| Energy infrastructure investment by institutional investors topped $31 billion last quarter.

And of that amount, 65% went to renewable energy. Only 8% went to conventional energy projects, with much of the rest going to hybrid projects. This is happening right now, folks, so let’s make some money. Suggested Stories: This Value Metric Can Tell Best Times to Buy and Sell Cryptocurrency Look Beyond the September Slump — Find Profits Every Week

| Investors aren't supposed to know about this secret stock under $5... It could help you achieve the kind of carefree retirement most people only dream of. But what if this turns out to be your biggest opportunity? How long will you stay in the dark? | |

Earnings Edge

Today, we’ll be looking at two stocks that are more sensitive to economic growth. An industrial manufacturing company, Worthington Industries Inc. (NYSE: WOR), and payroll processing giant, Paychex Inc. (Nasdaq: PAYX). Here’s what to expect this week… Suggested Stories: What Latest Market Dip Means for Cannabis Investors Flowers Foods: A Bullish Dividend Workhorse for Rough Markets | Most Americans have probably never heard of federal order #2222 before, but experts are calling it… "A Game-Changer"… "A Landmark Ruling"… and "The Most Significant Order Ever Issued." Why such the high praise? Because federal order #2222 just kicked off a new tech boom poised to surge 12,100%… Unlocking $1.2 trillion in new wealth over the coming years. With a little-known three-letter ticker symbol at the center of it all. | |

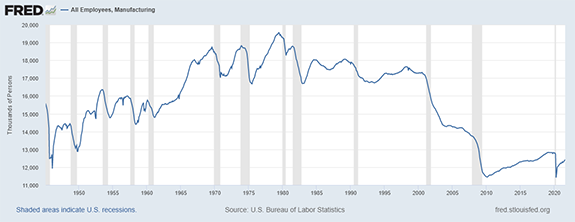

Chart of the Day Many politicians and economists look at the post-World War II economic boom as the ideal time for America. They attribute the good times to the rise of manufacturing jobs. At that time, manufacturing paid well and offered extraordinary benefits. That isn’t the case today, but we’re still seeing an uptick in manufacturing jobs. But that uptick also comes with an important caveat.  Suggested Stories: Spike in Rental Prices Sets Up the Next Long-Term Crisis Operating Margin Points to a Bullish Future for Large Caps |

1959: Typhoon Vera made landfall in Japan. It remains the strongest tropical storm to hit the country. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Sovereign Offshore Services, LLC. Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

No comments:

Post a Comment