Forex analysis review |

- The pound predicted at golden mountains

- AUD/USD. In the grip of contradictions: the aussie cannot choose the vector of its movement

- GBP/USD. The 5th of March. Results of the day. Six reasons for the pound sterling's decline

- EUR/USD. The 5th of March. Results of the day. Strong ISM index sent the pair to a new downward rally

- Oil took a breath

- EURUSD: Good performance in the eurozone inspires optimism in investors and traders

- Dollar is in no hurry to decline despite the efforts of Donald Trump

- Fractal analysis of major currency pairs on March 5

- GBP / USD: plan for the American session on March 5. Pound ignored the good data on the service industry, and this is a bad

- EUR / USD plan for the US session on March 5. Euro managed to hold the position after release of the PMI indices

- ECB meeting: the way of the euro is a foregone conclusion

- EUR / USD: where will the euro go with an eye on the ECB's position?

- Technical analysis of USD/CHF for March 05, 2019

- BITCOIN Analysis for March 5, 2019

- Technical analysis of GBP/USD for March 05, 2019

- Gold is gaining strength again - experts

- Bitcoin analysis for March 05, 2019

- Volatility will increase

- Analysis of Gold for March 05, 2019

- Simplified wave analysis. Overview of USD / CAD for the week of March 5

- EURUSD: RBA leaves rates unchanged. There is a possibility of a small upward correction of the euro

- GBP / USD. March 5. The trading system. "Regression Channels". There is no news about Brexit, the pound is falling again

- EUR / USD. March 5. The trading system. "Regression Channels". Business activity index will show the current trend in the

- Indicator analysis: Daily review for GBP / USD pair on March 5, 2019

- EUR/USD analysis for March 05, 2019

| The pound predicted at golden mountains Posted: 05 Mar 2019 03:53 PM PST The world's biggest analysts see the prerequisites for a large rally of the British currency. According to their calculations, this year sterling will overtake all competitors as concerns about Brexit without a deal decrease. The probability that Britain will leave the European Union at the end of March without a deal is 9%, Bloomberg estimated after a survey. The rest of the respondents are confident in the transfer of Brexit, they also admit that the amended draft agreement of Prime Minister Theresa May will pass through Parliament. Note that the probability of the last two scenarios is constantly growing. At the moment it is 54% and 37% respectively. News about the postponement of the exit procedure at a later date will provoke an increase in the sterling to $1.33. If May somehow manages to carry out a deal through the divided House of Commons, then the pound will rally to $1.38, which has not been since April 2018. Since the beginning of the year, the rate of the British currency has risen by more than 3% against the dollar and almost 5% against the euro, as investors have revised the odds of Britain leaving the EU without a deal. Judging by the CFTC report, the market maintained a net short position in the British pound as of February 19. Players expected an increase in opportunities for an optimistic reaction as a result of the rebalancing of positions. Risks Goldman Sachs bet on the pound's further growth, predicting that its rally will continue due to the fact that foreign investors out of positions opened to hedge risks after voting in favor of Brexit in June 2016. The most popular strategy in sterling today is a long position, especially on the options markets. However, some doubts still exist. Rabobank experts are worried that the market often underestimates the risks of a "hard" Brexit. So, investors showed full confidence that the result of the vote would be "to remain in the union", but they made a mistake and the pound collapsed. The material has been provided by InstaForex Company - www.instaforex.com |

| AUD/USD. In the grip of contradictions: the aussie cannot choose the vector of its movement Posted: 05 Mar 2019 03:33 PM PST The March meeting of the Reserve Bank of Australia was quiet and almost imperceptible. The regulator retained the parameters of monetary policy in its previous form and did not frighten the market with arguments about the interest rate reduction in the foreseeable future. The Australian dollar, in turn, reacted accordingly: paired with the US currency, the "aussie" remained within the 70th figure, and Tuesday's price fluctuations were associated more with Chinese data than with the results of the RBA meeting. In order to assess the prospects of AUD/USD, first of all it is necessary to remember the reasons for the pair's decline last month. The downward impulse was due to the rhetoric of the head of the RBA Philip Lowe, who, to the surprise of many traders, allowed the probability of lowering the interest rate this year. It is worth noting that in fact his phrase was more shrouded – firstly, he reported the transition to a "neutral position" in monetary policy, and secondly, he noted that the rate can be both increased and reduced. But the market interpreted this commentary in its own way, especially since earlier in the text of the accompanying statement there was only a phrase that "in the future" the parameters of monetary policy will be tightened. In other words, the regulator has transparently hinted that in the near future it will take a wait-and-see position, and then act on the situation, and the option of reducing the rate is likely to be the opposite scenario. In response to such prospects, the AUD/USD pair fell by almost 200 points, but the price did not fall below the 70th figure, stuck in a narrow-range flat. Given Philip Lowe's rather dovish rhetoric, many experts warned that the regulator could significantly soften its tone at the March meeting. However, these forecasts did not come true: the Reserve Bank voiced a cautious, but not pessimistic position, even noting positive developments in the Australian economy - in particular, regarding the labor market. Let me remind you that according to the latest published data, the unemployment rate in Australia remained at five percent, but the increase in the number of employed jumped to 39.1 thousand - the last time such a dynamics was observed was back in August 2018. Moreover, employment growth in January was not due to part-time employment — on the contrary, the employment rate for full-time jobs, which imply higher wages, surpassed a one-and-a-half high, while part-time employment showed a negative trend. This factor has a positive effect on the dynamics of wage growth and, indirectly, on the dynamics of inflation growth. However, despite the neutral and optimistic results of the March meeting of the RBA, the aussie did not regain its position or even leave the region of the 70th figure. The reason for this is China. Today, another disappointing data from China was published, which again reminded the market of the slowdown of the world's largest economy. Thus, the index of business activity in the services sector from Markit (Markit Services PMI) sharply declined in February, reaching 51.1 points. Over the previous three months, this indicator came out within the framework of 53 points, therefore, such a sharp and, most importantly, unexpected (forecast was at the level of 53.5 points) downward jump had an impact on the dynamics of today's trading. The Australian dollar is most sensitive to the decline in Chinese indicators, since China is its main trading partner. In turn, China's economy has been declining for the third consecutive quarter, confirming fears of many experts about the prospects of the world economy. The country's GDP came out at the expected level of 6.4% for the last quarter of 2018 , but this is the weakest growth in the last ten years. In annual terms, the situation is no better: the indicator fell to the level of 6.6%, an anti-record was marked: the Chinese economy grew at such a weak pace almost three decades ago - in 1990. In other words, China acts as an "anchor", which restrains the growth of the AUD/USD pair, even if there are fundamental reasons for an upward dynamics. The only hope of traders in this context is the possible conclusion of a deal between Beijing and Washington. According to the American press, the leaders of the countries can sign the agreement on March 27 – at the summit, which will be held in the United States. According to preliminary data, the United States offered China to reduce duties and other restrictions on American agricultural, chemical, automotive products and other goods. In return, Washington is ready to cancel most of the tariffs it imposed on Chinese goods last year. According to insider information, the parties reached a compromise on key issues, but some gaps still remain. Thus, the AUD/USD pair is traded in the conditions of a controversial fundamental background. On the one hand, the Australian labor market is strengthening, and the RBA is not in a hurry to soften the tone of its rhetoric - but, on the other hand, the Chinese economy continues to slow down, negatively affecting the raw materials market and the economy of Australia. The background to this is the US-China negotiations, which should be completed by the end of March. Taking into account such contradictory fundamental factors, the AUD/USD pair will continue to be traded in the flat - if only the data on Australian GDP growth for the fourth quarter of last year (the release is scheduled for March 6) prove to be stronger/weaker than forecasts. According to general expectations, the Australian economy should grow by 0.5% qoq and decrease to 2.7% year-on-year. If the release comes out at the level of forecasts, then the pair's situation will remain as before, otherwise the aussie will test either the support level (0.7020 - the lower boundary of the Kumo cloud on the daily chart), or the resistance level (0.7180, where Kijun-sen coincides with the upper line of the Bollinger Bands indicator on the same timeframe). The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. The 5th of March. Results of the day. Six reasons for the pound sterling's decline Posted: 05 Mar 2019 03:24 PM PST 4-hour timeframe The amplitude of the last 5 days (high-low): 195p - 116p - 66p - 114p - 88p. Average amplitude for the last 5 days: 116p (111p). On Tuesday, March 5, the British pound also continues the downward movement that began a few days ago. First of all, traders have clearly exhausted their desire to buy the pound sterling on mere rumors and expectations. Secondly, there was no special positive for the UK and its national currency. Third, in recent days, the US dollar has been in high demand against the background of information about the possible conclusion of a trade agreement between the United States and China before the end of March. This will mean the end of the trade war. Fourth, a strong index of business activity in the US ISM services sector was published today. Fifth, Mark Carney's speech will take place in the evening, and it does not promise anything good, at best it will be neutral for the pound. Many experts note that the dollar is gaining momentum again. Donald Trump has already once again criticized Jerome Powell and the Federal Reserve's monetary policy, but this did not lead to a weakening of the US currency. By and large, many economic agencies are right in thinking that the US dollar will continue to be in demand against the backdrop of high interest rates in the US relative to other countries. The US economy, despite the threat of recession, is strong, and the recession threatens the global economy. Well, we will not forget that there is a high probability that Britain will still exit the EU without agreements, because progress in the negotiations on key issues has simply not been available in recent months, and the postponement of the Brexit date is only a necessary measure unlikely to force one of the parties to suddenly make additional concessions. Trading recommendations: The GBP/USD currency pair continues to move down. Therefore, it is now recommended to trade short with targets of 1.3052 and 1.3015, but in small lots, since the "dead cross" is still weak. Buy orders will become relevant if the pair consolidates above the critical line. However, from a fundamental point of view, this scenario is unlikely at the moment. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Mar 2019 03:13 PM PST 4-hour timeframe The amplitude of the last 5 days (high-low): 58p - 42p - 61p - 56p - 73p. Average amplitude for the last 5 days: 58p (52p). On Tuesday, March 5, the EUR/USD currency pair resumed its downward movement after a short pause. The instrument stood in one place for most of the trading day since there were no important macroeconomic publications at that time. As we mentioned this morning, Markit's business activity indices for services and manufacturing in the US and the EU are more informative. Thus, traders were pleased to ignore the business activity indices in the eurozone, which exceeded forecasts, the business activity indices for the US, which were worse than market expectations, and at the same time, retail sales in the EU, the growth rate of which accelerated in January. But the really important index of business activity in the service sector ISM did not go unnoticed. This figure significantly exceeded forecast that were already high and amounted to as much as 59.7 units. After that, the US dollar began to rise in price. Thus, the naked eye can see that the pair has once again aimed at the area of the lows near the level of 1.1250. There is only 50 points in this area. Given the weakness of the bulls and the lack of strong fundamental reasons for the strengthening of the euro, this time the pair may go below the designated area. Much will depend on the ECB's decisions and statements, which are scheduled for tomorrow. Although what to expect from the European regulator in the face of falling macroeconomic indicators and uncertainty on Brexit? Certainly not a "hawkish" rhetoric. Thus, there is little hope for the ECB. From a technical point of view, the current "dead cross" may increase at the current bar if the price overcomes the Ichimoku cloud. Trading recommendations: The EUR/USD pair continues its downward movement. Therefore, at the moment it is recommended to consider short positions with targets 1.1277 and 1.1250. In case of a reversal of the MACD indicator up, manually cut the shorts. Long positions will again become relevant no earlier than when the price consolidates above the critical line. In this case, the actual target for buy positions will be the resistance level of 1.1414. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Mar 2019 06:29 AM PST After a long winter rally, oil decided to take a breath, which resulted in the consolidation of Brent in the trading range of $ 64.3-67.8 per barrel. Investors evaluate the prospects for black gold in the context of a set of multidirectional drivers, including the volume of OPEC and US production, changes in global demand and the dynamics of reserves. "Bulls" are confident that while positive news will be received from the negotiating tables of Washington and Beijing, the relevance of purchases will not disappear anywhere. "Bears", by contrast, indicate the presence of an oil market surplus in 2018 and the finding of global commercial reserves above their five-year average. While opponents are discarding their trump cards, black gold continues to consolidate. According to estimates from Bloomberg experts, OPEC reduced production to 30.5 million b / d in February (-56 thousand b / s m / m). Reuters calls the figure of 30.68 million b / s. According to the Minister of Energy of the Russian Federation Alexander Novak, in March, Russia will be more fulfilling its obligations to reduce production than before. The process of reaching the promised amount of -228 thousand b / s will go faster, which should be regarded as a "bullish" factor for Brent and WTI. On the other hand, the resumption of mining at problem sites in Libya and the growth of Venezuelan exports are supporting the "bears". The increase in US production is above 12 million b / s in February. Dynamics of oil production in Libya and Venezuela Can we say that the States supply the black gold market exclusively negative, obeying the will of their willingness to see the president of low prices? This is not entirely true. Along with the potential growth of US stocks by 1.05 million barrels in the five-day period by March 1 (if this happens, the figure will increase over five of the last six weeks), a helping hand to customers extends the drop in the number of drilling rigs from Baker Hughes to a 9-month minimum at 843. The markets react quite differently to news from the Washington and Beijing negotiating tables. According to Goldman Sachs estimates, the States will achieve their goals and at the same time maintain current tariffs on Chinese imports until 2020. This is necessary in order to monitor the fulfillment of the Celestial obligations. The Asian country will increase purchases of American products by $ 10 billion a year, which will lead to a decrease in its foreign trade surplus with the United States. Oil responded to the decline in Chinese GDP forecasts from the government from 6.5% to 6-6.5% by 2019 drop in prices, but the fact that Beijing is ready to expand the fiscal stimulus from 1.3 trillion to 2 trillion yuan ($ 298.3 billion ), allowed the "bulls" to go to the counter. Celestial is the largest consumer of raw materials, and the improvement in domestic demand should be regarded as positive for black gold. Technically, on the daily chart of Brent, correction continues as part of the transformation of the Shark pattern to 5-0. It is possible that the current range of consolidation will be expanded to $ 64.1-68.5 per barrel (rollback levels of 38.2% and 50% of the CD wave). Brent, the daily chart |

| EURUSD: Good performance in the eurozone inspires optimism in investors and traders Posted: 05 Mar 2019 05:39 AM PST Today, a number of reports came out that testified, albeit indirectly, that the European economy could easily survive the recession than previously expected. In January, the indices in a number of countries in the service sector moved below 50 points, which indicated a drop in growth, then the February data was more optimistic. Thus, the PMI Purchasing Managers Index for Italy in February was 50.4 points, while in January the index was at the level of 49.7 points. Economists had forecast a figure of around 49.2 points. The PMI Purchasing Managers Index for France in February rose to 50.2 points, while it was projected at 49.8 points. Back in January, this index was 47.8. Germany continues to be the leader of the eurozone. There, a similar PMI purchasing managers index for the service sector rose to 55.3 points in February, while it was projected at 55.1 points. In January, the index was 53.0 points. As for the euro area as a whole, then the purchasing manager's index for the service sector was at the level of 52.8 points in February against 51.2 points in January, which should definitely please the European regulator. Predicted the index at 52.3 points. The composite PMI of the eurozone also increased slightly in February and amounted to 51.9 points against 51.0 points in January, while the forecast was 51.4 points. A good report on retail sales in the euro area is also a sign of the recovery of the European economy. According to the European Bureau of Statistics, retail sales growth in the eurozone resumed in January after a sharp slowdown in late 2018. Thus, sales in stores and the Internet in January increased by 1.3% compared with December and by 2.2% compared with January 2018. The report indicates that the main reason for the growth in sales was the improvement in consumer sentiment and the acceleration of earnings growth. As for the technical picture of the EURUSD pair, it remained unchanged compared with the morning forecast. At least the bulls managed to stop the fall of the euro. Only a confident break of the 1.1340 range will allow the trading instrument to retain a correction impulse, which will lead to the highs of 1.1370 and 1.1405. In the event of a further decline in the euro, it is best to rely on purchases in the area of major support 1.1270 and 1.1230. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar is in no hurry to decline despite the efforts of Donald Trump Posted: 05 Mar 2019 05:06 AM PST Last Saturday, US President Donald Trump once again stated that the dollar is too strong and lashed out at the Federal Reserve Jerome Powell, calling him a man who likes to raise interest rates. The US currency initially reacted with a fall on the statement of the head of the White House but then continued to strengthen. The dollar index shows growth for the fifth day in a row. Analysts say that Donald Trump seems to have to show much more zeal if he wants to reduce the dollar. "The President of the United States, apparently, will not succeed in so simply" talking "the dollar. Where else to invest when major economies, including Europe, show weakness? There are not too many places around, and this will keep the dollar rate high, "says Stephen Miller from consulting company Grant Samuel. According to the senior portfolio manager at investment firm QIC Ltd., Stuart Simmons, the US assets remain in demand due to the cooling of the global economy, as well as the weak GDP growth in developed countries and the softening of the position of leading central banks, despite the pause of the Fed in the rate hike cycle. "However, if the statistical data of the United States becomes comparable with the indicators of other states and in these countries, economic recovery will begin then a weakening of the dollar will probably follow," the expert believes. "The high exchange rate of the American currency is explained by low-interest rates around the world. In 2019, yield differentials may peak and begin to shrink. If this happens, the greenback will unfold, "said Andrew Sheets of Morgan Stanley. "If the Fed has resorted to expansionist measures for very good reasons, Donald Trump will not hesitate to present it as a result of his pressure on Jerome Powell, which will cause even more damage to the dollar," commented by the currency strategist at Commerzbank, Ulrich Leichtman. The material has been provided by InstaForex Company - www.instaforex.com |

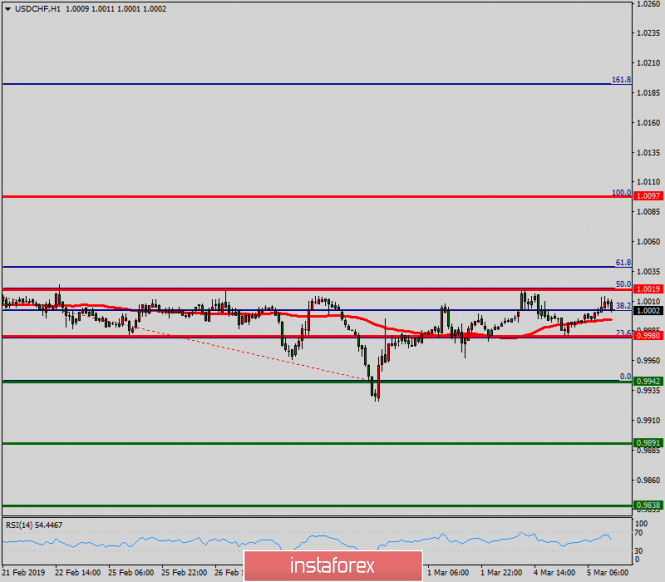

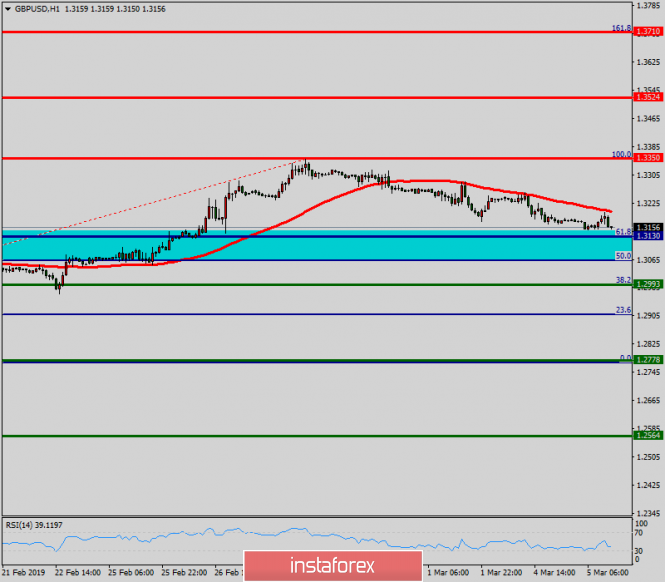

| Fractal analysis of major currency pairs on March 5 Posted: 05 Mar 2019 04:40 AM PST Dear colleagues. For the currency pair Euro / Dollar, we are following the downward structure of February 28 and the downward movement is possible after the breakdown of 1.1312. For the currency pair Pound / Dollar, we are following the downward structure of February 27 and the development of which is expected after the passage of the range of 1.3132 - 1.3105. For the currency pair Dollar / Franc, the price forms the initial conditions for the top of February 28 and the development of which is expected after the breakdown of 1.0022. For the currency pair Dollar / Yen, we are following the development of the upward cycle of February 27. For the currency pair Euro / Yen, the price is in deep correction and forms the potential for the bottom of March 1. For the currency pair Pound / Yen, the main development of the upward trend from February 22 is expected after the passage of the range of 147.75 - 148.21 and the level of 146.80 is the key support. Forecast for March 5: Analytical review of H1-scale currency pairs: For the Euro / Dollar currency pair, the key levels on the H1 scale are 1.1372, 1.1352, 1.1337, 1.1322, 1.1312, 1.1296, 1.1274, 1.1260 and 1.1232. We are following the downward structure of February 28. We expect the downward movement to continue after the price passes the range of 1.1322 - 1.1312. In this case, the target is 1.1296, and consolidation is near this level. The breakdown of the level of 1.1296 should be accompanied by a pronounced upward movement. The goal is 1.1274 and in the range of 1.1274 - 1.1260 is the price consolidation. The potential value for the bottom is considered the level of 1.1232, upon reaching which we expect a rollback to the correction. The short-term upward movement is possible in the range of 1.1337 - 1.1352 and the breakdown of the latter value will lead to a prolonged correction. The target is 1.1372 and this level is the key support for the downward structure. The main trend is the downward cycle of February 28. Trading recommendations: Buy 1.1337 Take profit: 1.1350 Buy 1.1353 Take profit: 1.1370 Sell: 1.1312 Take profit: 1.1296 Sell: 1.1294 Take profit: 1.1274 For the currency pair Pound / Dollar, the key levels on the H1 scale are 1.3284, 1.3235, 1.3202, 1.3132, 1.3105, 1.3041 and 1.2999. We are following the downward structure of February 27. A downward movement is expected after the price passes the range of 1.3132 - 1.3105. In this case, the target is 1.3041. The potential value for the bottom is considered the level of 1.2999, after reaching which we expect consolidation, as well as a rollback to the top. The short-term upward movement is expected in the range of 1.3202 - 1.3235 and the breakdown of the last value will lead to a deep correction. The target is 1.3284 and this level is the key support for the downward structure of February 27. The main trend is the downward structure of February 27. Trading recommendations: Buy: 1.3202 Take profit: 1.3233 Buy: 1.3236 Take profit: 1.3284 Sell: 1.3105 Take profit: 1.3045 Sell: 1.3040 Take profit: 1.3000 For the currency pair Dollar / Franc, the key levels on the H1 scale are 1.0107, 1.0092, 1.0065, 1.0047, 1.0022, 0.9968, 0.9952 and 0.9924. We follow the formation of the initial conditions for the top of February 28. We expect the continuation of the upward movement after the breakdown of 1.0022. In this case, the target is 1.0047 and in the range of 1.0047 - 1.0065 is the short-term upward movement, as well as consolidation. The breakdown of the level of 1.0065 should be accompanied by a pronounced upward movement. The goal is 1.0092. The potential value for the top is considered the level of 1.0107, upon reaching which we expect consolidation, as well as a rollback to the top. The short-term downward movement is possible in the range of 0.9968 - 0.9952 and the breakdown of the latter value will lead to a movement to the first potential target of 0.9924. The main trend is the formation of the ascending structure of February 28. Trading recommendations: Buy: 1.0022 Take profit: 1.0047 Buy: 1.0065 Take profit: 1.0090 Sell: 0.9968 Take profit: 0.9953 Sell: 0.9950 Take profit: 0.9925 For the currency pair Dollar / Yen, the key levels on the scale are 112.81, 112.56, 112.44, 112.23, 112.07, 111.81, 111.61 and 111.33. We continue to monitor the ascending structure of February 27. The short-term upward movement is expected in the range of 112.07 - 112.23 and the breakdown of the last value should be accompanied by a pronounced upward movement. The goal is 112.44 and in the range of 112.44 - 112.56 is the consolidation of the price. The potential value for the top is considered the level of 112.81, after reaching which we expect a departure to a correction. The short-term downward movement is possible in the range of 111.81 - 111.61 and the breakdown of the latter value will lead to a prolonged correction. The target is 111.33 and this level is the key support for the upward structure of February 27. The main trend is the ascending cycle of February 27. Trading recommendations: Buy: 112.07 Take profit: 112.21 Buy: 112.25 Take profit: 112.44 Sell: 111.80 Take profit: 111.63 Sell: 111.58 Take profit: 111.35 For the currency pair Canadian Dollar / Dollar, the key levels on the H1 scale are 1.3485, 1.3440, 1.3414, 1.3347, 1.3317, 1.3291, 1.3262 and 1.3237. We are following the formation of the ascending structure from March 1. The short-term upward movement is expected in the range of 1.3347 - 1.3373 and the breakdown of the last value should be accompanied by a pronounced upward movement. The target is 1.3414 and in the range of 1.3414 - 1.3440 is the price consolidation. The potential value for the top is considered the level of 1.3485, after reaching which we expect a departure to the correction. The short-term downward movement is possible in the range of 1.3317 - 1.3291 and the breakdown of the latter value will lead to an in-depth correction. The target is 1.3262. We expect the design of the top of the initial conditions for the downward cycle in the range of 1.3262 - 1.3237. The main trend is the formation of the initial conditions for the ascending cycle of March 1 Trading recommendations: Buy: 1.3347 Take profit: 1.3372 Buy: 1.3374 Take profit: 1.3314 Sell: 1.3317 Take profit: 1.3292 Sell: 1.3289 Take profit: 1.3262 For the currency pair Australian Dollar / Dollar, the key levels on the H1 scale are 0.7153, 0.7127, 0.7109, 0.7071, 0.7052, 0.7026 and 0.7010. We are following the development of the downward cycle of February 27. The short-term downward movement is expected in the range of 0.7071 - 0.7052 and the breakdown of the last value should be accompanied by a pronounced downward movement. The goal is 0.7026. The potential value for the bottom is considered the level of 0.7010, upon reaching which we expect a rollback to the top. The short-term upward movement is possible in the range of 0.7109 - 0.7127 and the breakdown of the latter value will lead to an in-depth correction. The target is 0.7153 and this level is the key support for the downward structure. The main trend is the downward cycle of February 27. Trading recommendations: Buy: 0.7109 Take profit: 0.7125 Buy: 0.7128 Take profit: 0.7152 Sell: 0.7070 Take profit: 0.7054 Sell: 0.7051 Take profit: 0.7026 For the currency pair Euro / Yen, the key levels on the H1 scale are 128.27, 127.85, 127.61, 127.29, 127.04, 126.52, 126.36, 126.04 and 125.63. The price is in a deep correction from the uptrend and forms the potential for the downward movement of March 1. The range of 126.52 - 126.36 is the key support for the ascending structure. Its price passage will make it possible to count on a move to the level of 126.04, near which is consolidation. The potential value for the bottom is considered the level of 125.63, after reaching this level, we expect a rollback to the top. The short-term upward movement is expected in the range of 127.04 - 127.29, hence the probability of a downward reversal. The breakdown of 127.30 will continue the development of the upward trend on the H1 scale. In this case, the first potential target is 127.61. The main trend is a deep correction, the formation of potential for the bottom of March 1. Trading recommendations: Buy: 127.05 Take profit: 127.27 Buy: 127.31 Take profit: 127.60 Sell: 126.36 Take profit: 126.10 Sell: 126.02 Take profit: 125.65 For the currency pair Pound / Yen, the key levels on the H1 scale are 150.49, 149.47, 149.01, 148.21, 147.75, 147.22, 146.80 and 146.06. We continue to monitor the ascending structure of February 22. The short-term upward movement is expected in the range of 147.75 - 148.21 and the breakdown of the latter value should be accompanied by a pronounced upward movement. The target is 149.01 and in the range of 149.01 - 149.47 is the short-term upward movements, as well as consolidation. The potential value for the top is considered the level of 150.49, upon reaching which we expect a rollback downwards. The short-term downward movement is possible in the range of 147.22 - 146.80 and the breakdown of the latter value will lead to an in-depth correction. The target is 146.06 and this level is the key support for the top. The main trend is the local structure for the top of February 22. Trading recommendations: Buy: 147.77 Take profit: 148.20 Buy: 148.25 Take profit: 149.00 Sell: 147.22 Take profit: 146.82 Sell: 146.78 Take profit: 146.10 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Mar 2019 04:40 AM PST To open long positions on GBP / USD you need: Despite a good report on the service sector, buyers failed to get above the resistance of 1.3195 today. Only a breakthrough and consolidation above this level will be a signal to buy, which will lead GBP / USD to update the highs around 1.3248 and 1.3308, where I recommend fixing the profits. When scenarios further reduce the pound, consider the new long positions best after updating the lows of 1.3093 and 1.3041. To open short positions on GBP / USD you need: The bears performed well in the resistance area of 1.3195. As long as trading continues below this range, the pressure on the pair will continue, and a repeated test of support at 1.3144 will lead to a new wave of sales pounds with an update of 1.3093 and 1.3041 lows, where I recommend fixing the profits. With the growth scenario above the 1.3195 area, GBP / USD sales can be expected to rebound from the highs of 1.3248 and 1.3308. Indicator signals: Moving Averages Trade is conducted below the 30-day and 50-medium moving, which keeps the market on the side of sellers. Bollinger bands Bollinger Bands indicator volatility is very low, which does not give signals on market entry. Description of indicators

|

| Posted: 05 Mar 2019 04:23 AM PST To open long positions on EUR / USD pair, you need: Buyers of the European currency managed to keep around the lows of yesterday, gradually building a good position to breakdown the resistance level of 1.1337. Good reports on the PMI indexes, which came out in the first half of the day, may contribute to the further growth of the pair. A fixation above the level of 1.1337 will lead to an upward EUR/USD trend in the region of the maximum at 1.1368, where I recommend taking profits. In case of a decline in the second half of the day, it is best to consider new long positions after a test of new lows around 1.1300 and 1.1279. To open short positions on EUR / USD pair, you need: Good fundamental data for the euro area has limited pressure on the euro. However, in the second half of the day, reports are expected on the American economy, which may return the demand for the US dollar. The next formation of a false breakdown in the area of resistance at 1.1337 may lead to a new wave of sales of the European currency and update of the minima in the area of 1.1300 and 1.1279, where I recommend taking profits. In case of growth above 1.1337, the short positions can be safely returned to the rebound from the large resistance of 1.1368, where the bears will try to build the upper limit of the downward channel. More in the video forecast for March 5 Indicator signals: Moving averages Trade remains below the 30- and 50-medium moving, indicating a bearish nature of the market. Bollinger bands Volatility is very low, which does not give signals for entering the market. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| ECB meeting: the way of the euro is a foregone conclusion Posted: 05 Mar 2019 04:22 AM PST In the conditions of a slowdown in the eurozone economy, the ECB at its meeting on March 7 may change the rhetoric and even tell about new incentive mechanisms. Bloomberg respondents and other economists believe that the regulator will again postpone the rate hike. All the fundamental factors will force Mario Draghi to take steps to stimulate the economy. With this development, the euro is prone to decline. The technical side of the picture is quite clear; a whole series of "bearish" signals are visible. So, in the minutes of the last ECB meeting, it was stated that some politicians consider the preparation of fresh measures "urgent". It is assumed that the most likely scenario will be a new round of long-term loan program (LTRO), linked to the interest rate and providing sufficient excess liquidity to the euro. This should stop the growth of the single currency in the currency markets. It is possible that the Central Bank will limit itself only to the preparation of the basis for such an operation, and not the actual start of the program. LTRO details will depend on what signal the policymakers decide to give to the markets. The ECB will probably fix market rates for up to about four years, offering new loans at a fixed rate. As Bloomberg economists have suggested, he may also leave the window open for earlier policy tightening by tying new loans to the base refinancing rate, which has been at zero for the past two years. The second option is considered the most likely since this step does not tie the hands of the regulator so tightly. This is important since in November a change of the head of the European Central Bank is expected. President of the Central Bank of Germany Jens Weidmann tries to eliminate any manifestation of generosity. At a press conference held a week earlier, he said that bidding with a fixed rate could weaken the OST, while a long maturity would violate the signals to the market. They are now a sensitive policy instrument of the bank since the net redemption of assets was completed. "The ECB probably does not want to make the conditions of its new liquidity operations so attractive that they will actually increase excess liquidity," say experts from Nordea. Therefore, it is "difficult to imagine a much weaker euro" when European financiers take action. The position is to some extent related to the likelihood that the demand for new loans will flow from the banks of Italy and Spain. This once again highlights the unpleasant truth about their ability to survive without the support of the ECB. According to Moody's Investor Service, the European regulator finances 6% of the assets of the Spanish and Italian banking systems. The regulation, which is agreed upon in Basel III, requires a minimum level of financing from banking companies for a period of more than 12 months (the so-called NSFR net stable financing indicator). Due to the fact that the remaining maturity of existing LTROs will fall in the current year below 12 months, banks should not bring them into compliance with the requirements of the NSFR. According to the head of the Bank of Germany, the question of whether banks need to "follow the rules should not play any role in monetary policy decisions." A similar opinion is shared by his colleague from France. To prevent any decisive action, at the next meeting, the resistance of these officials is enough. Draghi again has to show their talents. Markets need to believe that the ECB is serious about sustaining growth, even when it does nothing. If Draghi fails to convince the markets, we can witness a new round of sales of Spanish and Italian banks' debt obligations and expansion of the credit spread - "unreasonable tightening" of financial conditions. The regulator wishes to prevent this at all costs. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: where will the euro go with an eye on the ECB's position? Posted: 05 Mar 2019 04:10 AM PST For this week, the attention of investors will be focused on the next meeting of the European Central Bank (ECB), which will be held on Thursday. According to a consensus forecast of analysts recently surveyed by Bloomberg, the regulator will again keep borrowing costs unchanged and may even correct interest rate signals, postponing the timeframe for its possible increase due to the deteriorating economic outlook for the eurozone. It is assumed that at the next meeting of the ECB, the question of the resumption of long-term refinancing operations (LTRO) may also be brought up for discussion, although the decision to provide additional liquidity to banks will probably not be made yet. "I think that the monetary policy is very far from normalizing monetary policy. The weakness of the eurozone economy, the decline in consumer inflation in the region speak more about the need to mitigate, rather than tighten, the ECB, "said by the economist at Cantor Fitzgerald, Alan McQuade. Given the possible change in the mood of the ECB, Societe Generale Bank revised downward the forecast for the EUR / USD pair from 1.25 to 1.20 in 2019. According to the representatives of Societe Generale, "Due to the sharp slowdown in economic growth in key economies of the eurozone, including Germany, France, and Italy, the regulator may postpone the rate increase, and in the summer is likely to resume the program of long-term lending to banks". "Despite the fact that the euro is exhausted by political turmoil (from Brexit to populists in Italy), we expect that the single European currency will rise in price as the contradictions in the EU are resolved, although its growth will be slower than previously thought," they added. Meanwhile, Stephen Jen, Executive Director of Eurizon SLJ Capital, believes that the euro against the dollar may fall to a level that was last observed in early 2017. "By the end of this year, the euro risk falling against the dollar to $1.05 if economic stress from China spreads to Europe, which will not allow the ECB to begin in normalizing the monetary policy. In this case, the United States will retain a dominant position, which will affect the dynamics of the EUR / USD rate", said by the expert. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of USD/CHF for March 05, 2019 Posted: 05 Mar 2019 03:38 AM PST |

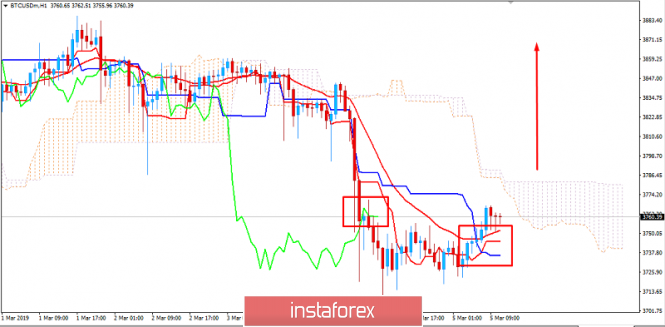

| BITCOIN Analysis for March 5, 2019 Posted: 05 Mar 2019 03:34 AM PST Bitcoin has been quite corrective and volatile after pushing lower towards $3,700 recently with a daily close. Today the price managed to gain certain momentum which lead to certain bullish pressure. Though the current trend is bearish, having Chikou span breaking above the price line while 20 EMA and Tenkan line breaking above the Kijun line as a crossover indicates that the price is pn track to climb higher. Though certain bullish pressure can already be seen, breaking above the Kumo Cloud resistance or $3,800 is required to have better bullish impulsive momentum along the way. As the price clears above $3,800, it is clear to advance with a target towards $4,000 or higher in the future. As the price remains above $3,500-600 support area, the bullish momentum is expected to continue. SUPPORT: 3,500, 3,600 RESISTANCE: 4,000, 4,250 BIAS: BULLISH MOMENTUM: VOLATILE

|

| Technical analysis of GBP/USD for March 05, 2019 Posted: 05 Mar 2019 03:26 AM PST The GBP/USD pair will continue rising from the level of 1.3130 in the long term. It should be noted that the support is established at the level of 1.3130 which represents the daily pivot point on the H1 chart. The price is likely to form a double bottom in the same time frame. Accordingly, the GBP/USD pair is showing signs of strength following a breakout of the highest level of 1.3130. So, buy above the level of 1.3300 with the first target at 1.3524 in order to test the daily resistance 1. The level of 1.3524 is a good place to take profits. Moreover, the RSI is still signaling that the trend is upward as it remains strong above the moving average (100). This suggests that the pair will probably go up in coming hours. If the trend is able to break the level of 1.3300, then the market will call for a strong bullish market towards the objective of 1.3524 today. On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.3130, a further decline to 1.3080 can occur. It would indicate a bearish market. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold is gaining strength again - experts Posted: 05 Mar 2019 03:19 AM PST According to analysts, the recent decline in the value of the yellow metal indicates the beginning of its consolidation. The cost of 1 ounce of gold has fallen to a minimum of the last five weeks. Experts believe that this fall is temporary, and the precious metal will rise again. Last Friday, the price of gold showed a significant decline. The cost of precious metals fell by 1.5%, below $ 1,300, which is the lowest figure since January 2018. According to analysts, after a massive increase in gold prices, sooner or later a correction occurs. She confirmed the fear of some experts who predicted a strong resistance level at around $ 1,350. Gold could not overcome it, experts emphasize. They believe that the yellow metal can fall in price to $ 1,280 for 1 ounce. This level will be an excellent opportunity for investors to increase their position in the precious metal for the long term. Experts urge market participants not to worry about the recent correction, recalling that the fundamental data on gold has not changed. Factors such as the trade conflict between the United States and China, the situation around Brexit, as well as the pause in the Fed's interest rates continue to support the precious metal. Experts believe that gold has a good chance to resume growth. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for March 05, 2019 Posted: 05 Mar 2019 03:16 AM PST BTC has been trading upwards. Bullish correction is in creation.

According to the M30 time – frame, we found potential bearish flag in creation, which represents that risk for going long. Key short – term resistance is set at $3.740 (recent lows now became key resistance). Support levels are seen at $3.653 and $3.636. Trading recommendation: BTC is in consolidation phase and we are awaiting end of the bullish correction to establish new short positions. The breakout of the recent low at $3.675 would confirm downward continuation. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Mar 2019 03:08 AM PST Big Picture: a major news is coming. The currency market quotations are in the range on the major pairs, which is actually since the beginning of November of last year as the market still waits for a trend. On Tuesday morning, the news about reduction of the Chinese economy forecast increases the chances of a US-China trade agreement and mutual reduction of duties. However, it also reduces the positive effect of the agreement. The US market has exhausted its growth potential and further move "sideways" before the crisis. British Prime Minister May is making recent attempts to save an agreement with the EU but the result will most likely be a postponement of the British release date from the EU during the voting in the British Parliament March 12th to 13th (March 29 term). In turn, this is positive for the markets. On Wednesday, there will be a report on employment from ADP and the Fed report "Beige Book" in the US. Most likely, we will see signs of a slowdown in the US growth. On Thursday, the ECB meeting on monetary policy exemplified a slowdown in growth as it is visible in the eurozone, which is a challenge for the ECB. In fact, its super soft policy no longer works. We are waiting for the euro trend, either a breakthrough at 1.1425 or breakdown at 1.1230. |

| Analysis of Gold for March 05, 2019 Posted: 05 Mar 2019 03:05 AM PST Gold has been trading downwards. The price tested the level of $1.282.80.

According to the H1 time – frame, we found bullish divergence on the Stochastic oscillator in creation, which is a sign that selling looks risky and that a potential corrective rally is possible. Key intraday support is seen at $1.282.80. Intraday resistance levels are seen at $1.289.40, $1.296.78 and $1.311.40. Trading recommendation: We exited our second half of position with a good profit. Now, we are neutral but with intraday bullish bias if Gold breaks the first resistance at $1.289.40. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis. Overview of USD / CAD for the week of March 5 Posted: 05 Mar 2019 03:00 AM PST Large TF: Over the past year and a half, the pair has steadily moved to the "north" of the chart. By the end of last year, the price reached the lower boundary of the powerful reversal zone, which caused the beginning of the oncoming wave. Small TF: The direction of the short-term trend is set by the bear wave design of December 28. The entire past month in its structure formed the correctional part (B). The rise is nearing completion. Forecast and recommendations: After a flat period, the price of the pair is waiting for a new round of decline. A preliminary calculation allows you to expect up to 5 price patterns down. Supporters of the international trade style are advised to track the signals of the sale of a major. Resistance zones: - 1.3400 / 1.3450 Support areas: - 1.3120 / 1.3070 - 1.2860 / 1.2810 Explanations for the figures: The simplified wave analysis uses waves consisting of 3 parts (A – B – C). On each of the considered scales of the graph, the last, incomplete wave is analyzed. Zones show calculated areas with the highest probability of reversal. The arrows indicate the wave marking by the method used by the author. The solid background shows the formed structure, the dotted - the expected movement. Note: The wave algorithm does not take into account the duration of tool movements over time. To conduct a trade transaction, you need confirmation signals from the trading systems you use! The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: RBA leaves rates unchanged. There is a possibility of a small upward correction of the euro Posted: 05 Mar 2019 02:59 AM PST The Australian dollar ignored decisions and statements of the Reserve Bank of Australia related to interest rates, and only slightly decreased in tandem with the US dollar. In general, the situation in the Australian economy is fairly stable, which does not cause significant concern to the regulator, allowing you to keep interest rates at current levels. According to the data, the Reserve Bank of Australia left the key interest rate unchanged at 1.50%, stating that the rates are in line with forecasts for GDP growth and inflation. The bank expects that inflation will continue to remain low and stable, while core inflation will grow in the coming years. During the speech, RBA Governor Philip Lowe said that the main factor of uncertainty in Australia is household consumption prospects, and now some indicators point to a slowdown in the economy in the second half of 2019. GDP growth in 2019 is expected to be 3%, as the labor market remains strong, and employment continues to grow significantly with a decrease in the unemployment rate, which could drop to 4.75%. The RBA Governor also noted that global trade tensions remain a source of uncertainty. As for the technical picture of the AUD / USD pair, trade is conducted near fairly large levels of support. A break of 0.7050 low could lead to a larger sale and aggravation of the downtrend. If the bulls manage to hold above this range in the near future, the formation of an upward correction will lead to a test of highs of 0.7140 and 0.7180. Data on the growth rate of activity in the service sector of China in February did not affect commodity assets, even though they were rather weak. According to the Caixin report, the PMI Purchasing Managers Index for China in February 2019 fell to 51.1 points from 53.6 points in January. Let me remind you that the indicator values above 50 indicate an increase in activity. The decline was due to the low number of new orders, in particular due to the weak growth of new export orders. Given the trade conflict, this decline is not surprising. Yesterday, the data on construction costs in the United States came, which decreased in December 2018 . According to the report of the US Department of Commerce, expenses decreased by 0.6% compared with the previous month and amounted to 1.293 trillion US dollars. Economists had expected spending to rise by 0.1%. Compared to the same period of the previous year, expenses increased by 1.6%. As for the technical picture of the EUR / USD pair, the pressure on the euro can significantly slow down in the event of another unsuccessful attempt to break through support for 1.1305, which is now being emphasized by large buyers of risky assets. Only a confident breakthrough of this range will allow the trading instrument to retain a downward impulse, which will lead to the area of 1.1270 and 1.1230 minimums. If it is not possible to break through 1.1305, the formation of a side channel and a slight upward correction of the euro are quite likely. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Mar 2019 02:59 AM PST 4-hour timeframe Technical details: The senior linear regression channel: direction - up. The younger linear regression channel: direction - up. Moving average (20; smoothed) - sideways. CCI: -152.6128 The GBP / USD currency pair continues its not too strong downward movement and broke the moving on March 5th. There is no new data on the subject of Brexit at the moment, but it seems that the entire growth potential of the British pound has been exhausted around the level of 1.3306. Of course, if we receive news of the signing of the "deal" on Brexit tomorrow, then the pound will most likely resume its upward movement, but so far such a scenario is unlikely. For example, the Deputy Foreign Minister of Poland Konrad Szymanski believes that the likelihood of a British exit from the EU without agreements is now as high as ever. But, according to him, the European side is doing everything possible to avoid such a scenario. We still believe that there are no weighty reasons and prerequisites for signing an agreement in the near future. In the same way as there is no reason to expect the British Parliament to endorse Theresa May's plan. Thus, now the pound sterling can again return to annual lows. From a technical point of view, the overcoming of the MA has reversed the downward trend in the instrument. There are no signs of completion of the downward movement at the moment. Tonight in the UK, there will be a speech by the head of the Bank of England, Mark Carney. By tradition, we expect from him a new portion of concerns about the "hard" Brexit. Nearest support levels: S1 - 1.3123 S2 - 1.3062 S3 - 1.3000 Nearest resistance levels: R1 - 1.3184 R2 - 1.3245 R3 - 1.3306 Trading recommendations: The pair GBP / USD began to move down. Thus, today, short positions with targets at levels of 1.3123 and 1.3062 are recommended. The bears are now taking the initiative, and the evening performance of Carney may put additional pressure on the pound. Buy positions are recommended to be opened in case of traders fix the pair back above the moving. In this case, the targets for buy orders will be the levels of 1.3245 and 1.3306. In addition to the technical picture should also take into account the fundamental data and the time of their release Explanations for illustrations: The senior linear regression channel is the blue lines of the unidirectional movement. The junior linear channel is the purple lines of the unidirectional movement. CCI is the blue line in the indicator regression window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heikin Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Mar 2019 02:59 AM PST 4-hour timeframe Technical details: The senior linear regression channel: direction - down. The younger linear regression channel: direction - up. Moving average (20; smoothed) - down. CCI: -175.9711 The EUR / USD currency pair on Tuesday, March 5, fixed below the moving average line and continues the downward movement that started earlier. Against the backdrop of the market's expectations of a US-EU trade agreement, the US dollar received tangible support. As we noted yesterday, this agreement will be beneficial for both sides especially for the States, since they did not have to sacrifice anything. Thus, paired with the euro currency, it turns out that the dollar is stronger since it has substantial fundamental support. Today in the European Union, the index of business activity in the services sector and the composite index of business activity in the industrial sector will be published. These indices are not significant but can show the current trend in the economy of the alliance. Also in the EU, data for retail sales in January will be known. After lunch, at the American trading session, similar European indices will be published. However, in America, the ISM index is also published, which is more important than Markit. From a technical point of view, the trend has changed to downward, so now short positions have become relevant. The Heikin Ashi indicator paints bars in blue, so there are currently no signs of the beginning of an upward correction. Nearest support levels: S1 - 1.1292 S2 - 1.1230 S3 - 1.1169 Nearest resistance levels: R1 - 1.1353 R2 - 1.1414 R3 - 1.1475 Trading recommendations: The EUR / USD currency pair has started a downward movement. Therefore, it is now recommended to trade short positions with the first goal of 1.1292. Manually reduce the short positions in the case of a turn up of the indicator Heikin Ashi. Considering the buy position will be possible not earlier than the reversal of the bulls above the moving average line. In this case, the trend in the instrument will change to ascending again. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The senior linear regression channel is the blue lines of the unidirectional movement. The younger linear regression channel is the purple lines of the unidirectional movement. CCI - blue line in the indicator window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heikin Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Indicator analysis: Daily review for GBP / USD pair on March 5, 2019 Posted: 05 Mar 2019 02:58 AM PST Trend analysis (Fig. 1). On Tuesday, the price will move down with the first lower target of 1.3135, which is the recoil level of 23.6% (blue dotted line). Fig. 1 (daily schedule). Comprehensive analysis: - indicator analysis - down; - Fibonacci levels - down; - volumes - up; - candlestick analysis - up; - trend analysis - up; - Bollinger lines - down; - weekly schedule - up. General conclusion: On Tuesday, the price will move down with the first lower target of 1.3135, which is the recoil level of 23.6% (blue dotted line). The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for March 05, 2019 Posted: 05 Mar 2019 02:57 AM PST EUR/USD has been trading sideways at the price of 1.1324. Intraday bullish divergence is in creation, be careful with selling.

According to the 30M time – frame, we found that every time EUR/USD makes a new low, buyers respond immediately which is a sign that sellers don't have enough power for larger selling. Another sign that the current downward movement is weak is the bullish divergence on the stochastic oscillator. Key short-term support is seen at 1.1308 and EUR/USD failed to test that support today. Key intraday resistance is seen at 1.1342. Trading recommendation: We are neutral on the EUR/USD pair but with the higher risk for the further downward side. We would like to see the successful breakout of resistance at 1.1342 to confirm the upward movement. If we see the breakout, we will open small long position with targets at 1.1380 and 1.1410. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment