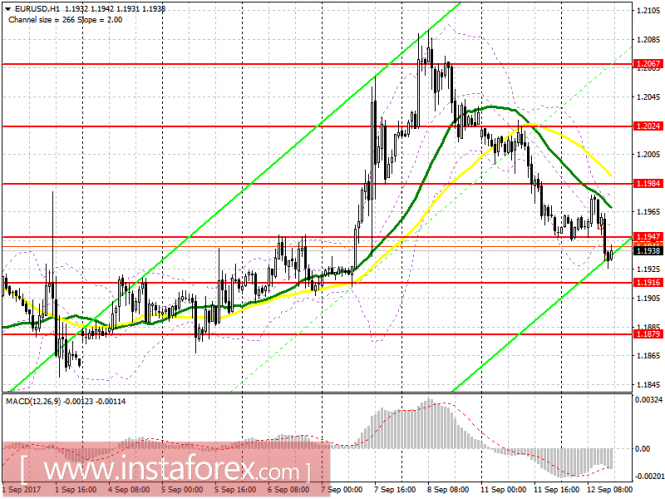

To open long positions for EURUSD, you need:

A return to buying the European currency is possible only with the prospects of growth and consolidation above the level of 1.1947 with the main purpose of updating 1.1984, where I recommend locking in profits. The more optimal choice will be an estimate for buying the euro after updating 1.1916, with the formation of a false breakdown in that area and the goal of a return to 1.1947, or buying for a rebound from a large support level of 1.1879.

To open short positions for EURUSD, you need:

Sellers broke below 1.1947, and an attempt at unsuccessful growth above this level can bring back big market players who will continue to push the EUR/USD pair at the level of 1.1916 and 1.1879, where I recommend locking in profits. In the event of a larger rise in the euro during the afternoon, a return to selling would be best for a rebound of 1.1984.

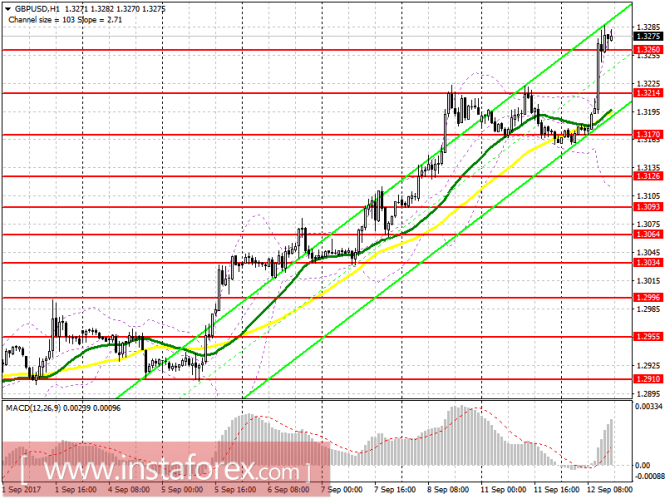

GBP/USD

Although such prospects, of course, are quite lengthy, judging by the latest data, with inflation in the UK, after a disastrous July month, everything is in order in August.

According to the report of the National Bureau of Statistics of Great Britain, both monthly and annual inflation grew. Remarkably, the two indicators were much better than the economists' forecasts. So, the consumer price index of Great Britain in August this year increased by 2.9% compared to the same period of the previous year, while economists expected growth of only 2.7%. The growth was due to a sharp jump in prices for clothing and footwear.

Compared to July 2017, the consumer price index rose by 0.6%, while economists forecast an increase of 0.5%.

The country's factory gate prices in August rose by 3.4% compared to the same period of the previous year, while purchasing prices jumped by 7.6%. The increase in purchasing prices was directly related to the rising prices of crude oil.

To open long positions for GBPUSD, you need:

Good inflation data led the pound to 1.3260. While the trade is conducted above this area, you can expect it to continue the upward trend with an update of 1.3325 and an exit at 1.3370, where I recommend locking in the profit. In case the pound drops below the level of 1.3260, a return to buying is better done on a rebound from the large support of 1.3214.

To open short positions for GBPUSD, you need:

Seller will try to return the pair to the level of 1.3260, from which a larger downward correction will lead to an update of support at 1.3214, where I recommend locking in the profit. In the event of a sustained growth of the pair on the trend, selling can be expected after updating 1.3325 or on a rebound from a stronger resistance of 1.3370.

Indicator description Moving Average (average sliding) 50 days - yellow Moving Average (average sliding) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA Bollinger Bands 20

No comments:

Post a Comment