Forex analysis review |

- Fractal analysis of the main currency pairs on October 2

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY - H4. Comprehensive analysis of movement options from October 2, 2019 APLs &

- Gold on the podium: the precious metal's price growth is logical

- Brent retreats but doesn't give up

- Euro and pound are racing to the bottom, while the yen is preparing to take the lead among the G10 currencies

- AUD/USD. Aussie's steep plunge: Reserve Bank of Australia knocks out the aussie

- EURUSD and GBPUSD: Weak inflation and a decline in production activity did not frighten European bulls. The pound continues

- October 1, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC 10.01.2019 - Sell zone for Bitcoin, bearish divergence on the MACD

- October 1, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- USDJPY under pressure after worse than expected ISM Manufacturing PMI for September

- Gold price breaks support and reaches first target

- GBP/USD: plan for the American session on October 1st. Weak data led to the further sale of the pound with a breakthrough

- EUR/USD: plan for the American session on October 1st. The euro stood firm after data on the manufacturing sector and inflation

- Gold 10.01.2019 - Downward target reached, potential for rally today

- GBP/USD 10.01.2019 - First downward target reached at 1.2230, momentum still on the downside

- Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 1)

- Technical analysis of EUR/USD for October 01, 2019

- Trading strategy for EUR/USD on October 1st. The business activity indices of the largest EU countries continue to fall

- Trading strategy for GBP/USD on October 1st. Boris Johnson will still provide Brussels with an alternative to Backstop

- Knockout for the euro: the main thing is not to get sink to the bottom

- Trading recommendations for the EURUSD currency pair - placement of trade orders (October 1)

- The dollar is the favorite of the week, CAD is trading in the range, JPY will give way slightly

- Simplified wave analysis for September 10. EUR/USD: we expect a price shake-up; AUD/USD: the calm before the decline

- Trading plan for EURUSD on 10/01/2019

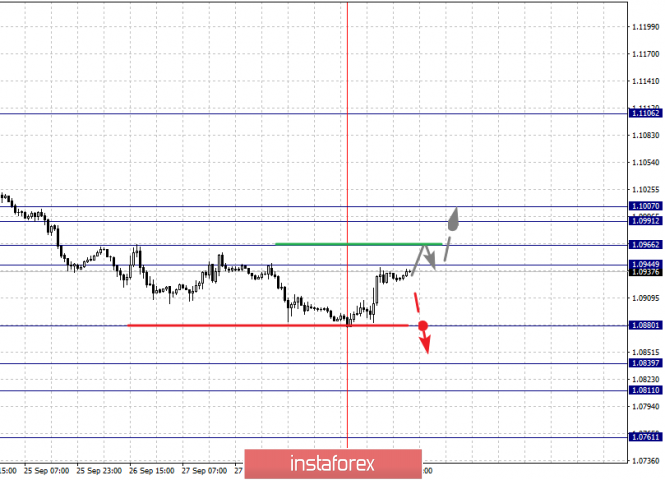

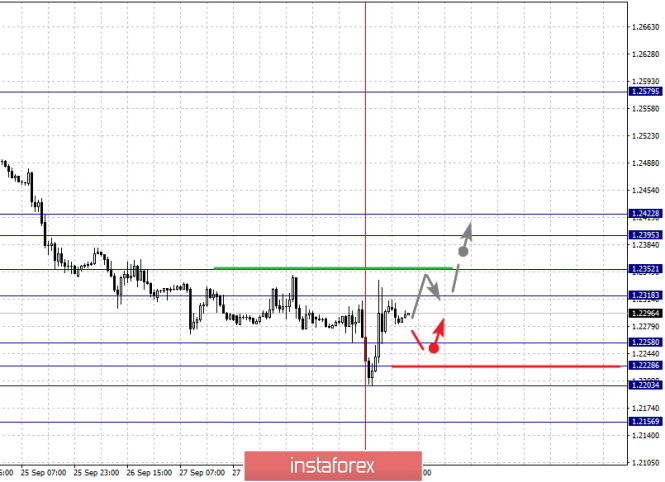

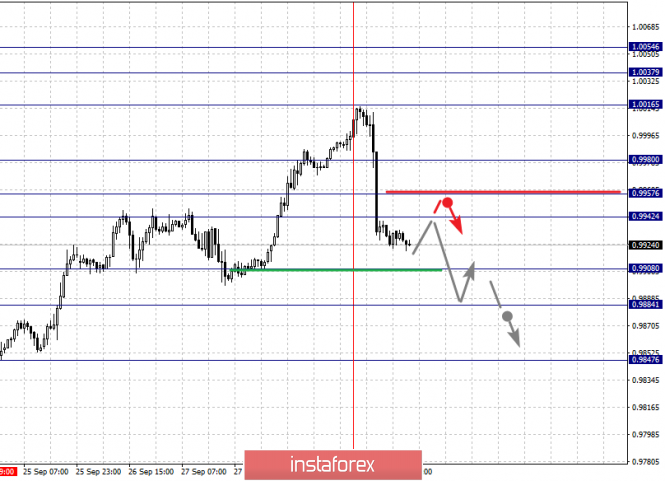

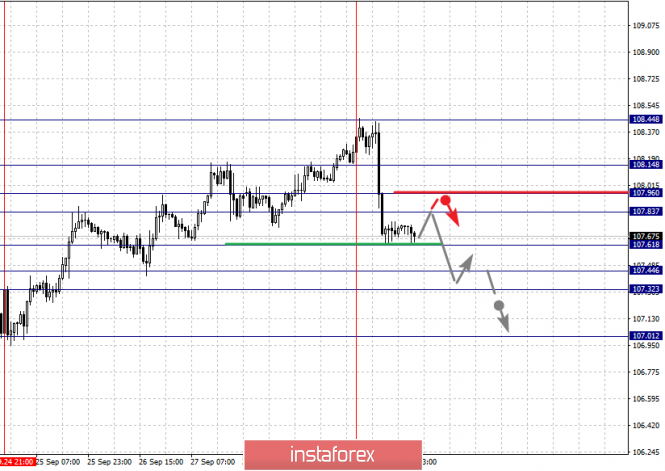

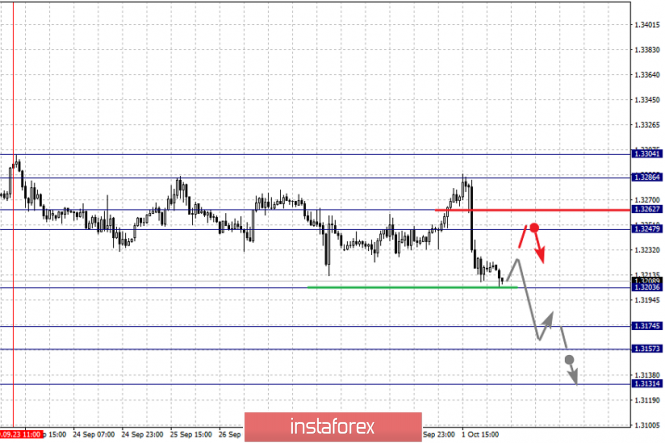

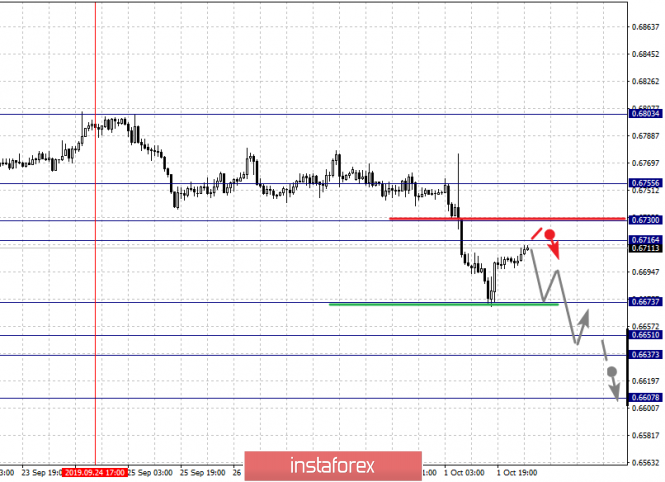

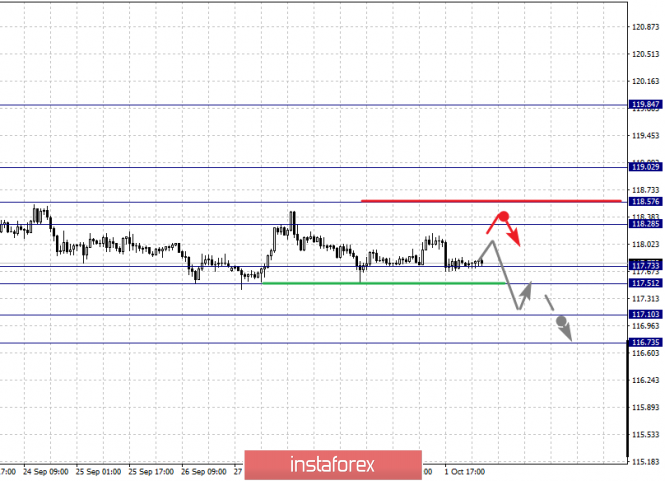

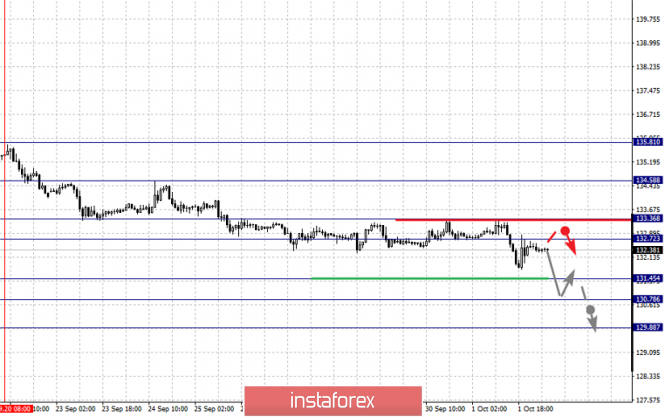

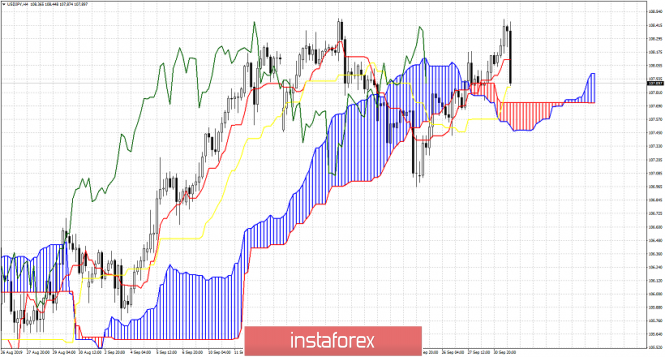

| Fractal analysis of the main currency pairs on October 2 Posted: 01 Oct 2019 07:00 PM PDT Forecast for October 2: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1007, 1.0991, 1.0966, 1.0944, 1.0880, 1.0839, 1.0811 and 1.0761. Here, the price is in correction and forms a small potential for the top of October 1. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.0880. In this case, the target is 1.0839. Short-term downward movement, as well as consolidation is in the range of 1.0839 - 1.0811. For the potential value for the bottom, we consider the level of 1.0761. Upon reaching this level, we expect a rollback to the top. Short-term upward movement is possibly in the range of 1.0944 - 1.0966. The breakdown of the latter value will lead to the formation of expressed initial conditions for the subsequent development of the upward cycle. Here, the goal is 1.0991. Noise range - 1.0991 - 1.1007. The main trend is the descending structure of September 13, the correction stage. Trading recommendations: Buy: 1.0945 Take profit: 1.0965 Buy 1.0967 Take profit: 1.0990 Sell: 1.0880 Take profit: 1.0840 Sell: 1.0837 Take profit: 1.0813 For the pound / dollar pair, the key levels on the H1 scale are: 1.2422, 1.2395, 1.2352, 1.2318, 1.2258, 1.2228, 1.2203 and 1.2156. Here, the price is in correction from the downward structure and forms a small potential for the top of October 1. Short-term upward movement is expected in the range of 1.2318 - 1.2352. The breakdown of the latter value will lead to the formation of expressed initial conditions for the upward cycle of October 1. Here, the target is 1.2395. Noise range 1.2395 - 1.2422. Short-term downward movement is expected in the range 1.2258 - 1.2228. The breakdown of the latter value will lead to the subsequent development of a downward trend in the scale of H1. In this case, the first goal is 1.2203. For the potential value for the bottom, we consider the level of 1.2156. Upon reaching this level, we expect a pullback to the top. The main trend is the descending structure of September 20, the correction stage. Trading recommendations: Buy: 1.2318 Take profit: 1.2350 Buy: 1.2353 Take profit: 1.2395 Sell: 1.2258 Take profit: 1.2230 Sell: 1.2226 Take profit: 1.2203 For the dollar / franc pair, the key levels on the H1 scale are: 1.0016, 0.9980, 0.9957, 0.9942, 0.9908, 0.9884 and 0.9847. Here, the price forms a pronounced potential for the downward movement of October 1. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9908. In this case, the target is 0.9884. Price consolidation is near this level. The breakdown of the level of 0.9884 will lead to a pronounced movement to a potential target - 0.9847. We expect a pullback to the top from this level. Short-term upward movement is possibly in the range of 0.9942 - 0.9957. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 0.9980. This level is a key support for the downward structure. The main trend is the formation of potential for the bottom of October 1. Trading recommendations: Buy : 0.9942 Take profit: 0.9956 Buy : 0.9960 Take profit: 0.9980 Sell: 0.9908 Take profit: 0.9886 Sell: 0.9882 Take profit: 0.9850 For the dollar / yen pair, the key levels on the scale are : 108.14, 107.96, 107.83, 107.61, 107.44, 107.32 and 107.01. Here, the price forms a pronounced potential for the downward movement of October 1. The continuation of movement to the bottom is expected after the breakdown of the level of 107.60. Here, the goal is 107.44. Price consolidation is near this level. Passing by the price of the noise range 107.44 - 107.32 will lead to the development of pronounced movement. Here, the potential target is 107.01. We expect a rollback to the top from this level. Short-term upward movement is expected in the range of 107.83 - 107.96. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 108.14. This level is a key support for the downward structure. The main trend: the formation of the downward potential of October 1. Trading recommendations: Buy: 107.83 Take profit: 107.96 Buy : 107.98 Take profit: 108.14 Sell: 107.60 Take profit: 107.45 Sell: 107.30 Take profit: 107.01 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3304, 1.3286, 1.3262, 1.3247, 1.3203, 1.3174, 1.3157 and 1.3131. Here, we are following the development of the descending structure of September 23. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3203. In this case, the target is 1.3174. Price consolidation is in the range of 1.3174 - 1.3157. For the potential value for the bottom, we consider the level of 1.3131. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 1.3247 - 1.3262. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3286. This level is a key support for the top. Its breakdown will lead to the development of an upward structure. In this case, the potential target is 1.3304. The main trend is the descending structure of September 23. Trading recommendations: Buy: 1.3247 Take profit: 1.3260 Buy : 1.3264 Take profit: 1.3286 Sell: 1.3203 Take profit: 1.3175 Sell: 1.3173 Take profit: 1.3158 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6755, 0.6730, 0.6716, 0.6673, 0.6651, 0.6637 and 0.6607. Here, the subsequent goals for the downward movement we determine from the local downward cycle on September 24. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6670. In this case, the target is 0.6651. Price consolidation is in the range of 0.6651 - 0.6637. For the potential value for the bottom, we consider the level of 0.6607. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 0.6716 - 0.6730. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6755. This level is a key support for the downward structure. The main trend is the downward cycle of September 13. Trading recommendations: Buy: 0.6716 Take profit: 0.6730 Buy: 0.6734 Take profit: 0.6755 Sell : 0.6670 Take profit : 0.6652 Sell: 0.6635 Take profit: 0.6607 For the euro / yen pair, the key levels on the H1 scale are: 119.02, 118.57, 118.28, 117.73, 117.51, 117.10 and 116.73. Here, we expect the development of the descending structure of September 18. The continuation of the movement to the bottom is expected after the price passes the noise range 117.73 - 117.51. In this case, the target is 117.10. For the potential value for the bottom, we consider the level of 116.73. Upon reaching this value, we expect a rollback to the top. Short-term upward movement is possibly in the range 118.28 - 118.57. The breakdown of the latter value will lead to in-depth movement. Here, the goal is 119.02. This level is a key support for the downward structure. The main trend is the descending structure of September 18. Trading recommendations: Buy: 118.28 Take profit: 118.55 Buy: 118.60 Take profit: 119.00 Sell: 117.50 Take profit: 117.10 Sell: 117.08 Take profit: 116.73 For the pound / yen pair, the key levels on the H1 scale are : 134.58, 133.36, 132.72, 131.45, 130.78 and 129.88. Here, we are following the development of the descending structure of September 20. Short-term movement to the bottom is expected in the range 131.45 - 130.78. The breakdown of the latter value will lead to movement to a potential target - 129.88, when this level is reached, we expect a pullback to the top. Short-term upward movement is possibly in the range of 132.72 - 133.36. The breakdown of the last value will lead to a long correction. Here, the target is 134.58. We also expect the formation of expressed initial conditions for the upward cycle to this level. The main trend is the descending structure of September 20. Trading recommendations: Buy: 132.72 Take profit: 133.30 Buy: 133.40 Take profit: 134.55 Sell: 131.43 Take profit: 130.80 Sell: 130.74 Take profit: 129.90 The material has been provided by InstaForex Company - www.instaforex.com |

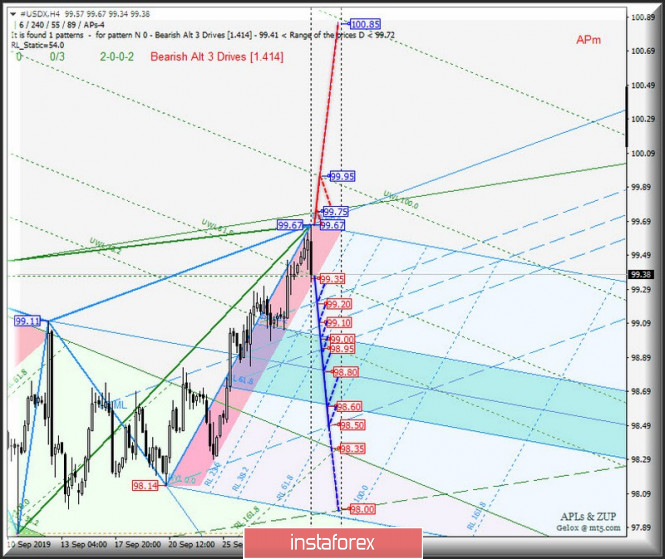

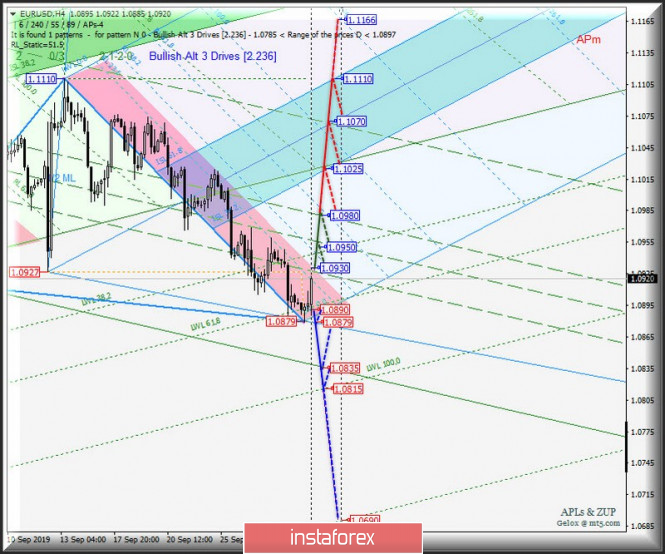

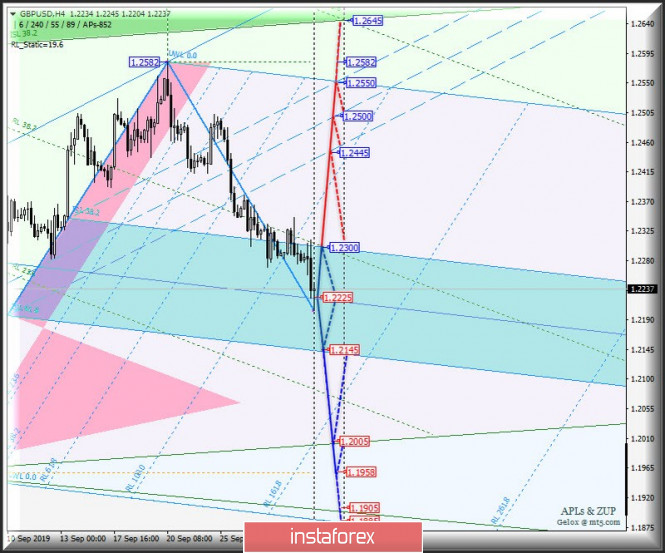

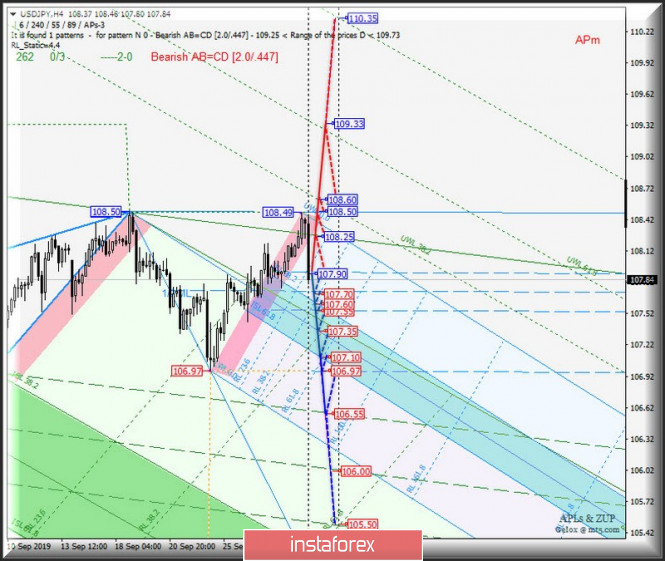

| Posted: 01 Oct 2019 06:04 PM PDT Here's a comprehensive analysis of the development options for the movement of currency instruments #USDX, EUR / USD, GBP / USD and USD / JPY from October 2, 2019 Minuette operational scale (H4 time frame) ____________________ US dollar index As further, from October 2, 2019, the development of the movement of the dollar index #USDX will begin to flow - it will be determined by the direction of the breakdown of the range :

The breakdown of the warning line UWL61.8 (support level of 99.35) of the Minuette operational scale fork will direct the movement of the dollar index to the boundaries of the 1/2 Median Line channel (99.20 - 99.10 - 98.95) and the equilibrium zone (99.00 - 98.80 - 98.60) of the Minuette operational scale fork with the possibility of reaching the ultimate Schiff Line Minuette (98.50). On the other hand, a consecutive breakdown of resistance levels - 99.67 (the initial SSL line of the Minuette operational scale fork - local maximum) and 99.75 (the control line of UTL Minuette) will cause the continuation of the upward movement of #USDX to the warning lines UWL100.0 (99.95) and UWL161.8 (100.85) Minuette operational scale fork. The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar The development of the movement of the single European currency EUR / USD from October 2, 2019 will also be determined by the direction of the breakdown of the range :

The breakdown of the resistance level of 1.0930 - the development of the movement of the single European currency will continue in the 1/2 Median Line channel (1.0930 - 1.0950 - 1.0980) of the Minuette operational scale fork, and if there will be a breakdown of the upper boundary (1.0980) of this channel, then the upward movement of this instrument can be continued to the equilibrium zone (1.1025 -1.1070 - 1.1110) of the Minuette operational scale fork. The consecutive breakdown of the initial SSL (support level of 1.0890) and the control LTL (1.0879) lines of the Minuette operational scale fork will make it possible to reach the EUR / USD control LTL (1.0835) and LWL100.0 (1.0815) lines of the Minuette operational scale fork. The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain pound vs US dollar Meanwhile, the development of Her Majesty's GBP / USD currency movement from October 2, 2019 will be due to the development and direction of the breakdown of the boundaries of the equilibrium zone (1.2145 - 1.2225 - 1.2300) of the Minuette operational scale fork. The movement markings inside this zone are presented in the animated chart. The breakdown of the upper boundary of ISL38.2 (resistance level of 1.2300) of the equilibrium zone of the Minuette operational scale fork will determine the development of the upward movement of GBP / USD to the 1/2 Median Line Minuette channel (1.2445 - 1.2500 - 1.2550). On the contrary, the breakdown of the lower boundary ISL61.8 (support level of 1.2145) of the equilibrium zone of the Minuette operational scale fork will make it possible to continue the downward movement of Her Majesty's currency to the start line SSL (1.2005) of the Minuette operational scale fork and minimum 1.1958. The details of the GBP / USD movement can be seen in the animated chart. ____________________ US dollar vs Japanese yen Starting from October 2, 2019, the movement of the USD / JPY currency of the "land of the rising sun" will be determined by the development and the direction of the breakdown of the boundaries of the 1/2 Median Line channel (107.90 - 107.70 - 107.55) and the equilibrium zone (107.60 - 107.35 - 107.10) of the Minuette operational scale. The markup of working out the indicated levels is shown in the animated chart. The breakdown of the lower boundary ISL61.8 (support level of 107.10) of the equilibrium zone of the Minuette operational scale fork - continuation of the downward movement of the currency of the country of the rising sun to the targets - the final Schiff Line Minuette (106.97) - 1/2 Median Line channel (106.55 - 106.00 - 105.50) Minuette operational scale fork. However, if you return above the upper boundary of the 1/2 Median Line channel (resistance level of 107.90) of the Minuette operational scale fork, it will be possible to continue the upward movement USD / JPY whose targets will be - control line UTL (108.25) of the Minuette operational scale fork - control line UTL Minuette (108.50) - warning lines - UWL38.2 Minuette (108.60) and UWL61.8 Minuette (109.33). We look at the details of the USD / JPY movement in the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold on the podium: the precious metal's price growth is logical Posted: 01 Oct 2019 03:46 PM PDT The topic of randomness or regularity of the current growth in the price of gold is of concern to many analysts. This question is asked by traders and investors. During market analysis Let's turn to history. After a record price growth in 2011, the yellow metal showed a downward trend for a long time. Currently, gold has more than regained its lost position, and bullish sentiment has returned to the precious metals market. According to the calculations of Thomas Bachheimer, president of the European Gold Standard Institute, this is not a coincidence, but a completely natural result of the current state of the market. Many years ago, starting in 2004, T. Bachheimer announced the future prospects of gold. At that time, precious metals cost about $430 per ounce. Few people believed the analyst, since the price of the yellow metal remained unchanged for a long time. However, much has changed after a sharp rise in value in 2011. Gold has repeatedly shown wave-like dynamics, and market participants began to look at it, and then actively acquire. A leading expert in the precious metals market is certain that today's return of rising prices for precious metals is explained by the existing system of fiat money, which is not provided with anything. The currencies of most countries are under serious pressure due to political and economic instability in the world. Above them, the sword of Damocles threatens to slow down the global economy and the global financial crisis. In such a situation, the yellow metal is the winner, emphasizes T. Bachheimer. He is confident that in the near future, gold will gain strength and move up. Such forecasts are often found among experts in the precious metals market. Some analysts argue that in the short term, the price of gold will rise to $1,600, or even to $2,000 per ounce. Currently, the dynamics of the yellow metal is not very stable, which is alarming for market participants. On Monday, September 30, the price of gold turned down from the resistance level of $1555, dropping below the support line at $1492. At the moment, the precious metal has fallen in price and is trading within the range of $1467–$1468 per ounce. Nevertheless, analysts expect a further rise in the asset. The material has been provided by InstaForex Company - www.instaforex.com |

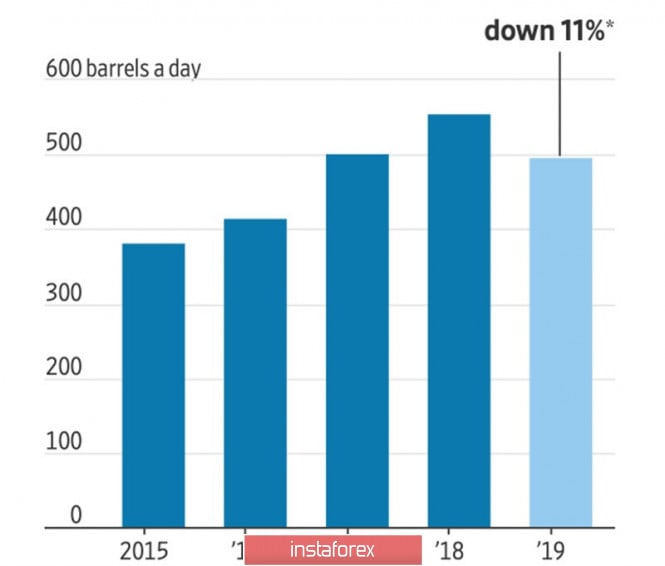

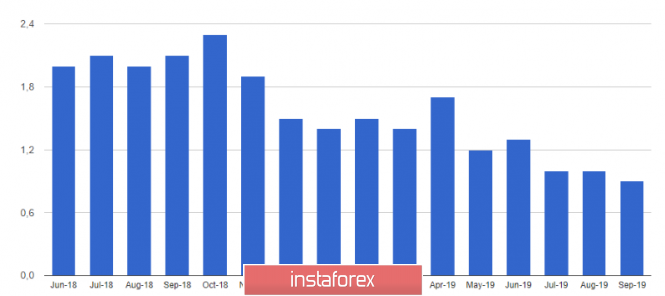

| Brent retreats but doesn't give up Posted: 01 Oct 2019 03:46 PM PDT According to the results of the third quarter, the North Sea variety lost about 9% of its value, which was the worst result from September-December last year, when futures quotes fell by 35%. After returning to the levels at which oil soared due to attacks on Saudi Arabia, buyers are hesitant to actively attack. Rising prices are seen as a reason for sales, as Riyadh was able to quickly restore damaged production, and the problem of slowing global demand due to the trade war has not disappeared. However, the situation could turn upside down in October. At first glance, the attempts of the Crown Prince of Saudi Arabia, Mohammed bin Salman, to scare the Brent and WTI bears with a statement that black gold could fly to unprecedented heights, seem like a belated shot at a rabbit that escaped the horizon. Yes, a war in the territory, which accounts for 30% of the world's energy supplies, about 20% of global trade routes and 4% of global GDP, will be a disaster, but Riyadh says it would like to resolve the conflict through diplomatic means. Gone are the days when futures quotes changed from the fact that the prince sneezed, now there are many strong players on the market. And this circumstance can become a lifeline for the "bulls". According to the US Energy Information Administration, US production fell to 11.81 million bpd in July. Let me remind you that in April, a record high of 12.12 million bpd was recorded. The growth rate was 1% for over seven months, while it was 7% over the same period last year. If in 2018 the periodic slowdown in the growth rate of shale production was mainly due to a fall in prices, then in 2019 technical factors came into play: the productivity of the wells turned out to be lower than expected due to their close proximity to each other. According to Evercore, the United States is at arm's length from peak production. The dynamics of the average 90-day production of new wells in the United States Oil production continues to fall in the Middle East Due to attacks on Saudi Arabia. Yes, Riyadh managed to recover most of the losses, but its current rate of 9.9 million bpd does not reach its previous values. OPEC countries' production in September, according to a Reuters survey of analysts, fell to an 8-year low of 29.8 million bpd. In recent years, the black gold market has been in a tug of war between the states that are rapidly increasing production and reducing it in order to stabilize the price of the cartel. In 2019, global demand came to support the Brent and WTI bears, which is slowing under the influence of trade wars. However, if the growth rate of shale production in the United States continues to decline, while OPEC and Russia prolong the Vienna agreement, then prices will go up. A breakthrough in the trade negotiations between Washington and Beijing can add fuel to the fire. Technically, purchases of the North Sea variety will become relevant at breakouts of resistance at $61.1 (correction level 61.8% of the AD wave of the "Bat" pattern) and $62.1 (Pivot level). The material has been provided by InstaForex Company - www.instaforex.com |

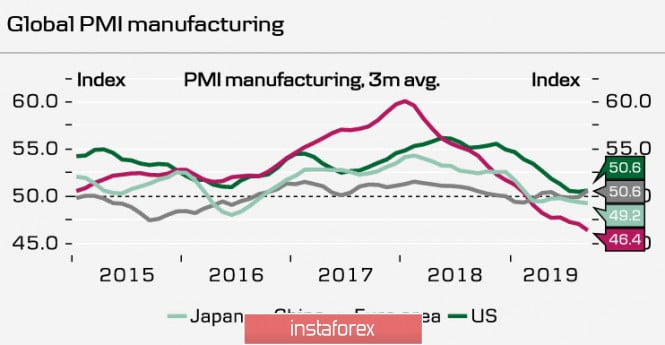

| Posted: 01 Oct 2019 03:46 PM PDT In September, the stock and currency markets calmed somewhat amid de-escalation of geopolitical tensions in the Middle East and increased optimistic sentiment regarding the upcoming round of US-China trade negotiations. Two weeks later, the United States may again increase duties on Chinese imports, but investors in the stock market and forex this does not seem to bother, but in vain, the leading Wall Street banks warn. "We are becoming increasingly convinced that in the absence of constraints, the escalation of the trade conflict will continue in the medium term, which means that any pause will be short-lived. Investors should take into account that all announced measures (that is, raising fees on October 15 and December 15) will be taken sooner or later, even if the parties announce their postponement," said strategists at Morgan Stanley. They noted that recent rounds of trade negotiations between the United States and China have been followed by higher duties, rather than easing tensions. "Despite the fact that trade negotiations have recently been presented as constructive, and the postponement of the introduction of certain duties has inspired some optimism among investors, we do not expect the White House to make any compromises to conclude a trade deal if the economic situation and financial conditions in the United States remain favorable," Citigroup economists said. "In addition, a semi-annual report by the US Treasury will be published in October. This department has already recognized China as a currency manipulator, and now the US Department of Commerce can clarify its position. If the latter considers that the depreciation of the renminbi is similar to subsidizing Chinese manufacturers, then this will open the way for Washington to increase duties, "they added. "Recently, a new element has been added to trade negotiations, namely the prospect of impeachment against Donald Trump. Under these conditions, an insight can "descend" on the owner of the White House, which will encourage him to conclude a compromise deal and end the trade war. However, the opposite scenario is also possible: Beijing, understanding the vulnerability of the position of the US president, can not only slow down the negotiations, but also ask for another increase in the expectation that another year of confrontation will increase the likelihood of Trump losing in the 2020 elections," JPMorgan analysts said. An optimistic attitude regarding the resolution of the US and China conflict undermined the defensive yen. The USD/JPY pair has been growing for the fourth consecutive session and reached two-week highs in the region of 108.40. However, according to some analysts, the Japanese currency will still surpass competitors from the G10 in growth rates and by the end of the year will rise in price by almost 3%, to 105 yen per dollar. "The situation in the world can be described as an unstable balance, which, in our opinion, will serve as a source of volatility and lead to a fall in risky assets, as well as to strengthen the yen," said strategists at Morgan Stanley. "The probability of a global recession in the next 12-18 months exceeds 50%. Assets like the Japanese yen will show a significant rally in the event of a crisis or global recession," according to Allianz Global Investors. Analysts call the limited possibilities of the Bank of Japan in terms of monetary stimulus as another factor in favor of the yen's potential growth "Compared to the Federal Reserve's ability to cut interest rates, the Bank of Japan's potential looks modest. In the Land of the Rising Sun, bets are already in negative territory. At the same time, the BoJ owns a huge share of bonds (45% of the domestic market). This means that, in terms of quantitative easing, it has fewer opportunities than the ECB," representatives of BNP Paribas said. "If the Fed easing monetary policy cycle leads to a drop in the federal funds rate below 1%, this will help the Japanese currency rise to 90 yen per dollar," RBC Capital Markets said. Meanwhile, the EUR/USD pair continues to go down, updating levels that it has not visited since May 2017. Today, the main currency pair sank to two-year lows around 1.0880 amid a growing gap between macroeconomic data from the US and Europe. According to the final assessment, the PMI in the eurozone manufacturing sector fell from 47 points in August to 47.7 points in September, reaching its lowest level since October 2012. Recall that the preliminary estimate was 45.6 points. At the same time, inflation in the region unexpectedly decelerated last month. According to Eurostat, in the reporting period, consumer prices in the eurozone rose by 0.9% in annual terms against the growth in August by 1%. The market understands that if the indicator continues to remain at such low levels, the ECB will be forced to take additional mitigation measures, despite the recent reduction in deposit rates and the launch of a bond purchase program. These expectations continue to put pressure on the euro. GBP/USD is trading below its peak on September 20, close to 1.26, as fear of Brexit without a deal again engulfed investors, so the pair tends to decline. RBC analysts say that a break below the moving average over the past 50 days, which is at 1.2259, will lead to a drop and testing of the next support at 1.2198, but in addition to this, you should also have 1.20 in sight. "Opponents of British Prime Minister Boris Johnson use everything that comes to hand against him: now he is even accused of abuses as mayor of London. The pound sterling is digesting all this well so far, but long-position holders can only hope that Johnson and the European Union are approaching a deal or, if this has not succeeded yet, at least a delay in Brexit is guaranteed," Saxo Bank analysts said. According to The Times, B. Johnson intends to ask the European Union to exclude the possibility of further postponement of Brexit in a new agreement with the EU. According to the publication, in the framework of the draft new agreement, the British prime minister will offer the EU an alternative to the so-called "back-stop", which will make it possible to both avoid checks on the Irish border and also control the movement of goods and transport through it. At the same time, B. Johnson privately made it clear that the agreement should include the obligation of the rest of the EU countries to impede the postponement of Brexit. Thus, the British Parliament may face a difficult choice: either vote for the agreement reached by B. Johnson, or Great Britain leaves the EU on October 31 without a deal. The material has been provided by InstaForex Company - www.instaforex.com |

| AUD/USD. Aussie's steep plunge: Reserve Bank of Australia knocks out the aussie Posted: 01 Oct 2019 03:46 PM PDT The Australian dollar collapsed throughout the market, responding to the outcome of today's RBA meeting. Paired with the US currency, the aussie approached annual lows, testing the middle of the 66th figure. Judging by the fundamental and technical signals, the pair's decline will be protracted - at least until the announcement of the results of US-Chinese trade negotiations (they will begin only on October 10-11). The aussie was under powerful pressure today, from which it will not be easy for it to escape. By and large, traders of the AUD/USD pair did not expect any "hawkish" or optimistic hints from the RBA October meeting. Prior to the release of data on Australia's GDP growth (which was published at the end of September), traders still had hope for patience on the part of the regulator. But the Australian economy, as they say, "let us down" - the country's GDP has been declining for four quarters since the beginning of 2018. The published data for the second quarter of this year confirmed the worst fears: the key indicator continued its downward trend, collapsing to a record low of 1.4%. Before that, quite contradictory data on the Australian labor market were published - the overall increase in the number of employed was due only to part-time employment. While the indicator of full employment completely plummeted into the negative area, resuming the negative trend. Such dynamics not only speaks of negative signals from the labor market, but also portends a slowdown in inflation, as regular posts imply a higher level of wages and a higher level of social security. Weak wage growth with a relatively low unemployment rate is one of the problems of the RBA, the root of which (in particular) is to increase part-time employment. It is worth noting that traders reacted quite calmly to the fact of lowering the rate. Although some analysts previously voiced the option that the head of the RBA would not rush things, lowering the rate following negotiations between the US and China. But for the most part, traders were ready to soften monetary policy. However, subsequent comments by Philip Lowe knocked out the Australian currency to the area of annual lows. The head of the Australian central bank said that, firstly, rates will remain at low levels "for a very long time," and secondly, today's decline is probably not the last. Although he did not announce any clear timeframe, the market is confident that the RBA will reduce the rate to 0.5% either at the December meeting or at the beginning of next year. The text of the accompanying statement was also extremely dovish-like. First of all, the regulator voiced concern about a certain imbalance in the Australian labor market (this refers to the above factor in reducing the number of vacancies on a full-time basis). The latest data on the country's GDP growth did not go unnoticed, especially amid a weak manufacturing PMI index for September and a decrease in the number of issued building permits. Thus, at the moment there is no doubt that the regulator will again resort to lower interest rates in the foreseeable future. The only question is when this will happen and whether further steps will follow in this direction. It can be assumed that the position of the RBA members will be affected to some extent by the results of the aforementioned US-Chinese negotiations. But the trigger in this context will be Australia's key macroeconomic data - primarily in the labor market and inflation. Particular attention should be paid to preliminary estimates of the country's GDP growth for the third quarter. All these macro indicators will determine the future fate of the interest rate. From a technical point of view, the pair is under significant pressure, and on all the "higher" time frames. On the charts H4, D1, W1 and MN, the pair is between the middle and lower lines of the Bollinger Bands indicator, which also indicates the priority of the downward movement. The pair shows a pronounced bearish trend, which is confirmed by the main trend indicators - Bollinger Bands and Ichimoku, which formed the strongest bearish "Parade of Lines" signal on all the above timeframes - all indicator lines are above the price chart, thereby demonstrating pressure on the pair. An additional confirmation of the bearish scenario is the oversold MACD and Stochastic oscillators. To determine the main goal of the downward movement, let's move on to the monthly timeframe: here we focus on the lower line of Bollinger Bands - this is the price of 0.6570. If Friday Nonfarm come out in the "green zone", then the bears will be able to reach this level already this week, thereby updating the annual low. The material has been provided by InstaForex Company - www.instaforex.com |

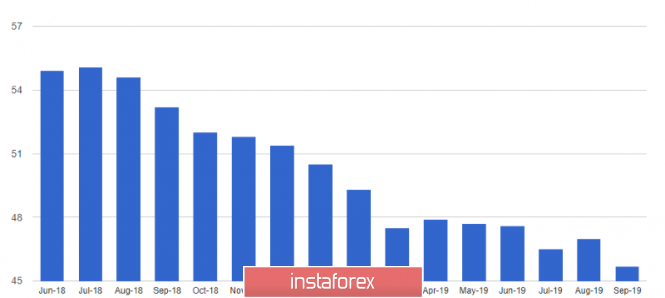

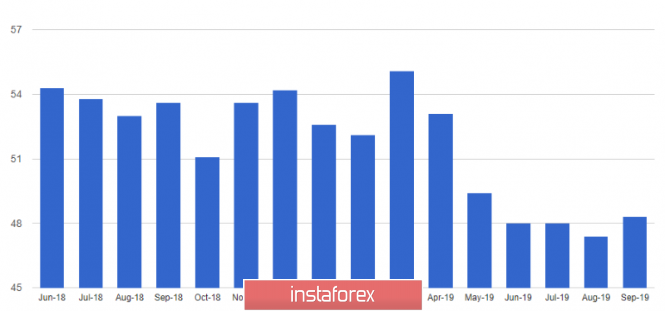

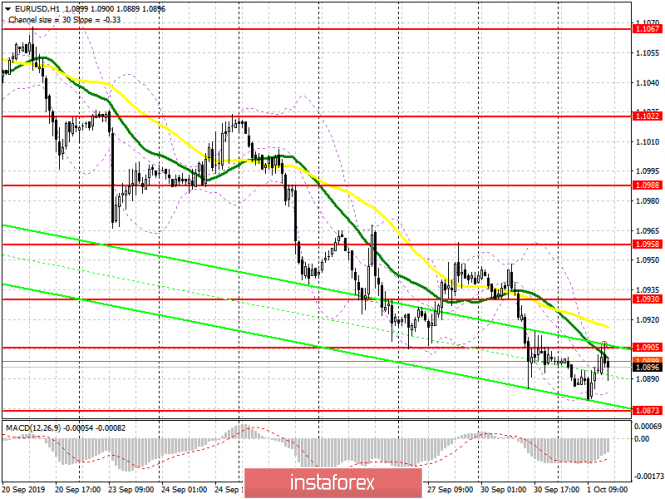

| Posted: 01 Oct 2019 03:45 PM PDT The expected decrease in production activity in the eurozone and data that generally coincided with the forecasts of economists - all this kept the European currency from a new wave of decline against a number of world currencies, including the US dollar. It is important to note that the report on the reduction in inflation in the eurozone was also ignored, which is yet another evidence of a slowdown in economic growth in the eurozone. According to Markit, the PMI Purchasing Managers Index for Italy's manufacturing sector dropped to 47.8 points in September this year from 48.7 points in August. Economists had forecast the index at 48.0 points. In France, a similar index also declined. According to the report, the PMI Purchasing Managers Index for France's manufacturing sector in September came close to 50 points and amounted to 50.1 points compared to 51.1 points in August this year. Economists had expected the index to fall to 50.3 points. The PMI Purchasing Managers Index for German manufacturing was of key importance. Activity continued to decline, reaching the next low, which indicates the onset of a technical recession in the economy. According to Markit, the index fell even further, to 41.7 points in September against 43.5 points in August this year. Economists had forecast the index at 41.4 points. The ongoing trade war between the US and China, as well as a slowdown in economic growth, together with a sharp decline in exports, all led to a slowdown in production activity in developed countries. However, most of the problems are observed in the eurozone. The report indicates that the PMI purchasing managers index for the eurozone manufacturing sector fell to 45.7 points in September against 47 points in August. Let me remind you that an index value below 50 points indicates a decrease in activity. Economists forecast this indicator at 45.6 points. Surprisingly, traders also ignored inflation data. So, in September this year, the annual inflation rate in the eurozone slowed even more. The inflation rate is one of the "headaches" of the European Central Bank, which requires a reduction in interest rates, which are already at zero. Will the next stage of the economic stimulus program, which will begin to operate in November this year, help? Only time will tell. According to published official data, in September 2019, compared with the same period last year, consumer prices in the eurozone rose only 0.9% after rising 1.0% in August. The basic consumer price index, which does not take into account the volatile categories of goods, grew by 1% over the same period. The target level of the ECB is just below 2%. Today's statement by Federal Reserve representative Charles Evans was ignored by traders. In an interview, Evans said the United States is still on track for 2.25% GDP growth this year, as unemployment will continue to remain at current low levels. The Fed representative expects that a softer monetary policy will keep the economy on the right track, as well as spur inflation, which is gradually moving to its target level. As for the technical picture of the EURUSD pair, it remained unchanged. The market is under the control of sellers, and the EURUSD pair is gradually approaching the next major support level of 1.0870. Its breakthrough will only increase pressure on risky assets, which will open a direct path to a low of 1.0840. With an upward correction of the trading instrument, the resistance at 1.0905 will limit the growth, while a larger level can be seen in the range of 1.0930. GBPUSD The pound continues to decline. The report on weak activity in the manufacturing sector, which also saw a very rapid reduction in the number of jobs, put pressure on the pair. According to a survey by purchasing managers and IHS Markit, the PMI for purchasing managers for the UK manufacturing sector rose to 48.3 points in September, but remained below 50 points, indicating a decrease in activity compared to the previous month. However, a report on the UK services sector, which accounts for more than 70% of the economy, will be more important. A breakthrough of support in the 1.2270 area led to a further bearish trend in the pair, aimed at the levels of 1.2170 and 1.2100. The material has been provided by InstaForex Company - www.instaforex.com |

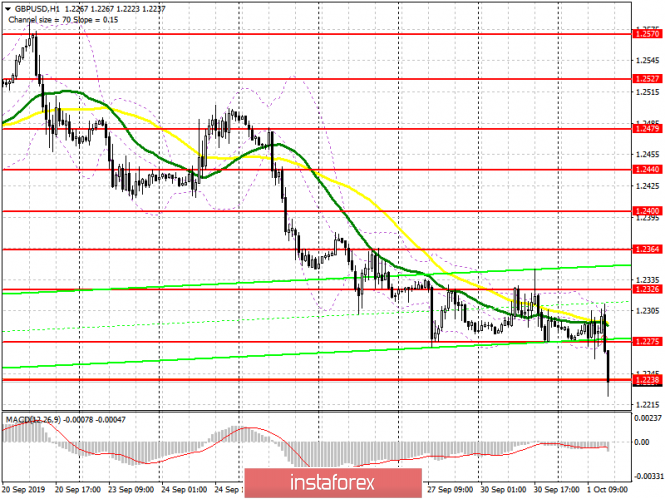

| October 1, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 01 Oct 2019 08:34 AM PDT

Since then, the GBP/USD pair has been trending-up within the depicted bullish channel except on September 3 when a temporary bearish breakout was demonstrated towards 1.1960. Around the price level of 1.1960, aggressive signs of bullish recovery (Bullish Engulfing candlesticks) brought the GBPUSD back above 1.2230 where the pair looked overbought. However, further bullish momentum was demonstrated towards 1.2320 maintaining the bullish movement inside the depicted movement channel. Moreover, Temporary bullish advancement was demonstrated towards 1.2550 where a reversal wedge pattern was established. As anticipated, the reversal wedge pattern was confirmed by the end of the previous Monday's consolidations supported by obvious bearish price action demonstrating a successful bearish closure below 1.2450. On Tuesday, the backside of the confirmed reversal wedge was successfully re-tested around 1.2500 where a new episode of bearish rejection was expressed. The Long-term outlook remains bearish as long as the most recent top established around 1.2500 remains defended by the GBP/USD bears. Bearish persistence below 1.2440-1.2400 (Reversal-Pattern Neckline) allowed more bearish decline to occur towards the price levels of 1.2210 where early signs of bullish rejection is being demonstrated Today. Trade Recommendations: Conservative traders can wait for bullish pullback towards the backside of the broken channel (Anywhere around 1.2400-1.2450) for another valid SELL entry. T/P level to be placed around 1.2360, 1.2330 and 1.2280 while S/L should be set as a H4 candlestick closure above 1.2450. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 10.01.2019 - Sell zone for Bitcoin, bearish divergence on the MACD Posted: 01 Oct 2019 07:54 AM PDT BTC is trading near the important resistance levels at the price of $8,629 and $8,800, which is sign that there is potential for reaction from sellers. I do expect more downside in the next period.

Red rectangles – Resistance levels Falling purple line – Expected path Green rectangle – Support and downward target MACD oscillator is showing bearish divergence on the last move up on BTC, which is sign that buyers are losing power and that sellers may react. Resistance levels are set at $8,629 and $8,800. Support level is set at the price of $7,750. Watch for selling opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| October 1, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 01 Oct 2019 07:52 AM PDT

On September 5, the EUR/USD pair was testing the backside of both broken trends around 1.1060-1.1080 where significant bearish pressure was demonstrated pushing the pair directly towards 1.0940 (Prominent Weekly Bottom). Bearish Breakout below the price level of 1.0940 was needed to enhance further bearish decline towards 1.0900 and 1.0840 (Fibonacci Expansion Key-Levels). However, considerable bullish rejection was demonstrated as a quick bullish spike towards 1.1100 where another episode of bearish pressure was expressed. Shortly-After, TWO DESCENDING-Tops were established around 1.1080 and 1.1050. This rendered the recent bullish spike as a bullish trap. Since then, the EURUSD has been trending-down within the depicted short-term bearish channel. On September 23, a recent bullish pullback towards the price level of 1.1020 was obviously rejected by the end of Tuesday's consolidations. Bearish persistence below 1.0965 (recent daily bottom) enhanced more bearish decline towards 1.0930 and 1.0890 (Fibonacci Expansion 161.8%) where recent signs of bullish recovery is being demonstrated. Moreover, the EUR/USD is demonstrating a long-term Head & Shoulders continuation pattern extending between (1.0930 - 1.1080) with neckline located around 1.0940. As long as bearish persistence below 1.0940 (Neckline) is maintained, Pattern projection target would remain projected towards 1.0840. Trade recommendations : Conservative traders should look for a new valid SELL entry anywhere around the price zone of 1.0940-1.0960 (upper limit of the depicted movement channel). Initial Target levels should be located at 1.0900, 1.0850 and 1.0840. The material has been provided by InstaForex Company - www.instaforex.com |

| USDJPY under pressure after worse than expected ISM Manufacturing PMI for September Posted: 01 Oct 2019 07:20 AM PDT In a previous post USDJPY has provided us with a weak bullish signal when it was trading at 107.55. In that post we mentioned that the bullish signal would strengthen on a break above 108. So far price remains below this important resistance level.

|

| Gold price breaks support and reaches first target Posted: 01 Oct 2019 07:08 AM PDT Gold price has broken $1,500 at the beginning of the week and has already reached our first target of $1,461 with a low at $1,459. Our next target is at $1,418 as long as price is below $1,500.

Blue rectangle- resistance (previous support) Gold price has already reached the 100% Fibonacci extension of the first leg down. Trend is bearish as long as price is below $1,535. As long as price is below $1,500 we expect a move lower towards $1,418 which is our next target. Price has broken out of the bullish channel and this is time for a correction as we also showed at the start of the week with our weekly chart.

Red rectangles - topping signs Black line - major resistance trend line (broken) now support Green line - major upward trend line support Gold price is overbought as the weekly RSI shows. In our previous posts I noted the importance and the warning signs from this weekly chart. The RSI turning below 70 is a sign of weakness and we already expected this pull back. This pull back can unfold into something bigger but it is too early to tell. For now we remain bearish as we consider the recent highs above $1,550 to be an important top. A break above $1,535 will open the way for a move above $1,600. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Oct 2019 06:36 AM PDT To open long positions on GBP/USD, you need: The report on the reduction of the index for the UK manufacturing sector, which remained below 50 points in September this year, returned the pressure on the British pound, and the expected breakthrough of the support of 1.2275 collapsed the pair to new monthly lows. At the moment, buyers are trying to hold the level of 1.2238, but in the absence of demand in this range and the rapid recovery of the pair, it is best to postpone short positions until the update of the larger support of 1.2165. The task of the bulls for the second half of the day will also be a return to the resistance of 1.2275, which will lead to a larger upward correction to the area of the maximum of 1.2326, where I recommend taking the profit. However, the main movement will depend on data on manufacturing activity in the US. To open short positions on GBP/USD, you need: The bears managed to break below the support level of 1.2275, which I paid attention to in my morning review, which increased the pressure on the pair. At the moment, the task of sellers will be a breakthrough and consolidation below the support of 1.2238, which will lead to a further decrease in GBP/USD to the area of lows 1.2165 and 1.2112, where I recommend fixing the profits. In the scenario of an upward correction of the pair in the second half of the day, the formation of a false breakdown in the resistance area of 1.2275 will be a clear signal to continue opening short positions further along with the trend. In the absence of sellers in this range, you can sell the pound immediately on the rebound from the maximum of 1.2326. Indicator signals: Moving Averages Trading is below the 30 and 50 daily averages, indicating a further decline in the market. Bollinger Bands In the scenario of growth of the pound, you can count on sales immediately on the rebound after the test of the upper limit of the indicator in the area of 1.2326.

Description of indicators

|

| Posted: 01 Oct 2019 06:36 AM PDT To open long positions on EURUSD, you need: Traders ignored weak data on inflation in the eurozone, which growth has once again slowed, which is bad news for the European Central Bank. Activity in the eurozone manufacturing sector also continued to decline in September this year. The bulls managed to return to the resistance of 1.0905, which I paid attention to in my morning forecast, but they have not managed to get above this level yet. All the focus will be on the afternoon and the US ISM manufacturing index report. Only a breakthrough and consolidation above the resistance of 1.0905 will lead to a larger upward correction to the highs of 1.0930 and 1.0958, where I recommend taking the profit. If the pressure on the euro returns, then a minimum level of 1.0873 remains a good level for purchases, as well as further support at 1.0840. To open short positions on EURUSD, you need: The bears coped with the morning task and did not let the pair go above the level of 1.0905, forming a false breakdown there. As long as trading is below this range, pressure on the euro will continue, and a good report on the ISM manufacturing index may even return EUR/USD to the low of the day, which will lead to an update of support 1.0873. A breakthrough in this range will push the pair to the lows of 1.0873 and 1.0840, where I recommend taking the profit. If the bulls manage to get above the level of 1.0905 in the second half of the day, it is best to look at short positions only after a false breakdown of the resistance of 1.0930 or sell EUR/USD immediately on the rebound from the maximum of 1.0958. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which indicates the continuation of the bearish trend. Bollinger Bands Volatility has decreased significantly, which is why there are no signals to enter the market.

Description of indicators

|

| Gold 10.01.2019 - Downward target reached, potential for rally today Posted: 01 Oct 2019 06:20 AM PDT Gold has been trading exactly what I expected yesterday. Gold did trade lower and met our downward target at $1,464, which is also a strong support level. Now, I do expect potential rally today and test of $1,485 due to oversold condition.

Yellow rectangle – Broken support now became resistance Rising purple line – Expected path Purple horizontal line – Target reached FE 100% MACD oscillator is showing decreasing momentum in the last down move, which is sign that buyers may react. Important support is set at the price of $1,464 and resistance at $1,485. Watch for buying opportunities today on the pullbacks 5/15 min time-frame. Anyway, in case of the down break of $1,460, there is potential for more downside and potential test of $1,423. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 10.01.2019 - First downward target reached at 1.2230, momentum still on the downside Posted: 01 Oct 2019 06:04 AM PDT GBP/USD has been trading exactly what I expected yesterday. GBP did trade lower and met our downward target at 1.2230, which is also a support level. The momentum is still on the downside and in case of the breakout of 1.2215; there is chance for more downside movement. Next support level is set at the price of 1.2110

Yellow rectangle – Important support levels Purple lines – Broken pennant pattern Purple falling line – Expected path MACD oscillator is showing good new momentum down in the background and there is chance for more downside in case of the down break. Key support is at 1.2215 and resistance at 1.2267. Bulls need to be very cautious as there is strong downward momentum in the background and potential selling the rally type of feeling. The material has been provided by InstaForex Company - www.instaforex.com |

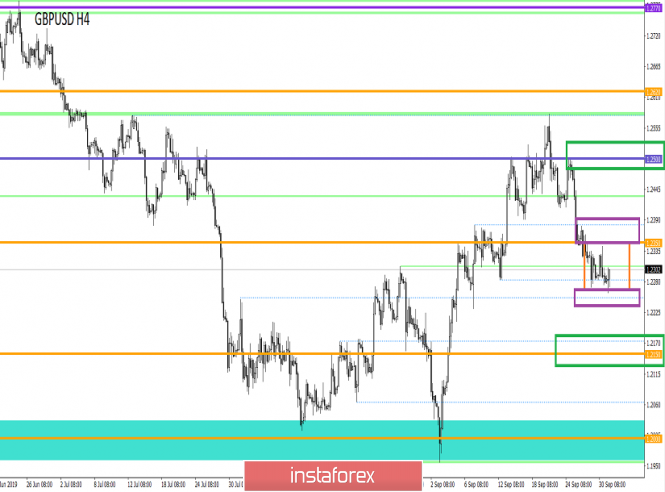

| Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 1) Posted: 01 Oct 2019 05:12 AM PDT The pound/dollar currency pair showed low volatility of 69 points for the last trading day, as a result of which there was a process of accumulation. From technical analysis, we see that the breakdown of the level of 1.2350 led to a distinct accumulation below it, where the local low of September 12 serves as the lower limit, and the previously passed level of 1.2350 is the upper limit. An interesting fact is that almost week-long descent did not affect the bearish interest, which persists in the market. As discussed in the previous review, traders showed little activity inside the accumulation (1.2270/1.2350), which, in principle, is understandable by certain risks. Thus, the work on the breakdown of the existing borders was a priority for the formulation of subsequent trade operations. Looking at the trading chart in general terms (daily period), we see that the process of restoring quotes has not yet reached 70-80% of working out relative to the elongated correction. Thus, I believe that the full resumption of the global trend is too early. In any case, the downward trend of the pound/dollar pair is the main one, and there are no prerequisites for its change yet. The news background of the last day had data on UK GDP for the second quarter, where, as expected, there was a slowdown in economic growth from 2.1% to 1.3%, but still it is worth paying tribute, as predicted a slowdown to 1.2%. Other statistical indicators were published simultaneously, and so, the investments of commercial enterprises continue to decline, showing a decline of -1.4%, but again, they predicted an even deeper decline to -1.6%. Lending in Britain is almost kept at the same level, so, taking into account the revised data on the volume of consumer lending, we have a decline from 1.007B to 0.901B, but the number of approved mortgage applications is reduced from 67.01K to 65.55K. The reaction of the pound to the statistical data package was moderate due to the stop and, as a fact, the formation of the accumulation process. In turn, the information background discusses the Brexit process. So, this time, the newspaper The Times reported on Tuesday night that London would provide Brussels with an official document containing proposals for alternative regulation of the "backstop" problem. Prime Minister Boris Johnson himself informally asks the EU authorities not to grant a delay on Brexit, which would thus put the British Parliament before a choice: to vote for the revised version of the Brexit treaty or leave the EU on October 31 without a deal. In turn, the UK Ministry of Finance, represented by Chancellor of the Treasury Sajid Javid, says the country is ready for any Brexit option. Such statements should be treated very skeptically since there are simply no foundations for the foundation of such statements. Today, in terms of the economic calendar, data on business activity in the UK manufacturing sector have already been released, where an increase from 47.4 to 48.3 was recorded. In the second half of the day, the final data on the index of business activity in the manufacturing sector will be published, but in the United States, where growth is forecast from 50.3 to 51.0. Thus, the US dollar may well be strengthened. Further development Analyzing the current trading chart, we see that the accumulation process continues its formation, where attempts to break the lower border (1.2270/1.2350), of course, were, but ended unsuccessfully, in the form of a puncture. In turn, speculators continue to analyze the behavior of quotes and, of course, the price fixing point, being currently out of the market. It is likely to assume that the accumulation process will continue for some time, but the longer we are in the restrictive framework, the sharper the way out of them. The principle of operation remains the same, the analysis of fixation points outside the borders, with subsequent entry into the market. Based on the above information, we concretize trading recommendations:

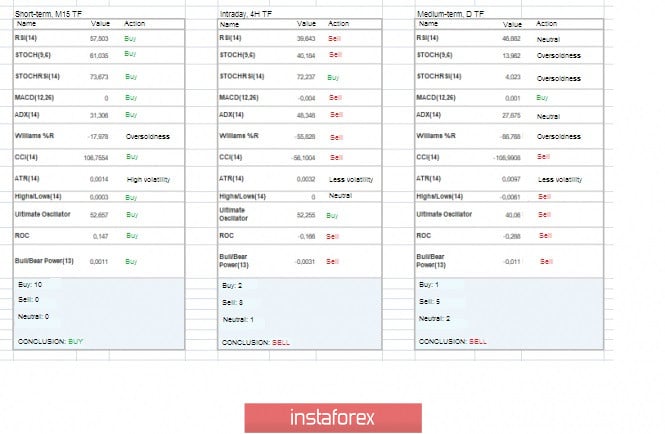

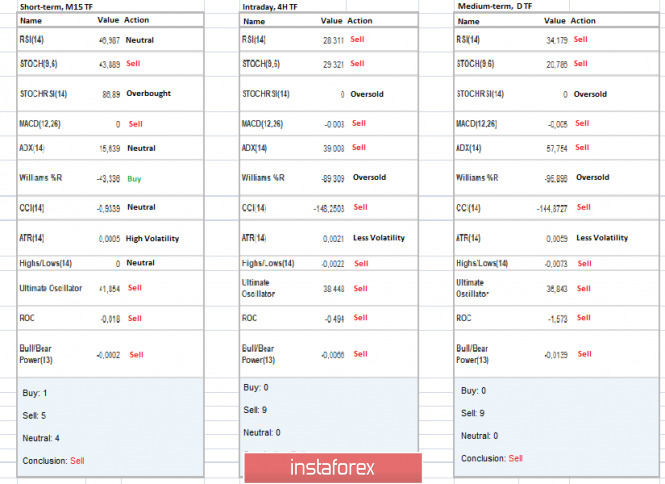

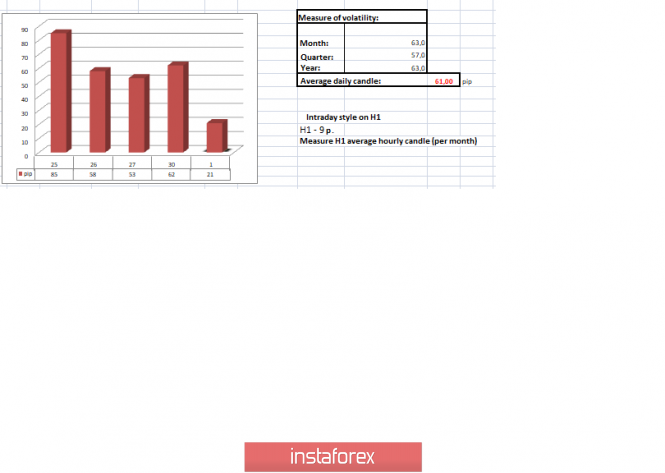

Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators in the short-term intervals fluctuate within the existing accumulation, giving as a fact a variable signal. Intraday and medium-term intervals signal a downward interest, thus reflecting the recovery process. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 1 was built taking into account the time of publication of the article) The volatility of the current time is 45 points, which is low for this period. It is likely to assume that if the accumulation process is delayed, the volatility will remain at a low level, but as soon as the existing framework of accumulation falls, we will see a local spike in the acceleration of volatility. Key level Resistance zones: 1.2350**; 1.2500**; 1.2620; 1.2770**; 1.2880 (1.2865 – 1.2880)**. Support zones: 1.2150**; 1.2000***; 1.1700; 1.1475**. * Periodic level ** Range level *** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for October 01, 2019 Posted: 01 Oct 2019 04:24 AM PDT The EUR/USD pair fell from the level of 1.0934 to bottom at 1.0878 since last week. Today, the EUR/USD pair has faced strong support at the level of 1.0934 . So, the strong support has been already faced at the level of 1.0934 and the pair is likely to try to approach it in order to test it again and form a double bottom. The EUR/USD pair is continuing to trade in a bullish trend from the new support level of 1.0934; to form a bullish channel. According to the previous events, we expect the pair to move between 1.0934 and 1.0878. Also, it should be noted major resistance is seen at 1.0969, while immediate resistance is found at 1.0934. Then, we may anticipate potential testing of 1.0934 to take place soon. Moreover, if the pair succeeds in passing through the level of 1.0934, the market will indicate a bullish opportunity above the level of 1.0934. A breakout of that target will move the pair further upwards to 1.0969. Buy orders are recommended above the area of 1.0878 with the first target at the level of 1.0934; and continue towards 1.0969. On the other hand, if a breakout takes place at the resistance level of 1.0854, then this scenario may become invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

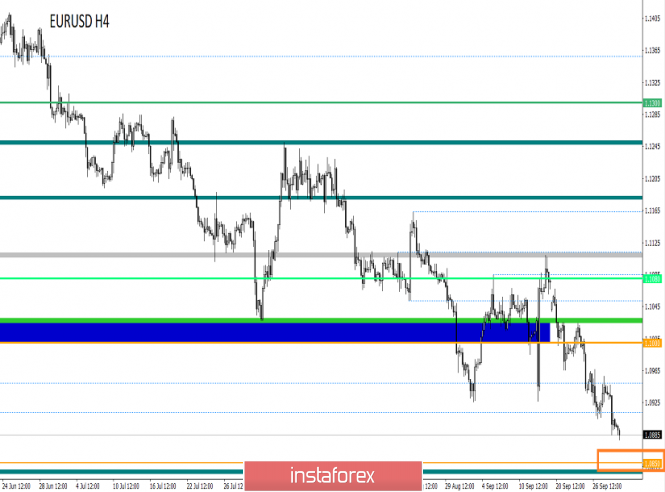

| Posted: 01 Oct 2019 03:12 AM PDT EUR/USD – 4H. As seen on the 4-hour chart, the EUR/USD pair made a second attempt to consolidate under the correction level of 161.8% (1.0918). Thus, the fall of quotations continues in the direction of the next correction level of 200.0% (1.0802) following the direction of the main trend channel. Also, a bullish divergence is brewing in the CCI indicator, which allows us to expect some growth of the euro/dollar pair, but does not allow us to expect this growth of the information background, which remains the main opponent of the European currency. This morning, business activity indices in the manufacturing sectors of the largest countries of the European Union have already been published. There is little positive news for the euro. In Switzerland, business activity fell from 47.2 to 44.6, in Italy – from 48.7 to 47.8, in Spain – from 48.8 to 47.7, in France – from 50.3 to 50.1. Only German business activity "grew" from 41.4 to 41.7, and the European – from 45.6 to 45.7. However, this growth is unlikely to please traders. All indices of business activity, except the French, remained below the key mark of 50.0, signaling a continuing slowdown in growth. Thus, the further fall of the European currency is now justified by the information background. In just half an hour, data on inflation in the European Union will also be known. Traders expect to see 1.0% inflation in September, and the underlying consumer price index may increase from 0.9% to 1.0%. However, the situation here is approximately the same as with business activity. Even an increase in core inflation to 1.0% can hardly be taken as a positive moment, given the fact that the ECB has been aiming for inflation at 2.0% for several years. This level is officially called the target, but we are not witnessing the movement of inflation to this level. Thus, I see no reason for traders to refuse further sales of the euro/dollar pair. After lunch, business activity in the US manufacturing sector will be known. Things are better in America. In any case, conclusions on these indicators can be drawn after their release. It is not necessary to guess whether they will show growth or fall. Meanwhile, the situation with the possible impeachment of Donald Trump acquires new details. According to world media, Trump could also put pressure on Australian Prime Minister Scott Morrison to obtain evidence of the insolvency of the investigation of Robert Mueller. Former US Attorney General Mueller has been investigating Russia's potential interference in the 2016 presidential election for almost two years. According to media reports, Trump wanted to conduct an audit to find out who initiated the investigation and what were the reasons. Thus, as I expected, any activity of Trump will now be under the scrutiny of the media, democrats, and special services. Presidential elections will be held in a year, during this time, Trump's opponents need to collect as much dirt as possible on the current US president, who wants to be re-elected for a second term. What to expect today from the euro/dollar currency pair? On October 1, I expect the euro/dollar pair to fall further in the direction of the Fibo level of 200.0% (1.0802). The information background today has already supported the US currency and caused new sales of the pair. Even taking into account, the unknown values of business activity indices in the US manufacturing sector, I would say that the dollar will continue to grow today. The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend selling the pair today with a target of 1.0802, as the close was made at 1.0918. A stop-loss order above the level of 1.0927. It will be possible to buy the pair after the close above the downward trend channel, before – I do not recommend it. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Oct 2019 03:12 AM PDT GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair still performed a close under the corrective level of 23.6% (1.2293). Thus, the bullish divergence of the CCI indicator is canceled, which initially implied a small corrective growth and the fall of the pound/dollar pair can be continued towards the level of 1.2014. There are no new emerging divergences on October 1 in any indicator. Boris Johnson stands firm on his original position: no postponement of Brexit, it should take place in any case on October 31, and whether it will be possible to negotiate a deal with the European Union or not, this is the second question. According to the latest information received, Boris Johnson is preparing a proposal to Brussels to replace the Backstop mechanism, which legally defines the relationship between Ireland and Northern Ireland after Brexit. The agreement that Boris Johnson wants to offer contains a clause that all 27 EU member states will not support the transfer of Brexit to January 31, 2020, as the British Parliament wants. That is Johnson offers his version of the deal to Brussels. Solving the issue of Backstop in exchange for implementing Brexit on time. If this deal suits the European Union, then the UK Parliament will be at a disadvantage and, most likely, will not be able to cancel Brexit, blocking it at the legislative level. After all, the condition of the law prohibiting Britain from leaving the EU "No Deal" will be fulfilled by Johnson, and the EU itself will refuse to postpone the exit date. Thus, it remains to wait for the moment when Johnson will send the document to the leaders of the EU and the reaction of all countries to it. According to the assumptions of some politicians and experts, Johnson is going to offer Brussels to establish customs control points at a distance of 5-10 km from the actual border on the island of Ireland. It is difficult to say what will give the bifurcation of the border and its transfer to a distance of 5-10 km from the actual. However, Johnson sees this as a possible solution. Frankly, there are not so many alternatives and possible options. The EU will certainly consider this proposal, but will it suit the EU government? In any case, such information brings Britain closer to Brexit, but not to the unambiguous Brexit "No Deal". Thus, the pound can stop falling in pair with the dollar, at least until the reaction of the European Union to the document is known. The UK manufacturing PMI rose to 48.3 in September. The value is still below 50, but still, the growth of the index is noticeable and did not allow traders to continue selling the pound/dollar pair. What to expect from the pound/dollar currency pair today? The pound/dollar pair secured under the correction level of 23.6% (1.2293), but it is again uncertain. Thus, it is not a fact that the fall will continue, given the background information. I recommend waiting for the development of the situation, as in recent days, traders are confused. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. Forecast for GBP/USD and trading recommendations: I do not recommend buying the pair soon, as the pair can now perform a maximum rollback to the top. I recommend considering new sales of the pair with the target of 1.2014, if a more confident close is made under the level of 23.6%, with the stop-loss order above the level of 1.2308. The material has been provided by InstaForex Company - www.instaforex.com |

| Knockout for the euro: the main thing is not to get sink to the bottom Posted: 01 Oct 2019 01:59 AM PDT The state of the single European currency is like a boxer who fought desperately to the last, but received a sudden blow, knocking him down. The euro sank sharply after news of a decline in the German economic growth forecast for 2019, and its recovery may be delayed, experts believed. Losses of the "European" after Reuters information about the deterioration of the German economic growth forecast for the current year amounted to 0.50%, to $ 1.0886. We can recall that the largest economic institutions expect only a slight increase from the locomotive of the European economy. In 2019, according to revised data, a growth of 0.5% is forecasted compared to the previous level of 0.8% recorded in April. Next year, the German economy is expected to rise by 1.1%, which is worse than the April forecast of 1.8%. Calculations for 2021, on the other hand, provide within 1.4% for economic growth in Germany. The collapse of the single European currency also contributed to a number of reasons. These include a stronger US dollar, easing the Fed's monetary policy and the protracted trade conflict between Washington and Beijing. These factors that increase the demand for US currency have hit Europe hard. To date, the EUR / USD pair has reached a price bottom that has not been fixed for 28 months. The beginning of October turned out to be difficult for the single European currency, due to the fact that the "European" is pressured by the burden of deteriorating statistical data over the past month. We can recall that in September, experts recorded a sharp decline in consumer prices in Germany. The data turned out to be worse than analysts expected. Now, the euro is "finished off" by the hopeless forecasts regarding the economic growth of Germany. The currency market is dominated by bearish sentiment. Thus, many traders and investors consider the fall of the euro to an extremely low bar of $ 1,0500 inevitable. However, more optimistic market players do not believe in such a development. They rely on an impressive margin of safety of the German economy. Meanwhile, a strong Eurozone labor market is driving domestic demand growth and offsetting the negative effects of trade wars and a slowdown in the global economy, analysts say. The statistics of past years, when the EUR / USD pair traditionally showed high rates in October, testify in favor of the euro. On the side of the "European" are the "bulls" who are ready to hold the defense and relying on weak statistics on the US labor market. They plan to gain a foothold at the previously noted support levels of $ 1.0875– $ 1.0885 and $ 1.0775– $ 1.0795. Currently, the European currency is trading between $ 1.0886– $ 1.0888. Recall that the euro fell to this level after the news about the worsening forecast for the growth of the German economy. Now, the main thing for the "European" is not to stay at the bottom, but to find a way to push from it, experts are sure. |

| Trading recommendations for the EURUSD currency pair - placement of trade orders (October 1) Posted: 01 Oct 2019 01:09 AM PDT Over the past trading day, the EUR / USD currency pair showed a high volatility of 62 points. As a result of which, the downward movement resumed. From the point of view of technical analysis, we see that the past pullback served the market in the form of a regrouping of trading forces, where the fulcrum in the form of a range level of 1.0900 / 1.0950 nevertheless fell under the onslaught of short positions, and, as a fact, the main trend continued its formation. As discussed in the previous review, traders were in no hurry to take hasty actions in the form of entering the market at the moment of fluctuation within the range level [1.0900 / 1.0950]. The main tactic in this case was to work on the breakdown of borders, which, as a matter of fact, turned out to be a lucrative undertaking. In fact, traders received the most suitable entry point at the time of the breakdown of the value of 1.0900, where the transaction is still being conducted. Considering the trading chart in general terms [the daily period], we see that the theory of preserving the global downward trend has been confirmed, where its basis on the fundamental and technical analysis reflects the reality of what is happening. In fact, the quote is already at the beginning of 2017, and this is not the limit, we still have where to fall. The news background of the past day had a data package for Europe, where the unemployment rate, surprisingly, fell from 7.5% to 7.4%, but this did not affect the single currency in any way. After that, preliminary data on inflation in Germany came out, and here, the euro was drained. Therefore, inflation is showing a slowdown from 1.4% to 1.2%, with a forecast of 1.3%, and if you recall the more recent data on industry in Germany, it will become much clearer. There is a slight lull in terms of informational background, where there are no particularly remarkable outbursts of activity from the West and Europe, but, as always, the regular Brexit comes to the rescue, who again makes its contribution to the activity. Thus, British Prime Minister Boris Johnson unofficially asks the European Union not to provide a new Brexit reprieve. In connection to this, it is expected that London will provide Brussels with a legal document containing proposals for alternative regulation of the problem of back-stop this week. Today, in terms of the economic calendar, we have preliminary data on inflation in Europe, where, according to expectations, its level should remain at 1.0%, but in view of yesterday's statistics for Germany, one should not be so sure about maintaining inflation at 1.0% . At the same time, Europe will publish data on business activity in the manufacturing sector, where they expect a decrease from 47.0 to 45.6. As you know, a data package for Europe does not carry anything good for a single currency. In the afternoon, the final data on the index of business activity in the manufacturing sector of the United States will be published, where they forecast growth from 50.3 to 51.0. Thus, we see that the American dollar looks quite attractive in terms of trading with it once again. EU 11:00 - Manufacturing PMI (Sep) EU 12:00 - Inflation (YoY): Prev 1.0% ---> Prog. 1,0% USA 17:00 - Manufacturing PMI Further development Analyzing the current trading chart, we see that downward interest remains in the market, where the quotation is fixed below the level of 1.0900, leaving behind the inertial move. In turn, speculators continue to hold short positions with the prospect of a further move, which, in principle, is quite logical. It is likely to assume that the temporary fluctuation within the levels of 1.0880 / 1.0900 will not last long, and sellers will nevertheless try to stretch the quotation towards the subsequent periodic level of 1.0850-1.0800, where we can already expect a fulcrum with subsequent rollback. The reverse picture of the plot, in this case, looks like stagnation within the lower boundary of the previously passed range level. Based on the above information, we derive trading recommendations: - We consider the buy positions in terms of finding a foothold in the area of 1.0850-1.0800 marks, with subsequent confirmation. - Most traders already have selling positions, thereby conducting a transaction in the direction of 1.0850-1.0800. Indicator analysis Analyzing a different sector of timeframes (TF), we see that indicators on all the main time intervals signal a further downward trend, which reflects the general background of the market trend. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 1 was built taking into account the publication time of the article) Volatility of the current time is 21 points, which is a moderate indicator for this time section. It is likely to assume that if the inertial course is maintained, volatility can still grow, reaching or exceeding the daily average. Key levels Resistance zones: 1.0926 ** 1.1000 ***; 1,1100 **; 1,1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support areas: 1.0850 **; 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level **** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

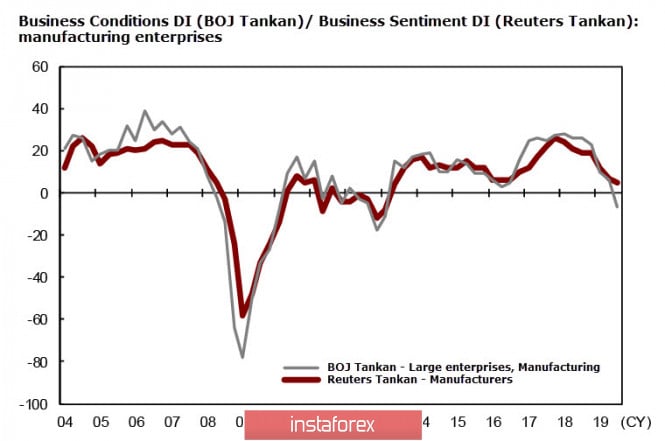

| The dollar is the favorite of the week, CAD is trading in the range, JPY will give way slightly Posted: 01 Oct 2019 01:08 AM PDT The dollar is growing across the entire spectrum of the market on Tuesday morning. Stock exchanges are traded mainly in the green zone, focusing on the fact that rumors about delisting of Chinese companies from US stock exchanges and restrictions on portfolio investment flows to China were promptly refuted by Spokeswoman of the US Treasury Monica Crowley and White House trading adviser Peter Navarro. At the same time, China does not expect positivity from the continuation of negotiations. The Shanghai index fell by -0.92% on Tuesday, which, with a simultaneous drop in oil below $ 60 per barrel and a decrease in gold, indicates a growing confidence of the markets due to the US dollar. Expectations of a global recession, in turn, are forcing investors to buy safe assets, but in the short term, expectations for trade negotiations will be fulfilled. Today, the main focus is on the publication of the ISM index in the US manufacturing sector. The forecast is positive, despite the global trend. Markets traditionally put on the United States with any increase in tension, especially since expectations on economic data remain generally positive. On Thursday - ISM in the service sector and on Friday - a report on the labor market. Until the markets see the result of their expectations, a change in trend is unlikely to happen. The dollar will remain a favorite until the end of the week. USD/CAD The Canadian dollar, in the absence of significant news, is trading in the range. A slight strengthening in recent days was caused by a reaction to oil growth after a decline in production, but the trend is not stable. Expectations that oil will jump to $ 100 per barrel were not met. On Monday, Saudi Aramco announced a full recovery in production to early September levels, and weak macroeconomic data in China and the eurozone which indicate a growing threat of falling demand. The Canadian continues to be in an unstable range from which an exit upward is slightly more likely. Moreover, a possible decrease in USD/CAD to the border of the channel 1.3180 will be used for repurchases. This support looks strong, and a little more likely movement to resistance 1.3305 / 10 and consolidation with the goal of breaking up. USD/JPY The Tankan index, which assesses the sentiment of large manufacturers, fell by 3 square meters. to 5p, which is the minimum since 2013. This decrease was less than predicted, but prospects remain weak. Large enterprises (all sectors) forecast that fixed investment in 2019 will grow by 6.6%. Meanwhile, the previous forecast is reduced by 0.7%. A worsening forecast indicates that enterprises are not expecting any optimism about rising demand due to an increase in tax. Forecasts on capacity utilization have also been revised downward, as well as the sales expectations (from 1.0% to 0.4%), while export reduction is projected. In general, the balance of risks, from the point of view of Japanese companies, is shifting downward. The data on industrial production published in December, which is a day earlier indicated a continued decline. The annual decline reached 4.7%. On the other hand, steel production in 2019 was already falling to a 10-year low, and there is little chance of a recovery in production, and hence export. Today, the consumption tax rate is raised from 8% to 10% in Japan. Thus, the Bank of Japan will begin to study the effects of tax growth on the economy. First of all, to change inflation expectations. However, it will take time to evaluate. Given the global slowdown and decline in exports, BoJ does not have much time to decide on new stimulus measures. Additionally, the dollar is strengthening throughout the spectrum of the market, and the yen is no exception. Today, an attempt is likely to test the resistance of 108.46 for strength. The probability of updating a local peak is high. Tankan survey data indicate that companies are waiting for the yen at the level of 108.60 or a little higher in the near future, and somewhere at this level, the yen will find the top. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Oct 2019 01:08 AM PDT EUR/USD Analysis: Since the beginning of August, a hidden correctional model has been developing on the euro chart. It lacks the final part (C). In recent days, the price of the pair is within the support zone of a large scale. An upward wave with a high wave level is formed on the shallow TF. Forecast: The current wave construction should end with a price jump up, at least to the minimum goals. In the coming sessions, a reversal and the start of a price increase are expected. The calculated zones show the expected limits of daily volatility. Potential reversal zones Resistance: - 1.0970/1.1000 Support: - 1.0900/1.0870 Recommendations: Euro sales are irrelevant today. As part of the intraday, it is recommended to pay attention to the emerging buy signals. For trading on large TFs, it is better to refrain from pair entry to the market at this time.

AUD/USD Analysis: The downward wave from September 12 to the present day exceeded the correction level of the previous bullish wave. The structure of the current movement looks complete. There is a need for correction. The price has reached the intermediate support level. Forecast: Contact with the reversal zone today can trigger a price pullback. Probably, it will take the form of a sidewall, but a short-term rise to the resistance zone is not excluded. A return to the main course of movement can be expected tomorrow. Potential reversal zones Resistance: - 0.6760/0.6730 Support: - 0.6700/0.6670 Recommendations: Being out of the pair's market is the safest tactic today. The potential for a decline in sales has been exhausted, but the conditions for purchases have not yet been created. At the end of the upcoming rollback, it is recommended to monitor the sell signals.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted – the expected movement. Attention: The wave algorithm does not take into account the length of time the tool moves! The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EURUSD on 10/01/2019 Posted: 01 Oct 2019 12:56 AM PDT