Forex analysis review |

- Fractal analysis of the main currency pairs for March 9

- GBP/USD. Trumps of the pound and the dollar's hopeless prospects

- Monthly EURUSD analysis

- Monthly USDJPY analysis

| Fractal analysis of the main currency pairs for March 9 Posted: 08 Mar 2020 07:09 PM PDT Forecast for March 9: Analytical review of currency pairs on the scale of H1:

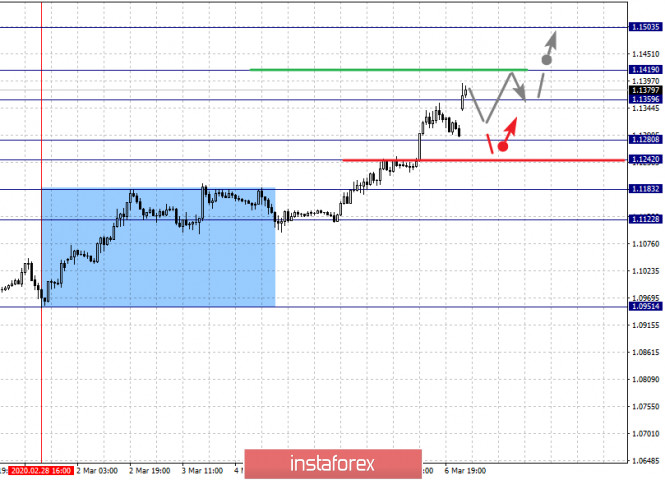

For the euro / dollar pair, the key levels on the H1 scale are: 1.1503, 1.1419, 1.1359, 1.1280, 1.1242, 1.1183 and 1.1122. Here, we are following the local upward cycle of February 28. Short-term upward movement is expected in the range of 1.1359 - 1.1419. The breakdown of the last value will lead to a pronounced movement. Here, the target is 1.1503. We expect a pullback to the bottom from this level. Short-term downward movement is expected in the range of 1.1280 - 1.1242. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1183. This level is a key support for the top. Its passage at the price will lead to the formation of initial conditions for the downward cycle. In this case, the goal is 1.1122. The main trend is the local upward cycle of February 28 Trading recommendations: Buy: 1.1360 Take profit: 1.1417 Buy: 1.1421 Take profit: 1.1503 Sell: 1.1280 Take profit: 1.1243 Sell: 1.1241 Take profit: 1.1184

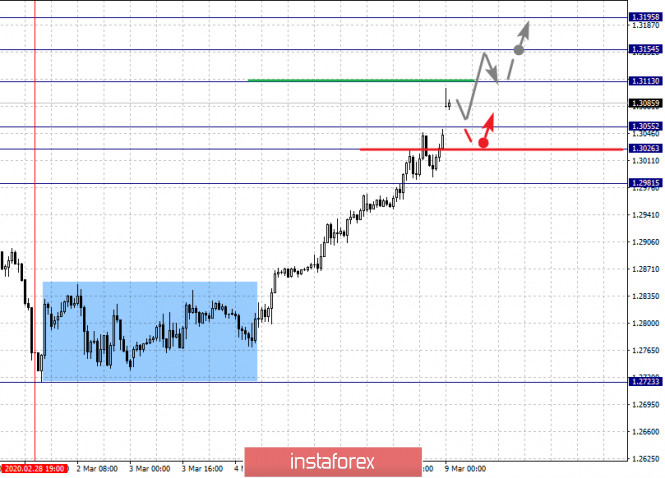

For the pound / dollar pair, the key levels on the H1 scale are: 1.3195, 1.3154, 1.3113, 1.3055, 1.3026 and 1.2981. Here, we are following the development of the ascending structure of February 28. The continuation of the movement to the top is expected after the breakdown of the level of 1.3113. In this case, the target is 1.3154. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.3195. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 1.3055 - 1.3026. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2981. This level is a key support for the top. The main trend is the upward cycle of February 28. Trading recommendations: Buy: 1.3113 Take profit: 1.3152 Buy: 1.3155 Take profit: 1.3193 Sell: 1.3055 Take profit: 1.3027 Sell: 1.3024 Take profit: 1.2981

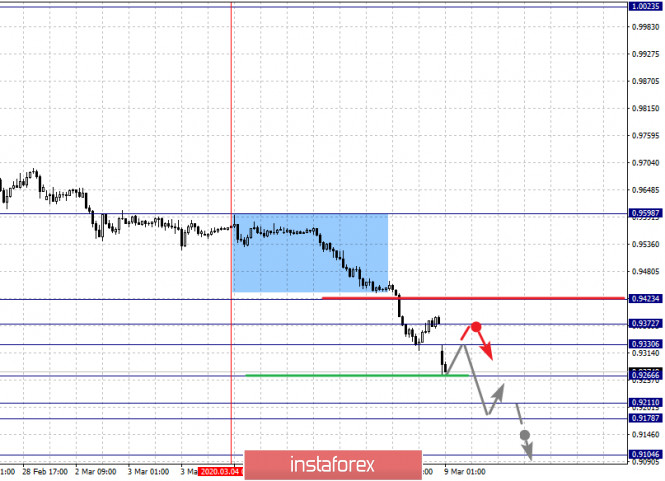

For the dollar / franc pair, the key levels on the H1 scale are: 0.9423, 0.9372, 0.9330, 0.9266, 0.9211, 0.9178 and 0.9104. Here, we are following the local descending structure of March 4. The continuation of movement to the bottom is expected after the breakdown of the level of 0.9266. In this case, the target is 0.9211. Price consolidation is in the range of 0.9211 - 0.9178. For the potential value for the bottom, we consider the level of 0.9104. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 0.9330 - 0.9372. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9423. This level is a key support for the downward structure. The main trend is the local descending structure of March 4 Trading recommendations: Buy : 0.9330 Take profit: 0.9371 Buy : 0.9373 Take profit: 0.9421 Sell: 0.9264 Take profit: 0.9211 Sell: 0.9177 Take profit: 0.9105

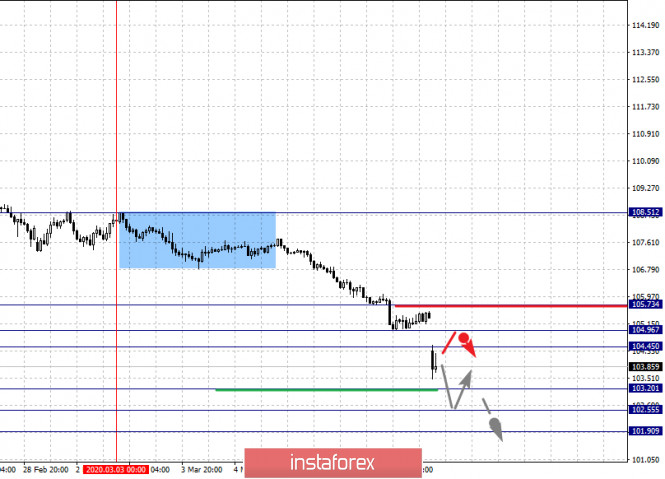

For the dollar / yen pair, the key levels on the scale are : 105.73, 104.96, 104.45, 103.20, 102.55 and 101.90. Here, we are following the development of the local descending structure of March 3. Short-term downward movement is expected in the range of 103.20 - 102.55. Hence, the high probability of a reversal to the top. The breakdown of the level of 102.55 will allow you to count on movement to a potential target of 101.90. Short-term upward movement is possibly in the range of 104.45 - 104.96. The breakdown of the latter value will lead to an in-depth correction. In this case, the target is 105.73. This level is a key support for the downward structure. Main trend: local descending structure of March 3 Trading recommendations: Buy: 104.45 Take profit: 104.95 Buy : 104.98 Take profit: 105.73 Sell: 103.20 Take profit: 102.57 Sell: 102.53 Take profit: 101.90

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3643, 1.3578, 1.3545, 1.3509 and 1.3438. Here, we are following the ascendant structure of March 3. At the moment, we expect a significant rollback to the correction. A short-term downward movement is possibly in the range of 1.3578 - 1.3545. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3509. This level is a key support for the correction zone. Its passage through the price will lead to a pronounced downward movement. Here, the potential target is 1.3438. For an upward movement, the breakdown of the level of 1.3643 should be accompanied by an unstable development of the trend until we consider further goals. The main trend is the upward structure of March 3 Trading recommendations: Buy: Take profit: Buy : Take profit: Sell: 1.3578 Take profit: 1.3545 Sell: 1.3543 Take profit: 1.3510

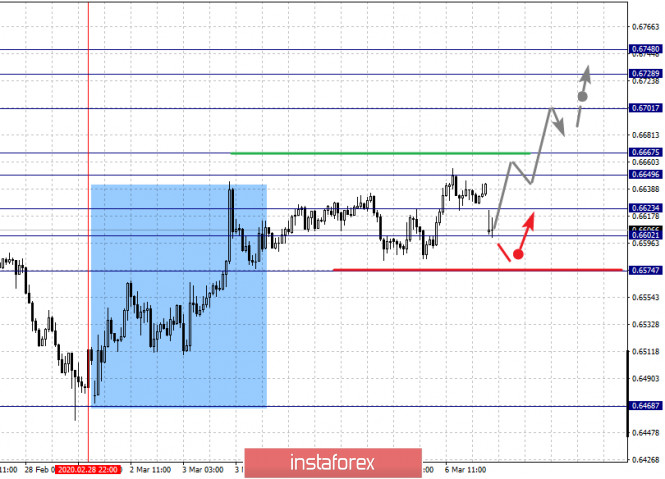

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6728, 0.6701, 0.6667, 0.6649, 0.6623, 0.6602 and 0.6574. Here, we are following the development of the upward cycle of February 28. Short-term upward movement is expected in the range of 0.6649 - 0.6667. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 0.6701. Price consolidation is near this level. For the potential value for the top, we consider the level of 0.6728. Upon reaching which, we expect a pullback to the bottom. Consolidated movement is possibly in the range of 0.6623 - 0.6602. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.6574. This level is a key support for the top. The main trend is the upward cycle of February 28 Trading recommendations: Buy: 0.6650 Take profit: 0.6665 Buy: 0.6668 Take profit: 0.6701 Sell : 0.6623 Take profit : 0.6604 Sell: 0.6601 Take profit: 0.6576

For the euro / yen pair, the key levels on the H1 scale are: 119.60, 119.31, 118.87, 118.51, 117.90, 117.37, 117.01 and 116.35. Here, we are following the descending structure of March 3. The continuation of the movement to the bottom is expected after the breakdown of the level of 117.90. In this case, the target is 117.37. Price consolidation is in the range of 117.37 - 117.01. For the potential value for the bottom, we consider the level of 116.35. Upon reaching which, we expect a pullback to the top. Short-term upward movement is possibly in the range of 118.51 - 118.87. The breakdown of the last value will lead to an in-depth correction. Here, the target is 119.31. The range of 119.31 - 119.60 is a key support for the downward structure. We expect the initial conditions for the upward cycle to be formed before it. The main trend is the descending structure of March 3 Trading recommendations: Buy: 118.51 Take profit: 118.87 Buy: 118.88 Take profit: 119.30 Sell: 117.90 Take profit: 117.38 Sell: 117.35 Take profit: 117.02

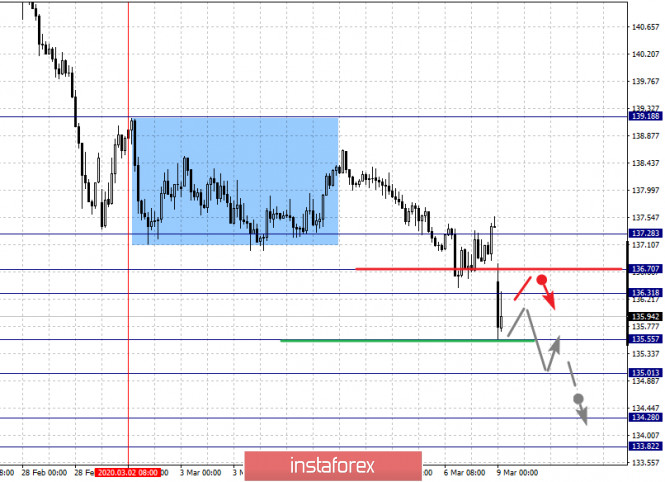

For the pound / yen pair, the key levels on the H1 scale are : 137.28, 136.70, 136.31, 135.55, 135.01, 134.28 and 133.82. Here, we are following the local descending structure of March 2. The continuation of movement to the bottom is expected after the breakdown of the level of 135.55. Here, the goal is 135.01. Price consolidation is near this level. The breakdown of the level of 135.00 will lead to a pronounced downward movement. Here, the goal is 134.28. For the potential value for the bottom, we consider the level of 133.82. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is possibly in the range of 136.31 - 136.70. The breakdown of the latter value will lead to the development of an in-depth correction. Here, the goal is 137.28. This level is a key support for the downward cycle. The main trend is the local descending structure of March 2 Trading recommendations: Buy: 136.31 Take profit: 136.70 Buy: 136.72 Take profit: 137.28 Sell: 135.55 Take profit: 135.01 Sell: 134.98 Take profit: 134.30 The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Trumps of the pound and the dollar's hopeless prospects Posted: 08 Mar 2020 03:47 PM PDT The pound ended the trading week on a major note: paired with the dollar, the pound was able to return to the area of the 30th figure, after falling to around 1.2725 at the end of February. Such dynamics is explained not only by the weakness of the US currency. The buyers of GBP/USD gave a rather positive assessment of the first results of the negotiation process between Brussels and London, although representatives of the parties announced serious disagreements that could not be overcome yet. Nevertheless, the negotiators also voiced encouraging theses - it was on them that the market focused its attention. In particular, the head of the European delegation Michel Barnier expressed confidence that they will be able to negotiate with the UK, despite the "very, very serious disagreements." He noted that the parties initially had completely different positions on key issues, so these differences in views were not a surprise to anyone. Nevertheless, he was optimistic about the prospects for negotiations. The market seized on this phrase, although it is actually unclear how the parties plan to find a common denominator. Barnier named four points on which there are serious differences. According to him, if no compromise is reached on these issues, an agreement is unlikely to be signed. First, it is about maintaining European standards that would guarantee equal trading opportunities. At the moment, London does not want to oblige itself to comply with these standards, and most importantly, it is opposed to the creation of appropriate mechanisms that could monitor the situation and record "unjustified commercial advantages". Secondly, the British refuse to recognize not only the jurisdiction of the European Court of Justice, but also the European Convention on Human Rights and the rules for the exchange of data. As Barnier noted, if the parties do not come to an understanding on this item, then further cooperation in this area will be "carried out in accordance with the norms of world law". Here you can also mention the contradictions in the field of law enforcement: we are talking about coordinated actions to combat terrorism, financial crime, organized crime and so on. Another contradiction is more fundamental. We are talking about the legal basis for future relationships. Britain plans to enter into several agreements – in every area where this is necessary. Brussels insists on signing a single, comprehensive agreement. In addition, the UK does not want to agree to common terms for both sides in the deal. And the last, fourth, disagreement is about fishing. London insists that fishing matters be discussed on a regular basis, that is, annually. On the contrary, Europeans want to include fishing in the structure of the general economic agreement. According to Barnier, the British position on the issue of fishing is "unacceptable". As you can see, the positions of the parties are still at different poles, and the first round of negotiations was inconclusive. But the market nevertheless "trusted" Barnier's optimism, which expressed confidence that Brussels and London would still come to a common opinion on all key issues. It is worth noting that last week, figuratively speaking, Brexit "did not prevent" the GBP/USD from growing, while the main driving force of the upward movement was the dollar, which swooped down on all fronts. Yesterday, the Federal Reserve Bank of New York significantly lowered its forecasts for US GDP growth in the first quarter of this year. While the previous estimate was at 2.15%, expectations have now dropped to 1.7%. Comments from Donald Trump's economic adviser, Larry Kudlow, also put pressure on greenback. According to him, certain sectors of the US economy will feel the "strong negative impact" of the epidemic, but it is "too early" to make decisions about supporting the economy with fiscal measures. At the same time, Trump himself is demanding that the Fed should hold another round of rate cuts. In this case, we can talk about a certain de-correlation. For example, if the head of the Bank of England (Andrew Bailey) insists on applying fiscal responses, the White House is trying to offset the impending threat with monetary policy. And the Fed seems to agree with this scenario. At least, the latest comments from the Fed representatives (Bullard, Kaplan) indicate a willingness to further soften monetary policy. While representatives of the BoE and the ECB are increasingly reminded that they are limited in their actions – in particular, Bailey allowed a rate cut to 0.1%, but at the same time excluded the option of reducing to a negative area. Thus, the pound is still in a winning position relative to the US currency. According to general market expectations, the Fed will lower the rate by another 25 basis points at the March meeting, and later, by another 25 basis points by the beginning of summer. In turn, the BoE can maintain a wait-and-see attitude on March 26, saving an arsenal of available actions for the future. Such a de-correlation provides support for GBP/USD, especially against the background of quite calm rhetoric of the Brexit negotiators. If this fundamental background for the dollar and the pound persists next week, the pair can test the next resistance level, which is located at 1.3105 - this is the lower boundary of the Kumo cloud on the daily chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Mar 2020 01:50 AM PST March has started strongly for EURUSD with bulls managing to recapture key short-term resistance levels and stopping the sequence of lower lows and lower highs. With February having a bullish reversal hammer candlestick pattern we are optimistic for EURUSD as long as price is above 1.1030.

EURUSD made a new low in February but the month ended near its highs. March is very strong as price has broken the latest high and combined with the fact that price is exiting a downward sloping wedge pattern we are optimistic for the rest of the month. The resistance trend line is at 1.1880. I believe over the next couple of months the chances of touching this trend line are high. Key support and trend change level is the monthly lows and previous resistance at 1.1030-1.10. As long as we trade above this level bulls are in control of the trend. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Mar 2020 01:45 AM PST USDJPY like the rest of the fx pairs has started March with weakening dollar. Price is well below February lows and is challenging important long-term support levels after being rejected at long-term resistance.

Green lines - resistance trend lines Yellow rectangle - long-term horizontal support USDJPY is most probably still in a correction phase relative to the big upward move that started back in 2011 and topped in 2015. Price retraced 50% of the move and bounced strongly to 118. Since then we see a choppy overlapping structure with a downward bias as price is unable to move above the green trend lines. Price is making lower highs and lower lows. But the lower lows have stopped three times in the 104.50 zone. This is the 4th time we test this support and I believe the chances of breaking below are now higher than any other time. This will most probably push price back towards the 50% retracement level and I believe it is more probable to test also the 61.8% which is the most important Fibonacci level. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment