Forex analysis review |

- Hot forecast and trading signals for GBP/USD on October 19. COT report. Professional traders leave the market, refuses to

- Hot forecast and trading signals for EUR/USD on October 19. COT report. Frustrating European data. EU gripped by second wave

- Overview of the EUR/USD pair. October 19. Europe is covered by the "coronavirus". The US continues to prepare for the elections.

- Overview of the EUR/USD pair. October 19. Europe is covered by the "coronavirus". The US continues to prepare for the elections.

| Posted: 18 Oct 2020 06:40 PM PDT GBP/USD 1H The GBP/USD currency pair traded in different directions on Friday, October 16 and failed to overcome either the support area of 1.2857-1.2873, nor the Senkou Span B line. Thus, the pound/dollar pair may continue high-volatility movements that are quite complex, which is extremely difficult to work out even for experienced traders. Formally, the downward trend remains, since there is a downward trend line, however, the movements are quite strong, accompanied by deep corrections. In simpler terms, we can call this a "storm". Therefore, the buyers have no initiative now, and the bears need to try to overcome the area of 1.2857-1.2873 in order to expect further downward movement. GBP/USD 15M The lower linear regression channel turned upward on the 15-minute timeframe, which reflects an unsuccessful attempt to overcome the 1.2857-1.2873 area on the hourly timeframe. Thus, the bulls may attempt to take the pair to the psychological level of 1.3000. COT report The latest Commitments of Traders (COT) report on the pound showed that from October 6-12, non-commercial traders continued to mostly close contracts for the British currency, rather than open new ones. The pound sterling increased by around 60 points during this period, which is very small, despite the rather volatile trading within each individual day. During this time, the "non-commercial" group of traders opened 149 Buy-contracts (longs) and closed 6,144 Sell-contracts (shorts). Thus, the net position of professional traders has grown again, by 6,000 contracts. However, as with price changes, these changes in the mindset of professional traders are purely formal. Moreover, the net position of non-commercial traders is growing for the third consecutive week, which casts doubt on the pound's succeeding decline, which is much more expected than growth. Even more interesting is the fact that the total number of contracts for the "non-commercial" group has been decreasing in recent months. That is, large traders do not believe in the pound and do not want to deal with it, whether it is about buying or selling it. The same case with the "commercial" group, which also mainly closes any contracts for the pound. In such circumstances, we would not make a long-term forecast based on the COT report. No macroeconomic reports released in the UK last Friday. However, traders don't really need it now. Market participants are completely absorbed in the topic of negotiations between Brussels and London, which fail over and over again. In such conditions, it is quite difficult to buy the pound, especially in the long term, since the British economy is almost expecting a new recession in 2021, and companies, firms and capitals continue to leave Great Britain. If relations between the eurozone and the UK become even more tense due to the "Johnson Bill" and the absence of a trade deal, then no one has a reason to envy the pound at all. So far, this currency continues to stay afloat due to the very unstable situation in the United States and the complete uncertainty of the future of this country and its economy. Traders are just as wary of investing in the dollar as they are in the pound. At the same time, there is even an element of panic in the market, since the pound is quietly moving two hundred points in different directions within a short period of time. There are no UK macroeconomic reports scheduled for Monday, but traders are encouraged to continue to monitor any news regarding the epidemic in that country, negotiations with the European Union, and any speeches by Prime Minister Boris Johnson. We have two trading ideas for October 19: 1) Buyers for the pound/dollar pair have released the initiative from their hands. Thus, long positions are not relevant right now, however, in case the new trend line has been broken, you can consider longs while aiming for 1.3105 and 1.3177. Take Profit in this case will be from 100 to 150 points. However, we draw your attention to very frequent changes in the direction of movement and high volatility, so we recommend trading in small lots. 2) Sellers keep the initiative, but at the same time they cannot overcome the 1.2857-1.2873 area. If they manage to settle below this area, then we can recommend new sell positions on the pair while aiming for the support level at 1.2773. Take Profit in this case can be up to 70 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Oct 2020 06:38 PM PDT EUR/USD 1H The euro-dollar pair was unable to overcome the support area of 1.1692-1.1699 on the hourly timeframe on October 16, instead the pair rebounded off it and traded higher for most of the day, reaching the upper line of the descending channel. The downward movement resumed since it failed to go beyond its limits. Thus, buyers have shown that they are rather weak. On the other hand, take note that the pair continues to almost trade in a horizontal channel with vague borders, which is clearly visible on higher timeframes. Therefore, the bulls and bears simply alternate their trends on the hourly timeframe. It is possible that sellers may not be able to overcome the support area of 1.1692-1.1699, from which the price has repeatedly rebounded off. EUR/USD 15M The lower linear regression channel turned to the upside on the 15-minute timeframe, indicating that a correction is about to start and an unsuccessful attempt to overcome the 1.1692-1.1699 area. The future prospects of the pair will depend on this particular area. COT report The EUR/USD pair has grown by around 30 points during the last reporting week (October 6-12). This is very small and, as a whole, there are still no significant price changes for the pair. Trades are held in a horizontal range of 250-300 points. Therefore, data from any COT report can only be used for long-term forecasting. Nonetheless, pro traders continue to become more and more bearish. We remind you that the most important group of traders is called "non-commercial". This group closed 2,500 Buy-contracts (longs) and opened 5,300 Sell-contracts (shorts) during the reporting week. Thus, the net position for this group immediately fell by 7,800. At the same time, the "commercial" group, which almost always trades in the opposite direction, has become more bullish. This group of traders increased their net position by 10,000 contracts at once. The first indicator continues to signal the convergence of the lines of net positions of these two groups of traders. We remind you that when the green and red lines diverge strongly, this is a signal of an impending reversal of the trend globally. Now these lines have begun to narrow, so we can assume that the high around the 1.20 level will remain the peak of the entire uptrend. The macroeconomic background for the pair remained unchanged on Friday, October 16, since we did not receive any important news for the euro or the dollar. Several rather important reports were published during the day, which were, as always, ignored by market participants. Nevertheless, inflation in the European Union remained at an unprecedented level of -0.3% y/y. That is, in fact, deflation that has been going on. So far, traders do not react to this indicator in any way. Possibly because deflation is driven in part by the euro's sharp rise over the past six months. Or perhaps because market participants still fear the uncertainty associated with the US presidential elections, which are only two weeks away. However, we are now still inclined to believe that the euro will begin to slightly fall. First of all, the Commitment of Traders (COT) report supports this. Secondly, a full-scale second wave of coronavirus has begun in Europe. There are anti-morbidity records in many European countries. This affects the pace of economic recovery after the first wave, respectively, the euro's appeal is also decreasing in international markets. Also a fairly strong report on retail sales was released in the United States on Friday, which showed an increase of as much as 1.9% m/m. Unfortunately, industrial production was disappointing, which turned out to be negative, while traders were expecting a 0.6% gain. We have two trading ideas for October 19: 1) The pair continues to trade within a new descending channel, so buyers are not dominant in the forex market now. You can consider long positions if the quotes return to the area above the critical line (1.1752) and the Senkou Span B line (1.1758), while aiming for the resistance level of 1.1868. Take Profit in this case will be up to 100 points. We do not expect this scenario to come true in the near future. 2) Bears continue to hold the initiative, but cannot overcome the 1.1692-1.1699 support area for now. Thus, sellers can now open short positions with targets at the 1.1664 and 1.1620 support levels if this area is overcome. The potential Take Profit in this case is from 20 to 60 points. Not much, but the current volatility remains low. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Oct 2020 05:08 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -72.8936 For the EUR/USD pair, the last trading day of the past week was again very quiet. Three of the last five business days ended with a volatility of 52 points or less. This is not much even for the euro/dollar pair, which has never been highly volatile. Thus, we can say that traders are not very willing to trade now. And first of all, this applies to major professional traders, because they set the tone for trading. This may be due to the upcoming US elections or it may be due to the generally unfavorable situation in both the US and the EU. One way or another, the pair continues to trade rather sluggishly, inactive and is still in a side-channel about 300 points wide. That is, if in the most short-term prospects (for example, on the hourly chart) you can still find a trend and work it out, then from the perspective of the 4-hour chart and above, the trend has been absent for several months. Market participants still do not want to risk making large or long-term purchases of the US currency, because no one knows who will win the US election. This will affect the economy, politics, and foreign economic policy of the country with the largest economy in the world, which in one way or another affects all other countries of the world and their economies. As for the euro, traders continue to be afraid to buy it due to the fact that since April, it has already risen by 1300 points (not counting the pullback) and continues to trade near two-year highs. Moreover, a full-scale second "wave" of COVID-2019 has now begun in the European Union. And this is a problem for the European Union and its economy, which has just begun to recover from the crisis of the first "wave" of the pandemic. In general, now it is difficult to give the advantage of one of the currencies of the EUR/USD pair. And the key topic for the pair is still the topic of the presidential election, although it does not have any immediate impact on quotes and the mood of traders. The election is about 2 weeks away, and the situation with the ratings of Joe Biden and Donald Trump does not change. All opinion polls suggest that Biden is leading by at least an 11% margin. All forecasts say that Biden will win with a probability of at least 80%. That's a lot. And even on issues such as the economy, most Americans no longer trust Trump, although, throughout his presidential term, the economy was considered his strongest trump card. However, times are changing, and the attitude of Americans towards the President is also changing when America experienced one of the most severe economic collapses in its history. We will not once again list the "merits" of Trump since we have already said this many times. By and large, it doesn't make much difference to the US dollar who becomes the next President. After all, there are no "convenient" or "inconvenient" presidents for the currency. The question is about a number of different factors that affect exchange rate formation. And all these threads in the US lead to the President and the Fed since the Fed in America is not subject to the White House. And how many factors are outside the United States? For example, paired with the euro currency to the European Union. Thus, it is impossible to say that if Joe Biden wins the presidential race, the US dollar will immediately perk up and begin to actively rise in price. Maybe this will be the reaction of the markets in the first week or two, but no more. Joe Biden, as well as Trump, by the way, may be an adherent of the "cheap" dollar. And given the huge US government debt and the trade war with China, Washington will benefit from the cheapest possible dollar. However, at the very beginning of his presidential term, Trump set out to devalue the US currency. And it didn't work out. Thus, the election is just one of the factors that will affect the US dollar exchange rate in the next 4 years. Meanwhile, protests against Donald Trump have begun in America. American media reports that at least 100,000 people in all states of the country on Saturday, October 17, took part in movements against the current US President. It is also noted that most of the protesters are women. Demonstrators carried placards criticizing Trump and his Deputy, Mike Pence. Also, criticism related to Trump's desire to appoint Amy Connie Barrett instead of the deceased Ruth Ginsburg (US Supreme Justice). As for the macroeconomic news, they simply do not exist now. And all macroeconomic statistics will continue to be strenuously ignored by traders. Republicans and Democrats have failed to agree on a new stimulus package for the US economy, which is why unemployed Americans and businesses are suffering. However, it seems that both sides are not very eager to agree on a new package of stimulus measures. As we have stated many times, everything in America is now viewed through the lens of elections. Thus, both sides want such a large-scale bill as a multi-trillion dollar package of assistance to the economy to improve the position of their candidate in the elections and do not allow a competitor to gain a few additional percent of support. For example, Donald Trump wants every unemployed American to receive a "coronavirus surcharge" of $ 1,200 in a check with their signature. Such a populist step is a desire to improve their positions before the elections. House Speaker Nancy Pelosi, who is one of the most ardent opponents of Trump, even gave the White House a 48-hour deadline after which the parties must agree on the issue of supporting the economy. Otherwise, the negotiations will be completed. Recall that the Democrats are pushing for $ 2.2 trillion in aid to unemployed Americans and businesses. Republicans do not agree to such an impressive package and offer no more than 1.8 trillion, although their initial offer was much lower. From a technical point of view, the euro/dollar pair continues to be located below the moving average line, however, the downward trend is so weak and uncertain that the pair may at any time consolidate above the moving average. It is also worth noting that last week traders again failed to go below the level of 1.1700, which for a long time was the lower limit of a clear side channel.

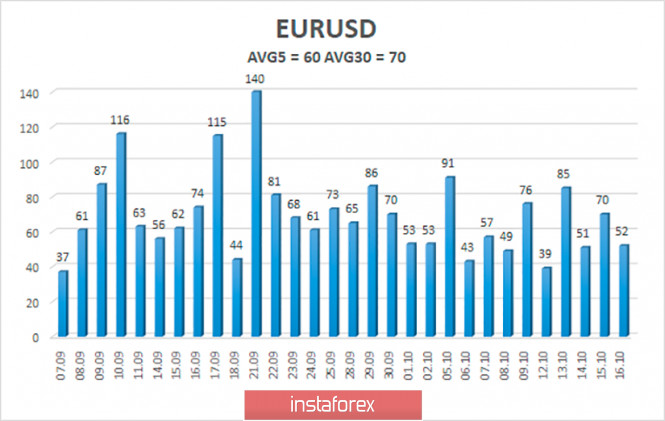

The volatility of the euro/dollar currency pair as of October 19 is 60 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1659 and 1.1779. A reversal of the Heiken Ashi indicator down may signal the resumption of a downward movement. Nearest support levels: S1 – 1.1658 S2 – 1.1597 Nearest resistance levels: R1 – 1.1719 R2 – 1.1780 R3 – 1.1841 Trading recommendations: The EUR/USD pair has started a round of corrective movement. Thus, today it is recommended to open new sell orders with a target of 1.1658 as soon as the Heiken Ashi indicator turns down or the price bounces off the moving average. It is recommended to consider buy orders if the pair returns to the area above the moving average line with targets of 1.1780 and 1.1841. The material has been provided by InstaForex Company - www.instaforex.com |

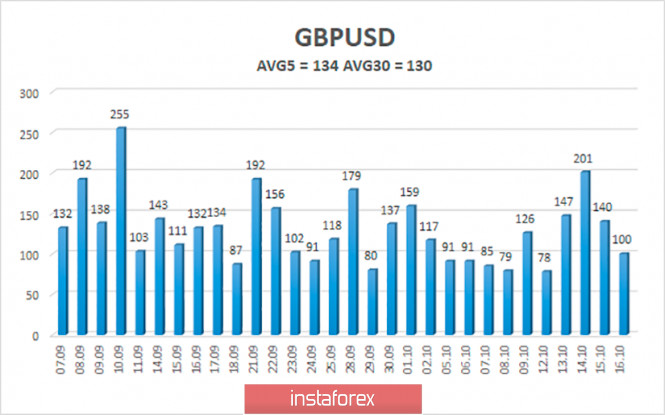

| Posted: 18 Oct 2020 05:08 PM PDT 4-hour timeframe Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -76.3766 The British pound sterling was trading more or less calmly against the US currency on Friday. It seems that traders also need a break from time to time. The last two weeks for the pound/dollar pair have been frankly stormy. The pair were thrown from side to side and passed 150-200 points in different directions. This is not to say that such movements were unfounded or illogical, although perhaps unexpected for many. The problem is that the fundamental background for the pair remains extremely strong and important. We have already discussed the American situation many times. The presidential election, especially the 2020 presidential election, will be one of the most important in the country's history, so many traders try not to take unnecessary risks when working with the US currency. If paired with the euro currency, such caution looks like a flat or a very similar movement on the chart, then paired with the pound, which has its no less strong fundamental background, it looks like utter chaos. For the UK and the British pound, the fate for the coming years continues to be decided. A lot has already been said about Brexit, however, the problem itself does not go away. Last week, the next EU summit was to be held, where issues related to the trade deal between Brussels and London were to be resolved. However, a few days before the start of the summit, several high-ranking officials from the European Union said that at the end of the summit, insufficient progress in the negotiations will be announced and no important decisions will be made. Adding fuel to the fire was British Prime Minister Boris Johnson, who once again accused the European Union of unwillingness to provide Britain with a "Canadian" version of the trade agreement. Johnson said that the European Union, despite Brexit, wants to bind the UK to itself as much as possible, which Britain itself wants to avoid since it wants to be as independent as possible. According to Johnson, the European Union should have met Britain, which has been in the bloc for 45 years. Thus, even before the summit began, it became clear that there was no news to be expected from there. Already during the summit, it became known about the possible infection with the "coronavirus" of the head of the European Commission, Ursula von der Leyen, who left it in the midst of it. And, accordingly, the official statement that followed the summit and spoke about the lack of progress was not a surprise to anyone. The European Council called on all market participants to prepare for a "divorce" without an agreement. Of course, there were calls from London for prudence. According to the Europeans, London must make certain concessions if it wants to get a deal. European Council President Charles Michel said: "Michel Barnier continues to negotiate, and we are ready to continue doing this. We want an agreement, but not at any cost. Equal competition, fisheries, and governance are extremely important issues for the European Union, for all its 27 member states." Michel also expressed bewilderment at the criticism of Boris Johnson. According to him, London initially knew about the requirements of the European Union, thus, it is not clear what London's claims are now. Thus, the negotiations will continue as expected. It seems to be as futile as before. Boris Johnson also said that the EU "refuses to engage in serious negotiations" and that he is waiting "for European leaders to change their approach to negotiations in a fundamental way". Foreign Minister Dominic Raab, in turn, said that the European Union should not force the UK to compromise alone. In his opinion, "the parties are close to an agreement, it remains only to agree on issues of fishing and competition". However, although negotiations continue, even many top EU officials do not believe in the success of the deal. The EU refuses to change its position. This was stated by Michel Barnier: "If the UK wants to access the 450 million consumers in the European Union and the single market with 22 million companies, it must ensure fair and transparent competition." German Chancellor Angela Merkel believes that "both sides must make compromises to finally reach a deal". However, all these are words that we have been hearing for several months, and there is no real process in the negotiations. Thus, as before, we tend to assume that there will be no deal. And this threatens the British economy with serious problems in 2021. Of course, the volume of trade between the EU and the Kingdom will decrease and become less profitable for both sides. But especially for the UK, where more than 50% of exports go to the EU countries. Thus, the absence of a deal threatens Britain with the loss of a few more percent of GDP. The Kingdom will lose up to 10% of GDP by the end of 2020, and no one knows what will be the losses from the second "wave" of COVID-2019. It is worth noting that the incidence rates in the Foggy Albion remain high. Thus, it is not necessary to talk about the retreat of the epidemic yet. In general, the failure of the parties to agree will cost the British economy very dearly. And of course, in such conditions, it is very difficult to wait for the strengthening of the British currency. If the flight of companies and firms from the Foggy Albion began in 2019. UK businesses have already asked the government to sign an agreement several times. And he does it for a reason. If the "hard" scenario could be prepared without particularly heavy losses, as Boris Johnson calls for, then this would be done. Therefore, the decline in investment in the British economy and capital outflows will continue in the coming years. This threatens a serious drop in demand for the British currency in the foreign exchange market and, in general, a drop in the attractiveness of the British pound, which a few years ago was considered one of the strongest and most stable currencies. However, times are changing. Only time will tell whether the British were right when they voted "yes" to leave the EU. As for forecasts for the further movement of the pound, we would not make it even one day ahead. It is likely that the "storm" will continue, and even based on a purely technical picture, it is extremely difficult to make assumptions now. The average volatility of the GBP/USD pair is currently 134 points per day. For the pound/dollar pair, this value is "high". On Monday, October 19, therefore, we expect movement inside the channel, limited by the levels of 1.2780 and 1.3048. A reversal of the Heiken Ashi indicator downwards signals a new round of downward movement. Nearest support levels: S1 – 1.2909 S2 – 1.2878 S3 – 1.2848 Nearest resistance levels: R1 – 1.2939 R2 – 1.2970 R3 – 1.3000 Trading recommendations: The GBP/USD pair started a new strong downward movement on the 4-hour timeframe, however, it is difficult to say how long it will last. Thus, today it is recommended to trade lower with the targets of 1.2878, 1.2848, and 1.2817 when the Heiken Ashi indicator turns down again. It is recommended to trade the pair for an increase with targets of 1.3000 and 1.3031 if the price returns to the area above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment