Forex analysis review |

- Fractal analysis of major currency pairs on July 25

- The chances of easing the ECB's policies have increased

- Gold has broken the connection with the past

- EUR / USD. July 24th. Results of the day. European indexes of business activity have completely failed, but traders reacted

- GBP / USD. De jure, Johnson became the prime minister, but the pair does not grow because of this

- AUDUSD remains inside short-term bullish channel and challenges support

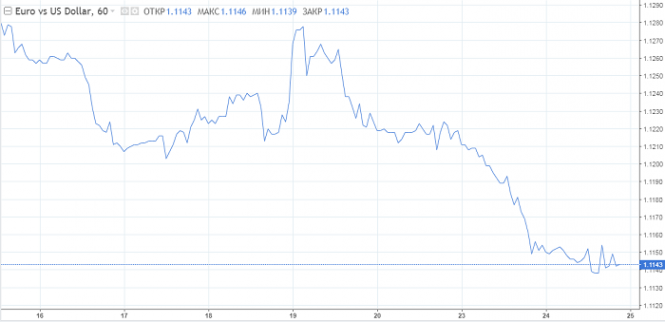

- EURUSD continues lower as expected after breaking below support of 1.12

- Neutral day for Gold but price still vulnerable to a move lower

- July 24, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- July 24, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

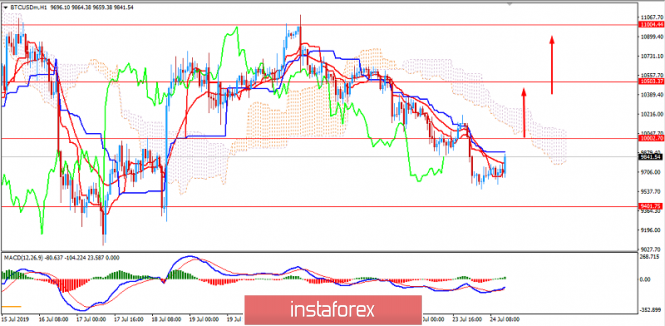

- Analysis of Bitcoin for July 24, 2019: prices heading towards $9,000

- BTC 07.24.2019 - Sellers in total control

- Gold 07.24.2019 - Important pivot at the price of $1.429 on the test

- EUR/USD for July 24,2019 - Sellers got exhauster, potential rally incoming

- EURUSD: PMI indices in Germany and the eurozone in a technical recession, which adds to the ECB's problems before tomorrow's

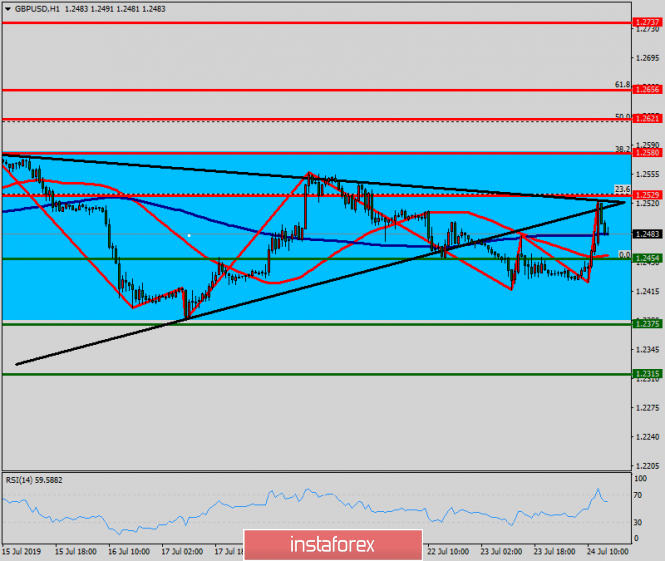

- Technical analysis of GBP/USD for July 24, 2019

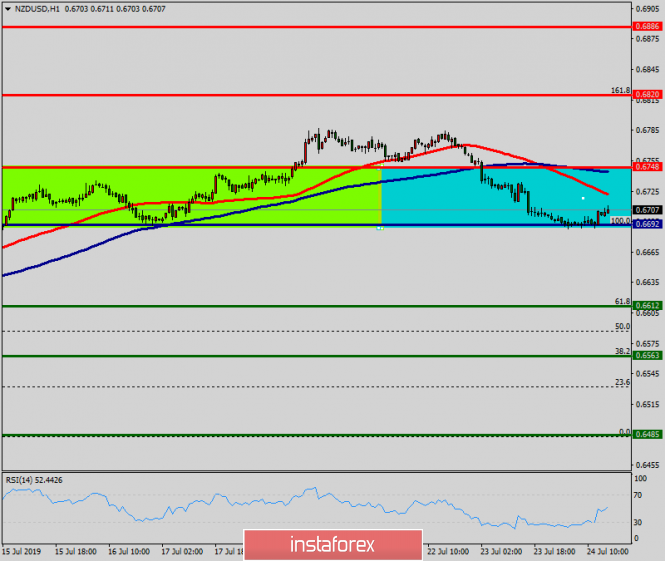

- Technical analysis of NZD/USD for July 24, 2019

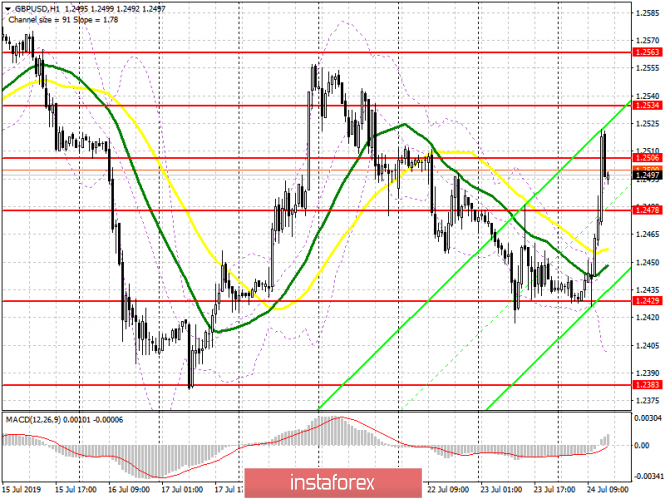

- GBP/USD: plan for the American session on July 24. The pound rebounded again after Theresa May left her post

- EUR/USD: plan for the American session on July 24. Euro buyers have successfully worked out the morning divergence, but do

- Brexit can be "tough" and the ECB's position is too "soft", which doesn't bode well for the euro

- What will the ECB do to save the region's economy? (We expect corrective movements in EUR/USD and USD/JPY pairs)

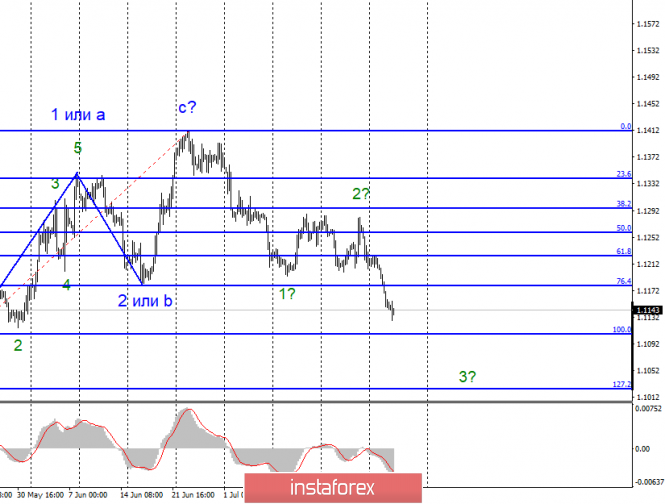

- Wave analysis for EUR/USD and GBP/USD on July 24th. Business activity in Europe and Germany continues to fall

- EUR/USD to fall even lower

- Review of EUR / USD and GBP / USD pairs on 07.24.2019: A complete surprise

- Trading recommendations for the EURUSD currency pair - placement of trading orders (July 24)

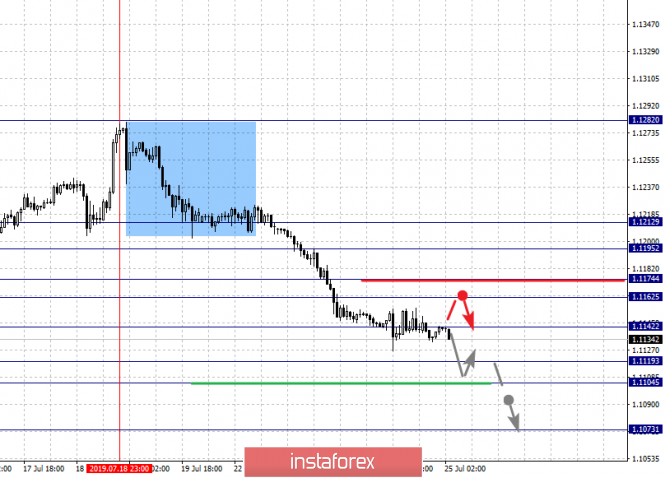

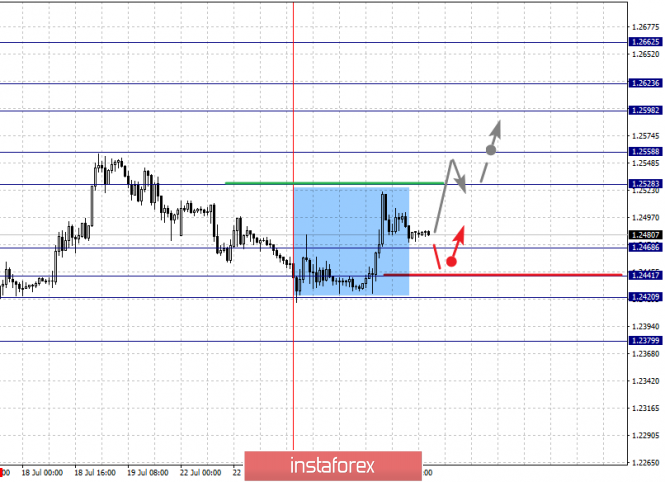

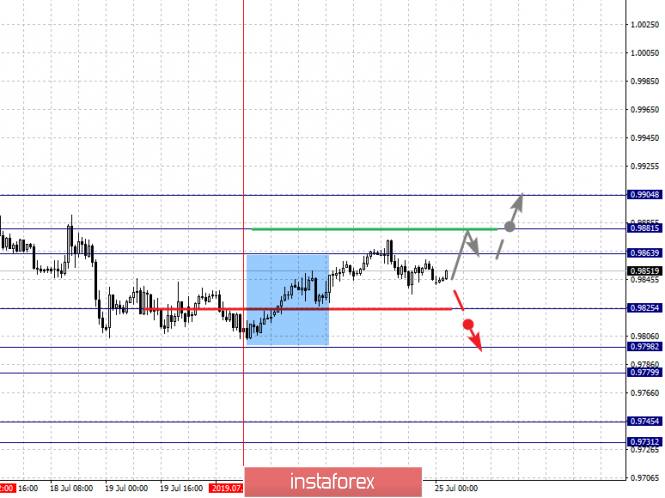

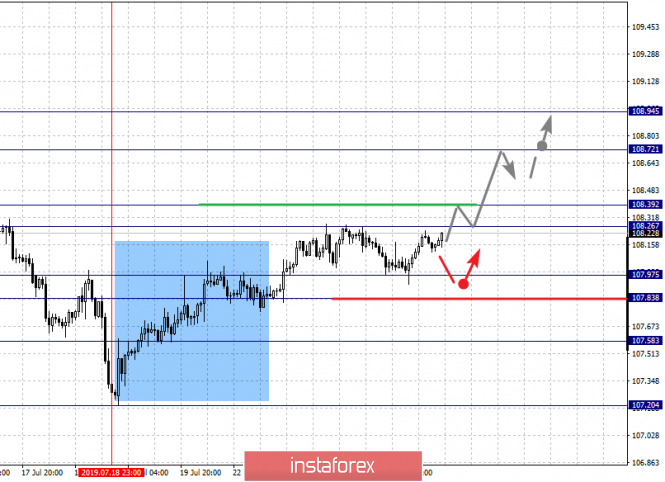

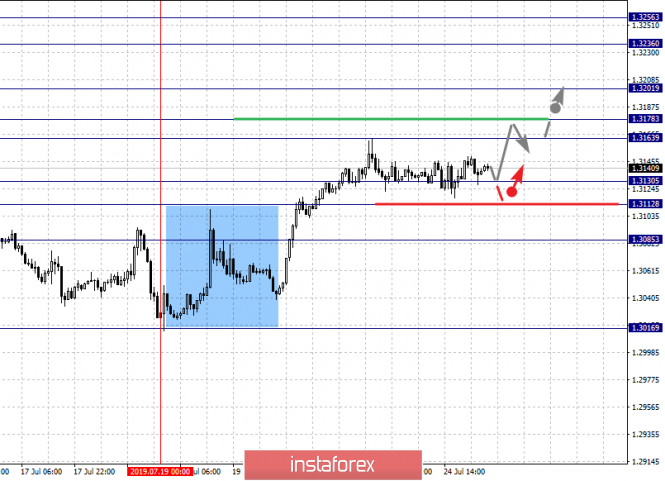

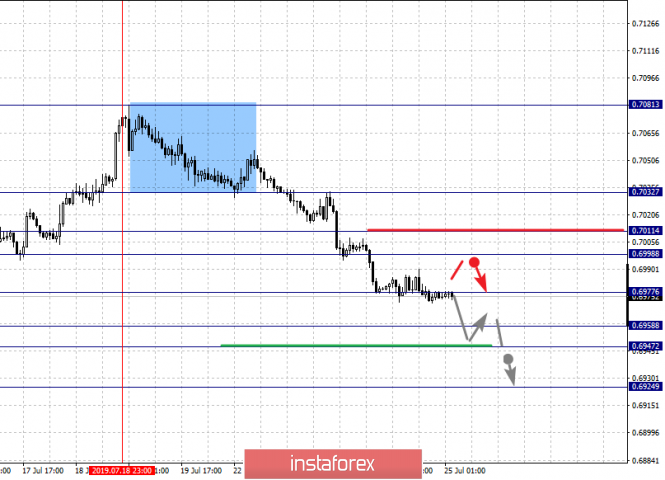

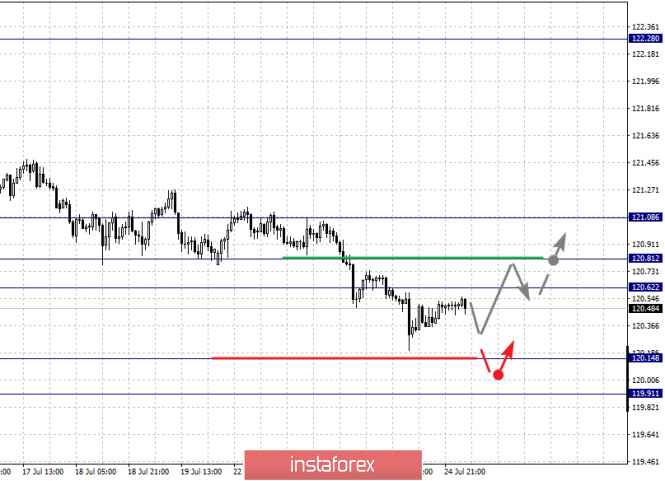

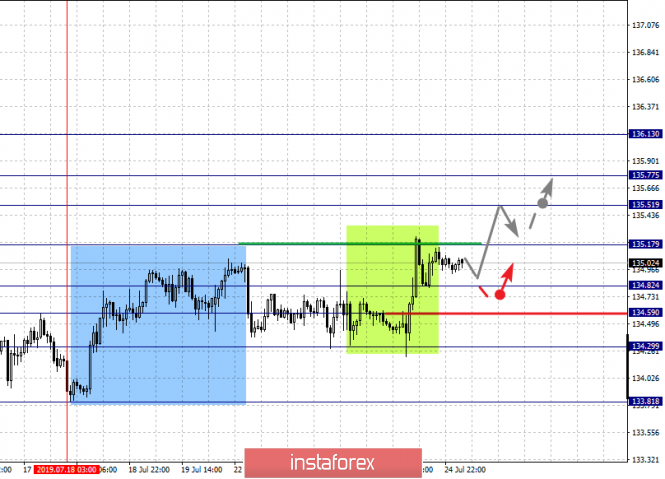

| Fractal analysis of major currency pairs on July 25 Posted: 24 Jul 2019 06:30 PM PDT Forecast for July 25: Analytical review of H1-scale currency pairs: For the euro / dollar pair, the key levels on the H1 scale are: 1.1212, 1.1195, 1.1174, 1.1162, 1.1142, 1.1119, 1.1104 and 1.1073. Here, we continue to follow the development of the downward cycle of July 18. At the moment, we expect to move to the level of 1.1119. Price consolidation is in the range of 1.1119 - 1.1104. For the potential value for the bottom, we consider the level of 1.1073. The movement to which, is expected after the breakdown of 1.1104. Short-term upward movement is possible in the range of 1.1162 - 1.1174. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.1195. We expect the registration of the expressed initial conditions for the ascending cycle to the level of 1.1212. The main trend is a local downward structure of July 18. Trading recommendations: Buy 1.1162 Take profit: 1.1174 Buy 1.1175 Take profit: 1.1195 Sell: 1.1140 Take profit: 1.1120 Sell: 1.1104 Take profit: 1.1075 For the pound / dollar pair, the key levels on the H1 scale are: 1.2662, 1.2623, 1.2598, 1.2558, 1.2528, 1.2468, 1.2441, 1.2420 and 1.2379. Here, the subsequent targets for the top is determined from the local ascending structure on July 23. The continuation of the movement to the top is expected after the breakdown 1.2528. In this case, the goal is 1.2558, and near this level is a price consolidation. The breakdown of the level 1.2558 should be accompanied by a pronounced upward movement. Here, the target is 1.2598. Consolidation is in the range of 1.2598 - 1.2623. For the potential value for the top, we consider the level of 1.2662. The movement to which, is expected after the breakdown of 1.2625. Corrective movement is possible in the range 1.2468 - 1.2441. The breakdown of the last value will lead to the cancellation of the local structure. Here, the first target is 1.2420. For the potential value for the bottom, we consider the level of 1.2379. The main trend is the local structure for the top of July 23. Trading recommendations: Buy: 1.2528 Take profit: 1.2556 Buy: 1.2560 Take profit: 1.2598 Sell: 1.2468 Take profit: 1.2443 Sell: 1.2420 Take profit: 1.2380 For the dollar / franc pair, the key levels on the H1 scale are: 0.9904, 0.9881, 0.9863, 0.9798, 0.9779, 0.9745 and 0.9731. Here, we follow the formation of the potential for the top of July 22. Short-term upward movement is expected in the range of 0.9863 - 0.9881. The breakdown of the last value will allow to expect movement towards a potential target - 0.9904, where consolidation is near this level. The level of 0.9825 is a key support for the top. Its price passage will contribute to the development of the downward movement. Here, the goal is 0.9798. Consolidation is in the range of 0.9798 - 0.9779. The breakdown of the level of 0.9779 should be accompanied by a pronounced move to the bottom. Here, the potential target is 0.9745. The main trend is the local downward structure of July 17, the formation of potential for the top of July 22. Trading recommendations: Buy : 0.9863 Take profit: 0.9880 Buy : 0.9882 Take profit: 0.9902 Sell: 0.9825 Take profit: 0.9798 Sell: 0.9796 Take profit: 0.9780 For the dollar / yen pair, the key levels on the scale are : 108.94, 108.72, 108.39, 108.26, 107.97, 107.83 and 107.58. Here, we are following the development of the ascending structure of July 18. The continuation of the movement to the top is expected after the passage by the price of the noise range 108.26 - 108.39. In this case, the goal is 108.72. We consider the level of 108.94 to be a potential value for the top. Upon reaching this level, we expect consolidation as well as a rollback to the bottom. Short-term downward movement is possible in the range of 107.97 - 107.83. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 107.60. This level is a key support for the upward structure. The main trend: the ascending structure of July 18. Trading recommendations: Buy: 108.40 Take profit: 108.70 Buy : 108.73 Take profit: 108.94 Sell: 107.96 Take profit: 107.84 Sell: 107.81 Take profit: 107.60 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3256, 1.3236, 1.3201, 1.3178, 1.3163, 1.3130, 1.3112 and 1.3085. Here, we are following the ascending structure of July 19th. The continuation of the movement to the top is expected after the passage of the price of the noise range 1.3163 - 1.3178. In this case, the goal is 1.3201, and near this level is a consolidation. The breakdown of the level of 1.3201 will lead to a pronounced movement. Here, the target is 1.3236. For the potential value for the top, we consider the level of 1.3256. Upon reaching which, we expect a rollback to the bottom. Short-term downward movement is possible in the range of 1.3130 - 1.3112. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3085. This level is a key support for the top. The main trend is the ascending structure of July 19. Trading recommendations: Buy: 1.3178 Take profit: 1.3200 Buy : 1.3203 Take profit: 1.3234 Sell: 1.3130 Take profit: 1.3112 Sell: 1.3110 Take profit: 1.3085 For the pair Australian dollar / US dollar, the key levels on the H1 scale are : 0.7032, 0.7011, 0.6998, 0.6977, 0.6958, 0.6947 and 0.6924. Here, we follow the development of the downward structure of July 18. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6977. In this case, the goal is 0.6958. Price consolidation is in the range of 0.6958 - 0.6947. For the potential value for the bottom, we consider the level of 0.6924. After reaching which, we expect a rollback to the top. Short-term upward movement is possible in the range of 0.6998 - 0.7011. The breakdown of the latter value will lead to a prolonged correction. In this case, the target is 0.7032. The main trend - the downward structure of July 18. Trading recommendations: Buy: 0.6998 Take profit: 0.7010 Buy: 0.7013 Take profit: 0.7030 Sell : 0.6977 Take profit : 0.6958 Sell: 0.6945 Take profit: 0.6926 For the euro / yen pair, the key levels on the H1 scale are: 121.08, 120.81, 120.62, 120.14 and 119.91. Here, we continue to monitor the downward structure of July 10th. The continuation of the movement to the bottom is expected after the breakdown of the level of 120.14. In this case, the potential target is 119.91. From this level, we expect a key turn to the top and the formation of the initial conditions for the upward cycle. Short-term upward movement is possible in the range of 120.62 - 120.81. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 121.08. The main trend - the downward structure of July 10. Trading recommendations: Buy: 120.62 Take profit: 120.80 Buy: 120.84 Take profit: 121.06 Sell: 120.12 Take profit: 119.94 For the pound / yen pair, the key levels on the H1 scale are : 136.13, 135.77, 135.51, 135.17, 134.82, 134.59, 134.29 and 133.81. Here, the continuation of the development of the ascending structure of July 18 is expected after the breakdown of the level of 135.18. In this case, the target is 135.51. There is a short-term upward movement, as well as consolidation in the range of 135.51 - 135.77. For the potential value for the top, we consider the level of 136.13. After reaching which, we expect consolidation, as well as a rollback to the bottom. Short-term downward movement is possible in the range of 134.82 - 134.59. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 134.29. This level is a key support for the upward structure. The main trend - the ascending structure of July 18. Trading recommendations: Buy: 135.18 Take profit: 135.50 Buy: 135.53 Take profit: 135.77 Sell: 134.82 Take profit: 134.60 Sell: 134.57 Take profit: 134.30 The material has been provided by InstaForex Company - www.instaforex.com |

| The chances of easing the ECB's policies have increased Posted: 24 Jul 2019 05:22 PM PDT

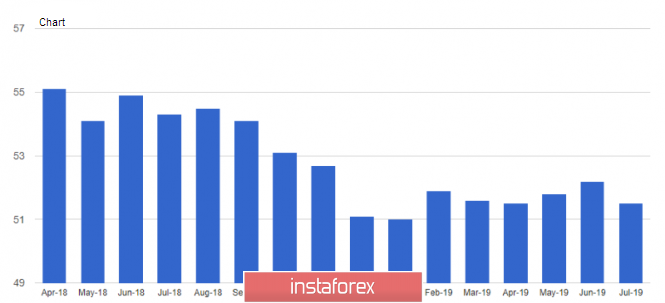

European currencies, especially the euro, are tensely awaiting for today's meeting of the ECB, which will be perhaps the most difficult this year. Currency strategists are waiting for the preservation of the parameters of monetary policy. In their opinion, European financiers will want to wait for the latest macroeconomic data in order to accurately assess the current picture of the economy. In addition, the Central Bank is not averse to start to see the scale of the projected rate cut by the Fed next week. Traders are stubbornly waiting for a "surprise" in the form of a rate reduction. Some global investment banks share their judgment, suggesting that the European regulator may surprise everyone by lowering the already negative deposit rate today. This will be a kind of message to the market about further easing of monetary policy. With such a development scenario, the euro will continue to move down. On Wednesday, the eurozone published such a leading indicator as the Market index, the value of which slipped from 52.2 to 51.5 in July. The data took by surprise the consensus analysts, who did not expect such a strong decline, which also spoiled the mood of the euro fans even more. The German report was even worse. Indicators of producers of goods decline to the lowest level in the last 7 years, suggesting a deterioration in the growth prospects of Europe's largest economy. On the other hand, the composite Purchasing Managers Index (PMI) fell in July to 51.4 from 52.6 and was the lowest since March. Analysts' forecast was 52.3. Such news has increased speculation regarding the easing of the ECB's policy at a meeting on Thursday. Money markets are now laying down the rate by 10 basis points with a probability of 54%. Euro sales increased, while the main pair tested two-month lows.

It is worth noting that the weakening euro, without even waiting for it, supported the falling pound in conjunction with the dollar. The pair has grown for the first time in the last four sessions. Given that the market has already seen the weakening of the euro against the dollar, the Japanese yen and the Swiss franc, as well as the EUR / GBP pair can be regarded as the best value for money before a meeting in Europe. Thus, this helps the pound to be at its best, currency strategies comment on the current situation.

If the European regulator maintains rates again, the single currency will have a chance to consolidate in the range of 1.114-1.12 in a pair with the dollar. Commerzbank is generally waiting for the euro to rise to 1.16 by the end of 2019, even if the ECB rate is reduced by 20 basis points. 5 reasons not to lower rates Waiting for Fed action. Americans have already set up markets for a quarter-per-cent rate cut. If the Fed surprises the markets with an aggressive step or announces the beginning of a mitigation cycle, the euro may rise. This will have a downward pressure on inflation and suppress export growth in the eurozone, resulting to a further complication in the position of the regional economy. Maybe it is really worth waiting for the verdict of the American Central Bank. Economic data. Key indicators - GDP for the second quarter and the latest data on inflation - will be released after the ECB meeting. Any additional signals about how long the slowdown will last will help economists decide on a solution, especially in recent times the statistics is ambiguous. Latest forecasts. Typically, the ECB adjusts monetary policy when it publishes latest economic forecasts. This is due to the fact that the revised estimates help explain the motives for the increase or decrease in incentives. Updated estimates will be presented in September. Market expectations. When deciding on a rate at the Central Bank, they do not rely on market expectations, but do not ignore them. Traders do not put in the price the full probability of reducing the rate by 10 basis points on Thursday. Therefore, the earliest easing may signal that the economic situation in the region is worse than expected. The complexity of the mechanism. The measures that the ECB may announce will require a thorough discussion of their application. Reducing the negative rate on deposits will require an adjustment to the mechanism for regulating bank deposits. At the moment, the monetary authorities hardly have a single position on this. The material has been provided by InstaForex Company - www.instaforex.com |

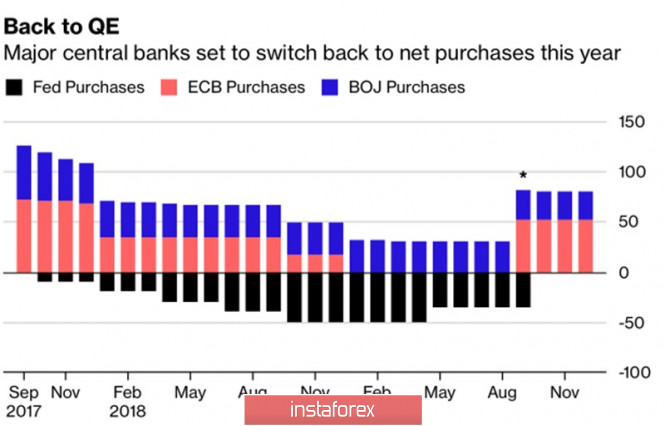

| Gold has broken the connection with the past Posted: 24 Jul 2019 04:43 PM PDT In the market, things that are often incomprehensible at first glance happens. And if the movement of gold and US stock indices in one direction already surprises few people, the violation of the inverse correlation between the precious metals and the US dollar puts to a standstill. The XAU / USD bulls feel comfortable around 6-month highs, even though the USD index soared to 5-week peaks. Will they continue on the same direction, although for decades, they walked in different directions? Formally, the external background for gold can be called favorable. The victory of Boris Johnson in the fight for the post of British Prime Minister increases the risk of disorderly Brexit. The IMF reduces its global GDP forecast for 2019 to + 3.2%. In addition, tensions in the Middle East are not disappearing, and the United States and China are in no hurry to stop a trade war. On the other hand, the White House and Washington managed to resolve the issue of the national debt ceiling, and the US yield curve returned to the green zone, which reduces the possibility of a recession in the US economy. At the same time, let us remember the 2018th: the political landscape in Britain has always been unsteady. The IMF constantly frightened investors with a crisis, and at the very height of a trade war, gold instead of growing, on the contrary, decline. The main culprit was named the American dollar, which in the conditions of monetary restriction of the Fed intercepted the status of the main asset-refuge from the precious metal and yen. As it turned out, the epic with the tightening of monetary policy was short-lived: the process of reducing the balance of the three leading central banks of the world took 11 months. After that, they returned to the idea of lowering rates. Dynamics of asset purchases by leading Central banks The sluggish growth of the world economy and the fashion for monetary expansion have led to the fact that about $ 13 trillion of the global bond market is trading with negative returns. It is better to buy non-interest-bearing gold than to bear the costs due to holding securities in the portfolio. In addition, the strength of the dollar is deceptive. If in the previous years, the USD index grew due to the Fed raising the federal funds rate, now it is due to the weakness of competitor currencies. The ECB is going to soften monetary policy, the Bank of England has sharply turned from a "hawk" into a "dove", and the Bank of Japan claims that it has enough ammunition to stimulate the economy. The positions of the "American" look vulnerable: firstly, the Fed is ready to cut rates, and secondly, the White House may surprise Forex with currency interventions for the first time in many years. Gold clearly benefits both bonds and major world currencies. As for stocks, concerns about the correction of the S & P 500 make investors extremely cautious about buying equity securities. If stock indices are growing solely because of expectations of the Fed's monetary expansion, while corporate profits are worsening and the economy is slowing, how long the rally can be? Technically, the further fate of the precious metal will depend on the output of quotations from the triangle. The repeated breakthrough of its upper border with the subsequent updating of the July maximum will bring the target to 161.8% according to the AB = CD pattern at arm's length. Gold daily chart

|

| Posted: 24 Jul 2019 04:42 PM PDT 4 hour timeframe The amplitude of the last 5 days (high-low): 34p - 75p - 78p - 19p - 64p. Average amplitude for the last 5 days: 54p (54p). On Wednesday, July 24, the EUR / USD pair continues its generally downward movement, despite the fact that volatility has significantly decreased. Today, again, did not bring any positive news to the Eurocurrency. The index of business activity in the areas of production and services in Germany failed, as well as the similar indices of business activity across the eurozone. It does not matter that these were only preliminary values for July, since there is no reason to expect that the final figures will be better. Business activity in the industrial sector is generally a headache for the European Union. The values of the indicator in this area are in the critical area, which captures not a slowdown, but a decline. In America, things are not much, but still better. The business activity index in the service sector increased compared to the previous month. On the other hand, in the manufacturing sector, it fell to the level of 50.0, below which the decline in this area will also be recorded. As in many other areas, the States again defeat the European Union. Yes, business activity in America does not show the best "numbers", but in the European Union things are even worse. Tomorrow, the ECB will announce the results of the meeting. Traders expect either a monetary policy easing announcement or an immediate reduction in the deposit rate. There will also be a press conference by the ECB on monetary policy, at which a restart of the quantitative incentive program can be announced. We do not expect anything optimistic from this event. At best, Draghi and the company will be as neutral and restrained as possible, which may save the Eurocurrency from new sales. Otherwise, the fall in the euro / dollar pair will continue, and Donald Trump will have new reasons to accuse the EU of deliberate depreciation of the euro. Trading recommendations: The pair EUR / USD continues to move down. Thus, now, it is again recommended to sell the Euro-currency with the aim of the support level of 1.1101 until the MACD indicator turns upward. Buying the euro / dollar pair is recommended not earlier than fixing the price above the Kijun-sen line with the first target resistance level of 1.1269, but with minimal lots, as the bulls remain extremely weak. In addition to the technical picture, we should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chinkou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP / USD. De jure, Johnson became the prime minister, but the pair does not grow because of this Posted: 24 Jul 2019 04:42 PM PDT The pound-dollar pair demonstrates a large-scale correction by today's standards, rising by 100 points in a few hours at once. After a two-day steady decline, this rebound was impulsive in nature, although this impulse faded rather quickly - the price barely touched the first resistance level of 1.2530 (the middle line of the BB indicator on the daily chart). Any corrective growth in a pair of GBP/USD is a kind of gift for those who play against the British currency - and such, apparently, the vast majority. Indeed, such price movements should be used to open short positions - at least in the medium term, while political uncertainty will put pressure on the pound.

It is noteworthy that today's correction is not due to British events, but to the weakness of the US currency. The market completely ignored the formal victory of Boris Johnson in the election of the leader of the Conservative Party, as well as the subsequent resignations of government ministers Theresa May. These events were too predictable and long expected, given the popularity of Johnson among ordinary conservatives. Therefore, the market won back his victory long ago - even when his main opponent (Jeremy Hunt) fell behind the leader of the political race by several tens of percent. The rhetoric of the new prime minister of Britain also did not surprise investors - he again repeated those theses that had become the talk of the town, above all about the need for the country to leave the EU on October 31. Traders did not learn anything new and, therefore, ignored this speech. Obviously, the market will now focus on political battles between the Johnson government and members of the House of Commons, because most parliamentarians (including Tories) do not support the idea of implementing a "tough" Brexit. There are several options for further action as the prime minister and the parliament. Experts do not rule out a new referendum, a new general election, or a no-confidence vote for Johnson. The essence of the future confrontation (which will inevitably take place) is who will defeat whom by law. The current composition of the House of Commons will by all means prevent the implementation of the "hard" Brexit without the approval of the deputies, forcing Johnson to take into account the views of parliamentarians. However, the prime minister will have to solve a difficult dilemma - whether to decide on an extraordinary general election (given the low rating of conservatives) or negotiate with the current composition of the House of Commons. But the main events in this vein will unfold somewhat later - and in the near future, Johnson will form his team, preparing for the main battle in the national parliament and Brussels. That is why today's and yesterday's statements of Johnson, who de jure became the head of the government, did not affect the mood of the traders of GBP/USD. But the weakness of the dollar allowed the pair of bulls to update this week's high, rising to the level of 1.2530. The US currency was under pressure from major US stock indices today, which, in turn, opened in the red zone due to weak reports on corporate profits of Boeing and Caterpillar. The aircraft manufacturing company received a net loss of $ 2.9 billion in the second quarter of the current year, while Boeing received a net profit of $ 2.2 billion in the same period last year. The company's quarterly revenue fell by 35%. Such negative dynamics is associated with large write-offs due to the suspension of flights of 737 MAX aircraft (after two deadly catastrophes).

In turn, the net profit of heavy equipment maker Caterpillar, fell by almost five percent due to lower demand for construction equipment in Asia (the effects of the trade war), as well as weak sales in the energy and transportation division. In addition, the market reacted negatively to the news that the US authorities decided to conduct an antitrust investigation against such giants as Google, Amazon, Apple and Facebook. If, as a result of the investigation, restrictions are imposed on these companies, then Internet heavyweights will have less opportunities to earn money. Against the background of an almost empty economic calendar, these factors played a role for dollar pairs - to one degree or another. However, the reduction of the greenback is limited, especially on the eve of the release of data on the growth of the American economy and the July Fed meeting. In other words, we are dealing with a short-term corrective movement, which is unlikely to receive its continuation. And given the fact that the growth of GBP/USD is due only to the weakness of the US currency, it can be assumed that the pair will return to the base of the 24th figure in a short time. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD remains inside short-term bullish channel and challenges support Posted: 24 Jul 2019 02:06 PM PDT AUDUSD is making higher highs and higher lows on a daily basis since middle of June when it bottomed around 0.6835. Price is now challenging the lower boundary of the upward sloping channel.

Red lines - short-term bullish channel AUDUSD is trading inside the red short-term bullish channel. Support is found at 0.6960 and resistance at 0.7080. Breaking above 0.7080 will not only provide a new higher high, it will mean that price is breaking above critical resistance trend line. If support fails to hold we should expect a move towards 0.6840 which is the major low area of June. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD continues lower as expected after breaking below support of 1.12 Posted: 24 Jul 2019 01:54 PM PDT EURUSD is making new lows and this selling pressure should come as of no surprise to traders especially after price had broken below the 1.12 support level. This was noted several times in previous posts and how important a support it was.

Magenta line - neckline support broken Blue lines - target of neckline breakdown EURUSD has broken below the key support of 1.12 and the road to 1.10 has opened. Price has made a bearish formation around 1.12 and combined with a triple top rejection at 1.1280 the mixture is deadly for bulls. Trend is bearish. EURUSD is heading below 1.11 and as long as price is below 1.1280 any bounce is considered selling opportunity. Target to the downside is found between 1.1050 and 1.0975. A bounce towards 1.12 could be seen at the end of this week in order for bears to liquidate some of their profits, but in order to see more downside towards 1.10 we should not see price recapture 1.12. The material has been provided by InstaForex Company - www.instaforex.com |

| Neutral day for Gold but price still vulnerable to a move lower Posted: 24 Jul 2019 01:49 PM PDT Gold price mostly moved sideways today holding above the short-term support at $1,415 and below resistance at $1,430. Gold price is consolidating and if support fails to hold, we should expect a move below $1,400.

Green rectangle - support Blue rectangle- target if support fails to hold Black line - resistance broken Red line - trend line support Gold price remains in a bullish short-term trend despite the recent pull back from $1,453. Price remains above the support area of $1,415-10 and above the trend line support. Gold price will move towards $1,350-60 only if this support area fails. On the other hand resistance is found at $1,430 and if broken we could expect one more new higher high towards $1,500. The material has been provided by InstaForex Company - www.instaforex.com |

| July 24, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 24 Jul 2019 11:26 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish movement was initiated towards 1.1275 followed by a deeper bearish decline towards 1.1235 (the lower limit of the newly-established bullish channel) which failed to provide enough bullish support for the EUR/USD. Recent bearish breakdown below 1.1235 invited further bearish momentum to move towards 1.1175. However, significant bullish momentum was earlier demonstrated around 1.1200 bringing the EUR/USD pair again above 1.1235. That's why, extensive bullish pullback was expected to pursue again towards the price zone around 1.1275 where a double-top Bearish pattern was demonstrated. Recent Bearish breakdown of the pattern neckline around (1.1235) confirmed the short-term trend reversal into bearish towards 1.1175. By the end of last week, lack of enough bearish momentum below 1.1235 brought another bullish pullback towards the depicted key zone around 1.1235 spiking up to 1.1275 (a Weekly High) where significant bearish rejection and a bearish engulfing candlestick were demonstrated. Fortunately, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD back below 1.1235 which stands as Intraday Supply zone to be watched for Intraday SELL entries upon any bullish pullback. Further bearish decline was expected to pursue towards 1.1175 where early signs of bullish recovery is being demonstrated. Intradaily bullish pullback may be demonstrated towards 1.1200 where another valid SELL entry can be offered. On the other hand, bearish breakdown below 1.1175 will probably facilitate a quick bearish decline towards 1.1115 (Previous Weekly Low). Trade recommendations : For Intraday traders, another valid SELL entry can be offered anywhere around 1.1200. Initial Target levels to be located around 1.1175 then 1.1115 while Stop Loss should be placed above 1.1240. The material has been provided by InstaForex Company - www.instaforex.com |

| July 24, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 24 Jul 2019 08:32 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550 with a prominent key-level around 1.2650. Moreover, signs of bearish rejection have been manifested near 1.2750 (Head & Shoulders reversal pattern with neckline located around 1.2650). Bearish breakdown below 1.2650 (reversal pattern neckline) confirmed the reversal pattern with bearish projection target located at 1.2550, 1.2510 and 1.2450. Intermediate-term technical outlook remains under bearish pressure as long as the market keeps moving below 1.2550 (the lower limit of the depicted consolidation range). In July 18, a recent bullish movement was initiated around 1.2385 (the lower limit of the depicted movement channel). A bullish pullback was demonstrated towards the backside of the broken consolidation range (1.2550) where another valid SELL entry was offered by the end of last week's consolidations. Bearish persistence below 1.2460 (38.2% Fibonacci levels) was mandatory to ensure further bearish decline. However, lack of sufficient bearish momentum was demonstrated around 1.2430 (38.2% Fibonacci Level). That's why, another bullish pullback is currently being demonstrated towards 1.2500 (61.8% Fibonacci level) which constitutes a prominent Intraday Supply Level to be watched for bearish rejection & another SELL Entry. Bearish breakdown below 1.2430 (38.2% Fibonacci Level) is mandatory to allow further bearish decline towards 1.2360 where the lower limit of the depicted movement channel comes to meet the GBP/USD pair. Moreover, Bearish breakdown below 1.2360 is needed to facilitate further bearish decline towards 1.2320 and 1.2270 which correspond to significant key-levels on the Weekly chart. On the other hand, please note that any bullish breakout above 1.2560 invalidates the previously mentioned bearish scenario. Trade Recommendations: For traders who missed the initial trade, another SELL Entry can be taken upon the current bullish pullback towards 1.2500. Initial T/P levels to be located around 1.2430 and 1.2360 while S/L should be placed above 1.2560. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Bitcoin for July 24, 2019: prices heading towards $9,000 Posted: 24 Jul 2019 08:07 AM PDT Bitcoin has been quite impulsive and non-volatile with the recent bearish move after breaking below $10,000 area with a daily close. Bitcoin and other cryptocurrencies have come under bearish pressure lately. Therefore, Bitcoin's price slid below $10,000, putting the cryptocurrency's recent bullishness in a counter trend volatility. Further deterioration of the market sentiment is the possibility that Bitcoin is currently in the process of validating a similar fractal pattern to the one that was formed in the bearish market in 2018. It could mean that the price may visit $8,500 area in the coming days. Meanwhile, some traders have taken this price action optimistically, claiming that it is only a matter of time before bitcoin resumes its crusade to highs. The fundamental and technical indicators suggest Bitcoin may stumble further. The price of bitcoin is down by more than 30 percent from its 2019 high but the cryptocurrency is eyeing a strong bullish run in the long-term scenario which could surpass the 2017 high and may push towards $40,000 by the end of 2020. As per the current bearish sentiment, the price has every chance of pushing towards $9,000 if the price does not manage to close above $10,000 area by the end of this month. TECHNICAL OVERVIEW: The price is currently being held by the dynamic levels like 20 EMA, Tenkan and Kijun lines along the way which also carried the price to breach below $10,000 area. The price is currently pushing higher towards $10,000 area. If it is broken above again, then the further upside pressure towards $10,500 is expected. Otherwise, if the price remains below $10,000 area with a daily close, the bearish bias is expected to continue and may lead the price towards $9,000 before any bullish intervention for counter can be observed. TECHNICAL LEVELS: SUPPORT- 9,000, 9,400, 9,500 RESISTANCE- 10,000, 10,500, 11,000, 11,500 CURRENT BIAS- Bearish MOMENTUM- Non-Volatile

|

| BTC 07.24.2019 - Sellers in total control Posted: 24 Jul 2019 07:24 AM PDT Industry news: One of the largest crypto derivatives exchange, BitMEX is currently under investigation by the US's top regulator, CFTC. The trading platform is majorly known for the crypto derivatives trading feature. . . Trading recommendation:

BTC has been trading exactly what I expected yesterday. The down breakout of the 3-day balance is still active and is confirming the selling pressure. You should still watch for potential selling opportunities with the main target at $9.083. Yellow rectangle – Resistance ($11.000) Blue horizontal line – Key swing low and downward target ($9.083) Red lines – Downward channel MACD oscillator is still showing the decreasing upward momentum and BTC, which confirms my bearish view. Slow MACD line is clearly going lower and that is another confirmation for the downside. Percent Bollinger oscillator is showing the strong momentum down and is supportive for my down view. My advice is to watch for selling opportunities with the target at $9.083. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 07.24.2019 - Important pivot at the price of $1.429 on the test Posted: 24 Jul 2019 07:14 AM PDT Gold is trading second time to break the key pivot at the price of $1.429 and we got good odds that break might happen. The breakout of the key pivot at $1.429 will lead us to potential $1.440-$1.450 level. Trading recommendation:

Blue horizontal line – Main pivot resistance ($1.429) Yellow rectangle – Support ($1.414) Blue rectangle – Upward target-resistance ($1.440) MACD oscillator is showing again flip into the positive territory above the zero, which is sign of the potential new wave up. Band Width indicator is showing low reading, which represents that bands range are narrowing, which is indication of the balancing market. My advice is to watch for the potential breakout of the $1.429 to confirm upside and potential test of $1.440-$1.450/ The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for July 24,2019 - Sellers got exhauster, potential rally incoming Posted: 24 Jul 2019 07:01 AM PDT Nothing special changed since our last analysis except that I got more evidence for further upside on EUR. My advice is to watch for potential buying opportunities due to sellers exhaustion. Upward target Is set at the price of 1.1206. Trading recommendation:

Yellow rectangle – Resistance (1.1206) Blue rectangle – Support 1.1144 Bullish divergence on the percent Bollinger oscillator in the background is the sign of the potential rally incoming. Additional confirmation is that Stochastic oscillator got fresh new bull cross, which is another sign of the potential strength. After the yesterday's big drop, today EUR is trying to find the balance and potentially start to rally. It is very unlikely that EUR take the major swing low at the price of 1.1107. Watch for buying opportunity with the upward target at the price of 1.1206. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2019 06:41 AM PDT Today's data on the eurozone indicate a decline in industrial production, which is clear evidence of a looming recession. Given the fact that the eurozone manufacturing sector has been in a bad state before, and is now even worse, this increases the risk of a technical recession, which will clearly make the European Central Bank think even more about the monetary policy course that will be announced tomorrow. Perhaps the only country where the purchasing managers index (PMI) for the manufacturing sector remained above 50 points was France. According to the report, the preliminary index of supply managers for the production sector in France in July fell to a neutral level of 50.0 points, while the decline was projected at 51.5 points. Back in June, the index was 51.9 points. The preliminary index of supply managers for the French service sector in July was 52.2 points, while economists had forecasted it at 52.6 points. As for the mood in the business community in France, they fell in July. According to the report, the index fell to 101 points against 102 points in June. The index was forecasted unchanged. As mentioned above, Germany's manufacturing sector is clearly in recession, and this is confirmed by the data published today by the statistics agency. The report indicates that the preliminary purchasing managers index (PMI) for the manufacturing sector in Germany in July fell even more, to 43.1 points, against 45.0 points in June. Economists had expected the index at 45.0 points. The weak manufacturing sector suffers from a sharp slowdown in external orders and is kept afloat only by the domestic market. Trade wars and the decline in global economic growth are also exerting serious pressure. As for the service sector in Germany, the preliminary purchasing managers index (PMI) in July amounted to 55.4 points against 55.8 points in June and the forecast decline to 55.3 points. All of these reports from IHS Markit resulted in one overall indicator for the eurozone, where the preliminary composite PMI of the eurozone in July fell to 51.5 points from 52.2 points in June, while economists had expected the index to be 52.1 points. Even considering the fact that the index is preliminary, it will be enough to strengthen the desire of central bank managers to soften the policy. Data on lending to companies in the euro area were ignored by the market, even despite the decline in the growth of the money supply. According to a report by the European Central Bank, lending to companies in the eurozone in June 2019 increased by 3.8% compared to the same period in 2018. Household lending rose 3.3% in July. The eurozone's m3 monetary aggregate rose only 4.5% in June after rising 4.8% in May, while economists had expected a growth of 4.7%. Tomorrow's decision of the European regulator is unlikely to please traders, although this can be seen in the market and the European currency, which is losing its position against the US dollar. As for the technical picture of the EURUSD pair, the prospects for risky assets, before tomorrow's ECB meeting, remain quite gloomy. The bears have reached the support of 1.1160 and fixed below it. Now, their new goal will be to break the low of 1.1135, which will only increase the pressure on the trading instrument and push it to the next lows in the area of 1.1110 and 1.1080. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for July 24, 2019 Posted: 24 Jul 2019 06:40 AM PDT The GBP/USD pair continues to move downwards from the level of 1.2580. This week, the pair dropped from the level of 1.2580 to the bottom around 1.2454. But the pair rebounded from the bottom of 1.2454 then closed at 1.2560. Today, the first support level is seen at 1.2454, the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.2529, which coincides with the 23.6% Fibonacci retracement level. This resistance has been rejected several times confirming the veracity of a downtrend. Additionally, the RSI starts signaling a downward trend. As a result, if the NZD/USD pair is able to break out the first support at 1.2454, the market will decline further to 1.2375 in order to test the weekly support 2. Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 1.2454 with the first target at 1.2375 and further to 1.2315. However, stop loss is to be placed above the level of 1.2580. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of NZD/USD for July 24, 2019 Posted: 24 Jul 2019 06:36 AM PDT Overview: The NZD/USD pair broke the resistance that turned into strong support at the level of 0.6612. The level of 0.9966 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as a major support on the H1 chart today. Consequently, the first support is set at the level of 0.6612. Moreover, the RSI starts signaling an upward trend, and the trend is still showing strength above the moving average (100). Hence, the market is indicating a bullish opportunity above the area of 0.6612. So, the market is likely to show signs of a bullish trend around 0.6612 - 0.6650. In other words, buy orders are recommended above the ratio of 61.8% Fibonacci (0.6612) with the first target at the level of 0.6748 in order to test last bullish wave in the same time frame. If the pair succeeds to pass through the level of 0.6748, the market will probably continue towards the next objective at 0.6818. The daily strong support is seen at 0.6612. Thus, if a breakout happens at the support level of 0.6612/0.6600, then this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2019 05:55 AM PDT To open long positions on GBP/USD, you need: The British pound rose against the dollar from the weekly lows that were reached yesterday after the House of Commons of the British Parliament held the outgoing Theresa May today. Already in the second half of the day, her post will be occupied by Boris Johnson, who won the Conservative Party's election the day before. As for purchases, the markets need to ensure the level of 1.2478, which was founded in the first half of the day. A good rebound from it will be a signal to open long positions, however, it will be possible to count on the continuation of the uptrend only after returning and consolidating above the resistance of 1.2506. In this scenario, the bulls will aim for new highs around 1.2534 and 1.2563, where I recommend taking the profit. If there will be no special activity in the support area of 1.2478, then I recommend postponing long positions until the update of the minimum of 1.2429. To open short positions on GBP/USD, you need: Bears will try to return to the market, but there will be a lot of envy from the speech of the new Prime Minister of Great Britain. In the case of Boris Johnson's harsh statements on Brexit, traders can begin to quickly get rid of long positions. The main task will be to return to the support level of 1.2478, the consolidation below which will hit the stop orders of buyers and push GBP/USD back into a downward peak. The aim of the sellers will be at least around 1.2429, where I recommend fixing the profit. In the scenario of further growth and the lack of a clear position of the new Prime Minister on the Brexit deal, it is best to count on short positions in the pound after a false breakout near the maximum of 1.2534 or a rebound from the larger local level of 1.2565. Indicator signals: Moving Averages Trading is conducted above 30 and 50 moving averages, however, given the high volatility due to political events, I do not recommend taking the indicator into account. Bollinger Bands If the pound falls in the second half of the day, the lower limit of the indicator in the area of 1.2405 will act as support.

Description of indicators

|

| Posted: 24 Jul 2019 05:54 AM PDT To open long positions on EURUSD, you need: Weak data, particularly on the production index of Germany and eurozone pressured the euro. Indices remained below 50 points, indicating a decline in the sector. However, buyers, using the divergence on the MACD indicator, managed to keep the pair above the level of 1.1137, forming a new upward correction from it. At the moment, while trading is above this range, the main task of the bulls will be to break and consolidate above the resistance of 1.1160, which was not possible in the first half of the day. Weak fundamental data on the US economy can help. However, in case of a repeated decline in EUR/USD in the area of the minimum of 1.1137, its breakthrough may occur. In this scenario, it is best to consider new purchases of the euro from the new local support areas of 1.1110 and 1.1080. To open short positions on EURUSD, you need: Bears waited for the correction of the pair to the resistance area of 1.1160 and did not postpone sales to the "long box". As in the morning, their goal is the support of 1.1137, the repeated test of which can lead to its breakthrough, which will increase the pressure on the pair and cause further movement down to the area of the lows of 1.1110 and 1.1079, where I recommend taking the profits. In the afternoon, a number of reports on the index for the US service sector, as well as the PMI manufacturing sector. Good reports will put additional pressure on the weak euro and lead to the renewal of the next lows. If the data coincide with the forecasts of economists, it is unlikely that major players will make further attempts to sell EUR/USD before tomorrow's meeting of the European Central Bank. The optimal level for opening short positions, in the case of an upward correction, is the area of 1.1160 and a larger level of 1.1183. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which indicates the predominance of euro sellers in the market. Bollinger Bands In the case of an upward correction, the upper limit of the indicator in the area of 1.1160 will act as a resistance.

Description of indicators

|

| Brexit can be "tough" and the ECB's position is too "soft", which doesn't bode well for the euro Posted: 24 Jul 2019 04:36 AM PDT In anticipation of one of the most important meetings of the European Central Bank on monetary policy this year, the euro is trading near two-month lows against the US dollar, remaining under the yoke of a number of problems. In anticipation of one of the most important meetings of the European Central Bank (ECB) on monetary policy this year, the euro is trading near two-months low against the US dollar, remaining under the pressure of a number of problems. On the eve of a portion of negative news for the euro came from the foreign trade front. EU Trade Representative Cecilia Malmstrom stated that the US is not in a hurry to begin negotiations with the free trade alliance. She also said that if the United States imposes duties on European cars imported into the country, the EU will respond with additional tariffs on American goods in the amount of € 35 billion. According to analysts, this may cause an escalation of transatlantic tensions since the cost of EU car exports to the US market is about 10 times higher than supplies to the US from a block of steel and aluminum combined. Another factor of pressure on the euro is the fact that Boris Johnson became the new head of the UK government, advocating the country's withdrawal from the EU at any cost. After the victory of Boris Johnson in the fight for the chair of the Prime Minister, the chances for an unorganized Brexit increased dramatically. It is assumed that if the "hard" scenario is implemented, then Foggy Albion will plunge into recession. The Bank of England will lower the interest rate and the pound will lose 5-10% in weight, pulling the single European currency. In addition, the economic outlook for the eurozone is still bleak. The mood of European business circles is deteriorating and activity in the manufacturing sector is slowing. Meanwhile, inflation in the region remains suppressed. In the best way for the euro is the situation in the field of monetary policy. Rumors that the ECB President Mario Draghi may be gallant and present a gift, Christine Lagarde, to replace him in this post in the form of lightening of monetary policy are being actively circulated on the market. As a rule, the European regulator prepares investors for serious changes in advance. Therefore, it may as well take the first step in this direction this week by adjusting the signals to the market. Now, the main question is when the ECB will begin mitigating, which may include lowering interest rates and resuming the asset purchase program. Also, it would obviously be interesting for investors to find out whether the financial institutions will increase its limits on the redemption of bonds and hint at any further plans regarding the transition to a multi-level rate. It is not excluded that the regulator will refrain from actions this week to find out what the scale of the projected Fed rate cut will be next week and whether the statistics for the eurozone will improve. Bloomberg experts expect that the European Central Bank will reduce the rate on deposits from -0.4% to -0.5% in September. In turn, Rabobank experts assume that the rate may even fall to -0.8%. "Perhaps the ECB will not wait until September and will surprise the market. The regulator may go all-in and lower the deposit rate by 20 basis points this coming Thursday to get ahead of the Fed's potential easing," said currency strategists at Commerzbank. Thus, despite the fact that the potential of the Federal Reserve's monetary expansion is greater than that of the ECB, it is the latter that can show increased activity in easing monetary policy. If the American regulator pauses this process after the reduction of the interest rate in July, then the EUR/USD risks a drop to 1.1 and may even go to 1.05. However, before the pair leaves the medium-term consolidation range of 1.11-1.14, it is premature to speak about a serious downward movement. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2019 04:25 AM PDT What will the ECB do to save the region's economy (we expect corrective movements in EUR/USD and USD/JPY pairs) The single European currency remains under heavy pressure in anticipation of a final ECB decision on monetary policy. An important negative factor for it is still the expectation of a certain surprise on the prospects for the monetary policy of the regulator. So what could be the "surprise" from the ECB and how can it affect the single currency rate? There are several opinions on the market about what the Central Bank can take to support the region's economy. Some investors believe that the slowdown in the growth of the Chinese economy, coupled with US trade sanctions against Europe and the Brexit factor, caused a significant slowdown in the growth of the European economy. In our opinion, in addition to these really important reasons, there is another one that is forgotten. These are the consequences of the crisis of 2008–09, from which, by and large, it is not only Europe but the United States has not recovered either. This problem has been stretching for 10 years now and has simply been drowned before but it has not been solved by massive measures of stimulating economies. The economies of Europe and the United States have not improved their health. Damping up the crisis with unprecedented support measures, they were never resolved. As for the trade wars, they just showed up this problem with new force. In fact, observing the current state of affairs in large Europe as a whole or in the Eurozone, we can say that they repeat the negative scenario of the Japanese economy in particular, which have fallen into the deflationary pit in the 90s but still practically not that I could get out. In this position, the ECB became hostage to its previous actions. He will have nothing left to do, how to lower interest rates deeper and deeper into negative territory and again "flood" the financial system with money. Despite these actions, we believe that it is unlikely to radically change the situation. The world economy is on the verge of a new financial crisis and the first signals of which have already begun to emerge more and more and which is only aggravated by the US selfish policy. We believe that the minimum that can be done tomorrow by ECB is to report the level of interest rates may be lowered. Immediately, the maximum decision is on both rates and new incentive measures. In our opinion, the regulator will stop at the first option in the current situation as it wants to see the Fed's decision on the monetary policy, which will be made next week. We believe that any of the above options will lead to a further fall in the euro. It can only be stopped by a radical decision on the Federal Reserve rates but we will already know what it will be next week. Forecast of the day: The EUR/USD pair remains under pressure in anticipation of the ECB monetary policy meeting. The pair may adjust upwards to 1.1170. If she keeps below this mark, there is a chance that it will continue to fall to 1.1120. The USD/JPY pair is trading below 108.15. We believe that it can be adjusted to the level of 107.60 in the wake of waiting for the outcome of the Fed meeting on interest rates. |

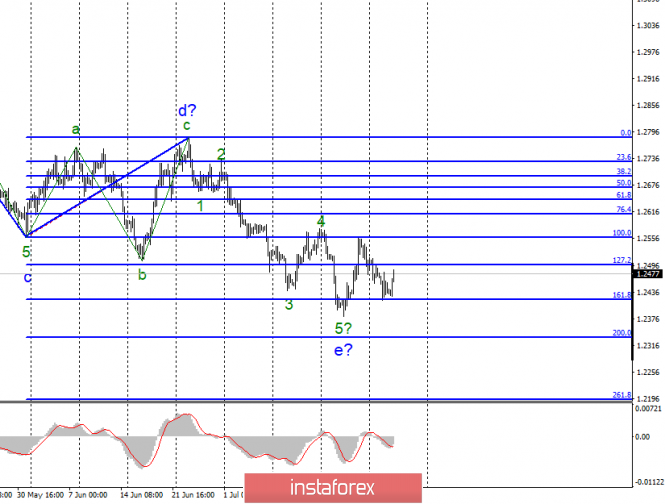

| Posted: 24 Jul 2019 04:22 AM PDT EUR/USD

On Tuesday, July 23, the EUR/USD pair ended with a decrease of 60 basis points. Quite unexpectedly, given that the news background for the pair was absent yesterday. No interesting news has been received, but the markets still found grounds for another purchase of the US dollar. Business activity in Germany in the manufacturing sector fell to 43.1, in the services sector to 55.4, and the composite index of business activity fell to 51.4. In the European Union, the situation is no better: in the manufacturing sector, business activity fell to 46.4, in the service sector – to 53.3, and the composite index – to 51.5. The only thing that at least slightly smoothes the effect of such weak economic data is the incompleteness of the values for July. That is, at the end of the month, business activity can be clarified and, accordingly, be higher than now. However, in the current realities of the euro, it should be feared that it was not even lower than it is now. But such a news background fully fits into the current wave layout, involving the construction of a downward trend section. Purchase targets: 1.1412 – 0.0% according to Fibonacci Sales targets: 1.1106 – 100.0% according to Fibonacci 1.1025 – 127.2% according to Fibonacci General conclusions and trading recommendations: The euro/dollar pair confirms its readiness to build a downward trend segment. The breakthrough of the minimum of the assumed wave 1 indicates the readiness of the instrument to build a downward wave 3. Thus, I recommend selling the pair with targets located near 1.1106 and 1.1025, which is equal to 100.0% and 127.2% of Fibonacci. GBP/USD

The GBP/USD pair fell by 40 basis points on July 23, and today, after an unsuccessful attempt to break the Fibonacci level of 161.8%, it began to grow. And it also fully fits into the current wave pattern, which involves the construction of an upward trend segment, at least corrective. All the attention of the markets yesterday was focused on the results of the election of the Prime Minister in the UK, and the victory was won very predictably by Boris Johnson. Now, he has to perform a huge layer of work, as his election promises imply the country's exit from the EU on October 31. As it will make the new Prime Minister, while it is difficult to assume, given the reluctance of Parliament to implement a hard Brexit. Perhaps there will be re-elections to the Parliament, it may be a referendum. In any case, the news background is still not in favor of the pound sterling. The current rise of the pound/dollar instrument may be short-lived. Sales targets: 1.2334 – 200.0% according to Fibonacci 1.2194 – 261.8% according to Fibonacci Purchase targets: 1.2783 – 0.0% according to Fibonacci General conclusions and trading recommendations: The wave pattern of the pound/dollar instrument involves the completion of the construction of the downward wave e. Thus, I recommend small purchases of the pair with targets placed near 28 figures and with an order that limits losses under the minimum of wave e, after the MACD signal goes up. I recommend returning to sales not earlier than a successful attempt to break the minimum of the wave e. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2019 03:05 AM PDT

The price hasn't fixated yet above +1/8 Murrey Math Level, that's why bears are pushing the pair lower and lower. The Super Trend indicator's Line has formed a bearish cross, and for now acting as resistance. This morning, after another pullback from the 1-hour Super Trend Line we've got a new local low. There's no any bullish sign so far. In this case, if the price trades firmly below 5/8 Murrey Math Level, there'll be a green light for the bearish rally to continue. The nearest target is 3/8 MM level at 1.1077, which could act as support. However, we also should watch 4/8 MM Level at 1.1108 because of the possibility to have a local upward correction from it. Besides, if the market goes through 3/8 MM Level, there'll be a moment to develop a steeper decline. If this happens, the pair will try to test 2/8 Level or drop even deeper. The Super Trend Lines are an essential barometer for the bearish scenario. If the price breaks these lines, there'll be an option to have a large upward correction. The bottom line is that EUR/USD is still in a bearish mood. The next target is 3/8 MM Level, which could stop the rally, for a while at least. The material has been provided by InstaForex Company - www.instaforex.com |

| Review of EUR / USD and GBP / USD pairs on 07.24.2019: A complete surprise Posted: 24 Jul 2019 02:14 AM PDT Politicians regularly demonstrate an incredible ability to change their opinion immediately after being elected to a particular position; that is what Boris Johnson showed us yesterday, as soon as it was announced that he was becoming the new head of the Conservative Party and the Prime Minister of Great Britain. After all, while the inner-party elections were going on, he tirelessly beat his heel on the chest and swore on blood, unlike the indecisive and weak Theresa May, that he would instantly solve the protracted Brexit issue and in October would bring the United Kingdom to Europe-free navigation. But during his victory speech, he said that October 31 is the most likely date of secession from the European Union, although divorce without an agreement is not a very good way for events to unfold. In other words, Boris Johnson does not exclude the possibility of another transfer of the date of resettlement from the European hostel at the moment. Not to mention it directly, but such a shift in rhetoric clearly indicates that. Nevertheless, the new prime minister reiterated once again that under no circumstances would the UK pay Europe anything. Even if you come to some kind of agreement, it will not work. So, on the whole, the intentions of Boris Johnson did not change much, although they somewhat softened. But as they say, the essence of this does not change as it is clear that the version of the agreement that the new prime minister is comfortable with, is simply unacceptable from the European perspective. After all, according to Boris Johnson, who at least speaks out in public, Europe owes it to Britain. It should be that the United Kingdom itself is simply obliged to maintain free and unhindered access of British business to the European market, and the UnitedKingdom itself can impose restrictive measures on European business in the British islands. Thus, the unregulated Brexit is a little closer and it is not surprising that the dollar has continued to grow steadily against this background. At the same time, not only the words of the new prime minister but the very fact of Boris Johnson's victory made such a strong impression on investors that they did not pay attention to the decline in housing sales by 1.7% in the secondary market of the United States at all. As if the victory of Boris Johnson was a complete surprise for many. Honestly, after such a confident step, the dollar is clearly overbought but we have a problem with a reason for a rebound and a local correction. The fact is that preliminary data on indices of business activity in the United States can show continuous growth. In particular, the business activity index in the service sector may grow from 51.5 to 51.7, while the manufacturing business activity index should increase from 50.6 to 51.0. All these will allow the composite index of business activity to show an increase from 51.5 to 52.1. Moreover, despite a serious decline in sales of housing in the secondary market, a growth of 6.0% is expected in the primary market. That is, the Americans do not want to buy old rickety huts but give them new houses. Hence, it is not possible to count on the help of US statistics of a single European currency. In principle, as well as its own, as preliminary data on business activity indices can show the immutability of the business activity index in the manufacturing sector. However, the services sector is expected to decline from 53.6 to 53.3. As a result, the composite business index should fall from 52.2 to 52.1. Therefore, the single European currency is waiting for a further decline around 1.1125. The picture is similar for the pound, especially since it will only focus on American statistics due today due to the lack of its own. Therefore, it is worth waiting for a gradual decline in the pound to 1.2400. |

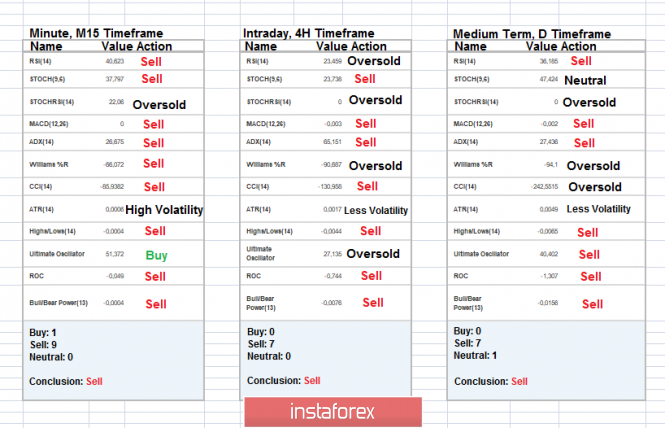

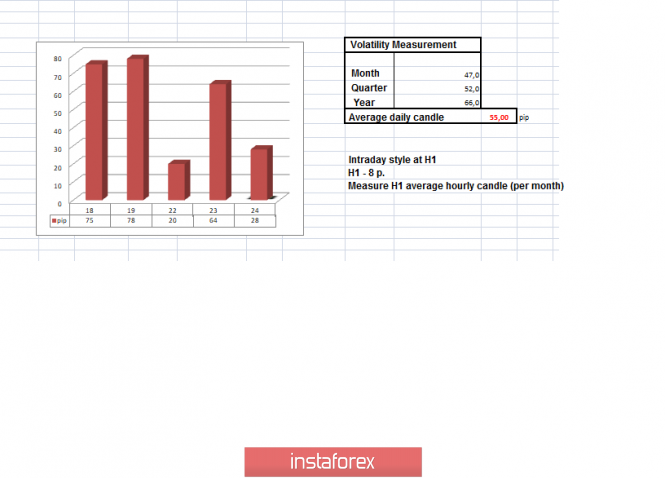

| Trading recommendations for the EURUSD currency pair - placement of trading orders (July 24) Posted: 24 Jul 2019 01:57 AM PDT For the last trading day, the euro / dollar currency pair showed high volatility of 64 points, and as a result, the quote traced a rapid downward move.From the point of view of technical analysis, we see the long-awaited breakdown of the support level of 1.1180, which for a long time kept the quote. The accumulation of 1.1200 / 1.1226 the day before the rally perfectly served for the regrouping of trading forces and, as a fact, a pulse train of more than 80 points for the current hour. As discussed in a previous review, traders occupied a waiting position in anticipation of the breakdown of a key value of 1.1180 for this part of the chart. There is a breakdown. The positions are also descending. The goal in the form of the second point 1.1100 is almost reached. Partial fixations are being considered and are already being made. Considering the trading chart in general terms (daily timeframe), we see that everything is going according to plan. The first point in the form of 1.1180 is passed. The second, 1.1100 is already close, thus the restoration of the global downward trend is no longer a theory, but actually an action. In the center of taking out the information and news background of the past day, of course, was the final election in Britain, where Boris Johnson won without any miracle. The market, in turn, reacted to the event in two ways. The British currency stood in ambiguity, but the euro was under pressure. What is the reason for the rapid decline of the euro? Experts are inclined to believe that with the arrival of Boris Johnson, the agreement on leaving Britain from the EU falls into a deeper pit. The fear of investors associated with a tough exit drives us down in addition to all the noise raised about the possible outcome of the July meeting of the ECB, which will be held this Thursday, where fear is heightened in the form of easing monetary policy and lowering the interest rate. Of course, this is all in theory, but the fear works with wonder. We return to the news background of the past day, and there we had statistics regarding data on sales in the secondary housing market of the United States, where we forecast growth from 5.34M to 5.35M, but received a review of previous data and a decrease: Previous: 5.36M - -> Fact. 5.27M. News in the larger plan remained in the background due to the array of information background. Today, in terms of the economic calendar, we see that data for Europe has already been released and it turned out to be worse than expected. The index of business activity in the manufacturing sector fell from 47.6 to 46.4. The index of business activity in the services sector also shows a decline from 53.6 to 53.3. In the afternoon, we are waiting for statistics on new home sales in the United States, where growth is expected from 626K to 660K. There are also preliminary data on PMI in the States, where growth is expected. Of course, do not forget about the information background, which can be a stimulus for further jumps. Further development Analyzing the current trading chart, we see that the quotation continued to decline, reaching a value of 1.1127, which is already in close proximity relative to a test point of 1.1100. It is likely to assume that overheating of short positions is certainly on the market, and a control point in the form of a range level of 1,1100 can play as a fulcrum. Traders, in turn, are insured and produce a partial fixation of their transactions with the movement of stops to breakeven. Based on the available information, it is possible to decompose a number of variations, let's consider: - Buy positions will be considered in case of working out the range level at 1.1100, you need to stop before laying the positions. - Positions for sale, as they wrote earlier, already existed, and now, there is a phase of profit taking. Further transactions will be considered after the price has been fixed lower than 1.1100, while maintaining the inertial move. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short, intraday and medium term have a downward interest against the background of the inertial course. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (July 24 was based on the time of publication of the article) The current time volatility is 28 points. It is likely to assume that in the case of finding a support in the region of the 1.1100 range, the volatility will be limited. Key levels Zones of resistance: 1.1180 *; 1,1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support areas: 1,1100 **; 1.1000 ***; 1,0850 ** * Periodic level ** Range Level *** Psychological level **** The article is based on the principle of conducting a transaction, with daily adjustment. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment