Forex analysis review |

- Technical analysis of EURUSD for June 5, 2019

- Technical analysis of Gold for June 5, 2019

- June 4, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- June 4, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Bitcoin analysis for June, 04.2019

- EUR/USD analysis for June 04,2019

- Analysis of Gold for June 04,.2019

- The dollar is playing a dangerous game, scaring off buyers

- Even the temporary weakness of the dollar gives reason to think about buying it

- EUR and AUD: Weak inflation in the eurozone brought euro buyers to their senses. Australian dollar shows strength after a

- GBP/USD: plan for the US session on June 4. Buyers have reached 1.2697, and the upward trend continues

- EUR/USD: plan for the US session on June 4. The expected correction for the euro took place

- Brent dives into the depths

- The market fired Powell, there is no more trust

- The Fed may signal a decrease in interest rates: promising growth for EUR/USD and AUD/USD pairs

- GBP / USD. Risky party: is the growth of the British currency worth believing?

- Trading recommendations for the GBPUSD currency pair - placing trade orders (June 4)

- EURUSD: Will the Fed Chairman support the topic of interest rate cuts?

- Wave analysis of EUR / USD and GBP / USD for June 3. Inflation in the EU might be disappointing; bears are prepared

- Bitcoin. Bitcoin rate declined after a large number of CME contracts expired

- Heading downward: NZD and AUD growth will be short

- GBP/USD: plan for the European session on June 4. The pound is approaching an important resistance of 1.2697

- EUR/USD: plan for the European session on June 4. Euro purchases may be limited by the level of 1.1261 and the divergence

- Overview of GBP/USD on June 4. The forecast for the "Regression Channels". Theresa May will remain as Prime Minister after

- Overview of EUR/USD on June 4. The forecast for the "Regression Channels". Traders optimism regarding the euro may collapse

| Technical analysis of EURUSD for June 5, 2019 Posted: 04 Jun 2019 01:43 PM PDT EURUSD is challenging the important horizontal resistance at 1.1260. Having broken out and above the medium-term bearish channel it was in since last December, EURUSD has the potential for a new upward move that will bring price even above 1.2550. So what is the risk for bulls expecting a new long-term upward move?Only 160 pips for a potential gain of 10000 or more.

Blue rectangle - resistance Green rectangle- support EURUSD is challenging the 1.1260 resistance. Worst case scenario I see for bulls is a pull back to the red channel and a back test of the upper boundary and then a bounce. Support can also be found at the green rectangle area at 1.12-1.1215. However it is not necessary to expect a pull back now. EURUSD is in bullish trend has most probably made an important long-term low at 1.11 where we also find the 61.8% Fibonacci retracement of the 1.03 to 1.255 move. A reversal from this level could signal the start of a new upward move starting that could eventually push price above 1.2550. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of Gold for June 5, 2019 Posted: 04 Jun 2019 01:38 PM PDT Gold price made a pull back today towards $1,320-18 area as we expected from our last analysis yesterday. Price then turned back upwards towards its recent highs. Trend remains bullish. A pause to the sharp rise is expected in order for the market to digest the sharp move.

Red lines - expected path Gold price is trading above $1,320 again near $1,325. Gold price has made a remarkable sharp move upwards nearly vertical. Such moves usually have a follow through to new higher highs but only after a small pause and maybe a shallow correction. There are very few chances that Gold makes a major top at current levels. This would be the case only if price were to break back below $1,300 again. Gold price should continue higher towards the longer-term resistance level of $1,340-50. The material has been provided by InstaForex Company - www.instaforex.com |

| June 4, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 04 Jun 2019 11:27 AM PDT

Since January 19th, the EURUSD pair has been moving within the depicted channel with slight bearish tendency. Few weeks ago, a bullish Head and Shoulders reversal pattern was demonstrated around 1.1200 allowing further bullish advancement to occur towards 1.1300-1.1315 (supply zone) where significant bearish rejection was demonstrated on April 15. For Intraday traders, the price zone around 1.1235 stood as a temporary demand area which paused the ongoing bearish momentum for a while before bearish breakdown could be executed on April 23. Short-term outlook turned to become bearish towards 1.1175 (a previous weekly bottom which has been holding prices above for a while) On May 17-20, a bearish breakdown below 1.1175 was temporarily achieved. As expected, further bearish decline was expected towards 1.1115. This is where significant bullish recovery was demonstrated bringing the EURUSD pair back above 1.1175. Recently, The EURUSD pair has maintained bullish persistence above the highlighted price level (1.1175) except last week on Tuesday when a temporary bearish breakdown was briefly demonstrated below 1.1175. That's why, further bullish advancement was expected towards 1.1235 which failed to apply any significant bearish pressure. Recent Bullish breakout above 1.1235 renders it a newly-established demand level to be watched for bullish rejection and a a valid BUY entry upon retesting. Bullish persistence above 1.1235 enhances further bullish advancement towards 1.1290 and 1.1320. Otherwise, the EURUSD pair would remain trapped between the same price levels (1.1235-1.1175). Trade recommendations : Intraday traders should look for a valid BUY entry anywhere around 1.1235. T/P level to be located around 1.1320. Stop loss should be placed below 1.1190. The material has been provided by InstaForex Company - www.instaforex.com |

| June 4, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 04 Jun 2019 09:25 AM PDT

On March 29, a visit towards the price levels of 1.2980 (the lower limit of the newly-established bearish movement channel) could bring the GBPUSD pair again towards the upper limit of the minor bearish channel around (1.3160-1.3180). Since then, Short-term outlook has turned into bearish with intermediate-term bearish targets projected towards 1.2900 and 1.2850. On April 26, another bullish pullback was initiated towards 1.3000 (the same bottom of March 29) which has been breached to the upside until May 13 when a bearish Head and Shoulders pattern was demonstrated on the H4 chart with neckline located around 1.2980-1.3020. Bearish persistence below 1.2980 enhanced further bearish decline. Initial bearish Targets were already reached around 1.2900-1.2870 (the backside of the broken channel) which failed to provide any bullish support for the GBPUSD pair. Further bearish decline was demonstrated towards the lower limit of the long-term channel around (1.2700-1.2650). The GBPUSD pair looked oversold around the mentioned price levels (1.2650-1.2600). That's why conservative traders were suggested NOT to consider any SELL signals at such low prices. As anticipated, bullish breakout above 1.2650 was achieved Yesterday. This enhances the bullish side of the market. Currently, short-term bullish movement is expected towards 1.2750 where price action should be re-assessed. Trade Recommendations: For counter-trend traders, a valid BUY entry was suggested around 1.2650. T/P level to be located around 1.2720 and 1.2820. S/L should be advanced to entry levels (1.2650) to offset the associated risk. Conservative traders should wait for an extensive bullish pullback towards 1.2870-1.2905 (newly-established supply zone) to look for valid sell entries. S/L should be placed above 1.2950. The material has been provided by InstaForex Company - www.instaforex.com |

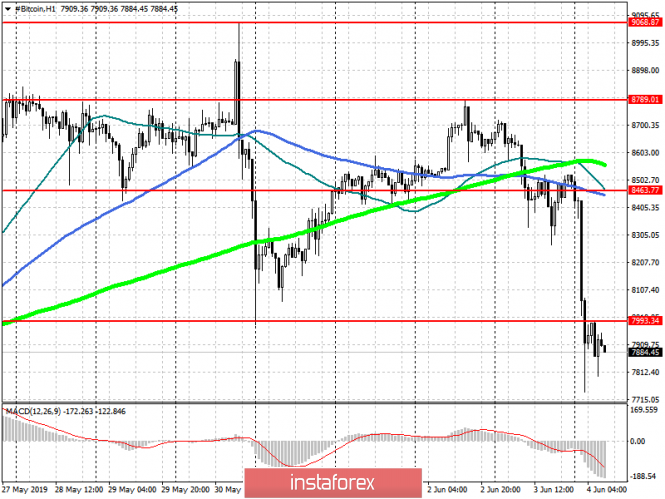

| Bitcoin analysis for June, 04.2019 Posted: 04 Jun 2019 09:20 AM PDT BTC has nice drop as we expected yesterday. Our downward target at the price of $7.990 has been met. We still expect more downside on the BTC to come.

Blue rectangle – Support 1 and downward target- $7.416 Pink rectangle – Support 2 and downward target 2- $7.025 White rising line – Support (bearish flag in creation) Our advice is to watch for potential selling opportunities on the BTC due to the breakout of the support and potential bearish flag in creation. BTC is testing the middle of the Bolinger Bands at $7.990, which is sign that buyers don't have enough power for any strong rally. The MACD momentum is still downward and the Oscillator is in overbought zone. Watch for selling opportunities with the targets at $7.416 and $7.025. Resistance levels are seen at $8.272 and $8.516. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for June 04,2019 Posted: 04 Jun 2019 09:10 AM PDT EUR/USD has been trading sideways in past 24 hours. The price tested the level of 1.1233. We are expecting more upside on the EUR/UD, key support is set at the price of 1.1215.

Yellow rectangle – Swing high acting like support 1.1215 Blue rectangle – Upward target 1.1320 White rising line – Support Our advice is to watch for potential buying opportunities on the EUR but near the support at 1.1215. If you see potential test and reject from the support, you should watc for long positions. The MACD is still rising and it is in positive teritory, which is positive sign for EUR. Also, the upward trendline is still holding and that is another sign of EUR strength. Support levels are seen at 1.1215 and 1.1115. Resistance is set at 1.1320. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for June 04,.2019 Posted: 04 Jun 2019 08:59 AM PDT Gold has been trading upwards as we expected. The price tested the level of $1.324 and then started to consolidate. We still expect more upside on the Gold, so watch for buying opportunities.

Blue rectangle – Upward target $1.345 White lines- flat channel White rising line – Support $1.319 We found that today is nothing more than consolidation day for Gold and we can expect more upside to come. The stochastic looks oversold and the support trendline at $1.320 is on the test. Our advice is to watch for buying opportunities with target at $1.345. Support levels are seen at the price of $1.318-$1.312. Strong momentum is still present, buying opportunities are preferable. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar is playing a dangerous game, scaring off buyers Posted: 04 Jun 2019 08:33 AM PDT Monetary policy has returned to the focus of the market. The Central Bank of Australia lowered the rate on Tuesday, two more easing is expected this year. Prior to this, investors saw incentives from the NBK, lowering the RBNZ rates and a pause in normalizing the policies of the Fed and the ECB. Nevertheless, America on Monday published weak macroeconomic reports, which surprised the markets. Moreover, the Fed for the first time publicly announced the need for policy easing. Investors are now trying to understand whether the current measures are enough to support economic growth. At this time, the dollar to the basket of major competitors began to fall, it does not help even the status of a protective asset. Market participants sell the US currency, preferring the euro and gold. How long will it last? Maybe the dollar is changing direction. EUR/USD The euro and the dollar bounced from local lows to local highs in the last six weeks, but formally the downward trend is not broken. To do this, buyers need to break above 1.1250. Meanwhile, the euro is supported by the expectations of the meeting of the Governing Council of the ECB. Note that the LTRO factor is already included in the quotes of the main pair, and in order to surprise the market, Mario Draghi needs to hint at the resuscitation of QE. However, we should not forget that the eurozone economy in the medium term is likely to continue to slip due to trade wars. While the current rise in the euro seems logical, it is unlikely to be a long-term one. Gold Gold rose to the highest levels since February. Today, there was some correction after methodical purchases during the previous three trading sessions. Among the factors supporting the quotations of precious metals in recent days can be identified a sharp decline in the yield of US treasuries and the weakening of the dollar, which forced investors to consider gold as a more profitable asset. If it goes on like this, the price may strengthen to $1340. Then there is a chance to grow to a six-year peak – $1360. Dollar index This year, it became clear that the United States is not an isolated state and the policy of protectionism of Donald Trump – a double-edged sword. The dollar without support from the fiscal stimulus and the Fed behaves differently. The decline in stock indices and the yield of treasuries lead to its weakening. And a year ago, everyone was told that trade wars allowed the "American" to intercept the status of the main asset-seeker from the yen and gold. Goldman Sachs reduced its estimate of US economic growth by 0.5 percentage points to 2% this year. Economists expect the Fed to weaken monetary policy. It seems that almost 10-year economic expansion, which brought more than 20 million new jobs and increased the assets of Americans by $47 trillion, is coming to an end. Last year, the Central Bank went too far with the rate increase and is now looking for an opportunity to correct his mistake. The material has been provided by InstaForex Company - www.instaforex.com |

| Even the temporary weakness of the dollar gives reason to think about buying it Posted: 04 Jun 2019 08:33 AM PDT In recent days, the US currency is cheaper against most of its major competitors, as investors began to lay in the quotes a higher probability of a decrease in the interest rate by the Fed before the end of this year. Investment banks such as Barclays, JP Morgan, NatWest Markets, have already said that they forecast a softening of the monetary policy of the Federal Reserve against the backdrop of escalating tensions in trade relations between the United States and China, which has a negative impact on economic growth in both countries. Now, the derivatives market estimates the probability of reducing the federal funds rate by the end of the year at 98%, and at the end of the July meeting of the FOMC – at 61%. JP Morgan experts expect that the US Central Bank this year will reduce the interest rate by 0.25% twice – in September and December. According to their estimates, the risk of a recession in the US in the second half of 2019 increased to 40% from 25% recorded a month ago, largely due to trade disputes between Washington and Beijing. The dollar situation was aggravated by the ISM index of business activity in the manufacturing sector (PMI) published yesterday. In May, the indicator was 52.1 points, which was 0.9 points lower than the forecast and 0.7 points lower than the April level. The indicator reached its lowest value since October 2016, which became a signal to market participants that their concerns were far from being unfounded. At the same time, the yield of 10-year Treasuries fell below the level of 2.11%, reflecting the high level of demand for safe assets. Against this background, the dollar index fell to three-week lows – in the area of 97.10 points. According to some experts, the world markets begin to "thaw" only when the USD index is trading below 97, and ideally, to ensure that the global recession is avoided, the dollar would be good to go 95 or even lower. Meanwhile, currency strategists at Jefferies believe that the dollar, if it loses its attractiveness, it is only temporary. "Even if the Fed cuts interest rates, other Central banks will follow the same path. Therefore, the mere fact of lowering rates in the United States does not mean the weakness of the US currency," – representatives of the financial institution noted. "The short-term reaction is clearly negative, but the prospects for the dollar do not look so gloomy in the medium term. We recommend using the current pressure on the US currency for its purchases at more favorable levels. If there is a need to be in short positions on the greenback, then it should be sold only against one currency – the Japanese yen," Jefferies believes. JP Morgan Bank adheres to a similar point of view, stressing that the weakening of the Fed's monetary policy does not mean that the dollar rally should stop. Based on this, it is unlikely to count on a strong strengthening of the euro. This week, the European Central Bank will hold a regular meeting, and it will be important not only because the details of the TLTRO program will be made public, but also because of the release of updated economic forecasts. On their basis, the ECB head Mario Draghi will decide whether the European economy is sufficiently weakened to signal the markets about the need for additional stimulus measures. The EUR/USD pair collapsed following the last ECB meeting and may fall even more if the regulator lowers its forecasts of growth and inflation in the EU. In addition, Donald Trump, who is "at war" with everyone at the same time, can very soon recall Europe, and the probability of this increases as the hopes for an easy US victory over China become more illusory. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Jun 2019 08:02 AM PDT The European currency failed to hold at weekly highs after the release of a more than disappointing report on the annual inflation rate in the eurozone, which slowed sharply, pushing even further expectations of the European Central Bank to reach the target level of 2.0%. Oddly enough, these data came out just at the time of the slowdown in the eurozone economy, which increases the chance of a more serious decline in the future. According to data, in May this year, the annual inflation rate in the eurozone slowed to 1.2% from 1.7% in April, which is a weak indicator. Let me remind you that the inflation target set by the Central Bank is slightly less than 2%. Especially the decline in inflation was noted in the service sector, where prices after the Easter holidays returned to their normal levels. As for the core inflation, which does not take into account volatile categories, then the annual rate in May slowed to 0.8% from 1.3%. The only thing that leaves a gap for the ECB and a chance to restore inflationary pressure is today's report on the eurozone labor market. According to data, the unemployment rate in the eurozone in April fell to 7.6% from 7.7% in March this year. The number of unemployed fell by 64,000. As for the technical picture of the EURUSD pair, buyers of risky assets have serious problems with further growth, and a breakthrough in support of 1.1230 can lead to a deeper downward correction, which will block all yesterday's growth observed in the North American session. However, there are some speeches by a number of Fed representatives, including the Chairman of the Committee, Jerome Powell, who probably will not avoid the problem of interest rates. The Australian dollar remains in place after a series of negative news. Today, it became known that the Reserve Bank of Australia lowered the key interest rate by 25 bp up to 1.25%. RBA Manager Philip Lowe said that lower interest rates are still possible and there are real reasons to expect their further decline. The RBA Manager noted that the rates were reduced in response to the growing trade risks, as the economic prospects are quite stable and there is no deterioration yet. Then came the report on retail sales, which in April this year fell by 0.1% compared to March. After that, data on consumer confidence in Australia also did not lead to a sharp decline in the AUDUSD pair. According to the report, consumer confidence in Australia fell by 1.4% last week. It ended with the fact that the Australian dollar did not respond to reports that the administration of US President Donald Trump was considering the possibility of introducing tariffs for imports from Australia. First of all, we are talking about the import of aluminum. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Jun 2019 07:50 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound coped with the morning task and reached the resistance of 1.2697. At the North American session, their task will be to break this range with the subsequent update of the maximum of 1.2744, where I recommend fixing the profit. When the pound is lowered again in the second half of the day, it is best to look at long positions after a false breakout in the area of 1.2644 or a rebound from the minimum of 1.2594. To open short positions on GBP/USD, you need: Sellers of the pound will count on the formation of a false breakout in the resistance area of 1.2697, which will be the first signal to open short positions in order to reduce to the support of 1.2644, which was formed today in the morning. The main task of the bears is to consolidate under this level, which will lead to the demolition of a number of stop orders of buyers and a larger decrease in GBP/USD in the area of the minimum 1.2594, where I recommend fixing the profits. In a growth scenario above 1.2697, the resistance range of 1.2744 will be an acceptable area for short positions. Indicator signals: Moving Averages Trading is conducted above 30 and 50 moving averages, which indicates the preservation of the upward correction. Bollinger Bands The volatility of the indicator has fallen, which does not give signals on entering the market. Description of indicators

|

| EUR/USD: plan for the US session on June 4. The expected correction for the euro took place Posted: 04 Jun 2019 07:49 AM PDT To open long positions on EURUSD, you need: In the first half of the day, I paid attention to the resistance level of 1.1261 and the formation of divergence on the MACD indicator, which led to a downward correction. At the moment, the support is provided by the level of 1.1230, and the task of buyers will be to hold it in the afternoon, which can return EUR/USD to the resistance area of 1.1261, where I recommend fixing the profit. In the absence of growth at a minimum of 1.1230, I recommend looking at long positions for a rebound from larger support of 1.11199. To open short positions on EURUSD, you need: The sellers of the euro reached the first target in the support area of 1.1230, but the main task for the second half of the day is to consolidate under this range, which will push EUR/USD to the minimum area of 1.11199, where I recommend fixing the profits. In a scenario of return of the pair to the maximum of the day, all the same, the resistance is the area of 1.1261, where you can watch a short position, provided the formation of a false breakout. Sell the euro on a rebound, as in the first half of the day, is best from the level of 1.1294. Indicator signals: Moving Averages Trading is above 30 and 50 moving averages, which indicates a possible continuation of the growth of the euro. Bollinger Bands The pair tested the lower limit of the indicator around 1.1230, the breakthrough of which may increase the pressure on the euro. Description of indicators

|

| Posted: 04 Jun 2019 06:49 AM PDT Oil moves in tandem with US stocks and the yield of US Treasury bonds, which indicates growing investor fears about the impact of trade wars on global demand for black gold. Speculators for the fifth week in a row reduce net longs for Brent and WTI, which contributes to almost 20% of the collapse of quotations from the levels available at the end of April. However, the physical asset market shows that it is too early for bears to rest on their laurels. The premiums on fixed-term contracts with the delivery of the North Sea variety in a month are $1.3, in 6 months – $4 per barrel. Derivatives expect prices to rise in the future, which may happen in the case of de-escalation of the conflict between the US and China after the meeting of Donald Trump and Xi Jinping at the G20 summit in Japan. Morgan Stanley believes that if Washington imposes duties on all imports of China, then in 9 months, the States will plunge into recession. JP Morgan warns that the chances of a US economic downturn on the time horizon of 12 months have increased over the past 30 days from 25% to 40%. The inversion of the yield curve signals a recession, and representatives of the Fed begin to talk about lowering rates. In particular, the head of the FRB of St. Louis James Bullard believes that it is time to weaken monetary policy. Against the background of growing fears for the fate of the US GDP, the fall of the S&P 500 and the yield of Treasury bonds look logical. The decline in business activity in the US manufacturing sector to the lowest level in the last 2 years adds fuel to the fire. Trade wars bring pain to all participants. China, the US, and the eurozone are the largest consumers of oil, so negative macroeconomic statistics lead to sales of Brent and WTI. Especially since on the supply side, the bulls are losing support. Saudi Arabia is trying to calm the markets by talking about the existence of a consensus in OPEC on the prolongation of the agreement on production cuts of 1.2 million b/s until the end of 2019, while increasing production itself (ostensibly to close the losses of Iran, where production fell to a minimum level since 1990) and sends letters about the postponement of the Vienna OPEC Summit from late June to July. Iran, Algeria, and Kazakhstan are against, which signals a split in the cartel. Changes in oil production within OPEC At the same time, the increase in the number of drilling rigs from Baker Hughes in the week to May 31 indicates that the US production of black gold is all right, which increases the desire of speculators to get rid of long positions on Brent and WTI. The market completely forgot about the problems in the Persian Gulf and switched to global demand. Technically, the inability of the "bulls" in the North Sea variety to keep quotes above $68.45 per barrel, as expected, was the first sign of their weakness. The fall of Brent below the support by $58.7 will increase the risks of continuing the Northern campaign of oil as part of the transformation of the shark pattern in 5-0. The consequences can be enormous, up to a fall in prices below $ 45 per barrel. The material has been provided by InstaForex Company - www.instaforex.com |

| The market fired Powell, there is no more trust Posted: 04 Jun 2019 05:18 AM PDT The escalation of the US-China trade conflict, which resulted in the collapse of the stock exchanges, has burned $4.6 trillion in May. It left the American government debt market to the upside. Investors are running into defensive assets, as concerns about a slowdown in economic growth intensify. The Federal Reserve can pour money again over the fire like 11 years ago. Market participants are selling almost everything, except for the sovereign bonds of the largest countries in the world. According to EPFR Global, the funds withdrew for a week up to $8.2 billion from US stocks, $1.8 billion from European and $2.8 billion from American "junk" papers. Losses in emerging markets amounted to $5.8 billion over the past two weeks, which was the worst result for the year. Global anti-risk sentiment redirected capital flows. The most popular are government securities of America and Germany. The yield of the German Bund with a maturity of 10 years fell to a historic low of minus 0.205% per annum. Rates on similar US securities collapsed earlier this week to a record low of 2.04% since September 2017. In early May, this figure was 2.5%. It is unlikely that this will be the limit. In connection with the expectation of a recession, a reduction in the Fed rate and the prices of US government securities will soar even higher but the yields will return to 2016 lows. It is expected that the Central Bank will lower rates by a quarter point in September and December. What will Powell say? On Tuesday, the head of the American regulator will make a speech, and he will need to clarify the situation that is occurring in the market. The fact that the States are on the verge of a recession, investors have already guessed on their own a rather soft monetary policy. That is, in the policy, which has not yet said a word to Jerome Powell. As of now, market participants are waiting for three rounds of rate cuts this year with the nearest decline, according to their estimates at the July meeting. In a sense, the situation is absurd on why lower the interest rate with the current QT program, which should last until September. Although no one knows what decisions can be made. It is worth noting that it was precisely the laying of soft monetary policy in the value of the dollar that weakened its position. This phenomenon is quite clearly seen in the dynamics of such pairs of EUR/USD, USD CAD, USD/JPY, USD/CHF, as well as GOLD and USDX. It looks like traders are unlikely to lay down expectations for a few more lows. In this case, the sale of the dollar will end soon, but there is one "but." This is about today's Powell performance. The Fed chief may not confirm market expectations and not hint at a policy easing but can he strengthen the dollar and will he believe the market? I would rather not believe, just as I did not believe the plans for 2019. The status of the defensive asset will help the dollar. Many global strategists are of the opinion that the dollar can stay afloat due to its protective status. Of course, its growth may stop when the Fed starts to soften the policy but you should not expect a serious fall about this in an interview on television, said by Rabobank foreign exchange strategy manager, Jane FoleyBloomberg, on Bloomberg. She also assured that the US Central Bank will lower the rate at least five times by the end of next year. |

| The Fed may signal a decrease in interest rates: promising growth for EUR/USD and AUD/USD pairs Posted: 04 Jun 2019 02:16 AM PDT The American dollar has already received a real, not imaginary blow, probably for the first time in recent months after Fed member of the Federal Reserve Bank of St. Louis James Bullard said in his speech that lowering interest rates in the near foreseeable future may be justified. Bullard himself has a "dovish note" in the last post-crisis years and even during the interest rate increase cycle, which had already begun under Janet Yellen. It was never seen in the supporters of the Fed's monetary tightening. Therefore, his statements earlier were often ignored by the markets but what he said on Monday lays on fertile soil as they say. Investors are confident that the US economy will continue to slow growth. Hence, its slowdown is already predicted in the second quarter to 1.1% with a steady growth of 3.1%in the first. If this is confirmed and in our opinion, this probability is extremely high against the background of the US trade wars. Thereby, the regulator will have nothing left to do, as it is possible to lower the key interest rate by 0.25% at the September meeting and then by the same most quarter percentage point in December. An additional incentive for such actions will be the need to feed the stock market at the beginning of the actual election campaign of Donald Trump and his competitors at the end of this year. It is not a secret that the American president connects his rating almost directly with the dynamics of the local stock market. Thus, the coming decrease in interest rates will become not only an economic factor but also a political one. Assessing such prospects, we believe that if Fed Chairman Jerome Powell hints at such a possibility in his speech, then we can expect the rally of the American stock market to start. Meanwhile, the dollar continues to weaken, which has already begun. We believe that nothing can prevent this since the dollar with this scenario will actively begin to be used as a funding currency. But at the same time, the rally may be limited if the markets again concentrate on the likely failure of US-China trade negotiations. Forecast of the day: The EUR/USD pair is trading below a strong resistance level in the wake of expectations of the coming easing of the Fed's monetary policy but there will be more ECB meetings ahead, which could put pressure on the euro. In this situation, the pair may adjust to 1.1220 before resuming growth to 1.1300. From a technical point of view, it needs to grow above the level of 1.1260. The AUD/USD pair rose despite the decision of the RBA to lower interest rates. The obvious prospective weakness of the dollar supports the pair. If the price stays above 0.6965, it can continue to climb to 0.7025. But if this does not happen, the pair may adjust to 0.6935 before resuming growth. |

| GBP / USD. Risky party: is the growth of the British currency worth believing? Posted: 04 Jun 2019 02:12 AM PDT The pound against the dollar follows the general trends in the market, dominating the US currency. Over the past month, a pair of gbp / usd has lost more than 600 points, dropping from a price peak in May of 1.3170 to an annual minimum of 1.2558. Therefore, the current correctional growth looks quite logical - both from a fundamental and a technical point of view. For the first time in a long time, the Briton did "let go" of the Brexit theme and took advantage of the weakness of the American dollar. Rumors of a decline in the Fed's interest rate put a strong pressure on the yield of the American debt market and on greenbacks, and because of which, the dollar index sank to the founding of the 97th figure. However, the current situation in the foreign exchange market should be treated with great caution. Traders are now too exposed to emotions, assessing the prospects for the monetary policy of the Fed in general and the dollar in particular. After all, the possible reduction in the interest rate was initially talked to among experts. Analysts and some American politicians, while the members of the Federal Reserve themselves did not voice such intentions. Here, I do not take into account such supporters of the "pigeon" of politics, like Bullard or Kashkari, - they have been advocating for easing monetary conditions since last year. However, the majority of Fed members are still supporters of the wait-and-see attitude, at least at the time of the May meeting of the Federal Reserve. Therefore, in my opinion, the market is too hastening events, laying at current prices. Of course, the idea that the Fed could lower the rate by the end of the year was not born out of thin air. The behavior of the debt market, the stock market, as well as the continued protectionism of the White House against the background of slowing inflation and other macroeconomic indicators cannot be ignored by the US regulator. However, the current situation so far allows the Fed to maintain a wait-and-see attitude, at least in the context of the coming months. Nevertheless, the market estimates the likelihood of interest rate cuts already at the July meeting at 55% (a week ago, the chances were no more than 18%). Such a rapid escalation of the situation could result in an equally rapid rise in the dollar if Jerome Powell rejects the idea of lowering the rate in the near future. It is worth recalling here that today in the period of the American session, the Fed Chairman will speak in the economic conference at the Federal Reserve Bank of Chicago. And the theme of his speech will be devoted directly to prospects (or rather, strategy) of monetary policy. The behavioral logic of gbp / usd traders (as well as eur / usd) is now determined by the market postulate "buy on rumors, sell on facts". But today, the long positions of the pair should be treated with extreme caution: Jerome Powell can either confirm the assumptions of the market, or refute the rumors that have appeared (as has repeatedly happened before). In addition, gbp / usd traders need to be vigilant for another reason. The Brexit theme has a time bomb that will sooner or later remind you of yourself. And judging by indirect signs, this "reminder" will not like the British currency, as well as the bulls of gbp / usd. Let me remind you that now there is an active (but so far "conspiratorial") political struggle between the candidates for the post of British prime minister. According to experts, the leader is still odious Boris Johnson, his most likely competitor is Dominic Raab (former negotiator with the EU). Both are fairly tough with respect to the prospects for Brexit, and both admit the likelihood of a chaotic exit of the country from the Alliance. According to them, they are ready for a dialogue with Brussels, but none of them have yet proposed a formula for a compromise that will suit both Europe and the British parliament. Both Johnson and Raab are not ready to make substantial concessions to the Europeans, while the Europeans themselves refuse in principle to revise the terms of the agreed deal. The situation again comes to a political dead end, from where there are two ways out: either a hard Brexit, or a new delay. The second option would have liked the British currency, but recently the chances for the implementation of this scenario are fading away. Initially, the Germans opposed this option. Bundestag deputies said that Germany would veto another postponement of Brexit if Britain does not hold a general election or a second referendum. Immediately, it should be noted that neither Johnson nor Raab would agree to fulfill this ultimatum. Another key country of the European Union, France, voiced the same conditions, albeit in a somewhat veiled form. French President Emmanuel Macron recently stated that the deadline set for October 31 is the deadline for implementing Brexit, and he personally is against granting any new deferments. True, at the same time, he voiced a rather important reservation - Macron clarified that Britain should withdraw from the EU on October 31, "unless the people of Great Britain want something else." This is a fairly transparent hint at the need for a second referendum, the idea of which is being lobbied by both the Labor Party and some conservatives. But here, it is worth remembering that the candidates for the premiership most likely in Britain are ardent opponents of a repeated referendum. Therefore, harsh statements about this will increase the likelihood of the implementation of the remaining option - hard Brexit. Thus, Powell and Brexit can quickly deploy a pair to the bottom of the 26th figure, and this nuance must be taken into account at least in the context of the placement of stops. In terms of technology, a pair of gbp / usd has the potential to grow up to the level of 1.2750 (the Bollinger Bands average line on the daily chart). The support level is still the price minimum of the year - 1.2558. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBPUSD currency pair - placing trade orders (June 4) Posted: 04 Jun 2019 01:32 AM PDT For the last trading day, the pound / dollar currency pair showed a low volatility of 64 points, as a result of having the structure of the corrective move. From the point of view of technical analysis, we see a steady corrective move on the general weakening of the American currency. The total correction at the current moment is 125 points, reaching a short-term Fibo level of 61.8. Considering the graph in general terms, we see the sequence of measures in the downward trend "Impulse --- Correction ---- Impulse ---- Correction", where the focus of attention, of course, is the maximum of the previous correction on May 27 (1.2746), as in the case of its breakdown, the clock sequence, like the trend itself, can change its meaning. The news background had statistics on business activity in the UK manufacturing sector, where the data went worse than expected, from 53.1 to 49.4. For a short time, the pound was under pressure, showing a decline, but the picture was eventually replaced by growth due to statistics from the United States. In the west, there were similar data on PMI, where liquefaction was also recorded from 52.8 to 52.1, which provoked further closing of positions on the dollar. We turn to the information background, and we see that the background of the trade war, where the United States has already managed to embed its "BUT" everywhere, is strongly pressing on the dollar, arguing that everyone is obliged to them. Go ahead, and we see that US President Donald Trump arrived in Britain on an official visit and has already managed to insert his "BUT" regarding the "divorce" process. Trump thinks that as the UK continues to work on a plan to secede from the European Union. The United States pledges to maintain close relations with both parties. The United States will continue to prepare for any outcome and coordinate its efforts with governments, financial institutions and international organizations to protect their interests. Trump said he supports Brexit, which will be implemented in such a way as not to affect global economic and financial stability, while ensuring the independence of the United Kingdom. If we recall Trump's earlier statements saying that the UK should not pay the EU for Brexit and should only bend its own line, otherwise go out without a deal, then everything falls into place. Today, in terms of the economic calendar, we have data on business activity in the UK construction sector in May, where, according to forecasts, the figure will remain at the same level of 50.5. In the afternoon, Fed Chairman Jerome Powell will speak, where, perhaps, we will hear at least some hints about the life of the bet. Further development Analyzing the current trading schedule, we see that after a slight stagnation within the short-term Fibo level of 61.8, the quotation went on a further increase, reaching as a result, the 1.2685 mark in the form of a puncture. Whether the correction will continue, the question is actually twofold, as the background for Brexit is undoubtedly held, although there is still a lull until the election of a new party leader. Thus, if the background of the trade war at the moment prevails, it is still possible to lose the dollar positions in the 1.2720 area, but then we analyze it further. In turn, traders are already eyeing short positions, since entry points, in principle, are available. Based on the available information, it is possible to expand a number of variations, let's consider them: - Positions to buy, as discussed in the previous review, was point 1.2670, perspective 1.2700-1.2720. - Positions for sale have so far been out of business in the short term. If viewed from current points, then traders view the value of 1.2650 as an entry point. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short and intraday perspective occupied the upward side against the background of the current correction. The medium-term perspective maintains a downward interest on the general background of the market. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (June 4 was based on the time of publication of the article) The current time volatility is 30 points. There is a prerequisite for accelerating volatility due to the information background, but you need to monitor emissions. Otherwise, we can remain in low amplitude. Key levels Zones of resistance: 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 *; 1.3000 **; 1.3180 *; 1,3300 **; 1.3440; 1.3580 *; 1.3700 Support areas: 1.2620; 1,2500 *; 1.2350 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: Will the Fed Chairman support the topic of interest rate cuts? Posted: 04 Jun 2019 12:55 AM PDT The US dollar continued to decline against risky assets after data that production activity in the US in May this year continued to slow down, and fell to its lowest level in 10 years. The problems in the US are the same as in Europe. Weak demand for American products and foreign trade tensions. But unlike the Europeans, the United States is the initiator of the entire conflict. According to a report by IHS Markit, the purchasing managers' index (PMI) for the manufacturing sector of the United States in May 2019 fell to 50.5 versus 52.6 points in April. Let me remind you that the index values above 50 indicate an increase in activity. Economists had forecast the index to be 52.3 points. As for the report of the Institute of Supply Management, it states that production activity in the United States also slowed down in May due to foreign trade tensions. According to the data, the purchasing managers' index (PMI) for the US manufacturing sector in May fell to 52.1 points against 52.8 points in April. Economists had expected the index to rise to 52.3. The main problem remains the escalation of the US-China trade conflict. Let me remind you that in early May this year, the White House administration increased duties on Chinese imported goods to 25%. The rise of the US dollar, which was observed also in recent years, has affected the exports of the United States, which made it less affordable for foreign buyers. Data on construction costs in the United States were ignored. According to the report of the US Department of Commerce, construction costs remained unchanged compared to the previous month and amounted to $1.299 trillion. Economists had forecast that spending in April would increase by 0.4%. Speech by representatives of the US Federal Reserve, and in particular the President of the Federal Reserve Bank of St. Louis, James Bullard, put pressure on the US dollar. Bullard said that a reduction in the rate may be justified in the near future, which will achieve the desired growth of inflation and maintain good economic growth. The topic of interest rate cuts has long been among representatives of the Fed, but no one has seriously stated the need for monetary policy easing. Bullard also noted that the risks to the prospects of the US economy are growing, as trade problems slow down global investment, and further uncertainty in this direction will soon harm the financial sector. The representative of the Fed also drew attention to the fact that not only he is wary of interest rates and considers them too high. Recent statements by US President Donald Trump on foreign trade issues have forced some banks to also expect lower interest rates from the Federal Reserve. Today will be the speech of Fed Chairman Jerome Powell. Traders will closely monitor whether he will share the point of view of his colleagues or will continue to adhere to the current monetary policy. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Jun 2019 12:49 AM PDT EUR / USD Just yesterday, I wrote that the current wave marking can be interpreted in a completely different way, and today it has been transformed. Now, at least on May 23, it is viewed as the completion of wave 3, and, accordingly, correction wave 4, within which three waves are already clearly visible, and has begun its construction. If the current wave counting is correct, then near the levels of 50.0% and 61.8%, the formation of the upward wave may be completed. The pair will move to the phase of the construction of wave 5 of the downward trend segment. The news background, which has recently been providing serious support to the euro may change to the opposite in the coming days. There are serious reasons to expect a slowdown in global economic growth, which will also affect the European Union. The latest euro rise was mainly due to weak US economic data, but don't forget, that the EU itself cannot boast of strong statistics. Thus, I believe that the euro news support will be enough just to build a correctional wave 4. Purchase goals: 1.1278 - 50.0% Fibonacci 1.1317 - 61.8% Fibonacci Sales targets: 1.1106 - 0.0% Fibonacci General conclusions and trading recommendations: The euro / dollar pair remains within the downward trend, but it has proceeded to build a correction wave. In general, purchases are risky now, as wave 4 can end at any time. I recommend maintaining open purchases with targets at 1.1278 and 1.1317, which equates to 50.0% and 61.8% Fibonacci. An unsuccessful attempt to break through one of these marks or the MACD signal is down - and I recommend closing the purchases. GBP / USD On June 3, the GBP / USD pair gained about 30 basis points, and the wave pattern still allows for several scenarios at once. For example, the minimum of May 31 may consider at least the 5-wave structure of waves within wave c. If this is the case, then from current positions, the tool may continue to increase within the new upward trend. However, the news background is not in favor of the pound, as there are too many political problems and problems with Brexit in Britain right now. Thus, from a wave point of view, the pair may be ready for a raise, but without news support, the foreign exchange market will not start to buy the British pound. In this case, I recommend re-buying the US dollar, if the markets again return to sales of the instrument and a successful attempt to break through the Fibonacci level of 200.0% will be executed. Sales targets: 1.2554 - 200.0% Fibonacci 1.2360 - 261.8% Fibonacci Purchase goals: 1.3175 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern of the pound / dollar instrument implies a continuation of the instrument decline within the framework of the supposed wave c. Thus, now I recommend waiting for a breakout level of 200.0% and selling the pound with targets located near the calculated levels of 1.2360 and 1.2176, which corresponds to 261.8% and 323.6% in Fibonacci. An unsuccessful attempt to break through the 200.0% mark could lead to the construction of an upward trend, but without news support, this option is unlikely. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin. Bitcoin rate declined after a large number of CME contracts expired Posted: 04 Jun 2019 12:45 AM PDT Bitcoin declined after a large number of contracts expired in the CME futures market. Over the past week, the total volume of futures contracts for bitcoin increased by 7% and exceeded 5000 units, which is a new historical maximum. However, despite the correction, the upward potential remains. Signal to buy Bitcoin (BTC): There's no point in panicking yet. Buyers need to return to the resistance of 8000, which will build a new wave of growth with the update of the maximum of 8460. Even in the scenario of further bitcoin depreciation, support to the area of 7554 is quite acceptable for opening long positions in the cryptocurrency. Signal to sell Bitcoin (BTC): Bears need to keep bitcoin below the resistance of 8000, which will increase the pressure on the cryptocurrency and allow to update the support of 7554, where I recommend fixing the profit. If the growth scenario is above 8000 USD, you can sell bitcoin on a rebound from a maximum of 8460.

|

| Heading downward: NZD and AUD growth will be short Posted: 04 Jun 2019 12:16 AM PDT The focus is still on the US and Chinese trade war, which contributes to the reduction of macroeconomic data around the world. The US production from ISM fell yesterday to 52.1p, which was the lowest level in 2.5 years as the capital leaves the stock and commodity markets. The market continues to focus on the US and Chinese trade war, which objectively contributes to the reduction of macroeconomic data around the world. The US Manufacturing from ISM fell yesterday to 52.1p, which was the lowest level in 2.5 years. On the other hand, the latest PMI data in Canada and the UK indicate a decline in indices below 50p, which is a shrinking sector. The capital is actively moving away from stock and commodity markets to safe-haven instruments. NZD/USD pair The Treasury published a report on the state of New Zealand's budget and all its indicators remained within the normal range even if government spending increased. In turn, this results in a smaller current account surplus and higher debt. ANZ Bank in a monthly business outlook review notes that inflation expectations have fallen to their lowest levels since the beginning of 2017. The most pronounced decline in spending is noted in residential construction with investment at 5-year lows. Activity in the sector is rapidly declining despite supporting the sector in a tax scheme for construction firms but capital gains tax was excluded. All of these against the background of population growth, which it would seem, should support the demand for housing at a high level. In theory, it is but the problem rests on the low growth rate of incomes of the population, which is a direct consequence of the deterioration of the labor market. The level of labor force participation fell to 67.5% in April, which is a two-year minimum. The decrease in inflationary expectations is a consequence of a reduction in the key rate in May, while the RBNZ in the accompanying commentary explained that more incentives may be needed to achieve a target of 2%. In fact, this means recognizing that New Zealand's economy is slowing down and among other things, restoring the growth impulse requires a decline in the weighted average of the New Zealand dollar. Thus, Kiwi expectations remain negative. The local minimum of 0.6479 formed at the end of May will be subject to verification in the coming days and an increase to 0.6604 on Monday is an excellent reason for sales from a higher level. Today, the price index for dairy products will be published. The dynamics are negative since February 2019 and if confirmed, the kiwi will go first to 0.6555/59 and then to the May lows with an eye to 0.6423. AUD / USD pair RBA expectedly reduced the interest rate by a quarter of a point to 1.25% at the meeting on Tuesday. The decision of the RBA was predicted and did not have a noticeable effect on the AUD rate. Markets waited for the rate cutback in May but then the RBA took a pause. This decision is motivated by the need to get more data. Well, this data was not long in coming. Lending to the private sector (CAPEX) decreased by 1.7% in Q1, according to the ABS. It was mainly due to the mining industry and construction while weak growth is only observed in the service sector. Moreover, the investment plans of companies for 201/20 are low and clearly show that companies are proceeding from the weak growth of the Australian economy. A preliminary estimate shows that investment may decline by 3.5% per year. As in New Zealand, investment in housing construction is decreasing. The number of building permits in April decreased by 4.7%. Everything slows down. The PMI in the manufacturing sector decreased from 54.8p to 52.7p in May as the profit of companies decreased in the first quarter. The price index for raw materials decreased while inflation slowed down. From a fall since April, the AUD undergoes a correction with an upward rollback by 38% on Tuesday morning. It can be assumed that the Australian will be able to rise to 0.7025 or 0.7075 on the effect of a weakening dollar. However, such a scenario is possible only if China shows confidence in the trade dispute with the USA. There is a slight chance for the formation of a local peak and a resumption of decline to 0.6840 and further since weakening AUD is objectively necessary to support the Australian economy, especially given that the growth of panic will lead to the departure of capital into defensive assets. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Jun 2019 12:10 AM PDT To open long positions on GBP/USD, you need: Yesterday, buyers of the pound held above the important support level of 1.2623, which bears tried to break through throughout the day. This allowed us to keep the upward correction, which is now aimed at the resistance of 1.2697, a breakthrough above will provide GBP/USD return to a maximum of 1.2744, where I recommend fixing the profit. In the scenario of a pound decline in the first half of the day, only the formation of a false breakout in the support area of 1.2656 will allow buyers to return to the market. In another scenario, it is best to open long positions on the rebound from the minimum of 1.2611. To open short positions on GBP/USD, you need: Sellers of the pound will count on the formation of a false breakout in the resistance area of 1.2697, which will be the first signal to open short positions in order to reduce to the support of 1.2656. However, the main task of the bears is to consolidate under the level of 1.2656, which will lead to the demolition of a number of stop orders of buyers and a larger decrease in GBP/USD in the area of the minimum of 1.2611, where I recommend fixing the profits. In a growth scenario above 1.2697, the resistance range of 1.2744 will be an acceptable area for short positions. Indicator signals: Moving Averages Trading is above 30 and 50 moving averages, indicating an upward correction in the pound. Bollinger Bands The average border of the indicator in the area of 1.2656 keeps the pound from a new wave of falling. In the GBP/USD growth scenario, short positions can be considered to rebound from the upper limit in the area of 1.2697. Description of indicators

|

| Posted: 04 Jun 2019 12:09 AM PDT To open long positions on EURUSD, you need: Yesterday, euro buyers reached the resistance of 1.1261 after statements about a possible decrease in interest rates in the US, but a breakdown of this range is necessary for continued growth. Divergence formed in the MACD indicator can prevent the buyers to continue the growth in the first half of the day. Therefore, the whole calculation is on good inflation data in the eurozone, which will provide a breakthrough of 1.1261 and exit to the highs of 1.1294 and 1.1336, where I recommend fixing the profits. With a decrease in EUR/USD, support will be provided by the area of 1.1230, from which it is best to open long positions if a false breakout is formed. I recommend to buy for a rebound from a minimum of 1.1199. To open short positions on EURUSD, you need: Sellers of the euro will count on the divergence, which is formed on the MACD indicator, so an unsuccessful breakthrough and a return to the level of 1.12261 will be the first signal for the opening of short positions of the euro, the purpose of which will be the support of 1.1230, where I recommend fixing the profit. However, it is worth remembering that weak inflation in the eurozone can help push the pair to a minimum of 1.11199. In the scenario of further growth in the trend above 1.1261, you can look at short positions from the resistance of 1.1294 or a rebound from the maximum of 1.1336. Indicator signals: Moving Averages Trading is conducted above 30 and 50 moving averages, which indicates the bullish nature of the market. Bollinger Bands In the event of a decline in the euro, support will be provided by the average indicator border in the area of 1.1230, while it can be sold after the unsuccessful breakdown of the upper indicator border in the area of 1.1285. Description of indicators

|

| Posted: 04 Jun 2019 12:09 AM PDT 4-hour timeframe Technical data: The upper linear regression channel: direction – down. The lower linear regression channel: direction – down. The moving average (20; smoothed) – sideways. CCI: 124.4577 The British pound sterling halted halfway above the MA, which formally changed the trend for the GBP/USD pair to an upward one. But both linear regression channel is still directed downwards, eloquently pointing to a downward trend. Meanwhile, Donald Trump, who is on a visit to the UK at the invitation of Queen Elizabeth II, said on what terms he supports Brexit. According to the US leader, Brexit should take place as soon as possible, but should not affect the "global economic and financial stability". Earlier, Trump advised London to leave the EU without paying any fines and agreements with Brussels. According to unofficial information, Trump will meet today with Nigel Farage, leader of the Brexit party, and supporters of the "hard" Brexit, to discuss the issues of the fastest exit of the UK from the EU. In general, we can say that the Brexit process is at a "dead point". Until a new Prime Minister is elected, there will be no change in this procedure. Thus, first, we need to wait for June 7, when Theresa May officially resigns as leader of the Conservative party. Secondly, we must wait for the elections to be held for the new conservative leader and Prime Minister. Only after that Theresa May will resign from the post of Prime Minister, and the country will be ruled by a new leader. And only after that can we expect any changes or actions in the Brexit procedure. In the meantime, despite the interception of the initiative in the market bulls, a strong strengthening of the pound should not wait. At any time, bears can again begin to put pressure on the pound sterling. Nearest support levels: S1 – 1.2634 S2 – 1.2573 S3 – 1.2512 Nearest resistance levels: R1 – 1.2695 R2 – 1.2756 R3 – 1.2817 Trading recommendations: The currency pair GBP/USD overcame the moving average line. Thus, it is now recommended to consider the purchase of the pound sterling in small lots with the targets at 1.2695 and 1.2756. Short positions should be considered after the consolidation of the pair pound/dollar below the moving average with targets at 1.2573 and 1.2512. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustrations: The upper linear regression channel – the blue line of the unidirectional movement. The lower linear regression channel – the purple line of the unidirectional movement. CCI – the blue line in the indicator regression window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels – multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Jun 2019 12:09 AM PDT 4-hour timeframe Technical data: The upper linear regression channel: direction – down. The lower linear regression channel: direction – down. The moving average (20; smoothed) – up. CCI: 195.0985 The EUR/USD currency pair continued its upward movement, which was initially provoked by the desire of traders to fix part of the profit on short positions but was later supported by another package of weak macroeconomic statistics from the States. Similarly, the failed statistics from the Eurozone were ignored by traders. As a result, the euro rose to the highs of May 1 and 13, the CCI indicator shows a strong oversold, and we expect at least a downward correction. Today, June 4, the preliminary value of the consumer price index for May will be published in the European Union. It is expected that the main inflation rate will slow down from 1.7% to 1.3% in annual terms. Given the growth of the euro in the last two days, we cannot say that such a weak value of inflation is already embedded in the euro/dollar exchange rate. Thus, if the forecasts come true, today we can see the return of the markets to the sales of the European currency. Also in Europe today, there will be a report on unemployment, and in the States, Jerome Powell will speak. It should be discussed in more detail. Recently, amid the escalation of the trade war with China and the failed reports from the US, conversations began to emerge that the Fed could go on reducing the rate in the near future. We believe that this information has no basis, as macroeconomic statistics from the United States is really bad only in the last few weeks, and during the first round of the trade conflict with China, the Fed was engaged in tightening monetary policy. The head of the Fed in the evening can dispel or, conversely, confirm this information. Nearest support levels: S1 – 1.1230 S2 – 1.1200 S3 – 1.1169 Nearest resistance levels: R1 – 1.1261 R2 – 1.1292 R3 – 1.1322 Trading recommendations: The currency pair EUR/USD continues the recoilless upward movement. Thus, it is recommended to support previously opened orders to buy the euro with the targets at 1.1292 and 1.1322 before the reversal of the indicator Heiken Ashi down. It is recommended to buy the US dollar after the bears return the initiative to their hands and there will be a consolidation of the euro/dollar pair under the moving average line with the targets at 1.1139 and 1.1108. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustrations: The upper linear regression channel – the blue line of the unidirectional movement. The lower linear regression channel – the purple line of the unidirectional movement. CCI – the blue line in the indicator window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels – multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment