Forex analysis review |

- Dollar consolidated its success, the Australian was able to rise after yesterday

- Indicator analysis: Review of the GBP / USD pair for the US session on February 22, 2019

- Fundamental Analysis of AUD.USD for February 22, 2019

- Indicator analysis: Review of the EUR / USD pair for the US session on February 22, 2019

- Cost of palladium for the first time exceeded $1500

- Intraday technical levels and trading recommendations for EUR/USD for February 22, 2019

- February 22, 2019: GBP/USD Bullish opportunity around the backside of the broken movement channel.

- GBP / USD plan for the American session on February 22. The pound is gradually decreasing due to the lack of news on Brexit

- EUR / USD plan for the US session on February 22. The market is completely calm after weak data for Germany and the Eurozone

- Bitcoin analysis for February 22, 2019

- BITCOIN Analysis for February 22, 2019

- GBP/USD analysis for February 22, 2019

- Analysis of Gold for February 22, 2019

- Fundamental Analysis of USD/CHF for February 22, 2019

- Fundamental Analysis of USD/CAD for February 22, 2019

- USD / JPY: Yen ignored inflation and looking forward to the meeting of Trump and Liu He

- Review of the foreign exchange market on 02.22.2019

- GBP / USD trading system of "Regression Channels" on February 22. Conservatives want to oppose Theresa May

- Trading recommendations for the GBPUSD currency pair - prospects for further movement

- EURUSD: Traders paused before the publication of the next series of important fundamental statistics

- Wave analysis of GBP / USD for February 22. Pound is waiting for confirmed information about the agreement in Brussels

- EUR / USD trading system of "Regression Channels" on February 22. Inflation in the eurozone can bring the pair out of stupor

- Wave analysis of EUR / USD for February 22. The pair is still preparing to build a downward wave

- The euro and the pound in anticipation for guidance

- GBP/USD: plan for the European session on February 22. It is very important for buyers to maintain the support level of 1.3020

| Dollar consolidated its success, the Australian was able to rise after yesterday Posted: 22 Feb 2019 06:41 AM PST At the same time, dollar growth is limited by weak economic data from the United States including an unexpected drop in orders for capital goods and weak sales in the secondary housing market, which supports the expectations that the Fed will not raise interest rates. The growth of US government bond yields supported the dollar and its Australian counterpart also stabilized after the recent sharp decline against the background of the Central Bank's comments and concerns about a ban on the import of Australian coal in China. Despite the fact that the dollar index versus a basket of six major currencies remained almost unchanged in general. The increase in US Treasury bond yields to a weekly maximum had a positive effect on the currency. At the same time, dollar growth is limited by weak economic data from the United States including an unexpected drop in orders for capital goods and weak sales in the secondary housing market, which supports the expectations that the Fed will not raise interest rates. The foreign exchange market is entering a phase in which it has already played almost all political events such as trade negotiations between the US and China and Brexit. The time has come again to "return to the sources" and pay special attention to fundamental factors. Special attention should be focused on the wage report next week. Most likely, it will be decisive for the dollar which direction to take. The Australian dollar was able to partially offset the recent losses and gradually rises from a 10-day low, where it was after information appeared about a ban on the import of Australian coal in some ports of China. A currency strategist at the National Bank of Australia, Rodrigo Catril, said that the Australian rebound occurred after the Chinese authorities eased the restrictions on fuel imports. In addition, the positive comments of the head of the Central Bank of the country at the beginning of the day also increased the exchange rate. The material has been provided by InstaForex Company - www.instaforex.com |

| Indicator analysis: Review of the GBP / USD pair for the US session on February 22, 2019 Posted: 22 Feb 2019 06:30 AM PST Trend analysis (Fig. 1). In the American session, the price may continue to move down to the first lower target of 1.2941 with 50.0% correction level (blue dashed line). Fig. 1 (twelve-hour chart). Comprehensive analysis: - indicator analysis - down; - Fibonacci levels - down; - volumes - down; - candlestick analysis - down; - trend analysis - up; - Bollinger lines - up; - weekly schedule - up. General conclusion: In the American session, the price may continue to move down to the first lower target of 1.2941 with 50.0% correction level (blue dashed line). The material has been provided by InstaForex Company - www.instaforex.com |

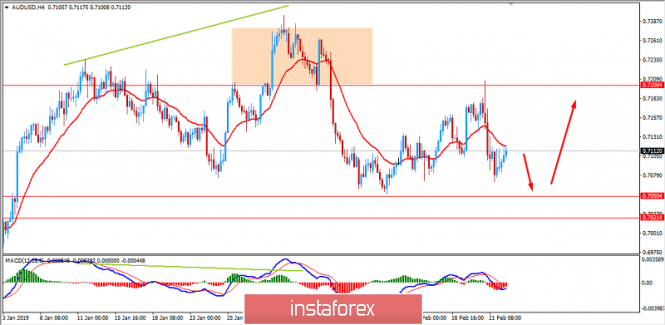

| Fundamental Analysis of AUD.USD for February 22, 2019 Posted: 22 Feb 2019 06:26 AM PST Reserve Bank of Australia's Governor Phillip Lowe today spoke quite optimistically about the growth of the economy. The hawkish statement from the RBA Governor helped AUD to regain momentum over USD after impulsive bearish pressure with a daily close. Recently Australia's Wage Price Index report was published with a decrease to 0.5% which was expected to be unchanged at 0.6%. The worse economic report weakened the currency earlier. However, today AUD gained momentum after positive statements from RBA Governor Lowe. Australian GDP is expected to be around 3% by 2019 and 2.75% by 2020. If achieved, stronger AUD is going to hold the upper hand in pair. Governor Lowe expressed good confidence about no rate hikes this year which is still variable as situation demands. The interest rate decision is very much depended on the inflation rate whereas any fluctuation on the inflation will lead to further variations. Recently the US FED unveiled a shift in stance on the balance sheet that aroused criticism from some media sources. The Federal Reserve is currently thinking of stopping the unwind of $4 trillion balance sheet later this year that is strongly disliked by market watchers as they think it will be a terrible mistake. According to the FED, balance sheet reduction is going on for a year and it has not made a significant impact on the economy and financial markets yet, though the economy is expected to benefit from normalization of the balance sheet. Additionally, JP Morgan recently downgraded US Q1 GDP growth outlook to 1.5% from the previous forecast of 1.75%. There are several reasons, but the dongraded forecast is clearly leading the market to indecision and volatility. Yesterday US Core Durable Goods Orders report was published with a minor increase to 0.1% from the previous value of -0.4% but it failed to meet the expected value of 0.3% and Philly FED Manufacturing Index was published with a decrease to -4.1 from the previous figure of 17.0 which was expected to be at 14.1. Another market moving event today is FED's Monetary Policy report. Besides, FOMC Members Williams and Clarida are due to speak later in the global trading day. These events are likely to inject volatility in the market. Meanwhile, certain gains on the USD side may be observed in the coming days but AUD supported by the long-term optimistic view on the economy is expected to lead to certain bullish pressure in the pair in future. Now let us look at the technical view. The price is currently climbing higher after an impulsive bearish pressure. If bulls are rejected by strong bearish pressure, further downward momentum is expected in this pair for a certain period. As the price is heading towards 0.7000-50 support area, there will be certain probability for bullish intervention in future.

|

| Indicator analysis: Review of the EUR / USD pair for the US session on February 22, 2019 Posted: 22 Feb 2019 06:22 AM PST Trend analysis (Fig. 1). In the American session, the price may continue to move down with the first lower target of 1.1322 on a lower fractal. Fig. 1 (twelve-hour chart). Comprehensive analysis: - indicator analysis - down; - Fibonacci levels - down; - volumes - down; - candlestick analysis - down; - trend analysis - down; - Bollinger lines - down; - weekly schedule - down. General conclusion: In the American session, the price may continue to move down with the first lower target of 1.1322 on a lower fractal. The material has been provided by InstaForex Company - www.instaforex.com |

| Cost of palladium for the first time exceeded $1500 Posted: 22 Feb 2019 06:13 AM PST During the Thursday auction, analysts said that the price of palladium successfully updated the previous record, reaching $1,490.95. Earlier, the cost of the precious metal rose to $1,506.25 on Wednesday. For the first time in the entire history of observations on the dynamics of the price of palladium, its value exceeded $1,500, according to experts of the precious metals market. Moreover, analysts deemed palladium to be surely demonstrating a rise in price for the seventh time in a row considering the results of February 2019. Experts consider the deficit in the global market to be the key driver of the increase in the price of precious metals. According to UBS experts, the demand for palladium exceeds its supply for eight consecutive years and a survey from Citibank shows that the deficit of this precious metal was 600,000 ounces last year. Another important reason for the rise in the price of palladium is the diesel scandal in the United States and Germany, which occurred three years ago. Recall that palladium is mainly used in gasoline engines, and the automotive industry consumes 80% of global demand. In such a situation, the volume of cars sales with gasoline engines began to increase while the diesel engines are in a decline. Restricting the requirements for the level of harmful emissions, which include the exhaust gases of cars, leads to an increase in demand for cars with petrol engines. In this regard, the demand for palladium will persist for a long time, as experts predicted. They do not exclude an increase in the value of precious metals to $1600. Last month on January 17, 2019, palladium exceeded $ 1,400 per ounce, reaching $ 1,439.29 for the first time in its entire history. In December 2018, the cost of precious metals for the first time in 16 years was higher than gold quotes. At that time, palladium reached a record level of $1,236.48 per 1 ounce and the yellow metal traded at around $ 1,235.37 per 1 ounce. The material has been provided by InstaForex Company - www.instaforex.com |

| Intraday technical levels and trading recommendations for EUR/USD for February 22, 2019 Posted: 22 Feb 2019 05:56 AM PST

Since June 2018, the EUR/USD pair has been moving sideways with a slight bearish tendency within the depicted bearish channel (in RED). On November 13, the EUR/USD pair demonstrated recent bullish recovery around 1.1220-1.1250 where the current bullish movement above the depicted short-term bullish channel (In BLUE) was initiated. Bullish fixation above 1.1430 was needed to enhance a further bullish movement towards 1.1520. However, the market has been demonstrating obvious bearish rejection around 1.1430 few times so far. The EUR/USD pair has lost its bullish momentum since January 31 when a bearish engulfing candlestick was demonstrated around 1.1514 where another descending high was established then. On February 5, a bearish daily candlestick closure below 1.1420 terminated the recent bullish recovery. This allowed the current bearish movement to occur towards 1.1300-1.1270 where the lower limit of the depicted DAILY channel came to meet the pair. The EUR/USD pair is demonstrating weak bullish recovery around the depicted price zone (1.1300-1.1270). This may indicate high bearish reversal probability (Note Thursday's bearish hammer daily candlestick). A bearish flag pattern may become confirmed if bearish persistence below 1.1250 is achieved on the daily-chart basis. Pattern target is projected towards 1.1000. Trade Recommendations: A counter-trend BUY entry was already suggested near the price level (1.1285) (the lower limit of the depicted movement channel). T/P level to be located around 1.1350 and 1.1420 while S/L should be advanced to entry level to offset the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| February 22, 2019: GBP/USD Bullish opportunity around the backside of the broken movement channel. Posted: 22 Feb 2019 05:40 AM PST

On December 12, the previously-dominating bearish momentum came to an end when the GBP/USD pair visited the price levels of 1.2500 where the backside of the broken daily uptrend was located. Since then, the current bullish swing has been taking place until January 28 when the GBP/USD pair was almost approaching the supply level of 1.3240 where the recent bearish pullback was initiated. Shortly after, the GBP/USD pair lost its bullish persistence above 1.3155. Hence, the short-term scenario turned bearish towards 1.2920 (38.2% Fibonacci) then 1.2820-1.2800 where (50% Fibonacci level) is roughly located. Last week, lack of bullish demand was demonstrated around 1.2920 until Friday when significant bullish recovery was demonstrated around 1.2800-1.2820 (Fibonacci 50% level) resulting in a Bullish Engulfing daily candlestick. This initiated the current bullish breakout above the depicted H4 bearish channel. Hence, remaining bullish target is projected towards 1.3155, 1.3200 and 1.3240. On the other hand, the GBP/USD currently has a significant demand zone located around (1.2960-1.2925) to be watched for BUY entries. Bullish persistence above 1.2960 (newly-established demand zone) remains mandatory so that the current bullish movement can pursue towards the mentioned bullish targets. On the other hand, any bearish breakdown below 1.2950 invalidates the bullish scenario for the short term. Trade Recommendations : Any bearish pullback towards the depicted H4 demand zone (1.2960-1.2925) should be watched for a valid BUY entry. S/L to be located below 1.2890. T/P levels to be located around 1.3040, 1.3155 and 1.3235. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Feb 2019 05:34 AM PST To open long positions on the GBP / USD pair, you need: There are rumors May was able to make progress in the negotiations on the Brexit with the EU remained rumors. Buyers missed the level of 1.3023 in the morning and now their main task is to return to this range the North American session, which can lead to an upward correction in the middle of the channel at 1.3060 and to update the week highs in the area of 1.3094, where I recommend taking profits. In the case of a further decline in the pound, you can count on support around 1.2984 and 1.2942. To open short positions on the GBP / USD pair, you need: As long as trading is below 1.3023, which I paid attention in my morning review, the pressure on the pound will continue. The main goal is testing the support of 1.2984 with an update of the minimum of 1.2942, where I recommend taking profits. In the case of a return to the resistance level of 1.3023, short positions in the second half of the day are best considered after updating the high of 1.3094. More in the video forecast for February 22 Indicator signals: Moving averages Trade remains of 30- and 50-moving averages, which indicates the lateral nature of the market. However, the advantage is on the side of the pound sellers. Bollinger bands The upper limit of the Bollinger Bands indicator near 1.3055 may limit the upward potential of the pound. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Feb 2019 05:25 AM PST To open long positions on EUR / USD pair, you need: Released in the first half of the day, statistics in Germany and the eurozone did not change the market situation, despite the decline in a number of indicators. Buyers still need breakdown and consolidation above the resistance of 1.1367, which will lead to a larger upward correction already in the area of maximum 1.1394 and 1.1432, where I recommend taking profits. In the event of a EUR/USD decline, long positions can be opened on the condition that a false breakdown is formed in the support area of 1.1324 or on a rebound from a minimum of 1.1279. To open short positions on EURUSD you need: Sellers will count on the formation of a false breakdown in the area of resistance at 1.1367 but you can also see sales, in case the pair fails to get above the middle of the channel in the area of 1.1345. This will lead to a downward correction in the support area of 1.1324, where the bears will count on its breakthrough today and a sale to the area of 1.1279 minimum, where I recommend taking profits. With the option of a further upward correction and a break of 1.1367, the euro can be sold for a rebound from the maximum of 1.1394. More in the video forecast for February 22 Indicator signals: Moving averages Trade remains of 30- and 50-moving averages, which indicates the lateral nature of the market. Bollinger bands Bollinger Bands indicator is very low, which doesn't signal on market entry. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for February 22, 2019 Posted: 22 Feb 2019 05:15 AM PST

BTC is trading at the price of $4.005 and in the trading range between the $4.074 (resistance) and the $3.881 (support). After the upward spike in the background, we found no follow through, which is the big warning for the buyers. The trend is still bullish but with the big potential weakness in the background. Trading recommendation: We are neutral on the BTC but we got 2 potential scenarios. Scenario 1: BTC is going to break the resistance at $4.074 and potentially test $4.196 Scenario 2: BTC is going to break support at $3.881 and potentially test $3.763 The material has been provided by InstaForex Company - www.instaforex.com |

| BITCOIN Analysis for February 22, 2019 Posted: 22 Feb 2019 04:49 AM PST Bitcoin has been consolidating at the edge of $4,000. The price is currently trading higher, aiming to break above $4,000. The price is being carried by the dynamic levels like 20 EMA, Tenkan, Kijun, and Kumo Cloud as support that is indicating further bullish momentum in the coming days. MACD is showing no evidence of bearish divergence that showcases the reliability and sustainability of the upcoming bullish pressure. The price recently also broke above the trend line diagonal resistance while Chikou Span also broke above the price line resistance. As the price remains above $3,900, being held by the dynamic levels and trend line as support, the probability of breaking above the $4,000 area will be quite high. Thus, the price might climb much higher towards $4,250 and later towards $4,500. SUPPORT: 3,500, 3,600, 3,900 RESISTANCE: 4,000, 4,250, 4,500 BIAS: BULLISH MOMENTUM: VOLATILE

|

| GBP/USD analysis for February 22, 2019 Posted: 22 Feb 2019 04:48 AM PST

The GBP/USD has been trading downwards. The price tested the level of 1.2992. According to the Daily time frame, we found the downside breakout of the 2-day balance, which is a sign of the weakness and developing of a potential trend day. The level of 1.3105 remains to be the key short-term resistance. We expect GBP to test lows at 1.2895 and 1.2785. Trading recommendation: We are short on the GBP/USD pair from 1.2995, and the protective stop is at 1.3105. Downward targets are set at the price of 1.2895 and 1.2785. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for February 22, 2019 Posted: 22 Feb 2019 04:19 AM PST

Gold has been trading downwards as we expected and the price tested the level of $1.322.00. Our first downward target at the price of $1.325.00 has been reached. We also found that the support at $1.325.00, which is a sign that Gold may test the next support at $1.302.25. As long as the resistance at the price of $1.345.00 is holding, the momentum is bearish. Trading recommendation: We are short from $1.332.00 with protective stop at $1.345.00. Our downward target is set at the price of $1.302.00. The material has been provided by InstaForex Company - www.instaforex.com |

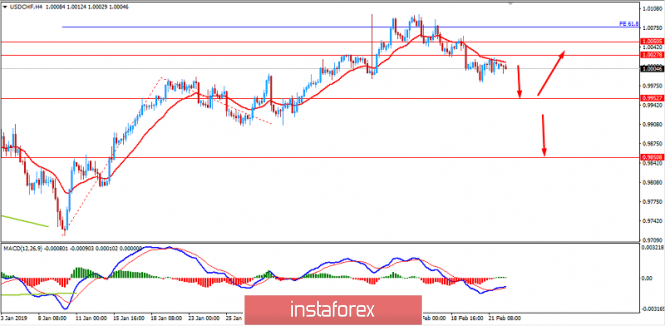

| Fundamental Analysis of USD/CHF for February 22, 2019 Posted: 22 Feb 2019 04:03 AM PST CHF has been holding the upper hand over USD recently after positive economic reports from Switzerland which managed to attract market sentiment. Recently Switzerland's Trade Balance report was published with an increase to 3.04B from the previous figure of 1.96B which was expected to be at 2.24B. Thanks to a larger trade proficit, CHF reinforced momentum against USD while it is struggling with worse economic reports and attracting criticism for Balance Sheet shift. Credit Suisse Economic Expectations report is due next week, which has been ranging between -44.0 and -14.3 area, any positive reading is expected to enhance CHF gains in the coming days. Recently the US FED unveiled a shift in stance on the balance sheet that aroused criticism from some media sources. The Federal Reserve is currently thinking of stopping the unwind of $4 trillion balance sheet later this year that is strongly disliked by market watchers as they think it will be a terrible mistake. According to the FED, balance sheet reduction is going on for a year and it has not made a significant impact on the economy and financial markets yet, though the economy is expected to benefit from normalization of the balance sheet. Additionally, JP Morgan recently downgraded US Q1 GDP growth outlook to 1.5% from the previous forecast of 1.75%. There are several reasons, but the dongraded forecast is clearly leading the market to indecision and volatility. Recently US Core Durable Goods Orders report was published with a minor increase to 0.1% from the previous value of -0.4% but it failed to meet the expected value of 0.3% and Philly FED Manufacturing Index was published with a decrease to -4.1 from the previous figure of 17.0 which was expected to be at 14.1. Another market moving event today is FED's Monetary Policy report. Besides, FOMC Members Williams and Clarida are due to speak later in the global trading day. These events are likely to inject volatility in the market. Meanwhile, USD is extending weakness on the back of downbeat economic data and bearsih market sentiment. Thus, CHF is taking advantage of USD weakness to assert its strength. Now let us look at the technical view. The price is currently trading below 1.0025 to 1.0050 resistance area while also being held by the dynamic level of 20 EMA as resistance. As the price continues to trade below 1.0050 with a daily close, further bearish pressure with a target towards 0.9950 and later towards 0.9850 is expected in the future.

|

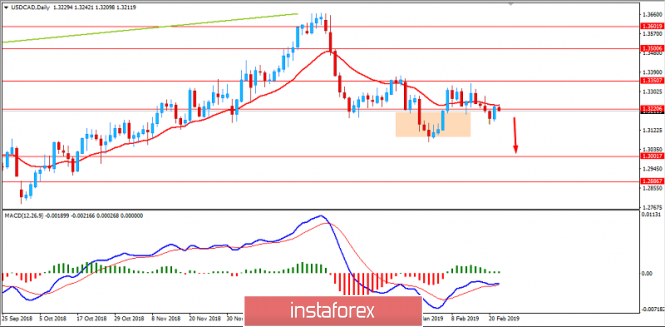

| Fundamental Analysis of USD/CAD for February 22, 2019 Posted: 22 Feb 2019 03:25 AM PST USD is now losing steam amid downbeat economic reports. CAD is asserting strength in light of the latest events. The pair is likely to trade with higher volatility where USD has a greater chance to win favor with investors. Recently the US FED unveiled a shift in stance on the balance sheet that aroused criticism from some media sources. The Federal Reserve is currently thinking of stopping the unwind of $4 trillion balance sheet later this year that is strongly disliked by market watchers as they think it will be a terrible mistake. According to the FED, balance sheet reduction is going on for a year and it has not made a significant impact on the economy and financial markets yet, though the economy is expected to benefit from normalization of the balance sheet. Additionally, JP Morgan recently downgraded US Q1 GDP growth outlook to 1.5% from the previous forecast of 1.75%. There are several reasons, but the dongraded forecast is clearly leading the market to indecision and volatility. Recently US Core Durable Goods Orders report was published with a minor increase to 0.1% from the previous value of -0.4% but it failed to meet the expected value of 0.3% and Philly FED Manufacturing Index was published with a decrease to -4.1 from the previous figure of 17.0 which was expected to be at 14.1. Another market moving event today is FED's Monetary Policy report. Besides, FOMC Members Williams and Clarida are due to speak later in the global trading day. These events are likely to inject volatility in the market. On the other hand, recently Bank of Canada's Governor Stephen Poloz spoke with a dovish tone which affected the market sentiment. Earlier, CAD was gaining favor with investors. Poloz signaled there is no rush to increase the interest rate like in the US. However, the regulator is sure to tighten monetary policy if the situation requires a rate hike. The Bank of Canada believes that they are at the peak of a tightening cycle and the ongoing economic slowdown is temporary. Recently Canada's ADP Non-Farm Employment Change report was published with an increase to 35.4k from the previous negative figure of -20.9k and Wholesale Sales also showed an increase to 0.3% from the previous value of -1.1% which was expected to be at -0.2%. Today Canada's Core Retail Sales report is going to be published which is expected to increase marginally to -0.5% from the previous value of -0.6% and Retail Sales is expected to increase to 0.0% from the previous value of -0.9%. Meanwhile, CAD finds support from optimistic expectations of the upcoming economic reports. The pair is expected to continue trading under of the bearish pressure in the coming days. Now let us look at the technical view. The price is currently being held by the dynamic level of 20 EMA as resistance after an impulsive Engulfing bullish pressure with a daily close yesterday. As of the preceding trend i.e. bearish, the price is expected to push lower with an impulsive pressure if a daily close below 1.3200 is observed in the coming days. As the price remains below 1.3350 area with a daily close, the bearish bias is expected to continue in this pair.

|

| USD / JPY: Yen ignored inflation and looking forward to the meeting of Trump and Liu He Posted: 22 Feb 2019 03:23 AM PST The dynamics of Japanese inflation did not please traders again. In January, the consumer price index came out at around 0.2%, continuing the negative downward trend. The index has consistently slowed down since the autumn of last year when the oil market collapsed to its minimum value. Japanese inflation does not repeat their trajectory although the quotations of "black gold" have been steadily growing steadily since January. The Bank of Japan is forced to respond to this state of affairs, however so far only verbally. Moreover, the head of the Central Bank Haruhiko Kuroda warned of a possible easing of the parameters of monetary policy, "if it is necessary to achieve the goal." Low growth rates of inflation rates are due to several factors. First of all, there is a weak dynamics of wage growth. A few years ago, Haruhiko Kuroda tried to give impetus to inflation growth in a rather original way. He met with the country's largest employers with a request to raise salaries for his employees but the method turned out to be ineffective. Although, there were still some shifts for the better. Inflation began to grow only amid the growth of the oil market last year. However, this year, the indicators no longer show a correlation at least the January inflation indicators showed a downward trend. Despite this state of affairs, the dollar/yen pair demonstrated a minimal response. In the second week, the price already fluctuates within 110-111 that is consistently starting from the boundaries of the specified range. By and large, a USD/JPY pair is currently focused only on American events and on the external fundamental background. Americans can't be surprised at anything: the Fed continues to think about the future of monetary policy, while the market has already laid a multi-month pause in current prices on the issue of a rate increase. This forces the USD/JPY traders to turn to external factors. One should not forget that the yen is the safe-haven currency. By the way, this factor explains the slight weakening of the Japanese currency in recent days, investor interest in defensive instruments has faded amid progress in trade negotiations between Beijing and Washington. Let me remind you that this week another round of negotiations took place, and according to insider information, the likelihood of concluding a "big deal" is higher than ever. True, this may take more time. The parties simply do not have time before March 1 to agree on all the nuances of a voluminous document. According to the information of American journalists, the participants of the working group are now working on six memorandums in which structural issues will be identified. We are talking about intellectual property rights, agriculture, monetary policy, and cyberspace. These protocols of intent will form the basis of a future transaction and the key details of which will be discussed by the leaders of the PRC and the United States in a personal meeting. This meeting can take place in the Vietnamese city of Da Nangfrom February 27 to 28. But today, Donald Trump will also hold an important meeting. The outcome of which will affect the mood of the markets. The American president will meet with the head of the Chinese delegation, Liu He, who is the Vice Premier of the State Council of the People's Republic of China. It is worth noting that China is taking obvious steps toward Washington. Yesterday, the press reported that Beijing allegedly agreed to increase the purchase of American agricultural products, soybeans, corn, and wheat by $30 billion. As a result, these volumes will exceed even those figures that were before the start of the trade war. On the one hand, this is a good sign for those who are awaiting a deal. But on the other hand, China can still be principled in issues that are more sensitive to Beijing, in particular, regarding the regulation of the yuan. Therefore, alertness in the markets remains and the growth of the euro/dollar pair is uncertain. Hence, for this reason, today's meeting of Trump and Liu He is so important. Its results will make it possible to understand whether numerous rumors about the achievement of key agreements between countries correspond to reality or the "shadow of a trade war" still hovers on the financial world. It is worth noting that the parties are unlikely to announce a deal. With a positive outcome of the negotiations, Trump is likely to postpone the increase in duties on imports of goods from China for another two months in order for Washington and China to finally agree on all the points of the "big deal" and finally stop the trade war. If these forecasts are justified, the USD/JPY pair will be able to test the 111th figure again with the subsequent assault on the nearest resistance level of 111.40 on the top line of the Bollinger Bands indicator on the daily chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Review of the foreign exchange market on 02.22.2019 Posted: 22 Feb 2019 02:11 AM PST In yesterday's result, the dollar remained virtually unchanged, although during the course of trading, it pretty much left from side to side. This is largely due to statistics coming out. Thus, the preliminary data on business activity indexes in Europe showed that the manufacturing index fell from 50.5 to 49.2, which is extremely bad since a decline in this indicator below 50 points indicates a stagnation of the industry. But at the same time, the business activity index in the service sector increased from 51.2 to 52.3, which led to an increase in the composite index from 51.0 to 51.4. In general, the data came out slightly better than expected. If you look at individual countries in the euro area, for example in Germany, the index of business activity in the services sector rose from 53.0 to 55.1 while the industrial index fell from 49.7 to 47.6, which indicates a deepening recession in European industry. Nevertheless, due to the growth of the index in the service sector, the composite index of business activity in Germany grew from 52.1 to 52.7. In France, the picture is slightly better in terms of dynamics, since all indices showed an increase. Indeed, both the service sector index and the composite index remain below 50 points, which clearly indicates the extremely weak state of the second eurozone economy. In particular, the business activity index in the service sector rose from 47.8 to 49.8, and the composite index from 48.2 to 49.9. However, the production index rose from 51.2 to 51.4. In addition to business activity indices, inflation data were published in the euro area countries, which showed that in Germany, it fell from 1.6% to 1.4%, in France from 1.6% to 1.2%, and in Italy from 1.1% to 0.9%. The American statistics was also not so unambiguous. Initially, there were data on applications for unemployment benefits, wherein the total number decreased by 78 thousand. In particular, the number of initial applications decreased by 23 thousand and repeated ones by another 55 thousand. Also, the number of orders for durable goods increased by 1.2% but they predicted a growth of 1.5%. This became a warning bell that the rest of the data will come out somewhat differently as expected. This was confirmed by the publication of preliminary data on business activity indices, which showed an increase from 54.2 to 56.2 in the services sector but the industrial index fell from 54.9 to 53.7. Of course, the composite index increased from 54.4 to 55.8 but a reduction in the production index is somewhat alarming. But what is more important is the decline in housing sales by 1.2% in the secondary market where sales are falling for the second month in a row. Thus, neither European nor American statistics could give an unequivocal answer to the question of what to buy. Today, the final data on German GDP has come out, confirming the fact of economic growth slowdown from 1.1% to 0.9%, which casts doubt on the growth prospects of the whole of Europe with the slowdown of the largest economy. Also today, the final data on inflation in the euro area will be published, which should confirm its decline from 1.6% to 1.4%. The very fact of a decline clearly indicates that the European Central Bank will not even think about raising the refinancing rate, at least until the end of this year. Thus, since the data are published only in Europe and the forecasts for them are rather negative, it is worth waiting for the dollar to strengthen. Consequently, it is most likely that the single European currency will drop to 1.1325. The pound will follow the single European currency, which has to decline to 1.3000. |

| Posted: 22 Feb 2019 02:09 AM PST 4 hour timeframe Technical details: Older linear regression channel: direction - up. Younger linear regression channel: direction - down. Moving average (20; smoothed) - up. CCI: 47.5003 The GBP / USD currency pair continues to trade between levels 1.3031 and 1.3092 on Friday, February 22. There are no important macroeconomic reports to date that have been scheduled either in the UK or in the USA. In the meantime, it received information once again that London and Brussels almost agreed on all points of the Brexit agreement, including on the backstop. To judge how this information is true, it is very difficult. We recommend waiting for official confirmations. If this is true then the British Parliament is obliged to accept the agreement with Brexit, since now the wishes of politicians should have been taken into account. If the vote is rescheduled or the parliament blocks this deal, then it is possible to understand the fact that parties still failed to reach an agreement or these agreements are not much different from the previous ones, which the parliament refused to accept. Interesting information was also received from the parliament itself. About 100 conservatives are going to oppose the Theresa May government in order to force her to postpone the Brexit date in order to avoid an unorganized "divorce". But rather, such an action will be carried out with the aim of not allowing Theresa May to blackmail the parliament on a "deal" that can go as close as possible to March 29. Moreover, it puts the parliament before a tough choice of either Theresa May's option or the absence of any deals. Nearest support levels: S1 - 1.3031 S2 - 1.3000 S3 - 1.2970 Nearest resistance levels: R1 - 1.3062 R2 - 1.3092 R3 - 1.3123 Trading recommendations: The GBP / USD pair has launched a new round of downward correction. Thus, it is now recommended to wait for the completion of this correction if it does not grow into a downward movement and open new longs with a target of 1.3092. Short trades will again become relevant after the price fixes back below the moving average line. In this case, the target levels will be 1.2909 and 1.2878. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The senior linear regression channel is the blue lines of unidirectional movement. The junior linear channel is the purple lines of unidirectional movement. CCI is a blue line in the indicator regression window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBPUSD currency pair - prospects for further movement Posted: 22 Feb 2019 12:34 AM PST Over the past trading day, the currency pair Pound / Dollar showed an extremely low volatility of 68 points, as a result of having a clear horizontal movement. From the point of view of technical analysis, we have a clear accumulation of 1.3020 / 1.3000, after the quote reached the value of 1.3000. This kind of slowdown has pulled traders to the fence ***, but at the same time, gives them attractive future positions. Meanwhile, the news and news background had quite diverse statistics on Europe, the States, and Britain, which reflects the current stagnation on the graph. In turn, statements by Jean-Claude Juncker regarding a recent meeting with the British Prime Minister appeared in the informational background. Juncker didn't rule out that the "hard Brexit" would eventually happen, and assessed the situation in more sombre tones. The upcoming trading week in terms of the economic calendar begins with a lull. The upcoming trading week in terms of the economic calendar begins with a lull. But, we have a large body of statistics from the United States since Tuesday. Listed below are the selected most significant events. Additionally, do not forget about the background information, which spontaneously takes off on the market. Tuesday United States 16:30 MSK - Number of building permits issued (December): Prev. 1,322M ---> Forecast of 1,280M United States 16:30 MSK - Prev. 1,322M ---> Forecast of 1,280M United States 18:00 MSK - Speech by Fed Chairman Powell Wednesday United States 16:15 MSK - Change in the number of people employed in the non-farm sector from ADP (Feb.): Prev. 213K United States 16:30 MSK - Basic orders for durable goods (m / m) (Feb): Prev. -0.4% ---> Forecast 0.3% United States 18:00 MSK - The Index of Pending Sales (m / m) (January) Thursday United Kingdom 10:00 MSK. - Nationwide house price index (y / y) (Feb) United States 16:30 MSK - GDP (q / q) (Q4): Prev. 3.4% ---> Forecast 2.4% Friday United Kingdom 12:30 MSK - Manufacturing Business Index (PMI) (Feb): Prev. 52,8 United Kingdom 12:30 MSK - M4 monetary unit (m / m) (Jan): Prev. 0.4% United States 18:00 MSK - Manufacturing PMI from ISM (Feb): Prev. 56.6 ---> Forecast 56.2 These are preliminary and subject to change. Further development Analyzing the current trading chart, we see price fluctuations inside the 1.3020 / 1.3100 cluster, which is developing at the current time at the lower limit. It is likely to assume that this kind of stagnation will lead to a subsequent impulse move, and many traders are focused on it, being on the fence ** now. With this logic, traders are now carefully analyzing the boundaries of the cluster on the subject of breakdown and regard possible pending orders. Based on the available data, it is possible to expand a number of variations. Let's consider them: - We consider buying positions in the case of price fixing higher than 1.3115, with the prospect of a move to 1.3200. - We consider selling positions in the case of price fixing lower than 1.3000, with a prospect of 1.2950 (the first point). Indicator Analysis Analyzing a different sector of timeframes (TF ), we see that there was a downward interest in the short term. But due to the fact that the price is still in the bump phase, the indicators of indicators for smaller TF change. However, intraday and mid-term prospects both retain an upward interest against the background of the market. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year. (February 22 was based on the time of publication of the article) The current time volatility is 23 points. In the event of a breakthrough of a particular cluster boundary, we will see a sharp surge in volatility. Key levels Zones of resistance: 1,3200 *; 1.3300; 1.3440 **; 1.3580 *; 1.3700 Support areas: 1.3000 ** (1.3000 / 1.3050); 1.2920 *; 1.2770 (1.2720 / 1.2770) **; 1.2620; 1.2500 *; 1.2350 **. * Periodic level ** Range Level *** We are out of the market The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: Traders paused before the publication of the next series of important fundamental statistics Posted: 22 Feb 2019 12:18 AM PST The dollar paired with the euro, remained traded in the side channel. The British pound, after the publication of versatile statistics on the American economy, indicates a decline in economic growth at the end of last year and the beginning of this year. According to the US Department of Commerce, the demand for durable goods in the US increased in December, but turned out to be worse than economists' forecasts. The fact that the investments of companies have declined over the above period is also a bad news. Thus, orders for durable goods in December 2019 increased by 1.2%, while economists had forecast growth of 1.5%. Excluding the transportation orders that fall into the volatile category, orders, rose only by 0.1% in December. Compared to the same period in 2018, total orders for durable goods increased by 8.1%. Labor market data did not help the US dollar. According to a report by the US Department of Labor, the number of initial claims for unemployment benefits fell by 23,000 in the week from February 10 to February 16. Economists had expected that the number of initial claims would be 227,000. But a weak report on housing sales in the secondary market of the United States has limited the upward potential of the US dollar, which was observed yesterday afternoon. This indicates that the demand for homes continues to decline in the United States at the beginning of this year again. According to the National Association of Realtors USA , sales in the secondary housing market in January fell by 1.2% and amounted to 4.94 million homes per year. Economists had expected sales in January to grow by 0.6%, to 5.02 million homes. Compared with the same period of the previous year, sales in January fell by 8.5%. The US business trend index declined in January. According to the report of the Conference Board, the leading indicators index in January 2019 decreased by 0.1% and amounted to 111.3 points. The data completely coincided with the forecast of economists. This suggests that, most likely, a slowdown in US GDP growth will continue. The traders did not like the report on the decline in manufacturing activity in the US in February of this year. It happened against the background of weak demand, which leveled the growth of expenses of companies and consumers. According to the IHS Market, PMI Purchasing Managers Index for the US manufacturing sector fell to 53.7 points in February against 54.9 points in January. But the service sector, on the contrary, showed an increase to 56.2 points against 54.2 points. Let me remind you that the index values above 50 indicate an increase in activity. As for the technical picture of the EURUSD pair, it is still difficult to determine its further direction. Despite this, the market remains on the side of buyers of risky assets. And as long as trading continues above the support range of 1.1320, we can expect a recovery of the trading instrument to the area of this week's maximum of 1.1370. In case of pressure on the euro and a break of the lower border of the side channel in the area of 1.1320, The sellers target will be a large level in the area of 1.1280, where new buyers of risky assets will also declare themselves. Today, a number of important fundamental statistics for Germany and the euro zone came, which may affect the future direction of the European currency. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Feb 2019 11:56 PM PST Wave counting analysis: On February 21, the GBP / USD pair lost about 10 bp. Thus, the other remaining are near the maximums of the assumed wave 2. If the current wave marking is correct, then wave 2 has completed its construction, which means that the instrument is preparing to build a new downward wave in the composition downtrend trend. To prevent the execution of this option, there should be positive news for the pound. Yesterday, the media spread the information that the EU and the UK are very close to the new agreement, which should satisfy the parliament. If this information is correct, then it should be accepted at the next vote on the agreement on withdrawal from the EU. And that is, in turn, will be good news for the pound. Shopping goals: 1.3109 - 76.4% Fibonacci Sales targets: 1.2734 - 61.8% Fibonacci 1.2619 - 76.4% Fibonacci General conclusions and trading recommendations: The wave pattern still assumes the construction of a new downward wave. Thus, now, I recommend selling the pair with targets located near the estimated levels of 1.2826 and 1.2734, which equates to 50.0% and 61.8% Fibonacci. A successful attempt to break through the level of 76.4% on the small Fibonacci grid will induce the conclusion of the complication of the current wave pattern. This option is possible, if the pound suddenly gets the necessary news background for growth. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Feb 2019 11:51 PM PST 4 hour timeframe Technical details: Older linear regression channel: direction - sideways. Younger linear regression channel: direction - down. Moving average (20; smoothed) - sideways. CCI: 47.7332 The EUR / USD currency pair cannot really overcome the Murray level of "2/8" at 1.1353, but it is was not able to go below the moving average line. On the last trading day of the week, the publication of the consumer price index in the eurozone in January is scheduled to be released. According to forecasts, this figure will be 1.4% y/y. Any value below the forecast can cause serious pressure on the euro currency since, at the moment, inflation is already well below the target value of the ECB of 2%. Also, today will be the speech of the ECB President Mario Draghi. It is not yet known whether the topics of interest to the market such as Brexit will affect the monetary policy, however, such an event cannot be overlooked. From a technical point of view, we are forced to state a kind of flat formed in recent days. Fixing the pair above the Murray level of "2/8" does not allow the bulls to continue to grow but traders cannot get a foothold below the MA. Thus, market participants need a tangible impetus that will lead them out of a stupor. Perhaps, the inflation report will be just such a push. However, the chances of continuing to strengthen the euro currency are now little and the pair will not decline below 1.1230 either. Therefore, the instrument may continue to trade between these areas for some time. Nearest support levels: S1 - 1.1292 S2 - 1.1230 S3 - 1.1169 Nearest resistance levels: R1 - 1.1353 R2 - 1.1414 R3 - 1.1475 Trading recommendations: The EUR / USD currency pair has adjusted. Therefore, it is recommended to open long positions after the Heiken-Ashi indicator turns up with the target of 1.1414. The probability of the pair returning to the area below the MA has increased in recent days. Short positions are recommended to open after the price fixes back below the moving average line. In this case, the trend in the instrument will change to downward with the first goal at the level of 1.1292. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The blue line of the unidirectional movement. Unidirectional movement. CCI - blue line in the indicator window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Wave analysis of EUR / USD for February 22. The pair is still preparing to build a downward wave Posted: 21 Feb 2019 11:42 PM PST Wave counting analysis: On Thursday, February 21, the trading ended for the currency pair EUR / USD without any exchange rate changes. Thus, the wave picture of the instrument has not changed. Still, the estimated wave 4 can be completed. At least, this opinion will be maintained until the pair makes a successful attempt to break through the 23.6% Fibonacci level. In this case, wave 4 can continue its construction with targets located near the 61.8% level on the small Fibonacci grid. Otherwise, the pair will have to proceed to the construction of a new downward wave in the near future. Today I draw the attention of traders to an important report on inflation in the eurozone. Sales targets: 1.1228 - 0.0% Fibonacci 1.1215 - 0.0% Fibonacci Shopping goals: 1.1356 - 23.6% Fibonacci 1.1408 - 61.8% Fibonacci General conclusions and trading recommendations: The pair is supposedly nearing completion of wave 4 construction. Thus, if the level of 23.6% holds, then I recommend selling the pair to build wave 5 of the downtrend trend with targets located near the estimated levels of 1.1228 and 1.1215. If the report on inflation in the EU turns out to be weak, then the instrument will be able to proceed to the construction of a downward wave today. The material has been provided by InstaForex Company - www.instaforex.com |

| The euro and the pound in anticipation for guidance Posted: 21 Feb 2019 11:37 PM PST Orders for durable goods in the US rose by 1.2% in December, it is slightly worse than expected, but better than the growth of 1.0% a month earlier, the data generally supported a positive view of the growth of the real sector. A deeper look at the report shows the situation from a slightly different angle - it is noted that the demand for goods for industrial purposes is slowing down, that is, business is investing less and less in the expansion or modernization of production, despite tax cuts. The index of business activity in the manufacturing sector in Philadelphia has dropped sharply from +17 p to -4.1 p, dropping below zero for the first time in May 2016, the slowdown is observed in all components of the index – new orders and shipments to manufacturing prices. Nevertheless, surprisingly, companies, firstly, are quite optimistic about growth prospects in the next 6 months, and secondly, an increase in payroll. Companies also expect their own sales to grow faster than inflation. This gap between reality and hopes for a bright future is a characteristic feature of many assessments of the current state of the US economy. The head of the Federal Reserve Bank of St. Louis James Bullard said on Thursday that, despite the slowdown in the economy, he does not feel any concern about this and does not see any signs of approaching recession. In general, the Fed is dominated by a moderate position, according to which the current rate level is close to neutral and does not have any stimulating or cooling effect on the US economy. Be that as it may, the dollar at the current stage has no substantial domestic support, which has been observed over the past three years, as the cycle of growth rates has clearly exhausted itself, the economic growth in 4Q is expected at the level of 1.4%, which is obviously not enough for optimism, and the rejuvenating injection from China is delayed – China is not ready to sacrifice national interests to support the aging American economy. EURUSD Business activity in the eurozone is trying to regain its position, but so far without much success. The PMI Markit index in the service sector rises from 51.2 p to 52.3 p in February, the composite index from 51 p to 51.4 p, while in the manufacturing sector the index fell below 50 p, showing 49.2 p, indicating a decrease in production. The situation in Germany is even more significant. If the composite index and the service sector index increased, setting 4 and 5-month highs, production fell from 49.7p to 47.6p, this is the 74-month low. Export orders declined to the greatest extent, reaching a low of 6.5 years, and manufacturers are pessimistic about possible improvements in the 12-month term. We should also note a weak increase in production prices, which showed more than a two-year low. German companies have pointed to a decline in orders in the automotive sector, a drop in demand in Asia, especially in China, due to ongoing trading tensions. The prospect of drawing Europe into a trade war through car tariffs shows that the problems facing the German economy will not be limited to the automotive sector. The size of the fall in the manufacturing sector of the eurozone may lead to the fact that economic growth will not go beyond 1% in 2019, and the ECB at the March meeting will have to start discussing new incentives. For several months, market participants have been waiting for information about the start of new liquidity transactions, but until recently the ECB has been able to evade the announcement of new incentives. Today, the CESifo Institute will present its assessment of business activity in the eurozone, and data on consumer inflation in January will be published. In the late afternoon, Mario Draghi is expected to give a speech. Today, the euro is trading neutral, a move beyond the 1.1320/70 range is unlikely. GBPUSD The pound, in the absence of macroeconomic guidance, has lost direction and is trading in a narrow range. Yesterday, European Commission President Jean-Claude Juncker said that he "aims to avoid the worst scenario," but looks at the course of negotiations with London without optimism. The pound is locked in the range of 1.3010/3110, there is no direction, a bit more likely to drift to the lower limit of the range. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Feb 2019 11:30 PM PST To open long positions on GBP/USD you need: It is best to return to buying the pound with a correction from larger support levels around 1.2984 and 1.2916. However, in the first half of the day you can also count on the formation of a false breakdown in the area of 1.3023. Only in this case would we be able to expect a re-wave of growth in the GBP/USD with a consolidation above the resistance of 1.3058, which will strengthen the upward impulse and return the pair to the highs of 1.3094 and 1.3152, where I recommend taking profits. To open short positions on GBP/USD you need: Sellers need to consolidate below the support level of 1.3023 or form a false breakdown in the area of resistance at 1.3058, which will raise the pressure on the pair and lead to a larger wave of selling, with a low of 1.2984 and 1.2942, where I recommend to take profits. However, the main task of sellers at the end of the week will be to update support at 1.2903. In the event of further growth in the trend, you can open short positions from a high of 1.3094 or to a rebound from 1.3152. Indicator signals: Moving averages Trade is conducted in the area of 30-day and 50-day moving, which indicates the lateral nature of the market. Bollinger bands Today, the pound's growth may limit the upper limit of the Bollinger Bands indicator around 1.3075. A break of the lower border of the indicator around 1.3012 will lead to the pound's sharper decline. Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment