Forex analysis review |

- Forecast for EUR/USD on February 27, 2020

- Forecast for GBP/USD on February 27, 2020

- Forecast for USD/JPY on February 27, 2020

- EUR/USD. Dollar took a breather: further correction depends on US data

- GBP/USD. Results of February 26. European Commission President Ursula von der Leyen: EU ready to start negotiations with

- EUR/USD. Results of February 26. China and Iran suspected of concealing the true extent of the spread of coronavirus

- Evening review 02/26/2020 EURUSD. Market awaits news on coronavirus

- Gold is dizzy with success

- Analysis of EUR/USD and GBP/USD on February 26. Markets are waiting for data on US GDP. The euro and the pound are consolidating

- February 26, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- February 26, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- GBP/USD: plan for the US session on February 26. The pound is playing last year's games. The bears aimed at 1.2930

- BTC analysis for 02.26.2020 - Sell zone at the price of $9.300, potential for test of $9.425

- EUR/USD: plan for the US session on February 26. Bulls can't handle the resistance of 1.0895

- Analysis and trading ideas for USD/CAD on February 26, 2020

- Gold 02.26.2020 - Pitchfork warning line 2 worked like solid resistance today, potential for the further drop increased

- EUR/USD for February 26,2020 - The upward target at the price of 1.0886 has been reached, potential for further upside and

- Market review. Trading ideas. Q&A

- Technical analysis of AUD/USD for February 26, 2020

- Trading recommendations for EURUSD pair on February 26

- US dollar eases against euro and competes with yen for being called best safe haven asset

- Pound vs Dollar: time to gather strength

- USD/CAD pullback in progress below resistance

- USD/CHF approaching support, potential bounce!

- EUR/USD testing support, potential bounce!

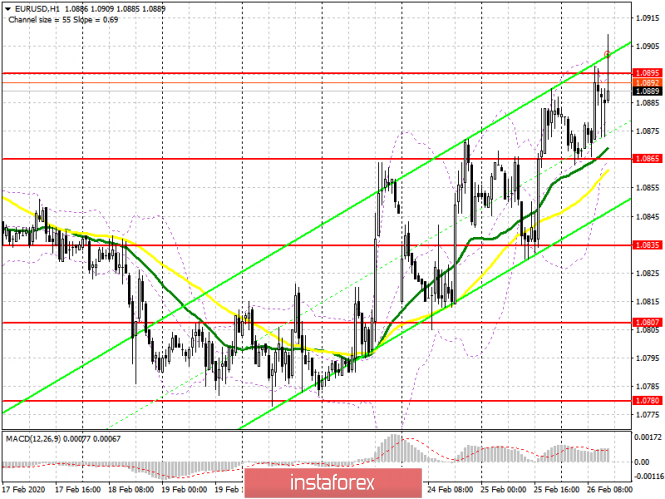

| Forecast for EUR/USD on February 27, 2020 Posted: 26 Feb 2020 08:07 PM PST EUR/USD The euro once again tried to compete with the resistance of the Fibonacci level of 138.2% (1.0898) on Wednesday, the trading volume was high, it is very likely that investors again accumulated short positions. The signal line of the Marlin oscillator reached the boundary of the growth territory. The degree of probability of a reversal from this boundary will be considered on a smaller scale chart. At H4, the oscillator signal line exited down from the wedge and returned to it. In general, this is still a signal for a price reversal. Confirmation of a reversal will be when the price leaves yesterday's low of 1.0855. The immediate goal of the euro 1.0813 is to support the MACD line. Next, we expect the euro at a quote of 1.0745 - at the Fibonacci level of 200.0% (daily). But the euro is still growing. The growth limit may be the Fibonacci level of 123.6% at the price of 1.0933. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for GBP/USD on February 27, 2020 Posted: 26 Feb 2020 08:05 PM PST GBP/USD The British pound lost a little over a hundred points on Wednesday, taking the technical conditions for a further decline. The Marlin oscillator on the daily chart is back in the declining trend zone. The immediate target of 1.2842 at the Fibonacci level of 110.0% is open. Below it is the second target at the level of 123.6% at the price of 1.2758. On a four-hour chart, the price consolidated under the MACD line (blue moving line), Marlin in the zone of negative values. The price continues to fall. |

| Forecast for USD/JPY on February 27, 2020 Posted: 26 Feb 2020 08:04 PM PST USD/JPY The Japanese yen has been trying for two days to recover from a fall since February 21, but it seems to have no strength. The price is still held by two supports at once - the MACD indicator line and the green price channel trend line, but the Marlin oscillator is in a hurry to penetrate into negative territory, which, when the price goes down to technical levels, will increase the fall of the USD/JPY pair. The purpose of the movement is the area of intersection of the trend lines of two price channels - green rising and red falling, this is the area 108.00. On a four-hour chart, the price is consolidating under the indicator lines of balance and MACD, the lines themselves are turning down. Marlin is in the decline zone. We are waiting for the price at the designated target of 108.00. The material has been provided by InstaForex Company - www.instaforex.com |

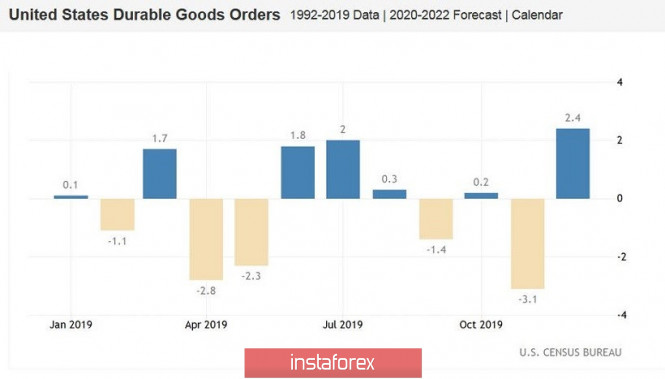

| EUR/USD. Dollar took a breather: further correction depends on US data Posted: 26 Feb 2020 02:48 PM PST The euro-dollar today has slowed its correction. After a three-day consecutive growth, buyers felt a certain discomfort - during the European session on Wednesday, the pair actually stagnated, showing rare and multidirectional price "delays". This price dynamics is due primarily to the behavior of the US currency. The dollar index suspended its decline, returning to the area of 99 points. But the European currency is not able to independently "pull out" the correction, even with the general phlegmatism of dollar bulls. Coronavirus continues to "walk" around Europe, provoking panic in the markets and putting natural pressure on the euro. The changed fundamental background did not allow EUR/USD buyers to enter the ninth figure and gain a foothold above the resistance level of 1.0920. This fact should alert supporters of long positions - purchases are now quite risky. Today's behavior of the pair suggests that the current corrective growth has almost exhausted itself - but for the next price wave, an appropriate informational occasion is needed. Let me remind you that the weakening of the US currency was primarily associated with the prospects for the monetary policy of the Fed. Rumors have intensified in the market that the Federal Reserve will lower rates in the foreseeable future - some spoke about the April meeting, others relied on June. Some currency strategists do not exclude a double rate cut (in summer and autumn). Oil was added to the fire and the comments of some representatives of the Fed, who spoke in favor of lowering rates. This is not only about successive doves (for example, Kashkari), but also other members of the Committee, such as Judy Shelton and Christopher Waller (protege of Donald Trump). Representatives of the hawkish wing also talk about the risks of the coronavirus epidemic, but at the same time they urge not to rush into action. In their opinion, now we should take a wait-and-see attitude in order to objectively assess the current situation. In other words, today there is no definitive confidence in the market that the Fed will announce a rate cut on March 18. The Fed vice president Richard Clarida also sowed certain doubts. Yesterday, he said that the central bank is monitoring the impact of the epidemic on the US economy, but at the same time, "it is too early to say that the epidemic will require changes in monetary policy." Therefore, the dollar slowed down as well - the probability of a rate cut has decreased, while the key macroeconomic indicators in the US have recently shown good dynamics. In turn, the euro has no arguments for its own growth, especially against the backdrop of increasing panic. To date, coronavirus has been recorded in 15 European countries. Italy has suffered the most - the number of infected has exceeded 300 people, 12 of them have died. Next, in descending order - Germany, France, Britain, Spain, Austria, Croatia and the lowest quantity - in some other countries. The Italian precedent frankly scares investors, including in the context of economic prospects. Judge for yourself: the measures taken by the Italian government have affected nearly 30 million people. Schools and universities were closed in the north of the country (not only in those regions where an outbreak was recorded). Many factories, bars, restaurants are closed. Government departments operate on a limited basis. According to preliminary data, if a similar situation persists in the coming months, Italy's GDP may decline by 0.5-1%. This will lead to a recession in Italy and an increase in its external debt. If you project the Italian precedent over the entire eurozone, the consequences will look disastrous. And judging by the dynamics of the spread of coronavirus in Europe, this scenario is quite likely. That is why the further corrective growth of the EUR/USD pair depends only on the "well-being" of the dollar - a single currency will only move in the wake of the greenback. In turn, the dollar will respond to the dynamics of macroeconomic statistics. For example, tomorrow, February 27, we will find out the second estimate of US GDP growth for the fourth quarter of last year. According to forecasts, this indicator will be revised upward from 2.1% to 2.2%. Although this review will be minimal, the very fact of such dynamics will improve the position of the greenback. The price index should remain at the same level, reflecting a slowdown - if in the second quarter of 2019 it reached 2.4%, then in the fourth quarter it fell to 1.4%. Data on the volume of orders for durable goods in the United States will be released on Thursday. The indicator showed positive dynamics in December, having got out of the negative area (similarly, excluding transport). Experts predict contradictory dynamics in January - the overall indicator should slow down to -1.4% (from the previous value of 2.4%), and without taking into account transport, it should grow to a low of 0.2%. If both indicators collapse into the negative area, the dollar may be under pressure. In this case, the EUR/USD bulls will be able to test the nearest resistance level of 1.0920 (the middle line of the Bollinger Bands indicator is on D1). If the statistics are on the dollar side, the pair will again return to the bottom of the eighth figure. The material has been provided by InstaForex Company - www.instaforex.com |

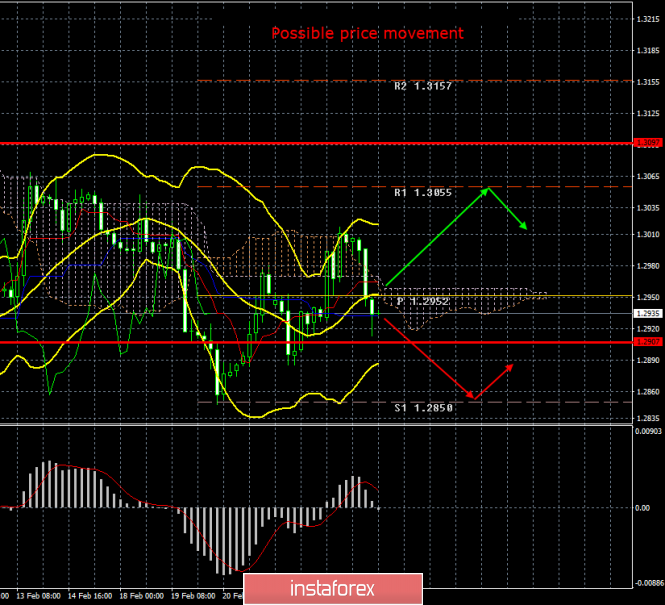

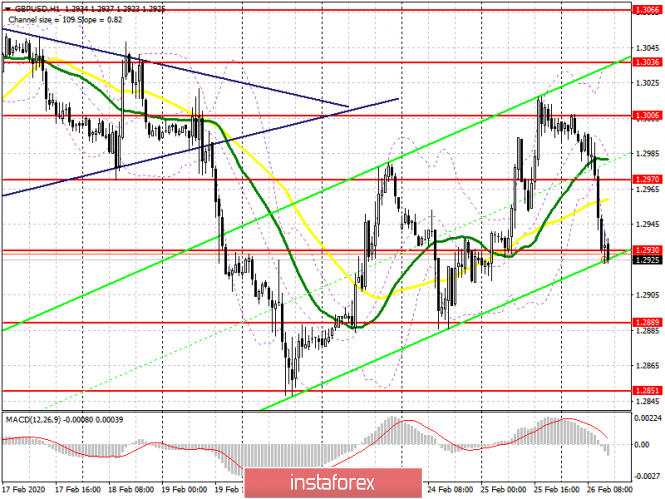

| Posted: 26 Feb 2020 02:48 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 115p - 80p - 105p - 68p - 104p. Average volatility over the past 5 days: 95p (average). The GBP/USD currency pair continues to trade in different directions. After the pound/dollar pair rose to the upper boundary of the Ichimoku cloud on Tuesday, a downward reversal and a rather strong fall of the British currency followed today. At the moment, the pair is trading even below the Kijun-sen critical line, overcoming which will change the current trend from upward to downward. However, on the whole, the swing continues without a pronounced tendency. If earlier the pound often refused to react to the fundamental and macroeconomic background, so that we even started thinking about the paradoxical situation for the pound, now there is simply no macroeconomic background. No important messages were received from the UK, no economic reports were published in the first three trading days of the week. It's impossible to even say that the pound is currently traded on pure technology, since the "swing" cannot be technically justified only if it is not a pronounced flat. However, there is no flat now. Therefore, we now have a simply completely unpredictable, non-trending, non-phletic movement, which has no fundamental justification. In this situation, each trader decides whether to trade this pair or not. In the meantime, from time to time, traders are informed about future trade negotiations between London and Brussels. So far, they have no significance, since the negotiations themselves have not yet begun. For example, today the head of the European Commission, Ursula von der Leyen, announced her readiness to begin negotiations with London. Judge for yourself, dear traders, how important this message is. "Negotiations with Great Britain will begin on March 2. We are ready to build a close relationship with an ambitious partnership with the UK. It's good for people and business," von der Leyen wrote on her Twitter. Information that negotiations will begin in early March has been known for a long time. Moreover, the European Council just the other day adopted a mandate, according to which negotiations will be held with London, Michel Barnier and his group of diplomats. In general, this news is not news at all. We continue to insist that the British currency ignores the general negative fundamental background. We believe that the pound should form a new downward trend a long time ago, since there are very few prospects for concluding an EU-Britain trade deal. Especially with such a prime minister as Boris Johnson, who decided to negotiate with everyone in the style of Donald Trump, that is, from the standpoint of his own benefit and strength. That's just Britain - not the United States. America has the strongest economy in the world, and the British economy has stalled very much in recent years. Boris Johnson, with his integrity and inability to negotiate, can only finish off the British economy. From a technical point of view, there is now a correction against the Golden Cross. Thus, a rebound in the price from the Kijun-sen line may trigger a new round of upward movement. Trading recommendations: GBP/USD has started a new round of correction against a correction or an upward trend. Thus, selling the British pound with the target of 1.2850 is now recommended no earlier than the return of quotes below the critical line. We recommend that you consider buying the pair with a target of 1.3055 in small lots if the bulls stay above the Kijun-sen line. The fundamental background still does not support the pound. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Feb 2020 02:48 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 52p - 26p - 43p - 80p - 67p - 60p. Average volatility over the past 5 days: 56p (average). The EUR/USD currency pair continued a not too strong upward correctional movement in the third trading day of the week against the downward trend of the last three weeks. The pair made another attempt to overcome the Ichimoku cloud on February 26, which again ended in failure. Formally, consolidation above the cloud took place, but very soon quotes of the euro/dollar pair returned to the Ichimoku cloud. Thus, the US currency has risen in price today, despite the fact that the pair continues to trade around three-year lows. Despite the fact that stock markets and indices in the United States collapsed this week. Despite the fact that the coronavirus continues to spread across the planet and its consequences can be very serious for the global economy, which has just recovered from trade wars. However, as we have repeatedly said, the COVID-2019 virus affects not only the US economy. It also has a negative impact on the European economy. Thus, nothing in the balance of power between the economies of the European Union and the United States does not change. Accordingly, in recent years there have been no new reasons for the appreciation of the euro or the fall of the US dollar. Not a single important macroeconomic report was published either in the European Union or in the United States on Wednesday. Thus, the fundamental and macroeconomic background was again completely empty. At the same time, the volatility of the pair remains at a fairly high level, about 60 points per day. Since traders simply do not receive any important messages of an economic nature, one has to pay attention to secondary (for the currency market) news and messages. In the United States, for example, Secretary of State Mike Pompeo made a statement accusing China and Iran of hiding reliable information about the extent of the spread of the pneumonia virus. Beijing previously expelled three Wall Street reporters from China, which sparked a storm of criticism in America. The official reasons for the removal of journalists from China are unknown, but the American side believes that independent reporters are necessary in order for the world to receive reliable information about the infection problem. "The exile of our journalists draws attention to the problem of the PRC government, which previously led to an outbreak of SARS, and now to an outbreak of coronavirus, namely censorship. This can be fatal," said Pompeo. Similar allegations have been directed against Iran. According to Pompeo, in Iran the number of infections and deaths from the virus can be much higher than the government reports. Pompeo also said that the United States was deeply saddened by the fact that the Iranian government had concealed "important information about the infection." "All countries, including Iran, must tell the truth about the coronavirus and collaborate with international healthcare organizations," Pompeo summed up. However, the coronavirus and its distribution do not yet directly affect the foreign exchange market. Yes, perhaps, amid the collapse of US stock markets, some investors are transferring their funds to safer assets, such as gold or franc, or the yen. However, the Chinese infection has not yet been reflected in the euro/dollar pair. Thus, the corrective movement is still ongoing, and it is very difficult to work out, as there is no news from the US and the EU, and the upward movement is extremely uncertain. Trading recommendations: The EUR/USD pair continues to be a corrective movement. Thus, now we can formally consider long positions with targets of 1.0915 and 1.0936 after the MACD indicator turns up, which will indicate the completion of a correction round, but only with small lots or not at all. It will be possible to return to selling the pair with targets at support levels of 1.0824 and 1.0795, if traders manage to gain a foothold back below the critical line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review 02/26/2020 EURUSD. Market awaits news on coronavirus Posted: 26 Feb 2020 02:47 PM PST Global markets have experienced two consecutive days of stress due to the spread of the Chinese virus to other countries - the most dangerous situation in South Korea and Italy. I think that Wednesday will be a day of respite - the markets will take a break to new data. EURUSD: We believe that the euro correction is complete - and you can sell in anticipation of a new wave of decline. We sell from 1.0900-1.0910. The target is 1.0600. The material has been provided by InstaForex Company - www.instaforex.com |

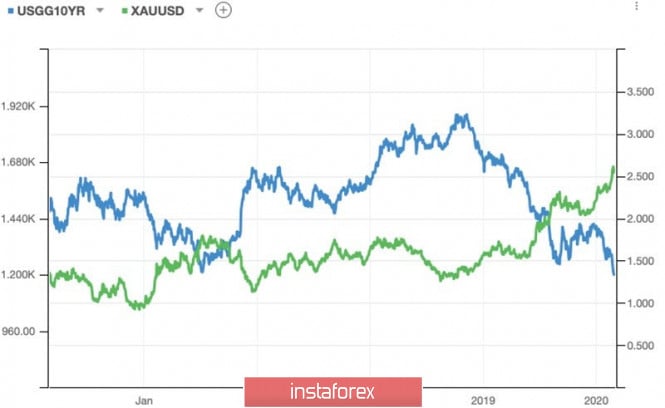

| Posted: 26 Feb 2020 02:47 PM PST Fears about the spread of coronavirus around the world and its transmission from person to person in the United States led to a large-scale correction of US stock indices, a fall in the yield of 10-year treasury bonds to record lows and cut the dollar's wings. As a result, gold soared to its highest level since 2013, but the bulls failed to continue the rally. Precious metal lost about $50 per ounce over a short period of time amid profit taking by speculators on long positions. TD Securities draws attention to the fact that hedge funds increased their net longs for gold by 22% by the end of the week by February 18, and currently they are located in a territory that the market has never seen. As a result, the risks of sudden XAU/USD pullbacks are greater than ever. If the bulls are seriously scared, the precious metal may collapse below $1,600 an ounce. In contrast, Goldman Sachs believes that if coronavirus in fact proves to be a longer-lasting factor and continues to scare investors in the second quarter, gold will rise to $1,850. So far, we can only say that a favorable background has allowed buyers of ETF products to increase inventories to a record high of 2624.7 tons. Capital inflows to specialized exchange funds have been going on for 25 days in a row. It could have been otherwise if the S&P 500 loses more than 3% of its value for two consecutive days, which has not happened to it since the massive devaluation of the Chinese renminbi in August 2018. The yield on 10-year US Treasury bonds has completely renewed record lows. As a rule, falling rates in the US debt market is good news for non-interest bearing gold. Dynamics of gold and US bond yields The last time the yield on 10-year Treasuries was at 1.4% was back in 2012 and 2016, when the federal funds rate did not exceed 0.5%. It currently stands at 1.75% and seems to be too high for the debt market. As well as the derivatives market. CME derivatives are almost 80% likely to expect the Fed to weaken its monetary policy in June. Monetary expansion is a bullish factor for XAU/USD. Gold competes not only with bonds, but also with currencies. The fact that it is growing against the dollar and against the euro, and even reached a record high of more than €1,500 per ounce, indicates that investors prefer precious metals. Indeed, if, as a defense against coronavirus, the leading central banks of the world begin to actively mitigate monetary policy, gold will be able to repeat its successes in 2019, when it grew by 18% due to the active reduction in rates around the world as a protection against the adverse effects of trade wars on global GDP. Technically, the precious metal reached the target by 200% according to the AB = CD pattern, after which, as a rule, the risks of rollback increase. The chances of correction will become even higher if the bears manage to storm the support at $1628 and $1614 per ounce. However, one can not even dream of a reversal of the upward trend without the implementation of the "Surge and Reversal with Acceleration" pattern. Purchases at lower prices are still relevant. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Feb 2020 05:57 AM PST EUR/USD On February 25, the EUR/USD pair gained about 25 basis points and continued to move away from the previously reached lows in the framework of the expected wave 4 or a new upward trend section. At the moment, the correction is 38.2% of the size of wave 3 or C. Thus, an unsuccessful attempt to break this mark may cause the instrument to resume its decline within the expected wave 5 with targets located much lower than the figure 8. Fundamental component: The news background for the EUR/USD instrument on February 25 was very poor. There is still no important news, all reports are absolutely uninteresting. Yesterday, Germany's GDP for the fourth quarter of 2020 was released – the first report at the beginning of the week that was worth paying attention to. However, its actual value coincided with the expectations of the markets, so any reaction has not followed. All the more so because now the wave markup is uncompromising – either the correction wave 4 or the correction set of waves. Thus, in almost any case, the instrument should have been raised even without any news background. Today, on February 26, it is better not to talk about the news background for the euro/Dollar instrument at all. The most important report of the day is "new home sales" in the US. It is unlikely that the markets will pay attention to this data. Most likely, the construction of the correction wave will continue. Only tomorrow, the news may affect the movement of the instrument and its amplitude, as on February 27, data on orders for long-term goods in America will be released, as well as data on GDP for the fourth quarter. The tool for building wave 5 needs strong data from America. Since there will be little news on Friday, tomorrow will be somewhat decisive for the euro and the dollar. General conclusions and recommendations: The euro/dollar pair have presumably completed the construction of a descending set of waves. Based on the current wave markup, an unsuccessful attempt to break through the 38.2% or 50.0% Fibonacci levels may lead to the beginning of wave 5 construction. Thus, I recommend waiting for such an attempt and the MACD "down" signal and then selling the instrument again with targets around 8 points or lower. GBP/USD The GBP/USD pair gained about 80 basis points on February 25, which led to additions to the current wave markup. Now the assumed wave 2 or b has taken the form of an oblique triangle with 5 waves inside it. If this assumption is correct, then after the last wave is completed, the price decline will resume within the wave 3 or C with targets located around 25 points and below. Fundamental component: The news background for the GBP/USD instrument was again absent on Tuesday. No economic reports, no more or less important news from Britain. Thus, the pound has to build intricate wave structures in order to somehow play out such a news background. Markets are still waiting for the start of negotiations between Britain-EU and Britain-US to assess the likelihood of trade deals in 2020. It is on these deals that the future of the UK, its economy and the prospects for the British currency depend. So far, nothing new can be said even about Britain's economic prospects, since all statistics remain contradictory and certainly do not indicate a recovery in the economy. In general, the markets can only wait. Wait for economic reports, wait for news about the negotiations. General conclusions and recommendations: The pound/dollar tool has complicated the current wave markup, which has now become much more extended. Thus, I recommend waiting for a new "down" signal from the MACD near the 23.6% Fibonacci level and selling the instrument with targets located near the mark of 1.2767, which corresponds to 50.0% Fibonacci. The material has been provided by InstaForex Company - www.instaforex.com |

| February 26, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 26 Feb 2020 05:48 AM PST

On December 30, a bearish ABC reversal pattern was initiated around 1.1235 (Previous Key-zone) just before another bearish movement could take place towards 1.1100 (In the meanwhile, the EURUSD pair was losing much of its bearish momentum). One more bullish pullback was executed towards 1.1175 where the depicted key-zone as well as the recently-broken uptrend were located. That's why, quick bearish decline was executed towards 1.1100 then 1.1035 which failed to provide enough bullish SUPPORT for the EURUSD pair. Further bearish decline took place towards 1.1000 where the pair looked quite oversold around the lower limit of the depicted bearish channel where significant bullish rejection was able to push the pair back towards the nearest SUPPLY levels around 1.1080-1.1100 (confluence of supply levels (including the upper limit of the channel). Since then, the pair has been down-trending within the depicted bearish channel until last week when bearish decline went further below 1.0950 and 1.0910 (Fibonacci Expansion levels 78.6% and 100%) establishing a new low around 1.0790. Currently, the EUR/USD pair looks quite oversold after such a long bearish decline and if bullish recovery is expressed above 1.0845-1.0860, further bullish advancement would be expected towards 1.0910 then 1.0950. Intraday traders were advised to look for signs of bullish recovery around the price levels of (1.0790) as a valid intraday BUY signal aiming towards 1.0910 (the nearest broken demand-level). By the end of Last week, recent signs of bullish recovery were manifested around 1.0790 leading to the current bullish movement. Further bullish advancement will probably pursue as high as the price level of 1.0910 provided that a quick bullish breakout above 1.0870 is achieved. On the other hand, bearish persistence below 1.0830 (recent low) may enable more bearish decline towards new historical lows around 1.0755 and even 1.0700. The material has been provided by InstaForex Company - www.instaforex.com |

| February 26, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 26 Feb 2020 05:44 AM PST

On the period between December 18th - 23rd, bearish breakout below the depicted previous bullish channel followed by transient bearish movement below 1.3000 were demonstrated on the H4 chart. However, immediate bullish recovery (around 1.2900) brought the pair back above 1.3000. Bullish breakout above 1.3000 allowed the mentioned Intraday bullish pullback to pursue towards 1.3250 (the backside of the broken channel) where the current wide-ranged movement channel was established between (1.3200-1.2980). Recent temporary bearish breakdown below 1.2980 enhanced further bearish decline towards 1.2890 (the lower limit of the movement channe) where evident bullish rejection was manifested on February 10. Last week, temporary bullish breakout above 1.3000 has been expressed until last Wednesday when another bearish decline below 1.3000 brought the GBPUSD pair back towards the lower limit of the channel @ 1.2870 -1.2850 where the current episode of bullish recovery was initiated. As expected, the current bullish pullback managed to pursue towards the price zone of 1.2980-1.3000 which is offering temporary bearish rejection. Although the Intermediate-term technical outlook remains bearish below the price level of 1.3000 (Supply-Zone), any bullish breakout above 1.3000 should be waited as a valid Intraday BUY entry. If so, further bullish advancement will be demonstrated towards the price levels of 1.3070 and 1.3150. On the other hand, bearish persistence below 1.2980-1.3000 will probably push the GBP/USD pair back towards 1.2870-1.2850 for another retesting. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Feb 2020 05:02 AM PST To open long positions on GBPUSD, you need: The British pound continues its games that we saw last year amid the uncertainty associated with Brexit. Today, the same thing is repeated. It happens before the start of important negotiations on trade between the EU and the UK. At the moment, buyers can not yet oppose the sellers, since the breakdown of the level of 1.2970 quickly pushed the pound to the support of 1.2930, the breakdown of which can lead to a reversal of the upward trend formed on February 20. Only the formation of a false breakdown at the level of 1.2930 will signal the opening of long positions since at the first test of this level, the rapid rebound up did not occur. It is best to open long positions immediately on the test from the minimum around 1.2889. An important task for buyers is also to return the resistance to 1.2970, which will keep the pair in an upward trend and lead to an update of the level of 1.3006, where I recommend fixing the profits. To open short positions on GBPUSD, you need: The bears started to act more actively after the breakdown of the support of 1.2970, which quickly pushed the pound to the minimum of 1.2930, where the lower border of the ascending channel passes. An important task for the second half of the day will be to consolidate below this range, which will provide the bears with a direct path to the lows of 1.2889 and 1.2851, where I recommend fixing the profits. In the scenario of an upward correction of GBP/USD after a weak report on housing sales in the primary US market, short positions can be returned to a false breakdown from the resistance of 1.2970 or sell the pound immediately on a rebound from the maximum of 1.3006. Any news related to trade negotiations and fiscal stimulus will have a serious impact on the market, as traders react very impulsively to these events. Signals of indicators: Moving averages Trading is already below the 30 and 50 daily averages, the breakdown of which has increased the pressure on the pound, which indicates a likely change in the trend in the short term. Bollinger Bands A break in the lower border of the indicator indicates large sales of the pound.

Description of indicators

|

| BTC analysis for 02.26.2020 - Sell zone at the price of $9.300, potential for test of $9.425 Posted: 26 Feb 2020 04:54 AM PST Industry news:

The Antminer E3 has stopped mining Ethereum Classic (ETC) and will cease mining Ethereum (ETH) by next month. In less than a month, Ethereum Classic's hash rate has dropped by almost half. Many miners are dropping out of the network, especially those who run the Antminer E3. The Antminer E3 mining rig is the first and only mining device on an Ethash algorithm ASIC. First released in the summer of 2018, the miner has been popular for some time — albeit pricey. Last week users reported difficulty mining with the Antminer E3 which may mark its end. Technical analysis: BTC has been reached my downside target at $9.060.Big resistance at the price of $9.265 is on the test and my advice is to watch for selling opportunities with the downward targets at $8.430 and $8.230 MACD oscillator is showing increase in momentum on the latest downside swing, which is good indication that supply is very strong. Major resistance level is set at the price of $9.300-$9.425. Support levels and downward targets are set at the price of $8.427 and $8.229. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: plan for the US session on February 26. Bulls can't handle the resistance of 1.0895 Posted: 26 Feb 2020 04:46 AM PST To open long positions on EURUSD, you need: Buyers of the euro managed to stay above the level of 1.0865 in the first half of the day, which quite expectedly led to growth in the area of the maximum of 1.0895, which is still not possible to break through. Only a real fixation on this range will allow the pair to maintain a bullish momentum that can lead to an update of the highs of 1.0925 and 1.0950, where I recommend taking the profits. This afternoon, the President of the European Central Bank, Christine Lagarde, will give a speech. In her speech, she may ignore the topic of interest rates, which will allow buyers to build up long positions in the euro. If the pressure on EUR/USD returns, then it is best to return to purchases if a false breakdown is formed in the area of 1.0865 or open long positions immediately on a rebound from the minimum of 1.0835. To open short positions on EURUSD, you need: The bears coped with the morning task and did not let the pair above the level of 1.0895, forming a divergence on the MACD indicator. A false breakdown of this level led to a decrease in the euro, however, the movement did not find support from major players. Good report on home sales in the primary market in the US and fears of a slowing eurozone economy can put pressure on the euro, which will lead to a break of the support of 1.0865 and larger downward trends in the area of the low of 1.0835, where I recommend taking the profit. In the scenario of growth above 1.0895 in the second half of the day, it is best to return to short positions on the rebound from the maximum of 1.0925. Signals of indicators: Moving averages Trading is above the 30 and 50 moving averages, which indicates that the euro will continue to grow in the short term. Bollinger Bands Bulls are trying to break above the upper limit of the indicator at 1.0895. In the scenario of a lower euro, support will be provided by the lower border in the area of 1.0865.

Description of indicators

|

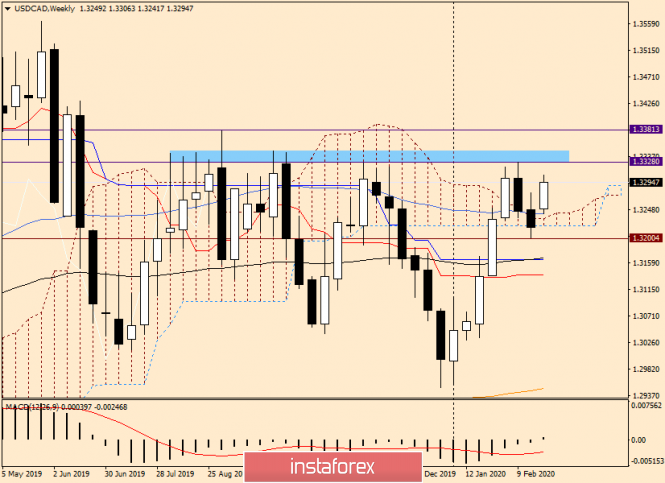

| Analysis and trading ideas for USD/CAD on February 26, 2020 Posted: 26 Feb 2020 04:46 AM PST Hello, traders! In today's article on the North American dollar pair, we will outline the main macroeconomic events that will be presented to market participants before the end of this week, after which we will proceed to technical analysis and search for optimal trading solutions for the USD/CAD pair. So, first on the expected statistics. USA: new home sales, durable goods orders, GDP, personal income and expenses, and the basic price index of personal consumption expenditures. Canada: balance of payments, producer price index, and GDP. Now let's consider the technical picture for the USD/CAD pair. Despite the fact that today is already Wednesday (mid-week), it makes sense to look at the weekly chart and note the most important nuances. Weekly

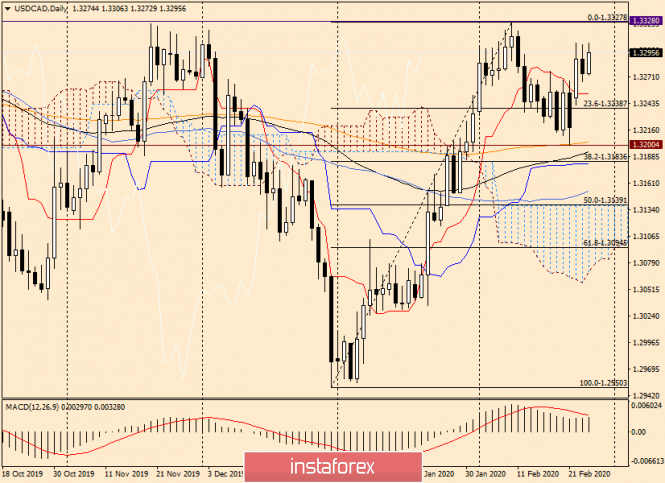

The "Canadian" in the company of the Swiss franc and the single European currency strengthened against the US dollar at last week's auction. The USD/CAD pair ended the session on February 17-21 under the lower border of the Ichimoku indicator cloud. It would seem that this may be a signal to continue the downward dynamics of the pair. However, at the time of writing this article, everything is exactly the opposite. The pair is growing and is likely to test the resistance of sellers for a breakdown of 1.3328, where the maximum values were shown at the auction the week before last. The lows of the previous trades of 1.3200 are significant support, the breakdown of which will return the market to the power of sellers. The pair found good support at 1.3242 during the current five-day trading session. By the way, there is also a 50-simple moving average, which also contributed to the movement of the quote in the north direction. It is necessary to pay attention to the difficulties experienced by the bulls on the instrument in the price area of 1.3328-1.3381. The pair have repeatedly fallen down from the indicated range, so in my opinion, it will be possible to talk about the prospects of an upward scenario only after the breakdown of the sellers' resistance at 1.3381 and consolidation above this level. The bears will regain their power over the pair only if the support of 1.3200 breaks down and is anchored under this strong and important technical level. Daily

In the daily timeframe, we see that along with the mark of 1.3200, the price was well supported by the 200-exponential moving average, which started the rate rise. The Tenkan line of the Ichimoku indicator has already been passed, and it seems that the pair has fixed higher. Now all attention should be focused on the resistance near 1.3381. If a bearish or Japanese candlestick pattern appears in the area, this will be a good signal to open short positions on USD/CAD. In the case of a breakdown of the resistance of 1.3328 and fixing above this mark, you can try careful purchases on the rollback to it, since a whole cascade of resistances passes above, the main of which is 1.3381. Can I try buying after a likely decline to the Tenkan line? I think so, but before that, you need to look carefully at the candles, after which the downward movement began. If we see a strong reversal signal, purchases will pose an increased risk. H4

The technical picture on this chart is more in favor of buying since the pair is trading in the ascending channel and above the moving averages used. Judging by H4, I can suggest the following plan. We consider purchases after the decline in the areas of 1.3260 and 1.3220. As you can see, there are moving averages of 50 MA, 89 EMA, and 200 EMA at 1.3217. We do not discount the level of 23.6 Fibo from the rise of 1.2950-1.3328, as well as the support line of the ascending channel. As I have repeatedly noted, the average channel lines tend to provide strong support or resistance to the price. In this case, the middle line crosses the resistance level of 1.3328. If candlestick signals for a decrease appear below this mark, you should try selling the pair. In my personal opinion, the most likely scenario at the moment looks upward. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Feb 2020 04:33 AM PST

Gold has been trading sideways at the price of $1.644.. The Pitchfork warning line 1 acted today like resistance, which is good indication the downside rotation is possible. Watch for selling opportunities with downward targets at $1.625 and $1.612. MACD oscillator is showing that slow line did turn to the downside, which is another indication that we got rotation to the downside. Resistance level is set at the price of $1.658. Support levels and downward targets are set at the price of $1.625 and $1.612. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Feb 2020 04:21 AM PST

EUR has been trading upwards as I expected. The price tested the level of 1.0908 and reached my yesterday's target at 1.0887. The Pitchfork warning line 2 at the price of 1.0887 is acting like support and there is chance for further upside movement towards the levels at 1.0920 and 1.0940. I would watch for buying opportunities on the dips using the intraday frames 15/30 minutes. The upward targets are set at the price of 1.0920 and 1.0940. MACD oscillator is showing positive reading above the zero, which is sign that upward pressure is still present. Resistance levels are set at the price of 1.0907, 1.0920 and 1.0940. Support levels are set at the price of 1.0865 and 1.0830 The material has been provided by InstaForex Company - www.instaforex.com |

| Market review. Trading ideas. Q&A Posted: 26 Feb 2020 03:31 AM PST Trading recommendations: EUR/USD – neutral GBP/USD – buy until the price reaches 1.3070 AUD/CHF - buy using limit orders EUR/CHF – buy using limit orders USD/CAD - buy until the price reaches 1.3350 GOLD - neutral The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for February 26, 2020 Posted: 26 Feb 2020 03:07 AM PST Overview: Pivot point: 0.6643 Trend: downtrend. The AUD/USD pair dropped from the level of 0.6643 to the bottom around 0.6569. But the pair couldn't rebounded for that it closed at the 0.6569 level. Today, the first support level is seen at 0.6569, and the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 0.6643, which coincides with the 23.6% Fibonacci retracement level. This resistance has been rejected several times confirming the downtrend. Additionally, the RSI starts signaling a downward trend. As a result, if the AUD/USD pair is able to break out the first support at 0.6569, the market will decline further to 0.6520 in order to test the weekly support 2. In the H4 time frame, the pair will probably go down because the downtrend is still strong. Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 0.6643 with the first target at 0.6520 and further to 0.6466. However, the breakdown of 0.6600 will allow the pair to go further up to the levels of 0.6643 in order to retest the daily pivot point again. The material has been provided by InstaForex Company - www.instaforex.com |

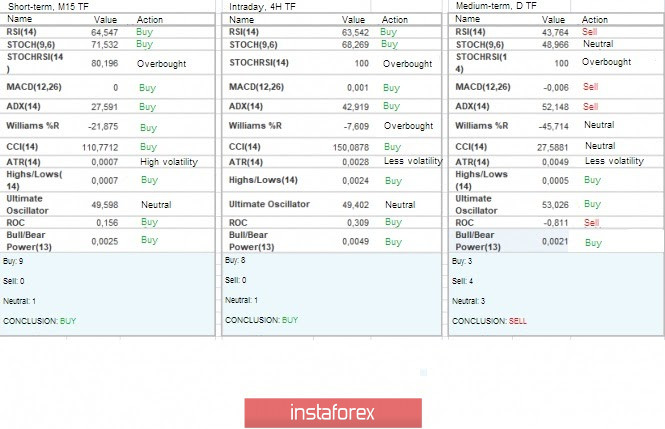

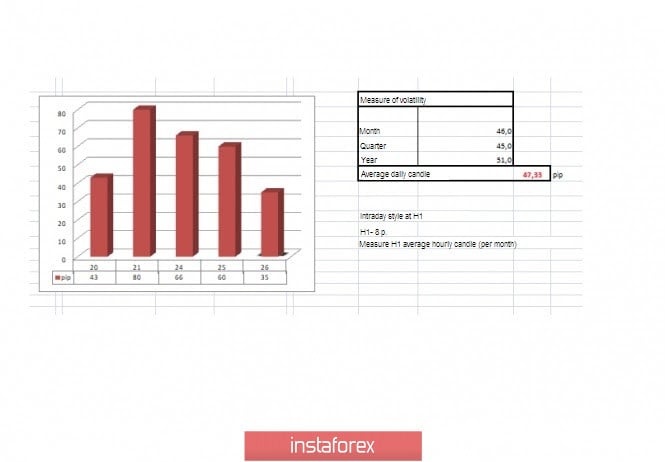

| Trading recommendations for EURUSD pair on February 26 Posted: 26 Feb 2020 02:23 AM PST From a comprehensive analysis, we see an interesting pattern with upward impulses. Now, about the details. The corrective move is in full swing, the quote has successfully worked out the average level of the psychological range of 1.0700//1.0775//1.0850 and went towards the upper border, where it managed to fix higher, thus prolonging the correction. Relative to the entire value of the last downward trend, the correction looks insignificant, thus there is no alarm of a possible fracture of the clock component. A remarkable point was the pattern of the past three days. At the same time, there were impulse jumps in the upward direction. We noticed this pattern yesterday, referring to Friday and Monday. However, it was repeated with a small error on Tuesday. Friday: 16:30-17:15 (time on the trading terminal) Monday: 16:00-17:00 (time on the trading terminal) Tuesday: 17:15-18: 15 (time on the trading terminal) What is happening is very similar to the capital overflow, where the placement of US debt obligations takes place. The phenomenon is interesting. There is no exact confirmation that there is such an impact on the course, so we continue to monitor and analyze this theory. In terms of volatility, we see a steady acceleration that lasts for the third day, where the daily average is steadily breaking through. In fact, this activity again proceeds from the above theory. Analyzing the past day by the minute, we see that there was an attempt to return sellers to the market in the beginning, fixing below the level of 1.0850, while having impulse candles. After that, the quote finds variable support in the area of 1.0830 and stagnation is formed in a few hours. Then comes an upward momentum, as described above. As discussed in the previous review, traders expected a breakdown of the area of 1.0815, which did not happen for the formation of short positions in terms of intraday trading. Medium-term positions remain on the decline, and the existing correction has not yet brought the necessary pressure. Tuesday's trading recommendation regarding the possible retention of the corrective move brought a small profit to the piggy bank. (Buy positions will be considered if the price is fixed higher than 1.0875.) Looking at the trading chart in general terms (daily period), we see that the correction is at the level of 18%. Regarding Fibo, the nearest level of 38.2 is located around the mark of 1.0950. The news background of the day included S&P / CS data on home prices in the United States, which recorded an acceleration from 2.5% to 2.9% with a forecast of 2.7%. There was no market reaction to the positive statistical data, and the dollar was losing its position at this time. In terms of the general information background, we have information that the EU General Affairs Council approved the mandate of the European Commission in negotiations on future relations with Britain after its withdrawal from the EU. In the existing document, it was mentioned that the European Union plans to designate free trade zones with Britain, as well as equal conditions, fair competition and relations in the field of fishing. During this event, EU chief negotiator Michel Barnier announced that the first round of talks on the future partnership between the EU and the United Kingdom will be held from March 2 to 5 in Brussels. Barnier also explained that they will not rush to conclude a deal due to the tight deadline. However, the deal will be concluded at any cost. "We will not conclude this agreement at any cost. We will methodically and calmly insist on a mutually beneficial partnership. The time is very short. Britain insisted on such a schedule. These are complex and multi-faceted negotiations," said Michel Barnier. In the previous review, we touched on the topic of a futures contract for the Fed rate, with the risk of its lowering during the next meeting. Now, Federal Reserve Deputy Chairman Richard Clarida said during a speech at the National Association of Business Economics conference that the Federal Reserve is monitoring the possible impact of the coronavirus outbreak on the American and other economies, and the risk of consequences remains. "There are still risks in the forecasts. In particular, we are closely monitoring the situation with the coronavirus outbreak, which is likely to have a noticeable effect on growth in China, at least in the first quarter of this year," said Richard Clarida. Today, in terms of the economic calendar, we have data on new home sales in the United States, where they forecast an increase from 694,000 to 710,000. Further development Analyzing the current trading chart, we see that the last jump updated the maximum of the available correction, where a conditional ceiling was found near the mark of 1.0900, forming a stagnation with a pullback. In fact, we see that the correction already has the proper scope, and we can expect a resumption of the original course in the near future. At the moment, the maximum possible correction point remains at 1.0950, which should be taken into account when calculating the risk. Detailing the available period by the minute, we see that the activity was recorded at the beginning of the European session, where the correction maximums were updated during the impulse candles. In turn, traders are now cautious about actions, since the conditional ceiling is already close, and entry into descending positions will only be possible if the price is fixed below 1.0860. At the same time, the next point of consideration for short positions will be in the area of 1.0950. It is likely to assume that the corrective move will still torment supporters of the downward move, where a swing towards the mark of 1.0950 is not excluded, although the mark of 1.0900 can play a reporting point for short positions. Based on the above information, we will output trading recommendations: - Buy positions will be considered if the price is fixed higher than 1.0900 (in the direction of 1.0950). - Positions for sale are already held by medium-term traders. Intraday traders are waiting for the price to be fixed below 1.0860. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments are in the correction phase, displaying a buy signal. At the same time, the daily periods maintain a downward interest, focusing on the overall tact. Volatility for the week / Volatility Measurement: Month; Quarter; Year. The volatility measurement reflects the average daily fluctuation from the calculation for the Month / Quarter / Year. (February 26 was based on the time of publication of the article) The volatility of the current time is 35 points, which is close to the norm for this period, but even lower than the average daily indicator. It is likely to assume that with the current speculative mood, there is a chance of acceleration. Key levels Resistance zones: 1.0900/1,0950**; 1.1000***; 1.1080**; 1.1180; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.0850**; 1.0775*; 1.0700; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| US dollar eases against euro and competes with yen for being called best safe haven asset Posted: 26 Feb 2020 02:22 AM PST Stock indices in the US plummeted. The S&P 500 Index slid more than 3% to the lowest level in two years. As a result, market players started buying treasuries and the 10-year Treasury note yield fell below 1.40% to their lowest levels since 2016 putting pressure on the American currency. Eventually, the EUR/USD currency pair rebounded from its three-year lows. However, the uptrend is expected to be short-term anyway. There are at least three possible reasons for the short-term bullish trend.

1.Monetary policy After a sharp decline on Monday, US Treasury yields are still higher compared to European peers. Thus, German government bonds yields are in negative territory. The short-term interest rates also have a positive impact on the dollar. Fed's interest rate is now 1.50% –1.75%, ECB's rate is 0%, and the deposit rate is minus 0.50%. Even if the US central bank again lowers the rate earlier than expected (according to the derivatives market, there is an 80% probability of the interest rate cut in June), the European regulator is likely to follow the lead. Overall, the fall in Treasury yields is a weak basis for the growth of the EUR/USD pair. 2. Italy is at risk The US stock market plunged as worries over the spread of the coronavirus in North Italy intensified. Around 50 thousand people are under quarantine in the country. Italy is the third largest economy in the Eurozone. Currently, there is almost no economic growth in the country. However, the economy edged out of technical recession. Apart from that, the coronavirus has affected Milan, Italy's industrial center. Thousands of events such as the Carnival of Venice and fashion shows have been canceled. The longer coronavirus spreads across the country, the higher the recession risks. 3. Problems in Germany The Federal Ministry of Health in Germany said it was ready to oppose the coronavirus, but the chances of the virus spreading from Italy to Germany are high. The German economy was stagnating in the fourth quarter, even before the virus outbreak. The economy has recently suffered from the trade conflict between the US and China. Today, Germany is at risk due to the serious situation in Italy and China. Moreover, Germany plunged into political crisis The governing party in Germany is expected to focus on choosing a successor of Angela Merkel. However, a certain political vacuum in this matter may affect the national economy. Moreover, Germany demonstrates a negative attitude towards fiscal stimulus, and the absence of a leader at the time of the crisis can further wreck the economy. The euro continues strengthening against the dollar for the fourth day in a row. On the contrary, open borders in Europe have become a serious problem to curb the spread of coronavirus.The growing number of coronavirus cases in the region can have a negative impact on the economic activity in the Eurozone. As a result, the ECB can become very cautious in making any decision. The EUR/USD pair is expected to reach the 20-day moving average at the level of 1.0917. However, later, there is a possibility of losing profit.

According to Australia and New Zealand Banking Group, the euro is likely to test the lows of 2016 in the coming months. ANZ economists believe that the EUR/USD pair can once again test the low of 1.04 recorded during the European debt crisis. Economists fear that German manufacturing industry will probably not recover in the first six months of 2020. Disruptions of manufacturing and tourism in Italy in the coming months is likely to lead the country to a technical recession. The USD/JPYcurrency pair has been the main victim of risk aversion. The pair is expected to find support near 108. It is a matter of time when the price can break out the level of 110 as the yield of government bonds and stocks in the US is falling.

The main drivers that boosted the price of the USD/JPY pair to the level of ten-month highs are the following: growth divergence in the US and Japan, possible expansion of the monetary stimulus from BoJ due to the high risks of a recession in the country, and capital outflow from Asia to the US based on the impressive S&P 500 index results and high demand for treasuries. It seems, investors were carried away by the purchase of securities issued in the US. The rise in stock indices amid a slowdown of GDP looked like a "bubble". However, a minor factor such as the spread of coronavirus outside China could blow it off. The Japanese currency showed the largest three-day growth against its main counterparts since last August as stocks of developed countries fell sharply. Yen climbed by 0.8% on Monday compared to the middle of last week, when the Japanese currency, traditionally seen as a safe haven asset during times of market turmoil, plummeted amid concerns that Asia's second-largest economy could slide into recession. The pressure on the USD/JPY pair intensified on Tuesday after the release of weak US consumer confidence data. This report covered the period in which the US stock market updated its record highs. The next report is likely to cause even sharper decline of consumer confidence in the US. Experts at BNP Paribas Asset Management believe that the yen is second only to the US dollar as a safe haven asset. They expect both currencies to outperform their G10 rivals in the second quarter. According to experts, the global financial market has finally realized the potential negative impact of the coronavirus. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound vs Dollar: time to gather strength Posted: 26 Feb 2020 02:21 AM PST The dollar weakened slightly due to the expectations that the Fed may cut the rates in the near future. The pound, taking advantage of the situation, rushed into battle to gain a foothold in the positions. As a result, the British currency started to grow. On Tuesday, February 25, the pound actively strengthened against the dollar. Strong support for the currency was provided by factors such as the gradual recovery of the British economy, and the possible easing of fiscal policy by Rishi Sunak, the new British Finance Minister. Analysts say that the pound took advantage of the favorable situation, thus, growing significantly. Moreover, the pound also began to regain its position because of the problems that other countries face. Experts have recorded a gradual improvement of economic indicators in UK, after the parliamentary elections held in December 2019, as well as after Brexit at the end of January 2020. The current situation gives confidence to investors and businesses, after a prolonged period of uncertainty. Yesterday, the pound updated local highs, but the upward trend in the GBP/USD pair did not last long. On Tuesday, the tandem cruised near 1.2951–1.2952, and then changed direction. On Wednesday, the GBP/USD pair, which had previously returned to the area of the 30th figure and came close to the round level of 1.3000, once again slid down to the levels of 1.2960–1.2961. At the moment, the pair is trying to overcome the pull of the downward trend, which is again gaining momentum. The driver of the pound's recent growth was the temporary ceasing of dollar purchases by the investors concerned about the active spread of the coronavirus. Earlier, mass purchases of the dollar dropped the pound. Now, the recovery of the currency was helped by the increase in risk appetite, recorded at the beginning of this week. As a result, the British currency, having gathered its strength and added 0.2% to 1.2958, rose to the psychologically significant mark of 1.3000. Currently, the pound is busy preserving the conquered positions, but it is quite difficult to keep them. Concurrently, this month, the British Finance Minister, R. Sunak, unknowingly extended a helping hand to the pound. The new head is expected to increase public spending in the budget, which will have a positive impact on the exchange rate of the national currency. The government spending plan will be presented on March 11, 2020. At the moment, the attention of the market participants is focused on the upcoming negotiations between UK and EU, which will start next month. The key theme is the conclusion of a trade deal by the end of the post-Brexit transition period, which is scheduled for completion in December 2020. In the process of further negotiations, experts do not rule out a possible significant drop in the pound. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD pullback in progress below resistance Posted: 26 Feb 2020 02:19 AM PST

Trading Recommendation Entry: 1.33054 Reason for Entry: Graphical swing high, 78.6% Fibonacci retracement Take Profit : 1.32453 Reason for Take Profit: 61.8% Fibonacci retracement Stop Loss: 1.33296 Reason for Stop loss: Horizontal swing high, 76.4% Fibonacci extension, -27% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CHF approaching support, potential bounce! Posted: 26 Feb 2020 02:16 AM PST

Trading Recommendation Entry: 0.9739 Reason for Entry: 78.6% Fibo extension Take Profit : 0.98126 Reason for Take Profit: Horizontal overlap resistance Stop Loss:0.97133 Reason for Stop loss: Horizontal pullback support, 61.8% Fibo retracement,100% Fibo extension The material has been provided by InstaForex Company - www.instaforex.com |

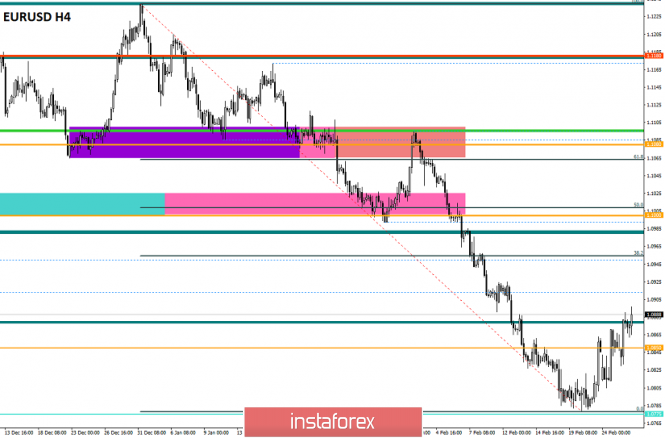

| EUR/USD testing support, potential bounce! Posted: 26 Feb 2020 02:14 AM PST

Trading Recommendation Entry: 1.08789 Reason for Entry: breakout level Take Profit : 1.09523 Reason for Take Profit: 38.2% Fibonacci retracement, Horizontal swing high resistance, 100% Fibonacci extension Stop Loss: 1.08364 Reason for Stop loss: Horizontal swing low support, 50% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment