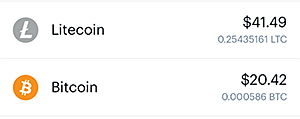

| Welcome! In this free e-letter, I’ll show you where the big money is headed in the markets so you can follow it to profits. And we love to hear from our subscribers… Tell us what you like, what you hate, and how we can make Palm Beach Insider the best free e-letter on following Wall Street to profits right here. | Why I “Hate” Cryptocurrency By Jason Bodner, editor, Palm Beach Insider Yesterday afternoon, I was talking with my editor about what to write for today’s issue… He suggested I write something about the recent crypto bull market. It makes sense – bitcoin has grabbed the headlines with its rise over $35,000 per coin. There’s no sign of it stopping anytime soon. People are clamoring to hear opinions on what comes next. But my response shocked him… “I hate crypto.” Today, I want to explain myself… to you and to my editor. I’ll show you that while I understand the enormous future potential of blockchain and cryptocurrencies, there’s a different place I’m putting my money today – one I’m far more comfortable with, and which has huge return potential. My Bitcoin Grudge During bitcoin’s spectacular 2017 run, I spent most of the time watching from the sidelines. I didn’t understand it. Bitcoin’s price seemed to rise simply because people were buying in hopes of selling at even higher prices – a bona fide speculative bubble. Still, at a certain point, I could no longer fight the urge… Rare Wealth-Building “Cycle” Set To Explode I caved and opened a Coinbase account on December 17, 2017. I only risked $100 out of my own pocket, to dip my toe in the water. Coinbase also gave me $15 of Bitcoin for free! Therefore, I had $115 to play with. After a brief, tiny rally to $117, 2018 saw my Coinbase account crumble. My $115 cratered to a low of $7.87 – a 93% loss in a matter of months. With Bitcoin’s recent meteoric rise, that $7.87 has risen 690%. But it’s still only worth $61.90. You can see for yourself: here’s a couple screenshots of my Coinbase account, taken this morning:

Jason’s Coinbase account Don’t get me wrong… I recognize that cryptocurrency is becoming a more entrenched asset class by the day. I understand its future potential. But I hate losing. I hate it more when it’s my own darned fault. So it’s less that I “hate” cryptocurrency… and more that I hold a grudge against my own impulsive behavior. Thankfully, there’s a bright spot to this experience. You see, this reminded me why I invest the way I do, and what brought me to my winning strategy in the first place… Cutting Out Emotions I learned decades ago that when it comes to investing, emotions are my enemy. As a rookie trader, making plays based on instinct and emotion, I lost huge. I bought the top and sold the bottom many times over, shredding my capital into oblivion. It was embarrassing… I suffered a losing streak that kept me from actively trading for years. Eventually, I got the courage to try again. Only this time, I chucked emotion out the window and invented a system that vastly increased my odds of winning. Since then, it’s given me and my readers monster results. You see, I’m a very analytical person. I work with things I can understand – like stocks. After all, a share of stock is really partial ownership in a public company. When you buy stock, you can benefit or suffer from the company’s performance. If it makes big profits and huge earnings, theoretically, you win as a shareholder. When you buy stocks, you’re an investor. There are reasons behind your investment beyond speculation. Because of this, I don’t grasp cryptocurrency the same way I do stocks. At the same time, one can’t deny that crypto and blockchain are super exciting technologies with big future implications. So, how can I quell my fear of missing out, while simultaneously appealing to my logic? How can I play crypto in a way I know I can win? The answer, as always with my strategy, lies in big money… How the Big Money Plays Crypto Big money is the hedge funds, pension funds, and other big asset managers of the financial world. The huge success of my unbeatable stock-picking system is based on when big money buys the best quality stocks. I use that formula over and over to help me beat the market. I don’t even have to know why big money is buying these stocks. I only have to know that they are, and that the stocks are of great quality. That means they have huge sales, earnings growth, and take in big profits. And right now, there’s no denying that big money is watching the crypto space carefully. With that in mind, let’s look at a few examples… In October, PayPal (PYPL) announced a service that would allow users to buy, hold, and sell cryptocurrency. Just a month later, a survey showed that 17% of PayPal’s users already use it to do just that. PayPal has more than 300 million users. 17% means potentially 52 million PayPal users have started interacting with cryptocurrency. That is a massive network, and foretells potentially much wider adoption of crypto in the future. Plus, PayPal takes a small cut of each transaction – good for its business and share price. Big money has known PayPal had this potential for a long time. Each green bar on the chart below shows big-money buy signals on PYPL, as told by my system. The big money has been scooping up shares of PYPL since late 2016, right before the crypto mega bull market got started.

Square (SQ) is another electronic payments company. It makes credit card-reading hardware for small businesses. Part of Square’s business is Cash App, which allows its customers to transact in bitcoin. Plus, in Q3 2020, Square said it bought 4,709 bitcoins for $50 million. But again, big money has liked Square for a long time. It’s been buying shares since late 2018.

But payments companies aren’t the only ones to benefit from crypto. Chipmakers like Nvidia (NVDA) are, too. You see, it’s possible to mine cryptocurrency by using powerful computer processors. Those with the best hardware have the best chance of mining crypto profitably. That has naturally helped propel Nvidia to new heights. Mining activity tends to rise in popularity with the physical price of bitcoin, as mining is more profitable at higher bitcoin prices. So, the higher bitcoin runs, the more potential demand for Nvidia’s chips. And once again, the big money has been eyeing this company for a long time – nearly 20 years…

(Note, NVDA is a Palm Beach Trader recommendation, well above my recommended buy-up-to price. I don’t recommend buying it today. PYPL and SQ are stocks I personally own – I similarly don’t recommend buying them at today’s prices.) The Best Way to Win Whether you love it or hate it, cryptocurrency is here to stay. But as I showed, if you don’t want to buy crypto itself, there are plenty of ways to profit on its rise in the traditional stock market. I always want to play a game I understand well. After decades on Wall Street, I’ve seen spectacular failures and successes. I came away with one unshakable conclusion: Following big money is the best way to win consistently. I lost big on crypto by having no clue what I was doing. But by owning crypto-related stocks that know what they’re doing better than anyone else, I won huge. So while I may not love cryptocurrency… I sure do love stocks tied to cryptocurrency. Any investor looking to profit on the next crypto bull market should be looking into which public companies are involved in crypto. Especially when the big money loves them too… Patience and process! Jason Bodner

Editor, Palm Beach Insider

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… COVID Surprise: Nobody Saw This Coming! The man some call America’s #1 tech expert, Jeff Brown, has just released this shocking pandemic update. It has nothing to do with a vaccine. Instead, Jeff is saying the pandemic has triggered what he considers to be the most profitable event in the stock market history… Something he calls ALDL. Hurry… The World Economic Forum says “the train is leaving the station, and individuals need to get on board quickly.” Click here to get the full story.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

No comments:

Post a Comment