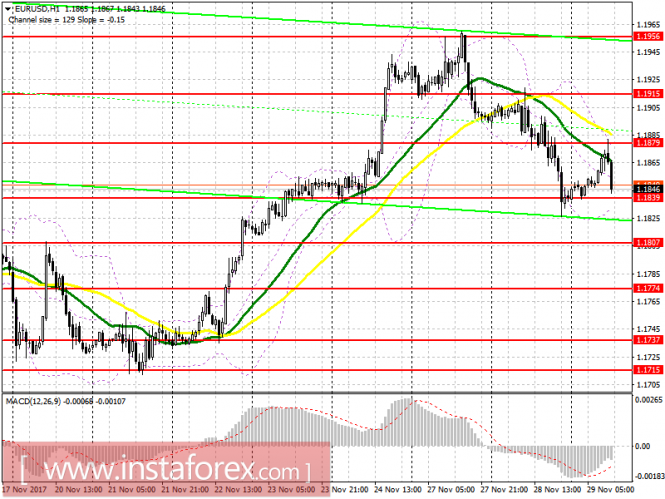

To open long positions for EURUSD, it is required: You can count on buying the euro only after forming a false breakout at 1.1839, and it is best to open long positions for a rebound from an important support in the area of 1.1807. In the absence of volume with a serious demand for the euro in the area of 1.1807, I recommend that buying be postponed until an update of 1.1774. The main goal of the buyers will be a return to the daily highs in the area of 1.1879.

To open short positions for EURUSD, it is required:

Sellers excellently worked out the morning level of 1.1879, and a consolidation below 1.1839 will give the euro a more bearish impulse, which will lead to the renewal of 1.1807 and the exit towards 1.1774. In the event of a false breakdown of 1.1839, it is best to return to selling from daily highs near 1.1879.

GBP/USD

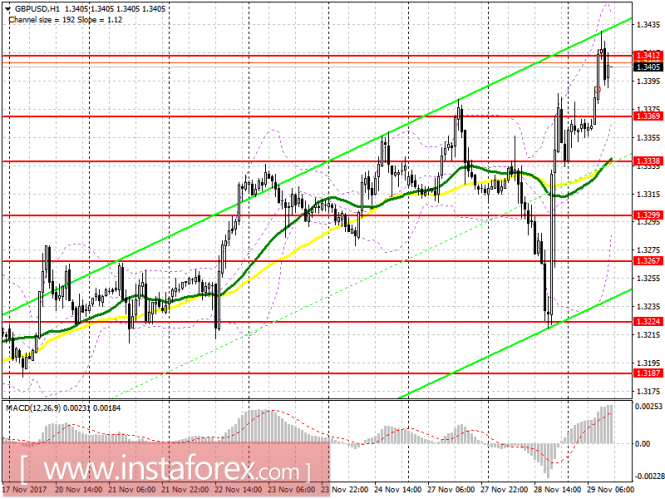

To open long positions for GBP/USD, it is required:

Buyers were not able to catch ahold of 1.3412, and only a retest with a breakdown of this area will lead to an increase in long positions on the pound with an update of 1.3465 and 1.3509, where it is advised to lock in profits. In the event of a decline in the pound during the afternoon, it's best to go back to long positions for a rebound of 1.3369.

To open short positions for GBP/USD, it is required:

While the trade is below 1.3412, you can count on a return of the GBP/USD pair towards the support level around 1.3369, where it is advised to lock in the profit. In the event of a continuation of the bullish trend, it would be best to consider selling the pound after upgrading 1.3465, or on a rebound from 1.3509.

Indicator description

Moving Average (average sliding) 50 days - yellow

Moving Average (average sliding) 30 days - green

MACD: fast EMA 12, slow

EMA 26, SMA

Bollinger Bands 20

The US economy is in order

The euro declined, despite the positive data on the eurozone's economy in the morning, as market participants expected a good report on U.S. GDP growth. According to the data, the confidence of companies and consumers in the eurozone in November this year continued to strengthen.

The European Commission said that the index of sentiment in the eurozone economy in November rose to 114.6 points from 114.1 points in October. Economists had expected the index to rise to 114.2 points. As noted in the report, the main growth was due to the French consumers, whose moods improved in the second quarter of this year. But the mood in Germany deteriorated slightly, which neutralized the growth of the main indicator.

Consumer prices in Germany in November rose due to higher prices for energy and food. According to the National Bureau of Statistics of Destatis, the harmonized index of consumer prices in November this year rose by 1.8% against growth of 1.5% in October. Economists had expected the index to grow by 1.7%. Energy prices in Germany rose by 3.7% compared to November 2016, while food prices increased by 3.2%. Today at a briefing on the presentation of the report on the financial stability of the eurozone, ECB representative Vitor Constancio said that the eurozone economy has become more resilient to shocks, and the main sources of risks are outside the eurozone.

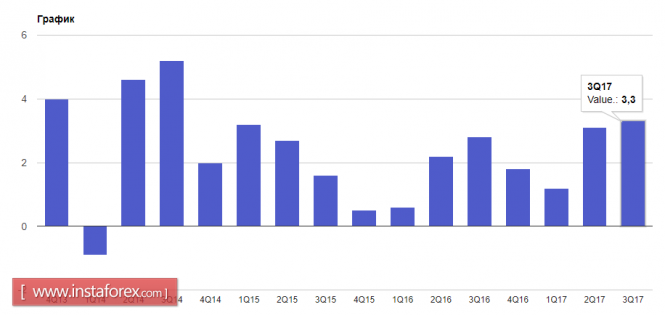

Constancio also noted that the markets at the moment are calmer towards the situation in Catalonia. Data on economic growth in the US in the third quarter of this year was stronger than expected, due to the growth of companies' revenues. According to the report of the US Department of Commerce, the gross domestic product grew by 3.3% per annum in the third quarter, which fully coincided with the forecasts of economists. Earlier it was reported about GDP growth of 3.0%. It should be noted that in the second quarter of this year, the US economy grew by 3.1%.

The British pound continued its growth even after data that the number of approved mortgages in the UK in October declined. According to the report of the Bank of England, the number of approved mortgage loans was 64,575 against 66,111 in September. Net mortgage lending in the UK in October 2017 reached 3.4 billion British pounds.

Moving Average (average sliding) 30 days - green

MACD: fast EMA 12, slow

EMA 26, SMA

Bollinger Bands 20

The US economy is in order

The euro declined, despite the positive data on the eurozone's economy in the morning, as market participants expected a good report on U.S. GDP growth. According to the data, the confidence of companies and consumers in the eurozone in November this year continued to strengthen.

The European Commission said that the index of sentiment in the eurozone economy in November rose to 114.6 points from 114.1 points in October. Economists had expected the index to rise to 114.2 points. As noted in the report, the main growth was due to the French consumers, whose moods improved in the second quarter of this year. But the mood in Germany deteriorated slightly, which neutralized the growth of the main indicator.

Consumer prices in Germany in November rose due to higher prices for energy and food. According to the National Bureau of Statistics of Destatis, the harmonized index of consumer prices in November this year rose by 1.8% against growth of 1.5% in October. Economists had expected the index to grow by 1.7%. Energy prices in Germany rose by 3.7% compared to November 2016, while food prices increased by 3.2%. Today at a briefing on the presentation of the report on the financial stability of the eurozone, ECB representative Vitor Constancio said that the eurozone economy has become more resilient to shocks, and the main sources of risks are outside the eurozone.

Constancio also noted that the markets at the moment are calmer towards the situation in Catalonia. Data on economic growth in the US in the third quarter of this year was stronger than expected, due to the growth of companies' revenues. According to the report of the US Department of Commerce, the gross domestic product grew by 3.3% per annum in the third quarter, which fully coincided with the forecasts of economists. Earlier it was reported about GDP growth of 3.0%. It should be noted that in the second quarter of this year, the US economy grew by 3.1%.

The British pound continued its growth even after data that the number of approved mortgages in the UK in October declined. According to the report of the Bank of England, the number of approved mortgage loans was 64,575 against 66,111 in September. Net mortgage lending in the UK in October 2017 reached 3.4 billion British pounds.

No comments:

Post a Comment