Forex analysis review |

- Forecast for USD/JPY on September 22, 2020

- Overview of the GBP/USD pair. September 22. America is preparing for lengthy legal proceedings at the end of the 2020 presidential

- Overview of the EUR/USD pair. September 22. Christine Lagarde is worried about the high euro. The ECB is going to study the

- EUR/USD. Lagarde's verbal pressure and coronavirus

- September 21, 2020 : EUR/USD daily technical review and trade recommendations.

- Analytics and trading signals for beginners. How to trade EUR/USD on September 22. Analysis of Monday deals. Getting ready

- EUR / USD: dollar again takes the virus as allies

- Trading idea for USD/JPY

- EURUSD gets rejected at key short-term resistance

- Gold price challenges major support

- USDJPY reached target and ready for bounce to 105

- Daily Video Analysis: AUDJPY High Probability Setup

- USDCAD holding above ascending trendline support, bounce expected!

- AUDJPY testing 1st resistance, potential for a further drop!

- EURJPY is facing bearish pressure, potential for further drop!

- September 21, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- September 21, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- "Almost never" or The secret of extraordinary income

- EUR/USD. September 21. COT report: major traders are getting rid of the euro currency.

- EUR/USD showing signs of downward trend

- USD undervalued by 4%

- GBP/USD. September 21. COT report: speculators open short contracts

- GBP / USD September 21: Markets are still wondering if the UK Internal Market Bill will officially be adopted and its consequences

- EUR/USD analysis on September 21. As America prepares for the presidential election, China hopes for Joe Biden's victory

- Trading plan for GBPUSD for September 21, 2020

| Forecast for USD/JPY on September 22, 2020 Posted: 21 Sep 2020 07:51 PM PDT USD/JPY The Japanese yen traded in a wide range of 88 points yesterday, closing the day with a 6 point gain. The limit will be the 123.6% Fibonacci level on the daily chart. The Marlin oscillator is in no hurry to turn upwards, therefore, we expect the decline to move towards the target level of 103.75. The four-hour chart shows that the price has worked out a triple small convergence according to the Marlin oscillator, its signal line has entered the zone of positive values, and now it is going back to the bears' territory. We expect the pair to fall towards the target level of 103.75. |

| Posted: 21 Sep 2020 05:38 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - downward. CCI: -191.5559 The British pound also spent the second trading day of the week in a downward movement. Thus, at the beginning of the new trading week, demand for the US currency increased significantly. With the British currency, everything is clear. In September 2020, this currency is only getting cheaper mainly due to the actions of the British government and Boris Johnson personally. However, we have already talked about this many times. The reasons for the fall in the British currency yesterday was quite difficult to find. In the States today, there were no important publications, no important speeches, and even the news flow from the White House was quite sparse. Well, the markets could not react so violently to another statement by Donald Trump about "the imminent creation of a vaccine against coronavirus". However, the US dollar has grown and we need to accept this. Sometimes there are situations when there are no visible reasons for the growth of a particular currency, however, the growth itself is there. We remind market participants that in addition to private small traders, there are a large number of major traders on the market (COT reports are just for them). It is these major traders who "rule the ball". Further private small traders can only join the trend that is formed by major players. That's why they always say that you need to trade according to the trend. Thus, it is possible that at the beginning of the new week, major traders began to buy the US currency. This led to its strong strengthening. We also remind you that both the pound and the euro grew for a long time against the dollar and were quite overbought. In the case of the euro, the growth was just very long and strong. In the case of the pound, it was almost groundless, since the economic situation in the UK is not much better than the American one. Thus, in both cases, the strengthening of the US dollar could be expected. Meanwhile, the number one topic in the United States remains the 2020 presidential election. The issue of elections has taken a very interesting turn in recent days. The fact is that one of the nine Supreme Court Justices of the United States, Ruth Ginsburg, died recently. As usual in America, various speculations immediately began around a rather mournful event. The fact is that in the United States, almost no one believes that the elections will be held quietly and calmly, and most importantly - honestly. Most experts and political scientists believe that none of the candidates will accept defeat and are almost guaranteed to accuse the opposite side of fraud. Recall that the Democrats have won the right to vote by mail. At the same time, the Trump electorate is expected to vote in reality. Consequently, a sharp increase in Trump's position is expected first, after which "postal votes" will be counted for at least a few days. Trump accuses Democrats of simply printing the number of ballots they need to win. Thus, there is a high probability that the case of the presidential election will end up in court that lost one of its nine judges the other day. With the election still 6 weeks away, Donald Trump is already pushing to appoint a new judge to replace Ms. Ginsburg. Further, Joe Biden and the Democratic Party oppose such a decision, because they believe that elections should be held first. And as soon as we see a clash of interests, we can immediately assume a "behind-the-scenes game". Since the 2020 election is highly likely to end in court, every presidential candidate needs to have support in this very court. As we remember, there are only nine judges, and four of them are Democrats and five are Republicans. Although Donald Trump has the advantage here, Chief Justice Roberts has recently voted against any decisions of the current president. It turns out that Joe Biden has a margin of one vote at this time - 5:4. However, with the death of Judge Ginsburg, who was a Democrat, the opportunity opened up for Trump to appoint "his" judge to the vacant position, as loyal as possible to him. Thus, it is clear why Trump now wants to quickly appoint a new judge, and the Democrats are opposed. Some experts still recall the "gentleman's rules" that once operated in high political circles. However, all as one note that now there is a full-scale war for power in America, where there is no place for any concessions and displays of honor. Thus, the intrigue of the coming weeks shifts to the US Supreme Court and the decision of Congress to appoint a new judge. We just note once again that the topic of elections in America is the most important at this time. All traders can see for themselves what a battle is raging around the president's chair. Any methods are used, and each side tries to use any event to its advantage. So far, the US dollar has not reacted to events related to the elections. However, it should be understood that this is a "long-playing" topic. We have repeatedly said that the international policy of this country over the next four years depends on who becomes the new president of the United States. And as Donald Trump showed us, in four years you can have time to accelerate the economy to unthinkable values and lose all progress, sliding into the worst recession in the last hundred years. That is why China, for example, actively supports Joe Biden, because it believes that it will be much easier to negotiate with him, while Trump has already announced the continuation of the war against Beijing. Also, the American economy depends on who will become the next president of the country, for which it is now extremely important to do without new government mistakes. Further, the country's economy directly depends on the "coronavirus" epidemic, the fight against which Donald Trump lost outright (still rating the actions of his administration at "5+"). So this is an extremely important question.

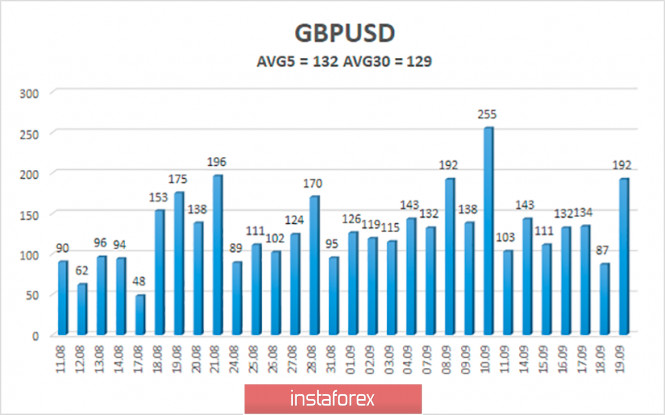

The average volatility of the GBP/USD pair is currently 132 points per day. For the pound/dollar pair, this value is "high". On Tuesday, September 22, thus, we expect movement inside the channel, limited by the levels of 1.2658 and 1.2922. A reversal of the Heiken Ashi indicator to the top signals the beginning of an upward correction. Nearest support levels: S1 – 1.2756 S2 – 1.2695 S3 – 1.2634 Nearest resistance levels: R1 – 1.2817 R2 – 1.2878 R3 – 1.2939 Trading recommendations: The GBP/USD pair resumed a strong downward movement on the 4-hour timeframe. Thus, today, it is recommended to keep open short positions with targets of 1.2756 and 1.2695 as long as the price is below the moving average and the Heiken Ashi is directed downward. It is recommended to trade the pair for an increase with targets of 1.3000 and 1.3062 if the price returns to the area above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Sep 2020 05:38 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - sideways. Moving average (20; smoothed) - sideways. CCI: -182.1159 The EUR/USD pair spent the first trading day in fairly active trading, which is not typical for Mondays. The US currency began to strengthen almost in the morning and rose by almost 150 points against the euro during the day. It is still quite difficult to say what caused such a strong growth of the US currency. There is no news about the speech of Fed Chairman Jerome Powell at the moment. This was the only macroeconomic event on Monday. Thus, the euro/dollar pair simply collapsed and at the same time remained inside the side channel of $ 1.17- $ 1.19, which we have been writing about for almost two months. Thus, from a technical point of view, the situation in the foreign exchange market has not changed completely. Further, the currency pair can already turn up today and start an upward movement inside the same side channel to its upper line of 1.1900. The most important thing is that the general fundamental background does not change for the pair. In America, things are still very bad. This applies to both the political and epidemiological crisis. Fortunately, they managed to solve the problems of the social crisis (mass protests and rallies after two cases of racism by white American police officers), however, the economic crisis did not go away. In general, the situation in America has not improved much in recent weeks. In the European Union, everything is much quieter and calmer. In recent weeks, we can only highlight the meeting of the European Central Bank, however, no important decisions have been made, and no important theses were voiced. However, it is well known that the ECB is very afraid of the current high exchange rate of the European currency. This was first mentioned a few weeks ago by the bank's chief economist, Philip Lane. Nothing has changed since then. Now Christine Lagarde is also talking about the euro exchange rate. "It is clear that the strengthening of the euro plays a significant role in various areas, and as for monetary policy, it puts downward pressure on the price level," Lagarde said. "We are very attentive to the growth of the euro and take this factor into account when determining monetary policy," the head of the ECB added. At the same time, it was reported that the ECB is going to study the economic consequences of the emergency economic assistance program PEPP (Pandemic Emergency Purchase Program) to re-evaluate its validity. The European regulator admits that some parameters of the PEPP program may be transferred to other programs to stimulate the economy. The debate is expected to take place inside the ECB next month. There was also some news from the White House on Monday. Donald Trump again talked about creating a vaccine and, according to him, "it will be ready long before the end of the year, maybe even by the end of October". The US President believes that Pfizer's vaccine, which is closest to the end of clinical trials, will be the first to be released. The US President also said that he gives an "excellent" rating for his administration's response to the "coronavirus", despite 200,000 deaths from this disease in the US. "We did a phenomenal job, not just a good job, but a phenomenal job. Except for public relations, because there is fake news," Trump said. At the same time, in the run-up to the presidential election, many experts continue to evaluate the four years of Donald Trump's presidency. One of the main achievements of Trump (the rise of the economy, the labor market) was easily leveled by the "coronavirus". The second major achievement (agreeing to a trade deal with China) is just a beautiful piece of paper. You don't need to be a serious analyst to see a direct and simple relationship. During the entire administration of Donald Trump, the US trade deficit has only increased. In other words, it doesn't matter what deal was signed with Beijing. The trade deficit is still increasing. However, China's trade balance is positive (who would doubt it). Further, it has only increased over the past 4 years. That is, in fact, Trump only hurt himself in the trade war with China. At least, he did not manage to achieve any positive results. Besides, the level of public debt has also increased. It also became known about new social surveys and studies that are conducted in the States by everyone who is not lazy. According to them, Biden is still ahead of Trump by 8-10%. It is worth noting that any poll has a certain margin of error. Therefore, 8% in practice can be 10%. Thus, most studies suggest that the situation has not changed at all over the past few months. As a result, we have the same technical picture as before. The euro/dollar pair continues to trade in a 200-point wide side channel. Even a fairly serious drop in quotes today does not change the essence of the matter at all. The fundamental background also remains the same. Even the Fed and ECB meetings, as well as the speeches of Jerome Powell and Christine Lagarde, could not change it. Because in principle, everything remains the same as it was in the last six months. In the first place in terms of significance, the "coronavirus" epidemic continues to stand. The second "wave" has already officially started in Spain, France, and the UK. This applies to European countries. In America, the first wave did not end yet. Thus, the economies of the European Union and the United States are recovering to the extent of their capabilities, however, there is no question of full recovery before the complete victory over the coronavirus. Thus, with the arrival of the cold season, the whole world may face a new round of the pandemic. The epidemic can be tougher and stronger, and whatever it is, it is obvious that this time it will leave its mark on the economy of every country in the world. And in the States, meanwhile, everyone continues to prepare for the elections. This is probably an even more significant topic across the ocean than the "coronavirus", which everyone has somehow forgotten about recently.

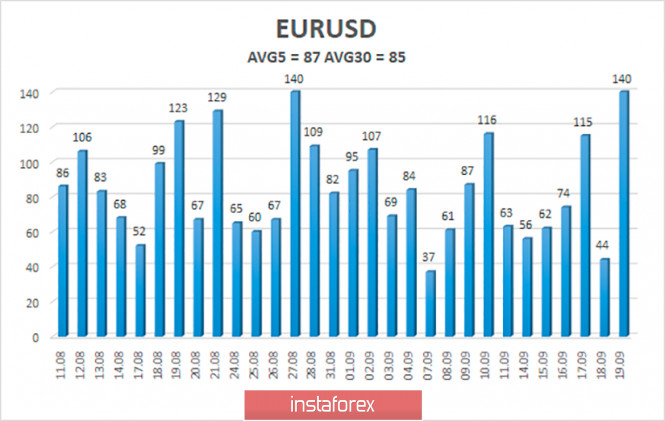

The volatility of the euro/dollar currency pair as of September 22 is 87 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1666 and 1.1841. A reversal of the Heiken Ashi indicator back up signals a round of upward movement in the remaining side channel of $ 1.17 - $ 1.19. Nearest support levels: S1 – 1.1719 S2 – 1.1658 S3 – 1.1597 Nearest resistance levels: R1 – 1.1780 R2 – 1.1841 R3 – 1.1902 Trading recommendations: The EUR/USD pair is fixed below the moving average line but continues to trade in the side channel. Thus, formally, we can now consider short positions with targets of 1.1719 and 1.1666 and keep them open until the Heiken Ashi indicator turns upward. It is recommended to re-consider options for opening long positions if the pair is fixed above the moving average with a target of about 1.1902. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Lagarde's verbal pressure and coronavirus Posted: 21 Sep 2020 02:32 PM PDT The dollar index is rapidly growing. The US currency is growing against nearly all dollar pairs amid an almost empty economic calendar. In the context of the EUR/USD pair, the greenback generally strengthened as the euro weakened, as it reacted to the dovish rhetoric of the European Central Bank President Christine Lagarde. This unipolar fundamental picture forced the pair's buyers to retreat from the positions they had won. In just a few hours, EUR/USD fell by more than 100 points, reflecting the bearish sentiment. The revaluation of the greenback is explained by a general strengthening of anti-risk sentiment in the market, against the background of an increasing number of coronavirus infected around the world. In other words, the dollar is enjoying the status of a safe-haven currency one again. Let me remind you that not so long ago, for several months, the dollar nearly served as the only protective instrument. Traders found refuge in the US currency throughout most of the spring (and partly the beginning of summer), amid surges in anti-risk sentiment. The dollar bulls were then the main beneficiaries of the pandemic in the context of the foreign exchange market. Since about mid-summer, the topic of coronavirus has "narrowed" to the borders of one country - the United States - so the former excitement around the greenback has come to naught. Of course, the increase in the number of infected people was noted in many other countries of the world, not only in America. But the United States was out of competition here - they were in the lead both in the number of infected, and in the number of deaths, and in the number of daily increase in cases. Therefore, the coronavirus factor ceased to be the greenback's ally, and the outbursts of anti-risk sentiment played in favor of other instruments (primarily in favor of gold). However, the situation is gradually changing. The United states still occupy leading places in anti-ratings, but at the same time, the general epidemiological picture in the world is not improving, instead, it is getting worse. The coronavirus is returning to countries where it has almost been defeated. For example, the world reported a record number of cases of coronavirus on Saturday: COVID-19 was found in 314,097 people. Furthermore, more than 50,000 patients were identified in European countries - first of all, we are talking about France, Russia, Spain, Great Britain and Ukraine. The situation is rapidly getting worse in Britain. In particular, 3,899 new cases of infection were recorded there yesterday - in recent days this figure was at a level that has not been observed since May. As a result of today's meeting, British Prime Minister Boris Johnson said that it is already possible to speak about the second wave of the epidemic with confidence. At the same time, he added that, on the one hand, he "does not want" to announce a repeated lockdown in the country. On the other hand, he warned that the government would consider options to strengthen the existing restrictive measures. In Spain, new quarantine measures have already entered into force, which are designed to curb a steady increase in new infections and an ongoing increase in the number of deaths. In the Czech Republic, the Minister of Health resigned against the background of a rapid jump in the daily increase in the number of cases. This country is also tightening quarantine restrictions. A similar situation, to one degree or another, has developed in the rest of the EU countries. It is noteworthy that the heads of European states have ruled out the option of a second lockdown (for now). But at the same time, restrictive measures are being strengthened everywhere. It is obvious that such trends will negatively affect the dynamics of key macroeconomic indicators in Europe. At the same time, the dollar was inspired by Trump's recent statement that Americans will have massive access to the vaccine by the end of this year. Of course, his rhetoric must be viewed through the prism of the election campaign - but still, the topic of COVID-19 is so painful for traders that the head of the White House was "taken at his word." Moreover, many specialized experts admit the reality of such a scenario. In turn, the European currency has suffered today due to Lagarde's rhetoric. Let me remind you that she did not focus on the euro's appreciation at the ECB's last meeting. Lagarde casually mentioned this, saying that the central bank "will closely monitor the exchange rate of the currency." But today Lagarde has intensified her criticism - during her speech, she said that the rise in the euro is putting significant pressure on prices. At the same time, she was pessimistic about the future prospects of the European economy - in her words, the recovery process is "uncertain, uneven and not dynamic." This fundamental background contributes to a further decline in the EUR/USD pair in the medium term. The market was again afraid of the coronavirus, and the euro came under additional verbal pressure from Lagarde. From a technical point of view, the pair is currently testing the upper border of the Kumo cloud on the daily chart (1.1730 mark). If the bears push through this support level, they will open their way to the lower border of the mentioned cloud, which corresponds to the "round" level of 1.1600. You can consider short positions after sellers are able to gain a foothold under the 1.1730 target. The material has been provided by InstaForex Company - www.instaforex.com |

| September 21, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 21 Sep 2020 11:30 AM PDT

The EUR/USD pair has been moving sideways within the depicted expanding channel since August 3. Previously, a temporary resistance level was formed around 1.1900 which prevented further upside movement for and forced the pair to have a downside pause for sometime. On August 31, the EURUSD pair achieved another breakout above the previously mentioned resistance zone. Significant SELLING pressure was applied around 1.2000 where the upper limit of the movement pattern came to meet the pair. Recently, the EUR/USD pair has demonstrated a quick bearish decline towards 1.1800. More downside movement was expected towards the lower limit of the movement pattern around 1.1770-1.1750 which has been providing Support for the EUR/USD pair until earlier Today. Earlier Today, a breakout to the downside was executed below the price level of 1.1750 (KeyZone). Hence intraday technical outlook has turned into bearish. Intraday traders should be waiting for any pullback to the upside towards the depicted key-zone (1.1750-1.1770) for a void SELL Entry. On the other hand, a breakout above 1.1820 (Exit Level) will probably enable further upside movement towards 1.1860-1.1900. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Sep 2020 10:05 AM PDT EUR/USD hourly chart On Monday, September 21, EUR/USD moved sharply to the downside within the 1.1700 -1.1900 sideways channel where it has been holding for almost two months. In the course of the day, the euro dropped against the US dollar by 150 pips. In the morning, we did not recommend buying the euro, as the price was holding near the upper boundary of the flat channel. We also recommended that traders consider placing short positions at their own risk following the MACD sell signal. Thus, those traders who placed sell orders have gained the profit of about 100 pips. The price of the euro/dollar pair has shifted to the lower boundary of the channel. First of all, this means that short positions can be closed. Secondly, now it is better to open buy deals from this area. Unfortunately, today we have not received any clear signals on the internal trends in the sideways channel. There is still no trendline, or channel, or any other pattern that can be used to determine the current trend. Therefore, all deals are now associated with high risks. From the fundamental point of view, there were no important events on Monday. That is, no macroeconomic reports were expected this day, so traders had no drivers to react to. However, it turned out that no statistical data is needed to cause sharp fluctuations on the pair. In the morning, the pair opened the day with a strong movement and continued the trend throughout the session. On Tuesday, September 22, Fed Chairman Jerome Powell will testify before the US Congress. Tomorrow, the Fed chairman will give speech before the US House of Representatives Financial Services Committee regarding the implementation of the legislation from March 27. The new law provided the US economy with a record $2.2 trillion stimulus package in order to tackle the coronavirus pandemic. On Wednesday, Jerome Powell will testify before the Congress once again, this time in front of the House Select Committee on the Coronavirus Crisis. Both the announcements can potentially provide important information to market participants. On the other hand, Powell's attitude to the coronavirus crisis is rather skeptical. The Fed's Chair has repeatedly stated that the risks associated with the pandemic are extremely high, and the future of the US economy is uncertain. Thus, Jerome Powell is likely to announce something similar in the next two days. However, we insist that you do not skip these events, as they may be of great importance for the US currency. Possible scenarios for September 22: 1) At the moment, we would recommend that novice traders should be cautious when opening buy deals on the pair. Currently, there is no clear signal that confirms long positions. However, it might be sensible to place buy orders from the lower boundary of the 1.17-1.19 channel, especially now when the pair dropped by almost 150 pips. You need to wait until the price pulls back to the upside by at least 50-70 pips. Thus, novice traders can open long positon at their own risk. An upward reversal of the MACD indicator may signal the completion of the downward movement. At the same time, it is important that both the quotes and the indicator show an uptrend. 2) Currently, selling the pair is not relevant any longer as it has already gone down by 150 pips. So, the beginners are recommended to close their short positions now. Otherwise, they can wait until the MACD indicates an upward signal and close short positions after that. However, we would not recommend waiting for the MACD upside reversal. It is highly possible that the indicator will start showing mixed signals. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trendlines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (10, 20, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines). Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exit the market in order to avoid sharp price fluctuations. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: dollar again takes the virus as allies Posted: 21 Sep 2020 08:13 AM PDT

The USD index continued to rebound on Monday from the area below 93 points, rushing to new local highs amid a decrease in risk appetite. The deterioration in investor sentiment is associated with increased fears about the rapid spread of coronavirus in the world, which could trigger a new wave of quarantine measures and another round of slowdown in business activity. At present, the demand for the greenback as a safe haven asset has resumed, resulting in the strengthening of the US dollar against its main competitors, including the euro. After updating the local highs around 1.1870, the EUR / USD pair sharply declined. The pressure on the common European currency is exerted by the news about the worsening epidemiological situation in the EU. Even before the weekend, Greece and Denmark announced the introduction of new restrictive measures. On Monday, the German health Minister expressed concern about the rate of spread of COVID-19 in the region. He noted an increase in the number of coronavirus infections in Austria, the Netherlands, Germany, and France. There are fears that the European economy will again come under pressure and the pace of its recovery will significantly slow down against the background of tougher quarantine measures. The nearest support for the EUR/USD pair is at 1.1750. A clean breakdown of this barrier will bring the 1.1735 and 1.1700 levels into play. The inability of the bulls to protect the 1.1700 mark may lead to a more stable decline and testing of the next round level of 1.1600. Strong resistance is located around 1.1900. Its breakdown can trigger a short squeeze and push the pair to 1.1930-1.1950, from where it can target the key psychological mark of 1.2000. This week, traders ' attention is once again focused on the US Federal Reserve Chairman, Jerome Powell. On Tuesday, he will appear before the Committee on Financial Services of the House of Representatives. On Wednesday, Powell will make another appearance in the House of Representatives, and on Thursday before the Senate Banking Committee. Investors are hoping to hear tips from the head of the Federal Reserve on the regulator's new approach to inflation. It's not yet clear whether Powell will say something fundamentally new or will only repeat what he said earlier. Although the second option is most likely, however, the comments of the Fed Chairman may well cause an increase in the volatility of the EUR/USD pair. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Sep 2020 07:42 AM PDT Hello dear traders! Let's me share an interesting trading idea for USD/JPY with you. In the American session today, open interest revealed powerful buying activity from one-year lows. I suggest the idea of working out the third wave of that open interest holding positions with huge opportunities. If the currency pair closes the trading day higher, this will be a convincing signal for long deals from the daily pin bar. Risks could be capped by the intraday low today. Profit could be taken at the price of 107. The profitability of a deal is 7:1. The trading idea is developed on the grounds of the two methods: Price Action and Chasing stop orders. Good luck in trading! Make sure you manage your risks! The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD gets rejected at key short-term resistance Posted: 21 Sep 2020 07:34 AM PDT In a previous analysis EURUSD has shown us bearish signs by breaking out of the bullish channel. Bulls have tried to push price back inside the channel but price got rejected at key short-term resistance at 1.1860.

Red line - resistance Pink line - support EURUSD is now out of the bullish channel, below the pink line support and got rejected at key resistance trend line. Everything points now to a deeper pull back towards 1.1685 and maybe lower towards 1.15-1.1550. As long as price is below 1.1870 we are short-term bearish looking for a move towards 1.16. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price challenges major support Posted: 21 Sep 2020 07:30 AM PDT Gold price got rejected once again at $1,970 and as we said last week, this was a bearish sign that could push price back towards $1,900 the lower triangle boundary. Price has now reached this critical support area at $1,910-$1,900 and if it is broken we should see price under pressure for a move towards $1,850-$1,800.

After readjusting the triangle pattern boundaries, we saw price weakness to overcome the resistance around $1,960-70 area. Price is now testing major horizontal support area for the fourth time. If this support level is broken we should expect a move towards $1,850-$1,800 to follow. If this support level holds, then a bounce towards $1,950 could follow. Price is moving sideways for more than a month. Is it time for price to break out of the trading range? A big will follow for sure. The material has been provided by InstaForex Company - www.instaforex.com |

| USDJPY reached target and ready for bounce to 105 Posted: 21 Sep 2020 07:24 AM PDT USDJPY has reached our 104 target level and is now bouncing higher. There are bearish divergence signs by the RSI that does not follow price to new lower lows. This is a warning that tells me there are significant chances of an upward bounce towards 105.

Pink line - resistance Black lines - Fibonacci retracement levels USDJPY is bouncing and it is now ready for a move towards the 38% Fibonacci retracement in the area of 105. This is not the time to be bearish USDJPY. Price is expected to move higher as the RSI is turning upwards from oversold levels. The bullish divergence should not be ignored either. It is not a reversal signal but a powerful warning to bears that a pause is coming to the downtrend. First target is 105 and next at 105.45. The material has been provided by InstaForex Company - www.instaforex.com |

| Daily Video Analysis: AUDJPY High Probability Setup Posted: 21 Sep 2020 07:02 AM PDT Today we take a look at AUDJPY. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD holding above ascending trendline support, bounce expected! Posted: 21 Sep 2020 07:01 AM PDT

USDCAD holding above ascending trendline support and 1st support at 1.31754. A bounce above this level towards 1st resistance at 1.32089 can be expected.. Trading Recommendation Entry: 1.31754 Reason for Entry: 50% fib retracement, Ascending trendline support Take Profit : 1.32089 Reason for Take Profit: Graphical swing high Stop Loss: 1.31463 Reason for Stop loss: Graphical swing low The material has been provided by InstaForex Company - www.instaforex.com |

| AUDJPY testing 1st resistance, potential for a further drop! Posted: 21 Sep 2020 07:00 AM PDT

AUDJPY is testing our 1st resistance at 76.44 where the horizontal overlap resistance and 50% fib retracement are. Price could touch 1st resistance and drop from there. Ichimoku also indicates that further downside will come. Trading Recommendation Entry: 76.44 Reason for Entry: horizontal overlap resistance and 50% fib retracement Take Profit: 76.06 Reason for Take Profit: Horizontal swing low Stop Loss: 76.76 Reason for Stop Loss: Horizontal swing high resistance The material has been provided by InstaForex Company - www.instaforex.com |

| EURJPY is facing bearish pressure, potential for further drop! Posted: 21 Sep 2020 07:00 AM PDT

Price is facing bearish pressure from our first resistance, in line with our 61.8% fibonacci extension, 38.2% fibonacci retracement and horizontal pullback resistance where we could see a reversal below this level to our first support level. Ichiomku cloud is showing signs of bearish pressure in line with our bearish bias. Trading Recommendation Entry: 124.555 Reason for Entry: 61.8% fibonacci extension, 38.2% fibonacci retracement and horizontal pullback resistance Take Profit: 122.355 Reason for Take Profit: 61.8% fibonacci retracement and horizontal overlap support Stop Loss: 125.398 Reason for Stop Loss: Horizontal pullback resistance, 61.8% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| September 21, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 21 Sep 2020 07:00 AM PDT Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the key-level level of 1.3300. A quick bearish decline took place towards 1.2900 then 1.2825 where some bullish recovery was recently expressed. The price zone of 1.3130-1.3150 (the backside of the broken trend) remains an Intraday Key-Zone to offer bearish pressure if retested again. The GBPUSD pair is showing lack of sufficient bullish momentum to pursue above the price level of 1.3000. That's why, bearish persistence below 1.3000 enabled further bearish decline initially towards 1.2800 where another episode of bullish recovery may be executed. Trade recommendations : Conservative traders are advised to wait for bullish pullback towards 1.3130-1.3150 (the backside of the broken trend) as a valid SELL Entry. Initial T/p level is to be located around 1.3050 and 1.2900 if sufficient bearish pressure is maintained. On the other hand, bullish persistence above 1.3200 invalidates this trading scenario. The material has been provided by InstaForex Company - www.instaforex.com |

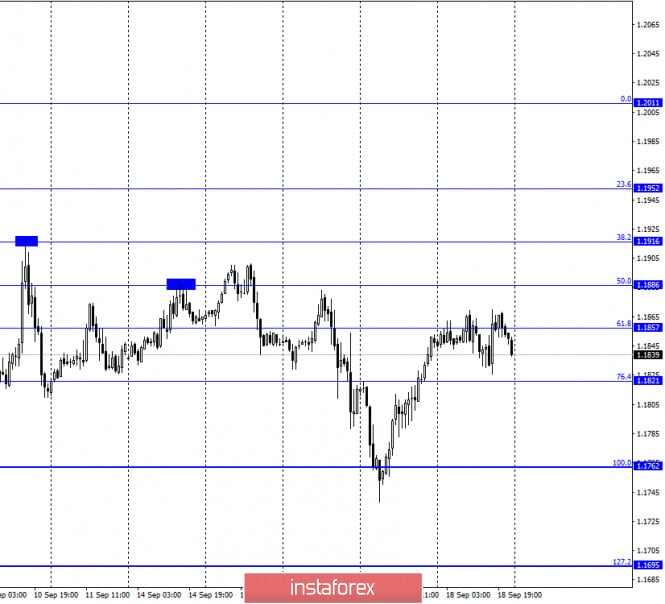

| September 21, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 21 Sep 2020 06:40 AM PDT

The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1700 which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) stood as a strong SUPPLY-Zone to offer bearish reversal. Conservative traders should be waiting for bearish closure below 1.1700 - 1.1750. As this indicates lack of bullish momentum and enhances further bearish decline initially towards 1.1645 and 1.1600. Trade recommendations : Conservative traders should wait for the current bullish movement to get back below 1.1750 as an indicator for lack of bearish momentum for a valid SELL Entry. T/P levels to be located around 1.1645, 1.1600 and 1.1500 while S/L to be placed above 1.1860 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| "Almost never" or The secret of extraordinary income Posted: 21 Sep 2020 06:32 AM PDT There is one statement that many investors follow when investing in securities: investments in the stock market and risk go hand in hand. And this statement is quite justified because the probability of losing money transferred to management at interest is very high. This risk is especially high in times of crisis when prices are falling relentlessly. In this case, the investor has to either fix losses or limit himself to constant payments of interest income.

However, successful investors try not to focus on market changes. This tactic follows a different rule: they buy the best stocks, but they never sell them. Long-term holding of shares is one of the most successful methods in the field of investment. One great investor, Philip Fischer, in his book "Ordinary shares and extraordinary returns", said that there is no better time to sell shares than "almost never". In order to generate a tangible cash flow before your own pension, you need to keep some assets in your investment portfolio forever. This is an opportunity to spend dividend income or, if there is no need for passive income, re-invest this money. The concept of "perpetual" shares implies securities that can provide dividends to the investor, and these dividends do not depend on the state of the economy, peaks, or dips. Even war or depression in the state can not affect the payment of part of the income of the selected company. Indeed, the stability of some companies is like an ATM that never runs out of funds. In the long-term investment sector, there are a large number of giant companies whose products are firmly embedded in the minds of people and are extremely necessary and irreplaceable by any analogues. As an example, let's take a look at three popular brands. The well-known Coca-Cola, which, despite the complexity of the business from the consumer sector, has been writing checks to its shareholders for more than a hundred years. Trade in food and beverages has always been characterized by fierce competition and required the constant introduction of innovative chips. However, Coca-Cola stands up to the obvious pressure with a bang. Moreover, it is a guarantee of strength and a vivid example of the brand's longevity. Even in the context of the COVID-19 pandemic, when the brand has actually lost sales in public places, the company still maintains a strong balance sheet, and the management does not lack liquidity. Fashion for a healthy lifestyle, the cult of healthy food also left an imprint on the demand for the usual sweet drinks from Coca-Cola. In this regard, the company has followed new trends and expanded the range of healthy products. This move beyond the brand of the same name is a necessary measure and a necessary condition for keeping the company in a leading position. Moreover, to maintain its status and high level of sales, Coca-Cola is acquiring various young companies, which is essential for following a healthy trend and finding new growth potential. Here is an example of recent brand investments: Honest Tea, Fairlife dairy, and Suja Life LLC. Public figures show that Coca-Cola's quarterly dividend is $0.41 per share and has more than doubled over the past five years. As for clothing brands, there are quite a lot of obvious leaders in this sector, the variety of strong brands is amazing and meets many consumer needs. For example, the sportswear company Nike claims to be a worthy and reliable candidate for inclusion in long-term investment portfolios. From a financial point of view, this is a very stable company that is also able to withstand the pressure from the ill-fated pandemic. The brand has successfully applied its e-Commerce channels to minimize financial losses due to the closure of retail outlets during the quarantine period. This is why wall street analysts recommend that customers not get rid of Nike securities, explaining this as an excellent potential for long-term growth of the brand and pointing to its clear success in the digital space. Nike's quarterly dividend is $0.245 per share and offers a yield of 0.80%. Moreover, this yield has been rising regularly since 2004. In addition to food and clothing, the Internet and wireless technologies are a necessary sector of the modern consumer. This is the sphere of human activity that has become of unprecedented importance over the past decade. It is difficult to overestimate the importance of information technology, wireless Internet, mobile communications, and television. It is not only a source of information, but also a universal environment for communication and learning. Every day the number of Internet users increases. That is why telecommunications companies are the same eternal assets, or one of the integral parts of the long-term investment sector. It doesn't matter what the current state of the economy is, because the Internet and wireless technologies are the last thing consumers will give up. Verizon Communications is one of the largest telecommunications companies in the world, which has been increasing its dividend for the past 30 years. Verizon has offices around the world, and has a revenue of $131.9 billion as of 2019. The company's range of services includes voice, data, and video solutions across award-winning networks and platforms. The company's quarterly payouts have increased by more than 50% since its stock first appeared on the market in 2000. To date, Verizon's stock is worth $0.6275. At a price of $60.37, the company's annual return is 4.14%. And this is despite the fact that the average indicator of companies from the S&P 500 list is 1.7%. Technological breakthroughs are extremely important for the dynamics of growth and development. And in this direction, the next important step for Verizon will be the construction of a 5G network, on which the success of futuristic destinations largely depends. In the near future, concepts such as self-driving cars, smart homes, or remote surgeries will become an integral part of modern life and will acquire the same status of things necessary for human life as food or clothing. Companies with clear competitive advantages and stable market positions are always the most profitable in terms of dividends for investors. Their undeniable advantage is the ability to remain stable in the face of economic downturns and the desire to surpass the trends of the rest of the market in the long term. To invest in such companies is to invest in your future. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. September 21. COT report: major traders are getting rid of the euro currency. Posted: 21 Sep 2020 05:27 AM PDT EUR/USD – 1H.

On September 18, the EUR/USD pair tried to continue the growth process, however, it could not confidently close above the corrective level of 61.8% (1.1857). Throughout the day, the pair traded in a narrow range, and the graphical picture did not clear up at all on Friday. The most important thing to understand in the near future is the dynamics of the pair in the coming weeks. Let me remind you that in the past two weeks, the ECB and the Federal Reserve have held alternate meetings. However, as of Monday, September 21, we can't say that these events had a significant impact on traders. Both central banks reported after their meetings that their GDP forecasts for 2020 and 2021 were slightly raised. But at the same time, both central banks also said that monetary policy will remain ultra-soft for a very long time. Both regulators still focus on inflation when adjusting monetary policies. Thus, until inflation in the European Union and America reaches a stable 2%, it makes no sense to expect a rate increase. I would also like to note that the COVID-2019 epidemic continues to be held in three central banks. If it is not possible to defeat the pandemic or prevent a second wave in the near future, the US and EU economies may begin to shrink again. Then the Fed and the ECB will have to adjust again in the direction of easing monetary policy and inject additional trillions of dollars and euros into the economy. Thus, I would say that the dollar and the euro are now in approximately the same position. EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair performed a reversal in favor of the euro currency near the corrective level of 127.2% (1.1729) and continued the growth process towards the upper border of the side corridor, in which the pair has been trading for several months. Closing the pair's rate above the side corridor will work in favor of continuing growth in the direction of the Fibo level of 161.8% (1.2027). The rebound of quotes from this line will allow us to count on a slight drop in the direction of the corrective level of 127.2%. EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed another reversal in favor of the EU currency and fixed above the corrective level of 261.8% (1.1825), which does not mean much, because the quotes continue to remain in the blue rectangle, which perfectly reflects the flat. The pair's quotes are fixed under the upward trend corridor, which slightly increases the probability of continuing the fall. However, the key remains the side corridor. EUR/USD – Weekly.

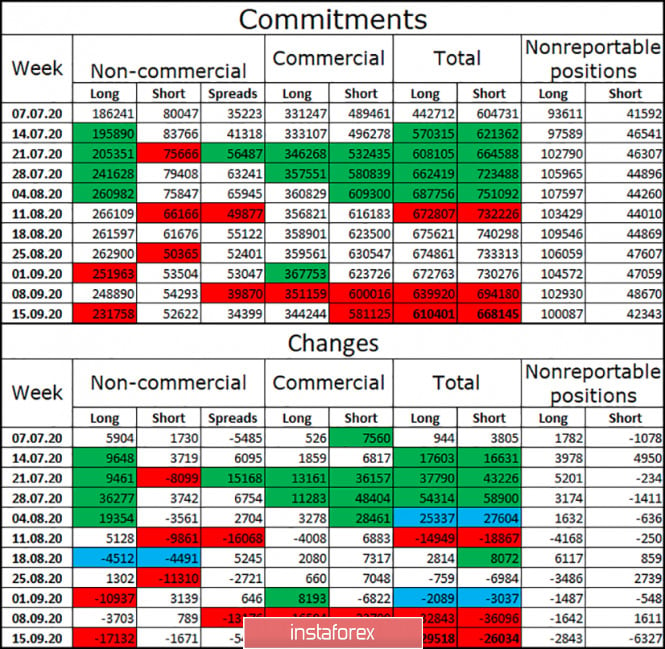

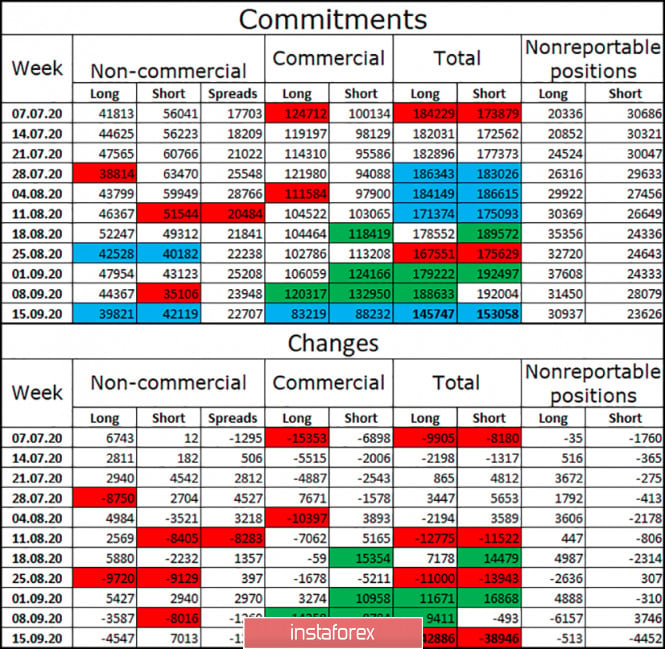

On the weekly chart, the EUR/USD pair has completed a consolidation above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term. Overview of fundamentals: On September 18, the European Union and America did not have a single important report or other events. Thus, the information background was not available on this day. News calendar for the United States and the European Union: EU - ECB President Christine Lagarde will deliver a speech (12:45 GMT). US - speech by Jerome Powell (14:00 GMT). On September 21, the calendars of economic events in America and the European Union contain only speeches by the chairmen of their central banks. COT (Commitments of Traders) report:

The latest COT report was very interesting. During the reporting week, the "Non-commercial" group got rid of 17,000 long contracts and only 1,700 short ones. Thus, the mood of major speculators began to change to "bearish". The total number of long contracts focused on the hands of speculators is 231,000 against 52,000 short contracts. Thus, the advantage is still with the bulls, however, it is beginning to decrease. Over the past three weeks, the "Non-commercial" group has closed almost 30,000 long contracts, which significantly increases the probability of a fall in the European currency in the near future. However, the number of short contracts has also decreased in the last two months - from 80,000 to 50,000. Thus, the euro may start the process of falling, however, it is unlikely to be strong. Forecast for EUR/USD and recommendations for traders: Today, I recommend selling the euro with a target of 1.1762, if the rebound is made from the upper line of the side corridor on the 4-hour chart (from the level of 61.8% - 1.1857 on the hourly chart, the rebound is already made). I recommend buying the pair if it closes above the side corridor on the 4-hour chart with a target of 1.2027. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD showing signs of downward trend Posted: 21 Sep 2020 05:27 AM PDT EUR/USD dropped again after a temporary rebound. It tried to test the broken uptrend line but it failed. It means that the bear will the upper hand. I've told you in my previous analyses that the pair could develop a corrective phase and decline if the price edges lower and fixes under the uptrend support, uptrend line. A dip below the 1.1752 former low could validate a deeper drop. Also, a drop below 1.17 psychological level confirms a larger downside movement.

Sell from below 1.1750 level or after a drop below 1.1700 static support with targets somewhere at the 1.1600 and 1.1500 levels. Buy only another jump above the $1,900 level with a potential target far above the 1.2 psychological level. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Sep 2020 05:21 AM PDT

Bank of America's strategist Ben Randall is confident that the US currency is undervalued by about 4%. The strategists made this conclusion based on the ratio of import and export prices. By the way, the bank recently recommended buying the US against the Swedish and Canadian currencies. The expert recalled that during the presidential elections, the US dollar usually grows. So, over the past 30 years during the elections, it added 2.5%. This time, there are also factors that will affect the American dollar rate. For example, there is a high level of uncertainty around the outcome of the elections, which can be challenged. Moreover, last week, the net speculative positions in the US dollar had reached a record high since 2011. However, most experts believe that the American currency may drop despite the fact that during the US elections the national currency usually strengthens. So, from 1980 to 2016, 10 US presidential elections took place, in 9 cases the currency grew over the next months. An interesting fact is that the US dollar showed the best dynamics in the case of the Democrats' victory. So, it grew by almost 4% and in other cases by almost 2%. However, the 1984 and 2008 elections are not taken into account, as they were accompanied by powerful non-political factors. Also, experts believe that there is no need to wait for a long-term bullish trend for the American currency. Analysts are confident that the US dollar will continue to fall for many more years, and any growth attempts will be short-lived due to the ultra-soft policy of the Fed. Today, the US dollar has depreciated, while the yen and yuan continued to rise. The US dollar index lost 0.1% against a basket of six major currencies to settle at 92.84. The Japanese yen gained 0.22% against the US dollar to 104.32 yen. The yuan in the mainland market rose by 0.11% to trade at 6.76, while in the offshore market it added 0.3% to 6.7584. The Australian dollar grew by 0.37% to $0.7317. The euro added 0.18% to trade at $1.1858. The pound sterling rose by 0.33% to $1.2958. On Thursday, the FTSE Russell is expected to include China in the global government bond index. This will definitely support the currency as cash flow is guaranteed. Experts from the Bank of Singapore are sure that China's economy is doing well compared to other countries. However, Biden's victory in the US election could provide even more support. Analysts say that if the Fed continues to keep rates low for a long time, it will negatively affect the US currency. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. September 21. COT report: speculators open short contracts Posted: 21 Sep 2020 05:19 AM PDT GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the US currency and a new close under the ascending trend line and the corrective level of 127.2% (1.2937). Thus, traders can again count on a slight drop in quotes in the direction of the corrective level of 161.8% (1.2789). Since September 10, the pound/dollar pair has been trading in a rather weak trend. It seems that there is an upward slope, on the other hand, it is too weak and fuzzy. The Briton showed that it is difficult to show growth at this time, and bull traders showed that they do not want to buy the pound after the events of early September, after which the strongest fall in the British quotes began. Now, as strange as it sounds, Boris Johnson and the UK government need to fix the situation. Ursula von der Leyen, President of the European Commission, said that London had called its reputation into question and must now restore it. She said that no new deal (meaning a trade agreement) is out of the question if London easily violates the previous agreement. Thus, the British can resume growth if London really shows that it is not going to violate the Brexit agreement. Otherwise, relations between Brussels and London will become very complicated. Further, the British will be affected. GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed an increase to the corrective level of 38.2% (1.3010), a reversal in favor of the US dollar, and began the process of falling in the direction of the Fibo level of 50.0% (1.2867). In general, the last few days of trading are between the levels of 50.0% and 38.2%. Thus, here again, we have the similarity of a flat. Closing the pair's rate above the level of 38.2% will work in favor of resuming growth in the direction of the Fibo level of 23.6% (1.3010). Closing quotes below the Fibo level of 50.0% will increase the probability of a further fall in the direction of the corrective level of 61.8% (1.2720). GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the Fibo level of 76.4% (1.2776), which now allows traders to expect some growth in the direction of the corrective level of 100.0% (1.3199). Fixing quotes under the Fibo level of 76.4% will work in favor of the US currency and fall in the direction of the corrective level of 61.8% (1.2516). GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, so a false breakout of this line followed earlier. The pair returns to a downward trend. Overview of fundamentals: On Friday, the UK released a report on retail trade for August, which almost exactly met market expectations and did not cause a special reaction from traders. News calendar for the US and UK: US - speech by Jerome Powell (14:00 GMT). On September 21, no news was listed on the calendar of the UK. COT (Commitments of Traders) report:

The latest COT report on the British pound, released last Friday, turned out to be much more logical than the previous one. This time, the report showed that the "Non-commercial" group reduced the number of long contracts on its hands by 4,547 units and opened 7,013 short contracts. Thus, the mood of the most important group (the group of professional speculators) became more "bearish" during the reporting week. Given that the British pound has fallen by 700 points since September 1, this behavior of the "Non-commercial" group is logical. The "Commercial" group (hedgers) managed to close about 80,000 contracts during the reporting week, in equal shares of short and long. For comparison, 80,000 contracts are more than the total number of contracts currently in the hands of speculators. Thus, the attractiveness of the British in the eyes of major traders begins to decline quite strongly. Forecast for GBP/USD and recommendations for traders: I recommend selling the British currency with a target of 1.2720 if the close is made under the level of 50.0% (1.2867) on the 4-hour chart. I recommend opening purchases of the British dollar if a close is made above the level of 1.3010 on the 4-hour chart, with a target of 1.3191. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

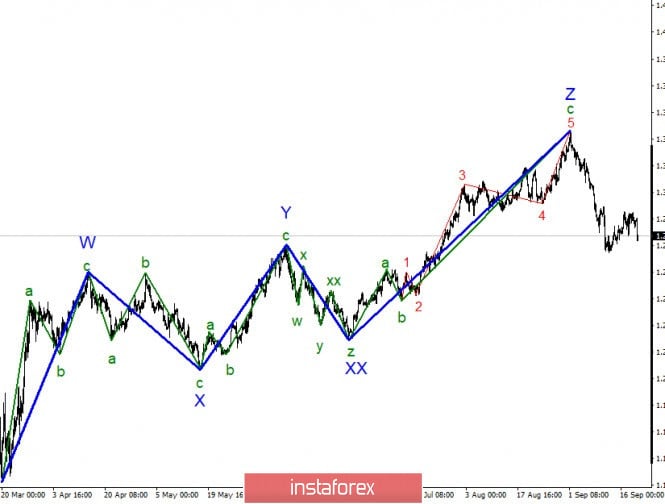

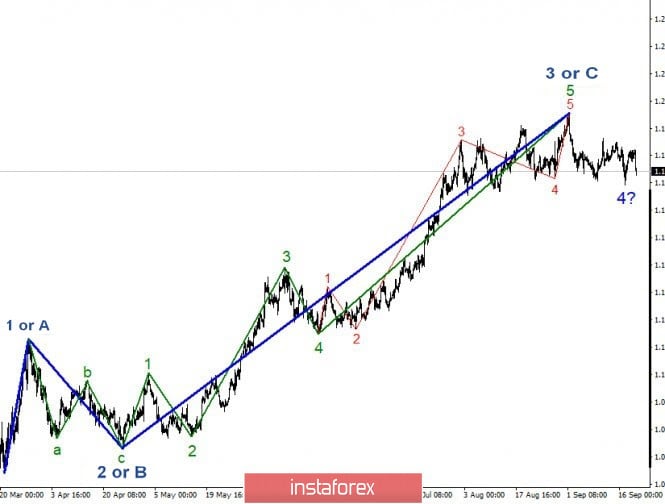

| Posted: 21 Sep 2020 05:16 AM PDT The construction of a new downward section of the trend continues. The continued decline in quotes suggests that the construction of wave 2 as part of this section has been completed which has taken a rather shortened form. The minimum of the expected wave 1 has not yet been passed so it is not yet possible to make an unambiguous conclusion about the completion of wave 2. Nevertheless, the chart shows very clearly the fall in demand for the British currency in recent weeks. Thus, the downward section of the trend is very likely to continue its construction. During the last trading day, the GBP/USD instrument lost about 60 basis points and today it lost another 60. Thus, there are more and more chances that the construction of the expected correction wave 2 or b is completed. If this is true, then the decline in the instrument's quotes will continue with targets located near the 61.8% and 76.4% Fibonacci levels. The depth of the British Pound's fall depends entirely on the news background. Despite the fact that it has been three weeks since the beginning of September, when the unfavorable events for the British began, the markets have not lost their desire to continue to get rid of the British currency. The driver of the fall of the British Pound now remains only one scandalous bill which has not even been adopted yet or may not be accepted at all. We are talking about the bill "on the internal market of the UK" which implies a violation of the Brexit agreement with the European Union. However, markets are now in disarray. Despite the fact that the law was approved by the majority of conservatives, it will most likely be adopted by Parliament. It does not imply a momentary violation of the agreement with Brussels. It only gives London the legislative opportunity to do so, guided by the interests of the country. Thus, the law may be adopted tomorrow but, if London violate violate the agreement with the EU is unknown if it will broken at all. According to many experts, Boris Johnson cannot fail to understand the severity of the consequences for the UK if he does violate international law. The British economy is already drained of blood by Brexit, Coronavirus, and quarantine. In addition, from 2021, it is likely that British companies will have to trade with European companies on WTO terms and this is another blow to the British economy. Against this background, the European Union may also impose sanctions against London with trade duties. So far, it looks like Boris Johnson is just bluffing. This is a very common opinion in the foreign exchange market. If this is true, the Pound will get a break. General conclusions and recommendations: The Pound-Dollar instrument presumably completed the construction of the upward wave Z and the entire upward section of the trend. At the same time, there is a high probability of building a correction wave 2 or B which could also have already completed its construction near the level of 38.2%. An unsuccessful attempt to break this mark allows the markets to start selling the instrument with targets around 1.2721 and 1.2539, which is equal to 61.8% and 76.4% for Fibonacci, based on the construction of the third wave. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Sep 2020 05:13 AM PDT The wave marking of the EUR/USD instrument still looks quite convincing in global terms. A sharp decline in the instrument's quotes began, which suggests that the markets are not ready to resume the upward section of the trend. Thus, the assumed wave 4 may take a more complex form than a three-wave one. If this assumption is correct, then the decline in quotes will continue, although the main option now is to resume building the upward section of the trend and its wave 5. The smaller-scale wave layout shows that three smaller-scale waves have already been built inside the assumed wave 4. Thus, the decline in quotes can be continued within the fifth wave of 4, but then this wave will take a non-standard and extended form. However, before a successful attempt to break through the minimum of the expected wave 3 or C in 4, it is premature to talk about the complexity of the entire wave 4. The beginning of the new trading week for the US currency was very positive. While it is difficult to say what is the reason behind the increase in dollar quotes by 50 basis points, nevertheless, it is available. However, this decrease has no effect on the wave pattern. So far, wave 4 cannot be considered either complete or complicated. Thus, 50 points of decline can generally be considered market noise. For the market, all the same topics continue to matter as before. The coronavirus, the presidential election, the development of a vaccine, the confrontation with China - it is extremely difficult not to note how sharply the topic of the trade war with China has faded into the background. If earlier news on this topic was received with enviable regularity, Beijing and Washington regularly exchanged accusations and sanctions. Now, everything is quiet and calm, as if there was no confrontation. In fact, this is very strange, because there was no truce between the parties. It seems that both Donald Trump and the Chinese "elite" are just waiting for the results of the November 3 election and their expectations are radically opposite. I said earlier that China is almost openly supporting Joe Biden. This is absolutely expected, since it was Donald Trump who started the trade war against China, which affected both China and America too. So, the Chinese are hoping for a democratic victory. Based on the latest data, Donald Trump has collected almost $ 325 million in campaign donations, while Joe Biden also managed to attract half a billion dollars. Recent support ratings also speak in favor of Joe Biden. Therefore, General conclusions and recommendations: The Euro-Dollar pair presumably completed the construction of the global wave 3 or C and the second corrective wave as part of the trend section that begins on September 1. Thus, at this time, I still recommend selling the instrument with targets located near the calculated levels of 1.1706 and 1.1520, which corresponds to 23.6% and 38.2% Fibonacci, for each MACD signal down. However, it is also possible that wave 4 has already been completed. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for GBPUSD for September 21, 2020 Posted: 21 Sep 2020 05:13 AM PDT Technical outlook: GBPUSD had carved a meaningful top around the 1.3500 level early this month before reversing sharply to the 1.2760 level. The single currency is seen to be trading around the 1.2860/70 levels at this point in writing and it is expected to move higher to the 1.3150/1.3200 level before finding resistance again. Immediate resistance is seen at the 1.3500 level, while interim support is around the 1.2760 level respectively. The recent boundary is between the 1.3500 and 1.2760 levels respectively. Also note that Fibonacci 0.618 retracement of the above drop is seen at 1.3200. The pair is likely to decrease if prices manage to reach there. The downside projections remain at the 1.2000 level in the next few weeks. Trading plan: It is recommended to open short deals at 1.3500. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment