Forex analysis review |

- Fractal analysis of major currency pairs on July 26

- #USDX vs GBP / USD H4 vs EUR / USD H4. Comprehensive analysis of movement options from July 26, 2019. Analysis of APLs &

- EUR/USD. July 25th. Results of the day. ECB left rates unchanged in July

- JPMorgan predicts the decline of the dollar era

- Oil is growing, but for a serious breakthrough you need something more positive

- The Fed will cut rates for the first time in a decade this month

- GBP/USD. July 25th. Results of the day. EU counter strike to Boris Johnson

- Minutes of fame: do not succumb to the illusions of EUR/USD growth

- Opinions on the euro are divided. Despite gloomy prospects, there is reason for optimism

- Golden collisions: 3-0 in favor of the precious metal

- Euro falls on expectations of lower ECB rates in September

- July 25, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- July 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- Wave analysis for EUR/USD and GBP/USD on July 25. A hint of a reduction in rates in the future from Mario Draghi was received

- BTC 07.25.2019 - Potential ABC upward correction completion

- Technical analysis of AUD/USD for July 25, 2019

- Technical analysis of EUR/USD for July 25, 2019

- Gold 07.25.2019 - Trading range defined

- EUR/USD for July 25,2019 - Shake out in the background, strong reaction from buyers

- Opportunity to buy USDCAD?

- EURUSD bounce is an opportunity to sell

- Gold gets rejected once again at short-term resistance

- EURUSD: the fall is coming to an end and traders will take profit on short positions in euros even if the Draghi signals

- GBP/USD: plan for the American session on July 25. Buyers of the pound made an unsuccessful attempt to continue growth

- EUR/USD: plan for the American session on July 25. The euro fell after the ECB said that rates can be lowered and will fall

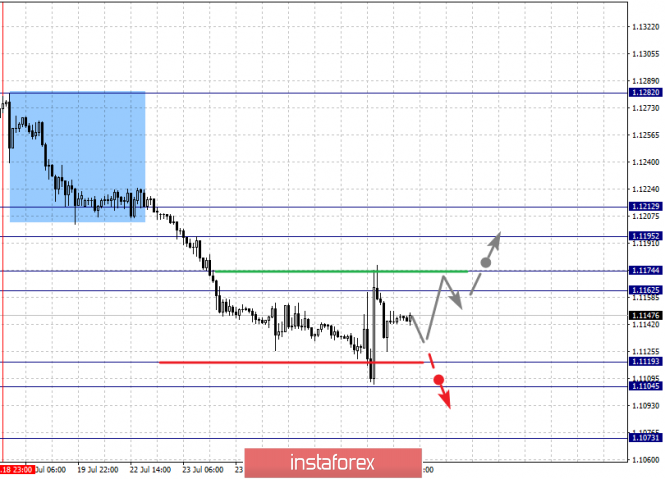

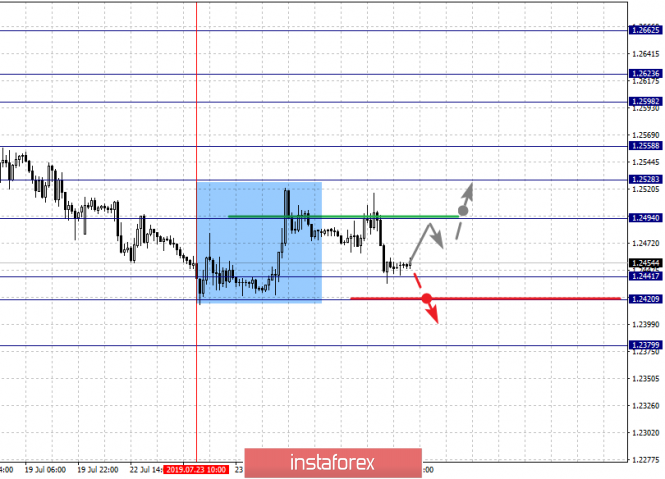

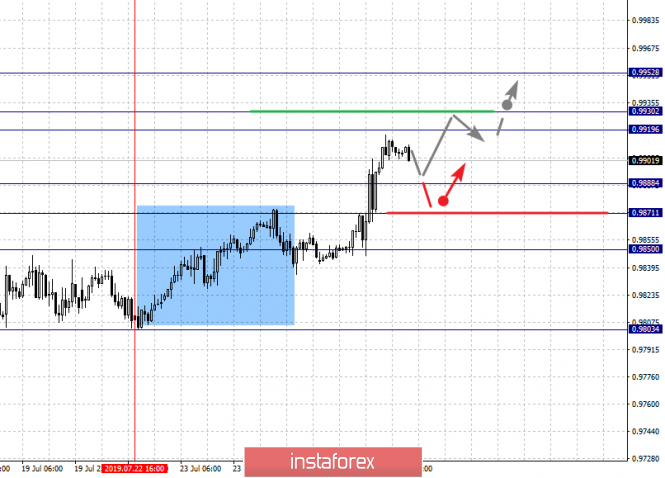

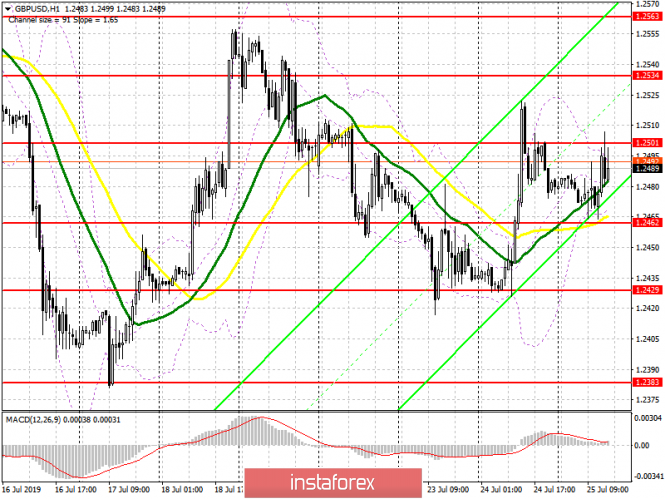

| Fractal analysis of major currency pairs on July 26 Posted: 25 Jul 2019 06:35 PM PDT Forecast for July 26: Analytical review of H1-scale currency pairs: For the euro / dollar pair, the key levels on the H1 scale are: 1.1212, 1.1195, 1.1174, 1.1162, 1.1119, 1.1104 and 1.1073. Here, the price is in the correction zone from the downward structure and forms a small potential for the top of July 25. The continuation of the movement to the to is expected after the price passes the noise range 1.1162 - 1.1174. In this case, the goal is 1.1195, wherein price consolidation is near this level.For the potential value for the top, we consider the level of 1.1212. Short-term downward movement is possible in the range of 1.1119 - 1.1104. The breakdown of the latter value will allow to expect movement towards a potential target - 1.1073. From this level, we expect a rollback to the top. The main trend is the local downward structure of July 18, the stage of correction. Trading recommendations: Buy 1.1175 Take profit: 1.1195 Buy 1.1197 Take profit: 1.1212 Sell: 1.1119 Take profit: 1.1105 Sell: 1.1103 Take profit: 1.1075 For the pound / dollar pair, the key levels on the H1 scale are: 1.2662, 1.2623, 1.2598, 1.2558, 1.2528, 1.2494, 1.2441, 1.2420 and 1.2379. Here, we are following the local ascending structure of July 23. At the moment, the price is close to canceling this structure, for which passing by the range of 1.2441 - 1.2420 is necessary. In this case, the first potential target is 1.2379. The continuation of the movement to the top is expected after the breakdown of the level of 1.2494. Here, the first goal is 1.2528. The breakdown of which will allow us to expect movement to the level of 1.2558, and near this level is the consolidation of the price. The breakdown of the level 1.2558 should be accompanied by a pronounced upward movement. Here, the target is 1.2598. Consolidation is in the range of 1.2598 - 1.2623. For the potential value for the top, we consider the level of 1.2662. The movement to which is expected after the breakdown of the level of 1.2625. The main trend is the local structure for the top of July 23, the stage of deep correction. Trading recommendations: Buy: 1.2494 Take profit: 1.2528 Buy: 1.2530 Take profit: 1.2558 Sell: 1.2441 Take profit: 1.2420 Sell: 1.2420 Take profit: 1.2380 For the dollar / franc pair, the key levels on the H1 scale are: 0.9952, 0.9930, 0.9919, 0.9888, 0.9871 and 0.9850. Here, we are following the development of the ascending structure of July 22. The continuation of the movement to the top is expected after the price passes the noise range 0.9919 - 0.9930. In this case, the potential target is 0.9952. After reaching this level, we expect a rollback to correction and the formation of large initial conditions for the upward movement. Short-term downward movement is possible in the range of 0.9888 - 0.9871. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.9850. This level is a key support for the upward structure. The main trend is the ascending structure of July 22. Trading recommendations: Buy : 0.9930 Take profit: 0.9950 Buy : Take profit: Sell: 0.9888 Take profit: 0.9872 Sell: 0.9868 Take profit: 0.9852

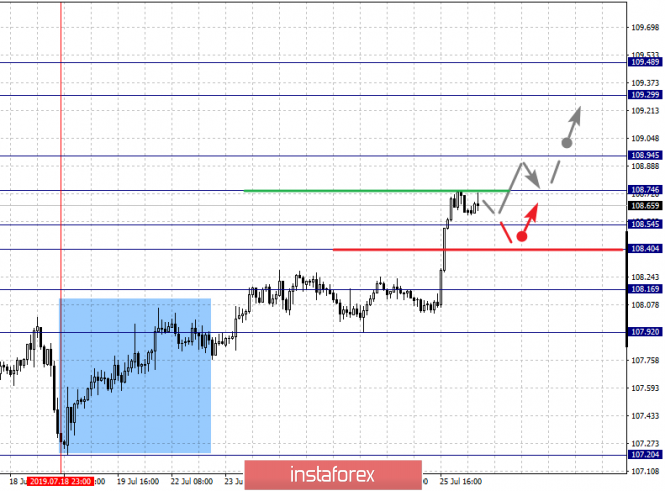

For the dollar / yen pair, the key levels on the scale are : 109.48, 109.29, 108.94, 108.74, 108.54, 108.40, 108.16 and 107.92. Here, we are following the development of the ascending structure of July 18. Short-term upward movement is expected in the range of 108.74 - 108.94. The breakdown of the last value should be accompanied by a pronounced upward movement. In this case, the target is 109.29. We consider the level of 109.48 to be a potential value for the top. Upon reaching this level, we expect consolidation as well as a rollback to the bottom. Short-term downward movement is possible in the range of 108.54 - 108.40. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 108.16. This level is a key support for the upward structure. Its price passage will have to form the initial conditions for the downward cycle. Here, the potential goal is 107.92. The main trend: the ascending structure of July 18. Trading recommendations: Buy: 108.75 Take profit: 108.92 Buy : 108.95 Take profit: 109.29 Sell: 108.54 Take profit: 108.42 Sell: 108.38 Take profit: 108.16

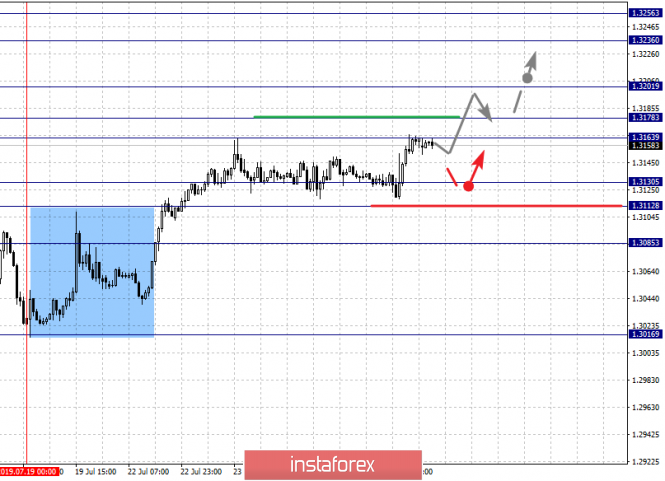

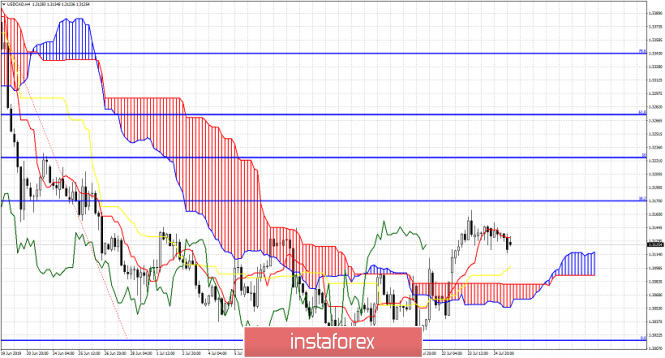

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3256, 1.3236, 1.3201, 1.3178, 1.3163, 1.3130, 1.3112 and 1.3085. Here, we continue to monitor the ascending structure of July 19. The continuation of the movement to the top is expected after the passage of the price of the noise range 1.3163 - 1.3178. In this case, the goal - 1.3201, and near this level is a consolidation. The breakdown of the level of 1.3201 will lead to a pronounced movement. Here, the target is 1.3236. For the potential value for the top, we consider the level of 1.3256. After reaching which, we expect a rollback to the bottom. Short-term downward movement is possible in the range of 1.3130 - 1.3112. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3085. This level is a key support for the top. The main trend is the ascending structure of July 19. Trading recommendations: Buy: 1.3178 Take profit: 1.3200 Buy : 1.3203 Take profit: 1.3234 Sell: 1.3130 Take profit: 1.3112 Sell: 1.3110 Take profit: 1.3085

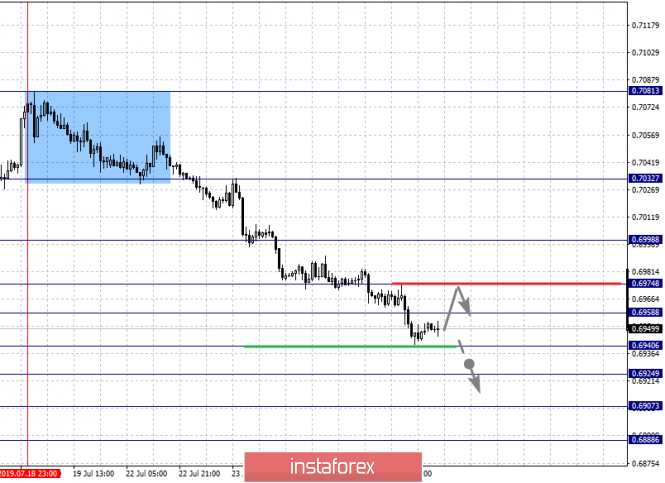

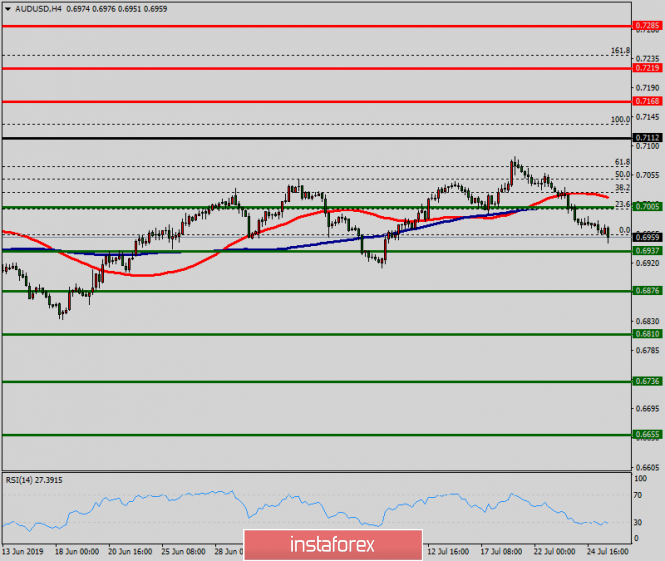

For a pair of Australian dollar / US dollar, the key levels on the H1 scale are : 0.6998, 0.6974, 0.6958, 0.6940, 0.6924, 0.6907 and 0.6888. Here, we are following the development of the downward structure of July 18th. Short-term downward movement is expected in the range of 0.6940 - 0.6924. The breakdown of the latter value will lead to the movement to the level of 0.6907. From this level, there is a high probability of a reversal to the correction. For the potential value for the top, we consider the level of 0.6888. However, the movement towards this goal is considered unstable. Short-term upward movement is possible in the range of 0.6958 - 0.6974. The breakdown of the latter value will lead to a prolonged correction. In this case, the target is 0.6998. The main trend - the downward structure of July 18. Trading recommendations: Buy: 0.6958 Take profit: 0.6972 Buy: 0.6976 Take profit: 0.6996 Sell : 0.6940 Take profit : 0.6925 Sell: 0.6922 Take profit: 0.6907

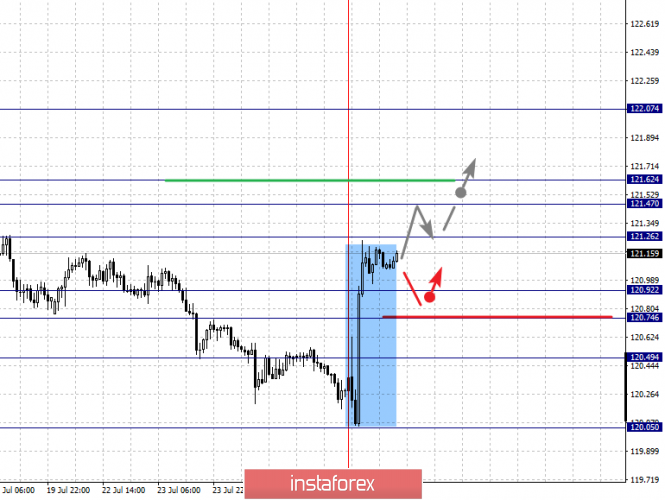

For the euro / yen pair, the key levels on the H1 scale are: 122.07, 121.62, 121.47, 121.26, 120.92, 120.74 and 120.49. Here, the price forms the initial conditions for the upward movement of July 25. The continuation of the movement to the top is expected after the breakdown of the level of 121.26. In this case, the goal is 121.47. We expect clearance of the expressed structure to the level of 121.62. For the potential value for the top, we consider the level of 122.07. The movement to which is expected after the breakdown of the level of 121.62. Short-term downward movement is possible in the range of 120.92 - 120.74. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 120.49. This level is a key support for the top. The main trend is the formation of the initial conditions for the upward cycle of July 25. Trading recommendations: Buy: 121.26 Take profit: 121.45 Buy: 121.64 Take profit: 122.05 Sell: 120.92 Take profit: 120.76 Sell: 120.72 Take profit: 120.54

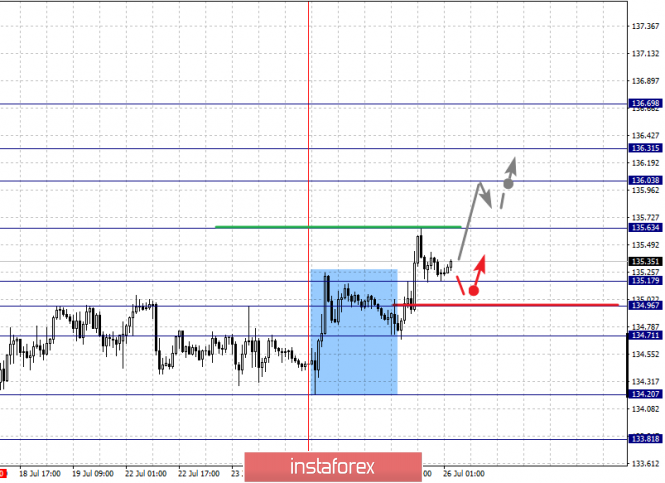

For the pound / yen pair, the key levels on the H1 scale are : 136.69, 136.31, 136.03, 135.63, 135.17, 134.96 and 134.71. Here, we determined more precise targets for the upward trend from the local structure on July 24. The continuation of the movement to the top is expected after the breakdown of the level of 135.63. In this case, the goal is 136.03. A short-term upward movement, as well as consolidation is in the range of 136.03 - 136.31. We consider the level of 136.69 as a potential value for the top. Upon reaching this level, we expect a rollback to the correction. Short-term downward movement is possible in the range of 135.17 - 134.96. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 134.71. This level is a key support for the upward structure. The main trend is the local ascending structure of July 24th. Trading recommendations: Buy: 135.65 Take profit: 136.03 Buy: 136.06 Take profit: 136.30 Sell: 135.17 Take profit: 134.97 Sell: 134.94 Take profit: 134.72 The material has been provided by InstaForex Company - www.instaforex.com |

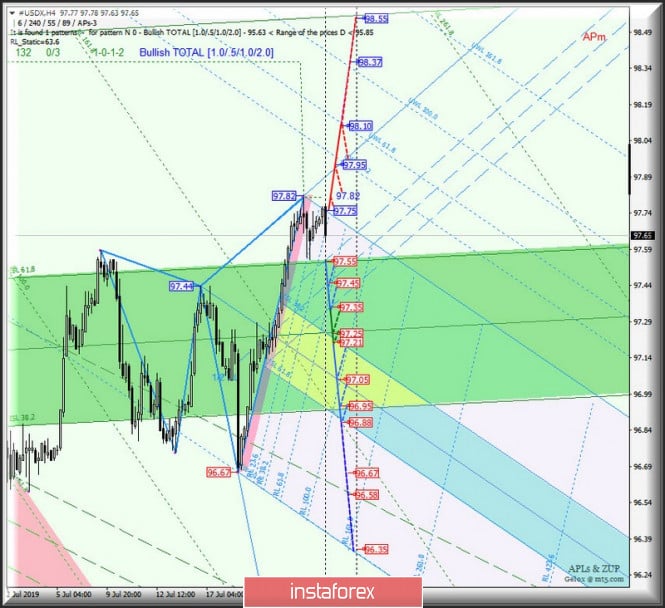

| Posted: 25 Jul 2019 05:43 PM PDT Let us consider the comprehensive analysis of the options for the development of the movement of currency instruments #USDX vs EUR / USD vs GBP / USD from July 26, 2019. Minuette (H4) ____________________ US dollar Index The movement of the dollar index #USDX from July 26, 2019 will result depending on the direction of the range breakdown :

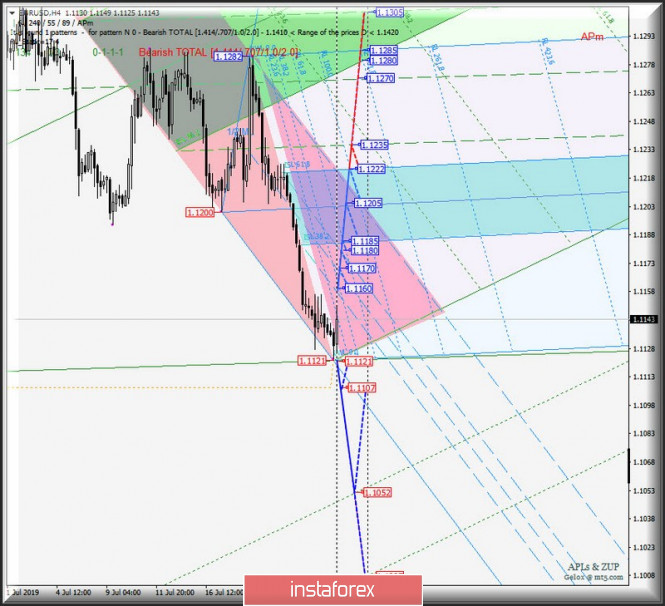

The breakdown of the upper boundary of the 1/2 Median Line channel of Minuette (support level of 97.55) will determine the development of the #USDX movement in the 1/2 Median Line channel of Minuette (97.55 - 97.45 - 97.35), and during the breakdown of the lower boundary (97.35) of this channel, the downward movement of the US dollar index can be extended to the median line (97.25) of the Minuette operating scale forks and the equilibrium zone (97.21 - 97.05 - 96.88) of the Minuette operational scale forks. On the other hand, in case of breakdown of the resistance level of 97.75 on the SSL start line, the Minuette operational scale forks will be followed by updating the local maximum 97.82. After that, the upward movement of #USDX can continue to the targets - the UTL Minuette control line (97.95) - the UWL61.8 Minuette warning line (98.10). The details of the #USDX movement are shown in the animated graphics. ____________________ Euro vs US dollar Similarly in the case of the dollar index, the development of the movement of the single European currency EUR / USD from July 26, 2019 will be due to the direction of the range breakdown :

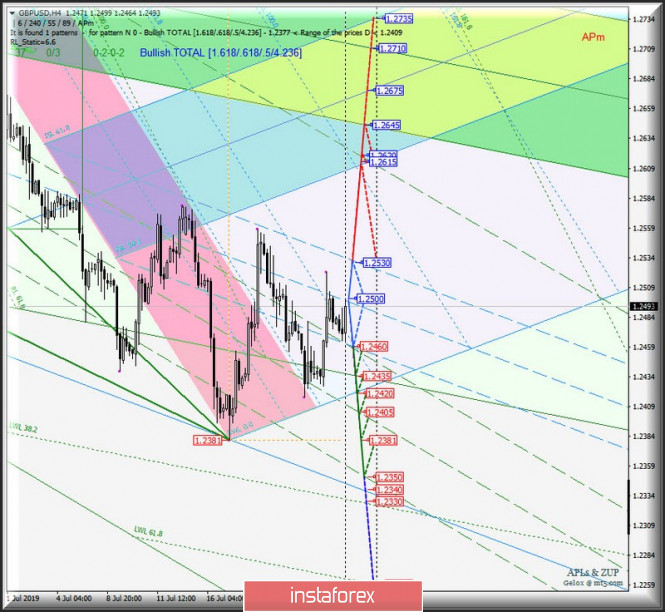

The breakdown of the resistance level of 1.1160 will make it possible to develop the movement of the single European currency within the boundaries of the 1/2 Median Line channel (1.1160 - 1.1170 - 1.1180) and the equilibrium zone (1.1185 - 1.1205 - 1.1222) of the Minuette operating scale. In the case of confirmation of the breakdown of the initial SSL line (1.1121) of the Minuette operating scale fork, the downward movement of EUR / USD can be continued towards the targets - minimum 1.1107 - warning line UWL38.2 (1.1052) of the Minuette operational scale fork. The details of the movement options for this pair are presented in the graph. ___________________ Great Britain pound vs US dollar Meanwhile, the development of the movement of Her Majesty's Currency GBP / USD from July 26, 2019 will be determined by the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (1.2530 - 1.2500 - 1.2460) of the Minuette operational scale. The movement options within this channel are shown in the animated graphic. If the resistance level of 1.2530 is broken down at the upper boundary of the 1/2 Median Line channel Minuette, the upward movement of GBP / USD can be continued to the targets - the lower boundary of the ISL38.2 (1.2615) and the equilibrium zone of the Minuette operating scale fork -the final Schiff Line Minuette (1.2620) is the lower boundary of the ISL38.2 (1.2645) equilibrium zone of the Minuette operational scale fork. The breakdown of the lower boundary of the 1/2 Median Line channel of Minuette operational scale (support level of 1.2460) will determine the further development of the movement of the single European currency in the 1/2 Median Line channel (1.2460 - 1.2405 - 1.2350) of the Minuette operational scale fork. The details of the GBP / USD movement are presented in the animated graphics. ____________________ The review was compiled without taking into account of the news background. In addition, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index is: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where power ratios correspond to the weights of currencies in the basket: Euro - 57.6% ; Yen - 13.6%; Pound sterling - 11.9% ; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula gives the index value to 100 on the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. July 25th. Results of the day. ECB left rates unchanged in July Posted: 25 Jul 2019 03:59 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 75p - 78p - 19p - 64p - 29p. Average amplitude for the last 5 days: 53p (54p). On Thursday, July 25, the EUR/USD pair adjusted to the critical Kijun-Sen line, from which it could rebound and resume a downward trend. A fairly strong growth in the euro was due to the wrap-up of the ECB meeting. Although, from our point of view, Mario Draghi didn't please traders in any way, the euro still managed to show growth, mainly due to the consolidation of the greenback's positions. During the press conference, Mario Draghi announced that rates would remain at the same level or even lower until the first half of 2020, or until the return of inflation to the ECB's target level of 2.0%. Thus, monetary policy should be extremely stimulating, according to a press release. Mario Draghi also noted that eurozone economic growth is likely to slow down in the second and third quarters, while trade wars and protectionism continue to put pressure on the global economy. In general, Draghi almost openly stated that at the next meeting, monetary policy would be relaxed. Now on to the US Federal Reserve. We have already mentioned that the euro's current rate most likely takes into account the ECB rate cut, however, this has not yet declined. Therefore, in the short term, the euro can even get some support from the forex market. The Fed will hold a meeting next week, at which a reduction in the key rate of 0.25 - 0.50% can be announced. Reducing the rate by 0.25% is already taken into account by the market, but a decrease of 0.5% will be an unpleasant surprise for dollar investors. In this case, it will be possible to expect the European currency to significantly grow due to the massive closure of short positions. Trading recommendations: EUR/USD adjusted to the Kijun-Sen line. Thus, it is now recommended to wait for a rebound from the Kijun-sen line and once again sell the euro with the aim of a support level of 1.1101. We recommend buying the euro/dollar pair not earlier than when traders overcome the Kijun-sen line with initial targets at 1.1209 and 1.1269, but with minimal lots, as bulls remain extremely weak. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| JPMorgan predicts the decline of the dollar era Posted: 25 Jul 2019 03:44 PM PDT The position of the greenback in the foreseeable future may falter, and it even runs the risk of losing the status of the main global reserve currency, analysts at JPMorgan Chase warn. "The dollar has been the main global reserve currency for almost 100 years. During this time, many investors, including those outside the United States, have become accustomed to the fact that dollar assets occupy a "higher than market" share in their portfolios. However, we believe that the US currency may lose its unique status due to structural and cyclical reasons, which will lead to a decline in its rate," representatives of the financial institute said. "After the end of World War II, the United States became the largest global economy, accounting for a quarter of global GDP. If we add the countries of Western Europe, then this value will increase to 40%. Since then, fast-growing Asia, in the heart of which China is located, has consistently won back the share of the world market from the West, "they added. According to experts, as the Asian region develops, the share of transactions in currencies other than the dollar will inevitably grow. "In addition, the current US administration has questioned agreements with all major US trading partners - from Mexico and Canada to China and the EU, and also left the Trans-Pacific Partnership. Such unfriendly actions on the part of Washington can induce these states to reduce the share of the dollar in trade calculations," noted JPMorgan experts. They believe that the permanent fiscal and trade deficits of the United States can trigger a decline in the dollar against a basket of currencies and gold, and advise investors to diversify their portfolios so that they prefer other currencies in developed markets and in Asia, as well as precious metals. However, according to analysts, selling the dollar immediately is also not worth it, because shifts in preferences in financial markets take a very long time, so those who are counting on a quick weakening of the US currency should have extraordinary patience. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil is growing, but for a serious breakthrough you need something more positive Posted: 25 Jul 2019 03:44 PM PDT Oil has enough reason to grow. Quotes have already risen by more than a dollar amid tensions in the Middle East and a significant decline in US oil reserves. On the opposite side of the scale, only weak production data in Western countries, indicating a slowdown in economic growth, which, in turn, may reduce the demand for fuel. Brent crude went up by $1.03, to $64.21 per barrel, while American WTI rose by $1, to $56.88 per barrel. A week after Iran captured a British-flagged tanker in the Persian Gulf, the British Ministry of Defense announced that the Royal Navy was assigned to escort ships through the Strait of Hormuz to protect the freedom of navigation. Saudi Arabia, the world's largest exporter of oil, also called for ensuring the safe transportation of energy in the Strait of Hormuz, through which about 20% of world supplies are transported daily. Prices also supported the decline in oil reserves in the US by almost 11 million barrels, despite the fact that a decline of 4 million barrels was expected. The numbers indicate that the oil market is finally recovering. Confirming the balance of supply and demand, Brent briefly plunged into contango - this is a market structure in which the prices for forward deliveries are higher than for urgent ones. However, this is not enough. "Despite the fundamental factors that support oil prices, such as the balance of supply and demand, geopolitics, on the side of bulls, the market, in order to rise noticeably, you still need a strong positive economic catalyst. If next week we receive positive comments on the results of the resumed trade negotiations between the United States and China, then oil may jump sharply in price," BNP is sure. The material has been provided by InstaForex Company - www.instaforex.com |

| The Fed will cut rates for the first time in a decade this month Posted: 25 Jul 2019 03:44 PM PDT According to economists surveyed by Reuters, a quarter-point reduction in the Fed's interest rate is a "resolved issue", and another decline is expected this year amid growing economic risks as a result of the continuing trade war between the US and China. Easing policy will push US stocks to new record highs. More than 95% of 111 economists predict a rate cut of 25 basis points at the meeting of July 30-31. At the same time, the markets are already so confident in the Fed's decision that if this does not happen, it will cause some shock. Expectations for the Fed rate this year have changed dramatically - from a stable tightening to a series of cuts. Just a month ago, the US central bank still predicted the continuation of policy and possible easing next year. But now fears about the negative impact of a trade war, a slowdown in growth, as well as weak inflationary pressure are causing increasing concern. The latest survey shows another rate cut in the last quarter, and almost 40% of respondents predict that another drop is likely to occur as early as September. In general, three rate reductions are expected this year - in July, September and December. "We do not think this is the beginning of a large-scale easing cycle; rather, these reductions are aimed at providing a little more opportunity to compensate for the headwind, "economist Josh Nay said. However, there is another opinion. "The problems that affect the economy and inflation right now will not solve lower rates. Economic prospects are overshadowed by trade tensions. Reducing rates by 25 or 50 basis points will not change this situation. From a fundamental point of view, this does not make sense," said analyst Thomas Simons. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. July 25th. Results of the day. EU counter strike to Boris Johnson Posted: 25 Jul 2019 03:38 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 134p - 80p - 58p - 64p - 96p. Average amplitude for the last 5 days: 86p (82p). No later than yesterday, Boris Johnson spoke for the first time as Great Britain's prime minister. In his speech, he unexpectedly stated that "there is a rather low probability that Brussels and London will not be able to agree on the terms of Brexit", clearly hinting at new negotiations with the European Union. We have repeatedly said that Boris Johnson's hopes may not come true, since his behavior and rhetoric is a bit like Donald Trump. Johnson changes his mind too often, makes overly loud statements, and his promises look too vain. The European Union, under Theresa May, made a statement that the current version of the "deal" is the best that it can offer Brussels, and there will be no revision of the agreements. However, Boris Johnson has managed to declare that he is going to conduct new negotiations with the EU, and at the same time he does not strive for a hard Brexit, but he does not fear it either. Recall that a couple of days ago, his rhetoric was "hard Brexit October 31 and nothing else." Today, in response to Johnson, a representative of the European Commission, Mina Andreeva, spoke, saying that they were following Johnson's speech in Parliament and did not want to comment on it, but could not speak about any new negotiations. Andreeva also added that residents and enterprises of Britain, rather than the 27 EU member states, will feel the greater effect of the hard Brexit. Thus, Johnson seems to have to implement Brexit without a "deal", but how can he convince Parliament to support this option? It seems that the whole saga of the "divorce process" will be delayed for many more months. Trading recommendations: The pound/dollar currency pair can resume the downward movement. Thus, it is now recommended to wait for the MACD indicator to turn down and consolidate the price below the Kijun-sen line and resume selling the pound in order to support the level of 1.2395. After the pair has been consolidated above the critical line, it will be possible to buy the British currency, however, with extreme caution and small lots. The first goal is the level 1.2567. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Minutes of fame: do not succumb to the illusions of EUR/USD growth Posted: 25 Jul 2019 03:38 PM PDT Contrary to the expectations of many traders, the euro-dollar pair did not collapse in the embrace of the 10th figure as a result of the July meeting of the European Central Bank. On the contrary, after reaching the new annual low (1.1102), the pair grew slightly and even emerged at the boundaries of the 12th figure. By and large, EUR/USD bears became hostages of their own expectations. Today's meeting of the ECB was preceded by many events, most of which increased the likelihood of aggressively easing monetary policy parameters. Some of the analysts (in particular, currency strategists of the German bank Commerzbank) warned their clients that the European Central Bank could begin concrete actions in July - so to speak, "without a declaration of war". But most analysts still tended toward a more moderate version - they believed that Mario Draghi would prepare the markets for the corresponding steps, and at the September meeting, it would lower the interest rate and resume the stimulating program. Considering such assumptions, traders got rid of the euro "ahead of schedule", laying in prices of the softest version of the July meeting. But the reality was somewhat different. Mario Draghi stunned the market with words that the members of the regulator at the last meeting did not discuss the issue of an interest rate reduction at all. In addition, according to him, the probability of a recession is "quite low", while further growth of the labor market supports the eurozone economy. The head of the ECB noted a relatively stable growth in employment, as well as an increase in wages. In addition, contrary to rumors circulated, members of the European regulator did not update the ECB's mandate on inflation. Let me remind you that on the eve of the European press, information appeared that the central bank will reduce the target inflation rate, which is now "slightly below" two percent in the medium term. Such a step would create conditions for a long period (longer than the market suggests) the use of incentive programs. However, Mario Draghi today unequivocally stated that such actions by the regulator are unacceptable, thus refuting the above rumors. Thus, the head of the ECB did not strengthen the downward trend of EUR/USD with his rhetoric, disappointing the pair's bears. Nevertheless, it should be immediately emphasized here that his stance did not have a "hawkish" character. Draghi did not justify the hopes of the pair's sellers, but at the same time he did not give any reasons for reversing the trend. On the contrary - he confirmed that the accommodation policy should be maintained for a long period of time, and further steps of the regulator will depend on the incoming data. Draghi noted that regulator's members need to see updated forecasts, after which it will be possible to talk about any specific actions. In addition, it should be noted that the regulator has changed some of the wording in the text of its accompanying statement. In particular, members of the ECB indicated that key interest rates would remain at "current or lower levels" at least until the end of the first half of 2020, and in any case, until inflation approaches the targets. Until today's meeting, the regulator has announced that it will maintain the status quo throughout the designated period. In other words, the European Central Bank actually warned the markets that rates could be lowered at any upcoming meeting, until June next year. In addition, members of the Board of Governors assured market participants that they will resume QE if medium-term inflation forecast continue to not meet the goal. During his press conference, Mario Draghi also made it clear that, if necessary, the central bank will resume its bond purchase program. What conclusions can be drawn from today's meeting? The main conclusion is that the members of the ECB are ready to apply a whole arsenal of actions available to them, including a reduction in the rate and the resumption of QE. In this case, traders were not mistaken in their expectations. However, the ECB will not take decisive action "automatically" - with the onset of autumn. The regulator continues to focus on key macroeconomic indicators - unemployment, wages, inflation, production, foreign trade, domestic demand, consumer activity and business confidence. This list is not exhaustive, but if most of the listed indicators in the near future (within two to three months) will go out in the "red zone", the European Central Bank will without hesitation begin to soften the parameters of monetary policy. And without any warning, because today the regulator has unambiguously indicated his intentions - both with the help of the accompanying statement and with the help of Mario Draghi. The reaction of EUR/USD traders to the outcome of the July meeting is emotional, impulsive and short-term. This reaction is due only to the fact that the market "screwed" itself on the eve of the meeting, responding to the relevant rumors, the dynamics of the PMI indices and the rather pessimistic report of the Bundesbank. It is likely that emotions will settle down today, and the market will reconsider its position regarding the prospects for the euro. In my opinion, in the near future, the pair will again take a course towards the low of the year, that is, towards the bottom of the 11th figure, with subsequent testing of the 10th figure. In general, the fate of a downward trend in the EUR/USD depends largely on the US currency's behavior. The dollar, in turn, depends on tomorrow's release on US GDP growth in the second quarter and the outcome of the Fed meeting on July 31. If the GDP figures are better than expected, the pair will continue to decline to the indicated levels - otherwise, the bulls will receive another reason for correction in the area of the 12th figure. But in any case, the pair's growth will depend on the degree of the dollar's weakness - the single currency did not have any arguments for revaluation. The material has been provided by InstaForex Company - www.instaforex.com |

| Opinions on the euro are divided. Despite gloomy prospects, there is reason for optimism Posted: 25 Jul 2019 03:38 PM PDT The euro is expected to continue falling, updating its two-month low against the dollar. Investors are waiting for a signal from the ECB about the beginning of the next phase of monetary policy easing, including a reduction in the rate and the resumption of bond purchases. The situation was aggravated by a more significant than expected fall in the German index of business climate. There is good reason to believe that the actions of the ECB will only increase pressure on the already besieged euro. Markets estimate the likelihood of a cut in the ECB's interest rate by 10 basis points at 50%, some expect Mario Draghi to set the stage for further rate cuts in the future, or to start a quantitative easing program. According to the Commodity Futures Trading Commission, hedge funds held short positions for the euro at $4.39 billion in the week ending July 16, at about the same levels as they were at the beginning of this year. The only thing that can help the single currency is the ECB's decision to wait until September to lower the key base rate. Given these expectations, some market participants see the euro strengthening against the dollar. These opposing views on the market were reflected in the volatility of the euro, which rose to 12.73 points, the highest level since December. The Swiss franc, on expectations of lower rates in the euro area, soared to a new two-year high of 1.0963 against the single currency. The leap of the franc reinforced expectations that the Swiss Central Bank could weaken the currency in order to protect the export-dependent economy. Perhaps the regulator will reduce rates in September. But the Australian dollar expectations of lower interest rates led to a new two-week low of 0.6963 dollars. The material has been provided by InstaForex Company - www.instaforex.com |

| Golden collisions: 3-0 in favor of the precious metal Posted: 25 Jul 2019 03:38 PM PDT The current situation in the global market contributes to the growth of "gold" sentiment among investors. According to some analysts, clouds are gathering in the economic horizon, which may erupt into a recession and slow down the global economy. Against this background, only precious metals, in particular gold, look like a haven of constancy. Experts cite three arguments in favor of acquiring the yellow metal. Recent statistics worry most market participants, and many of them are preparing for a crisis. The crisis is only taking shape, while the central banks, the issuers of world reserve currencies, have almost no tools left to fight it. In a number of countries - Japan, Sweden, Denmark - there are negative interest rates. The European Central Bank, as well as the Fed, for whom a return to the policy of quantitative easing only takes a matter of time, analysts are certain. The current situation deprives the US currency of the status of a reliable global means of payment. The US dollar has ceased to be considered a "safe haven", thanks to which you can wait out the financial storm. World regulators and major market players are reducing their share of dollars in the structure of reserves and are actively buying physical gold. Experts believe that the reason for this is an extremely unstable geopolitical situation. According to the apt expression of analyst Maxim Blunt, "the genie of protectionism is out of the bottle." This exacerbates the already difficult situation in the global market. "Trade wars are running, their geography is growing. On the verge of conflict were the traditional allies - the United States and the European Union. The US president may impose prohibitive duties against European cars, and the EU authorities promise not to remain in debt. Preparations for the "currency wars" and the "devaluation race" are in full swing," M. Blunt stresses. The external background is far from ideal, but the largest central banks and the authorities of several countries began to buy gold in an optimistic rush. This contributed to the active growth of its price. Analysts cite three arguments in favor of the yellow metal: 1) reliability and constant demand; 2) high value; 3) the status of the asset - "safe haven" and the associated benefits. According to M. Blunt, gold is acquired by market players who fear a political collapse that may follow the financial and economic turmoil. In such a situation, the yellow metal will undoubtedly become a "safety cushion" for investors, analysts believe. The material has been provided by InstaForex Company - www.instaforex.com |

| Euro falls on expectations of lower ECB rates in September Posted: 25 Jul 2019 03:38 PM PDT The ECB left rates unchanged. However, the euro sharply fell following the ECB's decision. The market is widely awaiting a signal from ECB Head Draghi at 12:30 London time to reduce the deposit rate (it is currently -0.4%). The euro is heading towards a large low of 1.1108 - if it breaks lower, the fall can accelerate strongly with targets down to 1.0500. The material has been provided by InstaForex Company - www.instaforex.com |

| July 25, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 25 Jul 2019 09:02 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550 with a prominent key-level around 1.2650. Moreover, signs of bearish rejection have been manifested near 1.2750 (Head & Shoulders reversal pattern with neckline located around 1.2650). Intermediate-term technical outlook remains under bearish pressure as long as the market keeps moving below 1.2550 (the lower limit of the depicted consolidation range). In July 18, a recent bullish movement was initiated around 1.2385 (the lower limit of the depicted movement channel). A bullish pullback was demonstrated towards the backside of the broken consolidation range (1.2550) where another valid SELL entry was offered by the end of last week's consolidations. Bearish persistence below 1.2460 (38.2% Fibonacci levels) was mandatory to ensure further bearish decline. However, lack of sufficient bearish momentum was demonstrated around 1.2430 (23.6% Fibonacci Level) allowed the current bullish pullback to be demonstrated towards 1.2500 (61.8% Fibonacci level) which constitutes a prominent Intraday Supply Level to be watched for bearish rejection & a possible SELL Entry. Bearish breakdown below 1.2430 (38.2% Fibonacci Level) is mandatory to allow further bearish decline towards 1.2360 where the lower limit of the depicted movement channel comes to meet the GBP/USD pair. Moreover, Bearish breakdown below 1.2360 is needed to facilitate further bearish decline towards 1.2320 and 1.2270 which correspond to significant key-levels on the Weekly chart. On the other hand, please note that any bullish breakout above 1.2560 invalidates the previously mentioned bearish scenario. Trade Recommendations: For traders who missed the initial trade, another SELL Entry can be taken upon the current bullish pullback towards 1.2500. Initial T/P levels to be located around 1.2430 and 1.2360. S/L should be placed above 1.2560. The material has been provided by InstaForex Company - www.instaforex.com |

| July 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 25 Jul 2019 08:54 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish movement was initiated towards 1.1275 followed by a deeper bearish decline towards 1.1235 (the lower limit of the newly-established bullish channel) which failed to provide enough bullish support for the EUR/USD. Recent bearish breakdown below 1.1235 invited further bearish momentum to move towards 1.1175. However, significant bullish momentum was earlier demonstrated around 1.1200 bringing the EUR/USD pair again above 1.1235. That's why, extensive bullish pullback was expected to pursue again towards the price zone around 1.1275 where a double-top Bearish pattern was demonstrated. Recent Bearish breakdown of the pattern neckline around (1.1235) confirmed the short-term trend reversal into bearish towards 1.1175. By the end of last week, lack of enough bearish momentum below 1.1235 brought another bullish pullback towards the depicted key zone around 1.1235 spiking up to 1.1275 (a Weekly High) where significant bearish rejection and a bearish engulfing candlestick were demonstrated. Fortunately, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD back below 1.1235 which stands as Intraday Supply zone to be watched for Intraday SELL entries upon any upcoming bullish pullback. However, early bearish breakdown below 1.1175 facilitated a quick bearish decline towards 1.1115 (Previous Weekly Low) where evident bullish rejection is being demonstrated. That's why, Intraday bullish pullback is being demonstrated towards 1.1175-1.1200 where a valid SELL entry can be offered. Trade recommendations : For Intraday traders, a valid SELL entry can be offered anywhere around 1.1175-1.1200. Initial Target levels to be located around 1.1175 then 1.1115 while Stop Loss should be placed above 1.1240. The material has been provided by InstaForex Company - www.instaforex.com |

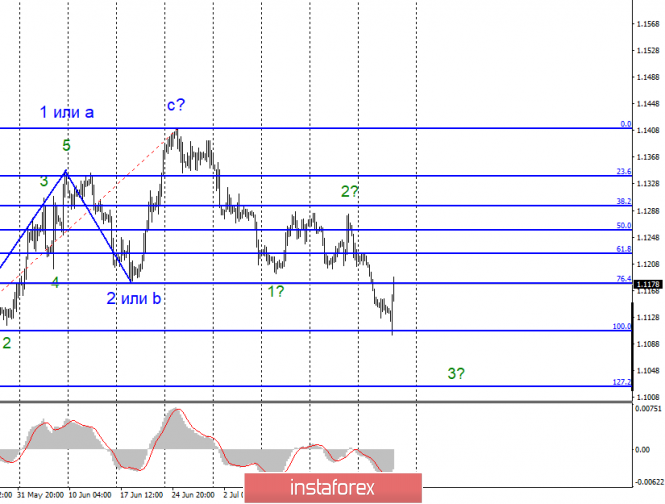

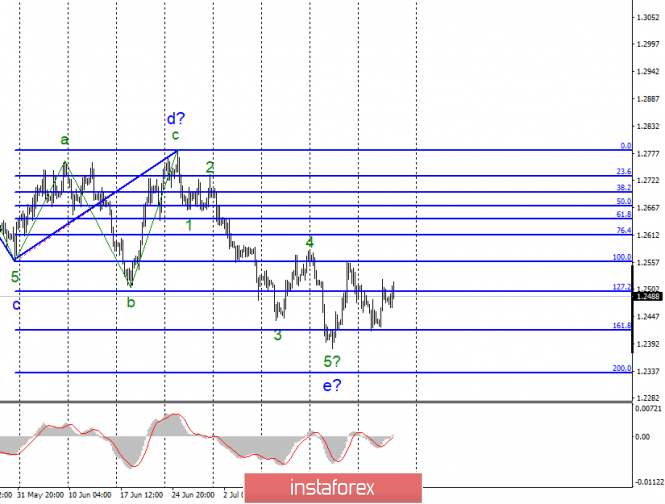

| Posted: 25 Jul 2019 08:17 AM PDT EUR/USD

On Wednesday, July 24, the EUR/USD pair ended with a decrease of only 10 basis points. Today, the currency market remained in a downward mood until the ECB announced that the deposit and credit rates remain at the same level at the moment. That is, there were no changes in monetary policy. This, on the one hand, is a positive point, and on the other, ECB Chairman Mario Draghi said that the rates will remain at the current level or below until mid-2020. This means that Mr. Draghi admits their reduction if the economic situation does not improve dramatically until the next meeting, which will be held in September. The ECB also notes low inflationary pressure and allows for an even greater decline in the consumer price index. Economic growth in the second and third quarters of 2019 will also slow down. Thus, I believe that the ECB gave the market more negative than positive, and the growth of the euro can be a short-term reaction and interpreted as a corrective wave in the future wave 3. The current wave layout continues to imply the construction of a downward trend. However, an unsuccessful attempt to break the Fibonacci level of 100.0% led to a departure of the euro/dollar pair from the achieved lows. Purchases targets: 1.1412 – 0.0% according to Fibonacci Sales targets: 1.1106 – 100.0% according to Fibonacci 1.1025 – 127.2% according to Fibonacci General conclusions and trading recommendations: The euro/dollar pair moved away from its lows amid the ECB meeting and its results. However, the downward mood in the forex market remains. Thus, I recommend selling the pair with targets located near the levels of 1.1106 and 1.1025, which is equal to 100.0% and 127.2% of Fibonacci, when the MACD signal is down. GBP/USD

The GBP/USD pair increased by 45 basis points on July 24, thus maintaining the integrity of the current wave marking, which implies the construction of at least three waves upwards. The news background still allows for some growth of the pound sterling, as the vector of market attention is shifted now towards the ECB, and next week, it will be shifted towards the Fed, which can lower the key rate. In the UK, while Boris Johnson officially took office as Prime Minister and will now take the first steps in his new post. Probably, we are waiting for a reshuffle among Ministers, and in his first speech, Johnson has already hinted at new negotiations with the European Union on agreements on Brexit and, in particular, the border between Ireland and Northern Ireland. Thus, it is possible that the negotiations will resume, because, despite all the slogans of Johnson during the elections that Brexit will be held on October 31 in any case, even if the hard option, the new Prime Minister understands that the UK economy could suffer serious losses in this case. Sales targets: 1.2334 – 200.0% according to Fibonacci 1.2194 – 261.8% according to Fibonacci Purchases targets: 1.2783 – 0.0% according to Fibonacci General conclusions and trading recommendations: The wave pattern of the pound/dollar tool involves the completion of the construction of the downward wave e. Thus, I recommend small purchases of the pair with targets placed over the mark of 1.2550 and with an order limiting losses under the minimum of wave e. I recommend returning to sales after a successful attempt to break through the minimum of wave e. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 07.25.2019 - Potential ABC upward correction completion Posted: 25 Jul 2019 07:19 AM PDT Industry news: A new research study published by cryptocurrency trading platform Strix Leviathan has revealed that cryptocurrency halving events do not necessarily result in the asset outperforming the market.. Technical picture:

Important levels to watch: $10.000 – Resistance (yellow rectangle) $10.200 – Multi swing high Resistance $9.805– Support 1 (gray rectangle) $9.510 – Support 2 (gray rectangle) I found potential upward correction completion (ABC) in the background, which is sign of potential downside continuation. Important pivot resistance for BTC is set at $10.200-$10.000. Additionally, I found that MACD slow line started to turn downward , which is another great addition to my bearish view; Watch for potential selling opportunities with the targets at $9.805 and $9.510. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for July 25, 2019 Posted: 25 Jul 2019 07:14 AM PDT Overview: The AUD/USD pair is set above strong support at the levels of 0.6876 and 0.6810. This support has been rejected four times confirming the uptrend. The major support is seen at the level of 0.6810, because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend in the area of 0.6810 and 0.6876. The AUD/USD pair is trading in the bullish trend from the last support line of 0.6876 towards thae first resistance level of 0.6937 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 0.6937 and further to the level of 0.7005. The level of 0.7005 will act as the major resistance and the double top is already set at the point of 0.7005. At the same time, if there is a breakout at the support level 0.6810, this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

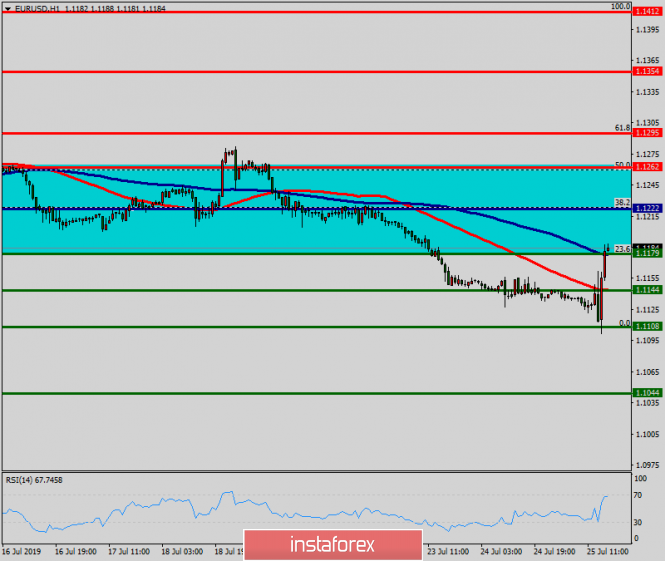

| Technical analysis of EUR/USD for July 25, 2019 Posted: 25 Jul 2019 07:09 AM PDT The EUR/USD pair continues to move upwards from the level of 1.1179/1.1222 (support zone). Last week, the pair rose from the level of 1.1179 to a top around 1.1222 (currently price is set at the 1.1234 price). Today, the first resistance level is seen at 1.1262 followed by 1.1295, while daily support 1 is seen at 1.1179 (23.6% Fibonacci retracement). According to the previous events, the EUR/USD pair is still moving between the levels of 1.1179 and 1.1295; so we expect a range of 116 pips. Furthermore, if the trend is able to break out through the first resistance level at 1.1222, we should see the pair climbing towards the double top (1.1295) to test it. Therefore, buy above the level of 1.1179 with the first target at 1.1262 in order to test the daily resistance 1 and further to 1.1295. Also, it might be noted that the level of 1.1295 is a good place to take profit because it will form a double top. On the other hand, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.1179, a further decline to 1.1108 can occur which would indicate a bearish market. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 07.25.2019 - Trading range defined Posted: 25 Jul 2019 07:08 AM PDT Gold did reject of the important pivot resistance that I mentioned yesterday at the price of $1.429. Anyway, support is on the test at $1.416 and the Gold is trading inside of the trading range between the price of $1.429 (resistance) and $1.416 (support). Watch for breakout of support or resistance to confirm further direction. Technical picture:

Important levels to watch: $1.429 – Resistance blue horizontal line $1.416 – Multi swing high Resistance $1.440 – Resistance in case of the up break $1.400 – Support in case of the down break Support at the price of $1.416 is on the test and selling at this stage looks very risky. My advice is to watch for potential rejection or higher high and higher low on M30 to confirm potential rejection. If that would be scenario, your upward targets should be at $1.429 and $1.440. In case of the stronger down break, downward target is set at the price of $1.400. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for July 25,2019 - Shake out in the background, strong reaction from buyers Posted: 25 Jul 2019 06:48 AM PDT EUR did trade lower to test key support at 1.1108 and then it rejected strongly upward. I found classic shake out on the EUR after the ECB today. My advice is still same like yesterday, upward opportunities are preferable. Key resistance and target is set at the price of 1.1206 Industry news: -Jacqui Douglas, chief European macro strategist at TD Securities, notes that the ECB left its policy rates on hold, but entirely re-wrote its press release, clearly preparing for a package of policy easing in September.. Technical picture:

Important levels to watch: 1.1206 – Resistance yellow shape 1.1276 – Multi swing high Resistance 1.1100 – Support and round number Based on 4H time-frame there is a bullish divergence on the Stochastic oscillator and on the Bollinger percent indicator, which is indication of the further rally. In my opinion sellers got trapped near the level 1.1100 and higher time-frame traders reacted on the price "too low" on the EUR. My advice is to watch for buying opportunities Key upward target and resistance is set at the price of 1.1206. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Jul 2019 06:39 AM PDT USDCAD has come close to our short-term target of the 38% Fibonacci retracement. Price is now pulling back towards cloud support. I expect price to bounce off that area.A

USDCAD has broken above the 4 hour Ichimoku cloud. Short-term resistance has been broken and we now expect prices to move higher. The current pull back is expected to reach cloud support around 1.31-1.3080. A bounce off that area will confirm our bullish expectations. Resistance is found at 1.3145 and breaking above it will open the way for a move towards the 61.8% Fibonacci retracement near 1.3270. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD bounce is an opportunity to sell Posted: 25 Jul 2019 06:34 AM PDT As we previously said, any bounce towards 1.12 is an opportunity to sell. Price bounced strongly today towards 1.1175 and got rejected. Bulls need to reclaim 1.12 area in order to hope for a longer-term reversal in prices.

Magenta rectangle - resistance Magenta line - trend line resistance EURUSD is trading below the magenta rectangle. As long as this happens short-term trend remains bearish. Price back tested the break down area and looks like a rejection in play. We expect the downward move to resume. Price made a new low relative to the May lows. Resistance is found at 1.1185 and next at 1.1235. For now bears remain in control of the trend. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold gets rejected once again at short-term resistance Posted: 25 Jul 2019 06:30 AM PDT Gold price tried to break above short-term resistance of $1,430 but price got rejected once again confirming the inability to break and stay above $1,430. This will eventually lead prices lower as we previously said Gold price is vulnerable to more downside.

Black line - resistance(broken) Green rectangle - support area Red rectangle - resistance Blue rectangle - target if support fails to hold Gold price continues to trade between $1,410-40. Price got rejected today on its attempt to break above the resistance area. This lead to a reversal and price is now trading $1,423 from $1,433 today's highs. Support is key at $1,410-$1,400 and a break below this area will open the way for a move towards $1,350-60. As long as price remains below today's highs at $1,433, we remain pessimistic for the short-term trend. The material has been provided by InstaForex Company - www.instaforex.com |

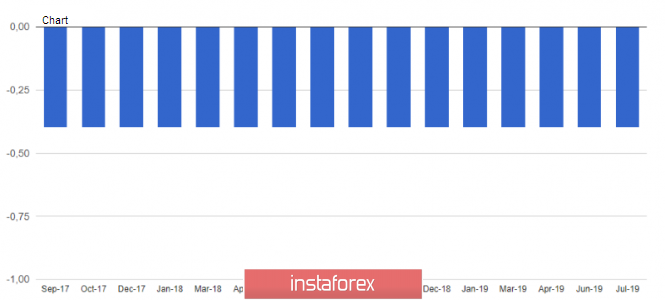

| Posted: 25 Jul 2019 06:12 AM PDT Sellers of the euro did not wait for the decision of the European Central Bank and after the release of a terrible index of business sentiment in Germany, they continued to get rid of risky assets. The ECB's decision to leave rates unchanged provided the euro only temporary support, after which sales resumed, but everything in order. Data from the Ifo institute that the mood of the German business community in July this year continued to deteriorate, relished the sellers of the euro. A weak report once again confirms the fact that Germany's economy is gradually slowing down. According to the report, the index of sentiment in the German Ifo business community in July fell to 95.7 points against the June value of 97.5 points, while economists had forecast the index at 97.0 points. The index of companies fell expectations to 92.2 points, against the June value of 94.0 points. Ifo was quick to announce that a number of the companies surveyed have become less stable in the business, with skepticism concerning the future. Let me remind you that the report is based on the results of a survey of about 9,000 companies. Problems are especially observed in the manufacturing industry index, which has shown one of the largest declines in recent years and is not expected to improve the position of the manufacturing industry in the short term. As noted above, the euro rose after the ECB left rates unchanged, but the growth was short-lived. Today, it became known that the European Central Bank left the refinancing rate unchanged at 0.0%, as well as the deposit rate at -0.4%, which coincided with a number of forecasts of economists. The ECB noted that it is ready to take the necessary measures to ensure that inflation meets the target level, and current rates will remain at current or lower levels until the end of the first half of 2020. The Central Bank also informed that it will consider possible options for advanced indication and purchases of assets. The speech of the President of the European Central Bank, which is scheduled for the afternoon, can "shed light" on the future of monetary policy of the eurozone. However, as for the current technical picture of the EURUSD pair, the bears have reached the expected weekly targets in the area of 1.1105, and most likely, they will start to take profit from there. Even the tough tone of Mario Draghi's statements will not be able to resume the downward movement in the pair. Large players will close their short positions on purchases from speculative traders, so do not expect a stronger decline even after Mario Draghi's statements on the topic of reducing interest rates, which everyone expects in the future. Returning to the topic of negotiations between the US and China, some details became known. Negotiations will resume on July 30. Lighthizer and Mnuchin will arrive in Shanghai and hold a series of meetings with Chinese Deputy Prime Minister Liu He. The negotiations will cover topics such as intellectual property, technology transfer, non-tariff barriers, as well as a number of other issues. A number of supporters of a tough stance against the United States have already commented on future negotiations, calling on the United States to stop and not inflate the conflict, which only harms the two countries. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Jul 2019 05:35 AM PDT To open long positions on GBP/USD, you need: In the first half of the day, buyers of the pound made an unsuccessful attempt to continue the upward correction, which put the market in a deadlock again. The target for the bulls is still the resistance of 1.2501, the breakthrough of which will lead to further growth of the pair to the highs of 1.2534 and 1.2563, where I recommend taking the profit. Under the scenario of reducing the pound in the second half of the day, which may occur after the ECB head Mario Draghi's speech, only another false breakdown in the area of 1.2462 will be the first signal for opening long positions. Otherwise, buying GBP/USD is best on the rebound from a minimum of 1.2429. To open short positions on GBP/USD, you need: Bears will wait for news related to Brexit and only then "tightly" back to the market. The formation of a false breakout and an unsuccessful attempt to consolidate above the level of 1.2501, which occurred in the first half, served as the first signal for the opening of short positions in GBP/USD, but it has not yet led to serious sales. Finding below the level of 1.2501 now serves the sellers of the British pound, which in the afternoon will seek to the area of the minimum of 1.2462, a breakthrough of which will only strengthen the bearish momentum and cross out any hope of buyers for further upward correction. As soon as the new British Prime Minister returns to the previous tone of the statement on the account of the hard Brexit, the pressure on the pound will certainly increase, as the uncertainty will only continue to increase, which will lead to new lows in the area of 1.2380 and 1.2340. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates market uncertainty. Bollinger Bands Volatility is low, which does not give signals to enter the market.

Description of indicators

|

| Posted: 25 Jul 2019 05:33 AM PDT To open long positions on EURUSD, you need: The euro rose slightly after the European Central Bank left rates unchanged but then resumed its fall, as the regulator signaled a likely decline in the future. An unsuccessful consolidation above the resistance of 1.1154 led to a new sale in EUR/USD and a breakout of the support of 1.1129. At the moment, buyers can only hope for the performance of the ECB President and the first level of 1.1105. Only the formation of a false breakdown on it with a soft tone of Mario Draghi's statements will retain at least some hope for a return and consolidation above the resistance of 1.1130. If the euro continues to fall, which is likely to happen, and activity will not be noticeable at the level of 1.1105, it is best to consider new long positions to rebound from the lows of 1.1079 and 1.1034. To open short positions on EURUSD, you need: The bears waited for the correction of the pair to the resistance area of 1.1154, formed a false breakout there, and the ECB continued the bearish trend, which led to a breakthrough and consolidation below the support of 1.129. In the afternoon, the President of the European Central Bank Mario Draghi will speak, who should shed light on the further situation with monetary policy. Statements by the President of the Central Bank on the resumption of the program to stimulate the economy will form a new pressure on the EUR/USD and will lead to an update of the lows of 1.1105 and 1.1079, where I recommend fixing the profit. Larger support levels are located at the lows of 1.1034 and 1.0990, which is also a psychological mark. In the scenario of the pair growth after Draghi's performance, the first level for opening short positions in the area of 1.1154, just above which the resistance of 1.1183 passes. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which indicates the predominance of euro sellers in the market. Bollinger Bands In the case of an upward correction, the upper limit of the indicator in the area of 1.1145 will act as a resistance.

Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment