| Welcome! In this free e-letter, I’ll show you where the big money is headed in the markets so you can follow it to profits. And we love to hear from our subscribers… Tell us what you like, what you hate, and how we can make Palm Beach Insider the best free e-letter on following Wall Street to profits right here. | Watch These Three Telltale Signs for a Market Bottom By Jason Bodner, editor, Palm Beach Insider As I’ve been telling you here and to my Palm Beach Trader readers, I suspect we’re in for a rocky October in the stock market. September and October are typically weak periods for stocks. On election years, even more so – with the possibility of that turbulence spilling into November. If you’re an investor with a shopping list ready to pick up quality stocks on sale… you might hesitate on making those buys when stocks seem to fall day after day. So today, I’m going to give you three classic signs that markets are bottoming. Pay attention to these three clues, and you’ll have a good idea of when to start putting your dry powder to work… The Three Symptoms of a Market Bottom Let me get one thing out of the way first: Barring an act of God, or at the very least a hotly contested presidential election, I doubt we’re going to revisit the March lows. So if you’re waiting for that, I’d advise setting your expectations a little lower. Now, let’s figure out how to tell when we’ll see those next lows… There are three signs that, over time, have signaled to me that the market is nearing a bottom: -

Massive selling of exchange-traded funds (ETFs) -

Massive selling of individual stocks, no matter what sector -

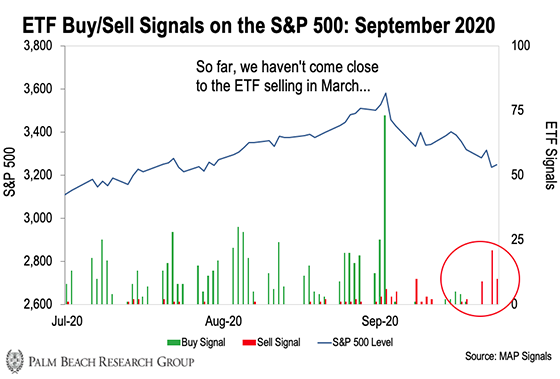

Highly elevated volume Let me show you what I mean. Take a look at this chart from back in March…

You can see that as we approached the March lows, we saw a mass exodus from ETFs. This kind of selling only amplifies the pain in the stock market. These are what cause the days where the market falls 4%, 5%, or more. It’s panic-selling which just causes more panic-selling. As we showed you a couple weeks ago, mass selling of ETFs tends to mark bottoms, while mass buying of ETFs tends to mark tops. And naturally, when ETFs sell off this way, it makes the broad market look ugly at a glance. So, holders of individual stocks also start running for the exits – no matter the fundamentals. That’s when you see the kind of market-wide sell-offs that make no rational sense. Remember in March when it seemed like every sector, even the safe havens, sold off in unison? There were days where gold stocks – traditionally seen as a safe harbor from a falling stock market – fell just as hard as tech stocks. This effect is called “correlation.” It’s when sell-offs become so pronounced, stocks and the broad market fall in unison. When it appears that almost every stock in the market is taking a dive, you can be confident that the market is close to bottoming out. Of course, during a market panic, lots of days look like this. But there’s one factor that sets a typical down day apart from one that marks a bottom: volume. Volume essentially refers to the amount of trading occurring in the market. When stocks are down on little volume, that’s not as strong of a bottom signal. Because it suggests there’s plenty more selling waiting in the wings. When you get that explosion of trading volume on a big down day, that’s capitulation at work. It’s the retail investors throwing in the towel… and the big-money sellers driving stock prices down deliberately – to profit on short positions and scoop up deals in the aftermath. With all that in mind, let’s take a look at the market today…

As you can see, we haven’t even come close to the level of ETF selling we saw back in March. Thus, asset prices are due for more of a back-and-forth chop downward than an outright dive. Note also that stocks have formed a series of lower highs and lower lows from the peak in August. That’s a clear medium-term downtrend, and I expect we’ll chop our way further down as we head into the election (remember also, the big money sells stocks ahead of elections, and buys them right after.) What to Do Between Now and the Bottom If our analysis is correct, we’re looking at possibly another month of downward chop, or more, before we hit bottom. So, should you just sit on the sidelines for that whole time? It’s an option… But the market always presents an opportunity to make money. Instead, I would consider scaling into the stocks you have on your buy list. If you see your favorite stock down big on no news, initiate a smaller position with plans to add as it falls further. This ensures you’re in the stock more cheaply than if you’d bought your full position up front. Then, once the signs emerge that the market has bottomed, you’ll have a clear sign to start shopping. We’re in for a bout of volatility, there’s no question. But instead of panicking and selling your whole portfolio, the thing to do now is find quality companies and buy them all on sale. Once the election volatility clears, you’ll be glad you did. Patience and Process! Jason Bodner

Editor, Palm Beach Insider

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… It isn't big pharma, but a small-cap stock that is driving this little-known wealth-creation event A small-cap stock is now set to soar up to 1,000%… in just one day. Within 12 months, it could turn a tiny stake into an entire nest egg. 99.99% of people have no idea it could happen. This could be your only chance to get the facts about this moneymaker before it's gone. Click here to watch this urgent briefing before time runs out.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

No comments:

Post a Comment