Forex analysis review |

- USD/CHF has broken ascending trend line. Big drop coming!

- AUD/USD rising towards a strong resistance level. Potential for a strong reversal!

- USD/JPY near key resistance, we could be seeing a big drop!

- The Fed can knock down the dollar (weekly review of EUR/USD and GBP/USD from 05.20.2019)

- The pound risks going below $1.27 in the coming days

- Euro: just ahead of the fall

- Gold will benefit from the US and EU trade war - Morgan Stanley

- USD/JPY: Japan's GDP, "fear index" and the conflict over Huawei

- GBP/USD. May 20. Results of the day. Announcements of Theresa May's "bold" proposal have not yet found any evidence

- EUR/USD. May 20. Results of the day. Trump continues to put pressure on China

- Bitcoin analysis for May 20, 2019

- Technical analysis for EURUSD for May 20, 2019

- Gold technical analysis for May 20, 2019

- May 20, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- EUR./USD analysis for May 20, 2019

- Analysis of Gold for May 20, 2019

- EURUSD: the positive balance of the eurozone continues to decline

- GBP/USD: plan for the American session on May 20. Buyers are trying to start at least some correction

- EUR/USD: plan for the American session on May 20. The market is calm and unchanged

- May 20, 2019 : GBP/USD demonstrating oversold status around the current price levels.

- Technical analysis of USD/CAD for May 20, 2019

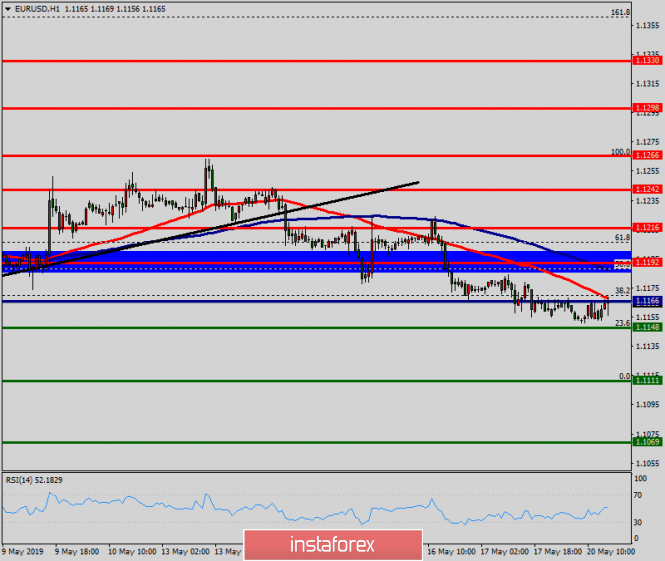

- Technical analysis of EUR/USD for May 20, 2019

- Euro clings to a straw

- How much more can the euro and the pound fall in price?

- Trading Plan for EUR/USD pair on 05/20/2019

| USD/CHF has broken ascending trend line. Big drop coming! Posted: 20 May 2019 06:41 PM PDT

Entry : 1.0123 Why it's good : Horizontal overlap resistance, 38.2% Fibonacci retracement, 100% Fibonacci extension Stop Loss : 1.0158 Why it's good : horizontal overlap resistance, 61.8% Fibonacci retracement Take Profit : 1.0008 Why it's good : 61.8% Fibonacci retracement, 100% Fibonacci extension, horizontal overlap support The material has been provided by InstaForex Company - www.instaforex.com |

| AUD/USD rising towards a strong resistance level. Potential for a strong reversal! Posted: 20 May 2019 06:39 PM PDT

Price is approaching resistance area at 0.6963 where it could potentially reverse to its support at 0.6903. Entry : 0.6963 Why it's good : horizontal pullback resistance, 100% Fibonacci extension, 50% Fibonacci retracement Stop Loss : 0.7021 Why it's good : horizontal swing high resistance Take Profit : 0.6903 Why it's good : 61.8% Fibonacci retracement, horizontal swing low supportThe material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY near key resistance, we could be seeing a big drop! Posted: 20 May 2019 06:37 PM PDT

USDJPY near key resistance, a drop to first support is possible Entry: 110.32 Why it's good : 100% Fibonacci extension, 38.2% & 61.8% Fibonacci retracement, horizontal swing high resistance Stop Loss : 111.051 Why it's good :61.8% Fibonacci retracement,horizontal overlap resistance Take Profit : 109.05 Why it's good: 100% Fibonacci extension, horizontal swing low support The material has been provided by InstaForex Company - www.instaforex.com |

| The Fed can knock down the dollar (weekly review of EUR/USD and GBP/USD from 05.20.2019) Posted: 20 May 2019 05:05 PM PDT Last week was much more successful for the dollar than the previous one, especially if you look at the single European currency, which seems to have tried to strengthen its position, but again started to weaken. Frankly, the reasons for dollar's success is largely due to the fact that the UK has once again remembered its threefold damn Brexit. Theresa May's so-called partners in the Conservative Party were the first to open their mouths and demanded that she immediately present an action plan for her resignation, which in itself sounds comical, and also submit the final version of the "divorce agreement" with the European Union to the court of the House of Commons as soon as possible. Their goal is very simple - to leave the EU as soon as possible. Which they can even without a deal, if it does not suit them. It also seems that no one doubts the fact that there will be no deal. After all, Theresa May spent almost two months negotiating with Jeremy Corbyn, but she never achieved anything. According to the Labour party, the prime minister does not intend to take their opinions into account, so as soon as the Conservatives set out their conditions, they immediately said that they would vote against the agreement with the European Union, if it would not be a compromise. But on a number of fairly serious and important issues, Labour and Conservatives have diametrically opposed positions. In other words, whatever agreement Theresa May has proposed, it will not suit either one or the other. As a result, Theresa May had no choice but to agree to put the Brexit plan into a vote, and then she will immediately resign. All this will happen before June 15. And not without the traditional cherry on top, the role of which was played by Boris Johnson, who at one time resigned because of his disagreement with the way Theresa May is negotiating Brexit. The same day that Theresa May announced her defeat, the former British foreign secretary immediately declared that he was ready to take the post of prime minister of the United Kingdom. But the most important thing in this whole story is that a "divorce" without an agreement really became a reality. This carries with it tremendous risks of uncertainty, both for the UK and for the entire European Union. But it is precisely this very uncertainty that investors fear the most. It's funny, but all the most dramatic events of this farce developed exactly at a time when retail sales and industrial production data were published in the United States, so investors were busy eating popcorn, not focusing on how Trump "makes America great again." The thing is that the growth rate of industrial production slowed down from 2.3% to 0.9%, and retail sales from 3.8% to 3.1%, which should have a negative impact on the dollar. But all were busy at much more exciting things. Fortunately, on other days, US statistics were purely positive. Thus, the number of construction projects starts increased from 1,268 thousand to 1,235 thousand, and the number of building permits issued from 1,288 thousand to 1,296 thousand. In addition, the number of initial applications for unemployment benefits decreased from 228 thousand to 212 thousand, while the number of repeated applications from 1,688 thousand to 1,660 thousand At the same time, the single European currency did not have a chance for a rematch, since European data was not surprising at all, and had completely coincided with preliminary estimates. Thus, the economic growth rate remained at 1.2%, and inflation accelerated from 1.4% to 1.7%. But everyone has already been ready for such a development. But the UK was pleasing, or rather upsetting, not only due to its exciting palace intrigues but also with its statistical data. Yes, you can, of course, say that the unemployment rate fell from 3.9% to 3.8%. But after all, this is data for March, whereas April data on applications for unemployment benefits showed an increase from 22.6 thousand to 24.7 thousand. That is, we are waiting for the growth of unemployment next month. But more importantly, the same March wages data makes us nervously recall where the drops of the heart were lying around at home. Indeed, the growth rate of average wages slowed from 3.4% to 3.3%. But this is not a reason to grab the heart. The trouble is that the rate of growth of average wages, taking into account bonuses, and this means remuneration for overtime, slowed down from 3.5% to 3.2%. These employees do not want to stay at work, and, in all likelihood, rush home to watch the next series of the most popular TV series of our time, which is Brexit. In any case, it is clear that even if it were not for the next scandals surrounding Brexit, the dollar had enough reasons to strengthen. Maybe not on such a scale, but nonetheless. So let's turn our attention to the US statistics, which will be published this week. The data itself will be quite small. Sales of new homes can decrease by 3.8%. Orders for durable goods are expected to fall by 1.8%. Moreover, there was a sharp decline in the number of applications for unemployment benefits, this number usually grows. Therefore, the dollar is worth worrying about. The Federal Reserve may add fuel to the fire. First, Jerome Powell comes up with a rather interesting topic called "Rising risks for our financial system." Here the name itself is scary, and if we still recall the regulator's endless lamentations about the risks associated with the trade war with China, and the recent mutual increase in customs duties between the United States and China, everything becomes much more interesting. Secondly, the text of the minutes of the meeting of the Federal Open Market Committee (FOMC) on open market operations will be published, from which indications can be removed not only on the dates for raising the refinancing rate, but even on such plans and reflections. In short, the dollar can only be helped by a miracle. The single European currency will not exactly play the role of a miracle worker, since no macroeconomic data is published in Europe itself. But data on inflation will be published in the UK, which, as an evil, should show its acceleration from 1.9% to 2.2%. However, the growth rate of retail sales should slow down from 6.7% to 4.5%, which is not compensated by any inflation growth. But we must remember that the dollar is significantly overbought, and European statistics have much more weight than the British one. So if British politicians do not strain again and do not come up with any more scandals with Brexit, nothing will be left for the dollar except to decline. Thus, we should expect a gradual growth of the single European currency to 1.1250. The pound's growth potential is much smaller, although it is more oversold. In many ways, expectations for British statistics are not that upbeat. Also, British politicians are completely unpredictable. Nevertheless, it is worth waiting for at least the beginning of the movement in the direction of 1.2850. |

| The pound risks going below $1.27 in the coming days Posted: 20 May 2019 04:39 PM PDT The British pound opened the week with a downside and remains one of the main outsiders of the foreign exchange market. Last week, the GBP/USD pair's loss exceeded 250 points. It is expected that in the coming session the pressure on the sterling will continue. However, on Monday during European trading, the British currency managed to recover a small part of the losses. GBP/USD was trading around $1.2755 after dropping to $1.2710 on Friday, the lowest since mid-January. On Sunday, Theresa May announced her intention to make a "bold new proposal" to British lawmakers. Despite the fact that her Brexit deal was rejected three times, the prime minister leaves no hope to enlist the support of Parliament before leaving office. Traders continue to follow developments around the UK exit from the European Union. Earlier last week, Labour's leader Jeremy Corbyn announced the failure of negotiations with Brexit Conservatives. He is confident that "interparty negotiations have gone as far as possible, however, have not yet helped overcome significant differences." In connection with the failure of the negotiations, the main oppositionist confirmed that his party would oppose the Theresa May deal. Voting is expected to take place in the House of Commons of the British Parliament in the first week of June. Another disastrous vote is likely to lead to the resignation of the current prime minister. With such a development, the chances of fulfilling a hard version of Brexit grows, and the risks of further slowing down the economy of the United Kingdom increase accordingly. Weak national statistics remain a factor of pressure on the British pound. A report on the consumer price index will be released this week. In case of another decline, the GBP/USD pair may fall below $1.27. With the development of a downward trend, quotes will meet support at around $1.2665. Meanwhile, the relative strength indicator implies that the pair is oversold. In this regard, the pound's correctional growth in the coming days is not excluded. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 May 2019 04:14 PM PDT The White House believes that you can sacrifice your ideas about the benefits of a weak dollar for the country's economy in favor of the revision of the terms of trade with Beijing. According to the presidential administration, China will sooner or later agree to a deal, since it is not in its interest to destroy its own economy. In most earlier years, China benefited from trade with the United States, and it is time to pay the bill. New terms of trade need to be convenient first and foremost for America. Thus, Donald Trump's campaign remarks begin to come to life. As a presidential candidate, he promised to be tougher with China than his predecessors. As for the dollar index, its fate will depend on whether trade wars - the United States or other countries of the world - do more harm. If we take into account that the consumer sentiment from the University of Michigan jumped to a peak in the last 15 years, then we can safely say that the slowdown in the first quarter was temporary. Consumer spending in the current quarter may accelerate, and this is a good sign for the economy and the US dollar. Over the weekend, the trade conflict escalated even more, which is increasingly beginning to correspond to the name "trade wars". If the USD/CNY quotes soar above the psychologically important mark of 7.00, then a repeat of the history of 2015 can happen. Then a massive outflow of foreign capital from the country was recorded. Now the scale of the disaster may be more serious than it was then. The futures market is extremely sensitive to the US-China conflict. By the end of this year, the risks of reducing the Fed rate increased to 70%, and the likelihood of monetary policy easing by the ECB in the first quarter of 2020 - to 40%. The most dramatic situation in the eurozone, since it is complicated by the elections to the European Parliament. The position of supporters of the French president was undermined due to mass protests in the country. The victory in the election of Emmanuel Macron in 2017 marked the beginning of a "bullish" trend for the euro. Since then, much has changed, euro skeptics are again in the spotlight. Italian politician Matteo Salvini, who said he was unwilling to comply with EU budget deficit requirements of 3%, demonstrates friendly relations with Marine Le Pen. Moreover, the increase in the yield differential of Italian and German bonds indicates an increase in political risks in the EU. Given the above, the fall in the EUR/USD quotes below $1.1165 looks quite plausible. The next step of euro bears could be its attack of support for $1,113. Changes in the technical picture also force us to forget about attempts to restore the EUR/USD rate. The main pair did not manage to leave the level above $1.1260. Despite the fact that the chances of continuing to consolidate remain, the risks of resuming the downward trend look stronger. The breakthrough of an important support at $1.1115 threatens to give impetus to the fall. First of all, $1.1050 and $1.0975 marks will be under the gun. On the whole, the EUR/USD's decline towards $1.0755 is not excluded. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold will benefit from the US and EU trade war - Morgan Stanley Posted: 20 May 2019 04:08 PM PDT Despite the fact that trade tensions in the world are increasing, and the global economy is on the verge of a recession, gold remains under pressure. Apparently, market participants still prefer other defensive assets, like the yen and the US dollar, which reduces the potential for the yellow precious metal to recover its value. Many investors think that Washington and Beijing may soon make a deal and the trade conflict between the two largest economies in the world will end. However, the hope for this is waning every day. Now Donald Trump will put pressure on Europe. According to some reports, the head of the White House plans to conclude an agreement with the European Union and Japan, according to which imports of cars from these regions to America will be restricted. This is very bad news, first of all for Germany, since the production of cars occupies an important part in the industrial sector of the country. According to the experts of the investment bank Morgan Stanley, the next trade conflict with the United States may begin with European partners. Experts believe that the trade war between Washington and Brussels will lead to a reduction in the key interest rate in the United States, from which the yellow precious metal can win. "EU counter-sanctions against American products may be more serious than Chinese ones. Under these conditions, the Fed will be forced to lower the interest rate in order to stimulate the country's economy, and this in turn will lead to a weakening of the US currency. Since the dollar and gold are inversely correlated to each other, the cost of the precious metal will receive support for growth, "said representatives of Morgan Stanley. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY: Japan's GDP, "fear index" and the conflict over Huawei Posted: 20 May 2019 03:52 PM PDT At the beginning of last week, the dollar-yen pair reached a 5-month low, recording 109.05. But then the price bounced off from the bottom of the price and returned to the 110th figure. Today, USD/JPY bears made another attempt to decline, dropping to the target of 109.80. Such fluctuations were a result of, above all, the external fundamental background, although today the Japanese yen was also supported by data on Japan's GDP growth. The Japanese economy surpassed the expectations of analysts and expanded by 0.5% in the first quarter, although most experts predicted a negative trend: according to their calculations, the indicator should fall into the negative area, reaching the -0.1% mark. Such a discord surprised traders, after which the pair impulsively descended into the region of the 109th figure. The fact is that the Japanese regulator took a wait-and-see attitude following the results of its last meeting: according to Haruhiko Kuroda, the Bank of Japan will adjust its policy "as the need arises". At the same time, he expressed hopes that the beneficial economic cycle remains in force, and this fact will affect GDP growth and inflation. Today's numbers have confirmed his words, reducing the likelihood of monetary policy easing in the near future. Although only recently, at the beginning of April, Kuroda assumed the probability of a decrease in the interest rate further into the negative area. At that time, he did not talk about a provisional guideline, but warned that such a scenario is quite likely. In the context of the stated intentions, today's release had a special meaning. Now the Bank of Japan, most likely, will keep a wait-and-see position at least until next spring, tracking the further dynamics of GDP and inflation (which, by the way, also shows a gradual growth). Such prospects provided background support for the Japanese currency. In general, the demand for yen was due to the growth of anti-risk sentiment against the background of deteriorating relations between the US and China. There is a so-called "fear index" (VIX, on the Chicago Stock Exchange of Options), which reflects traders' expectations of the US market. On May 13, when the USD/JPY pair reached a 5-month low, this index updated the annual high. By and large, the VIX reflects the level of demand for defensive instruments, which includes the yen. So, at the beginning of this week, the index began to show growth again. For comparison: today the value of VIX is located at 16.42, while in April it fluctuated in the range of 12-14 points. This dynamic is due to the escalation of conflict between the United States and China. The global trade war has narrowed to the situation around the Chinese company Huawei, which was recently included on the White House sanctions list. Now US technology can be sold or transferred to Huawei only if the Bureau of Industry and Security of the US Department of Commerce provides a special license for this. In addition, a giant like Google will have to request permission if it wants to install its Android operating system for Huawei gadgets. According to available information, Google has already introduced restrictions on the use of Android software on Chinese smartphones. Now the financial world froze in anticipation of a reciprocal step from China. According to the American press, Beijing is considering the option of termination of cooperation with those partners who agree to stop supplying Huawei. Wall Street responded to such prospects accordingly: at the beginning of the US session, the main indices sharply plummeted. At the time of this writing, the Dow Jones Industrial Average fell by 0.4%, the S&P 500 by 0.42%, and the Nasdaq Composite by 1.25%. In the foreign exchange market, demand for defensive assets increased, putting pressure on the USD/JPY pair. In addition, traders are concerned about the yuan's devaluation, which for two weeks fell against the dollar from 6.730 to 6.911. According to experts, such a trend will provoke Trump to a new wave of criticism: the US president has repeatedly accused China of deliberately cheapening its currency to ease the pressure of the US tariff policy. In other words, the general geopolitical tension suggests that interest in the yen may increase in the near future - especially if Beijing implements its threats regarding the situation with Huawei. From a technical point of view, the situation is as follows. On the daily chart, the USD/JPY pair is between the middle and lower lines of the Bollinger Bands trend indicator, as well as below the Kumo cloud, which indicates the priority of a downward movement. But the price is still above the Tenkan-sen line, which corresponds to the mark of 109.70. It is worth noting that when overcoming this level, the Ichimoku Kinko Hyo indicator will form a bearish "parade of lines" signal, which will indicate the resumption of a downward trend. In this case, the next target will be the 1.2125 mark - the bottom line of the Bollinger Bands indicator on the daily chart. If the political crisis in the relations between the two superpowers gets its continuation, the yen will quickly reach this level before the end of this week. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 May 2019 03:40 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 100p - 69p - 97p - 64p - 86p. Average amplitude for the last 5 days: 83p (77p). More than a day has passed since Theresa May's statement that she is preparing a new "bold" proposal for the Brexit deal to Parliament, but no new information has been received on this matter. Of course, May doesn't want to put her cards on the table ahead of time. On the other hand, once the announcement of this proposal was made, why not lift the veil? Most likely, Jeremy Corbyn is right, who believes that this time the document will not undergo any important additions. He has already managed to declare that his party still does not agree with Theresa May's current version of the deal with the European Union. It turns out that the main opposition party, before the moment when the new proposal was voiced, was already very skeptical of May. This is a significant moment.But from our point of view, there is an even more significant moment for the British pound, namely the complete absence of a correction on Monday, May 20, after five full days of a recoilless fall. Today, when the market could at least take part of the profits on previously opened short positions, it did not do that. This means that traders are waiting for the pound sterling to further fall and do not believe that in the near future the British currency will find fundamental support. The MACD indicator nevertheless turned up, which eloquently displays the picture of a "indicator discharge". Thus, it will be possible to determine the resumption of the downward trend by overcoming the Friday low. If the pair pound/dollar still starts to grow in accordance with the signs of the MACD indicator, then you can consolidate at the beginning of an upward correction. Trading recommendations: The GBP/USD currency pair is stuck in one place. Therefore, it is now recommended to maintain sell orders opened earlier, in order to support the level of 1.2653 and reduce them if the pair starts to grow. Buy orders can be considered in small lots only after when the price has been consolidated above the Kijun-sen line with the first target pivot level of 1.2933, which is not expected in the near future. In addition to the technical picture also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. May 20. Results of the day. Trump continues to put pressure on China Posted: 20 May 2019 03:25 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 42p - 43p - 47p - 58p - 29p. Average amplitude for the last 5 days: 44p (46p). As is often the case on Mondays, especially when there are no planned macroeconomic reports in countries whose currencies converge in one pair, volatility has dropped to almost zero. From the high to the low of the day, the pair passed (attention!) 18 points. Formally, the euro started a correction, since the last closed bar is bullish, and the MACD indicator moved up. In fact, this is a common market noise and a simple coincidence. Fundamental themes that are significant for the euro/dollar pair, such as the trade wars between the United States and the EU and China, now also have a special influence on the pair's movement. Donald Trump made a statement in his usual manner that American companies had already begun to leave China, since after the introduction of duties on Chinese imports, the importation of goods into the US became more expensive and has less demand in America. Of course, the leader of the United States is a bit crafty, since duties were introduced not more than a week ago, companies could hardly curtail production so quickly and transfer it to neighboring Asian countries. However, if China and the US cannot reach an agreement, which is more dependent on Beijing, then American companies can really begin to leave China. From a technical point of view, we would like to note that the pair has not begun to adjust. That is, even if traders do not currently have grounds to buy the euro, it is clear that markets do not have any reason to take profits on "dollar" positions. A large share of the probability of the formation of a downward trend will continue below 1.11. Trading recommendations: The EUR/USD pair formally started the correction. An update of today's low or a reversal of the MACD downward will indicate a resumption of the downward movement and short positions will again become relevant with a target level of 1.1123. It is recommended that you return to buying if traders manage to gain a foothold above the critical line. In this case, the first target for the longs will be the resistance level of 1.1228. In addition to the technical picture also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for May 20, 2019 Posted: 20 May 2019 11:09 AM PDT Bitcoin has been trading upwards in past 24h but the BTC hit overbought condition. Watch for selling opportunities.

According to the H4 time-frame, we found that there is the buying climax in the background followed by the up-thrust (reversal bar), which is sign that buying at this stage looks risky. Also, key swing high at the price of $8.312 is still we defended and as long as this swing high is holding, we will watch for selling opportunities. Additionally, we found that breakout of the support trendline (green trendline). Upward references are set: Swing high – $8.225 Major swing high – $8.312 Downward references are set at: Swing low – $7.030 Swing low 2– $6.820 The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis for EURUSD for May 20, 2019 Posted: 20 May 2019 09:51 AM PDT EURUSD remains in a bearish medium-term trend but shows signs of a possible bounce back towards 1.12. Trend remains bearish as long as price is below 1.1230-1.1260 but we find horizontal support from previous lows at the current trading area of 1.1150-1.1160.

Red line - major trend line resistance EURUSD is bouncing off the 1.1150 support area as shown by the red rectangle in the 4 hour chart above. EURUSD has made an important low back early May at current levels that lead to a move towards 1.1260. If this support area holds we could see a bounce towards 1.12-1.1230 where we find the first important resistance levels. Bulls need to break above 1,1260 in order to regain control of the trend. Until then every bounce is considered selling opportunity. Failure to hold above 1.1150 will lead price below 1.11. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold technical analysis for May 20, 2019 Posted: 20 May 2019 09:48 AM PDT Gold price has made a deep pull back from $1,302 just right on top of the major support level of $1,276 we have been talking about over the last few weeks. Gold price has stopped its decline and this gives hopes to bulls.

Blue neckline - short-term support Black line -trend line resistance Gold price is touching the green trend line support for the fifth time. Will we see another strong move higher? As we mentioned in previous posts, as long as Gold price is above $1,276 bulls will have hopes for a move towards 2019 highs and higher. However first they will have to recapture $1,300. So far we have a failed attempt and rejection at $1,300 which is a bearish sign. If this bearish sign is combined with a break below the green trend line support, we should expect Gold price to move lower towards $1,250. The material has been provided by InstaForex Company - www.instaforex.com |

| May 20, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 20 May 2019 08:53 AM PDT

On January 10th, the market initiated the depicted bearish channel around 1.1570. Since then, the EURUSD pair has been moving within the depicted channel with slight bearish tendency. Few weeks ago, a bullish Head and Shoulders reversal pattern was demonstrated around 1.1200. This enhanced further bullish advancement towards 1.1300-1.1315 (supply zone) where significant bearish rejection was demonstrated on April 15. Short-term outlook turned to become bearish towards 1.1235 (78.6% Fibonacci) then 1.1175 (100% Fibonacci level). For Intraday traders, the price zone around 1.1235 (78.6% Fibonacci) stood as a temporary demand area which paused the ongoing bearish momentum for a while before bearish breakdown could be executed on April 23. That's why, the mentioned price zone around 1.1235-1.1250 has turned into supply-zone to be watched for bearish rejection. Shortly-after, the market has failed to sustain bearish pressure below the price Level of 1.1175 during the previous weeks' consolidations. That's why, another bullish pullback was expected to occur towards the price zone of 1.1230-1.1250 where significant bearish pressure was expected to exist there. Since May 3, the EURUSD pair has been maintained above the depicted key-zone (1.1175) until Friday when a bearish breakout below 1.1175 was achieved. This enhances further bearish decline towards 1.1115 provided that no bullish breakout above 1.1190 is demonstrated on the H4 chart. Trade recommendations : Conservative traders who were advised to have a SELL entry around the supply zone (1.1235-1.1250) should lower their S/L towards 1.1190 to secure more profits. Remaining Target level should be projected towards 1.1115. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR./USD analysis for May 20, 2019 Posted: 20 May 2019 07:53 AM PDT EUR/USD has been trading downwards as we expected. Anyway, we expect potential rally on the EUR.

According to the H1 time-frame, we found that there is the breakout of the downward supply trendline, which is sign of the potential rally. We also found a rejection of the 20EMA at 1.1161, which is signal of the increase in demand for the EUR. Watch for potential buying opportunities with the targets at 1.1179 and 1.1182. Upward references are set: Swing high – 1.1180 Swing low acting like resistance – 1.1182 Downward references are set at: Intraday swing low – 1.1156 Swing low – 1.1150 The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for May 20, 2019 Posted: 20 May 2019 07:44 AM PDT Gold has been trading downwards as we expected. The price tested the level of $1.273. We still expecting more downside but we expect rally first.

According to the 30M time-frame, we found that there is the breakout of the downward channel and successful re-test, which is sign of the potential rally. We also found a strong bullish divergence on the MACD oscillator, which is another sign for the potential rally. Our advice is to watch for buying opportunities with the targets at $1.284 and $1.287. Upward references are set: Swing high – $1.284 Major high – $1.287 Downward references are set at: Intraday swing low - $1.274 Swing low - $1.273 The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: the positive balance of the eurozone continues to decline Posted: 20 May 2019 07:42 AM PDT The euro remains in the channel in the absence of important fundamental statistics and before the start of the elections to the European Parliament, which further discourage potential investors and traders. The report on the reduction of the eurozone current account surplus did not allow the bulls to return to the market and begin the formation of an upward correction. According to the European Central Bank, the current account surplus of the eurozone balance of payments in March amounted to 25 billion euros against 28 billion euros in February. Let me remind you that in March 2018, the surplus was 33 billion euros. The reduction in the balance is directly related to the slowdown in international trade and trade wars, which the United States unleashed 1.5 years ago. For 12 months, the positive balance in March amounted to 328 billion euros, representing 2.8% of eurozone GDP, against 376 billion euros, about 3.3% of GDP for the same period of the previous year. Today, the report of the Bundesbank was also published, in which a slowdown in German GDP growth in the 2nd quarter of this year is expected. A number of recent economic indicators clearly underline this. The bank is confident that Germany's GDP will stagnate in the 2nd quarter of 2019 since the negative factors that mainly prevail in the industry can only increase. The data on the US also did not make an impression on traders. The report of the Federal Reserve Bank of Chicago indicated that the index indicating economic activity declined in April of this year, indicating a slowdown in the economy. According to the data, the Chicago Fed index in April fell to -0.45 points against 0.05 in March (revised value). Let me remind you that the negative values of the index indicate that GDP is growing at rates below average. The average moving index of national activity for three months fell to -0.22 points. As for the technical picture of the EURUSD pair, it remained unchanged compared with the morning forecast. Further movement will depend on parliamentary elections. There is support in the area of 1.1135, below which it will be difficult for the bears to break through from the first rose. As for the upward correction, it will be limited by the resistance of 1.1205, where you can count on a return to the market of sellers of the European currency. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 May 2019 07:41 AM PDT To open long positions on GBP/USD, you need: Buyers made a false breakdown in the morning support area of 1.2723, but did not even manage to get to the resistance of 1.2766, near which the entire upward correction could have ended. In the case of a breakdown of the minimum of 1.2723 in the second half of the day, it is best to consider long positions to rebound from a larger level of 1.2672. The goal of the bulls remains the resistance of 1.2766, the consolidation of which will lead to the formation of a major upward correction with the update of the highs of 1.2812 and 1.2858, where I recommend fixing the profit. To open short positions on GBP/USD, you need: A break and consolidation below the support of 1.2723 will lead to a new wave of short positions in GBP/USD with an exit to the lows of 1.2672 and 1.2614, where I recommend taking profit. However, do not forget that the pound has been going down for two weeks without a single correction. Therefore, the best scenario will be sales after an upward correction from the resistance of 1.2766, under the condition of a false breakdown, or a rebound from the maximum of 1.2813. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which indicates the bearish nature of the market. Bollinger Bands The volatility of the indicator is low, which does not give signals to enter the market. Description of indicators

|

| EUR/USD: plan for the American session on May 20. The market is calm and unchanged Posted: 20 May 2019 07:41 AM PDT To open long positions on EURUSD, you need: The situation has not changed in comparison with the morning forecast. It is best to return to long positions after updating a large support level at 1.1138, from where you can expect an upward correction to return to a maximum of 1.1180, above which you can reach the resistance of 1.1205, where I recommend fixing the profits. If there is no rapid upward movement in the area of 1.1138, it is best to wait for the minimum test of 1.1112 and open long positions in EUR/USD there. To open short positions on EURUSD, you need: The bears have missed the support level of 1.1159, and now their main task will be to return and consolidate under it, which will keep the pair in the downward price channel and return sellers to the market who are counting on the minimum test in the area of 1.1138 and 1.1112, where I recommend fixing the profits. In the case of the euro growth in the second half of the day, it is best to look at short positions after updating the maximum of 1.1180 and 1.1205. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates a slowdown in the downward trend. Bollinger Bands The volatility of the indicator is low, which does not give signals to enter the market. Description of indicators

|

| May 20, 2019 : GBP/USD demonstrating oversold status around the current price levels. Posted: 20 May 2019 07:23 AM PDT  On March 29, the price levels of 1.2980 (the lower limit of the newly-established bearish movement channel) demonstrated significant bullish rejection. This brought the GBPUSD pair again towards the price zone of (1.3160-1.3180) where the upper limit of the depicted bearish channel was located. Since then, Short-term outlook has turned into bearish with intermediate-term bearish targets projected towards 1.2900 and 1.2850. On April 26, a bullish pullback was executed towards the price levels around 1.3000 (the bottom of March 29) where temporary bullish breakout was temporarily executed until May 13 when evident bearish rejection was demonstrated. Hence, a bearish Head and Shoulders pattern was expressed on the H4 chart with neckline located around 1.2980. That's why, the price zone of 1.3030-1.3060 turned to become a prominent supply-zone where a valid bearish entry was offered two weeks ago. Bearish persistence below 1.2980 (Neckline of the reversal pattern) enhanced further bearish decline. Initial bearish Targets were already reached around 1.2900-1.2870 (the backside of the broken channel) which failed to provide any bullish support for the GBPUSD pair. Currently, The GBPUSD pair looks oversold around the current price levels (1.2730). However, no signs of bullish recovery have been manifested yet. That's why, bullish breakout above 1.2756 is needed to enhance the bullish side of the market on the short-term. Trade Recommendations: For those who had a valid SELL entry around the price levels of (1.3035-1.3070). It's already running in profits. S/L should be lowered to 1.2765 to secure more profits. Conservative traders should wait for another bullish pullback towards 1.2870-1.2905 (newly-established supply zone) to look for valid sell entries. S/L should be placed above 1.2950. The material has been provided by InstaForex Company - www.instaforex.com |

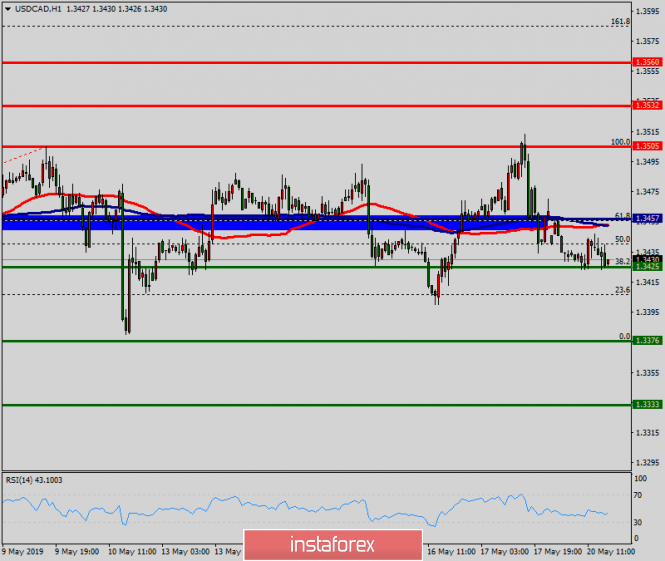

| Technical analysis of USD/CAD for May 20, 2019 Posted: 20 May 2019 07:05 AM PDT |

| Technical analysis of EUR/USD for May 20, 2019 Posted: 20 May 2019 07:01 AM PDT Overview: The EUR/USD pair continues to move downwards from the level of 1.1192. Last week, the pair dropped from the level of 1.1192 to the bottom around 1.1111. Today, the first resistance level is seen at 1.1192 followed by 1.1216, while daily support 1 is seen at 1.1111. According to the previous events, the EUR/USD pair is still moving between the levels of 1.1192 and 1.1111; for that we expect a range of 81 pips. If the EUR/USD pair fails to break through the resistance level of 1.1111, the market will decline further to 1.1069. This would suggest a bearish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 1.1069 with a view to test the second support. On the other hand, if a breakout takes place at the resistance level of 1.1192 (major resistance), then this scenario may become invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 May 2019 05:28 AM PDT The elections to the European Parliament, the release of data on business activity in Germany, the Eurozone for May and the publication of the minutes of the April meeting of the ECB make the euro the main contender for the role of the most interesting currency of the week by May 24. Despite the unfavorable external background, the "bulls" on EUR/USD are clinging to the trading range of 1.1135-1.1265, the break of the lower border of which can lead to the continuation of the southern hike of the main currency pair. Looking at how the euro fell against the background of the growing probability of a disorderly Brexit and the escalation of the US-EU trade conflict in 2018, you wonder why it does not do it now. Indeed, the States are ready to impose duties on all Chinese imports, Beijing is not eager to resume negotiations, stock indices and the currency of China are falling rapidly, while Donald Trump's belief at the conclusion of the deal supports the S&P 500. The US economy looks strong, while China has to use large-scale fiscal and monetary stimulus in order not to slow down GDP growth to less than 6%. Theoretically, the reduction in external demand will hit German exports and the eurozone economy as a whole, forcing the ECB to weaken monetary policy. The futures market has increased the chances of lowering basic rates in the first quarter of 2020 to 40%, and concerns about the "dovish" rhetoric of the minutes of the April meeting of the Governing Council keep the "bulls" on EUR/USD in check. The growing risks of monetary expansion and trade war are weighty "bearish" arguments for the euro. I associate its stability with low volatility, abnormal in the conditions of growth of global political risk. The dynamics of the volatility of the euro and political risks Indeed, when eurosceptics in the run-up to the elections to the European Parliament raise their heads, and in Britain, the probability of Theresa May's resignation from the post of Prime Minister is growing, it is quite unusual to see a more or less stable euro. According to the leader of the Northern League Salvini, Italy will abandon the EU's demand for 3% of the budget deficit from GDP if its party improves its position in the elections. The coming to power in the government of former foreign minister Boris Johnson could bring down GBP/USD to 1.2, according to a forecast by Societe Generale. Given the close correlation of the pound and the euro, we can only assume at what levels EUR/USD will be quoted in this situation. The dynamics of the euro and the pound The situation with business activity looks interesting. German and other European purchasing managers already knew about the escalation of the conflict between the US and China, so PMI may, in fact, be worse than forecasts of Bloomberg experts, which will put pressure on the euro. On the other hand, the fact that the White House decided to postpone the increase in import duties on cars from the EU for 6 months will allow the companies of the Old World to sigh with relief. Technically, a breakthrough of the lower limit of the consolidation range of 1.135-1.1265 within the activation pattern "splash and a shelf" will increase risks in the implementation of the target at 161.8% according to the model AB=CD. It corresponds to 1.1. The material has been provided by InstaForex Company - www.instaforex.com |

| How much more can the euro and the pound fall in price? Posted: 20 May 2019 05:28 AM PDT According to the results of the previous week, the dollar index showed maximum growth since the beginning of March. The tension in trade relations between Washington and Beijing remains in the focus of investors' attention. Although trade war harms both the US and the rest of the world, there is no doubt that the US is holding the blow more easily, which explains the continuing demand for the US currency. On Wednesday, the minutes of the FOMC meeting in May will be published in the US. The so-called "minutes" of the Fed can have a strong impact on the dollar if the protocol contains a forecast for the US economy for the current and next years, or will be given relatively clear guidelines for the future monetary policy of the Fed. The more optimistic the forecasts and statements of the regulator are, the stronger greenback will be able to strengthen against its main competitors. The euro retreated throughout the previous trading week. Despite the fact that the data on the eurozone cannot be called strong, the fall of the single European currency is largely due to the possible effect of a slowdown in global growth on the economy of the currency bloc. It should be noted that for most of this year, the ECB did nothing that warned about these threats. If trade relations between the United States and China do not improve over the next few weeks, the upcoming meeting of the European regulator promises to be bleak. This week, indicators of business activity in the eurozone and the IFO report on Germany will be published. If the data is weak, the EUR/USD pair may fall to the level of 1.10. If the numbers are strong, then the euro may form a springboard for further recovery. For the pound, the main problem is still Brexit. There is no progress in this process, which increases the risks of implementing the "hard" scenario. Last weekend, British Prime Minister Theresa May said that she intends to propose a new version of the "divorce" agreement with the EU for consideration by the House of Commons. According to her, this will be a new, bold proposal with an improved package of measures. The head of the Cabinet of Ministers believes that this option should be supported by parliamentarians. In the coming week, there will be April releases on inflation and retail sales in the country. It is expected that consumer spending may increase, but inflationary pressure should be restrained. Despite the fact that the mark of 1.2700 is an important support level for GBP/USD, we can not exclude the fall of the pair below 1.26. This week, investors will also follow the elections to the European Parliament, which will be held from May 23 to 26 and can be the decisive moment for the "United Europe" project. According to most experts, the party of eurosceptics will significantly improve their positions, which may complicate the task of choosing the next head of the European Commission and approval of the EU budget. The defeat of the UK ruling Conservative Party can accelerate the resignation of Prime Minister T. May and increase the chances of disordered Brexit. At the same time, the high performance of the Italian "League of the North" may be the reason for the dissolution of the coalition government and the holding of new elections in the country. It is assumed that good results for the extreme right and the extreme left will be bad news for the euro and the pound. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Plan for EUR/USD pair on 05/20/2019 Posted: 20 May 2019 04:06 AM PDT The big picture: The market is waiting for momentum. On Wednesday there will be "minutes" from the last Fed meeting. There is no important news. On Wednesday, there will be "minutes" from the last Fed meeting. In addition, there is a halt to the US-China trade negotiations but it is unlikely to play strongly until mid-June. EUR / USD: We sell from 1.1130 . We buy from 1.1225. |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment