Forex analysis review |

- Control zones USDJPY 08/23/19

- Control zones USDCHF 08/23/19

- Fractal analysis of the main currency pairs on August 23

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY. Comprehensive analysis of movement options from August 23, 2019 APLs &

- The pound believed in Brexit with a deal. How long?

- Between a rock and a hard place: Will Jerome Powell risk disappointing markets?

- GBP/USD. Light at the end of the tunnel: Merkel provoked the growth of the British currency

- The British pound rose after a meeting between the president of France and the prime minister of Great Britain. Eurozone

- Gold awaits news from Jackson Hole

- August 22, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- August 22, 2019 : EUR/USD bulls are demonstrating a reversal pattern waiting for a breakout above 1.1115.

- GBP/USD 08.22.2019 - Rejection of the key support and round number $1,500

- GBP/USD 08.22.2019 - Confirmed inverted head and shoulders pattern

- BTC 08.22.2019 - End of the upward correction

- Yuan Outsider: Drop to Multi-Year Lows

- Technical analysis of EUR/USD for August 22, 2019

- Gold drifts lower as fears ease slightly, wait to buy on dips

- GBP/USD: plan for the US session on August 22. The pound rose again on the optimism of solving the "backstop" problem

- EUR/USD: plan for the US session on August 22. Data on production activity provided only temporary support to the euro

- The focus of the market is the performance of Powell in Jackson Hole (We sell or buy EUR/USD and USD/JPY pairs based on the

- EUR / USD: the fate of the euro may be decided before the end of the week

- Trading plan for EUR / USD and GBP / USD pairs on 08.22.2019

- Gold starts and wins: growth is in full swing

- EUR boosted by eurozone's PMI data, EUR/USD gains still capped

- EUR/USD: "Minutes" of the Fed did not interest traders, the market is awaiting Powell's verdict

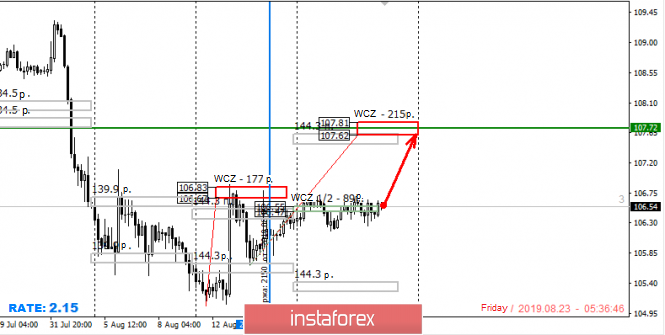

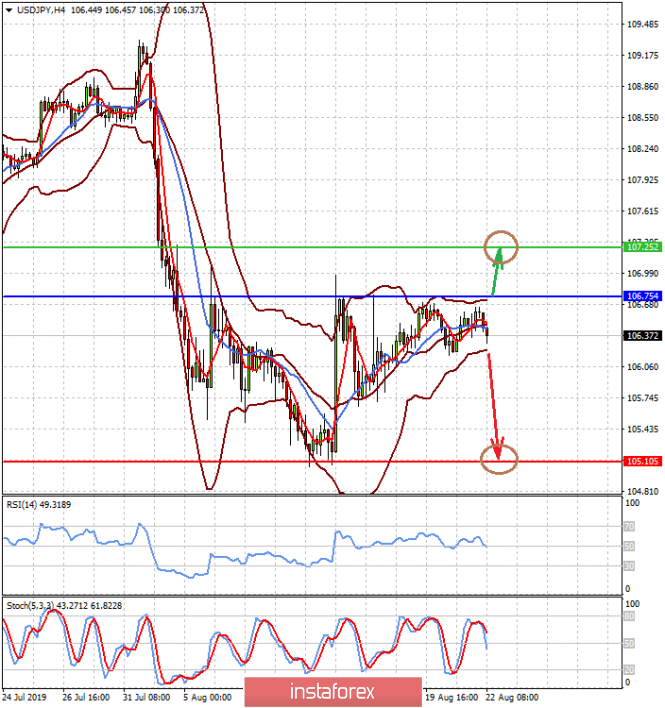

| Posted: 22 Aug 2019 07:56 PM PDT At the beginning of this week, the pair consolidated above Weekly Control Zone 1/2 106.53-106.46, which suggests an increase in the probability of growth to 70%. The next goal is the weekly control zone 107.81-107.62. Purchases which were opened on August 20, after testing the WCZ 1/4, must be kept in the expectation of further growth. In addition, new sales are possible after the release and consolidation above the upper boundary of the local flat. The probability of continued flat is still high, so any decrease to the lower boundary must be used to enter purchases. The depreciation of the entire current month leads to going beyond the monthly control zone, which ultimately makes it possible to work to return to its limits with a probability of 90%. Meanwhile, an alternative decline model has a low probability. Therefore, it is not recommended to enter the sales. However, the reduction must be used to enter a long position or to increase the volume of the already open. It is important to understand that closing a month within a monthly control zone or inside it is above 70%. Daily CZ - daily control zone. An area formed by important data from the futures market that changes several times a year. Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. An area that reflects the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

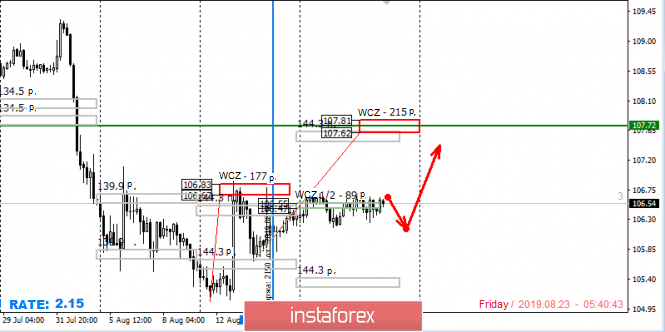

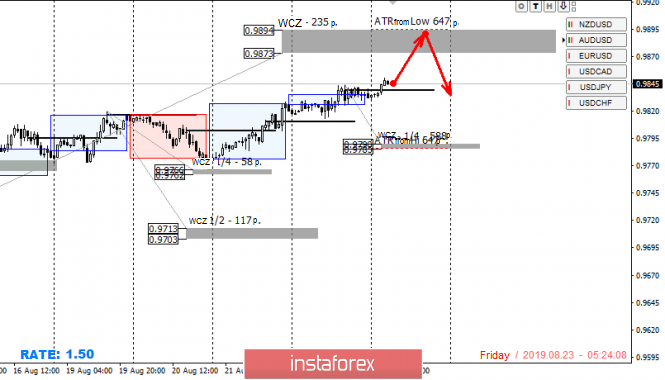

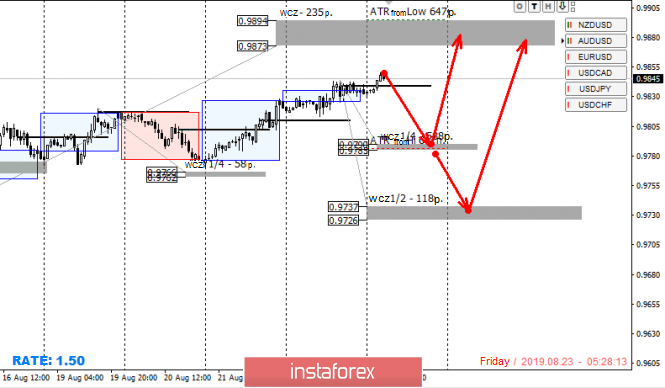

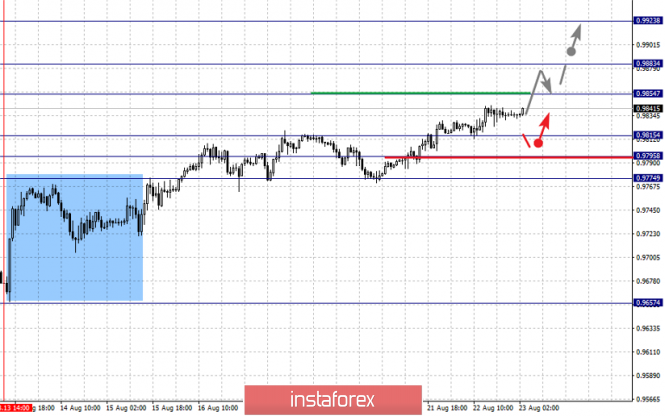

| Posted: 22 Aug 2019 07:36 PM PDT For today, the main plan is to maintain a long position opened on August 21. Within the current average daily course is a weekly control zone 0.9894-0.9873. The testing of the zone will allow you to close part of the position, and transfer the rest to breakeven, as the probability of moving to the monthly control zone of August continues. When testing a weekly control zone, it is important to understand that the probability of a large offer is increasing. In the case of the formation of a "false breakdown" pattern, corrective sales of the instrument can be considered. Meanwhile, the alternative model will be developed if the closing of today's trading is below the level of the American session on Thursday. This will allow us to talk about the formation of a local accumulation zone, where purchases at more favorable prices will come to the fore. Daily CZ - daily control zone. An area formed by important data from the futures market that changes several times a year. Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. An area that reflects the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

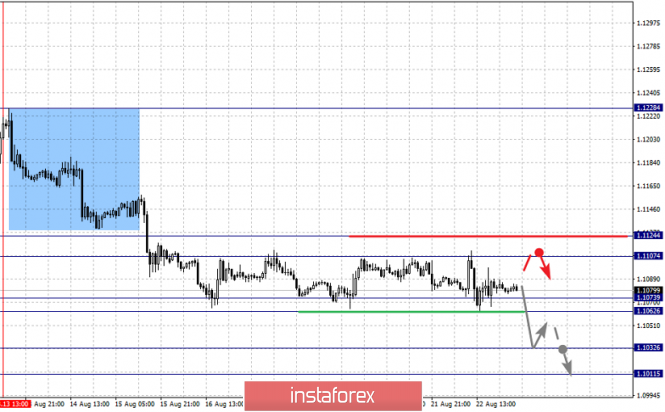

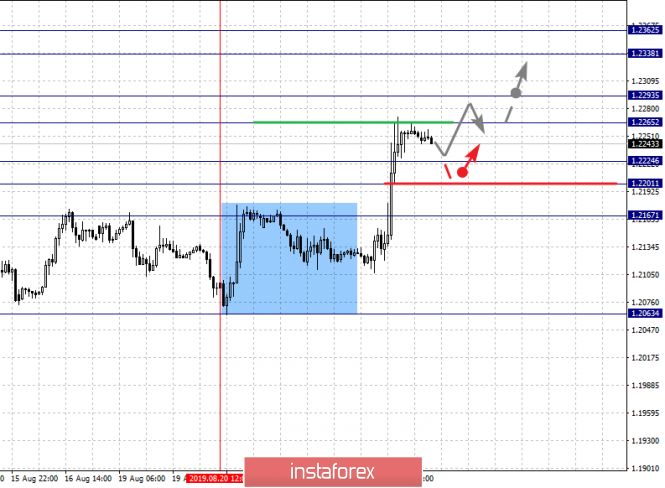

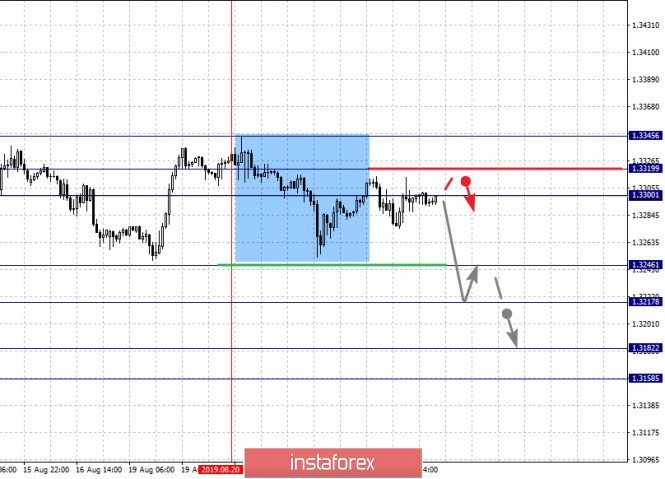

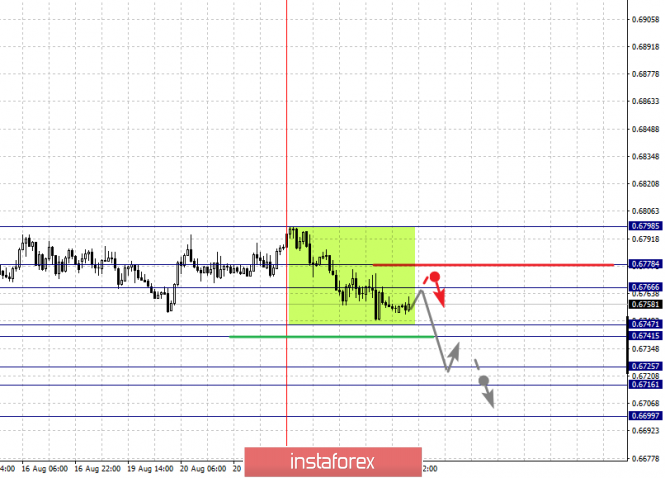

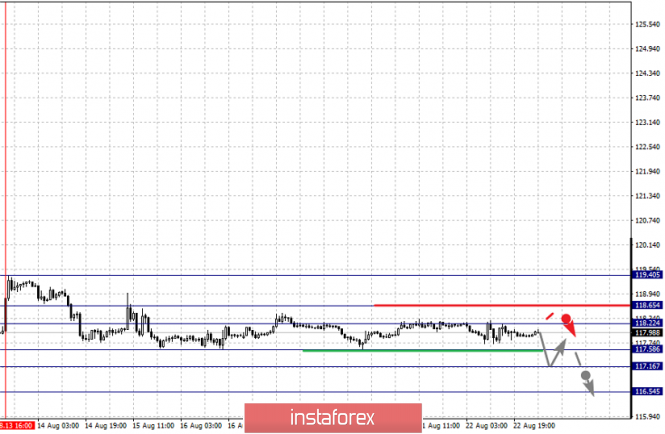

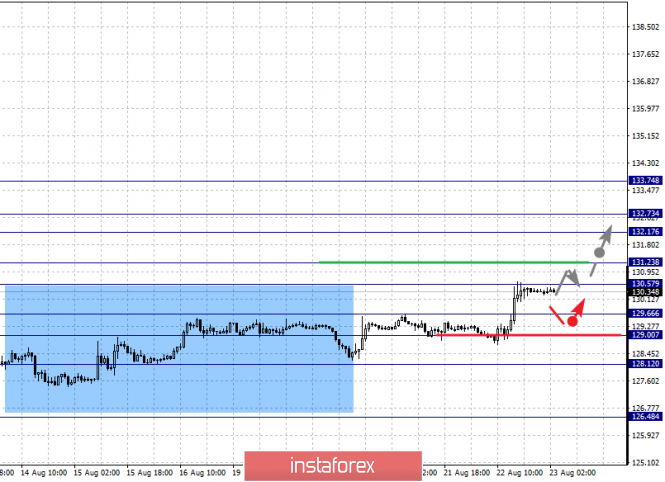

| Fractal analysis of the main currency pairs on August 23 Posted: 22 Aug 2019 06:21 PM PDT Forecast for August 23: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1124, 1.1102, 1.1073, 1.1062, 1.1032 and 1.1011. Here, the price is in correction from the downward structure on August 13. Short-term movement to the bottom is expected in the range of 1.1073 - 1.1062. The breakdown of the latter value will lead to a pronounced movement. Here, the goal is 1.1032. Price consolidation is near this level and hence the likelihood of a correction. For the potential value for the downward trend, we consider the level of 1.1032. The breakdown of the level of 1.1107 will lead to the formation of a pronounced potential for the top. In this case, the first goal is 1.1124, wherein consolidation is near this level. The main trend is the downward cycle of August 13, the correction stage. Trading recommendations: Buy 1.1108 Take profit: 1.1122 Buy Take profit: Sell: 1.1060 Take profit: 1.1035 Sell: 1.1030 Take profit: 1.1011 For the pound / dollar pair, the key levels on the H1 scale are: 1.2362, 1.2338, 1.2293, 1.2265, 1.2224, 1.2201 and 1.2167. Here, we continue to monitor the local ascending structure of August 20. Short-term upward movement is expected in the range of 1.2265 - 1.2293. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.2338. For the potential value for the top, we consider the level of 1.2362. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 1.2224 - 1.2201. The breakdown of the latter value will lead to in-depth movement. Here, the target is 1.2167. This level is a key support for the top. The main trend is the local structure for the top of August 20. Trading recommendations: Buy: 1.2265 Take profit: 1.2290 Buy: 1.2295 Take profit: 1.2336 Sell: 1.2224 Take profit: 1.2201 Sell: 1.2198 Take profit: 1.2168 For the dollar / franc pair, the key levels on the H1 scale are: 0.9949, 0.9923, 0.9883, 0.9854, 0.9816, 0.9815, 0.9795 and 0.9774. Here, we follow the ascending structure of August 13. Short-term upward movement is expected in the range of 0.9854 - 0.9883. The breakdown of the level of 0.9883 should be accompanied by a pronounced upward movement. Here, the target is 0.9923. For the potential value for the top, we consider the level of 0.9949. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9815 - 0.9795. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9774. This level is a key support for the top. The main trend is the upward cycle of August 13. Trading recommendations: Buy : 0.9855 Take profit: 0.9881 Buy : 0.9884 Take profit: 0.9923 Sell: 0.9815 Take profit: 0.9796 Sell: 0.9794 Take profit: 0.9774 For the dollar / yen pair, the key levels on the scale are : 108.62, 108.14, 107.45, 106.91, 106.35, 105.94, 105.64 and 105.01. Here, we continue to monitor the ascending structure from August 12. The continuation of the movement to the top is expected after the breakdown of the level of 106.91. In this case, the target is 107.45, where consolidation is near this level. The breakdown of the level of 107.45 should be accompanied by a pronounced upward movement. Here, the goal is 108.14. For the potential value for the top, we consider the level of 108.62. Upon reaching which, we expect a pullback to the bottom. The range of 105.94 - 105.64 is a key support for the top. Its passage at the price will lead to the development of a downward movement. In this case, the target is 105.01. The main trend: building potential for the top of August 12. Trading recommendations: Buy: 106.91 Take profit: 107.43 Buy : 107.47 Take profit: 108.14 Sell: Take profit: Sell: 105.62 Take profit: 105.04 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3345, 1.3319, 1.3300, 1.3246, 1.3217, 1.3182 and 1.3158. Here, the price forms the potential for the downward movement of August 20. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3246. In this case, the target is 1.3217, and near this level is a price consolidation. The breakdown of the level of 1.3217 should be accompanied by a pronounced downward movement. Here, the target is 1.3182. For the potential value for the bottom, we consider the level of 1.3158. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is possibly in the range of 1.3300 - 1.3319. The breakdown of the latter value will favor the formation of an upward structure. Here, the target is 1.3345. The main trend is the formation of potential for the bottom of August 20. Trading recommendations: Buy: 1.3300 Take profit: 1.3316 Buy : 1.3321 Take profit: 1.3345 Sell: 1.3246 Take profit: 1.3219 Sell: 1.3215 Take profit: 1.3182 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6798, 0.6778, 0.6766, 0.6747, 0.6741, 0.6725, 0.6716 and 0.6699. Here, the price forms a downward structure from August 21. The continuation of movement to the bottom is expected after the price passes the noise range 0.6747 - 0.6741. In this case, the target is 0.6725. Price consolidation is in the range of 0.6725 - 0.6716. For the potential value for the bottom, we consider the level of 0.6699. Upon reaching which, we expect a pullback to the top. Short-term upward movement is possibly in the range of 0.6766 - 0.6778. The breakdown of the latter value will lead to the formation of initial conditions for the top. In this case, the potential target is 0.6798. The main trend is the descending structure of August 21. Trading recommendations: Buy: 0.6767 Take profit: 0.6776 Buy: 0.6780 Take profit: 0.6798 Sell : 0.6740 Take profit : 0.6725 Sell: 0.6715 Take profit: 0.6700 For the euro / yen pair, the key levels on the H1 scale are: 119.40, 118.65, 118.22, 117.58, 117.16 and 116.54. Here, the situation is in equilibrium. Short-term downward movement is expected in the range of 117.58 - 117.16. The breakdown of the latter value will allow us to expect movement to a potential target - 116.54. Price consolidation is near this level. Short-term upward movement is expected in the range of 118.22 - 118.65. The breakdown of the last value will have the formation of an ascending structure for the top. Here, the first goal is 119.40. The main trend is the equilibrium situation. Trading recommendations: Buy: 118.22 Take profit: 118.62 Buy: 118.70 Take profit: 119.40 Sell: 117.56 Take profit: 117.18 Sell: 117.14 Take profit: 116.55 For the pound / yen pair, the key levels on the H1 scale are : 133.74, 132.73, 132.17, 131.23, 130.57, 129.66, 129.00 and 128.12. Here, we follow the development of the ascending structure of August 12. Short-term upward movement is expected in the range of 130.57 - 131.23. The breakdown of the latter value will lead to a pronounced upward movement. Here, the target is 132.17. Short-term upward movement, as well as consolidation is in the range of 132.17 - 132.73. For the potential value for the top, we consider the level of 133.74. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 129.66 - 129.00. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 128.12. This level is a key support for the top. The main trend is the ascending structure of August 12. Trading recommendations: Buy: 130.58 Take profit: 131.23 Buy: 131.26 Take profit: 132.17 Sell: 129.66 Take profit: 129.05 Sell: 128.96 Take profit: 128.12 The material has been provided by InstaForex Company - www.instaforex.com |

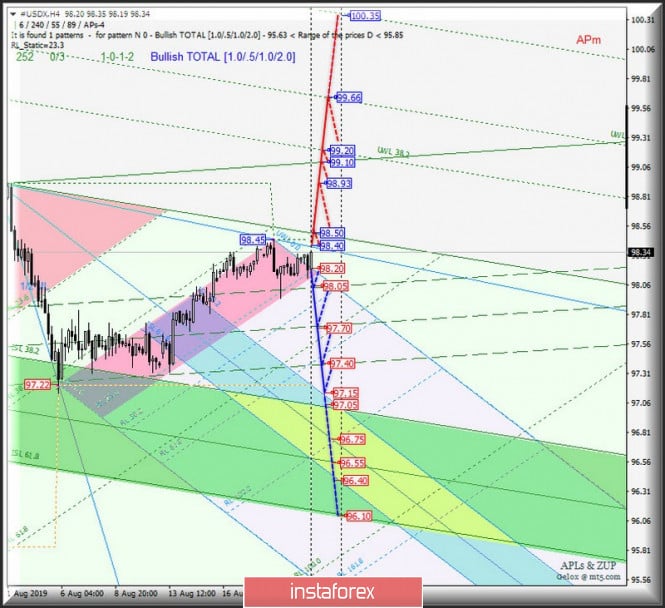

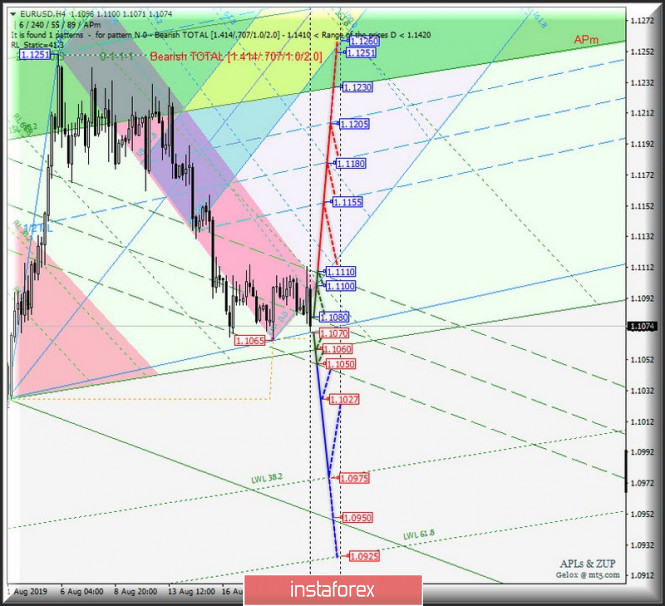

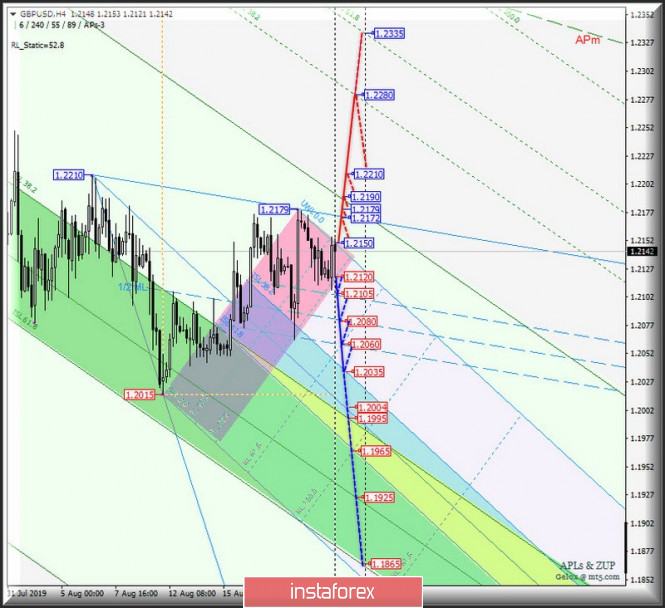

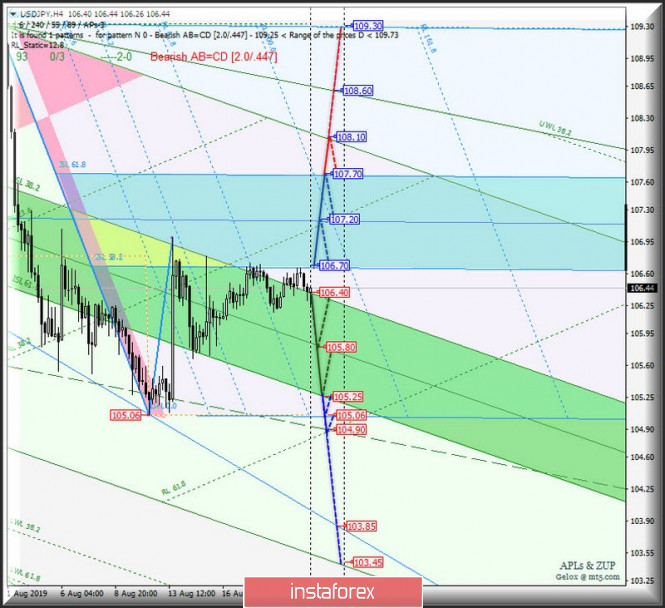

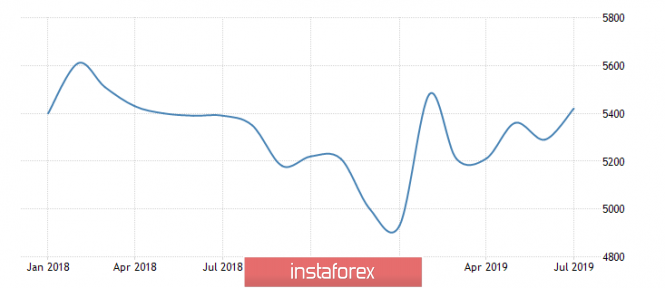

| Posted: 22 Aug 2019 05:01 PM PDT Now, we will continue to prepare the options for the movement of trading instruments #USDX, EUR / USD, GBP / USD and USD / JPY from August 23, 2019 according to the results of previous events. Minuette operational scale (H4 time frame) ____________________ US dollar index The movement of the dollar index #USDX from August 23, 2019 will depend on the direction of the breakdown of the range :

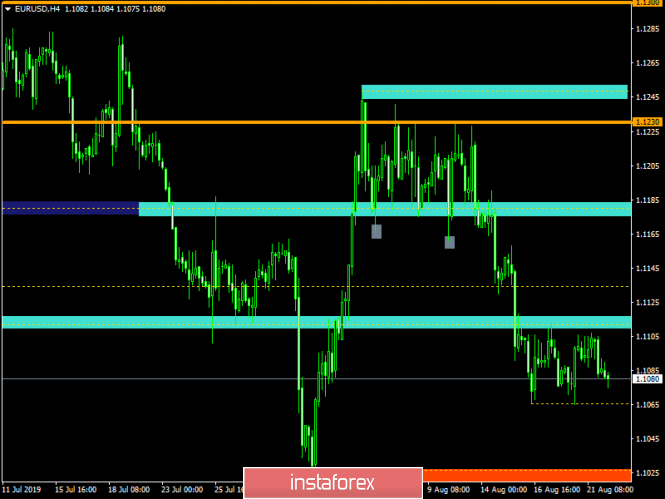

As the #USDX return below the SSL start line (support level of 98.20) of the Minuette operational scale fork, it will make it relevant to achieve the boundaries of the 1/2 Median Line (98.05 - 97.70 - 97.40) of the Minuette operational scale fork and the development of movement within this channel. With the combined breakdown of the UTL control line (resistance level of 98.40) of the Minuette operational scale fork and the SSL start line (98.50) of the Minuette operational scale fork, the continuation of the upward movement of the dollar index to targets will become relevant - maximum of 98.93 - UTL Minuette control line (99.10) - warning line UWL38 .2 Minuette (99.20) - warning line UWL61.8 Minuette (99.66). The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar Similarly, the movement of the single European currency EUR / USD from August 23, 2019 will also receive its development depending on the direction of the breakdown of the range :

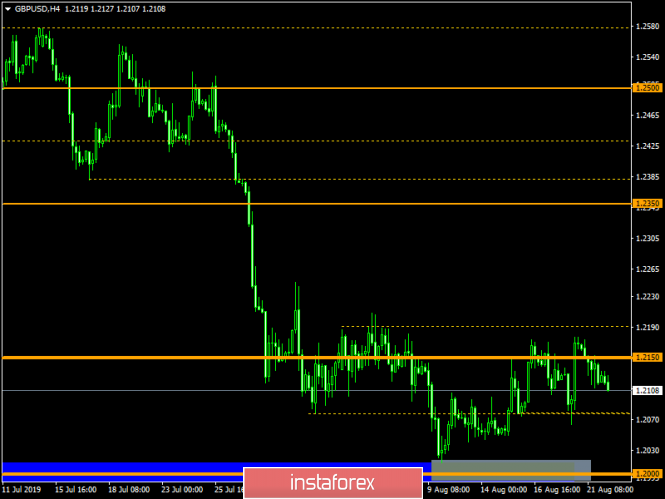

The breakdown of the resistance level of 1.1080 (1/2 Median Line Minuette) will make it possible to develop the upward movement of the single European currency towards the targets - the initial SSL line (1.1100) of the Minuette operational scale fork- the upper boundary of the 1/2 of the Median Line channel (1.1110) of the Minuette operational scale fork with the prospect of reaching the 1/2 Median Line Minuette channel (1.1155 - 1.1180 - 1.1205). With a sequential breakdown of the LTL control line (1.1070) of the Minuette operational scale fork, the initial SSL line (1.1060) of the Minuette operational scale forks and the lower boundary of the 1/2 Median Line Minuette channel (1.1050), the downward movement of EUR / USD will be possible to the targets - minimum 1.1027 - warning line LWL38.2 Minuette (1.0975). The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain pound vs US dollar Now, for Her Majesty's currency, the development of the GBP / USD movement from August 23, 2019 will also be determined by the direction of the breakdown of the range :

The breakdown of the SSL start line (resistance level of 1.2150) of the Minuette operational scale fork will direct GBP / USD movement to the targets - UTL control line Minuette (1.2172) - local maximum (1.2179) - SSL start line (1.2190) of the Minuette operational scale fork - local maximum 1.2210, and as an option - the achievement of the control line LWL38.2 Minuette (1.2280). In case of the breakdown of the support level of 1.2120 on the reaction line RL38.2 Minuette, the downward movement of Her Majesty's currency can continue to the boundaries of the 1/2 Median Line Minuette channel (1.2105 - 1.2080 - 1.2060) with the prospect of reaching the upper boundary of the equilibrium zone ISL38.2 (1.2035) Minuette operating scale. The details of the GBP / USD movement can be seen on the chart. ____________________ US dollar vs Japanese yen As with other currency instruments, the development of the USD / JPY currency movement of the "country of the rising sun" from August 23, 2019 will be determined by the direction of the breakdown of the range :

The breakdown of ISL38.2 Minuette (support level of 106.40) will determine the development of the USD / JPY movement in the equilibrium zone (106.40 - 105.80 - 105.25) of the Minuette operational scale, and if the breakdown of ISL61.8 Minuette (105.25) takes place, then it will be possible to reach the SSL start line (105.06) of the Minuette operational scale fork and the final Schiff Line Minuette (104.90). The breakdown of ISL38.2 Minuette (resistance level of 106.70) will confirm that further the development of the currency of the "country of the rising sun" will continue to the equilibrium zone (106.70 - 107.20 - 107.70) with the prospect of the Minuette operational scale fork. On the other hand, after the breakdown of ISL61.8 Minuette (107.70), we will be able to reach the SSL initial line (108.10) of the Minuette operational scale fork. We look at the details of the USD / JPY movement on the animated chart. ____________________ The review is made without taking into account the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| The pound believed in Brexit with a deal. How long? Posted: 22 Aug 2019 04:36 PM PDT On Thursday, the British currency jumped sharply up. Such a change of mood was facilitated by the statements of the German Chancellor. According to Angela Merkel, Britain still has time to make a deal with the European Union. These comments were perceived by the market as the willpower of politicians aimed at breaking the impasse of Brexit. Such a violent reaction of market participants can be understood. Due to difficulties with Brexit, pound positioning is too skewed towards sales. Therefore, a small, or even controversial, positive regarding the possible conclusion of an agreement with Brussels sets sterling in motion. After an unexpectedly strong increase in the British currency, strategists began to think about the correction of the market. "There is probably the potential for the development of a correction," wrote Credit Agricole SA. British Prime Minister Boris Johnson will soon meet with various EU leaders to discuss the possibility of a deal. Not the fact that everyone will be as friendly as Germany. Although French President Emmanuel Macron softened the rhetoric after Angela Merkel, there were still notes of disagreement in his comments. Macron opposed the demands of the UK to reconsider the country's exit from the EU, saying that this is "not an option." Some strategists drew attention to the fact that the French leader, speaking about the prospects for resolving the border issue with Northern Ireland, noted that in 30 days the parties would not be able to agree on a deal that would be fundamentally different from Theresa May's deal. Macron also made clear that a border decision should ensure that Northern Ireland remains in a single market with the European Union. Pound buyers have revived, but there is no guarantee that a compromise will be found. The chances of London and Brussels to reach a "workable solution" on the Irish miserable border, which should prevent the growth of the pound. The material has been provided by InstaForex Company - www.instaforex.com |

| Between a rock and a hard place: Will Jerome Powell risk disappointing markets? Posted: 22 Aug 2019 04:26 PM PDT Yesterday, the minutes of the July meeting of the Federal Reserve were published, at which the regulator lowered the interest rate for the first time in 10 years. Transcripts showed that FOMC members' opinions on monetary policy unexpectedly diverged. Most officials saw interest rate cuts from 2.5% to 2.25% last month as protection against too low inflation and the risks of a sharper reduction in business investment due to the uncertainty surrounding the trade war. At the same time, two of them did not support the decision to soften the monetary policy, while the other two, on the contrary, expressed the opinion that the rate needed to be reduced not by 25, but immediately by 50 basis points. Disagreements within the FOMC are also evidenced by the phrase that the central bank needs to be flexible. The Fed's claims of flexibility may simply be the regulator's refusal to follow U.S. President Donald Trump. Last Monday, he tweeted that the Fed should lower the rate by at least 100 basis points. According to the head of the White House, even despite such a significant reduction in rates, a quantitative easing may also be required. The US president, who constantly says that the country's economy is strong, for some reason was not satisfied with the current state of affairs. According to some analysts, despite the fact that the US administration is trying to convince the public that everything will be fine, in reality it is preparing for the worst. They argue that the US economy is on the verge of a recession:

However, it should be recognized that due to the fading effect of fiscal stimulus and trade conflicts, the United States economy is returning to normal growth rates. However, this is clearly not enough for the owner of the White House, because in his future election program he intends to bet on the rapid development of the economy. Hence the constant criticism of the policy of the Federal Reserve, and the search for various options for accelerating GDP. In addition, D. Trump obviously understood: in order to force the Fed to cut rates, he only needs to threaten China with new tariffs, which will alarm market participants.

On Friday, J. Powell will speak at a conference in Jackson Hole, and investors will look in his words for hints of the Fed's future plans. "Powell is between a rock and a hard place and cannot escape. The Fed should give up all principles and go straight to the zero rate, and also start a large-scale QE if it does not want to bring down global markets and lose control of the interest rate without soon starting to expand the balance sheet. Powell can only choose to control the discount rate or the Fed's balance sheet - there is no other choice, as everyone is driven by Trump deficits," said John Hardy, chief currency strategist at Saxo Bank. According to recent estimates by the Congressional Budget Office (CBO), the US budget deficit will reach $1 trillion two years earlier than previously thought, largely due to the trade war between Washington and Beijing. Following the results of the July FOMC meeting, J. Powell said that lowering the federal funds rate is not the beginning of a mitigation cycle, and now he will need to somehow avoid the contradictions. Apparently, the head of the Fed will not make any high-profile statements in Jackson Hole and confirm his previous comments that the US economy is still strong, the Fed softens its policy due to caution and does not see any risks for inflation. "We believe that, despite aggressive calls, the Federal Reserve will not commit itself to further easing policies, instead adhering to the current approach. An interest rate cut of 50 basis points in September seems excessive to us, because historically it has turned out that larger reductions occur during recessions and rising unemployment, "said Danske Bank experts. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Light at the end of the tunnel: Merkel provoked the growth of the British currency Posted: 22 Aug 2019 03:57 PM PDT The pound paired with the dollar today updated three-week highs, reaching the middle of the 22nd figure. The fundamental picture of today did not portend such price leaps: the European voyage of British Prime Minister Boris Johnson was more of a formal nature, and Thursday's economic calendar for the GBP/USD pair is completely empty. Nevertheless, bulls of the pair found a reason for the upward impulse - and this reason was provided to them by none other than German Chancellor Angela Merkel. Looking ahead, it is worth noting that the pound is now growing more on emotions - traders of the pair have been trading in constant fear and pessimism about the Brexit prospects for too long. Therefore, when among the gloomy news background a ghostly, but still "light at the end of the tunnel" had appeared, the pound's reaction was not long in coming. Moreover, at the beginning of today the head of the German government met her colleague from Britain with rather harsh rhetoric. She stated that "Britain has 30 days to resolve the Brexit issue to find an alternative to backstop." French President Emmanuel Macron, in turn, noted that there is no more time for additional negotiations on a new agreement - the parties need to build on the main positions of the agreements already reached. Boris Johnson, in his peculiar manner, "accepted the challenge" of Berlin and said that he would spend 30 days allotted to him to convince the EU that there was a viable alternative to the "back-up" mechanism. This rhetoric did not surprise, but did not upset, investors: even on the eve of Johnson's visit, it became clear that the parties would defend their positions. Earlier this week, the British prime minister sent a written appeal to the head of the European Council, Donald Tusk, with a request to review the deal, primarily regarding the prospects for the Irish border. Brussels rejected the offer and lamented that London did not offer constructive ideas for alternatives to backstop. In other words, traders were prepared for the fact that the parties at the meeting would only repeat the theses already voiced and disperse "in the corners of the ring" without any result. However, Angela Merkel still went beyond investors' expectations: she announced that London and Brussels will try to create a system that, firstly, preserves the terms of the Belfast Agreement, and secondly, retains Northern Ireland's access to the single EU market. In other words, we are talking about the notorious alternative to the backstop mechanism. The German chancellor emphasized that the parties will try to find a compromise solution in a relatively short time, that is, until October 31. Summing up, Merkel emphasized that London "can still solve the crisis." In my opinion, the German Chancellor accidentally remembered the Belfast Agreement - after all, the issue of the Irish border is considered not only in terms of economic and customs barriers. Let me remind you that for half a century, there has been a bloody ethnopolitical conflict on the island of Ireland - the rebel forces sought the withdrawal of Northern Ireland from the UK with the subsequent accession to the Republic of Ireland. According to various estimates, about four thousand people died during the long-running conflict. A ceasefire was reached only in 1998, when the parties entered into the aforementioned "Belfast Agreement". The main points of this agreement state that the Northern Irish separatists renounce their territorial claims, and London, in turn, introduces local government and Parliamentarism in this region. In addition, the agreement reached eliminated the border between Northern Ireland and the Republic of Ireland, and since then there has been a special economic zone regime. If London upsets this fragile balance that has been successfully working over the past 20 years, Britain could return to the chaos of political confrontation with the separatist forces of Northern Ireland. In particular, last year the Northern Irish party Sinn Fein announced that it was initiating a new referendum on accession to the Republic of Ireland. Under the conditions of a hard Brexit, taking into account possible economic losses and the effect of a tight border, the outcome of such a referendum is not difficult to predict. Obviously, both London and Brussels are well aware of the risks they face. That is why the current (albeit symbolic) step of Merkel allowed the pound to demonstrate a significant correction throughout the market, including paired with the dollar. However, long positions on the GBP/USD pair currently look risky - after all, we must not forget that the parties only promised to "consider various options". And it is far from a fact that the proposed options will ultimately be agreed/approved by Johnson, the European Union and, ultimately, by the deputies of the House of Commons. Therefore, with a high degree of probability, the spring of nervousness will continue to contract to a certain limit, putting pressure on the foot. But if the parties still find a compromise and the likelihood of a deal will increase again, this "spring" will fire an impulsive price increase, and marks 1.25-1.27 will not be any limit. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Aug 2019 03:43 PM PDT The British pound strengthened its position after yesterday's slight downward correction against the backdrop of a meeting between French President Emmanuel Macron and British Prime Minister Boris Johnson. In the morning, the French leader announced that the EU would continue to prepare for all the scenarios, including Brexit without an agreement. However, the EU would prefer an orderly exit. During the meeting, which took place today in Paris, both Macron and Johnson agreed that clarity on Britain's exit from the EU should appear within 30 days. Johnson also agreed on this with the German chancellor. First of all, we are talking about resolving the problem of "back-stop", because of which the parties can't agree on anything. The dispute between the parties on the border of Northern Ireland and its territorial division did not allow UK's former Prime Minister Theresa May to achieve a solution to the problem regarding Brexit. The President of France noted that, despite the likelihood of new proposals on the Irish border, new agreements will not be radically changed. He once again called on Michel Barnier, the EU's chief negotiator for Brexit, and his team to find a reasonable solution to the border problem in the next 30 days. Let me remind you that one of the stumbling blocks on the Brexit deal were disagreements between the parties on the border with Ireland and Northern Ireland, or the so-called "backstop", which is not resolved to this day. As for the technical picture of the GBPUSD pair, as I noted in my morning review, further upward movement of the pound will directly depend on the level of 1.2180. Its breakthrough may lead to the demolition of a number of stop orders and a larger correction, however, the main problem for bulls will still be a high of 1.2265. EURUSD The euro fell sharply against the US dollar after the publication of the minutes of the July meeting of the European Central Bank. Data on manufacturing activity in the eurozone provided only temporary support to risky assets. The minutes indicate that the ECB leadership agreed on the need for soft policies for a long period of time, and the new package of measures may include both lowering current interest rates and new asset acquisitions. The central bank emphasized once again that inflation in the medium term is an important element. As I noted above, reports on manufacturing activity supported the euro in the morning. So, according to Markit, the preliminary index of PMI procurement managers for the manufacturing sector in France in August amounted to 51.0 points versus 49.7 points in July, which indicates a resumption of growth in activity. Economists had forecast it at 49.5 points. The preliminary index of PMI procurement managers for the German manufacturing sector also strengthened slightly in August to 43.6 points, but remained well below 50 points, which indicates that significant problems remained in the manufacturing sector, even despite slight growth. The economists predicted the index at the level of 43.0 points against 43.2 in July.

As for the eurozone as a whole, here the preliminary index of purchasing managers for the manufacturing sector rose to 47.0 points against 46.5 points in July and with a forecast of 46.4 points. But the service sector remained at a fairly high level. There, the preliminary index of PMI purchasing managers' for the eurozone services sector in August rose to 53.4 points against 53.2 points. As for the technical picture of the EURUSD pair, it has not changed at all. Bears will also aim to update the lows of last week with a test of support levels 1.1060 and 1.1030. If bulls make an attempt to build an upward correction in a pair, then it is best to consider short positions in the trading instrument from the upper boundary of the side channel at 1.1130. A larger resistance level is the area of 1.1160. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold awaits news from Jackson Hole Posted: 22 Aug 2019 03:35 PM PDT Despite the rapid return of gold to the psychologically important mark of $1,500 per ounce, there is no doubt about the strength of the upward trend. The precious metal continues to flow from East to West, and this is a sure sign of the strength of the "bulls". In India, demand for the physical asset grew from a modest 9% from January to June, although jewelers at the beginning of the year seriously considered the possibility of a sharp increase in sales after a sluggish interest in gold in 2017-2018. Nevertheless, high prices and taxes, a slowdown in economic growth and floods in South Asia make their expectations high. Demand for ETF products, by contrast, is growing by leaps and bounds. Stocks of specialized exchange funds reached the level of 2425 tons, the highest since 2013. This is 1000 tons more than the lowest level since the global crisis that took place in 2016. Gold ETF Stock Dynamics The main reasons for the 15% XAU/USD rally since the beginning of the year are concerns about the recession of the US economy, trade wars and the related decline in bond yields around the world. The scale of the negative-yield debt market jumped above $16 trillion. Gold is not in a position to compete with interest-bearing bonds, however, if rates fall, the share of precious metals in investment portfolios begins to grow. Fears of a slowdown in global GDP are also an important driver of XAU/USD growth. In such conditions, central banks use a soft monetary policy, which leads to a weakening of their currencies. If the Federal Reserve, contrary to the strength of the US economy, continues to lower rates, the US dollar will come under pressure, which will allow gold to restore an upward trend. Goldman Sachs estimates prices will rise to $1,600 an ounce over the next 6 months, and SP Angel warns that if China intervenes in Hong Kong, they could jump $100 in a moment. In my opinion, if it were not for the return of investor interest in the US dollar, the precious metal would not get tired of rewriting 6-year highs. These assets traditionally go in different directions due to the fact that gold is traded in US currency. The future prospects of the USD index will be clarified by Jerome Powell, who has a difficult task in Jackson Hole - to explain the general position of the Fed, which is divided: "doves" say that in order to consolidate inflation at 2%, it was necessary to reduce the rate not by 25 but by 50 bp in July, "hawks" - that a weakening of monetary policy is not required. The central bank should look at its country and not try to save the global economy. Although there is an opinion on the market that Powell's dovish rhetoric in Jackson Hole will be a negative for gold, as it will allow US stock indices to recover, in my opinion, everything will be the other way around. In this situation, the US dollar will weaken, and XAU/USD will go up. Technically, while futures quotes are staying above $1,450 an ounce, bulls continue to control the market situation. Updating the August high will increase the risks of aiming for 161.8% and 88.6% in the AB = CD and Bat patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| August 22, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 22 Aug 2019 09:55 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550. On July 5, a bearish range breakout was demonstrated below 1.2550 (the lower limit of the depicted consolidation range). Hence, quick bearish decline was demonstrated towards the price zone of 1.2430-1.2385 (the lower limit of the movement channel) which failed to provide consistent bullish demand for the GBP/USD. Moreover, Bearish breakdown below 1.2350 facilitated further bearish decline towards 1.2320, 1.2270 and 1.2100 which correspond to significant key-levels on the Weekly chart. The previously-mentioned price levels were quite risky/low for having new SELL entries. That's why, Previous SELLERS were advised to have their profits gathered. Two weeks ago, a temporary consolidation-range was demonstrated above 1.2100 before Friday when another bearish movement could be executed towards 1.2025. Recent bullish recovery was demonstrated off the recent bottom (1.2025). This brought the GBP/USD pair back above 1.2100 (recently-established demand Level). As expected, recent bullish movement was demonstrated towards 1.2230. Further bullish advancement is expected to pursue towards 1.2320 if the current bullish momentum above 1.2100 (the short-term uptrend) is maintained on a daily basis. On the other hand, any bearish breakout below 1.2100 invalidates the previous scenario allowing another bearish visit towards 1.2025. Trade Recommendations: Intraday traders are advised to look for a bullish entry anywhere around 1.2170. Initial T/P level to be placed around 1.2250 and 1.2340 while S/L should be placed below 1.2100. The material has been provided by InstaForex Company - www.instaforex.com |

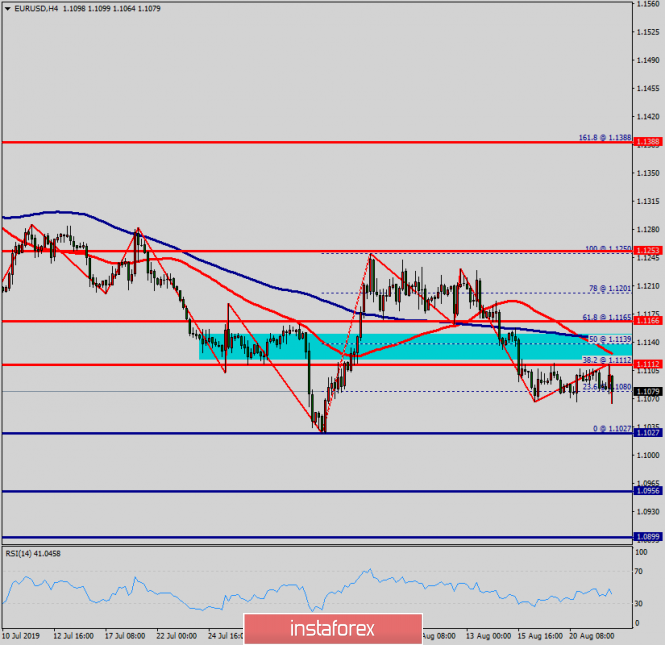

| Posted: 22 Aug 2019 09:24 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels which generated significant bearish pressure over the pair. Shortly after, In the period between 8 - 22 July, a sideway consolidation-range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Shortly after, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD below 1.1175. This facilitated further bearish decline towards 1.1115 (Previous Weekly Low) then 1.1025 (the lower limit of the depicted recent bearish channel) where significant signs of bullish recovery were demonstrated. Risky traders were advised to look for bullish breakout above 1.1050 as a bullish signal for Intraday BUY entry with bullish targets around (1.1115, 1.1175 and 1.1235). All of which were successfully reached. For the past two weeks, the depicted Key-Zone around 1.1235 has been standing as a prominent Supply Area where THREE Bearish Engulfing H4 candlesticks were demonstrated. Thus, the EUR/USD was trapped between 1.1235-1.1175 for a few trading sessions until bearish breakout below 1.1175 occurred on August 14. Bearish breakout below 1.1175 promoted further bearish decline towards 1.1075 where the backside of the broken bearish channel has been providing significant bullish demand so far (A Bullish Triple-Bottom pattern is in progress). A quick bullish breakout above 1.1115 is needed to confirm the short-term trend reversal into bullish. This would enhance another bullish spike towards 1.1175. Trade recommendations : Conservative traders were advised to have a valid BUY entry anywhere around 1.1070 (where the backside of the broken bearish channel is roughly located). Initial T/P levels should be located around 1.1130, 1.1175 and 1.1200. S/L should be placed just below 1.1020. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 08.22.2019 - Rejection of the key support and round number $1,500 Posted: 22 Aug 2019 08:16 AM PDT Gold has been trading in sideways-range environment at the price of $1,500 (round number). Anyway, the Gold is trading near the low boundary of the trading range and I see potential for the more upside, at least for test of the upper boundary around $1,508-$1,510.

Important levels to watch: Resistance levels: $1,507 $1,525 Support levels and downward targets: $1,492 $1,479 Based on the 4H time-frame, I found rejection of the key support at the price of $1,500, which is clear sign for me that there is upside yet to come. MACD is showing the bullish divergence and there is 20-day upward trend in the background. As long as the Gold is trading above the level of $1,479, watch for buying opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 08.22.2019 - Confirmed inverted head and shoulders pattern Posted: 22 Aug 2019 08:00 AM PDT GBP/ISD did successful breakout of the inverted head and shoulders pattern and there is the big chance for more upside. Watch for buying on the dips.

Important levels to watch: Resistance levels: 1.2390 1.2422 Support levels and downward targets: 1.2180 1.2114 Based on the 4H time-frame, I found strong breakout of the neckline (green trendline) and confirmation that there is a completion of the inverted head and shoulders pattern, which is sign that there is a big chance for more upside. MACD oscillator is showing the new momentum on the upside, which is good confirmation for our bias. Major projection and upside target is seen at the price of 1.2390. Major support for the GBP is set at the price of 1.2180 (recent swing highs). My advice is to watch for buying opportunities with the target at 1.2390. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 08.22.2019 - End of the upward correction Posted: 22 Aug 2019 07:44 AM PDT BTC has been trading sideways at the price of $10.000 in past few hours. There is potential for more downside and potential new wave down cause of the underlying down-trend.

Important levels to watch: Resistance levels: $10,000 $10,250 Support levels and downward targets $9,722 $9,137 Based on the hourly time-frame, I found potential end of the upward correction ABC and potential for more downside. I found that BTC is trading inside of the Pitchfork down channel (yellow lines) and that there is chance for potential test of $9.722 (yellow rectangle) and $9,137. Additionally, the Stochastic oscillator is showing the overbought condition and potential rotation back, which is another great confirmation for downside. As long as the BTC is trading below the $10,700, watch for selling opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Yuan Outsider: Drop to Multi-Year Lows Posted: 22 Aug 2019 06:19 AM PDT According to analysts, the Chinese currency began its growth on Thursday, August 22. The USD/CNY pair has kept it around 7.0905 but after the statements by US President Donald Trump about America's superiority in the trade war with China, it began to decline steadily. To date, the yuan has reached its lowest level since March 2008. The fall of the renminbi is not a challenge to the American leader, experts say. They are confident that the Central Bank of China is not interested in a unilateral collapse of the national currency. It is noted that a slight weakening of the renminbi will help China mitigate the negative effects of a trade standoff with the United States. Chinese authorities fear an uncontrolled collapse of the national currency. Currently, the USD/CNY pair is trading in the range between 7.0931 and 7.0934, while experts expect another update of current lows. The devaluation of the Chinese currency is one of the tactics of conducting a trade war with Washington. However, an excessive weakening of the renminbi can lead to a massive outflow of capital from the country. Recall that the yuan began to plummet in early August when US President Donald Trump announced the introduction of new tariffs on Chinese goods. Over the next ten days, the Chinese national currency gradually updated the 2008 lows, analysts emphasized. |

| Technical analysis of EUR/USD for August 22, 2019 Posted: 22 Aug 2019 05:54 AM PDT The EUR/USD pair in the H4 chart. US Dollar is the strongest nowadays, while the Euro is the weakest. The EUR/USD pair faced resistance at the level of 1.1166, while minor resistance is seen at 1.1112. The EUR/USD pair is still moving around the key level at 1.1112 , which represents a daily pivot in the H4 time frame at the moment. The RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100 and 50. Note that the EUR/USD pair traded below a broken trend line and swing zone at 1.1112-1.1166. The current rise will remain within a framework of correction. However, if the pair fails to pass through the level of 1.1166, the market will indicate a bearish opportunity below the strong resistance level of 1.1166. Since there is nothing new in this market, it is not bearish yet. Sell deals are recommended below the level of 1.1166 with the first target at 1.1027. If the trend breaks the support level of 1.1027, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.0956 in order to test the daily support 2 (horizontal blue line). Stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last top at 1.1253. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold drifts lower as fears ease slightly, wait to buy on dips Posted: 22 Aug 2019 05:52 AM PDT

According to minutes of July's Fed's policy meeting, there were significant divisions with a three-way split between those who wanted a 0.50% rate cut, a 0.25% reduction, and no change in rates. Those members who adviocate for a rate cut cited the move as a recalibration of policy stance or a mid-cycle adjustment in response to recent outlook changes rather than the start of an easing cycle. The minutes also reiterated that there was no pre-set course for policy. The minutes overall dampened expectations of very aggressive Fed easing. Kansas City Fed President George stated that now is not the time for policy accommodation and the dollar has maintained a firm tone. The eurozone's PMI data beat market expectations with the manufacturing index at 47.0 from 46.5 previously while the services sector index edged up to 53.4 from 53.2. German manufacturing data recorded a slight improvement, but remained firmly in the contraction territory. The data offered some reassurance over the outlook with waning fears that the downturn would gather pace. In this environment, demand for safe haven assets has faded with net losses for the yen and Swiss franc. With the dollar also holding the upper hand across the board, gold has drifted lower having retreated to just below $1,495 per ounce. Despite fragility, there is a likelihood of further market jitters and therefore higher demand for safe haven assets. Comments from Fed Chair Powell will be watched very closely on Friday and he will need to steer a fine path between maintaining confidence in the outlook without dashing market expectations of further interest rate cuts. Overall, he is unlikely to be as dovish as widely expected that would undermine gold demand. There are still strong reasons to expect further gold gains to $1,600 over the medium term amid an erosion of backing for fiat currencies. There is, however, a risk of a further correctional decline in the short term. Technically, immediate support is likely to be at near $1,492, although with the risk of a further net retreat to $1,480 per ounce. The material has been provided by InstaForex Company - www.instaforex.com |

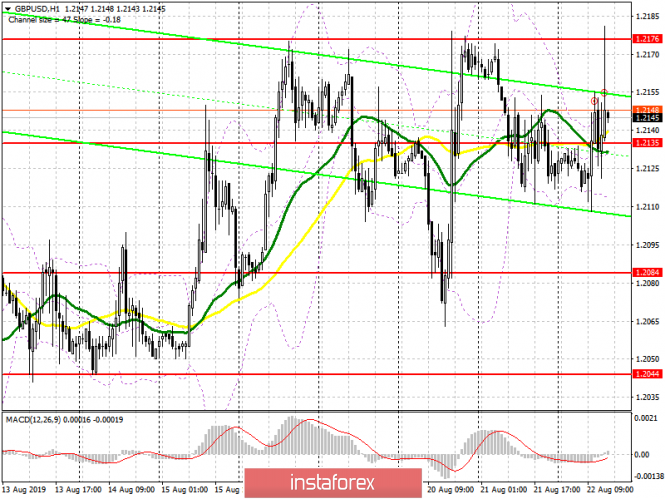

| Posted: 22 Aug 2019 05:50 AM PDT To open long positions on GBP/USD, you need: The British pound strengthened its position against the US dollar, and buyers returned to the level of 1.2135, above which we can talk about the continuation of the upward correction in the pair. The meeting between the President of France and the Prime Minister of Great Britain was held on a positive note, which strengthened the hope for resolving the border issue of Northern Ireland. At the moment, while trading is above the range of 1.2135, the bulls will continue to push the pound up to the resistance area of 1.2176, the breakthrough of which can lead to a larger growth wave of GBP/USD with the update of the highs of 1.2217 and 1.2264, where I recommend taking the profit. If the euphoria from the meeting ends quickly, and the pair returns to the middle of the channel in the area of 1.2135, then in this scenario, it is best to open long positions on the rebound from the minimum of 1.2084. To open short positions on GBP/USD, you need: The only thing left for the pound sellers is to rely on the return of GBP/USD to the level of 1.2135, as well as on a good report on manufacturing activity in the US, which will return demand for the American dollar and lead to a decrease in the pair to the lows of 1.2084 and 1.2044, where I recommend taking profits. If the media will continue to fuel interest in the problem of "backstop", hinting at its possible solution, the demand for the pound will remain. When breaking through the resistance of 1.2176, it is best to consider new short positions in GBP/USD for a rebound from the highs of 1.2217 and 1.2264. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands If the pair decreases, support will be provided by the lower border of the indicator in the area of 1.2110.

Description of indicators

|

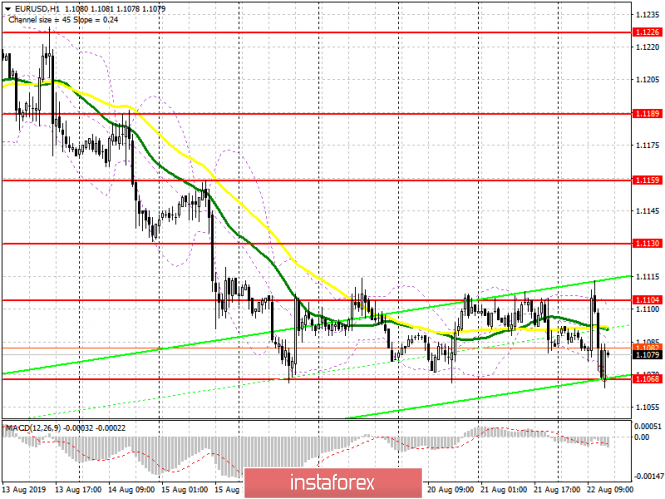

| Posted: 22 Aug 2019 05:39 AM PDT To open long positions on EURUSD, you need: As noted in my morning review, if the first signs of a recovery in manufacturing activity in the eurozone countries appear, the euro may strengthen, which is what happened. However, sellers took advantage of this moment, and a false breakdown of the level of 1.1104 led to a downward movement in the pair. At the moment, buyers of the euro held the level of 1.1068, from which I recommended to buy in the morning, but there is no larger demand for the euro yet. Until the moment the trade is conducted above the range of 1.1068, we can expect an upward correction to the resistance area of 1.1104, but the main goal of the bulls will be a maximum of 1.1130, where I recommend taking the profit. In the case of good reports on the service sector and production activity in the US, as well as the breakthrough of the support of 1.1068, it is best to return to long positions after a test of a minimum of 1.1028, and also buy for a rebound from the area of 1.0990. To open short positions on EURUSD, you need: The sellers of the euro are faced with the task of overcoming the support of 1.1068, the repeated test of which will certainly lead to its breakdown and further movement of EUR/USD down to the area of the minimum of 1.1028. However, the larger downward trend to the support area of 1.0990, where I recommend taking profit, will be directly related to the report on production activity in the US, which will be released in the afternoon. Under the scenario of the euro growth, short positions can also be considered on a false breakdown from the level of 1.1104 or sell for a rebound from a larger resistance 1.1130. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands The breakthrough of the lower limit of the indicator in the area of 1.1068 will provide sellers with new forces. The growth of the euro will be limited to the upper limit around 1.1105.

Description of indicators

|

| Posted: 22 Aug 2019 04:46 AM PDT The content of the final document presented showed that the regulator's view of the state of the economy remains positive but fears were raised about the likelihood of increased inflationary pressures against the backdrop of increased customs duties against the backdrop of the trade wars unleashed by Donald Trump and the actual negative impact of the likely development of the trade confrontation between Washington and Beijing. The protocol revealed some discrepancies in estimates of the level of interest rates between a member of the Open Market Committee (FOMC) but nothing more. In general, we can say that the presented document did not reveal any pitfalls or obstacles in the American Central Bank, which could show that it could radically change its course and begin to further lower interest rates. Yet, investors are not discouraged, believing that the escalation of the US-Chinese trade war will force the Federal Reserve to change its mind. Also, over the past month, there is a lot that happened including a decrease in the Chinese Central Bank by several stages of the yuan against the dollar. Trump's message says that he can decide to lower the tax burden to stimulate the growth of the national economy. In addition, the American president once again called on the regulator to continue lowering interest rates. In addition, recently, the yield curves of 2-year-old and 10-year-old Treasuries have been reversed twice showing the inversion effect, which, according to the many decades-old traditions, indicates the likelihood of an economic recession or recession in the American economy. However, if the Federal Reserve continues to ignore the appeals of the 45th president of the United States and focuses on the factor of prospective inflation growth due to the growth of customs duties, then it is unlikely that he will ignore the signals about the slowdown of production activity the external call in the form of the "Chinese trade threat" and the brutal prospects of continuing the collapse of the national stock market with a parallel strengthening of the dollar, which will only strengthen the losing position of US exports in the world market. That is why markets are still aggressively waiting for continued interest rate cuts and hope that Fed Chairman Jerome Powell will be forced to touch on monetary policy at the Jackson-0Hole economic symposium beginning today and may make it clear what markets should expect to cut in value in the near future borrowing. If this happens, then we expect a local weakening of the dollar and an increase in the US and not only stock indices. Forecast of the day: The EUR/USD pair is trading in the range of 1.1070-1.1110 in anticipation of the performance of Jerome Powell in Jackson Hole. Today, the pair can break out of the range both up to 1.1155 and down to 1.1025. If the head of the Fed either signals a continuation of interest rate cuts, the pair will go up. However, if he does not report anything, we should expect her to fall. A similar picture will be observed in the dynamics of the USD/JPY pair. Hints about the continuation of the reduction in rates will lead to a pair growth to 107.25, but only after overcoming the mark of 106.75. The absence of a signal about the impending reduction in rates will cause a new wave of demand for protective assets and the pair will resume falling to 105.10. |

| EUR / USD: the fate of the euro may be decided before the end of the week Posted: 22 Aug 2019 03:19 AM PDT The next two days may become very important for the EUR / USD pair, which has been trading in a narrow range of 1.1060-1.1120 for the past week. It is difficult to find buyers against the backdrop of the threat of a recession in Germany in the third quarter, as well as the political crisis in Italy, and the uncertain situation around the Brexit euro. The main currency pair stays above 2-year lows primarily due to expectations of a decrease in the Fed interest rate next month. If until recently, the probability of a reduction in the federal funds rate this year was estimated at 60%. Now, the derivatives market is almost 100% sure of two rounds of decline by December. So far, the leadership of the Federal Reserve has not commented on these prospects, which makes the speech of the head of the American Central Bank Jerome Powell on Friday at the Jackson Hole Symposium very important. The whole world is now watching this event and the Fed chairman may well take the opportunity to declare his intention to soften monetary policy, thereby, confirming market expectations. . Statistics on the eurozone recently did not please market participants: the currency block economy slowed down in the second quarter. According to the ZEW poll in Germany, investor sentiment has reached its lowest level since 2010 and industrial production has shown the highest rate of decline since November 2018. It is noteworthy that Barclays experts predicted three Fed rate cuts in 2019, naming the slowdown in the eurozone GDP growth rate as one of the reasons. "Brexit without a deal now looks like the most likely scenario. Its implementation will be a serious blow not only to the UK but also to Europe as a whole, whose economy is currently not in good shape. In this regard, we lowered the estimate for GDP growth in the eurozone for 2020 from 1.0% to 0.6%. Despite the fact that the US economy is in good condition and will grow at a rate of about 2% next year, the external background will leave the Fed no choice but to cut the federal funds rate by 25 basis points three times before the end of this year," said financial institute representatives. However, before the performance of Jerome Powell in Jackson Hole, the euro is waiting for another test. Today the minutes of the July meeting of the European Central Bank (ECB) will be announced. Although the regulator left interest rates unchanged last month, it adjusted its forecasts, which suggest a reduction in interest rates in the future. In fact, the Governing Council of the ECB laid the foundation for a possible reduction in September. In addition, the European Central Bank may resume its program of quantitative easing (QE) in the coming months. These are negative points for the euro. It is assumed that if Jerome Powell signals a further weakening of the Fed's monetary policy in September, then the EUR/USD rate may rise to the level of 1.12. If the statements of the head of the American Central Bank are evasive, the pair may break the mark of 1.10. The situation of the single European currency may be aggravated if Italy's political risks re-enter the agenda. After Prime Minister Giuseppe Conte resigned on Tuesday, everyone is waiting for the Five Star movement to create a new coalition, or if President Sergio Mattarella announces early elections. The material has been provided by InstaForex Company - www.instaforex.com |

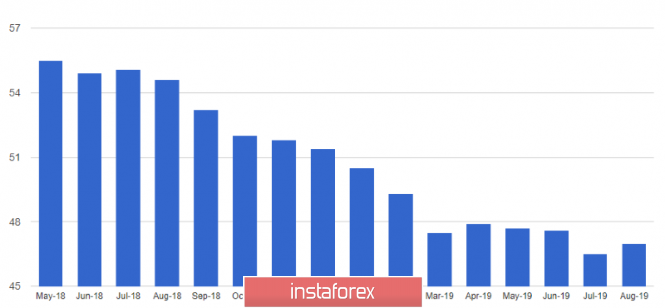

| Trading plan for EUR / USD and GBP / USD pairs on 08.22.2019 Posted: 22 Aug 2019 03:14 AM PDT Honestly, contemplating the course of yesterday's bidding was still tormenting as it was more like observing a predatory beast that made for a decisive jump on its prey. And now, the nerves are already tense to the limit, sweat floods my eyes, but at the most crucial moment, something went wrong as there were accumulation of muscles and strength overshot for about a kilometer. Yes, in the wrong direction. Of course, if you look at the horizontal line that the quotes depicted yesterday, the reaction to the content of the protocol text looks impressive - at least some movement. Although overall, the picture has not changed much and this is not surprising in many ways since investors only received confirmation of the thoughts that had been visited since the very end of the Fed meeting. At least until the end of this year, they will no longer take any steps to change the parameters of the monetary policy. Most importantly, Jerome Powell and colleagues completely ignore the curses and threats from Donald Trump, who demands an immediate reduction in the refinancing rate by 1.00%, and do not intend to soften the parameters of his monetary policy. Not only was the decision to lower the refinancing rate unanimous but there was also a suggestion to raise it altogether. The name of the new enemy, Donald Trump, who dared to express such seditious thoughts, is Neil Kashkari. In other words, The Federal Reserve does not intend to follow the fears and fears, which for the most part are nurtured by various media, and plan to make informed and careful decisions. Most importantly, the likelihood of another decrease in the refinancing rate is close to zero, at least during the current year. In any case, the content of the text of the minutes of the meeting of the Federal Committee on Open Market Operations favors precisely the strengthening of the dollar, albeit in the medium term. After all, the European Central Bank is clearly busy looking for ways to mitigate its already extremely soft monetary policy. As often happens, one particular event overshadows the macroeconomic statistics, which are taken into account when deciding on the parameters of monetary policy. After all, home sales in the secondary market of the United States grew by 2.5%, which of course, can be called a kind of recovery after a decline of 1.3%. Well, absolutely everyone ignored the data on net borrowing from the UK public sector, which fell by 2.0 billion pounds after an increase of 5.7 billion pounds. The dynamics of home sales in the secondary market of the United States: Today, market participants will be incredibly curious to look at preliminary data on business activity indices, first in Europe and then in the United States. True, the forecasts on them are extremely disappointing, especially if we talk about the Old World. Thus, the index of business activity in the services sector should decrease from 53.2 to 53.0. But the worst thing is that the index of business activity in the manufacturing sector may decline from 46.5 to 46.2. The index is already below 50.0 points, which indicates an increase in the risks of a recession. But the horror of the situation is that this index itself has been decreasing since the fall of 2017, only occasionally giving signs of growth, and even then, it is extremely uncertain. Of course, the composite business activity index should fall from 51.5 to 51.2. Therefore, the overall picture is extremely disappointing and the European Central Bank really needs to think about how to rectify the situation and the European Central Bank really needs to think about how to rectify the situation. The dynamics of the index of business activity in the manufacturing sector of the eurozone: However, the forecasts for American statistics are slightly better. Of course, the index of business activity in the services sector may fall from 53.0 to 52.8, but the index of business activity in the manufacturing sector should rise from 50.4 to 50.5. Although this does not help the composite business activity index (which is expected to decrease from 52.6 to 51.7), at least there is growth on some parameters. And of course, all indices are above the 50.0 points, which means there is little economic growth without any particular risks of a recession. Let's agree that this distinguishes the United States from Europe. In addition, it is expected to reduce the total number of applications for unemployment benefits by 30 thousand. In particular, the number of initial applications for unemployment benefits should decrease by 4 thousand, and the number of repeated by another 26 thousand. The dynamics of the business activity index in the manufacturing sector of the United States: The Euro/Dollar currency pair formed a temporary flat within the boundaries of 1.1066/1.1110, sequentially working out each side. It is likely to assume that this kind of accumulation is temporary in nature and it is worth paying attention to the lower border of 1.1066. In case of breakdown, we will go towards 1.1040-1.1020. The pound/dollar currency pair found a resistance point once again in the face of the level of 1.2150, forming as a fact of working it off. It is likely to assume that the downward mood will continue with the first descent to 1.2080. |

| Gold starts and wins: growth is in full swing Posted: 22 Aug 2019 02:27 AM PDT

According to experts, the precious metal was in a winning position at the moment. It will not be able to be shaken by any Fed decisions, including monetary policy easing. Experts believe that a possible recession in the economy and low-interest rates will strengthen the position of the yellow metal. Currently, gold holds the conquered peaks, although the price of the precious metal has rested in a zone of strong resistance due to high overbought. According to analysts, this is a harbinger of correction or consolidation of the value of gold in the new price range from $1,490 to $1,540 per ounce. Most experts do not expect a significant reduction in the price of precious metals. They consider the area from $1,400 to $1,460 per ounce to be the potential targets of the correction. The current moment is favorable for the yellow metal, and the Fed's actions play a key role here. Last month, the US regulator lowered rates for the first time since the financial crisis of 2008. The head of the Fed Jerome Powell made it clear that the trade conflict between the US and China may require the further easing of monetary policy. If the Fed follows this path or resumes the quantitative easing (QE) program, we should expect a massive outflow of capital to gold, which is trading near six-year highs. If the Fed leaves monetary policy unchanged, the probability of a recession will increase significantly, especially if Beijing and Washington fail to agree. Then the yellow metal will benefit from its status as a "safe haven" asset. In any case, gold will win, experts say. They recommend buying precious metals at any price rollback. According to experts, the cost of gold will increase. The end of this growth wave will stop at $1900 per 1 ounce. This should be expected in about a year and a half, analysts say. At the moment, the precious metal is trading at $1508 per 1 ounce, and in the medium term, it is possible to rise to $1670 per 1 ounce. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR boosted by eurozone's PMI data, EUR/USD gains still capped Posted: 22 Aug 2019 01:23 AM PDT The eurozone's flash PMI and business confidence data for August was an important focus on Thursday. The French PMI manufacturing index strengthened to 51.0 from 49.7 previously, beating the consensus of 49.5. There was also a stronger reading for the services sector. The German manufacturing data remained the key market focus with the PMI index climbing to 43.6 from 43.0 previously. The services index was little changed at 54.4 from 54.5 in July. The eurozone manufacturing PMI rose to 47.0 from 46.5 with the services index at 53.4 from 53.2. The data still indicated contraction in manufacturing and there was important evidence of further weakness with a further decline in orders and business confidence to the lowest level for over five years. According to Markit, there is still the threat that the German economy will contract again in the third quarter. Besides, the overall eurozone's growth will remain subdued. Nevertheless, there was relief over the data with reduced fears over a further slide and hopes of at least a tentative recovery. The euro responded to the data with significant gains. EUR/USD pushed to 1.1110 from 1.1075 and the euro made notable gains on the crosses with EUR/CHF moving above 1.0900. According to the minutes of July's Federal Reserve meeting, two members would have preferred a 0.50% rate cut in interest rates instead of 0.25% to tackle low inflation. In contrast, several members wanted to maintain rates unchanged, illustrating underlying divisions within the committee. Those members who advocate for a rate cut cited the move as a recalibration of policy stance or a mid-cycle adjustment in response to recent outlook changes rather than the start of an easing cycle. The minutes also reiterated that there was no pre-set course for policy. Markets were slightly more cautious over the possibility of aggressive rate cuts and the shift in expectations will protect the dollar.

|

| EUR/USD: "Minutes" of the Fed did not interest traders, the market is awaiting Powell's verdict Posted: 22 Aug 2019 12:47 AM PDT The market ignored the Fed protocol published yesterday and such a reaction of traders was very expected given the certain obsolescence of this document. Regulator members in their statements substantiated the July rate cut. According to most of them, this step will help inflationary growth and prevent a reduction in business investment. Members of the Fed associate the latter factor with the consequences of a trade war between the US and China, which "is unlikely to be completed in the near future." It is worth noting here that the uncertainty in this matter only increased for the past three weeks, after the end of the July meeting. This is an important point since the growth of macroeconomic statistics can be offset by a trade conflict in the context of the regulator's further steps to mitigate monetary policy parameters. Fed members are also worried about the "continued finding of inflation rates below inflation targets." In their opinion, this factor reduces inflationary expectations. Although in the past few years, inflation has typically exceeded the two percent long-term goal. June inflation really disappointed the market, however, July figures were in the green zone ahead of forecast values. Thus, the general consumer price index showed good dynamics, rising to 1.8% in annual terms with a forecast of growth of up to 1.7% and to the level of 0.3% on a monthly basis. But core inflation, excluding food and energy prices, showed more significant growth. In monthly terms, the indicator grew to 0.3% and in annual terms, it jumped to 2.2%, which is the strongest growth rate in the last 6 months. The labor cost index also increased. According to experts, the Fed members track this inflation indicator with a "special predilection". Hence, its dynamics have a significant impact on the dollar. In the first quarter of this year, it collapsed to -1.6% but turned out to be much better in the second quarter, reaching 2.4% than the expected forecasted increase to 1.7%. This indicator allows us to estimate the growth rate of the level of wages in the United States and accordingly, it is a good indicator of inflationary pressure in the country. I note that all the above figures were published after the July meeting. Hence, the voiced comments should be considered in the context of these releases. Another issue that has raised concerns among Fed members is the inverse of the yield curve. Let me remind you that this fact seriously alarmed market participants since similar trends were observed in anticipation of the 2008 crisis. In addition, the inversion of the curve preceded almost all recessions in the States over the past seven decades, only in the mid-sixties the signal was false. But even then, the US economy slowed down significantly. However, members of the Committee do not panic about this. In their opinion, low profitability is a "potential source of risk", but such risks "do not look high" at the moment. Judging by the rhetoric of the protocol, Fed officials were more concerned about the high level of corporate debt and lending volumes. According to regulators, these factors create "certain risks" for Fed forecasts. Thus, many theses of the Fed protocol published yesterday really look outdated. Key macroeconomic indicators have recently shown growth, although most of them came out after the July meeting. Indicators such as Retail sales, inflation, consumer confidence, average hourly wage growth and US GDP have recently shown positive dynamics, reflecting the growth of the US economy. On the other hand, Fed members are still concerned about the trade conflict between the United States and China, and more precisely, the consequences of this conflict. Business investment and factory production have recently continued to weaken amid unrest over the prospects for trade relations between the two superpowers. Some factors (besides the US-China conflict) could potentially weaken the business of investing in fixed assets even further. In particular, we are talking about "hard" Brexit and/or geopolitical tensions in the Far East. That is, if the unrest in Hong Kong leads to China's military intervention and the risks of implementing this option have recently increased. To summarize, it is worth noting that the Fed protocol has not changed market expectations. Traders still admit the probability of interest rate cuts at one of the autumn meetings and in the first half of next year. As of July 31, the Fed considered interest rate cuts a "correction" in the middle of the cycle. It is entirely possible that regulator members will come to the conclusion that the 25-point adjustment does not adequately reflect the existing risks, primarily the geopolitical plan. At least recent events increase the likelihood of such a scenario. The EUR/USD pair actually ignored yesterday's release, continuing to trade in a given price range. The market is waiting for the main event of this week - a speech by Fed Chairman Jerome Powell, which will be held tomorrow, during the American session. His rhetoric will allow EUR/USD traders to exit the price range, either to the base of the 10th figure with testing the support level of 1.0980 or to the borders of the 12th figure. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment