This is very good news for the cryptocurrency industry in Australia. At the same time, it could be a breakthrough for FinTech's future country policy. Previously, the Australian government had been regulating the exchange of cryptocurrency. In addition, Australian politicians and officials took over the leadership of FinTech by forming the Blockchain Parliamentary Group of Friends and chairing the 307 Technical Committee on the International Organization for Standardization (ISO).

Let's now take a look at the Bitcoin technical picture at the H4 time frame. The bullish rally was capped around the level of $4,111 and currently the price is trading in a narrow zone between the levels of $,3793 - $, 4038. From the Elliott Wave Theory point of view, the rally from the low at the level of $2,958 has been developed in three waves so far that means this leg might still be a part of a wave B correction, not an impulsive wave progression towards a new high. Any violation of the level of $4,362 invalidates this scenario.

SP 500 and Dow close at fresh highs while Nasdaq slips

US stocks closed at fresh record highs on Wednesday as Federal Reserve announced the start of its $4.5 trillion balance sheet reduction in October. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.7% to 92.441. The S&P 500 advanced less than 0.1% settling at fresh record high 2508.85 led by financial and industrial shares. The Dow Jones rose 0.2% to new record high 22412.59 with gains in McDonald’s and Pfizer offsetting 1.7% drop in Apple. Nasdaq composite meanwhile fell less than 0.1% to 6456.04.

The US central bank kept federal funds rate between 1% -1.25%, as widely expected, but said it would start to shrink its balance sheet by $10 billion a month. The Fed said it would increase that pace by $10 billion every three months to a maximum pace of $50 billion a month, or $600 billion a year. Twelve out of the sixteen policy committee members indicated they expected to deliver a third rate increase by the end of 2017. Treasury yields rose, with probability of another rate hike in December, as priced by traders in fed funds futures, jumping to 72% compared with 56% the previous day, according to CME Group’s FedWatrch tool.

European stocks slip

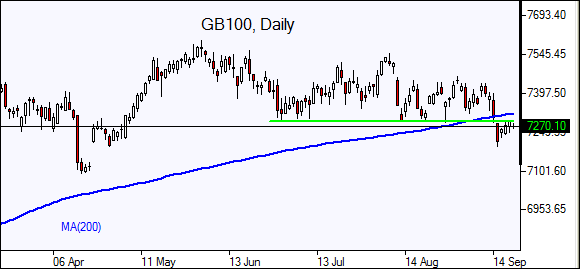

European stocks edged lower on Wednesday as investors awaited Federal Reserve’s decision. Both the euro and British Poundreversed previous session gains against the dollar. The Stoxx Europe 600 index slipped 0.04%. Germany’s DAX 30 added 0.1% to 12569.17. France’s CAC 40 rose 0.1% while UK’s FTSE 100 lost 0.05% to 7271.95. Indices opened higher today.

The Pound ended lower after hitting 15-month high above $1.36 level following UK’s Office for National Statistics report of better than expected retail sales in August: retail sales rose 1% after upwardly revised 0.6% increase in July.

No comments:

Post a Comment