Forex analysis review |

- EUR/USD reacting below resistance, potential drop!

- EUR/USD reacting below resistance, potential drop!

- USD/CAD Reacting below resistance for a pullback

- USD/CHF approaching support, potential bounce!

- Forecast for EUR/USD on December 9, 2019

- Forecast for USD / JPY on December 9, 2019

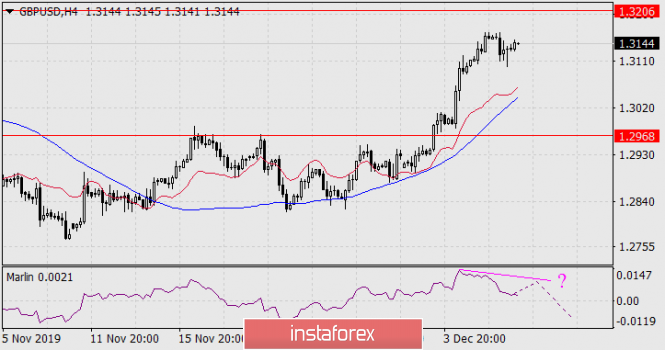

- Forecast for GBP/USD on December 9, 2019

- GBP/USD. Will the border between Ireland and Northern Ireland still appear?

- GBP/USD. December 8. Results of the week. Traders do not expect any other outcome of the election, except for the complete

- EUR/USD. December 8. Results of the week. "Black Friday" for the European currency.

| EUR/USD reacting below resistance, potential drop! Posted: 08 Dec 2019 06:54 PM PST

Trading Recommendation Entry: 1.10660 Reason for Entry: 38.2% Fibonacci Retracement Take Profit : 1.10280 Reason for Take Profit: 61.8% Fibonacci retracement Stop Loss: 1.11090 Reason for Stop loss: horizontal swing high resistance The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD reacting below resistance, potential drop! Posted: 08 Dec 2019 06:54 PM PST

Trading Recommendation Entry: 1.10660 Reason for Entry: 38.2% Fibonacci Retracement Take Profit : 1.10280 Reason for Take Profit: 61.8% Fibonacci retracement Stop Loss: 1.11090 Reason for Stop loss: horizontal swing high resistance The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD Reacting below resistance for a pullback Posted: 08 Dec 2019 06:52 PM PST

Trading Recommendation Entry: 1.32701 Reason for Entry: 61.8% Fibonacci retracement, Graphical Swing High Take Profit : 1.32270 Reason for Take Profit: 38.2% Fibonacci retracement Stop Loss: 1.33270 Reason for Stop loss: Horizontal Swing high The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CHF approaching support, potential bounce! Posted: 08 Dec 2019 06:51 PM PST

Trading Recommendation Entry: 0.9850 Reason for Entry: 161% Fibonacci extension, horizontal swing low support Take Profit : 0.9961 Reason for Take Profit: horizontal pullback resistance 61.8% Fibonacci retracement 61.8% Fibonacci extension Stop Loss: 0.9800 Reason for Stop loss: horizontal swing low support 61.8% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for EUR/USD on December 9, 2019 Posted: 08 Dec 2019 06:39 PM PST EUR / USD On Friday, the price returned to the Fibonacci level of 123.6% and under the embedded line of the declining blue price channel, due to excellent data on US employment. At the same time, the breakdown of support occurred exactly at the intersection of these two lines, which is a sign of strong movement, with prospects for further development. The signal line of the Marlin oscillator, in turn, returned to the downward trend zone. The first target of the movement will be the Fibonacci level of 138.2% at the price of 1.0985. After that, breaking through this support from which the price turned up on November 29 and 14, will open lower targets: 1.0925 (lows of September 12 and 3) and 1.0895. As it moves further, the price will have to fight with the Fibonacci level of 161.8% at the price of 1.0845 and go down to the lower line of the blue price channel in the region of 1.0710. On the four-hour chart, the price has consolidated below the MACD line; the Marlin oscillator is completely in a downward trend. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD / JPY on December 9, 2019 Posted: 08 Dec 2019 06:37 PM PST USD / JPY On Friday, the price reached the first "bearish" target at the intersection of the MACD line with the embedded price channel line on the daily chart. Also, the dollar weakened against the stock market growth where, today in the Asian session, the US S&P 500 index gained 0.91% while the Japanese Nikkei225 is adding 0.26%, this comes on a very good basis. The Japanese GDP for the 3rd quarter in the final assessment was 0.4% against the forecast of 0.2%, the balance of payments in October increased to 1.73 trillion yen from 1.49 trillion, the volume of bank lending in November increased from 2.0% yearly to 2.1% . This does not mean that the yen hinders the growth of the USD / JPY pair apparently it even gathers forces to break through the support that has already been achieved. Meanwhile, on the daily chart,

On a four-hour scale, Marlin is also held in a negative trend zone. If the price is fixed at the low of Friday (108.50), the scenario will be that the lower target 107.60 will open at the area of intersection of the green and red lines of the two price channels. Delay with a breakthrough may trigger a price increase to the first target up to the MACD line on H4 at the price of 109.08.

|

| Forecast for GBP/USD on December 9, 2019 Posted: 08 Dec 2019 06:37 PM PST GBP / USD The British pound came close to the target level at the Fibonacci level of 200.0% 1.3286. On the daily chart, a reversal pattern begins to appear. Thus, now, a reversal divergence may form with moderate growth or consolidation on the Marlin oscillator. The second target 1.3352 will open at the Fibonacci level of 223.6% with the price moving above the level of 1.3286, but even in this case, the divergence can be formed with a more gentle forming line only. The first "bearish" target is the Fibonacci level of 161.8%, which was a strong resistance at the peaks of October and November - 1.2968. The main driving force of the market will be the results of the elections in the UK on December 12. On the four-hour chart, the formation of a reversal divergence is also being prepared according to Marlin. The signal line of the oscillator will slightly increase if the pound rises to the first target 1.3206, after which a price and indicator reversal is likely. Moreover, the fundamental basis for such a reversal will be the "cost-conscious" victory of the conservatives in the parliamentary elections, since they retain an advantage over the Labor Party by 10%. The continuation of growth will also be directly related to the elections - to optimism about the deal with the EU. Another thing is that the deal is already considered "bad", but this issue will be raised by the markets a little later. Thus, we look forward to the results of the elections to the British Parliament on Thursday, December 12. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Will the border between Ireland and Northern Ireland still appear? Posted: 08 Dec 2019 04:20 PM PST Since it's been about a week before the elections, the main election opponents Jeremy Corbyn and Boris Johnson continue to fight against each other despite the fact that all the main political forces of Great Britain have already played the main cards and Trump cards. In principle, it is clear to absolutely everyone that the main battle for the status of the "ruling party" will take place precisely between the Labor and Conservatives. Thus, the leaders of these parties continue to seek incriminating evidence against each other, blame each other and try to expose the rival party and its leader in the most unfavorable light possible. It can be recalled that not more than a week ago, Boris Johnson quite cynically used the tragedy on the London Bridge in the fight against the Labor Party, saying that it was the party of Corbyn that was to blame for it, which approved the law during its reign. According to which convicted of terrorist activities are entitled to early release. As a result, a terrorist who attacked civilians was released from prison ahead of schedule. Now, it was the turn of the Labor leader himself, who allegedly published a secret document, and according to which, the border in the Irish Sea after Brexit would still appear. According to Jeremy Corbyn, Boris Johnson is deliberately misleading people (respectively, the electorate), and Brexit for Johnson's "deal" will have devastating consequences for Northern Ireland, as customs control will begin to operate on the border between it and the rest of the UK, which in fact means a tight border. Thus, Corbyn accuses the Prime Minister of lying and acting in ways that are not in the public interest. In principle, something like this can be expected from Boris Johnson. It can be recalled the story of the prorogation of the UK Parliament, through which Johnson wanted to reach an unauthorized exit from the European Union, and that parliamentarians did not interfere with him. Naturally, for the public and the media, this decision of the Prime Minister was submitted under the sauce of preparing a new government plan, and not in any way so that the Parliament simply could not block Brexit, then still "tough" Brexit. As a result, Boris Johnson misled not only the population of Great Britain, but also Queen Elizabeth II herself, who approved Johnson's request for proprietorship. Due to this, something similar may be happening now. It should be noted that the actions of Boris Johnson are far from always impeccable and clean, despite the fact that the Prime Minister is indeed very popular in the Kingdom. In addition, do not forget that Boris Johnson has not yet won a single significant victory at the helm of the UK. For this, he has already been convicted several times of incontinence, of trying to "bypass Parliament and the current legislation. Thus, it is entirely possible that Jeremy Corbyn is right when he talks about Johnson's true plans. A document, perhaps is no secret or perhaps, there is no document at all. However, the fact that there may indeed be a border between Ireland after the completion of Brexit is possible. And such an option to complete the "divorce" of the UK and the EU will mean potentially big problems on the island of Ireland in the future, where only they managed to suppress riots and protests thanks to the Belfast Treaty in 1998. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Dec 2019 04:20 PM PST 4 hour time-frame Amplitude of the last 5 days (high-low): 53p - 82p - 138p - 65p - 66p. Average volatility over the past 5 days: 81p (average). What can be said about the GBP/USD currency pair following the results of last Friday, last week, and the past two months? Only one. Traders ignored almost all macroeconomic statistics for this period. Almost all macroeconomic reports from the UK over the past 2 months have been either extremely weak or completely failed. Only a small fraction of the "numbers" was more or less "at the level". Moreover, everything also applies to data from overseas. Almost all reports from the United States, which were often quite strong, were ignored by traders. Thus, the pound would now be stealing back to multi-year lows of about 1.2000 - 1.2300, if market participants reacted to these news and reports. Based only on this, we can conclude that the pound is now either very much overbought, or may collapse at any moment as soon as traders recall all the statistics that they ignored. Meanwhile, the British currency continues to grow solely on expectations of a favorable parliamentary election outcome, which is now identified with a Brexit favorable outcome in late January. There can only be one "favorable outcome" now - the victory of conservatives in the elections, in which they won at least 325 seats in the British Parliament. It is such an election finale that will allow Boris Johnson to implement Brexit before the end of January and put at end in this epic. However, traders do not seem to admit even the slightest probability that the election may end in any other way. Otherwise, the pound would have fallen from the value against the US dollar by not 30 points on Friday, and not at a time when there were no macroeconomic publications at all. On the other hand, there were no important macroeconomic news in the UK last Friday, but this is not important, since traders are not interested in them now. During the last trading day of the week, volatility was below average. Thus, none of the range levels of the day has been reached. As for the most controversial topic of parliamentary elections, all parties continue to prepare for December 12, which is just around the corner. Next Thursday, the elections will finally be held and the results will be known on December 13. Then next week, the pound may return to the usual trading mode, when traders will develop all the news and macroeconomic data regarding the pair. Meanwhile, Boris Johnson played football in the English city of Cheadle as part of the final week of preparations for the 2019 Elections. He also announced that he will invest 550 million pounds in the development of this sport on the eve of the 2030 World Cup, which will be held in the UK if his party wins the election. In turn, Jeremy Corbyn drank coffee and met with leaders of the Welsh Labor Party. Liberal Democrats leader Jo Swinson played tennis at Shinfield, while Nigel Farage rode small businesses in Sedgefield England. As we can see, it seems that the leaders of the main political forces of Great Britain have already played all the Trump cards. As a result, it is unlikely that the mood of the electorate will change dramatically over the next few days. Despite that, opinion polls and social research still talk about the leading positions of conservatives, but Labor also "breathes in their backs," either reducing or widening the gap. Thus, at the moment, we still can not say with certainty at least 80%, whether the conservatives will win the election with the necessary margin from labour and other parties or not. Based on this, we still recommend following the trend until December 12. That is, to put technical factors in the lead. Due to the fact that it will be possible to build further trade plans for December-2019 after the election is over and it becomes clear what kind of alignment of political forces will be in the Parliament. In addition, we believe that if Boris Johnson's party does not get enough votes, then the pound may fall down in the same way as it soared up two months ago. Now, the technical picture speaks of the minimal downward correction that began on Friday, which, however, could already be completed. Then, on Monday, the upward movement may resume, which completely contradicts the current fundamental background. More so, even technical corrections can now be completely shallow, similarly as on Friday. Trading recommendations: The pair GBP/USD is minimally adjusted at the moment. Thus, it is now recommended to trade for an increase with the target of 1.33234 since the pair managed to get out of the side channel as well as review new targets tomorrow morning to buy the British pound which will be determined based on average volatility and standard support/resistance levels. On the contrary, it is not recommended to consider pound sales now. Since the pair is very far from the Kijun-sen critical line, traders ignore any macroeconomic data, and the pound rises in price exclusively on the subject of parliamentary elections. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. December 8. Results of the week. "Black Friday" for the European currency. Posted: 08 Dec 2019 04:20 PM PST 4 hour time-frame Amplitude of the last 5 days (high-low): 87p - 27p - 49p - 31p - 70p. Average volatility over the past 5 days: 53p (average). On Friday, December 6, the EUR/USD currency pair had every chance to continue the not-so-strong upward movement, as the macroeconomic publications planned for this day in America could not reach forecast values well. At the beginning of this week and last week, several macroeconomic reports from the United States have already made market participants nervous and even wonder whether the fed took a pause in the cycle of monetary policy easing too soon? However, as practice has shown, it is not early. The euro fell under serious market pressure and fell to the level of 1.1055, which we designated on Friday morning as the lower limit of the daily trading range for the euro/dollar pair. Thanks to the data received from overseas on Friday. Let's start with the least significant Friday report, which, however, is quite important. In October, industrial production in Germany declined by 5.3% yoy and 1.7% mom. Here, even any comments are unnecessary. The only positive thing about this report is that it is an October issue. Nevertheless, industrial production in Germany and the EU may grow slightly in November since business activity in the industrial sector of the EU countries has increased slightly according to the latest data. However, at present, we are not observing anything positive in the industry of the locomotive country of the European economy. Furthermore, all data are related exclusively to the United States. The unemployment rate, as the least significant indicator, pleased traders as it fell to a new record level of 3.5%. The average hourly wage rose in November by 3.1% y / y, which is higher than experts' forecasts. At the same time, the University of Michigan Consumer Confidence Index was 99.2 with the expectations of traders of 97.0. Now, the most anticipated indicator of the day NonFarm Payrolls with a very high forecast value of 180,000 managed to exceed it by 86,000 and make up 266,000 new jobs created outside the agricultural sector. Thus, as we can see, all macroeconomic data on Friday absolutely turned out to be in favor of the American currency, and traders did not ignore the statistics this time and worked it out as it should. In turn, the Euro currency was still lucky that the downward movement on Friday was relatively strong. The total volatility was only 70 points, although, given the nature of macroeconomic statistics, the fall of the Euro could have been much stronger. Now, what is the result? What to expect now from the euro / dollar currency pair? We believe that the pair is getting new excellent chances to resume the downward trend. Firstly, technical factors, such as consolidation under the Kijun-sen critical line, speak in favor of this. Secondly, fundamental factors. As it turned out, the US economy shows weak signs of slowdown from time to time, but after immediate 3 cuts in the key Fed rate, it allowed macroeconomic statistics to show growth again. Moreover, the trade wars fired by Donald Trump with great enthusiasm do not exert too much pressure on the American economy. But even when statistics begin to deteriorate, the Fed can always lower its key rate, which currently stands at 1.75%. That is, the Fed has plenty of room for maneuver. On the other hand, what can not be said about the European Union and the ECB? In December, the first meeting of the Regulator will be held under the leadership of Christine Lagarde, who has already talked about the need for "strategic measures" and hinted in every way that reforms, stimulation of the EU economy, and structural changes are all needed. Recent reports from the European Union have inspired a little optimism in the minds of traders, but some numbers still remain at extremely low values, at which any growth is not important and significant, since the overall picture remains the same, but the values still remain extremely weak (for example, business activity in the manufacturing sector, industrial production, inflation). Moreover, trade wars and global uncertainty will continue to have a negative impact on the EU economy. Europe will have a hard time, if Trump begins to put pressure on the EU with his favorite weapon - trade duties. We can also add here the Brexit, which does not end in any way, which in the future can also add a negative impact on the EU economy, and we see that the prospects for the Alliance's economy, as well as Eurocurrencies, remain very vague. From a technical point of view, a downward movement has begun, which is identified as a correction so far, although the price has already fixed below the Kijun-sen line. Thus, we believe that the fall of the pair will continue next week given the general fundamental background. Now, euro / dollar quotes need to break through the Ichimoku cloud, after which it will be more likely to expect a new downward trend. Trading recommendations: The EUR/USD pair has taken a big step towards a new downward trend. To open short positions, it is recommended to wait for the Ichimoku cloud to break through. In this case, the "dead cross" will strengthen, and the bears will be able to lower the euro / dollar to 1.0989 and 1.0959. Moreover, it is recommended to resume purchases of Eurocurrency in case that traders re-pin above the critical line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment