Forex analysis review |

- Hot forecast and intraday trading signals for the GBP/USD pair on May 27. COT report. Bears need to return to 1.2260, where

- Hot forecast and trading signals for the EUR/USD pair on May 27. COT report. Bulls need to overcome 1.0990-1.1006, otherwise

- Overview of the GBP/USD pair. May 27. Is the second wave of the "coronavirus" epidemic starting in the United States? Americans

- Overview of the EUR/USD pair. May 27. According to the "Merkel-Macron plan", the poorest countries of the European Union

- Three factors that could boost pound volatility in June

- EUR/USD. Bulls are hungry: China faded into the background, euro grows on Sassoli's statement

- Comprehensive analysis of movement options for #USDX vs Gold & Platinum & Silver (Daily) in May-June 2020

- May 26, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Overview of NZD/USD and AUD/USD for May 26, 2020

- May 26, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Evening review on EUR/USD for May 26, 2020

- GBPUSD and EURUSD: The pound soared after news that the EU may soften its position in the Brexit negotiations. The euro is

- GBP/USD: plan for the American session on May 26 (analysis of morning deals). The negative was replaced by optimism. The

- EUR/USD: plan for the American session on May 26 (analysis of morning deals). The EU can make concessions to the UK. The

- Technical analysis of USDJPY

- USDCAD breaking down a descending triangle

- BTC analysis for May 26,.2020 - Bearish flag on the 4H time-frame. Watch for downside towards the $8.160

- Weekly analysis of Gold

- Analysis of Gold for May 26,.2020 - First downside target at $1.721 has been reached. Second target is set at $1.715

- Trading recommendations for EUR/USD on May 26, 2020

- EUR/USD analysis for May 26, 2020 - First target at the price of 1.0945 has been reached. Next upward target is set at 1.0005

- Trading plan for GBP/USD for May 26, 2020

- Oil is gaining momentum

- Trading plan for Gold for May 26, 2020

- EUR / USD: Euro awaits news from Brussels

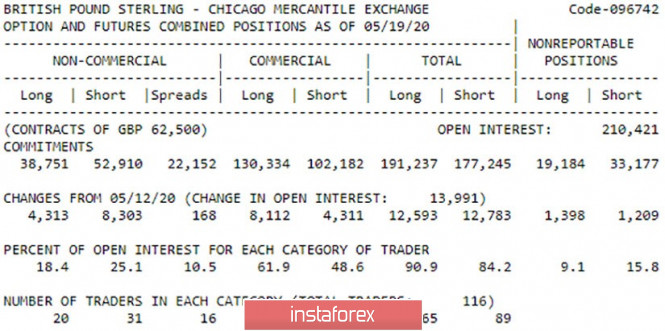

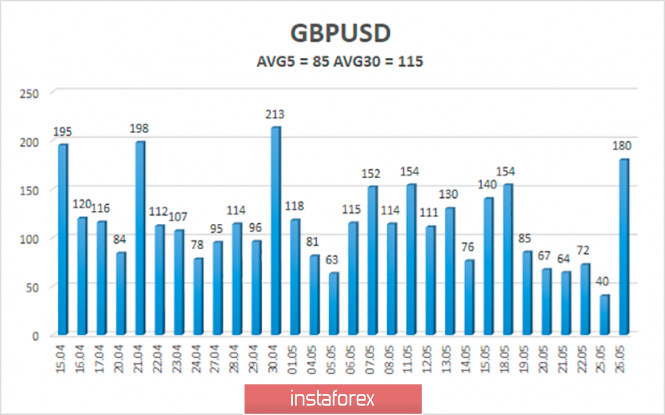

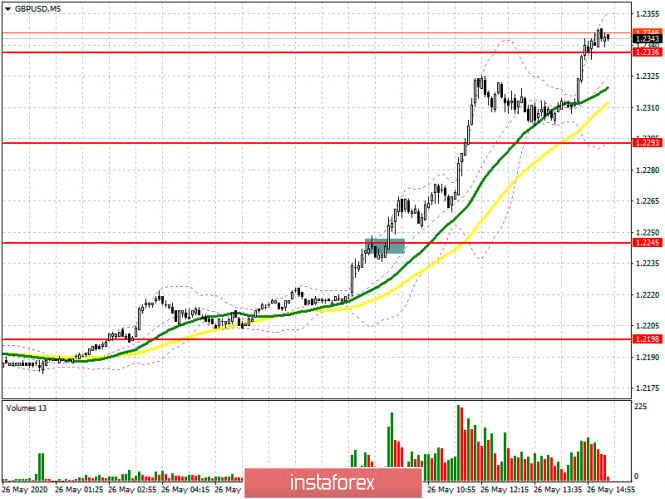

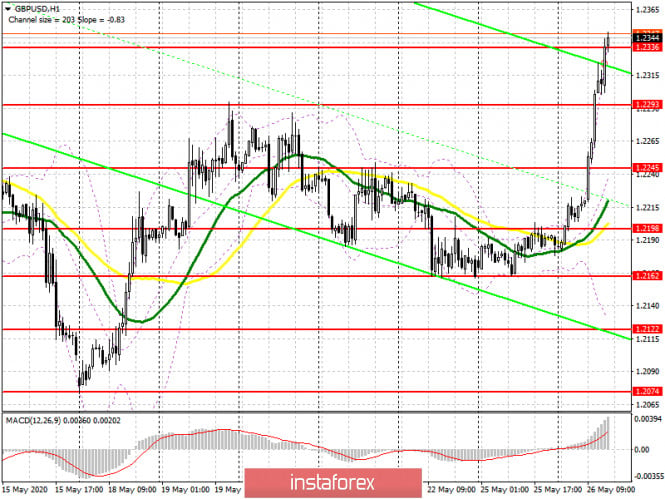

| Posted: 26 May 2020 06:13 PM PDT GBP/USD 1H The pound/dollar pair also made an impressive jump on Tuesday, so the US currency fell against two major European currencies. However, we do not believe that buyers have completely seized the initiative and are now ready to form an upward trend. From our point of view, the overall fundamental background remains negative for the pair, so it will be extremely difficult for the pound to show growth in the medium term. Nevertheless, technical factors are now speaking in favor of continuing the upward movement, possibly after a round of downward correction. Thus, buyers can lower the pair to three important levels of 1.2259, 1.2270 and 1.2280 at once, around which they can start buying the pound with renewed vigor. Consequently, a price rebound of this area will trigger new purchases and growth. We believe that it is more likely to overcome the 1.2259-1.2280 area with a further resumption of the downward trend. GBP/USD 15M Both linear regression channels are directed upwards on the 15-minute timeframe, signaling a strong position of buyers in the last trading day. At the same time, the GBP/USD pair has pinned itself below the moving average line on this chart, which is the first signal for a possible correction. After yesterday's strong growth, correction is the most likely scenario. COT Report The latest COT report for May 19 shows that the total number of buy and sell transactions among large traders per week increased by 29,000, and in equal proportions. Thus, large traders began to more actively trade the pound. And at the beginning of the current trading week, this became noticeable by the increased volatility of the pair. During the reporting week, professional traders continued to actively sell the British currency (+8303 sales contracts) and they were much less active in acquiring purchase contracts (+4313 in total). Thus, from our point of view, the mood for the GBP / USD pair remains more downward. It is on the basis of this conclusion that we expect the resumption of sales of the British currency. The fundamental background for the British pound remains negative. In the early days of this week, no important events are planned in either the US or the UK, which buyers used. The fact is that it is very difficult to buy the pound when the macroeconomic background is present. And besides the macroeconomics there is also a general fundamental background, which continues to put pressure on the British currency. Buyers do not want to deal with medium-term and long-term transactions, since it is completely unclear what awaits the UK economy in the third and fourth quarter of this year, not to mention the longer term. Thus, the growth potential of the pound is already limited due to Brexit and the so far failed negotiations with the EU. In the coming months, we recall that the Bank of England may lower its key rate in the negative zone and expand the program of quantitative easing, which will be another reason for traders to sell the pound/dollar. We have two main options for the development of the event on May 27: 1) The initiative for the pound dollar pair fell into the hands of the bulls, as they crossed the important Kijun-sen and Senkou Span B lines. Thus, purchases of the British pound are relevant now, but a new signal is needed to open deals. Such a signal may be a price rebound from the area of 1.2259-1.2280 after a downward correction. Take profit will be about 110 points in this case. 2) Sellers temporarily lost their positions, but will be ready to join the game below the 1.2259-1.2280 area. If the pair below this area is consolidated, we recommend selling while aiming for the support area of 1.2196-1.2216, as well as the May 18 low at 1.2073. In this case, Take profit will amount to about 40 to 180 points. The material has been provided by InstaForex Company - www.instaforex.com |

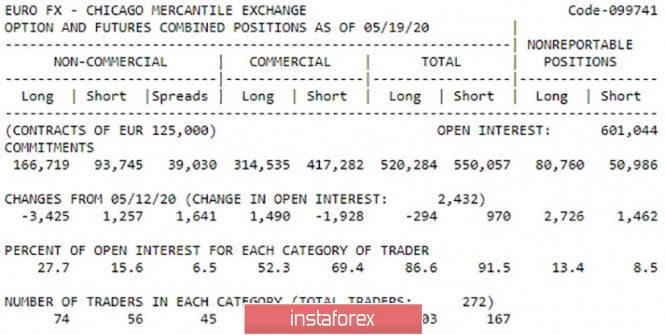

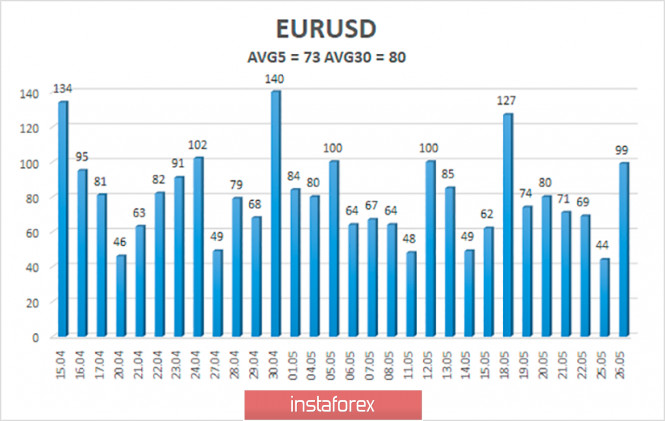

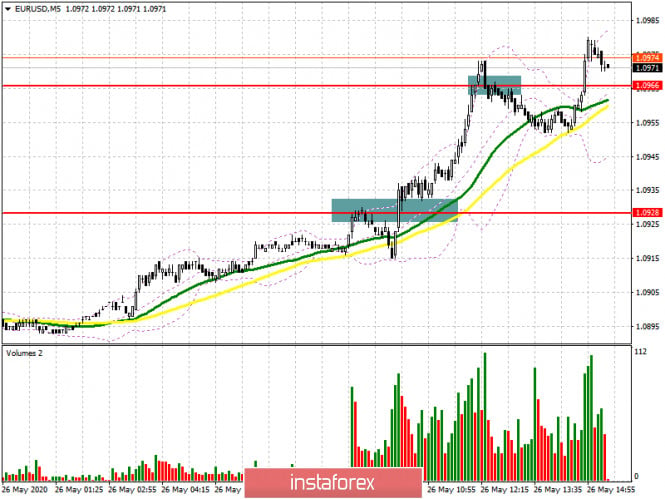

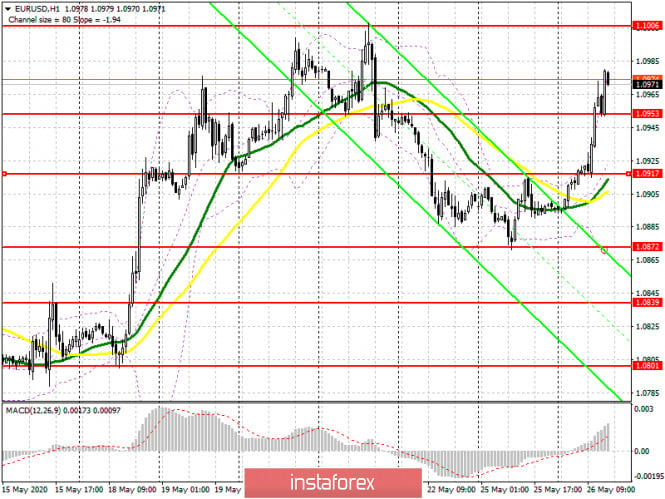

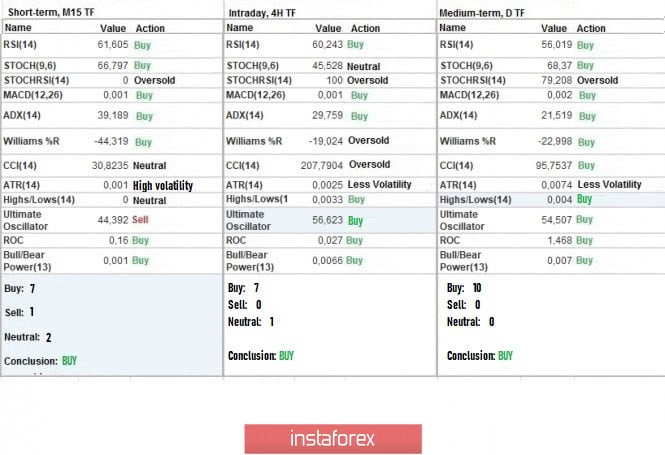

| Posted: 26 May 2020 05:52 PM PDT EUR/USD 1H EUR/USD unexpectedly showed an upward movement on the hourly timeframe during the second trading day of the week. Recall that a few days ago, buyers once again failed to overcome the upper limit of the side channel 1.0750-1.1000, from which the price successfully rebounded and began to move down. However, the bears did not "turn" below the Senkou Span B line and the support area of 1.0880-1.0893, thus providing a new chance for the bulls, which they successfully used. As a result, yesterday the euro/dollar pair returned to the April 19 high at 1.0990, worked it out and, as of the current moment, rebounded from it. Thus, sellers run the risk of losing the initiative again, which sellers will have to use to start a new downward movement, at least in the area of the Senkou Span B. line. We believe that this option is still the main and most likely one. However, there is a backup option, providing for the pair's growth. However, for this, the bulls still need to overcome the area of 1.0990-1.1006. EUR/USD 15M We see how buyers completely dominate the market on the 15-minute timeframe in the last trading day. Both channels of linear regression are directed upward, clearly indicating an upward trend. At the time of writing, there are not even signs of any channel turning down. However, everything, as before, depends on the area of the psychological level of 1,1000, from which the pair is likely to rebound again. COT Report The latest COT report of May 19 showed that large traders who trade for the purpose of earning exchange rate profit, and not for hedging and conducting current activities, continued to reduce euro purchases in the reporting week and increased sales. The growth of the latter was small, only 1257 contracts, but in aggregate with -3425 contracts for sale, we have a serious deterioration in the mood of traders regarding the euro. The total number of purchase contracts also decreased by 294 units, and the number of Short-deals increased by 970 units. Thus, we see that the mood of traders remains bearish and only intensifies. However, the beginning of the new week shows that the US dollar was not able to extract dividends from this, and trading continues to be held according to the "technical scenario". The fundamental background for the pair at this time remains neutral. Neither the euro nor the dollar are now taking advantage of the foreign exchange market. Of course, this does not mean that the pair will now trade in the 1.0750-1.1000 range until the crisis ends or something extraordinary happens. However, the current foundation does not make it possible to guess where the steam can go further. The adoption of the next package of stimulating the eurozone economy is the key issue in the European Union. But since the EU is not the United States, where everything depends on Congress, that is, on whether the Democrats and Republicans agree among themselves, there are problems with adopting this package. The euro is not yet experiencing market pressure in connection with this. Nevertheless, in the long run, this may lead to higher growth rates in the fall of the European economy. The topics of interest in the United States at this time are much larger and all of them are also long-term. Today we recommend that you pay attention to the speech of the European Central Bank President Christine Lagarde. Based on the foregoing, we have two trading ideas for May 27: 1) It is possible for the pair to grow further if the range of levels 1.0990 and 1.1006 is overcome. In total, these two levels form a strong area of resistance, which buyers are not yet able to overcome. However, it is not necessary to completely put an end to the possibilities of the bulls. Overcoming this area and buying will become relevant with the goal of 1.1111 - the second level of resistance. Potential to take profit in this case will be about 130 points. 2) The second option - bearish - as usual, is more likely. You are advised to sell the EUR/USD pair again, since a rebound from the 1.0990 level has already been completed. So the pair has already begun to fall to the Kijun-sen line (1.0939) and the Senkou Span B line (1.0887). Potential to take profit is 35 and 80 points. Given the average volatility of the pair, these profit indicators are quite good. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2020 05:16 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - up. CCI: 205.5926 The British pound rose sharply against the US currency on the second trading day of the week. At the same time, as in the case of the euro currency, it is difficult for us to say what caused this behavior of market participants. Given the fact that both the euro and the pound have risen in price synchronously, you need to look for reasons either in the US or not to look for them at all. We remind you that the foreign exchange market has a fairly large number of major players, international companies, syndicates, conglomerates, banks, central banks, investment banks, and so on. Any participant can buy or sell a large amount of dollars or other currency at any time, which will lead to a sharp skew in supply and demand for a particular currency. Thus, it could well be that today one or more major traders sold an impressive amount of dollars on the foreign exchange market, which led to its fall. We do not see any fundamental or macroeconomic reasons for the collapse of the US currency on Tuesday. And since there were no reasons for the sharp fall of the dollar, its growth may resume tomorrow. While the British pound sharply and unexpectedly resumed its upward movement against the US dollar, disappointing news about the "coronavirus" epidemic is beginning to arrive from the United States. Recall that according to the latest data, 1.663 million cases of the "Chinese virus" were recorded in America. Almost 100,000 deaths from the pandemic have also been recorded. President Donald Trump attributes such high morbidity and mortality rates to the large number of tests performed, "far more than in any other country in the world". However, we have already written that if we calculate the relative indicator "the number of tests performed per 1000 population", then the United States is not even in the top five. But, on the other hand, such high numbers are also explained by a much larger population in the United States than in many other countries of the world. However, many media outlets still believe that the Trump administration is to blame for the virus spreading so much across the country. And Trump blames WHO and China. However, America began to slowly relax the quarantine measures and all this led to the fact that on May 25, on Memorial Day, thousands of Americans rushed to the seas and lakes, without observing measures of social distance and without wearing masks. The Internet is flooded with photos from beaches that are literally teeming with people. It is reported that in some cities and states, the influx of people to beaches was so great that parking lots could not cope with it. According to Johns Hopkins University, the curve of the rate of growth of the disease in the United States is not slowing down, which means that the virus is spreading at the same rate, unlike, for example, in the European Union, where the "curves" begin to indicate a serious decline in the epidemic. Thus, the removal of quarantine measures or their easing in Europe is indeed justified, but not in the US. However, Donald Trump is eager to restart the country's economy in order to increase his chances of re-election in November. He is even willing to sacrifice Americans to achieve the goal. At the same time, it is not clear that the US leader himself adhered to at least some quarantine measures. No one has ever seen the US President in a mask, and as part of the election campaign, the President intends to hold thousands of rallies in many states of the country. Thus, we believe that America is the first candidate to receive the second wave of the epidemic. Meanwhile, China is going to use the current deterioration in relations with Washington to its advantage. Chinese President Xi Jinping, during the third session of the 13th convocation of the National Political Advisory Council of China, said that the country will begin to gradually reorient from economic growth through exports to the development of domestic markets. "We believe that it is domestic demand that should guarantee long-term and strong economic growth in China. We are actively developing the internal consumer system, as well as actively working on innovations in science and technology," he said. Some experts believe that China is preparing not only to break ties with the United States, but also with the entire West. An extremely small amount of fundamental information is still coming from the UK. The topic of Brexit and the Brussels-London negotiations has frankly stalled, although time is running out, on July 1, the countries will have to officially declare a decision on the "transition period" and, most likely, it will not be extended after December 31, 2020. However, negotiations have stalled, and London is frankly not eager to reach a consensus and sign an agreement. Thus, we believe that the government of Boris Johnson is ready for the fact that there will be no deal with the European Union or is openly bluffing, trying to force the Alliance to make concessions. Whether this is true or not, we will find out before the end of this year. We still fear for the British economy, which continues to suffer from the very fact of Brexit, and from the crisis caused by the pandemic, and next year may also start to suffer due to the lack of trade deals with the European Union and the United States. Yes, it is with the US. Just a few months ago, Donald Trump promised the British a "huge and profitable" trade agreement that would "undoubtedly bring the two nations closer together". We, however, even at the time of such speeches by the American President, believed that Trump meant "a favorable agreement for the United States". However, now that the COVID-2019 epidemic is raging in the world, negotiations are also put on pause, and Donald Trump himself may leave his post at the beginning of 2021. Thus, it is highly likely that Boris Johnson's team will negotiate with another US President. At the same time, the UK is preparing to completely abandon the use of equipment from the Chinese company Huawei in British 5G networks. Earlier, Boris Johnson has already denied the Chinese company access to the most important, key and vulnerable 5G nodes. Members of the Conservative Party of Great Britain consider the issue of Huawei's participation in the establishment of 5G a matter of national security. According to media reports, this decision was made by Johnson not without the influence of his friend Donald Trump, who previously imposed sanctions against Huawei, believing that the company cooperates with the Chinese intelligence services and harms the United States.

The average volatility of the GBP/USD pair has increased due to yesterday and is now 85 points. However, this is still a low indicator value. On Wednesday, May 27, we expect movement within the channel limited by the levels of 1.2245 and 1.2415. A reversal of the Heiken Ashi indicator downwards will indicate the beginning of a downward correction and a possible resumption of the downward trend. Fixing the price below the moving average will confirm some randomness of yesterday's growth of the pound. Nearest support levels: S1 – 1.2329 S2 – 1.2268 S3 – 1.2207 Nearest resistance levels: R1 – 1.2390 R2 – 1.2451 R3 – 1.2512 Trading recommendations: The GBP/USD pair on the 4-hour timeframe was fixed back above the moving average, so the trend changed again to an upward one. Thus, it is now recommended to trade the pound/dollar pair for an increase with the goals of 1.2390 and 1.2415, before the Heiken Ashi indicator turns down. However, from our point of view, there is a high probability of a downward turn in the near future. It is recommended to sell the pound/dollar pair when the bears manage to return to the area below the moving average, with goals of 1.2207 and 1.2146. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2020 05:16 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 104.6616 The EUR/USD currency pair spent the second trading day of the week in a strong upward movement and returned to the upper border of the side channel of 1.0750-1.1000. At the same time, it is quite difficult to find any good and unambiguous reasons for such a strengthening of the euro currency. No macroeconomic statistics were published yesterday, and there were no speeches by top officials of the European Union or the United States. Thus, the pair's quotes just returned to the Murray level of "4/8"-1.0986 and now can rebound again from it or from the level of 1.1000, starting a new round of downward movement to the lower border of the channel of 1.0750. Since the euro/dollar pair remains within this channel, we believe that the most likely development of events will be a new decline. However, do not forget that you cannot be 100% sure of anything in the Forex market. You always need to be safe and have a backup plan. If traders confidently overcome the area of 1.0986-1.1008, this may trigger the formation of a new upward trend. There is little fundamental support for the euro currency at the moment, but the same can be said for the US dollar. Thus, the foundation and macroeconomics are not a hindrance to the growth of the euro currency. Not so long ago, we wrote that France and Germany, in the faces of Angela Merkel and Emmanuel Macron, seems to propose a plan that will help the Eurozone to overcome the crisis caused by the pandemic. However, almost immediately it became clear that not all EU countries support such a scenario, and it seems that no one asked the smallest countries if they supported the German-French proposal. Anyway, after the idea with the "coronabonds" failed, and the European Council failed to agree on the sources of funding for the 2-trillion program of assistance to the European economy, the sacramental question arose: "What should we do?" If the European economy does not continue to pour money, the decline may continue at the same pace, and the recovery will be delayed for many years. It would seem that the solution to this issue would be the proposal to create a 500-billion recovery fund, which will be financed by the EU countries themselves, after which these funds will be divided among the most affected countries and sectors of the economy in the form of grants. However, it is not difficult to guess that Germany, which initially did not want to help the southern countries, accusing them of excessive spending and not being able to save money, would hardly have proposed such a plan, which implies the loss of serious financial resources. Germany itself coped with the "coronavirus" pandemic with relatively small losses, human and financial. Well, France, which has suffered from the "coronavirus" very much along with Italy and Spain, requires itself a serious cash injection from the European government. Thus, according to the plan of Merkel and Macron, the funds will be collected according to the size of the economies of each member country of the Alliance and divided among the most affected industries. It is easy to guess that the countries with the largest economies have suffered the most (with the exception of the "Northern" countries). Thus, in simple terms, the poorest EU countries will have to pay for the restoration of the most important and significant sectors of the economies of the countries most affected by the epidemic, that is, large and rich countries. This is the conclusion reached by the Center for European Economic Research. France, Spain, Greece, Portugal, and Italy can receive the most money from the fund, and they will not need to be returned. Spain and Italy have already announced that they will receive funds only on a free basis. And Austria, the Netherlands, Finland, and some other countries generally opposed the "Merkel-Macron plan". So, first of all, it is not obvious that anything will come out of this proposal at all, and secondly, discussions of this proposal among representatives of all countries have not even begun yet. Accordingly, the fate of the next ambiguous package of assistance to the European economy will be decided only in June, and a decision on it may not be made until July. While the European currency unexpectedly jumped up, the fundamental background for the euro/dollar pair remains essentially neutral. Yes, there are a huge number of important topics that can have a huge impact on the world economy, on the American and European economies. However, these are "long-term" topics that can have a negative impact on a particular currency, approximately like Brexit on the pound, that is, for many years. For example, if the EU countries fail to come to a common denominator in terms of saving the economy, the recovery will be much longer, which will negatively affect the euro, unless a similar picture is observed in the United States. And overseas are preparing to "cold war" with China, although many experts believe that Washington now has no resources to impose sanctions and duties against Beijing, will not be able to resist the retaliatory measures of the Celestial Empire, and therefore bluff openly, declaring its readiness to introduce a huge list various restriction. Experts believe that the "coronavirus" has crippled the US economy, which will recover hard and long without a new confrontation with China. Moreover, the question is open with Donald Trump and his further tenure as US President. After all, in January 2021, he can leave his post, and the new president can adhere to a completely different foreign policy. For example, Joe Biden is on friendly terms with China and will certainly try to establish relations with it. ECB President Christine Lagarde and Vice-President Luis de Guindos are scheduled to speak in the European Union on Wednesday, May 27. We do not believe that their statements can surprise the markets in any way, although everything will depend on what the two economists say. Christine Lagarde can just touch on the topic of stimulating the European economy, the "Merkel-Macron plan", and once again call on the European Commission to help businesses and employees. No important macroeconomic publications are planned for this day, either in the European Union or the United States.

The average volatility of the euro/dollar currency pair as of May 27 is 73 points. Thus, the value of the indicator is characterized at this time as "average". Today, we expect the pair to move between the levels of 1.0910 and 1.1056. The reversal of the Heiken Ashi indicator downwards signals a very likely resumption of the downward movement to the lower border of the side channel of 1.0750-1.1000. Nearest support levels: S1 – 1.0925 S2 – 1.0864 S3 – 1.0803 Nearest resistance levels: R1 – 1.0986 R2 – 1.1047 R3 – 1.1108 Trading recommendations: The EUR/USD pair made another round of upward movement within the side channel and again stopped near its upper border. Formally, buy orders are currently relevant since the price is located above the moving average. However, we do not recommend opening buy positions until the area of 1.0986-1.1008 is successfully overcome. It is recommended to return to selling the pair if the price reverts below the moving average line with the goals of 1.0864 and 1.0803. The material has been provided by InstaForex Company - www.instaforex.com |

| Three factors that could boost pound volatility in June Posted: 26 May 2020 12:30 PM PDT The pound significantly strengthened against the dollar and the euro on Tuesday. The British currency has gone above $1.23 for the first time in 13 days, which is primarily due to the general decline in the US dollar, which suffered from a risk appetite. Reuters added positive news to the sterling as it reported that the European Union was ready to change its position on fisheries in negotiations on the UK's future relations with the bloc. GBP/USD As for speculation about the possible introduction of negative interest rates in Britain, which Bank of England Governor Andrew Bailey implanted last week, here everything is as clear as it might seem at first glance. On Tuesday, BoE Chief Economist Andy Haldane made it clear that the regulator didn't even come close to deciding to switch to negative rates. While everything is at the level of conversation. The central bank will have to assess what the consequences of negative rates will be for British banks and lenders who will experience pressure on margins. It is also important how such a step will affect confidence in the economy. In addition, a number of recent economic data turned out to be slightly better than the economic development scenario provided for by the regulator. The pound was relieved, but the euphoria was unlikely to last long. Tomorrow will be a new day, although the sterling has already begun to lose the benefits it earned during the day against the dollar in the evening. Ahead of the sterling is a turbulent June, which may be the most volatile of all time after voting for Brexit. What does the pound prepare for June? The pound may finish the fall for the fourth straight month. Sterling lost 1.5% against the dollar in May. Meanwhile, the growing list of risks suggests that a lull typical of June should not be expected. In the first summer month, the pound traders seem to face increased uncertainty in several directions at once. This is the end of the Brexit transition period extension, the possible introduction of negative rates in the country and the expected exit of the economy from quarantine. Uncertainty is known to increase volatility. Britain and the EU do not have much time to conclude a new trade deal. What the parties have today, namely nothing, will not allow them even to come close to concluding a deal. The only way out is to once again extend the transition period. Here, too, the deadlines are tightened, the decision must be announced before June 30. Negotiations on this issue will resume on June 1. Unwillingness to extend the transition period will cause the pound to be volatile, however, as well as the prospect of any extension of Britain's exit from the EU. At the same time, we will no longer see the highest observed during the peak of panic around the pandemic in March. Pound fluctuations may increase as the BoE meeting approaches on June 18. Financial markets were quick to put in quotes the prospect of introducing negative interest rates by the end of the year. Bailey's recent comments on this have led UK bond yields to a record low, below 0%. There is an opinion in the market that negative rates will not help the economy; a more powerful set of measures is needed. Therefore, the central bank may increase the purchase of assets in addition to state budget incentives. If Britain nevertheless becomes the next largest country with negative rates, the pound may face pressure from options, where a change in risk suggests that the mood of traders is less bearish compared to the spot market. Risk reversal, a barometer of market positioning, indicates that the overall risks of a decline in the British currency still prevail. Published macroeconomic reports show the depth of damage caused by COVID-19. Investors will closely monitor the UK exit from quarantine, as well as the impact of easing restrictions on the rate of spread of coronavirus in the country. This topic will also not leave the pound indifferent, but Brexit news will nevertheless come to the fore. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Bulls are hungry: China faded into the background, euro grows on Sassoli's statement Posted: 26 May 2020 12:29 PM PDT After some hesitation, the euro-dollar pair jumped, breaking more than 100 points in just a few hours. In fact, the bulls won back last week's losses, when the price fell to the seventh figure. However, the downward impulse was expected to fade - sellers in May already tested the support level of 1.0790 several times, but could not gain a foothold below. And the last attempt also turned out to be a failure - buyers quickly seized the initiative, and only a surge of anti-risk sentiment prevented them from settling in the 10th figure. Traders were careful both with purchases and sales at the beginning of this week. Firstly, Monday's economic calendar was virtually empty, and secondly, the United States celebrated Memorial Day, so the US trading floors were closed. Today, market participants returned to the machines after a long weekend and reacted to the events of the past days. As it turned out, these events were not in favor of the dollar. First, the overall anti-risk sentiment in the foreign exchange market has declined, despite the ongoing political conflict between the US and China. The notorious Hong Kong issue has become another "bone of contention" between the two superpowers. Chinese parliament members are likely to review and pre-approve the Hong Kong National Security Bill before Thursday, which will strengthen the influence of mainland China in this administrative unit. Washington in response has already threatened Beijing with another package of sanctions, but, most likely, Xi Jinping will be unshakable in this matter. Nevertheless, the demand for protective assets, and especially for the dollar, has declined significantly. In my opinion, this is due to several reasons. First, Trump, in his recent speeches, has vaguely commented on the Chinese theme, focusing mainly on criticism of Joe Biden. This is probably due to the fact that the Democratic leader is confidently ahead of him in the national rating (and even increases the gap). Whatever it was, but so far the head of the White House prefers not to focus on the Hong Kong issue. Secondly, according to most experts, the political conflict will not prevent countries from fulfilling the terms of a trade deal concluded at the end of last year. Further negotiations, of course, are still in question - it's hard to imagine that under the current conditions the parties will begin to discuss the second stage of the agreement. But on the other hand, even before the coronavirus crisis, many were confident that the country would conclude the next deal after the US presidential election. Therefore, the fate of the second part of the agreement does not yet concern the market participants. The decline in anti-risk sentiment was also helped by news from the coronavirus front. According to the latest data, the number of new pandemic victims in the world is declining. Over the past 24 hours, 1,200 people have died from COVID-19 - this is the lowest rate in recent years. Previously, this sad indicator did not fall below three thousand a day (the day before, the number of victims was 3,000, on May 24 - 4,000). In addition, many European countries have begun to relax quarantine measures in recent weeks - some states in the United States do the same. From July 1, Spain is ready to accept foreign tourists. In anticipation of summer vacations, the German government also plans to lift the travel ban in more than 30 European countries. In particular, from June 15, German citizens will be able to re-visit the EU states, as well as Switzerland, Liechtenstein, Norway and the UK. In addition to the widespread weakening of quarantine, pharmaceutical companies continue to declare successes in the issue of creating a vaccine - in fact, now the only question is who will be the first to come to the finish line. In other words, the current fundamental background allows traders to show increased interest in risky assets - including the euro. Indeed, in addition to the vulnerability of the dollar, the pair is growing due to the "independent" strengthening of the single currency. Let me remind you that last week Berlin and Paris proposed creating a fund for the restoration of the European economy with a total volume of 500 billion euros. This idea was perceived differently in Europe: for example, the countries of the south (in particular Spain, Italy, Greece) supported this initiative. Brussels (in particular the head of the European Commission, the head of the European Parliament) and the chairman of the ECB also expressed their support. The main opponent of Merkel in this matter was Austria. In Vienna, they stated that they did not support the idea of Germany and France, therefore, together with three other EU countries (Denmark, the Netherlands and Sweden), they prepared an alternative proposal involving the issuance of loans instead of subsidies. But, apparently, this initiative will not be supported by the European community. In particular, today President of the European Parliament David Sassoli criticized the "thrifty" countries. He said that now "is not the time for hard thinking, but for reconstruction", adding that "otherwise we will find ourselves in Europe moving at different speeds." This is a rather clear signal to the opposition, because, in addition to Sassoli, the Merkel plan is supported by the main political players in Europe. All this suggests that political heavyweights will be able to convince representatives of Austria, Denmark, the Netherlands and Sweden to support the German-French initiative. However, despite the fundamental background favorable for the euro, it is not worth rushing to make purchases. The pair has now approached the borders of the 10th figure, and here buyers need an informational push to overcome the resistance level of 1.1010 (the upper line of the BB indicator on the daily chart). Without informational support, the pair could retreat to the bottom of the ninth figure. Therefore, to confirm the upward medium-term trend, the bulls need to gain a foothold above 1.1010, which will allow them to rise to the next resistance level of 1.1070 (the upper border of the Kumo cloud is on the same timeframe). Accordingly, long positions are relevant after passing the above price barrier. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2020 09:57 AM PDT Minuette operational scale (H4) Our precious metals and the dollar index at the end of May and in the first month of summer - an overview of the movement options for #USDX vs Gold & Platinum & Silver in May-June 2020. ____________________ US dollar index Starting May 27, 2020, the movement of the dollar index (#USDX) will be determined by working out and the direction of the breakdown of the boundaries of the equilibrium zone (99.50-98.45-97.45) of the Minor operational scale forks - see the animated chart for details of the movement in this equilibrium zone. With the breakdown of the lower boundary of the ISL61.8 equilibrium zone of the Minor operational scale forks - support level 97.45 - the downward movement of the dollar index towards the targets will become possible:

In case of breakdown of the upper limit of the ISL38.2 equilibrium zone of the Minor operational scale forks - resistance level 99.50 - #USDX movement can continue in the 1/2 channel Median Line Minor (99.35-100.30-101.30) with the prospect of reaching the initial SSL line (102.60) of the Minor operational scale forks. The layout of the #USDX movement options from May 27, 2020 is shown on the animated chart.

____________________ Spot Gold The development of the Spot Gold movement from May 27, 2020 will be determined by the development and direction of the breakdown of the range:

When the UTL control line is broken, the operating scale of the minor fork is the resistance level of 1737.00 - the option to continue the upward movement of Spot Gold towards the goals:

The breakdown of the support level of 1713.00 on the initial SSL of the Minor operational scale fork will guide the development of the movement of Spot Gold to the borders of channels 1/2 Median Line of the Minuette operational scale fork (1677.50-1648.00-1618.50) and Minor (1628.00-1596.00-1562.00). Details of the Spot Gold movement from May 27, 2020 can be seen on the animated chart.

____________________ #PLF (Platinum) The development of the #PLF (Platinum) movement from May 27, 2020 will also depend on the development and direction of the breakdown of the 1/2 Median Line channel (942.0-910.5-875.0) of the Minor operational scale fork - we look at the motion marking inside this zone on the animated chart. If the resistance level 942.0 is broken down at the upper border of the channel 1/2 Median Line of the Minor operational scale forks and the final FSL (957.0) line of the Minuette operational scale forks, the upward movement #PLF (Platinum) can be continued to the goals:

If the support level of 875 is broken at the lower border of the channel 1/2 Median Line Minor, the downward movement #PLF (Platinum) can be continued to the borders of the balance zones of the operational scales forks - Minor (843.0-793.0-741.0) and Minute (783.0-731.0-680.0). Details of the #PLF (Platinum) movement options from May 27, 2020 are shown in the animated chart.

____________________ Spot Silver The development of the Spot Silver movement from May 27, 2020 will also be determined by the development and direction of the range breakdown: resistance level 17.590 - the final line of FSL of the Minor operational scale forks; support level 17.100 - initial line of SSL of the Minuette operational scale forks. If a breakdown of the resistance level 17.590 takes place on the upper border of ISL61.8 of the equilibrium zone of the Minor operational scale forks, then the development of the Spot Silver movement will be aimed at the goals:

When the support level of 17.100 is broken on the initial line of the SSL of the Minuette operational scale forks the downward movement of Spot Silver to the equilibrium zone (14.900-14.000-13.200) of the Minor operational scale forks. Details of the Spot Silver movement options from May 27, 2020 are shown in the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers, and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| May 26, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 26 May 2020 08:37 AM PDT

Few weeks ago, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback at least towards 1.0980 and 1.1075 (Fibo Level 50%). Around the price zone between (1.1075-1.1150), a bearish Head & Shoulders pattern was demonstrated. That's why, Further bearish decline was demonstrated towards 1.0800 where the nearest demand level to be considered was located near the backside of the broken channel (1.0800-1.0750). Evident signs of Bullish rejection have been manifested around the price zone of (1.0800-1.0750) leading to the recent bullish spike up to 1.0990. The short-term technical bullish outlook remains valid as long as bullish persistence is maintained above the recently-established Demand Zone around 1.0770. On May 1, Lack of bullish momentum around 1.1000 lead to another bearish decline towards the depicted price zone around 1.0800. However, the price zone of (1.0815 - 1.0775) has been standing as a prominent Demand Zone providing quite good bullish support for the pair so far. Currently, bullish breakout above 1.1000 is needed to enhance further bullish advancement towards 1.1075 and 1.1175. On the other hand, any bearish breakdown below 1.0770 should be marked as an early Exit signal for all short-term BUY trades. Trade recommendations : Intraday traders are advised to wait for bullish breakout above 1.1000 as a valid BUY signal. T/P levels to be located around 1.1075 then 1.1175 if sufficient bullish momentum is maintained while S/L to be located below 1.0950. The material has been provided by InstaForex Company - www.instaforex.com |

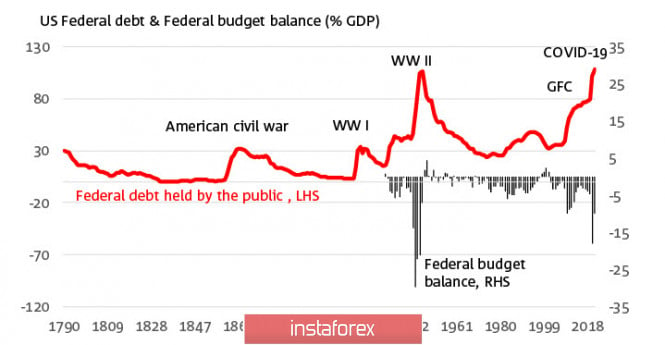

| Overview of NZD/USD and AUD/USD for May 26, 2020 Posted: 26 May 2020 07:15 AM PDT After the long weekend in the USA, Great Britain and a number of Asian countries, the markets are trading very vigorously, E-mini futures add about 2%, European stock indices are in a good plus. In the absence of other explanations for such ambitious optimism, it remains the main reason to consider a way out of the restrictive measures for coronavirus and the associated hopes for a global recovery. Countries announce the lifting of restrictions one by one, and news of rising tensions between the US and China is fading into the background. But let's not forget that the main blow to the global economy is yet to come. The Congressional Budget Office predicts the federal budget deficit in 2020 at 18%, and this is the highest level since World War II.

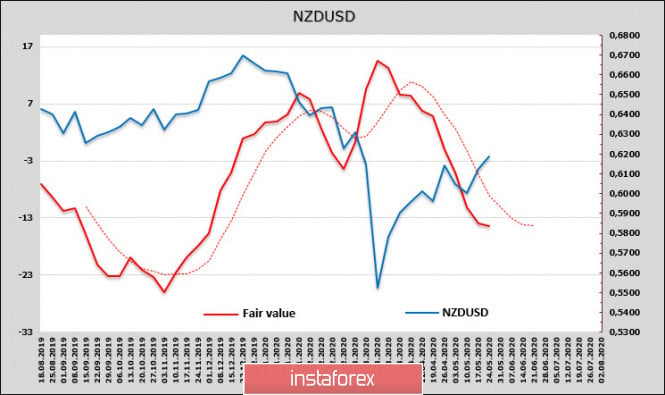

The development of the situation will most likely require an expansion of the incentive program, which will provide markets with short-term support, but will reveal underlying fundamental problems. Positive growth is not sustainable. NZD / USD The kiwi is one of the G10 growth leaders on Tuesday. In the previous review, we assumed that a resistance test of 0.6173 is possible, and it happened, the kiwi is trying to build on success by responding to the removal of quarantine measures in a number of countries. The main effect here is that tourism for New Zealand is about 10% of GDP, given its impact on related industries, so a way out of a pandemic for the New Zealand economy can become a stronger growth factor than for most G10 countries. The estimated fair price slowed down, but there was still no turning up.

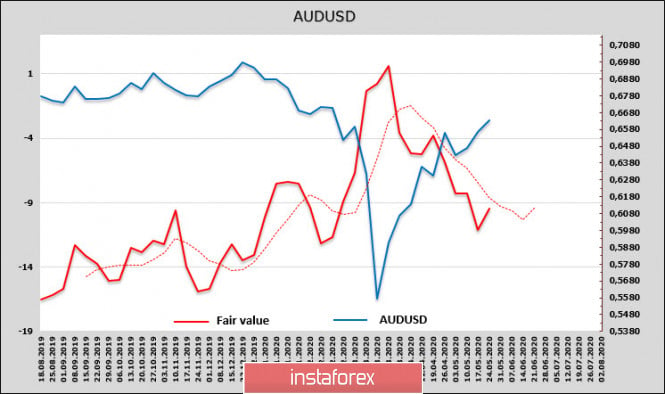

On CME, the net short position is still very large and weekly changes are minimal. Long-term interest rates continue to decline, this is primarily the impact of RBNZ, which supports the purchase of assets. The threat of negative rates persists, a lower level of the yield curve has a beneficial effect on the credit market, and there is no reason to expect changes in policies that already work well. In addition to tourism and the RBNZ, the demand for kiwi is also supported by a stable trade balance. In April, exports managed to stay above 5 billion amid falling imports. Despite updating the local maximum, we are still of the opinion that the growth of kiwi is poorly confirmed fundamentally and may end at any moment. Tonight, the RBNZ will provide a report on financial stability, which will be accompanied by a press conference, which may cause increased volatility. After the breakdown of resistance 0.6173, the kiwi is preparing to test the resistance zone 0.6250 / 70, if the markets assess the RBNZ report quite positively, this level can be reached already tonight, after which, from a technical point of view, nothing will restrain the growing momentum up to 0.6450. AUD / USD The Australian dollar is one of the leaders of growth, closely approaching the resistance of 0.6684. In addition to external positive, growth was also facilitated by a number of internal news. The Australian government has overestimated the amount of wage subsidies by $ 60 billion, which will reduce the projected budget deficit to 70 billion in 2019-20. NAB Bank expects that after September (the official date for the end of subsidies) the government will be able to extend the subsidy program, which increases consumer demand and inflation expectations will also contribute to increased investment. The estimated price has turned up, despite the fact that on the CME, the net short position in Aussie has grown by more than 11% per week. Deep support for the demand for risk has not yet formed, despite a bullish momentum.

On Thursday, the head of the RBA Low is expected to give a speech on the senate. The said speech can either strengthen the momentum of the Aussie or weaken it. In any case, we should not forget that for the time being CME speculators are confidently holding a short position, that is, AUD/USD can turn down at any moment when the external positive is gone. We should wait for testing at 0.6684, a purchase is possible in the expectation of a successful break with a short stop, since fundamentally risky assets are clearly not yet ready for purchases. The material has been provided by InstaForex Company - www.instaforex.com |

| May 26, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 26 May 2020 07:11 AM PDT

Recently, Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April). Currently, Atypical Bearish Head & Shoulders reversal pattern is in progress. The GBP/USD pair was recently demonstrating the Right Shoulder of the pattern. Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to confirm the pattern. Thus, enhance another bearish movement towards 1.2100, 1.2000 then 1.1920. Two Weeks ago, the price zone of 1.2300-1.2280 corresponded to a short-term uptrend as well as a recently established demand zone where a low-risk short-term BUY trade could be taken. However, the recently demonstrated Lower High around 1.2440 invalidated the suggested short-term bullish trade. Shortly After, the price zone of 1.2300-1.2280 failed to provide enough bullish support for the pair. Recent transient bearish breakdown below 1.2265 should have been taken into consideration as it has temporarily confirmed the previously-mentioned reversal-top pattern. Hence, further bearish decline was expected to be enabled towards 1.2020 as a projection target for the reversal pattern. Currently, the price zone of 1.2300 - 1.2330 (Backside of the broken Uptrend) stands as a recently-established SUPPLY-Zone to offer bearish rejection and a valid SELL Entry for the pair in the short-term. Trade recommendations : Intraday traders can still consider the current bullish pullback towards the price zone of 1.2300-1.2330 as a valid SELL Entry. T/P level to be located around 1.2150, 1.2100 and 1.2000 while S/L should be placed above 1.2350. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EUR/USD for May 26, 2020 Posted: 26 May 2020 06:49 AM PDT

About a month ago, the whole world was struck by the huge number of mortality in Italy (as well as in Spain and Britain later). The Italian health department issued a report that tried to explain the reason: 96% of coronavirus deaths were either very elderly or had severe comorbidities. Making the average age of those who died from coronavirus at about 80 years old. Only 1.1% of those who died were under the age of 50. In total, there are approximately 33 thousand people who died from coronavirus in Italy (now approximately 90 people die per day, at a maximum of 1000 per day). Meanwhile, Sweden is being observed by those who are trying to understand how quickly the economy will recover from the crisis caused by the quarantine of large economies. This is because unlike other neighboring countries affected by the pandemic, Sweden did not close the economy at all, and a quick recovery could be expected. However, unemployment rose to 8% - and is expected to rise to 17%. With this, the Swedish economy cannot but feel the global downturn. Thus, it is not setting an impressive example. Hence the conclusion: to those investors who are waiting for a quick V-shaped recovery may rest assure that this will most likely not happen. It will take some time before the global economy can fully recover, and the growth of stock markets over the past 2 months is an attempt to deceive you in order to drag you into a trap. EURUSD: Euro attempts to grow. You may keep purchases from 1.0855 and from 1.0915. Stop at 1.0869. The material has been provided by InstaForex Company - www.instaforex.com |

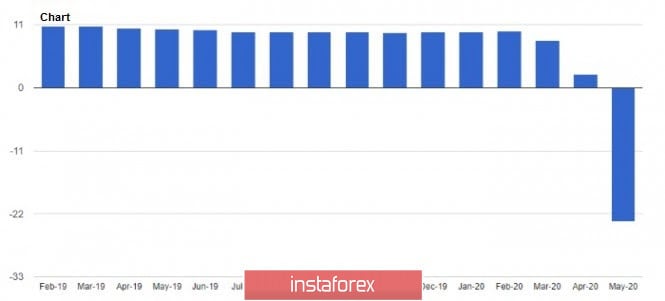

| Posted: 26 May 2020 06:45 AM PDT The euro rushed to the high of last week, and the British pound gained more than 120 points after news that the EU may soften its position in the Brexit negotiations. Such rumors began to circulate in the media today. With reference to one of the European diplomats, it became known that the EU is ready to abandon a hard approach to the problem of fishing in negotiations with the UK, which can significantly advance the process, which stalled a couple of weeks ago when negotiators were unable to reach a compromise on several important issues. Now that the hope for more successful negotiations has flickered, traders have begun to be optimistic about the pound, which has declined quite a bit by mid-May. Now it remains to guess whether these rumors have real force or in a few days the GBPUSD pair will fall in the same steep peak, as the details of the expected offer from the EU will be revealed. Let me remind you that the next round of trade negotiations between the UK and the European Union took place on May 15, and they ended in complete failure. Given the current state of the UK economy, the additional problems associated with post-Brexit trade relations only make the situation worse. Let me remind you that the transition period after the UK leaves the EU ends at the end of this year, and as stated in the EU, it should be extended to continue consultations. However, at the end of last year, British Prime Minister Boris Johnson said that he does not plan to make such a request to European partners, and has not yet changed his opinion. The pound was also supported by today's statements from the Bank of England that the latest data was better than expected. Bank of England Chief Economist Andy Haldane said that good economic data, which was higher than economists' forecasts, allows us to expect a faster economic recovery. As for interest rates, especially their negative value, according to Haldane, the regulator has not yet considered this issue and has not made any decision. It is worth recalling that the same economist recently stated that the Central Bank may resort to the introduction of negative interest rates. However, it is unlikely that such measures will be effective, since negative rates only make it more difficult to lend, so a zero interest rate will likely be the most effective solution. As for the technical picture of the GBPUSD pair, a significant breakthrough of fairly large resistance levels indicates the firm intentions of buyers to reverse the downward trend. At the moment, buyers have problems in the resistance area of 1.2340, a break in which will lead to a test of new highs in the area of 1.2430 and 1.2510. If the pound falls after unconfirmed information about EU concessions, support will be provided by the levels of 1.2290 and 1.2200. EURUSD Today, an important report on consumer sentiment in Germany was released, which is ahead of schedule. It is already clear that, most likely, in June this year, the mood will significantly improve after the lifting of strict isolation measures and restrictions due to the coronavirus pandemic. According to research company GfK, the leading consumer sentiment index for June 2020 rose to -18.9 points from -23.1 points in May. Economists had predicted that the index for June would be -18 points. Despite the removal of several restrictive measures, consumer uncertainty remains high enough that it will slow down the economy in the early summer of this year. Most of the problems will be related to the propensity to buy. As indicated in the report, the sub-index of propensity to buy rose to 5.5 from -4.6 points in April, and the gradual resumption of work of several companies will have a positive impact on the propensity to spend. As for other sub-indices, in May, the index of economic expectations rose to -10.4 points, while the indicator of income expectations rose to -5.7 points. The mood of German exporters has improved slightly after a record fall in April this year, which is also good news. According to the data, the IFO indicator of export expectations for the German manufacturing sector rose to -26.9 points in May from -50.2 points in April. Growth was observed in all key sectors. It is still very early to talk about the return of optimism in the company, but many German exporters, as they say, see the light at the end of the tunnel. As for the technical picture of the EURUSD pair, so far the bulls have not seen problems with overcoming several key resistance levels, which were discussed in the morning review. Good data continues to maintain demand for risky assets, and the nearest target for buyers of the euro is the maximum of last week in the area of 1.1005. In the case of a downward correction, the demand for risky assets may return after updating the major support of 1.0920. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2020 05:56 AM PDT To open long positions on GBPUSD, you need: The British pound strengthened its position throughout the first half of the day after media reports that the EU may ease requirements for a trade agreement with the UK, which returned buyers to the market, allowing them to demonstrate the growth of more than 100 points. If you look at the 5-minute chart, then pay attention to the weak attempt of the bears to return to the market after the resistance test of 1.2245, but fixing above this level led to the continuation of the upward correction. At the level of 1.2293, which I spoke about in my morning forecast, there was no one at all, and it turned out to be wrong. A breakout and consolidation above the resistance of 1.2336, which the bulls are now trying to form, will allow us to count on the continuation of the upward trend with the update of the highs of 1.2370 and 1.2425, where I recommend fixing the profits. However, much more will depend on data on consumer confidence in the US, which can quickly return demand for the US dollar. Therefore, if the pound falls below the level of 1.2336, it is best to postpone long positions until the support is updated at 1.2293, with the formation of a false breakout there or buy immediately for a rebound from the minimum of 1.2245, in the calculation of correction of 30-35 points within the day.

To open short positions on GBPUSD, you need: A lot will depend on how the bears behave after the report on the US economy. The return of GBP/USD to the level of 1.2336 may lead to profit-taking on long positions and, accordingly, to a decrease in the pair to the support area of 1.2293, where I recommend fixing the profits. The longer-term goal of sellers will be a minimum of 1.2245, but it will be extremely difficult to reach it today. If the demand for the pound continues in the afternoon, then it is best to look at short positions on a false breakout from the resistance of 1.2336 or sell immediately on a rebound from a larger maximum of 1.2425, since there is still optimism about the UK trade agreement with the EU and any good news in this direction will feed the British pound to new buyers.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily averages, which indicates further growth of the pound. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands In the case of a downward correction, the average border of the indicator in the area of 1.2245 will act as support. Description of indicators

|

| Posted: 26 May 2020 05:43 AM PDT To open long positions on EURUSD, you need: Buyers continued to push the euro higher amid rising optimism. If you look at the 5-minute chart, you can see how the breakout and consolidation of the euro above the resistance of 1.0928, which I paid attention to in my forecast this morning, led to the continuation of bullish momentum, supported by rumors that the EU may make concessions to the UK on the issue of trade relations. The sales that I recommended to make after the level of 1.0966 was updated also took place, but a larger downward correction could not be obtained. At the moment, new levels have been formed, which should be emphasized when making decisions in the afternoon. It is best to return to long positions after updating the level of 1.0953, provided that a false breakout is formed there or buy EUR/USD immediately for a rebound from the minimum of 1.0917, where the moving averages also pass, in the expectation of a rebound of 20-30 points within the day. While trading will be conducted above the range of 1.0953, we can expect the continued growth of the euro to the maximum of last week (1.1006), where I recommend fixing the profits.

To open short positions on EURUSD, you need: Sellers have tried several times to return to the market, as can be seen on the 5-minute chart. However, they have not yet managed to achieve a larger downward movement. The emphasis in the afternoon will be placed on the report on the financial stability of the eurozone, as well as on the data on the consumer confidence index in the United States, where good indicators, similar to the leading consumer climate index in Germany, can lead to a partial strengthening of the US dollar against the euro. The main task of the bears for the second half of the day will be to return the pair to the support level of 1.0953, fixing under which will lead to a larger sale of EUR/USD to the area of the minimum of 1.0917, where I recommend fixing the profits, since large buyers will surely return to the market from this level. If the demand for the euro continues, then short positions in the conditions of such a strong upward trend can be counted on only after updating the maximum of 1.1006, and then only with a small bounce down of 15-20 points within the day.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily moving averages, which indicates the continuation of the bullish market. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands In the case of a downward correction in the second half of the day, the average border of the indicator around 1.0920 will provide support. Description of indicators

|

| Posted: 26 May 2020 05:27 AM PDT USDJPY has recently provided us with a bullish signal by breaking above the downward sloping wedge pattern. Price pulled back to form a higher low but price has not moved much higher, stabilizing around key short-term horizontal resistance.

Green rectangle - horizontal resistance Blue line - long-term resistance trend line USDJPY has been moving mostly sideways during the last few sessions. Price has reached horizontal resistance at 107.90-108.05. So far price respects resistance and bulls are not strong enough to break higher. A rejection here does not cancel the bullish break out above the wedge pattern but delaying the move higher for more time, is not a good sign for bulls. Support is at 106.70 and next and most important at 106. Bulls need to respect these two levels. Otherwise they will be in trouble. A bullish signal will be given on a break above 108.10. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD breaking down a descending triangle Posted: 26 May 2020 05:19 AM PDT In a previous analysis on USDCAD we mentioned a bearish pattern that was being formed. Price was forming a descending triangle and we said that usually patterns like this break to the downside.

USDCAD has broken below the triple horizontal bottom at 1.3850. A daily close below this level will be a bearish sign. Price could move much lower. Price remains in a bearish trend making lower lows and lower highs. Resistance is at 1.3990 and as long as price is below that level we expect price to move towards 1.35. Next support and first target is at 1.37. Next at 1.35. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2020 05:16 AM PDT Corona virus summary:

Australia will not open the country's borders 'anytime soon'Technical analysis: Trading recommendation: Resistance level is set at 9,260 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2020 05:13 AM PDT Gold has started the week on a negative note following last week's inability to hold above $1,750. Despite moving higher towards our target of $1,770 last week, price closed around $1,735 and this week prices move lower.

Green rectangle -target area Black line -higher highs Gold price is making higher highs but the RSI is not following. Price of the RSI is making lower highs thus providing us with a bearish divergence. This is not a reversal signal but a warning sign for bulls to be extra cautious and raise protective stops. Over the last few weeks our main view was to be bearish Gold around $1,750 and higher, as long as the RSI was diverging. Our short-term view when price broke above $1,710-20 turned bullish targeting $1,770. Last week we came so close to this target area. Now price is turning back down again. Key support remains at $1,710-15. Breaking below this level will open the way for a move towards $1,650 at least. It is important to see if this weekly candle hold above $1,700-10 support. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2020 05:09 AM PDT Corona virus summary:

WHO warns of 'second peak' in areas where Covid-19 is decliningTechnical analysis: Gold has been trading downwards as I expected. The Gold reached my first downward target at $1,721 and is testing the support. Further downside move can lead us for test of $1,715 or $1,700 zone. Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for EUR/USD on May 26, 2020 Posted: 26 May 2020 05:04 AM PDT From the point of view of complex analysis, we can see the acceleration that occurred yesterday within the sideways channel. The dynamics of yesterday's trading day was quite low, with the quotes continuing to fluctuate within the average deviation of the flat 1.0775 // 1.0885 // 1.1000, practicing it as support and thereby stopping any downward movement from the upper border. Activity was low throughout the market, with which the GBP / USD pair also recorded a volatility of only 39 points. The lack of important news yesterday, as well as the day off in the US and the UK, served as a deterrent factor, which led to a decrease in trade volumes. The bright stop within the average deviation level attracted the special attention of speculators, which is indicated by the current charts. Looking at the dynamics of volatility separately, we can see that the series of accelerations took a short pause of 44 points, the lowest figure recorded for 31 trading days, which revealed why speculators became so excited when they saw so many successful, comparable factors for their current positions. As discussed in the previous review, traders worked on a downward move from the upper border of the flat, the result of which pushed the quotes to the value of 1.0885. Further decline will certainly occur while the quotes are within the flat, but local operations were not forgotten, so the level of 1.0920 was taken into account in case of a local rebound from the 1.0885 area. Analyzing the daily chart, we can see that the sequence of fluctuations within the flat indicates a one big downward trend. The news published yesterday contained the final data on Germany's 1st quarter GDP, the value of which coincided with economists forecast, recording a decline of -2.3%. However, market reaction was practically non-existent, since the people already expected such figures. With regards to the coronavirus, attempts of easing restrictive measures continue, with Hong Kong opposing the Beijing National Security Law. Meanwhile, data on the real estate market in the US will be published today, with the S & P / CS composite housing cost index expecting a decrease from 3.5% to 3.0%. New homes sales also expect a -21% drop in the index. If the forecasts turn out to be true, the dollar is sure to decrease value. Further development Analyzing the current trading chart, we can see a sharp surge in the activity of long positions from the area of the average deviation of the flat formation. The slowdown yesterday played a huge role in the market, where speculators took advantage of the situation and formed fluctuations. A similar development is present on almost all trading instruments [Forex], so we can conclude that the US dollar has fallen under sell-offs. Although the flat within 1.0775 // 1.0885 // 1.1000 seems to have lost its strength, the quotes are still within its boundaries, so a rebound in the opposite direction is still possible. Looking at the current dynamics, we can assume that the speculative mood is still present in the local market. Although there is no clear signal of a breakout of the 1.1000 border, consider the possibility of a rebound in the opposite direction, with the quotes returning to a deviation of 1.0885. The main development today is still downwards, but be prepared for any movement, such as upwards, especially if radical changes occur in the trading chart. Based on the above information, we derived these trading recommendations: -Consider selling positions lower than 1.0940, towards 1.0900 / 1.0885. - Open buy positions from the value 1.0920, with prospects of a movement to 1.0950. Wait for a consolidation and observe the dynamics. Indicator analysis Analyzing the different sectors of timeframes (TF), we can see that the indicators of the hourly and daily periods signal purchases, which reflects the movement of quotes in the upper border of the sideways channel. Volatility per week / Measurement of volatility: Month; Quarter Year The measurement of volatility reflects the average daily fluctuation calculated by Month / Quarter / Year. (May 26 was built, taking into account the time of publication of the article) Volatility is currently 81 points, which is almost twice of yesterday's dynamics. If quotes continue to trade inside the flat, a slowdown may occur, and the dynamics of the rest of the day will be conducted within the channel. Key levels Resistance zones: 1,1000 ***; 1.1080 **; 1,1180; 1.1300; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support areas: 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2020 04:50 AM PDT Corona virus summary:

Technical analysis: EUR/USD has been trading upwards. As I expected, the EUR reached my first yesterday's target at 1,0945 and is heading for the next one at 1,1005. Trading recommendation: Resistance level is set at 1,1005 The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for GBP/USD for May 26, 2020 Posted: 26 May 2020 04:27 AM PDT

Technical outlook: GBP/USD is seen to be trading at around 1.2310/15 levels at this point in writing.The pair is expected to push toward 1.2900 levels in the short term. The currency pair dropped to 1.2080 levels over the past few trading sessions before turning bullish again. Please note that GBP/USD had reached fibonacci 0.382 retracement of the entire rally between 1.1414 and 1.2485, around 1.2080 before bulls were back in control. Ideally, a higher low has been carved around 1.2100 levels and GBP/USD should stay above that, going forward. Looking at the overall wave structure, GBP/USD has managed to print a meaningful low around 1.1414 earlier and since then it has carved a series of higher highs and higher lows. It remains bullish towards 1.2900 and higher until 1.1414 lows hold good. Trading plan: Remain long, stop @ 1.1414, target at 1.3200 and 1.3500. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 May 2020 04:25 AM PDT How will the world change after the pandemic? People will work more remotely and travel less. If so, global demand for oil up to COVID-19 at just over 100 million b/d may become extreme, suggesting limited potential for a Brent and WTI rally. However, this opinion is not shared by all. The IEA believes that remote work and the vaccine will allow people to travel more, with a preference for personal rather than public transport, leading to a recovery in global demand for black gold in 2020-2021. As early as next year, the indicator may rewrite the maximum. In this scenario, the northern campaign of both varieties will be long. The oil market is returning to its normal state, as evidenced not only by a reduction in the spread of Brent and WTI from more than $ 10 to $ 2 per barrel, but also by a decrease in the volume of black gold stored in the sea. As of May 21, according to research by the analytical company Vortexa, the indicator fell to 258 million barrels, which is 7% less than the maximum that took place a week earlier. Prices are rising not only because of expectations of a rapid recovery in demand against the backdrop of the opening of the world's leading economies, but also because of a significant supply constraint. Russia claims that oil supplies in May decreased by 14-15 million b/d, and estimates the contribution of Canada, Norway, and the United States at 3.5-4 million b/d. Moscow remains committed to fulfilling OPEC+ obligations, which does not allow us to expect a "bearish" surprise for black gold at the June meeting of the cartel and other producer countries. Oil production in Russia in May fell to 8.5 million b/d. According to estimates of the consulting company Wood Mackenzie, the production of black gold in the United States is falling faster than previously estimated. We are talking about 2.3 million b/d or -20% of the March peak of 13.24 million b/d. Features of the technological process of shale production suggest rapid depletion of wells, so to maintain production at a high level, it is necessary to drill and drill again. This is not currently happening. The number of rigs from Backer Hughes in the week to May 22 fell to the lowest level since 2009, which signals a further reduction in US production. Dynamics of oil production in the United States

Dynamics of the number of drilling rigs in the United States

According to TD Securities, the worst for the oil market is over. And I will allow myself to agree with the company. The OPEC+ contract to reduce production, the forced decline in black gold production in the United States, coupled with increased global demand amid the opening and recovery of the economies of China, the USA, the eurozone and other countries, lead to a decrease in surplus. According to the Russian Ministry of Energy, the indicator will decrease by 7-12 million b/d by June or July. This circumstance allows you to hold the longs formed on breakouts of resistance at $ 25.75 and $ 28 per barrel for Brent and increase them on pullbacks. Technically, the North Sea variety continues to move within the ascending trading channel and is heading for the target of 88.6% on the "Shark" pattern. It corresponds to the level of $ 50.9 per barrel. Brent, the daily chart

|

| Trading plan for Gold for May 26, 2020 Posted: 26 May 2020 04:16 AM PDT

Technical outlook: Gold prices remain subdued after printing highs at $1,765 levels over the last week. The yellow metal has produced a trade cycle of lower lows and lower highs while it is trading at around $1,725 at this point in writing. Immediate price resistance is seen towards $1,750/51, while support is seen towards $1,710 respectively. The yellow metal is expected to drop lower towards $1,690/$1,702 levels in the short term to register yet another low. Please note that a drop towards $1,660 would be encouraging for bears, since it confirms that Gold has carved a meaningful top around $1,765 mark. On the flip side, a push above $1,765 would push further towards $1,775 levels before the yellow metal finds resistance again. Overall, Gold remains bearish until prices stay below $1,765, going forward. Trading plan: Aggressive traders remain short, stop @ 1,765, target @ 1,660. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: Euro awaits news from Brussels Posted: 26 May 2020 04:06 AM PDT

If the ECB is ready to save Italy, is it worth waiting for similar steps from the EU? According to Francois Villeroy de Galhau, head of the Bank of France, there is no need to use the capital key when the volume of asset purchases under the quantitative easing program is related to the size of the economy. The main preferences from QE are received by Germany, whose GDP this year is likely to decline by 6.5%, while the Italian counterpart can sag by more than 9%. Apparently, the European Central Bank is ready not only to expand the purchase of assets but also to step on the throat of its own principles. This is good news for the single European currency. However, in the current situation, little depends on Frankfurt alone. Historical decisions this week will be made in Brussels. The Franco-German initiative to save the European economy contributed to the growth of the EUR / USD pair last week above 1.10, but a counter proposal from a number of EU member states pushed it back below 1.09. Austria, the Netherlands, Denmark, and Sweden are in favor of providing loans from a time-limited fund for countries in the region that are struggling to recover from the pandemic, not the subsidies offered by France and Germany last week. Competitive bids were received earlier than the European Commission's own plans for a restoration fund, which will be announced on Wednesday. According to experts, any deviation from free aid provided by the original plan will be perceived as negative for the euro. However, if the Franco-German debt offer passes the test within the next week, this will be the main positive event for the euro. In the meantime, the main currency pair looks in the direction of US stock indices and weighs what is more important: the opening of leading economies or the growing tension between Beijing and Washington? According to the Netherlands Bureau of Economic Policy, in March, international trade fell by 1.4% in monthly terms and by 4.3% in annual terms. This is bad news for the export-oriented eurozone economy. However, it is expected that from May - June the indicator will begin to recover, also due to the active fulfillment of China's obligations to the United States. As for the relations of the latter, it has undoubtedly worsened, but it should be understood that Donald Trump needs to win the presidential election, and without pressure on Beijing this is unlikely to be possible. Moreover, the escalation of the situation forces China to stimulate its own economy to increase purchases of American goods. Since the beginning of the pandemic, the People's Bank of China has poured into it about $ 827.6 billion and is ready to continue in the same vein. This allows us to count on a V-shaped recovery of Chinese GDP, which can support the EUR / USD bulls in the medium term, which is stuck in the range of 1.0770–1.1000. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment