2018-07-09

In Asia, Japan will release the Economy Watchers Sentiment, Current Account, and Bank Lending y/y and the US will release some Economic Data such as Consumer Credit m/m. So there is a probability the USD/JPY pair will move with low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 111.00.

Resistance. 2: 110.78.

Resistance. 1: 110.57.

Support. 1: 110.30.

Support. 2: 110.09.

Support. 3: 109.87.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all Traders or Investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Technical analysis: Intraday Level For EUR/USD, July 09, 2018

2018-07-09

When the European market opens, some Economic Data will be released such as Sentix Investor Confidence, and German Trade Balance. The US will also release the Economic Data such as Consumer Credit m/m, so amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1808.

Strong Resistance:1.1801.

Original Resistance: 1.1790.

Inner Sell Area: 1.1779.

Target Inner Area: 1.1751.

Inner Buy Area: 1.1723.

Original Support: 1.1712.

Strong Support: 1.1701.

Breakout SELL Level: 1.1694.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all Traders or Investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Technical analysis of Gold for July 09, 2018

2018-07-09

On the 4-hour chart, after Gold had touch the support level of $1,240.74, the price bounced higher. Now, the price is making a Flag Pattern. It seems the gold price will test again the resistance level of $1,265.36. The overall trend for Gold is the bullish bias.

(Disclaimer)

Technical analysis on Gold for July 9, 2018

2018-07-09

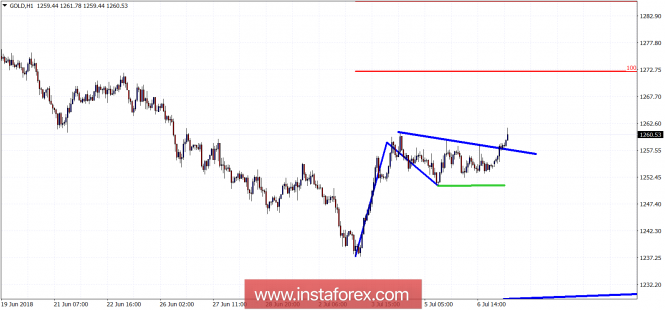

Gold prices are climbing above the resistance during the Asian session. Gold prices have the potential to reach $1,272 this week. However, we also have a second target around $1,285.

Blue line - short-term resistance (broken)

Green line- short-term support

Red lines -targets

Gold price is making higher highs and higher lows in the short-term. These are initial signs of a reversal that could be a major low for Gold in the longer term. Support is at $1,251 and resistance is at $1,258-60. The price is above the resistance. We could see a back test today, but any move below $1,256 should worry bulls. A sustained daily close above $1,261 today will be a bullish sign.

No comments:

Post a Comment