| Well, how's that for a comeback?

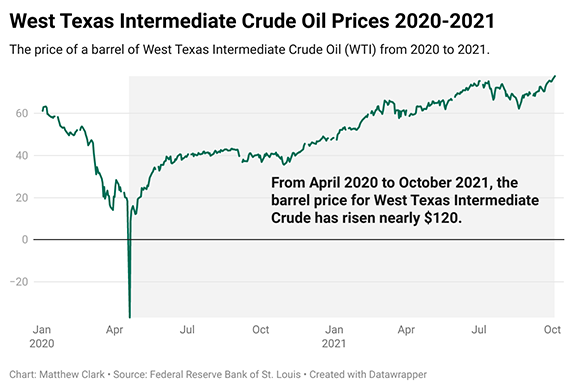

West Texas Intermediate crude oil is now trading for around $80 per barrel, touching levels not seen since 2014. Just a year and a half ago, you literally couldn’t give it away. Oil prices went to negative $37.63 in April 2020, as you might remember. We’ve gone from oil having a value of less than zero to having it trade at multi-year highs. (See chart below.) So, is energy back?  P.S. We have multiple energy stock recommendations within the Green Zone Fortunes model portfolio. We are covering all the bases with stocks focused on the current demand for fossil fuels and stocks focused on our renewable energy future. Our top-performing “old energy” recommendation is up 54% since recommending it in March, and I think it has room to run 50% higher over the next year and a half. To find out how you can gain access to all of these stock recommendations, along with guidance on the best times to buy and sell, click here. Suggested Stories: The Future for 2 Chinese Stock Giants (Alibaba & Tencent) Campbell Stock’s Dividend: A Pantry and Portfolio Staple

| Teeka Tiwari picked Bitcoin at $428 before it became the first trillion-dollar coin by market value. Now he's giving away the name of his next top pick for FREE! A coin he believes could follow in Bitcoin's footsteps to become Crypto's Next Trillion-Dollar Coin. | |

Marijuana Market Update Matt Clark, Research Analyst In the latest Marijuana Market Update, I discuss the biggest battleground state for cannabis companies. I also answer a viewer’s question about the SAFE act. Here’s more of the latest in the cannabis market.  Suggested Stories: Buy the Perfect Grocery Stock: High Growth, Value and Momentum Bonds Are Garbage: 3 Better Places to Put Your Money

| A little-known California startup has cracked the battery code. For the first time ever, we now have the technology to overcome all the obstacles currently preventing EVs from going mainstream. And it's predicted to send EV sales surging 1,500% or more over the next four years. Called the "Forever Battery," it takes just 15 minutes to charge … is smaller … lighter … and safer than traditional batteries … and could soon power your EV for 1,000 miles — on a single charge | |

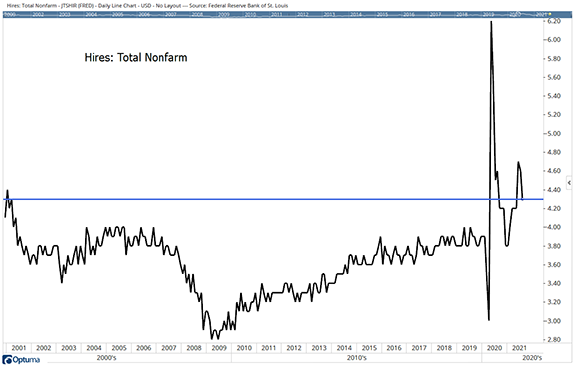

Chart of the Day Employers are hiring more people than they have since 2000. (See chart below.) The pandemic drove many people out of the workforce. With businesses opening back up, employees should be returning to their old jobs. But that isn’t happening. Click here or the image below for why employees are looking elsewhere as they return to work.  Suggested Stories: China's PMI Trend Is an Ominous Global Warning A Big Story Is Hidden in the Unemployment Report |

1793: French Queen Marie Antoinette is convicted of treason and confection tyranny. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

No comments:

Post a Comment