Forex analysis review |

- November 29, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- November 29, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC 11.29.2019 - Major Fibonacci confluence resistance at the price of $7.800 on the test, watch for selling opportuntiies

- EUR/USD for November 29,2019 - Key short-term support at the price of 1.0980 on the test, watch for potential rotation around

- Gold 11.29.2019 - Rejection of the main Fibonacci confluence resistance at $1.458, downside in play

- Gold for $ 4000 - fiction or reality?

- Technical analysis of GBP/USD for November 29, 2019

- Technical analysis of GBP/USD for November 29, 2019

- Simplified wave analysis of the AUD/USD, USD/CHF and GBP/JPY on November 29

- Trading recommendations for the GBPUSD currency pair - prospects for further movement

- Analysis of EUR / USD and GBP / USD for November 29. China's response to Hong Kong law could further worsen the relations

- Trader's Diary: EURUSD on 11/29/2019, About volatility.

- Fears of inflation (A review of EUR/ USD and GBP/USD on 11/29/2019)

- Analysis and forecast for AUD / USD on November 29, 2019

- Is the dollar synonymous with the leader and the euro with the outsider?

- Trading idea for gold

- Technical analysis of ETH/USD for 29/11/2019:

- EUR GBP CAD: The prospects for growth of the euro and the pound are very vague, while the pressure on the Canadian dollar

- Trader Morning Coffee 29/11_what you need to know

- Overview of the GBP/USD pair on November 29. Great Britain is out, is Scotland also out?

- Overview of the EUR/USD pair on November 29. The inflation in the European Union will probably not meet the expectations

- Technical analysis of BTC/USD for 29/11/2019:

- Technical analysis of GBP/USD for 29/11/2019:

- Hot forecast for EUR / USD on 11/29/2019 and trading recommendation

- Technical analysis of EUR/USD for 29/11/2019:

| November 29, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 29 Nov 2019 06:44 AM PST

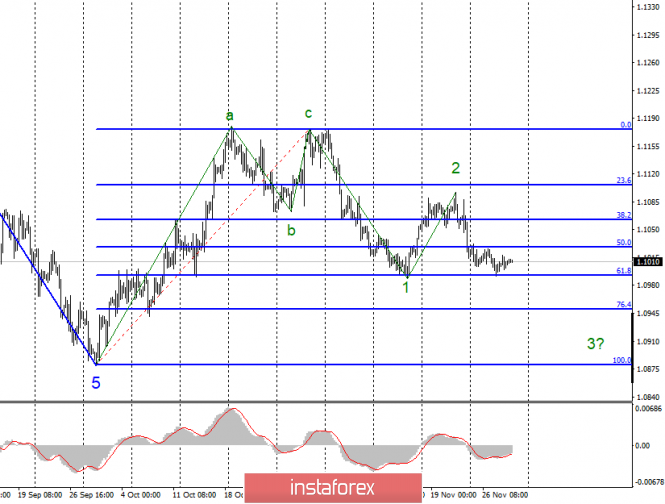

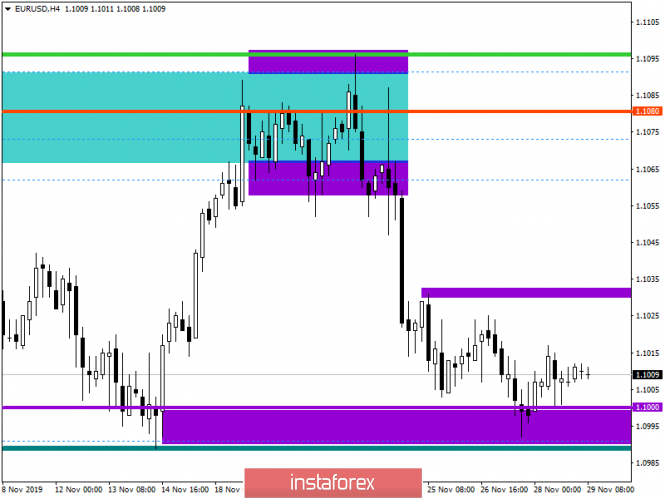

On October 2, an Inverted Head & Shoulders reversal Pattern was demonstrated around 1.0880. Few days later, bullish breakout above 1.0940 (neckline) confirmed the depicted pattern enabling further bullish advancement towards (1.1000 -1.1020). Since then, the EURUSD pair has trended-up until October 21 when the pair hit the price level of 1.1175. The price zone of (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Hence, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 which offered valid bearish positions few weeks ago. That's why, initial bearish decline was executed towards 1.1025 and 1.0995 where another episode of bullish pullback was initiated. Recently, the mentioned bullish pullback was demonstrated towards 1.1065-1.1085 where a cluster of supply levels were located (61.8% Fibo - 50% Fibo levels). Supply-Levels around 1.1065-1.1085 demonstrated significant bearish rejection that brought the pair back towards 1.1000 where a short-term flag pattern is being demonstrated. The current price action suggests a high probability of bullish reversal around 1.1000 that brings the EURUSD pair again towards 1.1065-1.1085. Thus the Pair remains trapped between the price levels of 1.1000 and 1.1085 until breakout occurs in either directions. Please note that any bearish breakout below 1.0980 invalidates the mentioned bullish scenario allowing further bearish decline towards 1.0940. The material has been provided by InstaForex Company - www.instaforex.com |

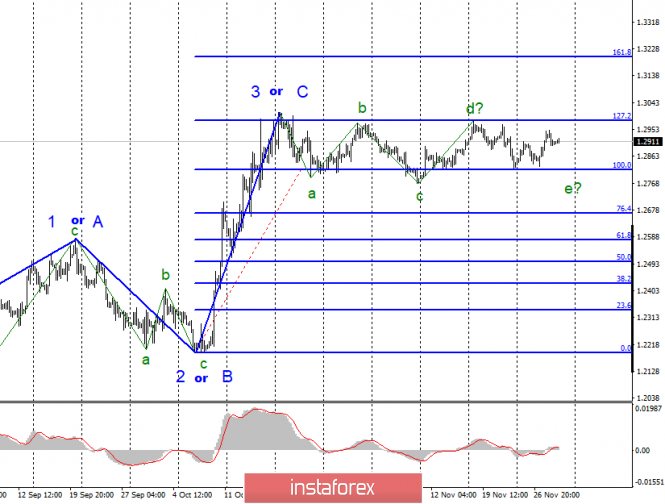

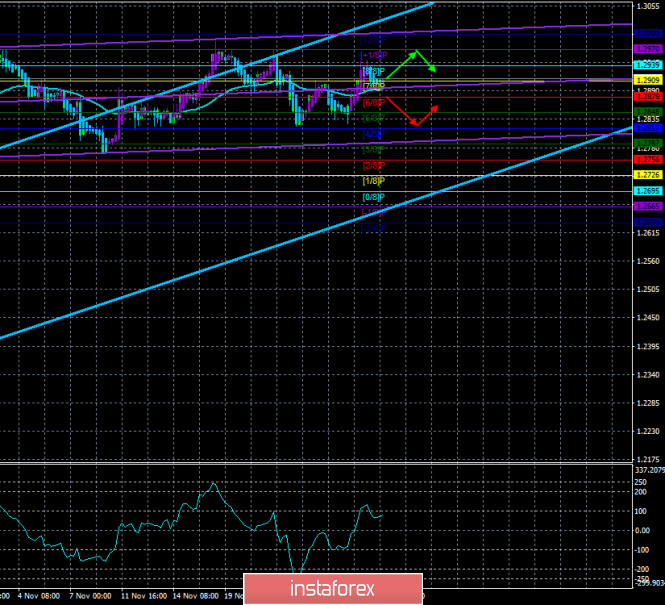

| November 29, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 29 Nov 2019 06:36 AM PST

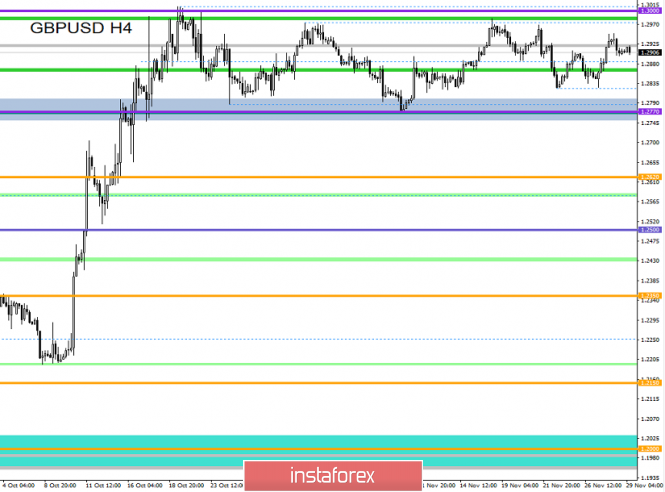

Since October 21, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Moreover, an ascending wedge reversal pattern was confirmed on October 22. This indicated a high probability of bearish reversal around the mentioned price zone. Hence, a quick bearish movement was anticipated towards 1.2780 (Key-Level) where bullish recovery was recently demonstrated on two consecutive visits. Since then, the GBP/USD pair has been trapped between the mentioned price levels (1.2780-1.2980) until now. Technical outlook remains bearish as long as consolidations are maintained below 1.3000 on the H4 chart. Moreover, negative divergence was being demonstrated on the H4 chart. That's why, high probability of bearish rejection existed around the price levels of (1.2980-1.3000). A quick bearish breakout below 1.2875 (short-term uptrend) was needed to enable further bearish decline towards 1.2780. However, early bullish recovery was demonstrated around 1.2825. On the other hand, the current bullish pullback towards 1.2900-1.2950 (backside of a broken uptrend) should be watched for early bearish rejection and another valid SELL entry. Please note that any bullish closure above 1.2950 invalidates the bearish scenario for the short-term. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2019 06:19 AM PST BTC has been trading upwards. The price tested the level of $7.775. Anyway, I see that there is potential end of the upward correction and strong resistance confluence at $7.800-$7.900. Watch for selling opportunities if you see any topping pattern around critical resistance $7.800.

Stochastic oscillator is showing overbought condition and potential for pullback. Resistance levels are set at the price of $7.800 ad $7.900 Support levels are set at the price of $7.730 and $6.550. Watch for selling opportunities near the resistance with the potential target at $6.550. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2019 06:10 AM PST EUR/USD did reach our main downward target at the price of 1.0994 but it found buyers there, which is sign that selling must be over for today. The level of 1.10980 is very important support and you should watch for potential reaction back to the upside.

Stochastic oscillator is showing rising highs and bullish divergence, which is sign that sellers are losing the power. Support levels are seen at the price of 1.1094 $ and 1.1080. Resistance level is set at 1.1018, 1.1028 and 1.1050. My advice is to watch for potential buying opportunities due to support on the test but anyway if you see the breakout of 1.1080 with high volume, there is potential for further downside and test of 1.0950 or 1.0915. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 11.29.2019 - Rejection of the main Fibonacci confluence resistance at $1.458, downside in play Posted: 29 Nov 2019 05:55 AM PST Gold did another rejection of our main multi-pivot resistance and Fibonacci confluence at $1.458, which is sign that there is still space for more downside movement and eventual test of $1.448.

Stochastic oscillator showed fresh new bear cross, which is good sign that sellers are still present and that selling opportunities are preferable. Support levels are seen at the price of $1.448 $ and $1.441. Resistance level is set at $1.458, $1.460 and $1.462. My advice is to watch for selling opportunities as long as the Gold is trading below the $1.462. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold for $ 4000 - fiction or reality? Posted: 29 Nov 2019 04:02 AM PST The current year for the yellow metal was full of surprises. Gold survived both the rise in prices and small drops but always remained a reliable asset. Nothing could shake its position except the recent force majeure situation. A fairly stable precious metals market was stirred up by the news that this week an unknown trader purchased a package of call options for gold with a strike of $ 4000 with expiration in June 2021. The amount of the shocking deal was around $ 1.75 million. According to analysts, profit from it is possible only if the precious metal price exceeds $ 4003.50 by the expiration date. Experts are unaware that what could change so dramatically in the world for the yellow metal to start trading at such a crazy price. Some market participants suspect that someone expects the collapse of the dollar system and makes similar bets on gold in order to protect their capital. Experts do not rule out a dizzying rally in the precious metals market when the price of gold goes to a new round and is many times higher than the current one. A number of gold options market players expect almost three times the rise in precious metals in a year and a half. However, the new deal exceeded all conceivable scenarios for the yellow metal. The previous gold price record was set in the summer of 2011, which was eight years ago, the cost of precious metals did not reach the level of $ 2000 per ounce. This happened at a time when the US Federal Reserve was carrying out a program of asset purchases, the volume of which reached an impressive $ 2 trillion. Nothing like this happened again, and the price of the yellow metal did not go beyond the standard framework. Since the beginning of this year, gold has risen in price by 14%, but still remains 25% below record levels. The precious metal is currently trading between $ 1462– $ 1463 per ounce. The market was agitated of buying expensive call options for gold due to the fact that no one relies on such rapid growth. If such a fantastic scenario is realized, the world of finance and precious metals will be turned upside down, analysts are sure. In a world where gold will cost more than $ 4,000, the US dollar will lose its status as the world's leading currency. Experts believe that the player who bets on a possible collapse of the dollar system admits the likelihood of such a development. In such a situation, one can only wait in which direction the vector of the precious metals market will go. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for November 29, 2019 Posted: 29 Nov 2019 02:14 AM PST Overview: The GBP/USD pair fell from the level of 1.2937 to bottom at 1.2888 yesterday. Today, the GBP/USD pair has faced strong support at the level of 1.2878. So, the strong support has been already faced at the level of 1.2878 and the pair is likely to try to approach it in order to test it again and form a double bottom. Hence, the GBP/USD pair is continuing to trade in a bullish trend from the new support level of 1.2878; to form a bullish channel. According to the previous events, we expect the pair to move between 1.2878 and 1.2969. Also, it should be noted major resistance is seen at 1.3023, while immediate resistance is found at 1.2969. Then, we may anticipate potential testing of 1.2969 to take place soon. Moreover, if the pair succeeds in passing through the level of 1.2969, the market will indicate a bullish opportunity above the level of 1.2969. A breakout of that target will move the pair further upwards to 1.3023. Equally important, the RSI is still calling for a strong bullish market as well as the current price is also above the moving average 100. Forecast: Buy orders are recommended above the area of 1.2878 with the first target at the level of 1.2969; and continue towards 1.3023. On the other hand, if the GBP/USD pair fails to break out through the resistance level of 12969 ; the market will decline further to the level of 1.2822 (daily support 1). The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for November 29, 2019 Posted: 29 Nov 2019 02:14 AM PST Overview: The GBP/USD pair fell from the level of 1.2937 to bottom at 1.2888 yesterday. Today, the GBP/USD pair has faced strong support at the level of 1.2878. So, the strong support has been already faced at the level of 1.2878 and the pair is likely to try to approach it in order to test it again and form a double bottom. Hence, the GBP/USD pair is continuing to trade in a bullish trend from the new support level of 1.2878; to form a bullish channel. According to the previous events, we expect the pair to move between 1.2878 and 1.2969. Also, it should be noted major resistance is seen at 1.3023, while immediate resistance is found at 1.2969. Then, we may anticipate potential testing of 1.2969 to take place soon. Moreover, if the pair succeeds in passing through the level of 1.2969, the market will indicate a bullish opportunity above the level of 1.2969. A breakout of that target will move the pair further upwards to 1.3023. Equally important, the RSI is still calling for a strong bullish market as well as the current price is also above the moving average 100. Forecast: Buy orders are recommended above the area of 1.2878 with the first target at the level of 1.2969; and continue towards 1.3023. On the other hand, if the GBP/USD pair fails to break out through the resistance level of 12969 ; the market will decline further to the level of 1.2822 (daily support 1). The material has been provided by InstaForex Company - www.instaforex.com |

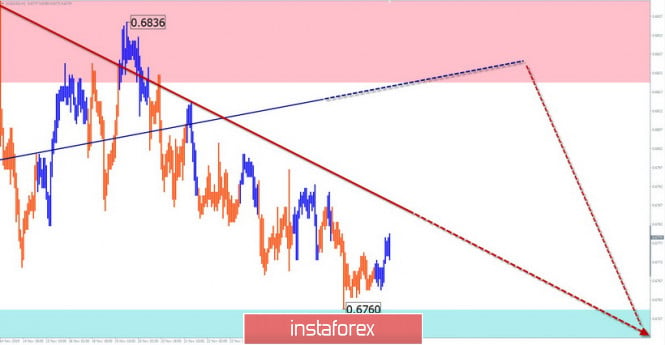

| Simplified wave analysis of the AUD/USD, USD/CHF and GBP/JPY on November 29 Posted: 29 Nov 2019 01:37 AM PST AUD / USD Analysis: On the chart of the Australian dollar, the unfinished wave design of the bearish, dated September 12, the last part of the wave started in late October. Within its framework, the last 2 weeks formed an intermediate correction, which lacks a final rise and the price is near the strong support. Forecast: Today is expected to be a "side", mainly with an upward vector, and the calculated resistance limits the level of probable rise. Potential U-Turn Zones Resistance: - 0.6820 / 0.6850 Support: - 0.6760 / 0.6730 Recommendations: Staying out of the Aussie market today will be the most sensible tactic. In the area of the resistance zone, it is recommended to track the reversal and the pair sell signals. Traders within the day can make short-term purchases with a reduced lot.

USD / CHF Analysis: On the Swiss franc chart, an upward wave structure has been developing since June, where the wave has a sufficiently large stroke potential and over time, this will allow us to move into the medium-term trend. Meanwhile, the price has reached its strong resistance. Forecast: On the following day, the price of the pair expects movement in the lateral plane. Before starting the decline, pressure on the resistance zone is possible, meanwhile, the support zone shows the most likely level of a rollback down. Potential U-Turn Zones Resistance: - 0.9990 / 0.1020 Support: - 0.9940 / 0.9910 Recommendations: Today, only intraday trading is possible on the pair market. Focus on sales. In the support area, it is recommended to monitor the reversal signals to find the most profitable entry points to long positions.

GBP / JPY Analysis: The main driving force of the cross in the short-term was the wave rising from August. The last section started on October 8th. Within its framework, over the past month, the price moved sideways, along the strong resistance. From November 22, the price forms an upward section with a reversal potential. Forecast: In the coming days, a lateral flat is likely, mainly with a downward vector. Before the start of the decline, pressure on the resistance zone is possible, with a short-term puncture of the upper boundary. Potential U-Turn Zones Resistance: - 141.50 / 141.80 Support: - 140.80 / 140.50 Recommendations: Today it is possible to trade a pair as part of the session, however, it is still too early to shop. Meanwhile, when selling, it is recommended to lower the lot and close deals at the first sign of a reversal. In the area of the support zone you need to prepare for cross-country purchases.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A, B and C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure presented in dotted lines, which is the expected movement. Attention: The wave algorithm does not take into account the length of time the instrument moves in time! The material has been provided by InstaForex Company - www.instaforex.com |

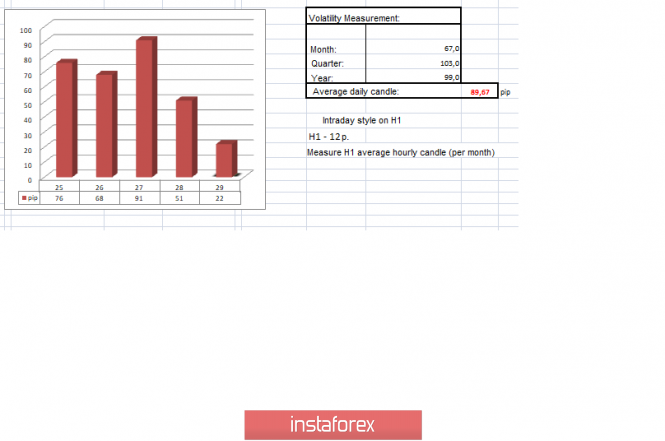

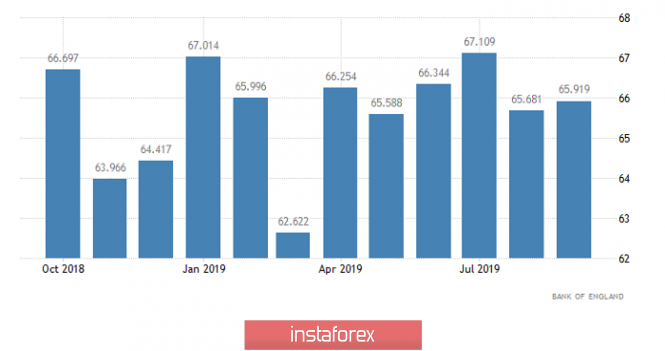

| Trading recommendations for the GBPUSD currency pair - prospects for further movement Posted: 29 Nov 2019 01:16 AM PST From the point of view of a comprehensive technical analysis, we see that against the background of inertial jumps of the past days, the quotation locally touched the high pressure area of 1.2950 / 1.3000, which led to a slowdown and partial return. Whether this is a conditional mining of the upper border of the flat or we have something else, this question worries many traders, so we will try to analyze it. Now, let's start with the fact that yesterday's movement could be triggered by several factors: local overbought amid a jump in quotes, as well as the massive fixation of long positions, which, due to the risk of further pressure from the 1.2950 / 1.3000 area, decided to leave trade deals. At the same time, no one forgot about such a factor as repetition, which was repeatedly confirmed in the flat structure, thereby slowing down relative to the upper frame maybe In terms of volatility, there is a slowdown, which may be due to the recent rally, but in terms of the emotional component of market participants, the same speculative interest is seen. As discussed in the previous review, many speculators left their long positions at the time of rapprochement with the 1.2950 / 1.3000 area and started to work on recovery, which also turned out to be profitable. Considering the trading chart in general terms [the daily period], we see that the movement within the flat has been going on for as long as a month and a half, and the key boundaries of 1.2770 / 1.3000 have not been broken even in terms of the test. This suggests that the indecision in terms of the main moves exceeds expectations, although they expect very strong jumps in case of breakdown. The news background of the past day did not have statistics, in addition to everything, the United States did not work, which was expressed in reduced trading volumes. The information background is still sorting through the news related to the election race of the two leading parties in Britain, and this is understandable, since the outcome of the elections will depend on whether the country leaves the EU or not. Therefore, the noise caused by the allegedly secret sale of the national health service [NHS] to US companies reached its peak. Prime Minister Boris Johnson officially replied that no one is going to sell our NHS service, and if such a question arises in the trade negotiations between England and Washington, then I will say "Goodbye" to Trump. Only time will tell how sincere is Johnson. Thus, it is worth understanding that the goal is to defeat the elections, and after the action can be radically different. In turn, his key opponent, Jeremy Corbyin, continues to work for the public, posting videos on his Twitter page with doctors and nurses who express problems with the existing system. Moreover, the leader of the Labor Party does not stop there, and during yesterday's debate on climate change, he announced Johnson's attitude to global issues, emphasizing that he did not attend the broadcast. "Boris Johnson demonstrated a lack of leadership in solving the biggest problems facing our planet today. What else can you hope for from someone who is funded by major polluters? ", - twitter @jeremycorbyn As you know, this whole show is built for only one thing - to lure voters and distract everyone from key issues. Today, in terms of the economic calendar, we only have data on lending in Britain, where the number of approved mortgage loans is reduced from 65.92K to 65.50K, and the volume of consumer lending by the Bank of England is growing from 0.828B to 0.900B. In turn, there is a shorter working day in the United States today, thereby trading volumes can be reduced. The upcoming trading week in terms of the economic calendar is expected to be filled. We have the ADP report and the subsequent report of the United States Department of Labor, which will interest market participants. At the same time, we have a conditionally finishing week ahead of the snap parliamentary elections, where again there will be a lot of noise and emotions. The most interesting events displayed below ---> Monday, December 2 Great Britain 9:30 Universal time - Manufacturing PMI (November): Prev 48.3 ---> Forecast 48.1 USA 18:00 Moscow time - Manufacturing PMI from ISM (Nov): Prev 48.3 ---> Forecast 49.4 Tuesday December 3rd Great Britain 9:30 Universal time - Index of business activity in the construction sector (November): Prev 44.2 ---> Forecast 44.0 Wednesday, December 4 Great Britain 9:30 Universal time - Composite PMI Index (Nov) Great Britain 9:30 Universal time - Index of business activity in the services sector (November): Prev 48.6 ---> Forecast 49.7 USA 13:15 Universal time - Change in the number of people employed in the non-agricultural sector from ADP (Nov): Prev 125K ---> Forecast 138K USA 15:00 Universal time - ISM index of business activity in the services sector (Nov): Prev 54.7 ---> Forecast 54.5 Thursday December 5th USA 13:30 Universal time - applications for unemployment benefits Friday December 6th USA 13:30 Universal time - Number of new jobs created outside of agricultural (Nov): Prev 128K ---> Forecast 183K USA 13:30 Universal time - Unemployment Rate: Prev 3.6% USA 13:30 Universal time - Average hourly wage (m / m) (November) USA 13:30 Universal time - Average workweek (Nov) Further development Analyzing the current trading chart, we see that the activity, ith the arrival of Europeans on the market, rose again after a nightly slowdown, where there was actually consolidation. Thus, the downward interest set by market participants yesterday, remains, displaying local candles in this direction. The focus is just yesterday's minimum 1.2898, which could give a kind of strengthening downward position. In terms of volatility, there is still weakness, but speculators are still on the market, which confirms the structure of the existing candles. By detailing the per-minute movement, we see that the Pacific and Asian trading sessions displayed consolidation from the candlesticks, and only during the period 05: 00-06:00 [UTC+00 time on the trading terminal] did the price jump. In turn, speculators plan to continue to work on the decline, as soon as the minimum of 1.2898 is broken yesterday. Given the overall picture of actions, it can be assumed that the 1.2950 / 1.3000 area will continue to exert pressure on the quotation, which over time may affect the increase in the volume of short positions. Thus, even in the case of repetition of plots of past periods relative to the side channel and decline, downward interest may prevail at one time or another, which will help direct the quotation again to the lower frame of 1.2770. Based on the above information, we derive trading recommendations: - Buy positions are considered in the case of a repeat of the amplitude fluctuation along the upper border of the flat, where you can consider local deals above 1.2950, but the prospect is small, from 15 to 35 points. The main purchase transactions are already considered in the case of a clear passage of the level of 1.3000, but this requires something more than just grazing, perhaps the election background or their results. - Sales positions are considered in terms of long-term recovery, where if the price is fixed lower than 1.2898, the quotation will go to the mirror level of 1.2885, and then it's worth looking at the fixing points to make a correct forecast. Indicator analysis Analyzing a different sector of timeframes (TF), we see that due to the return of the price back to the upper border of the flat, indicators on most periods changed the downward mood to the upward one. Short-term periods are working on recovery, signaling sales. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (November 28 was built taking into account the time of publication of the article) The current time volatility is 22 points, which is low for this time interval. It is likely to assume that volatility due to reduced trading volumes and freezing quotes will go within the framework of the average indicator. Key levels Resistance Zones: 1.3000; 1.3170 **; 1.3300 **. Support Areas: 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **. * Periodic level ** Range Level *** The article is built on the principle of conducting a transaction, with daily adjustments The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2019 12:58 AM PST EUR / USD On November 28, the EUR / USD pair completed with an increase of 5 basis points. Thus, the instrument continues to move away from previously reached lows after an unsuccessful attempt to break through the 61.8% Fibonacci level if a 5-point movement can be called a "movement". One way or another, an unsuccessful attempt to break through the low of wave 1 indicates that the market is not ready for further sales of the euro-dollar instrument. Since the current wave marking implies the construction of a bearish wave 3, only a successful attempt to break through the level of 61.8% can lead to continued decline in the instrument. Fundamental component: On Thursday, the news background for the euro-dollar instrument was much weaker than the day before. There is nothing I can highlight in the calendar of economic news but the preliminary inflation rate in Germany for November. However, even the inflation in Germany, which completely did not meet the expectations of the currency market, did not affect the activity of the instrument. On Friday, you can pay attention to inflation again, but only in the European Union. But the value, in Germany, will only be preliminary so I would not have expected that the activity of the market would increase due to one report, which is intermediate in nature. Today, the only conclusion that can be made during the day is the significance of inflation in the European Union by the end of the month - an approximate, of course. Thus, the amplitude of the EUR / USD pair remains today, which is most likely weak. At the same time, the markets will have to follow the news from China again, as Donald Trump has signed the laws relating to Hong Kong, and Beijing said it will definitely take measures in response to Washington's direct intervention in China's internal affairs. Moreover, the situation with Hong Kong could lead to a serious deterioration of relations between the countries and complicate negotiations on a trade agreement, which are already being moving "creakily". General conclusions and recommendations: The euro-dollar pair, presumably, continues to build wave 3. Thus, I now recommend selling the instrument again with targets located near the calculated levels of 1.0951 and 1.0880, which equates to 76.4% and 100.0% Fibonacci, but after a successful attempt to break through the 61.8% Fibonacci level. GBP / USD On November 28, the GBP/USD pair lost about 5 basis points, and the construction of the alleged wave of e continues to be in doubt. At the same time, the resumption of the construction of the upward trend section remains in even greater doubt until the successful attempt to break through the Fibonacci level of 127.2%. The entire trend section, originating on October 21, can transform into an even more complex horizontal wave structure. Fundamental component: On Thursday, the news background for the GBP/USD instrument remains quite weak. Thus, markets continue to pay attention to preliminary polls regarding voting in future elections. However, as we can see, the results of these sociological studies are not reflected in the chart of the movement of the instrument. In addition, there were no economic reports yesterday and there will also not be any today. Based on this, I believe that the wave pattern will not change for either the euro or the pound today. The markets, in turn, will continue to wait for new information about relations between China and the United States and they will wait for new information about the course of the election campaign in the UK, but all this news is unlikely to lead to strong movements. In December, meetings of the ECB and the Fed will be held, elections will be held in the UK, and Donald Trump will have to decide on the introduction of new duties on imports from China. Thus, it will be clearly more interesting than November. In the next few months, I expect more active trading, a stronger movement of each currency pair. General conclusions and recommendations: The pound / dollar instrument continues to build a horizontal trend section. Thus, now, I still expect the pair quotes to decline to around 1.2770 after the MACD signal "down", after which the wave pattern may require adjustments and additions. It is not recommended not to buy a pair not earlier than a successful attempt to break through the 127.2% Fibonacci level, which will indicate the willingness of the markets to build a new impulsive rising wave. The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's Diary: EURUSD on 11/29/2019, About volatility. Posted: 29 Nov 2019 12:51 AM PST

Let's talk about volatility. The European currency 17 years ago: This is a young currency, but statistics are already available. During its first 10 years, the euro "went" directionally per year on average of 2,000 - 2,200 points (in the 4-digit). In a crisis situation, volatility could be even higher, for example, the rapid collapse of the euro in 2008 is from 1.600 to 1.2400 in three months, and then the growth in a month is from 1.2400 to 1.4500. Against the background of these historical data, it is very noticeable how the EURUSD volatility fell over the past year. This, of course, had an extremely negative impact on the performance of the trend trading systems and strategies. Over the past 12 months, the maximum price of EURUSD is equivalent to 1.1570 and the minimum reached 1.0880, which is the annual volatility of 700 points. Over the past 7 months, it has a maximum of 1.1410 and a minimum of 1.0880, which is approximately 500 points, a strong slowdown in the market. What is the reason? The end of the eurozone debt crisis is what the euro feared in 2010-2014. The completion of the voluminous QE programs is first, the completion of the programs of the US Federal Reserve, and then followed by the ECB. Where the ECB's newly opened quantitative easing program is much smaller. Furthermore, and perhaps most importantly, the continuation of the ultra-long period of ultra-low rates of all the main Central Banks which are the Fed, the ECB, the Bank of England, and the Bank of Japan. Against this background, the pound's rapid movements recently became the result of the volatility due to Brexit, which slightly affects the euro. For stabilization, the euro plays its role as the "second major currency." The crisis in relations between the United States and China, due to the Trump trade war against China, has forced not only China but also other countries to ensure their reserves against US regulation in the event of an exacerbation of the crisis. Thus, it is possible that the low volatility of EURUSD will continue for a long time and probably, strong movements will be in the event of a new crisis in the global economy. Meanwhile, for local, the movement can start after December 11-12, when several important events will take place, the Fed, the ECB, and elections in Britain. EURUSD: We are ready to buy from 1.1035. We are ready to sell from 1.0985. The material has been provided by InstaForex Company - www.instaforex.com |

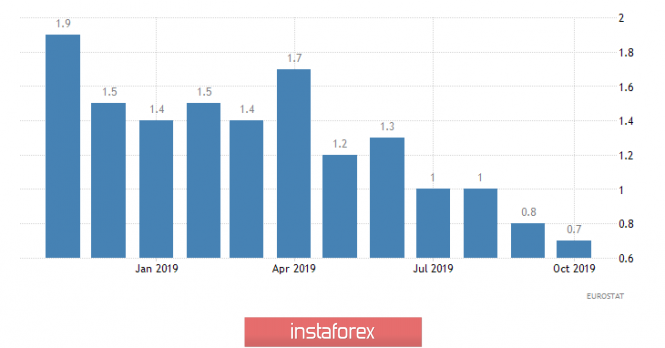

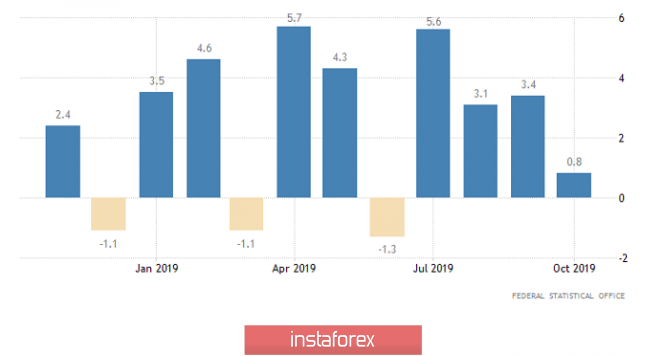

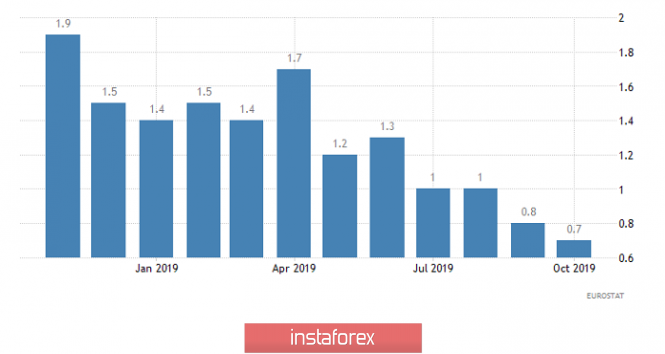

| Fears of inflation (A review of EUR/ USD and GBP/USD on 11/29/2019) Posted: 29 Nov 2019 12:32 AM PST While the Americans were sitting at the festive table and butchering their turkey, a number of quite interesting data was published in Europe. Thus, data on consumer lending showed an acceleration in its growth rate from 3.4% to 3.5%. However, this result is already expected, so no one was surprised. In addition, the data itself is not so important, and therefore, unable to exert any influence on the market. Nevertheless, there were a lot of interesting data from the eurozone countries besides this. Especially in Germany, where preliminary data on inflation were published, showing that it remained unchanged, although they expected acceleration from 1.1% to 1.3%. But these data are preceded by similar data for the entire euro area, and if the data turned out to be worse than forecasts in Germany, it is clear that you should not expect anything good from the pan-European ones. Besides, the decline in producer prices in Italy accelerated from -1.6% to -3.0%. And that makes it doubly sad when you realize that we are talking about the third economy of the euro area. Meanwhile, in the fourth economy of the euro area, that is, in Spain, preliminary data on inflation were also published, showing its growth from 0.1% to 0.4%. This, of course, is wonderful, but it still can not be compared with the data for Germany. Well, if we are to be completely meticulous, then we have the inflation in Belgium which slowed down from 0.5% to 0.4%. and this is not preliminary data, but quite the final ones. Moreover, I suggest looking at Ireland, not the North one, but the Republic, where the growth rate of retail sales slowed down from 3.8% to 3.0%. In the bottom line, the picture is clearly depressing except for Spain. But without their American colleagues busy celebrating Thanksgiving, European traders did not dare to take any steps. The Americans rested so they are now ready to join the battle. Moreover, in the financial world, nothing happens at all without them. So, the focus will be on preliminary data on inflation in Europe, which should show its acceleration from 0.7% to 0.9%. However, exactly the same forecasts were even before the publication of inflation data in Germany, which turned out to be worse. Thus, the idea suggests itself that the data for the entire euro area will be slightly worse than forecasts. At the same time, inflation is at an extremely low level, and if it continues to grow much slower than forecasts and plans, this increases the risk of further easing of the monetary policy of the European Central Bank. As a result, a single European currency may be under pressure. But in addition to inflation, there will also be published data on unemployment, which should remain at the same level, 7.5%. Inflation (Europe): Along with this, there is a lot of data on the countries of the euro area today. Thus, it is already known that the growth rate of retail sales in Germany slowed down from 3.4% to 0.8%, which, combined with stable inflation, does not represent the most promising prospects. In addition, German labor market data will also be published, and the unemployment rate is expected to remain unchanged. However, as we hope for the best, it was given by the data for France, which showed an acceleration of inflation from 0.8% to 1.0%, while the acceleration to 0.9% was predicted. Therefore, it is likely that the pan-European data will still turn out to be as predicted. At the same time, the final data on French GDP for the third quarter confirmed the fact of a slowdown in economic growth from 1.4% to 1.3%. We are also waiting for data on inflation and unemployment in Italy, which may please investors. The fact that preliminary data on inflation can show its acceleration from 0.2% to 0.3%, and the unemployment rate should decrease from 9.9% to 9.8%. As we can see, the data on the largest economies of the euro area are clearly mixed, although they are not as important as the pan-European ones. Retail Sales (Germany): The UK data is also of great interest, although everyone is now busy in the United Kingdom with pre-election battles and blaming their opponents for all conceivable and unimaginable sins. However, this does not negate the importance and significance of the real situation in the economy. So, the volume of consumer lending should be 900 million pounds against 828 million pounds in the previous month. Of course, credit growth is good, as it indicates an increase in consumer activity. However, the number of approved mortgage applications should be reduced from 65,919 to 65,500. Now, the reduction in the number of mortgages will clearly outweigh the growth in consumer lending given the enormous importance of the real estate market for the British economy. Mortgages Approved (UK): Thus, if we assume that inflation in Europe will accelerate exactly as expected, then a single European currency can grow to 1.1025. However, if the forecasts are not confirmed, then we should expect a decline to 1.0975. The pound will be under pressure due to its own data on mortgage lending, and thus, it is worth waiting for it to decline to 1.2825. |

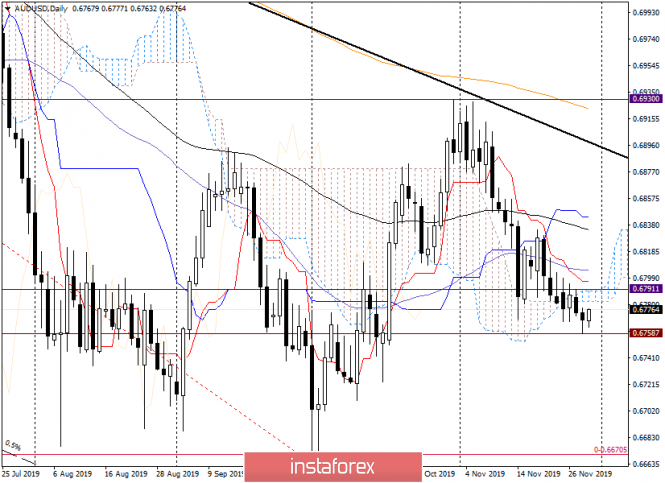

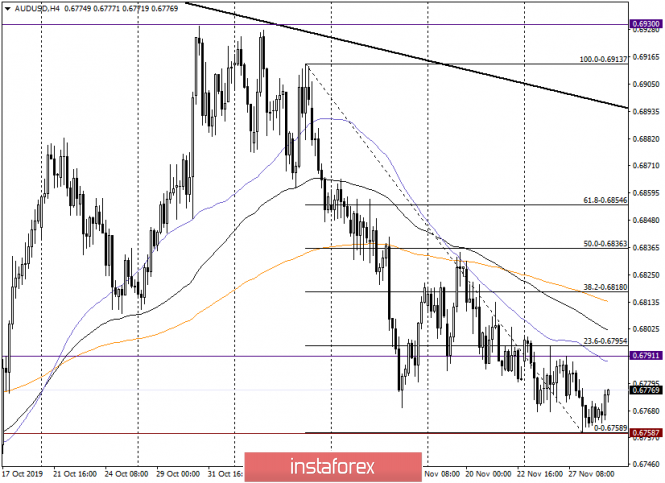

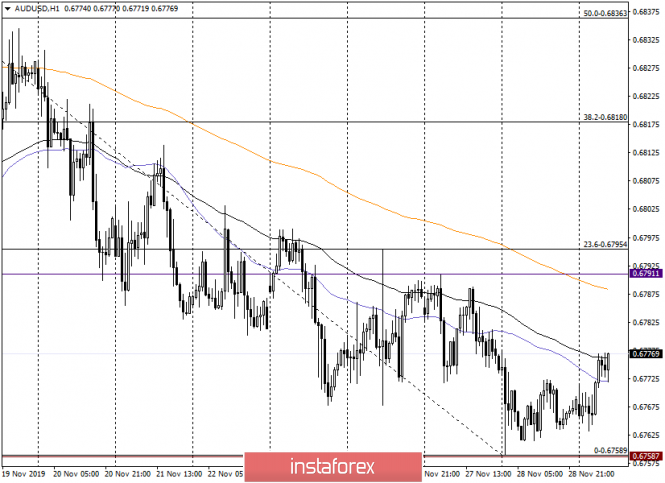

| Analysis and forecast for AUD / USD on November 29, 2019 Posted: 29 Nov 2019 12:14 AM PST Dear colleagues! The Australian dollar is likely to finish the fourth consecutive week with a decline against its opponent, the US dollar. However, at the moment, the downward trend is not as intense as it was in the previous five-day trading, but there is still time before the trading closes and much can still change. The shape of the weekly candle will be very important. Today, at 12:30 (Universal time), there will be a published data on lending to the Australian private sector on an annual and monthly basis. Both reports turned out to be weak and did not meet the expectations of market participants, amounting to 2.5% and 0.1%, respectively. Although it is worth recognizing that the dynamics of the Australian dollar, statistics on lending had virtually no effect. Moreover, despite the weak performance, at the time of writing the review, the AUD / USD pair is strengthening. Daily

Yesterday's candle, the lower shadow of which is larger than the body itself, gave every reason to believe that today the "Aussie" will grow, and so far this is exactly what is happening. If the climb continues, its closest target will be the lower border of the Ishimoku indicator cloud, which passes at 0.6782. Farther targets at the top are represented by the Tenkan line at 0.6797 and 50 simple moving average at 0.6805. Given that the weekly Tenkan is located at 0.6800, this mark, in my opinion, is extremely important for the pair. Because fixation above this significant level will indicate prospects for further growth, if this mission is impossible, most likely, the "Australian" will maintain a downward trend. At the current moment, key support is indicated by yesterday's lows at 0.6758, and its breakdown will open the way to targets in the area of 0.6725-0.6710. These are the prospects for AUD / USD on the daily chart. Now let's move on to smaller timeframes. H4

On this chart, I stretched the grid of the Fibonacci instrument to a decline of 0.6914-0.6759. Judging by the technical picture and the likely course correction, it is logical to assume that the pair can roll back to levels 23.6 and 38.2 from this downward movement. Given the close proximity to these levels of 50 MA, 89 EMA and 200 EMA, sales after rising to the price zone 0.6788-0.6814 seem like an interesting trading idea. At the same time, do not forget about the importance of the level of 0.6800, which only adds the prospect of sales near this mark. In the calculation of the correction of the purchase, you can try with current prices, with the removal of the stop below yesterday's lows of 0.6758 and targets near 0.6800. Further profit, in my opinion, is too early to expose. H1

On the hourly chart, at the time of completion of the review, the pair bogged down between 50 MA and 89 EMA, which provide support and resistance, respectively. I believe that it is this factor that can decide the direction of today's trading on AUD / USD. Leaving above 89 EMA will send the pair to 0.6788, where there are 200 exhibitors. A breakdown of 50 MA will make the next target of today's Asian session lows at 0.6763, the update of which will open the way to the support level of 0.6758. I suppose that in the current situation the pair will choose the northern direction and rise to the area of 0.6785-0.6815, from where it is worth taking a closer look at the sales of the "Australian". This is currently the main trading idea for AUD / USD. Meanwhile, shopping in the current situation can be profitable, but, given the main downward trend, it will be risky. You decide. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Is the dollar synonymous with the leader and the euro with the outsider? Posted: 29 Nov 2019 12:06 AM PST The desire of the dollar to occupy a dominant position in the pair EUR / USD is supported by the low volatility of the European currency. The euro goes through the crucible of disappointment and fatigue from trade wars and economic turmoil, while the greenback, on the contrary, is experiencing a surge of strength. Even the law on support for protesters in Hong Kong, signed by US President Donald Trump, could not affect the positive attitude of the "American". This step provoked a slight weakening of the greenback, although it managed to return quickly to the service. According to analysts, buyers will support the US currency as long as there is still hope for a trade deal between Washington and Beijing. A number of factors played into the hands of the dollar, including stunning statistics on the macroeconomic indicators of the United States. For the third quarter of this year, the country GDP showed explosive growth, which surprised and delighted experts. This caused a chain reaction in the market, triggering an increase in yield on US government bonds. In addition, investors were encouraged by the US labor market and durable goods sales. On this wave, market players were actively buying the dollar and selling the euro. The current situation has contributed to the stability of the dollar index against a basket of major world currencies. On Thursday, November 28, the EUR / USD pair showed moderate volatility. A day earlier, the European currency was declining in tandem, while the EUR / USD pair, fell to 1.0992 after the release of strong data on the US economy, including the GDP and durable goods. The key level on Thursday for the pair EUR / USD remained the range of 1.1013–1.1015. Buyers of the European currency tried to raise tandem quotes above this level, but the attempt failed. Moreover, the EUR / USD pair began to decline steadily, almost reaching the bottom. The tandem dropped to the psychologically important level of 1,1003–1,1004. According to experts, the EUR / USD pair found a balance near the key round level of 1.1000, while not having strong drivers to form a new impulse. Friday morning of November 29, the EUR / USD pair began on a major note, as the pair showed a moderate rise, stepping to the level of 1,1010, where the market perked up, but it was too early to rejoice. In the future, the pair will be in the grip of bearish sentiment again trading at around 1,1007–1,1008, contrary to this, analysts expect a small but stable tandem growth. The European currency in the EUR / USD pair is under more pressure than the American currency, experts emphasize. At the same time, the US dollar, like an experienced strategist, is strengthening its position step by step. This happens not only in the classic EUR / USD pair but also in other currency pairs, such as the USD / JPY. Greenback's potential is large enough not only to resist difficulties but also to expand its leadership in the global financial market. However, the euro also should not be written off, analysts are sure. A single currency can sometimes lose a local battle, but not a war, and you should not consider it an outsider of the financial market, economists conclude. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Nov 2019 12:04 AM PST Good afternoon, dear traders! I present to you the trading idea for gold. The strengthening of the US dollar is going on all fronts - both in currency and in stock. Therefore, investors go to the dollar "cache" before the turbulent New Year's month. On the other hand, the story of the impeachment of Trump did not lead to anything. At the same time, the United States controls the riots in Hong Kong, but continues to hope for successful negotiations with China. Against this background, gold falls all November. The technical picture is actually very interesting for the "geometric traders" longs, against which our trading method of "hunting for stops" is set up. Now, pay attention to the chart below. Gold came close to the mirror level, or, as many people call it the "support-resistance level". Moreover, it approached it for the second time. As you know, I regularly provide forecasts for the breakdown of obvious technical models, working against the "crowd". The first "mirror" test is usually true while the second and third - lead to a breakdown of the level. No one knows whether the breakdown will be true or false, but our task is to gain profit on this event. Therefore, I recommend choosing signals to go down with profit taking after the breakdown of November and the mirror level under the quotation 1446 and below. Good luck in trading and follow the money management! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of ETH/USD for 29/11/2019: Posted: 28 Nov 2019 11:58 PM PST Crypto Industry News: Leading cryptocurrency exchange Binance announced in its blog that it has started working with the TravelByBit crypto startup to introduce a reward card that facilitates cryptocurrency payments on major travel websites. According to the announcement, the card will work like a traditional prepaid card with access to additional rebates and rewards, which users will be able to load using Bitcoin, Binance USD, Binance Coina and Ontology. The card will be issued at the beginning of next year and will initially be addressed to travelers in the Association of Southeast Asian Nations, Australia and Europe, with plans for gradual expansion. The service will allow customers to book flights and hotels through major websites, including Booking.com, Expedia, Agoda and Ctrip, as well as their own TravelByBit platform. TravelByBit is not the first service enabling users to travel thanks to cryptocurrencies. Recently, there have been reports that the Travala cryptocurrency booking company has announced that it will now allow its clients to book any hotel that can be booked via cryptocurrency via Booking.com. Earlier this summer, the co-founders of the Scandinavian air carrier Norwegian Air announced plans to launch their own cryptocurrency exchange, which will then make it easier for the airline to accept cryptocurrency payments. Technical Market Overview: The ETH/USD pair is currently testing the key technical resistance located at the level of $152.28 and even a new local high was made at the level of $154.78. Nevertheless, the move upwards was made in three waves only, so it looks like a typical simple corrective move during a downtrend. When the correction is terminated, the market should resume the downtrend. The key short-term support is seen at the level of $136.98. Weekly Pivot Points: WR3 - $213.59 WR2 - $198.67 WR1 - $165.68 Weekly Pivot - $151.03 WS1 - $118.96 WS2 - $103.42 WS3 - $72.28 Trading Recommendations: The best strategy in the current market conditions is to trade with the larger timeframe trend, which is still up. All the shorter timeframe moves are still being treated as a counter-trend correction inside of the uptrend. When the wave 2 corrective cycles are completed, the market might will ready for another wave down.

|

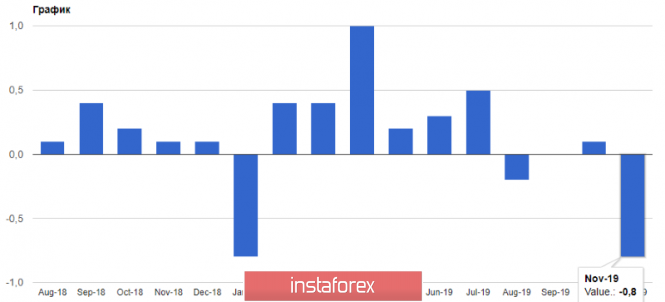

| Posted: 28 Nov 2019 11:54 PM PST Another weak inflation data in Germany confirmed the existence of problems due to which the European Central Bank has to keep rates at zero and negative levels. According to the report, consumer prices in Germany in November this year declined more significantly than expected. Thus, inflation in the country has moved further away from the target level of the European Central Bank. EUR/USD A report by the German Federal Bureau of Statistics indicates that the consumer price index in November declined immediately by 0.8% compared with the previous month. Harmonized by the standards of the EU, the index also fell. Despite that, economists had expected a decline, but only by 0.5%. The fall of the Germanized index was predicted at 0.7%. The main pressure on inflation was due to lower energy prices, which fell immediately by 3.7% in November compared to the same period in 2018. In general, the CPI index grew by only 1.1% compared to 2018, while economists predicted growth of 1.3%, which clearly does not reach the target level of the ECB at about 2.0%. As for the technical picture of the EUR/USD pair, it remained unchanged. The market continues to be in a "suspended" state. If the bears miss the resistance 1.1015, the demand for the euro may return, which will quickly lead to the renewal of highs 1.1040 and 1.1060. At the same time, an unsuccessful attempt to return to resistance 1.1015 can maintain negative views on the purchase of the euro, which will push the pair to a minimum of 1.0993 and lead to its breakdown, allowing the bears to reach support 1.0970. USD/CAD Yesterday, data on Canada did not significantly affect the USD/CAD pair. Canada's current account deficit in the balance of payments increased in the 3rd quarter, and the labor market created fewer jobs than projected. According to a report by the Bureau of Statistics Canada, the current account deficit in the balance of payments amounted to 9.86 billion Canadian dollars during the 3rd quarter, while economists expected the deficit to amount to 10.6 billion Canadian dollars. A deficit means that the economy imports more capital, goods, and services than it exports. Moreover, a report by the National Bureau of Statistics Canada also indicated that the number of non-farm jobs in September fell by 27,600 compared with the previous month. At the same time, the unemployment rate fell to 5.5% and most of the jobs lost are in retail and construction. Compared to the same period of the previous year, the number of jobs outside Canada's agriculture in September grew by 1.8%, which is to 303,700. In addition, a 4% increase in average earnings in Canada compared to the same period of the previous year also helped partially offset the negative effect of the report. As for the technical picture of the USD/CAD pair , the pair is currently locked in a wide side channel 1.3260-1.3320. The middle of the channel is area 1.3295, from which the further direction of the trading instrument will depend. An unsuccessful attempt to grow above this resistance may return the Canadian dollar to the market, which will lead to a decrease in the pair to the support area of 1.3260, beyond which it will provide a bearish impulse to a minimum of 1.3230. If the bulls catch on the middle of the channel, we can expect a smooth growth of the trading instrument to the resistance 1.3320. GBP/USD The British pound remains under slight pressure against the US dollar. While all the discussion is about the confident victory of the Conservative Party in the elections, the British pound is still gradually decreasing, and the reason for this is the uncertainty with the future of the UK. Thus, even if Boris Johnson and removes the country from the EU, the problems from this will be no less, but certainly even more. Due to this, concluding new trade agreements and agreements with partners in the EU will take a long time before the UK economy begins to show healthy and sustainable growth. As for the short-term technical picture of the GBP/USD pair , a lot will depend on how buyers will show themselves in the 1.2880 support area. If the bulls manage to maintain this level, we can talk about the continuation of growth to a maximum of 1.2970 and updating it with a resistance test of 1.3020. A larger downward correction below 1.2880, in turn, will lead to an update of the low of 1.2825. The material has been provided by InstaForex Company - www.instaforex.com |

| Trader Morning Coffee 29/11_what you need to know Posted: 28 Nov 2019 11:41 PM PST Good morning everybody, Thanksgiving Day has passed and American futures are fractionally down since yesterday's shortened and low-volume session (-0.2 / 0.3% on average). We woke up with Germany's retail sales disappointing (0.8% ag 1.3% expected Y/Y, -1.9% m/m) and the rating agency FITCH warning that the "Japanification of Europe" (slow growth and high debt) could soon trigger downgrades on Sovereign Bonds. By the way, tonight Mr Kuroda, Governor of the Bank of Japan, again advocated for new future monetary stimulus as 7 years of it has been largely unsuccessful and is a good idea not to lose the old vices. Ohh, monetarists! Volatility is extremely low on all major currencies pairs. It is a good time for playing it through options I would say. A bunch of data is due in the EU and Canada today. Let's have a look: ECONOMIC DATA

OVERNIGHT - Asian equity markets were mostly subdued after the holiday closure stateside and amid continued trade uncertainty - Hong Kong Polytechnic University siege was confirmed to have ended as police swept through a vacant but devastated campus yesterday - Bank Of China sets USD/CNH mid at 7.0298 (always look at 7 barrier!) while affirming to have enough room for monetary action. The OPEC countries will reach consensus to extend the pact on oil production cuts extension in Vienna according to OIL MINISTER OF OMAN CITI AND BNP PARIBAS lowers OIL TARGET for next year at $50 BBL - Data showed that 3Q earnings are now expected to decrease 4.4% YoY (up from -4.7% prior week) That's all, stay safe The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the GBP/USD pair on November 29. Great Britain is out, is Scotland also out? Posted: 28 Nov 2019 11:40 PM PST 4-hour time frame Technical data: Upper linear regression channel: direction - up. Lower linear regression channel: upward direction. Moving average (20; smoothed) - sideways. CCI: 90.3272 The GBP/USD currency pair continues to trade inside the side channel. The upper boundary of which is the Murray level of "+1/8" - 1.2970. Yesterday, traders tried to overcome this level once again, but they did not have enough strength to even get to it. Thus, the pair continues to be within the side range and, accordingly, the technical picture remains the same. The pound / dollar volatility has increased slightly, but this is still not enough to resume the trend movement. If for the EUR / USD pair we have at our disposal a "paradoxical situation" that does not allow quotes to go up or down, then in the case of the GBP / USD pair we have a complete reluctance of traders to trade until the announcement of the results of the elections to the UK Parliament is announced. The fact is that despite the possible victory of the conservatives, in which no one doubts, the question remains open whether they will gain the necessary number of votes in order to freely implement Brexit until January 31? According to the latest large-scale studies, it turns out that yes, they will, but still this is not a reliable fact. In addition to the fact that Brexit can still take place before January 31 and the long-standing saga finally ends, we draw the attention of traders to the fact that the UK will not have less problems. Yes, the problem of "divorce" with the European Union will go away, and immediately a much more serious problem "life of the country after the termination of all ties with the EU" will arise. Even if Brexit is "soft," it still will not save the UK economy from the economic downward turn, which is now visible to the naked eye even before leaving the EU. Now, for the economic situation in the UK to stabilize, it will need to establish trade relations with the European Union and other countries. This may take a year, or maybe more time. Thus, all of us are now witnessing trade negotiations between China and the States and we understand how long trade negotiations can last. However, Johnson's Great Britain also wants a "deal" with America. In addition to problems with the "new life of Great Britain", London may also face serious losses in the form of Scotland's exit from the United Kingdom. It can be recalled that the Prime Minister of Scotland, Nicola Sturgeon has repeatedly stated that the Scottish people do not want to leave the European Union, not impressed with the "deal" of Boris Johnson with Brussels. Yesterday at the event, which is eloquently called "Stop Brexit," Nicola Sturgeon reiterated that "Scotland's future is in jeopardy, and the outcome of the election will determine which path the country will take and who will determine its future." Sturgeon also noted that "Prime Minister Boris Johnson is dangerous and unsuitable for his office, and that his proposed Brexit deal will be a nightmare for Scotland." Thus, after the epic "Great Britain's exit from the European Union" is over, we can immediately witness the epic "Great Britain's exit from Great Britain", which can also last at least a year. Needless to say, the loss of Scotland has potentially additional economic problems for London? Thus, we believe that the prospects for the pound remain in any case extremely vague, even if the long-awaited Brexit takes place. At the moment, the pound/dollar pair is trading near the moving average line, which is directed to the side and still does not respond to any fundamental data, either economic or political in nature. Since no important publications are planned for Friday, November 29, it is unlikely that traders will be able to withdraw a pair from the wide side channel today. The nearest support levels: S1 - 1.2909 S2 - 1.2878 S3 - 1.2848 The nearest resistance levels: R1 - 1.2939 R2 - 1.2970 R3 - 1,3000 Trading recommendations: The GBP/USD remains inside the side channel. The area of 1.2970-1.3010 has remained unsurpassed, so we are not waiting for the formation of a new upward trend. Nevertheless, trading inside the side channel is possible. For example, a rebound is possible from the level of 1.2970 and a turn of the Heiken Ashi indicator down may signal a round of downward movement. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanations for illustrations: The upper linear regression channel is the blue unidirectional lines. The lower linear channel is the purple unidirectional lines. CCI - blue line in the indicator regression window. Moving average (20; smoothed) - a blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Nov 2019 11:40 PM PST 4-hour time frame Technical data: Upper linear regression channel: direction - up. Lower linear regression channel: direction - down. Moving average (20; smoothed) - down. CCI: -37.2052 The next trading week came to an end, and the currency pair managed to show the maximum amplitude of the movement of points 20-25 during the first four trading days, despite the fact that there were important macroeconomic publications on some days and simply important news of a political and geopolitical nature. However, traders continue to stubbornly remain "on the fence." Thus, we still believe that the "paradoxical situation", which we have already described several times, is to blame. At current minimum levels, sellers are simply afraid of new sales of the European currency, remembering the main postulate of the currency market: "Sell at the highs, buy at the lows". It is only at this time a fundamental background continues to work in favor of the American currency, in contrast with this postulate. Thus, the news speaks in favor of further sales of the euro / dollar pair, although it is trading around two-year lows. Traders might be glad to go purchasing, but there is no fundamental reason for this. Yesterday, inflation in Germany frankly failed, remaining at + 1.1% y / y, although experts expected acceleration to 1.3% y / y. What can we expect from pan-European inflation today if inflation in a country with a locomotive economy for the entire EU is not accelerating? We believe that the value of the consumer price index in the European Union will also remain at the same level - 0.7% y / y, although forecasts here also predict an acceleration to 0.9% y / y. However, even if the consumer price index rises to 0.9%, this is unlikely to support the euro and cause high demand for it. Just because the current inflation rate is very low and very far from the target level of the ECB. Moreover, it's worth adding that this is not the final value of the November CPI. That is, whatever the actual value of the indicator, the market is unlikely to react to it at all. In addition to this single macroeconomic report, no publications are planned for either the EU or the States today. Thus, from the last trading day of the week, November 29, we do not expect anything extraordinary. We don't think that traders will activate today and stop sitting on the fence, even if new information is received on the topics "US-China trade negotiations" or "Beijing countermeasures against the Hong Kong law". Most likely, we really have to wait now either for the next ECB meeting, where Christine Lagarde can either announce a reduction in the key rate in the near future, or immediately lower it, or a major player entering the international currency market that sets the tone for trading. Unfortunately, the second scenario is impossible to predict. Therefore, for those traders who do not want to trade in the 20-point range, there is only one thing left - to wait for the growth of volatility and the resumption of trend movement. From a technical point of view, everything rests on the level of 1.0989 now, which is the last local minimum. Until traders manage to overcome this level, it makes no sense to expect further strengthening of the American currency. Traders, in turn, still show a weak desire to sell a pair of euro/dollar in the area of two-year lows and near the previous local minimum. Thus, in order to have the opportunity to sell the currency pair again, it is recommended to wait until the level indicated above is overcome. By the way, the Bollinger bands narrowed as much as possible and turned to the side, which now signals a flat on the 4-hour time frame. Although with an average daily volatility of 30 points, nothing else was to be expected. The nearest support levels: S1 - 1,0986 S2 - 1.0925 S3 - 1,0864 The nearest resistance levels: R1 - 1,1047 R2 - 1,1108 R3 - 1,1169 Trading recommendations: The euro / dollar is correcting again, as indicated by the Heiken Ashi indicator, but the downward trend remains. Thus, it is now recommended that you wait for the correction to complete and trade the pair again for a decline with the first target of 1.0986. However, this level is very close to the level of 1.0989, so we even recommend waiting for it to be overcome and only then selling the pair. It is recommended to buy Euro currency no earlier than fixing traders above the moving average line with the first target of 1.1047. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanations for illustrations: The upper linear regression channel is the blue unidirectional lines. The lower linear regression channel is purple unidirectional lines. CCI - blue line in the indicator window. Moving average (20; smoothed) - a blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of BTC/USD for 29/11/2019: Posted: 28 Nov 2019 11:28 PM PST Crypto Industry News: Kraken, one of the largest and oldest Bitcoin exchanges in the world, has joined the Silvergate Exchange Network (SEN). By joining the SEN, the US cryptocurrency market enables its clients to deposit and withdraw US dollars from Silvergate accounts without charge, the company announced. According to the announcement, the deposit process will vary depending on whether Kraken users have a Silvergate account. If they have a Silvergate account, Kraken users will simply need to enable SEN funding on their Kraken account before using this option. Those who do not have a Silvergate account will need to submit a separate application to the bank. Silvergate Capital is a commercial bank based in California that focuses on businesses with digital currencies. SEN Silvergate is a network of cryptographic exchanges and investors that enables transactions in US dollars between network members. Silvergate's clients include crypto exchanges, miners and trustees. A cryptocurrency friendly bank increased the number of customers using digital currencies from 655 from June 30, 2019 to 756 on September 30, 2019. In August 2019, the SEN added another important partner, the Gemini Stock Exchange, founded by the Winklevoss brothers, thus enabling faster transfers in US dollars. Earlier this month, Silvergate Bank introduced its shares to trading on the New York Stock Exchange under the symbol NYSE: SI. Technical Market Overview: Since the new local high on the BTC/USD was made at the level of $7,616 which is above the key technical resistance located at the level of $7,234, the market has entered a sideways trading phase. The range has been established between the levels of $7,313 - $7,616. Please notice, the move up is in three waves only, so it is a typical corrective wave to the upside which should be only a local correction. When the correction is completed, the market will resume the downtrend. Weekly Pivot Points: WR3 - $9,581 WR2 - $9,033 WR1 - $7,830 Weekly Pivot - $7,282 WS1 - $6,055 WS2 - $5,531 WS3 - $4,254 Trading Recommendations: The best strategy in the current market conditions is to trade with the larger timeframe trend, which is still down. All the shorter timeframe moves are still being treated as a counter-trend correction inside of the uptrend. When the wave 2 corrective cycles are completed, the market might will ready for another impulsive wave up of a higher degree and uptrend continuation.

|

| Technical analysis of GBP/USD for 29/11/2019: Posted: 28 Nov 2019 11:22 PM PST Technical Market Overview: For the whole month, the GBP/USD pair has been trading inside of the narrow range located between the levels of 1.2765 - 1.3012 and there is no signal for any reversal or any breakout yet. The bulls still seem to be unable to break through the wall of technical resistance levels located from 1.2939 to 1.3012, nevertheless, they try again to break out higher and currently are testing the level of 1.2939 again. The momentum is now positive due to the market coming off the oversold conditions, which will help the bullish case. The larger timeframe trend remains down. Weekly Pivot Points: WR3 - 1.3071 WR2 - 1.3026 WR1 - 1.2910 Weekly Pivot - 1.2886 WS1 - 1.2750 WS2 - 1.2708 WS3 - 1.2590 Trading Recommendations: The best strategy for current market conditions is to trade with the larger timeframe trend, which is down. All upward moves will be treated as local corrections in the downtrend. In order to reverse the trend from down to up, the key level for bulls is seen at 1.3012 and it must be clearly violated. The key long-term technical support is seen at the level of 1.2231 - 1.2224 and the key long-term technical resistance is located at the level of 1.3509. As long as the price is trading below this level, the downtrend continues towards the level of 1.1957 and below.

|

| Hot forecast for EUR / USD on 11/29/2019 and trading recommendation Posted: 28 Nov 2019 11:21 PM PST As expected, nothing happened on the market at all while the Americans celebrated Thanksgiving. At the same time, several rather interesting data were published in Europe. In particular, the growth rate of consumer lending in Europe accelerated from 3.4% to 3.5%. However, the data coincided with the forecasts, and few people could be impressed. But the most important thing is that these data are of little interest to anyone and have practically no effect on the market. Nevertheless, preliminary data on inflation in Spain and Germany are more interesting, especially in anticipation of the publication of data for the entire euro area. Thus in Spain, the fourth euro zone economy, inflation accelerated from 0.1% to 0.4%. Although as expected, it did not accelerate in the flagship of Europe, Germany, inflation, and just remained unchanged. Therefore, there are suspicions that today's data across the Euro area, will be slightly worse than forecasts.

So, today, it is quite obvious that the focus of attention is only the preliminary data on inflation in Europe. Moreover, no data is released at all in the United States. As a result, forecasts indicate that inflation will accelerate from 0.7% to 0.9%. However, do not forget about yesterday's data on inflation in Germany, and since inflation is not growing in the largest economy of the euro area, there is every reason to believe that it will not accelerate even within the whole of Europe. So almost certainly, the data will be worse than forecasts, which will seriously disappoint investors. After all, they proceed precisely from long-term inflation forecasts, which are destined not to be successful, which means that there is a need to revise their investment plans. This is not in favor of a single European currency. Inflation (Europe):

In terms of technical analysis, we see all the same fluctuation within the psychological level of 1.1000, which holds back the quote from the beginning of the trading week. The characteristic slowdown clearly reflects the indecision in terms of the main recovery, relative to the elongated correction, where the level of 1.1000 plays the role of a support. Thus, multidirectional interest set variable boundaries 1.1000 / 1.1025, where the oscillation continues up to now, waiting for the next impulse. In terms of a general consideration of the trading chart, we see an oblong correction from 1.0879 to 1.1180, after which a long recovery process has begun, playing back a little more than half of the entire course. It is likely to assume that the fluctuation along the reference level of 1.1000 will remain in the market and only in the case of a characteristic push, possibly against the background of statistical data, we will see an attempt to break the accumulation. The best development strategy is still to analyze the control points 1.0990 / 1.1035, for their breakdown. Concretizing all of the above into trading signals: - Long positions are considered in case of price fixing higher than 1.1035, not a puncture shadow. - Short positions are considered in case of fixing the price lower than 1.0990, not a puncture shadow. From the point of view of a comprehensive indicator analysis, we see that many indicators have taken a neutral position due to multi-day narrow accumulation and only daily periods maintain a general downward market mood.

|

| Technical analysis of EUR/USD for 29/11/2019: Posted: 28 Nov 2019 11:19 PM PST Technical Market Overview: The bears at EUR/USD pair are clearly in control of the market in low liquidity conditions, but and they are testing the 61% Fibonacci retracement again located at 1.0994. The next target for bears is seen at the level of 1.0989, which is the key technical support. Please notice, that the negative momentum supports the short-term bearish outlook, but the trading conditions are now poor as the average trading range is 20 pips. The nearest technical resistance is seen at the level of 1.1024. The larger time-frame trend remains down. Weekly Pivot Points: WR3 - 1.1143 WR2 - 1.1119 WR1 - 1.1059 Weekly Pivot - 1.1036 WS1 - 1.0979 WS2 - 1.0950 WS3 - 1.0894 Trading Recommendations: The best strategy for current market conditions is to trade with the larger timeframe trend, which is down. All upward moves will be treated as local corrections in the downtrend. The downtrend is valid as long as it is terminated or the level of 1.1445 clearly violated. There is an Ending Diagonal price pattern visible on the larget timeframes that indicate a possible downtrend termination soon. The key short-term levels are technical support at the level of 1.0999 and the technical resistance at the level of 1.1267.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment