 Posted: 06 Nov 2020 03:04 AM PST The primary cryptocurrency made a strong surge, exceeding the $15,000 mark in the wake of the most important political event, that is, the US presidential elections. Analysts confirmed that this happened for the first time in the last two years. Last night, Bitcoin's price crossed the $ 15,000 barrier for the first time since January 2018. This main digital asset has shown its leadership qualities, turning the complexity of the current situation in its favor. At one point, it added almost 10%, continuing its bullish strategy the next day. Today, BTC is trading near $ 15,600 and is not going to stop there. According to Rob Sluymer, currency strategist at Fundstrat Global Advisors, the nearest goal of the first cryptocurrency is to reach a historic record of $ 20,000. On another note, the growing demand for military-technical cooperation was recorded in view of the dollar's decline and a sharp rise in prices for precious metals, in particular gold and silver. At the same time, the market is adding new fiscal incentives to the price of leading assets, as well as building up QE programs by central banks, without waiting for the summed up result of the US presidential elections. Experts have recorded a steady rise in bitcoin for the past five weeks. This week, the total capitalization of digital assets exceeded $400 billion. It should be noted that the last time the crypto market had a lot of money was before April 2018 ended. The benchmark cryptocurrency has risen this week along with the leading indices of the S&P 500 and Nasdaq. Its popularity is due to its presence in the portfolios of large investors. Over the current period, the bitcoin dominance index has increased by almost 3%, close to 65%. At the same time, several positive news provided invaluable assistance to the cryptocurrency market. For several months, the PayPal payment system has initiated the use of digital currencies, and Fidelity Investments has launched a fund focused on working with BTC. The promotion of the Grayscale Bitcoin Trust Fund also gives significant support to bitcoin. At the moment, the Fund owns almost 500K BTC worth about $6.7 billion, and this is not the limit. Based on the observations of analysts, strong capital flows are flowing towards the military-technical cooperation. Many large investors are showing increased interest in bitcoin, including the management of JPMorgan Chase, which created its own digital currency – JPM Coin. In view of this, supporters of virtual assets are confident that they are best suited for diversifying investment portfolios. This issue is most relevant during periods of uncertainty caused by events such as the spread of COVID-19 or the US election. In the medium and long term, experts do not rule out increasing interest in the crypto market. They concluded that this will be an important step towards increasing the cost of digital currencies, primarily Bitcoin. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for November 06, 2020 Posted: 06 Nov 2020 02:32 AM PST The EUR/USD pair rallied on Friday, reaching as high as 1.1865 in order to continue for a strong bullish market during this week. The bulls continue to have the upper hand this morning, suggesting that short-term traders could continue to buy the market on short-term dips. Price is starting to bounce politely off our major support area starting from 1.1765 (61.8% of Fibonacci retracement) which represents the horizontal swing low support and bullish price action. We expect a further bounce up to at least 1.1920 resistance one. On the one-hour chart, the EUR/USD pair continues moving in a bullish trend from the supprt level of 1.1765, which coincides with the weekly pivot. Currently, the price is in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. RSI (14) is seeing a nice bounce above 30% support and has good upside potential. The bias remains bullish in the nearest term testing 1.1865 and 1.1920. Immediate resistance is seen around 1.1920 levels. Moreover, the moving average (100) starts signaling an upnward trend; therefore, the market is indicating a bullish opportunity above the levels of 1.1765 - 1.1800. The EUR/USD pair has risen further and is starting to see an intermediate reversal. We expect a drop towards the 1.1817 area as we look to buy above 1.1817. And we expect a further bounce up to at least 1.1920 resistance (Fhorizontal swing high resistance). The EUR/USD pair will continue to rise from the level of 1.1817. The support is found at the level of 1.1817, which represents the 78% Fibonacci retracement level in the H1 time frame. The price is likely to form a new double bottom. Today, the major support is seen at 1.1765, while immediate resistance is seen at 1.1920. Accordingly, the EUR/USD pair is showing signs of strength following a breakout of a high at 1.1865. So, buy above the level of 1.1865 with the first target at 1.1920 so as to test the daily resistance 1 and move further to 1.1975. Also, the level of 1.1975 is a good place to take profit because it will form a strong bullish wave this week. Amid the previous events, the pair is still in an uptrend; for that we expect the EUR/USD pair to climb from 1.1920 to 1.1975 today. the same time, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.1765, a further decline to 1.1660 can occur, which would indicate a bearish market. The market is still in an uptrend. We still prefer the bullish scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| America right now: US elections, Fed meeting and data on employment Posted: 06 Nov 2020 02:27 AM PST The currency market already decided that Mr. Biden is the winner of the US presidential elections, while everyone is still waiting for the announcement. Why is this so? A clear signal indicating this is the rise of the US stock market, especially the shares of companies in the technology sector. This is because J. Biden personally and the Democratic party as a whole have supported technology companies broadly, which, in turn, are strongly linked by production chains to China. The subject of Apple's production in China alone is worth something. Therefore, investors believe that the victory of the Democratic candidate will lead to the normalization of trade relations between Beijing and Washington, which is the reason why the share prices of these companies rise. The markets also believe that the end of the presidential race will lead to the fact that Congress will finally decide on the adoption of the previously promised new measures to support the country's economy. Thus, the US dollar was expected to be under strong pressure against the background of strong growth of optimism in financial markets and increased demand for company shares. Earlier, its rate against major currencies was supported by the demand for protective assets, or rather for safe haven currencies, which also include the Japanese yen and the US dollar. Another signal indicating its extreme weakness was the decline of the USD/JPY pair, which was observed yesterday. Usually, this pair declines due to the increased demand for yen amid growing negative market sentiment. But on Thursday, yen's growth occurred precisely due to the weakness of the US dollar. By the way, the same strong demand for gold can also be explained by this. On another note, the Fed meeting on monetary policy was somewhat ignored, which reaffirmed the commitment of the regulator and personally of its leader J. Powell, to conduct an ultra-soft monetary policy. This is clearly the most main negative factor for the US currency rate amid electoral litigation between Trump and Biden. Today, investors' attention will be focused on the publication of the US employment data. According to the forecast, the US economy should have received 600,000 new jobs in October against the September value of 661,000. The unemployment rate is also expected to drop to 7.7% against 7.9% a month earlier. In this regard, we expect that the market is likely to interpret the negative data as another serious reason for adopting stimulus measures, and in turn, this will weaken the US currency in the future. Forecast of the day: The EUR/USD pair is trading below the level of 1.1840. Breaking through above this level will let the pair further rise to 1.1880. The USD/JPY pair remains under strong pressure. It may partially recover to 103.80 in the wake of the publication of US employment data, but it will most likely continue to decline to 103.00 in the future.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment