Older versions of MetaTrader 4 and MetaTrader 5 will continue to work on these systems, but will not be able to receive updates after 01 October 2017. Also, installers will not run on these operating systems.

Windows XP was released 16 years ago, it is now considered to be an outdated operating system. Microsoft no longer provides security updates that can help to protect your PC from harmful viruses, spyware, and other malicious software.

The minimum required operating system version for running MetaTrader 4/MetaTrader 5 will be Windows 7. However, we strongly recommend using the 64-bit versions of Windows 10.

Ichimoku indicator analysis of gold for September 26, 2017

Gold price has broken out of the bearish channel yesterday as we expected. Price has stopped right below the 4-hour Kumo and shows signs of rejection. However I believe the next leg up towards $1,400 has started.

Red lines - bearish channel Gold price has reached the 4-hour Kumo (cloud) after breaking the bearish channel. Price has stopped right at the resistance and is pulling back. Short-term support is at $1,301. Resistance is at $1,316.

On a daily basis Gold price has bounced as expected and stopped right at the daily tenkan-sen (red line indicator) resistance. Price needs to move above $1,316-20 level in order for bulls to feel more confident. I believe Gold has made an important low at $1,288. Breaking below that level will open the way for a move towards $1,270-60.

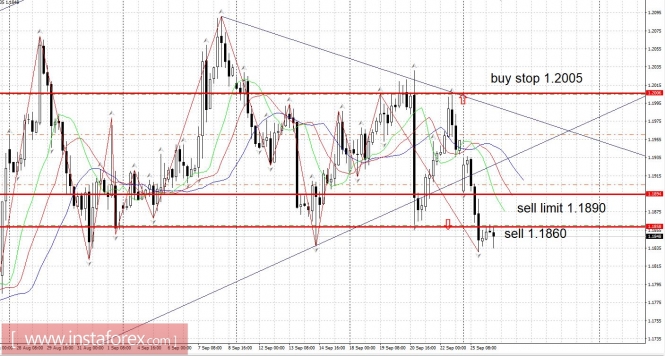

EURUSD: The way down is open

EURUSD: The way down is open. Last minute burning forecast 26.09.2017 Weak results from Merkel's party during the elections in Germany caused the price of the EURUSD pair to hit a reversal. A breakthrough at important levels of 1.1860 and 1.1835 opened the way down. There were different factors: fundamental - the weakening of the party and the government of Merkel, which is the foundation of the EU, and the technical - overdue correction after the 6-month strong growth of the EURUSD. On the daily chart, a figure of the reversal type "triple top" pattern appears, which lasts a month. Operation of the figure - fixing the EURUSD rate below 1.1800. The minimum goal based on the figure is 1.1660. We sell from 1.1860 and also from 1.1890. Downward movement cancellation signal - a breakthrough upwards at 1.2005.

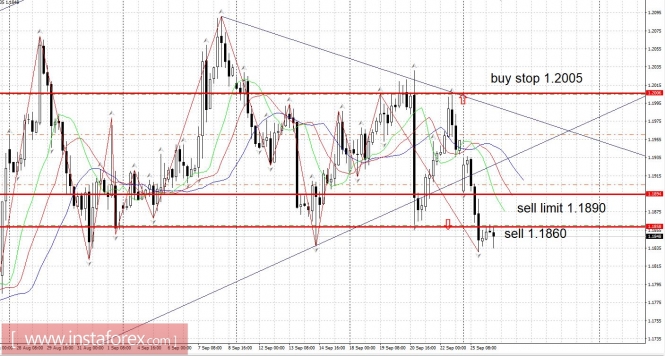

EURUSD: The way down is open

EURUSD: The way down is open. Last minute burning forecast 26.09.2017 Weak results from Merkel's party during the elections in Germany caused the price of the EURUSD pair to hit a reversal. A breakthrough at important levels of 1.1860 and 1.1835 opened the way down. There were different factors: fundamental - the weakening of the party and the government of Merkel, which is the foundation of the EU, and the technical - overdue correction after the 6-month strong growth of the EURUSD. On the daily chart, a figure of the reversal type "triple top" pattern appears, which lasts a month. Operation of the figure - fixing the EURUSD rate below 1.1800. The minimum goal based on the figure is 1.1660. We sell from 1.1860 and also from 1.1890. Downward movement cancellation signal - a breakthrough upwards at 1.2005.

Elliott wave analysis of EUR/NZD for September 26, 2017

Wave summary: We continue to look for more upside pressure above 1.6451 for a continuation higher towards 1.6875 and above. Short-term support at 1.6288 ideally will be able to protect the downside for the expected rally higher, but a break below here will indicate that an expanded flat correction is unfolding as red wave ii/ towards 1.6218 before turning higher in red wave iii/ towards 1.6690 and higher towards 1.6875. R3: 1.6488 R2: 1.6451 R1: 1.6385 Pivot: 1.6350 S1: 1.6317 S2: 1.6288 S3: 1.6237 Trading recommendation: We are long EUR from 1.6265 and will move our stop to break-even. If our stop is hit we will re-buy EUR at 1.6230 and place our stop at 1.6130.

Elliott wave analysis of EUR/JPY for September 26, 2017

EUR/JPY - Weekly

EUR/JPY - 4 Hourly Wave summary: The break below minor support at 133.24 was the first good indication that wave (D) has completed prematurely and wave (E) now is developing. A break below support at 131.70 will add confidence in this count, while a break below the support-line near 131.10 will confirm the count and look for more downside pressure in wave (E), ideally close to support at 117.72. This should complete the huge triangle that has been developing since July 2008 for a strong rally above 134.41. R3: 134.24 R2: 133.46 R1: 132.52 Pivot: 132.00 S1: 131.70 S2: 131.10 S3: 130.56 Trading recommendation: Our stop at 133.15 was hit for a profit of 139 pips. We will be looking for a new selling opportunity.

EUR/JPY - 4 Hourly Wave summary: The break below minor support at 133.24 was the first good indication that wave (D) has completed prematurely and wave (E) now is developing. A break below support at 131.70 will add confidence in this count, while a break below the support-line near 131.10 will confirm the count and look for more downside pressure in wave (E), ideally close to support at 117.72. This should complete the huge triangle that has been developing since July 2008 for a strong rally above 134.41. R3: 134.24 R2: 133.46 R1: 132.52 Pivot: 132.00 S1: 131.70 S2: 131.10 S3: 130.56 Trading recommendation: Our stop at 133.15 was hit for a profit of 139 pips. We will be looking for a new selling opportunity.

No comments:

Post a Comment