A new "digital leap" is underway… A digital leap is when an entire industry transitions from analog to digital. These moves can be wildly profitable. If you follow our tech expert, Jeff Brown, you’ll know what I’m talking about. But if you’re new to the conversation, here are some examples… Amazon.com (AMZN) digitized shopping and moved it online. Retailers who failed to make the digital leap – such as Sears – got crushed. But since it went public in 1997, Amazon’s stock is up 214,858%. Folks who bought Amazon shares at the initial public offering (IPO)… and held for the long run… were able to turn every $1,000 into $2,149,580. Or take Netflix (NFLX). It took the digital leap from renting DVDs from brick-and-mortar stores to streaming movies online. Since it went public in 2002, Netflix shares are up more than 50,000%. Now, an entire asset class is taking the digital leap – the roughly $400-billion-a-year market for art and collectibles. Before we dive into that, a shoutout to new readers… The Daily Cut is the premium e-letter we created for all paid-up subscribers of Legacy Research. So if you’re a fan of Jeff, Teeka Tiwari, Dave Forest, Nick Giambruno, Jason Bodner, Dan Denning, Bill Bonner, or Doug Casey… you’re in the right place. The mission is simple: Make sure you never miss a big moneymaking… or wealth-protection… idea from the team. And digital leaps are a hugely profitable idea for your radar. Take it from Jeff… When an entire industry goes from analog to digital, you have a rare opportunity to profit. I’d go as far as to say that digital leaps are the most lucrative events in the history of the stock market. Think of it as a bifurcation – or splintering – of the stock market. While some companies will stumble… and go out of business… others will skyrocket as they adopt bleeding-edge technology to make the leap. | Recommended Link | | A Trillion-Dollar Crypto Event?

(FREE Crypto Pick)

Earlier this year, bitcoin became the first cryptocurrency in history to reach a market cap over $1 trillion. Did you miss out on its incredible run? If so, crypto expert Teeka Tiwari says he believes you have another opportunity for bitcoin-like gains. Teeka’s past cryptocurrency recommendations have soared as high as 1,728%… 3,976%… 17,613%… and 38,055%. Now, he can’t promise gains that high. But a few days ago, he revealed his next top crypto pick… for free. A coin he believes could follow in bitcoin’s footsteps to become Crypto’s Next Trillion-Dollar Coin. In his livestream replay, you’ll get the name of this coin for free – along with details on a handful of other cryptos that could soar along with it. | | | -- | Jeff’s readers have already had the chance to profit from these leaps… Take DocuSign (DOCU). It’s a digital leap for business contracts. Its technology allows people and businesses to sign legally binding contracts online via secure electronic signatures. I bought a house in my native Ireland during the pandemic. And DocuSign was the only platform my bank would accept for e-signatures for my mortgage documents. Jeff recommended DOCU to paid-up subscribers of his large-cap tech investing advisory, The Near Future Report. Its shares have shot up 214% from their March 2020 low.

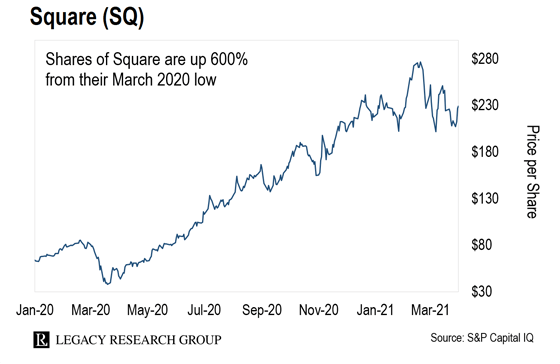

Or take online payment processor Square (SQ). It’s another digital-leap stock in Jeff’s model portfolio. It’s up 600% since its low last March.

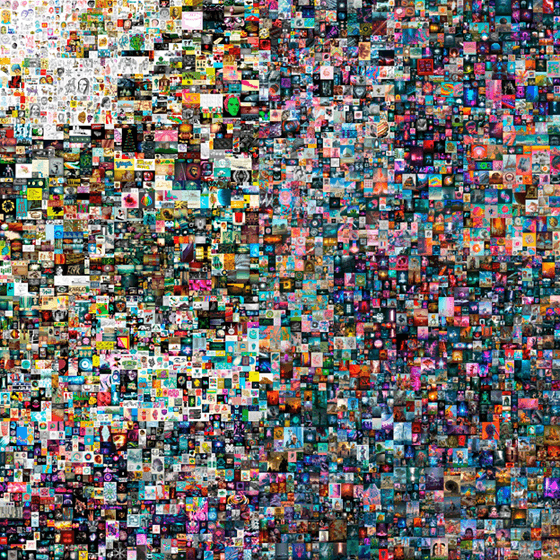

It’s easy to see why… In a pandemic, people worry banknotes and coins are full of germs. Some stores refuse to take physical cash for the same reason. Square’s Cash App allows customers to pay digitally, without contact, via their smartphones instead of physical cash. Now, the art and collectibles sector is taking a digital leap… You may have heard by now of Mike Winkelmann. He’s a digital artist out of Charleston, South Carolina, who calls himself Beeple. Did You Fall for This JUNK? He made $69 million from a piece of digital art he made called “Everydays – The First 5000 Days.” That’s the third-highest sale price any living artist’s piece has ever fetched. Here’s the piece…  “Everydays – The First 5000 Days.” Source: Christie’s “Everydays – The First 5000 Days.” Source: Christie’s

What’s even more interesting about the sale is… Beeple sold the artwork as an NFT. That stands for nonfungible token. It’s a unique digital token that represents ownership of an artwork or collectible. And it’s issued using the decentralized technology underpinning cryptocurrencies – a blockchain. Don’t be put off by the tech jargon… Some folks’ eyes roll when they hear about blockchain. But here’s all you need to know… Blockchains are databases that can securely store digital data in a way that anyone can verify. And unlike typical databases, which exist on one computer, blockchains are distributed across many computers on a network. The best-known blockchain is that of bitcoin (BTC). It allows anyone in the world to make secure global payments, 24/7, 365 days a year. Bitcoin is a “fungible” digital token. Another bitcoin can replace it and will have exactly the same value. A U.S. dollar bill is also fungible. You can exchange it for another dollar bill, and it will have the same value. It’s the same for gold. Every bar of assayed gold is worth the same as every other bar of the same weight. | Recommended Link | Jeff Brown: "Invest in ALDL NOW!" According to tech expert Jeff Brown, ALDL will make a lot of people rich. What's ALDL? It stands for what he calls America's Last Digital Leap. 100% of the previous digital leaps Jeff found in his backtest were profitable. In the worst-case scenario, you could have made 11 times your money. And now, Jeff says we're about to see the biggest of them all. He'll reveal all the details of this opportunity in a free online event on Wednesday, April 7th, at 8 p.m. ET. | | | | But NFTs aren’t interchangeable… Just as no two Picassos are the same, no two NFTs are the same. An independent authenticator verifies the authenticity of artwork or a collectible. Then its owner creates a unique NFT for the piece. They can then use the NFT to prove and transfer ownership. As Jeff sums it up… Simply think of NFTs as digital collectibles. Artwork, trading cards, video clips, poems, and similar items can all be “tokenized” into NFT form and sold as digital collectibles. There’s plenty of speculation around NFTs… You may think $69 million for a digital image – however talented the artist – is a lot of dough. And it is… I even wrote to you recently about how folks paid $3.1 million for NFTs representing 621 digital images of sneakers. That’s on average nearly $5,000 per digital pair. So there’s no doubt froth in the market. And you’ll hear plenty of claims in the mainstream press that NFTs are nothing but a bubble. But Jeff says otherwise… I’m confident NFTs are here to stay. What we’re seeing is a classic transition from analog to digital. This is a digital leap in the collectibles space. NFTs can’t be copied or stolen. And they can be strictly limited in quantity. Artists can make it so only one NFT representing a painting can ever exist. That makes them equally as scarce as the analog versions. Humans have placed high value on all kinds of collectibles throughout history. Cars, paintings, art, wine, the master recording of a record – you name it. NFTs are just placing these collectibles in digital form. And as Jeff points out, this is already big business. In February alone, roughly $800 million traded hands in the NFT market. That was a 29x increase over January. It’s not just artwork and collectibles taking this leap… There are also applications for NFTs in the gaming industry. The lion’s share of gaming companies’ revenues now often comes from in-game purchases. Gamers buy different digital items like “skins” – or looks – and dances for their avatars. It sounds crazy. But most of popular online game Fortnite’s $2.4 billion in 2020 sales came from these in-game purchases. And gamers can use NFTs to move these items from one game to another. Another use for NFTs is ticketing… Because they’re non-reproducible, NFTs can create digital tickets that can’t be forged. Once you have a corresponding NFT on your phone, you can get into a gig or a sports match. Your passport and driver license are other unique real-world items that could be digitized through NFTs. You could have an NFT in a wallet app on your phone that represents these paper or plastic ID documents. I’m running out of space today to go into more detail. But Jeff recently spoke with Glenn Beck on Glenn’s radio show about NFTs and their explosive growth potential. You can listen to his chat with Glenn by checking out the video below.

And don’t forget to sign up to attend Jeff’s America’s Last Digital Leap event this Wednesday at 8 p.m. ET. He’ll share all the details on an $11.9 trillion industry he believes is about to go through the very last digital leap… Even the worst of past digital leaps returned 11x investors’ money. So this is worth paying attention to. Sign up for Jeff’s event for free here. In the mailbag: “Bitcoin can perform better than gold, until it can’t”… Teeka Tiwari was the first in our industry to recognize the life-changing profit potential of cryptocurrencies. And he just made a bold new recommendation to his readers over at Palm Beach Research Group. He warned that gold is no longer doing its job guarding against inflation. So he urged readers to sell some of their gold – and buy bitcoin instead. Teeka compares the transition from gold to bitcoin as a store of wealth with the transition from the horse and buggy to the automobile at the start of the 20th century. Here’s how he put it recently in these pages… Gold has thousands of years of history. Bitcoin has been around for only a decade. I get it. But people also used horses to get around for thousands of years. Then, in less than a decade, cars rendered horses obsolete. Bitcoin is equally scarce, durable, and private as gold. But it’s more easily stored, transported, and exchanged than gold. That makes gold the horse… and bitcoin the car. This prompted a flood of feedback – with your fellow readers lining up on both sides of the bitcoin versus gold debate… On its network, bitcoin can stand in for gold and even perform better, until it can’t. A hunk of gold, without its network (the natural world, mines, refiners, mints, etc.) exists independently as a hunk of gold. The gold in a coin that was minted by a nation-state retains all its properties, whether that nation-state exists or is even remembered anymore. But bitcoin IS its network. A bitcoin will never be found in a stream, in the ground, in an old box, in the sea, in a “hard wallet,” or anywhere and just be what it is all by itself. Without its network, bitcoin is absolutely nothing, not even an electron, not even an idea – as attractive or effective an idea as it may be right now. – James W. Millennials might like bitcoin because it’s “cool” and “techy,” but they’re not the majority of the population. I’m pretty sure the majority has no idea how bitcoin works and what makes it worth the prices people are paying for it. People understand gold or a piece of paper with a fancy design and a value stated on it, but not bitcoin or altcoins. Crypto’s lack of transparency is often regarded as a valuable attribute, but will people trust it? – W.K. I have held both for years. Gold has underperformed. Bitcoin has overachieved. Bitcoin is the true real money. Unlike gold, it can be bought and sold instantly and moved anywhere in the blink of an eye, with no third-party involvement. The advantages bitcoin has with its historical average of 200% annual increase in value and its rapidly settling accounts speak to its superiority over gold. – Roger B. Today, the dollar, bitcoin, and gold are all real money, in that they can all be exchanged for goods and services. Gold is actually less real as money than the dollar and bitcoin, in terms of transaction volume for goods and services. However, gold and possibly bitcoin will still be around when it becomes cheaper to use dollar bills than toilet paper. – Lowell P. If it walks like a duck, quacks like a duck, and looks like a duck… probably is a duck. Bitcoin and many other cryptos are quacking very loudly. And some are looking more and more like a means of exchanging or storing value – globally. But what “value” to price these new ducks in? Dollars? Gold? The old ducks? As a businessman, would I prefer payment in crypto or fiat? Put the question another way – do I trust mathematics and cryptology more than I trust politicians and bankers? – Michael G. Has bitcoin stolen some of gold’s shine? Whether you’re a gold bug or a bitcoin bull, we’d love to hear from you at feedback@legacyresearch.com. Regards, Chris Lowe

April 5, 2021

Barcelona, Spain Like what you’re reading? Send your thoughts to feedback@legacyresearch.com. IN CASE YOU MISSED IT… Millionaire's Big Prediction From Living Room Couch Teeka Tiwari – America's No. 1 Investor – just made an outrageous prediction. Recorded live from his living room couch… He blasts Congress, reveals nasty truths about America… And reveals one technology set to radically change our nation. Already, 400,000+ viewers have checked it out. WARNING: This video may make you furious. Watch His Urgent Video Now.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

No comments:

Post a Comment