Forex analysis review |

- Forecast for EUR/USD on May 4, 2020

- GBP/USD right on ascending trendline support! Bounce expected.

- Forecast for GBP/USD on May 4, 2020

- Forecast for AUD/USD on May 4, 2020

- Forecast for USD/JPY on May 4, 2020

- Overview of the GBP/USD pair. May 4. Great Britain came third in the world in the number of deaths from the "coronavirus."

- Overview of the EUR/USD pair. May 4. The EU will survive the "coronavirus" crisis much more severely than the rest of the

- GBP/USD. Preview of the week. Bank of England meeting, NonFarm Payrolls, US unemployment rate

- EUR/USD. Preview of the week. EU countries are starting to weaken quarantine. Coronavirus continues to rage in the US, where

- EUR/USD and GBP/USD. Results of May 1. Trump: the "crown" virus is out of control in the laboratory of China. The United

- EUR/USD. Result of the week. How will "coronavirus" affect the results of the US presidential election in 2020?

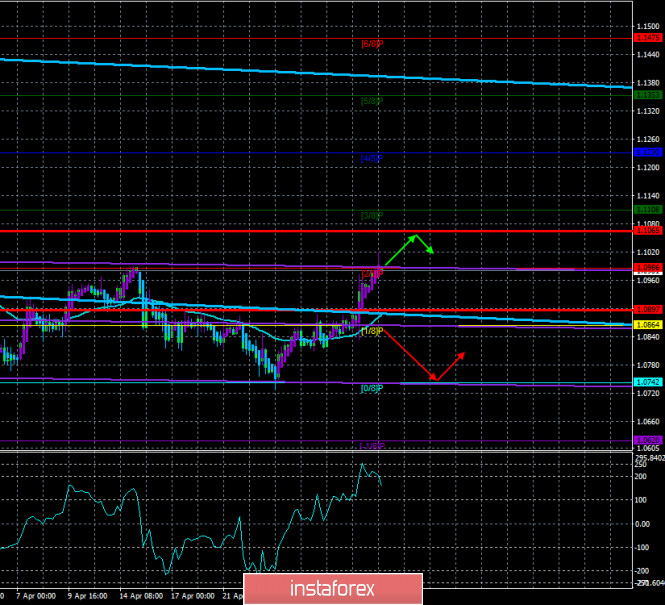

| Forecast for EUR/USD on May 4, 2020 Posted: 03 May 2020 07:58 PM PDT EUR/USD The euro took the opportunity to increase and hit the first target level for the growing trend of 1.1026. Today started with a falling gap and attempts to test support for the price channel and the MACD line on the daily chart of the currency pair. The signal line of the Marlin Oscillator is turning down, but the gap is not closed, so there is a chance of another upward movement before the expected reversal and medium-term downward movement. A prerequisite for a further decline will be for the price to fall below the MACD line on the four-hour chart (1.0870). At this point, the Marlin oscillator will also be in the negative trend zone. If the price goes above Friday's high, growth to the second bullish target of 1.1094 (peak on February 3) will be possible. We are waiting for events to unfold. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD right on ascending trendline support! Bounce expected. Posted: 03 May 2020 07:56 PM PDT

Trading Recommendation Entry: 1.24435 Reason for Entry: Ascending trendline support, 78.6% Fibonacci retracement Take Profit : 1.26161 Reason for Take Profit: Horizontal swing high Stop Loss: 1.23892 Reason for Stop loss: Graphical swing low The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for GBP/USD on May 4, 2020 Posted: 03 May 2020 07:54 PM PDT GBP/USD The British pound lost 100 points on Friday, which strengthened the reversal potential and the convergence power of the Marlin oscillator on the daily chart. To completely form conditions for the price to go down, it is necessary to gain a foothold under the MACD line (1.2365), while the Marlin signal line must go into the zone of negative values. Marlin is already in the decreasing trend zone on the four-hour chart, the price should overcome the support of the MACD line (1.2405). The support of the MACD line of the daily scope runs a little lower, in the region of 1.2365, therefore, the 1.2365-1.2405 range is transitional, it is possible to consolidate in this range. An attempt to move the price under technical support may occur after a preliminary increase to 1.2540 or slightly lower without breaking convergence on a daily basis. The current situation is not defined under any scenario, the price can freely wander in the range of 1.2365-1.2540. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on May 4, 2020 Posted: 03 May 2020 07:49 PM PDT AUD/USD The Australian dollar lost 92 points on Friday, continued to decline this morning and reached support for the embedded line of the price channel, indicated on the daily chart, at 0.6374. Overcoming the support will allow the price to test the strength of the MACD line at 0.6270 and in case of a breakout, develop success to 0.6150. The reason for prioritizing a declining scenario is the divergence on the Marlin oscillator. The price has consolidated under all indicator lines on the four-hour chart, Marlin is deep in the negative zone, this shows a further decline. So, with the price overcoming the support of 0.6374, it is possible to open a sale with a target near 0.6270. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on May 4, 2020 Posted: 03 May 2020 07:43 PM PDT USD/JPY The US stock index S&P 500 lost 2.81% last Friday, afterwards, the yen strengthened against the dollar (decreased on the chart) by 25 points. The embedded line of the price channel line did not make it possible for the price to go lower. The price is trying to overcome this support again in the Asian session. Advancement will enable the price to fall to the first target of 105.10. The Marlin indicator on the negative trend territory (falling). The signal line of the Marlin oscillator entered the zone of negative values on the four-hour chart, the price breaks below the blue MACD indicator line, and the subsequent departure of the line at a low of 106.62 Friday is a signal to open a short position while aiming for 105.10. You are advised to set a stop loss above 107.10. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 May 2020 05:14 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 37.3988 The British pound finished last week with a correction. However, the overall picture is very similar to that of the euro/dollar pair (although it has started to adjust). The pound also worked out the previous local maximum during the upward movement, which it failed to overcome and now the "double top" pattern suggests the end of the upward trend. As a confirmation of this hypothesis, we recommend waiting for the price to fix below the moving average line. But in order to start trading on the downside, you need to overcome the moving average in any case. On the other hand, the consolidation of quotes above the Murray level of "7/8"-1.2634 will provoke further strengthening of the British currency. No important macroeconomic statistics are scheduled for the first trading day of the week in the UK and the United States. At a time when the European Union is beginning to relax quarantine measures, the UK has reached fourth place in the world in the number of infections with "coronavirus". According to the latest data, Britain has overtaken France and Germany – 183,500 diseases. In addition, the country is in third place in the world in terms of the number of deaths from COVID-2019 – almost 29,000. Behind them were Spain, France, and Germany, where the epidemic started earlier. However, the UK also does not want to lag behind countries that remain in the European Union and plan to begin easing quarantine measures from May 26. The government is expected to present a plan for a gradual easing of the quarantine on May 7. However, the date of lifting the restrictions may be revised if the situation with the epidemic in the country does not change (that is, it does not get better). Representatives of the UK health sector believe that the "peak" of the epidemic has passed, so from May 26, residents can be allowed to leave their homes without an emergency, as well as shops, cinemas, etc. Schools are planned to open a little later, in June. However, if rallies are held in the States in favor of the quickest possible end of quarantine, people want to return to work and their usual life, then in Britain people have developed the so-called "coronophobia". More than 60% of citizens are afraid of mass gatherings of people and public transport. Thus, experts say that business and economic activity in the UK may recover at a slower pace than in other countries. The British government also fears that the easing of quarantine measures at the end of May may be too early, which could cause a new wave of pandemics and create a new powerful burden on the health system. Thus, the date of the country's exit from quarantine also wants to be linked to a decrease in the number of patients in medical institutions in case a new outbreak follows, so that the health sector will be able to cope with the wave of newly infected people.

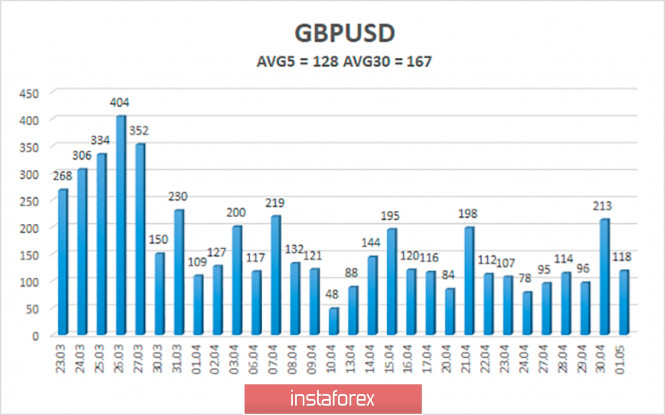

The average volatility of the GBP/USD pair has increased again due to the last trading day and now stands at 128 points. For the pound, this is not too much, the main thing is not to start a new trend of increasing volatility, which may mean a new panic in the market. On Monday, May 4, we expect movement within the channel, limited by the levels of 1.2365 and 1.2621. A reversal of the Heiken Ashi indicator upward will indicate the completion of the round of corrective movement. Nearest support levels: S1 – 1.2451 S2 – 1.2390 S3 – 1.2329 Nearest resistance levels: R1 – 1.2512 R2 – 1.2573 R3 – 1.2621 Trading recommendations: The GBP/USD pair started to adjust on the 4-hour timeframe. Thus, traders are recommended to buy the pound again with the goals of 1.2573 and 1.2621, if the Heiken Ashi indicator turns upward or the pair bounces off the moving average line. It is recommended to sell the pound/dollar pair not before fixing the price below the moving average with the first goal of the Murray level of "3/8"-1.2390. Explanation of the illustrations: The highest linear regression channel is the blue unidirectional lines. The lowest linear regression channel is the purple unidirectional lines. CCI - blue line in the indicator window. Moving average (20; smoothed) - blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. Possible variants of the price movement: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 May 2020 05:14 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: direction - sideways. Moving average (20; smoothed) - upward. CCI: 157.1972 The EUR/USD currency pair on Monday, May 4, has every chance to start a downward correction. The reasons for this are banal and simple. The market is not currently in a panic stage, so we do not expect a recoilless movement in one direction by several hundred points. There are a few fundamental reasons for the growth of the euro currency. The pair worked out the Murray level of "2/8"-1.0986, from which it had previously rebounded. On Monday, there will be no important statistics that could hypothetically affect the movement of the pair and support the euro currency. Thus, from our point of view, we will see a correction at the beginning of the week. However, it is still extremely difficult and even impossible to make forecasts for the long term. The reason is also simple and obvious - "coronavirus". In previous articles, we have already said that the countries of Europe and the United States are beginning to gradually weaken the quarantine measures, but no one knows how this step will end. Let's hope that it is not the second wave of the epidemic, but if it were so easy and 100% accurate to predict the development of the epidemic, then this epidemic would not have happened. The quarantine has helped reduce disease rates, but this does not mean that the virus will not return, for example, in the fall or winter, when most people on the planet are prone to diseases. And at the moment, we can not say that the virus is gone. It just slowed down. But people keep getting sick, they keep dying. Thus, it is completely impossible to say when the vaccine will be created, when the epidemic will end, when the negative impact on the economy will end, when the economy will begin to recover, and when it will fully recover, and how much the economy of each country will decline. But these factors will influence the exchange rates of the euro and the dollar. Thus, we believe that predicting the movement of the pair in the long term is like guessing on coffee grounds. We still recommend that traders trade strictly in accordance with technical analysis because it is the one that responds most quickly to reversals, trend changes, and corrections. As we have already said, it makes no sense to talk about the future of each currency now. However, we can speculate about what exactly awaits any economy. For example, the economy of the European Union. According to the absolute majority of experts, the whole world is racing towards the worst crisis in the last 100 years. Absolutely all countries will suffer from it, but political scientists and economists believe that the EU will have the worst (although the latest GDP data predict the largest fall in the American economy). The problem is that the EU can always print money or create it in bank accounts (functions of the ECB), or take it on credit. But how to distribute the created or raised funds? Even in peaceful years, the process of channeling financial flows is a long process, since there are 27 countries in the EU. Now, when some countries (Spain, Italy, France) have suffered more from the crisis, and others (Germany, Finland) are less affected, accordingly, the amount of assistance to all EU participants needs different. However, the very essence of the European Union implies the principle of unity and mutual assistance. This means that rich countries will have to help the poor. This is precisely the position that the increasingly rich do not like, who believe that less well-off countries should live within their means and form their reserve funds for a rainy day. But, as practice shows, Italy itself does not form any funds, it is knocked out of the EU norms on the budget and the maximum state debt, and now it requires huge amounts of assistance from the European Union. Amounts for which all EU members will pay. The idea with the "coronabond" at the moment has failed. The European Council could not approve the total amount of aid to the European economy, as well as the sources of attracting this money. No, Europe is not poor, and it feels no worse than the rest. But the greater the differences between countries, the greater the risk of falling European economy, the higher the probability of a split of the European Union. The UK has shown that it is possible to leave the EU, and London makes it clear to the whole world that the country almost fled the Alliance and does not want any new agreements on "mutually beneficial" terms. London is now ready to cooperate and trade either on terms that are favorable to it or will look for other markets and partners for cooperation. And, as we can see, the British are not afraid of this prospect at all. Other EU countries, again the wealthiest, can count as well. Therefore, it is very important for Europe that the current crisis, which is unknown how long it will continue, does not end in the collapse of the EU. This is, of course, the most pessimistic scenario, but who could have predicted 10 years ago that Britain would want to leave the EU? Many experts also note that the current crisis has already become much stronger than the debt crisis in 2008-2009. Then Europe had to save small states with small economies (Greece, Cyprus, Ireland, Portugal), for which about 500 billion euros were spent. Now the problems are experienced by European giants (Spain, France, Italy), whose economies are estimated in trillions of euros, respectively, requiring much higher costs for salvation. Several trillion euros have already been spent and several more are required. From a technical point of view, now the pair has formed an upward trend. The Heiken Ashi indicator continues to color the bars purple, so the upward movement is still expected to continue. Only a reversal of the Heiken Ashi indicator downwards will indicate the beginning of a correction or the end of an upward trend. Both linear regression channels are directed sideways, which indicates that there is no trend movement in the medium and long term. In principle, if you look at the entire chart of the EUR/USD pair, you can see with the naked eye that after the strongest movements in late February – early March, the pair is now consolidating. It's just not in a narrow price range, as we previously expected, but in a range of 250 points wide – between the levels of 1.0750-1.1000. Now the pair's quotes are just near its upper limit.

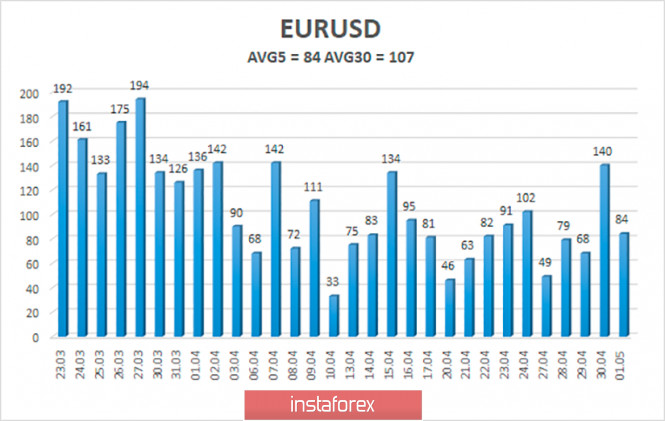

The volatility of the euro/dollar currency pair as of May 2 is 84 points. Volatility, therefore, remains average in strength, close to high, and there is still no reason to expect a new wave of panic. Today, we expect the pair's quotes to move between the levels of 1.0897 and 1.1065. The reversal of the Heiken Ashi indicator downwards may signal the beginning of a downward correction. Nearest support levels: S1 – 1.0864 S2 – 1.0742 S3 – 1.0620 Nearest resistance levels: R1 – 1.0986 R2 – 1.1108 R3 – 1.1230 Trading recommendations: The EUR/USD pair overcame the moving average and continues to move up. Thus, traders are recommended to stay in the purchase of the euro currency with targets at levels 1.0986 and 1.1065 until the Heiken Ashi indicator turns down. It is recommended to consider selling the euro/dollar pair not before fixing the price below the moving average line with the first target of 1.0742. Explanation of the illustrations: The highest linear regression channel is the blue unidirectional lines. The lowest linear regression channel is the purple unidirectional lines. CCI - blue line in the indicator window. Moving average (20; smoothed) - blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. Possible variants of the price movement: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Preview of the week. Bank of England meeting, NonFarm Payrolls, US unemployment rate Posted: 03 May 2020 12:49 PM PDT The British currency traded more logically than the euro during the past week. The main logic was that a downward movement began at the end of the week. And it began after the pair worked out the 1.2467 level, which is the previous local high. Thus, we can assume that the pound/dollar pair has encountered strong resistance and will not be able to continue the upward movement, which is completely unjustified, from a fundamental point of view. The US dollar could still fall against the euro, since the EU economy can suffer less than the American one (although this cannot be said with utmost certainty at the moment), but there will almost certainly be greater losses in the British economy than in the United States . And what will happen in 2021 is even hard to imagine. After all, negotiations between London and Brussels on an agreement that will be in force after 2020 have once again reached an impasse. They now continue only formally. No personal meetings between delegations. There are only videoconferences between David Frost and Michel Barnier, each of which only recently recovered from the coronavirus. The parties need to make a decision to extend the transition period until July 1 and London has flatly refused to postpone the deadlines. The second half of the upcoming week will be interesting for the GBP/USD pair. No news is expected from the United States and Britain on Monday, while indices of business activity in the service sectors will be published on Tuesday. The ISM index will be released in the United States, which is considered quite important and significant, but, as we already mentioned in the EUR/USD article, these data do not really matter now, as business activity has fallen to record low in all countries affected by the virus COVID 2019. There will be no economic data in the UK on Wednesday, and the April ADP private sector employment report will be released in the US. Recall that this report displays the change in the number of employees in the United States. Thus, its negative values, in fact, indicate the number of unemployed for a month and practically coincide with the total values of reports on applications for unemployment benefits for the same period. Thus, in April, the ADP report, according to experts, will show a reduction of ... 20-21 million workers. During the mortgage crisis in the United States, the highest decrease in ADP was 800,000. In total, the report showed negative values for about two years. On average, up to -10 million workers were recorded during this period. For two years. Now -20 million in one month. No matter how shocking this figure looks, we believe that market participants have long been ready for such values. After all, unemployment reports come out every week and the general trend is already clear. Thus, the ADP report can only confirm the data that has already been known for a long time. Accordingly, we believe that traders will ignore this report as well. The results of the Bank of England meeting will be summed up on Thursday. No special changes in monetary policy are expected. Bids will remain at an ultra-low level. As for programs to stimulate the economy, it is quite possible to inject additional money through lending and repurchasing securities from the open market, or to expand existing ones. However, this will not surprise traders. Especially after the Federal Reserve and European Central Bank announced similar actions. Accordingly, the speech of the BoE Chief Andrew Bailey will be of the greatest importance. Most likely, Bailey will declare an economic shock, the scale of the economy's decline, and so on. That is, it will provide the markets with exactly the same information that Jerome Powell and Christine Lagarde provided a week earlier. Since the news of the fall of the British economy is clearly not unexpected, then this event can be ignored. Only official forecasts for 2020 on the main macroeconomic indicators of the British economy will arouse interest. In the United States, the next report on applications for unemployment benefits is scheduled for publication on this day, which predicts an additional 3 million applications. Reflecting more accurately current unemployment levels, the secondary application rate is projected at 19.5 – 20.5 million as of April 25. In other words, it almost matches the value of the ADP report. Another few million unemployed people in the US are also unlikely to cause a shock among market participants. US nonfarm payrolls reports, the unemployment rate and changes in the average hourly wage are set to be released in the last trading day of the week. Everything is quite simple with the latest report– a neutral forecast value of 3 – 3.3%. But the official unemployment rate will jump to 15.5-16.0% by the end of April. And this will no longer be data on applications for benefits, but specifically on unemployment, that is, more accurate. Needless to say, during the publication of this report, it will be very difficult for US President Donald Trump to hold back tears? As he is eager to be re-elected for a second term. The number of new jobs created outside of agriculture may be reduced by 20-21 million. That is, the figures are exactly the same as for secondary unemployment claims, and as for the ADP report. What can I say about the result? First, all the most important information will come back from overseas, and it is unlikely to be a surprise for traders. Second, we will not get the most important data on how much the UK economy may contract this week. Thus, traders can continue to trade based solely on technical analysis or their own reasons, which are not related to macroeconomic data and the fundamental background. In technical terms, the pair began a downward correction against a new upward trend. The downward movement may continue since quotes consolidated below the critical Kijun-sen line. However, until the Ichimoku cloud is overcome, the sell signal (not yet formed) will remain extremely weak. Accordingly, short positions should not be large in volume. Recommendations for the pair GBP/USD: The pound/dollar may start a new downward trend now. We still believe that some unease remains on the market, and that the entire fundamental background is ignored. Therefore, increased attention should be paid specifically to technique. Consequently, as long as the pair is located below the critical Kijun-sen line, short positions with the goals of Senkou Span B and 1.2240 lines (will be reviewed at the opening of trading on Monday) are relevant. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 May 2020 12:49 PM PDT The new trading week promises to be quite boring in macroeconomic terms. News and reports will be, however, their degree of significance and quantity will not be comparable to the previous week. And since economic data will be, if not secondary, then not the most significant for sure, and market participants still ignore 95% of all incoming information, then, most likely, next week we will not see any correlation between the fundamental background and movement of the euro/dollar pair. Really important data are expected only on Friday. Thus, technical factors will continue to remain in first place, to which it is advised to pay increased attention when performing any trading actions. Last week ended with an upward movement, still baseless from a fundamental point of view. Thus, at least a correction is expected on Monday-Tuesday. The European Union will publish indices of business activity in the manufacturing sector on Monday. These figures have not surprised anyone for a long time. In Germany, it is expected to fall to 34.4 points in April, and to 33.6 in the EU as a whole. Only a secondary report is planned in the US – production orders for March, which are at risk of falling by 9.5% m/m. I would like to note at once that macroeconomic statistics do not have a strong impact on the pair, because the fall of the EU and US economies occurs synchronously and simultaneously. In other words, it's not that one economy is falling down, but the other is just feeling stable. And since both economies are contracting, neither currency has an advantage. As we found out last week, the US economy contracted by a higher value (-4.8% of GDP). Thus, we can expect the US dollar to face pressure in the following weeks. However, this pressure is unlikely to be long-term. We would like to note that after three months of highly volatile trading, one month of which was frankly panic-stricken, the quotes of the pair returned to their original positions - the positions that were traded at the end of January. No important statistics on the European Union are set for Tuesday. Data on business activity in the EU services sector in April will be published, and these figures threaten might be miserable. However, this is not surprising, since the service sector has suffered a lot from the quarantine measures. The volume of retail sales for the month of March will also be published, which is expected to decrease by 10% in annual terms and 12% in monthly terms. Needless to say, there were no such reductions in terms of volume, if not ever, then during the period of statistics collection – for sure (and this is at least 25 years). Again, these figures are unlikely to surprise market participants. As well as in the US, retail sales also sharply plunged. On Thursday, Germany will publish an indicator of industrial production in March. According to experts, the indicator will fall by 7% on a monthly basis. No economic data is expected from the European Union on Friday. We would also like to note that all the most important data will be received again from overseas and will be discussed in the next article on GBP/USD. What can be said as a result? We believe that all macroeconomic statistics from the eurozone will not cause any reaction from traders. Therefore, statistics will be the only thing that matters when the crisis, quarantine and epidemic are over. Unfortunately, despite the fact that coronavirus is a treatable disease, there is still no vaccine against it, people continue to get sick, and governments can only mitigate quarantine measures at the risk of new outbreaks of the epidemic. Because if this is not done, then there will be nothing to restore in six months or a year. Thus, in fact, the theme of the issue now is precisely the COVID-2019 virus pandemic. The world will not be able to return to normal life until an effective medicine or vaccine is found, and the economy will function at best in a limited mode. Almost 3.5 million cases of coronavirus were recorded in the world on Sunday morning, May 3. More than a million people recovered, almost 250,000 fatal outcomes. However, the fact that people are recovering from a disease cannot be positive for the economy. The problem is that the treatment takes around two weeks to a month or more. Thus, any person who becomes infected, firstly, can infect a huge number of other people, even if he suffers from the disease in a mild form, and secondly, all patients will not be able to work for at least a month. Thus, the removal of quarantine measures can lead to a second wave of infection, which will lead to new quarantines and new pauses in the work of the entire world economy. However, in the most infected Italy, quarantines begin to weaken from May 4. The industry and construction sector will resume work on this day. However, only vital enterprises and industries will be able to leave quarantine. For example, schools will open no earlier than September, so as not to risk the lives of children. In Germany, the situation with the coronavirus is one of the most favorable in Europe. Of the 167,000 patients, about 123,000 recovered, about 6.5 thousand people died. This is one of the lowest mortality rates in the world. Schools, museums, exhibition centers, galleries, various gardens and memorials will open in May (exact dates are still unknown). However, holding public events will be prohibited at least until the fall. Angela Merkel only opposes the opening of restaurants and cafes, considering the catering places to be the most dangerous. "We cannot check whether people at the table belong to the same family or they are from different households," said the German Chancellor. "We have no medicine, we have no vaccine against the virus, and therefore, the goal is to slow the spread of the virus," Merkel concluded. In Spain, which also suffered greatly from the pandemic, some quarantine prohibitions are also lifted. After a seven-week ban on people, people are allowed to go for walks and go in for sports from the second of May. The number of deaths from the coronavirus has been falling steadily for several weeks. The most difficult situation remains in the United States, where the coronavirus continues to spread rapidly, but Donald Trump is eager to restart the economy. The state of Texas has already resumed its work and will act in some way as an "experimental rabbit." If the number of infected people does not increase in this state, then another quarantine measure will be lifted starting on May 18. At the same time, the states of California and New York are toughening quarantine measures. The technical picture of the EUR/USD pair shows that the upward movement could end near the 1.0985 level. At least there is no panic in the foreign exchange market now, which means that the price is unlikely to go 100 points one way without a single correction. Therefore, we have the right to expect a corrective movement on Monday. I will clarify the goals of the Ichimoku framework on the same day. Trading recommendations for the EUR/USD pair: We believe that the influence of the fundamental background could be present next week, and the most important data will come from America. There may be low volatility of the euro/dollar pair and a corrective mood of traders on Monday and Tuesday. Turning the MACD indicator down will signal a round of downward correction. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 May 2020 02:55 AM PDT 4-hour timeframe Average volatility over the past 5 days: 88p (high). The EUR/USD currency pair continued its upward movement throughout the last trading day of the week after a similar even stronger movement on Thursday. As it turned out on Friday, the euro/dollar currency pair did not need correction. By the end of the day and week, the pair's quotes reached the second resistance level of 1.0985, and the trading ended there. We still need to understand what moved the European currency quotes up on May 1 and draw the appropriate conclusions. It should be said at once that last Thursday, many traders could conclude that the markets began to react again to macroeconomic statistics and the fundamental background. From our point of view, this is not the case. Given the huge number of macroeconomic reports from overseas and the EU, the pair stood in one place for most of the day. And then, when it rushed up, there were just no special grounds for this. We do not believe that the expansion of the Fed's lending program by $ 500 billion (another 500 billion to support the economy) could trigger a strong fall in the dollar. Otherwise, we might expect something similar from every ECB or Fed statement about injecting another hundred of billions and trillions into the economy. However, until the day before yesterday, there was no reaction to these actions by the central banks and governments of the US and the EU. We also do not believe that on Thursday, market participants reacted with mass sales of the US currency to reports on changes in personal income and spending of Americans. Yes, the figures were very disappointing, but again, did anyone expect that the income and expenses of people, 20 million of whom lost their jobs, would grow? Or that they will be reduced moderately? After all, Americans not only lose their jobs, they also stay at home, and most businesses and firms are closed for quarantine, that is, there is no money, and even if they were, there is nowhere to spend them especially. Therefore, from our point of view, hardly anyone was very impressed by the fall in these indicators. As for the report on applications for unemployment benefits, which amounted to another almost 4 million, there is also nothing surprising or unexpected. Moreover, there is a tendency to reduce the number of new applications, as all those who could be dismissed, the American business has already dismissed. Previously, the US dollar has never responded to more impressive numbers with a fall. Thus, we believe that even if some traders reacted to the published statistics on Thursday, the reaction was mixed. Thus, we can draw a similar conclusion on Friday. The growth of the European currency began in the morning when no new publications were published by that time. Moreover, in the European Union, no reports were scheduled for Friday. However, the euro currency continued to grow (at the same time, the pound has already started to adjust). In the second half of the day, when the indices of business activity in the US manufacturing sector were released, the strengthening of the euro currency stopped, although data from overseas were contradictory. On the one hand, the Markit business activity index was even worse than the preliminary value for April (36.9) and amounted to 36.1. On the other hand, the ISM index, which is considered more significant, fell not to 36.7, as predicted, but to 41.5. But what difference does it make if both of these values indicate a serious decline in production? The last thing we would like to draw traders' attention to is the correction of the British currency. In the UK, the index of business activity in the manufacturing sector was also published on May 1, the value of which did not surprise anyone. However, the pound began to fall in price during the night and continued to do so throughout the trading day. Thus, there was no correlation between the EUR/USD and GBP/USD pairs on Friday. And if there was a strong fundamental background in the Foggy Albion or the European Union that could cause the pair to split, then there would be no questions. But there was no such background. Thus, we come to the same conclusion that traders still do not pay attention to news and macroeconomic data, and it is best for market participants to trade now using "technology". And, of course, there's always Donald Trump, where a single day is not complete without his speech. Yesterday, the American President said that according to his information, the "coronavirus" was developed in the Wuhan laboratory, from where it broke free. Also, Trump said that the United States is now conducting investigations about the actions or inaction of China in the framework of countering the virus. "We are now finding out how this happened. We must get an answer, and it will determine how I will treat China in the future," the US leader said. Trump believes that China either failed to contain the virus or did not want to do so. The US President also said that he could impose new duties on imports from China, thus unleashing a new trade war with Beijing (since it is unlikely that China will not respond with mirror duties), if it is confirmed that it is involved in the deliberate spread or non-maintenance of the virus. Also, the American President issued a new forecast of mortality from the "Chinese pandemic" in the United States. According to the new opinion of trump, about 100,000 Americans will die. 4-hour timeframe Average volatility over the past 5 days: 120p (high). The GBP/USD currency pair has been adjusted since May 1. On Thursday, as well as for the euro/dollar pair, the quotes soared up. There was little reason for this since there was no important news from Britain that day at all. The main event of the day was the meeting and its results of the European Central Bank, as well as a package of important macroeconomic statistics from the European Union. However, the pound also rose in price, and on Friday began to logically play this movement in the opposite direction. The pair's quotes are fixed below the critical line, so now we are even talking about a possible change in the trend to a downward one. However, according to the fundamental picture of things, there is still no advantage for either the dollar or the pound. We also once again draw the attention of traders to the fact that the pair's quotes on Thursday perfectly worked out the previous maximum and bounced off it. Thus, the probability of forming a new downward trend is growing. Recommendations for EUR/USD: For short positions: On the 4-hour timeframe, the EUR/USD pair continues to strengthen its upward movement. Thus, the sale of the euro currency can be considered no earlier than the reverse fixing of the price below the Kijun-sen line with the first goal of the volatility level of 1.0862. For long positions: Long positions are currently relevant with targets of 1.1038 and 1.1073. A rebound from any target will signal the beginning of a downward correction. Recommendations for GBP/USD: For short positions: The pound/dollar pair started to adjust. Thus, traders on Monday are recommended to consider selling the British currency with the aim of selling Senkou span B, but in small lots, since there is no "dead cross" yet, and the "linear regression channels" system does not yet signal a change in the trend. For long positions: Purchases of the GBP/USD pair will again become relevant with the goal of 1.2624 if traders manage to gain a foothold back above the critical line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 May 2020 06:54 AM PDT 24-hour timeframe Another trading week on the Forex market has ended, and we are summarizing its results. The EUR/USD currency pair spent most of the trading week trading with an increase, which led to the end of the week to overcome the critical Kijun-sen line and change the trend to an upward one. Given the fact that the pair has updated the previous local high and low over the past 7 trading days, we can assume that the consolidation process is complete and traders are ready to form a new trend. But what will it be like? Movements in the past week speak in favor of the formation of a new upward trend. At the same time, until the Ichimoku cloud is overcome, the Golden cross buy signal (which is not even formed yet) will remain weak. Moreover, even if you close your eyes to the entire fundamental and macroeconomic background, which in any case is ignored by traders, it is very difficult to find the fundamental reasons for the growth of the euro currency. Thus, we recommend that traders continue to adhere to the indicator readings on the 4-hour chart to determine the trend. Meanwhile, market participants not only continue to ignore all macroeconomic reports but also have cooled down to the news on the topic of "coronavirus". If at the very beginning of the epidemic, markets were literally shocked by what is happening in the world, now no one is particularly surprised by almost 3.4 million cases of the disease, and many people again treat the "coronavirus" as seasonal flu, just more dangerous for humans. Despite 238,000 deaths from the epidemic worldwide (and this is just official statistics), many countries are beginning to relax quarantine measures and open up their economies. In fact, it is difficult to blame them for this, since there is still no vaccine and representatives of the medical field say that it should not be expected until the fall of 2020. And this is an extremely optimistic scenario. More realistic forecasts suggest that it will take from a year to 18 months to create a vaccine. It is impossible to imagine a "lockdown" that will last for another 18 months. Since after this period, there will be nothing to restore. Thus, many governments have taken a decision to relax quarantine measures to restart the economy and to function in the more loyal of quarantine measures. Most likely, in practice, it will look like this. Almost the entire business will open, but the rules of personal hygiene, mask mode, and social distancing will still apply. In the case of new outbreaks, the strict quarantine will be re-introduced. We can only evaluate how these actions of governments will be effective and correct. Despite the fact that the ECB and the Fed held meetings last week, and GDP data were published, more interesting topics remain the investigation of the origin and causes of the COVID-2019 virus leak, possible sanctions from around the world (183 countries were infected) against China, as well as the US presidential election, which will be held in November this year. According to many media outlets, the current US President treated the possible infection with disdain and that is why now the United States is leading in the number of diseases and in the number of deaths. This opinion is indirectly confirmed by the early statements of Trump, where he flippantly declared in his own manner that "the coronavirus does not pose a threat to Americans" and "will not survive the warm season of the year." As it turned out, nothing has changed with the arrival of the warm season, and the number of Americans who "will not suffer from the virus" already exceeds 1.1 million. And, probably, these mistakes would have been forgotten, as well as many others, over time, if only this year there were no presidential elections coming up. As practice shows, when the population is faced with a choice, they prefer the candidate with whom there is less negativity. Joe Biden was not the President of the United States and did not dirty his reputation with dubious stories, was not involved in international scandals, and did not provoke trade wars. Thus, according to many polls, it is the Democratic candidate who leads in political ratings. Trump can only shift the responsibility for what is happening to others (WHO, China, the chief epidemiologist of the United States), in order to at least try to "bleach" before the election. Trump has already lost all three of his main trump cards (low unemployment, high employment, and high economic growth) thanks to an epidemic that he himself treated with disdain. Thus, it is not clear what he will say to the American population in the framework of the election campaign, in which it will be necessary not only to make new promises but also to take stock of his four-year reign. But it will be much easier for the Democratic candidate, Joe Biden, to shape his election program. The former Vice President of the United States is free to criticize the current President. And there was much to criticize Trump for during his entire term of office. The US leader constantly provokes scandals, quarrels with the Democrats without hesitation, and calmly ignites international conflicts and trade wars. Thus, Biden just needs to draw the attention of Americans to Trump's discouraging actions and show that they did not bring any benefit to America. And the main topic that can help Biden become President is "coronavirus." Yes, unfortunately, the highest political circles in the United States believe that the politicization of "coronavirus" is absolutely normal. And Biden has already begun to act in this direction. More recently he stated: "The unpleasant truth is that Donald Trump has made America vulnerable to a pandemic. He ignored the warnings of experts in the field of health and intelligence, who instead trusted Chinese leaders. And now we are paying the price." Biden also focused the attention of Americans on the fact that Trump stopped funding the program for tracking epidemics and reduced by 60% the number of specialists on China in the centers for disease control and prevention. At the same time, Biden very competently bypasses the issues of WHO funding, which Trump refused, accusing the organization of failing to prepare for the pandemic and overly focusing its activities on China. If Biden had criticized Trump for refusing to fund WHO, then Trump could have accused Biden of approving taxpayer-funded organizations that treat the United States "unfairly." Now, Trump, in fact, has only one way to go. He needs to get China and WHO to admit their guilt in the spread and failed attempts to contain the "coronavirus" so that he himself can appear before the American people completely innocent. Especially if the US population believes that if it were not for the current government, the human losses would be much higher. How the US President will do this is still unknown. But there are reasons to assume that through the mechanism of sanctions, threats and pressure already known to the whole world. Trading recommendations: On the 24-hour timeframe, the euro/dollar pair continues to try to form a new upward trend. The nearest target is the Senkou Span B line, which almost coincides with the resistance level of 1.1086. However, on the 4-hour timeframe, which we continue to recommend using as the main one, a downward correction is expected on Monday and Tuesday. In general, the upward trend has already been formed and it can be rejected. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment