Forex analysis review |

- Fractal analysis of major currency pairs on July 2

- The manufacturing sector has increased the headache of the ECB and hit the euro

- EUR / USD vs USD / JPY vs EUR / JPY Daily. Comprehensive analysis of movement options for July 2019. Analysis of APLs &

- What are the coming days for the euro and pound?

- The dollar welcomes the truce of the United States and China, but the greenback's joy might be short-lived

- AUD/USD. July meeting of the RBA: preview

- GBP/USD. July 1. Results of the day. Boris Johnson believes that the "hard" Brexit is not as dangerous as they think

- EUR/USD. July 1. Results of the day. Eurozone business activity weighed on the euro

- EURUSD: Unemployment will only provide temporary support for the euro, while other indicators will continue to disappoint

- July 1, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- BITCOIN to break below $10,000 again? July 1, 2019

- EURUSD pulls back towards important Fibonacci retracement

- Gold 07.01.2019 - Sellers in control, new wave down possible

- Gold price pulls back towards $1,380 as expected. Now what?

- EUR/USD for July 01,2019 - Perfect test of the hourly EMA, new down wave yet to come

- BTC 07.01.2019 - Down breakout of the balance, more downside yet to come

- GBP/USD: plan for the US session on July 1. Sellers of the pound broke below 1.2660, but now we need to stay below this level

- EUR/USD: plan for the US session on July 1. The bulls came back after data on the labor market in the eurozone, but other

- Technical analysis of EUR/USD for July 01, 2019

- Technical analysis of GBP/USD for July 01, 2019

- Yen takes a step back

- The results of the G20 summit gave the markets a new batch of optimism (We expect a local decline in the EUR/USD pair and

- European currency may rise against the US dollar – Wells Fargo

- Gold to push lower towards $1320-50. July 1, 2019

- EUR/USD: USD to regain momentum ahead of NFP? July 1, 2019

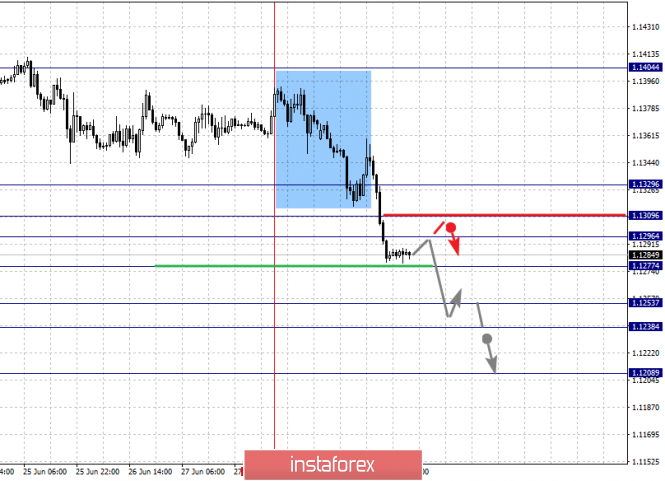

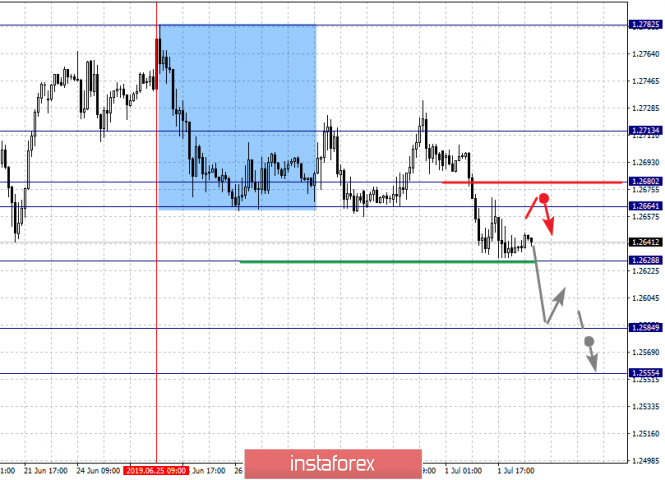

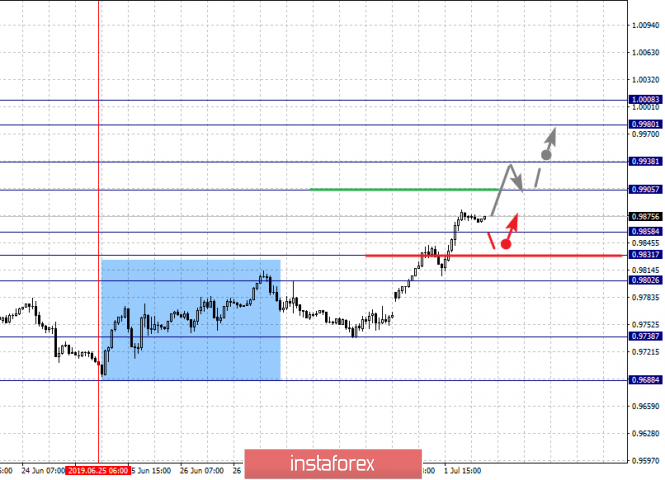

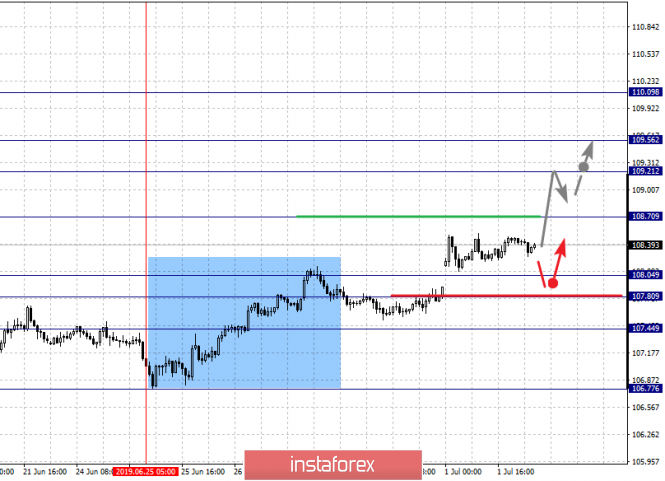

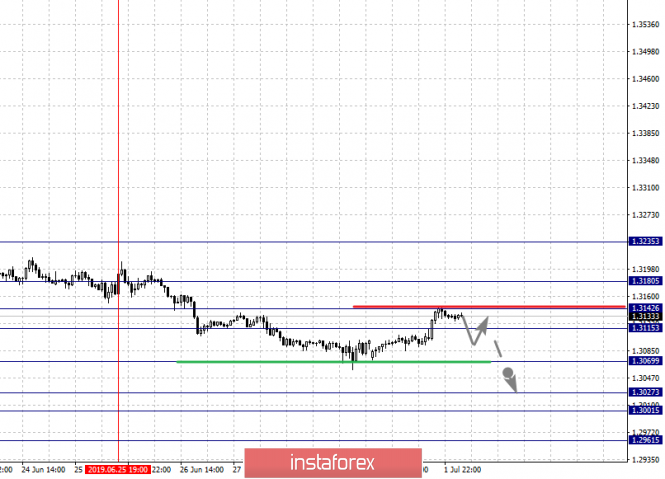

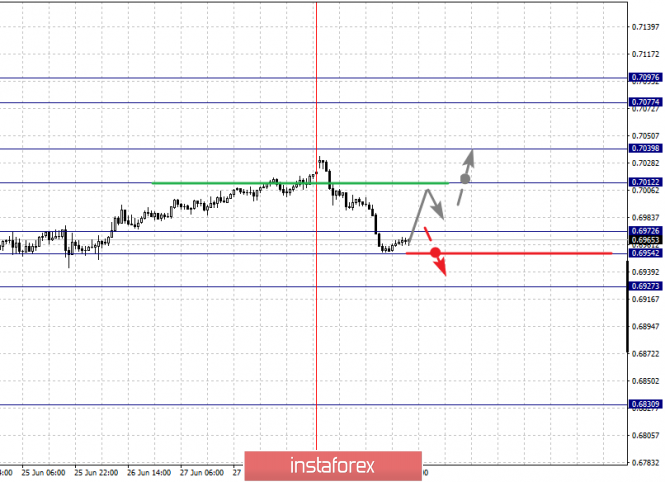

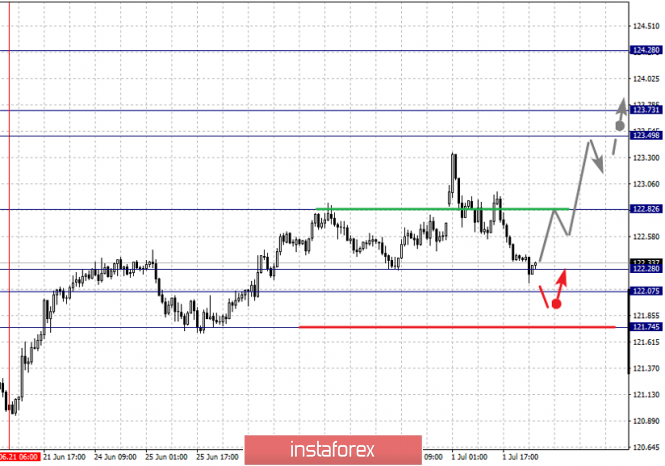

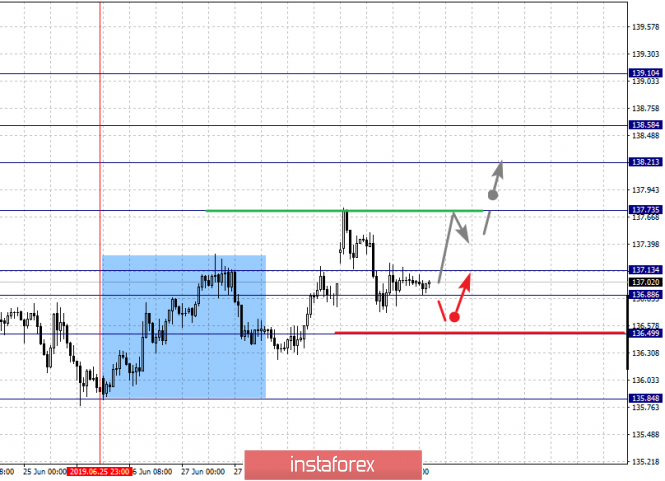

| Fractal analysis of major currency pairs on July 2 Posted: 01 Jul 2019 05:59 PM PDT Forecast for July 2: Analytical review of H1-scale currency pairs: For the euro / dollar pair, the key levels are: 1.1329, 1.1309, 1.1296, 1.1277, 1.1253, 1.1238 and 1.1208. Here, the development of the downward trend is expected 1.1277. In this case, the target is 1.1253. Price consolidation is in the range of 1.1253 - 1.1238. For the bottom value, we consider the level of 1.1208. After the breakdown of the level of 1.1238. Short-term upward movement, possible in the range 1.1296 - 1.1309. The breakdown of the latter will lead to in-depth correction. Here, the goal is 1.1329. This level is a key support for the downward structure. The main trend is the downward trend from June 24. Trading recommendations: Buy 1.1296 Take profit: 1.1307 Buy 1.1310 Take profit: 1.1327 Sell: 1.1275 Take profit: 1.1255 Sell: 1.1236 Take profit: 1.1210 For the pound / dollar pair, key levels on the H1 scale are: 1.2713, 1.2680, 1.2664, 1.2628, 1.2584 and 1.2555. Here, we are following the development of the downward structure of June 25th. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2628. In this case, the goal is 1.2584, wherein consolidation is near this level. For the potential value for the bottom, we consider the level of 1.2555. After reaching which, we expect to go into a correction. Short-term upward movement is expected in the range of 1.2664 - 1.2680. The breakdown of the last value will lead to a prolonged correction. Here, the target is 1.2713. This level is a key support for the downward structure. The main trend - the downward structure of June 25. Trading recommendations: Buy: 1.2664 Take profit: 1.2680 Buy: 1.2682 Take profit: 1.2710 Sell: 1.2626 Take profit: 1.2586 Sell: 1.2582 Take profit: 1.2557 For the dollar / franc pair, the key levels on the H1 scale are: 1.0008, 0.9980, 0.9938, 0.9905, 0.9858, 0.9831 and 0.9802. Here, we continue to follow the development of the ascending cycle of June 25. The continuation of the movement to the top is expected after the breakdown of the level of 0.9905. In this case, the target is 0.9938, and near this level is a price consolidation. The breakdown of the level of 0.9938 should be accompanied by a pronounced upward movement. Here, the target is 0.9980. For the potential value for the top, we consider the level of 1.0008. After reaching which, we expect consolidation, as well as a rollback to the correction. Short-term downward movement is possible in the range of 0.9858 - 0.9831. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 0.9802. This level is a key support for the top. Its price will lead to the development of the downward structure. Here, the potential goal is 0.9738. The main trend is the ascending cycle of June 25. Trading recommendations: Buy : 0.9905 Take profit: 0.9936 Buy : 0.9939 Take profit: 0.9980 Sell: 0.9858 Take profit: 0.9832 Sell: 0.9829 Take profit: 0.9802 For the dollar / yen pair, the key levels on the scale are : 110.09, 109.56, 109.21, 108.70, 108.04, 107.80 and 107.44. Here, we continue to follow the development of the ascending structure of June 25. The continuation of the movement to the top is expected after the breakdown of the level of 108.70. In this case, the goal is 109.21. Short-term upward movement, as well as consolidation is in the range of 109.21 - 109.56. For the potential value for the top, we consider the level of 110.09. The movement to which, is expected after the breakdown of the level of 109.56. Short-term downward movement, perhaps in the range of 108.04 - 107.80. The breakdown of the latter value will lead to in-depth correction. Here, the goal is 107.44. This level is a key support for the top. The main trend: the ascending structure of June 25. Trading recommendations: Buy: 108.70 Take profit: 109.20 Buy : 109.24 Take profit: 109.53 Sell: 108.04 Take profit: 107.82 Sell: 107.78 Take profit: 107.46 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3180, 1.3142, 1.3115, 1.3069, 1.3027, 1.3001 and 1.2961. Here, we continue to monitor the local downward structure of June 25. At the moment, the price is in the correction zone. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3069. In this case, the goal is 1.3027. Price consolidation is in the range of 1.3027 - 1.3001. For the potential value for the bottom, we consider the level of 1.2961. After reaching which, we expect a rollback to the top. Consolidated movement is possible in the range of 1.3115 - 1.3142. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3180. This level is a key resistance for the development of the ascending structure. Its breakdown will make it possible to count on movement towards the potential target - 1.3235. The main trend is a local downward structure from June 25. Trading recommendations: Buy: 1.3143 Take profit: 1.3180 Buy : 1.3182 Take profit: 1.3230 Sell: 1.3067 Take profit: 1.3027 Sell: 1.3001 Take profit: 1.2961 For the pair Australian dollar / US dollar, the key levels on the H1 scale are : 0.7097, 0.7077, 0.7039, 0.7012, 0.6972, 0.6954 and 0.6927. Here, we are following the development of the ascending structure of June 18. At the moment, the price is in correction and forms the potential for the downward movement of June 28. The continuation of the movement to the top is expected after the breakdown of the level of 0.7012. In this case, the goal is 0.7039, and near this level is a price consolidation. The breakdown of the level of 0.7040 must be accompanied by a pronounced upward movement. Here, the goal is 0.7077. For the potential value for the top, we consider the level of 0.7097. Upon reaching this level, we expect a consolidated movement in the range of 0.7077 - 0.7097, as well as a rollback to the bottom. Consolidated movement is possible in the range of 0.6972 - 0.6954. The breakdown of the last value will lead to a prolonged correction. Here, the target is 0.6927. This level is a key support for the top. The main trend is the upward structure on June 18, the correction stage is the formation of potential for the bottom of June 28. Trading recommendations: Buy: 0.7012 Take profit: 0.7037 Buy: 0.7041 Take profit: 0.7077 Sell : Take profit : Sell: 0.6952 Take profit: 0.6930 For the euro / yen pair, the key levels on the H1 scale are: 124.28, 123.73, 123.49, 122.82, 122.28, 122.07 and 121.74. Here, we are following the development of the ascending structure of June 21. The continuation of the upward movement is expected after the breakdown of the level of 122.82. In this case, the first target is 123.49. A short-term upward movement, as well as consolidation is in the range of 123.49 - 123.73. The breakdown of the level of 123.73 should be accompanied by a pronounced upward movement to the potential target - 124.28. Short-term downward movement is expected in the range of 122.28 - 122.07. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 121.74. This level is a key support for the upward structure. The main trend is the upward structure of June 21, the stage of correction. Trading recommendations: Buy: 122.82 Take profit: 123.49 Buy: 123.50 Take profit: 123.72 Sell: 122.28 Take profit: 122.08 Sell: 122.05 Take profit: 121.75 For the pound / yen pair, the key levels on the H1 scale are : 139.10, 138.58, 138.21, 137.73, 137.13, 136.88 and 136.49. Here, we continue to monitor the ascending structure of June 25. The continuation of the movement to the top is expected after the breakdown of the level of 137.73. In this case, the target is 138.21. A short-term upward movement, as well as consolidation is in the range of 138.21 - 138.58. For the potential value for the top, we consider the level of 139.10. The movement to which, is expected after the breakdown of the level of 138.58. Short-term downward movement is possible in the range 137.13 - 136.88. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 136.49. This level is a key support for the top. The main trend is the local rising structure of June 25. Trading recommendations: Buy: 137.75 Take profit: 138.20 Buy: 138.25 Take profit: 138.55 Sell: 137.13 Take profit: 136.90 Sell: 136.85 Take profit: 136.50 The material has been provided by InstaForex Company - www.instaforex.com |

| The manufacturing sector has increased the headache of the ECB and hit the euro Posted: 01 Jul 2019 05:18 PM PDT According to the survey, production activity in the eurozone declined last month more than previously thought. Pessimistic data is likely to strengthen the position of those who require the ECB to ease monetary policy. In June, the total index of purchasing managers (PMI) from IHS Markit was 47.6 points, which is lower than the previously recorded figure of 47.8 points and May points 47.7 points. This is the fifth month in a row, when the indicator is below the level of 50 points, separating growth from reduction. "Production in the eurozone remains at a standstill in a steep decline in June, continuing to fall at the fastest pace in the last six years. Disappointing survey data completes the second quarter, where the average PMI was the lowest since the first months of 2013," comments Chris Williamson, chief economist at IHS Markit. All this indicates that the beginning of the second half of the year will be weak, new orders fall for the ninth month, stocks of new materials are not replenished, the number of personnel has decreased for the second month in a row. To try to stimulate demand, manufacturers almost do not raise prices. The PMI price index in the manufacturing sector fell to 50.6 points compared with the May 51.6 points, reaching the lowest level since September 2016. Official data showed that inflation in the eurozone remained weak in June, at 1.2%, which is far from the 2% that the ECB would like. The decline in production is increasingly helping to reduce inflationary pressures, as manufacturers and suppliers restrain price increases in order to keep customers and increase sales. ECB President Mario Draghi, in his speech last month, spoke of the need for additional incentives in the absence of any acceleration in economic growth and inflation. According to a recent Reuters survey, by the end of September, the central bank will either lower the rate on deposits, or even further weaken its forward forecasts. The material has been provided by InstaForex Company - www.instaforex.com |

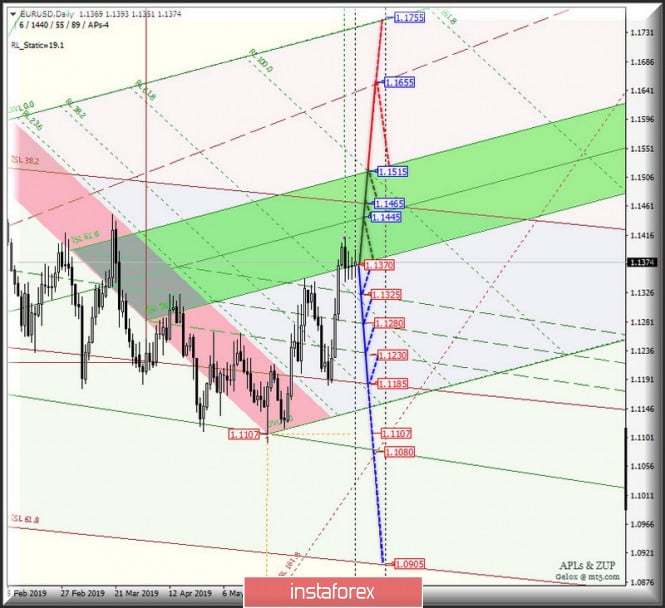

| Posted: 01 Jul 2019 05:18 PM PDT Minor (Daily) operating scale Let me bring to your attention a comprehensive analysis of the movement options for the development of the EUR / USD vs USD / JPY vs EUR / JPY movement for July 2019 on the Minor (daily timeframe) operational scale. ____________________ Euro vs US Dollar For July 2019, the movement of the single European currency EUR / USD will be due to the working out and direction of the breakdown of the equilibrium zone (1.1370 <-> 1.1445 <-> 1.1515) of the Minuette operating scale (movement options within this zone are shown in the animated graphic). EUR / USD return below the lower limit of ISL38.2 (support level of 1.1370) of the balance zone Minuette operational scale fork -> continuation of the downward movement of the single European currency to the boundaries of the a Median Line channel Minute (1.1325 <-> 1.1280 <-> 1.1230) with the prospect of reaching the Median Line (support level of 1.1185) of the Minor operational scale. The breakdown of resistance level of 1.1515 (upper limit of ISL61.8 equilibrium zone of the Minute operational scale fork) -> option to achieve a single European currency with the final Schiff Line (resistance level of 1.1655) of the Minor operational scale fork. Markup options for the movement of EUR / USD can be seen at the animated graphics ->

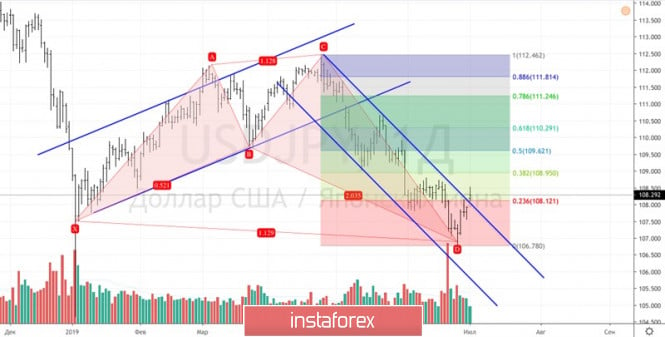

____________________ US Dollar vs Japanese Yen The movement of USD / JPY for July 2019 will be due to the testing and direction of the breakdown of the 1/2 Median Line channel boundaries (106.35 <-> 107.45 <-> 108.30) of the Minuette operating scale. The breakdown of the resistance level of 108.30 (upper limit of the channel 1/2 Median Line Minute) -> a variant of the development of USD / JPY movement inside the 1/2 Median Line channel (108.30 <-> 109.50 <-> 110.60) of the Minor operating scale fork with the prospect of achieving the goals - > warning line LWL38.2 Minor (111.30) <-> control line UTL Minuette (111.65) <-> maximum 112.45. In the event of the breakdown of the lower boundary of the 1/2 Median Line channel Minuette (106.35), it will be possible to continue the development of the downward movement of USD / JPY to the final Schiff Line (104.45) of the Minor operational scale and the upper limit of the ISL38.2 (103.80) balance zone of the Minuette operational scale fork. Markup options for the movement of the USD / JPY are shown in the animated graphic ->

____________________ Euro vs Japanese Yen The development of the movement of cross-instrument data currency instruments EUR / JPY for July 2019 will be due to the working out and direction of the breakdown of the boundaries of the 1/2 Median Line channel (122.45 <-> 123.15 <-> 123.75) of the Minuette operating scale fork. The details of this movement are presented in animated graphics. The breakdown of the support level of 122.45 (the lower limit of the 1/2 Median Line channel Minuette) -> the development of the downward movement of the cross instrument can be continued to the targets -> the initial SSL line (121.20) of the Minuette operational scale fork <-> 1/2 Median Line (120.60) Minor operational scale fork <-> LTL control line (120.30) Minuette operational scale fork. The breakdown of the resistance level of 123.75 (upper limit of the 1/2 Median Line channel Minute) -> continued development of the upward movement of EUR / JPY to the equilibrium zone (124.20 <-> 125.25 <-> 126.20) of the Minuette operational scale fork. The markup of the EUR / JPY movement options for July 2019 is presented in the animated graphic ->

____________________ The review was compiled without regard to the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy") The formula for calculating the dollar index is USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where power ratios correspond to the weights of currencies in the basket: Euro - 57.6%; Yen - 13.6%; Pound sterling - 11.9%; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula gives the index value to 100 on the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| What are the coming days for the euro and pound? Posted: 01 Jul 2019 05:02 PM PDT The desire of the United States and China to make concessions and resume trade negotiations was perceived positively by the markets. Donald Trump promised to suspend the process of imposing sanctions. In addition, the US allowed Chinese Huawei to buy its technology, with the exception of strategic products associated with the G5 network. China, in turn, will buy more US agricultural products. News from the Japanese Osaka contributed to the continuation of the rally in global stock markets, while the safe haven asset decreased in price due to moderate demand for risk-sensitive currencies. However, the good mood and a certain slackness, most likely, will not last long, since for serious fundamental changes it is necessary to stop the trade wars. Uncertainty has not really disappeared anywhere, which means that the rate cut in July will still happen. Trump will certainly continue to criticize the Fed. The US president still needs a scapegoat, and Jerome Powell is best suited for this role. A thaw in US-China relations will allow Fed officials to focus on statistics and the health of the US economy. Something suggests that easing the policy will be inappropriate in the best half-year terms of the S&P 500 from 1997, increasing consumer spending and for the third month in a row exceeding the PCE monthly growth rates. Inflation in the US really looks modest (1.6%), but it can easily reach the target (2%). A number of global strategists, including economists at Deutsche Bank, believe that the US regulator will lower the rate this year purely symbolically and then return it to its former state in order to support record economic expansion in the United States. This suggests a temporary weakness of the dollar. Was it really worth getting rid of dollars so actively? The desire of other world central banks to reduce the rate will benefit the US currency. The dollar's status as a safe haven asset in the medium to long term could have been undermined by the end of trade wars, but this has not yet happened. It is not necessary to count on the rapid ascent of the EUR/USD pair, since the eurozone is still weak. Quotes of the main pair are likely to continue to consolidate around $1.12-1.14. About the pound As for the pound, the general news background, including the last summit in Japan, does not set it in motion. It is also worth noting that Brexit has ceased to be a good reason for speculation. On Sunday, Boris Johnson again promised the best for Britain's exit from the EU if he wins the election. Pound traders completely ignored this message. Voting for the leader of the Conservative Party will end on July 22, and from the 23rd in the UK there will be a new prime minister. Traders should pay attention when voting for British MPs on Wednesday on the expenditure side of the budget with amendments to stop funding if the government chooses a "hard" Brexit without ratification by Parliament. The legality of such a correction of the plan for financial expenses is doubtful, but this is still the only fundamental factor of pressure on the pound. The overall distribution of large volumes remains the same, in the meantime, a priority to sell remains. We should look at the PMI industry and services with the publication on Monday and Wednesday, respectively. |

| Posted: 01 Jul 2019 04:55 PM PDT The exchange rate of the US currency is growing in relation to the majority of its main competitors against the background of the fact that over the past weekend the United States and China reached an agreement on the resumption of trade negotiations. "The market's positive reaction to the results of the meeting of the two leaders will be short-lived, and the dollar will resume falling," said Daisuke Karakama, chief economist at Mizuho Bank. He noted that the parties did not reach a long-term peaceful resolution, while the desire of the US Federal Reserve System (FRS) to lower the interest rate remains in force. According to the analyst, the euro and the yen are the currencies that will benefit most from the weakness of the greenback. Currency strategists at Wells Fargo forecast that in the medium term, EUR/USD will rise to a level of 1.18. However, they do not exclude growth to 1.20. Nissay Asset Management experts believe that the strengthening of the dollar against the yen will be limited to 108.50, as the improvement in risk sentiment caused by the truce of Washington and Beijing will be short-lived. In addition, the potential easing of monetary policy by the Fed will put pressure on greenbacks. "In the foreseeable future, the theme of the decline in the dollar exchange rate will become one of the key ones," said representatives of Aberdeen Standard Investments. "The decision of the United States and China to resume negotiations almost did not affect the market's expectations regarding further Fed actions, so traders will continue to rely on weakening the greenback," the experts are certain. In May, the USD index reached annual highs amid rising demand for the US currency as a safe-haven asset. However, since then, namely after the appearance of a signal about the readiness of the Fed, for the first time in ten years to reduce the interest rate, the greenback has fallen in price by more than 2%. According to the Commodity Futures Trading Commission (CFTC), big speculators have been reducing their long positions in the dollar for three weeks in a row. Derivatives market lays in quotes fast interest rate reduction in the United States and expects that the Fed can go for it in July. According to analysts of DBS Group Holdings, given the fact that tensions in trade relations between the United States and China temporarily faded into the background, US statistics will again be in the focus of attention of traders. This week, there will be data on business activity in the manufacturing sector and the US service sector, releases on the volume of industrial orders and the trade balance of the country, as well as a report on the US labor market in June. The material has been provided by InstaForex Company - www.instaforex.com |

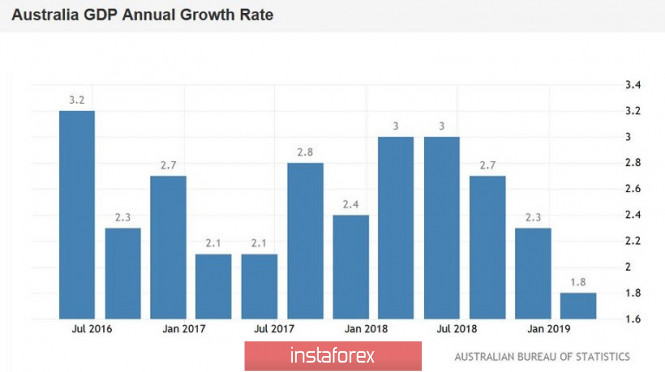

| AUD/USD. July meeting of the RBA: preview Posted: 01 Jul 2019 04:42 PM PDT The Australian dollar paired with the US currency overcame the key resistance level of 0.7000 at the end of last week, demonstrating a strong upward momentum. For two weeks, the pair grew steadily, rising from an annual low of 0.6838 to a local peak of 0.7027. But the bulls did not manage to stay at a high altitude: the US dollar strengthens its position against the background of the truce between the US and China, while the Australian dollar weakens throughout the market in anticipation of the July meeting of the RBA, which will be held on July 2 All other fundamental factors (for example, the continuing increase in the value of iron ore) are of secondary importance. Recall that at the end of the G-20 summit, the United States agreed not to introduce additional tariffs on Chinese imports, while canceling certain (but not all) restrictions on the telecommunications giant Huawei. Beijing, in turn, agreed to resume purchases of American agricultural products (the volume and list of goods remain unknown). In general, the parties agreed to return to the negotiating table, giving traders hope for the de-escalation of the US-China conflict. On the first trading day of the week, this optimism prevailed throughout the market, which provided support to the dollar. The AUD/USD pair here is no exception: the greenback puts quite a strong pressure on the price - the aussie lost more than 150 points in half a day. On the one hand, the trade truce between the United States and China is good news for the Australian currency, since the Australian economy is quite dependent on the Chinese. But the main beneficiary of the current situation is still the US dollar, since the risk of aggressively lowering the interest rate of the Fed has decreased significantly. The market does not exclude the possibility of monetary policy easing at the next meeting or in September, but almost completely eliminated the option of a one-time rate reduction by 50 basis points at once. Before the G20 summit, the probability of such a move was 26%. Also, some experts today suggested that the US regulator would take a wait-and-see attitude, postponing consideration of the issue of reducing rates for the second half of autumn. There are a lot of versions, but most of them boil down to the fact that the Fed will reconsider its position due to a decrease in geopolitical tensions. Although, in my opinion, the market makes premature conclusions, and the US dollar is growing only on emotions, the fact remains: anti-risk sentiment has now dropped, the trade war has been paused, and the likelihood of the Fed's aggressive actions regarding the rate cut has decreased to almost zero. All this makes it possible for the greenback to dominate in nearly all dollar pairs, including in conjunction with the Australian dollar, which is waiting for the next round of the RBA rate cut. The minutes of the June meeting of the Reserve Bank of Australia, published 2 weeks ago, made it clear that the regulator would not be satisfied with a one-time rate reduction: according to members of the regulator, further easing of monetary policy may be needed "soon" against the ambiguous situation in the labor market and the economy as a whole . Australian GDP growth in the first quarter really slowed to a ten-year low. GDP grew by only 1.8% over the same period last year. Compared with the previous quarter, the key indicator increased in January-March by 0.4%. The result was weaker than even the most pessimistic forecasts. The unemployment rate also shows a negative trend: in April it rose to the level of 5.2% and in May remained at the same values, although experts predicted a decline to the 5% mark. The increase in the number of employees should also be viewed through the prism of the structure of this indicator. In May, part-time employment increased significantly, while full-time employment (where higher wages) showed a minimal increase. This dynamic affects Australian consumer activity and ultimately inflation. The head of the RBA recently spoke about the existing probability of interest rate reduction. At the beginning of the week before last, he said that a one-time reduction in the rate to a record-low level of 1.25% would not be enough to stimulate economic growth. By this, he confirmed the market's concerns regarding the future actions of the Australian regulator. In addition, currency strategists at Westpac (one of the largest banks in Australia) again reminded of their forecast - in February they warned that the RBA would lower the rate twice even three times this year. After the relevant comments of Lowe, it became clear that the sounded scenario may well come true. Chinese data also added fuel to the fire. The manufacturing index PMI, calculated by Caixin, fell in June to 49.4 points. For the first time in four months, the indicator fell below the key mark of 50 - this indicates that manufacturing activity in China fell in June against the background of a trade conflict with the US Thus, the Reserve Bank of Australia is likely to lower its interest rate by 0.25% tomorrow. This fact is already partially taken into account in prices, so the initial effect will be limited to the support level of 0.6930 (at this price point, the Tenkan-sen Kijun-sen lines on the daily chart intersect). Further price dynamics will depend on the rhetoric of Philip Lowe. If he allows further easing of monetary policy, AUD/USD will go to the support level of 0.6850 (the bottom line of the BB on the daily and weekly charts). If the regulator will assure the market that now the RBA will take a wait-and-see position, a rebound to the level of 0.7000 is not excluded, with a possible overcoming of this price barrier. Therefore, one should not trust the initial reaction of the market to the decision of the Australian central bank, especially considering the fact that the speech of the head of the RBA will take place 5 hours after the announcement of the results of the July meeting. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Jul 2019 04:12 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 59p - 112p - 45p - 63p - 72p. Average amplitude for the last 5 days: 70p (77p). on Monday, June 27, the British pound sterling also fell against the US currency, as the index of business activity in the UK dropped compared with May from 49.4 to 48.0. Such a serious decline could not go unnoticed by traders. Recently, the drop in macroeconomic indicators in the United States is not only lazy, but at the same time, we would like to note that business activity in the industrial sector both in the UK and in the EU has decreased in June and is under the critical 50.0. While the same indicator is above 50.0 in the US, and this month it has improved. Thus, the disappointing statistics of June could be just a banal accident, of short duration. In any case, as new macroeconomic information comes from overseas, we will find confirmation or refutation of this hypothesis. If our assumption is correct, then the US dollar may return to the usual course of growth for itself in recent years against European currencies. The situation with the pound sterling is also specific due to the non-concluding Brexit. It is very difficult for the pound to show growth even in the face of weakness in US statistics, as the markets simply don't want to risk due to complete uncertainty about the future of the UK. Meanwhile, Boris Johnson does not do a single day without a new interview. Today, July 1, Johnson told the press that there is a whole mass of opportunities to reduce the negative effects of the "hard" Brexit, hinting that you should not be afraid of this option. He also said that he does not think that the UK will leave the EU without an agreement, again hinting at new negotiations with Brussels. Trading recommendations: The pound/dollar currency pair has started a downward movement, but has not yet been able to overcome the Senkou Span B line. Overcoming this line will make it possible for traders to trade for a fall in order to support the level of 1.2591. It will be possible to buy the British currency when the pair has consolidated above the Kijun-sen line. In this case, the upward trend may resume with the first target level of 1.2765. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. July 1. Results of the day. Eurozone business activity weighed on the euro Posted: 01 Jul 2019 03:56 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 37p - 68p - 43p - 34p - 42p. Average amplitude for the last 5 days: 45p (55p). On the first trading day of the week, the European currency resumed its downward movement, which was interpreted as a correction last week. Today, the euro was disappointed by macroeconomic reports on business activity in the European Union and the United States. If in the EU, business activity in the manufacturing sector has deteriorated even more and now stands at only 47.6 (the previous value was 47.8), in the United States, the ISM and Markit business indices exceeded forecast values and an important mark of 50.0 and reached 51.7 and 50.6 respectively. Thus, all three reports of today were in favor of the US currency. We already wrote about the results of the G-20 summit in the morning review, we believe that we cannot simply single out any important results. The fact that negotiations between Beijing and Washington will continue was clear before the summit. We do not know any details of the negotiations or future agreements. Accordingly, a week later Trump can inform in his intrinsic manner that China does not fulfill the terms of the agreement reached at the summit in Japan, and he will also be introducing a new package of import duties from China. From a technical point of view, a new downward trend has already formed, which is still at the very beginning. A new "dead cross" has formed at the Ichimoku indicator, and now the euro/dollar pair should break through the lower boundary of the cloud - the Senkou Span B line to confirm the formation of the down trend. We believe that the US dollar has good chances to increase in price, since the tension between China and the US has slightly subsided, the Fed and Jerome Powell should have calmed down, and talk about the imminent reduction of the key rate would subside. Trading recommendations: The EUR/USD pair continues to move down. Thus, it is now recommended to consider selling orders in small lots with targets at 1.1307, 1.1290 and 1.1270 before the MACD indicator reverses to the top. It is recommended to buy the euro/dollar no earlier than when the price consolidates above the Kijun-sen critical line. Most likely, the bulls will need new fundamental reasons for this. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

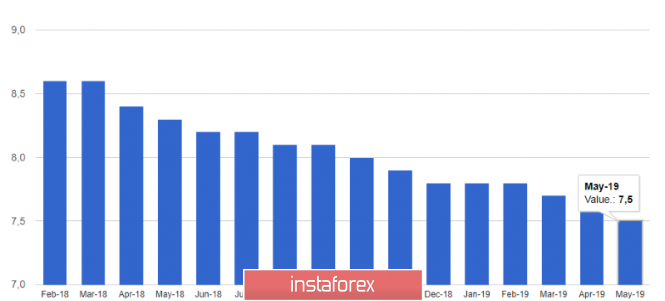

| Posted: 01 Jul 2019 03:41 PM PDT The euro rose after a report that the number of applications for unemployment benefits in Germany fell, and the unemployment rate in the eurozone fell. This indicates a good state of the labor market, which has recently caused concern to the European Central Bank. However, ahead of the report on the labor market, there were indices for manufacturing in France, Italy, Germany and the eurozone, which leave much to be desired, confirming the negative impact of the protectionist policies of the United States and the slowdown in the global economy against trade conflicts. As I noted above, according to published official data, the number of applications for unemployment benefits in Germany in June of this year fell by 1,000, after rising by 60,000 in May. The employment agency noted that the weak economic situation continues to be reflected in the labor market. Taking into account the seasonal adjustment, unemployment in June remained at the level of 5.0%, whereas in April of this year it reached a record minimum of 4.9%. The number of registered vacancies in June was 798,000, which is also less than in May. The sharp rise in the euro occurred after it became known that the unemployment rate in the eurozone in May of this year fell, not coinciding with the forecasts of economists. However, looking ahead, it is necessary to say that speculative traders in vain ignored the report on the eurozone production index for June, the decline of which will force enterprises to reduce staff, adversely affecting the June report on the labor market. According to the data, in May of this year, the number of unemployed in the eurozone decreased by 103,000 people, while the unemployment rate itself fell to 7.5% (the level of the crisis of 2008) from 7.6% in April. The report noted that the largest reduction in the number of unemployed was registered in Spain and Italy. Why is low unemployment so important for the ECB? In addition to influencing the growth rate of the economy, low unemployment also stimulates the acceleration of inflation, which the regulator is counting on. Data on lending to companies in the eurozone were ignored by traders. According to the ECB report, in May of this year, compared with April, lending to non-financial companies increased by 3.9%, which corresponds to the April rate. Lending to households in the euro area in May increased by 3.3%, as well as in April. Eurozone M3 monetary aggregate grew by 4.8%, while economists had expected the indicator to grow by 4.6% in May. As I noted above, ignoring weak reports on production activity will not lead to anything good. According to the data, the PMI Purchasing Managers Index for the Italian manufacturing sector fell to 48.4 points in June, while Italy's manufacturing PMI was 49.7 points in May. In France, the same index rose slightly in June, reaching 51.9 points, against 50.6 points in May. In Germany, the situation with production activity remains at a very bad level. There, the index remained below 50 points, which indicates a reduction, and amounted to 45.0 points in June against 44.3 points in May. In the euro area as a whole, the PMI purchasing managers index for the manufacturing sector in June dropped even more - to 47.6 points versus 47.7 points in May. As for the technical picture of the EURUSD pair, it remained unchanged. The upward momentum after a good report on the eurozone labor market helped to carry out a number of stop-orders of speculative players, but the market remains on the sellers side. The purpose of the bears is the support test of 1.1310, below which the lows open as early as June 21 - 1.1285 and June 20 - 1.1225. In case of a breakout level of 1.1350, the upward correction will be limited to a high of 1.1370. The material has been provided by InstaForex Company - www.instaforex.com |

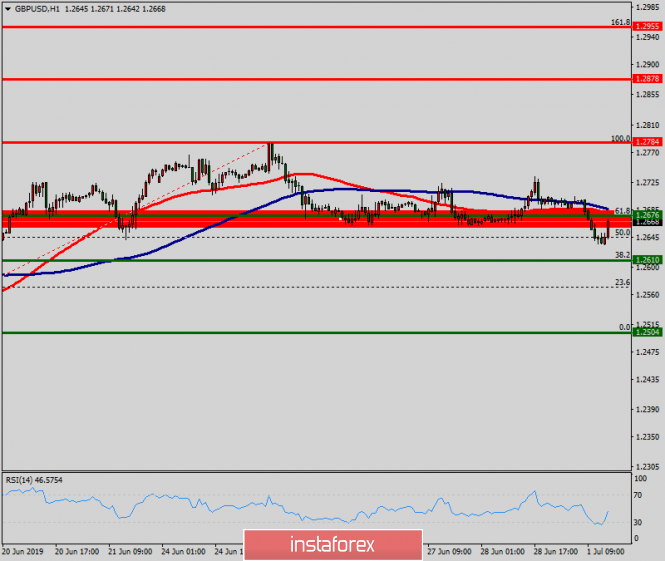

| July 1, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 01 Jul 2019 09:11 AM PDT

Since May 17, the depicted sideway consolidation range has been established between 1.2750 - 1.2570 with a prominent key-level around 1.2650. On June 4, temporary bullish consolidations above 1.2650 were demonstrated for a few trading sessions. This enhanced the bullish side of the market towards 1.2750 (consolidation range upper limit) which has been preventing further bullish advancement up till now. Recently, the GBP/USD failed to establish a successful bullish breakout above 1.2750. Instead, early signs of bearish rejection have been manifested (Head & Shoulders reversal pattern with neckline located around 1.2650). A quick bearish pullback towards 1.2650 was expected shortly. Bearish breakdown below 1.2650 (reversal pattern neckline) confirms the reversal pattern with bearish projection target located at 1.2510. On H4 chart, Obvious Bearish breakdown below 1.2570 confirms a trend reversal into bearish on the intermediate term. Immediate bearish decline would be expected towards 1.2505 initially. On the other hand, a bullish position can be considered only if EARLY Bullish persistence above 1.2650 is achieved on the current H4 chart. Trade Recommendations: Intraday traders can have a valid BUY Entry upon bullish re-closure above 1.2650. T/P levels to be located around 1.2750, 1.2840, 1.2900. S/L should be placed below 1.2570. The material has been provided by InstaForex Company - www.instaforex.com |

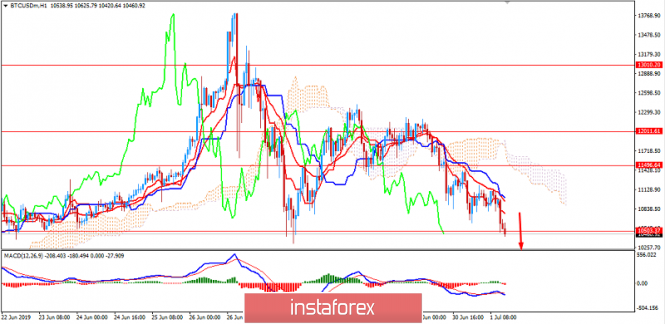

| BITCOIN to break below $10,000 again? July 1, 2019 Posted: 01 Jul 2019 08:14 AM PDT Bitcoin gained bearish momentum which pushed the price to the level below $10,500. The price may decline towards the psychological area of $10,000 in the short term. The Bitcoin market has been stronger than ever, but its price is following the bearish bias inside the long-awaited correction. At the weekend, the market siggested the scenario that the bulls could push the price higher. However, those thoughts have been ditched today as markets continue to dump. The BTC has shed over 10% in last 24 hours as the crypto markets shrank $25 billion recently. The weekly closing candle also indicates that further losses could be imminent as indecision between bulls and bears could signal a short-term trend reversal. Bitcoin is currently trading in range between $10,000 and $14,000 over the next couple of weeks. The biggest targets of $20,000 and $25,000 may be reached quite faster than previous times. A little sideways action may not be a bad thing for Bitcoin. It would allow more accumulation and may give some of the altcoins time to wake from their long hibernation. To sum it up, most analysts share the viewpoint that Bitcoin is making a correctional decline which might lead to further indecision. Though the price is currently trading above $10,000 under a strong bullish bias market sentiment, the ongoing bearish pressure is now stronger in comparison to previous retracements. As the price remains above $10,000, it is expected to bounce back towards $14,000 and later towards $15,000 and then $20,000 or so. Nevertheless, before pushing higher under such impulsive pressure, certain correction and volatility is imminent for BTC in the nearest days. SUPPORT: 9,800, 10,000 RESISTANCE: 10,500, 11,000, 12,000 BIAS: BULLISH MOMENTUM: VOLATILE

|

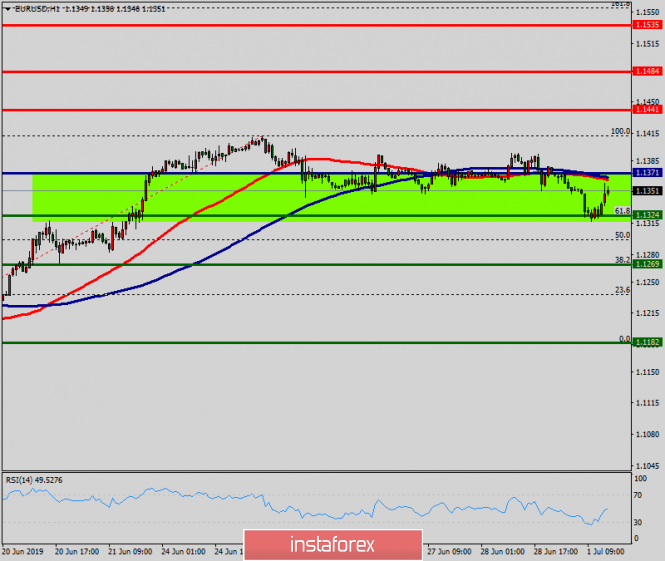

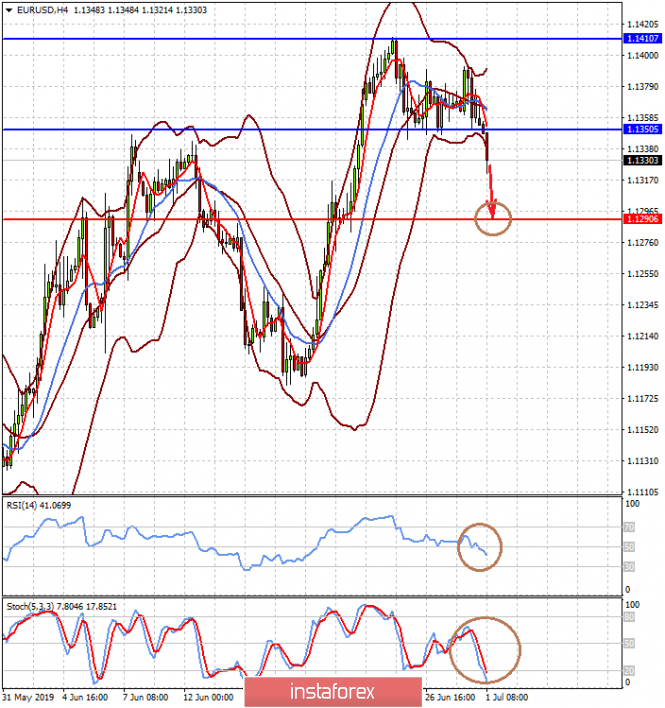

| EURUSD pulls back towards important Fibonacci retracement Posted: 01 Jul 2019 07:26 AM PDT EURUSD has pulled back towards 1.13 as expected and explained in our past analysis. EURUSD could continue lower towards 1.1260 before it resumes its up trend. As long as price is above 1.1250 bulls will remain in control of the trend.

Green line - major support trend line EURUSD is trading right inside the red rectangle target area and just above the 38% Fibonacci retracement level. We expected this move lower and we were not surprised. Short-term trend remains bearish with potential to see 1.1260-1.1280. As long as price is above 1.1250 we remain medium-term bullish. Resistance is found at 1.1360-1.1390. Breaking above this level will open the way for a move to 1.15. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 07.01.2019 - Sellers in control, new wave down possible Posted: 01 Jul 2019 07:25 AM PDT Industry news: G20 key Quotes: "The outcome was largely in line with market expectations and our own baseline. The Huawei news suggests that Trump may be more willing to cut a deal." "It reduces the tail risk of tariffs increasing on the remaining $300bn of Chinese exports into the US. However, there are few details currently available about what equipment US companies can sell. There is also no timeframe set for further talks." "Rates are pricing in 33bp of cuts in July, which implies that the market is still priced for continued deterioration in the economic data. We expect the subdued USD tone to persist as the combination of a dovish Fed and risk sentiment should extend gains elsewhere. The caveat is the extent to which key data this week impacts Fed pricing for July." Trading recommendation:

Gold did perfect test and reject of the hourly exponential moving average (20) in a downward trending channel, which is strong sign of further weakness on the Gold. The levels at $1393-$1.400 looks very attractive for new selling wave and my advice is to watch for selling opportunities. Red rectangle – Hourly EMA and previous swing low ($1.395) resistance Orange rectangle- Support 1 ($1.346) Red line – 20 EMA MACD oscillator is showing the new momentum low in the background and that Gold is trading in the negative territory, which confirms my bearish view. RSI oscillator is showing flip down and potential new wave down is coming. The Stochastic oscillator is showing overbought condition, which is another bear sign. On the of all of these, there is the breakout of the HSS pattern, which is now strong signal for further downside. As long as the Gold is trading below $1.425, I would watch for selling opportunities on the rallies. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price pulls back towards $1,380 as expected. Now what? Posted: 01 Jul 2019 07:22 AM PDT Gold price has broken below support of $1,400 and as we explained last week, it was vulnerable to a new downward wave towards $1,380-70 area. Price has reached our short-term downside target and important short-term support trend line.

Blue rectangle - target Green line support trend line Gold price has reached the green trend line support and the 50% Fibonacci retracement from $1,319. Gold price will most probably stop the decline around current levels. Price should start an upward reversal from the $1,370-80 area. If this does not happen then next support and most crucial one is found at $1,350-60 which is the previous highs and previous resistance. Bulls do not want to see price end the week below this level. On the other hand bears do not want to see Gold price recapture $1,400 and most importantly $1,425. If this happens we should expect price to move to new highs towards $1,500. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for July 01,2019 - Perfect test of the hourly EMA, new down wave yet to come Posted: 01 Jul 2019 06:59 AM PDT Industry news: European Central Bank (ECB) Governing Council member Klass Knot crossed the wires in the last minutes, reiterating that it was indisputable that inflation was still too low and the bank was determined to act if there were adverse scenarios. "We are still suffering from prolonged uncertainty," said Knot and added that the outlook for the second and the third quarters of the year was less favorable than the first quarter. Nevertheless, Knot also said that they were not in the recessionary territory yet. Trading recommendation:

EUR/USD did perfect test and reject of the hourly exponential moving average (20) in a downward trending channel, which is strong sign of further weakness on the EUR. The level at 1.1350 looks very attractive for new selling wave and my advice is to watch for selling opportunities. Green rectangles – Trading range (broken) Orange rectangle- Support 1 (1.1320) Red rectangle – Support 2 (1.1280) Red line – 20 EMA MACD oscillator is showing the new momentum low in the background and that EUR is trading in the negative territory, which confirms my bearish view. RSI oscillator is showing flip down and potential new wave down is coming. As long as the EUR is trading below the 1.1400, my advice is to sell on the rallies with targets at 1.1320-1.1280. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 07.01.2019 - Down breakout of the balance, more downside yet to come Posted: 01 Jul 2019 06:36 AM PDT Crypto Industry news: Since 2015, when bitcoin became an issue for regulators like the state of New York, the regulation of cryptocurrency (the G20 now calls it as a crypto asset) has been discussed in many places, mainly at bodies like the Financial Stability Board (FSB) and the Financial Action Task Force (FATF). However, Facebook's Libra cryptocurrency has changed the landscape, ensuring a massive number of debates on regulation are likely ahead. To be sure, these debates will be about the size of companies specializing in internet technologies more than they are about technology architecture. Trading recommendation:

BTC did exactly as I predicted on Friday. BTC did t test of mine Friday's target at the price of $10.500. Anyway, after the test of support we did see that balance but the down break also happened recently, which is good indication of further downward movement. Purple rectangle – Support became important resistance ($10.500) Red rectangle- Support 1 ($9.700) Green rectangle – Support 2 ($9.200) Red lines – Bear flag (broken) Stochastic oscillator is showing the oversold condition but there is no flip up yet. MACD returned to the down territory belowr the zero line. As long as the BTC is trading below the $11.400 (short-term swing high), I would watch for selling opportunities on the rallies.The material has been provided by InstaForex Company - www.instaforex.com |

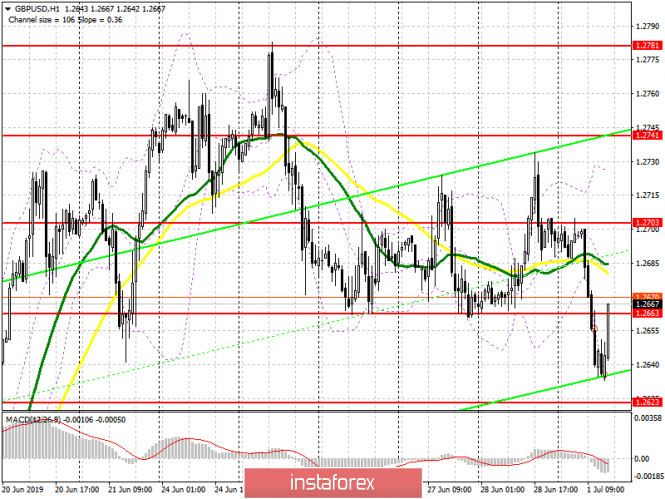

| Posted: 01 Jul 2019 06:18 AM PDT To open long positions on GBP/USD, you need: Buyers of the euro missed a large support level of 1.2660 in the first half of the day, but are now trying to return to it. The main task for the second half of the day will be to consolidate above 1.2660, which will lead to a sharp upward momentum of GBP/USD to the maximum area of 1.2703, and to the test of a large resistance of 1.2741, where I recommend taking the profit. In the scenario of a further decline in the pound, it is best to buy a rebound from the new low of 1.2623 and even slightly lower – around 1.2582. To open short positions on GBP/USD, you need: Bears will count on a good report of production activity in the US and hold the pair below the resistance of 1.2660, which will retain the downward potential and push the pound into the area of lows of 1.2623 and 1.2582, where I recommend taking the profit. In the scenario of GBP/USD growth in the second half of the day, it is best to return to short positions after the resistance test of 1.2703 or a rebound from the maximum of 1.2741. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, indicating a further decline in the pound. Bollinger Bands The growth of the pair will be limited by the middle of the indicator in the area of 1.2690, or its upper level in the area of 1.2725.

Description of indicators

|

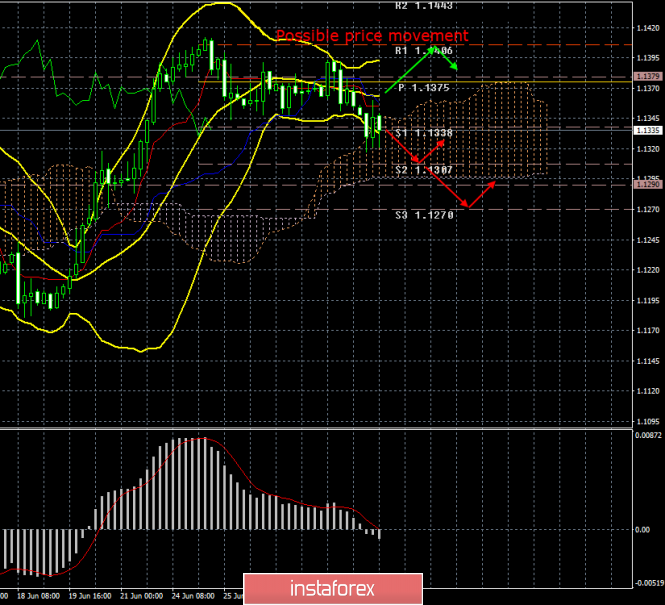

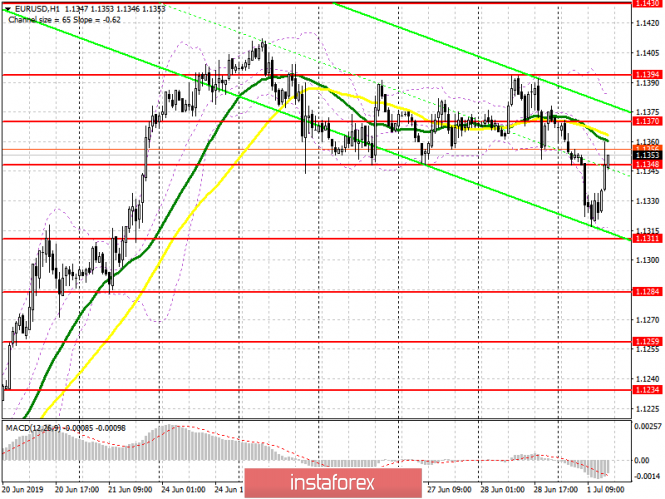

| Posted: 01 Jul 2019 06:18 AM PDT To open long positions on EURUSD, you need: Buyers of the euro managed to return to the market, and now they are trying to cope with the morning resistance level of 1.1348, the consolidation of which will lead to an update of the maximum of 1.1370 and, perhaps, a larger level in the area of 1.1394, where I recommend taking the profit. However, despite good data on the labor market, other indicators for the eurozone remain very weak, which limits the upward potential. In the case of the euro decline scenario, it is best to return to long positions after the test of the support of 1.1311 or to rebound from a minimum of 1.1284. To open short positions on EURUSD, you need: The bears will try to form a false breakout in the resistance area of 1.1348, and a return under it in the afternoon will be a signal for the continuation of the downward trend, which will return EUR/USD to the low area of 1.1311 and will update the larger support of 1.1284. If the demand for the euro continues, the upward potential will be limited by the resistance of 1.1370, just above which the upper limit of the downward channel passes. With their breakthrough, you can sell immediately on the rebound in the area of 1.1394. Indicator signals: Moving Averages Trading is conducted below 30 and 50 moving averages, and their test from the bottom up in the morning is a kind of signal to open short positions. Bollinger Bands The growth of EUR/USD is limited by the middle of the indicator in the area of 1.1348, but it is better to open new short positions on the rebound from the upper limit of 1.1385.

Description of indicators

|

| Technical analysis of EUR/USD for July 01, 2019 Posted: 01 Jul 2019 05:42 AM PDT The EUR/USD pair continues to move upwards from the level of 1.1371. Yesterday, the pair rose from the level of 1.1324 to a top around 1.1420. Today, the first resistance level is seen at 1.1441 followed by 1.1484, while daily support 1 is seen at 1.1324 (61.8.% Fibonacci retracement). According to the previous events, the EUR/USD pair is still moving between the levels of 1.1371 and 1.1441; so we expect a range of 70 pips at least. Furthermore, if the trend is able to break out through the first resistance level at 1.1441, we should see the pair climbing towards the level of 1.1484 to test it. Therefore, buy above the level of 1.1371 with the first target at 1.1441 in order to test the daily resistance 1 and further to 1.1484. Also, it might be noted that the level of 1.1484 is a good place to take profit because it will form a new double top. On the other hand, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.1371, a further decline to 1.1324 can occur which would indicate a bearish market. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for July 01, 2019 Posted: 01 Jul 2019 05:40 AM PDT The GBP/USD pair will continue to rise from the level of 1.2676. The support is found at the level of 1.2676, which represents the 61.8% Fibonacci retracement level in the H1 time frame. The price is likely to form a double bottom. Today, the major support is seen at 1.2676, while immediate resistance is seen at 1.2784. Accordingly, the GBP/USD pair is showing signs of strength following a breakout of a high at 1.2784. So, buy above the level of 1.2784 with the first target at 1.2878 in order to test the daily resistance 1 and move further to 1.2955. Also, the level of 1.2955 is a good place to take profit because it will form the last bullish wave. Amid the previous events, the pair is still in an uptrend; for that we expect the GBP/USD pair to climb from 1.2700 to 1.2955 in coming hours. At the same time, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.2676, a further decline to 1.2610 can occur, which would indicate a bearish market. The material has been provided by InstaForex Company - www.instaforex.com |

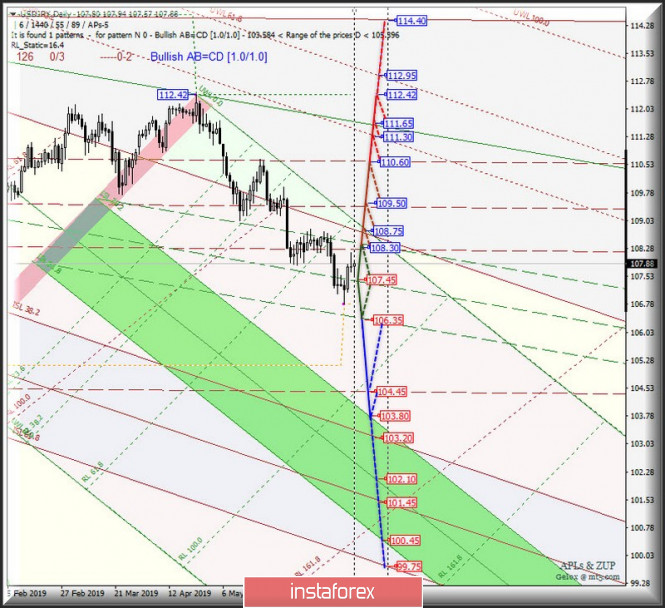

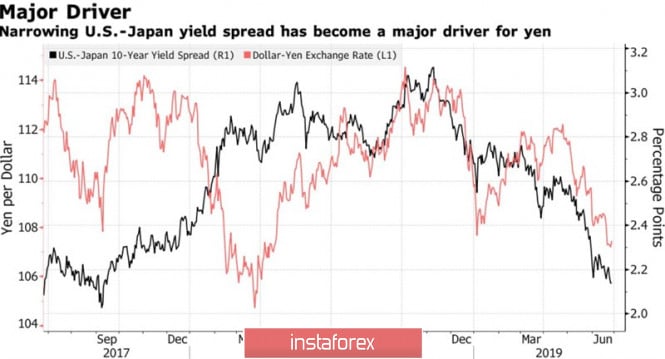

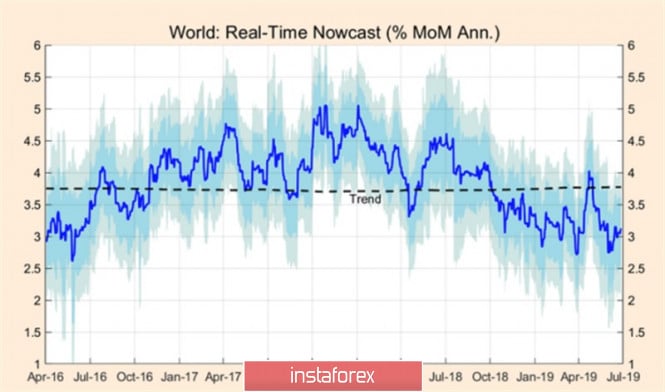

| Posted: 01 Jul 2019 05:39 AM PDT The introduction of additional tariffs on Chinese imports at the beginning of May brought down the USD/JPY quotes below the psychologically important mark of 110. The 5% duty on Mexican imports pushed them below 108.5 due to migration problems. If Donald Trump and Xi Jinping could not agree on the sidelines of the G20 summit in Osaka, Japan, the analyzed pair had all the prerequisites to go to 105. For now, the "bears" idea would have to be postponed until better times as Washington and Beijing agreed to resume negotiations and went to each other concession. The Middle Kingdom will buy more American agricultural products while the US will loosen the noose around Huawei's neck and delay with the introduction of new tariffs. Given the fact that the S&P 500 was marked by the best semi-annual dynamics since 1997, the strong position of the yen could cause bewilderment, having strengthened by 17.3% in January-June. Moreover, trade friction, as well as revaluation and increase in sales tax in the fall of the current year risk, caused the economy of the Land of the Rising Sun to plunge into a recession. The main reason for the peak of the USD/JPY pair was the growing expectations of a reduction in the federal funds rate in July. Derivatives market signals that over the next 12 months, it may be reduced by 75 bp. By the end of 2020 and at all by 125 bp, the Fed is worried that trade wars will slow down the US economy. Also, the Fed itself predicts monetary expansion next year. All of these lead to a decrease in the yield of treasury bonds. The rates on their Japanese counterparts for some time fell to the level of -0.2%. According to JP Morgan, if the yield differential of the debt of the United States and the Land of the Rising Sun collapses to 1%, the USD / JPY pair will be quoted at 100 yen per dollar. Dynamics of USD / JPY and the differential yield of US bonds and Japan

This situation is quite possible. Hardly anyone is 100% sure that after the meeting between Donald Trump and Xi Jinping. It will begin to improve before our eyes. The White House did not fully disclose the conditions by which China avoided raising tariffs on all its imports, not the fact that the US president will not change his position. The base for fees can be expanded in a month or later, which will return the demand for safe-haven assets. It should be noted that the state of the world economy leaves much to be desired. Judging by business activity, it grows below the trend by 0.7 pp. The Purchasing manager indices in the States have long been pleasing to the eye but the situation is starting to deteriorate. The eurozone and Germany are on the verge of recession, and China is clearly not up to 6-6.5% of GDP growth indicated by the government. Dynamics of the activity of the world economy

In such circumstances, the release of data on the US labor market for June is particularly relevant. Weak statistics will persuade investors to lower the Fed rate and allow the USD/JPY bears to continue the downward movement. Technically, there is a transformation of the "Shark" pattern in 5-0 on the daily chart of the analyzed pair. Breakouts from the levels of 23.6%, 38.2% and 50% of the CD wave are usually used to form short positions. USD / JPY daily graph

|

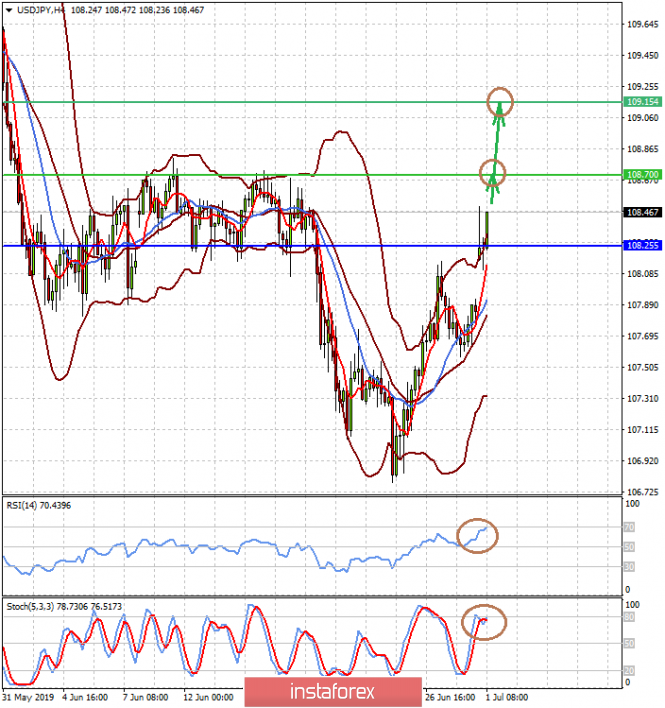

| Posted: 01 Jul 2019 04:48 AM PDT The G20 summit did not bring any significant changes in the topic of trade negotiations between Washington and Beijing. The parties only agreed on the continuation of the very fact of the negotiation process, which is not yet clear in what form it will take place, and agreed on a prolongation of the moratorium on the increase in customs duties. But it seems that this is already viewed by investors as a kind of positive, in which they want to believe in any case. This news had a positive local effect on market sentiment and led to an increase in demand for risky assets and increased the pressure on the US dollar but receives considerable support for major currencies today, on Monday. despite the publication of weak data index of business activity in the manufacturing sector (PMI) from Caixin, China's stock market fell below the level of 50 points to 49.4 points, indicating a decline in business activity and not just a decrease in its growth. What is the reason for the growth of Chinese stocks? We believe that the source of positive is the growth of expectations of expanding incentives from local monetary authorities. A similar picture is observed today in the dynamics of futures on the major US stock indices, which are growing before the opening of trading in Europe by more than 1.0%. By the way, it is also quite noticeably adds to the yield and the benchmark of 10-yr treasuries growing by 1.89% to 2.038% at the moment. There is a somewhat paradoxical situation on the market. On the one hand, the demand for risky assets is clearly growing against the backdrop of increasing expectations of new incentives in China, Europe and lowering interest rates in the United State. On the other hand, the dollar rate is rising, which is natural when treasury yields increase, but they do not beat with the prospect of continued growth in demand for shares of US companies. In our opinion, the reason is some discrepancies in the assessment of the prospects of market dynamics by investors. Some people probably believe that reducing the degree of tension between the United States and China will lead to the conclusion of a trade agreement between the countries. This spurs demand for stocks of companies, not only in the States and China but also in the whole world. Others believe that this reduction in tension will delay the Fed's decision to begin the process of lowering interest rates, which is why we are seeing a sharp rise in the yield of treasuries and an increase in the dollar. Today, the attention of the markets will be drawn to the publication of data on the index of business activity in the manufacturing sector in Germany, the eurozone, the UK and the US. From the point of view of possible movements today, figures from the United States will be interesting in the near future since they will undoubtedly have an impact on the dollar exchange rate. It is assumed that the indicator will show a decline to 51.0 points in June against 52.1 points in May. If the data turns out to be worse than expected, it will have to put pressure on the dollar as they will stimulate a rise in hopes that the Fed will be forced to lower interest rates. On the contrary, if they turn out to be higher than the forecast, then this will support the limited growth of the dollar rate. Forecast of the day: The EUR/USD pair fell below 1.1350. It can continue to fall to 1.1290 if the data of the index of business activity in the manufacturing sector in Germany and the eurozone are weaker than forecasts. The USD/JPY pair is growing due to the release of weak data from the business activity index in the manufacturing sector of Japan and against the background of a decrease in tension around trade negotiations between the US and the PRC. It is likely to continue growing towards 108.70 and then to 109.15. |

| European currency may rise against the US dollar – Wells Fargo Posted: 01 Jul 2019 03:53 AM PDT

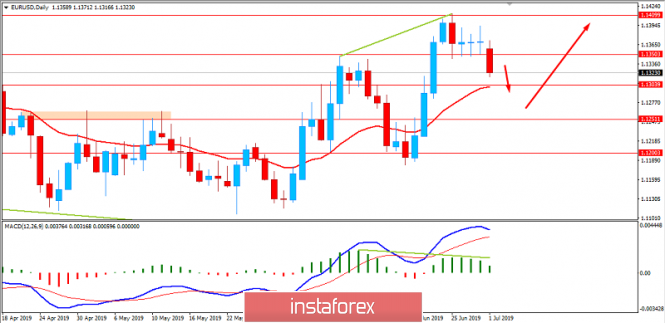

According to the calculations of Eric Nelson, currency strategist of the largest bank Wells Fargo, we should expect a rise in the price of the euro against the US dollar in the near future. The expert considers it possible to increase to 1.18-1.20 in the EUR/USD pair. E. Nelson estimates the probability of such an outcome at 65% The expert notes that the risks of medium and long-term forecasts for the euro are shifting towards a higher rate of the single currency against the background of the expected turn in the eurozone economy. According to the forecast of Wells Fargo expert, the growth of the EUR/USD rate in the medium term to 1.18 does not exclude a rise to 1.20. According to E. Nelson, the probability of 35% of the euro will depreciate compared to current levels. The decrease may be 2%-3%, the analyst believes. Pressure on the single European currency could be brought about by a significant weakening of the European Central Bank (ECB) policy, including a possible new round of quantitative easing. At the moment, the situation in the EUR/USD pair is relatively stable. After the breakdown of the support at the level of 1.1350, the EUR/USD pair fell back to the technical support level of 1.1325. According to the expert, the target for sellers is 1.1280. The "bearish" scenario can be implemented in the case of a more powerful strengthening of the US currency, the expert believes.

|

| Gold to push lower towards $1320-50. July 1, 2019 Posted: 01 Jul 2019 03:30 AM PDT Gold opened the week with a gap of 150 pips and pushed towards $1380. It managed to push higher again with the target towards $1500. Though the price started with a Bearish gap, it is currently trying to fill it up and continue with the bullish trend. Oil impacted the overall momentum of gold. However, the oil may lose ground as the US dollar lifts up ahead of optimistic NFP report. The precious metal is looking at markedly different fundamentals from those that propelled it to 6-year highs recently. Gold tamped down expectations for the Federal Reserve rate cut, and Wall Street to the oil market likely in risk-on mode. Meanwhile, demand for risky assets is increasing while for safe-haven currencies is lowering. As of the current scenario, gold is expected to go down towards $1320-50 support area before continuing the bullish trend. The price has formed Bearish Divergence in the intraday timeframes along with certain Bearish crossover in the MACD at the edge. Though the certain possibility of gap fill up is expected, the bearish pressure may endure before the bulls take control again pushing the price higher towards $1500 target area. SUPPORT: 1289, 1300, 1320, 1350 RESISTANCE: 1400, 1440-50, 1500 BIAS: BULLISH MOMENTUM: VOLATILE |

| EUR/USD: USD to regain momentum ahead of NFP? July 1, 2019 Posted: 01 Jul 2019 03:28 AM PDT EUR/USD has been quite corrective and indecisive recently trading at near 1.1400. The price gained impulsive bearish momentum today which is expected to last in the coming days. At present, the ECB is taking measures to spur consumer inflation. So, low inflation is not seen as a new challenge faced by the European economy as there are other challenges. Amid a slowdown in the ecnoomy and persistent low inflation, the monetary authorities in the eurozone are likely to announce a rate cut and restart an asset purchase cycle. Though the ECB's target may be achieved in the near future, headline inflation will hardly develop steadily. In light of the recent reports, the eurozone's lending growth held steady in May. A broader money supply indicator which often foreshadows future activity grew faster than expected. Household lending increased by 3.3%, holding steady at a post-crisis high while corporate lending rose by 3.9%, below its post-crisis peak but defying expectations for a slowdown. The eurozone is facing a sharp economic slowdown amid weak export demand for manufactured goods. The ECB set out plans to normalize policy and even flagged more stimulus, thus signaling a possible rate cut or a restart of bond purchases. The annual growth rate of the M3 measure of money supply, which is often viewed as a precursor of future activity, edged up to 4.8% from 4.7% a month earlier, beating forecasts for 4.6% which is also bullish for EUR. On the USD side, ahead of NFP reports to be published on Friday this week, USD opened the week with strong gains which could sustain further in the coming days. Recently FED's Vice Chairman Clarida stated that the US economy is in a good shape. Nevertheless, uncertainties from trade disputes and a slowdown in global growth are affecting it significantly. The market welcomed the news that trade negotiations between the US and China have entered a new stage. However, some Fed policymakers advocate for easier monetary policy in the face of uncertainties. Recently, record-setting run of US economic growth was sustained for a decade by low interest rates and massive Federal Reserve intervention. That helped 22 million people to return back to work, thus contributing to a positive employment report this week. If the forecast comes true, NFPs could help USD to regain losses against EUR in the coming days. To sum it up, EUR is being neutral with the recent fundamentals. USD will be able to assert strength if the official data on the US labor market comes up to expectations by the end of this week and other economic reports from the US perform better than expected. There are higher chances for USD to hold the upper hand over EUR, but upcoming reports should support it. Now let us look at the technical view. The price recently formed Bearish Regular Divergence which also completed recently after the price reached 1.1400 area. The price is currently going lower quite impulsively. The pair is expected to decline to 1.1250-1.1300 before showing any bullish sign.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment