Forex analysis review |

- Hot forecast and trading signals for GBP/USD on September 8. COT report. London does not want a deal with the EU. Pound began

- Hot forecast and trading signals for EUR/USD on September 8. COT report. Flat. Market participants await ECB meeting results

- Comprehensive analysis of movement options for the commodity currencies AUD/USD & USD/CAD & NZD/USD (H4) on September

- Overview of the GBP/USD pair. September 8. London is going to abandon part of the agreements with the EU concluded earlier.

- Overview of the EUR/USD pair. September 8. The "coronavirus" epidemic is receding in the US.

- Analytics and trading signals for beginners. How to trade EUR/USD on September 8? Getting ready for Tuesday session

- September 7, 2020 : EUR/USD daily technical review and trade recommendations.

- Ichimoku cloud indicator Daily analysis of EURUSD for September 7, 2020

- Ichimoku cloud indicator Daily analysis of Gold for September 7, 2020

- Trading plan for USDCAD

- September 7, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- September 7, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Analysis of GBP / USD on September 7. What does Michel Barnier and the EU expect in the negotiations with London?

- US dollar slightly progresses against several currencies

- EUR / USD analysis on September 7. The Eurocurrency tends to fall, but so far only within the framework of a correctional

- AUDJPY facing pressure from descending trendline and 1st resistance, further drop expected !

- USDCAD facing pressure from 1st resistance, further drop expected !

- AUDUSD testing resistance, potential reversal!

- Financial war outbreak: China vs USA

- BTC analysis for September 07,.2020 - Sellers in control and there is potential for bigger drop towards the $8.230

- Analysis of Gold for September 07,.2020 - Sideways condiiton with potential for downside break.

- EUR/USD analysis for September 07 2020 - Weekly dirft pattern in creation and potentia lfor biigger drop towards 1.1700-1.1500

- Stocks in Europe rally as Asia and America grapple with problems

- Trading recommendations for EUR/USD on September 7

- EUR/USD: Bears came out of the bearish corner

| Posted: 07 Sep 2020 06:38 PM PDT GBP/USD 1H The GBP/USD currency pair, in contrast to EUR/USD, started to move down again on September 7, and so it reached the first support level of 1.3139 and the support area of 1.3156-1.3184. Thus, despite the day's empty calendar of macroeconomic events, market participants found a reason for selling the British currency on Monday. Now sellers need to make a successful attempt to overcome the 1.3139 level, and it may continue to move down with renewed vigor. In addition to the fact that the downward movement is now visible with the naked eye, we have also formed a new downward channel, which supports the bearish traders. Setting the price above this channel will make it possible to conclude that the US dollar has temporarily stopped growing. However, you should only consider trading bearish while the pair's quotes are still within this channel GBP/USD 15M Both linear regression channels continue to be directed downward on the 15 minute timeframe, thus, we can conclude that the downtrend is weak, but it still persists. The latest Commitments of Traders (COT) report for the British pound turned out to be even more unexpected than the one for the euro. If non-commercial traders were already shorting the euro, the same category of traders continued to buy the pound sterling. In total, professional traders opened 5,500 new Buy-contracts and 3,000 new Sell-contracts during the reporting week (August 26-September 1), and so their net position even increased by 2,500, according to a new COT report. In principle, the data perfectly describes what is happening in the foreign exchange market, since the British currency continued to grow during all five trading days included in the report. The pound has been depreciating from September 1 to the present day, but there is no hint that professional traders have stopped looking towards the pound (unlike the euro) in the latest COT report. Therefore, we can not find a correlation between the two main competitors of the US dollar at this time, based on the COT reports, although both major currency pairs have been moving almost identical lately. The fundamental background on Monday, September 7, mainly came down to Brexit-related topics. First, traders received information regarding a new deadline for talks "by Boris Johnson", and then - unconfirmed information that London may refuse to fulfill some agreements with the European Union regarding Brexit, concluded last year. In addition, a new round of talks between the groups of Michel Barnier and David Frost starts on Tuesday, September 8, which means that we will be able to receive new information about the lack of progress, moving backward, not forward and other optimistic theses by today or tomorrow. We have finally received very interesting news from the UK, but, unfortunately, not everything was positive for the pound. In recent weeks, we have regularly reminded traders that there is no particular reason to strengthen the pound at this time, as there are still a huge number of geopolitical and economic problems in the UK. It seems that market participants have finally remembered them, which immediately translates into the pound's fall. We can expect the pound to fall If we do not receive disappointing news from overseas in the near future. We have two trading ideas for September 8: 1) Buyers remain in the shadows. Thus, it is recommended to consider buying the pound when the price settles above the descending channel with initial targets on the Senkou Span B (1.3266) and Kijun-sen (1.3310) lines. Take Profit in this case will be from 30 to 70 points. 2) Bears continue to slowly pull down the pair, therefore, short positions remain relevant while aiming for the support area of 1.3004-1.3024, but you are advised to resume trading down if the price manages to overcome the support level of 1.3139, which has already been reached yesterday. Take Profit in this case will be about 100 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Sep 2020 06:37 PM PDT EUR/USD 1H The EUR/USD pair was nearly moving from side to side on the hourly timeframe on September 7. We even defined the narrow side channel in articles for beginners, only 75 points wide. Trading took place in this channel throughout Monday. In addition, the price is still in a wider side channel, between the levels of 1.17 and 1.19. It has been trading in this range for over a month. Thus, the upward trend is maintained, since the price does not go far from its two-year highs and, accordingly, the bulls can become active at any moment and start attacking the US dollar again. Also, formally, there is not one but two flats that are now taking place, although the "higher flat" is more clearly visible on timeframes above 1H. The pair is located below the Kijun-sen and Senkou Span B lines, which makes it possible to trade down. But now the pair has problems with overcoming the 1.1780 level. EUR/USD 15M According to the 15 minute timeframe, both linear regression channels show that the pair is moving within the side channel even in the shortest term. The latest Commitment of Traders (COT) report, which, let me remind you, comes out with a three-day delay and so it only covers the dates from August 26 to September 1, rather unexpectedly showed a decrease in the net position for the "non-commercial" category of traders. Let me remind you that non-commercial traders are the most important category of traders who enter the foreign exchange market in order to make a profit. Non-commercial traders reduced Buy positions and opened Sell-contracts during the reporting week. The number of purchases decreased by almost 11,000, while the number of sales increased by 3,000. Thus, the net position immediately decreased by 14,000. We would like to take note that the euro did not really get cheaper during the reporting week, which is covered by the latest COT report. The euro strengthened during all five trading days, and then it only began to fall on September 1, which we can now describe as being provoked by professional traders and their sell positions. The euro fell after September 1, so the new COT report may signal an even greater decline in net positions. And in this case, it will confirm that the mood of non-commercial traders is changing to a downward one. Both America and the European Union did not release any significant macroeconomic report on Monday, September 7. In addition, there was no fundamentally important news from the EU. The European Central Bank will hold its meeting this week, during which the market could receive some really important information. Especially in light of the ECB Chief Economist Philip Lane's recent statements that the current euro exchange rate has an adverse effect on the EU economy. On Tuesday, we can expect the EU to release the GDP for the second quarter in the second estimate. It will be difficult for the euro currency to count on growth if the value of the first estimate is not revised for the better. German industrial production was also released yesterday, showing a 10% year-on-year decline in July, although traders were expecting a 12.1% gain. In monthly terms, the growth was only 1.2% instead of the forecasted +4.8%. We have two trading ideas for September 8: 1) Bulls continue to keep their finger on the pulse of the market and are ready to return to the market at any time and open new buy positions. At least the current drop in quotes is very weak, and the price has not yet managed to even approach the important level of 1.1700, which we consider as the lower border of the side channel. Small volumes can be bought in the case the quote settles above the Kijun-sen line (1.1896) with the target of 1.1972. Take Profit in this case will be about 45 points. 2) Bears got the opportunity to start forming a new downward trend, as they managed to gain a foothold below the Senkou Span B line (1.1882), but so far they clearly do not want to use it to the fullest. Thus, for now we can recommend selling the pair with the target of the support level of 1.1742. In this case, the potential Take Profit is 60 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

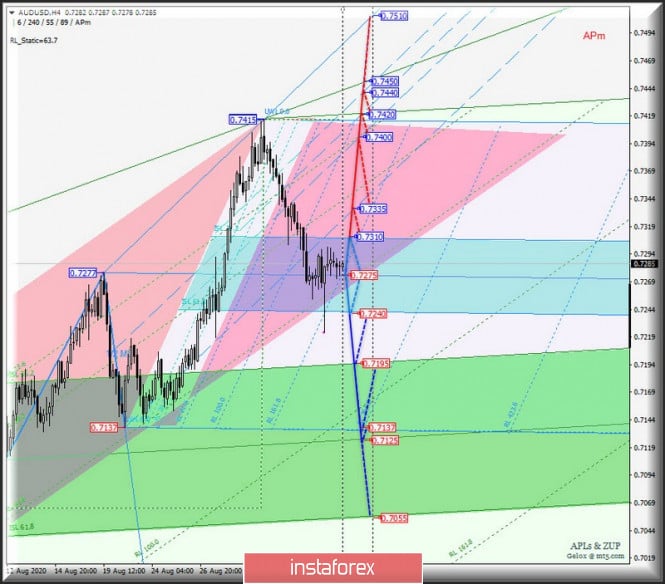

| Posted: 07 Sep 2020 05:49 PM PDT Minute operational scale (H4) What will happen next with commodity currencies after the local victory of the US dollar? Overview of AUD/USD & USD/CAD & NZD/USD (H4) on September 8, 2020. ____________________ Australian dollar vs US dollar The development of the movement of the Australian dollar AUD/USD from September 8, 2020 will continue depending on the development and direction of the breakdown of the channel boundaries of the equilibrium zone (0.7240 - 0.7275 - 0.7310) of the Minuette operational scale fork - see the details on the animated chart. A breakdown of the resistance level of 0.7310 at the upper boundary of the ISL38.2 of the equilibrium zone of the Minuette operational scale fork will make it relevant to develop an upward movement of AUD/USD towards the goals:

In case of breaking the lower border ISL61.8 of the equilibrium zone of the Minuette operational scale fork - support level of 0.7240 - the downward movement of the Australian dollar will continue to the borders of the equilibrium zone (0.7195 - 0.7125 - 0.7055) of the Minute operational scale fork. AUD/USD movement options from September 8, 2020 are shown on the animated chart.

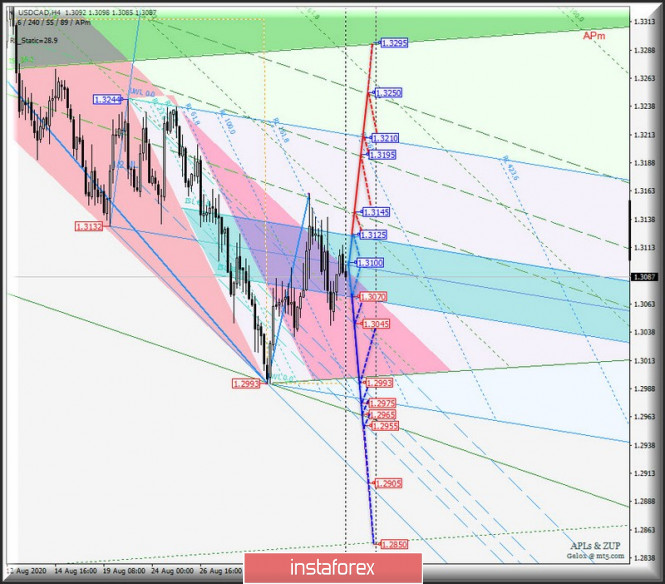

____________________ US dollar vs Canadian dollar The development of the movement of the Canadian dollar USD/CAD since September 8, 2020 will arise depending on the practice and direction of the breakdown of the boundaries of the equilibrium zone (1.3125 - 1.3100 - 1.3070) of the Minuette operational scale fork - we look at the markup movements within this zone on the animated chart. In case of a breakdown of the support level of 1.3070 at the lower border of ISL38.2 of the equilibrium zone of the Minuette operational scale fork, the downward movement of the Canadian dollar may continue to the targets:

If the resistance level of 1.3125 breaks at the upper limit of ISL61.8 of the equilibrium zone of the Minuette operational scale fork, the Canadian dollar movement can be continued to the borders of the 1/2 Median Line channel (1.3145 - 1.3195 - 1.3250) of the Minute operational scale fork. We look at the USD/CAD movement options from September 8, 2020 on the animated chart.

____________________ New Zealand dollar vs US dollar The movement of the New Zealand dollar NZD/USD from September 8, 2020 will develop depending on the development and direction of the range of boundaries of the channel 1/2 Median Line (0.6648 - 0.6680 - 0.6705) of the Minuette operational scale fork - we look at the animated chart for the movement markings within this channel. A breakout of the resistance level of 0.6705 at the upper border of the channel 1/2 Median Line Minuette, followed by a breakout of the median Line Minute (0.6720) - a variant of continuing the upward movement of NZD/USD to the targets:

A breakout of the lower border of the channel 1/2 Median Line Minuette - support level of 0.6648 - option of the movement NZD/USD to the equilibrium zone (0.6648 - 0.6605 - 0.6565) of the Minuette operational scale fork. The markup of the NZD/USD movement options from September 8, 2020 is shown on the animated chart.

____________________ The review is made without taking into account the news background, the opening of trading sessions of the main financial centers and it is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Sep 2020 05:49 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -142.9920 The British pound accelerated its fall against the US dollar on Monday, September 7. This happened after it became known about the new position of London and Boris Johnson personally on Brexit. Traders finally paid attention to the futility of negotiations and the lack of desire in London to negotiate. Thus, the pound began to fall after all, which may end in a new downward trend for the pound/dollar pair. So far, both channels of linear regression continue to be directed upwards, thus, we can not make a clear conclusion about the end of the upward trend. However, fixing the pair's quotes below the moving average line is sufficient to identify a change in the downward trend. Since 2016, we have repeatedly called everything that happens in the UK as "clowning" and "punning". Such a serious process as leaving the EU after a 47-year stay cannot be easy and simple. However, it should not be accompanied by an annual change of power, a complete disagreement of the Parliament with the ruling party and the Prime Minister, and an inappropriately persistent desire of the head of state to break all ties with the European Union at all costs and start building his foreign policy from a "clean slate". For about 3 years, we wrote that the main problem with the entire Brexit process is that it was ambiguous from the very beginning. The results of the 2016 referendum showed that the majority of Britons want to leave the EU. However, this option was not supported by the majority of Scots, the majority of Welsh, and the majority of Northern Irishmen. 52% is not the majority of such an important and serious issue. 75% is the majority, and 52% is half. Thus, the second half of the UK population did not want to leave the European Union from the very beginning. Accordingly, almost half of the UK population was not satisfied with the results of the referendum and everything that has happened in the last four years. However, the charismatic Johnson came to power, who did nothing for the country for a whole year of his rule. It is difficult to say how the British themselves feel about Johnson, however, we do not see why we can call him a "strong Prime Minister". He "overshadowed" the "coronavirus" epidemic, the British economy has lost the most percent of all EU countries, there are no free trade agreements with the EU and the United States. The negotiations have failed, and London's desire to bluff in negotiations with Brussels would have been seen through by a first-grader. The most important thing that many forget is that Johnson wanted to leave the EU from the very beginning without any agreements, under the scenario of a "hard" Brexit. It is this option that he is implementing under the guise of "negotiations with the EU, in which it is simply not possible to come to a common opinion". Moreover, Johnson is not interested in the fact that both sides must concede in negotiations. The fact that the "hard" Brexit will be paid not by him, but by ordinary Britons, is also not very interesting to the Prime Minister. Now the media also gets information that London may refuse to fulfill part of the agreements concluded with the EU in the fall of 2019. At the same time, the media reports that the UK government is going to cancel the "key agreements" concerning Northern Ireland. It is not yet known how true this information is, thus, we need to wait for an official statement from Boris Johnson or someone from the British government. However, "there is no smoke without fire". Perhaps this information was intentionally released to intimidate Brussels. Although what is the point of Britain striking a blow to its reputation? After all, it will then have to conclude new trade deals. Who, after such a unilateral termination of the deal with the EU, will treat Britain "like a gentleman"? In addition to unclear messages about the possible cancellation of some parts of the agreement with the EU, Boris Johnson continues to follow in the footsteps of his "big brother" Donald Trump and openly amuse his statements. It's a good thing Johnson doesn't speak as often as Trump, otherwise we'd have two major newsmakers. The British Prime Minister said that the parties (Brussels and London) must agree on an agreement defining the post-Brexit relationship by October 15. Earlier, Johnson had already given two or three deadlines, and, if you remember, was going to personally visit Brussels to hold talks with top officials of the European Union. Naturally, Johnson did not go to any Brussels, and he had already forgotten about the previous deadlines. Moreover, the negotiations have been in one place for a long time, and according to Michel Barnier, they are even moving in the opposite direction. It is also very symbolic that on the very day when it became known about the new deadline from Johnson, the media also got information about the possible refusal of London to fulfill some of the agreements previously negotiated with the EU. It all sounds like a pun, and hardly anyone else seriously believes that London wants to negotiate and will try to reach an agreement in the remaining six weeks. "We will have the freedom to make trade deals with all countries of the world and as a result, we will prosper," Boris Johnson said. However, Johnson did not say when this "period of prosperity" will begin. Maybe when all these deals will be concluded. However, the promise of a "period of prosperity" is very similar to Trump's formulation of a "Golden age" if he is re-elected. "If we can't reach an agreement by then, I don't think there will be a free trade agreement between us, and we should accept this and move on," the British Prime Minister commented on the current "progress" in the negotiations. At the same time, European negotiator Michel Barnier asked his British counterpart David Frost to explain the information that London may refuse to comply with previously reached agreements. He said that "everything that was signed must be respected" and insisted on the full implementation of all agreements on the border between Northern Ireland and Ireland, from customs checks on which, according to rumors, London plans to abandon. In general, in the coming days, we can count on news from the UK, and the pound can now respond to each of them with a new fall.

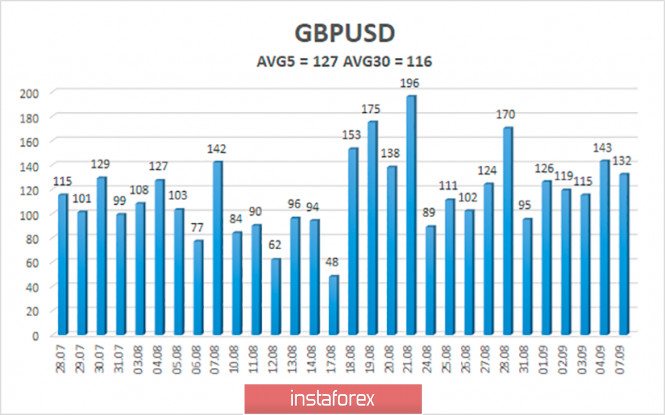

The average volatility of the GBP/USD pair is currently 127 points per day. For the pound/dollar pair, this value is "high". On Tuesday, September 8, therefore, we expect movement within the channel, limited by the levels of 1.3039 and 1.3293. A reversal of the Heiken Ashi indicator to the top will indicate a round of upward correction within a new downward trend. Nearest support levels: S1 – 1.3123 S2 – 1.3062 S3 – 1.3000 Nearest resistance levels: R1 – 1.3184 R2 – 1.3245 R3 – 1.3293 Trading recommendations: The GBP/USD pair continues its downward movement on the 4-hour timeframe. Thus, today it is recommended to stay in short positions with the goals of 1.3123 and 1.3062 until the Heiken Ashi indicator turns upward, which will indicate a round of correction. It is recommended to trade the pair for an increase with the first targets of 1.3306 and 1.3367 if the price returns to the area above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the EUR/USD pair. September 8. The "coronavirus" epidemic is receding in the US. Posted: 07 Sep 2020 05:49 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -75.6173 The EUR/USD pair spent the first trading day of the week in absolutely calm trading with minimal downward bias. The technical picture for the euro/dollar pair has not changed for several weeks. In general, the pair's quotes spent all this time between the levels of $ 1.17 and $ 1.19. There were two attempts to leave this channel and both failed. Thus, the situation remains as follows: the bulls continue to hold the market in their hands, however, they do not have any new reasons for making purchases of the euro currency; bears have the opportunity to sell the pair (that is, buy the dollar), however, there are few reasons for this. It turns out that both bulls and bears are simply waiting for a change in the general fundamental background, which remains quite unsightly for the US currency. As a whole, everything that is happening now in the United States can be called in one word - "mess". Intentionally, we do not want to touch on the topic of mass riots in Belarus, as they have nothing to do with the euro/dollar pair. Nevertheless, Belarus could have been expected to be in such a mess. The fact that Alexander Lukashenko has been in power for three decades now only shows that the word "elections'' in this country has nothing to do with the word "democracy". In the third decade of Lukashenka's rule, people's nerves broke down, and they have been protesting for a month. However, in the United States, there has not been such a mess as this for a long time. Let's start with the most painful topic of "coronavirus". There is undoubtedly positive news here for Americans, Donald Trump, and the US dollar. The number of daily registered cases of the disease continues to decline and on September 6, it was already 32,000. This is still a lot, however, the values were fixed twice as high a month ago. Thus, it is safe to say that the epidemic has begun to recede, and now the situation in the country will become a little easier. This also applies to the workload of hospitals and pressure on the White House, and economic stress caused by the crisis. Nevertheless, many processes in the United States now continue to pass through the prism of future presidential elections. For example, Donald Trump continues to bet on the invention of a vaccine against "coronavirus" until November 3 and has even managed to appoint the "pre-election vaccination" on November 1. This term means that if the vaccine is invented before the end of October, the most vulnerable segments of the population (people over 65 years of age, health workers) will be vaccinated on November 1. However, many Americans fear that the population will be vaccinated with a drug that has not passed all the necessary clinical trials. And perhaps everyone knows that it can take from a year to several years to create a vaccine with all the necessary tests, since Anthony Fauci, other epidemiologists, and doctors have repeatedly voiced similar figures and forecasts. Thus, the situation in the States with the "coronavirus" is slightly improving, however, no one knows what will be the consequences of the invention of such a "pre-election vaccine"... From other news, we can only state that Republicans and Democrats can not agree on a new package of financial assistance to the American economy, the topic of the US-China trade standoff is put on pause, and the situation with rallies and protests across America caused by racial scandals is softening a little. However, all this does not fundamentally change the fundamental background in favor of the US dollar. If America were currently in intensive care, its condition would be described as "stable severe". Yes, maybe it's not that bad. In the same Belarus, which does not have such economic power, everything is much worse now. However, we believe that it makes no sense to compare Belarus and the United States. It makes sense to compare the US with the US in the past. Most importantly, most experts, analytical agencies, and publications believe that the key to solving all the problems will be the elections on November 3. The future of the country and the way it goes further will depend on the results of the elections. Naturally, two months before "Hour X", the fierce debate between Trump and Biden, as well as between their entourage, continues. Trump continues to use the tactics of pressure on the opponent and tries to play the few remaining trumps on his hands. For example, the US President has been challenging Joe Biden to debate for several months in a row. Trump is confident that he will win a crushing victory, and even people who are skeptical of Trump's personality are sure of this. Everyone knows that Trump can speak in front of the public, and does not go for a word in his pocket. The Democrats, who have so far refused to hold debates, also know this. For example, the Speaker of the House of Representatives Nancy Pelosi says that Trump will behave obscenely at the debate, "as in principle and every day", and we personally also have little doubt about this. Trump, who only called Nancy Pelosi "crazy" several times, is unlikely to behave with restraint and correctly concerning Biden. Especially understanding and realizing that the Democrat is ahead of him in political ratings and did not make as many mistakes as he did. However, there is still no escape from the pre-election debates. They will be held in three stages between September 29 and October 22. In line with this, Biden will have a hard time. This is noted by all experts-political scientists. In their opinion, Biden does not have oratorical skills, often admits reservations, and does not have charisma. Thus, Trump is almost guaranteed to win the debate. But will the results of the debate affect political ratings? Most likely, yes. The ability to clearly express their position is what can convince some Americans to vote for the amorphous Biden, who has long been nicknamed "Sleepy Joe". Thus, Trump has a real opportunity to reduce the gap from his competitor by a few more percent. As a result, both candidates may approach the elections with almost equal political ratings. In general, in any case, despite all the opinion polls and social studies that predict a victory for Biden, everything will be decided on November 3. Or maybe for the next few weeks.

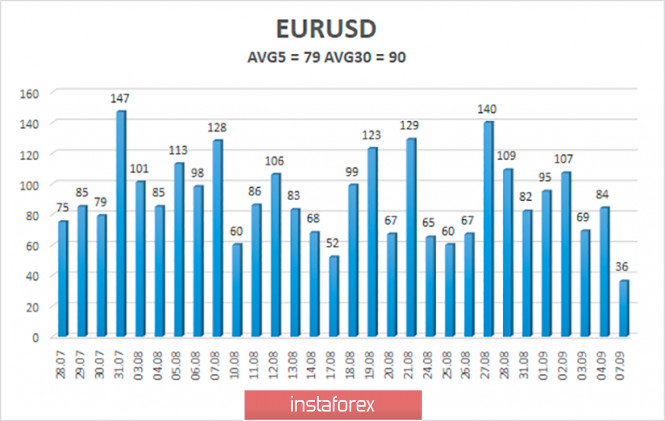

The volatility of the euro/dollar currency pair as of September 8 is 79 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1737 and 1.1895. A reversal of the Heiken Ashi indicator to the top will signal a possible new round of upward movement. Nearest support levels: S1 – 1.1719 S2 – 1.1597 S3 – 1.1475 Nearest resistance levels: R1 – 1.1841 R2 – 1.1963 R3 – 1.2085 Trading recommendations: The EUR/USD pair may continue its downward movement. Thus, today it is recommended to trade lower with the goals of 1.1737 and 1.1750 and hold short positions until the Heiken Ashi indicator turns upward. If the price is fixed above the moving average, it is recommended to trade for an increase with the goals of 1.1895 and 1.1963. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Sep 2020 02:11 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair moved down on Monday, September 7, as we expected in the morning. The MACD indicator turned down, this moment is marked in the illustration with two circles. However, after a sell signal was generated, the EUR/USD pair managed to go down by as much as 20 points... Actually, we also warned about this in the morning, when we said that volatility might be low today. In practice, this is exactly what happened. From the high to the low of the day, the pair passed only 36 points at the time of this writing. This is an ultra low value. Thus, the technical picture has not changed at all during the day. The pair's quotes may continue to fall towards the target support level of 1.1790, which is the lower border of the small side channel, only 75 points wide. The price has been trading within this channel for the third consecutive day and can not leave its limits. Thus, at this time, novice traders can only attempt to reach the lower border of this channel, we do not expect other signals to form in the next few hours. Everything that concerns the fundamental background, about news and economic reports, was already mentioned in the morning. Since no event was planned to date, market participants had nothing to react to during the day. Therefore, low volatility was partly low due to lack of data. There were also no important news and messages from the US. The country is preparing for elections, for the debate between Donald Trump and Joe Biden, as well as for the vaccination of the population against coronavirus, using a vaccine that has not yet passed all clinical trials. We can only take note of the drop in the number of new COVID-19 cases, which is good news for everyone: epidemiologists, doctors, the government, Trump, Jerome Powell and others. However, the victory is insignificant so far, so the US dollar is not getting strong support. In general, the economic situation in the United States remains rather difficult, so it is difficult for the dollar to find support from market participants. We can expect few macroeconomic data on September 8, Tuesday. Perhaps we can recommend novice traders to only pay attention to the eurozone's GDP report for the second quarter. This indicator was already published a month ago, but it has several estimates. That is, its meaning is reviewed every month. Thus, tomorrow's report may be better than the previous month. The forecasts, however, completely coincide with the value of the previous month. -12.1% q/q and 15% y.y. If there are no improvements, the US dollar will be able to sustain its moderate growth (downward movement of the euro/dollar pair). Possible scenarios for September 8: 1) We do not recommend novice traders to place buy positions at this time, since the pair has settled below the upward trend line, so now it has changed to a downward trend. There are currently no signals or technical patterns that support the upward trend. It will be possible to start working for an increase if the price settles above the side channel, but this is unlikely to happen before tomorrow morning. 2) Sell positions continue to look more relevant despite the fact that the pair is currently inside the side channel. Nevertheless, in the morning, traders can open sell positions while aiming for 1.1790 on a signal from MACD. Since the movement is very weak, you can even set the Stop Loss level to zero and Take Profit around 1.1790 and not monitor the trade. In the morning, we propose to re-evaluate the technical picture and then choose a new trading strategy for the day. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| September 7, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 07 Sep 2020 09:11 AM PDT

The EUR/USD pair has been moving sideways within the depicted expanding channel since August 3. Previously, a temporary resistance level was formed around 1.1900 which prevented further upside movement for and forced the pair to have a downside pause for sometime. On August 31, the EURUSD pair achieved another breakout above the previously mentioned resistance zone. Significant SELLING pressure was applied around 1.2000 where the upper limit of the movement pattern came to meet the pair. Currently, the EUR/USD pair has demonstrated a quick bearish decline towards 1.1800. More downside movement is expected towards the lower limit of the movement pattern around 1.1770-1.1750. Any downside pullback towards this price zone around 1.1750 should be considered for a BUYING opportunity. Initial target would be located around 1.1860 while Stop Loss should be placed just below 1.1720. The material has been provided by InstaForex Company - www.instaforex.com |

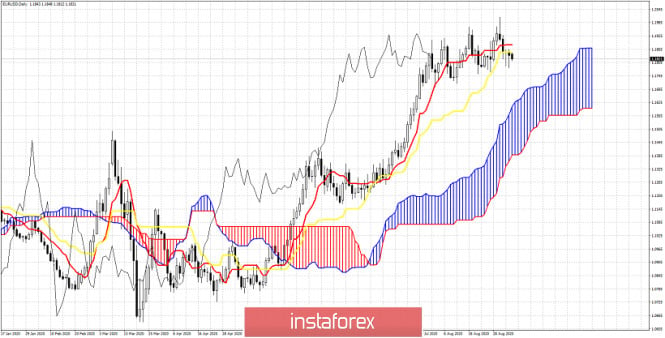

| Ichimoku cloud indicator Daily analysis of EURUSD for September 7, 2020 Posted: 07 Sep 2020 08:48 AM PDT Despite making a higher high last week, EURUSD is pulling back towards 1.1750-1.18 support area. In Ichimoku cloud terms price is vulnerable to a pull back towards 1.1685 as long as price is below 1.1885.

|

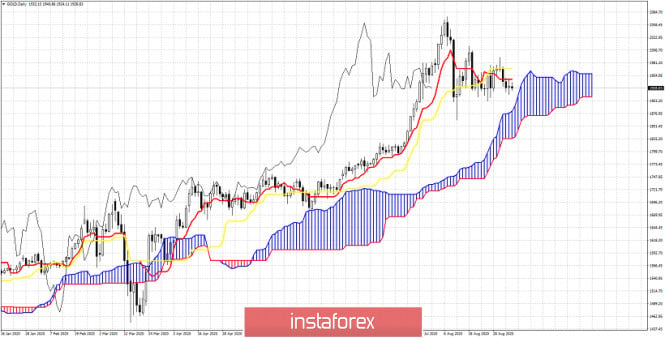

| Ichimoku cloud indicator Daily analysis of Gold for September 7, 2020 Posted: 07 Sep 2020 08:38 AM PDT Gold price continues to move sideways and below both the tenkan-sen and kijun-sen indicators increasing the chances of touching the Kumo (cloud) support at $1,900. Longer-term trend remains bullish as price remains above the Cloud.

|

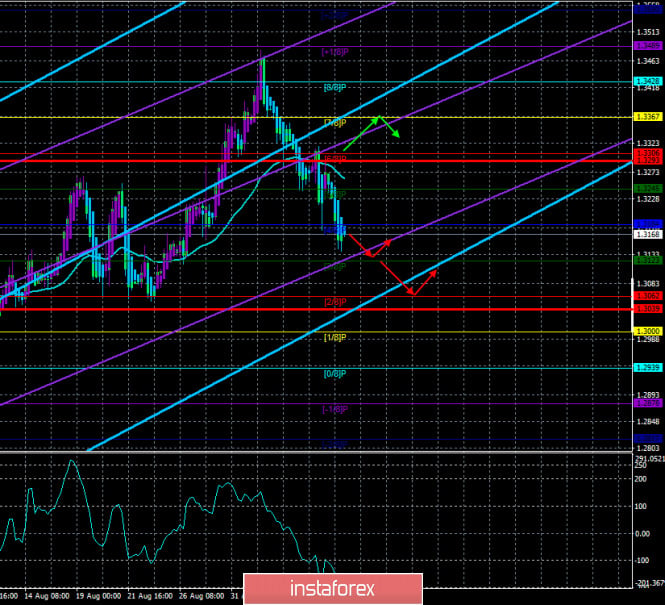

| Posted: 07 Sep 2020 08:33 AM PDT Since last week when USDCAD was challenging the upper channel boundary and our bounce target of 1.31-1.3150, we are bearish looking for a trend reversal towards 1.29. Our short position was reopened at 1.3130.

USDCAD is still inside the bearish channel. Price has stopped the advance at the upper channel boundary and is reversing. We remain bearish since 1.3130 with 1.3230 as stop. Target is 1.29 and bears want to see price break below 1.3045 in order to confirm rejection and reversal. A push above 1.3130 will put this trade at risk of getting stopped. The material has been provided by InstaForex Company - www.instaforex.com |

| September 7, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 07 Sep 2020 08:32 AM PDT

The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1700 which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) remains a strong SUPPLY-Zone to be watched for bearish reversal. However, Conservative traders should be waiting for bearish closure below 1.1700 - 1.1750. As this indicates lack of bullish momentum and enhances further bearish decline initially towards 1.1645 and 1.1600. Trade recommendations : Conservative traders should wait for the current bullish movement to get back below 1.1750 as an indicator for lack of bearish momentum for a valid SELL Entry.T/P levels to be located around 1.1645, 1.1600 and 1.1500 while S/L to be placed above 1.1860 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| September 7, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 07 Sep 2020 08:24 AM PDT

Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.2780 (Depicted KeyLevel) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal should be expected provided that bearish persistence is maintained below the current price level of 1.3300. Last week, significant bearish rejection was initiated around 1.3475 followed by a quick bearish decline towards 1.3245 where some transient bullish recovery was manifested. The price level of 1.3320 remains an Intraday Key-level to offer bearish pressure if retested again soon. Earlier Today, Some signs of bearish signs have already been manifested around 1.3300. Trade recommendations : Intraday traders are advised to look for bearish rejection anywhere around the price levels of (1.3320) as a valid SELL Entry. Initial T/p level is to be located around 1.3250, 1.3200 and 1.3100 if sufficient bearish pressure is maintained. On the other hand, bullish persistence above 1.3350 invalidates this trading scenario. The material has been provided by InstaForex Company - www.instaforex.com |

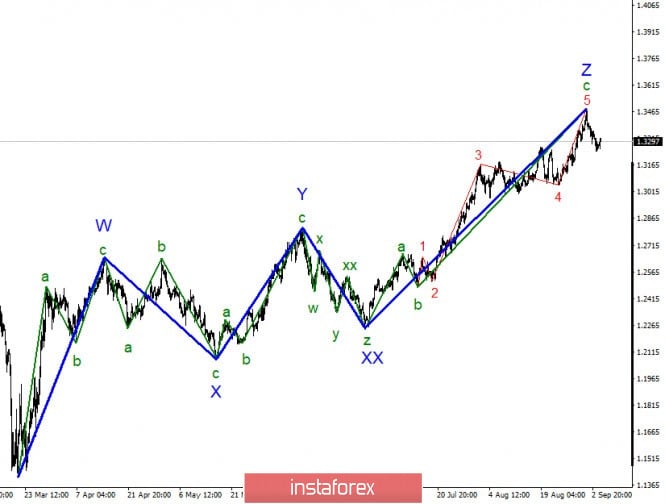

| Posted: 07 Sep 2020 06:15 AM PDT The wave structure of the upward movement trend section has again assumed a complete form. Wave Z looks quite complete, so the entire upward section of the trend can be completed and the tool in this case will move to building a new downward section of the trend with the first targets located around 25 and 27 figures. Much will depend on the news background. In particular, what form the new downtrend will take. The US dollar demand has been extremely low in recent months. If it continues, we will see the construction of a triangle or similar non-pulse wave structure. However, based on the closer examination of the current wave pattern wave Z is more complicated. The wave 4 in C in Z took the form of a triangle. However, the current wave pattern suggests the completion of the construction of the uptrend section. So the working option now is to build a downtrend wave, the first in the new downtrend. The news background from the UK over the past week has been contradictory but I believe that the decline in the British dollar is ultimately fair. After all, the wave marking has long predicted the construction of a downward wave and as per the news, British remain quite weak. The greater weakness of the American news background has caused a fairly strong increase in the British dollar for the past months. However, this cannot go on forever. Brexit negotiations between London and Brussels once again ended in nothing. Michel Barnier said that he is concerned and disappointed with London's position. Markets continue to wonder how much longer these negotiations will continue given that no progress has been made for a long time. It's already September now. When the negotiations began last March, few people believed that an agreement would eventually be reached. Almost all analysts cited the example of an agreement with Australia or Canada that the parties had been working on for years. Boris Johnson and the UK wanted to agree in an agreement of 6-7 months, which will be beneficial to them in the first place. And as practice shows, London does not intend to give in to the most important issues. So I don't understand why we should continue these negotiations at all. The Briton may fall into a new downward trend due to unsuccessful negotiations, as the absence of an agreement will certainly have a negative impact on the British economy. The worse state of the American economy can only save the British from a new strong decline in the coming months. I don't expect any important news or economic reports on Monday. General conclusions and recommendations: The Pound-Dollar instrument has presumably completed the construction of an upward wave Z. Thus, I would recommend now selling the instrument with targets located near the 1.3158 and 1.2960 marks, which corresponds to 161.8% and 127.2% for Fibonacci. The upward section of the trend may take a more complex form but you need to wait for a successful attempt to break the current maximum of the wave 5 in C in Z. The material has been provided by InstaForex Company - www.instaforex.com |

| US dollar slightly progresses against several currencies Posted: 07 Sep 2020 06:14 AM PDT

The US dollar slightly rose against the euro and the Japanese yen Monday morning. The observed growth may be weak, but the change in the trend is already a good sign. Presently, market participants' attention is mainly focused on the scheduled meeting of the European Central Bank on Thursday this week. Investors are looking forward to knowing the regulator's next steps on the stabilization of economic growth in the region. In the previous week, the euro began to strengthen well against the dollar, it even managed to reach the level of 1.2 dollars per euro. However, the euro then immediately collapsed, which happened against the background of the regulator's concern about such a sharp rise in the currency. According to the representatives of the European Central Bank, a significant increase in the value of the euro may negatively affect the inflation rate in the region. If it weakens, the introduction of new extraordinary measures of monetary stimulus to stabilize the situation will be necessary. The EUR/USD pair ended Friday's trading with a decline in the euro, which happened for the fourth time in a row. Note that in March this year, the ECB adopted a financial incentive program in the amount of $ 3 trillion. This was done in order to support the weakening economy of the region against the background of the coronavirus pandemic. Analysts believe that the recent growth of the euro is only temporary. At the same time, it will not pose any danger to the inflation rate in Europe, which means that the government's assumptions are premature and unjustified. At least for the next twelve months, the euro will not be able to find the strength to demonstrate long-term strengthening. This is due to structural and institutional weakness throughout the eurozone. The rate of the US dollar against the euro was at the level of 1.1833 dollars per euro on Monday morning. It closed at $ 1.1840 per euro in the previous trading. The growth of the greenback was recorded, which, however, cannot be considered significant. The value of the dollar against the Japanese yen also went up. The exchange rate by Monday was at the level of 106.28 yen per dollar, on Friday last week, it consolidated within 106.24 yen per dollar. Meanwhile, the pound sterling observed a decline against the US dollar. Its rate was $ 1.3216 per pound sterling, while the previous value was around $ 1.3281 per pound sterling. The dollar index against a basket of six major world currencies, including the Canadian dollar, the euro, the pound sterling, the Swiss franc, the Japanese yen, and the Swedish krona, rose 0.2% on Monday morning. The dollar index also increased by 0.1% against a basket of sixteen major world currencies. The material has been provided by InstaForex Company - www.instaforex.com |

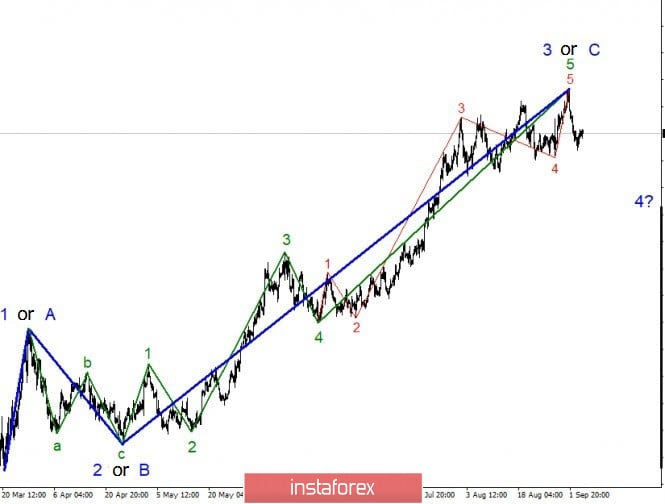

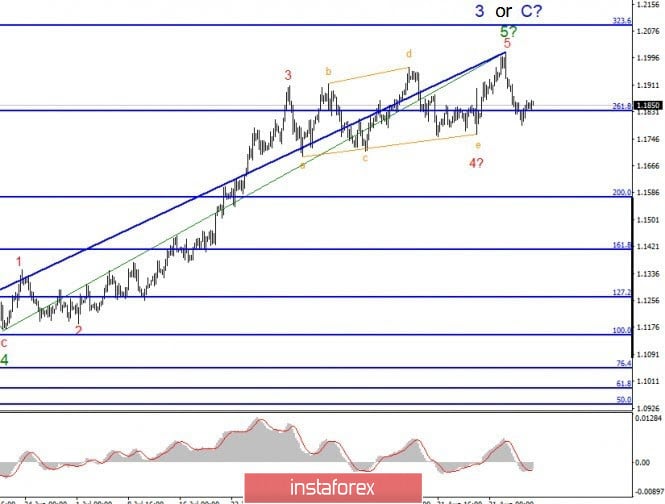

| Posted: 07 Sep 2020 06:13 AM PDT In the most global sense, the wave counting of the EUR / USD instrument has acquired a complete form. The retreat of quotes from the highs reached in recent days once again prompts the conclusion that the construction of wave 3 or C is complete. If this assumption is correct, then the decline in quotes will continue with targets located below the low of wave 4 at 5 at 3 or C as part of the construction of the assumed wave 4, after the completion of which the construction of the upward part of the trend can be resumed within the wave 5. It is also possible that the entire trend section, which originates in March, will take on a three-wave form and will be completed around 1.2011. The wave counting on a smaller scale shows that the supposed wave 5 in 5 in 3 or C is supposed to have completed its construction. If this is true, then the decline in quotes will continue with targets located near the 200.0% Fibonacci level within a downward wave or, perhaps, even a new downtrend section. On Friday, September 4, there were several important publications in America at once, which I have already mentioned. They will not be repeated, but in my opinion, all three American reports, namely Non-Farm's unemployment rate and average wages, showed positive dynamics. The demand for the US dollar was supposed to rise significantly that day, but instead the US currency managed to only add a little in price, and then not for long. In addition to economic statistics in the United States, at the end of last week the chief economist of the European Central Bank Philip Lane spoke regarding the current fairly high rate of the euro. According to Lane, the current exchange rate is beginning to negatively affect the economy of the European Union. Markets say Lane hinted that the ECB may resort to foreign exchange interventions to lower the euro in the international foreign exchange market. But, as we can see, and under the influence of this information, the euro did not fall too much in price at the end of last week. So far, the downward dynamics has been preserved, but everything looks as if the instrument is within the framework of a corrective wave, after the completion of which the construction of an upward trend will resume. As for the euro exchange rate and its possible artificial decline, the ECB is unlikely to resort to such measures. Donald Trump has repeatedly accused the European Union and China of manipulating the exchange rate and may take new measures to counter the European Union. It's simple, Donald Trump himself does not need a high dollar rate. Especially now, when the size of public debt has grown by more than 4 trillion in 2020. And the public debt needs to be serviced, which is very expensive if the dollar is high. General conclusions and recommendations: The Euro-Dollar pair has presumably completed the construction of a global wave 3 or C. Thus, at this time, I recommend selling the instrument with targets located near the calculated level of 1.1571, which corresponds to 200.0% Fibonacci, for each MACD (Moving Average Convergence Divergence) signal down. If at this time wave 4 is really being built, then it can take a three-wave form. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDJPY facing pressure from descending trendline and 1st resistance, further drop expected ! Posted: 07 Sep 2020 06:04 AM PDT

Price is facing bearish pressure from the descending trendline and the first resistance level, in line with 61.8% fib retracement where we could see a drop to our support level where the horizontal swing low is. The Ichimoku cloud is also showing resistance to the price. Trading Recommendation Entry: 77.54 Reason for Entry: 61.8% fib retracement, descending trendline resistance Take Profit: 76.96 Reason for Take Profit: horizontal swing low Stop Loss: 78.00 Reason for Stop Loss: Horizontal swing high The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD facing pressure from 1st resistance, further drop expected ! Posted: 07 Sep 2020 06:04 AM PDT

Price is facing bearish pressure from the first resistance level, in line with 78.6% fib extension and 50% fib retracement where we could see a drop to our support level where the horizontal swing low is. The EMA is also showing resistance for the price. Trading Recommendation Entry: 1.31091 Reason for Entry: 78.6% fib extension and 50% fib retracement Take Profit :1.3046 Reason for Take Profit: Horizontal swing low Stop Loss: 1.3138 Reason for Stop loss: Horizontal swing high The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD testing resistance, potential reversal! Posted: 07 Sep 2020 06:03 AM PDT

Price is testing our first resistance, in line with our horizontal swing high resistance, 38.2% fibonacci retracement and 100% fibonacci extension where we could see a reversal below this level. 20 Period EMA and the Ichimoku cloud are showing signs of bearish pressure as well. Trading Recommendation Entry: 0.72955 Reason for Entry: horizontal swing high resistance, 38.2% fibonacci retracement and 100% fibonacci extension Take Profit: 0.72090 Reason for Take Profit: Horizontal pullback support, 76.4% fibonacci retracement Stop Loss: 0.73429 Reason for Stop Loss: Horizontal pullback resistance, 61.8% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Financial war outbreak: China vs USA Posted: 07 Sep 2020 05:39 AM PDT

Relations between China and the United States continue to worsen. Beijing intends to toughly respond to the US sanctions. The Chinese would sell 20% of their trillion US dollar portfolio of Treasury bonds. The consequences of such a move are unpredictable. If we look at it from the side of politics, then everything is not so terrible. However, for the American financial markets, this could be a disaster. China has been looking for ways to defend itself against the US pressure for a long time. But the latest threats from Washington to distress the Chinese assets in America have ticked off Beijing. China now intends to damage the US economy by cutting its US Treasury portfolio by about 20% (to $800 billion). However, some American experts believe that selling 20% or even 50% of the Chinese portfolio will not be a disaster for the White House. The US budget deficit for 2020 will be $3.3 trillion. Even if the Fed has to print an additional $200 billion to buy from the market the bonds that the Chinese will dump, nothing will change in the short term. However, everything is much more interesting. The US dollar is the world's main currency. And its dominance is caused by two factors. Firstly, the American currency is in great demand outside the United States. Secondly, the United States is purposely destroying those politicians (sometimes together with their countries) who are trying to follow the path of de-dollarization of their foreign trade relations. One of the significant sources of demand for the US dollar are central banks and finance ministries of other countries, which need the US dollar reserves in order to maintain the confidence of their citizens and foreign investors in their own national currencies. In other words, countries wishing to have a stable currency were literally forced to lend to the US budget, and not always on favorable terms. Thus, by selling off American bonds from its foreign exchange reserves, China will not only put pressure on the US economy, but may become a revolutionist of the existing world financial system. China will be able to function without American bonds due to its gold and foreign exchange reserves. This means that the largest global economy and the main player in the international trade has got rid of the US dollar dependence. This is precisely the major problem for the United States. Moreover, China has all chances to become a new "financial pole" in the world, which is gradually moving away from a total focus on the American currency. On September 1, China opened access for foreign investors to its domestic bond market. The Chinese yuan is becoming more international. In addition, Yves Bonzon, a chief investment officer of the Swiss bank Julius Baer, believes that China's economic model and its growing influence on the global economy require strategic investments in the Chinese stocks and bonds. China's government bond market has become one of the largest in the world and is therefore included in a growing number of leading bond indices. This, in turn, contributes to liquidity and transparency. Soon, most of the financial flows will be redirected to China. And the financial privileges will go to China instead of the United States. The process has just begun and will take years, but the prospect terrifies Washington. Therefore, such leaders of the United States as Donald Trump and Joe Biden are showing great readiness to destroy China, economically and literally, before the US dollar's dominance around the world comes to an end. Washington's problem is that this ambition will not be enough to maintain American financial hegemony. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Sep 2020 05:15 AM PDT As I discussed in the previous review, the BTC is in creation of the second down leg in my opinion and our second target at the price of $9,921 has been met. Further Development

I still see further downside on the BTC with potetnial for test of third and fourth targets at $8,975 and $8.228 I didn't find any reversal pattern yet and the short-term target shifted from bullish to bearish. The 1H and 4H time-frame combination is serving good for selling on the rallies and from the middle Bollinger band. Key Levels: Resistance: $10,800 Support levels: $8,975 and $8.228 The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for September 07,.2020 - Sideways condiiton with potential for downside break. Posted: 07 Sep 2020 05:07 AM PDT A tweet by European Commission president, Ursula von der LeyenI trust the British government to implement the Withdrawal Agreement, an obligation under international law & prerequisite for any future partnership. Protocol on Ireland/Northern Ireland is essential to protect peace and stability on the island & integrity of the single market. The fact that they're communicating in such a way isn't exactly telling us that they are "in close contact". All of this should be part of the negotiating process but instead it is like airing dirty laundry out to dry in public.

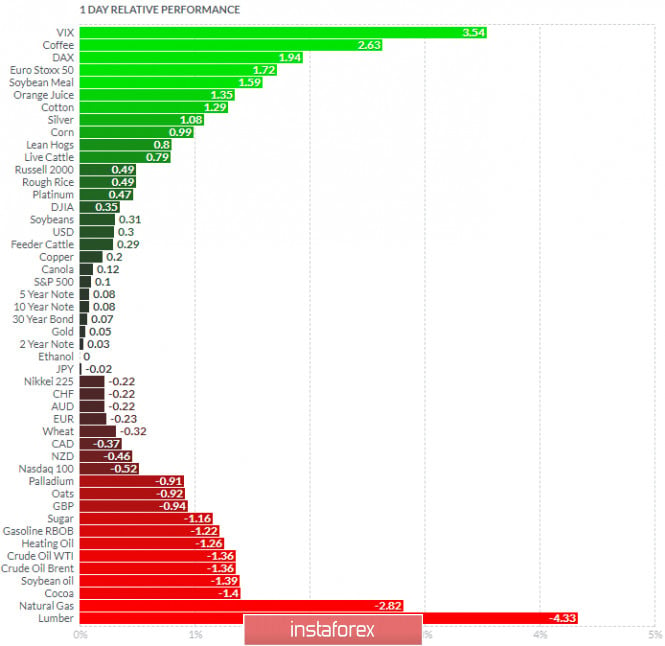

As I discussed in the previous review, the Gold is in creation of the second down leg in my opinion. Further Development

Analyzing the current trading chart of Gold, I found that there is contraction lat few days at the price of $1,928 but that downside movement is more likely to happen.

Resistance is set at the price of $1,950 1-Day relative strength performance Finviz:

Based on the graph above I found that on the top of the list we got VIX and Coffee today and on the bottom Natural gas and Lumber. Key Levels: Resistance: $1,950 Support levels: $1,884 and $1,815 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Sep 2020 04:59 AM PDT

Different day, same story. Both sides are still pushing for each other to move their red lines but until we move closer to deadline day, the pressure is yet to be truly felt.

As I discussed in the previous review, the EUR is creating drift pattern on the weekly time-frame, which is big warning for the ehaustion from buyers and potential drop yet to come.\ Further Development

Analyzing the current trading chart of EUR, I found that the buyers got exhausted in the last weeks and that there is potential for the downside movement towards the first support at 1,1700. The stronger breakout of the 1,1700 might indicate even bigger drop towards the 1,1500 level. Watch for selling opportunities on the rallies with short-term downside targets at 1,1700 and 1,1500 1-Day relative strength performance Finviz:

Based on the graph above I found that on the top of the list we got VIX and Coffee today and on the bottom Natural gas and Lumber. Key Levels: Resistance: 1,1835 and 1,1845 Support levels: 1,1700 and 1,1500 The material has been provided by InstaForex Company - www.instaforex.com |

| Stocks in Europe rally as Asia and America grapple with problems Posted: 07 Sep 2020 04:49 AM PDT

The main stock indicators of the US stock exchanges traded in a negative zone on Friday following the fall which occurred the day before. Market participants have not yet moved on from the news about the decline in the value of securities of companies in the technology sector. The Dow Jones Industrial Average fell 0.56% or 159.42 points. Its current level is 28,133.31 points. The S&P 500 Index sank 0.81% or 28.1 points, which forced it to move to the level of 3,426.96 points. The Nasdaq Composite index fell 1.27% or 144.97 points, which sent it to the 11,313.13 points. Note that in the previous trading, a significant drop in indicators was also observed. The Nasdaq parted with 4.96%, the Dow Jones fell 2.78%, and the S&P 500 fell 3.51%. Nevertheless, some analysts do not see much of a problem in such a significant decline in the US stock indices. They stressed that a correction after a rapid and long-term rise is necessary. Market participants rushed to fix their profits until statistics and news on the US economy force the indicators to decline. In general, over the last month of the summer, the S&P 500 was able to demonstrate a record high growth, which has not happened in almost thirty-four years. It rose 7% for the month of August and already gained 2.3% in the first couple of days of September. So literally just before the fall, it took its maximum values. Market participants' attention shifted from the tech sector, where they tried to lock in profits, to the energy, finance, and raw materials sectors. Friday's trading on stock exchanges began with growth due to the positive news from the US labor market. According to the US Department of Labor, the unemployment rate in the country immediately fell to 8.4% for the month of August, while the previous figure was at around 10.2%. In addition, the number of new applications for unemployment benefits decreased by 130,000, and the total number of applications is now consolidated within 881,000. This was the lowest level in the history of the coronavirus pandemic. Thus, fundamental indicators do not pose any danger to the market. Instead, they act as a catalyst for growth. The current correction, according to experts, will end rather quickly, and the indicators will again go up to new record values. According to the revised forecast from the analytical company BofA Securities, the S&P 500 index may well reach the level of 3,250 points and gain a foothold there by the end of 2020. The initial estimated growth amounts to no more than 2,900 points. This figure is only 5.9% below the level that was recorded by the indicator at the end of the trading session on Thursday. Meanwhile, almost no significant dynamics were noted on the Asian stock exchanges. Market participants froze in suspense, watching what was happening on the US stock markets. In addition, traders are trying to assess Chinese foreign trade statistics for the last month of the summer. Japan's Nikkei 225 Index fell 0.38% Monday morning. China's Shanghai Composite Index fell 0.35%. The Hong Kong Hang Seng Index followed this trend and fell 0.18%. The total volume of China's exports over the last month of the summer has exceeded experts' expectations. The reasons for such positive dynamics were the growth of demand on a global scale, as well as the gradual lifting of quarantine measures in most countries of the world. The export level rose by 9.5% over the same period last year. This is the third in a row and the most noticeable increase over the past six months. It is also higher than analysts' initial forecast with an estimated growth of no more than 7.1%. South Korea's Kospi index climbed 0.67%. The Australian index S & P / ASX 200 moved multidirectional but so far marked a meager increase of 0.01%. The European stock markets, on the other hand, traded in a positive zone Monday morning. The main stock indicators are growing, following a notable decline in Friday's trading. Market participants were particularly concerned about the new stage in the negotiation process between the UK and the EU on Brexit. According to the British authorities, the trade agreement should be signed by mid-October, otherwise this deal may not take place at all. Another reason for concern is the ECB's decisions on the financial policy which will be known at the meeting which is scheduled for next Thursday. The Stoxx Europe 600 Index of Large Enterprises in the European Region went up by 1.03% which pushed it to 365.67 points. The UK FTSE 100 Index is up 1.23%. The German DAX Index gained 1.3%. France's CAC 40 jumped 1.09%. Italy's FTSE MIB Index rose 0.94%. Spain's IBEX 35 Index went up 0.52%. The material has been provided by InstaForex Company - www.instaforex.com |

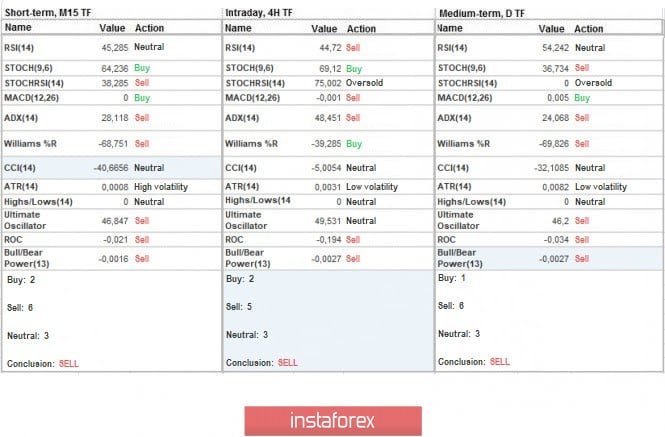

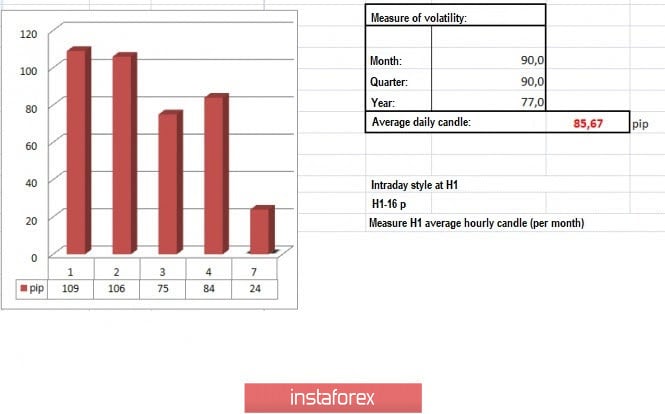

| Trading recommendations for EUR/USD on September 7 Posted: 07 Sep 2020 04:39 AM PDT EUR / USD demonstrated an impressive bearish move last week, during which the quote managed to decrease from 1.2000 to 1.1790 / 1.1800. Reaching it did not only signal the resumption of short positions, but also indicated a change in the local trend, which may lead to a full-fledged resumption of the sideways channel that took place in August. Thus, if we look at the M15 chart for Friday's trading, we will see that short positions surged at 13:30 - 15:00, while long positions arose at 16:30 and lasted until 19:30. Such gave volatility equal to the average level, but if we analyze the dynamics relative to the minute period, we will see that the acceleration is mainly caused by high speculation in the market. This is because as discussed in the previous review , activity surged in the market when traders set up local short positions, targeting the levels 1.1840 / 1.1865. So, in the trading chart, the upward movement slowed down, but still managed to renew local highs. With regards to news, very good data was released on the US labor market last Friday, which resulted in an inevitable increase in dollar demand in the market. The report said that unemployment rate dropped by 8.4% in the US, largely due to the return of self-employed and contracted workers to their works, as well as 1.4 million new jobs created outside of agriculture. Unfortunately, the joy over this event did not last long as at 16:00, ECB member Philip Lane made a speech and said that the ECB's target inflation will remain at 2%, but hinted a possible change of approach to monetary policy. It resulted in a reversal in EUR / USD, bringing the quote back to its previous level. Meanwhile, Fed Chairman Jerome Powell released a statement regarding low rates. "Recovery continues, but we really think it will be harder from now on. In some ways, it will be harder for Americans to find work because some areas of the economy will take longer to recover. We think the economy will need a low interest rate to sustain economic activity over a long period of time, "he said. This hints that low rates may last for more than one year. Today, the economic calendar is empty and trading volumes have been reduced due to the weekend and holiday in the United States. Further development As we can see on the trading chart, the quote continues to focus at 1.1800, forming a low-amplitude swing. Trading is expected to remain within 1.1780-1.1865, so the best option is to overcome the limits of this range. Indicator analysis Looking at the different time frames (TF), we can see that the minute and hourly periods emit various signals due to the quotes trading in a range, while the daily period has an unstable sell signal and is waiting for a consolidation below 1.1780. Weekly volatility / Volatility measurement: Month; Quarter; Year Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year. (The dynamics for today is calculated, all while taking into account the time this article is published) Thus, volatility is at 24 points today, which is considered an extremely low value for the indicator. And since the United States is on a holiday (Labor Day), volatility is expected to remain low, and maybe even undergo a local slowdown. Key levels Resistance zones: 1.1910 **; 1.2000 ***; 1.2100 *; 1.2450 **; 1.2550; 1.2825. Support Zones: 1,1800; 1.1650 *; 1,1500; 1.1350; 1.1250 *; 1.1180 **; 1.1080; 1.1000 ***. * Periodic level ** Range level *** Psychological level Also check trading recommendations for the GBP/USD pair here, or brief trading recommendations for the EUR/USD and GBP/USD pairs here. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: Bears came out of the bearish corner Posted: 07 Sep 2020 04:17 AM PDT The current week for the EUR/USD pair may not be the most positive. Experts fear that the downward trend will continue, although it ended last week. In such a situation, the bears on the EUR/USD pair will benefit, expecting the current market leader, dollar, to further weaken. According to experts, the decline of the US currency will continue over the next three months. Analysts do not exclude the continuation of this trend early next year. They also believe that the reason for such changes is the recent innovations in the Fed's policy related to targeting inflation. Fed's updated strategy implies keeping America's interest rates at near-zero level for a long time. Based on a poll by Reuters, the current situation provokes further weakening of the US currency. It can be recalled that the increase in interest rates has been the main driver for the dollar over the past two years. However, negative real returns are now a priority in the US, and this drives the dollar into a narrow framework, provoking its decline. As a result of the pressure, it is gradually losing ground. Last week, the EUR/USD pair immediately slipped to two-year lows, to 1.2000, but later corrected to the level of 1.1800. Today, the EUR/USD pair was trading near the level of 1.1838-1.1839, trying to go beyond the current range. Thus far, the euro has become the main beneficiary of the weakening dollar. The price increase of the single currency by 3.5% in the EUR/USD pair began in July this year, when the European Union approved a financial aid package in the amount of € 750 billion. The ECB believes that euro's further strengthening will cause problems with exports, so the regulator plans to reduce the price pressure. The bank, in turn, does not exclude the introduction of additional incentives to support the region's economy. A number of economic issues related to the "pain points" of the Eurozone will be resolved at the ECB meeting on Thursday, September 10, where market participants expect an extension of the asset purchase program. According to currency strategists at National Australia Bank, the implementation of such a scenario could increase pressure on the Euro. At the same time, the dollar's weakness will increase, caused by the Fed's new monetary policy strategy and negative yields. The ECB believes that euro's growth will have a very negative impact on exports, provoking a collapse in prices and the need for new monetary incentives. According to the ECB's Governing Council, further strengthening of the Euro against the dollar and a number of other currencies will slow down the economic recovery of the Eurozone. Nevertheless, European leaders will try to prevent such a development and find the best solution to this problem by discussing it at the upcoming meeting. Awaiting the ECB's decision, the euro is in uncertainty. Its price can swing in any direction, and this keeps the market in tension. According to one of the representatives of the ECB Council, excessive growth of the single currency in conditions of low demand poses a threat to the European economy. In this regard, the regulator will have to revise the current strategy. Experts also expect the ECB to lower its inflation forecast for 2022 to 1.1-1.2% from the current 1.3%. The updated calculations will consider the deflationary impact of the appreciation of the euro on imports. According to Frederik Ducrozet, currency strategist at Pictet Wealth Management, the euro will become one of the drivers of low inflation in the short-term. He also said that a further change in the inflation forecast below the target level of 2% will increase pressure on the ECB, and then the regulator will have to return to increasing monetary stimulus. It should be noted that the ECB has not been able to reach the inflation target for more than ten years, and this creates significant risks for the European economy. Experts said that the regulator may expand the emergency bond purchase program for an additional € 500 billion. However, Ducrozet emphasized that this will not necessarily happen at the next meeting. Besides the above, there are other ways to support the EU economy. According to Christian Keller, head of economic research at Barclays, the most effective of these may be cutting interest rates. However, there is an important nuance here: the rate on deposits is now at an extremely low level of -0.5%, so the ECB will not take this step. According to analysts' calculations, bearish mood for the EUR/USD pair will prevail in the near future, which may last in 2021, when it becomes clear how much the dollar has weakened and the euro has strengthened. At the same time, experts expect to maintain a balance in a pair and moderate competition between both currencies. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment