Forex analysis review |

- Fractal analysis of the main currency pairs for March 12

- Coronavirus pandemic and its impact on the EURUSD rate, as well as other assets

- GBP/USD. Results of March 11. UK GDP and industrial production declines. Bank of England lowers key rate after Fed

- EUR/USD. Results of March 11. European Union allocates 25 billion to fight the Coronavirus. US inflation accelerates, not

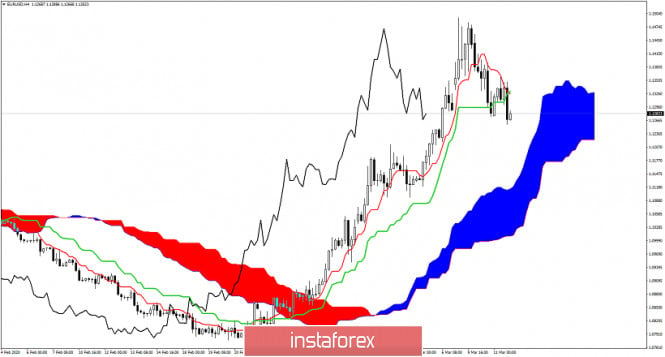

- Ichimoku cloud indicator Daily analysis of Gold

- Ichimoku cloud indicator short-term analysis of EURUSD for March 11, 2020

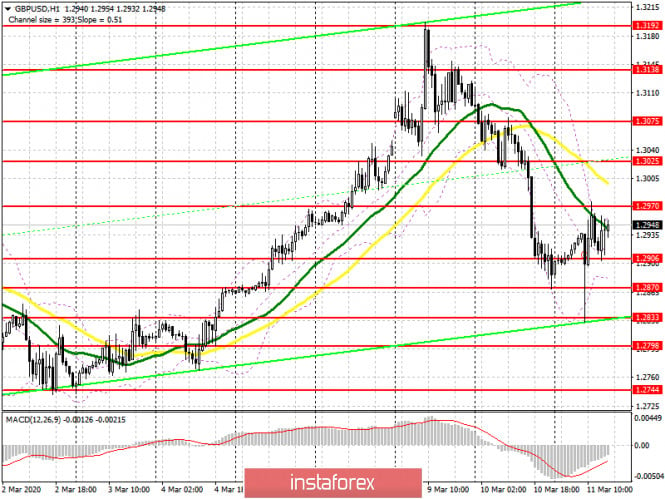

- March 11, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- GBPUSD: Following the Federal Reserve System, the Bank of England lowers the interest rate to 0.25%. We are waiting for similar

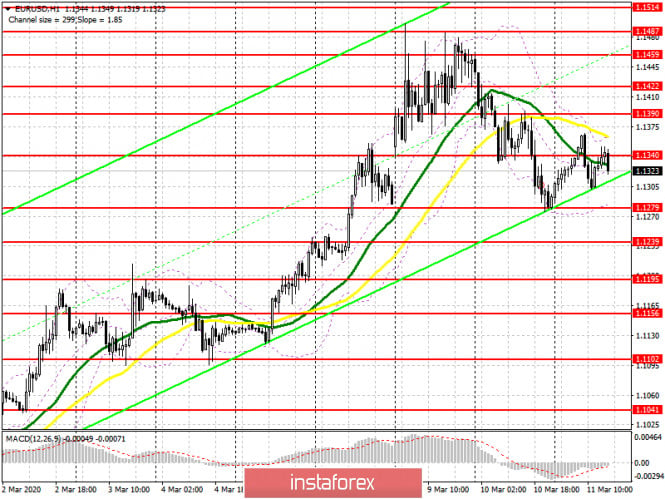

- March 11, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- GBP/USD: plan for the US session on March 11. The Bank of England lowers interest rates to 0.25%

- EUR/USD: plan for the US session on March 11. Bears are trying to keep the market under their control

- Trading plan for Gold for March 11, 2020

- Evening review of EURUSD 03/11/2020. The market is waiting for a signal for a new wave of fall

- Trading plan for EURUSD for March 11, 2020

- Trading recommendations for EURUSD pair on March 11

- AUD/USd analysis for 03.11.2020 - Bear flag pattern completed, watch for selling opportutniies with the first target at 0.6460

- Analysis for Gold 03.11.2020 - Watch for the breakout of mini Pitchfork channel to confirm downside continuaiton and potential

- BTC analysis for 03.11.2020 - Downside continuation is present, watch for selling oppportuniteis and eventual bigger drop

- GBP/USD. Rates down, pound up: British held back blow after unexpected BoE decision

- Technical analysis of GBP/USD for March 11, 2020

- Will gold hold the horses?

- Analysis and forecast for USD/CHF on March 11, 2020

- Forex market faces consequences of lower interest rates in the US. Dollar likely to fall further

- Analysis and trading ideas for EUR/USD on March 11, 2020

- Pound: awaiting change

| Fractal analysis of the main currency pairs for March 12 Posted: 11 Mar 2020 08:26 PM PDT Forecast for March 12: Analytical review of currency pairs on the scale of H1:

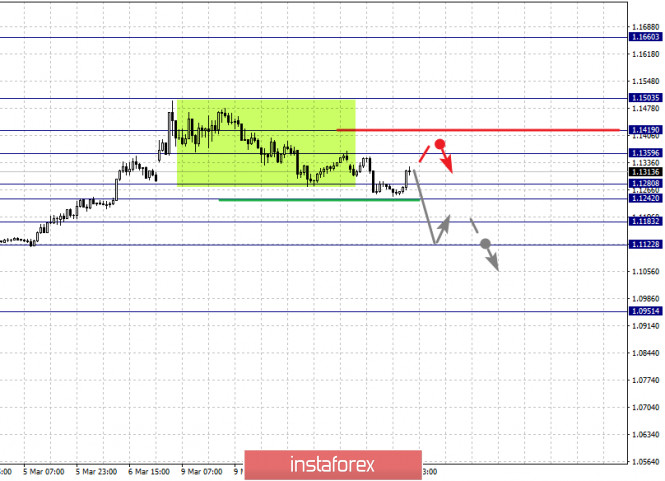

For the euro / dollar pair, the key levels on the H1 scale are: 1.1503, 1.1419, 1.1359, 1.1280, 1.1242, 1.1183 and 1.1122. Here, the price is in correction from the upward trend and forms the potential for corrective movement of March 9. Consolidated movement is expected in the range of 1.1359 - 1.1419. The breakdown of the last value will lead to a pronounced movement. Here, the target is 1.1503. We expect a pullback to the bottom from this level. Short-term downward movement is expected in the range of 1.1280 - 1.1242. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.1183. This level is a key support for the top. Its passage at the price will lead to the formation of initial conditions for the downward cycle. In this case, the goal is 1.1122. The main trend is the correction stage. Trading recommendations: Buy: 1.1421 Take profit: 1.1503 Buy: 1.1505 Take profit: 1.1660 Sell: 1.1280 Take profit: 1.1243 Sell: 1.1241 Take profit: 1.1184

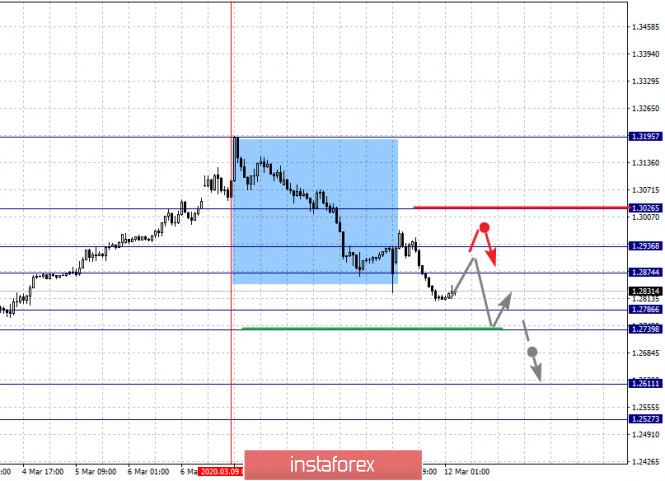

For the pound / dollar pair, the key levels on the H1 scale are: 1.3026, 1.2936, 1.2874, 1.2786, 1.2739, 1.2611 and 1.2527. Here, the price forms the initial conditions for the downward cycle of March 9. The continuation of the movement to the bottom is expected after the price passes the noise range 1.2786 - 1.2739. In this case, the target is 1.2611. For the potential value for the top, we consider the level of 1.2527. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is possibly in the range of 1.2874 - 1.2936. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3026. This level is a key support for the downward structure. The main trend is the initial conditions for the downward movement of March 9 Trading recommendations: Buy: 1.2874 Take profit: 1.2934 Buy: 1.2938 Take profit: 1.3024 Sell: 1.2738 Take profit: 1.2613 Sell: 1.2609 Take profit: 1.2528

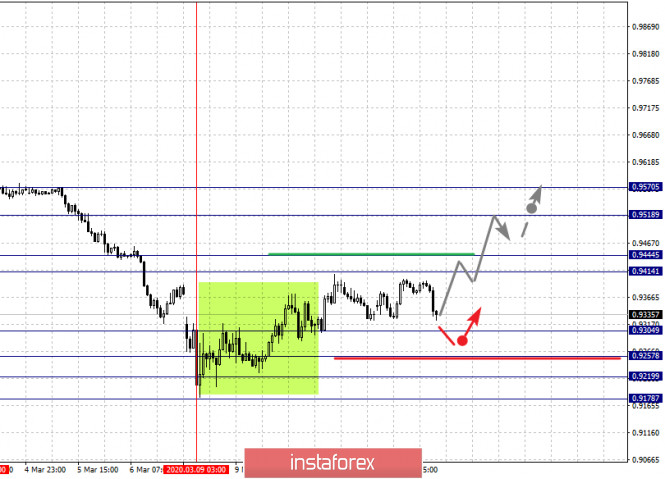

For the dollar / franc pair, the key levels on the H1 scale are: 0.9570, 0.9518, 0.9444, 0.9414, 0.9304, 0.9257, 0.9219 and 0.9178. Here, we are following the formation of the initial conditions for the top of March 9. The continuation of the movement to the top is expected after the price passes the noise range 0.9414 - 0.9444. In this case, the target is 0.9518. For the potential value for the top, we consider the level of 0.9570. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9304 - 0.9257. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9219. This level is a key support for the upward structure, its passage in price will lead to the formation of initial conditions for the downward trend. Here, the goal is 0.9178. The main trend is the initial conditions for the top of March 9 Trading recommendations: Buy : 0.9444 Take profit: 0.9516 Buy : 0.9519 Take profit: 0.9570 Sell: 0.9304 Take profit: 0.9259 Sell: 0.9255 Take profit: 0.9220

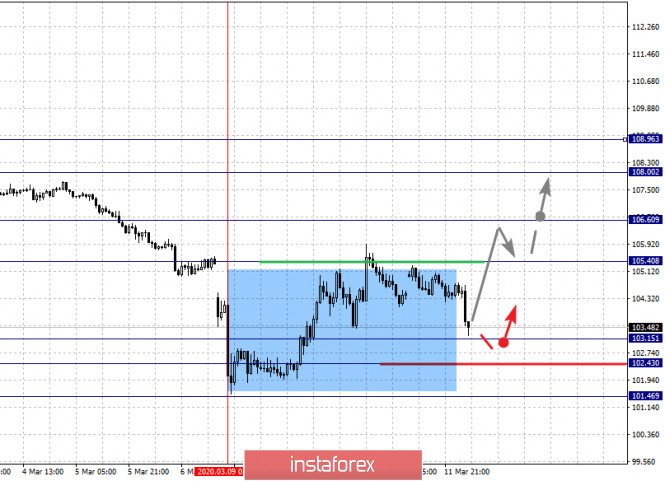

For the dollar / yen pair, the key levels on the scale are : 108.96, 108.00, 106.60, 105.40, 103.15, 102.43 and 101.46. Here, we are following the formation of the initial conditions for the upward cycle of March 9. The continuation of the movement to the top is expected after the breakdown of the level of 105.40. In this case, the target is 106.60. Price consolidation is near this level. The breakdown of the level of 106.60 should be accompanied by a pronounced upward movement. Here, the target is 108.00. For the potential value for the top, we consider the level of 108.96. Upon reaching which, we expect consolidation, as well as a rollback to the correction. Short-term downward movement is possibly in the range of 103.15 - 102.43. The breakdown of the latter value will have the downward structure. In this case, the first potential target is 101.46. The main trend: the formation of initial conditions for the upward cycle of March 9 Trading recommendations: Buy: 105.40 Take profit: 106.54 Buy : 106.62 Take profit: 108.00 Sell: 103.15 Take profit: 102.45 Sell: 102.40 Take profit: 101.48

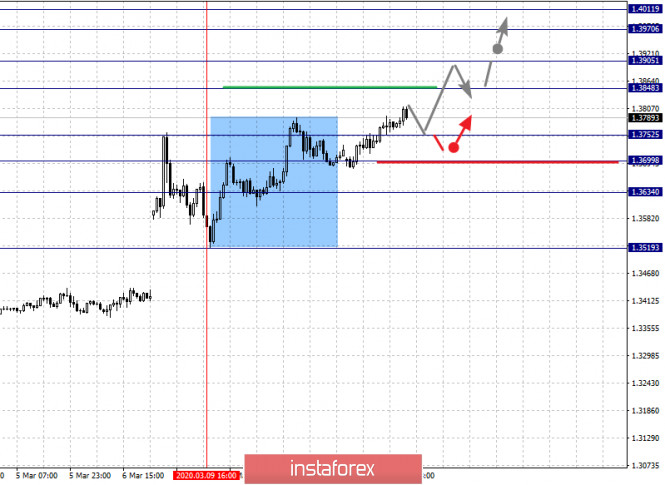

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4011, 1.3970, 1.3905, 1.3848, 1.3752, 1.3699, 1.3634 and 1.3519. Here, we are following the development of the local ascendant structure of March 9. Short-term movement to the top is expected in the range of 1.3848 - 1.3905. The breakdown of the last value will lead to a pronounced movement. Here, the target is 1.3970. For the potential value for the top, we consider the level of 1.4011. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 1.3752 - 1.3699. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3634. This level is a key support for the top. The main trend is the local upward structure of March 9. Trading recommendations: Buy: 1.3848 Take profit: 1.3905 Buy : 1.3907 Take profit: 1.3970 Sell: 1.3752 Take profit: 1.3700 Sell: 1.3696 Take profit: 1.3636

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6952, 0.6806, 0.6758, 0.6695, 0.6579, 0.6448, 0.6392 and 0.6304. Here, we are following the formation of a medium-term upward structure from March 9. At the moment, the price is in the correction zone of this structure. The continuation of the movement to the top is expected after the breakdown of the level of 0.6580, In this case, the target is 0.6695. The breakdown of this level will allow us to expect movement to the level of 0.6758. The passage at the price of the range 0.6578 - 0.6808 should be accompanied by a pronounced upward movement. Here, the potential target is 0.6952. Short-term downward movement is possibly in the range of 0.6448 - 0.6392. The breakdown of the latter value will lead to the formation of local initial conditions for the downward trend. Here, the potential target is 0.6304. The main trend is the formation of the ascending structure of March 9, the correction stage Trading recommendations: Buy: 0.6580 Take profit: 0.6695 Buy: 0.6697 Take profit: 0.6758 Sell : 0.6448 Take profit : 0.6394 Sell: 0.6390 Take profit: 0.6306

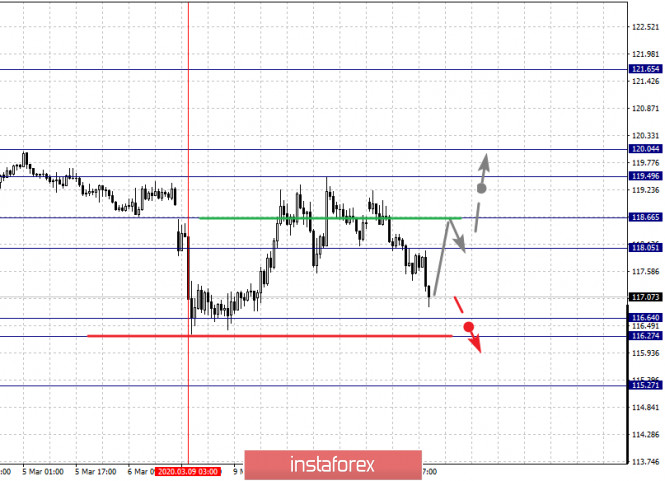

For the euro / yen pair, the key levels on the H1 scale are: 121.65, 120.04, 119.49, 118.66, 118.05, 116.64, 116.27 and 115.27. Here, we are following the formation of the initial conditions for the upward cycle of March 9. Short-term upward movement is expected in the range of 118.05 - 118.66. The breakdown of the latter value will lead to a movement to the level of 119.49. Short-term upward movement, as well as consolidation is in the range of 119.49 - 120.0. The breakdown of the level of 120.04 should be accompanied by a pronounced upward movement. Here, the potential target is 121.65. The range of 116.64 - 116.27 is a key support for the top. Its passage at the price will lead to the development of a downward trend. Here, the potential target is 115.27. The main trend is the formation of the rising structure of March 9 Trading recommendations: Buy: 118.05 Take profit: 118.64 Buy: 118.68 Take profit: 119.49 Sell: 116.25 Take profit: 115.30 Sell: Take profit:

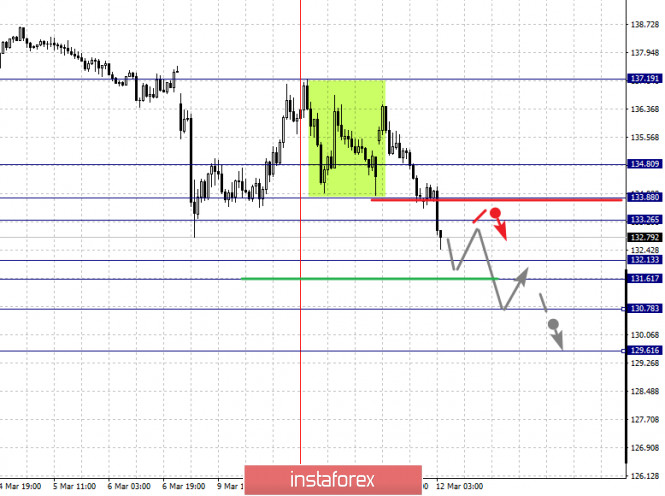

For the pound / yen pair, the key levels on the H1 scale are : 134.80, 133.88, 133.26, 132.13, 131.61, 130.78 and 129.61. Here, we are following the development of a small downward cycle of March 10. The continuation of the movement to the bottom is expected after the price passes the noise range 132.13 - 131.61. In this case, the target is 130.78. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 129.61. Upon reaching which, we expect a pullback to the top. Short-term upward movement is possibly in the range of 133.26 - 133.88. The breakdown of the latter value will lead to the development of an in-depth correction. Here, the goal is 134.80. This level is a key support for the downward cycle. The main trend is the local descending structure of March 10 Trading recommendations: Buy: 133.26 Take profit: 133.86 Buy: 133.90 Take profit: 134.80 Sell: 131.60 Take profit: 130.78 Sell: 130.74 Take profit: 129.61 The material has been provided by InstaForex Company - www.instaforex.com |

| Coronavirus pandemic and its impact on the EURUSD rate, as well as other assets Posted: 11 Mar 2020 03:45 PM PDT The COVID-19 coronavirus and trade wars are provoking the most powerful global crisis since 2008, when the collapse of Lehman Brothers Bank sent the global economy into deep shock. Central banks and governments are trying to counter the impending disaster, but so far to no avail. Last week, the Federal Reserve at an emergency meeting lowered the rate by 0.5%, but this did not calm the markets, frightened by the epidemic and its consequences, but only added fuel to the fire of falling quotes. Rates were lowered by the Reserve Bank of Australia and the Bank of Canada. The Bank of England also cut the rate by half a percent at an emergency meeting today, on Wednesday, March 11. On Tuesday, at a meeting with Republican lawmakers on Capitol hill, the US President Donald Trump proposed setting the payroll tax rate at 0% by the end of this year. As Treasury Secretary Steven Mnuchin later said, the president has support among both parties. As you can see, Trump not only writes messages on Twitter, but also takes measures to somehow stabilize the situation. Although his reaction last week, when he did not actually comment on the events taking place in the markets, indicated that he was completely at a loss. In addition to measures to reduce taxes, Trump proposes the introduction of state subsidies for shale oil producers, seriously affected by the collapse of the price. So the competition between low oil prices and the printing press may well be won by the printing press, which, apparently, can only be broken by sticking an iron scrap in its mechanism. However, the markets continue to be nervous while the decision on the tax incentive has not been made. The volatility of the US market is at its highest levels in at least five previous years, exceeding the average values at the level of 15 by more than 5.5 times (Fig.1). And in contrast to previous years, in 2015 and 2018, the volatility of the stock market increases more and more every week, which drives investors into a stupor, forcing them to sell off assets, and this, in turn, causes prices to fall further. Rice.1: volatility of the US stock market. The decline in the US stock market led to a sharp rise in the euro. The fact is that starting in 2015, when the Fed stopped its quantitative easing programs, the European currency began to replace the US dollar as the funding currency. This stimulated massive currency arbitrage operations, which are known to us by the term carry-trade. The essence of such operations is that investors receive financing in euros at a zero interest rate, then buy dollars and place money at a rate in US dollars. However, when assets start to fall in value, especially as it is now, investors rush to exchange dollars for euros, which causes its rate to rise. We observed this phenomenon at the end of February and last week. However, we must understand that there are still more dollars on the market than the euro, and the European currency has only recently become a funding currency and cannot replace the dollar. Therefore, the appreciation of the euro is rather temporary and will end with the decision of the ECB, which has not yet responded to the shocks. The problem is that Christine Lagarde has almost no tools to respond, and the epicenter of the COVID-19 infection from China is gradually moving to Europe. Most likely, the central bank will announce additional incentives in the form of long-term financing programs and create some funds to help countries affected by the epidemic. For now, the situation in Europe is only getting worse. At the moment, more than 10 thousand people have been infected in Italy, more than one and a half thousand in Germany and France, and more than two thousand infected in Spain. However, when you read these lines, the situation is likely to get even worse. In addition, the idea that, for example, the United States, a wage tax can be abolished in Europe, will hardly occur to European bureaucrats. Today, Merkel said that up to 60% of Germans are likely to be infected with the virus. It is easy to calculate that with a death rate of about 5% and a population of 83 million people in Germany, as a result of the epidemic, up to 250 thousand people may die, most of whom will be elderly. This is a terrifying figure. If we assume an ideal situation in which there are no meetings of central banks, coronavirus and crazy volatility, then the dynamics of the EURUSD pair may look as follows. After receiving the sell pattern, the goal for pulling down the euro will be the 1.12 level. However, it is advisable that the position does not remain in the market during the announcement of the ECB decision and the press conference of Lagarde, when, in addition to the existing volatility, new uncertainties will appear. Saudi Arabia's announced plans, which decided to sharply increase production to 13 million barrels per day, which could be another negative for the oil market, should be highlighted from Wednesday's news, but it cannot be ruled out that Saudi statements are no more than a bluff to force Russia to return to the negotiating table. In any case, the Russian economy looks more stable than the economy of Saudi Arabia, especially taking into account the fact that in Russia the budget is made up at an average annual price of oil of $42.5 and is surplus, and in the kingdom for $80 there is a huge hole. So Crown Prince Salman can raise rates as much as he wants, only hardly anyone will behave against his tantrum. In general, wait and see, let the coronavirus pass us, amen! The material has been provided by InstaForex Company - www.instaforex.com |

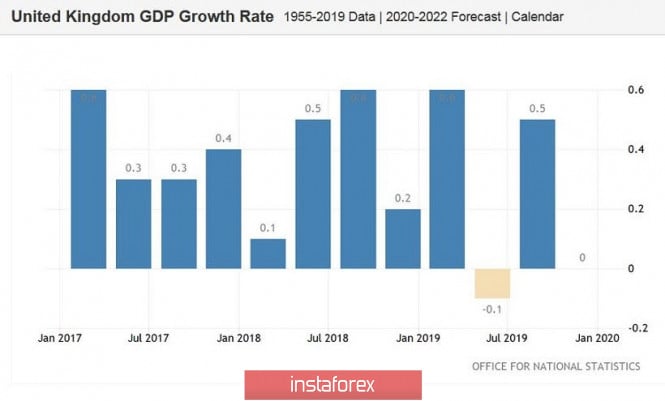

| Posted: 11 Mar 2020 03:45 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 111p - 103p - 107p - 103p - 165p. Average volatility over the past 5 days: 116p (high). The British pound was at a loss on Wednesday, March 11. In the morning, right after it became known that the Bank of England had lowered its key rate by 50 basis points, the pound/dollar pair fell. However, either large pending buy orders triggered when certain levels were reached, or traders remembered that the pound had fallen 200 points a day earlier, but sales of the British currency stopped very quickly. Thus, the reaction of market participants to the BoE rate cut was approximately the same as to a similar decrease in the Fed. That is very weak. At the moment, GBP/USD quotes fell to the Senkou Span B line, rebounded from it and even tried to resume the upward movement. There was a fresh fall during the US trading session caused by rather strong macroeconomic statistics from across the ocean. As a result, the pair continues to move down after a small upward correction. Once again, we would like to note that the panic has not completely left the markets. For example, yesterday the volatility of the instrument was about 200 points. Thus, the pair can still move in any direction, abruptly and unexpectedly. So, the BoE lowered its key interest rate. The regulator lowered it when many central banks in the world were doing the same thing. However, it seems that Mark Carney and his successor, Andrew Bailey, were waiting for similar actions from the Fed, and only when this happened did they decide to ease British monetary policy. At a press conference after the emergency meeting, the current and future heads of the central bank said the following: 1) Lowering the key rate is intended to help and support British businesses, firms and households to cope with the effects of the coronavirus. According to Bailey and Carney, the economic shock will be sharp, strong, but short-lived. 2) The measures taken by the BoE are aimed at keeping firms and people in their jobs. 3) In addition to the measures taken by the BoE, Carney and Bailey expect the UK government to take similar measures to support the country's economy. 4) According to the latest stress tests, the UK banking system must withstand a prolonged economic downturn, and commercial banks will be able to continue lending to households and businesses. It should also be noted that the British regulator has almost reached its lower limit of reducing the key rate. According to both Carney and Bailey, it makes no sense to lower the refinancing rate below the 0.1% mark, since such actions can have a negative impact on the UK banking sector. Thus, the BoE can lower the rate one more time, while the Fed can resort to such a step five more times. The question is whether Jerome Powell and company will take even more serious steps to ease monetary pressure on the US economy. Since a rate cut, especially such a strong one, is always a bearish factor for a currency whose issuer makes such a move, it is not surprising that the pound is now losing positions in a pair with the dollar. However, again, it is extremely difficult to say how long the downward movement will continue. We already said yesterday that the entire situation for the GBP/USD pair has transformed from a "swing" to a "roller coaster". Also, do not forget that if you delete the last two weeks, or simply do not pay attention to them, the British pound's position still causes great concern. We will not talk again about the uncertainty associated with Brexit, the future of the UK, the negotiations on trade deals with the EU and the US. The most banal thing that puts pressure on the pound and will continue to do so is macroeconomic statistics. Here is a simple example. The Fed feared a slowdown in the economy and lowered the rate. However, macroeconomic information from the US was strong and remained firm. Inflation is above 2%, the labor market has shown record growth rates in the last two months (based on reports from ADP and NonFarm Payrolls), and other indicators have at least not failed. What about the UK, whose central bank also feared for a slowdown in the economy and also cut the rate by 0.5%? Data continued to be weak, and remains so. Today, data on GDP was published in Great Britain. According to the first report, GDP in January in monthly terms was 0%. According to data from NIESR, the growth rate in January is also zero. Forecasts were higher. And that's not all. Data on industrial production for January was released today, which also failed. In annual terms, the decline was 2.9%, and 0.1% in monthly terms. From a technical point of view, the pair is again approaching the Ichimoku cloud, which they could not overcome the first time. Given the fact that the indicators did not even have time to react to a small correction, there were no new sales signals. A 24-hour timeframe But on the 24-hour timeframe, there is a strong signal in the form of an unsuccessful attempt to overcome the Senkou Span B. line. It was followed by a rebound with the resumption of the downward movement. At the moment, the quotes of the pair have returned to the area below the Kijun-sen line, so the prospects for further movement downwards are quite good. Recommendations for short positions: The pound/dollar pair resumed a strong downward movement on the 4-hour timeframe. It was very inconvenient to sell the British currency during the day today, as there were a large number of different fundamental and macroeconomic events. However, those traders who remain in sell positions can hold them with targets at 1.2838 and 1.2753. Recommendations for long positions: Buying the GBP/USD pair is recommended only when quotes return to the area above the critical line with the goal of the first resistance level of 1.3150. When opening any positions, it is recommended to act as carefully as possible and remember about the increased risks. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Mar 2020 03:45 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 92p - 125p - 143p - 156p - 184p. Average volatility over the past 5 days: 140p (high). Have the markets calmed down? Today, on Wednesday, March 11, the EUR/USD pair passed "only" 80 points. Although two weeks ago this volatility value would have been considered high, in the current reality it is low. During the third trading day of the week there was no new growth or collapse of quotes of the euro/dollar pair. For most of the day, the pair traded along the critical Kijun-sen line. Thus, we believe that now there are signs that traders are starting to trade again consciously, and the state of panic is passing. Ironically, the reassurance of market participants came precisely on the day when the Bank of England urgently lowered the rate by 50 basis points, and important macroeconomic data were published in the United States and Great Britain. We will consider all British news in the next article on the GBP/USD pair, in the same we will focus on European and American news. In fact, only one indicator was published in the United States today, but what! February consumer price index in several variations and dimensions. The main inflation rate in the United States was 2.3% y/y, which is higher than forecasted but lower than the previous month. Thus, it is definitely impossible to say whether the report turned out to be strong or weak. Moreover, the consumer price index excluding food and energy was stronger than forecast and amounted to +2.4% y/y (with market expectations +2.3%). Some experts consider this indicator to be more important and significant. Thus, both inflation rates in the US exceeded forecast values. True, these data do not yet take into account the easing of the Fed's monetary policy, as well as the panic week during which oil prices and US stock markets collapsed, and panic and chaos reigned in the foreign exchange market. There is reason to believe that the March values of all the most important indicators in the United States will give a big surprise to market participants. However, at the moment we are again stating a fact: the US macroeconomic statistics continues to remain at a very high level and shows practically no signs of slowdown. Thus, we are once again wondering if the Fed was in a hurry to lower the rate by 0.5%. And did the Fed look for a formal reason to meet Donald Trump? So far, everything looks that way. The latest 50 basis point cut in the BoE's key rate looks like a game of catch-up. As the Fed eased monetary pressure on its economy so as not to lose on the international stage (as Trump has repeatedly said, urging Powell to lower rates as quickly and as strongly as possible), the British regulator took a similar step. Thus, the status quo between the countries has been restored. There is now only the ECB, which has not yet called emergency meetings, and has not given any comments on monetary policy. Everyone is interested in the question: what can the European regulator do in the current situation? According to many experts, when rates are already negative, each subsequent reduction will have a smaller stimulating effect on the economy. Thus, we are unlikely to get a situation with thoughtless monetary policy easing and frankly "helicopter money" in the European Union. However, it is likely that the ECB will also lower the rate, and at the same time expand the asset purchase program. Thus, all the central banks we are interested in will resort to serious stimulus measures in March. And only the Fed will have some room for maneuver in the future. At the same time, all 27 heads of EU member states decided to invest 25 billion euros to fight the spread of the coronavirus. It is expected that 7.5 billion euros will be allocated from the Treasury of the EU, the remaining funds have yet to be raised. So far, the funds will be used to help the most affected EU countries: Italy, France and Germany. Although, according to our data, only Italy can be considered affected, and Germany and France are likely to be helped as the most developed EU countries to avoid slowing down their economies, which will lead to a slowdown in the growth of the entire bloc. There is no talk of closing the borders between the countries, but everything will depend on the further map of the spread of the COVID-2019 virus. In general, the situation is complicated. From a technical point of view, the pair continues to adjust. As you have already understood, traders did not particularly react to today's data from overseas. Thus, the markets are calming down, but are still far from the usual trading mode. If the pair crosses the Kijun-sen line, the downward movement should continue. A 24-hour timeframe On the 24-hour timeframe, the pair made an increase to the resistance level of 1.1470, rebounded from it and also started a downward correction. At the moment, it has fallen to the level of 1.1282 and, most likely, will not stay near it. After a strong upward movement, we expect a fall to the critical Kijun-sen line at least. Recommendations for short positions: For selling the euro, we recommend waiting for quotes to be consolidated below the Kijun-sen line. In this case, it is recommended to sell the currency pair in small lots with the goals of the volatility level of 1.1146 and the support level of 1.1090. The daily Kijun-sen line is also located near these levels, which also serves as a target for correction. Recommendations for long positions: Purchases of the euro currency with the goals of 1.1417 and 1.1549 can be opened if the correction is completed and the pair returns to the area above the critical line. In any case, we recommend that you be as careful as possible when opening any positions. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator Daily analysis of Gold Posted: 11 Mar 2020 11:43 AM PDT Gold price is under pressure again today trading in lower levels since yesterday. Despite the bounce towards $1,670, price is now trading again at $1,638 under pressure. Short-term trend remains bullish despite the pull back.

|

| Ichimoku cloud indicator short-term analysis of EURUSD for March 11, 2020 Posted: 11 Mar 2020 11:35 AM PDT EURUSD is pulling back as we expected by our latest analysis. According to the Ichimoku cloud indicator we have a weak sell signal as price is breaking below short-term indicators. The pull back could unfold all the way to 1.1130.

|

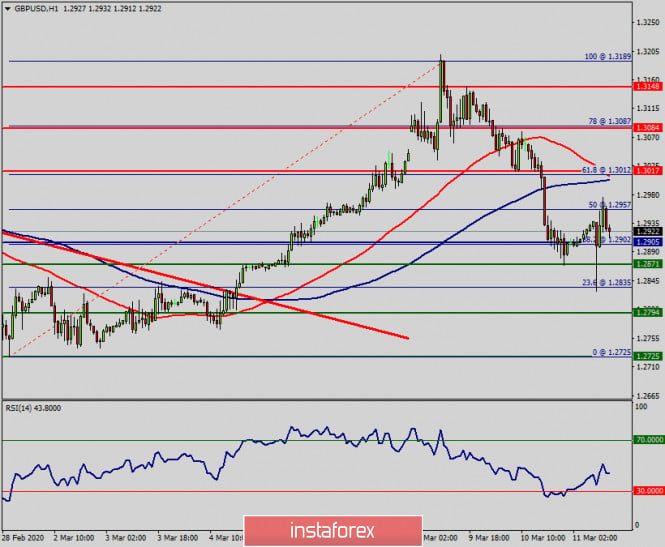

| March 11, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 11 Mar 2020 11:27 AM PDT

In the period between December 18th - 23rd, bearish breakout below the depicted previous bullish channel followed by quick bearish decline below 1.3000 were demonstrated on the H4 chart. However, Immediate bullish recovery (around 1.2900) brought the pair back towards 1.3250 (backside of the broken channel) where the current wide-ranged movement channel was established below 1.3200. Since January 13, progressive bearish pressure has been built over the price zone of 1.2980-1.3000 until February 5. On February 6, bearish breakdown below 1.2980 enhanced further bearish decline towards 1.2890 (the lower limit of the movement channel) where two episodes of bullish rejection were manifested on February 10th and 20th. Shortly after, the lower limit of the channel around 1.2850 has failed to provide enough bullish Support for the GBPUSD pair. That's why, further bearish decline was expressed towards the nearest DEMAND level around 1.2780 where significant bullish rejection and an inverted Head & Shoulders reversal pattern was demonstrated in the period between Feb. 28 - March 4 especially after The Fed unexpectedly cut rates by half-point for the first time since 2008 to protect against an anticipated slowdown of US economy for the fear of a possible Corona Virus outbreak. Hence, a quick bullish movement was demonstrated towards the price zone of 1.2980-1.3000 which has temporarily failed to offer enough bearish pressure on the GBPUSD pair. Further bullish advancement was demonstrated towards 1.3200 where significant bearish pressure brought the pair back below 1.3000 via quick bearish engulfing H4 candlesticks. The pair remains trapped between 1.2830 (the lower limit of the current movement channel) and 1.3000 (Prominent Key-Zone) until breakout occurs in either directions. Based on the recent aggressive bullish price action around the lower limit of the current channel near 1.2830, a possible bullish breakout above 1.3000 is more probable to be expected. If so, another bullish visit towards 1.3110 would he expected. On the other hand, bearish persistence below 1.2980 enhances the bearish side of the market again towards 1.2870 then 1.2830. The material has been provided by InstaForex Company - www.instaforex.com |

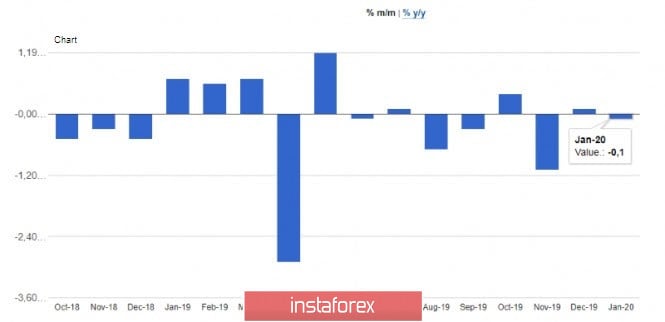

| Posted: 11 Mar 2020 08:26 AM PDT Aggressive measures of the Bank of England clearly make it clear that the regulator does not intend to sit on the sidelines and wait for the situation to improve itself. Preventive measures are currently the most effective, which will avoid the global crisis of 2008. Today, at an extraordinary meeting, the Bank of England decided to lower interest rates, which led to a sharp collapse of the British pound, which quickly regained its position. The actions of the government and the regulator are joint, and later today, the country's Finance Minister Rishi Sunak will present a draft budget that will be very much changed due to the spread of the coronavirus. By the way, more than 400 people have been infected in the UK. Following a special meeting of the monetary policy committee, the Central Bank's management decided to reduce the key interest rate to 0.25% from 0.75%. The Bank of England also announced measures to combat the effects of the coronavirus. We are talking about creating a funding program designed to support lending to small businesses affected by the epidemic. During his speech, Bank of England Governor Mark Carney said that the economic shock may be significant and sharp, but it will be temporary, and if necessary, there is space for applying additional monetary policy tools. Carney also hinted that quantitative easing remains part of the toolkit, and all measures taken today are coordinated with the presentation of the budget. Now about the speech by the future head of the Bank of England, Andrew Bailey, who took part in making all the decisions. Bailey said that the destabilization of the British economy will be temporary, and the measures taken will allow banks to avoid obstacles in providing loans, which will help them survive in the conditions of destabilization of markets. Bailey also pointed out that the analysis of monetary and financial policy needs to be even clearer and more thorough. As for the stimulus capacity, the Bank of England still has about half of the existing capacity at its disposal. Data on UK industrial production, after a sharp decline in interest rates, no longer had such a clear impact on the market. According to the report, production decreased in January this year by 0.1% and fell by 2.9% compared to the same period in 2019. Production was forecast to grow by 0.3% and decrease by 2.5% per annum. Surprisingly, the deficit of foreign trade in UK goods in January this year was 3.7 billion pounds with a forecast of 7 billion pounds, and the positive balance of UK trade with countries outside the EU in January was at the level of 2.2 billion pounds. As for the UK economy, it showed no growth in January compared to December 2019 and grew by only 0.6% compared to January last year, indicating real problems, which are added to the uncertainty over the EU-UK trade negotiations. As for the technical picture of the GBPUSD pair, it seems that the pound enjoys good support due to the stimulus measures resorted to by the UK authorities. As long as trading is above the level of 1.2870, we can expect the upward correction of the trading instrument to continue to the area of the highs of 1.3020 and 1.3080. If the area of 1.2870 is breached, which is where the major players took advantage of the moment and opened long positions after the Bank of England's decision to lower interest rates, then the pressure on the pound will return, which will lead to an update of the lows in the area of 1.2790 and 1.2730. Do not forget that the European Central Bank will hold a meeting tomorrow, where it will also announce packages of measures aimed at mitigating the impact of the spread of coronavirus on the economy. I have discussed this in detail in my previous reviews. In short, deposit rates are likely to be reduced by 10 basis points, to -0.60%, and monthly net asset purchases will rise to 40 billion euros from 20 billion euros. The material has been provided by InstaForex Company - www.instaforex.com |

| March 11, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 11 Mar 2020 07:42 AM PDT

On December 30, a bearish ABC reversal pattern was initiated around 1.1235 which turned the technical outlook into bearish. Since then, the EURUSD pair has trended-down within the depicted bearish channel until few weeks ago, when extensive bearish decline established a new low around 1.0790 especially after Coronavirus news has delivered a bump to non-volatile Currency Markets. This was where the EUR/USD pair looked OVERSOLD after such a sudden quick bearish decline. Hence, Intraday traders were advised to look for signs of bullish recovery around the price levels of (1.0790). On February 20, recent signs of bullish recovery were demonstrated around 1.0790 leading to the current steep bullish movement towards 1.1000, 1.1175 and 1.1235. The Fed unexpectedly cut rates by half-point for the first time since 2008 to protect against an anticipated slowdown of economy for the fear of a possible Corona Virus outbreak. This unexpected move made the G-7 currencies like the EURO more appealing than USD. The price level of (1.1175) constituted a transient congestion-zone in confluence with the origin of the previously-mentioned ABC pattern. Temporary bearish pullback was demonstrated towards 1.1100-1.1095 where another bullish swing was initiated targetting 1.1300, 1.1360 and 1.1480. Recently, the price-Level of 1.1360 (100% Fibo Expansion) was being breached to the upside until earlier this week when bearish rejection was demonstrated around the price levels of 1.1480. Remaining Bearish targets are projected towards 1.1300, 1.1235 and 1.1175. That's why, bearish persistence below 1.1360 is needed to ensure further bearish decline towards the mentioned target levels. However, another Bullish breakout above 1.1360 (100% Fibo Expansion) enables another upward movement towards 1.1450-1.1480 where a high-probability double-top reversal pattern may be established. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the US session on March 11. The Bank of England lowers interest rates to 0.25% Posted: 11 Mar 2020 07:36 AM PDT To open long positions on GBPUSD, you need: The sharp fall in the pound in the first half of the day was due to an unscheduled reduction in interest rates by the Bank of England to 0.25%. However, the market very quickly played back this decision with new purchases, which indicates that there are large players betting on the growth of the pound in the medium term. In the morning review, I recommended opening long positions from the support of 1.2833, and now the bulls need to focus on breaking through and fixing above the resistance of 1.2970, which will preserve the upward potential, and will lead to an update of the highs of 1.3025 and 1.3075, where I recommend taking the profits. In the scenario of a repeated decline in GBP/USD in the second half of the day to the area of 1.2906, it is best to abandon long positions until the update of the lows of 1.2870 and 1.2833, the breakthrough of which can cause a lot of problems for buyers To open short positions on GBPUSD, you need: Sellers protect the resistance of 1.2970, and the repeated formation of a false breakdown on it will be a direct signal to open short positions, which may lead to a decrease in the pound to the support area of 1.2906, where I recommend taking the profits. However, a more important task for the future will be to break this range, which will return the market to bearish momentum and lead to an update of the lows of 1.2870 and 1.2833. If the bears do not "rest" in the resistance area of 1.2970 in the second half of the day, then it is best to postpone short positions until the test of the highs of 1.3025 and 1.3075, from where you can sell immediately for a rebound in the calculation of 20-30 points of a downward correction inside the day. Signals of indicators: Moving averages Trading is conducted below the 30 and 50 daily averages, which indicates that the downward correction potential remains. Bollinger Bands A break of the indicator's middle border at 1.2925 will increase pressure on the pound. A break of the upper border in the area of 1.2960 will lead to a new wave of GBP/USD growth.

Description of indicators

|

| Posted: 11 Mar 2020 07:31 AM PDT To open long positions on EURUSD, you need: From a technical point of view, nothing much has changed. In the first half of the day, euro buyers made an attempt to return the resistance to 1.1340, but it did not go very smoothly, which again led to the pair falling below this level and kept control on the side of the bears. Data on inflation in the United States did not significantly affect the market situation. At the moment, the bulls still need a breakdown and consolidation above the resistance of 1.1340, which will strengthen their positions and lead to an update of the highs of 1.1390 and 1.1422, where I recommend fixing the profits since large sellers will start operating in this area. In the scenario of a further decline in EUR/USD in the second half of the day, it is best to return to long positions only on a false breakdown in the support area of 1.1279, since confidence in this level is much less than yesterday or buy the pair immediately on a rebound from the lows of 1.1239 and 1.1195. To open short positions on EURUSD, you need: The bears managed to form a false breakdown in the resistance area of 1.1340, which I paid attention to in my morning forecast, which keeps the market under their control. At the moment, sellers are focused on returning and fixing under the support of 1.1279, which will increase the pressure on the pair and lead to the update of new local lows in the area of 1.1239 and 1.1195, where I recommend fixing the profits. However, given the weak data on inflation in the US, it is unlikely that demand for the US dollar will continue without the support of major players. If the bulls again manage to tighten the pair to the level of 1.1340, I recommend returning to short positions in this scenario only after the resistance test of 1.1390 or a rebound from the larger level of 1.1422. Signals of indicators: Moving averages Trading is conducted just below the 30 and 50 moving averages, which indicates that the correction potential remains in the second half of the day. Bollinger Bands In the event of a further decline in the euro, the lower border of the indicator around 1.1279 will provide support, while a breakdown of the upper border of the indicator around 1.11365 will lead to a larger upward trend.

Description of indicators

|

| Trading plan for Gold for March 11, 2020 Posted: 11 Mar 2020 07:14 AM PDT

Technical outlook: Gold has finally printed fresh highs at $1,703 levels, just a few points above $1,692 from the last week. It seems that the yellow metal has formed a meaningful top and should be looking to reverse lower in a major trend reversal. Also please note that it has broken the immediate support at $1,643 last night and registered fresh intraday lows around the $1,642 levels, before pulling back higher again. The rally during the day was a retracement towards the fibonacci 0.50 of the earlier drop. The odds are still high that Gold might rally towards $1,680 levels before reversing lower again. The $1,680 is also 61.8% retracement of the earlier drop between $1,703 and $1,642 respectively and hence there is high probability for a bearish move. From the trading point of view, the yellow metal is good to sell on rallies with risk at $1,703 and a potential downside initial target at $1,560. A break below $1,560 would confirm that the trend has reversed and bears would be poised to print lower lows and lower highs going forward. Trading plan: Remain short @ 1,658/60 and add more @ 1,680, top above 1,703 and target is below 1,560. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review of EURUSD 03/11/2020. The market is waiting for a signal for a new wave of fall Posted: 11 Mar 2020 06:29 AM PDT The market continues a period of some calm after the collapse of the previous period. However, you should not hope for a reversal in a positive direction: the epidemic of coronavirus spreads at a very high speed (+10% per day). The market will receive a new portion of negativity on Thursday morning. EURUSD: The euro awaits ECB decisions on Thursday. The ECB is likely to offer a new amount of liquidity - but the market reaction is not predictable. I think it is more likely that the trend for the euro will continue upward. We keep purchases from 1.1100. We buy from 1.1200. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EURUSD for March 11, 2020 Posted: 11 Mar 2020 06:20 AM PDT

Technical outlook: EURUSD rose to 1.1500 level amid the spread the Corona Virus epidemic around the globe. After almost hitting the first price target around 1.1500 level, the pair is expected to retrace towards 1.1100 and up to 1.1050 level which is Fibonacci 0.618 retracement of the entire rally between 1.0778 and 1.1500 respectively. The overall structure remains bullish over the next few months and EURUSD could reach 1.1800 and 1.1200 levels at least during that time. Traders who went long earlier might have looked profits around 1.1500 resistance. Prepare to buy again after the retracement to 1.1050 level. It seems that the euro has formed a support at 1.0778 level and is expected to grow as long as the prices remaim at this level. Immediate support is seen at 1.1100 level and also the resistance turned into the support trend line would provide the bounce for the next rally even higher than bebore. Trading plan: Remain long, buy more around 1.1050/1.1100, stop at 1.0770, target is open. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

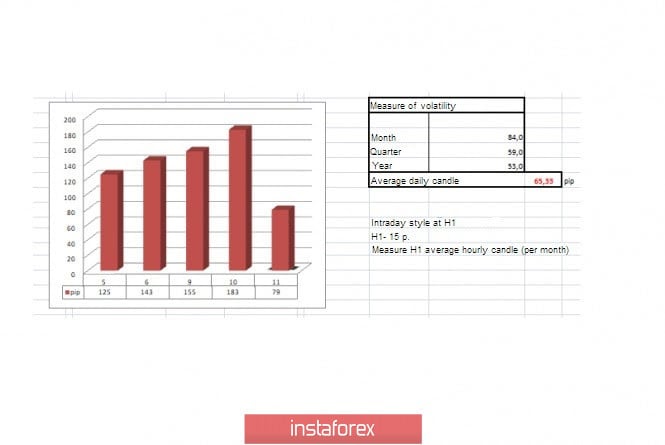

| Trading recommendations for EURUSD pair on March 11 Posted: 11 Mar 2020 05:46 AM PDT From a comprehensive analysis, we see a partial recovery process, where the quote managed to fall just below the predicted level of 1.1300. Now about the details. The area of interaction of trading forces 1.1440/1.1480 still managed to influence the insatiable speculators, who managed to overheat the single currency so much that the recovery of more than 200 points does not seem to be something significant. In fact, the pressure of the external background has freed the hands of speculators, who easily move the market, and in the current situation, it is not quite appropriate to talk about trends and cycles. The overbought single currency was considered normal. It is worth considering that in the current state of affairs, it may turn out that market activity will continue to please speculators and we need to work on the same wave as they do. Regarding the assumption of a change in the medium-term trend, as discussed in the previous review, we should not jump to conclusions, since everything that happens on the chart is unstable and focused on noise. Thus, when the external climate normalizes, everything can return to its original course, that is, to the original downward trend. In terms of volatility, we see the highest indicator for the last time (183 points), which is 188% higher than the average daily value. The fact of acceleration has been maintained in the market for a long time, which led to a significant adjustment of the average indicator. So, at the end of 2019, the average daily figure was about 48 points, where it seems like the dynamics were there, but speculators did not complain. Now the average daily figure was 65 points, that is, an acceleration of 35%, which is considered a lot for the dynamics of the euro/dollar pair. Volatility details: Monday-152 points; Tuesday-118 points; Wednesday-92 points; Thursday-125 points; Monday-155 points; Tuesday-183 points. The average daily indicator relative to the volatility dynamics is 65 points (see the volatility table at the end of the article). Analyzing the past day by the minute, we see a two-stage downward movement, where the quote first descended to the area of the upper border of the gap, and after that, the expected acceleration occurred, just at the time of the passage of the gap price. The result is a local descent towards the level of 1.1300 (1.1275), which ended the trading day. As discussed in the previous review, traders were waiting for a similar development, where the gap pass was the starting point for a profit in the face of the level of 1.13000. The trading recommendation from Tuesday coincided, having another profit on the account. (We consider selling positions if the price is fixed at 1.1330, with the prospect of a move to 1.1300-1.1285.) Looking at the trading chart in general terms (the daily period), we see that the recovery process relative to the inertial course has not come conditionally since the existing oscillation is more similar to a pullback in comparison with the scale of the vertical impulse. The news background of the previous day included data on eurozone GDP for the fourth quarter, where another estimate confirms a slowdown from 1.2% to 1.0%, but it is worth considering that they predicted a slowdown to 0.9% at all. The market reaction was to locally restrain the single currency from falling. In terms of the general information background, we have a noise based on coronavirus, where Europe is drowning in cases: Italy has more than 10,000 cases of the disease; France (1.8 thousand) and Germany (1.3 thousand). The panic is on an imaginable and non-mental scale, and the head of the European Central Bank (ECB), Christine Lagarde, warns everyone of the possible consequences. So from Lagarde's judgment, the threat of an economic crisis comparable to the situation in 2008, if you do not take action in connection with the coronavirus. In turn, experts are concerned about how the regulator will behave at the upcoming meeting on March 12, whether the rate will be reduced to a negative zone, or whether we will only manage to reduce the deposit rate, as it was before. Let me remind you that the Fed set the trend for a rate cut that week, and the Bank of England supported this "flashmob", which urgently lowered the rate by 0.5%. The ECB has the last word, as next week's scheduled meeting of the Federal Reserve System, where everyone is again afraid of a possible reduction in the refinancing rate. Regarding the rate level, US President Donald Trump spoke out, calling on the Fed to continue reducing its level. "Our pathetic, slow-moving Fed, led by Jerome Powell, which raised the rate too quickly and lowered it too late, should reduce the rate level to the level of our competing countries. Now they have a two-point advantage with even more currency help," Trump wrote on Twitter. Today, in terms of the economic calendar, we have data on inflation in the United States, where they expect a slowdown from 2.5% to 2.3%, which may put pressure on rumors about a possible reduction in the Fed's refinancing rate. Further development Analyzing the current trading chart, we see a fluctuation within the level of 1.1300, where the quote has slightly recovered from the previous downgrade. In fact, we are standing still, concentrating on the level where the external background puts pressure on the quote and new bursts are not excluded. It is worth understanding that now the main driver will be the ECB meeting and with the development of rumors, facts, there will be development. If you look at the current situation, you can take into account the cycle of 1.1275/1.1366, where you can perform local manipulations with respect to the coordinate data. The main actions are waiting for us tomorrow, where you should carefully monitor the background activity and publications on Bloomberg. In terms of emotional mood, we see that the speculative mood exceeds expectations, thus the characteristic acceleration will remain in the market. Detailing the minute-by-minute time interval, we see the same clock cycle 1.1275-1.1366, which was set at the very opening of the daily candle and lasted until 9:00 hours. The subsequent cycle was in the reverse course to the level of 1.1300, where the price again found a foothold. In turn, intraday traders are now working at 1.1275-1.1366, on the principle of breaking one of the values. It is likely to assume that external noise can give rise to new local jumps, where it is not necessary to take unnecessary risks and lay higher trading volumes. The tactic was chosen using the breakdown method of one of the values 1.1275-1.1366. Based on the above information, we will output trading recommendations: - Buy positions are considered if the price is fixed higher than 1.1366, with the prospect of a move to 1.1400-1.1440. - We consider selling positions if the price is fixed at 1.1275, with the prospect of a move to 1.1200. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators for the minute and hour periods work on the oscillation within the clock cycle of 1.1275-1.1366. Daily periods invariably maintain an upward interest due to the general inertia of the course. Volatility for the week / Volatility Measurement: Month; Quarter; Year. The volatility measurement reflects the average daily fluctuation from the calculation for the Month / Quarter / Year. (March 11 was based on the time of publication of the article) The current time volatility is 79 points, which is already 21% higher than the daily average. It is likely to assume that acceleration is possible due to the external background and the speculative mood. Key levels Resistance zones: 1.1440; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1300; 1.1180; 1.1080**; 1.1000***; 1.0950**; 1.0850**; 1.0775*; 1.0700; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Mar 2020 05:44 AM PDT Technical analysis:

AUD/USD has been trading upwards most recently. Anyway, I see potential for the downside continuation and eventual test of 0.6460 and 0.6315. There is the potential end of the upward correction and completed bear flag on the 1H time-frame... The zone around the 0.6520 seems like a nice short zone. Watch for selling opportunists with the downward targets at the price of 0.6460 and 0.6315. Stochastic oscillator is showing the overbought condition, which is good sign that buyers got "too long" and that sellers might be attracted... Resistance at the price of 0.6543 is very important pivot. Support levels and downward targets are set at the price of 0.6460 and 0.6315. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Mar 2020 05:32 AM PDT Technical analysis:

Gold has been trading upwards. The price tested the level of $1.670 and reached mini Pitchfork median line.There is still goo potential for the Gold to go downside and test the levels at $1.610 and $1.585. Watch for selling opportunities on the rallies with the main target at $1.610. The breakout of the mini Pitchfork upward channel would confirm the downside continuation... MACD is showing the new momentum down, which is good confirmation for the further downside. Resistance levels are set at $1.667, $1.680 and $1.700 Support levels are set at the price of $1.641, $1.610 and $1.584 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Mar 2020 05:23 AM PDT Industry news:

According to a blog post, crypto exchange Kraken is excited to recommit resources to grow its services in the region through new features and offerings. The exchange claimed that they have long served the Indian market with a full suite of exchange products, including spot, derivatives, and futures. Kraken believes that with its youthful and tech-savvy population, they are excited to help again Indian customers re-enter the crypto market. Earlier, the global blockchain company HashCash Consultants announced to invest $10 million in the Indian crypto market. Technical analysis: BTC been trading downwards. As I expected, the BTC started with downside continuation. In my opinion, the level at $8.460 seems like a strong resistance level and potential short-zone. In the background, there is the gap down and the BTC is trying to test the gap area. There is no indication of any reversal yet. Watch for selling opportunities on the ralllies with the main target at $6.475. MACD is showing the new momentum down, which is good confirmation for the further downside. Major resistance is set at the price of $8.460 Support levels are set at the price of $7.615 and $6.476 The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Rates down, pound up: British held back blow after unexpected BoE decision Posted: 11 Mar 2020 05:17 AM PDT The Bank of England today decided to prematurely join those central banks that eased monetary policy in response to the spread of the Chinese coronavirus. Members of the English regulator reduced the rate immediately by 50 basis points, as did their colleagues from the Fed. This is not to say that this decision was completely unexpected and shocking for market participants - recent events and comments by British officials (including representatives of the Bank of England) prepared the markets for such a scenario. The initial reaction of the pound also suggests that traders took this option into account in their forecasts. Moreover, now the British currency has received a certain immunity, given the previous rhetoric of Andrew Bailey. Let me remind you that the successor of Mark Carney (Bailey will take up his duties this month) recently announced that the central bank could reduce the interest rate "approximately to 0.1%." The British currency initially slumped, reacting to such dovish forecasts - but subsequent official remarks offset the initial reaction. Bailey said that the regulator had virtually no room for political maneuvers, so you can't count on an aggressive reaction from the central bank. But according to the head of the regulator, the British government urgently needs to increase the role of fiscal policy. Mark Carney expressed a similar position today, commenting on the decision to reduce the rate. He noted that the measures taken by the central bank should only complement incentive government programs. In addition, he also outlined the lower limit of the rate cut - according to him, the BoE could reduce it to the level of "just above 0%". This position is consistent with the position of Andrew Bailey, who set the "red line" at 0.10%. Carney's successor virtually ruled out the option of reducing to the negative area - in his opinion, negative interest rates will have a negative impact on the UK banking sector. Thus, last week, Bailey announced the boundaries of possible actions on the part of the English regulator, and also actually warned the markets that the central bank was preparing to take appropriate countermeasures. This fact supported the pound at the moment when the dovish scenario began to come true. Moreover, the market should be ready for the next possible decision - when the BoE will reduce the rate by another 10 or 15 basis points. In other words, the pound held back a hit today, but paired with the dollar still could not enter the 30th figure. UK GDP growth data released today put pressure on the British currency. In January, this indicator reached zero (with a forecast of growth of up to 0.2%) on a monthly basis. The economy of Great Britain "froze in place" after a slight growth in December, when GDP grew by 0.3%. In quarterly terms, the key indicator also remained at zero, although experts expected a minimum increase of 0.1%. Disappointed and indicators of industrial production. In both monthly and annual terms, the indicators appeared in the red zone, not reaching the forecast values (-0.1% and -2.9%, respectively). But the volume of production in the processing industry collapsed to -3.6% (on an annualized basis) - this is the weakest result in the past almost two years. And although experts expected a downward trend in the above indicators, real numbers turned out to be worse than pessimistic forecasts. Despite such weak releases, the GBP/USD pair still shows character. This indicates the general weakness of the US currency. First, dollar bulls are disappointed with incentive measures proposed by the White House, around which political debate is still ongoing. The Trump administration and Congress cannot find a common denominator in this matter, and this fact puts additional pressure on the greenback. Secondly, the dollar continues to be under pressure from panic. The number of confirmed cases of infection with a new coronavirus in the United States has reached a psychologically important thousandth, while the rate of spread of COVID-19 continues to increase. Many states have declared a state of emergency, and universities across the country are closing down or transferring students to online education. All this suggests that the Fed at the March meeting may again resort to aggressive measures to mitigate monetary policy. In particular, the US president, as well as some of his advisers, are urging the Fed to lower the rate to zero. Further spread of the epidemic will only increase the likelihood of this scenario. It is for this reason that the pound today "held back the blow": while the BoE is limited in its actions, the Fed can afford more ambitious steps to soften monetary policy. This suggests that the GBP/USD pair retains the potential for its growth to the first resistance level, that is, to around 1.3070 (the lower boundary of the Kumo cloud on the daily chart). The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for March 11, 2020 Posted: 11 Mar 2020 04:39 AM PDT Overview: The investors will likely concentrate on upcoming Brexit talks and coronavirus headlines. But technically, the resistance of GBP/USD pair has broken; it turned to support around the zone of 1.2905 (pivot point) By that means, forming a strong support at 1.2905. The level of 1.2905 coincides with the golden ratio which is acting as major support today. Another thought; the Relative Strength Index (RSI) is considered overbought because it is above 70. At the same time, the RSI is still signaling an upward trend, as the trend is still showing strong above the moving average (100), this suggests the pair will probably go up in coming hours. Accordingly, the market will probably show the signs of a bullish trend. In other words, buy orders are recommended above 1.2905 level with the first target at the level of 1.3017. From this point, the pair is likely to begin an ascending movement to the point of 1.3084 and further to the level of 1.3103. The price of 1.3103 will act as a strong resistance and the double top has already set at the point of 1.3017. On the other hand, if a break happens at the support of 1.2905, then this scenario may become invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

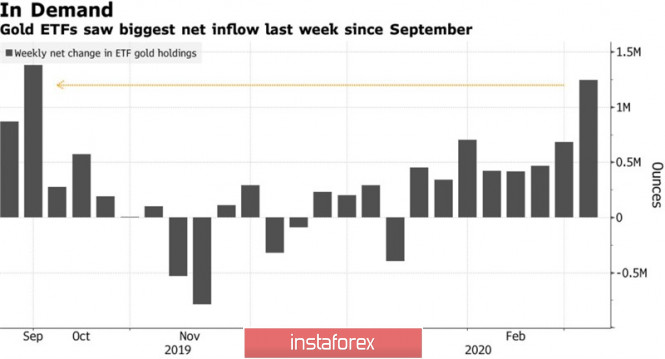

| Posted: 11 Mar 2020 04:21 AM PDT If you ask any investor about the reasons for the rapid growth of gold, then a single word immediately comes to mind – coronavirus. The Chinese epidemic not only leads to a breakdown in supply chains and a slowdown in global GDP but also became the main catalyst for the most rapid correction of US stock indices from levels of record highs in history. The S&P 500 was about to burst sooner or later, and the pandemic forced it to do so in late February. However, many people forget that in the modern world, the precious metal is a hedging tool against the monetary expansion of central banks. The success of the "bulls" on XAU/USD, which inflated the quotes to the highest levels since December 2012, would not have been so bright if it had not been for the reduction of the federal funds rate at an extraordinary FOMC meeting by 50 bps and the expectation of its fall to zero before the end of 2020. Donald Trump never tires of criticizing the Fed for its slowness, demanding a reduction in borrowing costs to levels that have major US competitors. The Federal Reserve was followed by the Reserve Bank of Australia and the Bank of Canada. The ECB, as well as regulators from Japan and England, say they are ready to ease monetary policy. Monetary expansion is a "bearish" driver for any currency, while the weakness of the latter contributes to the growth of demand for gold. Isn't that why ETF stocks rose at the fastest pace since September in the first week of March? Dynamics of gold ETF stocks

Interest in gold is fueled by significant turmoil in the financial markets. In this regard, the collapse of the S&P 500 by 10% for 6 days, more than 7% sagging stock index at the auction on March 9, as well as the fastest peak in oil since the crisis in the Persian Gulf in 1991 could not leave the "bulls" on XAU/USD indifferent. The rise in the volatility of various assets, including precious metals, contributes to the growth of quotes of safe-haven assets, which once again proved gold. Dynamics of gold volatility

Despite the fact that major banks are predicting the continuation of the northern hike XAU/USD, I would not be so confident in their targets. UBS expects the precious metal to jump to $1,800 an ounce in the next few weeks, while Citigroup forecasts it to strengthen to $2,000 by the end of 2021. In my opinion, the market situation is beginning to change, which increases the risks of correction and consolidation. First, the White House and the Fed will most likely be able to stabilize the stock market with fiscal and monetary stimulus, which will return interest in the US dollar. Second, China is gradually defeating the coronavirus, which allows us to count on a V-shaped recovery of its economy in the second quarter. Technically, the formation of the "Three Indians" subsidiary and parent model on the daily chart of the precious metal at the target level of 224% on the AB=CD pattern increases the risks of correction to $1630 and $1600 per ounce. However, until the quotes fall below the trend line of the initial stage of the "surge and reversal with acceleration" model, the situation will continue to be controlled by the "bulls" and pullbacks will be used for purchases. Gold, the daily chart

|

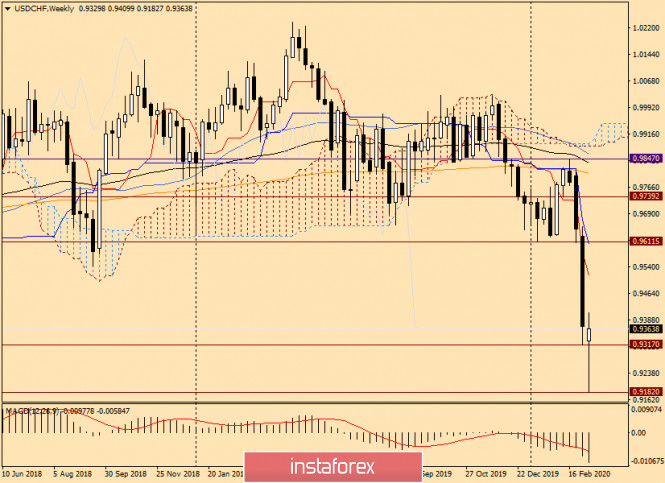

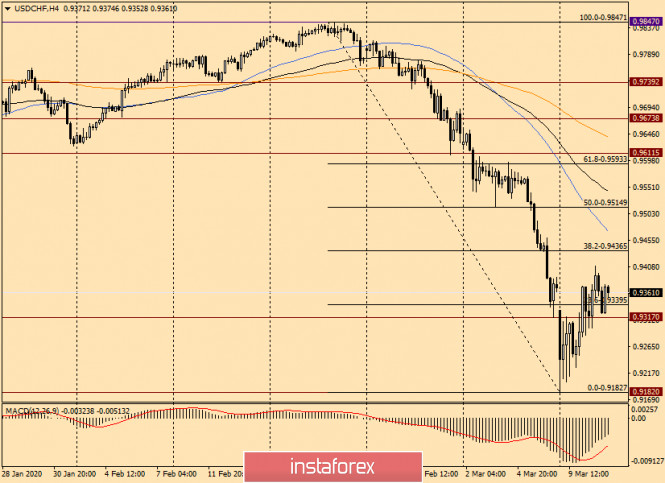

| Analysis and forecast for USD/CHF on March 11, 2020 Posted: 11 Mar 2020 04:17 AM PDT Hello, traders! The spread of coronavirus on our planet continues and has already covered about 100 countries. Against this background, the Swiss franc as a safe-haven currency has been in high demand over the past few weeks and has strengthened significantly against the US dollar. However, the US President's promises to present a plan to support the world's leading economy somewhat reassured market participants. In this regard, the US currency began to win back the losses suffered earlier, which must be recognized as very significant. Today, data on consumer prices in the United States will be published, but it is unknown whether they will have an impact on the price dynamics of the "American". Now investors have the topic of coronavirus in the foreground. One by one, the world's leading central banks are switching to ultra-soft monetary policy and urgently reducing their main interest rates. It is expected that at its March meeting, the Federal Reserve will again reduce the refinancing rate, but by 0.25%. Weekly

After a large-scale fall during the previous two weeks at the current five-day trading session, the bears tried to continue to put pressure on the pair. However, at 0.9183, the pair found strong support and started an active recovery. The White House's plan to save the national economy supports the demand for the US dollar. At the time of writing, the dollar/franc is trading above the minimum values of last week (0.9317) and has chances to continue the rise. However, much of the price dynamics of all dollar pairs will depend on news from the US about what real measures will be taken to combat the coronavirus. Technically, if USD/CHF continues to rise, its nearest target may be the Tenkan line of the Ichimoku indicator, which is located at 0.9515. Given the important psychological level of 0.9500, the pair may face serious resistance in this area. Naturally, this will only be possible if the bulls manage to raise the price to the area of 0.9500. At the moment, the current candle is definitely a reversal, but there is still enough time to change the picture before the end of the weekly trading. Daily

On the daily chart, I stretched the Fibonacci tool's grid by a drop of 0.9847-0.9183. As you can see, the pair has already passed the first pullback level of 23.6 and is ready to move to 38.2 and 50.0. It should be noted here that the Tenkan and Kijun lines are located directly on the indicated corrective Fibo levels, respectively. Thus, we can expect that after the rises to 0.9436 and 0.9515, the pair will meet strong resistance and be ready to return to the main downward dynamics. During today's trading, the bears tried to return the price to 23.6 Fibo, but at the end of the review, the pair rebounded from 0.9323 and is trading above the level of 23.6 near 0.9366. Judging by the picture that is observed on the daily timeframe, the main trading idea for USD/CHF is sales near the prices highlighted above. H4

The situation on the 4-hour chart, in principle, confirms the assumption of opening sales, only taking into account the finding of 50 simple and 89 exponential moving averages. The prices for opening short positions should be slightly adjusted. The next sales can be considered after the rise in the price area of 0.9436-0.9472. More attractive prices for opening short positions on USD/CHF should be looked for after the growth in the area of 0.9515-0.9547. I would like to draw your attention to the fact that it is better to wait for the confirmation signals of Japanese candles before opening positions. With this coronavirus, you don't know what to expect, and a dramatic change in the situation shouldn't surprise you. It is quite possible. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Forex market faces consequences of lower interest rates in the US. Dollar likely to fall further Posted: 11 Mar 2020 04:01 AM PDT

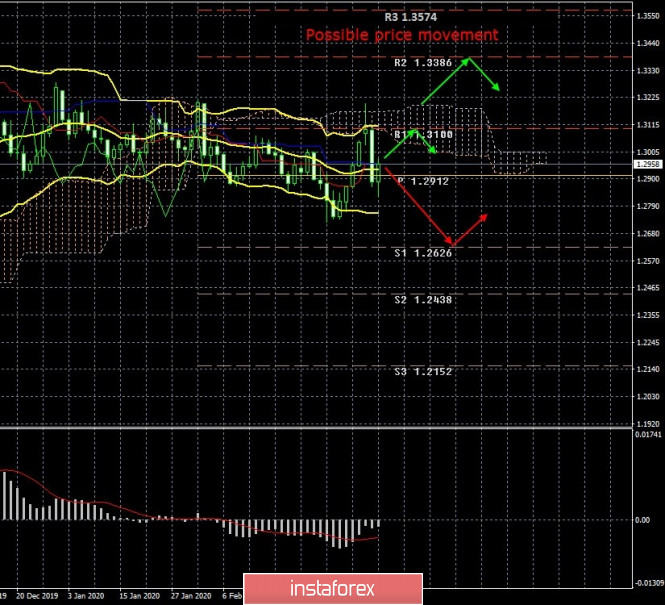

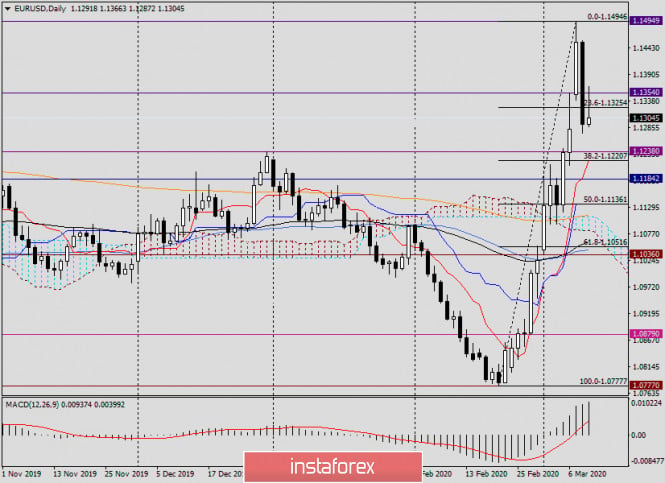

Bulls were less eager to buy the EUR/USD pair as the US Treasures had been sold off at the fastest rate over the past three years and the US stock indices increased by 5%. Risk appetite improved on hopes for coordinated monetary and fiscal stimuli by the world's central banks and national governments. The White House is planning to introduce a bill on the temporary reduction of payroll tax until December 31. Italy intends to extend support for those affected by the coronavirus to more than 10 billion euros. EU finance ministers consider a possibility of creating a 25 billion euros investment fund. Japan said that it is ready to use extra budget. Australia is expected to cut taxes and increase government spending. The EUR/USD pair has grown by 4% since February 20 and is likely to pull back. There are also fundamental reasons for that. The EU was hit by the coronavirus more compared to the US. The number of cases as well as the impact of the quarantine on the economy demonstrates that. At the same time, the dollar weakened against the euro because the US central bank has more space for cutting interest rates compared to the European regulator. The Fed's unexpected lowered the borrowing costs by 0.5% last Tuesday which fueled expectations that the bank would continue easing monetary policy.

The ECB's policy meeting is going to take place this week. The regulator is expected to announce monetary easing to combat the negative impact of the coronavirus epidemic. Because of the negative interest rates in the eurozone, the bank is likely to extend its quantitative easing program. These measures are not as painful for the suffering banking industry in the region as negative rates. According to technical analysis, the EUR/USD is likely to drop below 1.1300 in case of a corrective pullback. If the price breaks through the support levels of 1.1300 and 1.1280, bears can try to sell the pair. In the long term, the dollar is expected to fall as a result of the Fed's monetary easing and a decrease in demand for the US government bonds as their yield has plummeted in recent weeks. The markets expect the Fed to cut interest rates even further. According to the Bank of America, the regulator does not have any other choice under current circumstances. The prospect of interest rate cuts in the United States by another 50 basis points can prove the carry trade strategy viable in the next 1-2 months. The Bank of America says that the weaker dollar and the Fed's monetary stimuli can save the world economy and improve the situation in the developing markets. RBC Capital Markets expects the dollar to drop as well. The company increased its forecast for the EUR/USD pair for the end of 2020 to 1.20 from 1.10. According to experts at RBC Capital Markets, the value of the dollar is declining giving investors a reason to change their currency risk hedging strategies. The foreign exchange market starts facing consequences of lower interest rates in the US and future cash flows are likely to be more apparent. The material has been provided by InstaForex Company - www.instaforex.com |

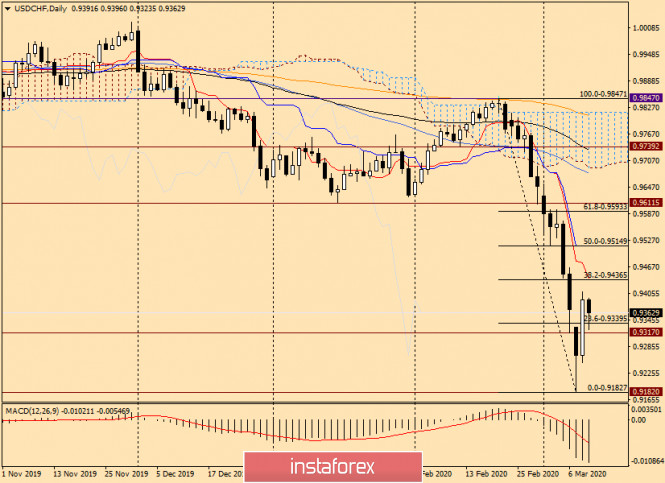

| Analysis and trading ideas for EUR/USD on March 11, 2020 Posted: 11 Mar 2020 03:04 AM PDT Hello, colleagues! Yesterday's trading for the main currency pair of the Forex market ended with a fairly decent decline. Even positive GDP reports for the 4th quarter did not help the single European currency. Despite the forecast value of 0.9%, the final data for the eurozone's GDP was 1%. Markets are much more concerned about the topic of coronavirus and fears that the epidemic could cause a global economic crisis comparable to what it was in 2008-2009. Judge for yourself, the tourist business is almost paralyzed and international airlines are missing a huge number of passengers. Football matches in Spain will be played without fans for at least two weeks. This also applies to international tournaments (the Champions League and the Europa League) whose revenues are not small. In general, the losses are very large-scale, but the coronavirus epidemic does not think to end. In order to protect its economy from the impact of the coronavirus, US President Donald Trump was going to announce a special package of measures. However, according to some sources, the plan is not yet fully ready and needs to work out many nuances. Nevertheless, investors were encouraged by the news of a special package of measures to combat the coronavirus. The growth was demonstrated by the stock and oil markets, and the US dollar received support, which yesterday strengthened across the entire spectrum of the market. The main macroeconomic event of today will be the publication of the US consumer price index. This is an important indicator that affects the level of inflation in the country. Although in the current situation, if inflation increases and stabilizes near the target level of 2%, it is unlikely that monetary policy will tighten. This is all the fault of the coronavirus epidemic, which forces the world's leading central banks to conduct a soft monetary policy to prevent negative economic consequences. Daily

If we turn to the technical picture for the euro/dollar pair, yesterday's decline at this stage is perceived as a correction to the growth of 1.0777-1.1494. At the auction on March 10, the pair fell slightly below the level of 23.6 from the indicated upward movement. Today, there are attempts to resume the rise and return trading above 23.6 Fibo, but this is still difficult. After rising to the level of 1.1366, the pair met strong resistance there and fell back down and now is trading around 1.1320. In general, it should be noted that the mark of 1.1360 is quite a strong technical level, which has repeatedly influenced the price movement of the euro/dollar pair. As we can see, the current situation is no exception. If the quote cannot return to the area of 1.1366 and continue to grow, it is possible to reduce to the next pullback level of 38.2, next to which the broken resistance level of 1.1238, as well as the Tenkan line of the Ichimoku indicator. In my opinion, it is possible to consider opening long positions here, and the confirmation will be the characteristic candlestick patterns on smaller time intervals. H1

This chart clearly shows that the pair has rolled back to the broken resistance line of the channel, which is still supporting the quote. The exponential moving average also keeps the pair from further falling. However, under the 89 EMA, one hourly candlestick has already closed, so it is not excluded that the price will drop to 1.1240-1.1220, where the broken resistance level is 1.1238, 38.2 Fibo from the growth of 1.0777-1.1494, as well as 200 exponential. As already suggested above, at the moment, the decline in EUR/USD is corrective, so the main trading idea, in my opinion, is to buy after the decline in the area of 1.1240-1.1220. If the euro/dollar resumes growth from current prices, breaks through 50 MA and fixes higher, on the rollback to 1.1371 (50 MA), you can try to buy, but for now, it is better with small goals. If a bearish candle or (candles) appears below 50 MA, you can try to sell it, but also short, with goals in the area of 1.1240/20. It is not yet known exactly what Trump's plan will be to protect the US economy from the coronavirus and how market participants will react to it. In this regard, the movement of the pair may not be completely predictable in any direction. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |