Forex analysis review |

- Hot forecast and trading signals for GBP/USD on September 28. COT report. US companies are suing the Donald Trump administration

- Hot forecast and trading signals for EUR/USD on September 28. COT report. Large traders can restrain the euro's long term

- Overview of the GBP/USD pair. September 28. The pound has more bad long-term prospects than the US currency.

- Overview of the EUR/USD pair. September 28. A chess game between Donald Trump and Joseph Biden with the main prize – the

- Analytics and trading signals for beginners. How to trade EUR/USD on September 28? Getting ready for Monday session

| Posted: 27 Sep 2020 07:07 PM PDT GBP/USD 1H The GBP/USD pair continued to trade mostly sideways on September 25. The horizontal movement continued under the Kijun-sen line for two consecutive days, as a result of which the pair's quotes left the descending channel. And so a situation has now emerged for the pound, in which falling in the long term is called into question, and an upward correction will not start. Therefore, it is necessary to wait until this situation is clarified. If buyers succeed in pushing the pair above the critical line, then the chances of an upward correction will sharply increase. Otherwise, the initiative will remain in the hands of the bears. GBP/USD 15M Both linear regression channels are more sideways than up or down on the 15-minute timeframe. Therefore, the sideways movement can be seen on the lowest timeframe as well. The latest Commitment of Traders (COT) report for the British pound showed that non-commercial traders got rid of buying the pound and opened Sell-contracts (shorts). A group of commercial traders got rid of huge amounts of both longs and shorts of the pound. We then concluded that the pound sterling is now, in principle, not the most attractive currency for large traders. The new COT report showed absolutely minor changes for the "non-commercial" group. Buy-contracts (longs) fell by 2,000 while Sell-contracts decreased by 1,500. Thus, the net position for non-commercial traders remained practically unchanged for the reporting week (September 16-22). At this time, the British pound continued to fall, which can be considered a consequence of the previous reporting week, when the net position of non-commercial traders greatly decreased, by 11,500 contracts. No changes in the rate of the pound/dollar pair on the 23rd, 24th, 25th, which will be included in the next report. Thus, a long term decline in the pound's quotes is indeed questionable, although the pound is still the most unattractive currency in the foreign exchange market. No major macroeconomic reports were released in the UK on Friday, September 25. And so, traders had to turn their eyes to the United States. However, they did not find anything interesting for themselves over there, because the pair spent the whole day in a narrow price range. But there is a new scandal that is associated with US President Donald Trump. This time, 3,500 American companies filed lawsuits against the presidential administration, which believe that authorities have illegally increased duties on Chinese goods. The only thing that can be said about this is "What a turn!" It seems that American businessmen did not wait for Trump to continue the trade war with China, from which, as we have already found out, so far only damages America itself. It seems that US business did not wait for the war to begin against it, as Trump believes that all American companies should return their production to the United States. And for those who refuse to do this, it is quite possible that taxes will be greatly increased. Thus, just 5 weeks before the election, big American business showed how badly it wants Trump to be re-elected for a second term. We have two trading ideas for September 28: 1) Buyers took the first step to meet the initiative by breaking the downward channel. You can still consider buy positions on the pound, but first the price should settle above the Kijun-sen line (1.2768), and then you can aim for the Senkou Span B line (1.2871) and the resistance level of 1.3020. Take Profit in this case will be from 80 to 200 points. The current fundamental background is simultaneously bad for both the pound and the dollar. Therefore, we might even observe a flat for some time. 2) Sellers can only focus all their efforts on keeping the pair below the critical line. However, this is not enough, it is necessary that the downward movement resumed in the coming days, otherwise a flat will begin. While this is not the case, short positions remain relevant with the targets at support levels 1.2667 and 1.2558. Take Profit in this case can range from 60 to 160 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Sep 2020 07:06 PM PDT EUR/USD 1H The EUR/USD pair moved down after a low correction on the hourly timeframe on September 25, within which it could not even reach the critical line, which was very close. Therefore, the downward trend continues for the pair, as evidenced by the descending channel. The price even tried to go below this channel on Friday, but it didn't work out. Thus, after such a long break, bears are now in control of the pair's direction. The long-awaited downward pullback began, which we had been waiting for at least a month. Now the only question is how much the US dollar will be able to rise in price, for which the fundamental background has not changed much in recent weeks. EUR/USD 15M Both linear regression channels are still pointing to the downside on the 15 minute timeframe, indicating that the downward movement may continue. The euro/dollar fell by about one and a half cents last reporting week (September 16-22). Recall that the previous Commitment of Traders (COT) report showed that the "non-commercial" group of traders, which we have repeatedly called the most important, sharply reduced their net positions. Thus, in general, the downward movement that began later on was sufficiently substantiated. The only problem is that it started late. The new COT report, which only covers the dates when the euro began its long-awaited fall, showed completely opposite data. Non-commercial traders opened 15,500 new Buy-contracts (longs) and almost 6,000 Sell-contracts (shorts) during the reporting week. Thus, the net position for this group of traders has increased by around 9,000, which shows that traders are becoming bullish. Accordingly, the behavior of the EUR/USD pair and the COT report data simply do not match. For the second week in a row. However, if you try to look at the overall picture, you can still note a very weak strengthening of the bearish sentiment, so the COT report allows a slight fall in the euro. The question is, how little movement can you expect? The pair went down 270 points from the last local high. There was only one important report on Friday, September 25. Durable goods orders in the United States. The main indicator increased by only 0.4% in August, the indicator excluding defense and aviation - by 1.8%. Indicator excluding transport - by 0.4%. Indicator excluding defense - by 0.7%. In general, approximately the same figures were predicted. Therefore, traders did not particularly react to this report. The dollar began to grow much earlier than when this report was released. Meanwhile, more and more economists believe that the potential for recovery in the US economy is nearing its peak. In other words, without additional stimulus and with current levels of coronavirus disease, the US economy will find it difficult to continue to show "higher growth rates than expected," said Federal Reserve Chairman Jerome Powell. And the Democrats and Republicans still have not agreed on the size of the new package of financing the economy. And the number of daily recorded cases of the disease is stable at 40-45,000 per day. No important macroeconomic and fundamental events in the EU and the US are scheduled for Monday. We have two trading ideas for September 28: 1) Buyers remain outside of the market, but they can be active at any time, as evidenced by the data of the COT report. Therefore, we recommend considering long positions if the pair settles above the Kijun-sen line (1.1696) and the resistance area of 1.1704-1.1728, while aiming for the Senkou Span B line (1.1763) and the resistance area of 1.1894-1.1910. Take Profit in this case will be from 20 to 150 points. Of course, ideally, you should wait for the quotes to settle above the descending channel. 2) Bears have been showing more and more desire to put pressure on the pair lately. Nevertheless, the same COT report warns that the dollar's rise may be very short-lived. Nevertheless, while the price is below the Kijun-sen line, you are recommended to continue trading down while aiming for 1.1588 (new target levels will be formed today). In this case, the potential Take Profit is up to 40 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Sep 2020 05:06 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - downward. CCI: -57.2772 For the last three trading days of last week, the British pound was trading quite calmly in a narrow price range. In fact, all trades were held between the Murray levels of "0/8" - 1.2695 and "1/8" - 1.2756. The pair broke out to the moving average line once, bounced off it, and resumed a semi-sideways movement. Thus, the fall of the British pound temporarily stopped. We remind you that it is the US dollar and the British pound that remain the main "losers" of 2020. At least, judging by the events of the last 6 months in the UK and the US. However, the pound/dollar pair cannot standstill. For a while, there may be a flat, however, it is not constant. Thus, with an absolutely negative background from the UK and the same background from the US, the pair should still move in one direction. It remains only to determine which one. The simplest way to do this is technical analysis. For example, when the pair's quotes are below the moving average line, you should trade lower. The mood of traders, both large and small, can change at any time. There is no way to predict this. However, traders still react sluggishly to macroeconomic statistics. Thus, we can only track the overall fundamental background and only try to predict how it may affect the overall mood of market participants. Unfortunately, things are just as bad in Britain and the US right now. This applies to almost all aspects of the country's life. Starting from the "coronavirus" epidemic, ending with political crises. Of course, the situation is still different. For example, in the US, the first "wave" of the pandemic, which began in March, is still ongoing, and in the UK, the second "wave" began a couple of weeks ago. In Britain, the number of diseases is increasing daily. On September 25, a new anti-record was set - almost 7,000 cases per day. In the States, everything is a little better – "only" 40,000 diseases per day. "Better" – because a few weeks ago, 60,000 were recorded. As for political crises, of course, in fact, they are not. In general, the concept of "political crisis" is very vague and each author or analyst puts his own meaning in it. However, we believe that if the government does not show high results of its work, and approval ratings fall to 30% (and this applies to both Trump and Johnson), then there is a political crisis in the country. We can even say that the States were more fortunate. Trump may leave as early as January 20, and Joe Biden will take his place. Thus, the question is only in the Americans themselves. If they vote for Biden in the majority, then no courts, no proceedings will be able to influence the results later. If Biden wins by a margin of 100-120 votes (recall that the electoral system in the United States is special, "electoral votes" are considered to be distributed in unequal proportions among all States), then no court will recognize that the vote was dishonest. Thus, the fate of the future of the United States is literally in the hands of the American people. The same cannot be said for the British, who managed to put all power in the hands of Boris Johnson over the past year. The British Prime Minister was appointed to his post only last year, which means that he can lead the country for several more years (provided that the Conservative Party fully supports him). Thus, it is in Britain that it is unlikely that anything will change dramatically in the near future. Well, 2021 for the States can really be a year of growth (in our opinion, if Biden wins the election), however, it can be a year of a new fall for the UK since there was no free trade agreement with the European Union or the States. It is impossible to predict when and how the COVID-2019 epidemic will end, and how many more victims it will have in the Foggy Albion. Well, Boris Johnson's actions are even harder to predict than answering the question: "When will the pandemic end?" Recall that this year, Johnson may not just "go in different directions" with the European Union, but completely fall out with it. Thus, it will be extremely difficult for him to sign an agreement with Brussels in the future. However, from our point of view, if this happens, it may also be the first step for Britain on the road to liberation from Boris Johnson. To do this, Johnson must lose the internal support of his party. In principle, his bill "on the free market" was not supported by anyone except his own party members, and even then not all of them. Thus, we believe that with this bill, Johnson first of all cast a shadow on himself. He simply showed that he could easily violate the principles of international law. Who would want to negotiate anything with such a leader? Such is the sad news from London.

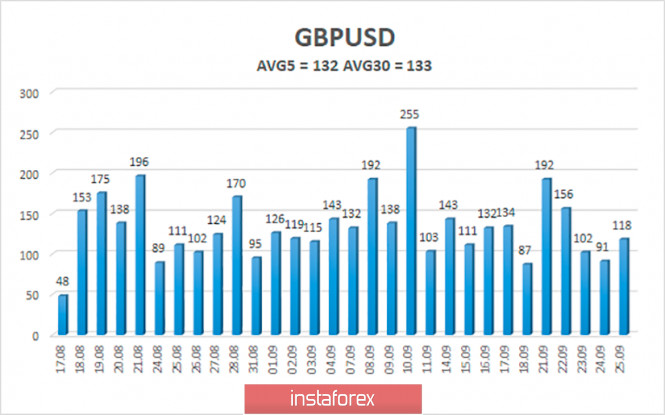

The average volatility of the GBP/USD pair is currently 132 points per day. For the pound/dollar pair, this value is "high". On Monday, September 28, thus, we expect movement inside the channel, limited by the levels of 1.2611 and 1.2875. The reversal of the Heiken Ashi indicator back down may signal about a possible resumption of the downward movement. Nearest support levels: S1 – 1.2695 S2 – 1.2634 S3 – 1.2573 Nearest resistance levels: R1 – 1.2756 R2 – 1.2817 R3 – 1.2878 Trading recommendations: The GBP/USD pair continues to adjust on the 4-hour timeframe, mostly sideways. Thus, today it is recommended to open new short positions with targets of 1.2695 and 1.2634 as soon as the Heiken Ashi indicator turns back down or the price bounces off the moving average line. It is recommended to trade the pair for an increase with targets of 1.2875 and 1.2939 if the price returns to the area above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Sep 2020 05:06 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - downward. CCI: -99.1177 On the last trading day of last week, the EUR/USD pair continued to trade with a downward bias. Thus, the overall trend for the instrument does not change. The downward trend persists after a two-month movement in the 200-point side channel. However, as we have said many times, the prospects for the US dollar remain very vague, especially when paired with the European currency. With the pound sterling – everything is clear. This currency is an absolute outsider for the last four years. However, the European economy does not look problem-free, but rather stable. The only serious concern is inflation. In the United States, there are still many more problems in both economic, epidemiological, and political. We have already listed them several times. By and large, nothing changes in the fundamental background from overseas, thus, we continue to insist that the main reasons for the further fall in the pair's quotes can only be technical. Most of the news from America continues to concern the topic of the election and Donald Trump personally. For example, the current US President in an interview last week said that he does not even expect any process of transferring power to Joe Biden, because, in his opinion, "he will win the election". "We will only lose the election if the Democrats cheat. We can't let them do this, because our country is at stake. These people will destroy our country, we can't let that happen. This is a scam, they know it, and the media knows what will happen," said Donald Trump. It is unclear how Trump and his team will be able to convict the Democrats of fraud. However, this is the most alarming moment. No one will forbid Trump to say something like "the Democrats rigged the election, they forged a lot of ballots, we have evidence, we will present it in a week" and file with the Supreme Court. Naturally, as in the case of the accusations against China, no evidence will be presented "in the near future". But at the time, both Mike Pompeo and Donald Trump have repeatedly stated that the evidence will be made public in the coming weeks. The same can happen with elections and accusations against Democrats. And most American journalists and experts have little doubt that this is exactly what will happen. Accusations are one of Trump's favorite weapons. Also, Trump has already begun to accuse the Democrats that all "his votes" will be counted within a day, but all those who will vote by mail (that is, for Biden) can be counted within weeks or even months. It is unknown why Trump believes that all of his voters will vote in person and all of Biden's voters will vote by mail. The current US President also believes that this is the calculation of the Democrats. The number of votes they received will be known in a day. Thus, the Democrats can fake all-new ballots. Thus, the situation with the elections looks like this now. Biden and his entourage are afraid that against the background of the "coronavirus", Trump and the company may prevent voters from voting in many "Biden" states and cities. This is what mail-in voting was designed for so that every Biden voter could cast their vote for the Democrat without hindrance. Again, under the cover of the "coronavirus". Trump is afraid that Biden's people will simply cheat the necessary number of votes by using fake ballots. Thus, as we've said before, it's likely that the election results will be challenged in the US Supreme Court, no matter who wins them. And with this development, we are not ready to say that Trump is 70-80% likely to lose the election. The problem is that if the case is decided in the US Supreme Court, then Trump already has the support (according to various estimates) of 4-5 judges out of 9. In the near future, Trump wants to appoint another judge to replace the untimely Ruth Ginsburg. Most likely, he will be able to do this, because no legal grounds are prohibiting him from doing so. On the contrary, the law prescribes the appointment of judges if the situation so requires. A candidate has already been selected to replace the deceased Ginsburg, who did not support Trump's policies. Trump offers Amy Coney Barrett, who was previously appointed by him to the Chicago District Court of Appeals. It doesn't even matter who Trump chooses. Thus, it remains only to wait for the approval of the candidate by the US Senate, the majority of which are Republicans. Thus, almost everything related to politics and power in America now passes through the prism of elections. Even the situation with the "coronavirus", Democrats and Republicans are trying to use against each other. For example, Joe Biden says that all the President's demagoguery is connected only with the desire to distract the attention of Americans from the real problems, from the epidemic that persists at high levels and from the high level of unemployment. Trump also says that the Democrats are trying to "delay" the process of creating a vaccine. Thus, we will witness another 5-week series called "elections". Well, for the euro/dollar pair, this means only one thing. In the near future, the US dollar may start falling again. The reasons are extremely fundamental. Investors and traders are now afraid to deal with the US economy and the US currency because their future is uncertain. Thus, the euro now looks more stable currency. Perhaps, after the election results are known, the US currency will again be in demand, however, we do not want to get ahead of ourselves so far. No one knows what will happen after November 3.

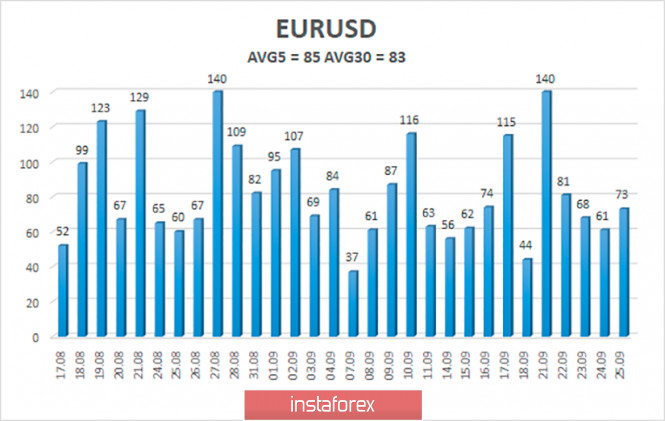

The volatility of the euro/dollar currency pair as of September 28 is 85 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1546 and 1.1716. A reversal of the Heiken Ashi indicator upward signals a new round of upward correction. Nearest support levels: S1 – 1.1597 Nearest resistance levels: R1 – 1.1658 R2 – 1.1719 R3 – 1.1780 Trading recommendations: The EUR/USD pair continues its downward movement. Thus, now you can continue to hold open short positions with targets of 1.1597 and 1.1546 until the Heiken Ashi indicator turns up. It is recommended to re-consider options for opening long positions if the pair is fixed above the moving average with the first targets of 1.1780 and 1.1841. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Sep 2020 02:03 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair was trading in full accordance with our morning assumptions on Friday, September 25. In the morning article, we said that it is not advisable to buy the pair now, since there is a downward trend, and trading against the trend is als not recommended. This also applies to experienced traders, not just beginners. The MACD indicator had previously been discharged to zero, which made it possible to consider it again as a provider of strong sell signals. And so it happened. The MACD indicator reacted to the first downward bar with a downward reversal (the signal is circled), according to which novice traders could open short positions. The targets were the levels 1.1633 and 1.1599. The first one was reached, the second was not. But even if traders did not close sell orders near the first target, the pair returned to this level again afterwards, thus, a profit of about 20-30 points could be obtained. On the whole, the overall technical picture did not change at all on Friday. The pair's quotes remained in the lower area of the descending channel, so an upward correction is still very likely. A report on durable goods orders for August was released in America on the final trading day of the week. We have already said that this report is quite important, since this category of goods is quite expensive, which means it has a significant impact on GDP and well reflects the purchasing power and desire to make expensive purchases. However, we also mentioned that, according to forecasts, changes are expected to be minimal compared to July. And so it happened in practice. Four derived indicators, two of which turned out to be worse than forecasted, two - better. In general, the highest growth was 1.8%, the lowest at 0.4%. As such, the changes were minimal and we cannot conclude that the markets were diligently working through this report. However, demand for the US dollar recovered on Friday. We believe that for the same technical reasons, due to which it began in principle, there was a need for a deeper correction after rising by 1300 points. There are no macroeconomic events scheduled for Monday, September 28, in the European Union and the United States. Therefore, the first trading day of a new week might be very boring, as is often the case. An upward correction to the area of the upper line of the descending channel may even begin. Possible scenarios for September 28: 1) Novice traders are still not recommended to place buy positions at this time, since there is a clear downward trend, and trading against the trend is not recommended in principle. Thus, it will be possible to consider long positions but first the price should settle above the downward trend channel or a new upward trend should appear, supported by a trend line or other channel. 2) Selling remains relevant despite the fact that the pair is trading near the lower border of the descending channel, that is, it retains high chances for starting an upward correction. However, in our experience, we can say that such forward movements along the trend, which have been observed since September 21, can be very long. Thus, on Monday it will be possible to open new short positions with targets at 1.1599 and 1.1572 after the MACD indicator recovers to the zero level and forms a new sell signal. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment