Forex analysis review |

- Comprehensive analysis of movement options of #USDX vs EUR/USD vs GBP/USD vs USD/JPY (DAILY) for December 6

- Fractal analysis for major currency pairs on December 6

- Developing the trading idea for oil

- GBP/USD. December 5. Results of the day. Pound will continue to grow under the influence of a single factor

- EUR/USD. December 5. Results of the day. Euro is growing. Negotiations between China and the US hardly progress

- EUR/USD. Selling is risky, purchases are unreliable: bulls are trying to reverse the trend

- GBPUSD: pound is betting on the Tories' victory, but will Johnson fulfill his promise to implement Brexit by January 31,

- EUR/USD: increasing headwinds for the US economy, the dollar loses its trump cards

- Canadian dollar optimism: strengthening and growing

- Pound's balancing act before decisive election

- BTC 12.05.2019 - Downside expected

- Gold 12.05.2019 - Wait for the brrreakout of the mini Pitchfork channel to confirm largerr bull move

- USD/JPY analysis for December 05, 2019 - Broken beaar flag pattern, potential test of 108.44

- December 5, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- December 5, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Evening review of EURUSD on 12/05/2019. ECB will support the euro

- EUR/USD. December 5. Failure in the negotiations between China and the United States may collapse the euro

- GBP/USD. December 5. Pound longs for the victory of the Conservative Party in the election and completion of Brexit

- Fractal analysis for major currency pairs as of December 5

- Overview of the GBP/USD pair on December 5. Boris Johnson promises early Brexit, the pound grows joyfully on these statements

- Technical analysis of EUR/USD for December 05, 2019

- Trader's Diary: EURUSD on 12/05/2019, Foundation and equipment

- Where to buy EUR/USD pair better?

- Analysis of EUR/USD and GBP/USD for December 5. Business activity and labor market data in America disappointed the markets.

- Politicians regained power over the pound (EUR/USD and GBP/USD review on 12/05/2019)

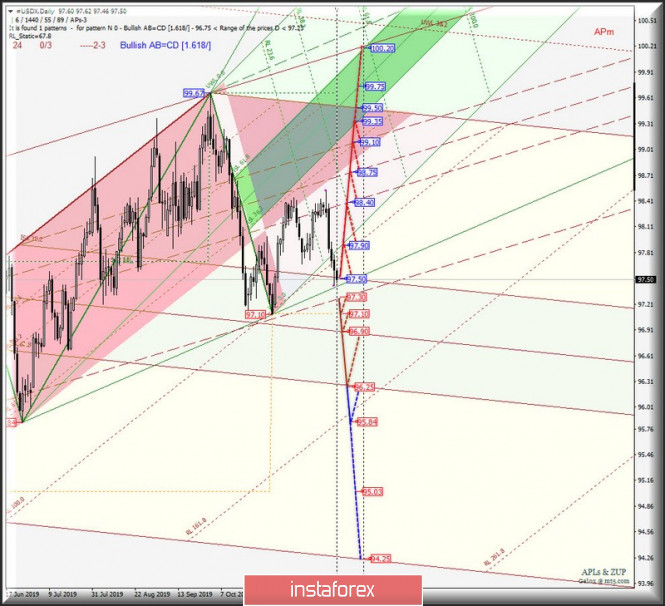

| Posted: 05 Dec 2019 06:40 PM PST Here's a comprehensive analysis of the movement options for the main currency instruments - #USDX , EUR/USD, GBP/USD and USD/JPY - DAILY for December 6, 2019. Minor operational scale (Daily time frame) ____________________ US dollar Index Starting from December 6, 2019, the development of the movement of the dollar index #USDX will depend on the development and direction of the breakdown range :

The breakdown of the final Schiff Line Minor - support level of 97.30 - will lead to the continuation of the downward movement of the dollar index to the targets: local minimum 97.10 - 1/2 Median Line Minor (96.90) - lower boundary of the ISL61.8 (96.25) equilibrium zone of the Minor operational scale forks - minimums (95.84 - 95.03). On the contrary, when the upper boundary of ISL38.2 (resistance level of 97.50) is broken, the equilibrium zone of the Minor operational scale forks will develop the movement #USDX to the boundaries of 1/2 Median Line channel Minor (98.40 - 98.75 - 99.10) and equilibrium zones (99.35 - 99.75 - 100.20) of the Minuette operational scale forks. The markup of #USDX movement options from December 6, 2019 is shown on the animated chart. ___________________ Euro vs US dollar From December 6, 2019, the development of the movement of the single European currency EUR/USD will be determined by the development and direction of the breakdown of the boundaries of 1/2 Median Line channel (1.1090 - 1.1125 - 1.1165) of the Minuette operational scale forks. The details of the movement is presented on the animated chart. The breakdown of the upper boundary of the 1/2 Median Line channel Minuette (resistance level of 1.1165) is a continuation of the upward movement of EUR / USD to the equilibrium zones (1.1185 - 1.1250 - 1.1305) of the Minuette operational scale forks. On the other hand, the return of the single European currency below the support level of 1.1090 on the lower boundary of the 1/2 Median Line channel of the Minuette operational scale forks will determine the continuation of the downward movement of this currency instrument to the goals: the initial SSL Minuette line (1.1035) - LTL Minuette control line (1.1000) - minimums (1.0981 - 1.0879). The details of the EUR / USD movement options from December 6, 2019 are shown on the animated chart. ____________________ Great Britain pound vs US dollar Development and direction of the breakdown range:

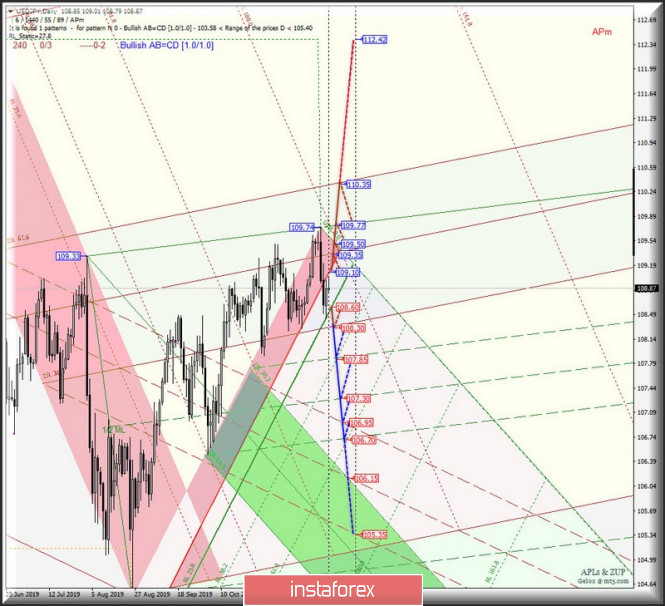

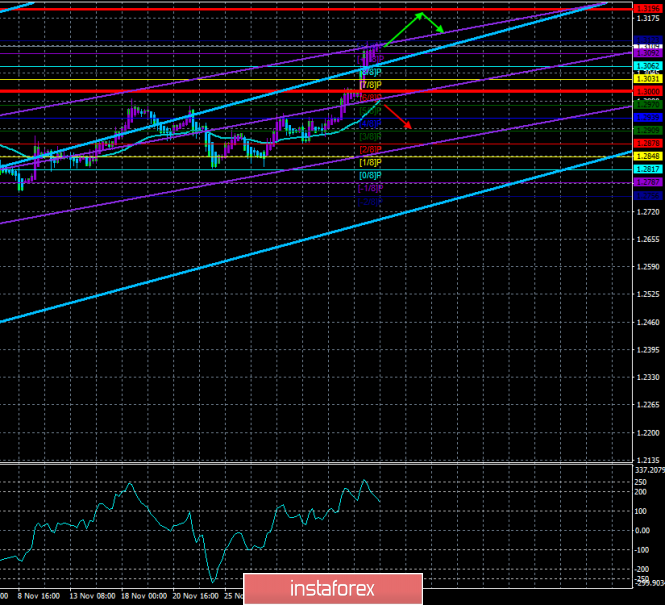

will begin to determine the development trend of Her Majesty's GBP/USD currency movement from December 6, 2019. A consecutive breakdown of resistance levels : - 1.3140 - the upper boundary of the ISL61.8 equilibrium zone of the Minor operational scale forks; - 1.1.3185 - warning line UWL61.8 of the Minuette operational scale forks; will make it possible to continue the development of the upward movement of Her Majesty's currency to the local maximum 1.3379 and the warning line UWL100.0 (1.3410) fof the Minuette operational scale forks. In case of breakdown of the warning line UWL38.2 (support level of 1.3045) of the Minuette operational scale forks, the development of the GBP / USD movement can be continued towards the goals: the 1/2 Median Line Minor (1.2950) - the control line UTL Minuette (1.2920) - the initial line SSL Minuette (1.2780) - the lower boundary of the ISL38.2 (1.2750) equilibrium zone of the Minor operational scale forks with the prospect of reaching the upper boundary of the 1/2 Median Line Minuette channel (1.2495). The details of the GBP / USD movement from December 6, 2019 can be seen on the animated chart. ____________________ US dollar vs Japanese yen Similarly, the development of the currency movement of the "country of the rising sun" USD / JPY from December 6, 2019 will also depend on the direction of the breakdown of the range :

The breakdown of the reaction line RL23.6 (support level of 108.60)of the Minuette operational scale forks - continuation of the downward movement of USD / JPY to the targets: lower boundary of the ISL38.2 (108.30) equilibrium zone of the Minor operational scale forks - 1/2 Median Line channel (107.85 - 107.30 - 106.70) pof the Minuette operational scale forks. Successive breakdown of resistance levels : - 109.10 - red border of the of the Minuette operational scale forks; - 109.35 - the 1/2 Median Line Minor; - 109.50 - start line SSL Minuette; - 109.77- control line UTL Minuette; will determine the continuation of the development of the upward movement of the currency of the "land of the rising sun" to the upper boundary of ISL 61.8 (110.35) of the equilibrium zone of the Minor operational scale forks with the prospect of reaching a maximum of 112.42. We look at the details of the USD / JPY movement on the animated chart. ____________________ The review was compiled without taking into account the news background. Thus, the opening of trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

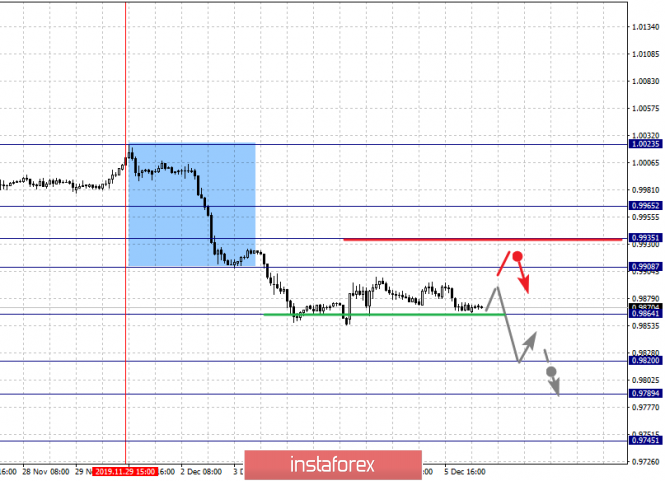

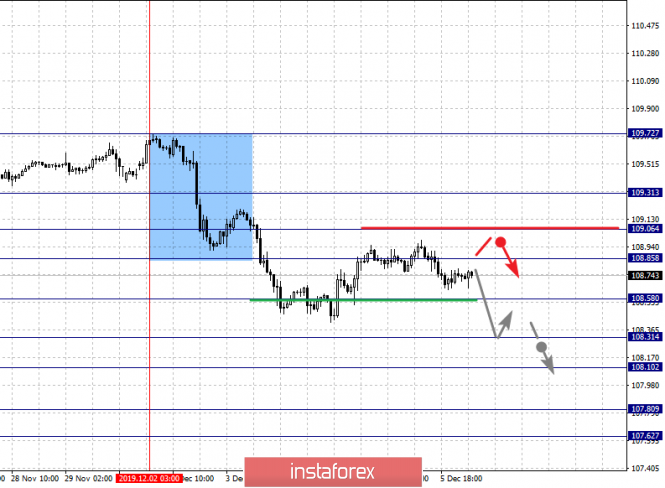

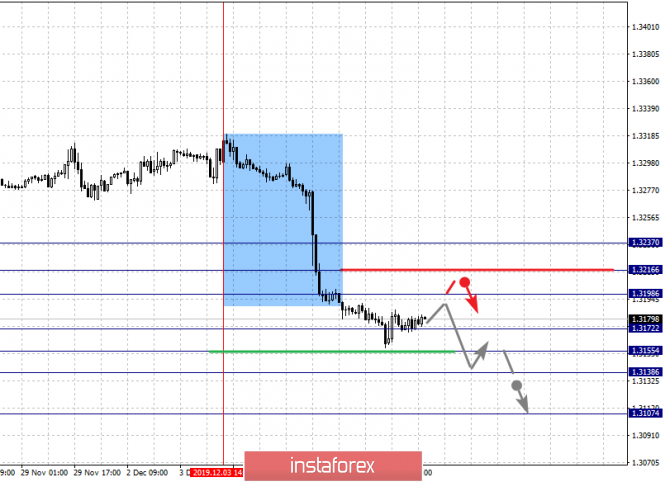

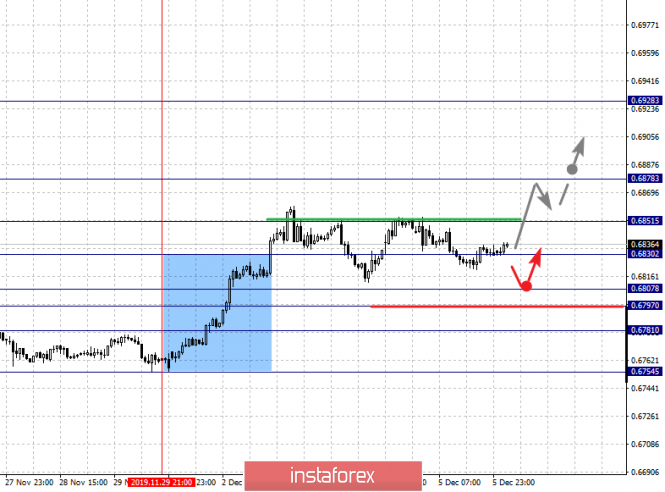

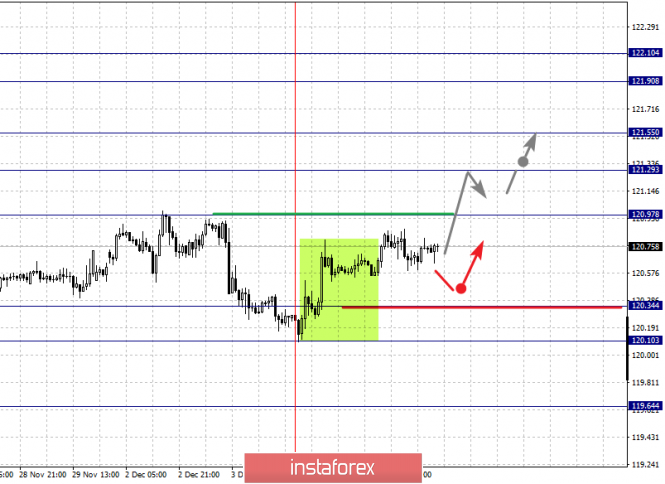

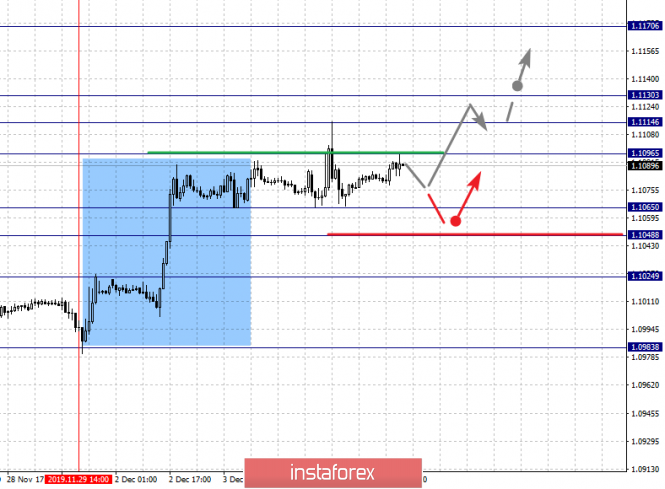

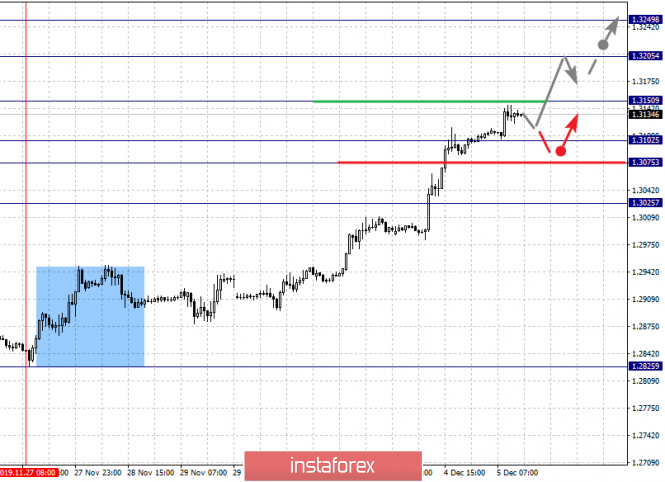

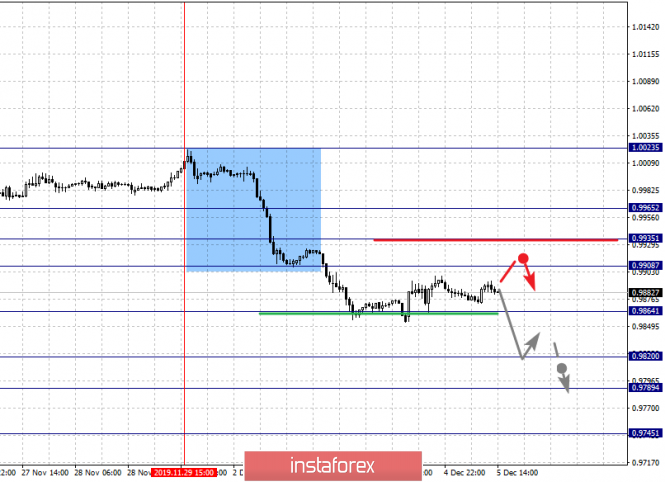

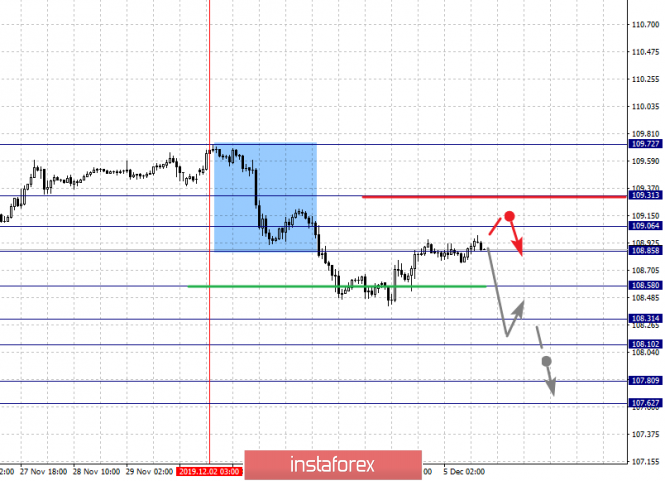

| Fractal analysis for major currency pairs on December 6 Posted: 05 Dec 2019 06:37 PM PST Forecast for December 6: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1170, 1.1130, 1.1114, 1.1096, 1.1065, 1.1048 and 1.1024. Here, we are following the development of the upward cycle of November 29. We expect a short-term upward movement, as well as consolidation in the range of 1.1096 - 1.1114. The breakdown of the level of 1.1114 will lead to a movement up to 1.1130. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.1170. The movement to which is expected after the breakdown of the level of 1.1130. Short-term downward movement is expected in the range of 1.1065 - 1.1048. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1024. This level is a key support for the upward structure. The main trend is the formation of initial conditions for the top of November 29 Trading recommendations: Buy: 1.1114 Take profit: 1.1130 Buy: 1.1132 Take profit: 1.1170 Sell: 1.1065 Take profit: 1.1050 Sell: 1.1046 Take profit: 1.1026 For the pound / dollar pair, the key levels on the H1 scale are: 1.3249, 1.3205, 1.3150, 1.3102, 1.3075 and 1.3025. Here, we are following the development of the upward cycle of November 27. The continuation of the movement to the top is expected after the breakdown of the level of 1.3150. In this case, the target is 1.3205. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.3249. Upon reaching this level, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 1.3102 - 1.3075. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3025. This level is a key support for the top. The main trend is the upward cycle of November 27 Trading recommendations: Buy: 1.3150 Take profit: 1.3205 Buy: 1.3207 Take profit: 1.3247 Sell: 1.3102 Take profit: 1.3076 Sell: 1.3073 Take profit: 1.3027 For the dollar / franc pair, the key levels on the H1 scale are: 0.9965, 0.9935, 0.9908, 0.9864, 0.9820, 0.9789 and 0.9745. Here, we are following the development of the downward structure of November 29. The continuation of movement to the bottom is expected after the breakdown of the level of 0.9864. In this case, the target is 0.9820. Short-term downward movement, as well as consolidation is in the range of 0.9820 - 0.9789. The breakdown of the level of 0.9789 should be accompanied by a pronounced upward movement. In this case, the potential target is 0.9745. We expect a rollback to correction from this level. Short-term upward movement is possibly in the range of 0.9908 - 0.9935. The breakdown of the latter value will lead to in-depth movement. Here, the target is 0.9965. This level is a key support for the downward structure of November 29. The main trend is the formation of initial conditions for the bottom of November 29 Trading recommendations: Buy : 0.9908 Take profit: 0.9933 Buy : 0.9937 Take profit: 0.9965 Sell: 0.9862 Take profit: 0.9825 Sell: 0.9820 Take profit: 0.9790 For the dollar / yen pair, the key levels on the scale are : 109.31, 109.06, 108.85, 108.58, 108.31, 108.10, 107.80 and 107.62. Here, we are following the formation of the descending structure of December 2. The continuation of the movement to the bottom is expected after the breakdown of the level of 108.58. In this case, the first goal is 108.31. Short-term movement to the bottom is possibly in the range 108.31 - 108.10. The breakdown of the last value will lead to a pronounced movement. Here, the goal is 107.80. For the potential value for the bottom, we consider the level of 107.62. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is expected in the range 108.58 - 109.06. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 109.31. This level is a key support for the downward structure. The main trend: the formation of initial conditions for the downward movement of December 2 Trading recommendations: Buy: 108.85 Take profit: 109.04 Buy : 109.08 Take profit: 109.30 Sell: 108.30 Take profit: 108.12 Sell: 108.08 Take profit: 107.80 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3237, 1.3216, 1.3198, 1.3172, 1.3155, 1.3138 and 1.3107. Here, we are following the development of the downtrend of December 3. Short-term downward movement is expected in the range 1.3172 - 1.3155. The breakdown of the latter value will lead to a movement to the level of 1.3138. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.3107. Upon reaching this value, we expect a rollback to the top. Short-term upward movement, as well as consolidation are possible in the range of 1.3198 - 1.3216. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3237. This level is a key support for the downward structure. The main trend is the descending structure of December 3 Trading recommendations: Buy: 1.3198 Take profit: 1.3215 Buy : 1.3217 Take profit: 1.3236 Sell: 1.3171 Take profit: 1.3155 Sell: 1.3154 Take profit: 1.3138 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6878, 0.6851, 0.6830, 0.6807, 0.6797 and 0.6781. Here, we are following the formation of the expressed initial conditions for the top of November 29. Short-term upward movement is expected in the range of 0.6830 - 0.6851. The breakdown of the level of 0.6851 will lead to a marked development of an upward trend. Here, the potential target is 0.6878, and consolidation is near this value. Short-term downward movement is expected in the range of 0.6807 - 0.6797. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.6781. This level is a key support for the upward structure. The main trend is the formation of expressed initial conditions for the top of November 29 Trading recommendations: Buy: 0.6830 Take profit: 0.6848 Buy: 0.6853 Take profit: 0.6878 Sell : 0.6807 Take profit : 0.6797 Sell: 0.6795 Take profit: 0.6783 For the euro / yen pair, the key levels on the H1 scale are: 122.10, 121.90, 121.55, 121.29, 120.97, 120.66, 120.34, 120.10 and 119.64. Here, the price registered a local upward structure from December 4 to continue the upward trend. The continuation of the movement to the top is expected after the breakdown of the level of 120.97. In this case, the first goal is 121.29. Price consolidation is near this level. Short-term upward movement is in the range of 121.29 - 121.55. The breakdown of the level of 121.55 should be accompanied by a pronounced upward movement. Here, the goal is 121.90. For the potential value for the top, we consider the level of 122.10. Upon reaching which, we expect consolidation in the range of 121.90 - 122.10, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 120.52 - 120.34. The breakdown of the latter value will lead to movement to the level of 120.10. This level is a key support for the upward trend. The main trend is the local ascending structure of December 4 Trading recommendations: Buy: 120.98 Take profit: 121.27 Buy: 121.30 Take profit: 121.55 Sell: 120.32 Take profit: 120.10 Sell: 120.05 Take profit: 119.70 For the pound / yen pair, the key levels on the H1 scale are : 144.56, 144.06, 143.45, 143.09, 142.50, 142.06 and 141.51. Here, we determined the subsequent goals for the top from the local ascending structure on December 4. Short-term movement to the top is expected in the range of 143.09 - 143.45. The breakdown of the last value will lead to a pronounced movement. Here, the goal is 144.06. For the potential value for the top, we consider the level of 144.56. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 142.50 - 142.06. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 141.51. This level is a key support for the top. The main trend is the local ascending structure of December 4 Trading recommendations: Buy: 143.10 Take profit: 143.44 Buy: 143.50 Take profit: 144.06 Sell: 142.50 Take profit: 142.10 Sell: 142.04 Take profit: 141.54 The material has been provided by InstaForex Company - www.instaforex.com |

| Developing the trading idea for oil Posted: 05 Dec 2019 03:53 PM PST Good evening, dear traders! I present to you the development of a trading idea for oil based on volumetric analysis! Let me remind you that the idea for purchasing oil for the absorption of the decline last Friday was presented yesterday (12/04/19), which happened without the participation of America, because they had a public holiday. After that, the Americans traded for the next 2 trading sessions at prices that were not very profitable for sales, i.e. cheap relative to prices before the holidays. The price increase occurred before the news on Oil Reserves, but this also increased the probability of a maximum update, since oil production was sharply reduced and today, there was an opportunity to add long positions in order to update the last maximum of 58.74. As a result, 250 points were earned from the entry point 56.30 to the crossing 58.74. Moreover, it would bring +60 points when adding a long position or purchasing from oil reserves. Forecast: Developing trading idea with a description: Good luck in trading and follow the money management! The material has been provided by InstaForex Company - www.instaforex.com |

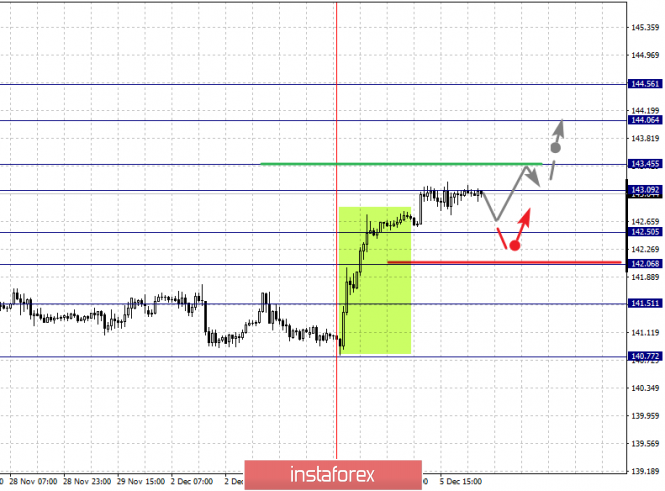

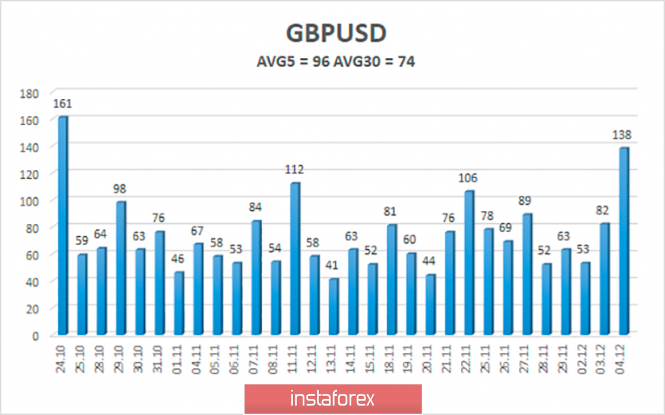

| Posted: 05 Dec 2019 02:56 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 52p - 63p - 53p - 82p - 138p. Average volatility over the past 5 days: 96p (average). The GBP/USD currency pair continues its upward movement as if nothing had happened. Not a single important macroeconomic report was published either in the UK or in the US today, but this did not prevent traders from continuing confident purchases of the British pound. What does this day? Firstly, that traders continue to completely ignore all macroeconomic information, and secondly, that the political factor for the pound/dollar pair is not just in the first place, it occupies the only place in the list of factors that affect the movement of the pair. Thus, only one conclusion can be drawn now: the pound is growing and can continue to grow only on the expectations of market participants that the Conservative Party will win the parliamentary elections and not just win, but win with the necessary number of deputy mandates, which will allow Boris Johnson to implement Brexit under an agreement with the European Union unhindered, which was reached literally "in the last 5 minutes" back in October. Based on the conclusions made, we can assume that tomorrow's macroeconomic statistics from the United States will either have no effect on the movement of the currency pair, or that it would but very restrained. The macroeconomic calendar for tomorrow is completely empty in the UK. Thus, we can fully expect continued strengthening from the pound/dollar pair at the end of the trading week. About one week remains until the election date, the results will be known, most likely, on December 13th. Traders do not need to reduce long positions tomorrow, which is called "before the weekend." Considering the fact that in the last two months, the pound sterling shows growth solely on the expectations of the Conservative victory in the elections, nothing prevents traders from continuing to buy the pair tomorrow. In such a situation, when in reality only one factor affects the currency, it is best to pay attention to technical indicators. All of them are currently pointing up. The Heiken Ashi indicator (or MACD), for example, will show the willingness of traders to start a downward correction if they turn down and begin to color the bars in blue. The immediate goal, which we determined in the morning, based on the average volatility indicator for the last five days - 1.3196. The pair can even work today, or at least get close to it. A new goal will be obtained tomorrow, which is likely to be located at about $1.33 and will also be quite real to work out this week. After December 12, the future of the pound will depend entirely on the election results, so it makes no sense to guess where the pound could be for the New Year. As for the likelihood that Conservatives will win the election, there is essentially nothing to talk about here, just look at the chart of the pound/dollar currency pair and everything becomes clear. If traders did not believe in victory, if rating and analytical agencies did not publish the results of opinion polls and social studies every day, which clearly indicate a 10-15% gap between the Conservatives and the Labour Party, then maybe the British currency would not grow on the eve of the elections. We can only once again warn traders that the political rating of Conservatives is now about 44-45%, which is far from necessarily converting to more than 50% of parliamentary seats. Of course, if Johnson's party gains 48% of the 650 seats in Parliament, then the deal with Brexit can also be considered resolved, it will be possible to gather Conservatives to vote for the deal with the European Union, but the total number of MPs less than 300 can already create certain problems and tighten Brexit for a few more months or even years. The technical picture is now unambiguous - all indicators are directed upwards. Thus, it is recommended to continue to remain in purchases until the Heiken Ashi (or MACD) indicator turns down. During tomorrow's publication of macroeconomic reports in the United States, it is advised to be aware of open transactions, but we believe that there will not be a particularly strong reaction. And if the reports turn out to be weak, it can further push the pound to new heights. Trading recommendations: GBP/USD continues to move up. Thus, since the pair managed to get out of the side channel, it is now recommended to trade for an increase while aiming for 1.3196. New targets for buying the British pound will be determined in the morning review tomorrow. It is not advised that you consider selling the pound at the moment, as we are witnessing an upward trend, and the pair is very far from the critical Kijun-sen line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

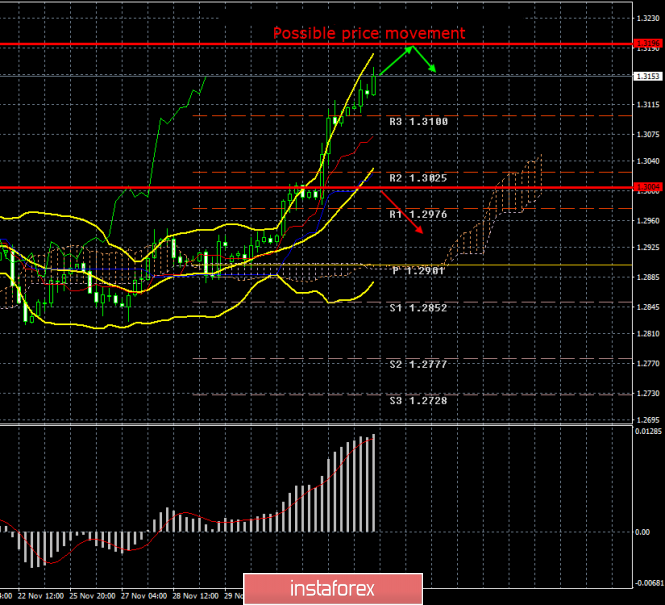

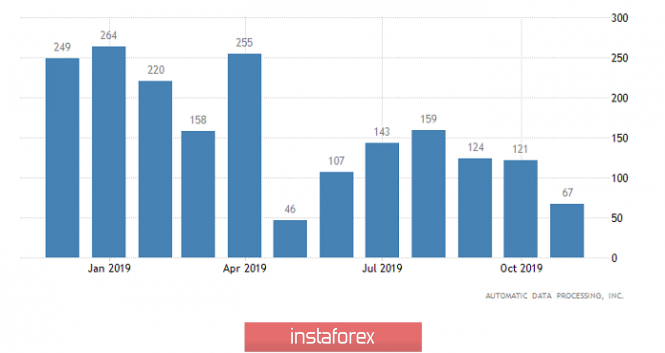

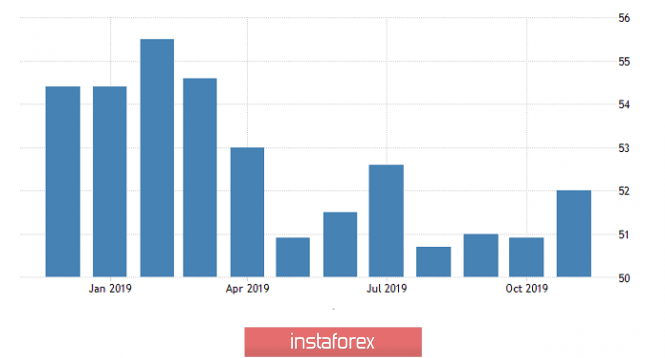

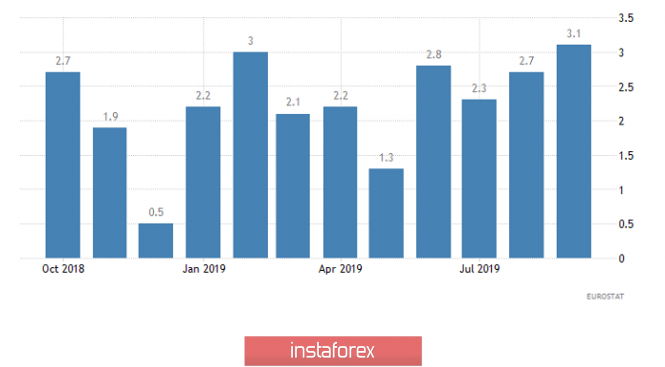

| Posted: 05 Dec 2019 02:56 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 20p - 47p - 87p - 27p - 49p. Average volatility over the past 5 days: 53p (average). Following yesterday's retreat from monthly highs, the EUR/USD pair resumed the upward movement, which is still identified as rather weak. Bulls continue to resist the bears with all their might, but on the whole neither the first nor the second now have the advantage. The paradoxical situation seems to have been left behind, since the euro/dollar pair still managed to move away from the area of two summer lows. However, this does not mean that an upward trend will now begin to form. Neither the bulls nor the bears have a sufficient number of grounds for action. Meanwhile, traders continue to selectively tear away all the macroeconomic data at their disposal. Recall that yesterday the euro had good chances to show strong growth against the US dollar, as the American report on the change in the number of employees in the private sector, as well as the index of business activity in the ISM services sector failed at the same time, while reports from the eurozone showed a slight improvement compared to the previous period. However, the price of the pair fell instead of continuing the upward movement. Today the situation looks completely opposite to yesterday. If the report on EU GDP for the third quarter fully coincided with the forecast values of +1.2% Y/Y and + 0.2% Q/Q, then the data on retail sales for October were much weaker than the weak forecast. Experts expected an increase of 2.2% Y/Y, compared with the previous month +3.1% Y/Y. In reality, everyone saw the figure of +1.4% Y/Y. However, just today, traders decided that it was not worth selling the euro on the basis of these macroeconomic data. Thus, we are forced to say that either market participants do not pay any attention to macroeconomic publications at all, or the market is now extremely thin (which is partly confirmed by weak volatility), therefore, any reaction of traders to this or that news is easily blocked by transactions of large players who do not seek profit due to exchange rate differences. It's all the more interesting to see what will happen on the market tomorrow, when the United States will publish a large package of important macroeconomic information, which includes unemployment, average hourly wages, NonFarm Payrolls, and the University of Michigan consumer confidence index. Especially considering the fact that the forecast for Nonfarm is quite high - 180,000, and the less significant report on the labor market by ADP failed this week. Based on this, it can be assumed that tomorrow's statistics from across the ocean will also disappoint traders, and if it is unlikely that anyone will pay attention to the unemployment rate (this indicator, although important, but more statistical), then the value of Nonfarm is less than 180,000 almost certainly disappoint traders. It remains only to understand whether traders will react to what is happening tomorrow or will the pair move in absolute disagreement with the nature of the published macroeconomic information? Meanwhile, according to assurances from various sources, including the media and anonymous sources close to the participants in the negotiation process, negotiations between China and the United States continue despite the aggravation of relations between the countries due to two laws passed by America, which provoke indignation of the Chinese government . Nevertheless, sources assure that although negotiations have been difficult, they will still continue. However, no specific information is provided. That is, it remains completely incomprehensible at what stage of the negotiations, what concessions the parties made, on what issues have yet to be agreed, and most importantly, what are the chances that Beijing and Washington will be able to agree before December 15? We still believe that the parties take one step towards each other, and then three back. Over the past year, we have already received several times reports that the parties are close to consensus and each time it all ended with an escalation of the conflict, recriminations and the introduction of new trade duties and sanctions. Thus, in the best case, Trump simply does not introduce a fee of another $160 billion on December 15, motivating this decision with a desire to continue the negotiation process. However, knowing Trump's manner of doing business, it can be assumed that duties will be introduced just so that China does not take time and is more accommodating. From a technical point of view, the upward movement is continuing now, but we still believe that the euro/dollar pair has few fundamental reasons for this. Thus, traders can continue with not actively purchasing the euro (no one can forbid them), but, from the point of view of macroeconomic statistics, the euro's growth is not justified. And even the technical picture, which implies continued growth, in practice looks like regular pullbacks, open flat periods, followed by a sharp but slight increase. Trading recommendations: The EUR/USD pair retains the prospects for an upward movement, but volatility is low again today. Thus, it is still recommended to buy the euro very carefully, since it is growing very reluctantly. Tomorrow there will be a lot of important and significant information, but not the fact that traders will work it out. It will be better to sell the euro, which has more fundamental reasons, after traders overcome the critical Kijun-sen line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Selling is risky, purchases are unreliable: bulls are trying to reverse the trend Posted: 05 Dec 2019 02:56 PM PST Following a short price pullback, the euro-dollar pair again shows a fighting character, testing the boundaries of the 11th figure. The pair ended yesterday in the negative territory - after reaching a multi-week price peak of 1.1116, the pair fell in a matter of hours to the middle of the 10th figure. But the downward impulse turned out to be false - the price suspended its decline, and resumed growth during the US session on Thursday. I mentioned the dollar's vulnerability yesterday - the downward price movements of EUR/USD should be treated with extreme caution, not forgetting the stops. Tomorrow's Nonfarm, as well as news from the front of the US-Chinese negotiations, can have a strong impact on the pair, and it is extremely difficult to predict the future direction of the price. Let me remind you that according to the report that ADP released, only 67 thousand jobs were created in November in the US private sector. This is the lowest result in the last five months, that is, from May, when the US labor market unexpectedly fell (Nonfarm then reached the level of 72 thousand). According to the same report, the number of jobs significantly declined by 18 thousand in the manufacturing sector. In other words, another wake-up call was sounded yesterday in the form of a weak report from the ADP agency. Now the market is waiting for the main macroeconomic report of the week, which will be published tomorrow. If the official figures repeat the trajectory of data from ADP, the dollar will again fall under a wave of sales - in that case, rumors will intensify in the market about another round of easing of monetary policy at the beginning of next year. But here it is worth emphasizing that the current situation is somewhat different from the May one. Then the traders were ready for Nonfarm to come out at low values (although real numbers were weaker than a weak forecast). To date, a consensus forecast for official data suggests that the labor market will show growth in November: 189 thousand jobs created with unemployment at a record low of 3.6%. Therefore, a certain intrigue regarding Friday data remains. A separate line should pay attention to the inflationary component of Nonfarm - an indicator of the average hourly wage. A month ago, this indicator came out at the level of 0.2% M/M and 3% Y/Y. This is a good result, and for the bulls of the pair it is important that tomorrow's release confirms the positive trend. Let me remind you that core inflation did not reach forecast values (in annual terms). Instead of projected growth of up to 2.4%, the core index remained at around 2.3%. In monthly terms, the indicator reached expectations, that is, at around 0.2%. Therefore, the inflationary component of Nonfarms is now extremely important for EUR/USD traders, even outside the context of an increase or decrease in the number of employees. If we talk about the external fundamental background, then the situation is uncertain. On the one hand, negotiators continue to hold consultations as part of trade negotiations. On the other hand, recent political events are not conducive to mutual friendly steps. Earlier this week, Trump signed bills that actually support protesters in Hong Kong. China called this step a gross interference in the internal affairs of the state. Yesterday, the House of Representatives took another step toward worsening relations between the United States and China: congressmen approved a bill on sanctions for oppressing Uighurs in China. The document provides for sanctions against senior Chinese officials for violating human rights in Xinjiang. Beijing, in turn, again criticized the bill, calling it interference in the country's internal affairs. At the same time, there are only ten days remaining until December 15. Prior to this date, the White House must decide on the introduction of new duties on Chinese imports. But according to unofficial information, the negotiators cannot reach a compromise on a number of key issues (necessary to sign the first phase of the deal) - these issues relate to how to guarantee Beijing's purchase of US agricultural products and which fees will be canceled by the United States. Amid continuing uncertainty, the dollar is showing general weakness in the market. The technical picture of EUR/USD speaks in favor of the pair's growth. On the daily chart, the pair is located above the Kumo cloud of the Ichimoku Kinko Hyo indicator and above all its lines. The bullish Parade of Lines signal indicates the potential for further price growth. In addition, the pair is located on the upper line of the Bollinger Bands indicator. This also indicates the bullish mood of traders. We can consider the mark of 1.1190 - this is the upper line of the Bollinger Bands indicator on the W1 timeframe - as the closest target of the upward movement. Stop loss can be placed at 1.1030 - this is the lower boundary of the Kumo cloud on the daily chart, coinciding with the middle line of the Bollinger Bands indicator. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Dec 2019 02:56 PM PST The pound has noticeably gained weight following opinion polls, which have shown growing expectations that the Conservative Party will significantly strengthen its position in the British Parliament following the election next week. Investors are now looking positively at the British currency, since they are waiting for the completion of the Brexit process, which began more than three years ago and during this time has already managed to get tired of everything. The head of the Cabinet of the United Kingdom, Boris Johnson, promises to withdraw the country from the European Union on January 31, 2020 - market participants seem to believe him, but the pound is growing. Will the prime minister keep his promise? It's impossible to say for sure, because once he already missed when he promised to finish Brexit on October 30th. It should be noted that the market reaction even looks somewhat ironic, since the pound fell to multi-year lows in August precisely on the news of Johnson's coming to power. Then GBP/USD traded near the lowest levels for more than thirty years. However, since then, the pound has risen in price by almost 10% against the US dollar, and Johnson's strengthening of positions is now perceived as good rather than bad news, and there is nothing surprising here. In less than five months, the prime minister managed to significantly bring the country closer to breaking the legislative deadlock. According to some experts, the victory of Conservatives with Great Britain's subsequent exit from the EU is becoming preferable, as this will mean higher predictability in the economy and in the financial market. "It seems that the pound could reach $1.35 at a fairly fast pace if the Conservatives win. In order to make further progress, we will need to ratify the Brexit deal, and then gain confidence that there will be a significant trading deal finalized with the EU," said Rupert Thompson, Head of Market Analysis, UK asset management company Kingswood Holding. "The market's perceptions of the exact advantage the Conservatives will win in the election can be tracked by the pound. The stronger the pound, the higher the market's confidence in the ability of Conservatives to conduct a Brexit deal through Parliament," said Sean Darby, Jefferies strategist. At the same time, analysts admit that the pound could fall if the Conservative Party does not win a landslide victory. "The results of a recent YouGov poll have led many market participants to expect the pound to rise to $1.34 if the Tories win. The irony, however, is that the study follows a pattern very similar to the one we saw in 2017. Many of the polls turned out to be erroneous last time. I have a healthy dose of skepticism," said Jordan Rochester of Nomura. According to BMO Capital Markets, one of the worst results of the December 12 general election in the UK will be a "suspended" Parliament for the pound, leading the GBP/USD pair to decline to 1.25. "If GBP/USD trades at 1.30 at the time of the release of such news, we expect the pair to fall to at least 1.27, followed by further movement to 1.25 in one or two subsequent trading sessions" said BMO strategist Stephen Gallo. The material has been provided by InstaForex Company - www.instaforex.com |

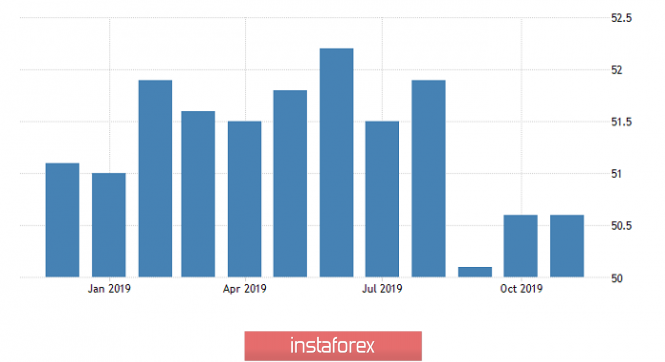

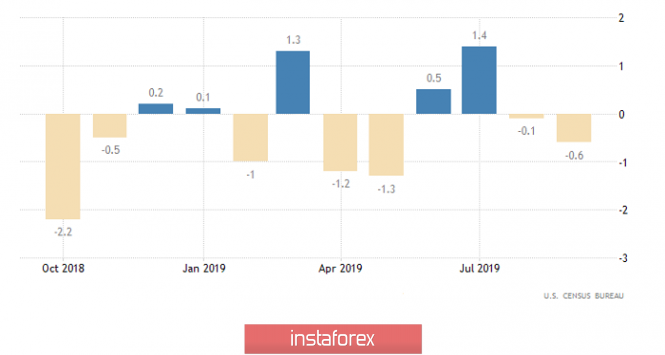

| EUR/USD: increasing headwinds for the US economy, the dollar loses its trump cards Posted: 05 Dec 2019 02:55 PM PST 26 out of 62 analysts recently surveyed by Reuters stated trade wars as the main factor in the change in the exchange rate of the US currency, the same as macro statistics in the US, seven respondents believe that the main factor is economic indicators in other countries, while three pointed to other reasons. Admittedly, most experts are on the right track. Released on the eve of mixed data on the US labor market and business activity, as well as an unexpected change in the rhetoric of US President Donald Trump rolled the EUR/USD pair on a roller coaster. The owner of the Oval Office said that substantial progress has been made in Washington's trade negotiations between China and the United States: dialogue between the parties is going very well. A rather unexpected statement by the US president after words about his readiness to wait until the end of 2020 before signing a comprehensive treaty. According to Bloomberg, the United States and China are at the stage of agreeing on the question of which part of import tariffs should be rolled back, and the interim agreement will very soon lie on the table before the leaders of the two countries. Market sentiment significantly improved amid this background, stock indices rose, and the defensive dollar, on the contrary, declined. In addition, the greenback suffered from weaker-than-expected US employment data from ADP. The indicator increased by only 67 thousand in November with a preliminary estimate of 150 thousand. Given the close correlation of the indicator with Nonfarm Payrolls, it can be assumed that the US labor market report on Friday may turn out to be worse than expected. At the same time, the non-manufacturing index of the Institute for Supply Management fell to 53.9 in November from 54.7 recorded in the previous month. "This week we saw weak data on the US, which negatively affected the mood for the dollar, as they indicate a slowdown in the US economy," said Scotiabank currency strategists. The bears in EUR/USD were saved from defeat only by the index of managers in the eurozone services sector from Markit, which fell to 51.9 points in November from the level of October at 52.2 points. "Recent data indicate eurozone GDP growth of only 0.1% in the fourth quarter, while the manufacturing sector continues to act as the main impediment on growth. It's alarming that the region's services sector is also on its way to its weakest quarterly growth in five years," said IHS Markit chief economist Chris Williamson. Fans of the euro are hoping for an end to the Washington-Beijing trade war and a recovery in the European economy, including through fiscal stimulus called for by the eurozone's national governments, ECB President Christine Lagarde. According to the estimates of the Center for European Policy Studies, a fiscal stimulus of at least 3-4% of GDP is needed for a steady inflation rate in the EU to reach a 2% target and also for a related increase in the ECB deposit rate from the current -0.5% to zero. It is doubtful that the eurozone will do this. Meanwhile, the growth rate of the USD index slowed to 2% in 2019 from 4% recorded in 2018, which indicates that the greenback is losing its trump cards. Reuters experts predict that over the next six months, the EUR/USD pair will reach 1.12, and in twelve months - 1.15. As for short-term prospects, the bears managed to repel the first storm of resistance at 1.1115, however, while the quotes are above 1.1055, the chances of a re-attack of the bulls remain quite high. The material has been provided by InstaForex Company - www.instaforex.com |

| Canadian dollar optimism: strengthening and growing Posted: 05 Dec 2019 02:55 PM PST This week has been quite favorable for the Canadian dollar. After the decision of the Bank of Canada to leave the interest rate unchanged at 1.75%, the loonie perked up and grew. Many experts predict a short term growth in the loonie. Another driver of strengthening the loonie was the rapid rise in oil prices. It was also supported by the position of the leaders of the Bank of Canada, declaring the stability of the national economy. Earlier, Stephen Poloz, Governor of the Bank of Canada, focused on the fact that the country's economy is in good shape, therefore, it is not worth changing the current monetary policy. Nevertheless, a number of economists believe that the regulator should consider reducing interest rates. This is necessary to stop the negative economic consequences of trade conflicts, experts are certain. According to current statistics, in the third quarter of 2019, Canada's GDP grew by 1.3% year-on-year. According to economists, the growth of the Canadian economy will be below 2% by the end of this year. Experts believe that this indicator will remain at the current level for the next two years. According to experts, the long trade confrontation between Washington and Beijing provides support not only for the greenback, but also for the Canadian currency. Experts note that the USD/CAD pair has a pronounced upward trend, which may increase in the near future. At the moment, the USD/CAD pair rose to the level of 1.3185, but then returned to its previous frame. Nevertheless, experts are upbeat over the loonie. The situation of the Canadian dollar is quite stable and encourages investors. The loonie has strengthened and is trying to maintain its position. Analysts were divided with regard to interest rates. For example, TD Securities experts are confident that the Canadian regulator will nevertheless reduce the rate by 25 basis points (bp), but this will happen no earlier than April 2020. Some analysts believe that everything will depend on the dynamics of economic data in Canada. In the event of their strengthening, a complete rejection of the forecast of a decrease in rates is possible. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound's balancing act before decisive election Posted: 05 Dec 2019 02:55 PM PST The British currency froze in anticipation of the upcoming changes that are associated with the upcoming elections in the country. According to experts, they will determine the further dynamics of the pound. Sterling is currently dominated by conflicting drivers, when turbulence alternates with a lull period. The pound demonstrated the wonders of staying in balance on Wednesday, November 4, rising sharply after a long stagnation. The GBP/USD pair has skyrocketed after negotiations between the British government and US President Donald Trump. According to experts as another driver for the sterling's growth, the Conservative Party of Great Britain is highly likely to win. Against this background, the pound was growing rapidly, and this trend continues. According to analysts, the dizzying rise in the price of the British currency is associated not only with its strengthening, but also with the weakening of the greenback. On Wednesday, the dollar index updated multi-week lows, and the pound took this opportunity. The dynamics of the pound became a mirror of the ups and downs of the election campaign, instantly reacting to current events. At present, the main rivals of Prime Minister Boris Johnson, the Labour Party, are either gaining a majority of the votes or are on the verge of failure. The British currency also demonstrates similar somersaults, emerging from a state of stagnation and making a giant price leap. On Wednesday, the pound rose above 1.3000 in the wake of reports that the Conservative Party of Great Britain is confidently holding the palm in the race. It was ahead of the Labour Party by 12 points, providing invaluable support to the pound. In addition, the current situation increases the chances of approving a deal with Brussels in early January 2020. Sterling is currently celebrating a victory: it managed to overcome the most important key level of 1.3000, which the GBP/USD pair has not succumbed to since October 2019. Yesterday, the pair began to move forward, rising sharply to 1.3060. As a result, the GBP/USD pair entered the upward trend, but periodically stagnated and even dropped to 1.3042–1.3043. However, these hitches were not a signal for a fall, but a springboard before the next jump of the British currency. After a while, the pound turned into a battering ram and managed to get to the psychologically important level of 1.3100. The market delightedly watched the British currency's surge. Sterling also began on a major note on Thursday morning, December 5. Not only did it not lose its gained positions, but also managed to strengthen them. The GBP/USD pair ran in the range of 1.3111–1.3112, demonstrating a clear tendency to rapid growth. At the same time, buyers of the pound, who became the hero of the day, intensified. The pair met market expectations in the future. In a short period of time, the GBP/USD pair soared almost threefold. At the moment, it is trading within 1.3136-1.3137, trying to get to the following peaks. Many experts believe that the British currency will not lose stability with any outcome of the election. The market believes in the reliability and strength of the pound, which has repeatedly demonstrated growth in difficult circumstances. The positive dynamics of sterling helps it strengthen and grow, analysts summarize. Many experts expect the GBP/USD pair to rise to 1.3900 in 2020. In connection with the current price pound surges, growing exponentially, this forecast may become a reality. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 12.05.2019 - Downside expected Posted: 05 Dec 2019 07:51 AM PST Crypto news: While Ukraine's Ministry of Digital Transformation was only established in August of this year, it has been very active in the crypto field. For example, it recently partnered with Binance to jointly work on new crypto rules. However, the ministry wants to learn from its neighboring countries as well. On Wednesday, the Ukrainian Government's online portal reported that the Ministry of Digital Transformation partnered with crypto exchange, Currency.com, a Belarusian service that is allegedly the first regulated exchange in the Commonwealth of Independent States (CIS) region to provide support for crypto currencies, fiat, and tokenized assets. On a side note, Ukraine is also part of the CIS. The cooperation between the Ukrainian government and the Belarusian crypto exchange will touch upon IT legislation, including regulating crypto assets. Ukraine wants to adopt the Belarusian experience in managing the crypto space within a legal framework. Technical analysis:

Bitcoin has been trading sideways at the price of $7.330. Anyway, my bearish view from yesterday didn't change. BTC reached and rejected of the very important resistance at the price of $7.650, which his good sign that sellers are still in control. In my opinion BTC did re-test of the broken bear flag pattern. Watch for selling opportunities and downward targets at $7.079, $6.889 and $6.561. Stochastic oscillator is flag Resistance levels are found at the price of $7.650 and $7.750. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 12.05.2019 - Wait for the brrreakout of the mini Pitchfork channel to confirm largerr bull move Posted: 05 Dec 2019 07:39 AM PST Gold has been trading sideways at the price of $1.476. I see that there is still chance for more upside in case of the upside breakout of $1.481. Upward target levels are set at the price of $1.484, $1.494 and $1,502.

Stochastic oscillator got fresh new bull cross and it seems that it is oversold condition, which is good opportunity for buyers. Medium Pitchfork is serving us like the pest pivot and you should expect few pivots to build around ML before the next directional move. Anyway, the breakout of mini Pitchfork channel to the upside, may confirm further stronger bull move. Support levels are set at $1.471 and $1.467. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY analysis for December 05, 2019 - Broken beaar flag pattern, potential test of 108.44 Posted: 05 Dec 2019 07:27 AM PST USD/JPY has been trading sideways in past 24 hours at the price of 108.80. Anyway, I do expect more downside due to potential end of the upward correction (bear flag) and new momentum down on the oscillator. Downward targets are set at the price of 108.44, 108.28 and 107.92.

MACD oscillator did show the new momentum down in the background and it seems that it is ready for the new wave down. Slow line is in the negative territory, which is good sign for the further downside. Resistance level is found at 109.00. The material has been provided by InstaForex Company - www.instaforex.com |

| December 5, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 05 Dec 2019 07:20 AM PST

Since October 2, the EURUSD pair has been trending-up until October 21 when the pair hit the price level of 1.1175. The price zone of (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Hence, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 offering valid bearish positions few weeks ago. That's why, two consecutive bearish pullbacks were executed towards 1.1025 and 1.0995 where two episodes of bullish rejection were demonstrated. Recent bullish pullback was demonstrated towards 1.1065-1.1085 where a cluster of supply levels were located (61.8% Fibo - 50% Fibo levels) that initiated a bearish movement towards 1.1000. On the other hand, recent price action suggested a high probability of bullish reversal around 1.1000 that brought the EURUSD pair again towards 1.1065-1.1085 as expected. Thus, the EUR/USD Pair has been trapped between the price levels of 1.1000 and 1.1085 until Yesterday as a bullish spike was demonstrated towards 1.1110. Initial bearish rejection was anticipated around 1.1110 to bring bearish decline towards 1.1065. Moreover, a Head & Shoulders reversal pattern is being demonstrated with neckline located around 1.1065. Hence, a valid SELL entry can be offered upon bearish breakout below 1.1065. Initial bearish target would be located around 1.1010. Please also note that any bullish breakout above 1.1100 will probably bring further bullish advancement towards 1.1140 and 1.1175. The material has been provided by InstaForex Company - www.instaforex.com |

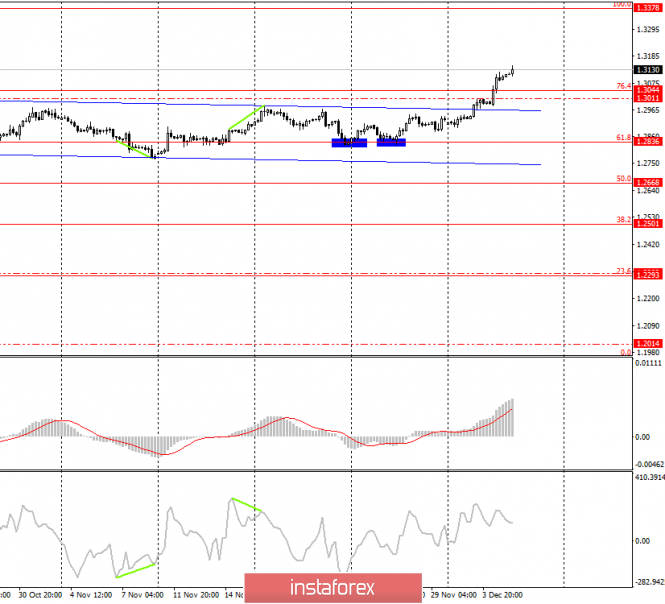

| December 5, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 05 Dec 2019 07:03 AM PST

On October 21, the GBP/USD pair was demonstrating an ascending wedge reversal pattern while approaching the depicted SUPPLY-zone (1.2980-1.3000). This pattern was confirmed on October 22. Since Then, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. This indicated a high probability of bearish reversal around the mentioned price zone. Hence, a quick bearish movement was initiated towards 1.2780 (Key-Level) where bullish recovery was demonstrated on two consecutive visits. That's why, the GBP/USD pair has been trapped between the mentioned price levels (1.2780-1.3000) until Yesterday when bullish breakout above 1.3000 was achieved. Short-term technical outlook remains bullish as long as consolidations are maintained above 1.3000 on the H4 chart. On the other hand, the pair is currently testing the upper limit of the newly-established depicted short-term bullish channel. That's why, high probability of bearish rejection exists around the current price levels. Conservative traders may have to wait for a bearish pullback towards 1.2980-1.3000 for a valid BUY signal. Estimated bullish target would be located around 1.3120 and 1.3150. On the other hand, please note that any bearish closure below 1.2980 invalidates the bullish scenario for the short-term allowing further bearish decline towards 1.2900 then 1.2850. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review of EURUSD on 12/05/2019. ECB will support the euro Posted: 05 Dec 2019 05:16 AM PST

The moment of truth for the markets is approaching. The main events of December 11-12: the Fed meeting on December 11, the ECB and the elections in Britain on December 12. The pound showed a new growth of 200 points (1.2900-1.3100) - on expectations that the conservatives will get a strong majority - the markets obviously like the Brexit option from Johnson. The Fed may cut the rate again by 0.25%. The ECB is expected to announce that it will not pursue a new policy easing. This set is likely to cause the euro to rise. We keep purchases from 1.1035, stop at 1.0990 and expect a new wave of euro growth. The material has been provided by InstaForex Company - www.instaforex.com |

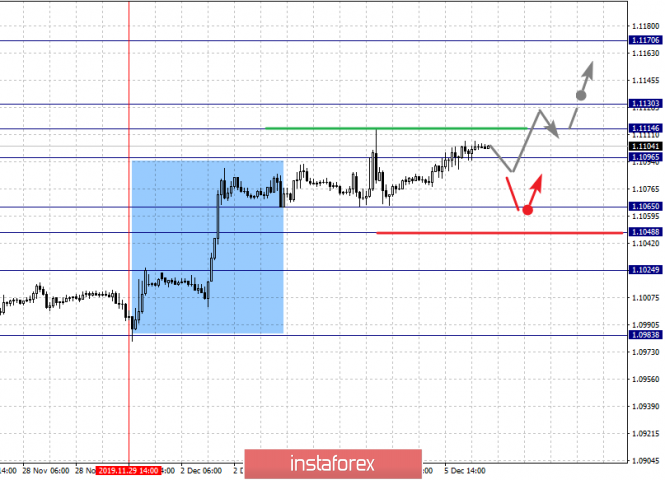

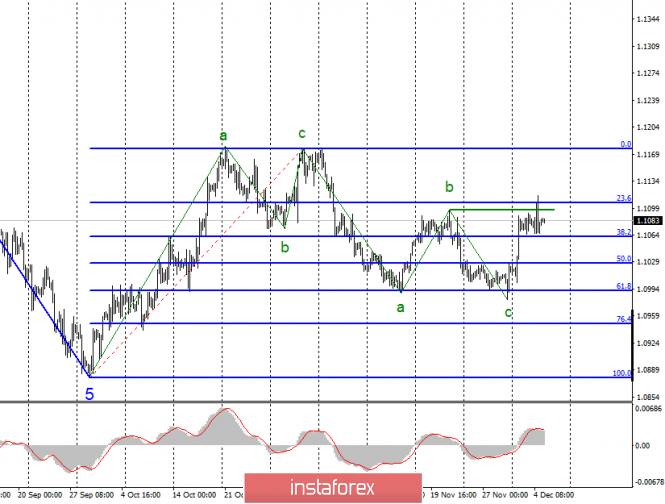

| Posted: 05 Dec 2019 05:16 AM PST EUR/USD – 4H.

On December 5, the EUR/USD pair performed growth to the correctional level of 61.8% (1.1104), and this level has become quite a serious obstacle for traders. In the morning trading on Thursday, there is again a slight tendency of traders to buy, but their activity remains quite low. If during the day the pair passes 30-35 points, it is very difficult to earn on them with the help of any transactions. Especially if during the whole day the pair does not show movement in a certain direction, but jumps up and down. Thus, traders can now expect to resume growth in the direction of the correction levels of 61.8% (1.1104) and 76.4% (1.1133), but it is unlikely that activity will increase, as well as the strength of the pair's movement. Sometimes it seems that the participants in the US-China trade battle are playing some kind of understandable game. How else can traders react to events that contradict each other? The States and their president, Donald Trump, make statements almost every two days that trade negotiations on a deal are ongoing and call them optimistic. In practice, we see the adoption of two laws by the States at once, which China interprets as unacceptable interference in the internal affairs of the country. We are talking about the "Hong Kong law" and the "Uighur law", each of which implies certain sanctions against Chinese officials and a reduction in the number of trade preferences. Beijing, of course, is taking retaliatory measures, and about trade negotiations, in general, remains silent. And this silence, in my opinion, is much more eloquent than any statements of the American government. Beijing remains silent because there is no progress in the talks. There is no information to confirm that Beijing agreed to buy agricultural products in the United States for a fixed amount, as the States wanted. There is no information that America has agreed to cancel all duties imposed earlier, as China wanted. What, then, is progress? If there is progress, then the parties would have declared it openly. What is the point of hiding an agreement on key issues if they become public anyway? On the horizon, meanwhile, the date of December 15 looms ever clearer when Donald Trump will either have to introduce new duties on goods from China or announce the signing of an agreement. So far, the euro currency is growing, as hopes that the parties will still be able to conclude at least the first phase of the agreement still warm in the hearts of traders. However, demand for the euro is still low, which is confirmed by yesterday's economic reports from the United States, which could cause a serious increase in demand for the EU currency. The ISM business activity index (services sector) in November fell to 53.9, and the report on the change in the number of employed ADP showed an increase of only 67 thousand instead of the expected 140. These data could well lead to a strong growth of the European currency but did not. Thus, I believe that the mood of bullish traders now borders on uncertainty, and at any moment, they can close purchases and exit the market, which will lead to a new fall in the European currency. Today, GDP and retail sales reports have already been released, and if the first report coincided with traders' expectations, the second was much worse. The euro currency has not yet reacted to these data. Forecast for EUR/USD and trading recommendations: On December 5, traders will continue to try to bring the pair out of another stupor. The attempt to overcome the correction level of 61.8% (1.11104) can be considered unsuccessful or false, but at the same time, there was no noticeable drop in the quotes. The activity of traders remains low, and it is impossible to guarantee the working out of the level, which is only 30-40 points. The Fibo grid is based on the extremes of October 21, 2019, and November 29, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

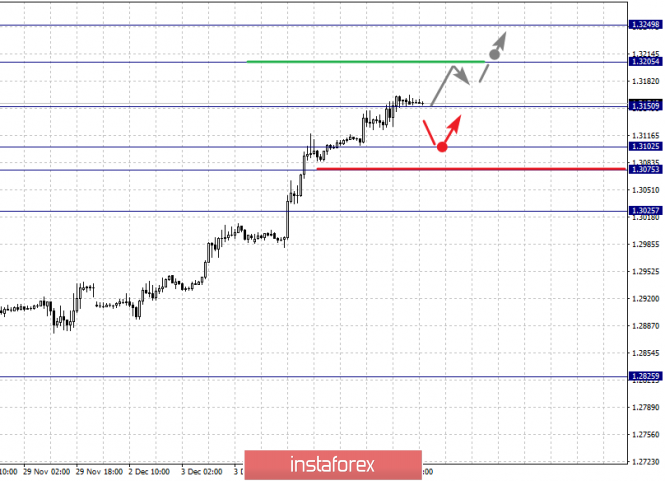

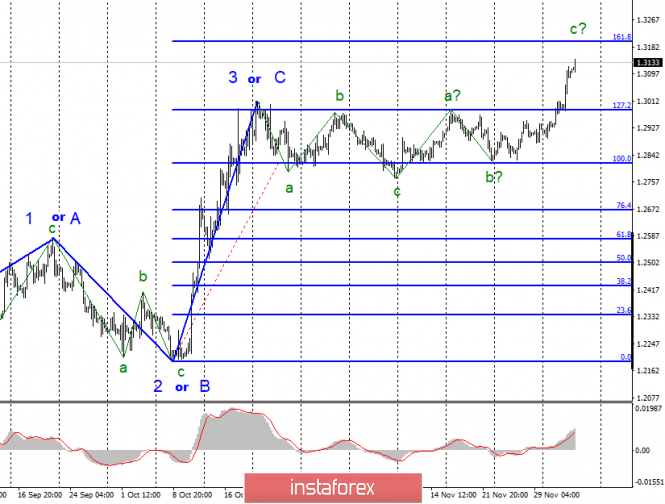

| Posted: 05 Dec 2019 05:16 AM PST GBP/USD - 4H.

On December 5, the GBP/USD pair continues the growth process in the direction of the correction level of 100.0% (1.3378), after fixing the quotes above the Fibo level of 76.4% (1.3044) and above the trend area. The period of calm has ended and the British currency updates local highs every day. There are no visible obstacles for the pound-dollar pair on the way to its goal. The emerging divergence is also not observed today. The pound has perked up and continues to grow with pleasure, expecting that the election, which will be held in a week, will be won by the party of Boris Johnson. Although Johnson himself has a twofold attitude among the electorate, the British are now driven by the desire to complete the Brexit process as soon as possible. About the same logic and traders in the forex market. The more powerful Johnson's party wins, the faster Brexit will end and this page of British history can be turned. What will wait for the country after it officially leaves the European Union is not worth thinking about. First, we need Brexit to be completed. Thus, traders now react only to the factor of the high probability of victory of conservatives in elections, other economic reports and news are not taken into account. Therefore, the growth of the "Briton" can continue until December 12. Boris Johnson continues to rest on his laurels and is preparing to win the election. The Prime Minister gave an interview in which he said that only with the conservatives at the head of the country, the parliament will once again begin to work and take care of the UK and its population. Johnson said that with Brexit, it is time to end and he can guarantee it only if the Conservative Party wins by the necessary margin from the Labor Party. Thus, the population of Britain is well aware that either the conservatives will win, or Brexit will be delayed for an indefinite period. Boris Johnson's party is likely to win the election and for the pound, in the short term, it is a good thing. Once Brexit is implemented, economic factors will again come to the fore, which can cause a serious fall in the British currency, as the Kingdom's economy has recently shown clear signs of weakening. Forecast for GBP/USD and trading recommendations: The pound-dollar pair resumed the growth process. Thus, now I advise buying "Briton" with a target of 1.3378. A new trend corridor may be built soon. Information background now does not prevent the pound to grow, as traders continue to pay no attention to it. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

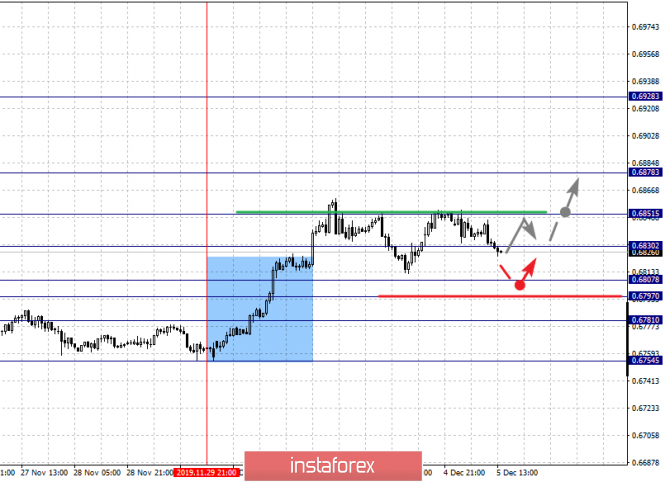

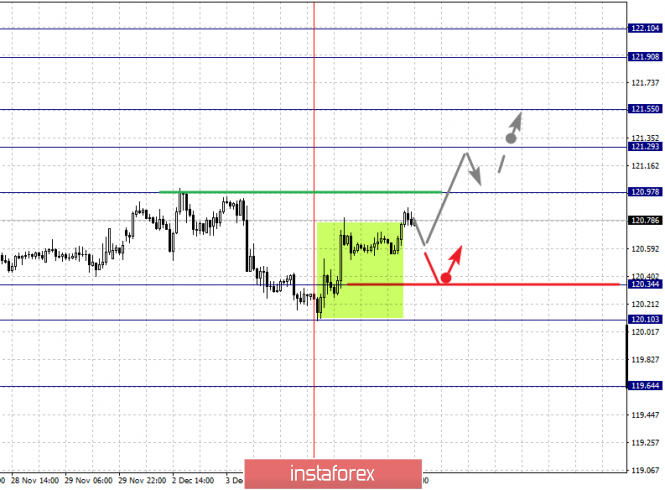

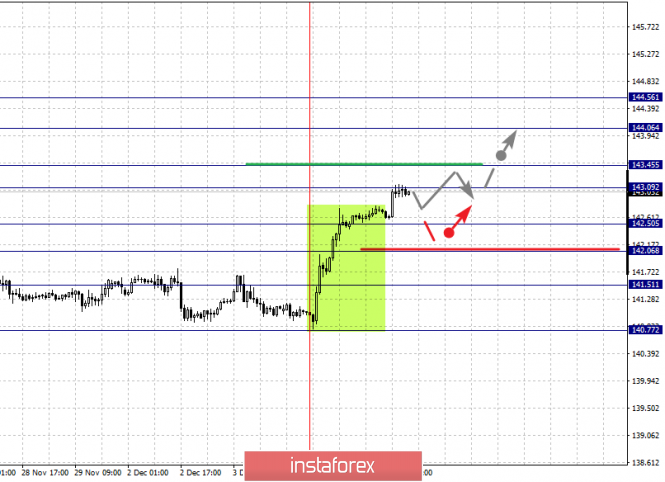

| Fractal analysis for major currency pairs as of December 5 Posted: 05 Dec 2019 05:16 AM PST Hello, dear colleagues. For the Euro/Dollar pair, the development of the upward trend of November 29 is expected after the breakdown of 1.1114. For the Pound/Dollar pair, the continued development of the upward cycle of November 27 is expected after the breakdown of 1.3150. For the Dollar/Franc pair, the development of the upward structure of November 29 is expected after the breakdown of 0.9862. For the Dollar/Yen pair, we follow the formation of a downward structure from December 2; the level of 108.58 is the key resistance and the level of 109.31 is the key support. For the Euro/Yen pair, the price formed a local upward structure for the subsequent development of the upward trend and the level of 120.98 is the key resistance. For the Pound/Yen pair, the next targets for the top are determined from the local structure on December 4 and the level of 143.45 is the key resistance. Forecast for December 4: Analytical review of currency pairs on the H1 scale:

For the Euro/Dollar pair, the key levels on the H1 scale are 1.1170, 1.1130, 1.1114, 1.1096, 1.1065, 1.1048, and 1.1024. We continue to follow the formation of the expressed initial conditions for the top of November 29. We expect the upward movement to continue after the breakdown of 1.1096. In this case, the target is 1.1114 and in the area of 1.1114-1.1130 is the price consolidation. The breakdown of the level of 1.1130 will lead to the development of a pronounced movement. The potential target is 1.1170. The short-term downward movement is expected in the range of 1.1065-1.1048 and the breakdown of the last value will lead to an in-depth correction. The target is 1.1024 and this level is the key support for the upward structure. The main trend is the formation of initial conditions for the top of November 29. Trading recommendations: Buy: 1.1096 Take profit: 1.1146 Buy: 1.1132 Take profit: 1.1170 Sell: 1.1065 Take profit: 1.1050 Sell: 1.1046 Take profit: 1.1026

For the Pound/Dollar pair, the key levels on the H1 scale are 1.3249, 1.3205, 1.3150, 1.3102, 1.3075, and 1.3025. We follow the development of the upward cycle of November 27. We expect the upward movement to continue after the breakout of 1.3150. In this case, the target is 1.3205 and consolidation is near this level. We consider the level of 1.3249 as a potential value for the top, upon reaching this level, we expect consolidation, as well as a pullback downwards. The short-term downward movement is possible in the area of 1.3102-1.3075 and the breakdown of the last value will lead to a deep correction. The target is 1.3025 and this level is the key support for the top. The main trend is the upward cycle from November 27. Trading recommendations: Buy: 1.3150 Take profit: 1.3205 Buy: 1.3207 Take profit: 1.3247 Sell: 1.3102 Take profit: 1.3076 Sell: 1.3073 Take profit: 1.3027

For the Dollar/Franc pair, the key levels on the H1 scale are 0.9965, 0.9935, 0.9908, 0.9864, 0.9820, 0.9789, and 0.9745. We follow the development of the downward structure of November 29. We expect the downward movement to continue after the breakout of 0.9864. In this case, the target is 0.9820 and in the area of 0.9820-0.9789 is the short-term downward movement, as well as consolidation. The breakout of the level of 0.9789 should be accompanied by a pronounced upward movement. In this case, the potential target is 0.9745 and from this level, we expect a pullback to the correction. The short-term upward movement is possible in the area of 0.9908-0.9935 and the breakdown of the last value will lead to an in-depth movement. The target is 0.9965 and this level is the key support for the downward structure from November 29. The main trend is the formation of initial conditions for the bottom of November 29. Trading recommendations: Buy: 0.9908 Take profit: 0.9933 Buy: 0.9937 Take profit: 0.9965 Sell: 0.9862 Take profit: 0.9825 Sell: 0.9820 Take profit: 0.9790

For the Dollar/Yen pair, the key levels in the H1 scale are 109.31, 109.06, 108.85, 108.58, 108.31, 108.10, 107.80, and 107.62. We follow the formation of the downward structure of December 2. We expect the downward movement to continue after the breakdown of 108.58. In this case, the first target is 108.31. The short-term downward movement is possible in the range of 108.31-108.10 and the breakdown of the last value will lead to a pronounced movement. The target is 107.80. The potential value for the bottom is the level of 107.62, upon reaching which we expect consolidation, as well as a pullback upwards. The short-term upward movement is expected in the range of 108.58-109.06 and the breakdown of the last value will lead to an in-depth correction. The target is 109.31 and this level is the key support for the downward structure. The main trend is the formation of initial conditions for the downward movement from December 2. Trading recommendations: Buy: 108.85 Take profit: 109.04 Buy: 109.08 Take profit: 109.30 Sell: 108.30 Take profit: 108.12 Sell: 108.08 Take profit: 107.80

For the Canadian dollar/Dollar pair, the key levels on the H1 scale are 1.3237, 1.3216, 1.3198, 1.3172, 1.3155, 1.3138, and 1.3107. We follow the development of the downward trend of December 3. The short-term downward movement is expected in the range of 1.3172-1.3155 and the breakdown of the last value will lead to a movement to the level of 1.3138, consolidation is near this level. The potential value for the bottom is the level of 1.3107, upon reaching this value, we expect a pullback upwards. The short-term upward movement, as well as consolidation, are possible in the area of 1.3198-1.3216 and the breakdown of the latter value will lead to an in-depth correction. The target is 1.3237 and this level is the key support for the downward structure. The main trend is the downward structure of December 3. Trading recommendations: Buy: 1.3198 Take profit: 1.3215 Buy: 1.3217 Take profit: 1.3236 Sell: 1.3171 Take profit: 1.3155 Sell: 1.3154 Take profit: 1.3138

For the Australian dollar/Dollar pair, the key levels on the H1 scale are 0.6878, 0.6851, 0.6830, 0.6807, 0.6797, and 0.6781. We follow the formation of the expressed initial conditions for the top of November 29. The short-term upward movement is expected in the range 0.6830-0.6851. The breakout of the level of 0.6851 will lead to a pronounced upward trend. The potential target is 0.6878 and consolidation is near this value. The short-term downward movement is expected in the area of 0.6807-0.6797 and the breakdown of the last value will lead to an in-depth correction. The target is 0.6781 and this level is the key support for the upward structure. The main trend is the formation of pronounced initial conditions for the top of November 29. Trading recommendations: Buy: 0.6830 Take profit: 0.6848 Buy: 0.6853 Take profit: 0.6878 Sell: 0.6807 Take profit: 0.6797 Sell: 0.6795 Take profit: 0.6783

For the Euro/Yen pair, the key levels on the H1 scale are 122.10, 121.90, 121.55, 121.29, 120.97, 120.66, 120.34, 120.10, and 119.64. The price formed a local upward structure from December 4 to continue the upward trend. We expect the upward movement to continue after the breakdown of 120.97. In this case, the first target is 121.29 and consolidation is near this level. In the area of 121.29-121.55, there is a short-term upward movement and the breakdown of 121.55 should be accompanied by a pronounced upward movement. The target is 121.90. The potential value for the top is the level of 122.10, upon reaching which we expect consolidation in the area of 121.90-122.10, as well as a pullback downwards. The short-term downward movement is possible in the area of 120.52-120.34. The breakdown of the last value will lead to a movement to the level of 120.10 and this level is the key support for the upward trend. The main trend is the local upward structure from December 4. Trading recommendations: Buy: 120.98 Take profit: 121.27 Buy: 121.30 Take profit: 121.55 Sell: 120.32 Take profit: 120.10 Sell: 120.05 Take profit: 119.70

For the Pound/Yen pair, the key levels on the H1 scale are 144.56, 144.06, 143.45, 143.09, 142.50, 142.06, and 141.51. We determined the following goals for the top from the local ascending structure on December 4. The short-term upward movement is expected in the area of 143.09-143.45 and the breakdown of the last value will lead to a pronounced movement. The target is 144.06. The potential value for the top is the level of 144.56, upon reaching this value, we expect consolidation, as well as a pullback downwards. A short-term downward movement is possible in the area of 142.50-142.06 and the breakdown of the last value will lead to an in-depth correction. The target is 141.51 and this level is the key support for the top. The main trend is the local upward structure from December 4. Trading recommendations: Buy: 143.10 Take profit: 143.44 Buy: 143.50 Take profit: 144.06 Sell: 142.50 Take profit: 142.10 Sell: 142.04 Take profit: 141.54 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Dec 2019 01:59 AM PST 4-hour timeframe

Technical data: The upper channel of linear regression: direction - up. The lower channel of linear regression: direction - up. The moving average (20; smoothed) - up. CCI: 160.9320 The GBP/USD currency pair continues a fairly strong upward movement, no matter what. It is unlikely that yesterday's strengthening of the pound can be somehow linked to weak macroeconomic data from overseas. Recall that the index of business activity in the ISM service sector was worse than forecast values, as well as the report on the change in the number of employees in the private sector ADP. Until yesterday, for more than a month, traders stubbornly ignored any macroeconomic statistics from the UK and America, some of which could send the British pound far down. Now, the volatility of the pound/dollar pair has increased, the trend movement has resumed. And what about the reasons for what is happening? And the reasons are still the same - the markets stubbornly believe in the victory of Boris Johnson's party in the elections and the implementation of Brexit with a "deal" before the end of January. This is the scenario considered by most traders now. It is this belief of traders that pushes the British pound up when macroeconomic statistics should push the pair down. In the current situation, realizing that traders stubbornly do not want to react to anything other than the new promises of Boris Johnson and in addition to the data of various sociological studies, speaking in favor of the advantage of the conservative party over Labor, it remains only to trade on the basis of technical factors and wait for the results of parliamentary elections. The British Prime Minister himself has always been generous with promises. We have already witnessed about three months of a continuous stream of promises by Boris Johnson to withdraw the country from the European Union before October 31. It didn't work. Now, Boris Johnson is promising to end Brexit within 100 days if the Conservative Party wins the election. Several questions immediately arise: 1) how is Johnson going to withdraw the country from the EU, if the conservatives fail to form a "parliamentary majority"? 2) why exactly within 100 days if the Brexit deadline at the moment is January 31? Also, the Prime Minister, who seems willing to promise anything to win the election, offers the British almost no exchange: lower taxes in exchange for winning the election of the conservatives. Johnson also promised to increase spending on education, security and immigration issues. "If the conservative majority wins next week, we will have Brexit by the end of January. 2020 will be the year we finally put the objections and uncertainty over Brexit behind us. We will make parliament work again," Boris Johnson said. In general, we cannot note anything new in the actions and statements of the Prime Minister. The same strategy of action, which involves promises of "golden mountains" and focusing on the negative aspects of life in case of defeat of the conservatives in the elections. According to the latest sociological research, the situation in the balance of power between the conservatives and Labor is not changing. Still, the conservatives are more popular and ahead of the Labor Party by 9-10%. But how far ahead will they be on December 12? On Thursday, December 5, the calendar of macroeconomic events in the UK and the US is empty. However, even if certain events were not planned today, it would hardly change anything for the pound/dollar pair, whose traders now react exclusively to political news, which is reduced to the calculation of preliminary ratings and statements by Boris Johnson. Thus, the strengthening of the pound may continue today, if no news contrary to the expectations of market participants will not be received. From a technical point of view, all the last bars of the Heiken Ashi indicator are colored purple, which indicates the continuation of the upward trend of intraday. Accordingly, long positions continue to be relevant, they should be supported.

The average volatility of the pound/dollar pair in the last 5 days rose to 96 points and in the last 30 days - to 74 points. Thus, volatility is rising after a month of frankly sluggish and boring trading. Based on the average volatility of the pound/ dollar pair, the maximum possible level for today is 1.3196 if the pair continuously moves up all day. Based on the same indicators of volatility, we can conclude that the sale of the British currency today will not become relevant since the price is unlikely to be able to consolidate below the moving average line today. Nearest support levels: S1 - 1.3092 S2 - 1.3062 S3 - 1.3031 Nearest resistance levels: R1 - 1.3123 Trading recommendations: The GBP/USD currency pair resumed its upward trend. Thus, in these conditions, it is recommended to continue to buy the pound until the reversal of the Heiken Ashi indicator down to 1.3196. It is not recommended to return to sales today, as the price is too far from the moving average line. All macroeconomic statistics are now ignored by traders, political and technical factors are in the foreground. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustrations: The upper channel of linear regression - the blue line of the unidirectional movement. The lower channel of linear regression - the purple line of the unidirectional movement. CCI - the blue line in the regression window of the indicator. The moving average (20; smoothed) - the blue line on the price chart. Support and resistance - the red horizontal lines. Heiken Ashi - an indicator that colors bars in blue or purple. Possible variants of the price movement: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for December 05, 2019 Posted: 05 Dec 2019 01:38 AM PST Overview: Pivot: 1.1078. The EUR/USD pair didn't make any significant movements this week. There are no changes in our technical outlook. The bias remains bullish in the nearest term testing 1.1175 or higher. Immediate support is seen around 1.1027. The EUR/USD pair continues to move upwards from the level of 1.1027. Today, the first support level is currently seen at 1.1027, the price is moving in a bullish channel now. Amid the previous events, the price is still moving between the levels of 1.1027 and 1.1132. The daily resistance and support are seen at the levels of 1.1101 and 1.1132 respectively. In consequence, it is recommended to be cautious while placing orders in this area. Thus, we should wait until the uptrend channel has completed. Furthermore, if the trend is able to break out through the first resistance level at 1.1101, we should see the pair climbing towards the double top (1.1132) to test it. Therefore, buy above the level of 1.1055 with the first target at 1.1101 in order to test the daily resistance 2 and further to 1.1132. Also, it might be noted that the level of 1.1175 ais a good place to take profit because it will form a double top. Moreover, in larger time frames the trend is still bullish as long as the level of 1.1027 is not breached. This support (1.1027) has been rejected two times confirming the validity of an uptrend. On the other hand, it would also be sage to consider where to place a stop loss; this should be set below the second support of 1.0981. The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's Diary: EURUSD on 12/05/2019, Foundation and equipment Posted: 05 Dec 2019 01:10 AM PST