Forex analysis review |

- GBP/USD approaching support, potential bounce!

- AUD/USD approaching support, potential bounce!

- USD/CAD approaching resistance, potential drop!

- This April is going to be idle again for the pound

- Apathy in the market: When will it stop?

- GBP/USD. April 16th. Results of the day. Brexit goes into the background. The pound is waiting for a new fall

- EUR/USD. April 16th. Results of the day. The pair is waiting for a report on inflation in the European Union

- Pound at a dead end: Labour and Conservatives cannot find a compromise

- April 16, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- April 16, 2019 : EUR/USD demonstrating significant bearish rejection around 1.1320.

- Elliott wave analysis of GBP/JPY for April 16, 2019

- Elliott wave analysis of EUR/JPY for April 16, 2019

- Fundamental Analysis of USD/JPY for April 16, 2019

- EUR/USD: focus on the euro area locomotive – Germany

- EUR/USD: a false move down and waiting for future releases

- EUR./USD analysis for April 16, 2019

- EURUSD: Euro buyers are preparing a new upward trend but it's not that simple

- EUR / USD plan for the US session on April 16. Euro returned to position after a report on the business sentiment

- USD/JPY analysis for April 16, 2019

- GBP/USD: plan for the American session on April 16. The pound remains in the wide side channel

- Bitcoin analysis for April 16, 2019

- Technical analysis of GBP/USD for April 16, 2019

- Technical analysis of NZD/USD for April 16, 2019

- Trading Plan for EUR / USD and GBP / USD pairs on 04/16/2019

- Trading recommendations for the EURUSD currency pair - placement of trading orders (April 16)

| GBP/USD approaching support, potential bounce! Posted: 16 Apr 2019 06:41 PM PDT GBPUSD is approaching our first support at 1.3000 (horizontal swing low support, 61.8% Fibonacci retracement , 61.8% Fibonacci extension ) where a strong drop might occur below this level to our first support level at 1.3136 (horizontal swing high resistance, 38.2% Fibonacci retracement ). Stochastic is also approaching support where we might see a corresponding bounce in price. Trading CFDs on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

|

| AUD/USD approaching support, potential bounce! Posted: 16 Apr 2019 06:39 PM PDT AUDUSD is approaching our first support at 0.7147 ( ascending channel support, 61.8% Fibonacci extension , 61.8% retracement ) where a strong bounce might occur to our first resistance at 0.7189 (horizontal swing high resistance, 100% Fibonacci extension ). Stochastic is also approaching support where we might see a corresponding bounce in price. Trading CFDs on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

|

| USD/CAD approaching resistance, potential drop! Posted: 16 Apr 2019 06:37 PM PDT USDCAD is approaching our first resistance at 1.3404 (horizontal overlap resistance, 76.4% Fibonacci retracement , 100% Fibonacci extension ) where a strong drop might occur below this level pushing price down to our major support at 1.3342 (horizontal pullback support, potential 61.8% Fibonacci retracement ). Stochastic is also approaching resistance where we might see a corresponding drop in price. Trading CFDs on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks. |

| This April is going to be idle again for the pound Posted: 16 Apr 2019 05:45 PM PDT For the second year in a row, the British currency is missing the once-solid seasonal April rally associated with dividend flows. Blame it on the long-suffering Brexit and the risk of participating in European elections. Earlier for more than a decade, the sterling rose in price against the dollar every April. It was a kind of tradition. The reasons for the pound's growth at this time of year were simple. Local companies repatriated "home" dividends. Most firms are transnational. Not surprisingly, after receiving dividends abroad, they converted them to pounds. This model was absolutely workable and even withstood a powerful shock in the form of the 2008 crisis. While the pound rose 0.4% in tandem with the US dollar since the end of March, over the past 13 years to 2017, the average sterling grew by 2.3% in April. Last April, the pound approached the peak after the 2016 Brexit, when a referendum was held before turning down. As a result, the GBPUSD pair ended April with a fall of 1.8%. London has achieved the extension of the country's exit date from the European Union, market concerns about the chaotic "divorce" process have decreased, but this does not mean that the worst is over. Now investors will have to face political risks, such as the upcoming local elections in the UK, and the Brexit deadlock is only delayed. Alarming moods are likely to return and would put even more pressure on the pound. In late April, the British currency may start a new wave of decline. |

| Apathy in the market: When will it stop? Posted: 16 Apr 2019 05:04 PM PDT Prolonged low volatility is alarming. Major currencies are traded so stably that traders have doubts on the health of their monitors. The current week will be shortened, ahead of Good Friday, and then Easter. This time in the forex market has always been difficult, and currency movements were confusing. Before the holidays, traders try to take profits, but in the Easter week there is often a formation of new short-term peaks or falls. They are usually followed by a reversal. Given the fact that on Friday all markets go away for the weekend, and some of them will be closed on Monday, then we are talking about false breakouts. Currently, currencies are stuck in consolidation ranges. Traders need good reasons to start moving. One of such catalysts can be the publication of a report on China's GDP. It is worth noting that this week is characterized by an abundance of data that is released today, as well as on Wednesday and Thursday. Releases that are worth paying attention to

The best currency on Monday was the British pound. Now it is facing a period of calm in connection with the Brexit postponement, which should positively affect the value of the pound. The tone throughout the week sets the rise in housing prices, but the sterling's fate will depend on employment, retail sales and consumer inflation. If the price level promises to increase, then retail sales may not reach the forecast. In the event of strong macroeconomic data, the GBP/USD pair has a chance to overcome the $1.32 mark. Perhaps the main outsider of the beginning of the week was the Canadian dollar. Falling oil pulled the loonie down. The weak economic situation also played its role. The Australian dollar, on the contrary, grew, while its New Zealand counterpart ignored the deterioration in business activity in the services sector. Perhaps it will shift the value of consumer inflation in New Zealand, which will be released on Wednesday. The indicator may well accelerate. On Tuesday, the focus was on the euro, everyone was waiting for the publication of the indices of the ZEW Research Institute and a breakthrough of the EUR/USD pair. It defended resistance at $1.1315, followed by a sharp decline. The single currency has fallen in price across the market after Reuters reported that ECB representatives consider the regulator's forecasts, according to which the recovery of the eurozone economy is expected in the second half of the year, as too optimistic. Market participants in sharp multidirectional movements extinguished both the "bullish" and the "bearish" impulse. Overall, the euro's resilience is impressive. The scope of fluctuations in the main pair is close to a record low, which was recorded 5 years ago. Then the currency was stuck in the range of $1.13. One of the reasons for the prolonged apathy in the market is the situation with interest rates in Europe and the United States. The US Federal Reserve does not plan to raise the cost of lending this year, and the ECB followed suit. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Apr 2019 04:44 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 91p - 77p - 60p - 82p - 52p. Average amplitude for the last 5 days: 72p (72p). On Tuesday, April 16, the British pound, since it failed to overcome the resistance level of 1.3119, has started a downward movement that could grow into a full-fledged downtrend. Recently, traders have not spoiled their activity, so the volatility of the GBP/USD pair has also decreased to values unusual for the instrument. However, this could not last forever. Now the pair has taken its first step towards resuming a downward trend. The most interesting thing is that from a fundamental point of view, it was the pound sterling that should have risen in price today, since all the UK macroeconomic data published today were not disappointing. The unemployment rate remained unchanged, 3.9%, the average wage, taking into account and excluding bonuses grew in February by 3.5% and 3.4% respectively, which is fully in line with experts' forecasts. Only the number of applications for unemployment benefits in March slightly exceeded the forecast value. However, the report on industrial production in the US turned out to be weaker than forecast. As for Brexit, there is no new information on this issue. New important data. Donald Tusk believes that Brexit will not be the end of the European Union, and Theresa May's government is preparing for a "hard" Brexit scenario. We believe that in the near future news on this topic will be much less than before, so traders need to switch to other factors. In particular, the technical ones, which have long predicted a new fall in the pound sterling, given its inability to overcome the Ichimoku cloud at least three times. Trading recommendations: The GBP/USD currency pair has failed to overcome the Senkou span B line and could resume its downward movement. Thus, it is now recommended to consider short positions with targets levels of 1,3017 and 1,2974. Buy orders are recommended to be considered not earlier than overcoming the level 1,3125 with a target of 1,3183. However, significant fundamental information will be needed in order to support the bulls. In addition to the technical picture, one should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Apr 2019 04:25 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 29p - 58p - 38p - 71p - 23p. Average amplitude for the last 5 days: 44p (52p). The EUR/USD pair ends the second trading day of the week with a downward correction to the critical line against a weak uptrend, which still persists. The rebound in prices from the Kijun-sen line could trigger a resumption of the upward movement, which is likely to remain extremely weak, given the lack of fundamental support for the euro currency. Today, a report on industrial production in the United States was released, which, as it turned out, declined by 0.1% in March against the forecast of +0.2% m/m. However, this did not prevent the US currency as a whole to rise in price. Thus, the instrument's trend, as already mentioned, will still be growth while volatility continues to be extremely low. Therefore, in any case, it is extremely difficult to trade with such movements. As for the forecast for the EUR/USD pair, now we can say one thing: without strong fundamental reasons, it is very difficult to expect a sharp increase in volatility. Daily movements of about 20-40 points do not add to the desire of traders to open long-term and medium-term positions. Although the flat itself is absent, trading the pair now is extremely unappealing. A report on inflation in the EU will be published tomorrow, which could have an impact on the pair. However, no one is waiting for a strong value of the consumer price index, so it is unlikely for the euro to receive support once again. Based on this, we expect the US dollar to grow more. And the consolidation of the pair below the critical line will indicate a change in the technical trend to a downward one. Trading recommendations: The EUR/USD pair continues to adjust at the beginning of the new week. Thus, it is recommended to open new purchases of the pair in the event that the price rebounds from a critical line with a target of a resistance level of 1.1338. Sell positions are recommended to be considered in small lots with targets at 1.1249 and the Senkou Span B line has not initially been overcome below the Kijun-sen line. The theme of the trade war is now having a very indirect effect on the pair, but this may change in the future. In addition to the technical picture, one should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound at a dead end: Labour and Conservatives cannot find a compromise Posted: 16 Apr 2019 03:57 PM PDT The UK labor market data provided slight support to the pound. Despite a significant increase in applications for unemployment benefits (28 thousand instead of the projected 17), the pair rose to the boundaries of the 31st figure. Traders drew attention to the positive aspects of the release: first, the unemployment rate remained at a record low level of 3.9%, and secondly, the level of wages rose to 3.5% in annual terms. All this made it possible for the pair to demonstrate a slight increase, however, the upward offensive petered out before it even started. Brexit reiterated itself: sluggish negotiations between Conservatives and Labourists have now become public, exposing existing problems. Let me remind you that on the eve of the last EU summit, at which Britain received another delay for Brexit, Theresa May called on Labour to sit at the negotiating table and work out a common position regarding the prospects of the "divorce process". The opposition agreed, after which the parties repeatedly held meetings behind closed doors. The information vacuum generated various rumors, but no one really knew in which direction the pendulum would swing further relations: either the politicians would take a step to approve the deal, or they would again disperse to the corners of the ring without any result. In my opinion, these negotiations are initially doomed to fail, because Theresa May should take into account not only the requirements of Brussels, but also the position of her party members, who for the most part reject any compromise solutions. Nevertheless, for almost two weeks, the parties remained silent, which is why traders had certain hopes for the completion of the negotiating epic. Today, these hopes have collapsed: if you believe the British press, the Labour Party and the Conservatives have not moved a jot in negotiations, or, to put it simply, they are deadlocked. This information was published in a fairly influential British publication, so the pound dramatically changed the course of its movement. Although the official representative of the Labour Party almost immediately denied the rumors, the market did not change its opinion: the GBP/USD pair is still under pressure from sellers. Actually, it is difficult to call it a "refutation": Laborites only reported that the negotiation process is still ongoing, and it is premature to talk about any conclusions. Point. Such an answer, a priori, could not satisfy market participants, since Labour did not disclose the main point: is there any progress in the negotiations or is the dialogue just a formality? Taking into account all previous attempts of the parties to find a compromise, it can be concluded that there is no progress, and therefore the chances of an approval of the transaction before May 22 are minimal. Let me remind you that Theresa May has designated an "internal deadline" until the end of May (despite the fact that Brussels postponed Brexit until October) in order not to take part in the elections to the European Parliament. The prime minister's motives lie on the surface: firstly, the very fact of participation in these elections looks, to put it mildly, ridiculous: Britain, on the one hand, declares its intention "to leave" the EU, on the other hand, takes part in the formation of the legislative body of the European Union. Secondly, the European elections are quite a costly event. In other words, the British will have to pay from their own pockets for politically useless elections - only because the government of Theresa May (and the Conservatives associated with it) cannot put an end to the negotiation process. It is not surprising that the rating of the Conservative Party has been steadily declining recently. Recent polls do not bode well to the Conservatives: if the elections were held today, the Tories would have suffered a crushing defeat, ceding power to the Labour Party, and Jeremy Corbyn would most likely have taken the prime minister's position. According to experts, the Labour Party would receive 296 seats, enter into a coalition alliance with the Scottish National Party and formed an appropriate government. Conservatives, in turn, can only claim 250 seats in Parliament at the moment. Thus, Laborites have no political motivation to play "giveaway" with the Conservatives: their goal is early elections. Therefore, the current negotiation process is unlikely to end with a happy ending, despite the external desire of the parties to seek a compromise. Today's events have once again confirmed this assumption, putting significant pressure on the British currency. In summary, it should be noted that Brexit again overshadowed macroeconomic reports. If, in the near future, rumors that the negotiation process has stumbled reappear on the market, the pound will continue to lose ground, despite the other fundamental factors. The support level is the bottom line of the Bollinger Bands indicator on the daily chart - this is 1.2980. To pass below this target, GBP/USD bears need a powerful information channel, so you need to be careful with short positions. The resistance level is the price of 1.3170 (Kijun-sen line), but it's not yet possible to reach this level - even if the March inflation data in Britain are better than expected. The material has been provided by InstaForex Company - www.instaforex.com |

| April 16, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 16 Apr 2019 10:53 AM PDT

On January 2nd, the market initiated the depicted uptrend line around 1.2380. This uptrend managed to initiate two successive bullish waves towards 1.3200 (Jan. 25) then 1.3350 (Feb. 27) before the bearish pullback brought the GBPUSD pair towards the uptrend on March 8th. A weekly bearish gap pushed the pair below the uptrend line (almost reaching 1.2960) before the bullish breakout above short-term bearish channel was achieved on March 11. Shortly after, the GBPUSD pair demonstrated weak bullish momentum towards 1.3200 then 1.3360 where the GBPUSD failed to achieve a higher high above the previous top achieved on February 27. Instead, the depicted bearish channel was established. Significant bearish pressure was demonstrated towards 1.3150 - 1.3120 where the depicted uptrend line failed to provide any bullish support leading to obvious bearish breakdown. On March 29, the price levels of 1.2980 (the lower limit of the depicted movement channel) demonstrated significant bullish rejection. This brought the GBPUSD pair again towards the price zone of (1.3160-1.3180) where the upper limit of the depicted bearish channel as well as the backside of the depicted uptrend line came to meet the pair. Currently, the price zone of 1.3140-1.3170 corresponds to the upper limit of the depicted bearish channel where another bearish movement may be initiated. Short-term outlook has turned into bearish towards 1.2920-1.2900 where the lower limit of the depicted channel is located. Trade Recommendations: Any bullish pullback towards 1.3150-1.3170 should be considered for another SELL entry. TP levels to be located around 1.3100, 1.3020 then 1.2950 - 1.2920. S/L to be located above 1.3190. The material has been provided by InstaForex Company - www.instaforex.com |

| April 16, 2019 : EUR/USD demonstrating significant bearish rejection around 1.1320. Posted: 16 Apr 2019 10:32 AM PDT Hello On January 10th, the market initiated the depicted bearish channel around 1.1570. Since then, the EURUSD pair has been moving within the depicted channel with slight bearish tendency. On March 7th, recent bearish movement was demonstrated towards 1.1175 (channel's lower limit) where significant bullish recovery was demonstrated. Bullish persistence above 1.1270 enhanced further bullish advancement towards 1.1290-1.1315 (the Highlighted-Zone) which failed to provide adequate bearish pressure. On March 18, a significant bullish attempt was executed above 1.1380 (the upper limit of the Highlighted-channel) demonstrating a false/temporary bullish breakout. On March 22, significant bearish pressure was demonstrated towards 1.1280 then 1.1220. Two weeks ago, a bullish Head and Shoulders reversal pattern was demonstrated around 1.1200. As expected, this enhanced further bullish advancement towards 1.1300-1.1315 (supply zone) where recent bearish rejection was being demonstrated. Short-term outlook turns to become bearish towards 1.1280 (61.8% Fibonacci) where price action should be watched cautiously. For Intraday traders, the price zone around 1.1280 stands as a prominent demand area to be watched for a possible Bullish pullback if enough bullish rejection is expressed. On the other hand, bearish breakdown below 1.1280 opens the way for further bearish decline towards 1.1250-1.1210. Trade recommendations : A valid SELL entry was suggested around 1.1300-1.1320. It's already running in profits. TP levels to be located around 1.1280 and 1.1250 and 1.1210. SL should be lowered to 1.1310 (entry level) to offset the risk. The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of GBP/JPY for April 16, 2019 Posted: 16 Apr 2019 08:49 AM PDT

After a nice run higher from 144.90 GBP/JPY is consolidating. We expect support near 145.95 will be able to protect the downside for renewed upside pressure, through minor resistance at 145.63 and more importantly a break above resistance at 147.00 that will call for a continuation towards 148.50 on the way towards 151.50. R3: 147.00 R2: 146,63 R1: 146.30 Pivot: 145.95 S1: 145.63 S2: 145.30 S3: 144.90 Trading recommendation: We are long GBP from 146.25 with our stop placed at 144.80. The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of EUR/JPY for April 16, 2019 Posted: 16 Apr 2019 08:45 AM PDT

After a nice run up from 124.76 EUR/JPY is consolidating in a narrow range between 126.15 - 126.80. Once this consolidation is complete, we will be looking for a break above minor resistance at 126.80 for a continuation higher towards 128.50 and 129.50 as the next upside targets. Ideally support at 126.15 will be able to protect the downside, but if broken a dip to 125.65 should be expected before up again. R3: 127.50 R2: 127.00 R1: 126.80 Pivot: 126.15 S1: 126.00 S2: 126.65 S3: 125.45 Trading recommendation: We are long EUR from 125.65 with our stop placed at 125.25 The material has been provided by InstaForex Company - www.instaforex.com |

| Fundamental Analysis of USD/JPY for April 16, 2019 Posted: 16 Apr 2019 07:39 AM PDT USD/JPY has been trading amid higher volatility making correctional moves. The pair is trading at near 112.00 area which prospects for a further decline in the coming days. The US economy is coping well that is proved by economic data, but the inflation rate remains below the 2% target that was mentioned by Boston Fed President Eric Rosengren. To deal with inflation tensions, the US central bank can purchase longer-term assets to reduce their rates, using its balance sheet. But as the US 10-year Treasury yields are still low by historical standards, policymakers may wish to hold more short-term securities in good times. If the Federal Reserve fails to achieve the 2% inflation target, recession iwill loom the US economy that might be avoided by changing short-term interest rates. The Consumer Price Index increased by seasonally adjusted 1.9% that is still below the 2% target. The US labor market is healthy while GDP is expected to rebound in the next quarter that is expected by the federal Reserve in the latest minutes. The unemployment rate was 3.8% in February while the production rate somehow rebounded in February. The US retail sales data will be published this week where the expectation of a 0.4% increase from the previous decline to -0.2%. The Industrial Production is expected to increase from 0.0% to 0.3% and the Building Permit is expected to come better. On the JPY side, the BOJ insists on its ultra-loose monetary policy aiming to achieve the 2% inflation rate. Recently BOJ Governor Kuroda vowed to continue waiting patiently about monetary easing as it is taking longer to achieve the inflation target. Consumer inflation is still sluggish in Japan. Today, Tertiary Industry Activity report of Japan was published with a slump to -0.6% from the previous value of 0.6% which was expected to be at -0.2%. Tomorrow Japan's Trade Balance is expected to show a deficit of -0.30 trln yen from the previous proficit of 0.12 trln yen. Meanwhile, USD has lost the impulsive momentum it had over JPY earlier. So, JPY is going to hold the upper hand over USD in the coming days. The latest reports from Japan were quite positive. The consensus suggests positive upcoming economic reports. In the forecasts come true, JOY will receive solid support. Now let us look at the technical view. The price is currently trading at near 112.00 with certain volatility. The price has been rejected off the same area several times. As the price remains firmly below 112.00 with a daily close, the pair will continue its uptrend with a target towards 110.00 area in the coming days.

|

| EUR/USD: focus on the euro area locomotive – Germany Posted: 16 Apr 2019 07:27 AM PDT The EUR/USD pair is still trading in a narrow price range in anticipation of the release of statistics for the eurozone, which may indicate the state of the economy of the currency bloc. It should be noted that for half a year, the EUR/USD pair has been in the range of 1.12-1.16. According to JP Morgan, the volatility of quotations fell to the lowest levels since mid-2014. According to experts, the reasons for the "sleepy" state of the major currencies should be sought in the passive position of the leading central banks, as well as in the gradual clarification of the situation with the US and China trade disputes. It is assumed that at least until the end of this year, the Fed will keep the interest rate at 2.5%, and the ECB will not begin to normalize monetary policy. "I think that the target range of the federal funds rate will not change until the autumn of 2020. This will improve inflation forecasts and ensure that it reaches the level of 2% or slightly higher," – said the President of the FRB of Chicago Charles Evans. According to Reuters, some ECB members doubt that economic growth in the eurozone will recover in the second half of the year. This increases the likelihood that the first interest rate hike by the ECB, which is expected next year, will be delayed even further. On Monday, Bloomberg reported that the United States does not intend to waive previously imposed duties on $50 billion worth of Chinese-made products to America, even if a trade agreement is concluded. At the same time, Washington would like the People's Republic of China to change the structure of goods subject to tariffs by $50 billion of goods. Such a state of affairs would allow the head of the White House, Donald Trump, to declare his victory in the trade war with China before the 2020 presidential election. Along with trade conflicts, Germany remains the focus of investor attention. It is known that the fish rots from the head, and the problems of the German economy can echo throughout the eurozone. According to the monthly report of the Center for European Economic Research (ZEW), the index of economic sentiment in Germany in April increased by 3.1 points against minus 3.6 points, noted in March. Analysts had expected the indicator to grow to 0.8 points. The indicator returned to the positive zone for the first time since March last year. "The improvement in the economic sentiment indicator in Germany is primarily due to the hope that the global economy will not develop as bad as previously expected. The postponement of Brexit also contributed to improved expectations," said ZEW President Achim Wambach. The fact that economic sentiment in Germany has been positive over the past 13 months suggests that the Eurozone's largest economy is gaining momentum again after nearly reaching recession at the end of last year. "After a long series of revisions in the direction of reducing forecasts for economic growth in Germany, perhaps it's time for the first revision in the direction of growth, albeit slight," – says specialist ING Carsten Brzeski. "It may turn out that the gloomiest forecasts for the growth of the European economy in the first quarter will have to be revised," said Angel Talavera, lead economist for the eurozone at Oxford Economics. Thus, if the Bundesbank's hopes for a gradual recovery in Germany's GDP are confirmed, the EU's faith in concluding a trade agreement with the US will grow, and statistics for the eurozone improve, the bulls of EUR/USD will have an excellent reason to go to the next storm of resistance at 1.132-1.1325. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: a false move down and waiting for future releases Posted: 16 Apr 2019 07:02 AM PDT The intermediate resistance level of 1.1320 turned out to be too tough for the bulls of the EUR/USD pair, at least, the buyers could not overcome this target impulsively. After Friday's growth, the pair got stuck in the flat, reacting to minor fundamental factors and market rumors. This morning, the EUR/USD bears intercepted the initiative and tried to return the price to the area of the 12th figure. They almost succeeded, though only for a short while: at the start of the American session, the pair turned 180 degrees and returned to the previously occupied positions in the area of 1.1310. This unsuccessful attempt of the southern movement is explained by weak arguments from bears. Traders reflexively responded to an unconfirmed insider about the mood among members of the ECB. So, according to American journalists, some members of the European regulator do not share the opinion of their colleagues about the recovery of the eurozone economy in the second half of this year. In their opinion, the economic forecasts of the Central Bank are too optimistic, since the slowdown in China's key indicators and the ongoing trade conflicts will continue to have a negative impact on the growth dynamics of Europe. They also questioned the accuracy of the forecast models that are used by the regulator – in their opinion, this model gives a distorted picture and does not fully take into account the revised macroeconomic indicators. Traders were concerned about this insider action: first, the split in the ECB is a negative signal a priori, and secondly, on the basis of the above forecast model, the members of the regulator calculate the approximate timing of tightening monetary policy. Today, the market expects to see the first rate increase in the first half of 2020 (the ECB is still limited to the wording "the rate will be maintained at least until the end of this year"). If the regulator suddenly revises its forecasts and/or the formula for calculating forecasts, then the approximate date of the rate increase may be postponed to a later date. Such prospects (albeit hypothetical) put pressure on a pair EUR/USD. But just a few hours later, the pair recovered: the market did not perceive the sounded signals as a threat. Firstly, even insider sources emphasized that such views are held by a "significant minority" of ECB members. Secondly, all decisions taken at the last meetings of the regulator were taken unanimously, which indicates the solidity (at least in external manifestation) of the opinions of members of the Board of Governors of the Central Bank. Thirdly, we should not forget about the recent speech by Mario Draghi, who rather optimistically assessed the prospects of the European economy. Speaking this weekend, the head of the ECB said that negative factors "gradually weaken their influence," so, in the second half of the year, the key economic indicators can again demonstrate growth. The bearish EUR/USD pair fell today and for another reason: business sentiment indices from the ZEW institute in Germany and throughout the eurozone were released in the "green zone". Let me remind you that the German indicator in March showed the strongest growth over the last year, although the indicator remained in the negative area. But traders still paid attention to the dynamics of its growth – and today this dynamics has been confirmed. For the first time since March 2018, the index exceeded zero and reached 3.1 points, significantly exceeding the expectations of experts (who predicted an increase to 0.9 points). In addition, the increase in the index in the eurozone as a whole also exceeded expectations, updating the 11-month maximum. Coming out of the negative area, the indicator reached 4.5 points against 1.2 forecast points. It is worth noting here that PMI data in the manufacturing sector will be published on Thursday, and according to preliminary forecasts, these indicators will also show positive dynamics. In other words, on the one hand, traders did not attach importance to disturbing rumors, but on the other hand, they reacted to the block of secondary macroeconomic statistics. As a result, the pair remained virtually in place, while the bears needed to lower the price below the support level of 1.1280 (where the middle line of the Bollinger Bands indicator coincides with the Tenkan-sen line). Now all the attention of traders will be focused on tomorrow's releases. First of all, we are talking about data on the growth of China's GDP: we will know the preliminary figures for the first quarter of this year. According to general estimates, the Chinese economy will again show signs of a slowdown: the volume of real GDP should be 6.3% (6.4% in the fourth quarter), and GDP growth from the beginning of the year to the reporting quarter should be 6.3% (6.6% - in the fourth quarter). If the Chinese are surprised by the growth of the economy, the risk appetite will increase again in the market, exerting strong pressure on the US currency. Also tomorrow you should pay attention to the publication of data on inflation in the eurozone (the final estimate for March). Let me remind you that the March figures were disappointing: the consumer price index dropped to 1.4%, while the core index fell to 0.8%. Both indicators were in the "red zone", not reaching the forecast levels. According to general forecasts, the final assessment should coincide with the preliminary one. But if the figures are revised upwards (especially for core inflation), the pair EUR/USD will receive a reason for its further growth. From the point of view of technology, the situation has not changed: the bulls of the pair need to keep the level of 1.1280, the bears, respectively, go lower. To confirm the northern movement, buyers need to overcome the resistance level of 1.1370 (the upper boundary of the Kumo cloud, which coincides with the upper line of the Bollinger Bands indicator on D1). The material has been provided by InstaForex Company - www.instaforex.com |

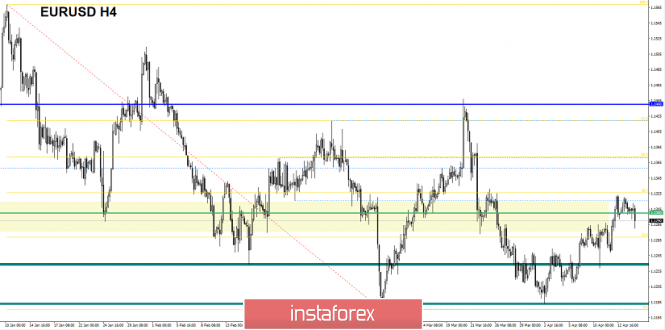

| EUR./USD analysis for April 16, 2019 Posted: 16 Apr 2019 06:21 AM PDT EUR/USD has been trading downwards. The price tested the level of 1.1279. Anyway, we expect further upside movement on the EUR.

According to the H4 time-frame, we found that there is rejection of the key short-term support level at the price of 1.1287, which is sign that selling looks risky and that buyers decided to load their buying positions. In our opinion, there is potential end of the downward correction (abc), which is another sign to watch for buying opportunities. Important resistance level is seen at the price of 1.1320. As long as the support at the price of 1.1287 is holding, we are bullish on the EUR. Trading recommendation: We are long on EUR from 1.1300 and target at the price of 1.1320. Protective stop is placed at 1.1277. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: Euro buyers are preparing a new upward trend but it's not that simple Posted: 16 Apr 2019 06:06 AM PDT The European currency managed to recover its positions after another attempt by sellers to resume the downward trend in the trading instrument. Good data on the ZEW index, which suggests a possible recovery of the German economy and the Eurozone in the 2nd quarter of this year, supported the demand for risky assets in the morning. According to the report, the prospects for the German economy grew in April of this year, despite a slight deterioration in the assessment of the current conditions. The report of the ZEW research Institute indicates that the index of economic expectations of ZEW in April 2019 rose to 3.1 points from a negative value of -3.6 in March this year. However, let me remind you that the average value of the index is 22 points. Economists had forecast the index to rise to 1.5 points in April. A similar index for the eurozone in April of this year was 4.5 points against the March value of -2.5 points. Economists had forecast an increase in the index in April to 1.5 points. ZEW noted that the improvement of sentiment is directly related to the hope for more positive growth and development of the situation in the global economy. The index was supported by a recent Brexit deferment of six months. However, we should not forget that other more important indicators, such as reports on orders and industrial production, still indicate the weakness of the German economy. As for the technical picture of the EURUSD pair, the formation of the upper boundary of the new downward channel continues to be seen on the chart, therefore, it is rather problematic to talk about the further growth of the euro. Only a confident consolidation above the resistance of 1.1315 will return an upward impulse to risky assets, which will lead to a test of new weekly highs around 1.1360 and 1.1390. The downward movement in euros, which can be formed at the beginning of this week, will be restrained by the levels of 1.1280 and 1.1255. The British pound has completely ignored today's report on the number of applications for unemployment benefits, which was slightly higher than economists' forecasts than expected. According to the data, the number of applications for unemployment benefits in the UK increased by 28,000 in March of this year, while economists had expected growth of only 17,000. In February, the same indicator showed an increase of 26,000. The average earnings in the UK for the period from December to February 2019 increased by 3.4%, which fully coincided with the forecast of economists. The overall unemployment rate from December to February remained unchanged at 3.9%. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Apr 2019 05:52 AM PDT To open long positions on EUR / USD pair, you need: A good report on the business sentiment of the eurozone allowed euro buyers to return to the level of 1.1293 and keep the pair in a side channel with the probability of continuing the uptrend. However, it is best to consider long positions after breaking through and consolidating above the resistance of 1.1315, which I paid attention to in my morning review. A breakthrough of this range will allow the formation of a new upward trend with the update of the highs at 1.1336 and 1.1358, where I recommend fixing the profit. When the retracement takes place in the support area of 1.1293, it is best to consider EUR/USD purchases from this range provided that a false breakdown is formed. Meanwhile, larger long positions are best opened to rebound from 1.1265 and 1.1232 lows. To open short positions on EUR / USD pair, you need: In the first half of the day, the bears formed a false breakdown in the area of resistance at 1.1315, which led to the downward movement of the euro. However, it failed to consolidate below the support of 1.1294, which maintains uncertainty about the future direction. Only a repeated test of 1.1294 can lead to a larger sale of EUR/USD to test the area of support at 1.1265 and 1.1232, where I recommend taking profits. With the EUR/USD growth scenario above 1.1315, short positions can be considered to rebound from the highs of both 1.1336 and 1.1358. More in the video forecast for April 16 Indicator signals: Moving averages Trade is conducted in the region of 30 and 50 medium moving ones, which indicates the side character of the market with a slight bearish advantage. Bollinger bands In the event of a euro decline in the afternoon, support will be provided by the lower limit of the Bollinger Bands indicator around 1.1293, against it will lead to a larger wave of euro decline. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY analysis for April 16, 2019 Posted: 16 Apr 2019 05:34 AM PDT USD/JPY has been trading sideways at the price of 111.98. Major resistance at the price of 112.14 is holding and buying USD/JPY at this stage looks risky.

According to the Daily time-frame, we found that buyers didn't have power to break key resistance at the price of 112.15, which is sign that downward correction might me possible. Yesterday, the day closed neutral (doji candle), which is confirmation of indecision near the important resistance. We do expect potential test of the Friday's low at the price of 111.60 before any further upside. Trading recommendation: We are short USD from 111.98 with tight protective stop at 112.15. Target is set at the price of 111.60. The position will be only active till end of the day. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on April 16. The pound remains in the wide side channel Posted: 16 Apr 2019 05:20 AM PDT To open long positions on GBP/USD, you need: The data that came out today on the unemployment rate in the UK was completely ignored by traders, even despite the small increase in the number of applications for benefits. The formation of a false breakout in the area of 1.3118 will be the first signal to sales, and if the pound rises above 1.3118, you can sell on a rebound from the new weekly high in the area of 1.3160. The main goal of the bears will be to decrease to the lower border of the channel to the area of 1.3052 and consolidate under it, which will lead to an update of the minimum in the area of 1.3021, where I recommend fixing the profit. To open short positions on GBP/USD, you need: The data that came out today on the unemployment rate in the UK were completely ignored by traders, even despite the small increase in the number of applications for benefits. The formation of a false breakout in the area of 1.3118 will be the first signal to sales, and if the pound rises above 1.3118, you can sell on a rebound from the new weekly high in the area of 1.3160. The main goal of the bears will be to decrease to the lower border of the channel to the area of 1.3052 and consolidate under it, which will lead to an update of the minimum in the area of 1.3021, where I recommend fixing the profit. Indicator signals: Moving Averages Trading is conducted in the region of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger bands In the scenario of the pound decline, the lower limit of the Bollinger Bands indicator in the area of 1.3075 will act as support, the breakthrough of which will lead to a sharp decline in the pound. The breakthrough of the upper boundary in the area of 1.3107 may increase the demand for GBP/USD. Description of indicators

|

| Bitcoin analysis for April 16, 2019 Posted: 16 Apr 2019 04:56 AM PDT BTC has been trading downwards. The price tested the level of $4.936. We are still expecting more downside in the next period

. BTC did fake breakout of the major resistance at the price of $5.330, which did set the done for the future decline. Most recently, there is the breakout of the bearish flag pattern (red line channel), which is sign that sellers are ready for the next downward movement. The key support is seen at the price of $4.640 (first pullback low after the climatic action in the background). In case that you see the breakout of the $4.640, next downward target will be set at $4.121. Trading recommendation: We are still short on the BTC from $5.130 with the targets at $4.660 and $4.121. Protective stop is placed at $5.460. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for April 16, 2019 Posted: 16 Apr 2019 04:46 AM PDT |

| Technical analysis of NZD/USD for April 16, 2019 Posted: 16 Apr 2019 04:43 AM PDT |

| Trading Plan for EUR / USD and GBP / USD pairs on 04/16/2019 Posted: 16 Apr 2019 03:58 AM PDT In general, the market stood still rooted to the spot yesterday as expected. This is not surprising since the macroeconomic calendar was completely empty and even politicians did not say anything about Brexit or negotiations between the United States and China on a trade agreement. In short, it will be longing without end. However, do not be discouraged because we are waiting for solid fun today and it all starts with data on the UK labor market. In fact, almost all indicators should remain unchanged. In particular, we are talking about the level of unemployment and the rate of growth of average wages excluding bonuses but wages with premiums can fairly please investors since their growth rates should accelerate from 3.4% to 3.5%. This means that employees are ready to recycle and give all the best. Consequently, the profit of companies is growing, and some of this profit falls a little to the workers themselves but most importantly, the profit of investors grows much stronger than the income of employees. In general, everything we love. Well, the number of applications for unemployment benefits can be reduced from 27 thousand to 20 thousand. Thus, the pound has every reason to be optimistic and its growth potential is quite good since at the end of last week he did not support the growth of the single European currency and he needs to catch up. But in the United States, the growth rate of industrial production can slow down from 3.6% to 3.2% and this is almost a fifth of the country's economy, which, we agree that it does not add optimism. Although, it has already become great again. The euro/dollar currency field reaching a value of 1.1323 slowed down and forms accumulation at 1.1300/1.1323, where the upper bound of Fibo 38.2 and the lower level of 1.1300 are situated. It is likely that the current amplitude will be maintained with movement to the upper boundary. The pound/dollar currency pair continues an ambiguous fluctuation in the range of 1.3050/1.3120, which reduces the volatility several times. It is likely to assume the preservation of the existing amplitude oscillation with a return to the point of 1.3120, where we have repeatedly felt a resistance. |

| Trading recommendations for the EURUSD currency pair - placement of trading orders (April 16) Posted: 16 Apr 2019 03:28 AM PDT Over the previous trading day, the euro / dollar currency pair showed an extremely low volatility of 22 points. As a result of which, to say the least, the quotation stood in one place. From the point of view of technical analysis, we had a cluster of 1.1300 / 1.1325, where the upper limit is Fibo 38.2, and the lower limit represents the level of 1.1300. The news background continues to flounder in the uncertainty of the "divorce" process of Brexit. The head of the European Commission, Jean-Claude Juncker in Strasbourg, gave a number of comments on this process. Juncker believes that Brexit will not be the end of the EU. I want to remind you that when the Eurogroup was created, Denmark, Sweden, and the United Kingdom refused to participate in this union. It was attended only by those who were interested, and this principle worked perfectly. At the same time, the head of the EC added: "I want to emphasize that the European Union does not intend to point the UK at the door. The European Union will not force Brexit and is ready to wait. The decision must come from London, the sooner he accepts it, the better. "

Today, in terms of the economic calendar , we have data on industrial production in the United States, where they expect a decline from 3.6% to 3.2%. Further development Analyzing the current trading chart, we see that a break through was made for the previously steady accumulation of 1.1300 / 1.1325, where a pulsed candle with a fixation phase has been drawn through that very cluster. It is likely to assume that if the inertial move continues, we can still be pulled aside to 1.1270 (Fibo 23.6).

Indicator Analysis Analyzing a different sector of timeframes (TF ), we see that in the short-term, intraday perspective, a downward interest has appeared against the background of the surge and earlier stagnation. The medium-term perspective maintains an upward interest. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation , based on monthly / quarterly / year. (April 16, was based on the time of publication of the article) The current time volatility is 33 points. If the inertial move still remains on the market, then the volatility may grow a little more, but it still remains within the daily average. Key levels Zones of resistance: 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support areas: 1.1300 **; 1.1180; 1.1000 * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment