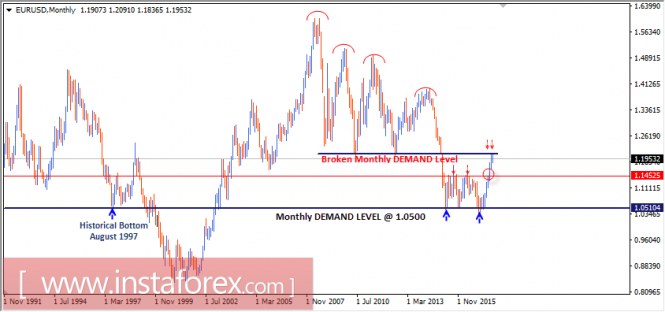

Hence, a long-term bearish target was projected toward 0.9450. In March 2015, EUR/USD bears challenged the monthly demand level around 1.0500, which had been previously reached in August 1997.

In the longer term, the level of 0.9450 remains a projected target if any monthly candlestick achieves bearish closure below the depicted monthly demand level of 1.0500.

However, the EUR/USD pair has been trapped within the depicted consolidation range (1.0500-1.1450) until the current bullish breakout was executed above 1.1450.

The current bullish breakout above 1.1450 allows a quick bullish advance towards 1.2100 where price action should be watched for evident bearish rejection and a valid SELL Entry.

Daily Outlook In January 2017, the previous downtrend reversed when the Head and Shoulders pattern was established around 1.0500.

Since then, evident bullish momentum has been expressed on the chart. As anticipated, the ongoing bullish momentum allowed the EUR/USD pair to pursue further bullish advance towards 1.1415-1.1520 (Previous Daily Supply-Zone).

The daily supply zone failed to pause the ongoing bullish momentum. Instead, evident bullish breakout is being witnessed on the chart.

The next Supply level to meet the pair is located around 1.2100 (Level of previous multiple bottoms) where bearish rejection and a valid SELL entry can be anticipated.

On the other hand, If bearish pullback persists below 1.1800 and 1.1700, the price zone of 1.1415-1.1520 can be watched for a valid BUY entry

EUR/USD has been quite volatile and corrective recently but still been able to hold on the gains and long-term non-volatile bullish trend. There has been no directional bias on the pair right now but the bulls are having an advantage today due to positive eurozone's economic reports. Today, Italian Trade Balance report was published with an increase to 6.56B from the previous figure of 4.50B which was expected to decrease to 3.89B, Final CPI was published unchanged as expected at 1.5%, Final Core CPI was also published unchanged as expected at 1.2%, and German Buba Monthly report was also hawkish in nature showing positive changes in the coming days. On the other hand, today US NAHB Housing Market Index report was published with a worse figure at 64 which was expected to be unchanged at 67. To sum up, in light of upbeat reports from the eurozone EUR sustained the gains which signals that a further bullish price action is on the way. As for the USD, a substantial number of high impact reports are going to be published this week including the FOMC Statement which is expected to create a good amount of volatility in the market this week. The weekly close of this week will surely provide a directional bias of the upcoming long-term view of the pair where EUR is expected to have an upper hand over USD.

Now let us look at the technical chart. The price is currently residing above the support level of 1.1900 and the dynamic level of 20 EMA as well. The non-volatile bullish trend is still very intact as the dynamic level and the nearest support level has not been violated by now. As long as the price remains above the 1.1900 with a daily close, the bullish bias is expected to continue further with a target towards 1.2070-1.2140 resistance area.

No comments:

Post a Comment