The situation did not make any significant changes. Bears leveled again the entire achievements of the opponent and secured the daily short-term advantage. The benchmarks for the decline of the previous weekly Fibo Kijun is at 147.41, Senkou Span B of the daytime cloud at 146.06 and the weekly Kijun can be seen at 145.74. Benchmarks for the recovery today also retain their location, and the nearest resistance is located at 148.52 (daylight Tenkan) and 149.24-40 (weekly Tenkan + daytime Senkou Span A + monthly Fibo Kijun).

The pair failed to cope again with the H4 cloud and forced to retreat from the resistance of the H4 cloud. It is currently supported by daytime Tenkan at 148.52 level. This resistance zone retains its value, followed by the resistance levels of higher timeframes at 149.24-40 - 149.76 - 150.23. From lower timeframe moving to an upward direction, the target will boost the breakdown of clouds.

The support for today has not changed its location, the primary target of the bears remains to be the renewal of minimum extremes and testing of the monthly level of 147.41.

EUR / JPY

Another positive trend of the rising players failed to received confirmation and development. Yesterday, the pair returned to the levels and entered again the daylight cloud. The focus was drawn to daylight Tenkan (132.31), the role of the most important resistance remains at the 132.83 (daily Kijun + week Tenkan) and 133.23 (daytime Fibo Kijun), the benchmark for the decline is 130.98 (daytime Senkou Span B).

The pair returned in the daytime cloudiness and also to the clouds of lower time intervals. An exit from the cloudiness will form new downward targets for the breakdown of clouds. If the H4 cloud could maintain the long-term interests of players on the rise, the main task for recovering the bullish benefits will again be testing the final lines of the day's cross (Kijun 132.83 + Fibo Kijun 133.23) in order to overcome the mentioned level, it is further strengthened by a weekly Tenkan at 132.83.

Indicator parameters: all time intervals 9 - 26 - 52

The color of indicator lines: Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray, clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines: support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray, horizontal levels (not Ichimoku) - brown, trend lines - purple.

Brent: Russia is muddy with waters

He who rises high falls painfully. Oil is now at risk of plunging into a wave of sales after achieving more than two-year highs if the OPEC meeting does not give the market what it expects of it. Goldman Sachs warns that given the current prices, positions in the futures market and the existing spread of Brent-WTI has convinced almost 100% of investors that the Viennese agreement of the cartel will be prolonged, at least until the end of 2018. If the results of the meeting disappoint, the massive curtailment of speculative net-longs will carry black gold far to the south.

Another confirmation of the excessive calm of investors on the eve of November 30 is the fall of the implied volatility to 22%. This is the lowest since March and is not far from the three-year low. If the OPEC does not want to allow a quick return of the North Sea grade of $ 50 per barrel, then it is obliged to extend the contract to reduce production by 1.8 million bpd. However, not everything will depend on the cartel.

First, the risks of increased production in US companies have not disappeared. According to forecasts of the US Energy Information Administration, the indicator will grow by 720 thousand bpd and exceed the level of 10 million bpd next year. In addition, Canada and Brazil are actively developing. If strong demand is contributing to the reduction of global reserves this year, it is not guaranteed that the same situation will take place in 2018.

Secondly, investors do not have confidence that Russia will be able to, as before, support the OPEC's desire to stabilize the market.

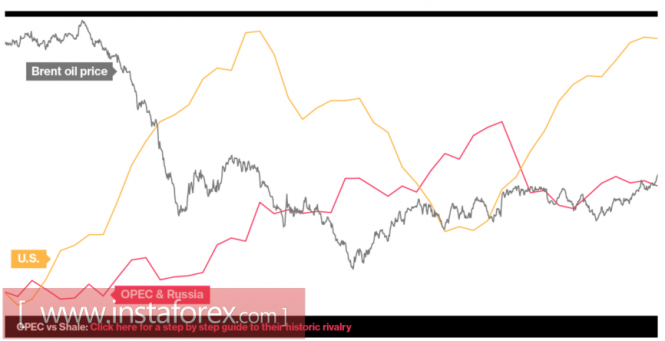

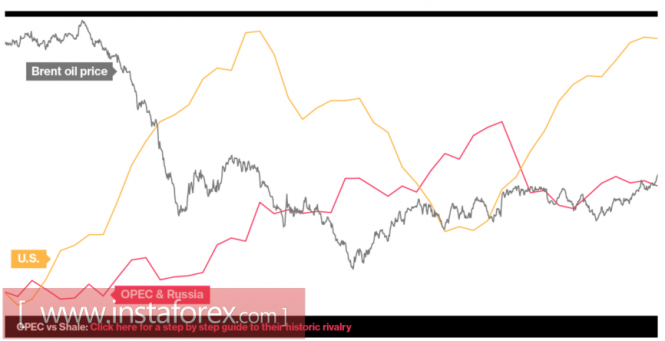

Dynamics of Brent and volumes of oil production

Source: Bloomberg.

During the previous week, investors were agitated by information about the disagreement of the oil barons from Russia with the official position belonging to Moscow. Insiders from Reuters has allowed us to understand more deeply what is occurring.

According to reliable sources, the production at the Sakhalin-1 project, a controlling stake which is in the hands of ExxonMobil, will increase by 200-250 thousand bpd in the first quarter of 2018. In order for the Russian Federation to continue to fulfill its obligations to reduce total production by 300 thousand bpd, it is required to implement a more serious reduction in production from other companies.

They are already losing their market share so the displeasure of the oil barons is understandable. Under the circumstances, Moscow can insist on a temporary postponement. For example, why not take a decision about the prolongation a little later? Perhaps in late March. The problem is that the market has already laid in the quotations of futures for Brent and WTI as the factor of extending the terms of the OPEC agreement and surely, this will arrange a large-scale sale. The question is not how far prices can go to the south.

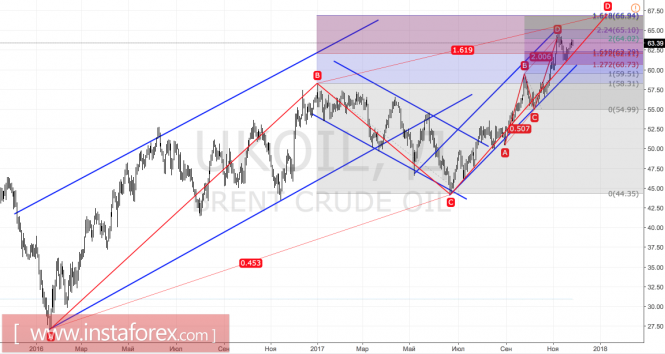

The question is whether they would arrange with Russia or not. The most likely scenario is that it will be satisfied with the previous trading range of $50-60 per barrel. Technically, only the update of the November high is able to push Brent quotations to the target by 161.8% on the AB = CD pattern. On the contrary, prices falling below the support level of $ 60.75-61.15 per barrel will strengthen the correction risks in the direction of $ 59.5, $ 58.3, and below.

Brent, daily chart

Another confirmation of the excessive calm of investors on the eve of November 30 is the fall of the implied volatility to 22%. This is the lowest since March and is not far from the three-year low. If the OPEC does not want to allow a quick return of the North Sea grade of $ 50 per barrel, then it is obliged to extend the contract to reduce production by 1.8 million bpd. However, not everything will depend on the cartel.

First, the risks of increased production in US companies have not disappeared. According to forecasts of the US Energy Information Administration, the indicator will grow by 720 thousand bpd and exceed the level of 10 million bpd next year. In addition, Canada and Brazil are actively developing. If strong demand is contributing to the reduction of global reserves this year, it is not guaranteed that the same situation will take place in 2018.

Secondly, investors do not have confidence that Russia will be able to, as before, support the OPEC's desire to stabilize the market.

Dynamics of Brent and volumes of oil production

Source: Bloomberg.

During the previous week, investors were agitated by information about the disagreement of the oil barons from Russia with the official position belonging to Moscow. Insiders from Reuters has allowed us to understand more deeply what is occurring.

According to reliable sources, the production at the Sakhalin-1 project, a controlling stake which is in the hands of ExxonMobil, will increase by 200-250 thousand bpd in the first quarter of 2018. In order for the Russian Federation to continue to fulfill its obligations to reduce total production by 300 thousand bpd, it is required to implement a more serious reduction in production from other companies.

They are already losing their market share so the displeasure of the oil barons is understandable. Under the circumstances, Moscow can insist on a temporary postponement. For example, why not take a decision about the prolongation a little later? Perhaps in late March. The problem is that the market has already laid in the quotations of futures for Brent and WTI as the factor of extending the terms of the OPEC agreement and surely, this will arrange a large-scale sale. The question is not how far prices can go to the south.

The question is whether they would arrange with Russia or not. The most likely scenario is that it will be satisfied with the previous trading range of $50-60 per barrel. Technically, only the update of the November high is able to push Brent quotations to the target by 161.8% on the AB = CD pattern. On the contrary, prices falling below the support level of $ 60.75-61.15 per barrel will strengthen the correction risks in the direction of $ 59.5, $ 58.3, and below.

Brent, daily chart

No comments:

Post a Comment