Forex analysis review |

- Dollar prepares for June Non-Farm Payroll

- Comprehensive analysis of movement options for #USDX vs EUR/USD & GBP/USD & USD/JPY (H4) on June 29, 2020

- June 26, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- June 26, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Greenback lost landmark

- Second wave of COVID-19 horrifies oil market

- The euro will quickly get out of the hole

- Oil: cost of raw materials is growing rapidly

- USA, Europe, and Asia stock indices continue the rally

- BTC analysis for June 26,.2020 - Potential for further drop towards the levels at $8.880 and $8.426

- Analysis of Gold for June 26,.2020 - Watch for potential new buying wave and test of $1.778

- EUR/USD analysis for June 26 2020 - Potential for the bigger rally on the EUR due to the breakout of the downward channel

- Europe on brink of economic collapse

- Analysis and forecast for GBP/USD on June 26, 2020

- Trading recommendations for EUR/USD

- GBP/USD: plan for the American session on June 26

- Trading idea for S&P 500

- USD/JPY Turned Back By Confluence Area!

- EUR/USD: plan for the American session on June 26

- Is the digital dollar the currency of the future?

- Analysis of EUR/USD and GBP/USD for June 26. ECB's head, Christine Lagarde, fears second wave of COVID-19 and expects GDP

- Technical analysis of GBP/USD for June 26, 2020

- EUR/USD: A surge in unemployment in the US may occur again. Disagreements within the ranks of the ECB continue to rise.

- Trading idea for NZD/USD

- USDCAD is approaching 1st support, possible bounce !

| Dollar prepares for June Non-Farm Payroll Posted: 26 Jun 2020 09:56 AM PDT

The dollar index completes the week in positive territory. The demand for the greenback as a protective asset has grown in recent days due to the worsening situation with coronavirus in the USA and other developed countries of the world. America records a record increase in cases, an indicator even higher than peak levels in late April. Thus, the risks of the second wave of the pandemic are becoming more real. Nevertheless, traders are reluctant to win them back and try to find positive in a whole heap of negative news. At the end of the week, the mood was mostly negative, the weekend can all change or worsen more. Much will depend on the rate of spread of coronavirus infection, as well as on what decision will be made regarding the reimplementation of the quarantine measures by the leaders of the States with the highest increase in COVID-19. Recently, the US economic data has been mostly positive, which gave hope to traders to restore economic growth. However, the current unfavorable situation with coronavirus can change everything for the worse and significantly slow down the pace of economic recovery. This is most worrying for market players who are more supportive of defensive assets. USDX

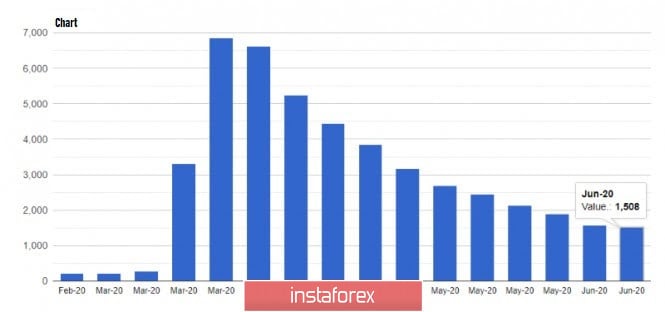

In addition to the spread of the virus, next week traders will focus on the release of the June NFP. This report will not only reflect the situation on the labor market in June but also shed light on the surprise that was presented to the markets in May. Judging by the weekly data from the American labor market, one should not count on another fabulous performance. The fact is that the weekly increase in initial applications for unemployment benefits in the United States exceeds forecast values. This week was most noticeable. The number of initial applications for unemployment benefits fell by only 60 thousand, to 1.48 million, while the markets were waiting for a decrease of 280 thousand, to 1.3 million. This means that the growth of layoffs this month is steadily ahead of market consensus. However, the market cannot be so scared. It is unlikely that investors will be upset: the worse the recovery in employment is, the more likely it is to extend the generous income insurance that expires at the end of next month. The applications received for more than one week amounted to 19.5 million with a forecast of 20.3 million. However, a weekly decline in the indicator is not consistent with the enchanting restart of the economy. Undoubtedly, the data indicate that Americans are returning to work. Here again, there is a "but." Improvement could occur due to features in reporting. California and Florida, for example, send data once every two weeks. This Thursday just fell out. The main condition for receiving payments is the fact of deprivation of work. Due to the pandemic, the authorities have so far removed the second important condition, a person does not have to hurry to search for a new job. In the category of unemployed, only those who are actively seeking it are taken into account. This means that a significant proportion of the unemployed simply fell out and the underestimated unemployment rate of 13.3% can be safely ignored. The topic of extending unemployment benefits is probably being actively discussed now, but it will most likely be covered after the publication of the unemployment report, which will allow the American authorities to clarify the size and conditions of the program. The material has been provided by InstaForex Company - www.instaforex.com |

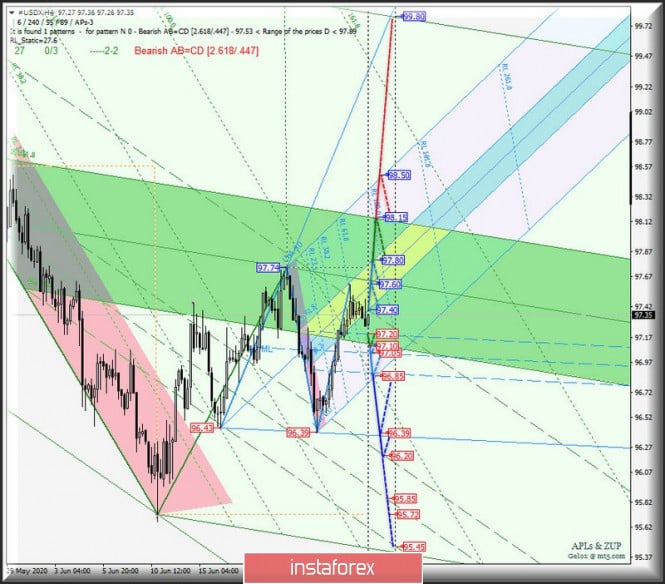

| Posted: 26 Jun 2020 09:52 AM PDT Minute operational scale (H4) The end of June, the beginning of July - what's next? Development options for the movement of #USDX vs EUR/USD & GBP/USD & USD/JPY (H4) on June 29, 2020. ____________________ US dollar index From June 29, 2020, the movement of the dollar index #USDX will be determined by the development and direction of the breakdown of the range:

In the breakdown of support level of 97.20, the movement of the dollar index will arise in the channel 1/2 Median Line (97.20-97.05-96.85) of the Minuette operational scale fork, and if there's a breakout of the lower border (96.85) of this channel, the downward movement of the tool can be extended to a local minimum 96.39 and the channel 1/2 Median Line (96.20-95.85-95.45) of the Minute operational scale fork. With the breakdown of ISL38.2 Minuette - resistance level of 97.40, the #USDX movement will continue in the equilibrium zone (97.40-97.60-97.80) of the Minuette operational scale forks. In the case of breakdown ISL61.8 Minuette (97.80), then the dollar index can continue to move to the upper border ISL61.8 (98.15) of the equilibrium zone of the Minute operational scale forks and the final line FSL Minuette (98.50). The markup of #USDX motion options since June 29, 2020 is shown on the animated chart.

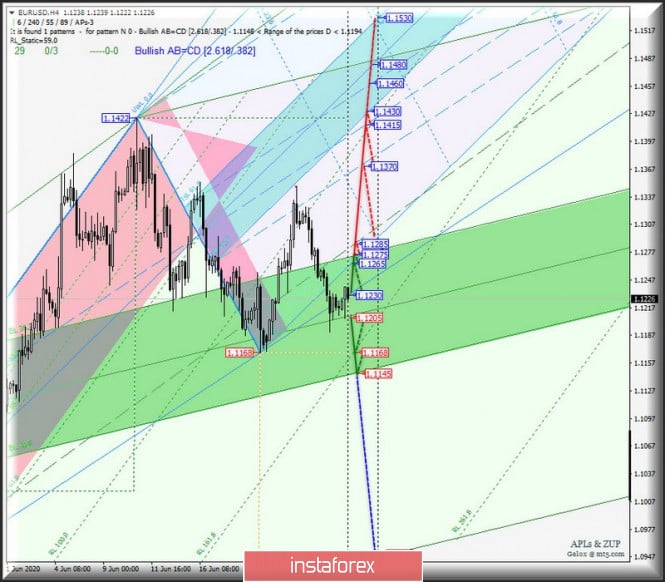

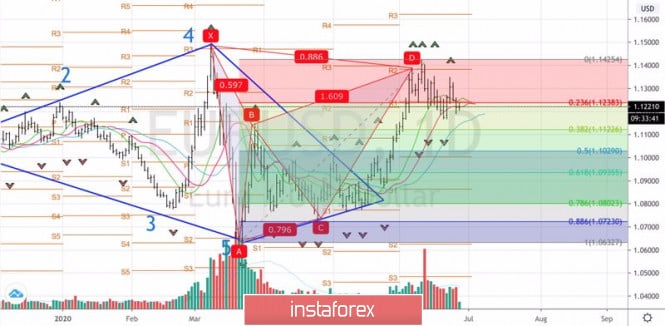

____________________ Euro vs US dollar The development of the movement of the single European currency EUR/USD from June 29, 2020 will continue in the equilibrium zone (1.1275-1.1205-1.1145) of the Minute operational scale forks, taking into account the direction of the breakdown of the range:

When the LTL Minuette control line is broken - the resistance level of 1.1230 - then the movement of EUR/USD can be directed to the goals:

In the case of a breakdown of the support level of 1.1205 on the Median line Minute, the downward movement of the single European currency can be directed to the local minimum of 1.168 and the lower border of ISL61.8 (1.145) of the Minute operational scale forks. The EUR/USD movement options from June 29, 2020 are shown on the animated chart.

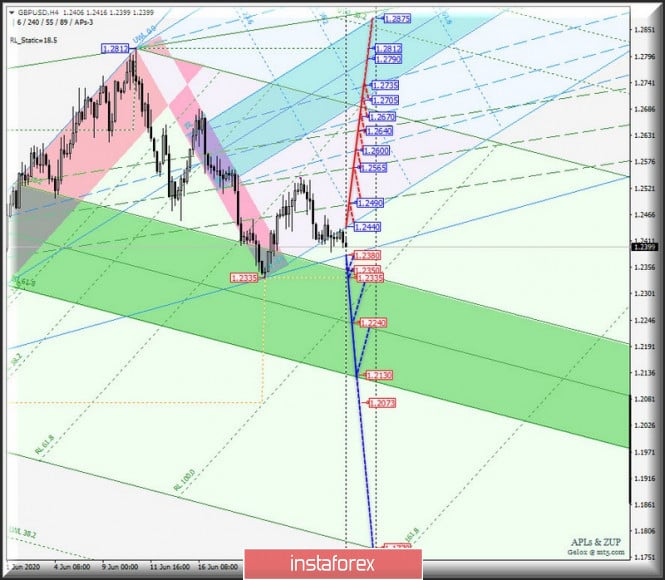

____________________ Great Britain pound vs US dollar The development of the movement of Her Majesty's currency GBP/USD from June 29, 2020 will be determined by the development and direction of the breakdown of the range:

If the resistance level of 1.2440 on the starting line SSL of the Minuette operational scale forks will make it possible to achieve the currency of Her Majesty's borders of channels 1/2 Median Line of the Minute operational scale forks (1.2490-1.2565-1.2640) and Minette (1.2600-1.2670-1.2735). Breakdown of the support level of 1.2380 at the control line LTL of the Minute operational scale forks with subsequent breakdown ISL38.2 Minute (1.2350) and update local minimum of 1.2335 will determine the further development of the movement of GBP/USD in the zone of equilibrium (1.2350-1.2240-1.2130) of the Minute operational scale forks. From June 29, 2020, we look at the GBP/USD movement options on the animated chart.

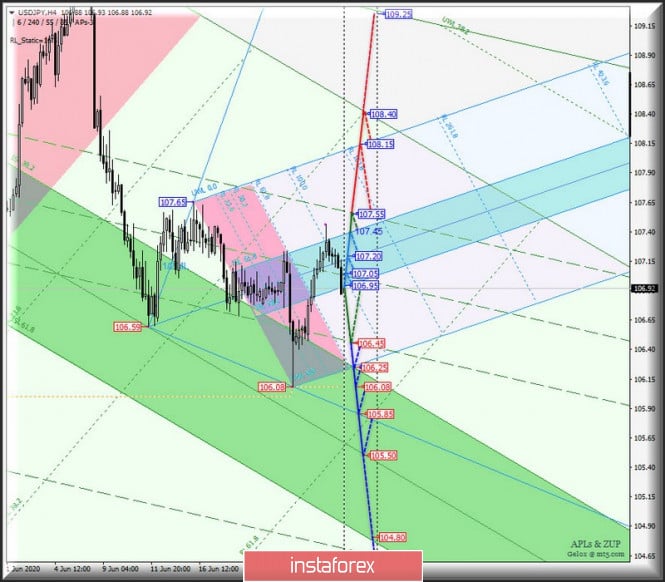

____________________ US dollar vs Japanese yen From June 29, 2020, the development of the USD/JPY currency movement of the "Land of the Rising Sun" will continue in the 1/2 Median Line channel (107.55-107.05-106.45) of the Minute operational scale forks, taking into account the development of the boundaries of the equilibrium zone (107.45-107.20-106.95) of the Minuette operational scale forks - the marking of movement within the 1/2ML Minute channel is shown on the animated chart. If the support level of 106.45 breaks at the lower border of the channel 1/2 Median Line Minute, it will be possible for the currency of the "Land of the Rising Sun" to reach the boundaries of the equilibrium zone (106.25 - 105.50 - 104.80) of the Minute operational scale forks. The breakdown of the resistance level of 107.55 on the upper border of the channel 1/2 Median Line of the Minute operational scale forks upward movement in the USD/JPY will be allocated to the target line FSL (108.15) of the Minuette operational scale forks and the initial line SSL (108.40) trading recommendations. The markup of the USD/JPY movement options from June 29, 2020 is shown on the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy"orders). Formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of currencies in the basket: Euro - 57.6 %; Yen - 13.6 %; Pound sterling - 11.9 %; Canadian dollar - 9.1 %; Swedish Krona - 4.2 %; Swiss franc-3.6 %. The first coefficient in the formula brings the index value to 100 on the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| June 26, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 26 Jun 2020 09:49 AM PDT

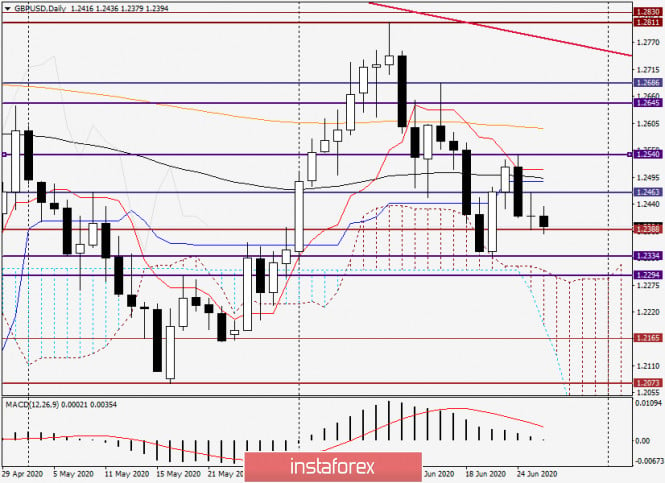

Recently, Bullish breakout above 1.2265 has enhanced many bullish movements up to the price levels of 1.2520-1.2590 where temporary bearish rejection as well as a sideway consolidation range were established (In the period between March 27- May 12). Shortly after, transient bearish breakout below 1.2265 (Consolidation Range Lower Limit) was demonstrated in the period between May 13 - May 26. However, immediate bullish rebound has been expressed around the price level of 1.2080. This brought the GBPUSD back above the depicted price zone of 1.2520-1.2600 which failed to offer sufficient bearish rejection. Hence, short-term technical outlook has turned into bullish, further bullish advancement was expressed towards 1.2780 (Previous Key-Level) where signs of bearish rejection were expressed. Short-term bearish pullback was expressed, initial bearish destination was located around 1.2600 and 1.2520. Moreover, a bearish Head & Shoulders pattern (with potential bearish target around 12265) is being demonstrated on the chart. That's why, bearish persistence below 1.2500 ( neckline of the reversal pattern ) pauses the bullish outlook for sometime and should be considered as an early exit signal for short-term buyers. Any bullish pullback towards 1.2520-1.2550 (recent supply zone) should be watched by Intraday traders for a valid SELL Entry. Trade recommendations : Intraday traders can wait for the current bearish movement to persist below 1.2340 for another valid SELL Entry. S/L should be placed above 1.2375 while T/P level to be located around 1.2265 and 1.2200. The material has been provided by InstaForex Company - www.instaforex.com |

| June 26, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 26 Jun 2020 09:34 AM PDT

Previously, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection have been manifested around the price zone of (1.0815 - 1.0775). Moreover, recent ascending bottom has been established around 1.0870 which enhances the bullish side of the market in the short-term. Intermediate-term technical outlook remains bullish as long as bullish persistence is maintained above the recently-established ascending bottom around 1.0850-1.0870. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1175 (61.8% Fibonacci Level) then 1.1315 (78.6% Fibonacci Level) where bearish rejection was anticipated. Although the EUR/USD pair has temporarily expressed a bullish breakout above 1.1315 (78.6% Fibonacci Level), negative divergence as well as bearish rejection were being demonstrated in the period between June 10th- June 12th. This suggested a probable bearish reversal around the Recent Price Zone of (1.1270-1.1315) to be watched by Intraday traders. That's why, Bearish persistence below 1.1250-1.1240 (Head & Shoulders Pattern neckline) was needed to confirm the pattern & to enhance further bearish decline towards 1.1150 Trade recommendations : The recent bullish pullback towards the price Zone around 1.1300-1.1350 (recently-established supply zone) was recommended to be watched as a valid SELL Signal.T/P levels to be located around 1.1175 then 1.1100 while S/L to be lowered to 1.1300 to offset the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Jun 2020 08:05 AM PDT

Today, there are no significant changes in the course of the greenback in relation to the euro and the yen. The rate of the euro this morning amounted to 1.1213 dollars. Recall that the previous trading day closed at around 1.1218 dollars per euro. Yen against the euro was at around 120.06 yen per euro, while yesterday's rate was around 120.25 yen per euro. In the morning, the course of the greenback was at 107.07 yen per dollar. Yesterday's trading closed at 107.19 yen per dollar. The dollar index against the basket of six major world currencies (ICE Dollar) fell slightly today by 0.08%. Yesterday, the indicator managed to return almost all of the part that was lost during the week. The reason for yesterday's positive was the growing concern of market participants regarding the second wave of the pandemic. The US dollar is also supported by rhetoric, reflecting the impossibility of a rapid economic recovery amid the growing incidence of coronavirus and the return of restrictive quarantine measures, which are likely to be needed to contain the wave of infections. In this regard, the authorities in Texas already announced that the removal of the quarantine measures is suspended indefinitely due to the tense epidemiological situation. This decision was made due to a sharp increase in the number of cases this week. It is noted that there is no plan to return to full quarantine, which was in the spring of this year. Another important news for the foreign exchange market was a statement by the Chairman of the Bank of Japan, who stated that the main regulator intends to continue a soft stimulating policy that favorably affects the pace of economic recovery after the coronavirus pandemic. In the end, the Bank of Japan should return to its inflation target of around 2%. The pound sterling also remained almost unchanged against the US dollar this morning with a rate of 1.2418 dollars per pound. Yesterday, it stopped at around 1.2419 dollars per pound. It also moved a little in relation to the euro. Today, the pound was trading in the region of 1.1074 euros against yesterday's value of 1.1072 euros. The main news that could change the balance of power in the foreign exchange market next week will come from the next round of the negotiation process between the UK and the EU. Recall that the parties can not agree on a trade agreement. According to recent reports, London did not express a particular desire to extend its EU membership, which will finally come to an end on December 31, 2020. Meanwhile, the Chinese yuan is also marking time. The rate for today was 7.0784 yuan per dollar, and yesterday's level was at around 7.0782 yuan per dollar. Here, the main news was the signing by the US Senate of a bill by which the country could introduce sanctions against China. This also applies to Chinese officials who passed the Hong Kong National Security Bill. The aussie, on the other hand, gradually won back its lost positions in relation to the greenback. Today its rate was 0.6884 aussie per dollar, and yesterday it was at 0.6887 aussie per dollar. The country also saw an increase in the number of COVID-19 patients, which forced the authorities to hold a meeting on further actions in this direction. Its results will be announced today. Thus, the aussie did not feel any pressure from the outside today, however, support factors were also not found. The material has been provided by InstaForex Company - www.instaforex.com |

| Second wave of COVID-19 horrifies oil market Posted: 26 Jun 2020 05:40 AM PDT

Today, there are two main problems in the oil market. The first one is a huge surplus in oil stockpiles. Moreover, the situation is deteriorated by fears of the second wave of coronavirus. Chris Midgley, a director of S&P Global Platts Analytics, assumes that oil demand will rise by 4 million barrels per day each month until the end of August amid the economic recovery. However, in September, the growth rate may slow down to 1 million barrels per day amid the seasonal recession. In other words, the world could face oversupply again in autumn. OPEC + participants have achieved a result. The implemented measures have removed 14.5 million barrels per day from the market. Nevertheless, experts doubt that Iraq and Nigeria will continue to comply with the terms of the deal and fulfill their obligations. Moreover, rising oil prices have encouraged some US companies to increase production. In this regard, the US oil market has more or less stabilized, but the country is afraid of the arrival of the second wave of COVID-19. Platts Analytics experts suggest that "black gold" prices will remain in the range of $35- $45 per barrel in the near future. However, for many oil producers this range is hardly acceptable. Mercuria's head Marco Dunand noted that Saudi Arabia, the United States, and non-OPEC oil producers are ready to raise prices above $40 per barrel. The material has been provided by InstaForex Company - www.instaforex.com |

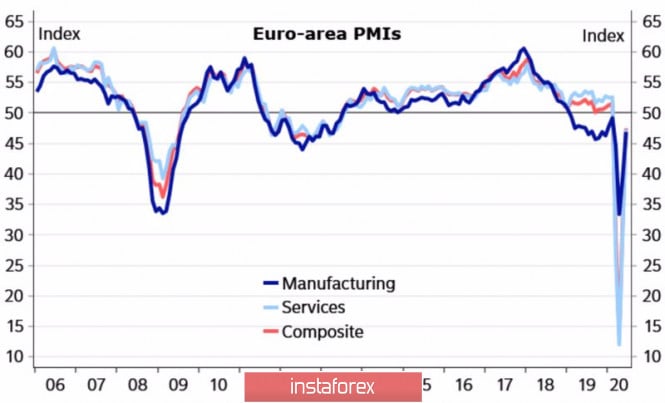

| The euro will quickly get out of the hole Posted: 26 Jun 2020 05:24 AM PDT If the White House does not abandon the idea of a V-shaped recovery of US GDP, the Fed is cautious and argues that the return of the economy to the trend will not be as fast as many believe. Optimists believe in an early victory over COVID-19, and pessimists are pointing facts in their faces about the record number of infected people in the United States and around the world. Both the fate of US stock indices and the fate of EUR/USD will depend on who is right in the end. The euro started the last full week of June for health and finished for peace. Impressive statistics on European business activity set up the "bulls" on a major scale. Especially since the minutes of the ECB's last meeting should have contained conciliatory notes about the German Constitutional Court. Indeed, Christine Lagarde and her colleagues noted that they discussed the effectiveness of QE at each meeting and agreed to transmit more detailed information to the Bundesbank for further submission to the German parliament and court. Unfortunately, this was not enough to continue the EUR/USD rally. The weather for buyers was spoiled by the collapse of the US stock indices and the deterioration of the IMF's forecasts for global GDP for 2020 from -3% to -4.9%. Dynamics of European business activity

The International Monetary Fund, citing a slower recovery from the crisis and a more severe contraction in economic activity, increased estimates of the depth of the recession. First of all, these affected countries such as France and Spain, which, together with a record sagging of international trade in April, raised serious doubts about the ability of the Eurozone's GDP to recover quickly. Dynamics of international trade

However, the leading indicators of Bloomberg indicate that Europe will get up from its knees faster than the United States, and there is a logic in this. The epidemiological situation in the Old World is better than in the New, and given the large-scale incentives, the Eurozone economy is quite capable of presenting a pleasant surprise. If it does, the ECB may not spend the entire €1.35 trillion. This is the amount estimated for the scale of the emergency asset purchase program due to the pandemic. Of course, due to the difficult situation with COVID-19, the "bulls" for US stocks are in an extremely difficult position, however, according to Larry Kudlow, the US economy will not be closed again. At the same time, cheap money from the Fed and verbal interventions by Donald Trump, for whom the strong position of the S&P 500 is almost the only way to win the election, allow us to expect that the stock index correction will not be deep. The good news about a vaccine or medication for coronavirus can return buyers' interest in equity securities. For the euro, this is positive. The return of the quotes of the main currency pair to the resistance at 1.129, followed by its successful assault, will be an occasion for purchases. Technically, the daily EUR/USD chart continues correction to the 23.6% and 38.2% Fibonacci levels from the AD wave after implementing the 88.6% target for the "Bat" pattern. The end supports should be used for the formation of long positions. EUR/USD, the daily chart

|

| Oil: cost of raw materials is growing rapidly Posted: 26 Jun 2020 05:21 AM PDT

The price of crude oil this morning went up amid good statistics from the United States of America. However, in general, due to the not very stable situation in the black gold market that has developed this week, the average oil price may be in the negative zone. An increase in raw material reserves in America should be considered the reason for the reduction. In addition, the rapid spread of coronavirus infection in the United States also puts serious pressure on the price of oil. This morning, the price of futures contracts for Brent crude oil for delivery in August on a trading floor in London rose significantly after an even more dramatic drop in the previous days. The rise was 1.49% or 0.61 dollars, which sent the brand to the level of 41.66 dollars per barrel. Recall that yesterday's trading also ended on a positive note: an increase of 1.8% or 0.74 dollars. The price of futures contracts for WTI light crude oil with delivery in August on the electronic exchange in New York today also moved upward to 1.45% or 0.56 dollars. Thus, its morning level was in the region of 39.28 dollars per barrel. Yesterday, at the close of trading, there was also an increase to 1.9% or 0.71 dollars. The main growth factors in the oil market are statistics on increasing orders for durable goods, which are recorded in the United States of America. According to recent statistics received from the Ministry of State Trade, the total volume of such orders in the last month of spring was 15.8% more compared to the previous period. Analysts' forecasts in this regard turned out to be much more modest than real numbers. According to their preliminary data, the increase should have been no more than 10.9%. Of course, such an excellent result could not but please investors who were inclined towards an accelerated pace of economic recovery. Even more positive was added after the release of data on the unemployment rate in the United States. As it became known, the number of new applications for unemployment benefits last week fell by 60 thousand. Thus, according to the report of the Ministry of Labor of the country, 1.48 million people wrote applications. Meanwhile, a more significant result was expected. Experts assumed that the decline would reach 1.3 million people. Nevertheless, the fact that this indicator is steadily declining is already perceived positively in the oil market. However, negativity is also enough. Market participants are extremely concerned about the epidemiological situation in the world and in the United States in particular. A sharp increase in the number of new infections in some US states may lead to the re-introduction of restrictive quarantine measures, which will negatively affect the pace of economic recovery. Nevertheless, the authorities assure that if the restrictions are returned, then only partially and in individual cases. So, there are plans to close the so-called "distribution points", individual places and stores, and this must be done very quickly so as not to spread COVID-19 to a wider territory. Investors do not yet believe too much in this rhetoric, which speaks of minor quarantine measures since statistics on the number of cases dictate quite the opposite. The positive aspects of the oil market include a possible increase in demand, which is expected in the near future. At least investors saw some signals for this. Thus, satellite data reflect a rather serious recovery on the roads of China, the United States of America, and Europe, which indicates an increase in fuel demand and provokes an increase in demand for crude oil. Road congestion in Shanghai has already exceeded the same indicators of the previous year, and in other major cities of the world, this level has returned to the pre-crisis mark. This suggests that demand is rapidly recovering, which inspires hope in the hearts of investors who already have enough negative. In general, the week for the oil market was not easy. The rapid growth was followed by an equally significant drop, which is unlikely to be played out on the last working day of the current week. However, it is already positive that the negative pressure is broken and a positive correction has begun. The material has been provided by InstaForex Company - www.instaforex.com |

| USA, Europe, and Asia stock indices continue the rally Posted: 26 Jun 2020 05:20 AM PDT

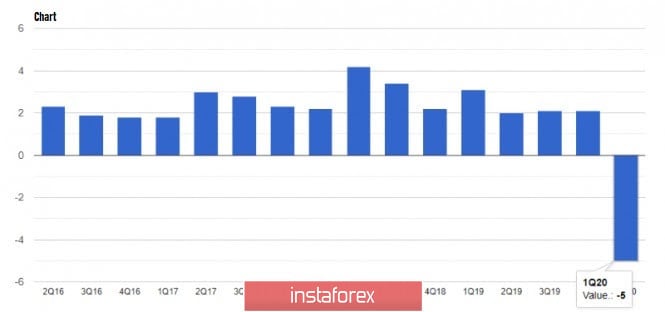

Today, the stock indices in the Asia-Pacific region mainly grow against the backdrop of good dynamics in the markets of America, which was noted at the closing of yesterday's trading session. The head of the Bank of Japan made a statement that the country was ready to continue a soft stimulating policy, as it has proven itself to support the economy in a difficult situation associated with the global COVID-19 pandemic, and remains extremely relevant against the background of a possible second wave of the disease. As the state emerges from the crisis, the regulator will smoothly return to its goal in terms of inflation in the region of 2%. Japan's Nikkei 225 Index rode rapidly by 1.22% in the morning. On the other, the country's clothing production and sales sectors are growing the worst: the increase in Fast Retailing was only 0.2%. Things are best in the investment technology and car manufacturing sectors. Stock markets in China remain inoperative due to the holidays, but the Hong Kong Hang Seng index fell slightly by 0.6%. The South Korean Kospi Index rose 1.08%. Samsung Electronics Co. managed to achieve good results here rising to 2.9%, and Kia Motor with 1.8%. Australia's S & P / ASX 200 index rose by 1.42%. Here, the financial sector and the largest oil producers became growth leaders. Thus, the securities of the largest financial corporations in the country rapidly move up. Commonwealth Bank of Australia added 2.3% to its previous value, Westpac Banking increased by 3.2%, National Australia Bank by 2.7%, and Australia & New Zealand Banking Group also rose by 3.1%. Yesterday, the stock markets of America completed their work on a positive acquiring and increase almost everywhere. The Dow Jones Industrial Average jumped immediately by 1.18% or 299.66 points, which moved it to the mark of 25 745.60 points. The Standard & Poor's 500 index increased by 1.1% or 33.43 points. Its current level is in the region of 3 083.76 points. The Nasdaq Composite Index rose by 1.09% or 107.84 points, which sent it to the mark of 10 017 points. The steady growth of US stock indices began to be recorded only in the last hour of the trading session when very positive data began to come on statistics on the economic recovery of the state. Until that moment, the indicators were in an extremely unstable situation, which was accompanied by multidirectional dynamics, provided by news of an increase in the number of COVID-19 patients in the territory of individual states, which in turn signaled a very probable second wave of the COVID-19 pandemic. The situation was aggravated by the fact that the authorities decided to cancel the lifting of quarantine measures, which was already taking place everywhere. Market participants were wary of the background of such steps, which are likely to further slow down economic growth in the country. So, according to statistics from the country's Department of Commerce, in the first quarter of this year, the United States economy shrank by 5% in terms of average annual rates. This decline was the first in six years. In 2014, there was also a decrease, which nevertheless was much lower with 1.1%. Statistics on the number of newly submitted applications for unemployment benefits also turned out to be slightly worse than preliminary forecasts of analysts. Real numbers reflected a growth of 1.48 million people, while earlier growth was expected to be no more than 1.3 million people. Despite too positive statistics on economic growth, the US government still hopes that V-shaped growth should happen. European stock markets also found themselves in a positive zone following yesterday's trading. The EU's total Stoxx Europe 600 index of enterprises increased by 0.72%, which sent it to the level of 359.74 points. The UK FTSE 100 index rose 0.38%. The German DAX Index climbed 0.69%. The CAC France index showed one of the highest growth levels with 0.97%. The Italian FTSE MIB index gained 0.37%. Spain's IBEX 35 Index takes the lead with an increase of 1.04%. The main market support came from the region's main regulator, the ECB, which proposed a new mechanism for issuing loans to the Central Bank, which are not in the euro area. Using this mechanism, most central banks in the world will be able to issue loans in a single European currency, while debt securities also denominated in euros will act as collateral. This will help maintain the liquidity of the euro in the event of too much negative from the pandemic and its influence will call into question the implementation of the monetary policy of the European Central Bank. Among other things, yesterday it became known that consumer confidence in the economy of the main EU country - Germany - is gradually growing. Particularly quickly, this growth began to occur after enterprises began to return to their work after quarantine measures. This gives hope for an even more confident rise in the future. In the meantime, positive news for the stock markets is enough to ensure a steady increase continued until the next correction. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for June 26,.2020 - Potential for further drop towards the levels at $8.880 and $8.426 Posted: 26 Jun 2020 04:46 AM PDT

Japan's Covid-19 contact-tracing app has been downloaded more than 4 million times since its launch a week ago as the government seeks to head off a second wave of infections now that businesses and schools have reopened.Health ministry official Yasuyuki Sahara said while there was no target number for downloads, "we want to make as many people as possible to use this app". Technical analysis: Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for June 26,.2020 - Watch for potential new buying wave and test of $1.778 Posted: 26 Jun 2020 04:30 AM PDT

Markets showed signs of optimism on Friday, with European shares opening higher and oil prices rising despite a record number of new Covid-19 infections in the United States. They rose across the US by at least 39,818 on Thursday, the largest one-day increase of the pandemic. The governor of Texas temporarily stopped the state's reopening on Thursday as infections and hospitalisations surged. Technical analysis: Gold has been trading sideways at the price of $1,764. I see potential for the further rally towards the level at $1,778. Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Jun 2020 04:22 AM PDT Corona virus summary:

France's health minister, Olivier Veran, says the scheme involving residents of 30 districts who have been invited to take a diagnostic virology test, could be extended to the rest of France if it proves useful. The virology tests, as opposed to blood antibody tests, are usually done by taking a swab from the patient's nose to check for the presence of the virus's genetic material (RNA) and are considered extremely accurate. Technical analysis: EUR/USD has been trading sideways at the price of 1,1225. The EUR did break the downside channel in the background and I expect further rally towards the levels at 1,1255 and 1,1280. Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| Europe on brink of economic collapse Posted: 26 Jun 2020 03:44 AM PDT

Europe is going through tough times. The EU economy is in danger because emergency programs are about to expire. Restaurant owners could meet with great difficulties. Mr. Carvalho owns a restaurant in Braga next to the country's oldest cathedral. He said that income is less than a third of the level that existed before the coronavirus outbreak. Thereby the country's borders were closed for tourists, and local residents had to stay at home. Even now, when the restrictions are lifted, there are no customers in his restaurant. At the end of the summer, the Portuguese government is going to move on to other measures that are designed to encourage companies to maintain jobs positions, but the consequences can be unpredictable. Other countries also understand the danger of the situation, but despite the budget deficit, they are trying to expand support. Most likely, this would not be enough, because demand remains low and is unlikely to recover in the near future. The Statistical Office of France INSEE reports that the activity of the European economy is below normal by more than 10%. Small firms are on the verge of collapse. The shutdown of businesses means the loss of jobs, and, consequently, an unemployment increase. This, in turn, does not bode well for an already weak economy. According to the report of the Allianz SE insurance company, due to the cancellation of the fiscal policy, about 9 million people would be unemployed in 2021. Former chairman of the bank Mervyn King is confident that support programs should be in effect until the moment when GDP is close to the pre-crisis level. European countries continue to allocate billions to economic recovery. Thus, Germany would provide another €130 billion ($147 billion) to stabilize the economy. The government promised to allocate as much as needed, because it was not for nothing that Germany had been saving a budget surplus for many years. The European Union, in turn, plans to launch a fiscal package in the amount of €750 billion. This support would help countries go further and possibly overcome the crisis. Italy would provide financial incentives for another €10 billion and prolong vacation programs from 14 to 18 weeks, which would protect some employees until the end of the summer. The virus pandemic has shown how fragile an economy is. Obviously, shutting down the production is always much easier than restoring the global economy. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis and forecast for GBP/USD on June 26, 2020 Posted: 26 Jun 2020 03:30 AM PDT Good day, dear traders! Daily

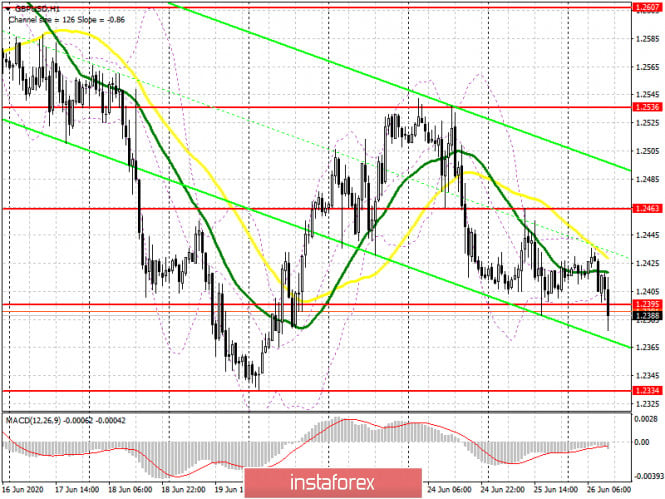

At yesterday's trading, the pound/dollar currency pair showed quite interesting dynamics. The quote rose to 1.2462, however, it failed to gain a foothold above the strong technical level of 1.2453 and turned south. The minimum values of Thursday's trading were shown at 1.2388, however, the bears did not manage to make a true breakdown of the important mark of 1.2400. Also, the trades on June 25 closed at 1.2415, that is, exactly where the Thursday session opened. As a result, a disembodied doji candle with a longer upper shadow appeared on the daily chart. This is unlikely to indicate further movement of the British currency. In recent days, the US dollar has again become popular with investors amid an increase in the number of COVID-19 infections in several US states, as well as in connection with US trade tensions with China and the European Union. Yesterday and today's macroeconomic statistics were discussed in more detail in the article on EUR/USD, so I think it makes no sense to repeat it. It is only necessary to add that no reports are scheduled from the UK today, and the fundamental component will be determined by data from the United States, which will begin to arrive, starting at 13:30 (London time). More detailed information can be found by looking at the economic calendar. If we return to the technical picture on the daily chart, the closing price of today's trading will be very important. The pair's return to the mark of 1.2400, with the mandatory closing of the weekly and daily sessions below these levels, will indicate the further prospect of a bearish scenario. If the trading ends above 1.2463, the option is not excluded, in which the pair will try to once again gain a foothold above the significant psychological mark of 1.2500. However, this can be judged as early as next week, starting from Monday. H4

In the four-hour timeframe, the pair started to consolidate in the area of 1.2463-1.2388, that is, exactly where the maximum and minimum values of yesterday's trading were shown. There is every reason to assume two options for the development of today's trading on GBP/USD and, accordingly, offer recommendations for opening positions. Those who regularly read the author's articles remember that on Monday the main trading scenario of the current five-day period was considered a downward one. It was recommended to open short positions on the pair after rollbacks to the area of 1.2500-1.2525. Such a pullback took place, and the bulls on the pound managed to raise the quote even to the level of 1.2541. After that, the forces left the players to increase the exchange rate, which was facilitated by the renewed need for the US dollar as a protective asset. The main reason for this change in market participants' moods is the same - COVID-19. When the situation with coronavirus infections worsens, the US dollar acquires the status of a safe-haven currency and is in high demand. Conclusion and trading recommendations for GBP/USD: Taking into account the initial weekly forecast for a decline in the GBP/USD exchange rate, it was recommended to open short positions after short-term rises in the quote to the psychological level of 1.2500. Although such a pullback has already occurred, I do not exclude that today the pound bulls will again try to move the pair in the north direction. In this situation, I recommend looking at the sales of GBP/USD after short-term rises in the price zone of 1.2460-1.2490, where the 4-hour chart contains moving averages (200 EMA, 50 MA, and 89 EMA), each of which can provide a decent resistance and turn the course down. If there is a true breakdown of the current support of 1.2388 and the price is fixed below this level, you can also try selling the British currency on a pullback to it. In both cases, I do not recommend setting goals and targets and closing trades before the end of current trading. Regarding sales, I recommend that you wait. Let's see how this trading week ends and what shape the weekly candle will take. On Monday, there may be more clarity and more options for trading the pound/dollar currency pair. Have a nice weekend! The material has been provided by InstaForex Company - www.instaforex.com |

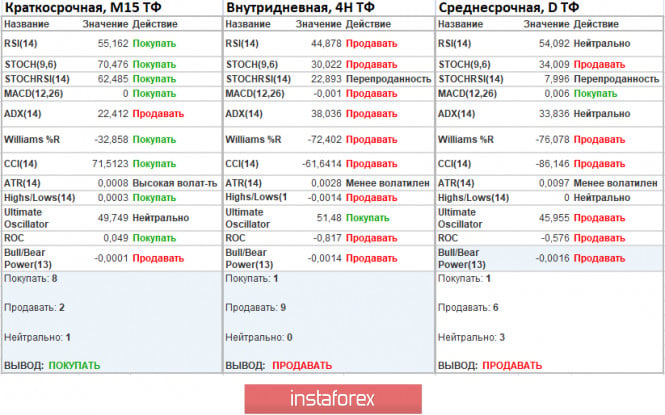

| Trading recommendations for EUR/USD Posted: 26 Jun 2020 03:20 AM PDT According to the comprehensive analysis, we can see a V-shaped reversal patter that proves a 100% recovery of the quote. The trading week is coming to an end and it is time to sum up all the analyses. Let's take a look at the euro/dollar pair. According to the chart, the pair hit the support level of 1.1180 and moved to the area of 1.1300/1.1350. After that, buyers lost momentum and sellers opened a lot of deals. As a result, the quote returned to the level of 1.1180. We can see a V-shaped reversal. It means that the downtrend which began on June 11 near the levels of 1.1440/1.1500 is still in force. Thus, the price may fall even deeper. According to the alternative scenario, the pair may fluctuate within the levels of 1.1180//1.1300//1.1500. The prediction is based on the fact that the market trend has changed. Besides, the pair will hardly resume the downtrend that occurred on March 10 as there is no proper emotional influence on the market. As a result, the pair may fluctuate within a new range that will prevent it from both a fall and a rise. Analyzing the previous trading day, we can see that a number of short deals was opened at the beginning of the European session. The quote managed to reach the level of 1.1180 (1.1190). After that, it rolled back towards 1.1231 and got stuck within the levels of 1.1210/1.1230. The market volatility was the lowest in the last 12 days. Moreover, it was 19% below the average daily reading. The current dynamic points to the accumulation that may result in the significant market acceleration. As it is said in the previous review, traders were working on the recovery process from the value of 1.1280. The primary target should have been the level of 1.1180. The above-mentioned alternative scenario can be proved by the fact that in 2015-2016, the price was hovering within these levels. Yesterday, the US disclosed its GDP data for the first quarter. The US economy contracted by 5% while the preliminary estimates showed a drop of 4.8%. I think that markets were not surprised and the data was already priced in. At the same time, the US published quite positive figures on its durable goods orders. The indicator jumped by 15.8% in May while analysts had predicted a rise of 8.5%. It is the most significant rise since July of 2014. However, the US labor market situation is really alarming. The number of the first-time claims declined to 1,480,000 from 1,540,000. Economists had expected a drop to 1,380,000. The number of the continuous claims exceeded the forecast. The indicator decreased to 19,522,000 from 20,289,000. The ECB disclosed its monetary policy meeting minutes. According to the document, its council members debated the pros and cons of its monetary policy. The ECB said there was "broad agreement" that the "negative side effects had so far been clearly outweighed by the positive effects of asset purchases on the economy in the pursuit of price stability". Notable, the envelope for the pandemic emergency purchase programme (PEPP) will be increased by €600 billion to a total of €1,350 billion. Today, traders are focused on the US personal spending and income. However, such data never has significant influence on the market. Besides, Christine Lagarde, the president of the European Central Bank, believes that the world has passed the worst of the coronavirus crisis. During the online Northern Light Summit Christine Lagarde said: "We probably have passed the lowest point and I say that with some trepidation because of course there could be a second wave." She also noted that the economic recovery will be gradual. Early next week all eyes will be turned to the eurozone inflation data. Economists do not expect any improvements. Then, there will be a flow of information from the US, including ADP reports, the US Labor Department report, and the FOMC meeting minutes. The most important events of the next week: Monday, June 29 US - Pending Home Sales Tuesday, June 30 EU – Consumer Price Index, June (Flash) US – S&P/Case-Shiller 20 City, April Wednesday, July 1 EU – Manufacturing PMI (June) US – ADP Non-Farm Employment Change (June) US – ISM Manufacturing PMI (June) US – FOMC Meeting Minutes Thursday, July 2 EU – Unemployment Rate (May) EU – Producer Price Index (May) US – Labor Department reports - Non-Farm Employment Change - Unemployment rate - Average hourly earnings US – Unemployment Claims Friday, July 3 US – Independence Day According to the chart, the price is hovering within the levels of 1.1205/1.1240. It can be considered as accumulation ahead of a jump in activity. To resume the downtrend, the pair should consolidate below 1.1165. According to the alternative scenario, the pair may fluctuate within the levels of 1.1180//1.1300//1.1500. It is quite possible that accumulation near 1.1205/1.1240 will soon come to an end. Thus, buy deals could be opened above 1.1240 with the targeted level at 1.1260. Sell deals could be initiated below 1.1205 with the target at 1.1170-1.1180. The main deals could be opened when the price consolidates below 1.1165 on a four-hour chart. Indicator analysis Indicators of technical instruments on an hourly and daily chart point to selling. The volatility for the week / Measurement of volatility: Month; Quarter; Year The volatility measurement reflects the average daily fluctuation calculated for a month / quarter / year. At the moment, volatility is on the 34-point level, which is 60% lower than the average daily value. It can be assumed that as soon as the accumulation is completed, there will be acceleration that may lead to an increase in volatility. Key levels Resistance levels: 1.1300; 1.1440/1.1500; 1.1650*; 1.1720**; 1.1850**; 1.2100 Support levels: 1.1180; 1.1080**; 1.1000***; 1.0850**;1.0775*; 1.0650 (1.0636); 1.0500***; 1.0350**; 1.0000***. * Periodic level * * Range level ***Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

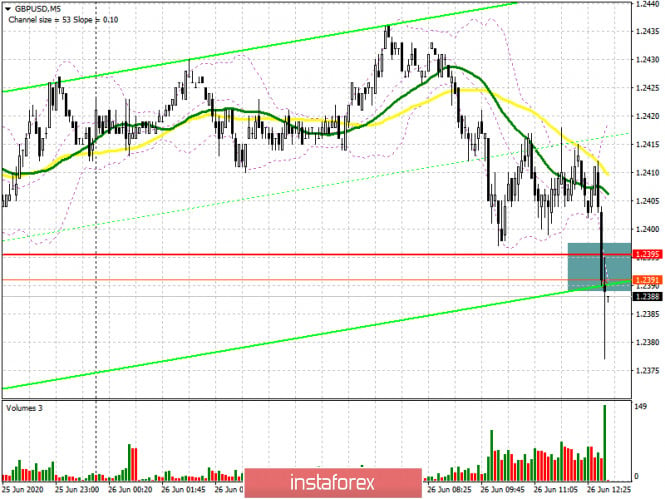

| GBP/USD: plan for the American session on June 26 Posted: 26 Jun 2020 03:15 AM PDT To open long positions on GBPUSD, you need: Buyers of the pound tried several times today to keep the pair above the support of 1.2395, however, they still missed this level. If you look at the 5-minute chart, you will see how the bears achieved a breakout of the support of 1.2395 and now the trade is conducted under this range. However, the signal to open short positions has not yet been formed. We'll talk about this later. Buyers in the second half of the day need an urgent return above 1.2395, which forms a good signal already to buy the pound in the expectation of a return and updating the resistance of 1.2463. The longer-term goal, in the case of active profit-taking on short positions, will be a maximum of 1.2536. If the bulls do not manage to return above the level of 1.2395, then I advise you to wait for the opening of long positions. The optimal scenario for buying will be to update the week's minimum in the area of 1.2334, based on a correction of 30-40 points within the day.

To open short positions on GBPUSD, you need: The bears achieved their goal and broke below the level of 1.2395. Now it needs a bottom-up test to make sure that the market intends to continue the downward trend. I marked the test zone on the 5-minute chart. Only after this, you can sell the pound/dollar pair in the expectation of returning to weekly lows and updating the support at 1.2334, where I recommend fixing the profits since it is unlikely that you will be able to break through below this range. If this happens, the next target will be a minimum of 1.2290 and 1.2237. If the bulls regain the area of 1.2395 in the second half of the day, it is best to open short positions only after forming a false breakout near the maximum of 1.2463 or sell the pound/dollar pair immediately on the rebound from the larger resistance of 1.2536 in the calculation of correction of 20-30 points within the day.

Signals of indicators: Moving averages Trading is conducted below the 30 and 50 daily averages, which act as a resistance for buyers. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the lower border of the indicator at 1.2395 should increase the pressure on the British pound. If there is no rapid downward movement, it is best to abandon sales at the lows at the end of the week. Description of indicators

|

| Posted: 26 Jun 2020 03:13 AM PDT Good afternoon, dear traders! I present to you the trading idea for S&P 500. Over the past two weeks, the instrument has left a very interesting platform with the stops of sellers trading against the trend. On the other hand, a pin bar appeared on D1 yesterday, On the other hand, a pin bar appeared on D1 yesterday, which can be used to open long positions in the future. H1: The return on current prices has a probability of 3 to 1. The trading idea is presented in the framework of the method "Price Action" and "Hunting for Stops" Have a successful trading and control the risks! The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY Turned Back By Confluence Area! Posted: 26 Jun 2020 03:13 AM PDT USD/JPY is trading at 106.90 after the failure to take out the near-term resistance levels, still, the drop could be only a temporary one if the Nikkei and the USDX will climb higher in the short term. The US data could be decisive today for the USD, some goo figures could help the pair to recover after the current sell-off. USD/JPY has rebounded in the short term, but it is still premature to talk about a reversal as long as we don't have confirmation that the USD will dominate the market in the medium term.

USD/JPY has found strong resistance at the confluence area formed at the intersection between the Pivot Point (107.28) with the first warning line (WL1) of the former descending pitchfork. The false breakout above these levels has signaled a bearish momentum in the short term. The major and critical support stands at the 50% retracement level and at the S1 (106.47) level, only a valid breakdown below this area will open the door for a further drop and for another lower low. Personally, I'm still confident that we could have an important leg higher if the pair will stay above the 50% and S1 levels. A valid breakout above the warning line (WL1) will represent a first signal that we could have another leg higher, but only a valid breakout above the Pivot Point (107.28) will really confirm it.

USD/JPY is under pressure as long as it stays below the first warning line (WL1), we could have a long opportunity if the price jumps above the WL1 and above the PP (107.28) and if it makes another higher high, to close above 107.44 high. MACD has shown a bullish divergence lately, but the reversal is still unconfirmed. The pin bar, false breakdown with great separation below the 50% level, and below the S1 (106.47) has suggested that the downside is finished and that the USD/JPY pair could develop an upside swing, but as I've just said, only a valid breakout above the WL1, PP, and another higher high will bring a long opportunity. On the upside, the R1 (108.57) could be used as strong resistance and viable target on the H4 chart. The material has been provided by InstaForex Company - www.instaforex.com |

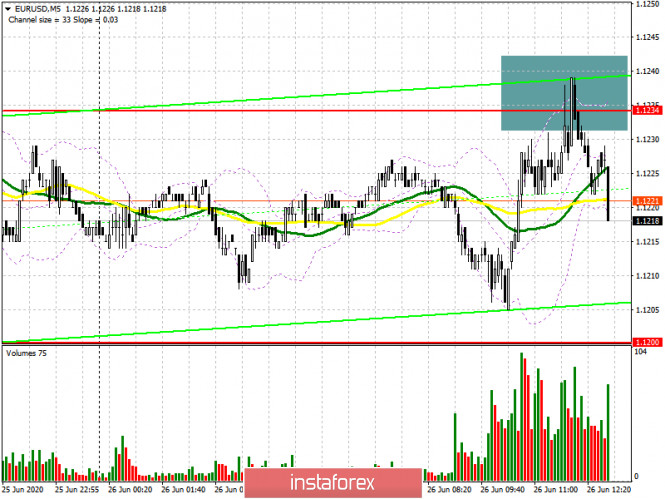

| EUR/USD: plan for the American session on June 26 Posted: 26 Jun 2020 03:12 AM PDT To open long positions on EURUSD, you need: A small upward correction of the euro in the first half of the day ended with another failure of buyers, while the bears continue to actively protect the resistance of 1.1234, below which they managed to gain a foothold yesterday. If you look at the 5-minute chart, you will see how after an unsuccessful attempt to break through the level of 1.1234, a new signal was formed to sell the euro, which I spoke about in more detail in my morning forecast. Now the task of the bulls is to prevent a major sale of the euro/dollar pair and return the pair to the resistance level of 1.1234. Only a break of the level of 1.1234 will provide the bulls with an impulse that can return the euro/dollar pair to the maximum of 1.1280, where I recommend fixing the profits. Also, the task of buyers of the euro will be to protect the support of 1.1200, where the lower border of the current ascending channel, formed at the beginning of this week, passes. But only the formation of a false breakout there will be a signal to open long positions. If there is no bull activity at this level, it is best to postpone purchases until the weekly low is updated around 1.1170, based on a correction of 20-25 points within the day.

To open short positions on EURUSD, you need: Sellers are confidently bending their line, and have already formed a signal to sell the euro. While trading will be conducted below the level of 1.1234, you can count on a repeated decline in the euro/dollar pair to the support area of 1.1200, the breakdown of which will lead to a larger movement of the euro down to the minimum of this week of 1.1170, where I recommend fixing the profits. If the pair returns to the level of 1.1234 again in the second half of the day, and the bulls regain this range, it is best to postpone selling the euro/dollar pair until the maximum of 1.1280 is updated, based on a correction of 25-30 points within the day.

Signals of indicators: Moving averages Trading is conducted in the area of 30 and 50 daily moving averages, which indicates an active confrontation between buyers and sellers at current levels. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the lower border of the indicator around 1.1205 will lead to a new wave of euro decline. Description of indicators

|

| Is the digital dollar the currency of the future? Posted: 26 Jun 2020 02:27 AM PDT One of the key issues in the cryptocurrency sphere is the possibility of combining digital payment means and traditional ones. Disputes between supporters and opponents of the synthesis of virtual and actual money do not subside. Nevertheless, many experts and crypto enthusiasts support the idea of combining online and offline payments. Among the proponents of this approach, crypto enthusiast and large investor Mike Novogratz stand out. Earlier, the American billionaire and founder of the crypto-trading bank Galaxy Digital has repeatedly announced a possible increase in the price of bitcoin to $ 10,000, and after a while - up to $ 14,000– $ 15,000. According to M. Novogratz, the cause for the military-technical cooperation rally, as in the case of gold, will be large-scale incentives for the US economy. The head of Galaxy Digital is confident that with the growing interest of institutional investors in digital assets, the no. 1 cryptocurrency will rise in price in the next 6-24 months. Support for the BTC can be provided by an important event, which is expected on Friday, June 26, - large-scale expiration of options for Bitcoin worth more than $ 1 billion. According to analysts, this is a record amount of funds for the first cryptocurrency. Economists note the significant impact of the options market on the bitcoin exchange rate. Earlier, the leading digital asset overcame the psychologically important mark of $9000, and by the beginning of trading on Friday, June 26, it was worth $9110. Currently, bitcoin has slightly fell and is moving near $9090. According to experts' observation, the current expiration occurs after extremely volatile months. It can be recalled that the no. 1 cryptocurrency fell in price from more than $10,000 to $3800, and then rapidly soared to $5000 in February-March 2020. analysts emphasize that the military-technical cooperation almost returned to February highs in the first month of summer. In this situation, M. Novogratz, who had previously approached the American authorities about the digital dollar, repeated this attempt again. He called on the US government to accelerate the development of a "crypto-American", believing that this would give America an advantage in the global financial system in the near future. Many experts believe that this step will be the first on the way to the synthesis of digital and fiat means of payment. He also called on the United States to follow the lead of China and devote all its efforts to developing an innovative digital dollar. According to the calculations of the crypto enthusiast, the American virtual asset will be distinguished by an important detail - decentralization. It can be recalled that the key feature of any cryptocurrency is their decentralization, as well as their lack of control over the authorities and banks. In this case, experts emphasize that this element of potential digital USD runs counter to the very nature of virtual money. Moreover, experts warn that the creation of such a cryptodollar and its implementation can cause a number of difficulties during use. The material has been provided by InstaForex Company - www.instaforex.com |

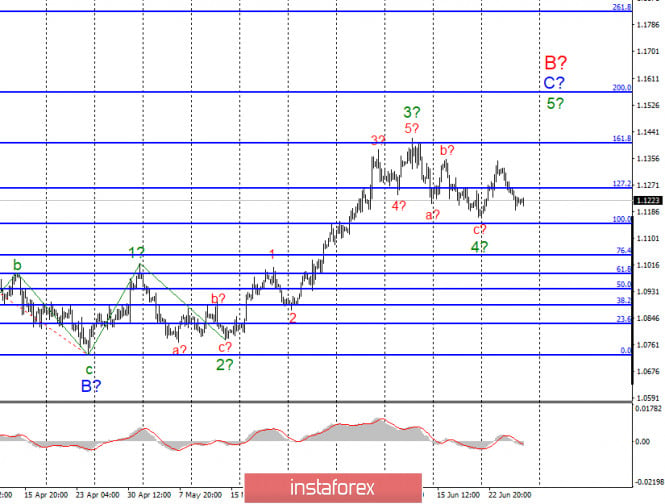

| Posted: 26 Jun 2020 01:53 AM PDT EUR / USD On June 25, the EUR/USD pair has lost around 40 basis points, but has not violated the current wave counting, which involves the construction of an upward wave of 5 in C in B. Until a successful attempt to break through the minimum of wave 4, the current one will remain unchanged. In the case of a successful attempt to break through, wave 4 will first be considered complicated, and waves e and d can also be constructed inside it. If its construction is not completed after that, then the entire wave markup will require adjustments and additions. Fundamental component: On Thursday, the informational background for the euro/dollar pair was quite interesting, but I'm completely not sure that the markets worked it out. Over the past day, the demand for the US dollar continued to remain high, which contradicts the current wave counting. Thus, either the wave counting will have to be clarified, or the demand for the US currency should sharply decline in the next day or two. A report on GDP was released in America yesterday, which showed a 5% reduction, as expected by the markets, a report on applications for unemployment benefits, which in general also did not surprise anyone, and a report on orders for durable goods, which turned out to be much better than expected markets. Thus, in general, the entire news package can be described as neutral. Nevertheless, the markets found motivation for new purchases of the dollar. But will they continue today when no important news is expected from America? Christine Lagarde, who delivered a speech this morning, could adjust the mood of the markets. The ECB chairman said that "Europe has probably gone through the most difficult phase of the crisis caused by the coronavirus epidemic." However, at the same time, the head of the ECB also called on the authorities of the EU countries to prepare for a possible second wave, which, given what is happening in the US, may well begin in Europe. Moreover, she said that the economy of the European Union in the second quarter may decline by 13%. The markets do not expect any more news from the European Union today. General conclusions and recommendations: The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located near the calculated levels of 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each signal "up" MACD calculated on the construction of wave 5 in C in B. GBP / USD On June 25, the GBP/USD pair lost only a few basic points, and thus, the current wave markings have not suffered any changes. As before, wave 4 is considered completed, and if this is true, then the increase in quotes of the instrument will resume in the near future within the framework of wave 5 to 3 or C with targets located about 29 figures and above. So far, wave 4 has taken on a pronounced three-wave form, so wave 5 can turn out to be very extended. Fundamental component: There was nothing interesting again In the UK on Thursday and the markets excellently played this absent news background, having spent the whole day in a range with an amplitude of no more than 30 points. Today, the news background for the pound will remain the same, since nothing interesting is expected from Britain again. Thus, all attention is paid to the US, where the coronavirus sets new records in the number of infections. I believe that it will be difficult for the US currency to rise due to a new outbreak in America. General conclusions and recommendations: The pound/dollar pair supposedly continues to build the rising wave 3 or C. Thus, buy deals remain valid with targets located near the calculated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend buying the pound for each MACD signal "up", calculated on the construction of a rising wave 5 to 3 or C. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for June 26, 2020 Posted: 26 Jun 2020 01:52 AM PDT Overview: The GBP/USD pair continues to move downwards from the level of 1.2469. Yesterday, the pair dropped from the level of 1.2469 (this level of 1.2469 coincides with the pivot point) to the bottom around 1.2418. Today, the first resistance level is seen at 1.2469 followed by 1.2552, while daily support 1 is found at 1.2335. Also, the level of 1.2469 represents a daily pivot point for that it is acting as major resistance/support this week. Amid the previous events, the pair is still in a downtrend, because the GBP/USD pair is trading in a bearish trend from the new resistance line of 1.2469 towards the first support level at 1.2353 in order to test it. If the pair succeeds to pass through the level of 1.2353, the market will indicate a bearish opportunity below the level of 1.2353. However, if a breakout happens at the resistance level of 1.2552, then this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Jun 2020 01:48 AM PDT Demand for the euro declined after the ECB published the minutes of its last meeting, during which it was pointed out that rather high disagreements remain within the bank's management with regards to the timing and volume of its bond purchase program. Just recently, the ECB agreed to increase its PEPP emergency assistance program by € 600 billion euros and extended its validity until June 2021. However, some executives advocated to wait for new data, pointing out the need to have more time to make an accurate forecast on the medium-term prospects and situation of the economy. But there are also those who believe that it is necessary to increase the program more significantly, as there are risks of a second wave of coronavirus, coupled with the generally weak state of the economy, as well as disappointing prospects of inflation. Such division strengthened the idea that the German Supreme Court will be dissatisfied with the rationale of the bond purchase program, putting forward the possibility of the German central bank pulling out its cooperation to the program. Recall that the supreme court already suggested such action last spring, when it questioned the need of ECB's large-scale program. As for forecasts, the ECB predicts the eurozone GDP to decline by 9% this year, which is one of the optimistic scenarios that do not take into account the occurrence of a second wave of coronavirus pandemic. Thus, if a re-outbreak occurs, financial conditions will deteriorate even further, which will require stronger monetary measures to recover. Unfortunately, such a scenario will intensify the serious disputes currently happening within the ranks of the ECB. Meanwhile in the US, a weak report on the labor market, which came out yesterday, fueled the demand for the US dollar. According to the data, initial applications remained at a historic 20 million, increasing by 1.5 million during the reporting week. Although the figure is slightly lower than the record earlier, the possibility of a second outbreak risks a surge in the number of unemployed for the upcoming weeks. Another outbreak will cause the implementation of another quarantine restrictions which will hinder the return of people to work as well as instigate another jump in unemployed figures in the country. As for secondary applications, 19.5 million was recorded from the week of June 7 to June 13. The contraction of the US economy in the 1st quarter of this year fully coincided with the forecasts of economists. According to the report published by the US Department of Commerce, GDP in the 1st quarter of 2020 fell by 5.0% per annum, the same as what experts predicted. The decline is mainly due to the drop of costs of consumers and companies prompted by the coronavirus pandemic. Meanwhile, the improving figures of orders for durable goods in the United States greatly pleased traders. The rise started after quarantine restrictions were lifted, in which supply chains and new orders recovered. According to the data, orders for durable goods in May grew by 15.8% compared with the previous month, up from economists' forecast of 9.8%. New orders for transportation equipment jumped 80.7% in May, while orders excluding this category jumped 4%. Good data on production activity in the area of Kansas City Fed also did not go unnoticed. The rise of figures in June occurred due to the removal of quarantine restrictions in the country. According to the report of the Kansas City Fed, the composite index in June rose to 1 point from its -19 points in May, while economists predicted the indicator to just be -8 points. However, despite good and improving data, the expectations of the White House and the Federal Reserve will not be met since it is already clear that the US economy is under a longer and slower recovery from the bottom. According to the report of S&P which was published yesterday, the US economy will take at least two years before it can reach its pre-crisis levels. The main problem will be unemployment in the United States, which will remain high enough that will affect consumer spending and the restoration of business demand. The high likelihood of a second wave of the pandemic will also limit economic growth, so the US GDP is expected to decline by 5.0% this year, and grow by only 5.2% in 2021. Robert Kaplan, president of the Dallas Fed also agreed to such forecasts. According to him, GDP will decline by 5% this year, and unemployment is likely to be 8% -10%. These figures are the average forecast among most leading economic agencies, including the Fed. Kaplan also expressed doubts that the United States has passed the peak of the coronavirus pandemic. As for the technical picture of the EUR / USD pair, demand for risky assets will most likely remain low today, in which a breakout from the support level of 1.1200 will provide the bears a comfortable advantage which will quickly push the quotes into the area of Lows 1.1170 and 1.1100. However, the bulls can quickly seize the control in the market, and for this, they will need to breakout the quotes and consolidate above the resistance level 1.1235. The success of it will provoke the demolition of a number of sellers stops, which will lead to a rapid increase to the area of highs 1.1280 and 1.1230. ECB head Christine Lagarde will also conduct a speech today, during which she will discuss economic prospects and several predictions for the future. If Lagarde mentions the emergency assistance program, demand for risky assets will continue to decline. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Jun 2020 01:37 AM PDT Good afternoon traders! A trading idea for the NZD / USD currency pair. For the past two weeks, buy stops have been placed at the level of 0.63700. As a result, on Wednesday, a good short-term initiative appeared, from which a breakout may occur from the level. Short the pair by forming a classic "ABC" wave pattern, with the exit of buy stop orders at 1.63700. Forget the idea if the quotes breakout above 0.65. Have a successful trading and make sure to control the risks! The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD is approaching 1st support, possible bounce ! Posted: 26 Jun 2020 01:30 AM PDT

Trading Recommendation Entry: 1.3618 Reason for Entry: Horizontal pullback support Take Profit :1.3742 Reason for Take Profit: Horizontal overlap Stop Loss:1.3496 Reason for Stop loss: Horizontal swing low support The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment