Forex analysis review |

- June 28, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Gold 06.28.2019 - Key sell zone - resistance got protected

- Euro disobeyed ECB

- GBP/USD 06.28.2019 - Major cluster on the test, selling opportunity

- June 28, 2019 : Based on the current bullish breakout, the GBP/JPY is heading towards 138.50.

- BTC 06.28.2019 - Bear flag in creation, more downside yet to come

- "Fictitious" meeting of Trump and Xi will end in nothing

- The euro is waiting for the steepest drop in 17 months and the dollar is firmly on its feet

- Three vectors that set the direction of the oil market

- GBPSGD: GBP to gain momentum over SGD. June 28, 2019

- The market froze in anticipation of the outcome of the G20 summit and statistics from the US (We expect the growth of pairs

- Trading Plan for EUR/USD pair on 06/28/2019

- USD / CAD. The southern trend is still in force: on the basis of the G20, the price may collapse under 1.30

- EURUSD and G20: the United States and China are unlikely to find understanding in trade relations that will hit the US dollar

- Technical analysis of USD/CHF for June 28, 2019

- Burning forecast 06.28.2019 EURUSD and trading recommendation

- Bitcoin. Bitcoin volatility remains very high

- Wave analysis of EUR / USD and GBP / USD for June 28. Both currency pairs came to a standstill before the G20 meeting

- Technical analysis of AUD/USD for June 28, 2019

- A gift for Trump (a review of EUR / USD and GBP / USD on 06/28/2019)

- GBP/USD: plan for the European session on June 28. Sellers of the pound cannot cope with the support in the area of 1.2664

- EUR/USD: plan for the European session on June 28. The further direction will depend on the results of the G20

- Forecast for EUR/USD and GBP/USD on June 28. Will inflation continue to decline in Europe?

- BITCOIN to continue decline? June 28, 2019

- NZDUSD: RBNZ rate decision likely to boost USD. June 28, 2019

| June 28, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 28 Jun 2019 09:13 AM PDT

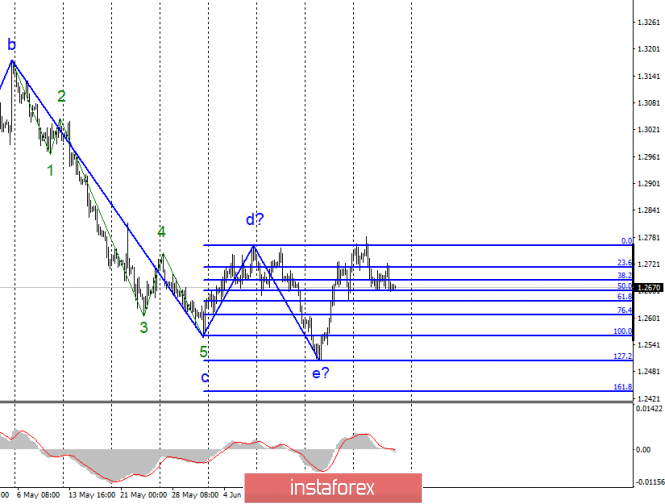

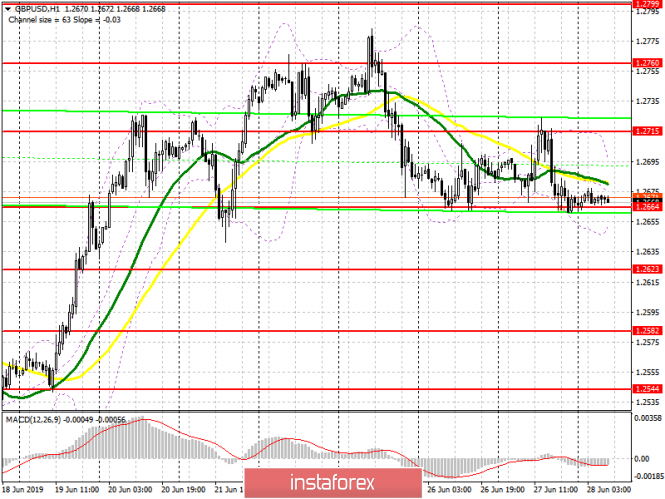

Since May 17, the depicted sideway consolidation range has been established between 1.2750 - 1.2570. On June 4, temporary bullish breakout above 1.2650 was demonstrated for a few trading sessions. This enhanced the bullish side of the market towards 1.2750 (consolidation range upper limit) which has been preventing further bullish advancement up till now. On June 14, recent temporary bearish decline was demonstrated below 1.2600 hindering the mentioned bullish scenario for some time before bullish breakout could be re-achieved last week. For the bullish side of the market to remain dominant, bullish persistence above 1.2750 (consolidation range upper limit ) should be achieved by the bulls. Bullish breakout above 1.2750 is mandatory to bring further bullish advancement towards 1.2840 and 1.2900. Recently, the GBP/USD failed to establish a successful bullish breakout above 1.2750. Instead, early signs of bearish rejection have been manifested (Head & Shoulders reversal pattern with neckline located around 1.2650). A quick bearish pullback towards 1.2650 was expected shortly. Bearish breakdown below 1.2650 (reversal pattern neckline) confirms the reversal pattern with bearish projection target located at 1.2510. However, For conservative traders, SELL positions shouldn't be considered around the current price levels unless bearish breakout below 1.2570 becomes confirmed on higher timeframes (which is low probability). On the other hand, a bullish position is preferred around the current price levels. Bullish breakout above 1.2750 is mandatory as a valid BUY signal. Trade Recommendations: Intraday traders can have a valid BUY Entry upon bullish breakout above 1.2750. T/P levels to be located around 1.2840, 1.2900 and 1.2940. S/L should be placed below 1.2680. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 06.28.2019 - Key sell zone - resistance got protected Posted: 28 Jun 2019 08:58 AM PDT Industry news: "A softening in the core PCE deflator earlier this year was a big factor in the Fed's shift to a more accommodative stance. That key measure of inflation rose to 1.6% today and the sequential increase in recent months suggests modestly firmer footing in Q2, though not enough to dissuade the Fed from cutting rates." Trading recommendation:

Gold did hit and then rejected of the strong resistance at the price of $1.422, which is sign that sellers are still present and there is not enough buying power for new highs on the Gold. Red rectangle – Important resistance ($1.423) Green rectangle- Support 1 ($1.400) Green rectangle – Support 2 ($1.380) Gold has been trading sideways in the well defined trading range between the price of $1.423 (resistance) and $1.380 (support). The price is near the resistance and you should watch for potential selling opportunities. Stochastic oscillator is flipping down and that is another good sign that there is potential for more downward movement. As long as the Gold is trading below the $1.437, I would watch for selling opportunities on the rallies. Sell zone – $1.423 Profit zones – $1.400-$1.380 The material has been provided by InstaForex Company - www.instaforex.com |

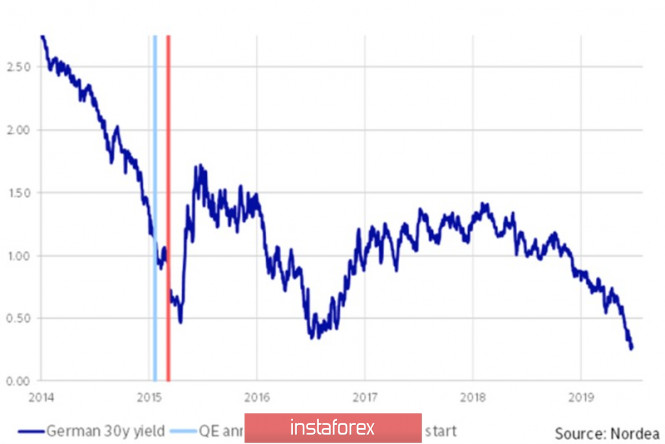

| Posted: 28 Jun 2019 08:40 AM PDT The euro felt very confident at the beginning of the last week of June contrary to Mario Draghi's hints at a weakening of monetary policy, as well as weak statistics on European inflation, business activity in the manufacturing sector and the German business climate. Investors have adopted the depth of the potential monetary expansion of the leading central banks of the world. If the interest rate on deposits of the ECB is practically nowhere to reduce, it already amounts to -0.4%, then the Fed has room to roam. The figure of 2.5% is quite a decent figure. It does not matter that borrowing costs in the Old and New World were 4% and 5% at the beginning of the previous cycles of monetary easing. As a rule, expectations of lower rates or resuscitation QE is "bearish" factor for any currency. The history of 2015 shows that rumors about the launch of a quantitative easing program led to a collapse in German bond yields and a decline in the euro. But as soon as the ECB began to buy assets, German debt rates went up. Many banks were selling previously purchased securities to the regulator. The principle of "buy on rumors, sell on facts" led to an increase in the yield of German bonds and allowed the EUR/USD pair to maintain stability for some time, despite the Fed's willingness to begin the monetary policy normalization cycle. Dynamics of bond yields in Germany However, very soon everything returned to normal as the euro collapsed to the mark of $1.05and then to $ 1.035. History repeats itself and investors have the right to rely on the main currency pair to sink after Mario Draghi in Sintra, Portugal, started talking about lowering rates and QE. According to Bloomberg experts, the deposit rate will fall from -0.4% to -0.5% in September. About 42% of respondents expect to resume the program to purchase assets of €30 billion per month. Alas, but if in 2015 the Fed hinted at an increase in the federal funds rate, now it is ready to lower it. At the same time, the potential of the monetary expansion of the American central bank is broader than that of its European colleagues. This allowed the EUR / USD "bulls" to push quotes to the area of 3-month highs. The further fate of the pair will depend on the outcome of the meeting between Donald Trump and Xi Jinping at the G20 summit in Japanese Osaka and on US labor market statistics for June. Only a breakthrough in relations between the States and the Celestial Empire will allow the dollar to recover. In this scenario, the chances of a Fed rate cut will fall and the yield on US bonds will rise. If employment also pleases, the EUR/USD pair will start to move confidently to the bottom of the trading range at 1.11-1.14. Unfortunately, the chances of making a deal solely due to the meeting of the two presidents are not so great. The most likely scenario is the desire of the parties to continue negotiations, which will allow investors to shift investor attention to non-farm payrolls. Technically, the implementation of the"Expanding wedge" and "Diamond-shaped bottom" patterns indicate the transition of control in the hands of "bulls". The targets for the upward movement are the levels of 1.1445 (target at 161.8% for the model AB = CD) and 1.157 (target for Wolfe Waves). EUR / USD daily chart |

| GBP/USD 06.28.2019 - Major cluster on the test, selling opportunity Posted: 28 Jun 2019 08:39 AM PDT Forex Industry news: According to the Federal Reserve Bank of New York's latest Nowcasting Report, the U.S. economy is expected to expand by 1.3% in the second quarter and 1.2% in the third quarter of 2019. "News from this week's data releases decreased the nowcast for both quarters by 0.1 percentage point.," NY Fed said. "Negative surprises from housing data and the Advance Durable Goods Report accounted for most of the decrease." The greenback didn't pay any attention to the data and the US Dollar Index was last down 0.14% on the day at 96.08. Trading recommendation:

GBP has been trading higher for almost whole London session but it found strong resistance at the price of 1.2730/ I did mention this strong resistance cluster yesterday. The strong rejection of the resistance is sign that there is no real buying for for the GBP, which may result with new down movement. Red rectangle – Important resistance (1.2725) Green rectangle- Support 1 (1.2666) Green rectangle – Support 2 (1.2563) GBP has been trading sideways in the well defined trading range between the price of 1.2725 (resistance) and 1.2666 (support). The price is at the resistance and you should watch for potential selling opportunities.IN the background, there is broken wedge pattern, which is important clue for me that sellers are still in control. Sell zone – 1.2710-1.2730 Profit zone – 1.2666 – 1.2563 The material has been provided by InstaForex Company - www.instaforex.com |

| June 28, 2019 : Based on the current bullish breakout, the GBP/JPY is heading towards 138.50. Posted: 28 Jun 2019 08:32 AM PDT

On May 3rd, the GBPJPY pair initiated the depicted bearish movement channel around 146.45 On March 21st, another visit towards the upper limit of the same channel (141.70) was demonstrated. Since then, the depicted downtrend/channel has been intact until June 4 when the pair failed to achieve a new low below 136.50. This was followed by a bullish breakout off the depicted bearish channel. Moreover, a short-term uptrend line was established around the same Price levels (136.50) until June 12 when the latest bearish pullback was initiated towards 136.50 (23.6% Fibonacci Expansion) then 135.44 (78.6% Fibonacci Expansion). Recently, obvious bullish recovery has been manifested. Bullish persistence above 136.50 is currently being demonstrated on the H4 chart. Technically, a quick bullish advancement should be expected towards 138.00 initially where the backside of the broken uptrend is currently located. On the other hand, H4 re-closure below 136.50 hinders any bullish momentum enhancing the bearish side of the market towards 135.44 and probably 135.03 for further retesting. Trade Recommendations: Short-term outlook remains bullish as long as bullish persistence above 136.50 is maintained on the H4 chart. Conservative traders can wait for the current bullish breakout above 136.95 to be confirmed as a valid BUY entry. Initial Target levels should be located around 137.80 and 138.50. Any bearish breakdown below 136.00 invalidates the mentioned bullish scenario. The material has been provided by InstaForex Company - www.instaforex.com |

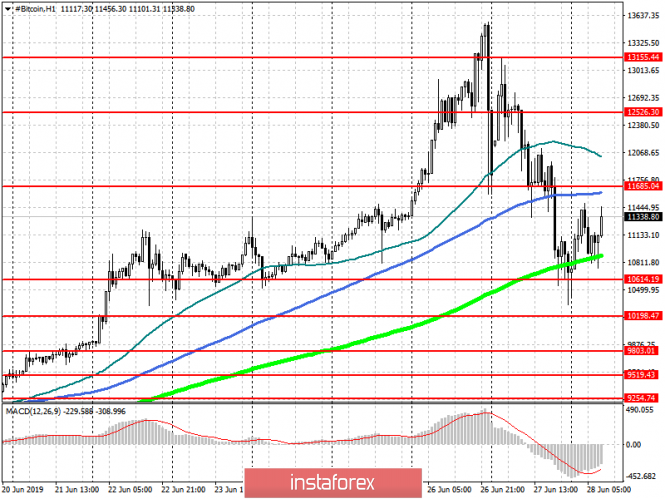

| BTC 06.28.2019 - Bear flag in creation, more downside yet to come Posted: 28 Jun 2019 08:15 AM PDT Crypto Industry news: According to reports in the crypto press Thursday, cryptocurrency exchange Binance is talking to Facebook about getting involved in the social media giant's upcoming Libra project. Finance Magnates says it spoke to Binance at the FinTech Junction event in Israel on Thursday, with the exchange's CSO, Gin Chao, saying that early discussions have taken place with Facebook over a possible future listing of the libra token. Chao said that as Libra will be on a private blockchain initially, it won't need external liquidity. However, Facebook may ultimately desire a secondary market. Trading recommendation:

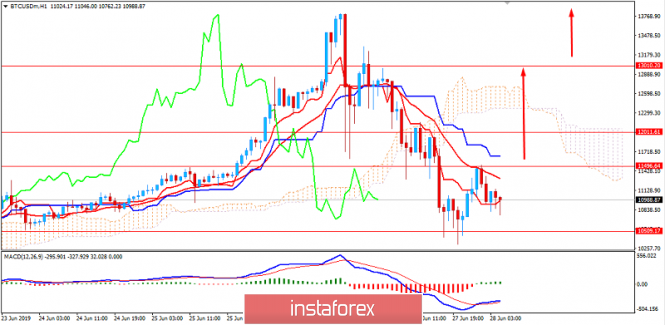

BTC did exactly as I predicted yesterday. BTC did perfect test of mine second target at the price of $10.400 and it rejected. Anyway, on the way up I found that BTC is creating the bear flag and the price action suggest very corrective cycle, which is sign that sellers are still present and you should watch for selling opportunities. Red rectangle – Important resistance ($12.067) Purple rectangle- Support 1 ($10.400) Red rectangle – Support 2 ($9.715) Red lines – Bear flag in creation Stochastic oscillator is showing the overbought condition and the down flip, which is another good sign for me that down cycle is expected. MACD returned to the neutral territory near the zero line. As long as the BTC is trading below the $13.700 (major swing high), I would watch for selling opportunities on the rallies. The material has been provided by InstaForex Company - www.instaforex.com |

| "Fictitious" meeting of Trump and Xi will end in nothing Posted: 28 Jun 2019 08:08 AM PDT The probability that the summit in Japan will put an end to trade disputes between the US and China is extremely small. It is unlikely that China will agree to the draconian conditions dictated by Washington, and Trump understands this perfectly well. He will not introduce additional duties on Chinese goods either, because he knows the market reaction to this. By the way, the market began to react sluggishly to the latest information in this dispute, and in the absence of agreements may even stand still. Another thing is if the leaders of the US and China decide to cheat and make small mutual concessions, conclude a nominal transaction, the terms of which will be radically different from the important tasks. In this scenario, it is not easy to predict market behavior. Anyway, there's a lot at stake. If Donald Trump does not like what Xi Jinping says, he can still consider the introduction of tariffs for all imports of China. This will force the Fed to lower the rate already at the July meeting and to signal the continuation of the policy easing cycle, which, in turn, will drop the dollar. The futures market signals three rounds of rate cuts within twelve months. It should be admitted that the CME derivatives were right. Despite the statements of US Federal Reserve officials about the rate hike in December and their desire to pause in January, fixed-term contracts believed that the Central Bank will have to change the course of monetary policy and the escalation of the US-China conflict will force the Fed to act. On the one hand, the deal with China will be a plus for Donald Trump. The world community and financial markets will see this as a personal success. There are elections ahead, and the Republican will have more chances for re-election for a second term. There's another side. The owner of the White House understands that the agreement with China will further strengthen the position of the dollar, the Fed will refuse to reduce the rate, because the US economy is already strong, and the uncertainty associated with the trade conflict with China will disappear. The yield of Treasury securities will go up, taking with USDX. In this situation, it is necessary to strengthen criticism of Jerome Powell and put pressure on other countries. Recently, the President of the United States was asked: will the EU be the next target of the policy of protectionism? He replied that Europe treats America even worse than China. Criticism of ECB head Mario Draghi and the statement that the EU and China have been using the practice of weakening their national currency for many years, suggests that one of the "hot" topics at the summit will be the currency war. Sharp movements in the EUR/USD pair to 1.12 or 1.15, perhaps, can be expected in two cases: at the conclusion of the transaction between the US and China or after the introduction of new tariffs for imports of China. If the parties only announce the resumption of negotiations, the market will take time to reflect. The yen will grow by 4.5% Positive news about the results of negotiations between Washington and China may contribute to the decline of the Japanese yen paired with the dollar in the short term. However, the traditional role of a protective asset portends good prospects for it. According to Goldman Sachs forecasts, the national currency of Japan, unlike many other assets of the safe zone, still remains undervalued. The bank expects that within twelve months, the USD/JPY pair will fall to 103, that is, it will be 4.5% below the current levels. At the same time, the fair value of the rate in Goldman is called 95 yen per dollar. The Japanese Central Bank has limited opportunities for easing monetary policy. This factor also supports the "bullish" view of the yen. The current situation, according to experts, resembles the period of growth of the yen before "Abenomics". The material has been provided by InstaForex Company - www.instaforex.com |

| The euro is waiting for the steepest drop in 17 months and the dollar is firmly on its feet Posted: 28 Jun 2019 06:49 AM PDT The euro is on its way to the biggest monthly losses in 17 months, as traders doubt whether the ECB will have enough firepower to support a weakening economy and boost inflation. The June data is expected to show inflation in the eurozone at 1.2%, well below the ECB target. The regulator has promised to increase incentives if necessary, but some investors are skeptical. "The space for the ECB to soften its policy is much more limited than that of the Fed, and this is putting pressure on the euro," Commerzbank believes. As traders doubt whether the ECB will have enough firepower to support a weakening economy and boost inflation, the euro is on its way to the biggest monthly losses in 17 months. The June data is expected to show inflation in the eurozone at 1.2%, well below the ECB target. Some investors are skeptical and the regulator has promised to increase incentives if necessary. Although inflation expectations in recent weeks have declined in both the US and Europe, US indicators stabilized after the Fed last week "opened the door" to lower rates. Interest rates in Europe are already negative. In relation to the dollar, the single currency lost almost 1.6 percent over the month, which was the largest monthly decline, even if it stabilized at around $1.1384. The dollar against the yen is trading at 107.66 yen and the rate has changed little over the last day. But this week, the American added 0.3 percent and rebounded from a five-month low then reaching 106.77 yen on Tuesday. Markets also hope that the meeting between US President Donald Trump and Chinese President Xi Jinping at the G20 summit will move the process of signing a trade agreement from the dead center. However, as practice shows, negotiations between the two largest economies in the world have not yielded results for a long time. Traders and analysts warn that even if a resolution is signed during the summit, it will be more a kind of formality than the real end of a trade war. The material has been provided by InstaForex Company - www.instaforex.com |

| Three vectors that set the direction of the oil market Posted: 28 Jun 2019 06:12 AM PDT According to analysts, three factors will come into effect on the oil market in the second half of 2019. They will determine the demand for black gold, experts believe. Previously, growth drivers were US sanctions against Iran's oil sector, rising tensions in the Persian Gulf and the threat of recession in the global economy. Now, market participants should pay attention to something else. 1) Trade relations of the United States and China Experts consider the current progress in the negotiations of the two superpowers as the main driver of oil prices. He has a significant impact on the mood and market prospects, experts believe. They believe that even a small hint at improving or worsening trade relations between the United States and China can change the direction of oil prices. At the same time, analysts believe that one should not hope for an early resolution of the conflict. However, the results of the negotiations will become the most important factors to determine global economic sentiment and forecast demand for raw materials. In the event of a settlement of the trade conflict in 2019, we should expect an increase in the cost of black gold. Rising oil prices will be a positive sign for the global economy and energy demand, experts believe. 2) Worldwide oil production and US exports After analyzing the recent information from the Energy Information Administration (EIA), experts recognized the US petroleum industry as the second main driver of commodity prices. According to the EIA report on June 27, America achieved record oil exports of 9.4 million barrels per day and a decrease in reserves by 12.8 million barrels. The United States continues to actively produce oil and if their reserves start rising again, prices will decline. The US authorities are perplexed by improving the oil infrastructure, including the pipeline network. This will help minimize the cost of pumping large volumes of oil to refineries and export terminals. According to the EIA report, the Achilles heel of the US oil industry is only a relatively weak refinery load. This indicator is very important for market players attention should be paid to it in the second half of 2019. If US refineries do not operate at full capacity, this means that either they are expecting a reduction in the demand for fuel or lacking in certain grades of oil required for production at affordable prices. 3) OPEC and independent oil producers The third vector, which sets the direction for the oil market in the next six months, experts consider the actions of OPEC +. Early next week, July 1-2, a meeting of the countries of the cartel is expected. According to its results, it will be clear what to expect from the world's largest oil producers in the second half of the year. The US sanctions against Venezuela and Iran have reduced the total production of OPEC by several times. However, the further development of the situation depends on other major oil producers, such as Saudi Arabia and Iraq. Saudi Arabia still produces less than its quota, but is able to increase production in the second half of 2019. Aramco, the national oil company, recently agreed to supply a significant amount of raw materials to South Korean refineries. She also plans to expand her activities in India. If the kingdom increases production and exports to ensure these consumers, oil prices may fall, analysts say. Also, Iraq continues to exceed its quota and seeks to increase oil production. Experts recommend market participants to closely monitor production in Iraq. Baghdad will use any opportunity to increase production and export regardless of any decision of the cartel countries. With regard to Russia, the situation is much more favorable: the country is ready to roll over the current deal. The reason for this was also the recent incident with the pumping of dirty oil through the Druzhba pipeline. In this regard, the Russian Federation had to significantly reduce its own production. However, as soon as Russia settles this issue, it will look for any ways to increase production, even bypassing the OPEC + transaction. The growth of oil production in the Russian Federation is able to put pressure on prices in the second half of 2019, experts reminded. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPSGD: GBP to gain momentum over SGD. June 28, 2019 Posted: 28 Jun 2019 04:30 AM PDT The Singapore dollar was the dominant currency in the pair while the pound sterling was trying to regain grounds. The quotes of the pair reached 1.7120 support area. The Bank of England is still on its tightening bias towards a rate cut. The ultimate inflation target set by the BOE is 2%. Ministry of Trade & Industry estimated the Singapore economy expanded by 1.3% on a year-ago basis in Q1 2019, following the 1.9% growth in Q4 2018. Moreover, GDP growth of the UK was seen to be lower than expected indicating a weaker economic growth due to the global growth and ongoing Brexit uncertainties. CPI Inflation was 2% in May with Core CPI at 1.7%. The labor market remains tight in Q2 in line with expectations. The British currency weakened ahead of the BOE's interest rate decision and the release of the second reading of Q1 GDP growth rate. The Singapore economy has slowed from the beginning of 2019. It is likely to expand at a modest pace in the coming quarters. Core inflation has become lower than expected due to weaker global oil prices and a stronger impact from the liberalization of the retail electricity market. Consequently, MAS is downgrading its growth forecast for MAS Core Inflation to 1–2%. The GDP growth is expected to come in slightly below the mid-point of the 1.5–3.5% forecast range in 2019. The labor market conditions remain firm and will support moderate wage increases. The unemployment rate for the Q1 kept unchanged at 2.2%. Private road transport costs are projected to be unchanged from while accommodation costs are likely to decline at a slower pace this year. Additionally, the industrial Production on monthly basis dropped to -0.7% from the previous value 2.1% and on a yearly basis, the value slid to 0.1% from -2.4%. The Consumer Price Index increased from 0.8 to 0.9 on an yearly basis. The Purchasing Managers Index is pending next week. The previous value was 49.9. The Singapore dollar is expected to sustain gains over GBP but certain correction and volatility may occur after the G20 summit. Now let us look at the technical view. The price is currently residing at the support area of 1.7120. It is expected to counter for certain retracement towards the dynamic level of 20 EMA as pullback and continue pushing lower towards 0.70 area with a daily close. As the price remains below 0.7200 area, the bearish bias is expected to continue. |

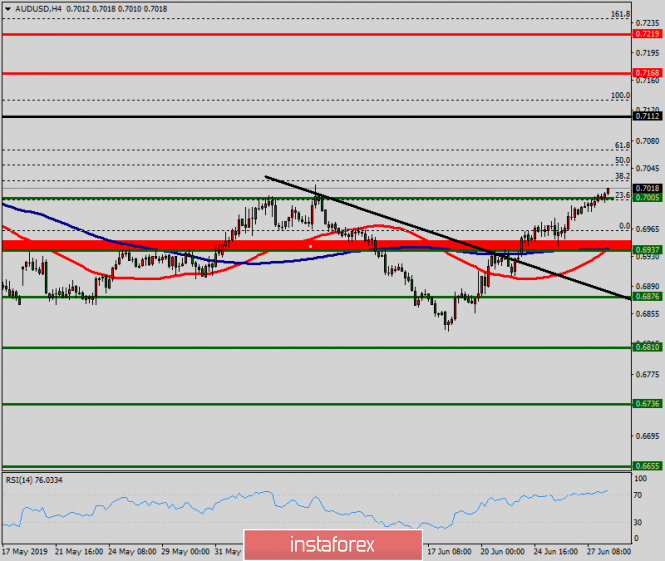

| Posted: 28 Jun 2019 02:11 AM PDT The activity on the world markets has noticeably decreased in anticipation of the outcome of the G20 summit, where the main subject with economic nature will be about trade negotiations between Donald Trump and Xi Jingpin. Recall that on Thursday, the media reported on the allegedly achieved trade "truce" between the Chinese and the Americans, which caused an upward trend in the US stock market. However, it did not break through that could really cause a rally as has been the case at the beginning of this year, when the American president began to show optimism occasionally about the progress in trade negotiations. In general, a peculiar dichotomy in assessing the prospects of the negotiation process has recently been noted in the markets. There are still a number of investors who, logically speaking, believe that the normalization of trade relations between Washington and Beijing is simply necessary for the economies of the two countries. They are confident that the continuation of the confrontation will lead to large economic losses not only for the two countries but also for the entire world economy. Yet, a significant number of skeptics stand out lately, who shows more and more skepticism, believing that Trump will not agree to equal trade relations anyway since his behavior on this topic is clearly combined with his general presidency and cannot be different. This means that he will seek an agreement only on American terms, which is unacceptable for the Chinese side in any case. In addition to the summit topic, today, we should pay attention to the publication of important for the Fed in terms of monetary policy prospects, data of the basic price index for personal consumption expenditure (RFE), as well as values for income and expenditure of Americans. According to forecasts, it is expected that the indicator will maintain its previous dynamics for an increase of 1.6% and 0.2% on an annual and monthly basis, respectively. With regard to the dynamics of income and expenses, it is expected that incomes of individuals decreased in growth to 0.3% in May from a value of 0.5% in April. On the contrary, expenses increased by 0.4% compared with an increase of 0.3% in the previous period under review. Assessing the importance of this data for the Fed, we can assume that if they turn out to be lower than expected, this may stimulate some local weakening of the dollar. At the same time, the release of values in line with forecasts is unlikely to have a noticeable effect on investor sentiment. Forecast of the day: The AUD/USD pair is above the level of 0.7010 on the wave of news about the new "truce" between the United States and China, which supports the rates of commodity currencies of Australia and New Zealand. If data from the US does not show growth above the expected values, the pair will continue with upward momentum and rush to 0.7065. The NZD/USD pair is testing the level of 0.6700, which is also supported by news about the trading "truce". Weak data from the US can strengthen the expectation of a more active reduction in interest rates of the US Federal Reserve, which will push the pair up to 0.6755. |

| Trading Plan for EUR/USD pair on 06/28/2019 Posted: 28 Jun 2019 01:55 AM PDT The euro is ready for a new wave of growth up to 1.1500. Meanwhile, the market is waiting for a Trump-China meeting at the G-20 summit in Osaka. Everything is set to a positive outcome of the meeting. We keep buying from levels of 1.1250 and 1.1350. We are waiting for the result of the negotiations. |

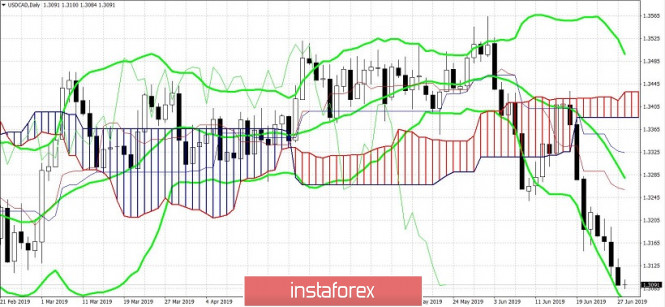

| Posted: 28 Jun 2019 01:23 AM PDT In just a week and a half, a pair of USD / CAD fell almost 400 points. The June rally was driven by many factors. Good macroeconomic reports, successful negotiations between Trump and Trudeau, the expectation of USMCA ratification, the growth of the oil market and the low profile of the Bank of Canada — all these circumstances pushed the loonie down to semi-annual minimums. Yesterday, the pair tested the 30th figure already (for comparison, at the beginning of June the price was trading in the 1.3510 area), and according to some experts, before the end of the summer, the bears pushed the key support level, "diving" under the mark of 1.30.

Judging by the dynamics of the southern impulse, such a scenario cannot be excluded - especially if the Canadian regulator follows the current line of conduct. According to the head of the Bank of Canada, further actions by the Central Bank will largely depend on the incoming data, so today's release will be of particular importance for the pair. This is the publication of data on the growth of Canadian GDP in April. On a monthly basis, this indicator has demonstrated contradictory dynamics since the beginning of the year - rising to 0.3% in January. In February, it fell into the negative area (-0.2%), whereas in March it was again in the "green zone", reaching 0.5%. In April, experts expect a slight decrease - up to 0.2%. If, contrary to forecasts, the indicator will show further growth, this will give the Canadian an additional impetus for growth. Moreover, in annual terms, experts predict a growth rate of up to 1.5%, after an increase of up to 1.4% in March. Such figures will indicate a steady growth trend of the Canadian economy, and this fact eliminates investors ' concerns about the easing of monetary policy by the Bank of Canada. And here, it is worth recalling that the overall level of Canadian inflation in May was stronger than the forecast values. One of the key indicators for the Central Bank increased to 2.4%, while the Bank of Canada's guidance was at 2.1%. This allows the regulator to take a patient position in the foreseeable future, and not to follow the US Federal Reserve, which is likely to lower the interest rate in the coming months. Such a correlation keeps the attractiveness of the Canadian dollar. It is likely that today's release on the growth of the Canadian economy will push a pair of usd / cad to the base of the 30th figure (if, of course, it will be released in the "green zone"). But to overcome the 1.3000 mark, a more weighty reason is needed. Obviously, on the eve of the G20 summit, all other fundamental factors go into the background. By and large, the fate of the US dollar will be decided in Osaka, since the outcome of the summit will allow us to estimate the extent of monetary easing by the US regulator. Predicting the outcome of the personal talks between the leaders of the United States and China is problematic, especially given Trump's impulsiveness. Expert opinions on this score also differ - according to some analysts, the Chinese will not succumb to the threats of the head of the White House, given the relative closeness of the US presidential election and Trump's preliminary ratings (which is inferior to Democrat Biden about 10%). Other experts say a high probability of a deal: according to them, the text of the agreement is already 90% ready, while the leaders of superpowers need to agree on the most difficult sides of the "truce" (for example, the issue of lifting the sanction from the Chinese telecommunications giant Huawei). In my opinion, a half-hearted decision will be made in Osaka: the parties will conclude a kind of "non-aggression pact" that will prevent further escalation of the conflict, but will not solve the problem in essence. A similar decision was made at the end of last year, when Trump threatened China with new duties, however, after the talks, he postponed their introduction, and the parties continued the dialogue. The press even appeared a corresponding definition - "fake deal". If Beijing and Washington complete negotiations in Japan in this way, the dollar will remain under pressure, because the duties already introduced earlier will continue to have a negative impact on both the US economy and on the Chinese economy. In other words, a half-hearted solution to the problem will not remove from the agenda the question of reducing the interest rate of the Fed. While the Bank of Canada, in such a scenario, will be able to maintain the status quo, at least within the foreseeable future.

From a technical point of view, the pair shows a pronounced bearish trend, as evidenced by the main trend indicators - Bollinger Bands and Ichimoku Kinko Hyo. Thus, the Ichimoku Kinko Hyo indicator on the daily chart formed its strongest bearish signal, "Parade of Lines," in which all lines of the indicator are above the price chart, thereby showing pressure on the pair. In turn, the price is on the lower line of the Bollinger Bands indicator, which shows a narrowed channel - this is also a strong signal for the downward direction. An additional confirmation of the bearish scenario is the oversoldness of the MACD and Stochastic oscillators. To determine the main goal of the downward movement (resistance level), let's move to the weekly timeframe: here we focus on the lower boundary of the Kumo cloud - this is the price of 1.2950. But the initial resistance level is the psychologically important "round" mark of 1.3000. When it is overcome, reaching the level of 1.2950 will only take a matter of time. The material has been provided by InstaForex Company - www.instaforex.com |

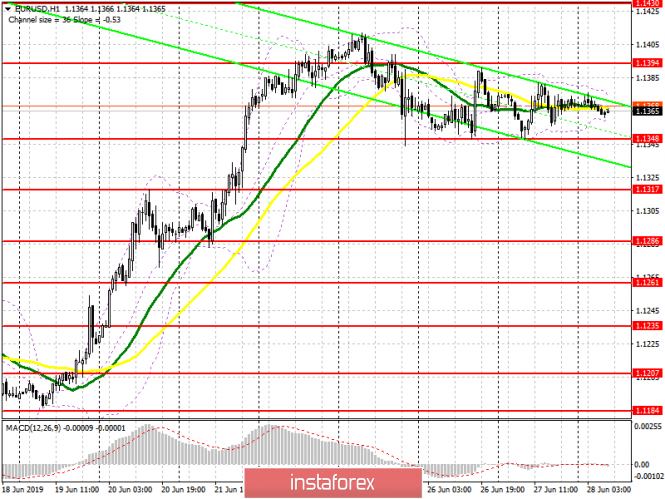

| Posted: 28 Jun 2019 01:09 AM PDT The euro remained to trade in a side channel against the US dollar and a number of other currencies before the important weekend, which will host the G20 summit. The main point of the summit will be a meeting of the leaders of the United States and China, who can sign an agreement allowing the two world powers to resume trade relations without additional duties and restrictions. However, a number of analysts expect the US dollar to decline against the euro in the short term. This scenario is directly related to the "early transaction" on trade between Washington and Beijing, to which we can add a 99% probability of lowering the key interest rate of the US Federal Reserve. It is already known that before the meeting of the leaders of the two countries, no preconditions in the negotiations of Trump and Xi have not yet been indicated. However, it is worth recalling that in the middle of the week, the Chinese authorities said that Xi will focus on Huawei and on the removal of trade duties, which the US introduced last month on a number of goods from China.

As for the fundamental data, the report on consumer prices in Germany allowed the European currency to stay above the level of 1.1350. According to the data, the rise in prices in the service sector helped to maintain the overall consumer price index. The report of the Federal Bureau of Statistics Destatis indicates that the preliminary consumer price index (CPI) in June 2019 increased by 0.3% compared to the previous month and by 1.6% compared to the same period of the previous year. Economists had expected an increase of 0.1% over the previous month and 1.4% over the same period of the previous year. As noted above, prices in the service sector increased by 2.0% in June compared to the same period of the previous year. The index harmonized by EU standards in June increased only by 0.1% compared to May and by 1.3% compared to June 2018, which fully coincided with economists' forecasts. The data on the US economy also did not make serious changes in the technical picture of the EURUSD pair. According to the report, the number of initial applications for unemployment benefits for the week from June 16 to 22 increased by 10,000 and amounted to 227,000. Economists had expected the number of applications to be 219,000. The US GDP growth rate for the 1st quarter of this year remained quite high. According to the third final estimate, the US economy showed growth of 3.1% per annum. However, the current growth rate is unlikely to be maintained in the 2nd quarter, where there is a serious decline in consumer spending. Economists had expected Q1 growth rates to remain unchanged. Data from the National Association of Realtors did not help the US dollar to resume growth. The report shows that the index of signed contracts for the sale of housing in May 2019 increased by 1.1% and amounted to 105.4 points, which is directly related to a slight decrease in mortgage rates for that period. However, compared to the same period of the previous year, the index fell by 0.7%. Economists had expected the index to show a 1.0% increase in May. The report on the decline in the activity of the Federal Reserve Kansas city was not surprising, as production in the US slows down in many regions due to trade problems. According to the Federal Reserve Bank of Kansas City, the composite manufacturing index was 0 points in June versus 4 points in May. As noted above, the slowdown in production activity was due to a decline in the production of durable goods, the demand for which fell sharply.

As for the technical picture of the EURUSD pair, it remained unchanged. The bulls are clearly pushing, and the further short-term downward correction will be the envy of the breakthrough of a large support level of 1.1350. Only then can we expect the demolition of a number of stop orders and a more rapid decline in the trading instrument in the area of 1.1317 and 1.1280. However, it should be understood that if the level of 1.1350 will continue to hold, by all means, the emerging technical model can lead to a new, larger growth of risky assets, and the breakthrough of the resistance of 1.1410 will be a signal for the opening of long positions in the expectation of updating the highs of 1.1490 and 1.1570. The material has been provided by InstaForex Company - www.instaforex.com |

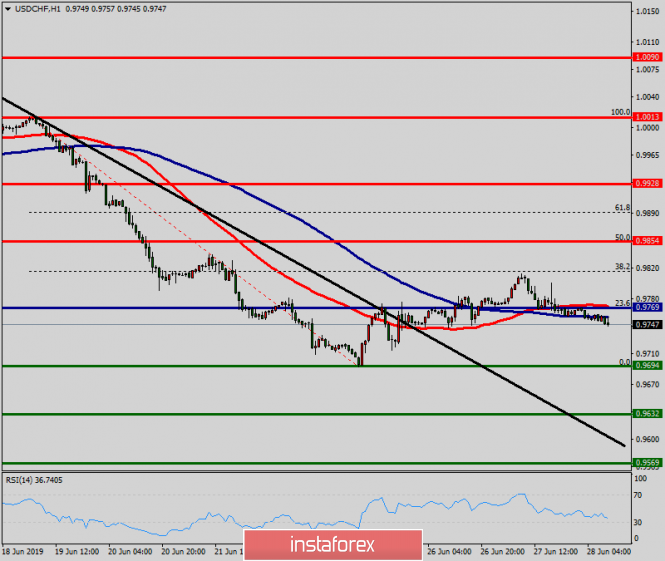

| Technical analysis of USD/CHF for June 28, 2019 Posted: 28 Jun 2019 12:50 AM PDT The USD/CHF pair fell sharply from the level of 0.9854 towards 0.9694. Now, the price is set at 0.9748. The resistance is seen at the level of 0.9854 and 0.9928. Moreover, the price area of 0.9854 and 0.9928 remains a significant resistance zone. Therefore, there is a possibility that the USD/CHF pair will move downside and the structure of a fall does not look corrective. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Thus, amid the previous events, the price is still moving between the levels of 0.9770 and 0.9694. If the USD/CHF pair fails to break through the resistance level of 0.9770, the market will decline further to 0.9694 as as the first target. This would suggest a bearish market because the RSI indicator is still in a negative spot and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 0.9632 so as to test the daily support 2. On the contrary, if a breakout takes place at the resistance level of 0.9854, then this scenario may become invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Burning forecast 06.28.2019 EURUSD and trading recommendation Posted: 28 Jun 2019 12:47 AM PDT The main topic for the markets is the negotiation between Trump and Xi Jin Ping (China) at the G20 summit in Japan - on trade disputes. The market is set to positive from the negotiations - if the positive is confirmed - the growth of stock markets and a new wave of falling of the US dollar is likely. In the case of a negative option - the stock markets will fall, and the dollar will grow. The rest of the news faded into the background. EURUSD: The euro is standing still, and prepares for growth through 1.1410 at 1.14450 to 1.1500 From the point of view of technical analysis, possible purchases with rebound are from and below 1.1350 and 1.1415 for a breakthrough. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin. Bitcoin volatility remains very high Posted: 28 Jun 2019 12:27 AM PDT After updating the maximum of 13600 USD, traders began to take profit, which led to a very serious surge in volatility in the market, which was observed for a long time. However, the level of 10500 remains very large support, on which much will depend in the medium term. Signal to buy Bitcoin (BTC): Buyers will try to do everything to keep bitcoin above the support of 10500, but the intermediate goals will be a return to the resistance of 11680, as well as an update of the maximum of 12500, where I recommend fixing the profits. Signal to sell Bitcoin (BTC): Such high volatility cannot be maintained for a long time, and the main task of bitcoin sellers will be to keep the rate below the resistance of 11500, which will cool down the bulls and lead to further downward correction to the area of 10600 and 10200, where I recommend fixing the profits. With growth above 11500, you can sell on a rebound from the level of 12500.

|

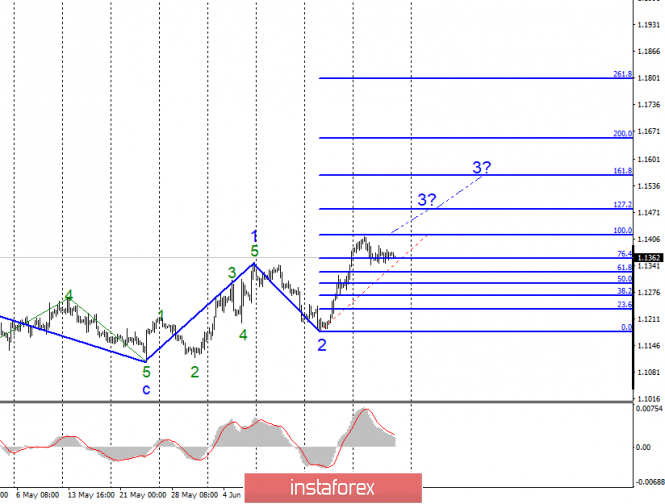

| Posted: 28 Jun 2019 12:27 AM PDT EUR / USD Thursday, June 27, ended for the pair EUR / USD with no changes. The activity of the foreign exchange market has greatly decreased, perhaps because of a very important event that starts today and ends tomorrow. We are talking about the G-20 summit, which would unlikely have attracted such an amount of attention if it were not for the planned meeting of Presidents Trump and Xi Jinping to hold a new round of negotiations on trade disagreement. Thus, markets are not set up either positively or negatively, since they are just waiting for what decision will be made and whether there will be progress in the negotiations. US Treasury Secretary Steven Mnuchin said that 90% of the parties have already agreed, but this does not mean that the leaders of China and the United States can only sign and withdraw duties from each other. Moreover, it is possible that Mnuchin just tried to calm the markets, knowing full well that Donald Trump by his actions and so strongly excites them. There is no need to panic. After the summit is over, I think it will become clear whether the upward trend segment will continue to be built, or whether the segment will be transformed into a 3-wave structure after May 23. Purchase goals: 1.1417 - 100.0% Fibonacci 1.1480 - 127.2% Fibonacci Sales targets: 1.1180 - 0.0% Fibonacci General conclusions and trading recommendations: The euro / dollar pair is presumably located within the 3 waves of the upward trend. I recommend buying euro currency with targets located near the estimated marks of 1.1417 and 1.1480, which equates to 100.0% and 127.2% Fibonacci, with the MACD signal up. Now, the correctional wave continues its construction. GBP / USD Everything written about the EUR / USD pair also applies to the GBP / USD pair. Yesterday, the pound sterling lost only a few base points, and the activity on the instrument declined dramatically. Markets are also waiting for the results of the G-20 meeting. Thus, it is unlikely that there will be strong movements in the market for both pairs today. In the case of the pound / dollar, it is still not clear whether the instrument is ready to build an upward set of waves. An unsuccessful attempt to break through the maximum of the supposed wave d suggests that there is none. But then, you should find out if the markets are ready to continue the descending part of the trend and complicate it. There is no answer to this question yet. Thus, what remains is that we should wait first for the completion of the G-20 summit, and then breaking through either the maximum of wave d or the minimum of wave e. Sales targets: 1.2434 - 161.8% Fibonacci 1.2359 - 200.0% Fibonacci Purchase goals: 1.2767 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern of the pound / dollar instrument has changed and is now suggesting the construction of a new upward trend. At the same time, I recommend waiting for a successful attempt to break the maximum of wave d, which confirms the willingness of the markets to further increase, and only then, we can buy the instrument. The material has been provided by InstaForex Company - www.instaforex.com |

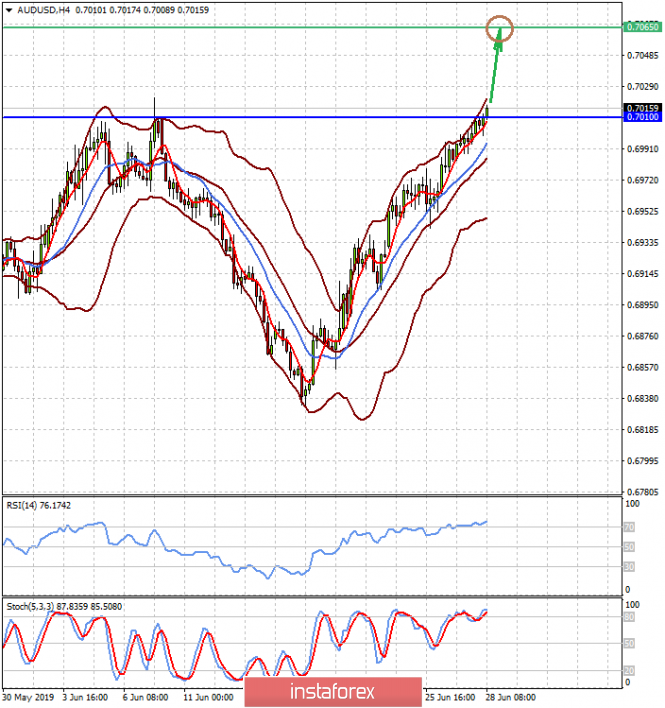

| Technical analysis of AUD/USD for June 28, 2019 Posted: 28 Jun 2019 12:08 AM PDT The AUD/USD pair is set above strong support at the levels of 0.6876 and 0.6810. This support has been rejected four times confirming the uptrend. The major support is seen at the level of 0.6810, because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend in the area of 0.6810 and 0.6876. The AUD/USD pair is trading in the bullish trend from the last support line of 0.6876 towards thae first resistance level of 0.6937 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 0.6937 and further to the level of 0.7005. The level of 0.7005 will act as the major resistance and the double top is already set at the point of 0.7005. At the same time, if there is a breakout at the support level 0.6810, this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| A gift for Trump (a review of EUR / USD and GBP / USD on 06/28/2019) Posted: 27 Jun 2019 11:56 PM PDT Yesterday, the dollar trampled again on the spot, despite the fact that data on applications for unemployment benefits clearly favored its decline. The total number of applications increased by 32 thousand, while growth was projected by 2 thousand. In particular, the number of initial claims for unemployment benefits increased by 10 thousand and not 3 thousand. Moreover, instead of decreasing per 1 thousand, the number of repeated applications has increased by 22 thousand. Therefore, there's no reason to celebrate. The results of GDP for the first quarter has been released, which confirmed all previous preliminary estimates, and showed an acceleration in economic growth from 3.0% to 3.2%. However, the fact of accelerating the pace of economic growth in America did not impress anyone because investors had long been ready for this. So the dollar had to somewhat weaken, but this did not happen.

Today, the final data on UK GDP for the first quarter was published, confirming the preliminary estimate, which showed an acceleration of economic growth from 1.4% to 1.8%. But as with the case of yesterday's GDP data for the United States, investors will disregard them, since they have long taken into account this fact in the quotes. Also, few people will be impressed by the preliminary data on inflation in Europe, as they have to show its immutability, which of course somewhat increases the likelihood of some easing of the monetary policy of the European Central Bank. After all, inflation is seen at the level of 1.2%, which is significantly below the target level of 2.0%. But, in the United States, there have been data on personal income and expenses, which may increase by 0.3% and 0.4%, respectively. Given the fact that in the previous month they increased by 0.5% and 0, 3%, respectively, the advanced growth in personal spending looks quite normal. Moreover, the increase in spending foreshadows the growth of retail sales and profits of large companies. So, the expectations of American statistics are rather positive, although the data itself is not so significant and is unlikely to have a significant impact on the market.

Thus, the single European currency will remain at the mark of 1.1350.

The pound will also steadily keep at 1.2650.

|

| Posted: 27 Jun 2019 11:52 PM PDT To open long positions on GBP/USD, you need: Buyers of the pound need to keep the level of 1.2664, and the formation of a false breakdown there will be another signal to open long positions. The goal of GBP/USD buyers will be to return to the resistance of 1.2715, which was formed yesterday, which will lead to an update of the weekly highs in the area of 1.2760 and 1.2799, where I recommend taking the profit. In the scenario of further decline of the pound, it is best to return to long positions on the rebound from the low of 1.2623. To open short positions on GBP/USD, you need: Bears will try to break below the support of 1.2664, which will increase the pressure on the pound and will lead to an update of the lows in the area of 1.2623 and 1.2582, where I recommend taking the profit. If in the first half of the day, the bulls form an upward correction and you can count on sales from the resistance of 1.2715, provided that a false breakout is formed, or on a rebound from the maximum of 1.2760. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which indicates a downward correction in the pair. Bollinger Bands The upward correction will be limited by the upper limit of the channel in the area of 1.2695, while the downward movement may be limited by the lower limit of the indicator in the area of 1.2645.

Description of indicators

|

| Posted: 27 Jun 2019 11:52 PM PDT To open long positions on EURUSD, you need: The situation remained unchanged, as well as the technical picture. At the moment, it is best to return to long positions on a false breakout from the level of 1.1348, after updating the low of yesterday, or on a rebound from larger support of 1.1317. The main task of buyers will be to return to the resistance of 1.1394, which will break through the upper limit of the new downward channel and continue the growth of the euro in the area of the highs of 1.1430 and 1.1460, where I recommend taking the profit. To open short positions on EURUSD, you need: The main direction in the pair will depend on the results of the G20 summit and on whether the US and China will sign a trade agreement. If signed, the bears in EUR/USD can return to the market. The formation of a false breakout today in the resistance area of 1.1394 will be the first signal for the sale of the euro. However, the main task will be the breakdown and consolidation below the support of 1.1348, which will lead EUR/USD to new lows of 1.1317 and 1.1286, where I recommend taking the profit. In the case of growth above 1.1394, the area of 1.1430 will be a good level for opening short positions. Indicator signals: Moving Averages Trading is conducted in the region of 30 and 50 moving averages, which indicates market uncertainty. Bollinger Bands Volatility fell sharply before an important summit, which does not give signals to enter the market.

Description of indicators

|

| Forecast for EUR/USD and GBP/USD on June 28. Will inflation continue to decline in Europe? Posted: 27 Jun 2019 11:52 PM PDT EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair is trading along with the correction level of 76.4% (1.1367). Most of the traders either left the market or hid as much as possible on the eve of the G20 summit. On the agenda, in fact, is one question: will the leaders of China and the United States agree on a trade agreement? Of course, it is unlikely, if they can, the agreement will be signed "immediately". Thus, the main question is: will there be progress in the negotiations or will the trade conflict flare up with a new force? A lot will depend on this, starting with the mood of traders in the next week or two, ending with the actions of the Fed regarding monetary policy. Even now, Jerome Powell, Chairman of the Fed, is considering the feasibility of reducing the key rate in July, in fact, just like everyone else, waiting for the results of the G-20 summit. Powell has repeatedly drawn attention to the fact that it is the US trade wars that carry the maximum risks for the country's economy. Thus, today, the closing above/below the Fibo level of 76.4% will be formal, and traders' attention will be focused on inflation in the Eurozone for June. The Fibo grid is built on extremums from March 20, 2019, and May 23, 2019. Forecast for EUR/USD and trading recommendations: The EUR/USD pair is trading near the correction level of 76.4%. Thus, I recommend waiting for the release of the inflation report in the European Union today, after which either to trade "on the news", or to analyze the reaction of the market and start trading next week, as today there is a high probability of a flat. GBP/USD – 4H.

The GBP/USD pair made a new return to the correction level of 76.4% (1.2661). The new rebound of the pair from this Fibo level will again allow traders to expect a reversal in favor of the pound and some growth in the direction of the correction level of 61.8% (1.2661). Today, the divergence is not observed in any indicator. At this time, the main candidate for the post of British Prime Minister Boris Johnson said that he did not support the idea of suspending the work of Parliament to ensure non-interference in the process of the country's exit from the EU, probably on the "hard" option. Johnson supports democracy and believes that every politician should face the entire government and ensure the country's implementation of the option that the people chose in the referendum. Earlier, Boris Johnson reported that the country, in any case, will leave the European Union until October 31. One thing is for sure now: the bulls have stopped considering the pound even as an attractive short-term instrument. There is a high probability of resuming the fall of the pound/dollar pair. Closing the quotes below the Fibo level of 76.4% will work in favor of the US dollar and will allow traders to count on a fall in the direction of the correction level of 100.0% (1.2661), and cancel the bullish divergence at the same time. The Fibo grid is built on the extremes of January 3, 2019, and March 13, 2019. GBP/USD – 1H.

As seen on the hourly chart, the pound/dollar pair remained between the correction levels of 61.8% (1.2665) and 76.4% (1.2701), although there was an attempt to get out of this side channel. As a result, the pair performed a fall to the Fibo level of 61.8% again. A new rebound on June 28 from this level of correction will work in favor of the pound and some growth in the direction of the correction level of 76.4%. The consolidation of the pair's rate under the Fibo level of 61.8% will increase the chances of a further fall in the direction of the correction level of 50.0% (1.2634). The Fibo grid is based on the extremes of June 7, 2019, and June 18, 2019. Forecast for GBP/USD and trading recommendations: The GBP/USD pair performed a fall towards the correction level of 61.8%. I recommend selling the pair with the targets at 1.2634 and 1.2603, with the stop-loss order above 1.2665, if the closing is performed under the level of 61.8%(hourly chart). I recommend buying the pair with the purpose of 1.2701, if it will be rebounded from a Fibo level of 76.4% and with a stop-loss level of 1.2665 (hourly chart). The material has been provided by InstaForex Company - www.instaforex.com |

| BITCOIN to continue decline? June 28, 2019 Posted: 27 Jun 2019 11:10 PM PDT Bitcoin recently faced a drastic fall from the peak near $14,000 towards $10,500 support area with a daily close. Such bearish pressure is seen to be a wave retracement before the price continues to climb higher in the coming days. According to analysis and research on the recent fall, it is considered healthy for the market momentum to grow if the price remains above $10,000 area with a daily close. Analysts think that slumps like the one when BTC prices plunged below $11,000 from a high of almost $14,000 just yesterday are welcome since they shake out the "weak hands". The recent rally developed in light of the Federal Reserve's latest program of quantitative easing. It is believed that people are hedging against the controversial policy by investing in alternative assets such as Bitcoin. Such massive volatility enabled many investors to question whether $13,800 was a long-term top for Bitcoin. Please note that it could be the perfect time to increase investment in the cryptocurrency, as it may continue its journey upwards soon. Meanwhile, Bitcoin is struggling to jump above $11,500 after bouncing off the $10,500 area while being held by the dynamic level resistances including 20 EMA, Tenkan, and Kijun line. The breakout lower was analyzed earlier when the price broke below Kumo Cloud support and Chikou Span broke the price line support. Currently the price is expected to extend its rally though the market is volatile and corrective. Nevertheless, the price could break above $11,500 remaining above $10,000 with a daily close. If so, this will indicate further upward pressure towards $13,000 and later towards $14,000 and $15,000 in the coming days. SUPPORT: 10,000, 10,500 RESISTANCE: 11,500, 12,000, 13,000, 14,000 BIAS: BULLISH MOMENTUM: VOLATILE

|

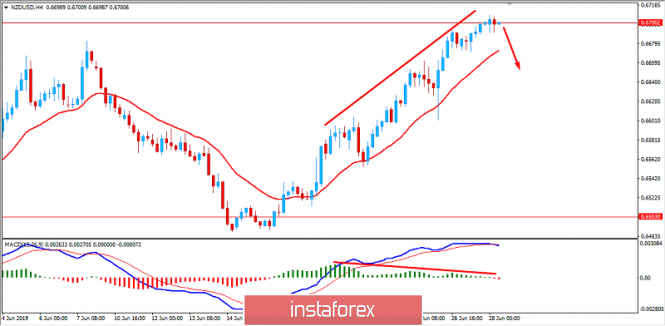

| NZDUSD: RBNZ rate decision likely to boost USD. June 28, 2019 Posted: 27 Jun 2019 10:46 PM PDT The residing at the edge of 0.6700 area. Some economists suppose that this is a short-term trend and the pair is likely to slide a bit. The Reserve Bank of New Zealand became the first major central bank to cut its key rates in the latest global shift due to the looser policy. After the meeting in May, the RBNZ has met again in June. It kept the interest rates unchanged at 1.5%. Recently published New Zealand's economic data were mostly in line with the forecasts. The growth of economy expanded by 0.6% quarter-on-quarter rate in Q1. In March, the reading amounted to 2.6%, its record low since 2014. However, Household Consumption and Business confidence indexes are still showing weakness. The kiwi remains stable against the US dollar despite weak economic data. ANZ Business Confidence report published recently showed a decrease to -38.1 from the previous figure of -32.0. At the same time, the Fed feels pressure after the publication of weak economic reports. Trump bombarded the Fed with a new potion of criticism. What is more, trade wars also put pressure on the greenback. Now traders are sitting on the sidelines, awaiting the Fed's meeting in July. Some economists expect that the Federal Reserve may reduce its benchmark interest rate. The Fed is worried about US inflation rate and wants to avoid hyperinflation impact like Japan. US Final GDP has been finally released. The reading remained unchanged as expected at 3.1% and Final GDP Price Index rose to 0.9% which was also expected to be unchanged at 0.8%. Additionally, US Pending Home Sales report was published. The figure grew to 1.1% as expected from the previous value of 1.5%. Today, the G20 meeting is taking place. Traders are awaiting hints about the future of US-China trade relations. Meanwhile, the US dollar is likely to regain momentum amid better economic data while the New Zealand dollar may slow down. Now let us look at the technical view. The price is currently residing at 0.6700 event area where Bearish Divergence is taking place. The price is expected to push lower towards 0.6500 support area. The pair is trading in a bearish channel. However, it is likely to lift up towards 0.70 area in the future. |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment