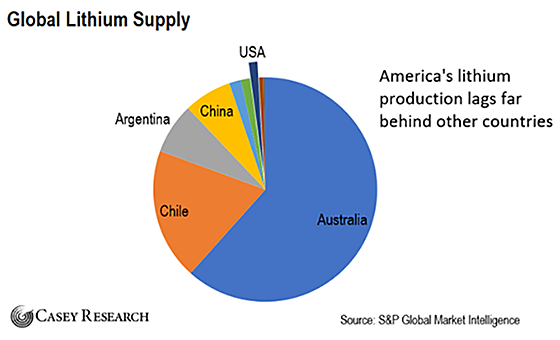

| By David Forest, editor, Strategic Investor For the first time in a century, we’re seeing world-altering industrial changes unfolding in the U.S… Just look at all the new megatrends sweeping America: advanced 5G communications, the Internet of Things, artificial intelligence, and robotics. But what most people are missing is that these innovations will require a new wave of materials to “fuel” them. Take one of the biggest trends unfolding today, the electric vehicle (EV) revolution, which you’ve undoubtedly heard about. Analysts estimate that in about another 15 years, over half of all vehicles sold worldwide will be electric. And because EVs use batteries, they require a different kind of fuel than gasoline. I’m convinced this will reignite interest in a long-neglected industry in America… and trigger a wave of new fortunes. Smart investors are already positioning themselves to profit. Let me explain… | Recommended Link | Americans Now Being Banned for 'Failure to Comply.' Are you next? According to MarketWatch, ordinary Americans are being put on “restriction lists,” being banned from using certain businesses. Why is this happening? And what does it mean for you? Widely-followed geopolitical expert Nick Giambruno explains: "This is just the beginning of a much larger movement I've been watching unfold for years in the United States. Law-abiding Americans will soon have a critical decision to make." Will you be banned next? | | | | No Longer Made in America The manufacturing of EV batteries requires a variety of critical metals. But many of these metals are either not produced in the U.S. anymore, or they’re in short supply. Right now, even as EVs surge, companies have to look abroad for the resources that power them. One of these metals is cobalt, a key element needed to make the cathodes in EV batteries. Currently, the world’s go-to supplier for cobalt is the Democratic Republic of the Congo. Today, Congolese mines supply over 70% of all the cobalt on Earth. The next-largest producing nation, Russia, puts out just 4%. Stunning Fact About the Top 2 Stocks During COVID-19 Crisis… How can one country dominate supply like this? It’s just geology. The Congo’s cobalt comes bound up with valuable copper metal. Profits from copper help produce associated cobalt that might not be otherwise economic. That means cobalt users are – largely – stuck buying from the Congo. But the Congo is a contentious supplier. There are allegations of child labor, inhumane working conditions, and rampant corruption. EV makers like Tesla are supposed saviors of the planet. So associating with child labor is decidedly off-brand. It’s going to be hard for Tesla and other manufacturers to continue to hang their hat on supply from this region. Elon Musk has tried to address the cobalt conundrum. In May, reports surfaced that Tesla has hit on a cobalt-free battery design. But this is still in the research and development stage – and so far, it’s only slated for China. For current vehicle production in the U.S. and elsewhere, cobalt is still a must. But there are only two cobalt mines in America: The Eagle mine in Michigan, and a minor production facility in Missouri that just launched last year. And cobalt is just one of several critical metals needed to fuel EV batteries. And it’s not the only material mined in risky, far-flung regions that aren’t go-to investment destinations. Trader Legend Reveals “3-Stock Retirement Blueprint” Lithium is the most critical element Tesla needs to power its electric vehicles. For example, a Tesla Model S needs about 140 pounds of the metal. Currently, most of the world’s lithium supply comes from just a few countries, like Australia, China, and Chile.

And a homegrown supply of lithium is worse than cobalt. There’s only one lithium mine in America. A Shot in the Arm for an Old-World Industry As the EV revolution ramps up, supply will tighten. Tesla and other companies will need to look for new sources of lithium, cobalt, and other metals. Musk has already indicated he’s looking to get more of Tesla’s critical metal supply from the U.S. That’s why I believe this is such a lucrative opportunity right now. America is one of the biggest markets on the planet for EV sales, but there are only a handful of companies positioned to feed the enormous need for lithium, cobalt, and other metals in EV manufacturing. | Recommended Link | Trading Expert Reveals Irresistible Option Trade This unique plan is designed to help you get your retirement on the fast track. To start, it uses options… Now, there are a lot of misconceptions about options. But there's one thing everyone agrees on: Options have the potential to make you rich — fast. With a single trade, you could make 3x, 5x, and even 10x your money far faster than with traditional buy-and-hold methods. That makes them the perfect vehicle to jump-start your retirement. Do you know what it really takes to become a successful trader? | | | - | I believe this will act as a massive push to restart the mining of critical tech metals in the U.S. In fact, we’re already seeing part of this trend unfold. For example, the biggest shot in the arm looks to be a new cobalt mine in Idaho that’s underway. I’ve covered its junior development company for a few years now in my International Speculator advisory. Final technical studies just launched, along with negotiations for project finance. It’s not just cobalt. Mining companies are moving to open new supplies of other battery metals, like lithium, nickel, vanadium, and manganese. Mining on U.S. soil is clearly a real possibility, and would provide Tesla with a much-needed supply of metals. This isn’t a trend many people are aware of yet. Most U.S. investors still see mining as an outdated, old-world industry. But with world-changing technologies like electric vehicles coming on strong, mining for critical metals in America is anything but outdated. If you’re not sure how to take advantage of this trend, take a look at the Global X Lithium & Battery Tech ETF (LIT). It’s a convenient one-stop shopping tool that holds a number of lithium miners and battery producers. As lithium demand grows and supply runs short, this ETF should climb higher. Just remember to position size your stake appropriately. And never invest more than you can afford to lose. Keep walking the path, David Forest

Editor, Strategic Investor P.S. As I mentioned above, lithium is a critical metal needed to power the electric vehicle revolution. And I’ve found a tiny company mining a supply… right here in the U.S. In fact, it’s on the verge of a multibillion-dollar deal with Tesla. This deal could happen any day. And when it does, savvy investors could pocket a fortune. There’s not much time left. You can go here to find out all about this story…

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… Tech Guru Makes Massive 2020 Election Prediction (Watch) In 2016, Jeff Brown told an exclusive room of people that a small processor company called NVIDIA would be the best tech stock of the year. He was right. Nvidia became the top-performing tech stock of that year, eventually soaring 1,048%. In 2018, he said the same thing about another microchip company – AMD. And again, he was right. AMD ended up as the top stock performer of 2018. And last year, he recommended AMD again. Sure enough, the stock more than doubled in 2019, outperforming everything else on the stock market. Now, he has a massive new prediction for this November that will directly affect the tech markets. Click here to see what he has to say in this exclusive video.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

No comments:

Post a Comment