Forex analysis review |

- December 13, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- USD/JPY analysis for December 13, 2019 - Daily analysis, broken inverted head and shoulders pattern

- December 13, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Gold 12.13.2019 - Potential for the new down move on the Gold, watch for the breakout of the channel

- BTC 12.13.2019 - Watch for new down cycle and breakout of the bear flag pattern

- Evening review for EURUSD for 12/13/2019

- Three trump cards for the euro

- GBPUSD: Boris Johnson moves to the active action phase, pledging to leave the bloc by January 31, 2020

- GBP/USD: plan for the US session on December 13. The pound is adjusted after the lightning growth due to the victory of the

- EUR/USD: plan for the US session on December 13. The euro remained in a narrow channel, showing low volatility ahead of US

- Technical analysis of USD/CAD for Decembre 13, 2019

- EUR/USD. December 13. Christine Lagarde is trying to calm the markets and to instill optimism in them

- Dollar at crossroads, while Euro and Pound already celebrating Christmas

- Australian dollar claims to be the most promising currency in 2020

- GBP/USD. December 13.

- Overview for EUR/USD for December 13, 2019

- Gold - worked out successfully!

- Overview and opinion for XAU/USD for December 13

- EURUSD - take profits!

- Trader's Diary: EURUSD on 12/13/2019, British elections have changed the picture

- Analysis of EUR/USD and GBP/USD for December 13. ECB leaves the policy unchanged and Boris Johnson wins the election

- Simplified wave analysis of EUR/USD, AUD/USD, and GBP/JPY on December 13

- Technical analysis recommendations for EUR/USD and GBP/USD on December 13

- Overview of the GBP/USD pair on December 13. Friday the 13th is a holiday for the pound. Boris Johnson wins the election

- Overview of the EUR/USD pair on December 13. Preliminary data on the elections in the UK pulled the euro up

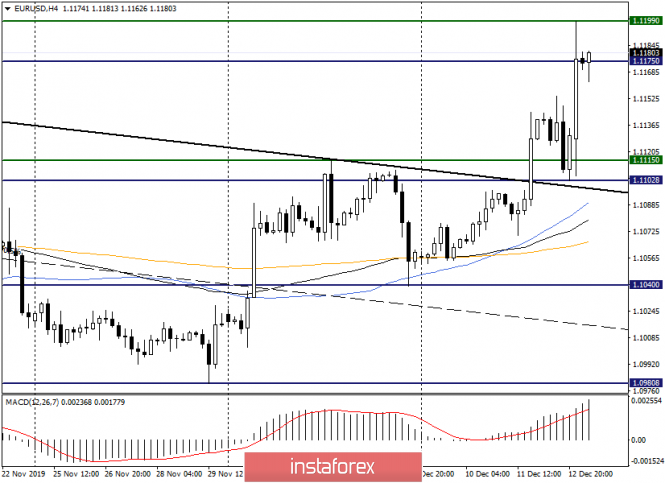

| December 13, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 13 Dec 2019 07:25 AM PST

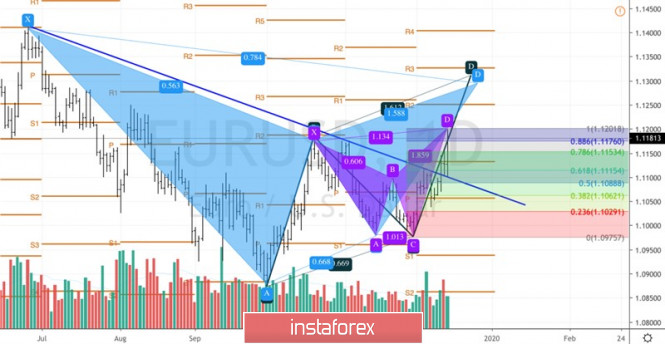

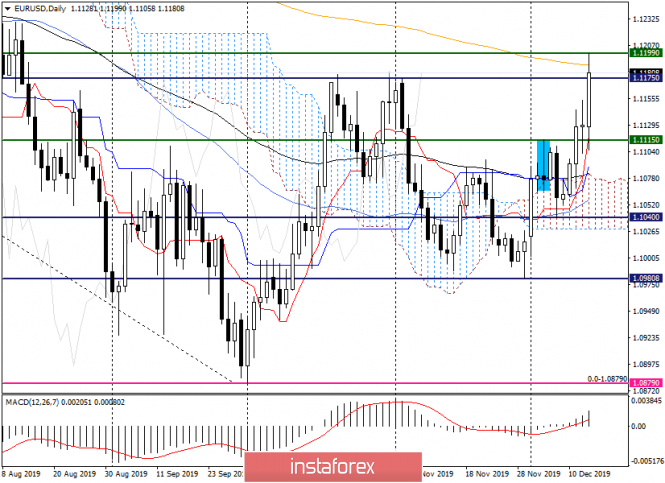

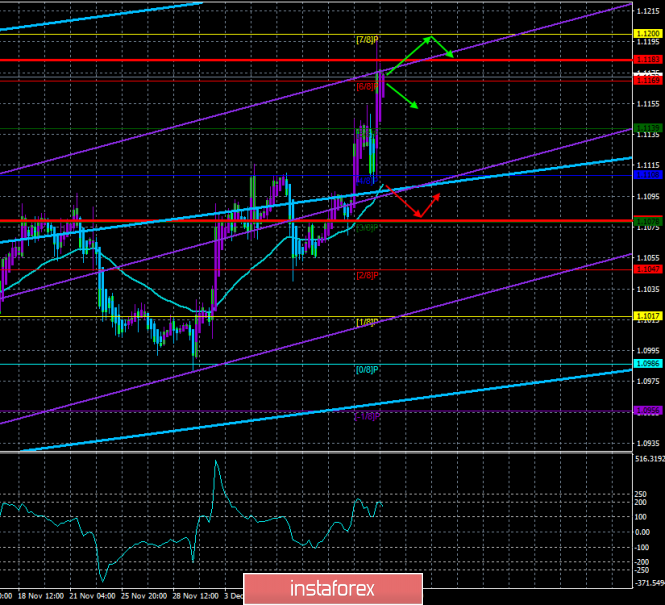

Since October 2, the EURUSD pair has been trending-up until October 21 when the pair hit the price level of 1.1175. The price zone of (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Hence, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 offering valid bearish positions few weeks ago. On the other hand, the price levels around 1.1000-1.0995 stood as significant DEMAND zone which has been offering adequate bullish SUPPORT for the pair so far. Thus, the EUR/USD pair remained trapped between the price levels of 1.1000 and 1.1085-1.1100 (where a cluster of supply levels were located) until Wednesday. Earlier this week, considerable bullish recovery was manifested around 1.1040 allowing the current recent bullish breakout above 1.1110 to pursue towards 1.1175 within the depicted newly-established bullish channel. Intraday bearish rejection should be expected around the current price levels (1.1175). Quick bearish decline to be expected towards 1.1115 (38.2% Fibonacci level). On the other hand, the price level of 1.1115 stands as a recent demand level to be watched for bullish rejection and a possible BUY entry. However, bearish breakout below 1.1080 invalidates this bullish scenario. If so, Bearish projection target to be located around 1.1040 and 1.1010. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY analysis for December 13, 2019 - Daily analysis, broken inverted head and shoulders pattern Posted: 13 Dec 2019 07:17 AM PST USD/JPY has been trading upwards in past 48 hours. I found the breakout of massive inverted head and shoulders pattern in the background, which is good confirmation for the further upside.

Watch for buying opportunities with the upward targets at the price of 110.65 and 112.50. Stop loss level is set at 106.50. The very important pivot level (neckline) is set at the price of 109.30.The material has been provided by InstaForex Company - www.instaforex.com |

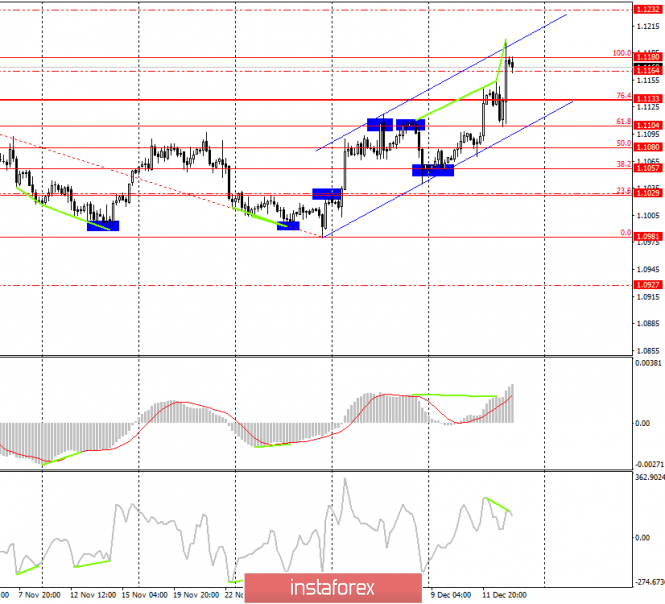

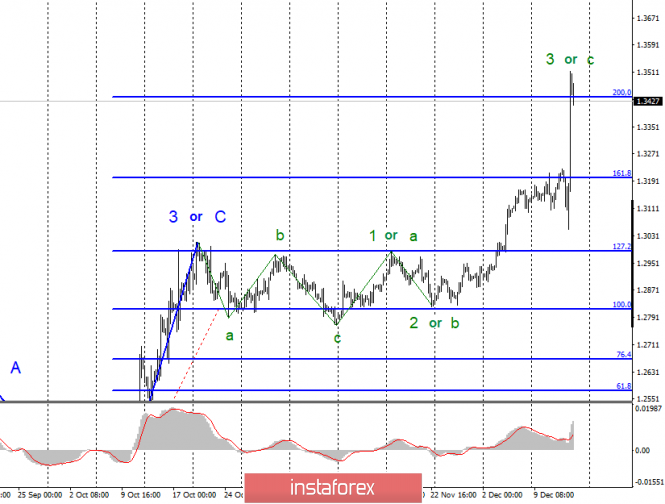

| December 13, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 13 Dec 2019 07:01 AM PST

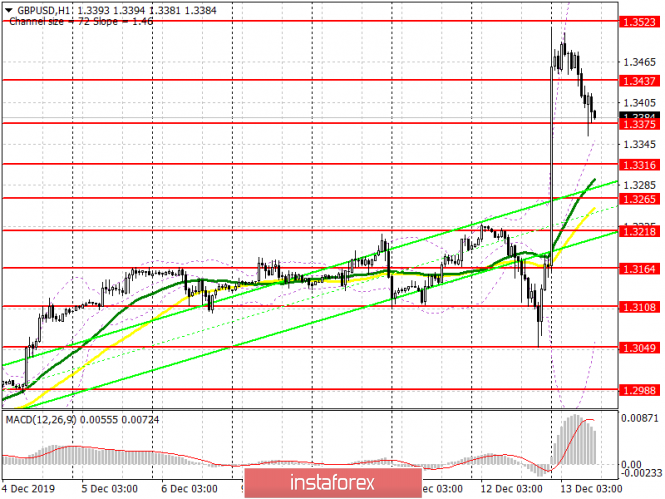

On October 21, the GBP/USD pair was demonstrating an ascending wedge reversal pattern while approaching the depicted SUPPLY-zone (1.2980-1.3000). For the following few days, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponded to a previous Prominent-TOP that goes back to May 2019. Thus, a high probability of bearish reversal existed around the mentioned price zone. Hence, a quick bearish movement was initiated towards 1.2780 (Key-Level) where bullish recovery was demonstrated on two consecutive visits. That's why, the GBP/USD pair has been trapped between the mentioned price levels (1.2780-1.3000) until Last week on Wednesday when bullish breakout above 1.3000 was achieved. Moreover, a newly-established short-term bullish channel was initiated on the chart. In which, the GBPUSD has recently hit the price level of 1.3500. Technical outlook remains bullish as long as consolidations are maintained above 1.3170-1.3190 on the H4 chart. On the other hand, the GBPUSD has recently exceeded the upper limit of the depicted bullish channel on its way towards 1.3500 where the pair looked quite overpriced. Moreover, this was followed by successive bearish-engulfing H4 candlesticks which brought the pair back towards 1.3300 quickly. That's why, further bearish decline should be expected towards 1.3170-1.3190 where price action should be considered for a possible BUY entry. On the other hand, Bearish closure below 1.3170 (Key-level) is mandatory before short-term outlook can turn into bearish again. The material has been provided by InstaForex Company - www.instaforex.com |

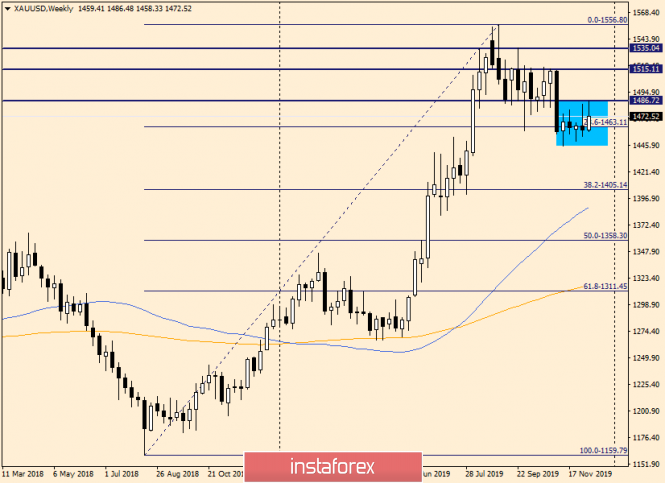

| Gold 12.13.2019 - Potential for the new down move on the Gold, watch for the breakout of the channel Posted: 13 Dec 2019 06:59 AM PST Gold has been trading in consolidation phase for days. The price is still trading in the falling wedge cycle and most recently there is potential bull corrective structure that it may end. Yesterday, there was strong reaction from sellers, which is sign that sellers are still present.

Eventual breakout of the channel to dhe downside at $1.460 may confirm test of $1.446. MACD oscillator is showing neutral condition with the slow line turned to the downside Resistance levels are seen at $1.487 and $1.515 Main support level is set at the price of $1.446. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 12.13.2019 - Watch for new down cycle and breakout of the bear flag pattern Posted: 13 Dec 2019 06:41 AM PST Industry news: On-Demand Liquidity (ODL), Ripple's XRP payment solution used by "more than two dozen" of the firm's customers, reportedly helps save up to 80% in remittance fees, according to money transfer firm SendFriend. Ripple revealed David Lighton, co-founder and CEO of SendFriend, touted ODL as a solution that helps its own customers save while speaking at a conference this week. The CEO explained that Ripple's XRP solution removed the need for businesses to pre-fund their accounts in destination currencies, removing the need for a large amount of working capital. Technical analysis:

BTC is still trading in consolidation phase at the price of $7.250 Anyway, there is chance for further downside and I expect down cycle with potential for test of $6.857 and $6.545. I also found, the potential bear flag pattern in creation. MACD oscillator is showing neutral condition with the slow line below the zero. Resistance levels are seen at $7.282 and $7.620. Support levels are set at the price of $6.857 and $6.543 The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for EURUSD for 12/13/2019 Posted: 13 Dec 2019 05:42 AM PST

On Friday, the market is likely to have a quiet day - after strong movements on Thursday. The election in Britain was confidently won by the conservatives and this is good for both Britain and the EU. Finally, the problem of Brexit will get a normal solution on January 31. Another positive is the emerging progress in the Trump-China trade talks. So we have to look at the closing prices of the day: EURUSD - closing the day and week above 1.1180 gives a strong signal for a big upward trend. We keep purchases from 1.1035 stop at breakeven. The material has been provided by InstaForex Company - www.instaforex.com |

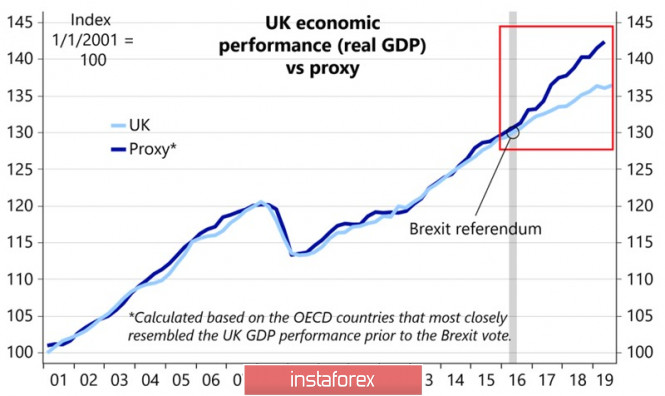

| Three trump cards for the euro Posted: 13 Dec 2019 04:20 AM PST The Conservatives' unconditional victory in parliamentary elections paves the way for a quick agreement with the EU. The uncertainty that has been hovering over the market for more than three years begins to dissipate, which allows the fans of the pound to spread their wings. Thus, it is unlikely that it will return to the levels that took place before 2016 referendum, but it is quite capable of growing up to 1.4-1.45. Moreover, the gap between potential and actual GDP will narrow and the British economy will recover, which is good news for both the eurozone and the bulls on EUR/USD. The dynamics of British GDP: The second euro issue for 2018-2019 was the trade war. Despite the fact that the eurozone did not directly participate in them, a slowdown in global GDP, international trade, and a decrease in external demand are extremely negative factors for the export-oriented economy of Germany. It was on the verge of a recession, and in such circumstances, the currency cannot be strong. In mid-December, Donald Trump began to say that not only China wants a negotiation, but he, the US president, also wants it. In turn, investors took this as confirmation of the version that no new tariffs would be introduced from the 15th, and Washington and Beijing were about to sign the agreement. In compensation for the increase in Celestial purchases of agricultural products, the States propose to roll back existing duties on $ 360 billion of Chinese imports, at least by 50%. Next, phase 2 will begin, within which Beijing will most likely require additional concessions. In any case, even the signing of an interim agreement is a sign of de-escalation of the conflict, which gives hope for the restoration of the eurozone economy. At the same time, Christine Lagarde, replacing Mario Draghi as head of the ECB, does not identify herself with either hawks or doves. She wants to be a "wise owl." This position reduces the probability of an additional monetary stimulus and caresses the ears of the "bulls" on EUR / USD. Now, to continue the rally, they would like to see positive from the German business activity and business climate. Both indicators are closely correlated with German GDP and are rightfully considered to be leading. German business climate and GDP So far, everyone looks as though clouds over the euro are beginning to disperse, but who will guarantee that Donald Trump does not start a new trade war? This time with the EU. Technically, a 113% target for the Double Bottom pattern has been reached, which increases the risk of a rollback to levels of 23.6%, 38.2% and 50% of the CD wave. However, failures from the support may be a signal of the restoration of the upward trend. As a result, the chances of targeting by 78.6% and 161.8% for the Gartley and AB = CD models will increase. Daily chart for EUR/USD: |

| Posted: 13 Dec 2019 04:19 AM PST The euro remains in a narrow range, and bulls rushed to record several profits in the GBPUSD pair, which led to its downward correction. However, a triumphant victory for the Conservative Party will continue to support the pound, but much depends on how quickly and how actively British Prime Minister Boris Johnson acts.

During today's speech, the Prime Minister said that the implementation of Brexit is an indisputable decision of the British people, as his victory eliminated the threat of a second referendum on this topic. Johnson also promised to implement Brexit by January 31 without any "buts" and "ifs". As for the fears associated with the rupture of trade relations with the EU in the form that they are now, the Prime Minister promised to increase government spending to offset the consequences for the economy. Johnson also reiterated the importance of investing in the national health system and promised to increase spending on schools. Let me remind you that as a result of the general elections to the UK Parliament, Boris Johnson's Conservative Party won a majority of 650 seats in the House of Commons. His party is projected to win 364 seats, 68 more than all other parties combined. A decisive majority leaves Johnson free to act, which will quickly ensure the passage in the parliament of his proposed version of the EU withdrawal agreement, which has been stalled throughout this year. The UK is expected to officially exit the bloc on January 31, 2020. But it should be understood that the ratification of the agreement is only the beginning of a long road, which will be associated with the problems of reaching an agreement on future ties between the UK and the EU. Such problems will be settled by the end of 2020. However, the difficulties in signing the agreement on both sides will put pressure on the British pound, which has risen quite strongly in the last few months against the US dollar. As for the technical picture of the GBPUSD pair, as noted above, any positive news related to Brexit will push the pound up to the area of the 40th figure. The breakout of today's high around 1.3520 will lead to new automatic purchases of the trading instrument, counting on the update of new levels in the area of 1.3605, 1.3690 and 1.3750. The downward correction in the pair will be limited by the strong support in the area of 1.3370, however, if it breaks, the major players can retreat to the lows in the area of 1.3310 and 1.3220, from where an attempt will be made to build the lower boundary of the medium-term upward trend. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Dec 2019 03:40 AM PST To open long positions on GBPUSD, you need: A small technical correction of the pound in the area of support levels, which I paid attention to in my morning forecast, did not greatly affect the balance of forces. Let me remind you that Johnson's Conservative Party won a majority of 650 seats in the House of Commons, which will allow moving more quickly towards signing a Brexit agreement with the EU. This is a good signal for buyers. In the short term, while the bulls hold the support of 1.3375, we can expect a new sharp wave of growth of the British pound, otherwise, we can consider new long positions immediately on the rebound from the lows of 1.3316 and 1.3265. The bulls are waiting for data on the volume of retail sales in the United States and will begin to act more actively after them. The return of the level of 1.3437 will strengthen the demand for the pound and lead to a larger increase in the area of monthly highs of 1.3523, and possibly to their renewal, which will allow reaching the area of 1.3563 and 1.3604, where I recommend taking the profits. To open short positions on GBPUSD, you need: The bears performed well on the morning targets, and further downward movement depends entirely on the data on retail sales in the United States. A weak report will quickly return the pound buyers to the market, so it is best to postpone short positions until a false breakout is formed in the resistance area of 1.3437, or sell immediately for a rebound from today's high in the area of 1.3523. On the contrary, a good report will lead to a breakthrough of the support of 1.3375, which the sellers of the pound rested against, which will push GBP/USD even lower to the lows of 1.3316 and 1.3265, where I recommend taking the profits. Any positive news related to Brexit will continue to push the pound up, so short positions in the pair should be treated very carefully. Indicator signals: Moving Averages Trading is above the 30 and 50 daily averages, indicating a bullish market scenario. Bollinger Bands Breaking the lower border of the indicator around 1.3164 will lead to a larger sell-off of GBP/USD.

Description of indicators

|

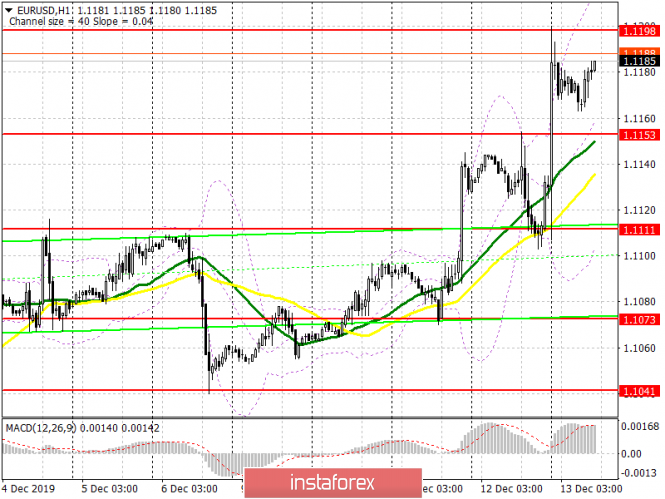

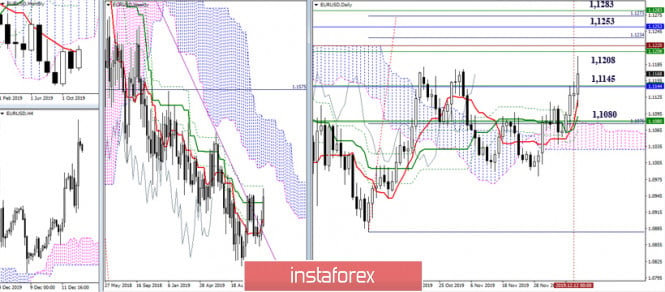

| Posted: 13 Dec 2019 03:32 AM PST To open long positions on EURUSD, you need: From a technical point of view, nothing has changed for the European currency amid the absence of important fundamental statistics. Yesterday's sharp rise after the UK election results were not supported by the big players today. Bulls still need to break above the resistance of 1.1198, as only this will strengthen the demand for the euro and will lead to an update of the highs in the area of 1.1226 and 1.1263, where I recommend taking the profits. All attention in the second half of the day will be shifted to the data on retail sales in the United States, and in case of continuation of the downward correction to the support area of 1.1153, only the formation of a false breakout at this level will be a signal to open long positions to continue growth. Otherwise, it is best to buy EUR/USD on the rebound immediately from the minimum of 1.1111. To open short positions on EURUSD, you need: Bears will wait for an unsuccessful consolidation above the resistance of 1.1198, which will be the first signal to open short positions. A more important task will be the return and breakdown of the support of 1.1153, which will lead to a downward correction of the euro to a minimum of 1.1111, where I recommend taking the profits. However, it will be possible to count on such a move only after the release of good data on the volume of retail sales in the United States. In the scenario of EUR/USD growth above the resistance of 1.1198 in the afternoon, it is best to return to short positions only after updating the maximum of 1.1226 or sell immediately on a rebound from the larger resistance of 1.1263. Indicator signals: Moving Averages Trading is above the 30 and 50 moving averages, which indicates the continued growth of the euro. Bollinger Bands In the case of a decline in the euro after the ECB decision, the indicator will support the average border at 1.1153, while growth will be limited by the upper level of the indicator at 1.1215.

Description of indicators

|

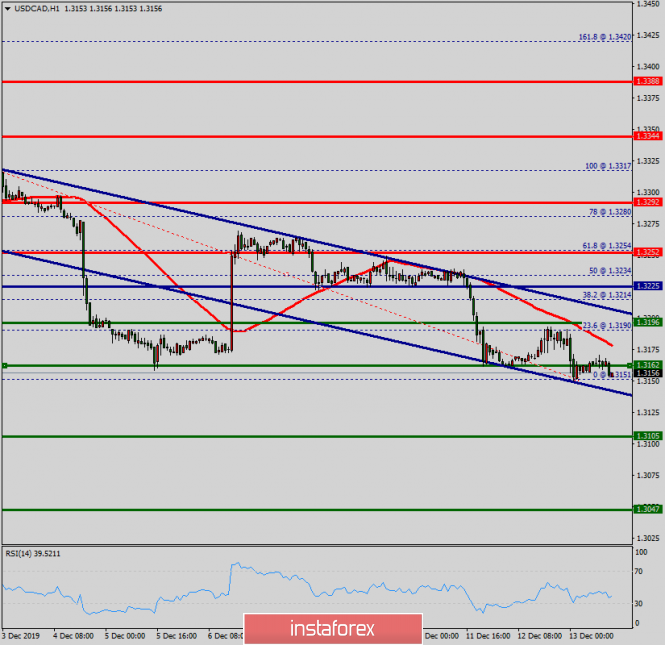

| Technical analysis of USD/CAD for Decembre 13, 2019 Posted: 13 Dec 2019 03:07 AM PST Overview: The key level of USD/CAD pair is set at the 1.3151 price. The USD/CAD pair is trading at the spot of 1.3151 and 1.3252. Right now, the pair has already been corrected by 50.0% and may yet continue trading towards 61.8% or 38.2% Fibonacci retracement levels at 1.3252 or 1.3151. The USD/CAD pair was argumentative as it was trading in a narrow sideways channel, the market showed signs of instability. Resistance and support are seen at the levels of 1.3252 and 1.3151 respectively. The support is the low at 1.3151. The USDCAD pair is still moving around the key level at 1.3225, which represents a daily pivot in the H1 time frame at the moment. All these signals taken together indicate further sideways trend movement. Immediate resistance is seen around 1.3252 levels, which coincides with the first resistance. In case of a successful breakout at 1.3252 , the next target will be at the level of 1.3291. This would suggest a bulish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to rise higher towards at least 1.3344 so as to test the daily support 3. On the other hand, if a breakout happens at the support level of 1.3151, then this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

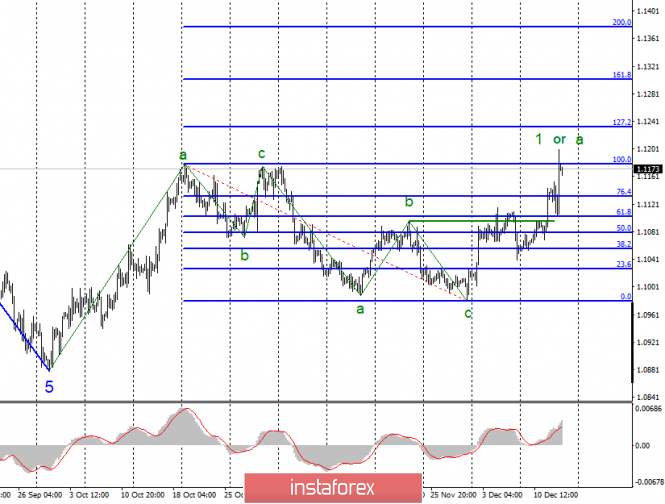

| Posted: 13 Dec 2019 02:28 AM PST EUR/USD - 4H.

The EUR/USD pair performed a reversal in favor of the European currency on December 12 after rebounding from the correction level of 61.8% (1.1104) and rising to the correction level of 100.0% (1.1180). The rebound of the pair from this Fibo level allows traders to expect a reversal in favor of the US dollar and some fall in the direction of the correction level of 76.4% (1.1133). Also, a second bearish divergence was formed, this time at the CCI indicator, which increases the pair's chances of rebounding from the Fibo level of 100.0%. In addition to this, the pair reached the upper line of the upward trend area and also performed a rebound. Thus, most factors indicate that traders are preparing for a pullback down. The euro may fall in today's trading. In the last two days, the euro currency was in demand among traders, although its reasons for growth were far from clear. For example, the ECB meeting was held yesterday, which, by and large, was in the shadow of the elections in the UK. However, traders could not ignore the outcome of the ECB meeting and Ms. Lagarde's speech. Following the meeting, the European Central Bank decided not to change the key points of monetary policy. Rates remained unchanged, the volume of monthly stimulation of the economy through cash injections by buying securities from the market - as well. But Christine Lagarde's speech undoubtedly aroused the interest of traders and also left some questions unanswered after its conclusion. The fact is that the ECB President has considered positive aspects in the current state of the EU economy. According to her, "there are some initial signs of stabilization and moderate growth in core inflation," as well as "the risks to economic growth, although negative, are now somewhat less pronounced." From my point of view, such a statement is not true. Especially in the context of the fact that the ECB lowered its forecasts for inflation and GDP for the next 3 years. That is, it turns out that in the long term, the ECB expects the situation to worsen, but Christine Lagarde "sees" signs of stabilization. I also believe that the acceleration of inflation in November to 1.0% y/y is, firstly, a one-time character (based on the fact that inflation, for example, in Germany remained unchanged at the end of November and about any of its growth is now out of the question), and secondly, the consumer price index is now so weak that acceleration by several tenths of a percent is very difficult to regard as a positive point. Lagarde also announced the first revision of the Central Bank's strategy since 2003, which will make it possible to assess the possibility of adjusting the inflation target. At the moment, it is 2.0% y/y. And the European Central Bank has not been able to achieve this inflation rate for many years, despite record low key rates and a long bond redemption program. On Thursday, Ms. Lagarde also announced that she intends to start updating the strategy in January and complete it before the end of the year. "The new policy should be comprehensive and include consultations with members of the European Parliament, the academic community and civil society," Lagarde said, explaining what "strategic changes in the ECB" mean. Forecast for EUR/USD and trading recommendations: On December 13, traders will move away from the entire information background of this week. Although some economic reports and news were ignored by traders, and some were blocked by more important messages, at the end of the week you need a break from the huge flow of news. Most likely, the rebound from the correction level of 100.0% (1.1180) will cause the pair to fall in the direction of 1.1133 and 1.1104. The Fibo grid is based on the extremes of October 21, 2019, and November 29, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar at crossroads, while Euro and Pound already celebrating Christmas Posted: 13 Dec 2019 02:27 AM PST One gets the feeling that this year, Christmas came to the financial markets somewhat earlier than the due date. The strong release on American employment for November, the proximity of the Tories victory in the UK early elections, as well as the growing confidence in the conclusion of a trade agreement between the United States and the Celestial Empire, became a real holiday for investors. Against this background, the risk appetite rose sharply, as did the pound, which demonstrated one of the best daily dynamics in its history. The GBP / USD currency pair jumped to the highest level since May 2018 on the news that conservatives won a landslide election victory, defeating Labor and gaining more than 350 seats in the House of Commons. "This is certainly a significant advantage for the Conservative Party in the framework of the Brexit vote before Christmas. It is likely that the United Kingdom will exit the EU in early 2020. In this case, the pound will soar to $ 1.36–1.37, "said MUFG Bank strategist Fritz Louw. Amid the pound rally, the US dollar showed a weakening on all fronts. The USD index broke down the "bear flag", which is part of a pullback to the double top. Together with the breakdown of the flag, the indicator crossed the 200-period DMA and completed the larger head and shoulders figure, which has been forming since August. At the same time, the index fell below the upward trend line and the bottom of the upward channel, which we observed since September 2018. If the indicator remains below the bottom of the channel, the situation will develop into a full-fledged downtrend. On the other hand, it can equally return to the upper boundary of the channel. At the end of the December meeting, the American Central Bank made it clear that the rate would remain low throughout the next year, but we were already witnesses of how the Fed's rhetoric changed dramatically from meeting to meeting, and sometimes even between them. Apparently, the regulator decided not to worry the markets and the US president on the eve of the critical date of December 15, when the White House should introduce new tariffs against Chinese imports. It is possible that this is why the dollar cannot decide between the resumption of its upward movement and slipping into a downtrend. Now everything will depend on the trade negotiations between Washington and Beijing, but even in this case, it is difficult to predict how the market will react. In the past, we have repeatedly noted that the greenback sometimes grows both because of its status as a "safe haven" (the currency in which US government bonds are denominated) and as a risky asset. The optimistic mood on Brexit was strengthened by the euro, and the EUR / USD pair reached its highest level since August around 1.1200. ECB President Christine Lagarde at her first press conference following the December meeting of the regulator expressed optimism about the prospects for the eurozone economy. Few doubted that the former head of the IMF would be a much lesser fan of super-soft monetary policy than its predecessor, Mario Draghi. She even joked that she was not a "dove" and not a "hawk", but a "wise owl". Considering the words of Lagarde about the risks less pronounced today than before and about some initial signs of economic stabilization, it can be assumed that new characters will appear in the ECB Governing Council. "Owls", which will soon supplant "doves". As a result of the December meeting of the ECB, the derivatives market shifted expectations regarding a reduction in the deposit rate by 2021, while the yield on German government bonds increased, which supported the single European currency. Moreover, the growth of EUR/USD could be even more impressive if Lagarde spoke about the side effects of the policy of negative interest rates. Meanwhile, Washington and Beijing are on the verge of concluding a trade agreement. The United States may suspend some duties on Chinese products and lower others in exchange for the purchase of a greater amount of American agricultural commodities in China, Reuters reported, citing informed sources. If in the short-term period the S&P 500 rally supports the greenback and restrains the offensive impulse of the "bulls" in EUR/USD, then in the medium and long-term horizons the recovery of the European and Chinese economies will help the pair rise to 1.15. The material has been provided by InstaForex Company - www.instaforex.com |

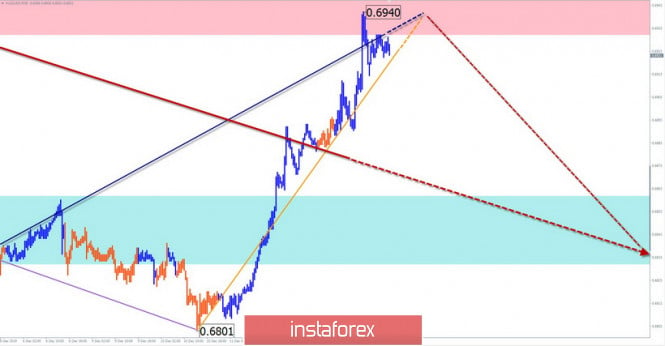

| Australian dollar claims to be the most promising currency in 2020 Posted: 13 Dec 2019 02:27 AM PST This week, the currency of the Green Continent experienced moderate volatility. Aussi declined from time to time, but then continued to strengthen. Thus, many experts believe that there are excellent prospects for the "Australian" in 2020. Forecasts of leading analysts regarding the Australian currency are multidirectional. Sometimes they are very controversial: some experts await the depreciation of the Aussies, and their opponents expect a sharp rise in the rate. However, the dynamics of the US-China trade conflict remain the most important driver for the growth or fall of the "Australian" currency. Moreover, the "Australian" currency soared up to the level of 0.6935 after the statements of US President Donald Trump about the high probability of concluding a trade deal with China. Although it did not last long at this peak, it rolled back again to a lower position - to 0.6925 on Friday, December 13. Currently, the AUD/USD pair runs in the range of 0.6917-0.699, trying not to go to the bottom. The Australian dollar is not easy to maintain the conquered peaks, but analysts rely on its stability. Based on the forecasts of major experts, it can be assumed that the coming year will be a time for the Australian dollar to determine further status. In addition, experts are sure that i "Aussi" will be able to claim the title of one of the best and most promising world currencies in 2020. It is possible that the currency of the Green Continent will confirm this status and demonstrate its strength. According to preliminary estimates, the pair AUD/USD will reach 0.7000 by the end of 2020. A similar opinion is shared by the strategists of Monex Europe. They expect that the "Australian" will grow by 14%, to 0.7800. It also believes that a trade dispute between Washington and Beijing will be resolved safely. Thus, this will lead to the strengthening of the Australian currency, since the economy of the Green Continent is highly dependent on its main trading partner - China. In contrast, the opposite point of view is expressed by analysts Rabobank and Nomura, wherein they expect the Australian currency to decline 5%, to 0.6500. Among the optimists predicting Aussie strengthening is Morgan Stanley, the largest Bank. The Bank's currency strategists are positive about the prospects for the Australian dollar next year, expecting it to strengthen to 0.7100. Leading experts of Bank of America Merrill Lynch agree with them, predicting the strengthening of the "Aussie" to 0.7300. However, a minor difficulty may turn out to be the current state of the economy of the Green Continent. In 2019, economic growth in the country slowed to a minimum over the past ten years. Experts record a steady decline in household spending. More so, the Central Bank of Australia does not rule out the launch of a quantitative easing (QE) program. This opinion was voiced by Philip Lowe, head of the Reserve Bank of Australia (RBA), after cutting rates to 0.25% last month. It can be recalled that the regulator reduced the rate thrice to an extremely low level of 0.75% this year. Thus, experts do not exclude that the RBA will repeat this step in the first half of 2020, reducing the rate by 25 basis points (bp). As a result, many experts consider the dynamics of the Australian currency in a global context. Rabobank analysts attribute the fluctuations in the Aussie rate with the actions of the US Federal Reserve. They believe that the Federal Reserve will have to resume lowering rates next year after the current pause. The regulator also can decide on such measures in the second half of 2020, according to Rabobank. In the event of the implementation of such a scenario, the Central Bank of Australia may launch QE next year, experts conclude. The material has been provided by InstaForex Company - www.instaforex.com |

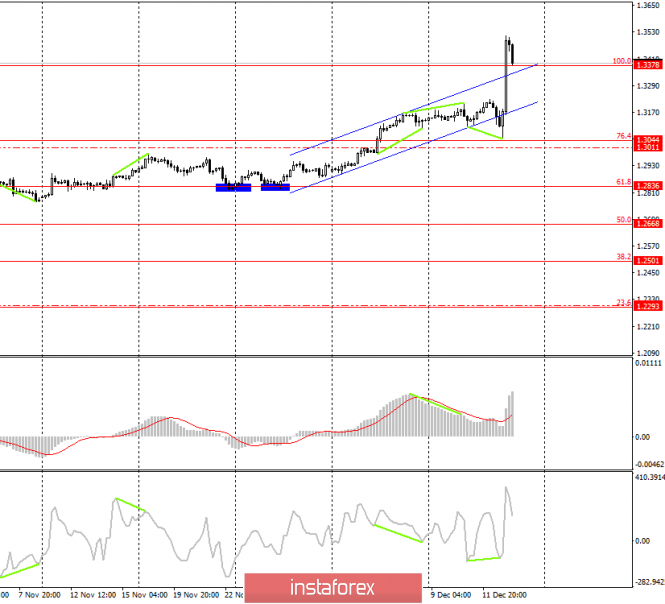

| Posted: 13 Dec 2019 02:25 AM PST GBP/USD - 4H.

On December 12, the GBP/USD pair performed a fall to the corrective level of 76.4% (1.3044), rebound from it and performed a reversal in favor of the British currency after the formation of a bullish divergence at the CCI indicator. Also, a strong rise to the Fibo level of 100.0% (1.3378) with consolidation above it. Of course, such an impressive growth of the pair became possible because of the information background, which was extremely important tonight and remains so now. For a few hours in the morning, the pair's quotes managed to make a return to the Fibo level of 100.0%. The closing of the pound-dollar pair under the Fibo level of 100.0% will work in favor of the US dollar and the beginning of the fall of the quotes in the direction of the correction level of 76.4%. So, although there are no official data on the results of the elections to the UK Parliament, the data from exit polls give a very eloquent picture of the distribution of parliamentary seats among the parties. According to preliminary information, the Conservative Party receives 368 seats, the Labor Party- 191, the Scottish Party - 55, the greens - 1, the Liberal Democrats - 13, the "Brexit" party - 0, the rest - another 22 seats. In this way, the Conservative Party gets to form a "majority" and put any bills on the agenda without any worries that they could be blocked by other parties or coalitions. The Labor Party is showing its worst result since 1935. Boris Johnson has already managed to thank everyone involved in his victory, writing on Twitter: "Thank you to everyone across the country who voted, who worked as a volunteer, who was a candidate. We live in the greatest democracy in the world." Also, the British Prime Minister said that "it is time to complete Brexit" – what the country has been striving for and going for 3 years and that now it is possible to implement. Thus, based on the current election results, which are likely to remain so, Brexit will indeed be completed by January 31, as Boris Johnson's second promise states. Other parties, even if they form a general coalition, will not be able to interfere with Johnson's plans. By the way, many political analysts now note that all of Johnson's previous defeats in Parliament were almost orchestrated by him to be able to hold early parliamentary elections under the slogan "Let's finish Brexit". Tired of not ending the UK exit from the European Union just "gave" votes to Boris Johnson. Now the ruling party in the UK has the opportunity to implement anything and change the country as it pleases. The US President has already congratulated Boris Johnson on his victory and said that "Now America and Britain are ready to conclude a major trade deal." However, as it happens always, there is a second side of the coin. The first is almost 100% probability of a completed Brexit and a point with a three-year series of exit from the European Union. However, with such a serious mandate that Johnson now has, he can make absolutely any decisions. That is, no other political force will be able to prevent it for the next few years. Accordingly, the principle of democracy as such will not work in the UK in the coming years. Will the British people regret giving the reins of power to the country in one hand? Forecast for GBP/USD and trading recommendations: The pound-dollar pair performed consolidation above the Fibo level of 100.0% (1.3378). Since the elections in the UK can officially be considered history, today the pound-dollar pair will have a day of consolidation. Traders have more than worked out information about the election results, but it will be difficult for the pound to continue to be in high demand. Summary - today, I expect the closure under the Fibo level of 1.3378 and the fall of quotes. Until the close below the level of 1.3378, you can stay in the pair's purchases. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview for EUR/USD for December 13, 2019 Posted: 13 Dec 2019 02:08 AM PST Hello! As it became known yesterday, the European Central Bank (ECB) kept the interest rate at zero, and this decision coincided with the expectations of market participants. At the same time, the purchase of assets will continue as necessary. Most likely, soon, the ECB will refrain from changes in monetary policy and take a wait-and-see position. As for the press conference of the President of the European Central Bank, Christine Lagarde, it turned out to be quite faceless. Lagarde chose to sidestep many thorny issues and left investors to their thoughts and arguments. Simply put, with weak macroeconomic indicators in the euro area, the option of easing monetary policy is not excluded, in which the main interest rate will be lowered, as an option, by 10 basis points and will move into negative territory. In this scenario, in the medium and long term, the single European currency will be under pressure, and the EUR/USD pair will be under the control of bears. If the statistics from the eurozone are neutral or moderately positive, the ECB will continue to monitor the further situation but will refrain from changes in monetary policy. In my personal opinion, such conclusions can be drawn from yesterday's press conference of Christine Lagarde. However, as noted above, the new ECB President, for the most part, refrained from specifics. Well, let's move on to the price charts of the main currency pair of the market and see what are the prospects for closing the next trading week. Daily

Yesterday's candle "Long-legged Doji" perfectly reflected the mood of investors and the reaction to the speech of the head of the ECB. In a word - uncertainty. In its essence and form, yesterday's candle is a reversal model of candle analysis, especially since it appeared in a strong technical zone and not so far from the peaks. But what are we seeing today? At the moment, the euro/dollar pair shows a very decent strengthening and tests the strength of the strong technical resistance level of 1.1178, as well as testing for a breakdown of at least a strong 233-exponential moving average. Now in the area of 1.1175, there is a struggle of the warring parties, the winner of which we will know only after the close of trading. The closing price can clarify a lot! Judging by the daily chart, the targets are at the top of 1.1200 and 1.1250. In turn, the bears will try to push the quote to 1.1155 and 1.1115. H4

On the 4-hour timeframe, the pair is trading in the range of 1.1102-1.11199. It is characteristic that only 1 point fell short of the strong and significant technical level of 1.1200. In my opinion and the experience accumulated over the years, this may indicate that the players on the rate increase will face very serious problems in the price area of 1.1200-1.1250. If so, after the appearance here (or under 1.1180) of bearish candlestick analysis models, you can try neat sales with small stops and goals. So far, only counting on the correction. On the turn, it's hard to judge after the appearance of clear signals from higher timeframes, in the first place on the weekly chart. At the moment, the most relevant are the purchases of the euro/dollar, which I think is inappropriate to open at the peak of the market, and even before the close of weekly trading. I recommend staying out of the market. Do not go into hell, let the market shark close the auction. On Monday, we will summarize the results of the current five-day period, calmly assess the situation and decide on positioning on the main currency pair of the forex market. Have a good week and a good weekend! The material has been provided by InstaForex Company - www.instaforex.com |

| Gold - worked out successfully! Posted: 13 Dec 2019 01:57 AM PST Good day, dear traders! I congratulate those who, on our recommendations, kept gold in longs from December 12, 2019 https://www.instaforex.org/ru/forex_analysis/24163... At the ECB press conference, during Christine Lagarde's speech, A short-term strong weakening of the US dollar was mentioned, allowing profits to record longs for both goals: 1480 and 1484 Plan: Adjustment: Good luck on trading and have a good weekend! The material has been provided by InstaForex Company - www.instaforex.com |

| Overview and opinion for XAU/USD for December 13 Posted: 13 Dec 2019 01:26 AM PST The role of gold as a protective asset. Hello, dear traders! Today, we will analyze the technical picture of gold. To be honest, for a hundred years, I have not considered the graphics of this noble metal. However, this has its pros and cons. Plus, after such a long break, there is a chance to see the technical nuances, as they say, with an unwashed eye. To begin with, a little about the general background, which affects the quotes of the most popular precious metal. Let me remind you that gold is a protective asset and in troubled times is in high demand among investors, and its price is rising. Naturally, trade confrontation between countries with the first and second world economies has a significant impact on metal quotes, that is, a trade war between the United States and China. Just yesterday, the 45th President of the United States, Donald Trump, once again through his world-famous Twitter said that the conclusion of a large trade deal between Washington and Beijing is close. Both parties wish to conclude it. In general, the situation here is as follows. The US has made an offer to China to reduce by 50% duties on goods from China in the amount of $360 billion. Also, the United States will offer to refrain from imposing new tariffs, which were scheduled for December 15. This statement by Trump led to an improvement in sentiment on trading floors and increased risk appetite. As a rule, the risk sentiment of market participants leads to a decrease in gold prices, which was observed at yesterday's trading. Weekly

The weekly chart of XAU/USD clearly shows consolidation in the selected range. In the vast majority of cases, after such consolidations, there is a sharp exit of the price from the existing range and there are good and directed price movements. Given the current upward trend in gold, it is logical to assume that we will see the continued growth of gold quotes. However, an alternative scenario should always be considered. For the fifth week, the quote is trading around the Fibo level of 23.6 from the growth of 1160-1557 dollars per troy ounce. In the case of a downward scenario, the price of gold will fall to the Fibo level of 38.2 and to the area of 1390, where the 50 simple moving average passes. If the market decides to resume and continue the upward trend, XAU/USD will first head to the strong technical level of $1515 per ounce, and overcoming this mark will open the way to 1535 and highs at 1557. Daily

On the daily chart, the quote got bogged down between the Tenkan and Kijun lines of the Ichimoku indicator. At today's trading at the time of writing, gold prices are showing growth. If market sentiment does not change, I expect further strengthening of the precious metal in the area of 1480-1486 dollars per ounce. Taking into account the closure of the weekly trading and profit today is unlikely to count on a higher purpose. Nevertheless, above 1486, there is a cloud of the Ichimoku indicator, which will become another obstacle for bulls on the way of moving the quote up. On the other hand, I would like to note that yesterday's candle looks like a reversal and does not give special reasons for optimism. If the gold market decides to work out this model of candlestick analysis and moves the rate down, the nearest and very important goal will be supported at 1445, from the breakdown (or lack thereof) which will determine the further direction of XAU/USD. In my personal opinion, there is a better chance of continued growth, so I consider buying gold the most relevant. You can try opening long positions gently from current prices or while lowering to the area of 1468-1463. Do not forget about the role of gold as a protective asset, so the direction of the quote of XAU/USD will largely depend not only on technical factors but also on market sentiment. Successful trading! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Dec 2019 01:08 AM PST Good day, dear traders! Congratulations to those who held the EURUSD pair in long positions according to our recommendations. On the positive news from the shores of "Foggy Albion" about the victory of the conservatives in the parliamentary elections in the UK, the EURUSD pair updated the October extremes with a false breakout, which allowed to record a profit on the take profit recommended at the quote of 1.11800. Plan: Adjustment: The passage amounted to 1300 p for 5 characters. Good luck with trading and follow the rules! The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's Diary: EURUSD on 12/13/2019, British elections have changed the picture Posted: 13 Dec 2019 01:07 AM PST

The ECB has not changed anything in the market as Christine Lagarde continues Draghi's super-soft policy on the ECB. This, however, did not drop the euro. Furthermore, the Trump administration said it was ready to reduce duties on goods from China as long as China made concessions for the purchase of agricultural products in the United States and tightened its actions against theft of intellectual property in the United States. But the main driver was the election in Britain where the Conservatives won with a strong advantage. The pound rose more than 300 points in the 4-digit. This is due to the fact that the majority at Johnson's party finally resolves the issue with the Brexit where the uncertainty will end on January 31st. Good news for the euro as the EURUSD reached its highs in late October. If we close the week above 1.1180, a trend with a target of 1.1860 and above is very likely. We keep purchases from 1.1035 and wait for the close of the day. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Dec 2019 12:54 AM PST EUR / USD On December 12, the EUR / USD pair completed with an increase of only a few basis points. However, during the day the instrument made impressive movements both up and down, and then added 45 basis points at once on the night of December 13. However, an unsuccessful attempt to break through the 100.0% Fibonacci level indicates the readiness of the markets to complete the construction of the first upward wave as part of a new upward trend section. If this assumption is correct, then the instrument will begin to decline within the framework of building wave 2 or b from the current positions. Fundamental component: On Thursday, the news background for the euro-dollar instrument was quite noticeable. First, a report on industrial production in the European Union was released, which fully met the expectations of the market and showed a decrease of 2.2% y / y. A little later, the results of a two-day meeting of the European Central Bank were summed up, which consisted in the fact that the parameters of monetary policy and the volume of the program for the purchase of assets from the open market (QE) remained unchanged, and ECB head Christine Lagarde was as neutral as possible in her comments and press statements conferences. In addition, the most interesting markets were data from exit polls in the UK, which predict a confident victory for the Conservative Party. The victory with the formation of the "ruling majority" (326 representatives in Parliament or more) is identified with Britain's exit from the European Union until the end of January, as promised by Boris Johnson. Since almost no one doubts that the conservatives won the election, it remains only to find out how many deputies from Tory will be in the Parliament of the next convocation. The more conservatives, the greater the chances of an exit on January 31. There is no doubt that all other parties will vote against the agreement of Boris Johnson when the Prime Minister again puts this issue on the agenda in Parliament. Past votes show that even some conservatives do not approve of Boris Johnson's plan to secede from the European Union. Thus, the greater the supply of votes will be for Boris Johnson, the more likely that the three-year epic of leaving the Bloc will come to an end. General conclusions and recommendations: The euro-dollar pair presumably continues to build a new upward trend section. Thus, I recommend buying an instrument with targets near the calculated levels of 1.1233 and 1.1303, which equates to 127.2% and 161.8% Fibonacci, in case of a successful attempt to break through the level of 100.0%. Meanwhile, an unsuccessful attempt to break the level of 1.1179 may lead to quotes moving away from the highs reached. GBP / USD On December 12, the GBP/USD pair lost several basis points during the day, but tonight, it gained 316 points in a matter of hours. However, the euphoria of the market is slowly decreasing and the instrument quotes are moving away from the highs reached. Moreover, estimated wave 3 or C may complete its construction near the Fibonacci level of 200.0%. If this is true, then either the construction of a new bearish section of the trend will begin, or waves 4, b, 5 in the upward part. One way or another, a certain rollback should happen. Fundamental component: On Thursday, there was no news background for the GBP/USD instrument, and markets were eagerly awaiting the first vote counting results. They waited and waited. At night, the British pound gained more than 300 basis points, as soon as information appeared that the Conservative Party would defeat the Labor Party and other participants in the race by a wide margin, it would form a majority in the new Parliament without problems and, accordingly, would now complete Brexit unhindered. At the same time, it is expected that Conservatives will gain about 370 votes, which is significantly more than half of the total number of parliamentarians. Labor, in turn, will lose about 70 deputies, and their total number will be about 190 deputies. Thus, the pound is now only paying attention to the news about the elections and, most likely, it will not pay any attention to the report on retail sales in America, which will be released in the afternoon. All of today will be devoted to counting votes, followed by interviews with all party leaders who fought among themselves over the past two months. Today, it is logical to expect a decline after an overnight increase in the instrument. This option also implies the current wave marking. General conclusions and recommendations: The pound / dollar instrument continues to build an upward trend. I recommend considering new purchases of the instrument with targets around 1.3823, which equates to 261.8% Fibonacci, after quotes roll back down and after a new successful attempt to break through the Fibonacci level of 200.0%. The fulfillment of this condition will show the readiness of the currency market for new purchases of the pound. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis of EUR/USD, AUD/USD, and GBP/JPY on December 13 Posted: 13 Dec 2019 12:18 AM PST EUR/USD Analysis: The formation of the upward wave structure of the euro major continues. The wave of September 3 corrects the last section of the trend and looks like a stretched plane. The last section counts from November 14. The price has stalled at the next resistance. Forecast: After yesterday's breakout before further growth of the rate, the algorithm requires to form a counter pullback. It can be in the form of a flat sidewall, but the option of a more significant reduction is not excluded. By the end of the day, the probability of a second attempt to break up increases. Potential reversal zones Resistance: - 1.1260/1.1290 - 1.1190/1.1220 Support: - 1.1140/1.1110 Recommendations: Sale of the euro today is possible in the coming sessions, the minimum lot. At the end of the expected decline, it is recommended to monitor the reversal signals and entry points into long positions.

AUD/USD Analysis: The direction of the short-term movements of the "Aussie" is set by the bearish wave of September 12. The structure of the wave has the appearance of an ascending pennant, but it lacks the final part. Quotes of the pair are at the upper edge of a strong reversal zone of a large TF. Forecast: The upward part of the movement has reached the limit of elongation. In the coming day, as part of the calculated resistance, it is expected to form a reversal and start a downward move. When changing the course, you cannot exclude the puncture of the upper boundary of the zone. As the volatility of the pair decreases, it will increase. Potential reversal zones Resistance: - 0.6930/0.6960 Support: - 0.6860/0.6830 Recommendations: The pair's purchases are irrelevant today. It is recommended to monitor the signals of the pair reversal on your TS, to sell the instrument.

GBP/JPY Analysis: The current trend wave of August 5 completes the upward wave of the weekly scale. Yesterday's upward sturt significantly brought the price closer to the preliminary target zone, to which there are about 3 price figures. Forecast: An intermediate pullback is expected in the next sessions. The expected nature of price movements is flat. The resumption of price growth is likely at the end of the day or early next week. The resistance zone shows the upper limit of the expected range of the pair within the current day. Potential reversal zones Resistance: - 147.70/148.00 Support: - 146.60/146.30 Recommendations: Sales of the pair are possible today, but you need to consider the probability of counter-rollbacks. It is recommended to focus on finding entry points to long positions at the end of the upcoming price rollback.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure for determining the expected movement. Attention: The wave algorithm does not take into account the duration of the tool movements in time! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis recommendations for EUR/USD and GBP/USD on December 13 Posted: 13 Dec 2019 12:16 AM PST Technical analysis recommendations for EUR / USD and GBP / USD on December 13 Economic calendar (Universal time) The pound's expectations came true. Boris Johnson and his government received an instruction to implement Brexit. The market quickly hit this news, and the bulls managed to fly to new heights. Meanwhile, in today's economic calendar, important statistics are not dominant again. We can only note data on retail sales in the USA (13:30). EUR / USD Yesterday, the players on the upside were not able to break through the important levels at 1.1145 (weekly Kijun + monthly Tenkan), but today, this did not prevent them from leaving these levels behind and into the tight approach to the next resistance zone. The resistance zone encountered is quite wide and concentrates many significant targets. To pass it, players on the upside will first have to eliminate the weekly dead cross (1.1208 Fibo Kijun), then work out the daily target for the breakdown of the cloud (1.1234-73) and meet the lower boundaries of the clouds 1.1253 ( monthly cloud) and 1.1283 (weekly cloud). The role of immediate support in this situation belongs to 1.1145 (weekly Kijun + monthly Tenkan) and 1.1080 (weekly levels + daily Kijun + upper boundary of the daily cloud). In the lower halves, the pair has already completed the rise to the zone of influence of the final resistance of the classic pivot levels (1.1207) today. I think that no significant new results are expected in the course of the day. Most likely, the day and closing of the week will take place at approximately the designated boundaries. At the moment, key support on H1 is located at 1.1130 (central pivot level) and 1.1096 (weekly long-term trend). GBP / USD Yesterday, players on the upside still allowed the opponent to perform a full correction to the daily short-term trend (1.3062), but this was limited and used support for a new take-off. As a result, two monthly levels were tested today - 1.3350 (the lower boundary of the monthly cloud) and 1.3452 (the final boundary of the monthly dead cross). Breaking through these levels will open the way to the fulfillment of the goal for the breakdown of the weekly cloud (1.3675 - 1.3866). Today's performance has already broken many records, so closing the current day and week is unlikely to bring new shocks. Now, support can have more value. Today, key levels on H1 are located in the region of 1.3150-84 (weekly long-term trend + central pivot level), while intermediate levels can be noted at 1.3431 (R3) - 1.3329 (R2) - 1.3225 (R1). Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Dec 2019 12:11 AM PST 4-hour timeframe

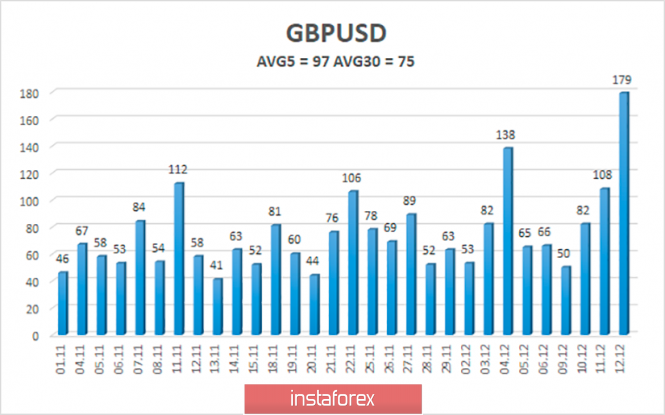

Technical data: The upper channel of linear regression: direction - up. The lower channel of linear regression: direction - up. The moving average (20; smoothed) - up. CCI: 335.2473 The British currency in the Asian trading session of the last trading day of the week has already managed to grow by 300 points. This was the reaction of traders to the preliminary victory of Boris Johnson in the elections. Given the maximum volatility of the GBP/USD pair, it is now quite problematic to trade the upward movement. It is not known how much longer it will last and when the downward correction will begin, which usually always happens after a strong rise or fall. However, the most important thing now for the pair and the whole of the UK is that Boris Johnson and his party seem to get the necessary majority in parliament after all. According to the latest data, 368 seats will be won by the conservatives, 191 - by Labor, the other parties and deputies - 91. Last night, we wrote that the probability of Johnson's Conservative Party winning is about 80%. There were, of course, concerns about the 100 regions that could vote both Conservative and Labor. However, these fears were not to be realized. So now is the time to follow Boris Johnson's advice, open the champagne and celebrate. Celebrate while there are times and opportunities. Because in a short time, the British pound and the whole of the UK will come out of a state of euphoria and resume the harsh everyday life. Harsh weekdays in which macroeconomic statistics in the UK continue to deteriorate every month without any Brexit. Harsh weekdays, when Boris Johnson and his government will have to negotiate with the European Union on trade relations after Brexit, to negotiate until the end of 2020, when the "transition period" ends, or ask for a new delay from the European Union. The harsh everyday life when you have to negotiate on a trade agreement with the United States and Donald Trump. Needless to say, these trade negotiations can be extremely difficult and lengthy, and the US leader himself, who today speaks well about the UK and Boris Johnson, tomorrow can change his rhetoric to the opposite and accuse London of "unfair treatment of America." Thus, according to many experts, a "majority government" in parliament is a victory for Boris Johnson. The implementation of Brexit - too. However, the pound will not rise permanently based on these two factors. The greatest concern we have is precisely the macroeconomic reports. As the last meeting of the Fed showed, Jerome Powell is optimistic about the future and positively assesses the current monetary policy and the state of the US economy. But the Bank of England clearly cannot boast of such a mood. At the last meeting, two of the nine members of the Monetary Committee voted "in favor" of a 0.25% rate cut. Given the macroeconomic statistics in the UK, not even for the last few weeks, but for the last two months, the British regulator has no other options but to ease monetary policy. Soften and hope that after the official exit from the European Union, the situation will not worsen even more. Recall that at a time when the Brexit process "went according to plan" and there was no political crisis in Britain, the greatest fears of Mark Carney and many experts were exactly how the UK will live after the "divorce" from the EU, how many years it will take to restore the economy. Brexit is not the end of the UK. It is obvious that sooner or later the British will learn to live outside the EU. The economy will reach the usual growth rates. However, the economy will suffer a serious blow in any case, respectively, and the pound may resume its decline, despite the possible end of the Brexit epic. From a technical point of view, it is now necessary for the markets and traders to calm down. After the 300-point growth of the pair, it is impractical to start buying it. However, the fall of the pair within the correction is not obvious. Thus, we believe that the best option is to wait until the emotions subside and the pair returns to the usual trading volumes.

The average volatility of the pound/dollar pair in the last 5 days rose to 97 points, in the last 30 days - 75 points. Thanks to today, the average volatility will grow even stronger, but it is worth understanding that 300 points tonight are an exception to the rule. Thus, they cannot even be taken into account when calculating the average volatility of the pound/dollar pair. It is clear that the levels of maximum volatility (the upper level) to date, the pair overcame at night. Nearest support levels: S1 - 1.3428 S2 - 1.3367 S3 - 1.3306 Nearest resistance levels: R1 - 1.3489 R2 - 1.3550 Trading recommendations: The GBP/USD pair resumed its upward movement. Thus, in these conditions, it is recommended to remain in the purchases of the pound until the reversal of the Heiken Ashi indicator down from the targets of 1.3489 and 1.3550. It is recommended to return to sales not earlier than the crossing of the moving average line by traders, which is not expected soon. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustrations: The upper channel of linear regression - the blue line of the unidirectional movement. The lower channel of linear regression - the purple line of the unidirectional movement. CCI - the blue line in the regression window of the indicator. The moving average (20; smoothed) - the blue line on the price chart. Support and resistance - the red horizontal lines. Heiken Ashi - an indicator that colors bars in blue or purple. Possible variants of the price movement: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Dec 2019 12:11 AM PST 4-hour timeframe

Technical data: The upper channel of linear regression: direction - up. The lower channel of linear regression: direction - up. The moving average (20; smoothed) - up. CCI: 166.1718 On Friday, December 13, the EUR/USD currency pair started quite cheerfully. Tonight, the correction that had begun quickly ended, and a strong upward movement was resumed. So strong that by the morning, the euro/dollar pair worked out the upper line of the volatility channel for today. Such growth in the Asian trading session was provoked, of course, by the preliminary results of parliamentary elections in the UK. According to preliminary data, despite all the fears, Boris Johnson's party will be able to win the election by a large margin from the closest pursuers - the Laborites. They will also be able to form a "ruling majority", thus, if this information is confirmed, the probability of a "divorce" of the UK and the European Union at the end of January under the agreement of Boris Johnson is now 99%. Since Brexit also has a very specific relation to the European Union and, accordingly, the European currency, currency traders did not leave aside the EUR/USD pair. However, the elections in the UK will be described in more detail in the article on the British pound. The last trading day of the week for the EUR/USD currency pair will not be too interesting. Of course, throughout the day, traders can work out the results of the elections in the UK, but we believe that the night movements for the euro/dollar will end. Of the interesting macroeconomic events planned for today, only US retail sales for November can be singled out. This indicator and its derivatives can complement a series of positive macroeconomic reports from the States, which are stubbornly ignored by traders. By the way, now that the parliamentary elections in the UK can be considered complete, the euro and the pound is "minus one" growth factor. We assume that the European currency has also grown in recent days on expectations of a victory for the Conservative Party and on expectations of speedy completion of Brexit, which everyone is already tired of. Now, when it is almost 100% likely that Brexit will take place at the end of January, it will be difficult for the euro currency to show growth based on this geopolitical factor. Also, the question is still in the air, and how much longer will market participants ignore weak macroeconomic statistics from the EU and the UK, as well as strong - from overseas? Theoretically, as much as you like, but this situation is nonsense for the currency market. The fundamental factor is one of the main drivers of the movement of any currency pair. Meanwhile, the topic of the US-China trade negotiations, which is of interest to all, is getting a new development. Donald Trump, as usual, through social media said that the parties are close to concluding a trade deal. "We are coming very close to a big deal with China. They want it and so do we," Trump wrote on Twitter. According to unconfirmed official information, the States are ready to halve the duties on Chinese imports, which are already in effect, as well as to refuse to introduce additional duties from December 15. In turn, the States require Beijing to guarantee purchases of agricultural products for a fixed amount annually, guarantees regarding intellectual property rights and providing the United States with broad access to China's financial sector. It is difficult to say whether the negotiations are really at the final stage. Several times, Trump has already announced the proximity of signing the agreement, then a few days later accused China of "non-compliance" and imposed new duties. In any case, on December 15, we will find out how things are. From a technical point of view, the euro/dollar currency pair resumed its upward movement, most likely, it will not continue today. Firstly, no important data will be available to traders during the day (except for one report), and secondly, traders have already shown their daily volatility today. Third, today is Friday, a good time for correction. The upward trend remains.

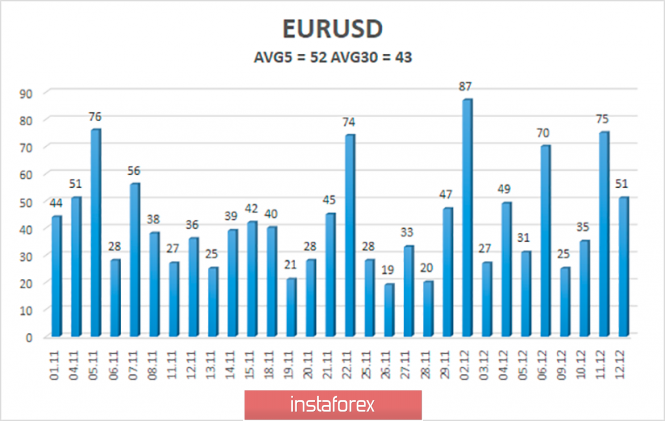

The average volatility of the euro/dollar currency pair is growing slightly and is now 52 points per day. The average volatility over the last 30 days rose to 43 points. Thus, the channel in which the pair can move today is limited to the levels of 1.1079 and 1.1183. And the upper line of this channel has already been worked out. Thus, we do not expect further strong upward movement. Maximum - working out the Murray level of "7/8" - 1.1200. Nearest support levels: S1 - 1.1139 S2 - 1.1108 S3 - 1.1078 Nearest resistance levels: R1 - 1.1169 R2 - 1.1200 R3 - 1.1230 Trading recommendations: The euro/dollar pair continues its upward movement. Thus, it is now relevant to buy the euro currency with the targets of 1.1183 and 1.1200 before the reversal of the Heiken Ashi indicator down, which is very likely today. The general fundamental background remains not on the side of the euro, but until the Heiken Ashi indicator turns down, the upward movement can continue, despite this. It is recommended to buy the US dollar not earlier than the crossing of the moving average line by traders with the first target of 1.1078. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustrations: The upper channel of linear regression - the blue line of the unidirectional movement. The lower channel of linear regression - the purple line of the unidirectional movement. CCI - the blue line in the indicator window. The moving average (20; smoothed) - the blue line on the price chart. Support and resistance - the red horizontal lines. Heiken Ashi - an indicator that colors bars in blue or purple. Possible variants of the price movement: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment