Forex analysis review |

- Fractal analysis of major currency pairs for December 16

- GBP/USD. Great Britain is outside the European Union. Problems begin even before the official Brexit.

- GBP/USD. December 15. Results of the week. Parliamentary elections are already in the past. Brexit is on the horizon again

- EUR/USD. December 15. Results of the week. "Fragile" truce between Beijing and Washington.

- Weekly EURUSD analysis

- Weekly analysis of Gold

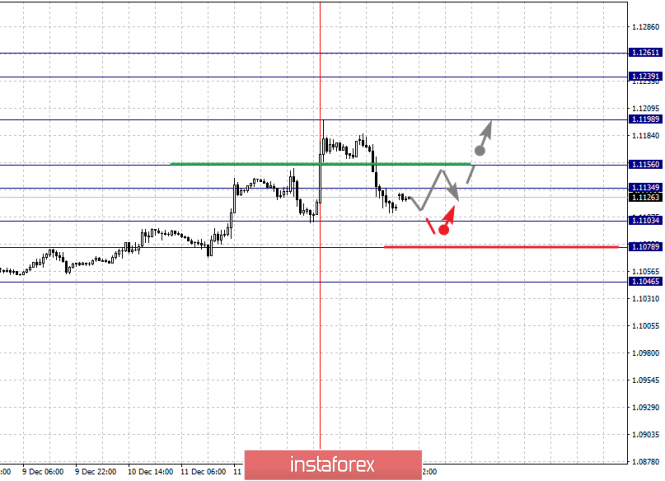

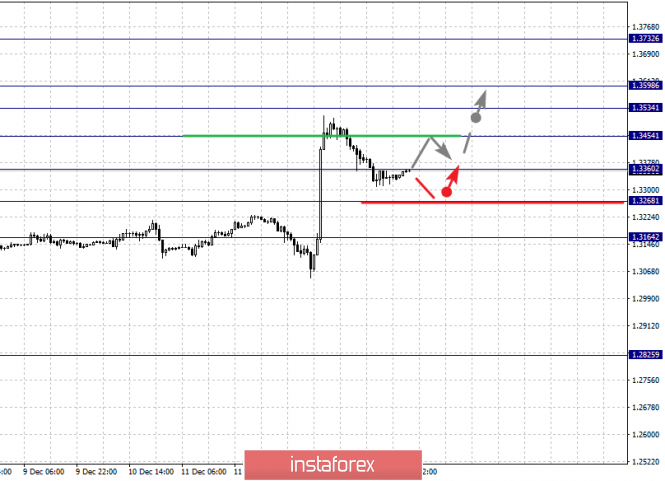

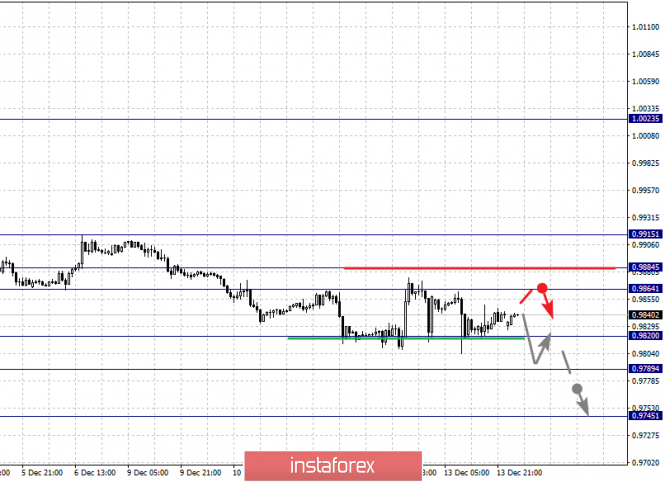

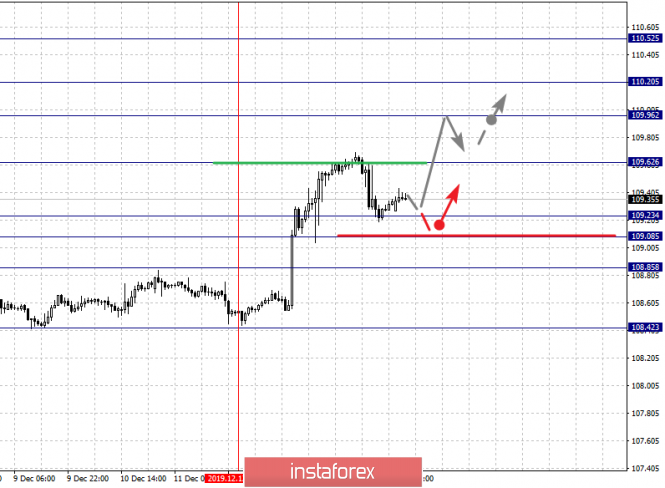

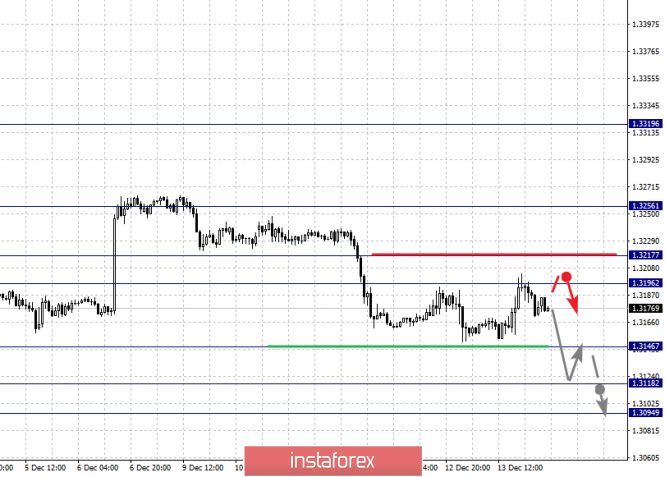

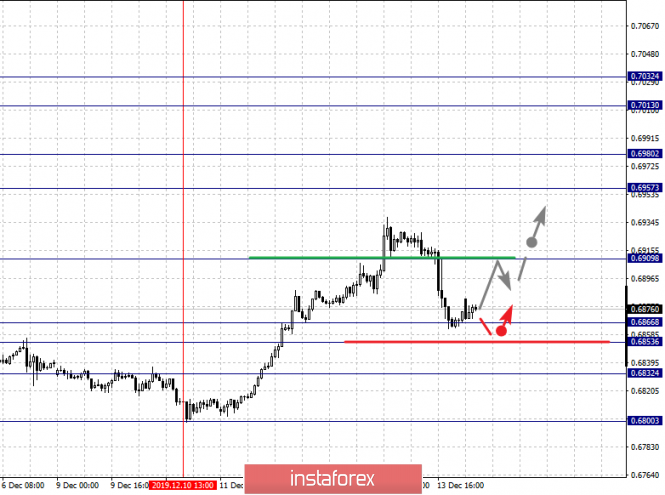

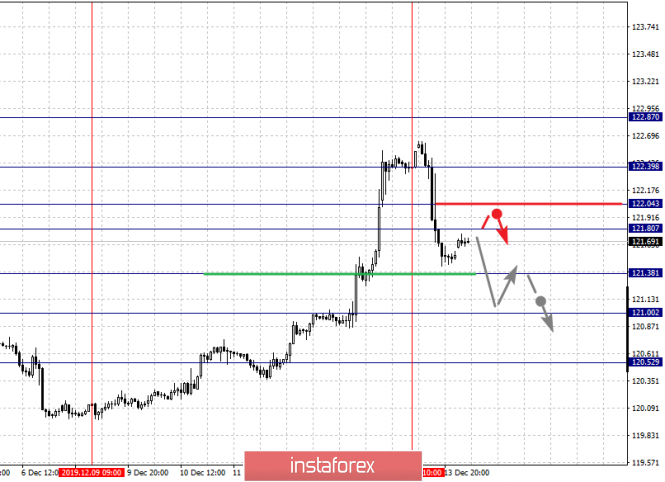

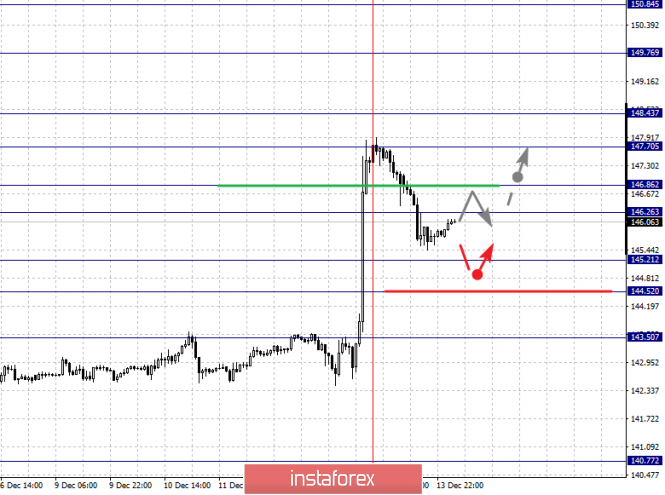

| Fractal analysis of major currency pairs for December 16 Posted: 15 Dec 2019 06:09 PM PST Forecast for December 16: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1261, 1.1239, 1.1198, 1.1156, 1.1134, 1.1103, 1.1078 and 1.1046. Here, the price is in the correction zone from the ascending structure on November 29. Short-term movement to the top is expected in the range of 1.1134 - 1.1156. The breakdown of the last value will lead to a movement to the level of 1.1198. Price consolidation is near this level. The breakdown of the level of 1.1200 will allow you to count on movement towards a potential target - 1.1261. Upon reaching this level, we expect consolidation in the range of 1.1261 - 1.1239. A short-term downward movement is expected in the range 1.1103 - 1.1078. The breakdown of the latter value will have the downward structure development from December 13. In this case, the potential target is 1.1046. The main trend is the upward structure of November 29, the correction stage Trading recommendations: Buy: 1.1134 Take profit: 1.1154 Buy: 1.1158 Take profit: 1.1196 Sell: 1.1103 Take profit: 1.1080 Sell: 1.1076 Take profit: 1.1046 For the pound / dollar pair, the key levels on the H1 scale are: 1.3732, 1.3598, 1.3534, 1.3454, 1.3360, 1.3268 and 1.3164. Here, the price is in correction from the upward structure on November 27. The continuation of the movement to the top is expected after the breakdown of the level of 1.3454. In this case, the first target is 1.3534. Short-term upward movement is possibly in the range of 1.3534 - 1.3598, Here, price consolidation is expected. The breakdown of the level of 1.3600 will lead to a movement to a potential target - 1.3732. We consider the movement to this level as unstable. Short-term downward movement is possibly in the range of 1.3360 - 1.3268. The breakdown of the last value will lead to a long correction. Here, the target is 1.3164. This level is a key support for the upward trend. The main trend is the upward cycle of November 27, the correction stage Trading recommendations: Buy: 1.3455 Take profit: 1.3534 Buy: 1.3535 Take profit: 1.3596 Sell: 1.3358 Take profit: 1.3280 Sell: 1.3365 Take profit: 1.3170 For the dollar / franc pair, the key levels on the H1 scale are: 0.9915, 0.9884, 0.9864, 0.9820, 0.9789 and 0.9745. Here, we are following the development of the downward structure of November 29. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9820. In this case, the target is 0.9789. Price consolidation is near this level. The breakdown of the level of 0.9789 should be accompanied by a pronounced downward movement. In this case, the potential target is 0.9745. We expect a rollback to correction from this level. Short-term upward movement is possibly in the range of 0.9864 - 0.9884. The breakdown of the latter value will lead to in-depth movement. Here, the target is 0.9915. This level is a key support for the downward structure of November 29. The main trend is the downward structure of November 29 Trading recommendations: Buy : 0.9864 Take profit: 0.9883 Buy : 0.9885 Take profit: 0.9913 Sell: 0.9820 Take profit: 0.9791 Sell: 0.9787 Take profit: 0.9745 For the dollar / yen pair, the key levels on the scale are : 110.52, 110.20, 109.96, 109.62, 109.23, 109.08 and 108.85. Here, we are following the formation of the initial conditions for the top of December 12. The continuation of the movement to the top is expected after the breakdown of the level of 109.62. In this case, the target is 109.96. We expect a short-term upward movement, as well as consolidation in the range of 109.96 - 110.20. For the potential value for the top, we consider the level of 110.52. Upon reaching which, we expect a rollback to the correction. Short-term downward movement is expected in the range 109.23 - 109.08. The breakdown of the last value will lead to an in-depth correction. Here, the target is 108.85. This level is the key support for the upward structure from December 12. Main trend: initial conditions for the top of December 12 Trading recommendations: Buy: 109.63 Take profit: 109.96 Buy : 109.98 Take profit: 110.20 Sell: 109.23 Take profit: 109.08 Sell: 109.06 Take profit: 108.85 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3256, 1.3217, 1.3196, 1.3146, 1.3118 and 1.3094. Here, we continue to monitor the long-term descending structure of December 3. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3146. Here, the target is 1.3118. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.3094. Upon reaching which, we expect a consolidated movement. Short-term upward movement is possibly in the range of 1.3196 - 1.3217. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3256. We expect the expressed initial conditions to formulate for the upward cycle up to this level. The main trend is the long-term descending structure of December 3 Trading recommendations: Buy: 1.3196 Take profit: 1.3215 Buy : 1.3218 Take profit: 1.3252 Sell: 1.3145 Take profit: 1.3119 Sell: 1.3116 Take profit: 1.3095 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.7032, 0.7012, 0.6980, 0.6957, 0.6909, 0.6866, 0.6853 and 0.6832. Here, we continue to monitor the development of the ascending structure of December 10. The continuation of the movement to the top is expected after the breakdown of the level of 0.6909. In this case, the target is 0.6957. Short-term upward movement is possibly in the range 0.6957 - 0.6980. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 0.7012. For the potential value for the top, we consider the level of 0.7032. Upon reaching this value, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 0.6866 - 0.6853. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.6832. This level is a key support for the upward structure. The main trend is the local structure for the top of December 10 Trading recommendations: Buy: 0.6910 Take profit: 0.6955 Buy: 0.6958 Take profit: 0.6980 Sell : 0.6853 Take profit : 0.6834 Sell: 0.6830 Take profit: 0.6800 For the euro / yen pair, the key levels on the H1 scale are: 122.87, 122.39, 122.04, 121.80, 121.38, 121.00 and 120.52. Here, the price is in a deep correction from the upward structure on December 9 and forms the potential for the bottom of December 13. The continuation of the movement to the bottom is possibly after the breakdown of the level of 131.38. Here, the first goal is 121.00. Price consolidation is near this level. The breakdown of the level of 121.00 will lead to a pronounced downward movement. Here, the potential target is 120.52. Short-term upward movement is possibly in the range of 121.80 - 122.04. The breakdown of the last value will have the subsequent development of the upward trend. Here, the first goal is 122.39. This level is the key resistance for the top. The main trend is the rising structure of December 9, the stage of deep correction Trading recommendations: Buy: 121.80 Take profit: 122.02 Buy: 122.06 Take profit: 122.35 Sell: 121.38 Take profit: 121.05 Sell: 121.00 Take profit: 120.60 For the pound / yen pair, the key levels on the H1 scale are : 149.76, 148.43, 147.70, 146.86, 146.26, 145.21, 144.52 and 143.50. Here, the price is in correction from the upward structure on December 4. Short-term movement to the top is expected in the range of 146.26 - 146.86. The breakdown of the latter value will lead to a movement to the level of 147.70. Price consolidation is in the range of 147.70 - 148.43. The breakdown of the level of 148.45 will lead to a pronounced movement. Here, the potential target is 149.76. We expect price consolidation near this level. Short-term downward movement is possibly in the range of 145.21 - 144.52. The breakdown of the latter value will lead to the development of a downward trend. Here, the potential target is 143.50. The main trend is the local ascending structure of December 4, the correction stage Trading recommendations: Buy: 146.26 Take profit: 146.82 Buy: 146.90 Take profit: 147.70 Sell: 145.20 Take profit: 144.60 Sell: 144.48 Take profit: 143.55 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Dec 2019 03:34 PM PST Fanfares died out, everyone was drunk from champagne, and the whole Kingdom celebrated the victory of Boris Johnson in the elections, and now the country really has the right to prepare for the final "divorce" from the European Union. Most likely, Boris Johnson will succeed in unhindered dragging his version of the "deal" with the European Union on Brexit through the new Parliament, which means that London and Brussels can announce the beginning of the "transition period" on January 31 (or even earlier). We said earlier that despite the strong appreciation of the pound against the optimism of traders regarding Brexit and the formation of a "majority government" by conservatives, the UK and the pound are now facing harsh everyday life. Moreover, pound may continue to strengthen in pair with the dollar, however, traders will begin to pay attention to macroeconomic statistics from Foggy Albion and from overseas sooner or later, and it does not need to be analyzed for a long time in order to draw appropriate conclusions. It is unequivocal, in favor of the American currency. Moreover, market participants can "remember" all those failed statistics from Britain in those two months when no one paid attention to it. If we add to this the still potentially long and complicated negotiations with the European Union on new trade relations between the bloc and the Kingdom, it becomes clear that the economic situation in the UK may continue to deteriorate, which will definitely negatively affect economic performance.And in the last three months, the main indicator of the state of the economy of any country – GDP - either showed negative growth rates, that is, decreased, or showed zero growth. Nevertheless, this is not all the potential problems that may be encountered in the UK. The fact is that no less high-profile than Boris Johnson, Nicola Sturgeon won in her Scottish Parliament. From which her party scored 48 out of 59 possible seats. Sturgeon had also previously stated that Scotland is against leaving the European Union. Now, after the deafening victory of the Scottish nationalists, talk of holding a second referendum resumed. The leader of the Scottish National Party said that "the future of Scotland should be in the hands of the Scots." According to Sturgeon, British Prime Minister Boris Johnson has a mandate for Brexit in England, but does not have a mandate to withdraw Scotland from the European Union. Next week, the Sturgeon party will submit an official application for a referendum on independence. "It's not about to ask permission from the prime minister of Great Britain or any other Westminster politician. This is a confirmation of the democratic right of the people of Scotland to determine their future." Sturgeon emphasized. "Scotland cannot be a prisoner of Britain, it needs to be allowed to hold a referendum on independence, since it was on the verge of leaving the European Union against its will." summed up by the first minister of Scotland. Thus, we believe that the UK can now face the new Brexit, even before the implementation of its own. Although it is difficult to say whether Nicola Sturgeon is able to hold such a referendum without the approval of London. And there is no doubt that London will not give approval. Thus,we can witness a new epic called "Scexit" (Scotland EXIT) very soon. The material has been provided by InstaForex Company - www.instaforex.com |

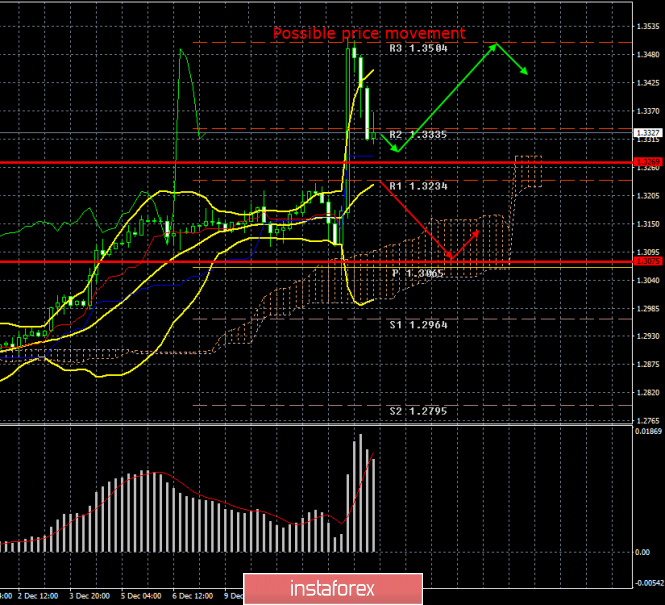

| Posted: 15 Dec 2019 03:34 PM PST 4 hour time-frame Amplitude of the last 5 days (high-low): 65p - 66p - 50p - 82p - 108p. Average volatility over the past 5 days: 75p (average). On Friday, GBP/USD currency pair began a downward movement, which was justified immediately for a number of factors. Firstly, the correction was clearly brewing after the pair's 300-point growth on the night when the vote was counted in the parliamentary elections. Even then, the probability of the victory of the party of Boris Johnson grew to almost 100%, and traders worked out this information. Secondly, do not forget that the pound as a whole has been growing for the last two or three weeks almost without a break based on the same high probability that the Conservative Party will win the election. Thirdly, if we exclude a few weeks of flat, then the British currency has been growing non-stop for more than two months, since October 10. Thus, after the election is left behind, the best time has come to take profits and begin the correction of the pound / dollar pair. In addition, do not forget that the currency pair traders all this time (more than 2 months) have zealously ignored absolutely all macroeconomic reports and data, both from the UK and from the United States. It cannot be that traders never worked out this information or continued to ignore any macroeconomic reports in the future. And if so, then the pound will begin to fall because the UK economic indicators remain at the level "below the plinth". Recent months have shown a serious slowdown in inflation, a fall in business activity in all sectors, a drop in industrial production, and negative or zero GDP growth. As with such indicators of the state of the economy, the British pound will be able to continue growth against the US currency in the issuing country whose macroeconomic statistics began to accelerate and grow again in recent weeks. Moreover, we continue to insist that Brexit is definitely a positive development after a three-year saga and it seems that the current composition of the Parliament will finally be realized, but the UK's secession from the EU itself is another negative development for the economy, Great Britain and, accordingly, pound sterling. Thus, we are still waiting for the pair to turn down and start a new long-term downward trend. This, of course, is not the only possible scenario, but the most likely, from our point of view, and to be more confident, you need to wait for the reversal down technical indicators. By the way, we remind you that the Bank of England may lower the key rate at the next meeting or do it immediately after January 31. Meanwhile, Boris Johnson, who remained the country's prime minister, continues to celebrate the victory and hand out interviews. Johnson has already stated that "this is an exceptional victory for his party" and thanked absolutely all the inhabitants of Great Britain, and those who voted for the conservatives, and those who voted for other parties. In the near future, Boris Johnson is going to vote in Parliament on his deal with the European Union and now, no one expects that any problems will arise with this. Most likely, an agreement with the European Union will be approved and in early 2020, the UK will begin an 11-month transition period before the country finally leaves the Alliance. On the other hand, the leader of the Labor Party, Jeremy Corbyn, apologized to the party members for the failed result, and promised to regain the confidence of the residents who had previously voted for the Labor Party, but now they have changed their choice and even hinted that he might resign. "We will learn from this defeat, first of all, after listening to the Labor voters whom we lost ... This party exists to represent them. We will regain their trust." Corbyn said. The leader of the party, which won 59 seats less than in the 2017 elections, said: "The election results were a crushing blow for everyone who needs real changes in the country. I wanted to unite the country that I love, and I am sorry that we did not manage. I take responsibility for that." Well, the leader of the third most popular party in the UK, Nicola Sturgeon, said that the results of the Scottish party should return Boris Johnson to "reality" and recognize that the party received the right to hold a second referendum on independence, winning in 48 counties. "The results of this referendum on Scottish independence will need to be taken much more seriously than in 2014," Sturgeon said. Thus, as we see, the Scottish government does not want to leave the European Union, which has been openly stated more than once, but wants to leave the United Kingdom, because it understands that now Boris Johnson and his plans can no longer be stopped. Based on all this, we believe that the most interesting thing for the UK and the British pound is just beginning. Now the "transition period", negotiations on trade relations between the UK and other countries, and the "battle for Scotland" will begin. And all this is against the background of continuing to slow down the UK economy. Trading recommendations: GBP/USD has started a downward correction, which could develop into a full-fledged downward trend. However, while the price is above the critical line, the chances remain that the British currency will continue to grow with targets around 1.3504. Thus, a rebound in the price from the Kijun-sen line can provoke the completion of the correction and leave bulls in business. However, breaking through the critical line for traders will be the first step towards a new downward trend with the first goals near the lower border of the Ichimoku cloud. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. December 15. Results of the week. "Fragile" truce between Beijing and Washington. Posted: 15 Dec 2019 03:34 PM PST 4 hour time-frame Amplitude of the last 5 days (high-low): 31p - 70p - 25p - 35p - 75p. Average volatility over the past 5 days: 48p (average). On Friday, December 13, EUR/USD currency pair began a round of downward correction after it had ideally developed the resistance level of 1.1173 and the upper line of the volatility channel - 1.1183, which was indicated as early as Friday morning. However, it should be recognized that for most of the last trading day of the week, the euro/dollar currency pair did not openly know what to do. Traders were confused as the Euro currency, during the night trading, managed to gain a foothold in the framework of the continuing upward trend (which raises great doubts from the point of view of fundamental validity) solely due to the crushing victory of the Conservative Party in the UK elections. That is, it is safe to say that the pound on the most important day of the year for itself simply dragged up and the euro. It is in this interpretation, because if the euro also responded to Brexit events, then it would start to rise in price simultaneously with the pound, that is, at least a few weeks earlier. Thus, the nightly growth of the Euro currency on Friday can be called a coincidence and does not fit into the big picture. Further, a much more logical correction began at the American trading session after the not quite justified growth of the European currency. Firstly, the end of the week is the best time to take profits on previously opened positions. Secondly, a point was immediately set in several cornerstones on Friday that worried and worried market participants for a long period of time. It's all about the same parliamentary elections in Great Britain (markets waited for them for about 2 months), about Brexit, which should now be realized before the end of January (markets have been waiting for this for more than three years), as well as the de-escalation of the trade conflict between the United States and China, which on Friday the 13th, agreed on a kind of ceasefire, but did not sign any agreements, even in the "first phase". That is, in fact, we know only from the words of the American president that the parties have agreed and will not introduce new duties against each other. In addition, part of the duties that are already in effect will be canceled.. According to media reports, China and the States should sign the relevant document in January. That is, purely hypothetical since the situation may change several more times until January. Moreover, all the conditions that were announced by the States (not China and the States, but only the States) sound like this. Washington upholds 25% of trade duties that affect $ 250 billion worth of imports from China to the United States. Washington will lower $ 120 billion from China's import duties from 15% to 7.5%. And from December 15, it refuses to introduce new duties in the amount of another 160 billion dollars. In turn, Beijing is committed to buying more agricultural products, goods and services from America. We are talking about the amount of about $ 100 billion a year. However, it's hard to say how the issues of intellectual property protection and America's access to the financial sector of China were resolved. We believe that the agreements between Donald Trump and Xi Jinping are a very good sign for the entire world economy. This agreement gives real hope that the parties will continue the dialogue and eventually cancel all duties against each other and the trade war will end. However, from our point of view, it is still very early to open and drink champagne in this matter. Firstly, we would like to draw attention to the fact that more than half of imports from China remain under US duties. That is, in fact, the States only canceled half of the second package of fees in the amount of about $ 60 billion, that's all. The very first package of duties remained in operation. Thus, the global economy will continue to suffer due to the trade war between China and the United States. Secondly, we have already witnessed a situation where Beijing and Washington seem to have agreed, but at the last moment, Trump declared that "China is playing a dishonest game" or "does not comply with the terms of the agreement", introduced new duties and the trade war escalated. Thus, a trade war can erupt with renewed vigor at any time until the parties sign the agreement. Moreover, both sides note that the "first step" has been taken, but there are still a lot of complex and difficult issues that need to be addressed. Based on the previously mentioned, we believe that the best reflection of the de-escalation of the trade conflict between the United States and China will be an improvement in macroeconomic indicators in both America and the European Union (since we are interested in the currencies euro and dollar). This has a more indirect relation to America, because macroeconomic statistics in the United States is at a fairly good level after the Fed has taken actions. However, everything is very bad in the EU, if we take economic indicators. It is the de-escalation of the trade conflict (if it is not only on paper and in sufficient volume) that can positively affect the performance of the EU economy. Thus, we will find out in the next few months if there is any reason for the global economy from the fact that Beijing and Washington have agreed? Trading recommendations: The EUR/USD pair started a new round of correction against the upward trend. Thus, long positions formally remain relevant with the goals of the resistance level of 1.1173 and 1.1183, but only after the completion of the current correction and the back fixation of the bulls above the Kijun-sen critical line. Now, it is formally possible to sell a pair of euro/dollars, since the Kijun-sen line has been broken through, but with targets 1.1079 and Senkou Span B line in small lots. Tomorrow morning, new and more accurate targets for trading will be determined. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support/Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Dec 2019 02:13 PM PST EURUSD is challenging important long-term resistance area. There is a confluence of resistance levels between 1.11-1.1160 that makes this area a very important area for the future price movement in EURUSD.

EURUSD is trying to make a higher high relative to the October highs. So far we have seen a higher low. A higher high will increase the chances of a weekly trend reversal signal, as price is breaking above the long-term downward sloping trend lines. Key support remains at 1.0980-1.10 area. Upside target in case we see a breakout is at 1.1260-1.13 at first. 1.14 will be expected to follow. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Dec 2019 02:08 PM PST Gold price is trading right below the important medium-term resistance area and previous support at $1,490-$1,500. Short-term trend remains bearish as long as price is below that level, however the price pattern looks very similar to the price action during the start of 2019.

Gold price back then formed a similar bullish flag pattern. We all know what followed. Gold bulls have a similar opportunity now. If Gold price recaptures $1,500 then we turn bullish looking for new highs towards $1,600 and higher. Support is found at $1,450. As long as price is above that level bulls maintain their hopes. If support fails to hold, then we should expect $1,400 to be challenged. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment