Forex analysis review |

- Forecast for EUR/USD on November 16, 2020

- Forecast for GBP/USD on November 16, 2020

- Forecast for USD/JPY on November 16, 2020

- Hot forecast and trading signals for GBP/USD on November 16. COT report. Analysis and recommendations

- Hot forecast and trading signals for EUR/USD on November 16. COT report. Analysis and recommendations

- Overview of the GBP/USD pair. November 16. A high-profile resignation in the British Parliament. New "coronavirus" anti-record.

- Overview of the EUR/USD pair. November 16. The European and American economies continue to be very "sick". Jerome Powell

- Analytics and trading signals for beginners. How to trade the GBP/USD currency pair on November 16? Preparation for trading

- Analytics and trading signals for beginners. How to trade the EUR/USD currency pair on November 16? Analysis of Friday's

| Forecast for EUR/USD on November 16, 2020 Posted: 15 Nov 2020 06:56 PM PST EUR/USD The dollar was unable to turn the tide in its favor at the end of last week. The postponement of the deadline for the Brexit negotiations to November 18th with the simultaneous appearance of the prospect of its postponement to an even later date, as well as Donald Trump's desire to have time to bring Judy Shelton, a nominal supporter of the gold standard, to the Federal Reserve's Board of Governors, the vote on which will be in the Senate tomorrow, along with active purchases of US government bonds, all these factors pushed the euro above the target level of 1.1830, opening the way for it to the nearest target of 1.1910 - to the MACD line on the daily chart. A little above the first target is the second one formed by the price channel line - 1.1940. The price tends to go above the balance indicator line on the four-hour chart, the signal line of the Marlin oscillator is already being introduced into the growth zone. We expect the euro to rise towards the first target at 1.1910, although here it is more appropriate to speak about the target range of 1.1910/40. |

| Forecast for GBP/USD on November 16, 2020 Posted: 15 Nov 2020 06:56 PM PST GBP/USD The pound continues to rise today in the Asian session. Investors are encouraged by another shift in the deadline for the Brexit talks, now to November 18th. If this deadline is overdue, then, according to rumors, it may be postponed to early December, even if the deal is ratified in January. At the moment, the last deadline for all procedures is December 31, after which England's exit from the EU should follow without a deal. But for now, the pound is aiming for 1.3350/80, formed by the highs on February and March 2019. The price has already crossed the balance indicator line on the four-hour chart, shifting the market mood to growth. The Marlin oscillator is a little late. As a leading indicator, it is still in the negative zone. But this has its own sign - if the price hits the target range of 1.3350/80, especially if this growth turns out to be fast, the oscillator will be able to form a reversal divergence with the price. |

| Forecast for USD/JPY on November 16, 2020 Posted: 15 Nov 2020 06:54 PM PST USD/JPY The USD/JPY pair fell by 48 points last Friday, breaking the support of the embedded price channel line (104.75) on the daily chart. The Marlin oscillator has penetrated the negative trend zone, the nearest target at 104.05 (October 29 low) is just ahead, followed by the second target of 103.18 – November 6 low. The price currently lies on two indicator lines on the four-hour chart – the MACD line and the balance line. In fact, the price is stuck between the daily price channel line (104.75) and the indicator lines. This creates the probability that the price would go above the resistance, reaching the MACD line on the daily timeframe, near the 105.14 level. Subsequently, however, the price is most likely to fall with an attempt to take 104.05. If a short-term reversal from the MACD line does not take place, the price will immediately go to the first goal. Depending on external circumstances, the price will either continue to fall to the second goal of 103.18, or will hesitate in correcting from the level of the first goal. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Nov 2020 06:39 PM PST GBP/USD 1H The GBP/USD pair failed to overcome the upward trend line on Friday, November 13 and rebounded off it, thus maintaining the upward trend. The bulls managed to keep the initiative in their hands, which means that the absolutely illogical, from a fundamental point of view, upward movement may continue for some time. The nearest barrier from above is the Kijun-sen line. If buyers manage to pass then the upward movement will remain present. At the same time, take note of the fact that the British pound's current positions are extremely high and practically unfounded. Therefore, we are still waiting for a downward movement. The price could not move far from the trend line on Friday, so it is absolutely possible to test this line. And on the second attempt, the price can still overcome it. Only the news of the signing of a trade agreement between the UK and the European Union can prolong the sweet life of the pound. However, so far there are no prerequisites for this. GBP/USD 15M The lower linear regression channel turned to the upside on the 15-minute timeframe, so there are signs of bringing back the upward movement on the hourly timeframe. In the next couple of days, buyers need to keep the pair above the trend line and it is desirable to overcome the critical Kijun-sen line, as the bears will make new attempts to form a new downward trend. COT report The GBP/USD pair increased by 250 points in the last reporting week (November 3-9). It is not surprising that the pound strengthened, since the US presidential election was held during this period, and the dollar was declining against its main competitors. However, the pound began to grow after this period. In general, the pound has been growing recently. But the Commitment of Traders (COT) reports does not really provide any useful information. Non-commercial traders closed 3,300 Buy-contracts (longs) and opened 1,100 Sell-contracts (shorts). Therefore, they became more bearish, and the net position decreased by 4,400, which is not so small for the pound. Recall that the "non-commercial" group opened a total number of 87,000 contracts. Thus, 4,400 is 5%. As for the general trend among professional traders, the indicators in the chart clearly show that there is no trend at this time. The green line (net position of non-commercial traders) on the first indicator constantly changes its direction. The second indicator also shows the absence of a trend, as professional traders increase the net position, then reduce it. Thus, no long-term conclusions or forecasts can still be made based on the COT report. We recommend paying more attention to technique and foundation. The fundamental background for the British pound was completely empty last Friday. No important news on that day. Therefore, traders simply had nothing to react to. There is still no information on the topic of the British-European talks. And even the topic of the US presidential election is slowly receding into the second or third plan. Donald Trump has not done anything that he promised to do. He still does not recognize Joe Biden's victory in the election (meaning a fair victory) and continues to insist that the Democrats rigged the election. However, no evidence has been provided for public viewing. Just like charges against China, impeachment charges, and many other cases. Also, Trump recently promised to provide new information from the intelligence services regarding fraud, but this has also not been done so far. Thus, there will most likely be no high-profile legal proceedings. The Trump team has filed numerous lawsuits, but it is not enough to just review the results in just one or two states. In general, Trump lost and now the only concern is whether he will hand over the reins of government of the country in a peaceful way and without a new war with the Democrats or not. No major events in the UK scheduled for Monday. Therefore, the volatility of the pound/dollar pair may remain quite weak. However, market participants will continue to wait for information from the Brexit negotiations, which are ongoing in London. However, there is little hope that positive information will be received on Monday. However, the next round of negotiations will end sooner or later, so we can only wait. We have two trading ideas for November 16: 1) Buyers for the pound/dollar pair kept the initiative in their hands. Thus, we recommend buying the pair while aiming for the resistance levels of 1.3266 and 1.3382, if the bulls also manage to overcome the critical line of the Kijun-sen (1.3208). Take Profit in this case will be from 40 to 160 points. 2) Sellers could not pull down the pair below the trend line, so they are still out of work. If the price settles below the trend line, the trend will change to a downward trend and you can sell the pound/dollar pair while aiming for the Senkou Span B line (1.3064) and the support area of 1.3004-1.3024. Take Profit in this case can range from 60 to 100 points. Hot forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Nov 2020 06:34 PM PST EUR/USD 1H The euro/dollar pair continued to adjust on the hourly timeframe on November 13, and it reached the Kijun-sen line by the end of the day. Thus, the upward trend within the 1.1700-1.1900 horizontal channel is still present, as is the horizontal channel itself. Take note that the pair's quotes have been trading in between the levels of 1.1700 and 1.1900 for more than three months and only occasionally leave it for a short time. Short-term trends are formed within the channel from time to time. Traders do not have a trend line or a trend channel at their disposal at the moment. We make a conclusion about the upward trend solely based on the price rebounding from the Senkou span B line, which is a strong support. However, we can also conclude that the price is on a downward trend, since the price bounced from the resistance area of 1.1886-1.1912 earlier, failing to gain a foothold higher once again. Thus, it is best to trade on the rebound or once important lines of the Ichimoku indicator or important levels have been overcome. For example, the price rebounding from a critical line can trigger a round of downward movement, no matter what the current trend is. EUR/USD 15M Both linear regression channels turned to the upside on the 15-minute timeframe. Not breaking the Senkou Span B line made it possible for traders to bring back the upward trend in the short term. However, the Kijun-sen line can stop this trend. Thus, the pair could move up to 1.1886-1.1912, but only if it overcomes the Kijun-sen line. COT report The EUR/USD pair increased by 170 points in the last reporting week (November 3-9). The US presidential elections provoked a rather strong drop in the US currency, however, it lasted no more than a few days. Nevertheless, the euro rose in price, and market participants can expect that professional traders are leaning towards being bullish. However, the latest Commitment of Traders (COT) report showed that the mood of large traders has become more bearish. The net position of the "non-commercial" group of traders decreased again, this time by 17,000 contracts, which is quite a lot. Recall that non-commercial traders have been reducing their net position for several consecutive weeks, which is eloquently signaled by the lower indicator in the chart. A decrease in the net position, in fact, means that Buy-contracts (longs) are closed and Sell-contracts (shorts) are opened. The first professional traders closed 9,200 during the reporting week, and the second - opened 7,800. However, despite the fact that the net position of non-commercial traders has been falling since the beginning of September, the downward trend has still not started for the EUR/USD pair. The green and red lines on the first indicator continue to move towards each other, which means that the trend has already begun long ago. However, there is actually no downward movement in the long term. Therefore, based on the latest COT report, we can say the following: our forecasts remain the same, since the report data allows only such conclusions to be drawn. We still believe that the upward trend has ended at around 1.2000. There were a lot of macroeconomic statistics on Friday, November 13, but the euro/dollar pair was very sluggish for most of the day and so it ended the day with low volatility of around 40 points. Thus, in almost any case, traders ignored all of the reports. However, after analyzing it, we can still draw certain conclusions. For example, inflation in Germany remained at a negative level of -0.2% y/y. This means that the situation remains unchanged and it will be extremely difficult for the German economy to expect net growth in the near future, rather than to recover from the fall in the second quarter. Moreover, a new lockdown may lead to a new drop in GDP. The US inflation report also showed a deterioration, as it fell from 1.4% y/y to 1.2% y/y. Inflation, excluding food and energy, also declined. And so the dollar did not receive support during the day. The speeches of Jerome Powell and Christine Lagarde did not provide any new information to the markets. No important macroeconomic reports for the European Union and the United States on Monday, November 16. Therefore, volatility could remain at a low level. The general fundamental background now also does not contribute to active trading. Traders will only have to rely on technical analysis on Monday. We have two trading ideas for November 16: 1) Buyers kept the pair above the Senkou Span B line (1.1760), but now they need to go beyond the Kijun-sen line (1.1833) in order to expect another 70 points to rise. If the price settles above this line, then you are advised to open long positions while aiming for the resistance area of 1.1886-1.1912. Take Profit in this case will be about 40-50 points. 2) Bears started their trend, however, they stumbled upon a serious obstacle near the Senkou Span B line (1.1760). Thus, in order to be able to resume trading down while aiming for the Senkou Span B line (1.1760) and the support area of 1.1692-1.1699,it is necessary for the price to rebound from the Kijun-sen line (1.1833). Take Profit in this case can range from 50 to 110 points. Hot forecast and trading signals for GBP/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Nov 2020 04:47 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -7.7734 The British pound sterling against the US dollar continues to trade very ugly from a technical point of view. In the last couple of months, the pair have regularly crossed the moving average line. However, this is not a problem. The problem is that the trend does not change after overcoming the moving average and the pair returns to its main movement. Thus, trading the pound/dollar pair has been very difficult recently. And this is only a graphical picture that constantly displays pullbacks that lead to consolidation below the moving average (the trend in recent weeks is upward). If we also remember the fundamental component. We have repeatedly said that we do not see any reasons for the strengthening of the British pound. The fundamental background in the UK is now so bad that it is the pound sterling that should fall, not the dollar. Moreover, the presidential elections were held in the United States, which means that the uncertainty factor has been exhausted. Markets should have calmed down and stopped getting rid of the US currency. However, this has not happened at the moment. And if you add here the COT reports, which in recent weeks show complete uncertainty with the mood of professional traders, it becomes obvious that the pound/dollar pair is now trading very unconventionally, so it is extremely difficult to predict its behavior even for the next couple of days. Meanwhile, there was a resounding reshuffle in the British Parliament. Dominic Cummings has resigned as chief adviser to Boris Johnson. Cummings is called the "architect of Brexit", largely thanks to him in 2016, the British voted "for" leaving the EU. It is believed that the author of the most "cool" and "loud" steps of Boris Johnson is Cummings. Last year, when Boris Johnson excluded anyone from the Conservative party who did not support a "hard" Brexit (even before the dissolution of Parliament and the election), many believe that Cummings is responsible for this. At the same time, the deadline set for negotiations on the Brexit deal is coming to an end. And it is at this difficult moment, when London needs a strong government more than ever, that another high-profile resignation occurs, of which there was a lot under the government of Boris Johnson. We can not say that this news is "black" for the pound, but this is another portion of the negative. Especially now, when, in fact, the next deadline for negotiations, which was set by Johnson himself, has passed. We received no news about progress in the negotiations at all. The UK is just going with the flow and hoping for an acceptable result. Meanwhile, the COVID-2019 epidemic continues to rage in the Foggy Albion. In the past few days, the number of daily reported cases has jumped to 30,000, and death rates have also increased significantly. That is, we can already say that the "hard" quarantine of Boris Johnson, which many doctors and politicians scold for being too soft, does not work. Johnson, like his American counterpart who lost the recent election, Donald Trump, is an adherent of the view that the economy should work even during a pandemic. Otherwise, the damage to the population and the country will be even worse than from the epidemic itself. However, as practice shows, in the UK and the US, the economy is working, but this only leads to new cases of infection and new deaths. Many believe that it was Trump's disregard for the "coronavirus" that cost him a second term. Boris Johnson may also soon follow his American friend into retirement. Especially if an agreement with Brussels on a trade deal still fails. And now everything is going to fail. At least none of the parties gave any signals that there is progress. Well, we have already talked about the problems of the UK economy a million times. In short, the economy lost a lot in 2020. At the end of this year, it may return to decline and contraction, and 2021 may be a new shock for British businesses, citizens, and the economy itself. Because, in addition to the still unresolved problems with the pandemic and recovery, trade with the EU under WTO rules will also be added to the problems, which will inevitably cause a new reduction in GDP. And even if the agreement is signed, it will only mitigate the negative consequences of the "divorce" with the European Union. Overall, the outlook for the British economy remains extremely dim. And the Bank of England, therefore, will be forced to resort to negative rates. And negative rates are an extra "dovish" move that will inevitably lead to a fall in the British currency. This is how things are in the Kingdom a month and a half before the new year and a month and a half before the country's independence from the European Union.

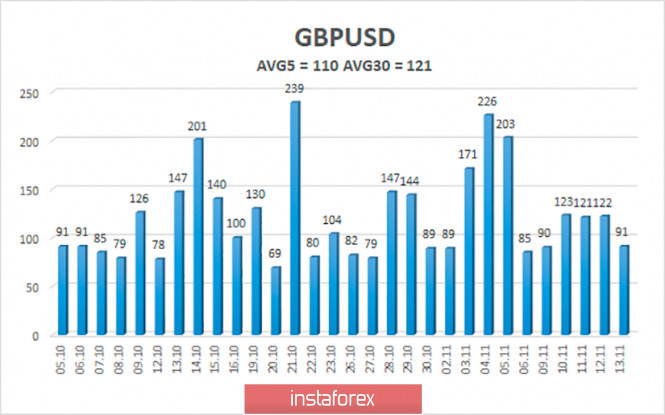

The average volatility of the GBP/USD pair is currently 110 points per day. For the pound/dollar pair, this value is "high". On Monday, November 16, thus, we expect movement inside the channel, limited by the levels of 1.3078 and 1.3298. A reversal of the Heiken Ashi indicator downwards signals a new round of downward movement. Nearest support levels: S1 – 1.3123 S2 – 1.3062 S3 – 1.3000 Nearest resistance levels: R1 – 1.3184 R2 – 1.3245 R3 – 1.3306 Trading recommendations: The GBP/USD pair is trying to return to the upward movement on the 4-hour timeframe. Thus, today it is recommended to keep open long positions with targets of 1.3245 and 1.3298 until the new reversal of the Heiken Ashi indicator down. It is recommended to trade the pair down with the targets of 1.3078 and 1.3000 if the price is again fixed below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Nov 2020 04:47 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - sideways. Moving average (20; smoothed) - sideways. CCI: 39.9564 The last trading day of the week for the EUR/USD pair was in an upward movement. However, this is only in the short term. In the long term, the sideways trend remains, which traders failed to break in 3 months. At the moment, the pair's quotes are once again fixed above the moving average line, which means that traders can expect an upward movement to the upper border of the 1.1900 side channel. However, we once again draw the attention of traders to the fact that in the last three months the pair has been trading, by and large, in the flat. And this point should be taken into account when opening any positions. Even such important topics as "presidential elections in the USA", "coronavirus in the EU and the USA", "absence of a stimulus package in the USA", as well as an outright political crisis in America failed to contribute to the exit of quotes from the flat. There is still a situation in which traders are afraid of new large purchases of the European currency, which has already risen by 10-13 cents against the dollar in the last 6-7 months. And the bears do not find any reason to buy the US currency, although now it seems that the tension that has persisted recently due to the elections should have subsided. Meanwhile, Donald Trump, in a manner unique to him, admitted that Joe Biden won the election. Through his favorite Twitter, Trump wrote that "the election was rigged and only thanks to this Biden won". This message was immediately marked as "questionable" by the social network itself, which regularly does this with the tweets of the US President. At the same time, he does this quite rightly, because the current President continues to make absolutely unfounded statements and accusations. As a mantra, Trump continues to repeat that GOP observers were not allowed to enter many polling stations, and ballots with votes for Joe Biden continued to arrive after November 4 and should not have been counted in any case. However, even such a simple statement is smashed to smithereens by simple logic. If ballots continued to arrive after November 4 and were taken into account by election commissions, why did no one try to hide or disguise this? If it's illegal. If it's legal, why does Trump say it's a fraud? In general, the more Trump makes such statements, the more the whole world is convinced that he lost the election and is now just engaged in "waving his fists after a fight". Joe Biden was congratulated by almost all world leaders, thus recognizing the victory of the Democrat in the elections and the elections themselves. But don't forget about the economy, either. Unfortunately, recent economic news has been closely shadowed by political and epidemiological news. This applies to both the European Union and America. With America, everything is clear, with what has long been. The government of the country refused to fight the epidemic using quarantines and "lockdowns". Therefore, the United States remains in first place in the world in the number of cases and deaths from COVID-2019. However, it is precisely because the economy continues to function that it also continues to recover. However, it is quite difficult to estimate the pace of its recovery. After all, there were serious GDP losses in the second quarter and strong growth in the third. But if you add both values for the second and third quarters together, it becomes clear that the final contraction of the economy is still present and it is quite large. For example, it is much lower in the European Union. Thus, the American economy, starting from the third quarter, may be recovering faster than the European economy, but the European economy lost three times less GDP in the second quarter. We believe that the lack of strengthening of the US dollar in the last three months, when even technical factors that require correction spoke in favor of this, most eloquently shows the state of the US economy at this time. It is also quite difficult to compare the American and European economies. At least because Europe has a full-fledged "lockdown", so the economy will experience problems in November and December in any case. If the "hard" quarantine was completely painless, it would be introduced all over the world. However, this is an extreme and very drastic measure. Even last week's speeches by Christine Lagarde and Jerome Powell confirmed that neither regulator is optimistic. Both heads of the Central Bank noted that the creation of an effective vaccine is very good, but both economies continue to be under pressure, require incentives, and vaccination should become publicly available so that the negative impact on the economy due to the "coronavirus" completely disappears. Lagarde notes that the European economy is recovering unsteadily, with "jumps" and "jerks". The head of the ECB also fears a full-scale recession due to a repeated "lockdown". According to her, households may become more fearful of the future and increase their savings instead of investing them and putting them into business, so many credit firms may cease to exist. But Jerome Powell said he was very concerned about the fate of women, children, and business owners who face the long-term consequences of the "coronavirus crisis". According to Powell, children do not get enough education as a result of the crisis, women drop out of the labor market (not by their own will), and workers lose their jobs and their standard of living. Powell also noted that the economy is recovering, but will never return to its pre-crisis form. The economy is becoming more technological, less dependent on workers. Accordingly, despite the recovery of the labor market, a full recovery to pre-crisis levels may not occur. Many companies and industries try to replace human labor with automation as much as possible. Also, Powell once again noted that about 11 million Americans remain unemployed and they need the support of the government, which is still unable to agree on a new package of stimulus measures that includes assistance to the unemployed and businesses. "My main conclusion is that even after the unemployment rate drops and the vaccine is available, a significant group of workers will still need support until they find their place in a post-pandemic environment," Powell concluded. Thus, both the European and American economies continue to be very "sick" and, despite the creation of a vaccine, recovery is still very far away. We still expect the upward trend to end around the 1.2000 level and the US currency should adjust properly. However, remember that any fundamental hypothesis must be confirmed by technical analysis.

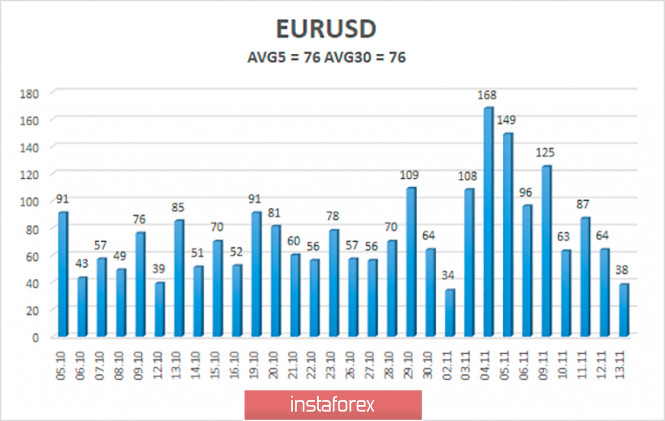

The volatility of the euro/dollar currency pair as of November 16 is 76 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1758 and 1.1910. A reversal of the Heiken Ashi indicator down may signal a new round of downward movement. Nearest support levels: S1 – 1.1780 S2 – 1.1719 S3 – 1.1658 Nearest resistance levels: R1 – 1.1841 R2 – 1.1902 R3 – 1.1963 Trading recommendations: The EUR/USD pair has started a new round of upward movement. Thus, today it is recommended to stay in long positions with targets of 1.1841 and 1.1902 as long as the Heiken Ashi indicator is directed upwards. It is recommended to consider sell orders if the pair is fixed below the moving average with the first targets of 1.1758 and 1.1719. The material has been provided by InstaForex Company - www.instaforex.com |

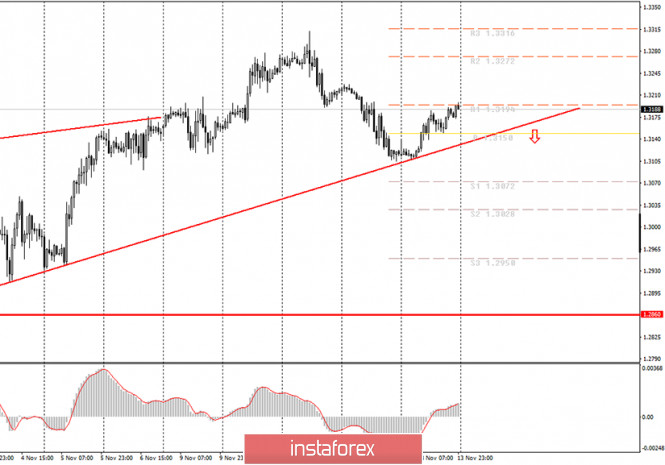

| Posted: 15 Nov 2020 02:57 AM PST The hourly chart of the GBP/USD pair.

For the GBP/USD currency pair, trading during the last trading day and the entire week as a whole raised a lot of questions. In short, the pound continues to rise in price at a time when there is no particular reason for this. It continues to rise in price when it would be most logical to fall. However, as we have said many times, traders move the markets, not news or fundamental background. Fundamental analysis is very important and often predicts the long-term trends of the pair. However, at this time, it does not correspond to what is happening in the market for the pound/dollar pair. The upward trend line keeps the British pound's prospects up. Thus, it is still recommended to consider trading for an increase until this line is crossed. We cannot say that the pound/dollar is now in a side channel in the long term, as the euro/dollar pair, so the pairs are moving differently now. This, in turn, means that the main reasons for the price movement are not in the US dollar. The fundamental background for the British currency over the past week has been "moderately negative", but in general, it remains simply "negative". Last week, the UK released several macroeconomic reports (unemployment, GDP, industrial production), which once again confirmed that the British economy is experiencing problems. On the one hand, who is not experiencing them now? On the other hand, the crisis in the UK is much deeper than in many EU countries, even those that are most severely affected by the "coronavirus" infection. The UK was the most affected EU country by COVID-2019 during the first "wave". Currently, only Spain and France "overtake" Britain in this sad rating. However, Britain still ranks as one of the top countries in terms of daily recorded cases of the disease and the first in Europe in terms of the number of deaths from COVID. Needless to say, all these "anti-records" will affect the economy. On its recovery and/or growth. And apart from the immediate problems, London can't agree with Brussels on a trade agreement that will allow them to trade without duties after Brexit, that is, as they do now, when Britain is still a member of the European Union. If there is no deal, and everything goes to the point that there is no deal, then this will be a new, additional blow to the British economy. We have already said in our fundamental articles that the losses from Brexit for the UK amount to tens or even hundreds of billions of pounds. And Britain began to bear these losses back in 2016. And will continue to carry them into 2021, even if a trade deal is still in place. However, if an agreement is not reached, the losses will be higher. These are no bright prospects for the British economy. On November 16, the following scenarios are possible: 1) Purchases of the pair look more relevant now, as the upward trend, which is signaled by the trend line, remains. However, it is possible that in the near future the trend line will be overcome and a downward trend will begin. However, until this happens, it is recommended to trade for an increase with the target of 1.3272. The MACD indicator has formed a buy signal near the trend line. At this signal, you can still stay in purchases, or wait for the next one. 2) Sales, from our point of view, are not appropriate now. To have a reason to sell the pound/dollar pair, novice traders should wait for the price to consolidate below the ascending trend line. In this case, it is recommended to open sell orders with the target level of 1.3072. What is on the chart: Price support and resistance levels – target levels when opening purchases or sales. You can place Take Profit levels near them. Red lines – channels or trend lines that display the current trend and indicate which direction is preferable to trade now. Up/down arrows – show when you reach or overcome which obstacles you should trade up or down. MACD indicator – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines(channels, trend lines). Important speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement. Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management is the key to success in trading over a long period. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Nov 2020 12:20 AM PST The hourly chart of the EUR/USD pair.

On Friday, the EUR/USD currency pair "went" along the downward trend line for quite a long time. However, it overcame this line and continued the upward movement that began a few days ago. Thus, the first and most important thing to note is that the euro/dollar pair continues to trade inside the side channel of 1.1700-1.1900. Moreover, it is currently trading exactly in the middle of this channel. Thus, in the long term, sideways movement is maintained. Secondly, if we look at short-term trends inside this side channel, we see a new trend – an upward one. However, once the descending line has been overcome, then novice traders should now consider trading for an increase. As for the prospects of the currency pair, the upward movement may continue up to the upper line of the side channel – 1.1903. For the movement to continue above this level, the level of 1.1903 must be overcome. During the fifth and last trading day of the week, there were a lot of planned events, however, most of them were boring and uninteresting. If you look at the chart of the pair's movement on Friday, it becomes clear that traders were not interested in any event of the day, since the total volatility was as much as 38 points. This is a minimal value, which is very rare. The speeches of Jerome Powell (Fed Chairman) and Christine Lagarde (ECB Chairman) did not attract any attention at all, because the speeches of both central bankers did not contain anything interesting related to the economy or monetary policy. Thus, the main event of the day was the report on inflation in the United States. And this indicator disappointed traders. The main indicator decreased from 1.4% per annum to 1.2% per annum. The consumer price index excluding food and energy declined from 1.7% to 1.6% y/y. Thus, in general, the decline in the US currency during the day was logical but very weak. No major events are scheduled for Monday in either the European Union or the United States. Therefore, novice traders can only track the news of the general fundamental background. For example, messages from Donald Trump, who continues to fight for the 2020 election. Or reports of a coronavirus or a vaccine. However, we believe that Monday can be extremely boring and volatility will be low, just like on Friday. However, this does not mean that there can't be a stronger movement in principle. We remind novice traders that it is traders who drive markets, not news or reports. On November 14, the following scenarios are possible: 1) Since traders managed to take the pair above the downward trend line, long positions have now become relevant. The growth potential of the euro currency, as always, is limited to the level of 1.1903, but even before this level, you can manage to earn several dozen points. The bad thing is that now the movement is very weak, which is fraught with frequent reversals of the MACD indicator in different directions. Therefore, it is recommended to trade for an increase cautiously, with targets of 1.1860 and 1.1896. 2) Trading on the downside is no longer relevant at this time, as the downward trend has been canceled. Thus, novice traders are advised to wait now for the eloquent end of the upward trend or the formation of a new downward trend to have a reason to open short positions. What's on the chart: Price support and resistance levels – target levels when opening purchases or sales. You can place Take Profit levels near them. Red lines – channels or trend lines that display the current trend and indicate which direction is preferable to trade now. Up/down arrows – show when you reach or overcome which obstacles you should trade up or down. MACD indicator (14,22,3) – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines(channels, trend lines). Important speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement. Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management is the key to success in trading over a long period. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment