Forex analysis review |

- Forecast for EUR/USD on December 26, 2019

- Forecast for GBP/USD on December 27, 2019

- Forecast for AUD/USD on December 27, 2019

- Comprehensive analysis of movement options of #USDX vs AUD/USD vs USD/CAD vs NZD/USD (H4) on December 27

- Trading idea for natural gas on 2020 of the 3rd millennium

- Christmas debts on euro. Trading idea for the EUR/USD pair

- USD/JPY: Kuroda's usual concern, Trump's optimism and general risk appetite

- EUR/USD: will 2020 be favorable for the dollar or the euro

- EUR/USD. December 25. Results of the day. Stephen Mnuchin confirms the agreement with China

- December 26, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- December 26, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- USD Index analysis for 12.26.2019 - Breakout of the well-defined upward channel, downward movement is expected

- Gold 12.26.2019 - Gold has been trading upside and I do expect potential test of $1.515

- BTC 12.26.2019 - Important Fibonacci confluence resistance is set at $7.305, watch for selling opportuntiies near this zone

- Evening review for EURUSD for 12/26/2019

- GBP/USD: plan for the US session on December 26. The bears are coming after a failed attempt by the bulls to take the level

- EUR/USD: plan for the US session on December 26. The euro retreated from its daily highs. Volatility remains low after the

- Analysis and trading recommendations for USD/JPY as of December 26, 2019

- Analysis of EUR/USD and GBP/USD for December 26. Christmas holidays continue

- Technical analysis recommendations for EUR / USD and GBP / USD for December 26

- USDCAD could see price move above 1.32 soon

- Trading recommendations for EURUSD for December 26

- Simplified wave analysis for GBP/USD and USD/JPY for December 26

- Trader's Diary: EURUSD on 12/26/2019, Where to begin?

- Analysis and trading ideas for EUR/USD and GBP/USD for December 26, 2019

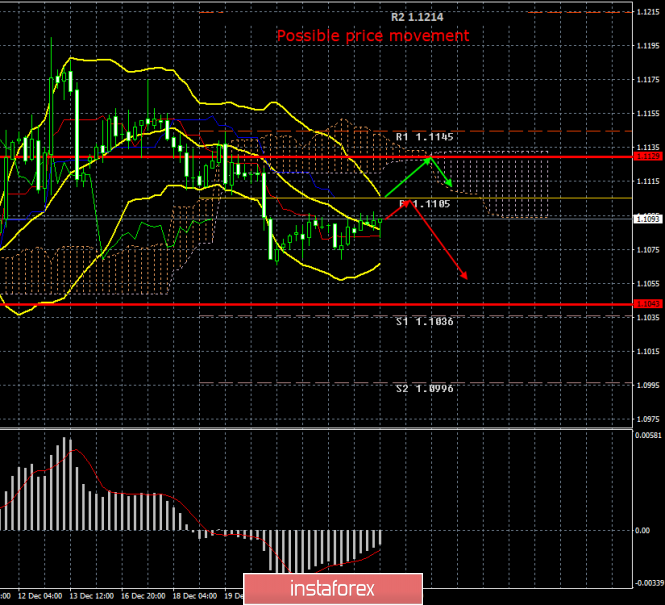

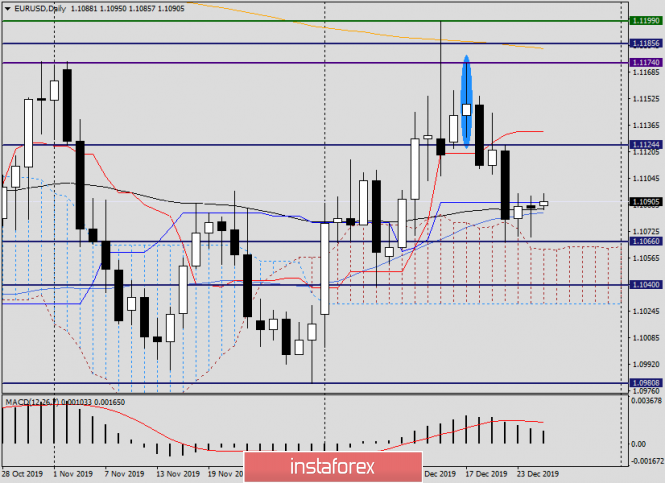

| Forecast for EUR/USD on December 26, 2019 Posted: 26 Dec 2019 06:49 PM PST EUR/USD The dollar is in no hurry to breakthrough in the foreign exchange market, probably leaving decisive action in the early days of the new year. Today, the euro enjoys easing and continues to correct. The first barrier to this growth is the MACD line on a four-hour chart at a price level of 1.1120. Overcoming this resistance may extend growth to the top of December 19 at the price of 1.1144. The signal line of the Marlin oscillator is in the growth zone, but has penetrated into this zone along a gentle trajectory, which warns of a weak trend. After the correction is completed, we are waiting for the price to fall to support the embedded line of the price channel on the daily chart, in the area of 1.1056. When the price exits below the MACD line (1.1036), this will signal a medium-term decline in the euro. The Marlin oscillator slightly rises after the market, its positive reading is weak, consolidation in the growth zone has not yet occurred. The material has been provided by InstaForex Company - www.instaforex.com |

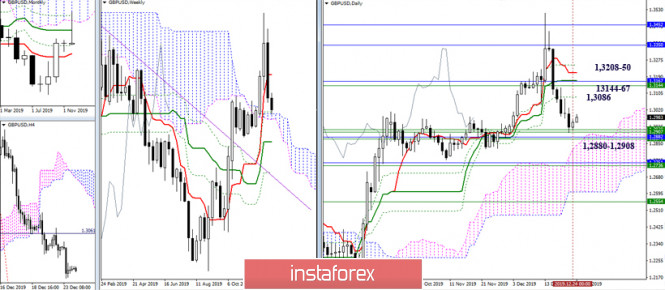

| Forecast for GBP/USD on December 27, 2019 Posted: 26 Dec 2019 06:47 PM PST GBP/USD On Thursday, the British pound slightly grew (32 pp), taking advantage of the general weakening of the dollar (-0.09%). The MACD line on the daily chart (1.3010) acts as a growth limiter. In the main scenario, a pound reversal for a further decline can occur today. The target until the end of the year is the Fibonacci level of 138.2% at a price of 1.2820. The Marlin oscillator is in the decreasing trend zone. On the four-hour chart, yesterday's growth was delayed by the balance line indicator. Here, the probability of continued correctional growth to the Fibonacci level of 23.6% (1.3049) or even to the MACD line at the price of 1.3095 is manifested here. But if the price lingers at current levels until tonight, the signal line of the Marlin oscillator, already showing the intention to turn down, could be in the zone of negative numbers, and then continued growth will have low chances. |

| Forecast for AUD/USD on December 27, 2019 Posted: 26 Dec 2019 06:47 PM PST AUD/USD The Australian dollar showed strong growth yesterday, supported by the growth of oil and gold: oil grew by 1.01%, gold by 0.73%. However, the growth occurred at the lowest daily volumes for the last 12 months, that is, even less than the Christmas period last year, according to the Marlin oscillator, a reversal divergence is being prepared - the price yield over the embedded price channel line can already be determined as false. With the price leaving yesterday's low, the 0.6846 target opens - the point of coincidence of the MACD line with the underlying embedded line of the price channel. On the four-hour chart, the main support is the MACD line (0.6915). Consolidating the price below it can strengthen the aussie's decline. The material has been provided by InstaForex Company - www.instaforex.com |

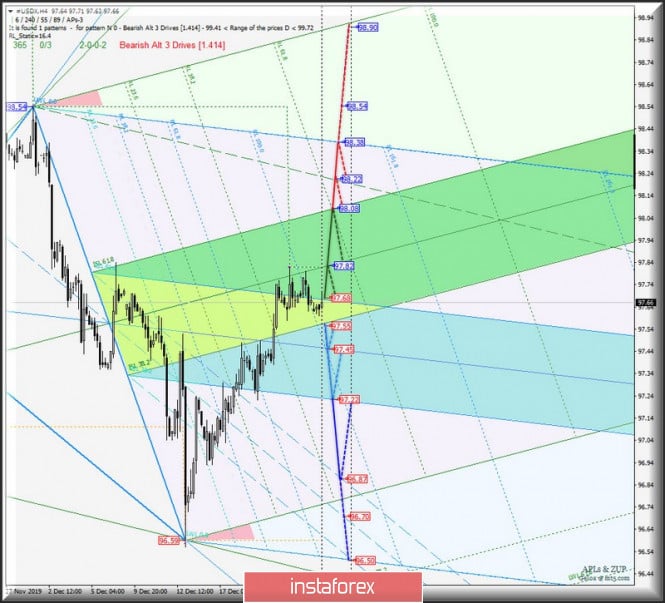

| Posted: 26 Dec 2019 06:00 PM PST Minuette operational scale (H4) It is already the end of year 2019 - what will happen next with the raw materials instruments? Here's a comprehensive analysis of the development options for the movement #USDX vs AUD / USD vs USD / CAD vs NZD / USD from December 27, 2019. ____________________ US dollar index The development of the movement of the dollar index #USDX from December 27, 2019 will be due to the development and direction of the breakdown of the range:

The breakdown of the resistance level of 97.68 at the upper boundary ISL61.8 of the equilibrium zone of the Minuette operational scale forks will determine the further development of the #USDX movement in the equilibrium zone (97.55 - 97.82 - 98.08) of the of the Minuette operational scale forks with the prospect of reaching the final Schiff Line Minuette (98.22) and the final line FSL Minuette (98.38). On the contrary, the breakdown of the lower boundary of the ISL38.2 channel of the equilibrium zone of the Minuette operational scale forks (support level of 97.55) - an option to return the development of the movement of the dollar index within the boundaries of the equilibrium zone (97.68 - 97.45 - 97.22) of the Minuette operational scale forks with the prospect of reaching the boundaries 1/2 Median Line Minuette channel (96.87 - 96.70 - 96.50). The details of the #USDX movement are presented on the animated chart. ____________________ Australian dollar vs US dollar The movement of the Australian dollar AUD / USD from December 27, 2019 will also occur depending on the development and the direction of breakdown of a narrow range:

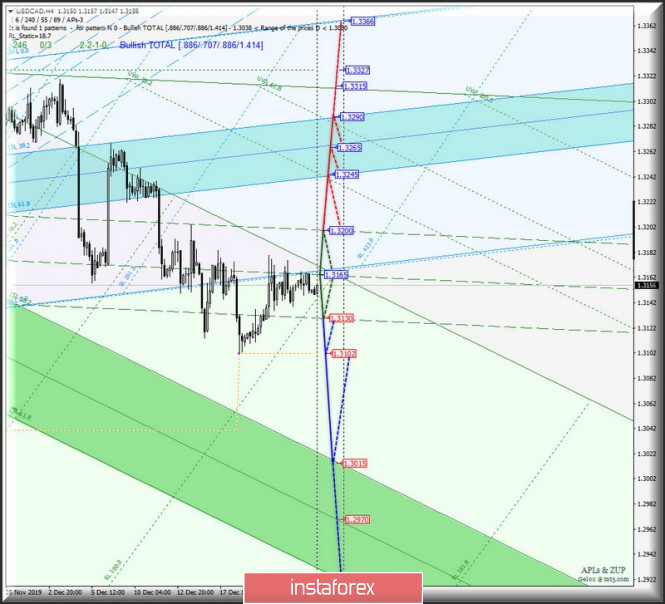

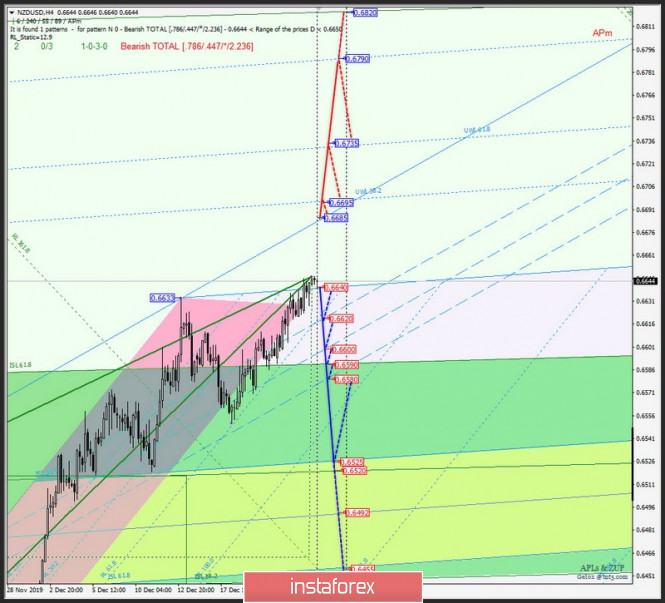

In the event of a breakdown of the support level of 0.6925, the development of the Australian dollar will begin to flow again in the 1/2 Median Line (0.6925 - 0.6900 - 0.6875) of the Minuette operational scale forks with the prospect of reaching the SSL Minuette start line (0.6855). On the other hand, in case of breakdown of the resistance level 0.6930 - it will lead to an option for the development of the AUD / USD movement in the 1/2 Median Line channel (0.6930 - 0.6945 - 0.6960) of the Minuette operational scale forks with prospect. Now, after the breakdown of the above levels of this channel - the price of the instrument will try to reach the boundaries of the equilibrium zone (0.6965 - 0.7000 - 0.7040) of the Minuette operational scale forks. We look at the layout of the AUD / USD movement options on the animated chart from December 27, 2019. ____________________ US dollar vs Canadian dollar Te development of the USD / CAD movement, respectively from December 27, 2019, will be determined by the development and direction of the breakdown of the levels boundaries (1.3130 - 1.3165 - 1.3200) of this channel - traffic marking inside the 1/2 Median Line Minuette channel is presented on the animated chart. The breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 1.3200) of the Minuette operational scale forks will confirm the development of the upward movement of the Canadian dollar to the equilibrium zone (1.3245 - 1.3265 - 1.3290) of the Minuette operational scale forks. In case of breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 1.3130) and the local minimum 1.3102 is updated, the downward movement of USD / CAD will be directed to the equilibrium zone (1.3015 - 1.2970 - 1.2925) of the Minuette operational scale forks. We look at the markup of the USD / CAD movement options on the animated chart from December 27, 2019. ____________________ New Zealand Dollar vs US Dollar New Zealand Dollar in the range:

The breakdown of the support level 0.6560 (the initial SSL Minuette line) - the development of the NZD / USD movement will be directed to the boundaries of the 1/2 Median Line channel (0.6620 - 0.6600 - 0.6580) of the Minuette operational scale forks and the equilibrium zones of the Minuette operational scale forks (0.6590 - 0.6525 - 0.6450) and Minuette (0.6525 - 0.6492 - 0.6455). Meanwhile, the breakdown of the control line of the pitchfork UTL operational scale Minuette (resistance level of 0.6685) will make possible the development of the movement of the New Zealand dollar to levels of resistance: - 0.6695 - warning line UWL38.2 of the Minuette operational scale fork; - 0.6735 - warning line UWL61.8 of the Minuette operational scale forks; - 0.6790 - warning line UWL100.0 of the Minuette operational scale forks. We look at the layout of the NZD / USD movement options on the animated chart from December 27, 2019. ____________________ The review was prepared without taking into account the news background. Thus, the opening of trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6%; Yen - 13.6%; Pound Sterling - 11.9%; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

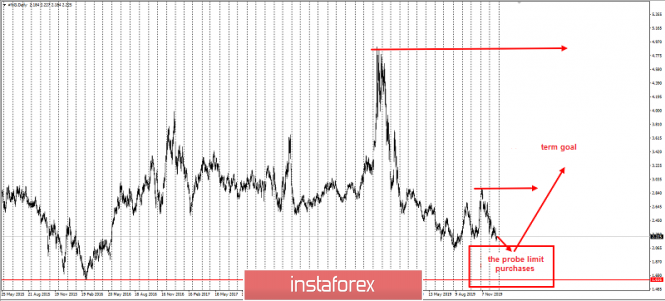

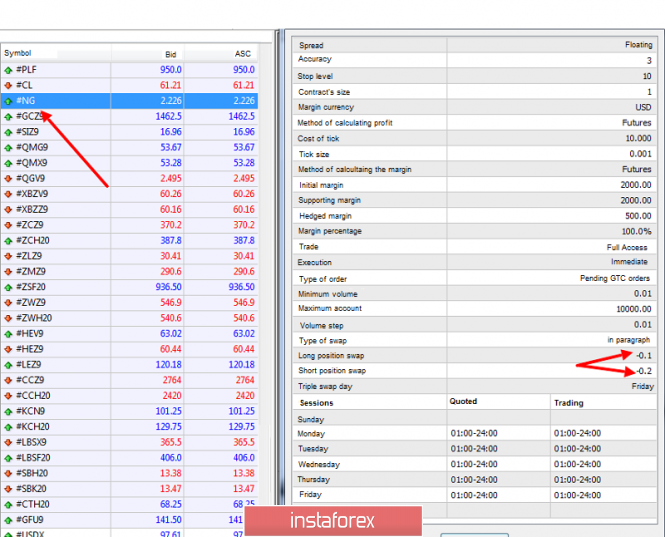

| Trading idea for natural gas on 2020 of the 3rd millennium Posted: 26 Dec 2019 03:39 PM PST Good evening, dear traders. Merry Christmas and a Happy New Year to all Catholics! The market is relatively quiet. Some instruments were opened with gaps after yesterday's Christmas, while some have not been opened so far. This is normal. Thus, you must understand that this happens every year, as inevitably as the seasons change. Moreover, Forex is an interbank market, and, as you know, not a single bank will carry out serious large operations at this time. This time is characterized by low interest and liquidity. This means that you should not rely on objective medium-term trends in the currency exchange market at this time. However, the movements can vary, and more so, very sharp and often unpredictable, which then explain everything with reduced liquidity. Against this background, I recommend reducing sales volumes before the start of the year, as well as paying attention to NG natural gas. Gas is traded at the lows of the year near the historical low of 2016. If you want to build a long-term idea for the purchase of one of the most popular energy resources on the planet, you should pay attention to this from the point of view of the investor. Nevertheless, few people know that the currency market has one of the lowest gas swaps: In addition, even if they can not be paid by using accounts without charging swaps - they can do another option which is by putting only one checkmark when opening an account. The trading idea for the purchase of natural gas can be implemented by a network of limit purchases in the range shown in the first figure. Holding a position can be from several months to a year. Therefore, this idea can bring good and stable returns at the investment level. Good luck in trading! The material has been provided by InstaForex Company - www.instaforex.com |

| Christmas debts on euro. Trading idea for the EUR/USD pair Posted: 26 Dec 2019 03:28 PM PST The EUR/USD pair, which is the most popular trading instrument among currency traders, left a good three-day trading floor for December lows after the decline on December 20, thereby indicating the risk level of sellers in this zone. Indeed, if you imagine that, for example, the last 3 days you have been buying euros against the US dollar, then the most likely scenario will be the placement of a stop order exactly at the level of 1.1066. In my opinion, this is a classic trap. Thus, the hunt for this level is declared! Today is not closed yet, but in the case of closing the American session in the red - you can develop in the sell with take-down at the stop level of buyers 1.10663. From the point of view of Price Action, I recommend waiting for the close of the day, and if it ends with a D1 pin-bar, you can rely on it in sales for the specified target. Have a successful trading and control the risks! The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY: Kuroda's usual concern, Trump's optimism and general risk appetite Posted: 26 Dec 2019 02:57 PM PST Christmas Eve, Christmas Day, Boxing Day, St. Stephen's Day - the foreign exchange market continues to trade amid low liquidity. Only Japan has a peculiar role as a news provider, influencing the yen accordingly. The Japanese currency also reacts more actively to the external fundamental background - at least in comparison with other currencies of the major group. The increased risk appetite against the backdrop of a dovish speech by the head of the Bank of Japan helped the bulls of the USD/JPY pair rise by several dozen points. Nevertheless, the pair remained in the price range of 109.00-109.90, within which it has been trading for almost two weeks. To break out of this price range, bulls or bears of the pair need a more compelling information event - either from the Japanese regulator or from China/US. Today, the head of the Japanese central bank Haruhiko Kuroda made a speech at the annual meeting of representatives of the Nippon Keidanren Business Federation. He reiterated his thesis that the regulator "without hesitation" will resort to additional measures to mitigate monetary policy if the momentum of inflationary growth fades. It is worth noting here that inflation in Japan shows an extremely weak, but still growth: the November consumer price index reached 0.5% (in annual terms), while this figure could only increase to 0.2% in October. On a monthly basis, inflation in November grew by a modest 0.2%. The consumer price index excluding the cost of fresh food (the main indicator for the Japanese regulator) in November increased by 0.4% year on year after rising 0.2% in September. In general, this dynamics did not come as a surprise to most experts - the indicator came out at the forecast level. Weak but stable inflationary growth allows the Bank of Japan to maintain a wait-and-see attitude - the latest meetings are held in a verbal setting mode, which everyone has become accustomed to by and large. Kuroda has repeatedly shown readiness for action, but does not mean the "red lines" at the intersection of which the Bank of Japan will move from words to deeds. So far, the head of the Japanese regulator is trying to influence the situation using slightly different methods. For example, at today's meeting, he called on major Japanese employers to increase the payroll for their employees. According to him, this will help increase consumer demand and accelerate inflation. On the one hand, this is just a recommendation from the head of the central bank. But on the other hand, it is worth considering the specifics of the relationship between Japanese business and the banking regulator. As we know, Japan is a country of financial conglomerates, industrial giants and other large holdings. Their impact on the country's economy is very significant. Kuroda several years ago already resorted to such requests, but then they could not get the situation off the ground. Now the situation is repeating itself - apparently, the head of the central bank considers the interest rate cut as a necessary measure. Despite the threats of the dovish nature voiced today, he voiced an optimistic assessment of global economic prospects. This suggests that the de facto Japanese regulator in the foreseeable future will maintain a wait-and-see attitude. Despite the contradictory results of today's speech by Kuroda, the yen lost ground with the dollar. The Japanese currency is weakening amid a general risk appetite. Let me remind you that just recently - at the beginning of this week - relations between the United States and China again worsened, against the background of Trump's signing of the military budget for next year. This document includes the provision of military assistance to Taiwan, and the provision of support to Hong Kong protesters. The Chinese were outraged by this state of affairs, since they consider these territories part of their country. A spokesman for the Chinese Foreign Ministry threatened the United States with almost a cold war if the intentions declared by the Americans were implemented. After that, the dollar slowed down, especially against the backdrop of weak data on the volume of orders for durable goods (the only significant release this week). But then Donald Trump tweaked the fundamental picture with his tweets - he announced that "in the near future" the ceremony of signing the first phase of the trade transaction will take place. According to preliminary data, this will happen in January, after the 86-page text of the agreement is translated and finally agreed. Trump said that next year he will "meet" with the Chinese leader, although the procedure for signing the first part of the deal will be at the ministerial level. Nevertheless, the optimistic mood of the US president encouraged dollar bulls, while interest in the yen (as a defensive asset) declined throughout the market. Tokyo's consumer price index will be published tomorrow in Japan. This indicator is considered a leading indicator for price dynamics across the country. In normal times, this index is ignored by the market, but against the background of an almost empty economic calendar, traders can turn their attention to it. According to the general forecast, the index should demonstrate positive dynamics (growth up to 0.9%). Otherwise, the USD/JPY pair will continue its upward dynamics, at least up to the resistance level of 109.90 - this is the upper line of the Bollinger Bands indicator on the daily chart. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: will 2020 be favorable for the dollar or the euro Posted: 26 Dec 2019 02:57 PM PST As the western world moves away from Christmas, experts continue to evaluate the prospects for EUR/USD in 2020. According to a consensus forecast of analysts recently surveyed by Bloomberg, the euro will rise against the US dollar to $1.16 by the end of 2020. It is assumed that the loss of investor interest in US stocks amid a slowdown in the US economy, lack of support from the Federal Reserve's monetary expansion and overbought S&P 500 will expand capital flows. They will flow from the US to the EU. Hints of this have already appeared in the fourth quarter. For the first time since the middle of last year, the net demand for ETFs oriented to European securities entered the positive zone. In 2019, the S&P 500 index increased by more than 28%, which is near the levels of 2013 (+29.6%) and 1997 (+31%). However, history shows that the next year, after such an impressive rally, the stock index usually lost ground and increased only by 6.6% on average. On the one hand, the loss of investor interest in American securities is an important trump card in the sleeve of bulls on the euro. On the other hand, if you refer to history, then the slowdown in the S&P 500 is not a reason to refuse to buy the dollar. If we study the behavior of the US currency (starting from 1978) after the inversions of the yield curve of the Treasuries, the last of which took place about 4-5 months ago, and try to transfer the dynamics of the USD index from the past to the future, then in the next three months the dollar may rise in price by 3 .5%. This will run counter to the majority opinion on the market, which will accelerate the decline in EUR/USD. Experts at Nordea Markets believe that such a scenario is quite possible, and predict a collapse of the euro to $1.0750. However, not everything depends solely on the US currency. If Washington and Beijing manage to resolve trade disputes, and the eurozone economy embarks on a recovery path, the European Central Bank will have an excellent opportunity to follow in the footsteps of the Riksbank and abandon the policy of negative interest rates, which has many side effects. It is noteworthy that the derivatives market has already begun to lay in the quotes the probability of an increase in the deposit rate in 2020. Skeptics argue that the European regulator will start the process of normalizing monetary policy only if it wants to get deflation, but in reality everything will depend on the state of health of the eurozone economy. If the divergence in US and EU economic growth narrows, the Fed, instead of sitting on the sidelines, will begin to talk about lowering the interest rate, and on the contrary, the ECB will raise it, then EUR/USD will go up. In this regard, the consensus forecast of Bloomberg experts on the growth of the euro to $1.16 looks quite convincing. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. December 25. Results of the day. Stephen Mnuchin confirms the agreement with China Posted: 26 Dec 2019 02:56 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 45p - 37p - 59p - 26p - 25p. Average volatility over the past 5 days: 39p (average). On Thursday, December 26, the EUR/USD currency pair continues to trade as boring and uninteresting as the last few days. Macroeconomic statistics are now zero integers, zero tenths, and the euro/dollar pair is doing its best to at least move. At the moment, an upward correction has begun and is continuing, of course, at very low volatility, and the critical Kijun-sen line may be worked out in the near future. However, even a rebound in quotes from this line cannot be considered a signal for selling under current conditions. The pair can safely go into full flat now or have already done so. In any case, whether the trend is moving now, whether it is corrective, lateral, with the current levels of volatility, it is extremely difficult to work in the market. According to the last five trading days, the average volatility is 39 points, but in fact, it has not exceed 26 points since the beginning of this week. From the positive news (due to the very fact of their presence on an empty general fundamental background), one can note the statement by US Treasury Secretary Stephen Mnuchin that the parties (China and the US) will soon sign the agreement in the first phase . Actually, that's all and there is absolutely nothing new in this news, since the information that the parties are preparing to sign a trade agreement has been known for a long time. It also appeared that China officially protests to the United States over some restrictions on Chinese companies that were adopted in the US defense budget for 2020. The PRC Ministry of Commerce notes that the United States are tightening sanctions against Chinese companies, although they should not seem to aggravate the situation between the countries against the background of the signing of a trade agreement soon. According to the Chinese side, the United States continues to intervene in domestic Chinese affairs, now in commercial activities. Actually, there is no fundamentally new information. China regularly protests in response to various US actions that interfere with China's internal affairs. Recall, just recently, China protested against the adoption by the US Congress of two laws, which are also regarded as interference in the internal affairs of China. We are talking about Uyghur and Hong Kong laws. However, as we see, these protests do not prevent Beijing and Washington from continuing to conduct dialogue on the terms of trade between the countries. In addition to these two news, there is absolutely nothing to report from a fundamental point of view. Traders can only continue to wait for the completion of the low volatility flat, and most likely it will end no earlier than the first days of the new, 2020. In this regard, it is not recommended to trade the pair that passes 20-25 points per day. Trading recommendations: The EUR/USD pair continues to adjust. Thus, short positions with the target support level of 1.1043 remain relevant, but after the rebound the price is from the Kijun-sen line. It is recommended to buy the pair no earlier than when the bulls consolidate above the Kijun-sen line with the first goal of the resistance level of 1.1145, however, with minimal lots. Given the low volatility in recent days, it would not be the worst option to not open new positions. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

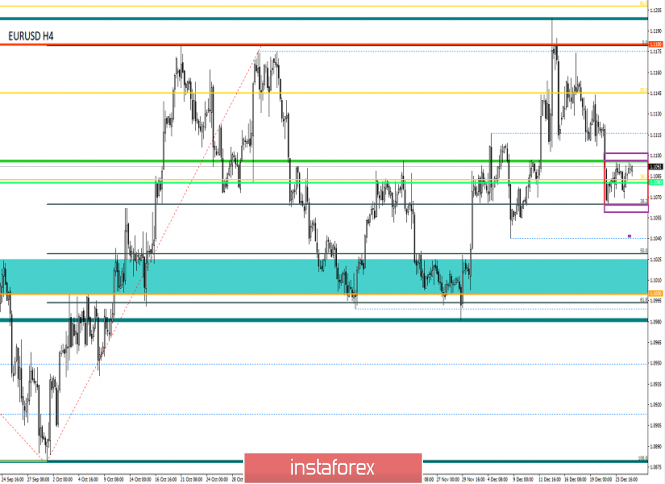

| December 26, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 26 Dec 2019 08:59 AM PST

Since November 14, the price levels around 1.1000-1.0995 has been standing as a significant DEMAND zone which has been offering adequate bullish SUPPORT for the pair on two successive occasions. Shortly-after, the EUR/USD pair has been trapped within a narrower consolidation range between the price levels of 1.1000 and 1.1085-1.1100 (where a cluster of supply levels and a Triple-Top pattern were located) until December 11. On December 11, significant bullish swing was initiated around 1.1040 allowing recent bullish breakout above 1.1110 to pursue towards 1.1175 within the depicted newly-established bullish channel. Intraday bearish rejection was expected around the price levels of (1.1175). Quick bearish decline was demonstrated towards 1.1115 (38.2% Fibonacci level) which got broken to the downside as well. On December 20, further bearish decline was demonstrated towards 1.1065 where early signs of bullish recovery is currently manifested. Any bullish pullback towards 1.1115 should be watched for bearish rejection and another SELL entry. On the other hand, If earlier bearish decline below 1.1065 is demonstrated, next bearish projection target would be located around 1.1010. Trade recommendations : Conservative traders should wait for further bullish pullback towards 1.1115 ( reversal pattern neckline ) as a valid SELL signal. Bearish projection target to be located around 1.1090, 1.1040 and 1.1010. The material has been provided by InstaForex Company - www.instaforex.com |

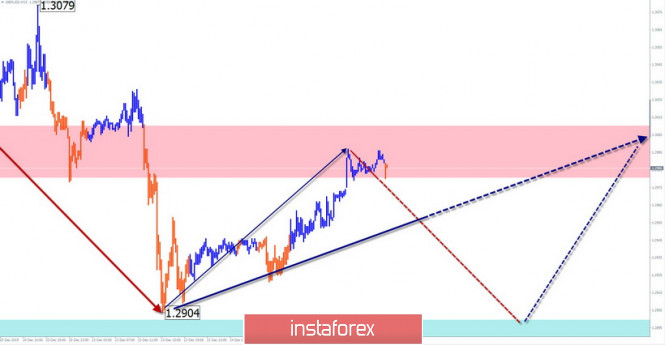

| December 26, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 26 Dec 2019 08:40 AM PST

In the period between October 17 to December 4, the GBP/USD pair has been trapped between the price levels of 1.2780 and 1.3000 until December 4 when bullish breakout above 1.3000 was achieved. Moreover, a newly-established short-term bullish channel was initiated on the chart. The GBPUSD has recently exceeded the upper limit of the depicted bullish channel on its way towards 1.3500 where the pair looked quite overpriced. This was followed by successive bearish-engulfing H4 candlesticks which brought the pair back towards 1.3170 quickly. Further bearish decline was pursued towards 1.3000 which got broken to the downside as well. Technical short-term outlook turned into bearish since bearish persistence below 1.3000 was established on the H4 chart. Hence, further bearish decline was expected towards 1.2840 - 1.2800. However, early signs of bullish recovery as well as some positive divergence were manifested on the chart denoting a high probability bullish breakout to be expected. That's why, bullish breakout above 1.3000 may be anticipated. Thus allowing Intraday bullish pullback to pursue towards 1.3170-1.3190 where bearish rejection and another bearish swing can be initiated. Bearish persistence below the newly-established downtrend line (located around 1.3000) remains a key-event to be considered for Intraday technical outlook. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Dec 2019 06:08 AM PST Dollar index is trading at the price of 97.11. I foun

d that breakout of well-defined upward channel, which is sign that short-term downside movement is expected. The downward targets are set at the price of 96.46 and at the price of 96.30 MACD oscillator is showing in the negative territory below the zero and the slow line just turned downside, which is good indication for the further downside movement. Major resistance level is seen at the price of 97.33 Support levels are seen at the price of 97, 96.45 and 96.30 The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 12.26.2019 - Gold has been trading upside and I do expect potential test of $1.515 Posted: 26 Dec 2019 06:00 AM PST Gold has been trading upward, exactly what I expected in my previous analysis. Gold is going towards our first main target at the price of $1.515 and potentially is heading to test the level of $1.535.

I see no indication of any reversal yet. Stay bullish and watch for buying opportunities on the dips. MACD oscillator is showing new momentum up, which is confirming firm upward condition. Resistance levels are seen at the price of $1.515 and $1.535 Support level is set at the price of $1.482 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Dec 2019 05:47 AM PST Bitcoin has been trading sideways at the price of $7.192. I found multi-Fibonacci resistance pivot at the price of $7.305-$7.336, which is good zone for selling opportunities. I do expect down cycle and potential test of $7.075.

Stochastic oscillator is showing bull cross and my advice is to watch for fresh bear cross before you place sell order. Resistance levels are seen at the price of $7.235 and $7.305 Support levels are set at $7.158 and $7.075 (main downward target) The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for EURUSD for 12/26/2019 Posted: 26 Dec 2019 05:22 AM PST

Movements in the market remain very small during the Christmas holidays - it is quite possible that we will not see any sharp movements until January 2. EURUSD: range. Entry to the top - for long-term traders after the breakout of 1.1200 up, short-term from 1.1100. Entry down at breakout of 1.1065 down, stop at 1.1110, target (minimum) 100 points in 4-digit. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Dec 2019 03:16 AM PST To open long positions on GBPUSD, you need: In the morning, I pointed to the return of the pound to the resistance level of 1.3000, a break above which would provide the bulls with a more powerful upward correction. However, there was no fixing on this range, as well as a signal to open long positions, the purpose of which was to update the highs of 1.3074 and 1.3128, where I recommended fixing the profit. At the moment, the pressure on the pair is gradually returning, but the bulls will try to protect the support of 1.2930, but only the formation of a false breakout on it will be a signal to open long positions. For a more reliable scenario, it is best to postpone purchases until the lows of 1.2879 and 1.2831 are updated. To open short positions on GBPUSD, you need: Bears today need to return the pound to the support of 1.2930, but only a breakdown and consolidation below this range will form a new downward channel, which will lead to further preservation of the trend with the pair entering the area of the lows of 1.2879 and 1.2831, where I recommend taking the profits. In the scenario of GBP/USD growth in the second half of the day, you can return to short positions on a false breakout near the maximum of 1.3000 or sell the pound immediately on a rebound from the resistance of 1.3074. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 daily averages, which indicates the lateral nature of the market. Bollinger Bands In the case of further decline of the pound, the lower border of the indicator around 1.2945 will provide support. Growth is still limited by the upper level of the indicator in the area of 1.3000.

Description of indicators

|

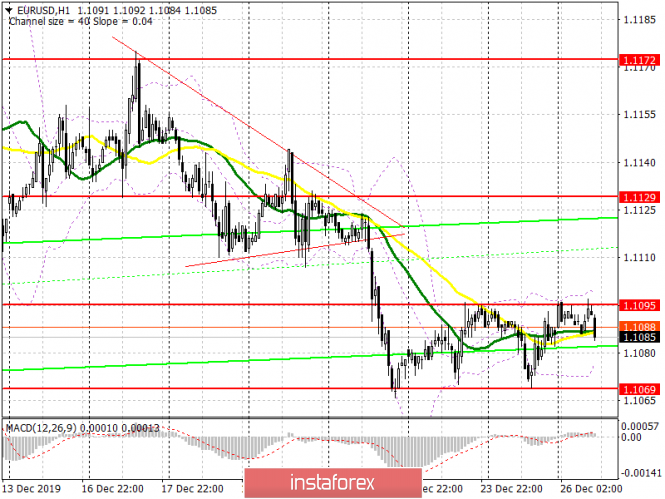

| Posted: 26 Dec 2019 03:16 AM PST To open long positions on EURUSD, you need: Low volatility in the pair persists after the Christmas holidays, and from a technical point of view, except that the bulls retreated from the daily highs, nothing has changed. The entire focus remains at 1.1095, but it will be very problematic to break above this range since even if the US labor market data is bad, it will not put serious pressure on the US dollar. Only fixing on the range of 1.1095 will lead to a larger upward correction of EUR/USD in the area of the maximum of 1.129 and 1.1172, where I recommend fixing the profit. If the pressure on EUR/USD persists, it is best to return to long positions only on the support test of 1.1069, provided that a false breakout is formed, or on a rebound from a larger minimum of 1.1041. To open short positions on EURUSD, you need: Sellers will continue to protect the resistance of 1.1095, and the formation of a false breakout there will be a direct signal to open short positions in the continuation of the downward trend to update the lows of 1.1069 and 1.1041, where I recommend fixing the profits there. If there is no pressure on the euro around 1.1095, it is best to postpone the sale until the update of the maximum of 1.129. Also, I recommend selling immediately for a rebound in the resistance area of 1.1172, the test of which will indicate the formation of a new upward trend in the euro. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands Low volatility does not give signals to enter the market.

Description of indicators

|

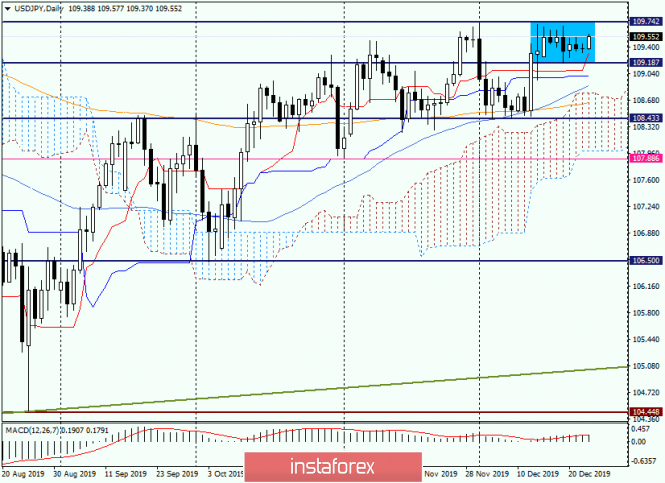

| Analysis and trading recommendations for USD/JPY as of December 26, 2019 Posted: 26 Dec 2019 03:16 AM PST This Christmas week, the Japanese are perhaps the most active in terms of providing macroeconomic statistics. However, the Japanese currency reacts rather sluggishly to its statistics, which cannot be said about the reaction of the yen to macroeconomic reports from the United States. Nevertheless, it is worth noting that data on construction orders and bookmarking of new homes came out of Japan this morning. Both reports were weaker than expected and, oddly enough, led to a significant decline in the yen against the US dollar. In this regard, let me remind you that tomorrow at 12:30 (London time) a large block of statistics will be released from the Land of the Rising Sun. Here it is necessary to highlight the report on the unemployment rate, data on industrial production and retail sales. These are much more important releases than today's, the more interesting it will be to observe the reaction of market participants to them. In the meantime, let's go to the charts of the USD/JPY currency pair and see what interesting trading ideas there might be. Daily

This is amazing, but by and large, nothing has changed here. The pair is still trading in the range of 109.19-109.74 and cannot say goodbye to it. However, judging by today's growth, USD/JPY is dominated by bullish sentiment. However, only the breakdown of sellers' resistance at 109.74 and consolidation above will convince of this. In other words, to make sure that the pair can move to new goals higher, it is necessary to go out of the designated range up. At the same time, do not forget about the strong and extremely important price area of 110.00-110.20, which has repeatedly influenced the price and turned the market. Thus, in my personal opinion, the breakdown of 109.74 will not give a clear answer to the question of the ability to move further north. There are too many strong resistances at the top. In addition to the area of 110.00-110.20, another strong price zone is slightly higher (110.50-110.80). Although I do not exclude that after such a long and diligent consolidation, the exit to one of the parties can be very strong and powerful. If you go up, 110.00 and 110.20 will fly by first, as if these levels are not there at all, but then they will return to them and circle. According to long-term observations, this is exactly what happened more than once. Well, let's see. H4

It is characteristic that the pair meets strong resistance from sellers near the level of 109.70, after which it shows a decline. Despite today's positive mood, at the end of the review, there is a fading upward momentum. If the current candle is formed in the form of a bearish model, you can expect a decline and try accurate sales of USD/JPY. Although I generally look at the dollar/yen pair from a bearish position, in the current situation, the growth in the area of 110.00-110.20 looks more likely. From here, we can expect a corrective pullback to the area of 109.80, after which the pair will again try to return above the key technical zone of 110.00-110.20. In my opinion, the purchases look most optimal on the short-term decline to 50 of the simple moving average, which passes slightly below another important level of 109.50. It is characteristic that there is a support line built at points 108.46-109.33. If 50 MA and the black support line are broken and the pair consolidates below, on the rollback to the broken lines and movings it will be time to think about selling USD/JPY. Since the current situation is far from certain, for those who do not want to be nervous and take risks, I recommend staying out of the market for now. Let's see at what price the current Christmas week closes. Perhaps, after that, you will have a clearer idea of the future direction of this currency pair. Have a nice day! The material has been provided by InstaForex Company - www.instaforex.com |

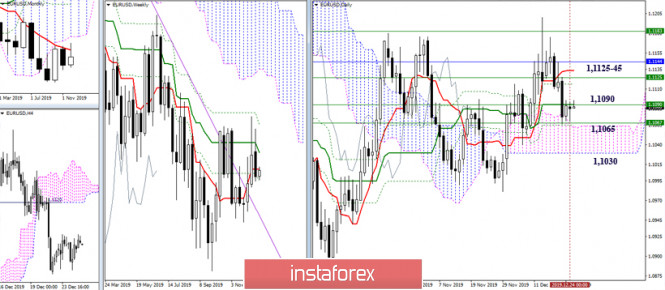

| Analysis of EUR/USD and GBP/USD for December 26. Christmas holidays continue Posted: 26 Dec 2019 03:16 AM PST EUR/USD

On December 25, the EUR/USD currency market was closed, so there was no trading. The current wave marking, thus, remains the same. The euro-dollar instrument continues to be held between the levels of 50.0% and 61.8% by Fibonacci, and although it retains excellent chances of continuing the fall within the new downward trend section, however, during the New Year and Christmas holidays, the execution of the working version can be put on pause. Given the weakest market activity, perhaps the best option is to wait until all the holidays are over. Fundamental component: Markets only opened early this morning. The news background for the tool remains missing. No economic reports, no speeches by heads of state or central banks, no interesting data or reports from Parliaments or Congress (USA). Only Donald Trump, President of the United States, continues to do posts on social networks from time to time, continuing verbal skirmishes with representatives of the Democratic Party, who, by the way, do not respond to the president's insults. The case, of course, concerns impeachment, which soon can be transferred to the Senate, which will decide the fate of the president. However, all those political news can be of little help to the foreign exchange market. Information about the impeachment and the fact of the investigation is, of course, interesting, but the euro-dollar tool (and other tools, too) is not affected. Today in America, one economic report will be released - on applications for unemployment benefits for the week of December 13-20, but this indicator usually does not cause any market reaction. Most likely, it will be so today. Thus, I recommend waiting for news, waiting for economic reports, waiting for the holidays to end, because now is not the best time to try to make money in a market that is almost immobilized. General conclusions and recommendations: The euro-dollar pair have presumably completed the construction of an upward trend section. Thus, I would recommend selling the instrument with targets located near the marks of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% for Fibonacci. An unsuccessful attempt to break through the level of 50.0% may lead to the completion of the withdrawal of quotes from the reached lows and the resumption of building a downward wave. At the same time, given the festive mood of the market, the decline may resume after the New Year. GBP/USD

On December 24, the GBP/USD pair increased by 20 basis points, and on the morning of December 26, added another 30 points and, presumably, completed the construction of the first downward wave as part of a new downward trend section. If this assumption is correct, then the price increase will continue to the area of 23.6% Fibonacci level in the framework of building a wave 2 or b. I recommend that you consider the corrective wave as an opportunity to sell the instrument at a more attractive rate. Fundamental component: There is no news background for the GBP/USD instrument. The UK Parliament and the Prime Minister have already gone on New Year's holidays, so no information on political topics is currently available. The same is true of economic reports. For this week, the economic news calendar is empty. Thus, the activity may decrease for the GBP/USD instrument, and the markets can only wait for the holidays to end. General conclusions and recommendations: The pound-dollar instrument continues to build a new downward trend. I recommend resuming sales of the instrument with targets located near the mark of 1.2764, which corresponds to the 50.0% Fibonacci level, after the completion of wave 2 or b. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis recommendations for EUR / USD and GBP / USD for December 26 Posted: 26 Dec 2019 03:00 AM PST EUR / USD Before the holiday weekend, the situation has not changed. The pair remained between the resistance of 1.1090 (daily Kijun + weekly Tenkan) and the support of 1.1065 (Senkou Span A + weekly Fibo Kijun + daily Fibo Kijun). At the same time, there is now uncertainty in the preponderance of forces with a slight predominance of players to increase. Their return of support for the daily medium-term trend and the weekly short-term will open the way to the next important resistance zone of 1.1145-25 (daily short-term trend + weekly medium-term trend + monthly short-term trend) . If the downgrade players manage to overcome the support line of 1.1065, then the pair will have a daily cloud and the strongest daily support is a long-term trend (Senkou Span B 1.1030). In the past working days, the couple continued the struggle for the central Pivot level. As a result, this level plays the role of support again today which is at 1.1083 and defends the interests of players to increase. The next significant level for the development of the upward correction is now located at 1.1102 (weekly long-term trend). Another loss of central Pivot will return the relevance of testing the strength of the minimum extremum of 1.1066, overcoming which will continue the downtrend. Resistances of the classic Pivot levels are located today at 1.1096 - 1.1108 - 1.1121, while the supports are at 1.1071 - 1.1058 - 1.1046. GBP / USD As expected, it was not possible to overcome the support they met immediately since several strong levels are concentrated in this support zone which is at 1.2880 - 1.2908 (weekly cloud + monthly Fibo Kijun + weekly Fibo Kijun). With further restoration of positions by players on the increase, the pair are waiting for the resistance of 1.3086 (daily Fibo Kijun) - 1.3144-67 (weekly Tenkan + monthly Kijun + daily Kijun) and 1.3209-50 (daily Tenkan + Fibo Kijun) . In the lower halves, an upward correction develops. Rising players are now supported by almost all of the analyzed technical indicators and are close to testing the key resistance at H1, a weekly long-term trend located at 1.3201. Reliable consolidation above will allow us to consider the development of an upward correction in high halves and new benchmarks. Failure to cope with resistance will return the pair to supports, among which today we can distinguish 1.2950 as central Pivot level and 1.2880 as S3 of classic Pivot levels. Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD could see price move above 1.32 soon Posted: 26 Dec 2019 02:59 AM PST USDCAD is most probably forming a short-term bullish flag pattern. This patterns targets 1.3220 if price breaks above 1.3175.

Red lines -bullish flag pattern Green line - upper triangle boundary USDCAD is trading inside a longer-term triangle pattern as we explained in our previous analysis. As we explain above and show in the chart, in the 4 hour time frame we observe a possible bullish flag pattern. Breaking above resistance at 1.3175 will enable our first target of 1.3220. So in the short-term we expect prices to move higher. The material has been provided by InstaForex Company - www.instaforex.com |

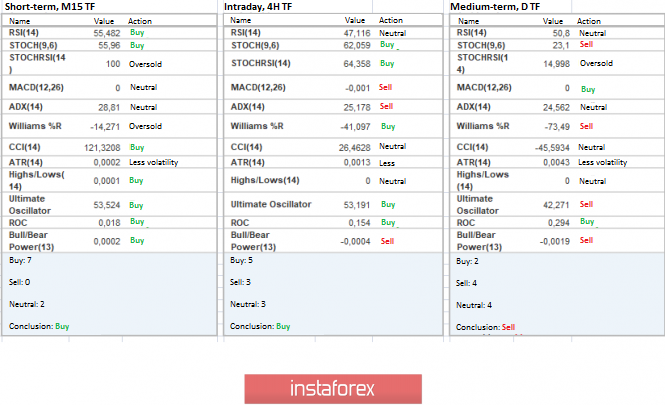

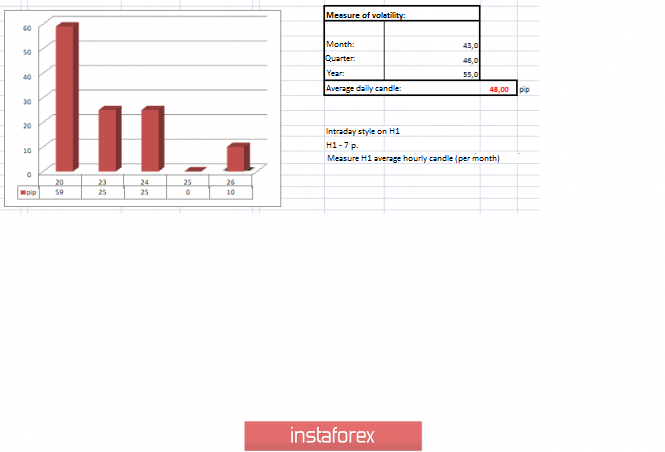

| Trading recommendations for EURUSD for December 26 Posted: 26 Dec 2019 01:09 AM PST From the point of view of a technical analysis, we see that from the beginning of the trading week, the EUR / USD currency pair conditionally moved to the stage of a sluggish movement, where the value of 1.1080 plays the role of a mirror level, relative to which the range of 1.1065 / 1.1095 is built. In fact, we are witnessing a kind of decline in trading volumes caused by the festive week, where the quote is trying to consolidate for a while until major players again return to the market. Thus, the absence of leading participants suggests not trading, as the prospect of expectations is extremely small, and the risk of worthless transactions is high. But there it was, speculators were hoping for a finishing chord, using a narrow market as a lever for local leaps. From here the theory began to arise everywhere, 12/24/18 - 12/31/18 = 69 points [daily average candle] 12/26/17 - 12/31/17 = 61 p. 12/26/16 - 12/31/16 = 83 p. 12/28/15 - 12/31/15 = 64 p. 12/26/14 - 12/31/14 = 63 p. 12/26/13 - 12/31/13 = 91 p. 12/26/12 - 12/31/12 = 75 p. 12/26/11 - 12/31/11 = 87 p. 12/27/10 - 12/31/10 = 133 p. 12/28/09 - 12/31/09 = 101 p. 12/26/08 - 12/31/08 = 278 p. 12/26/07 - 12/31/07 = 139 p. 12/26/06 - 12/29/06 = 76 p. 12/26/05 - 12/30/05 = 83 p. 12/27/04 - 12/31/04 = 105 p. 12/26/03 - 12/31/03 = 89 p. 12/26/02 - 12/31/02 = 82 p. 12/26/01 - 12/31/01 = 95 p. 12/26/00 - 12/29/00 = 119 p. It is worth considering that the market dynamics have changed over the years and, for example, from 2000 to 2009 we had an average daily candle of 118 points, and in the period 2010 to 2018 it was only 106 points. Having statistical data, it can be assumed that in the current period, daily average volatility can break out of the framework of stagnation and still show remarkable values. As discussed in the review on December 24, traders moved to the stage of partial fixation of short positions at the time of the initial approximation of the quotes to the level of 1.1080. The next steps were in the waiting stage, where special attention was paid to the area of 1.1060 / 1.1065, for clear price-fixing. Considering the trading chart in general terms during the daily period, we see that the global trend is always downward, but the clock component is at the stage of elongated correction. The was no news background on December 24 and 25 due to the celebration of Christmas. In terms of informational background, we had a conditional lull, however, there is still something to read. So, last Tuesday, the White House announced that the signing of the first phase of the trade agreement between the United States and China will be in terms of a ceremony where two leaders will be present. "Yes, the ceremony will take place when we meet. The transaction is completed. Now its text is being translated," said Donald Trump. In turn, Beijing did not confirm that a meeting of the two leaders was planned. Earlier, it was generally said that the document would be signed by the ministers of the two countries. Let me remind you that the agreement of 86 pages has not yet been made public, and the completion of legal procedures will be completed in early January. Today, in terms of the economic calendar, we have acquired data on applications for unemployment benefits in the United States, where they are expected to reduce in Primary by 10 thousand and on Repeated by 31 thousand. At the same time, it is worth considering in the work of the factor that Europe continues to rest today, celebrating the "Boxing Day" holiday, thereby this can affect trading volumes. Further development Analyzing the current trading chart, we see the same fluctuation within 1.1065 / 1.1095, where the quotes develop within the upper limit without undue enthusiasm. In fact, the lack of the proper amount of trading volumes speaks for itself, and all hopes remain only for speculative interest, which in the thin market can help move the quotes off the ground. By detailing the time interval per minute, we see that at the moment the amplitude is 10 points, and the structure of the candles is similar to an inactive trading session. In turn, the bulk of the traders relax, having some short positions on deposit. Complete closure of trade transactions, in this case, will not be considered a mistake, sometimes it is better to wait. In turn, speculators are trying to confirm the theory of the thin market in the hope of revealing the leaps of the outgoing year. It is likely to assume that the horizontal movement of 1.1065 / 1.1095 will still remain on the market, having small allowances designed for punctures by shadows. If you are a speculator and can not sit still, then it is worthwhile to carefully analyze the behavior of the quotes and the structure of the candles, identifying characteristic impulses. The analysis will be conducted on periods M30 and H1, and the control values are 1.1100 and 1.1078. Based on the above information, we derive trading recommendations as follows: - Buy positions are considered in case of a price exit higher than 1.1105. - Many traders already have sale positions; refilling is considered in the region of 1.1065-1.1060. Indicator analysis Analyzing a different sector of timeframes (TF), we see that indicators of relatively shorter periods are more prone to neutral interest than to upward, due to the slowdown process. In turn, the medium-term outlook holds a downward interest and is also on the verge of a neutral nature. Volatility per week / Measurement of volatility: Month; Quarter Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (December 26 was built taking into account the time of publication of the article) The volatility of the current time is 10 points, which is a low indicator for this time section. It is likely to assume that if speculators fail to take advantage of the thin market situation, then due to the absence of leading players, volatility is still low. Key levels Resistance Zones: 1.1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support Areas: 1,1080 **; 1,1000 ***; 1.0900 / 1.0950 **; 1.0850 **; 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level ***** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis for GBP/USD and USD/JPY for December 26 Posted: 26 Dec 2019 01:08 AM PST GBP/USD Analysis: A downward wave has been forming on the chart of the British pound since December 13. It can take the place of a correction in the main structure or give rise to a wave of a new short-term trend. The price reached the support zone, from which the formation of an upward pullback began. Forecast: In the coming day, the most likely scenario for the price movement will be a planned depreciation in the side corridor between the nearest zones. A breakthrough in the upper border of the resistance zone is expected in the next days but it is possible today. Potential reversal zones Resistance: - 1.2980/1.3010 Support: - 1.2900/1.2870 Recommendations: Today, only intra-session trading is possible on the pound market. Purchases have more potential. You need to track the signals for them only after the price rollback is formed.

USD/JPY Analysis: The current upward wave of the instrument since the beginning of August has the potential for further growth. The price of the yen has reached the zone of a potential reversal, which began to form a hidden correction. Its structure is not complete. Forecast: Today, there is a high probability that the current flat sentiment from last week will continue. In the first half of the day, a downward vector is likely. By the end of the day, the exchange rate is expected to change and the price will start to rise. Potential reversal zones Resistance: - 109.80/110.10 Support: - 109.20/108.90 Recommendations: The main attention today in the yen market should be paid to the search for buy signals. Sales are possible with a small lot, taking into account the probability of sharp counter-rollbacks.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, the dotted background shows the expected movements. Attention: The wave algorithm does not take into account the duration of the tool movements in time! The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's Diary: EURUSD on 12/26/2019, Where to begin? Posted: 26 Dec 2019 12:39 AM PST

There is a lull in the market as most Westerners have Christmas holidays which will last until January 2. Therefore, if your Trading System does not require this from you, it makes sense not to assume the high risks of trading in a thin market. EURUSD: There is an update by levels where a new level of daily order is formed down. Right now we sell when breaking down at 1.1065. Purchases from 1.1200 and more aggressively from 1.1100. Where to start learning trading? In my opinion, the study of trading in financial markets should have the following parts/sections: 1. The idea of the "foundation", mainly the economy and investment, respectively. I recommend the textbook "Economics" by Dornbusch, Fischer, and Schmalenzi. Fundamentals of Investing, an investment textbook by Gitman and Joehnk (many advise Sharpe's book Investing — I don't like it, but I got used to it — Sharpe is overloaded with math) 2. Technical analysis: There is a lot of literature, I would single out Thomas DeMark's "Technical analysis: A new science". 3. System Engineering: Way of the Turtle by Curtis Face. This is about how to build a vehicle correctly. And also "How to make money in the stocks" by William O'Neill 4. Money management: I will not recommend any particular book - but this part is required as a separate one. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis and trading ideas for EUR/USD and GBP/USD for December 26, 2019 Posted: 26 Dec 2019 12:17 AM PST Hello, dear colleagues! After the Christmas celebration, investors returned in a corresponding mood. Volatility is low, there are no drivers for good movements yet, the economic calendar is empty. I usually write separate reviews for each currency pair. I looked at the charts and decided today to combine the euro/dollar and the pound/dollar in one article. I don't know what will happen, but I think it's worth a try. EUR/USD So, the technical picture for the main currency pair is perhaps the most uncertain. Since the beginning of this week, the euro/dollar has been consolidating in a narrow trading range. As a rule, after such consolidation, there is a good directional movement in one of the parties.

As seen on the daily chart, the lows of December 23 (1.1070) and the highs of the same day (1.1095) are currently benchmarks for further movement of the quote. The breakdown of support in the area of 1.1066 may trigger a decline to 1.1060, where the upper border of the Ichimoku indicator cloud passes. If the pair enters the cloud limits and gains a foothold there, I expect a decline to the support level of 1.1040 and the lower border of the Ichimoku cloud, which passes at 1.1029. Characteristically, at the time of writing, EUR/USD is stuck near the Kijun line, as well as 89 exponential and 50 simple moving averages. In my opinion, the current situation is quite difficult for making trade decisions. There is too much uncertainty about the future direction of the course. In this regard, it is not necessary to exclude growth or its attempts, so it is necessary to indicate the goals of a possible correction. If the pair rises, it will go to the highs on December 20 and the Tenkan line - this is the price zone of 1.124-1.1132. If this happens, you can look at the euro/dollar sales from the dedicated zone. Perhaps this is the main trading idea for the main currency pair of the Forex market. At least for now. Those who want to buy should wait for the characteristic candle signals on the lower timeframes, in the price area of 1.1070-1.1040, and only after they appear open long positions in a pair. GBP/USD

As for the pound, the situation is more definite. The pound/dollar pair has started a correction to its previous decline and will attempt to return above the important technical and psychological level of 1.3000. We will soon find out what will happen, but in the meantime, let's look for points for opening short positions on the pound on the H4 chart. Here I stretched the Fibonacci grid for a fall of 1.3513-1.2903. At the time of writing, the pair has passed a strong 233 exponential moving average on the rise and is trading higher. This may indicate a continuation of the corrective pullback to the area of 1.3047-1.3066, where the important technical and historical level of 1.3047, as well as 23.6 Fibo from the decline of 1.3513-1.2903 and 89 EMA. It seems that sales from the selected area look very decent from a technical point of view. Even more convincing is the appearance of candle signals for a decrease in the designated area or near it. At the same time, given the speculative and volatile nature of sterling, I do not rule out a deeper correction in the price zone of 1.3113-1.3136. Here are 50 simple moving average and 38.2 Fibo from the indicated fall. Given that the current growth of the pair is corrective, as well as the fact that GBP/USD is trading under the symbolic level of 1.3000, purchases look riskier. However, those who wish can look at the opening of long positions when the pound falls in the price range of 1.2975-1.2965. In both cases, before opening positions, it would be good to see the confirming signals of the Japanese candlesticks. A thin market where any surprises are possible. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment