Rising players used their advantages and achieved the resistance 143.20-44 (day Senkou Span B + week Tenkan) at the end of last week. After that, the following upward direction moves near the 144.44 (Senkou Span B weeks). The breakdown of the weekly cloud, as well as the release of daytime clouds, will allow us to consider new perspectives and landmarks.

The Ichimoku indicator is completely on the side of the rising players, which continue to move higher and is now testing the upper boundary of the weekly cloud (144.44). The support of the lower half strengthened by the levels of the higher time intervals. As a result, it is possible to settle with the regions of cross H4 (143.44 - 143.20 - 142.87) and clouds H4 (141.83).

EUR/JPY

The pair closed the previous day above the daily short-term trend at 130.48 and continues to rise. The main task now for players to increase is the update of the maximum (131.71) and reaching the first target for the week at 132.09. After that, new perspectives will appear. The key support level that can affect the situation remains at 129.63 (Weekly Tenkan + daytime Kijun).

The euro-yen pair moved away from the clouds of the lower half, entered the support of the daily short-term trend and continued to rise. The nearest targets serves as a target for the breakdown of the H4 cloud, the update of the maximum (131.71) and the first target level of the weekly target at 132.09. The major and most important support for today stayed on its location at 130.48 - 130.13 - 129.63. In addition, it is possible to mark the area of 130.80 (cross H1).

Indicator parameters:

all time intervals 9 - 26 - 52 Color of indicator lines: Tenkan (short-term trend) - red, Kijun (medium-term trend) - green, Fibo Kijun is a green dotted line, Chinkou is gray, Clouds: Senkou Span B (SSB, long-term trend) - blue, Senkou Span A (SSA) - pink. Color of additional lines: Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray, Horizontal levels (not Ichimoku) - brown, Trend lines - purple.

EUR/USD

EUR/USD

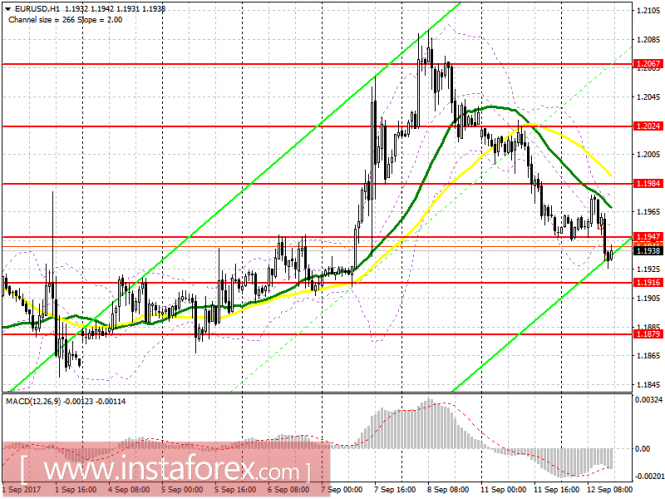

To open long positions for EURUSD, you need:

A return to buying the European currency is possible only with the prospects of growth and consolidation above the level of 1.1947 with the main purpose of updating 1.1984, where I recommend locking in profits. The more optimal choice will be an estimate for buying the euro after updating 1.1916, with the formation of a false breakdown in that area and the goal of a return to 1.1947, or buying for a rebound from a large support level of 1.1879.

To open short positions for EURUSD, you need:

Sellers broke below 1.1947, and an attempt at unsuccessful growth above this level can bring back big market players who will continue to push the EUR/USD pair at the level of 1.1916 and 1.1879, where I recommend locking in profits. In the event of a larger rise in the euro during the afternoon, a return to selling would be best for a rebound of 1.1984.

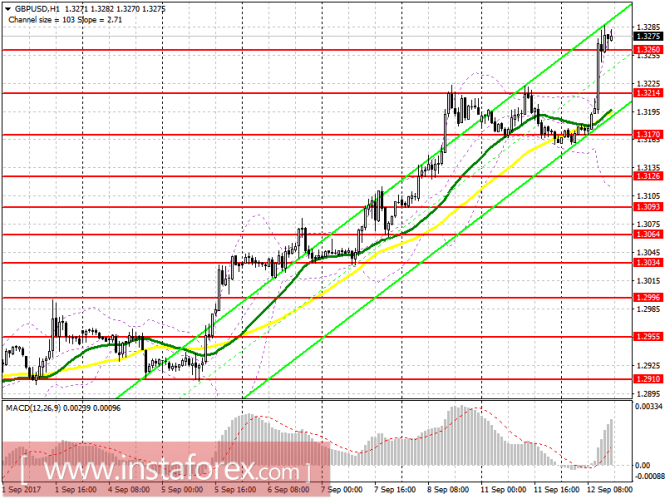

To open long positions for GBPUSD, you need:

Good inflation data led the pound to 1.3260. While the trade is conducted above this area, you can expect it to continue the upward trend with an update of 1.3325 and an exit at 1.3370, where I recommend locking in the profit. In case the pound drops below the level of 1.3260, a return to buying is better done on a rebound from the large support of 1.3214.

To open short positions for GBPUSD, you need:

Seller will try to return the pair to the level of 1.3260, from which a larger downward correction will lead to an update of support at 1.3214, where I recommend locking in the profit. In the event of a sustained growth of the pair on the trend, selling can be expected after updating 1.3325 or on a rebound from a stronger resistance of 1.3370.

Moving Average (average sliding) 50 days - yellow

Moving Average (average sliding) 30 days - green

MACD: fast EMA 12, slow

EMA 26, SMA Bollinger Bands 20

Before sterling, new horizons open up

On Tuesday, the US dollar stopped strengthening locally in the world currency markets. Investors played according to yesterday's news, which was a message that the United States submitted to the UN Security Council. It was a softer proposal to expand sanctions against the DPRK compared to its previous claims. In addition, the North Koreans themselves did not launch, as promised, a new ballistic missile over the weekend, which was regarded positively. Now, all the attention of market players has switched to published data for consumer inflation in the UK.

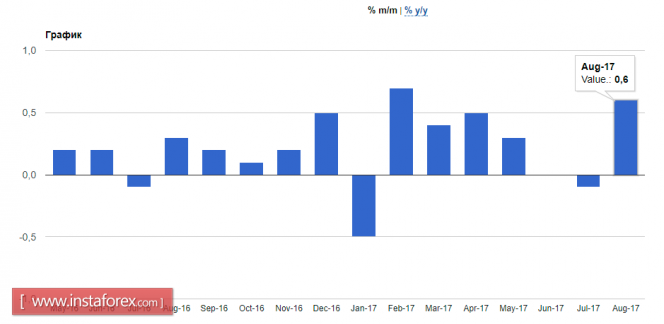

Published in the morning, the UK consumer price index showed more growth than anticipated. The annual value of the indicator increased by 2.9% against the 2.6% forecast and the increase for the previous month by 2.8%. The monthly indicator value in August added 0.6% against the decrease in July by 0.1% and expectations for growth by 0.5%. In addition to these important figures, the values of producer price indices were also displayed, which also showed an increase. On the wave of these data, the pound soared against the major currencies in the world Forex market.

Positive inflation figures increase the likelihood of the Bank of England deciding to raise interest rates at the September meeting. In the summer, they did not dare do this because the country is still under pressure from the history of Britain's withdrawal from the EU or Brexit. However, this factor has not disappeared yet, leaving the possibility of uncontrolled development of events due to the uncertainty of the Brexit process. Despite this, one thing can be said with a high degree of certainty: the sterling can receive support locally and grow against all major currencies without exceptions before the meeting of the British regulator. In the long term, if the rates are raised in Britain, this will open up the pound's great prospects for growth.

Forecast of the day:

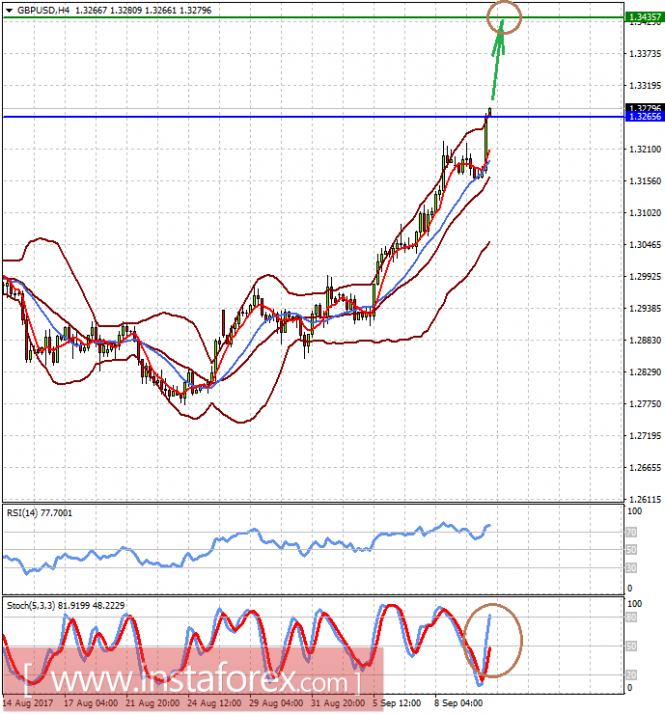

The GBPUSD pair broke through a high of 1.3265 from August 3 this year on the wave of consumer inflation in the UK. Against this background, there is a possibility of continuing its local increase to 1.3435 after consolidating above 1.3265. The decision of the Bank of England to raise interest rates at its September meeting will also affect it.

The EURGBP pair fell to the level of 0.9000. Overcoming this level may cause the continuation of its decline to 0.8885. Technically, the pair has grown strongly since 2015 against the background of Brexit, which was the main negative factor for the pound sterling. However, the weakening of the prospects for the complete elimination of incentive programs from the ECB has already rolled the pair down. And now, if the Bank of England raises interest rates, the price drop will only increase.

What are the prospects for the British pound?

The British pound rose sharply against the US dollar and other world currencies after the release of good inflation data, which again "awakened" the talks about raising interest rates by the Bank of England.

Although such prospects, of course, are quite lengthy, judging by the latest data, with inflation in the UK, after a disastrous July month, everything is in order in August.

According to the report of the National Bureau of Statistics of Great Britain, both monthly and annual inflation grew. Remarkably, the two indicators were much better than the economists' forecasts. So, the consumer price index of Great Britain in August this year increased by 2.9% compared to the same period of the previous year, while economists expected growth of only 2.7%. The growth was due to a sharp jump in prices for clothing and footwear.

Compared to July 2017, the consumer price index rose by 0.6%, while economists forecast an increase of 0.5%.

The country's factory gate prices in August rose by 3.4% compared to the same period of the previous year, while purchasing prices jumped by 7.6%. The increase in purchasing prices was directly related to the rising prices of crude oil.

The most positive forecasts of economists indicate an increase in the cost of borrowing at the beginning of next year, although the optimal period is mid-2018.

As for the technical picture of the GBPUSD pair, majority will depend on how the new buyers show themselves at the level of 1.3260, because an unsuccessful consolidation above this level can trigger a gradual selling of the pound in the medium term. The high that buyers can expect in this scenario is the update of 1.3330 and 1.3370. If, after the decision of the Bank of England, the trade moves below the level of 1.3260, then it is likely that the pound will be sold quickly to the larger support levels 1.3190 and 1.3090.

According to The Retail Economist and Goldman Sachs, the US retail sales index for the week of September 3-9 fell by 3.0% compared to last week, which is generally related to seasonality before the start of the academic year. Compared to the same period in 2016, the sales index in the US retail chains grew by 2.3%.

No comments:

Post a Comment