Forex analysis review |

- Forecast for GBP/USD on August 10, 2020

- Forecast for AUD/USD on August 10, 2020

- Forecast for USD/JPY on August 10, 2020

- Hot forecast and trading signals for the GBP/USD pair on August 10. COT report. Buyers retreat, failing to take the 1.3169

- Hot forecast and trading signals for the EUR/USD pair on August 10. COT report. Major players continue to buy euros, but

- Overview of the GBP/USD pair. August 10. The pound is preparing for the publication of the UK GDP. Trump is closing the gap

- Overview of the EUR/USD pair. August 10. The US labor market is recovering, and unemployment is falling. Donald Trump promises

- Analysis and trading signals for beginners. How to trade the EUR/USD pair on August 10? Analysis of Friday. Preparation for

| Forecast for GBP/USD on August 10, 2020 Posted: 09 Aug 2020 08:44 PM PDT GBP/USD The pound sterling, supported by the US dollar's appreciation, continued to work with reversal technical patterns last Friday. These are price divergences with the Marlin oscillator on the daily and four-hour charts. The pound fell 90 points on Friday, marking the 61.8% Fibonacci level with the lower shadow. Now we are waiting for the price to overcome the Friday low and decline further towards the Fibonacci level of 76.4% at 1.2912. In the future, we are waiting for a movement to the Fibonacci level of 100.0%, towards the MACD line (1.2727). The price has already consolidated below the balance (red indicator) and MACD (blue) lines on the four-hour chart. Marlin is in the negative trend zone. The trend is completely downward on this chart, you should wait for the price to break through the Friday low, which will be a signal to move to the first target of 1.2912. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on August 10, 2020 Posted: 09 Aug 2020 08:41 PM PDT AUD/USD The Australian dollar fell by 77 points last Friday, against the backdrop of the US dollar's appreciation across the entire spectrum of markets. Copper fell 4.12%, oil 0.93%, wheat 0.97%, meat futures an average of 0.50%. In an isolated examination of the technical picture, we can note a market reversal after a four-fold price divergence formed with the Marlin oscillator. This pattern is rare in the market, therefore, it provides a groundwork for a long decline. We believe that with a high degree of probability, the aussie will correct to the target level of 0.6370, that is, to half of the previous growth from the March 19 low. At the moment, the nearest target is the 0.7070 level (high on June 10). A little lower, the price will meet the support of the MACD blue indicator line, where it could slightly slow down. With its overcoming, the price opens wide doors to the goals of 0.6975, 0.6745, and so on. The price has consolidated below both indicator lines on the four-hour chart - the balance line and the MACD line. The Marlin oscillator is in the negative zone. We are waiting for a further price decline to the 0.7070 level. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on August 10, 2020 Posted: 09 Aug 2020 08:39 PM PDT USD/JPY USD/JPY was optimistic about US employment data and gained 38 points last Friday. The reversal occurred from the support of the embedded price channel line on the daily chart, which the price pierced with lower shadows in the previous two days. As we said earlier, the main trend for the pair is ascending from July 31. We are waiting for the price in the 106.60/80 range, formed on the daily scale by the MACD line and the upper line of the price channel. But the upward trend is still not fixed from a technical standpoint; the Marlin oscillator did not leave the zone of negative values, the price is not above the MACD indicator trend line, therefore, if the price consolidates under the support of 105.50, a further decline to the local and temporary line of the price channel at 104.45 is likely. The price is higher than the balance and MACD indicator lines on the four-hour chart, but Marlin is stuck at the border separating the growth trend zone from the decline trend zone. The signal for growth is the price breaking the Friday high of 106.06. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Aug 2020 06:50 PM PDT GBP/USD 1H The GBP/USD pair moved almost identical to the European currency on August 7. This is easily explained by the fundamental background that was the same for both pairs. Thus, by the end of the trading day, the pound/dollar pair fell below the critical Kijun-sen line, which gives some hope for a further drop in quotes. It should also be noted that earlier the pair was pinned below the upward trend line, and later failed twice to overcome the resistance level of 1.3169. Thus, the bears get a good chance of moving down. However, the pair has not yet been able to even reach the previous local low. Thus, the bears' positions look very shaky right now. GBP/USD 15M Both linear regression channels turned down on the 15-minute timeframe, indicating a downward trend in the short term. The latest Commitment of Traders (COT) report for the British pound, which was released on Friday, finally matched what is happening now in the market. Recall that two COT reports previously showed a decline in the net position of non-commercial traders, which, in fact, means that the bullish mood is weakening. That is, the most important category of "non-commercial" traders reduced (roughly speaking) purchases of the pound over the previous two weeks and at the same time, the British currency started to appreciate. However, the latest COT report finally showed that non-commercial traders increased the number of Buy-contracts by almost 5,000. At the same time, they also closed Sell-contracts, which were reduced by 3,500. Thus, the total net position for this category increased by 8,500. Consider the illustration below. If the graphical representation of the COT report looked absolutely clear for the euro, then it is more difficult for the pound. In recent weeks, the difference between the net positions of non-commercial(green line) and commercial (red line) traders has been narrowing. This does not mean that the pair should stand in one place in the flat, but such indicator readings do not allow us to assume a change in the trend in the near future. However, this may still happen, since this is the scenario that is brewing for the euro/dollar pair, and the pound has even more reason to fall than the euro. The fundamental background for the GBP/USD pair slightly changed on Friday. The US economy has begun to recover, as signaled by reports on unemployment and new jobs created outside the agricultural sector. The UK did not provide any news or reports, so the fundamental background was the same as for the euro/dollar pair. Not surprisingly, both pairs traded identically on the last trading day of the week. Traders will not receive any important information on Monday, at least not planned. But a large amount of important macroeconomic information will be published in Britain on Tuesday and Wednesday, which can change the mood of traders. The unemployment rate and changes in average wages will be released on Tuesday, and GDP for the second quarter and industrial production will be published on Wednesday. Thus, the mood of market participants for this week will depend on these reports. And of course, do not forget about the coronavirus epidemic in the United States. If data on the increase in the number of diseases begins to arrive again, the US dollar may very quickly fall under a new wave of sales. There are two main options for the development of events as of August 10: 1) Buyers continue to dominate the market. However, they did not manage to gain a foothold above the previous local high of 1.3169. Thus, we recommend opening new purchases of the British currency, but not before the 1.3169 level has been overcome with targets at the resistance levels of 1.3240 and 1.3400 (to be specified today). Potential Take Profit in this case is from 40 to 200 points. 2) Bears have a new chance to start a downward trend, as prices have consolidated below the Kijun-sen line. Thus, it is now recommended to trade down while aiming for the Senkou Span B line (1.2919) and the support level of 1.2850. Potential Take Profit in this case is from 110 to 170 points. However, you should be careful with sales. There are many factors working in favor of a brewing fall, but the bears are still very weak. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Aug 2020 06:47 PM PDT EUR/USD 1H The euro/dollar pair continued its downward movement and finally broke the critical Kijun-sen line on the hourly timeframe of August 7. Thus, given the fact that the bulls have not managed to overcome the resistance area of 1.1884-1.1910, the sellers' positions are beginning to improve, but at the same time they are waiting for at least two significant resistance lines in the form of the Senkou Span B line and the support area of 1.1702-1.1727. If sellers manage to overcome these barriers, we can finally count on a new downward trend to form. Until then, the bulls can be active and enter the game at almost any moment. Given that the "four types of crises" continue to rage in America. EUR/USD 15M Both linear regression channels turned down on the 15-minute timeframe, which perfectly reflects what is happening on higher timeframes. The latest COT report, released on Friday, showed that the mood of professional traders did not change at all during the last reporting week (we remind you that the report is published with a three-day delay) on July 29-August 4. During this time period, the "non-commercial" category of traders re-opened a large number of Buy-contracts, namely 19,354. At the same time, non-commercial traders closed Sell-contracts, which were reduced by 3,561. Thus, the net position for the most important category of traders has grown by 23,000 at once, which is a very large and eloquent indication of the current mood of the major players. The most important thing is that the report data exactly matches what is happening in the foreign exchange market, since the euro as a whole continued to grow until August 4. In addition, the single currency managed without any losses in the next three trading days of the week. Therefore, so far, everything is going to the point that the next COT report will show that non-commercial traders are increasing purchases. However, we also suggest that you read the illustration below. The lower indicator shows how the net positions of non-commercial traders are growing. The upper indicator shows the discrepancy between the net positions of non-commercial traders (green line) and commercial (red line) (the two main groups of major players). Such a strong divergence usually occurs before trend reversals. Therefore, we still believe that the trend could change to a long-term downward trend in the near future. The fundamental background for the EUR/USD pair on Friday finally began to change in favor of the US dollar. In fact, the entire background was reduced to three macroeconomic reports, one of which was absolutely not important at this time. But the other two, the unemployment rate and Nonfarm Payrolls, can be said to have provided significant support to the dollar. First, this day's volatility was higher than usual. Secondly, the dollar has not often become more expensive in recent months. We can't say that both reports significantly exceeded their forecasts, but the figures were very optimistic for the currently troubled American economy. The main thing is that the labor market has started to recover, and unemployment has started to decline. Unfortunately, since all reports display data from a month ago, the following reports may be worse than the current ones, since the coronavirus has been openly raging in the United States in the past month, and although US authorities have not been able to introduce a new lockdown, the epidemic cannot but negatively affect the growth of macroeconomic indicators. We expect that the US economic recovery may slow down at the end of August. This may prevent the dollar from continuing to win back previously lost positions against the euro. There will be no significant publications in the EU and US on Monday. Thus, trading can be calm and without sudden movements. Based on the above, we have two trading ideas for August 10: 1) Buyers did not overcome the resistance level of 1.1911. Therefore, they temporarily retreated from the market. Now, to make new purchases, you need to wait for the price consolidation above this level (or the resistance area of 1.1884-1.1910). Then we will recommend buying the pair with the target at the resistance level of 1.2043. In this case, the potential Take Profit is about 100 points. 2) Bears are still struggling to use their chances. The fact that they still managed to overcome the Kijun-sen line (1.1806) is good. However, for now they can only count on a downward movement to the Senkou Span B line (1.1724). Thus, we recommend considering new sales of the euro after overcoming the support area of 1.1702-1.1727 with targets at 1.1644 and 1.1509. Potential Take Profit in this case is from 40 to 160 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Aug 2020 05:48 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -93.7423 The British pound also started falling on Friday, in sync with the European currency. Thus, in principle, we can say that the US dollar has started to become more expensive across the entire spectrum of the market. We have already discussed the reasons in the article on EUR/USD, and in general, more than once recently. The most significant of them is the overall oversold dollar and the technical need to pass 400-500 points against the main trend within the correction. We have also repeatedly said that if we take into account purely economic factors, the situation in the UK is not much better than in the same United States. Yes, the US economy as a result of the "coronavirus" has shrunk by half as much as the British one. However, the British economy will also lose at least 20% in the second quarter. For comparison, even the most affected in the European Union, Italy and Spain lost less than 20%. Thus, if the growth of the European currency in recent days is even more or less justified ("4 American crises" is the reason for this), then this is why the British pound strengthened so much with all the problems with Brexit, negotiations on trade deals with the EU and the US, and the contraction of the British economy in the last 4 years (at first it was just a slowdown), it is unclear. However, market participants thought otherwise and, despite the fact that in the last two weeks professional traders (according to COT reports) absolutely did not like the British pound, nevertheless, this currency continued to grow in price on the foreign exchange market. In the UK, there were no significant statistics published last week, no new data on negotiations with the European Union on the deal, and no worthwhile information at all. So, by and large, traders are now focused on the second-quarter GDP report we announced, which will be published on Wednesday, August 12. Most likely, this report will create additional pressure on the British currency, which has long since started its march to the south again. Unfortunately, at this time, much will depend not on Britain or the pound, but on the United States and the dollar. The number 1 problem in America remains the same – it is "coronavirus". It cannot be defeated, nor can it be stopped from spreading. Although such a statement would be appropriate if the US authorities were diligently fighting the epidemic, and not just making millions of tests for "coronavirus", which the country's chief epidemiologist Anthony Fauci has already called almost useless in terms of preventing new infections. Fauci also believes that without a good vaccine, the virus will continue to spread, since it is impossible to make sure that all 100% of people on the globe strictly adhere to the rules of social distance and wearing masks. This means that quickly or slowly, the virus will continue to live among people and at any convenient moment will try to provoke new outbreaks in certain countries. Thus, it is America and the US dollar that remain in the "red risk zone". If in the UK so far everything is more or less calm with "coronavirus" (as in Europe), then in America... Donald Trump in such a difficult situation continues to blame China, which, in principle, is quite reasonable, but what is the point now? European leaders probably understand this, but the US President does not. "We created the greatest economy in world history, and then China released this plague. Whether through incompetence or other reasons, they got away. It didn't break into China, but it leaked into the US, into Europe, into just 188 countries. We will not forget this," Trump said in Ohio last week. In addition, the American President did not forget to once again accuse the Democrats that they are trying to rig the election with all their might, this is their only chance to win, and in general they are funded by China, which "sleeps and sees" that Trump is not the President. I wonder when Trump makes such statements, does he think that China treats him unfairly? The US President also blamed (also once again) house speaker Nancy Pelosi and Senate democratic leader Chuck Schumer. "They only want to get money to save cities and states that they can not manage with dignity and effectively (meaning management under the leadership of Democrats). This has nothing to do with the Chinese virus! They want a trillion dollars. Without interest. We will go the other way!", said Trump. The most interesting thing is that the Democrats are trying to find a compromise with the Republicans and even offer to lower their demands from 3.4 billion dollars to 2.4, if the Republicans in turn increase their offer by one trillion. According to Democrats, this will allow us to get out of the current impasse more quickly with a new package of support for the American economy. Well, the last thing that should be stated is that according to the latest opinion polls, the ratings of Donald Trump have started to gradually grow, and Joe Biden – to decline. However, so far we are only talking about 2-3%. According to the latest social studies, Biden still continues to lead, just by a slightly smaller margin. At this time, about 49% of Americans are ready to vote for a Democrat and 43% – for a Republican. The most interesting thing is that Joe Biden continues to remain almost in the shadows. No, he is also campaigning, but there is far less discouraging information coming from him than from Trump. On Monday, no macroeconomic reports are expected from either the UK or the United States. Thus, traders can try to build on Friday's success and continue selling the pound/dollar pair, which would be very logical from our point of view. However, we believe that the position of the US currency is now very shaky. That is, at any moment, especially if a disappointing news stream continues to pour out of America, the bulls can re-activate and start new purchases of the pound and sales of the dollar. The technical picture is identical to the EUR/USD pair. The pair has settled below the moving average, however, it is not yet possible to say that this consolidation will definitely lead to the formation of a downward trend. Although, of course, we believe that most of the factors are still on the side of the US dollar, since all the American negative has already been won back several times by traders.

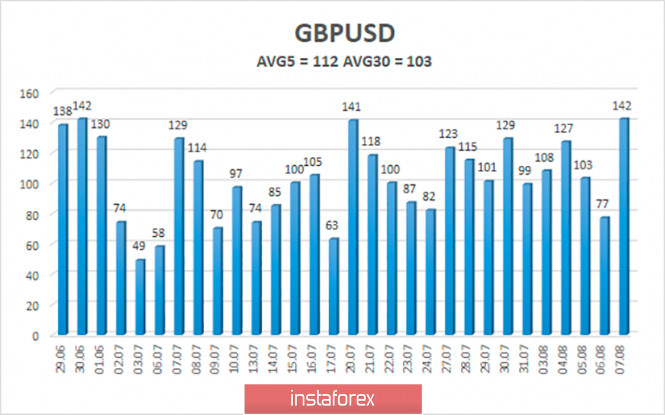

The average volatility of the GBP/USD pair continues to remain stable and is currently 112 points per day. For the pound/dollar pair, this value is "high". On Monday, August 10, thus, we expect movement within the channel, limited by the levels of 1.2934 and 1.3158. Turning the Heiken Ashi indicator upward will indicate a possible resumption of the upward trend. Nearest support levels: S1 – 1.3000 S2 – 1.2939 S3 – 1.2878 Nearest resistance levels: R1 – 1.3062 R2 – 1.3123 R3 – 1.3184 Trading recommendations: The GBP/USD pair started a new downward movement on the 4-hour timeframe, overcoming the moving average. Thus, today it is recommended to open short positions with the goals of 1.3000 and 1.2939 and stay in them until the Heiken Ashi indicator turns upward. Buy orders are recommended to be considered no earlier than fixing the price above the moving average with the first targets of 1.3123 and 1.3158. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Aug 2020 05:48 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -47.7677 The EUR/USD currency pair has finally started a downward movement, which everyone has been waiting for more than a month. At the end of the last trading week, the pair's quotes still performed a more or less noticeable downward movement and overcame the moving average line, which indicates that the trend has changed to a downward one. However, does this mean the formation of a new downward trend? One way or another, it is quite obvious that traders failed to overcome the level of $ 1.19, from which two rebounds followed. So now the bears have gone on the attack, and we just need to find out how the fundamental and macroeconomic backgrounds affected this, and whether they did at all. The first thing to consider is Friday's macroeconomic statistics. If we do not take into account the secondary report on industrial production in Germany, then all the most interesting reports came from overseas. However, of the three conditionally important reports, one was absolutely insignificant, the second – contradictory, and the third clearly expected more. The first report is average wages in the United States, which rose by 0.2% in July. The second is the unemployment rate, which has fallen to 10.2%, which still remains very high (higher than in the European Union and in the UK). The third is NonFarm Payrolls, which grew by 1.763 million at the end of July with a forecast of +1.6 million. Formally, all three reports were better than the forecast values, so the strengthening of the US currency on Friday is absolutely logical and justified. We can also say that the macroeconomic statistics in the United States are improving, which is also a positive factor for the dollar. However, if six months, a year, or two years ago we regularly wrote that the US economy continues to look stronger and more powerful than the European one, then the coronavirus pandemic has made significant adjustments to the balance of power between the United States and the Alliance. It was America that suffered the greatest losses from the epidemic, lockdown, and crisis. And now it is America that is catching up, even though its absolute GDP remains much higher than the European one. Plus, the epidemic in America is not abating, and in 35 states of the country there are certain restrictions designed to slow down the spread of the "Chinese virus" at least a little. Naturally, this also affects the speed of economic recovery, and also creates risks of a possible second "lockdown". Thus, the optimism of buyers of the US dollar is still local. But we have already said that whatever it is now in America, the US dollar has already fallen quite heavily in the last three months and is now heavily oversold, and the euro is overbought. Thus, we believe that 400-500 points of the euro/dollar pair can easily go down now. Meanwhile, US President Donald Trump continues to worry only about the problems of his own re-election. The US leader continues to quarrel with everyone he can, while believing that the whole world is against him. This time, Trump managed to fall out with the largest sponsor of the Republican Party, multi-billionaire Sheldon Adelson, accusing him of insufficient funding for his election campaign. Media reports that the US President during a telephone conversation with Adelson said that to win the election, he needs more sponsorship money. It is unknown how Adelson himself reacted to this, but some Republicans now fear that their party's funding will become more scarce. Also, Donald Trump once again "distinguished himself" in exaggerating his importance to the United States. The American leader said that his face should appear on the memorial of the founding fathers of the United States, located on mount Rushmore in South Dakota. We will remind you that the mountain is carved with images of the faces of George Washington, Thomas Jefferson, Theodore Roosevelt and Abraham Lincoln. As we can see, Trump puts himself next to these, of course, outstanding people in American history. At the same time, Trump continues to cling to any opportunities that are at least theoretically able to increase his political ratings. For example, last week, Trump ordered an extension of the tax holiday for those Americans who receive less than $ 100,000 a year until the end of this year. And he promised to make the tax holidays permanent and to forgive Americans all their tax debts in the event of his re-election as President. It is also reported that Donald Trump ordered that the "coronavirus" allowances for unemployment benefits amounted to $ 400 a week, and the payments of part of this amount will be transferred to the state authorities. Democrats immediately criticized another brilliant plan of Trump, accusing the President of not understanding the gravity of the situation. In principle, the essence of this plan looks very simple – to promise anything to win the election. Trump can now only promise to completely remove all taxes for Americans and hand out money just like that. It is also completely unclear whether Donald Trump has the right to make decisions bypassing Congress on payment issues. Thus, this may just be another unfounded statement by Trump, simply aimed at his own popularization among the electorate before the elections. However, for the US dollar, this is all irrelevant now. The main thing is that after three absolutely disastrous months, the US currency has finally started to get more expensive. So far, all medium and long-term indicators remain directed upward, but if the price does not return quickly to the area above the moving average this week, they will begin to turn down. On Monday, no important statistics are planned either in the United States or in the European Union, so sellers should not be prevented from continuing to form a new downward trend. At the same time, the pair has not yet gone so far below the moving average to speak about the "strength of the trend". So far, the situation is very shaky and with the slightest pressure from the bulls, the upward trend can resume. Thus, the main thing is that in the coming weeks there will not be a new outbreak of "coronavirus" in the United States, and Donald Trump will not have time to distinguish himself in the international arena with a new conflict.

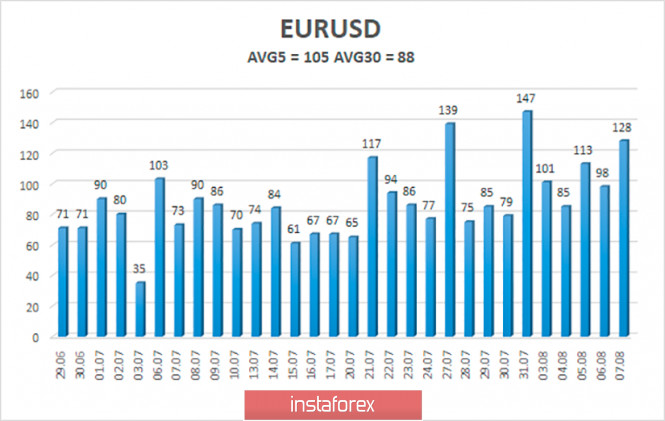

The volatility of the euro/dollar currency pair as of August 10 is 105 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1680 and 1.1890. A reversal of the Heiken Ashi indicator upward will signal a round of upward correction within the now downward trend. Nearest support levels: S1 – 1.1719 S2 – 1.1597 S3– 1.1475 Nearest resistance levels: R1 – 1.1841 R2 – 1.1963 Trading recommendations: The EUR/USD pair may have started a new downward trend, breaking the moving average. Thus, at this time, it is recommended to sell the currency pair with the goals of 1.1719 and 1.1680 before the Heiken Ashi indicator turns upward. It is now recommended to open buy orders no earlier than the pair is re-anchored above the moving average line with the first targets of 1.1841 and 1.1890. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Aug 2020 01:40 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair still resumed to go down last Friday, August 7. In our morning article, we mentioned that you are not yet advised to consider buying, since three attempts to overcome the 1.1903 level at once were unsuccessful. Sellers also showed no desire to buy the dollar until Thursday and Friday of last week. Nevertheless, the last two trading days of last week still allowed the US dollar to rise by 120 points. Thus, after overcoming the 1.1824 level, novice traders could remain in the sales of the pair (or open new ones) with the targets of 1.1772 and 1.1726, the first of which was eventually successfully reached. Therefore, it was possible to earn about 40-50 points, which is an excellent result for the not very volatile EUR/USD pair. The MACD indicator did not turn upward during Friday, so there was no reason to close sales during the day. The day turned out to be absolutely "bearish" (bears are the players of the foreign exchange market, which sell this or that instrument, while bulls - buy). Fundamentally, as we said in our morning review of August 7, the Nonfarm Payrolls report was of great importance. As a result, the forecast value of this report has exceeded by around 150-200,000, so traders more actively bought the US dollar during the day. In addition, the unemployment rate in America fell to 10.2%, which also supported the dollar. We can say that, in principle, all the reports on Friday were in favor of the dollar. And we remind novice players that the stronger data from a particular country, the more likely that the national currency of that country will grow. Investors and traders love the currencies of strong economies. No important news or macroeconomic reports are expected in America or the European Union on August 10, Monday. This means that trading on Monday can be rather sluggish and slightly volatile (this means that during the day the pair can pass a small number of points from the low to the high of the day). The attitude of the sellers is also not clear now. Either they are set for strong sales of the pair, since before that the price had been growing for about three months, therefore, a downward correction by at least 30-50% of the upward movement is necessary. Either the big epidemiological, political and economic problems in the United States will still outweigh and bulls will return to the market. Let's remember that despite the good US data on Friday, the American economy contracted by 33% in the second quarter, while the European one lost only 12.1%. The following scenarios are possible on August 10: 1) Buying the pair remains irrelevant, since the price was unable to overcome the 1.1903 level. Thus, traders are now simply deprived of buy signals. Based on this, we do not recommend trading the pair up on Monday. An important point: the MACD indicator could move upward at the opening of trading on Monday, but the price may continue to decline. This indicator is now very low and due to its capabilities, it cannot fall constantly. Thus, even an upward reversal of the indicator may not signal the beginning of the pair's growth. 2) Selling the currency pair is still more promising now, at least with the target of 1.1696 (the previous local low). However, there are about 90 points to this goal, so the price will hardly be able to cover such a distance in one day. Especially if it's Monday. In the current situation, it would be best to wait for a slight upward price pullback, after which, upon a downward reversal of the MACD indicator, reopen sales with targets at 1.1726 and 1.1696. What's on the chart: Support and Resistance Price Levels - Levels that are targets when buying or selling. You can place Take Profit levels near them. Red lines - channels or trend lines that display the current trend and show which direction it is preferable to trade now. Arrows up/down - indicate when you reach or overcome which obstacles you should trade up or down. MACD indicator is a histogram and a signal line, the crossing of which is a signal to enter the market. It is recommended to use in combination with trend lines (channels, trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners in the forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment