Forex analysis review |

- Overview of the EUR/USD pair. July 13. A virologist who escaped from China accuses Beijing of hiding information.

- Hot forecast and trading signals for the GBP/USD pair on July 13. COT report. Britain starts building customs points on the

- Hot forecast and trading signals for the EUR/USD pair on July 13. COT report. Buyers lost ground, great opportunity for bears

- GBP/USD. Hong Kong can cause serious deterioration in relations between the UK, US and China

- EUR/USD. November 3 can change a lot in the world. What are the real odds of Joseph Biden winning?

| Posted: 12 Jul 2020 05:36 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -1.6055 A new trading week begins for the euro/dollar pair with the same vague movement that has been observed in the last month. On the one hand, the side channel with the borders 1.1200 and 1.1350 is preserved. On the other hand, there is a slight upward bias in the movement of quotes. However, corrections against the main movement are very frequent, and before overcoming the Murray level of "5/8"-1.1353, it makes no sense to talk about a full-fledged upward trend. Thus, in general, the current situation is not the most favorable for trade. Buyers remain uncertain, and sellers do not have enough strength to overcome the moving average line. Most of the macroeconomic reports continue to be ignored by traders, and the general fundamental background allows for various scenarios in the coming week. Naturally, we will start the review of the most interesting events with the American President, who on Sunday, July 12, for the first time in public during the pandemic, put on a medical mask. Yes, this message can be considered the news of the day, because Trump managed to contradict himself again. Earlier, Trump said that he does not imagine how he will communicate with world leaders while wearing a mask. Yesterday, the US leader said that "wearing a mask is great". "I made the decision to wear a mask because of a visit to the hospital. During this event, I will communicate with many military personnel, people who conduct operations. I think it's a great idea to wear a mask on these occasions. I have never opposed wearing a protective mask. Just everything has its time and place," said Donald Trump. In addition, the American President commented on the desire of American musician Kanye West to run for President of the United States. However, Trump does not believe that a black musician can compete with him, but said that "West will easily take away some of the votes from Joe Biden, who did nothing good for black people". This is a very interesting statement, especially against the background of the fact that in the course of the racist scandal, it was Trump who was accused of racism, and it was Trump who wanted to disperse the protesters and people with the help of the US national army. After these actions and intentions of Trump, Trump's political ratings again rushed down, and many sociologists said that the majority of the black population of the United States will vote for Biden. Meanwhile, the Eurogroup meeting was held in the European Union last week, where, however, the issue of creating a recovery fund was not discussed, although traders are waiting for information on this topic. However, on Friday, the head of the European Council, Charles Michel, spoke and shared interesting information with the markets. The head of the European Council said that he updated the proposal to the EU member states on the budget for 2021-2027, as well as on the economic recovery fund. The new proposal is to fix 1.7 trillion euros, as well as an additional 750 billion euros for economic recovery. The balance between loans, subsidies and guarantees will be maintained, "in order to avoid overloading the country's budgets due to too high debt". 70% of the fund can be used in 2021-2022, where and to whom the funds will be sent, the European Commission will determine. 30% can be used in 2023, depending on the macroeconomic indicators. "During the discussions between the governments of the states, it became clear that there are serious objections to the fund. After that, I held a series of bilateral talks with European leaders, following which I will present a revised draft of the multi-year budget plan and the recovery fund," Michel said. "If we still want to see Europe on the map in 10-15 years, we must now do everything to prevent an economic collapse," Michel concluded. On July 17-18, a new EU summit will be held in Brussels, which will focus on the fund for recovery from the pandemic crisis. There are still no agreements between the countries, as Austria, Sweden, Denmark and the Netherlands do not consider it necessary to provide 500 billion euros to the affected countries on free terms. At the same time, there was quite interesting information that a former virologist of the Institute of Public Health of Hong Kong fled from China to the United States. Li Meng Yan accused the Chinese authorities in an interview with Fox News of deliberately hiding information related to the "coronavirus" epidemic. According to Li Meng Yan, she was one of the first to study the COVID-2019 virus. She is confident that the Chinese government was aware of the true extent of the threat posed by the virus. Li Meng Yan said that the Chinese government knew about the ability of the virus to be transmitted from person to person as early as December 2019, but did not allow foreign scientists, even from Hong Kong, to start studying the virus. At the same time, the virologist notes that "coronavirus" was previously discussed quite freely in scientific circles, but at a certain point all conversations about it stopped. The fleeing virologist also said that "she knows about corruption in the WHO, the Chinese government and the Chinese Communist Party, so she is not at all surprised by what happened". The Chinese Embassy in the United States has already rejected everything that Li Meng Yan said, saying that they do not know such a person, she has never worked in the health sector in Hong Kong, and Beijing responded to the outbreak in a timely and effective manner. On the first trading day of the new week, no macroeconomic reports or events are planned in the European Union and the United States. Thus, it is unlikely that traders will find grounds on Monday to overcome the important Murray level of "5/8"-1.1353. More or less important news will begin to arrive on Tuesday, when America will release a report on inflation, and the EU – on industrial production. However, traders will closely monitor the topics of "coronavirus" in the US and the EU summit on July 17-18. Of course, we should not forget about the topic of the China-US confrontation, which continues to escalate.

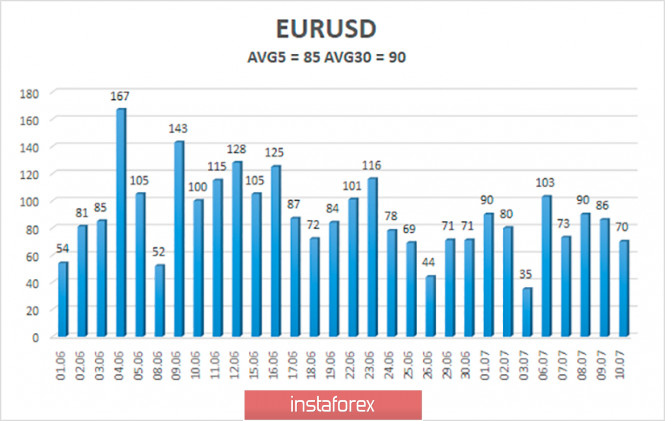

The volatility of the euro/dollar currency pair as of July 13 is 85 points and is characterized as "average". We expect the pair to move between the levels of 1.1214 and 1.1384 today. A new reversal of the Heiken Ashi indicator downwards will signal a new round of downward movement within the side channel. Nearest support levels: S1 – 1.1230 S2 – 1.1108 S3 – 1.0986 Nearest resistance levels: R1 – 1.1353 R2 – 1.1475 R3 – 1.1597 Trading recommendations: The EUR/USD pair continues to trade near the moving average line, inside a side channel with a slight upward slope. Thus, it is recommended to open long positions if traders manage to overcome the level of 1.1353, which is the approximate upper limit of the channel, with the goal of 1.1475. It is recommended to open sell orders no earlier than the 1.1200 level with the goal of 1.1108. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Jul 2020 05:21 PM PDT GBP/USD 1H The GBP/USD currency pair, unlike EUR/USD, remained inside the ascending channel on Friday, but the bulls failed to push through the resistance area of 1.2667–1.2687. Thus, at the moment either the bulls or the bears can prevail. The victory for the bulls can be awarded if the pair is pinned above the 1.2667–1.2687 area. In this case, we can expect the British currency to strengthen further within the ascending channel. Sellers also need to overcome the Kijun-sen line, which will automatically mean leaving the ascending channel and changing the trend to a downward one. Thus, the pair's quotes are now squeezed in a narrow price range and only an exit from it will indicate the further trend of the pair. GBP/USD 15M The lower linear regression channel turned up on the 15-minute timeframe, and the higher one turned sideways. This means that in the most short-term plan, the upward trend has not dried up, so market participants can expect a new upward movement in the new week. As for the COT report, it turned out to be absolutely logical and reflects the essence of what is happening for the pound/dollar pair in the currency market at the moment. Professional traders during the reporting week actively opened Buy-contracts (+6,743 contracts) and did not open Sell-positions (+12). Thus, the total net position in the commercial category immediately increased by 6,700. But the category of commercial market participants actively closed both Sell and Buy contracts. At the same time, Buy in much larger quantities. However, as we can see, this did not affect the overall strengthening of the British currency. In technical terms, there are no signs of ending the upward movement yet, so long positions remain relevant at the moment. The fundamental background for the GBP/USD pair did not change much on the last trading day of last week, as well as on the weekend. Market participants are still waiting for the successful conclusion of negotiations between Brussels and London, but it seems unlikely to wait. The UK announced that it is going to spend 890 million euros on the construction and modernization of infrastructure at the borders. The British government's communique says that on January 1, 2021, Britain's stay in the European Union will end and the country will leave the bloc and the Customs Union, regardless of what agreement London will achieve in the negotiations. However, we believe that London itself is well aware that an agreement with the EU will not be achieved and is going to spend almost one billion euros on infrastructure that will provide customs and border checks at the borders with the EU. So far, this negative fundamental background has almost no effect on the pound, as traders are still paying more attention to the coronavirus epidemic in America, which is unclear how it will end for the country's economy. However, this cannot continue permanently. Britain and America are now, in fact, competing to see who has the worst news background. So far, the US is winning, so the greenback continues to fall in price. However, we still recommend that you closely monitor the technical data, as, for example, today the pair may be consolidated below the ascending channel and therefore begin to fall. There are two main scenarios as of July 13: 1) The prospects for upward movement are preserved thanks to the ascending channel. A small correction that took place may be completed today. The price rebound from the lower border of the channel or the Kijun-sen line will signal the opening of new purchases with the goals of the resistance area of 1.2668–1.2688, but we still advise you to wait until this area has been overcome and only then open long positions with the goal of the resistance level of 1.2867. The potential Take Profit in this case will be from 160 points. 2) Sellers are still advised to wait until the pair consolidates below the ascending channel, and at the same time below the Kijun-sen line (1.2563). The downward trend will resume in this case, and the first targets for sell orders will be the support area of 1.2403–1.2423 and the support level of 1.2311. Potential Take Profit in this case will be from 110 to 230 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Jul 2020 05:21 PM PDT EUR/USD 1H On the one hand, buyers oddly traded the pair on the hourly timeframe and quite technically on the other on July 10. The first thing we would like to note is that buyers did not break through the resistance area of 1.1326–1.1342, as well as through the resistance level of 1.1362. We remind you that the euro/dollar pair remains in the side channel, limited by the 1.1350 and 1.1200 levels. Thus, it is quite possible to conclude that traders failed to overcome the upper limit of this channel. Second, the pair's quotes were fixed below the ascending channel, so the trend on the hourly chart changed to a downward one. However, sellers failed to push the Senkou Span B line last Friday, so a corrective growth began, possibly within the framework of a new downward trend, which was interrupted near another important Ichimoku line – Kijun-sen indicator. Thus, the pair was trading between the important lines of the Ichimoku indicator on the last trading day of the week. In the current conditions, we are waiting for the resumption of the downward movement. However, it will be quite difficult for bears to break through below the 1.1200 level in the near future. EUR/USD 15M The higher linear regression channel turned down on the 15-minute timeframe, which signals a downward trend. The lower channel is directed up, indicating Friday's correction. The latest COT report from July 7 turned out to be quite boring. As usual, we are most interested in changes in contracts in the Commercial category, which represents professional traders entering the foreign exchange market in order to make a profit. Speculators in the reporting week opened almost 6,000 Buy-contracts and only 1,700 Sell-contracts. Thus, the overall net position for this category has increased, which, simply put, means a strengthening of the bullish mood. However, do not forget that the COT report only shows changes that have already occurred, so as a forecasting tool, it always requires confirmation by other signals or factors. The technique currently indicates a high probability of going down. The fundamental background for the EUR/USD pair was nearly unchanged on Friday. No important news or macroeconomic publications were planned for this day. There was very little news from the European Union last week, and the election of the new president of the Eurogroup was the main event of the week. The only thing that could be noticed on Friday was the statement of the President of the European Council, Charles Michel, regarding the recovery fund. He told MEPs that EU member states continue to consider the European Commission's proposal to create a 750 billion euro fund to help the sectors of the economy most affected by the pandemic. However, according to him, serious differences remain between the members of the bloc on the issue of the balance of subsidies and loans. In other words, those countries that were initially opposed to providing aid in the form of grants (the" stingy four") do not seem to have changed their minds, which means that the entire draft aid package is in question. This is bad news for the euro, but there is no final decision yet, so do not make conclusions ahead of time. Traders continue to pay more attention to the coronavirus epidemic in the United States. Based on all of the above, we have two trading ideas for July 13: 1) Buyers did not overcome the area of 1.1326–1.1342. Thus, we advise you to purchase the euro only if buyers manage to break the bearish market mood, gain a foothold back above the Kijun-sen line, above the area of 1.1326–1.1342 and the resistance level of 1.1362. We recommend buying the euro only in this case, while aiming for 1.1422. The potential Take Profit in this case is about 55 points. 2) The bears managed to seize the initiative in the market, so now they have an excellent opportunity to return to the Senkou Span B line (1.1265) and continue the downward movement to the area of 1.1228–1.1243 and lower to the support level of 1.1186. It is for these purposes that we advise you to sell the pair at the beginning of a new week. Stop Loss orders can be placed above the critical line. The potential Take Profit in this case is from 30 to 110 points. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Hong Kong can cause serious deterioration in relations between the UK, US and China Posted: 12 Jul 2020 02:26 PM PDT The British pound has recently been trading very attractively against the US dollar. The pound/dollar pair has a pronounced trend, which clearly adds to its fans among traders. However, unfortunately, there is still very little news from the UK. The authorities of the UK decided to relax the quarantine measures and allow public events to be held in the open air, as well as to open almost all public institutions. However, Prime Minister Boris Johnson urges Britons to wear masks in crowded areas. Meanwhile, a group of British scientists has warned of a high risk of a second wave of the disease. Research and simulation data suggest that local COVID-19 outbreaks are becoming very likely, all of them can form a second wave. A large number of high-ranking UK doctors have signed the official warning. The authors of the document say that it is very difficult to predict the epidemic's development in Great Britain, but the experience of other countries shows that there are outbreaks of the disease after removing the lockdown. If one or more of these outbreaks are missed, the entire country could be re-engulfed in a pandemic. There is also little news on Brexit, or rather on the negotiations between Brussels and London. Over the past two weeks, many media outlets have written and mentioned the failure of the next stage of negotiations, then about the resumption, then about another failure, then about possible concessions from the European Union on the issue of fishing. However, there is still no officially confirmed positive information. Therefore, the conclusion we can draw is this: the British pound continues to grow in price solely due to the US dollar and what is happening now in the United States. Therefore, when the situation in the US gets better (the situation with the coronavirus), the demand for the dollar may begin to recover, and traders may remember that there were no fundamental and macroeconomic reasons for the pound's growth. Moreover, the UK economy is expected to lose more % of its GDP than the US or EU, and the future of this country is not defined at all, since Brexit will end on December 31, 2020, and no one knows what and how it will turn out after this date. It has nothing to do with foreign policy or economic issues. One of the current most pressing foreign policy issues is associated with Hong Kong. What does it matter for both the UK and the USA? The leaders of these countries call themselves friends, and claims to China are approximately the same. Thus, the Hong Kong problem is directly related to both the UK and the US. Recall that China, by adopting the law on national security in Hong Kong, violated the 1984 agreement with London, according to which Hong Kong will remain independent from Beijing in most matters until the end of the transition period, which ends by 2047. London has already announced that all Hong Kong citizens can obtain British citizenship and the opportunity to work in Britain if Beijing does not change its mind. Beijing did not change its mind, passed the law and is now trying to confront a verbal skirmish with Washington and London, while the first is actively developing sanctions packages against the Chinese and Hong Kong authorities. Washington has already stopped delivering military goods to Hong Kong. In addition, the US Department of Commerce has suspended a number of trade preferences in relation to Hong Kong, which was announced a week earlier by department head Wilbur Ross. Ross said that "technologies important for ensuring national security may fall into the hands of the People's Liberation Army of the People's Republic of China and the United States is not ready to accept these risks, therefore they withdraw Hong Kong's special status." "The provisions of the Ministry of Commerce, allowing the introduction of preferential treatment for Hong Kong compared with China, including access to exceptions in export licenses, have been suspended," the head of the Ministry of Commerce said. US Consul General in Hong Kong Hanscom Smith said, "Our interest is to guarantee Hong Kong the high degree of autonomy that was promised to it. It worked very well for us, meeting our economic and commercial interests." "The application of the National Security Act is a tragedy for Hong Kong," said the US Consul General in Hong Kong. "Hong Kong has been successful precisely because of its openness, and we will do our best to preserve this." Interestingly, the Chinese authorities do not believe that they violated any agreements or international law. Formally, the new law is aimed at combating terrorism, separatism and foreign collusion against China. Beijing will create a special security authority in Hong Kong that will be subordinate only to the Chinese capital, which will decide the fate of Hong Kongers who come to its attention. Experts say that no terrorist attacks have been observed in Hong Kong in the past six years, so the new law is not aimed at terrorism, but at the opposition. It is noted that mass protests and rallies were attended by up to two million people with a total population of seven million. Meanwhile, there is a new coronavirus outbreak in Hong Kong at the moment. The city authorities have already decided to close all schools for quarantine and tighten quarantine restrictions among the entire population. So far, we are not talking about a new wave of the disease, only 147 new cases were recorded in the last week. However, for Hong Kong, with its highest population density, these 147 cases may be enough for the city to be engulfed by a new wave of the epidemic. Thus, in the near future, not only the issue of Brexit and the future relationship between London and Brussels will be resolved, but also the future relationship between London and Beijing, which may also become very strained. In technical terms, the pair continued its upward movement and reached the level of 1.2666 last Friday. Thus, despite the fact that the correction has formally begun now (the previous high was not overcome), we believe that the upward trend remains and has good chances to continue. All the main technical indicators for both trading systems are directed upwards, and the fundamental background from the UK, which could put pressure on the British pound, is ignored. Recommendations for the GBP/USD pair: We advise you to continue buying the pound/dollar pair as it continues the upward trend, mainly using the readings of the 4-hour timeframe. Volatility remains the same, about 100-130 points per day, and is comfortable for trading. The closest targets for buy orders are the resistance levels 1.2698 and 1.2867. They will be revised on Monday. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. November 3 can change a lot in the world. What are the real odds of Joseph Biden winning? Posted: 12 Jul 2020 02:26 PM PDT We have repeatedly written and mentioned the future election of the US President in November 2020. How much does it affect the US currency right now? Low. However, this is a fundamental background. Such topics have a long-term impact on the currency market, on the mood of traders and investors. Thus, topics like the US-China trade conflict, the US elections, and the coronavirus should not be overlooked in any case. At this time, according to the latest conducted social studies, Joseph Biden is leading in the election race. At the same time, this is evidenced by the results of independent opinion polls, and the results of research by Republicans and Democrats. The numbers themselves are only slightly different. So according to various data, Biden is ahead of US President Donald Trump from 6% to 10%. The balance of power may change more than once over the next few months. Six percent is not a big margin. However, from our point of view, the main problem of Trump is something else: Joe Biden did almost nothing to become a leader. If the American president gives several interviews every day, speaks at briefings, has started traveling around the country with campaign rallies, and his Twitter account is full of messages, then Biden rarely gives interviews and comments on anything. Trump regularly criticizes and openly insults his opponent, doubts that he is able to pass an IQ test and calls him "sleepy Joe", while Biden rarely pays attention to Trump. Moreover, now that the coronavirus epidemic is still raging in the country, Biden is in his residence and rarely appears in public. On the one hand, it is understandable since the presidential candidate is 77 years old, and it is known that people of this age are at high risk. However, Trump is not young, but this does not prevent him from traveling around the country and fundamentally not wearing a protective mask. All this makes it clear to the American population that Biden is much more serious about the epidemic, and one of his last speeches, recorded on video, is just dedicated to criticizing Trump in matters of governing the country in difficult times and opposing the coronavirus. However, let's return to the topic of election campaigns. Many experts and political analysts note that Biden's position looks much more attractive than Trump's. However, Biden also has its disadvantages. First, is his age at 77 years and since the presidential term is long, this means that when it comes to an end Biden will be 81 years old. Many people doubt whether a person at this age can lead a country with the largest economy in the world. Especially since Biden has repeatedly made blunders on air in the past. However, on this issue, he is unlikely to lose to Trump, who does not consider himself old, and produces much more blunders. Second, the American electoral system is designed so that you do not necessarily need to get more votes than the opponent. It is enough to win in the largest number of so - called disputed states - states where the electorate doubts who to give their vote to. Experts also note that if Trump's political ratings are "near the plinth" now, then they can grow by November, if the economy begins to recover, unemployment falls, and the coronavirus will be able to win. Of course, we do not think that everything will be so easy and simple. After all, it is unlikely to significantly boost the economy and localize the coronavirus at the same time in three months. These two concepts counteract each other. Trump opened the economy, completed the lockdown and immediately got the second wave of the pandemic, although we consider it the first, which did not end. At the same time, sociologists note that over the past four years, a new group of young voters have appeared in the country who do not support Trump, preferring Biden over him. Trump was not supported by young people in 2016 either. In addition, voters are extremely reluctant to vote for those rulers during whose time there were financial crises, epidemics, natural disasters, etc., although objectively they are hardly to blame for them. As for the foreign exchange and stock markets, the outcome of the elections can have a rather strong effect on them. According to experts, in the event of the Democrats' victory, periods of high volatility may begin in both markets, as many investors will begin to sell assets or transfer them to the safest, for fear of raising various direct and indirect capital taxes. No less important will be the issue of interaction between the new government and the Federal Reserve. Formally, the US central bank is not subject to Congress or the president. Nevertheless, many economists agree that Trump managed to find leverage over the Fed and personally US central bank Governor Jerome Powell. We all remember Powell's unexpected calls to the White House a year ago, the regular criticism of the Fed's head for high stakes, which ultimately led to a fall in stakes almost to zero, although not without the help of the epidemic. Experts also note that the Fed during the time of the coronavirus crisis behaved much more actively than in the crisis of 2008-2009. It is unknown how the Fed will be configured if Biden becomes president. Our opinion remains the same. We believe that Trump has a chance of winning the election, but they will depend solely on the various tricks of the Trump team. It is possible that there will be attempts of foul play, attempts to block the results of voting in the states where Trump will lose, attempts to accuse of fraud in the same states, attempts to close certain states, cities or districts to quarantine in order to influence the outcome of the election. In general, we expect anything from Trump, but not fair and open elections, although, of course, we do not dare accuse the American president of anything like this. As we have mentioned many times, you need facts and evidence in order to bring charges. Thus, in fact, only one question remains open: will the Trump team be able to bypass Biden, who in principle understands quite clearly what can be expected from the current president and, accordingly, should prepare for this, or not? Trading recommendations for the EUR/USD pair: The technical picture of the EUR/USD pair shows that the price continues to trade with a low upward slope inside the side channel, limited by levels of 1.1200-1.1350. Thus, consolidating the euro/dollar pair above 1.1350 is still required in forming an upward trend. At the same time, the euro has no fundamental support now, so the prospects for the euro depend more on what is happening in the United States and the demand for greenback. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment