Forex analysis review |

- EUR./USD analysis for March 15, 2019

- March 15, 2019: EUR.USD approaching the upper limit of its trend channel

- BITCOIN Analysis for March 15, 2019

- March 15, 2019. GBP/USD: High probability of intraday bullish pattern

- Technical analysis of NZD/USD for March 15, 2019

- Technical analysis of AUD/USD for March 15, 2019

- Analysis of EUR / USD divergence for March 15. Chart signals further growth

- Analysis of GBP/USD divergence for March 15: pair is stuck in narrow price range

- Technical analysis for EUR/USD for March 15, 2019

- Trading Plan for 03/15/2019

- Burning Forecast 03/15/2019

- USD struggles amid volatility reduction

- Technical analysis for Gold for March 15, 2019

- Technical Analysis of EUR/USD for 15/03/2019

- Technical Analysis of GBP/USD for 15/03/2019

- Ethereum Elliott Wave analysis for 15/03/2019

- Bitcoin Elliott Wave analysis for 15/03/2019

- Elliott wave analysis of GBP/JPY for March 15, 2019

- Fundamental Analysis of GBP/JPY for March 15, 2019

- Elliott wave analysis of EUR/JPY for March 15, 2019

- Trading plan for EUR/USD for March 15, 2019

- Fundamental Analysis of USD/CHF for March 15, 2019

- Technical analysis: Intraday Level For EUR/USD, Mar 15, 2019

- Technical analysis: Intraday level for USD/JPY, Mar 15, 2019

- USD/CAD approaching support, potential bounce!

| EUR./USD analysis for March 15, 2019 Posted: 15 Mar 2019 09:53 AM PDT EUR/USD has been trading sideways at 1.1315, and we found the fake breakout of the resistance at 1.1337, which was a sign of weakness.

According to the H4 timeframe, we found the fake breakout of the resistance at 1.1337 and the bearish divergence on the Stochastic oscillator, which was a sign of the potential weakness. Also, there is the breakout of the upward trendline on the background, which is another sign of weakness. The key resistance is seen at 1.1337 and the key support - at 1.1180. The level of 1.1293 is the first short- term support. Trading recommendation: we are to short EUR from 1.1315 with the stop at 1.1370 and target at 1.1180. The material has been provided by InstaForex Company - www.instaforex.com |

| March 15, 2019: EUR.USD approaching the upper limit of its trend channel Posted: 15 Mar 2019 08:46 AM PDT

On January 10th, the market initiated the depicted bearish channel around 1.1570. The bearish channel's upper limit managed to push price towards 1.1290 then 1.1235 before the EUR/USD pair could come again to meet the channel's upper limit around 1.1420. Bullish fixation above 1.1430 was needed to enhance a further bullish movement towards 1.1520. However, the market has been demonstrated obvious bearish rejection around 1.1430 That's why, the recent bearish movement was demonstrated towards 1.1175 (channel's lower limit) where significant bullish recovery was demonstrated on March 7th. Bullish persistence above 1.1270 (Fibonacci 38.2%) enhanced a further bullish advance towards 1.1290-1.1315 (the depicted supply zone) where lack of significant bearish pressure was demonstrated. Earlier this week, previous negative fundamental data from US could push the EUR/USD pair for a temporary bullish breakout above 1.1315 which was followed by a period of indecision/hesitation. Today, another bullish breakout attempt is being executed above 1.1327 (61.8% Fibonacci level). This probably enhance further bullish movement towards 1.1370 and 1.1390 where the upper limit of the depicted movement channel is located. On the other hand, a bearish breakout below the price level of 1.1270 (38.2% Fibonacci) will probably liberate a quick retracement towards 1.1160 again where the lower limit of the movement channel can be tested again. The material has been provided by InstaForex Company - www.instaforex.com |

| BITCOIN Analysis for March 15, 2019 Posted: 15 Mar 2019 08:24 AM PDT Bitcoin has been quite indecisive at the edge of $3,880 for a few days in a row. The price sustained the bullish momentum. The price was trapped in a range between $3,800 and $4,000 for a while. Now it is expected to rebound with a higher target in the coming days. Fundamentally, there is not much going on the Bitcoin side but technical aspects show indecision and low liquidity in the market. During the range-bound correction, the price has been carried by the dynamic level of 20 EMA after the impulsive fall off the $4,200 in February. Currently the price has come under the bullish pressure with a target towards $4,000. If broken above with a daily close, we expect further bullish momentum with a target towards $4,250 and later towards $4,500. As the price remains above $3,500-600 with a daily close, BTC will maintain strong bullish bias. SUPPORT: 3,500-600, 3,800-80 RESISTANCE: 4,000, 4,250, 4,500 BIAS: BULLISH MOMENTUM: VOLATILE

|

| March 15, 2019. GBP/USD: High probability of intraday bullish pattern Posted: 15 Mar 2019 07:01 AM PDT

On January 2nd, the market initiated the depicted uptrend line around 1.2380. This uptrend line managed to push the price towards 1.3200 before the GBP/USD pair came to meet the uptrend again around 1.2775 on February 14. Another bullish wave was demonstrated towards 1.3350 before the current bearish pullback was demonstrated towards the uptrend again. A weekly gap pushed the pair slightly below the trend line (almost reaching 1.2960). However, significant bullish recovery was demonstrated on Monday rendering the mentioned bearish gap as a false bearish breakout. Moreover, a short-term bearish channel was broken to the upside following the mentioned bullish recovery on Monday rendering the current outlook for the pair as bullish. As expected, bullish persistence above 1.3060 allowed the GBPUSD pair to keep the bullish momentum towards 1.3130, then 1.3200. For the current bullish outlook to remain valid, bullish persistence above 1.3200 ( 61.8% Fibonacci expansion level ) is mandatory. Otherwise, the current bullish scenario would be invalidated. Moreover, bullish persistence above 1.3250 (78.6% Fibonacci expansion level) and 1.3320 (100% Fibonacci expansion level) is needed to pursue towards 1.3550-1.3580 (Bullish flag projection target). On the other hand, a bearish breakout below 1.3200 (61.8%Fibonacci Exp. level) invalidates this bullish setup rendering the short-term bearish outlook towards 1.3070-1.3050 where the depicted uptrend line comes to meet the GBP/USD pair. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of NZD/USD for March 15, 2019 Posted: 15 Mar 2019 04:28 AM PDT The pair is still trading around the daily pivot point of 0.6882. The NZD/USD pair breached resistance which had turned into strong support at the level of 0.6705 this week. The level of 0.6705 coincides with a golden ratio, which is expected to act as major support today. The RSI is considered to be overbought, because it is above 70. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). Besides, note that the pivot point is seen at the point of 0.6882. This suggests that the pair will probably go up in the coming hours. Accordingly, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended to be placed above 0.6800 with the first target at the level of 0.6882. From this point, the pair is likely to begin an ascending movement to the point of 0.6882 and further to the level of 0.6984. The level of 0.6984 will act as strong resistance. On the other hand, if there is a breakout at the support level of 0.6705, this scenario may become invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

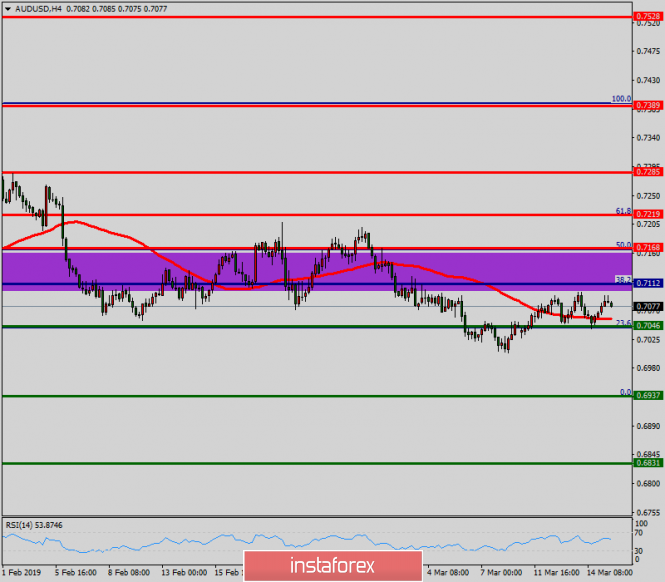

| Technical analysis of AUD/USD for March 15, 2019 Posted: 15 Mar 2019 04:22 AM PDT The AUD/USD pair is set above strong support at the level of 0.7046 which coincides with the 23.6% Fibonacci retracement level and 0.7168. This support has been rejected four times confirming the uptrend. Hence, the major support is seen at the level of 0.7046, because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend in the area of 0.7046 and 0.7168. The AUD/USD pair is trading in the bullish trend from the last support line of 0.7112 towards the first resistance level of 0.7168 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 0.7168 and further to the level of 0.7290. The level of 0.7389 will act as the major resistance and the double top is already set at the point of 0.7389. At the same time, if there is a breakout at the support levels of 0.7112 and 0.7046, this scenario may be invalidated. Overall, however, we still prefer the bullish scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of EUR / USD divergence for March 15. Chart signals further growth Posted: 15 Mar 2019 01:48 AM PDT On the 24-hour chart, the pair consolidated above the correction level of 127.2% - 1.1285. Thus, the pair will continue its growth in the direction of the next Fibo level of 100.0% - 1.1553. Closing below the level of 127.2% could be viewed as a trend reversal in favor of the US dollar. Besides, the pair could decline in the direction of the correction level of 161.8% - 1.0941. None of indicators shows emerging divergences today. The Fibo grid is built on the ground of extremums from November 7, 2017, and February 16, 2018. Trading recommendations: Now traders can open long positions on EUR / USD with a target of 1.1351 as the pair closed above the level of 1.1299. Stop loss could be placed under the correction level of 76.4%. Besides, tarders can consider short deals on EUR / USD with a target of 1.1216 provided that the pair closes below 1.1299. Stop loss order could be set above the Fibo level of 76.4%. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of GBP/USD divergence for March 15: pair is stuck in narrow price range Posted: 15 Mar 2019 01:48 AM PDT 4h On the hourly chart, the pair rebounded several times from the retracement levels of 38.2% (1.3220) and 23.6% (1.3228). As a result, the latter rebound led to a possibility of a rally towards the retracement level of 23.6%. If the pair rebounds from this Fibo level, the US dollar will have a chance to reverse upwards and get back to the retracement level of 38.2%. If the pair settles below the Fibo level of 38.2%, it will increase the chances for a further fall towards the next retracement level of 50.0% - 1.3171. The Fibo grid is built on extremes of March 11, 2019 and March 13, 2019. Trading advice: Buy deals on GBP/USD can be opened with the target at 1.3281 and the stop loss below the level of 38.2% since the pair has completed the rebound from the level of 1.3220 (hourly chart). Sell deals on GBP/USD can be opened with the target at 1.3281 and the stop Loss order above the level of 23.6% if the pair bounces off the retracement level of 1.3281 (hourly chart). The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis for EUR/USD for March 15, 2019 Posted: 15 Mar 2019 12:44 AM PDT EUR/USD has pulled back towards 1.13 which is important short-term support and so far it holds above this level. There are some bearish reversal signs in the short-term 4-hour chart but we will need more signs of weakness to confirm the reversal.

Blue lines - support trend lines Green line - support Orange rectangle - resistance area EUR/USD has stopped its rise inside the orange rectangle resistance area. This is where we also find the 61.8% Fibonacci retracement level. EUR/USD has pulled back towards the short-term support of 1.13-1.1290 we mentioned yesterday and continues to trade above it at the same time not clearly breaking below the blue upward sloping trend line. The RSI has broken through the blue support trend line. For this reversal to be confirmed bears need to see a lower low both in price and in the RSI. Therefore bulls must defend 1.1293. A four close below this level could push price towards 1.1240 or lower. I remain bearish as long as price is below the red resistance trend line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Mar 2019 12:34 AM PDT Big picture: Investors not annoyed about Brexit The British parliament voted for a Brexit delay by a wide margin that is 400 vs. 200. So far, a delay of three months has been approved. Premier Theresa May will make another attempt to make an agreement with the EU Parliament until March 20. However, if a new deal is not settled by that date that is almost guaranteed, the UK departure will be postponed for a very long time. So, the vote for the Brexit delay has calmed markets down as this matter is not so urgent any more. The US provided a batch of macroeconomic data which clearly indicates that the domestic economy is losing momentum, but the downturn is not severe. On the whole, the US economy has proved its health in the 10-year period of growth without a crisis. The US Federal Reserve is holding a policy meeting on Wednesday next week on March 20. The market is anticipating that the Fed will confirm its dovish rhetoric. EUR/USD: The pair is likely to escape out of a trading range and start a clear trend. At the moment, it looks like the pair will move upward. We buy at the breakthrough of 1.1340. Alternative: Sell from 1.1175. |

| Posted: 15 Mar 2019 12:33 AM PDT After a gruelling vote in the British Parliament, a widely expected decision was eventually made. This decision was the least wanted by Prime Minister May, so Brexit was postponed for only for three months. Theresa May is deteremined in her ambition to finalize an agreement with the EU until March 20. However, if her efforts are in vain, the departure of the UK from the EU will be delayed for a long time. Meanwhile, market turbulence has calmed down. Thus, the time is ripe for EUR/USD to develop the spring trend. EURUSD: We are ready to buy the euro from 1.1340. Alternative: Sell from 1.1175. |

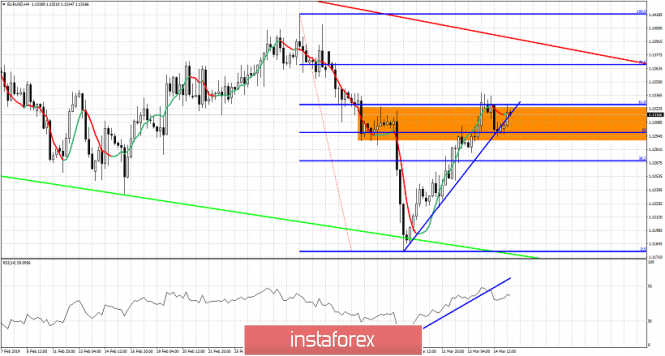

| USD struggles amid volatility reduction Posted: 15 Mar 2019 12:33 AM PDT The US-China trade war is entering a new phase. At the session of the National People's Congress, a law on foreign investments was adopted aiming at increase of transparency in the use of foreign capital as well as the investment's growth. At the same time, there is more and more evidence that China is not in a hurry to complete the trade negotiations. The Trump-Xi meeting has been postponed indefinitely. As recently reported by the House Budget Committee (CBO), the budget deficit has increased by $146 billion relative to 2018 in the first 5 months of the current fiscal year. The revenue dropped due to the 2017 tax act, while Trump's tariff war added to the budget only 22 billion. Obviously, it was not enough considering the skyrocketing deficit. Investors are awaiting to see the outcome of the US-China trade war and the outlook for the US economy for the current year. In the meantime, they see no reasons to hike the Fed's interest rate that has remained unchanged since January. Thus, Fed Funds Futures show an absolute inability to tighten the monetary policy in the current year. Moreover, there is a growing possibility of the rate's reduction by 0.25% in late 2019 amid expectations of recession in the next 12 months.

The US administration has to find a way to top up the budget as soon as possible. However, there are no domestic resources for that. The EU has already made it clear that it will firmly defend its interests, while an attempt to unilaterally impose duties on European cars will lead to the immediate introduction of counter measures amounting up to 300 billion. The greenback could take advantage of the weakened euro after the ECB announced the launch of the third TLTRO wave in September. Yet, it struggles to firm. EURUSD The pace of consumer inflation's growth in Germany is slowing down. The CPI rose by 0.4% in February after an upturn of 0.5% a month earlier. Annually, the index improved by 1.5% in February against an increase of 1.6% in January. Meanwhile, both indicators were expected to remain unchanged. A slowdown in inflation indicates that the economic problems that have covered the eurozone in 2018 are still far from being resolved. The IFO Institute lowered its forecast of Germany's GDP growth to 0.6% versus 1.4% in 2018 as the rise of the largest European economy has come to its end. The index plummeted amid a number of production issues in key industrial sectors of Germany. Basically, the eurozone's GDP is anticipated to advance by 1% failing to match the previous year's rise of 1.8%. According to the IFO, Germany's industry took the brunt of all the problems that covered Europe. Uncertainty on customs duties, Brexit, Italy's economic issues have reduced the capacity of sales markets for Germany and held back the recovery of the export-oriented industry. Only sectors aiming for the domestic market kept the country's economy going. In general, the IFO's conclusion is pessimistic. Despite the gradual recovery of Germany's indicies, a global economic slowdown and low demand for German exports will lead to the recession in the country's economy. In the meantime, the IFO assumes that the EU-UK divorce will be civilized and will not create barriers to cross-border trade, while the United States will not escalate the trade conflict with the EU. However, it is not likely. The eurozone's inflation data is due today. Forecasts are neutral. The euro has no clear movement, it is anticipated to trade sideways. Resistance at 1.1353 is formed by the upper boundary of the descending channel. Support is at 1.1270-75. In case of a breakout, the quote might move to 1.1234, yet, such an outcome seems to be unlikely. GBPUSD The high volatility of the pound is over as the UK Parliament finally made up its mind towards Brexit. It is expected to trade in a range today. There is no reason to retest 1.3383, support levels are at 1.3095 and 1.3010. Nontheless, the pound will most likely stay within 1.3208-1.3295. The material has been provided by InstaForex Company - www.instaforex.com |

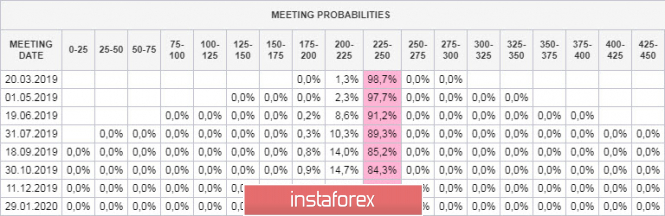

| Technical analysis for Gold for March 15, 2019 Posted: 15 Mar 2019 12:31 AM PDT Gold price has started a pull back from the $1,310 resistance area towards the first important short-term support of $1,290. The bullish short-term channel has been broken. This fact increases the importance of the $1,290 support level. A bigger bounce towards $1,320 is viable only while we trade above $1,292.

Red line - RSI support (broken) Earlier, considering the 38% Fibonacci retracement and with the RSI at overbought levels, we spoke about a pull back at least towards the support level of $1,300. However, price movement exceeded our expectations and even broke below this support. This is a bearish sign. Resistance is now the lower channel boundary as we could see a back test and bounce from $1,305. Major short-term support is at yesterday's low of $1,292. A breakout below this level opens a way for a move towards $1,280 and maybe lower. As long as we stay above $1,292, we can see another leg higher towards $1,321 and the 61.8% Fibonacci retracement. I prefer the trend to turn bearish once $1,292 fails to hold. Until then, we should be cautious as there are still chances of one more new higher high. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical Analysis of EUR/USD for 15/03/2019 Posted: 15 Mar 2019 12:20 AM PDT Technical Market Overview: The EUR/USD pair is testing the 61% Fibonacci retracement located at the level of 1.1326 and even a local high was made at the level of 1.1338. The Harami candlestick pattern appeared at the top of the wave up, so the bears might be preparing to push the prices lower. Nevertheless, the market is still trading above the orange trendline, so the bulls are temporary in control over the market, so the bears must wait for the trendline to be broken in order to push the price lower towards the level of 1.1285 - 1.1275. Weekly Pivot Points: WR3 - 1.1534 WR2 - 1.1453 WR1 - 1.1330 Weekly Pivot - 1.1249 WS1 - 1.1129 WS2 - 1.1042 WS3 - 1.0913 Trading Recommendations: The sell orders should be opened only is the price will break through the orange trend line. Please keep your protective stop-loss orders tight. The first target is seen at the level of 1.1176.

|

| Technical Analysis of GBP/USD for 15/03/2019 Posted: 15 Mar 2019 12:09 AM PDT Technical Market Overview: The GBP/USD pair is currently hovering just under the technical resistance zone located between the levels of 1.3258 - 1.3304. The local low for the consolidation zone was made at the level of 1.3207, but the market did not follow down the path but bounced yet again. The candles are with the log upper and lower wicks and this indicates indecision of market participants. Even the momentum is getting towards its neutral level. All of this indicates a quiet Friday unless the level of 1.3207 is clearly violated. Weekly Pivot Points: WR3 - 1.3385 WR2 - 1.3316 WR1 - 1.3123 Weekly Pivot - 1.3053 WS1 - 1.2856 WS2 - 1.2781 WS3 - 1.2654 Trading Recommendations: The sell orders should be opened only if the level of 1.3207 is clearly violated. Then the projected take profit level is seen at the level of 1.3012, so this would be a more than 200 pips trade. Otherwise, no trading setup is present currently at the market so it is better to say aside until one occurs.

|

| Ethereum Elliott Wave analysis for 15/03/2019 Posted: 14 Mar 2019 11:37 PM PDT Technical Market Overview: The ETH/USD pair might be still unfolding into a more complex and time-consuming pattern because bulls were not able to break through the technical resistance zone located between the levels of 139.63 - 142.22. Moreover, the pair is still trading below the orange trend line, so the bears are still in control over the market. The market is then still unfolding the corrective cycle and the most probable pattern is a Double Three corrective cycle, which needs one more wave to the downside in order to complete the cycle. The first target for this wave is seen at the level of 125.20 and below at 121.92. Any breakout above the trendline will invalidate the downside scenario. Weekly Pivot Points: WR3 - 160.89 WR2 - 150.37 WR1 - 143.35 Weekly Pivot - 132.11 WS1 - 124.46 WS2 - 114.39 WS3 - 108.32 Trading Recommendations: Only sell orders should be open as close as possible to the level of 134.00 The protective stop-loss orders should be placed at 134.81 level as any violation of this level will invalidate the short-term bearish outlook. The first target is seen at the level of 125.20, then at 121.92. Any violation of the wave X low at the level of 121.92 will confirm the bearish outlook.

|

| Bitcoin Elliott Wave analysis for 15/03/2019 Posted: 14 Mar 2019 11:29 PM PDT Technical Market Overview: The BTC/USD pair has made a very interesting candlestick on the H4 time frame chart. It looks like a Dart Maul lightsaber, which is why I called it that way. This candlestick indicates indecision of market participants and a lack of a movement in either direction. Neither bulls not bears have decided yet what way to move: up or down. This is why the candlestick has closed in the middle of the range. The horizontal correction continues, but please remember there is still wave (c) of the wave 2 to be made in order to complete the correction. Weekly Pivot Points: WR3 - $4,374 WR2 - $4,179 WR1 - $4,091 Weekly Pivot - $3,907 WS1 - $3,816 WS2 - $3,625 WS3 - $3,539 Trading Recommendations: Please keep an eye on the market reaction to the trendline test and trade accordingly. The protective stop-loss orders for the long-term traders should be placed at $4,010 level as any violation of this level will invalidate the short-term bearish outlook. The short-term traders or daytraders should place the protective stop-loss orders above the level of $3,951 if they are on the sell side of the market. The potential wave (c) should be a form of an impulsive wave, so it will be a sudden and quick wave down (it even might be a spike down), so please be prepared.

|

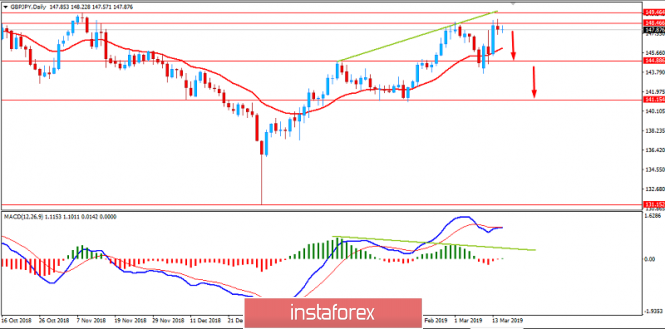

| Elliott wave analysis of GBP/JPY for March 15, 2019 Posted: 14 Mar 2019 10:21 PM PDT

GBP/JPY is consolidating in a minor triangle and should ultimately push higher once this consolidation is complete. This should take us closer to the 151.50 target and ultimately above here too. Support is now seen at 147.60 and with back-up support at 147.36. Support at 147.36 must protect the downside or the triangle will turn out to be a B-wave triangle calling for a dip to 146.25 before turning higher again. R3: 150.52 R2: 149.50 R1: 148.63 Pivot: 147.50 S1; 147.36 S2: 146.81 S3: 146.30 Trading recommendation: We are long GBP from 144.80 and we will move our stop higher to 147.35. The material has been provided by InstaForex Company - www.instaforex.com |

| Fundamental Analysis of GBP/JPY for March 15, 2019 Posted: 14 Mar 2019 10:16 PM PDT GBP has been quite strong versus JPY despite BREXIT-related jitters which could affect GBP gains in the coming days. Japan is facing economic slowdown and declining exports that is certainly bearish for JPY. As for BREXIT, the quesion is still uncertain whether the UK will leave the EU with a deal, without a deal or Brexit will be delayed. A delay has created a dilemma in the market sentiment recently. BREXIT is going to produce the enormous impact on the financial industry, so the BOE is currently trying to prepare them with proper guidance along the way before the banks are hurt by the negative consequences. The UK Parliament voted several times on whether to ask the EU for an extension of the BREXIT deadline. After a series of rejection, the decision is passed with majority vote recently. The positive vote assured GBP buyers that theyh should not be afraid of sudden GBP weakness. However, GBP could lose momentum as the days progress. On the other hand, the Bank of Japan kept monetary policy unchanged today but moderated its optimism as soft exports and factory output are going to affect the domestic economy. The risk is still there as the fragile economic recovery is going to derail the overall process of regaining momentum. Today the BOJ also made optimistic comments on stable economic growth despite certain obstacles like soft export sales. The regulator consider this to be temporary as measures are being taken to prop up the economy. The BOJ Policy Rate was published unchanged at -0.10% today. The BOJ has to solve a problem as Factory Output and Exports slumped in the recent months. Massive money printing dried up the market and may cause the economic downturn in the future. Meanwhile, GBP is still being under pressure due to the BREXIT uncertainty. GBP may show certain weakness in the coming weeks. On the other hand, JPY is also weak, but it could regain momentum thanks to the BOJ optimism. If BREXIT is delayed, GBP is not going to suffer a major blow like a No-Deal BREXIT, but it is going to lose ground in the medium term. Now let us look at the technical view. The price formed a Bearish Divergence from 148.50-149.50 resistance area from where a bearish candle is expected to lead the price lower towards 145.00 support area in the coming days in a volatile trade. As the price remains below 150.00 area with a daily close, the pair will have chances of a bearish counter-move.

|

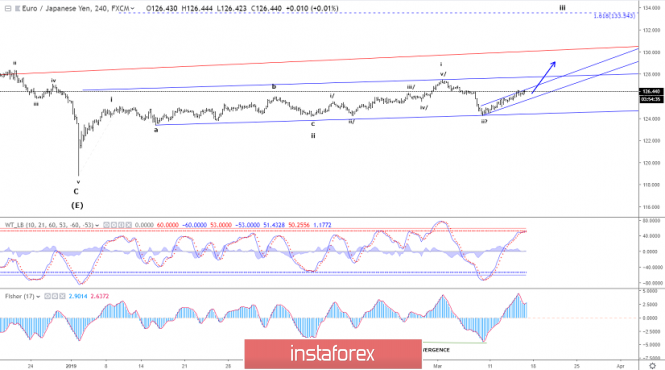

| Elliott wave analysis of EUR/JPY for March 15, 2019 Posted: 14 Mar 2019 10:12 PM PDT

EUR/JPY continues to push higher, but we would like to see upside acceleration out of the channel towards 127.50 on the way higher to 129.25 and the 161.8% extension target at 133.50. Support is seen at 125.96 which ideally will be above to protect the downside for the next push higher to 127.50. Should support at 125.96 give away, strong back-up support is seen at 125.43. R3: 127.50 R2: 126.93 R1: 126.57 Pivot: 126.23 S1: 125.96 S2: 125.43 S3: 125.05 Trading recommendation: We are long EUR from 124.80 and we have our stop placed at 125.25 The material has been provided by InstaForex Company - www.instaforex.com |

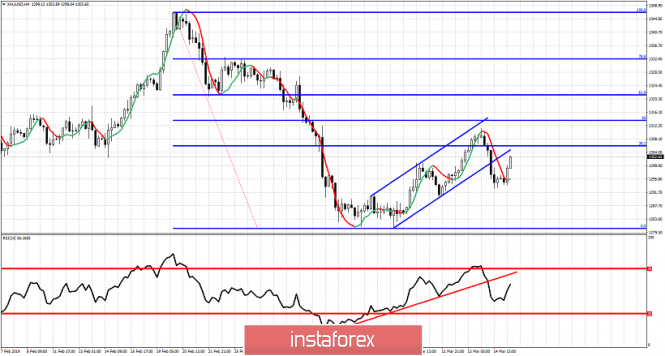

| Trading plan for EUR/USD for March 15, 2019 Posted: 14 Mar 2019 09:54 PM PDT

Technical outlook: The 4H chart presented here for the EUR/USD pair might suggest that the single currency pair is not yet ready to drop lower. As labelled here, the EUR/USD pair might be looking to produce a 5 waves rally and thus complete an impulse. The projected target for the wave v should be very close to the 1.1420 levels and if the resistance is taken out, it could be a huge boost for the EUR bulls. Looking into the objectivity of the above structure to remain valid, the prices should ideally stay above the 1.1240/45 levels and if it does, we can expect another high at the above levels before a corrective drop resumes. An aggressive trading strategy is long with a higher target, while conservatives could remain aside for a while. On the other hand, a drop below the 1.1240 levels would confirm that EUR/USD is looking to go lower for now before the rally resumes. Clearly, a higher probability remains for a push towards the 1.1420 levels. Trading plan: Aggressive traders may want to long now, stop at 1.1240, target of 1.1420 Conservative traders, please remain flat for now. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

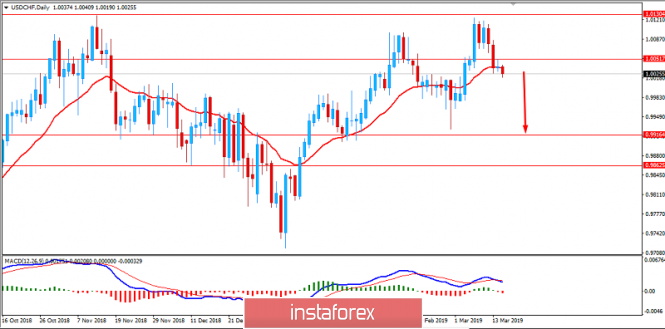

| Fundamental Analysis of USD/CHF for March 15, 2019 Posted: 14 Mar 2019 09:49 PM PDT The USD/CHF pair has been quite volatile and impulsive with the recent bearish momentum rejecting off the 1.0130 area with a daily close which is expected to lead to further bearish pressure in the coming days. The US Federal Reserve could announce a plan to shrink its bond stockpile which could be held between next week or late June. The Fed is going to hold a meeting on March 19 and 20 to discuss about the reducing bond portfolio and the possibility of another interest rates hike again. According to the reports, the Fed assets have increased to more than $4.5 trillion and the central bank is currently trying to reduce it to below $4 trillion. The US having better data on Retail Sales failed to perform well with the CPI and PPI reports published this week, which led the currency to further weakness and certain CHF gains which can build up further in the coming days. Today, the US Empire State Manufacturing Index report is going to be published which is expected to increase to 10.1 from the previous figure of 8.8; Capacity Utilization Rate is anticipated to rise to 78.5% from the previous value of 78.2%; Industrial Production is expected to increase to 0.4% from the previous negative value of -0.6%; and Prelim UoM Consumer Sentiment is expected to grow to 95.5 from the previous figure of 93.8. On the CHF side, CHF SECO Economic Forecast has been recently held with optimistic outcome which helped the currency to gain further momentum over USD. Moreover, PPI report has also been published with a significant increase to 0.2% from the previous negative value of -0.7% which was expected to be at -0.1%. Swiss Central Bank is still quite neutral about their policies despite the recent domination of USD, but as the things turns significantly, certain changes may occur in the coming months. As of the current scenario, USD with its recent economic reports has underperformed resulting in the weakness of the impulsive gains against CHF. Moreover, CHF has been quite positive with the economic events and reports which also managed to attract the potential bears to push the price against USD as well. If the upcoming USD economic reports does not meet the expectation, further gains of CHF is expected. Now let us look at the technical view. The price has been residing below the 1.0050 area after an impulsive bearish pressure since the bounce off the 1.0130 area. The price is currently quite volatile and is forming a bearish divergence which may lead the price further lower towards the 0.9900-50 support area in the coming days. As the price remains below the 1.0130 area with a daily close, the bearish pressure is expected to continue further.

|

| Technical analysis: Intraday Level For EUR/USD, Mar 15, 2019 Posted: 14 Mar 2019 08:39 PM PDT

When the European market opens, some economic data will be released such as Final Core CPI y/y and Final CPI y/y. The US will also publish the economic data such as TIC Long-Term Purchases, Prelim UoM Inflation Expectations, JOLTS Job Openings, Prelim UoM Consumer Sentiment, Industrial Production m/m, Capacity Utilization Rate, and Empire State Manufacturing Index, so amid the reports, EUR/USD will move with a low to a medium volatility during this day. TODAY'S TECHNICAL LEVEL: Breakout BUY Level: 1.1361. Strong Resistance: 1.1354. Original Resistance: 1.1343. Inner Sell Area: 1.1332. Target Inner Area: 1.1305. Inner Buy Area: 1.1278. Original Support: 1.1267. Strong Support: 1.1256. Breakout SELL Level: 1.1249. (Disclaimer) The material has been provided by InstaForex Company - www.instaforex.com |

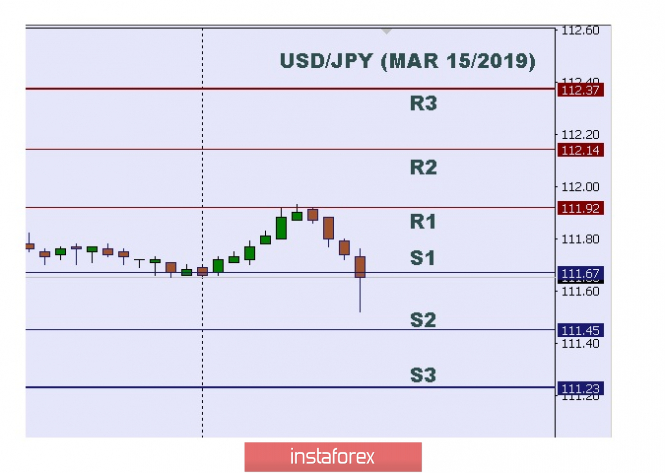

| Technical analysis: Intraday level for USD/JPY, Mar 15, 2019 Posted: 14 Mar 2019 08:37 PM PDT

In Asia, Japan will release the Monetary Policy Statement and the US will publish some economic data such as TIC Long-Term Purchases, Prelim UoM Inflation Expectations, JOLTS Job Openings, Prelim UoM Consumer Sentiment, Industrial Production m/m, Capacity Utilization Rate, and Empire State Manufacturing Index. So there is a probability the USD/JPY pair will move with a low to a medium volatility during this day. TODAY'S TECHNICAL LEVEL: Resistance. 3: 112.37. Resistance. 2: 111.14. Resistance. 1: 111.92. Support. 1: 111.67. Support. 2: 111.45. Support. 3: 111.23. (Disclaimer) The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD approaching support, potential bounce! Posted: 14 Mar 2019 06:51 PM PDT USD/CAD is approaching our first support at 1.3241 (horizontal pullback support, 61.8% Fibonacci retracement, 100%, 61.8% Fibonacci extension) where a strong bounce to our major resistance level at 1.3347 (50% Fibonacci retracement) might occur. Stochastic (89,5,3) is also nearing support where we might see a bounce in price. Trading CFDs on margin carries high risk. Losses can exceed the initial investment, so please ensure you fully understand the risks.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment