Forex analysis review |

- Fractal analysis of major currency pairs on July 18

- AUD / USD vs USD / CAD vs NZD / USD vs #USDX. Comprehensive analysis of movement options from July 18, 2019. Analysis of

- The decrease in USD rates is decided, but what do they think on Wall Street?

- July 17, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- July 17, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- EUR/USD. July 17. Results of the day. Inflation in the European Union has accelerated slightly

- Gold 07.17.2019 - Strong bullish momentum but resistance on the test

- EUR/USD for July 17,2019 - Double bottom confirmed

- BITCOIN below $10,000 signals end of bullish run. July 17, 2019

- Buy the cheaper pound while others are afraid – Westpac

- EUR and GBP: sellers of the euro and the pound expectedly took a breather, but it's too early to talk about the bottom of

- GBP/USD: plan for the American session on July 17. Buyers grabbed the divergence, but the demand for the pound is very weak

- EUR/USD: plan for the American session on July 17. Divergence worked, and what to do next – it is unclear

- BTC 07.17.2019 - Potenteial new momentum down is on the way

- Analysis of GBP/USD for July 17, 2019: GBP to regain momentum against USD

- Ichimoku cloud indicator short-term analysis of USDCAD for July 17, 2019

- EURUSD challenges important support levels.

- Technical analysis of Gold for July 17, 2019

- Technical analysis of GBP/USD for July 17, 2019

- Technical analysis of NZD/USD for July 17, 2019

- Gold puts on currency wars

- Oil prices will go up after the crash, experts say

- EUR/USD: the Fed will reduce the rate proactively, and the ECB can bring super-soft policy to a new level

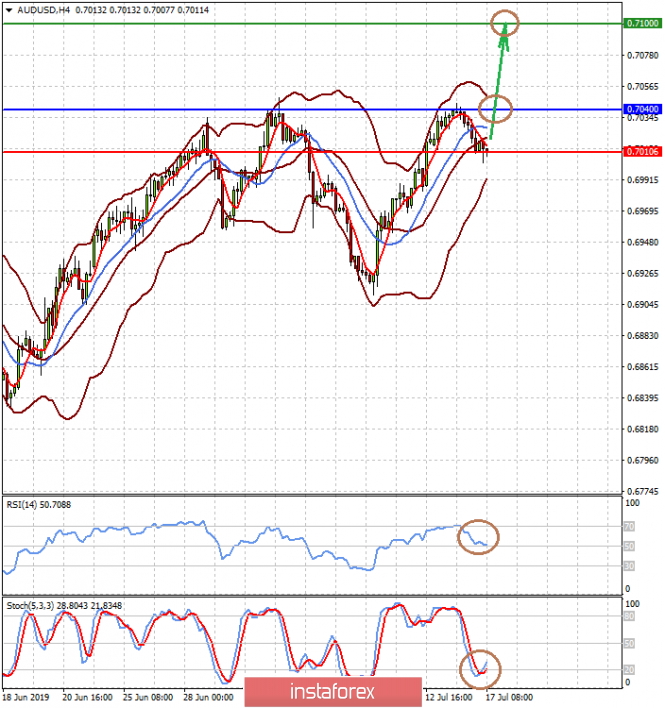

- Fed lowering interest rates may turn into a cycle of declines (There is a chance that the AUD/USD pair will continue to

- Trading recommendations for the EURUSD currency pair - placement of trading orders (July 17)

| Fractal analysis of major currency pairs on July 18 Posted: 17 Jul 2019 07:39 PM PDT Forecast for July 18: Analytical review of H1-scale currency pairs:

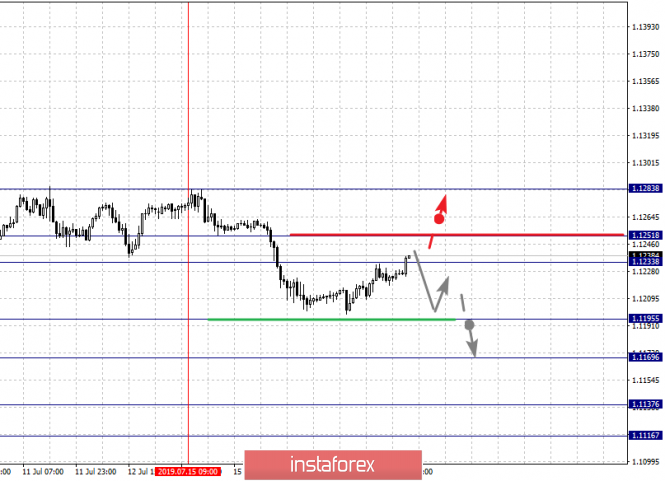

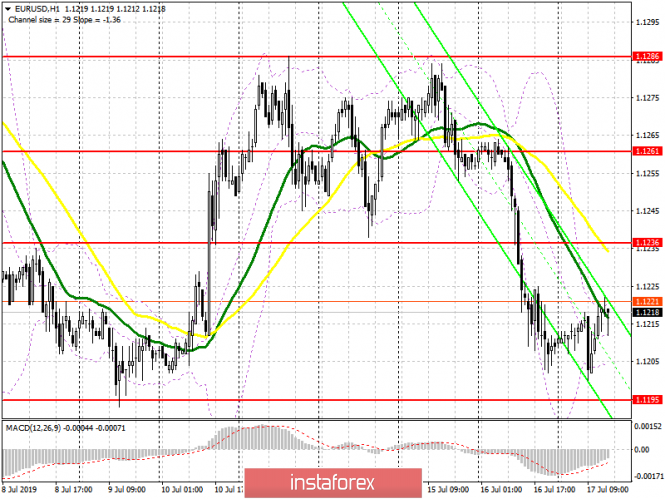

For the euro / dollar pair, the key levels on the H1 scale are: 1.1283, 1.1251, 1.1233, 1.1195, 1.1169, 1.1137 and 1.1116. Here, the price is in the correction zone from the downward structure on July 15. Continuation of the movement to the bottom is expected after the breakdown at 1.1195. In this case, the goal is 1.1169. Consolidation is near this level. The breakdown of the level 1.1169 should be accompanied by a pronounced downward movement. Here, the target is 1.1137. For a potential value at the bottom, we consider the level 1.1116, after reaching which, we expect consolidation, as well as rollback to the top. Short-term upward movement is possible in the corridor 1.1233 - 1.1251. The breakdown of the last value will have to form the initial conditions for the upward cycle. Here, the potential target is 1.1283. The main trend - the formation of potential for the bottom of July 15 Trading recommendations: Buy 1.1335 Take profit: 1.1250 Buy 1.1253 Take profit: 1.1280 Sell: 1.1195 Take profit: 1.1170 Sell: 1.1167 Take profit: 1.1140

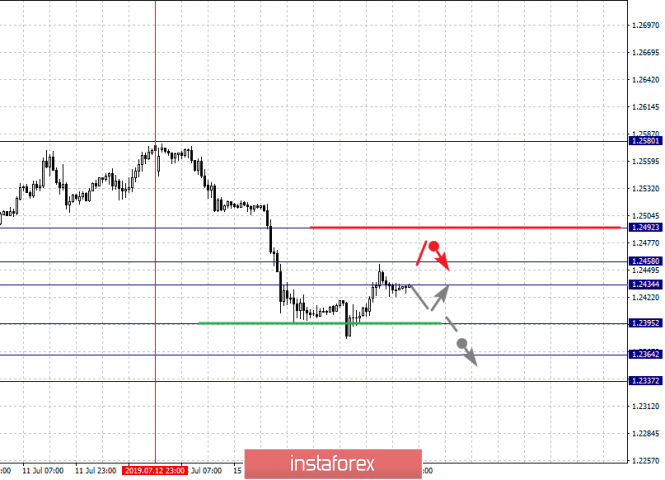

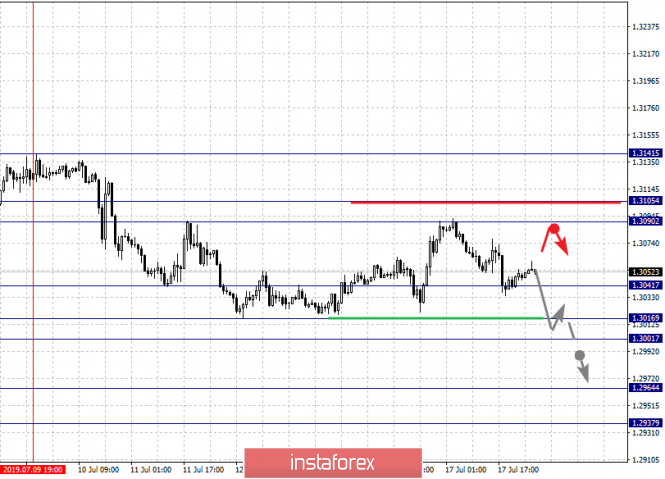

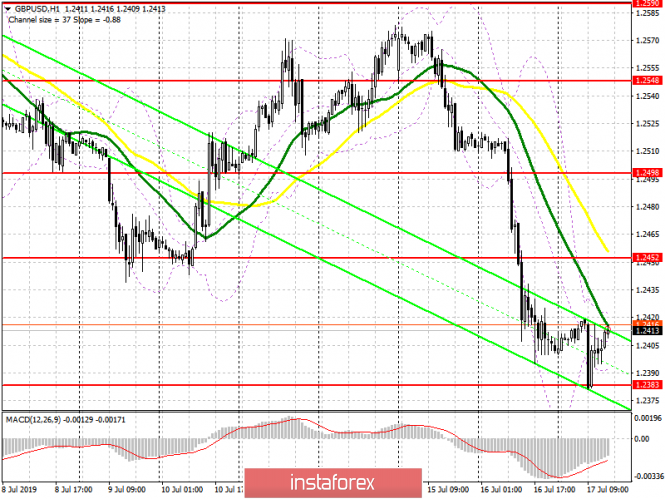

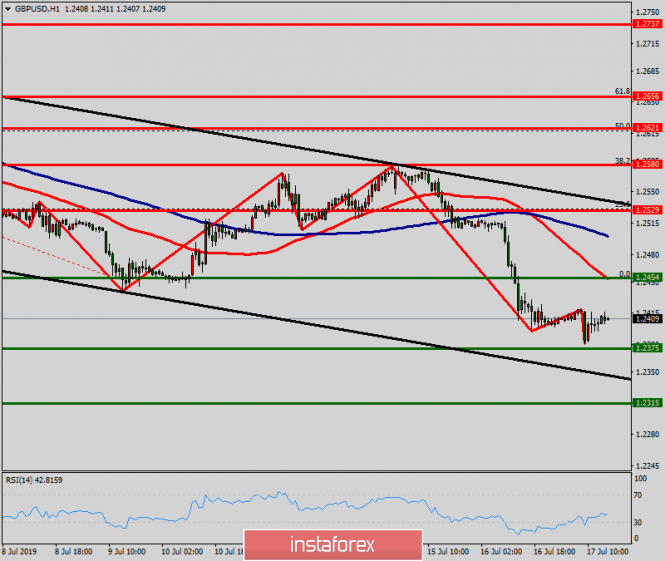

For the pound / dollar pair, the key levels on the H1 scale are: 1.2492, 1.2458, 1.2434, 1.2395, 1.2364 and 1.2337. Here, we are following the downward trend of July 12. Continuation of the movement to the bottom is expected after the breakdown at 1.2395. In this case, the target is 1.2364. For the potential value at the bottom, we consider the level of 1.2337, after reaching which, we expect a rollback to the top. Short-term upward movement is expected in the corridor 1.2434 - 1.2458. The breakdown of the last value will lead to a prolonged correction. Here, the target is 1.2492. This level is a key support for the downward structure of July 12. The main trend - the downward structure of July 12. Trading recommendations: Buy: 1.2435 Take profit: 1.2457 Buy: 1.2460 Take profit: 1.2492 Sell: 1.2395 Take profit: 1.2365 Sell: 1.2362 Take profit: 1.2337

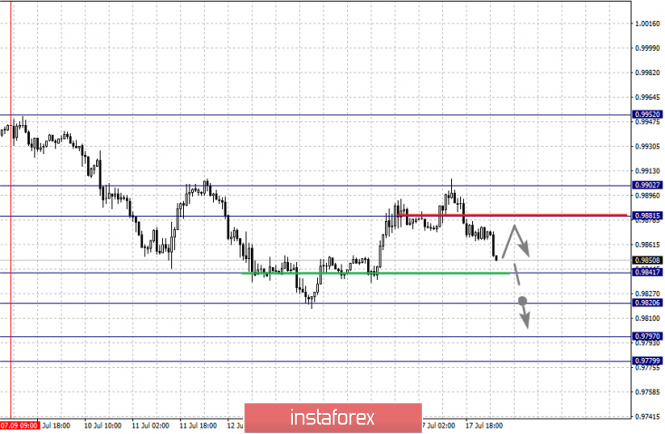

For the dollar / franc pair, the key levels on the H1 scale are: 0.9952, 0.9902, 0.9881, 0.9841, 0.9820, 0.9797 and 0.9779. Here, we are following the development of the downward structure of July 9. At the moment, the price is in the correction zone. Continuation of the movement to the bottom is expected after the breakdown of 0.9841. In this case, the goal is 0.9820. The breakdown of which, in turn, will allow us to count on the movement to 0.9797. There is a potential value for the downward trend, while we consider the level of 0.9779, and upon reaching this level, we expect a rollback to the correction. Consolidated movement is possible in the corridor 0.9881 - 0.9902. We expect the formation of the initial conditions for the upward cycle to the level of 0.9902. The main trend is the formation of the downward structure of July 9, the stage of correction. Trading recommendations: Buy : 0.9881 Take profit: 0.9902 Buy : 0.9910 Take profit: 0.9950 Sell: 0.9840 Take profit: 0.9822 Sell: 0.9818 Take profit: 0.9797

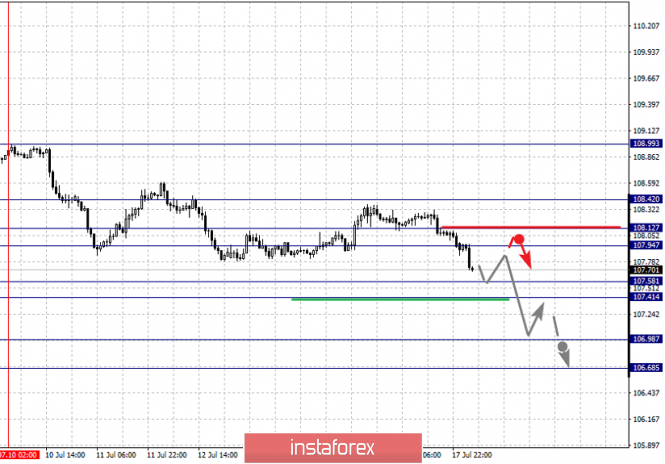

For the dollar / yen pair, the key levels on the scale are : 108.42, 108.12, 107.94, 107.58, 107.41, 106.98 and 106.68. Here, we are following the downward structure of July 10. Continuation of the movement to the bottom is expected after the price passes the noise range 107.58 - 107.41. In this case, the goal is 106.98. For the potential value at the bottom, we consider the level of 106.68. From which, we expect a rollback to the top. Short-term upward movement is possible in the corridor 107.94 - 108.12. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 108.42. This level is a key support for the bottom. The main trend: the downward structure of July 10. Trading recommendations: Buy: 107.94 Take profit: 108.12 Buy : 108.14 Take profit: 108.40 Sell: 107.40 Take profit: 107.00 Sell: 106.96 Take profit: 106.70

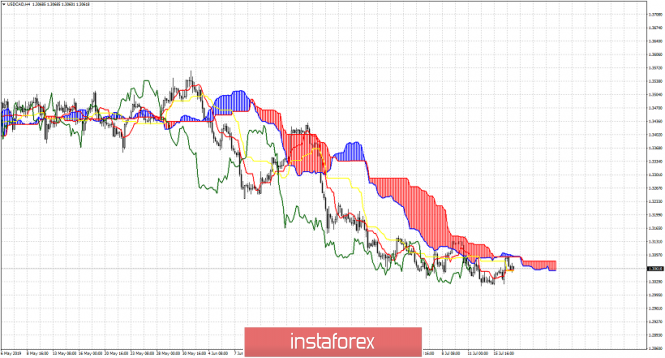

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3141, 1.3105, 1.3090, 1.3041, 1.3016, 1.3001, 1.2964 and 1.2937. Here, we are following the development of the downward structure of July 9. Continuation of the movement to the bottom is expected after the breakdown level at 1.3041. In this case, the first goal is at level 1.3016. The price passage within the noise range 1.3016 - 1.3001 should be accompanied by a pronounced downward movement. In this case, the target is 1.2964. For the potential value at the bottom, we consider the level of 1.2937, after reaching which, we expect a rollback to the top. The range 1.3090 - 1.3105 is a key support for the downward structure. Its price passage will have to form an upward structure. In this case, the potential target is 1.3141. The main trend - the downward structure of July 9. Trading recommendations: Buy: 1.3105 Take profit: 1.3140 Sell: 1.3041 Take profit: 1.3016 Sell: 1.3000 Take profit: 1.2965

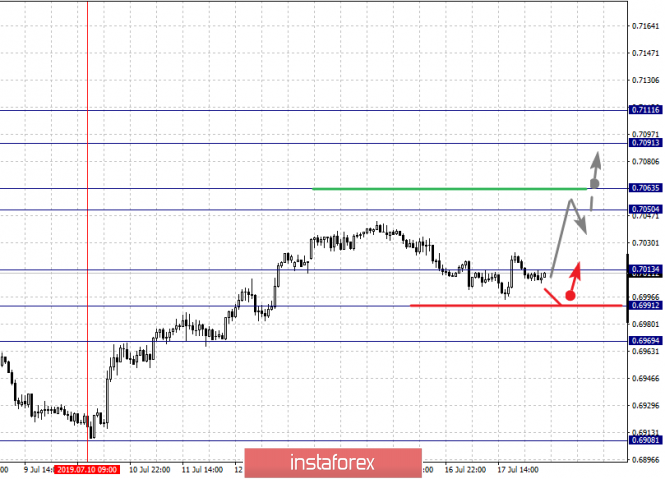

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.7111, 0.7091, 0.7063, 0.7050, 0.7030, 0.7013, 0.6991 and 0.6969. Here, we are following the development of the ascending structure of July 10. The resumption of the movement to the top is expected after the breakdown of 0.7030. In this case, the first target is 0.7050. Short-term upward movement is possible in the corridor of 0.7050 - 0.7063. The breakdown of the latter value should be accompanied by a pronounced upward movement. In this case, the target is 0.7091. For the potential value to the top, we consider the level of 0.7111, after reaching which, we expect a rollback to the bottom. Short-term downward movement is possible in the corridor 0.7013 - 0.6991. The breakdown of the latter value will have to form the initial conditions for the downward cycle. Here, the goal is 0.6969. The main trend - the rising structure of July 10. Trading recommendations: Buy: 0.7030 Take profit: 0.7050 Buy: 0.7063 Take profit: 0.7090 Sell : 0.7011 Take profit : 0.6993 Sell: 0.6988 Take profit: 0.6972

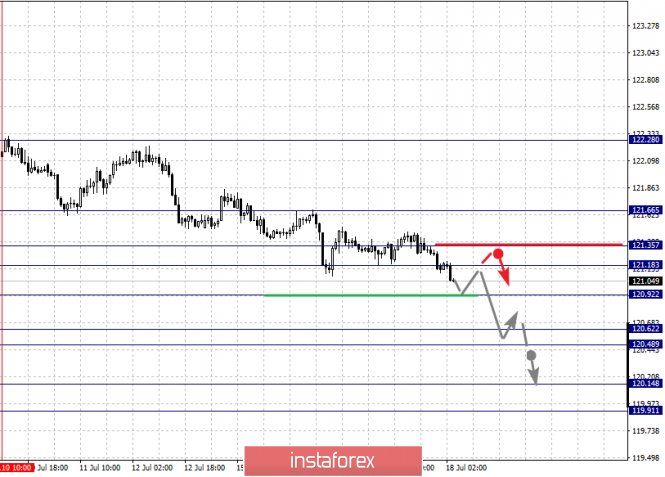

For the euro / yen pair, the key levels on the H1 scale are: 121.66, 121.35, 121.18, 120.92, 120.62, 120.48, 120.14 and 119.91. Here, we are following the downward structure of July 10. Continuation of the movement to the bottom is expected after the breakdown of 120.90. In this case, the target is 120.62. Price consolidation is in the corridor 120.62 - 120.48. The breakdown of the level of 120.46 should be accompanied by a pronounced downward movement. Here, the goal is 120.14. For the potential value at the bottom, we consider the level of 119.91, after reaching which, we expect a rollback to the top. Short-term upward movement is possible in the corridor 121.18 - 121.35. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 121.66. This level is a key support for the downward structure. The main trend - the downward structure of July 10. Trading recommendations: Buy: 121.18 Take profit: 121.33 Buy: 121.37 Take profit: 121.66 Sell: 120.90 Take profit: 120.62 Sell: 120.46 Take profit: 120.14

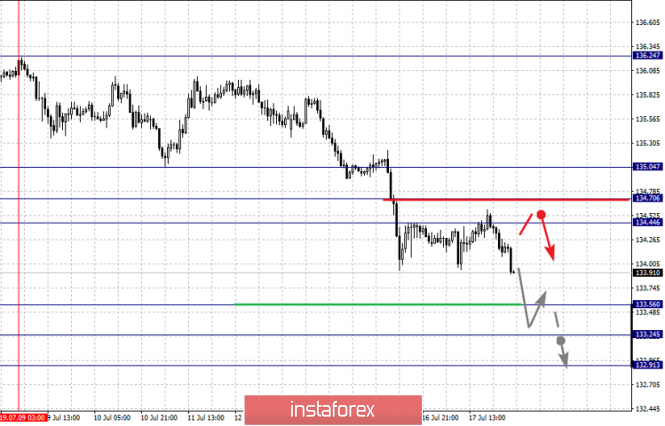

For the pound / yen pair, the key levels on the H1 scale are : 135.04, 134.70, 134.44, 133.56, 133.24 and 132.91. Here, we are following the development of the downward structure from July 9, and at the moment we expect a movement to the level of 133.56. The breakdown of this value will allow us to expect a movement to the level of 133.24, near which, we expect consolidation. We consider the level 132.91 to be a potential value for the bottom. And after reaching this level, we expect a rollback to the correction. Short-term upward movement is possible in the range of 134.44 - 134.70. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 135.04. This level is a key support for the downward structure. The main trend is the downward cycle of July 9. Trading recommendations: Buy: 134.45 Take profit: 134.65 Buy: 134.72 Take profit: 135.04 Sell: 133.50 Take profit: 133.25 Sell: 133.20 Take profit: 132.91 The material has been provided by InstaForex Company - www.instaforex.com |

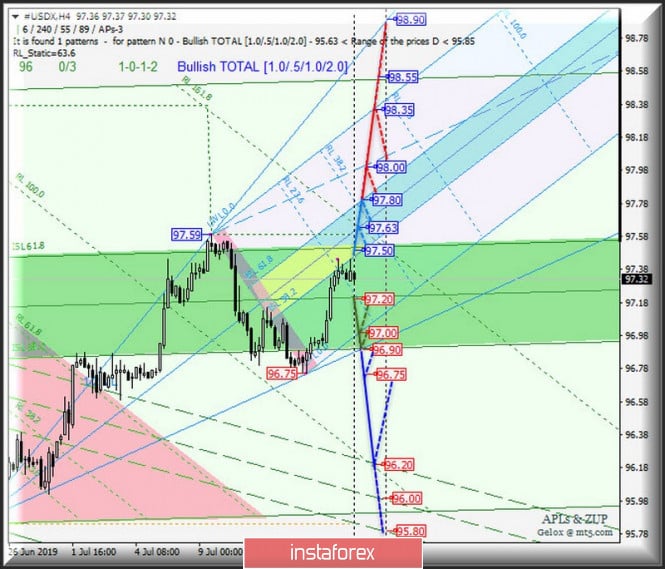

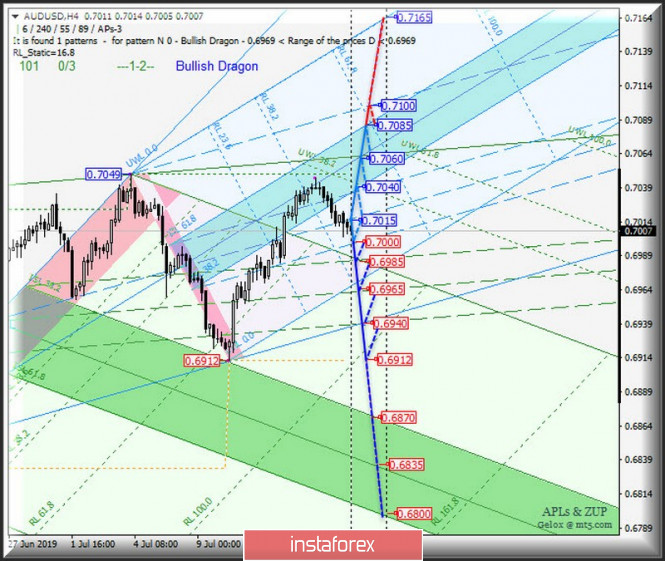

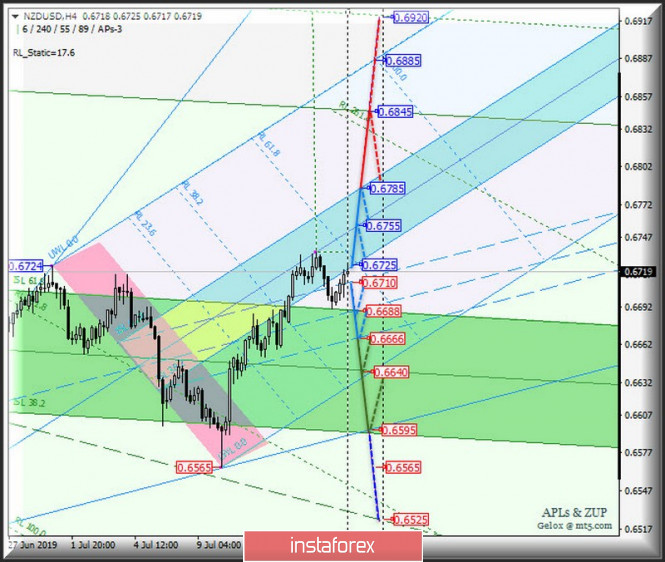

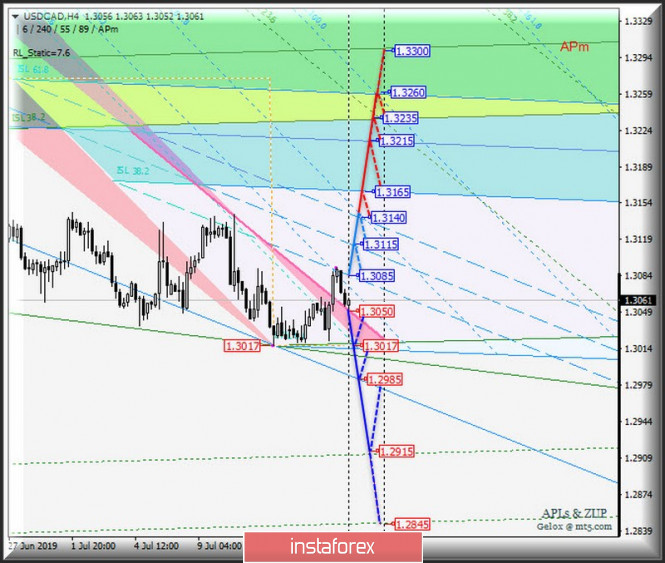

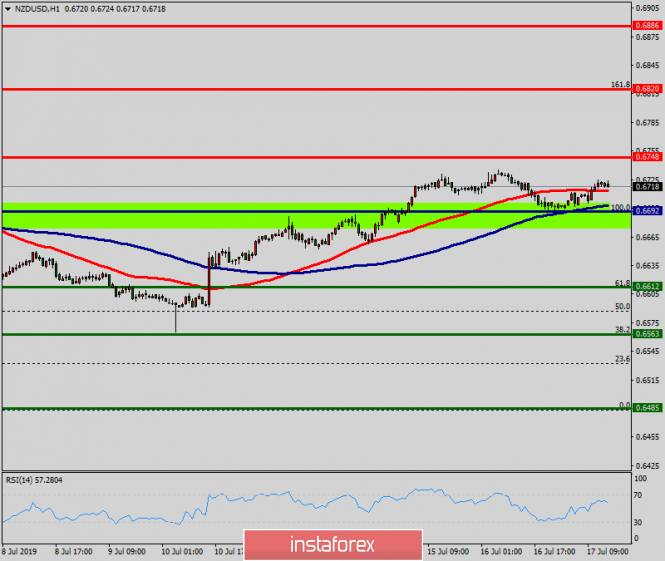

| Posted: 17 Jul 2019 05:52 PM PDT Minuette (H4) Let us consider the comprehensive options for the development of the AUD / USD vs USD / CAD vs NZD / USD vs #USDX movement from July 18, 2019 in the Minuette operational scale (H4 time frame). ____________________ US Dollar Index On July 18, 2019, the development of the movement of the dollar index #USDX will be determined by the direction of the range breakdown : - resistance level of 97.50 (lower boundary of the ISL38.2 equilibrium zone of the Minuette operating scale fork); - support level of 97.20 (1/2 Median Line channel of the Minuette operating scale). The breakdown of the support level of 97.20 (1/2 Median Line Minuette) will cause the downward movement of the dollar index to continue to the targets - the initial SSL line (97.00) of the Minuette operational scale fork - the lower boundary of ISL38.2 (96.90) of the Minuette operational scale - local minimum 96.75 - and as an option - to reach the upper boundary of the 1/2 Median Line channel Minuette (96.20). In case of the breakdown of the lower boundary of ISL38.2 Minuette (resistance level of 97.50), the development of the #USDX movement will continue in the equilibrium zone (97.50 - 97.63 - 97.80) of the Minuette operational scale, and if ISL61.8 Minuette (97.80) will be broken down, then it would be important to continue the upward movement of the dollar index to the final Schiff Line Minuette (98.00), with the prospect of reaching the final FSL Minuette line (98.35). The details of the options for movement #USDX on July 18, 2019 are presented at the animated graphics. ____________________ Australian dollar vs US dollar The development of the movement of the Australian dollar AUD / USD from July 18, 2019 will be determined by the working out and direction of the breakdown of the 1/2 Median Line channel borders (0.7000 - 0.7015 - 0.7040) of the Minuette operating scale. The breakdown of the upper boundary of the 1/2 Median Line Minuette channel (resistance level of 0.7040) will determine the development of the AUD / USD movement in the equilibrium zone (0.7040 - 0.7060 - 0.7085) of the Minuette operating scale with the prospect of reaching the final Schiff Line Minuette (0.7100). In case of breakdown of the lower boundary of the 1/2 Median Line channel ( support level of 0.7000), the operational scale of the Minuette operational scale fork will become topical for the Australian dollar to reach the 1/2 Median Line channel (0.6985 - 0.6965 - 0.6940) of the Minute operating scale with the possibility of updating the minimum of 0.6912. The details of the options for the movement of AUD / USD from July 18, 2019 can be seen at the animated graphics. ____________________ New Zealand Dollar vs US Dollar The development of the movement of the New Zealand dollar NZD / USD from July 18, 2019 will be determined by the direction of the range breakdown : - resistance level of 0.6725 (lower boundary of the ISL38.2 equilibrium zone of the Minuette operating scale fork); - support level of 0.6710 The breakdown of the resistance level of 0.6725 (ISL38.2 Minuette) will confirm the development of the movement of the New Zealand dollar in the equilibrium zone (0.6725 - 0.6755 - 0.6785) of the Minuette operational scale fork with the possibility of reaching the final FSL line (0.6845) of the Minuette operational scale. On the other hand, in the event of the breakdown of the support level of 0.6710, the movement of the NZD / USD will continue to the 1/2 Median Line channel (0.6710 - 0.6688 - 0.6666) Minuette operational scale fork with the possibility of the continuation of this movement (after the breakdown of the support level of 0.6666) is already in the zone of equilibrium (0.6688 - 0.6640 - 0.6595) Minuette operational scale fork. The details of the options for the movement of NZD / USD from July 18, 2019 are presented at the animated graphics. ____________________ US Dollar vs Canadian dollar. Range Breakdown Direction : - resistance level of 1.3085 (the lower boundary of the 1/2 Median Line channel of the Minuette operational scale); - support level of 1.3050 (boundary of the red zone of the Minuette operational scale fork); will begin to determine the development of the movement of the Canadian dollar USD / CAD from July 18, 2019. After the support level of 1.3050 breaks down at the boundary of the Minuette operational scale fork, the development of the movement of the Canadian dollar will continue to the goals - local minimum 1.3017 - control line LTL (1.2985) of the Minuette operational scale - warning line LWL38.2 (1.2915) of the Minuette operational scale fork. As a result of the breakdown of the resistance level of 1.3085, the development of the movement of the Canadian dollar will continue in the 1/2 Median Line Minuette channel (1.3085 - 1.3115 - 1.3140), and during the breakdown of the upper boundary (1.3140) of this channel, it will be possible to reach the boundaries of the equilibrium zone of USD / CAD (1.3165 - 1.3215 - 1.3260) Minuette operating scale. The details of the options for the movement of USD / CAD from July 18, 2019 can be seen at the animated graphics. ____________________ The review was compiled without regard to the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders " sell " or " buy "). The formula for calculating the dollar index is USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where power ratios correspond to the weights of currencies in the basket: Euro - 57.6%; Yen - 13.6%; Pound sterling - 11.9%; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula gives the index value to 100 on the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| The decrease in USD rates is decided, but what do they think on Wall Street? Posted: 17 Jul 2019 05:08 PM PDT The response of the market to the strong US retail sales was negligible; traders preferred to focus on the next comments of the Fed. Therefore, on Wednesday, the dollar was only able to fix the growth of the previous session just above the level of 97. Speaking in Paris, Jerome Powell intervened in market expectations again, hinting at the risks of lowering inflation expectations, which requires a more flexible policy adjustment from officials. At the same time, the Federal Reserve persists in ignoring traditional fundamental data, showing its concern with leading indicators. After Powell's speech on Tuesday, the odds of a 50 bps rate cut increased to 31%. At the same time, the head of the Central Bank was able to convince the market that the Central Bank would be able to stimulate inflation, since the market metrics of inflationary expectations turned into growth from the end of June. Thus, pressure on the American economy comes from trade relations with partners. Inflation expectations declined after the announcement of an increase in tariffs for Chinese goods. Powell has pointed out on this for more than once. It cannot be ruled out that the reaction of inflation expectations to the bottom was a "foresight" of the new cycle of mitigation of policy in response to the escalation of tariff tension. In this case, the Central Bank is led, as it responds to a false signal and ignores strong economic reports. Be that as it may, it is difficult to consider a reduction in the rate of half a percent at once as a reasonable precautionary measure. The labor market and retail volume are growing quite confidently. Next week, the ECB is expected to give a strong stimulus signal, which will reduce the risks of a further slowdown in growth abroad. This is one of the reasons for the Fed's concerns, along with the trade war. Friday's report on US GDP may contain a positive surprise, at least there are prerequisites for this. In this scenario, traders are unlikely to sell dollars. Estimates and expectations of the world's largest banks about the Fed rate cut The Goldman Sachs are waiting for the reduction of 25 basis points in July and another by the same amount until the end of this year. A similar opinion is shared by experts JPMorgan. Everyone understands that the Fed is set to soften the policy in July, they write. The situation in the world remains alarming, business sentiment continues to deteriorate, and deflation signals from a slowdown in producer price pressure put pressure on corporate profits. The combination of these factors has a negative effect on the increase in capital expenditures in the world. Representatives of Morgan Stanley and UBS predict an aggressive policy easing - immediately by 50 basis points without an additional reduction before the end of the year. In their opinion, the current situation requires decisive action. Over the past 12 months, the global economy has noticeably slowed down, aided by trade conflicts. US GDP also risks slowing growth. Citigroup, on the other hand, forecasts a quarter percent decline in July and the same in September. According to them, a decrease of 25 basis points is a kind of compromise on the committee. Although, it is possible that some officials will vote to reduce by 50 basis points. There is a consensus in Bank of America and Barclays. Jerome Powell made it clear that at the next meeting, the rate will be reduced regardless of statistics, they comment. The cost of lending will decline by at least 0.25% in July and another 0.5% by the end of the year. The material has been provided by InstaForex Company - www.instaforex.com |

| July 17, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 17 Jul 2019 09:13 AM PDT

Initially, Temporary Bullish breakout above 1.1335 was demonstrated (suggesting a high probability bullish continuation pattern). However, the EURUSD pair has failed to maintain that bullish persistence above 1.1320 and 1.1275 (the depicted price levels/zones). This was followed by a deeper bearish pullback towards 1.1175 where significant bullish price action was demonstrated on June 18. The EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish pullback was initiated towards 1.1275 as expected in a previous article. Further Bearish decline below 1.1275 enhanced a deeper bearish decline towards 1.1235 (the lower limit of the newly-established bullish channel) which failed to provide enough bullish support for the EUR/USD. The recent bearish breakdown below 1.1235 invited further bearish momentum to move towards 1.1175. However, significant bullish momentum was earlier demonstrated around 1.1200 bringing the EUR/USD pair again above 1.1235. That's why, the recent bullish pullback was expected to pursue towards the price zone around 1.1275 where a confluence of resistance/supply levels came to meet the pair. A recent double-top Bearish pattern was demonstrated around the price zone of 1.1275 where a valid Intraday SELL position was suggested in previous articles. Recent Bearish breakdown of the pattern neckline around (1.1235) confirms the short-term trend reversal into bearish towards 1.1175. The current bullish pullback towards the depicted key zone around 1.1235 should be considered for a valid SELL entry. On the other hand, a bullish breakout above (1.1235-1.1250) brings the EUR/USD pair again between depicted price-zones (1.1235-1.1275) until another breakout attempt is demonstrated in either directions (More probably to the downside). Trade recommendations : For Intraday traders, another valid SELL entry can be offered at retesting of the broken neckline around 1.1235. Initial Target levels to be located around 1.1200 and 1.1175. Stop Loss should be placed above 1.1260. The material has been provided by InstaForex Company - www.instaforex.com |

| July 17, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 17 Jul 2019 09:08 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550 with a prominent key-level around 1.2650. In June , temporary bullish consolidation patterns were demonstrated above 1.2650 for a few trading sessions. However, the price level of 1.2750 (consolidation range upper limit) has prevented further bullish advancement few times so far. Moreover, signs of bearish rejection have been manifested (Head & Shoulders reversal pattern with neckline located around 1.2650). Bearish breakdown below 1.2650 (reversal pattern neckline) confirmed the reversal pattern with bearish projection target located at 1.2550, 1.2510 and 1.2450. Intermediate-term technical outlook remains under bearish pressure as long as the market keeps moving below 1.2650 (mid-range key-level and neckline of the reversal pattern). Moreover, the recent Bearish breakdown below 1.2570 - 1.2550 (the lower limit of the depicted consolidation range) confirmed a trend reversal into bearish on the short-term. On the other hand, the recent bullish pullback towards 1.2550-1.2570 was recommended as a valid SELL opportunity for Intraday traders. All bearish Target levels have already been reached. Quick bearish decline was expected to occur towards 1.2450-1.2400 (the lower limit of the current movement channel) where early signs of bullish rejection and a bullish pullback are currentlybeing demonstrated. As mentioned in a previous article, Intraday traders can have a short-term BUY trade anywhere around (1.2400 - 1.1450) provided that no bearish breakdown occurs below 1.2400 (the lower limit of the depicted movement channel). Trade Recommendations: Intraday traders can have a valid BUY Entry anywhere around the lower limit of the current movement channel (1.2400). T/P levels to be located around 1.2450 and 1.2510. S/L should be placed below 1.2370. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. July 17. Results of the day. Inflation in the European Union has accelerated slightly Posted: 17 Jul 2019 08:43 AM PDT 4-hour timeframe The amplitude of the last 5 days(high-low): 62p – 41p – 37p – 31p – 62p. Average amplitude over the last 5 days: 47p(39p). The most interesting macroeconomic report of today was, of course, the inflation report in the EU. As it turned out, the consumer price index in June accelerated to 1.3%, while experts predicted the preservation of the previous "figures", that is, 1.2% y/y. Core inflation showed an increase of 1.1% in accordance with predicted values. This information was supposed to support the euro currency, as it is at least some positive news from the European Union. However, traders seem to have judged otherwise. After all, the target of 2.0% set by the European Central Bank is very far away, and in the long term, 2% of inflation has not been seen for a long time. Thus, the growth of 0.1% is not particularly pleased with the foreign exchange market. There were no more important macroeconomic publications on July 17th. We can only recall the trade war between China and the United States. After the G20 summit, many traders were overwhelmed with optimism, as Donald Trump and Xi Jinping said that the countries were returning to negotiations. However, as we wrote back then, "to return to negotiations" does not mean "to agree". Yesterday, the US President wrote on his Twitter that the fall in the growth rate of China's economy to the levels of 1992 is directly related to the introduction of duties by America. And that Washington can further increase the pressure on China if it imposes duties on absolutely all imports from this country. In turn, the Ministry of Foreign Affairs of China made a statement, according to which 6.2% of GDP – is "good figures" in any case, given the slowdown in global economic growth. Thus, as we can see, there is no question of any truce, and the signing of the notorious trade deal is still very far away. And not the fact that the parties will be able to agree. Trading recommendations: The EUR/USD pair started the weakest upward correction with the target of the critical line. Thus, now the sales of the euro are still relevant to the targets at the levels of 1.1179 and 1.1157, but after the completion of the correction round. It is recommended to buy the euro/dollar pair not before fixing the price back above the critical line with the first targets of 1.1274 and 1.1306, but with the minimum lots, as the bulls remain extremely weak. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-Sen – red line. Kijun-Sen – blue line. Senkou Span A – light brown dotted line. Senkou Span B – light purple dotted line. Chinkou Span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD Indicator: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 07.17.2019 - Strong bullish momentum but resistance on the test Posted: 17 Jul 2019 08:14 AM PDT The Gold did perfect test-reject of our yesterday's downward target $1.401 and it rallied all the way to the resistance at the price of $1.419. Since I found resistance levels at $1.419 and $1.4126, I would watch for selling opportunities. Logical downward objective is set at the price of $1.407. Industry news: The Consumer Price Index (CPI) rose 2.0% on a year-over-year basis in June, down from a 2.4% increase in May, largely due to lower month-over-month energy prices. Excluding energy, the CPI rose 2.6% year over year. Prices increased year over year in all eight major components. On a seasonally adjusted monthly basis, the CPI declined 0.1% in June, following a 0.3% gain in May. Technical view: .

On the H1 time-frame I found that there is a strong up void spike, which is sign of the strong upward momentum. Anyway, since there is a resistance around $1.419, I would advise you to watch for selling opportunities. Watch for potential sell divergence on the oscillator to confirm potential down turn. Potential downward target is set at the price of $1.407. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for July 17,2019 - Double bottom confirmed Posted: 17 Jul 2019 07:43 AM PDT The EURUSD has been trading sideways in past 24 hours. Anyway, there was the U turn (double bottom) in the background, which is sign that EUR may trade higher towards the resistance levels at 1.1239 and 1.1254. Industry news: The Consumer Price Index (CPI) rose 2.0% on a year-over-year basis in June, down from a 2.4% increase in May, largely due to lower month-over-month energy prices. Excluding energy, the CPI rose 2.6% year over year. Prices increased year over year in all eight major components. On a seasonally adjusted monthly basis, the CPI declined 0.1% in June, following a 0.3% gain in May.

. Technical view: . On the H1 time-frame I found that there is bull divergence on the % Bollinger oscillator, which represents potential rally. The volume for today is light and there is not much going on so far. Anyway, rejection of the support at the price of 1.1200 is sign that buyers are still in control and that you should watch for buying opportunities with the first target at the price of 1.1239.The material has been provided by InstaForex Company - www.instaforex.com |

| BITCOIN below $10,000 signals end of bullish run. July 17, 2019 Posted: 17 Jul 2019 07:32 AM PDT Bitcoin has lost steam residing below the $10,000 psychological area. The price went down below $9500. Bitcoin managed to reach $10,000. Nevertheless, it could not break above this level. The Bitcoin pullback that started over the weekend has accelerated as we hit mid-week. During yesterday's US trading session BTC dropped below the highly critical $10,000 level and has failed to reclaim it. Recent comments from US Treasury Secretary Steven Mnuchin may have accelerated the pullback but in reality, one was overdue anyway. Mnuchin did recognize Bitcoin as a store of value and it received a further endorsement from US House Representative Kevin McCarthy who admitted to 'liking Bitcoin'. A further $30 billion has flowed out of cryptocurrency markets in the past 24 hours but this story is nothing new. Bitcoin's dominance remains a healthy 67 percent meaning that, as usual, the altcoins have bled out harder, many dumping double digits today. Bitcoin has lost 25% in the past week, falling to as low as $9,300. Even though optimists are expecting for bulls to experience some form of short-term reprieve, historical trends and other key indicators predict a further unwinding of the cryptocurrency bull market. TECHNICAL OVERVIEW: The price is currently residing above $9500 area after breaking below the $10,000 area. The price is held by the dynamic level of 20 EMA, Tenkan, and Kijun line as resistance. A break above $10,000 will trigger Bitcoin growth. As the price remains above $9500, there is still a chance that it will break above $10,000 area again. The current correction is likely to be a part of the trend playing cycle. Bitcoin may lift up if it breaks above $10,000.

|

| Buy the cheaper pound while others are afraid – Westpac Posted: 17 Jul 2019 07:23 AM PDT

The rate of the British currency against the euro reached its lowest level since January this year. Westpac experts believe that now is the time to buy the pound. They recommend selling EUR/GBP from 0.9085 with the target at 0.8845 and a stop at 0.9125. The bank's strategists note that a combination of factors speaks in favor of a short position in the pair. "Hysteria regarding Brexit without a deal seems to have reached its climax. The British Prime Minister candidates, Boris Johnson and Jeremy Hunt, added fuel to the debate, but these were the last, and when one of them heads the government, it will be forced to act more carefully to gain the support of parliamentarians. The need to support the deputies also gives reason to think that the fears regarding the "cleansing" of the Cabinet of Ministers from the supporters of the preservation of the country in the EU risk being excessive," the experts said. "The European Central Bank (ECB) is also capable of reducing EUR/GBP, which will meet next week on July 25. According to its results, we can expect to soften the rhetoric of the regulator, which will strengthen expectations regarding the weakening of the monetary rate, which implies a reduction in the deposit rate, which is already negative, or the resumption of asset purchases," they added. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 17 Jul 2019 07:16 AM PDT The euro and the pound made an attempt to continue the decline against the US dollar, but inflation data in the UK and the eurozone limited the downward potential. To say that bears have groped the bottom, it will not be quite right, as for a real market reversal and the formation of an upward correction in the euro and the pound requires a re-update of the current lows, and it is desirable to do it on some good news on the US economy. Only then will the big players be able to exit the market, replacing themselves with speculative traders. EURUSD Inflation report in the eurozone in the first half of the day, although it has supported the euro, the pessimism associated with the launch of ECB purchases of bonds continues to put pressure on risky assets. According to data, in June this year, compared to June last year, consumer prices in the eurozone rose only by 1.3%, while the preliminary estimate was at 1.2%. As mentioned above, as early as last month, ECB President Mario Draghi said that he was ready to take the necessary measures to stimulate the economy, up to lowering interest rates. Let me remind you that the ECB's target level is just below 2%. Also, a report was recently released from the European Commission, where inflation forecasts for the current and next years in the euro area were lowered to 1.3%, which only strengthened traders' confidence in the conduct of incentive measures. Core inflation, which does not take into account volatile categories, rose only by 1.1%, fully coinciding with the forecasts of economists. As for the technical picture of the EURUSD pair, the bears will not give up trying to continue the downward movement, and this only requires a return to the lows of today, which will increase the pressure on risky assets and lead to a further fall of the trading instrument in the area of the lows of 1.1160 and 1.1130. The upward correction is likely to be limited by the resistance of 1.1240 and 1.1260. GBPUSD The British pound managed to hold its positions against the US dollar and returned to the opening level of the day after yesterday's lows. Data on consumer prices in the UK, which grew in June this year, forced the bears to fix profits on short positions. According to the report of the National Bureau of Statistics, the consumer price index in June this year remained unchanged compared to May but increased by 2.0% compared to the same period in 2018, which fully coincided with the forecasts of economists. Current inflation fully corresponds to the target level of the Bank of England. If inflation goes beyond this level, it is possible that the Central Bank of England will signal its intention to raise the key interest rate, as repeatedly mentioned in the reports, which can support the pound in "difficult times". However, a small increase in the pound, or rather even a rebound from the monthly lows, does not mean that the bearish trend is completed or sellers have groped the bottom. Most likely, investor sentiment will continue to push the pound down as the probability that Boris Johnson will take the post of Prime Minister of the United Kingdom will increase. Let me remind you that Johnson recently said that he is ready for a tough Brexit on October 31, which will entail serious difficulties for the economy. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 17 Jul 2019 07:16 AM PDT To open long positions on GBP/USD, you need: The morning forecast for the purchase from the level of 1.2382 has fully worked itself out and now the bulls' goal is the resistance of 1.2452, which will be difficult to reach, given that inflation in the UK coincided with the forecasts of economists. With the GBP/USD falling again to the support area of 1.2382, it is best to return to long positions under the condition of a false breakout and to rebound from the new lows of 1.2342 and 1.2266. To open short positions on GBP/USD, you need: Bears will try to return to the support of 1.2383, and a repeated test of this range will lead to its breakdown and further decline of GBP/USD in the area of monthly lows of 1.2342 and 1.2266, where I recommend fixing the profit. With the growth of the pound in the second half of the day, for example, after weak fundamental data on the US, you can look at short positions on a false breakout in the area of 1.2452 or on a rebound from the maximum of 1.2498. Indicator signals: Moving Averages Trading is conducted below 30 and 50 moving averages, which indicates the preservation of the downward trend. Bollinger Bands The breakthrough of the lower limit of the indicator in the area of 1.2385 can strengthen the downward trend in the pair.

Description of indicators

|

| Posted: 17 Jul 2019 07:16 AM PDT To open long positions on EURUSD, you need: Buyers managed to hold the pair after updating the lows of yesterday and returned to the market after the divergence, which I drew attention to in my morning review. At the moment, the situation is not very clear. The bulls will strive for the resistance of 1.1236, where I recommend fixing the profit, while the repeated descent to the lows of the month to the area of 1.1195 can draw new sellers, so it is best to count on buying from this level after a false breakdown or already on a rebound from larger supports of 1.167 and 1.138. To open short positions on EURUSD, you need: Bears can count on a false breakout in the resistance area of 1.1236, but the main task will be to re-descend to a minimum of 1.1195, the breakthrough of which will increase the pressure on the pair and lead to another local support in the area of 1.167 and 1.138, where I recommend fixing the profit. If sales from the level of 1.1236 will not be observed after it is updated, then it is best to open short positions to a rebound immediately at the maximum of 1.1261. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates market uncertainty with a further direction. Bollinger Bands The breakthrough of the lower limit of the indicator in the area of 1.1205 can form a new downward wave in the pair.

Description of indicators

|

| BTC 07.17.2019 - Potenteial new momentum down is on the way Posted: 17 Jul 2019 07:15 AM PDT Industry news: The JP Morgan CEO told analysts in a recent earnings call that Libra was not a near-term threat whatsoever. Blockchain, the foundation on which both Libra and the JPM Coin are being built, was also criticized by the CEO, who stated that in the distributed ledger industry, "little has happened." Technical view:

BTC did trade exactly what I expected yesterday. BTC did hit both downward targets at the price of $8.632 and $8.987. So far, BTC found support at $8.987 and started to rally. Anyway, we got resistance levels at $9.632 and $9.866. Watch for potential test-reject of the important resistance at $9.866 (purple rectangle) to confirm further downward continuation. The trend is still downside and I would watch for selling opportunities. In case of the break out of $8.987, there is a chance for the test of $8.163. As long as the BTC is trading below the $11.300, I would watch for selling opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of GBP/USD for July 17, 2019: GBP to regain momentum against USD Posted: 17 Jul 2019 07:14 AM PDT USD has been the dominant currency in the pair while GBP struggled to regain momentum. As a result, the price settled down at near 1.2500 with a daily close recently. The UK economy has going through troubled times on the back of the looming Brexit issue. British finance minister Philip Hammond recently said that it was a terrifying idea about Britain which could be better off by leaving the EU without an exit deal. Hammond warned that a no-deal exit from the EU could badly damage the British economy. Moreover, the size of the Bank of England's balance sheet is likely to roughly halve when it reverses quantitative easing to around 275-375 GBP. The impact of such QE is expected to impact the UK GDP roughly by 12-18% margin. Today UK CPI report was published unchanged as expected at 2.0%, PPI Input slumped to -1.4% from the previous value of 0.0% which was expected to be at -1.0%, HPI fell to 1.2% as expected from the previous value of 1.5%, and PPI Output also dropped to -0.1% from the previous value of 0.3% which was expected to be at 0.1%. On the other hand, the Federal Reserve and other leading central banks are declaring that the peak in global interest rates has been reached. So, global centrla banks are ready to start the cycle of monetary easing. Recently Fed Chairman Jerome Powell signaled a rate cut as the global economy is losing steam and the trade war between the US and China continues to impact the overall growth of the economy. Powell has assured Americans that the central bank is committed to keeping the economy on track. With inflation running below the Fed's 2% target, officials have scope to ease, though some one may worry about fanning investor appetite for risk amid hefty corporate borrowing with US stocks around record highs. Recently US Retail Sales report was published without any change at 0.4% which was expected to decrease to 0.1% but Import Prices declined to -0.9% from the previous value of 0.0% which was expected to be at -0.7%. Today US Building Permits report was posted with a decrease to 1.22M from the previous figure of 1.30M and Housing Starts decreased to 1.25M from the previous figure of 1.27M which was expected to be at 1.26M. To sum it up, USD is holding the upper hand over GBP. The pair is expected to struggle to sustain the bearish pressure as weak economic reports and the dovish Fed's rhetoric may impact the upcoming gains. Now let us look at the technical view. The price is currently trading below 1.2500 with a daily close that is expected to push the price down towards 1.2350. Along the way, a retracement towards 1.2500 is expected before the bearish trend continues to dominate further in the coming days. As the price remains below 1.2500 area with a daily close, the strong bearish bias is expected to continue. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator short-term analysis of USDCAD for July 17, 2019 Posted: 17 Jul 2019 06:51 AM PDT USDCAD is in bearish trend in Ichimoku cloud terms as price continues to make lower lows and lower highs below the Kumo (cloud). Each time we see price touch the cloud in the 4 hour chart we see a rejection. Will we see another one at current levels?

|

| EURUSD challenges important support levels. Posted: 17 Jul 2019 06:45 AM PDT EURUSD is trading just above the crucial support of 1.12. Price shows stabilization signs. Price has many chances of a full scale reversal to the upside as bears have not under their control the trend. Yet.

Red rectangle- resistance area Green rectangle - horizontal support area EURUSD bulls need to step in now and recapture 1.1250 at least. Bulls need to react as bears are taking control of the trend. Holding above the green trend line support is the line in the sand for bulls. This is their last defense against bears. On the other hand bears do not want to see EURUSD break the double top at 1.1280. Breaking above it will open the way for a move towards 1.14. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of Gold for July 17, 2019 Posted: 17 Jul 2019 06:41 AM PDT Gold price is bouncing higher. Price remains trapped inside the trading range and below important resistance levels. The price action over the next few sessions will be critical for the medium-term trend.

Red rectangle - support Black line - downward sloping trend line resistance Yellow rectangles - resistance levels Gold price has resistance at $1,415-20 and at $1,430-40. Support is found at $1,385. Current price action and structure suggest to me that the chances of a break down are equal to that of a break above resistance. However a break above the short-term resistance at $1,415 will make me favor the bullish side and I will have increased chances of a break out above the trading range we are in since end of June. As we said before, a break above $1,440 will open the way for a move towards $1,500-$1,525. A failure to hold above $1,385 support will open the way for a move towards $1,300-$1,350. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for July 17, 2019 Posted: 17 Jul 2019 06:17 AM PDT The NZD/USD pair broke the resistance that turned into strong support at the level of 0.6612. The level of 0.9966 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as a major support on the H1 chart today. Consequently, the first support is set at the level of 0.6612. Moreover, the RSI starts signaling an upward trend, and the trend is still showing strength above the moving average (100). Hence, the market is indicating a bullish opportunity above the area of 0.6612. So, the market is likely to show signs of a bullish trend around 0.6612 - 0.6650. In other words, buy orders are recommended above the ratio of 61.8% Fibonacci (0.6612) with the first target at the level of 0.6748 in order to test last bullish wave in the same time frame. If the pair succeeds to pass through the level of 0.6748, the market will probably continue towards the next objective at 0.6818 . The daily strong support is seen at 0.6612. Thus, if a breakout happens at the support level of 0.6612/0.6600, then this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of NZD/USD for July 17, 2019 Posted: 17 Jul 2019 05:52 AM PDT The NZD/USD pair broke the resistance that turned into strong support at the level of 0.6612. The level of 0.9966 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as a major support on the H1 chart today. Consequently, the first support is set at the level of 0.6612. Moreover, the RSI starts signaling an upward trend, and the trend is still showing strength above the moving average (100). Hence, the market is indicating a bullish opportunity above the area of 0.6612. So, the market is likely to show signs of a bullish trend around 0.6612 - 0.6650. In other words, buy orders are recommended above the ratio of 61.8% Fibonacci (0.6612) with the first target at the level of 0.6748 in order to test last bullish wave in the same time frame. If the pair succeeds to pass through the level of 0.6748, the market will probably continue towards the next objective at 0.6818. The daily strong support is seen at 0.6612. Thus, if a breakout happens at the support level of 0.6612/0.6600, then this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

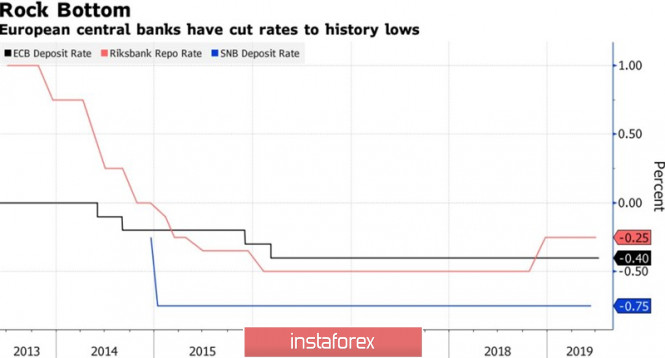

| Posted: 17 Jul 2019 05:07 AM PDT Strong statistics on retail sales and the resistance of industrial production to external shocks have somewhat cooled the fervor of the bulls over gold. The USD index rose to weekly highs as investors understand that the US economy looks better than its competitors. If the Fed mitigates monetary policy, other central banks in the world will do the same. Moreover, the response to US foreign exchange interventions will be similar actions by other countries. Since the beginning of the year, the precious metal has added about 10% due to the escalation of the trade conflict between Washington and Beijing and the Fed's intention to lower the federal funds rate in response to the slowing global economy. Despite strong data on retail sales and industrial production, the derivatives market still gives out a 27% chance of a 50 bp drop in interest rates at the July FOMC meeting. Jerome Powell, in a speech to bankers in Paris, said that much had changed since the global economic crisis. Central banks operate under protectionism and political pressure and must take into account feedbacks: just as the States influence the global economy, it also influences the American economy. Indeed, investors believe in the monetary expansion of the Fed in similar actions of other central banks. Regulators from Australia and New Zealand are already lowering rates, queueing for the ECB and the Bank of England. As a result, the global debt market returns will continue to be at historically low levels, which is a bullish factor for XAU/USD. Dynamics of central bank rates According to Deutsche Bank, if the States unleash a currency war and use currency interventions while other countries will respond similarly, then a better investment than gold will be difficult to find. Donald Trump's dissatisfaction with the allegedly competitive devaluation of the euro and the yuan has long been known but it's hard to assume that the pressure on the US dollar will be coordinated as in 2011, when several countries were selling a fairly strong yen. Thus, it is not worthwhile to exclude reciprocal currency interventions from the central banks-competitors of the Fed. The weakening of the main monetary units, coupled with the historically low rates of the global debt market, creates a favorable environment for the purchase of precious metals in the medium and long-term investment horizon. The disappointing corporate reporting of American issuers can provide him with short-term support. Currently, the S&P 500 is growing due to expectations of a loosening of the Fed's monetary policy and low borrowing costs. Nevertheless, the slowdown in the US GDP and weak corporate results can trigger a wave of correction of stock indices and increase the demand for safe-haven assets. Bloomberg analysts predict a recession of profits with a decline over two quarters in a row, which has not happened since 2016. Technically, the breakthrough of supports by $1,398 (23.6% of the CD wave of the maternal pattern AB = CD) and $1,393 per ounce (the lower boundary of the triangle) will increase the risks of gold recoil in the direction of $1,372 and $ 1,352. To resume the rally, it requires a confident test of the June highs. Gold daily chart |

| Oil prices will go up after the crash, experts say Posted: 17 Jul 2019 04:57 AM PDT According to some analysts, the price of black gold will grow in the near future. A day earlier, on Tuesday evening, July 16, oil quotations went down sharply against the backdrop of statements by US President Donald Trump. Recall that the American leader announced the readiness of negotiations with Iran on the nuclear program. On Wednesday morning, July 17, the cost of Brent crude fell from $67 to $64 per barrel. The price of a light grade of WTI fell from $ 0 to $57.80 per barrel. According to experts, the drop reached 4%, which is considered quite impressive. Analysts believe that powerful oil bulls have again entered the market, which brought down oil in favor of the US leader. Negative of the black gold market added statistics on stocks in the US. According to the American Petroleum Institute (API), total stocks of raw materials fell by 1.4 million barrels over the past week. At the same time, WTI light oil quotations reacted positively to the API report, increasing by 1.42% to $58, 40 per barrel. However, the decline in weekly reserves turned out to be much weaker than forecast. Today, this information should confirm or deny the US Department of Energy, experts reminded. Market participants expect a decline of 2.7 million barrels. If the real reduction turns out to be much more than expected, then oil quotes can win back $1- $1.5 from yesterday's collapse, analysts are certain. According to experts, the global black gold market is threatened by an imbalance if Iran returns. The appearance on the world stage of this player may bring down oil prices. According to the International Energy Agency (IEA), the oil market is on the verge of oversupply at the moment, when Tehran is almost cut off from exports.According to some analysts, the price of black gold will grow in the near future. A day earlier, on Tuesday evening, July 16, oil quotations went down sharply against the backdrop of statements by US President Donald Trump. Recall that the American leader announced the readiness of negotiations with Iran on the nuclear program. On Wednesday morning, July 17, the cost of Brent crude fell from $67 to $64 per barrel. The price of a light grade of WTI fell from $ 0 to $57.80 per barrel. According to experts, the drop reached 4%, which is considered quite impressive. Analysts believe that powerful oil bulls have again entered the market, which brought down oil in favor of the US leader. Negative of the black gold market added statistics on stocks in the US. According to the American Petroleum Institute (API), total stocks of raw materials fell by 1.4 million barrels over the past week. At the same time, WTI light oil quotations reacted positively to the API report, increasing by 1.42% to $58, 40 per barrel. However, the decline in weekly reserves turned out to be much weaker than forecast. Today, this information should confirm or deny the US Department of Energy, experts reminded. Market participants expect a decline of 2.7 million barrels. If the real reduction turns out to be much more than expected, then oil quotes can win back $1- $1.5 from yesterday's collapse, analysts are certain. According to experts, the global black gold market is threatened by an imbalance if Iran returns. The appearance on the world stage of this player may bring down oil prices. According to the International Energy Agency (IEA), the oil market is on the verge of oversupply at the moment, when Tehran is almost cut off from exports. According to some analysts, the price of black gold will grow in the near future. A day earlier, on Tuesday evening, July 16, oil quotations went down sharply against the backdrop of statements by US President Donald Trump. Recall that the American leader announced the readiness of negotiations with Iran on the nuclear program. On Wednesday morning, July 17, the cost of Brent crude fell from $67 to $64 per barrel. The price of a light grade of WTI fell from $ 0 to $57.80 per barrel. According to experts, the drop reached 4%, which is considered quite impressive. Analysts believe that powerful oil bulls have again entered the market, which brought down oil in favor of the US leader. Negative of the black gold market added statistics on stocks in the US. According to the American Petroleum Institute (API), total stocks of raw materials fell by 1.4 million barrels over the past week. At the same time, WTI light oil quotations reacted positively to the API report, increasing by 1.42% to $58, 40 per barrel. However, the decline in weekly reserves turned out to be much weaker than forecast. Today, this information should confirm or deny the US Department of Energy, experts reminded. Market participants expect a decline of 2.7 million barrels. If the real reduction turns out to be much more than expected, then oil quotes can win back $1- $1.5 from yesterday's collapse, analysts are certain. According to experts, the global black gold market is threatened by an imbalance if Iran returns. The appearance on the world stage of this player may bring down oil prices. According to the International Energy Agency (IEA), the oil market is on the verge of oversupply at the moment, when Tehran is almost cut off from exports. |

| Posted: 17 Jul 2019 03:14 AM PDT

If stock indices are an indicator of the effectiveness of the US President, as Donald Trump has repeatedly stressed, and the S&P 500 index is growing on expectations regarding the easing of the Fed's monetary rate, then why not the head of the White House continue to criticize the Central Bank, forcing it to reduce the interest rate? In addition, this task is simplified if the regulator makes decision-making dependent on trade conflicts and the state of the world economy. "Uncertainty about the Fed's economic outlook has increased, especially in terms of the situation in the trade sector and global growth," Fed Chairman Jerome Powell said yesterday. At the same time, he once again stressed that the US Central Bank is closely monitoring the downside risks for the US economy and is ready to take appropriate measures to support its growth. Thus, the White House only needs to maintain tension in relations with China, pushing Jerome Powell and his team to monetary expansion. Yesterday, D. Trump said that Washington and Beijing have a long way to go in trade negotiations. He also noted that the US can introduce additional duties on goods from China worth $325 billion if required. On July 31, the next FOMC meeting will be held, following which the federal funds rate may be reduced by 25 basis points. The increase in the probability of a rate cut in July by 50 basis points immediately after the Fed Chairman's speeches in Congress contributed to the weakening of greenback, but strong statistics on the United States intervened. When retail sales in the country grow for four months in a row, exceeding the forecasts of experts in June, and industrial production begins, albeit slowly, to recover, there are doubts about the slowdown in US GDP and the feasibility of easing monetary policy on the part of the Fed. The latest strong US statistics have allowed Macroeconomic Advisers to increase the country's economic growth in the second quarter from 1.8% to 2.1%. At the same time, the leading indicator from the Atlanta Federal Reserve Bank indicates that US GDP will expand by 1.7%, rather than 1.3%, as was previously expected. Apparently, the Fed rate cut by 25 basis points on July 31 is already included in the quotes. It is assumed that the dollar will respond to the decline only on the signals of the subsequent rate cuts. There is no reason to expect that it will be reduced by 50 points at the end of the month – the US economy is still in good condition. That is, the rate will be reduced proactively, to insure against a recession in the United States due to trade wars and the slowdown of the world economy. On the eve of the head of the Federal Reserve Bank of Dallas, Robert Kaplan said that any reduction in the federal funds rate should be modest, restrained and limited. According to him, this is not the beginning of the monetary expansion cycle, but merely a tactical move due to the inversion of the Treasury yield curve. Meanwhile, the latest weak statistics from the EU have caused a new wave of talk about a possible reduction in rates by the ECB and the resuscitation of the quantitative easing (QE) program. According to the forecast of Societe Generale, in September, the regulator will cut the rate on deposits by 10 basis points, and before that, it will strengthen the downward bias of its statements of intent following the meeting scheduled for next week. Recently, the nomination of the former head of the IMF Christine Lagarde as head of the ECB. Market participants expect that under her leadership, the European regulator will bring the already "soft" monetary policy to a whole new level. Given the above, the EUR/USD pair has all the chances to decline to the area of 1.10. The material has been provided by InstaForex Company - www.instaforex.com |

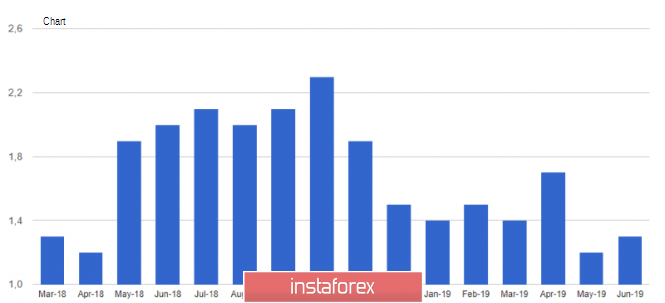

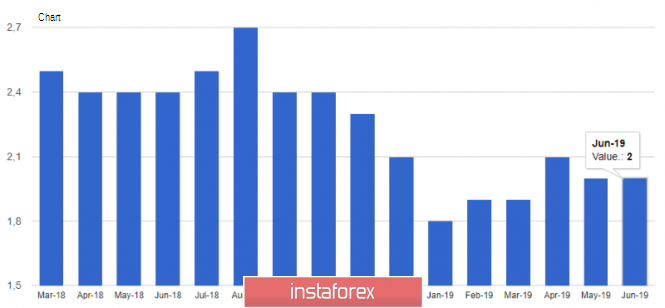

| Posted: 17 Jul 2019 02:59 AM PDT The economic data published on Tuesday from the United States does not shine with certainty, which still does not allow investors to understand what their prospects in the monetary policy of the American regulator. The presented values of the base retail sales index for June showed preservation of the growth rate of 0.4% against the expectation of its decline to 0.1%. At the same time, the annual values of the export price index fell more than expected of 1.6%, while for imports this decline was slightly less by only -2.0% against -2.1%. Although, by and large, it is still noticeably lower than last year's data of -1.5%. On the wave of these data, the dollar started to add sharply to the major currencies but it should still be recognized not as much as it was, for example, in a pair of gray European currencies, it decreased by 50 points at the moment after the statistics were published. This was due to data from Germany. The index of economic conditions from ZEW in Germany continued to fall in July, dropping to -24.5 points against the forecast of falling to 22.1 points and the previous June value of -21.1 points. Recall that the indicator is noticeably below zero for more than one year. Back to the dynamics of the American currency, the head of the Fed, Jerome Powell, commented on Tuesday in the background of the country's economy. He said that he sees a slowdown in economic growth, although he is still strong and uncertainties have grown. The dynamics of economic growth and inflation contribute to the expected decline in interest rates. He added that all of these are happening against the background of a weak manufacturing sector, rising consumer spending and a marked slowdown in investment growth. In addition to him, the theme of the prospects for interest rates in yesterday's comments touched upon Charles Evans said that he was waiting for a decrease in rates by 0.50%, as well as the President of the Federal Reserve Bank of San Francisco, Mary Daly, who made it clear that he had not yet decided on the issue of interest rates. Meanwhile, the head of the Fed Dallas, Robert Kaplan is inclined to believe that lowering interest rates is justified. In the wake of Powell and his colleagues' speeches, the strengthening of the dollar stopped and the US stock market received support in the belief that lowering rates this month would not be a one-time event. Of the important statistics that will be published today, we highlight the values of consumer inflation in Britain, in the eurozone and Canada. As well as the number of building permits issued and the publication of the Beige Book in America, paired with the values of oil and petroleum products from the US Department of Energy. Forecast of the day: The AUD/USD pair found support at 0.7010. If this mark resists, the pair will rush to 0.7100 when it breaks the level of 0.7040. The GBP/USD pair is trading above 1.2400, remaining under strong pressure. On the Brexit theme, it will still remain central to Britain, which puts pressure on the local currency rate with its uncertainty. If it falls below the level of 1.2400, the pair will continue to fall to 1.2330. |

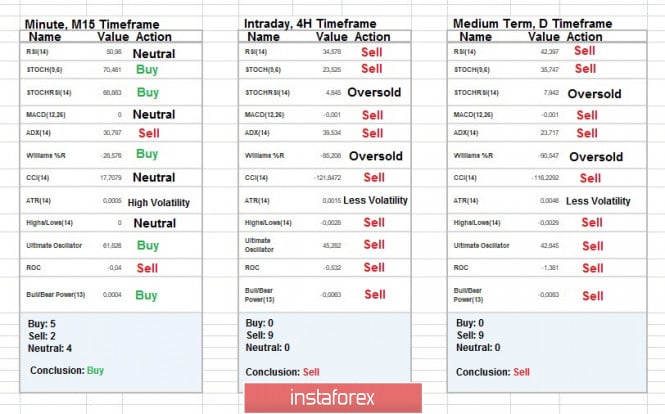

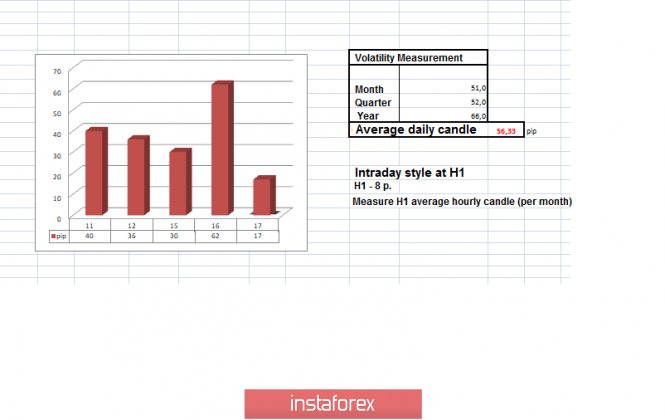

| Trading recommendations for the EURUSD currency pair - placement of trading orders (July 17) Posted: 17 Jul 2019 02:32 AM PDT For the previous trading day, the euro / dollar currency pair showed a high volatility of 62 points. As a result, the quote went down to the predicted level. From the point of view of technical analysis, we see that the accumulation phase of 1.1245 / 1.1280 resulted in a layer of short positions, overcoming the lower boundary and directing us to the priority point 1.1180, the area of the stop on the history (July 9; June 18). As discussed in a previous review, traders occupied a waiting position, at the moment of accumulation, tracking clear breakdowns of existing borders, which they got as a result. Downward positions were opened, and the past movement made it possible to take the first piece of profit from the market. Considering the trading chart in general terms (daily timeframe), we see that the tact of the impulse is in the active phase, for the full recovery of the verbal downward trend, we need to overcome the values of 1.1180 --- 1.1100. The news background for the previous day contained data on retail sales in the United States, where, as expected, it accelerated from 2.9% to 3.4% with a forecast of 3.0%. The main factor driving the growth of the dollar against the euro was played, of course, by another factor, and it's none other than, Brexit. The information background once again stirred up the sensation of the "divorce" process. This time, everyone remembered that nothing had been decided yet, and the output according to the plan was as of October 31 of the current year. The side of the English knights in the persona of the candidates for the post of Boris Johnson and Jeremy Hunt declares that the European Union must make concessions. Although we recall that the head of the EC Jean-Claude Juncker has repeatedly stated that everything has already been decided and will not make concessions, but it is not worth scaring with tough Brexit, the EU is ready for it. At the same time, European officials are preparing for discussions on Brexit which will become more hostile under the new British government. To be more precise, the European Union is preparing for the prospect that Boris Johnson will become the Prime Minister, whom the EU considers to be an unreliable populist. So we understand the reason for yesterday's jump, hysteria and speculations led to the fact that the pound has updated at least in the current year, and the euro on the general background simultaneously flew down. Today, in terms of the economic calendar, we have data on inflation in European Union, where, according to forecasts, 1.2% is expected to remain unchanged. In the afternoon, data will be released on the construction sector of the United States, where, in principle, unchanged. Particular attention is paid to the information background, in the case of a regular release, criticism, or simply statements regarding Brexit. United States 12:30 UTC+00 - Number of building permits issued (June): Prev. 1.299M ---> Forecast 1,300M United States 12:30 UTC+00 - The volume of construction of new homes (June): Prev. 1.269M ---> Forecast of 1.261M Further development Analyzing the current trading chart, we see the quotation felt a foothold within the level of 1.1180, which was quite expected. Traders, in turn, ensuring against a rebound, produced a partial fixation of previously received profits, pushing restrictive orders to the breakeven zone. Rolling back - stagnation is certainly possible, but traders do not miss out on the option of a further inertial move, thus waiting for clear fixations lower than 1.1180. Based on the available information, it is possible to decompose a number of variations, let's consider: - Positions for purchase are considered in case of price fixing higher than 1.1225. - Positions for sale, if we still do not have, or are considering topping up, then it is worth waiting for a fixation moment lower than 1.1180. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short term have changed from descending to ascending against the background of a slowdown within the level. Intraday and mid-term outlook maintain a downward interest. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (July 17 was based on the time of publication of the article) The current time volatility is 17 points. In the case of a slowdown within a level, volatility may be low. In case of continuation of the inertial course and breakdown of the value of 1.1180, the volatility may increase. Key levels Zones of resistance: 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support areas: 1.1180 *; 1.1112; 1.1080 *; 1.1000 ***; 1,0850 ** * Periodic level ** Range Level *** Psychological level **** The article is based on the principle of conducting a transaction, with daily adjustment. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment